Closing Bell: No Budget cheer for market, Sensex, Nifty end flat amid volatility; realty, FMCG shine

-330

February 01, 2025· 18:55 IST

Market Close | Sensex, Nifty end flat; realty, FMCG shine

Indian equity indices ended flat in the volatile session on February 1 (Budget day). At close, the Sensex was up 5.39 points or 0.01 percent at 77,505.96, and the Nifty was down 26.25 points or 0.11 percent at 23,482.15.

We wrap up today's edition of the Moneycontrol live market blog, and will be back Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

February 01, 2025· 18:49 IST

Sehul Bhatt, Director- Research, Crisil Intelligence

The 80% rise in allocation for the PM Surya Ghar Muft Bijli Yojana over this fiscal’s revised estimate, which itself was 78% higher than the budgeted estimate, indicates the scheme’s continued success. The increase in allocation is in line with the target to add 30 GW of residential rooftop solar capacity by 2027 and will contribute to the overall rooftop solar capacity addition target of 40-45 GW. So far, the scheme has seen 1.46 crore registrations and 27 lakh applications (as of November 2024), with rooftop solar systems already installed in more than seven lakh households (as on January 9, 2025).

-330

February 01, 2025· 18:46 IST

Markets will recalibrate to the new growth trajectory over time

We will see greater faith in our government's ability to consolidate the fiscal path and global investors will change their India stance, if they see private capex revive...Read More

-330

February 01, 2025· 18:43 IST

Pushan Sharma, Director- Research, Crisil Intelligence

The budget’s agriculture focus is on four ‘I’s — income, inflation, import reduction and insulation from climate change. This assumes importance as changing weather patterns have contributed to food inflation, which averaged 8.4% during April-Dec 2024 versus 2.7% for non-food inflation.

The budget aims to enhance crop productivity through the PM Dhan Dhanya Yojana; climate resilience of inputs through higher allocation for RKVY and PMKSY; 20% higher allocation under the Agriculture Infrastructure Fund and through self-sufficiency measures for pulses, edible oil and fertilisers.

-330

February 01, 2025· 18:36 IST

Rally in FMCG stocks on Budget sops will be short term, says Vikas Khemani of Carnelian Asset Advisors

The Nifty FMCG index was higher by 4 percent, which is the most in seven months. FMCG players like Godrej Consumer Products, ITC, Varun Beverages and Hindustan Unilever also gained around 4 percent, ...Read More

-330

February 01, 2025· 18:27 IST

Amar Ambani, Executive Director, YES Securities

With urban consumption slowing down, it was essential for the government to intervene. Rising to the occasion, the Modi administration displayed a genuine commitment to strengthening middle-class savings, which is expected to drive consumption. The expansion of the nil tax slab for salaried individuals, along with revisions in the tax structure and TDS/TCS relaxations, will increase disposable income for households. Additionally, the Budget has prioritized growth in domestic manufacturing, MSMEs, and agriculture. However, concerns remain over government capital expenditure, as FY26 projections indicate a slowdown compared to the robust double-digit growth seen in earlier years (before FY25). Time will tell whether these consumption measures will materially help lift private capex.

-330

February 01, 2025· 18:14 IST

Budget 2025 Market Verdict: Big voices cheer consumption push but keep an eye on valuations

Veteran market investors have praised the consumption boost in the Union Budget, one view is that valuations in the space cannot be overlooked, as also the increasing disruption being caused by new age players....Read More

-330

February 01, 2025· 18:10 IST

Hungry for more stocks: Right time to bite into consumption theme?

Consumer demand, especially from the middle and lower-middle classes, has been sluggish, which should stage a turn-around on the income tax relief announced in Budget 2025....Read More

-330

February 01, 2025· 18:06 IST

Jatin Gedia – Technical Research Analyst at Mirae Asset Sharekhan

Nifty opened on a flat note and witnessed volatile price action during the day. It closed marginally in the red down ~26 points. On the daily charts we can observe that the Nifty has been rising steadily since the last five sessions. Despite all the volatility the Nifty has held on to the crucial support zone 23300 – 23250. The Hourly momentum indicator has a negative crossover which is a sell signal and can lead to some consolidation before resuming upmove and hence dips towards 23300 – 23250 should be considered as a buying opportunity.

On the upside, the immediate hurdle is placed at 23620 (200EMA) and above that it can rise towards the psychological level of 24000.

-330

February 01, 2025· 17:59 IST

Centre allocates Rs 5,936 crore for Polavaram Project in Andhra Pradesh

Terming the project as the lifeline for the state and its farmers, the FM noted that the central government is fully committed to financing and early completion of the Polavaram Irrigation Project....Read More

-330

February 01, 2025· 17:55 IST

Sunil Kalra, Forvis Mazars

"The government in its Budget proposals has continued its focus on boosting manufacturing in the country and furthering Make in India initiative. We applaud this policy continuity that gives confidence in the government's priorities. While continuing to focus on existing commitments, the Finance Minister also announced a number of new initiatives that will boost the manufacturing sector in India. This includes National Manufacturing Mission, Clean Tech manufacturing, mission to make India a global toy hub, tax certainty for electronics manufacturing schemes, etc.

The establishment of the National Manufacturing Mission will provide policy support, execution roadmaps, governance and monitoring framework for central ministries and states. It will not just give clarity on messaging from the government but also provide a platform to the industry to present its concerns to the policymakers.

The Indian toy industry has already seen remarkable growth in recent years with a rise in exports by 239 percent and decline in imports by half. The announcement to implement a scheme to make India a global hub for toys will lead to more investment in the industry. The development of clusters, skills, and a manufacturing ecosystem will attract larger players in the industry that remains largely fragmented.

-330

February 01, 2025· 17:49 IST

Nifty snaps weekly losing streak, coming week to decide immediate direction: Osho Krishnan, Sr. Analyst, Technical & Derivatives of - Angel One

The recent elongated trading week brought significant developments in both economic and technical aspects for the Indian equity markets. The benchmark index showcased a strong bullish trend throughout the week, navigating some volatility during the Budget session, yet ultimately concluded with a positive outcome. With gains of nearly 1.70 percent, the index settled just below the 23500 zone, reflecting a modest pullback.

A decent bullish candlestick on the weekly chart has overshadowed previous candle but it does not qualify for the term 'Bullish Candlestick' pattern, since the previous candle also needs to be big theoretically. Having said that, market has certainly seen a respite precisely at the lower end of the 'Falling wedge' pattern (in daily time frame) which we have been mentioning since the last couple of weeks. Now, the major Union Budget is behind us, and it appeared as a non-event but practically speaking, FIIs participation was very minimal. Hence, the actual reaction is likely to be witnessed on Monday and hence, we need to wait for a day or two to understand whether the market has really discounted the Budget factor or not. Additionally, the risk with respect to Donald Trump imposing various tariffs is still looming over. Hence, it's better not to jump on to any conclusion at this moment and better to keep a close eye on these developments.

Technically, the 20 DEMA levels of 23400 - 23350 is to be seen as immediate supports and in case of any aberration, 23100 - 22800 are to be treated as key support zones in the coming week. On the upside, the 50 DEMA around 23670-23700 and the upper band of the ‘Falling Wedge’ near 23800 - 24000 are likely to serve as key resistance levels to watch in the upcoming period.

As we look to the upcoming week, there are several important events on the horizon, including the MPC outcome, the Delhi state election, and developments regarding US tariffs. These events present an opportunity for market participants to remain engaged and informed, as they are likely to introduce some volatility. Embracing a proactive approach with effective risk management will be essential in navigating this dynamic landscape.

-330

February 01, 2025· 17:44 IST

Sumit Bajaj, Director, Choice Insurance Broking

This is a landmark shift that the government has taken recently by proposing the increase in the FDI limit of Indian insurance companies to 100% from 74% which will open up the capital inflow, bring in innovations, and grow healthy competition.

The increase in foreign participation will help fill the protection gap, ensuring that more citizens and insurable assets are covered, as IRDAI has envisioned "Insurance for All" by 2047. This will not only make the financial system more resilient but also fuel the growth of insurtech startups, making the insurance landscape more dynamic and consumer-centric.

More global players will translate into better choices for consumers, improved product offerings, and a more robust sector overall. The future of insurance in India is poised for unprecedented expansion—driven by capital, competition, and customer focus.

-330

February 01, 2025· 17:43 IST

Budget is done! Bulls need to keep Nifty above 23,280 for further momentum, say technical analysts

The underlying trend of Nifty remains positive and the market is facing stiff resistance around 23,500-23,600 levels, says an analyst...Read More

-330

February 01, 2025· 17:34 IST

Amisha Vora, Chairperson and Managing Director, PL Capital

The Budget was a bold and decisive one to spur economic growth by reviving consumption. With no income tax on income up to 12 lakh, the Budget has ensured that the middle class has more disposable income in its hands. This is positive for sectors like consumer durables, travel, tourism, auto, jewellery, delivery, and ecommerce.

The moderate growth in capital expenditure over revised estimates is still good. Increasing capex in data centers, PLI-led capex, PSU capex, and state-level capex will collectively drive robust growth in the manufacturing sector. At a macro level, India remains one of the world's fastest growing economies. In 2025, investors will make money, albeit at a slower pace. Right stock picking will be key to creating wealth. While other factors like Trump's policy moves, Fed's interest rate decisions and ensuing currency outlook will be important determinant of market moves, I believe Union Budget 2025 has done its job well.

-330

February 01, 2025· 17:30 IST

Technical View: Bullish engulfing pattern signals positive trend ahead for Nifty, crossing 23,620 crucial for further rally

The weekly options data indicated that the Nifty 50 may trade within a broad range of 23,000–24,000 in the short term....Read More

-330

February 01, 2025· 17:28 IST

Anand Kulkarni, Director, Crisil Ratings

The pace of new-project-awarding in the roads sector, which moderated last fiscal, is expected to remain subdued in the near term as budgetary allocation is unchanged at Rs 2.72 lakh crore. In the medium term, the government is expected to focus on two areas to boost capex in the sector. First, monetisation of assets with the expected launch of the second phase of the National Monetisation Pipeline with plans to monetise Rs 10 lakh crore of projects during 2025-30, a sizeable portion of which is expected to be in roads. The capital unlocked from the monetisation can be used for new projects. Second, the focus on increasing the share of BOT-toll projects, which will reduce dependence on government funding.

-330

February 01, 2025· 16:49 IST

Motilal Oswal, Group MD & CEO, Motilal Oswal Financial Services

The overall budget is managed with a fine balance between growth and fiscal prudence. The fiscal deficit is packed at 4.4% below the long-term target of 4.5%, which will be positive for the economy.

The budget has focused on key areas like rural farmers' low incomes, which will boost consumption both in the near term and long term and help revive economic growth. Overall, capex spending planned at 11.2 lakh crore is in line with market expectations. Focusing on MSME manufacturing will also be positive for several sectors.

The sectoral budget would be positive for consumption-driven sectors like FMCG, auto footwear, etc. She delivered six in the last over by reducing the income tax on the middle class.

I remain positive in the medium to long term.

-330

February 01, 2025· 16:43 IST

India VIX cools down by 24% in 3 days, bulls get into comfort zone post Union Budget

The VIX also dropped below all short-, medium-, and long-term moving averages in just three days, which is another positive factor for the market. Generally, experts feel that as long as the VIX sustains below the 14 mark, the bulls may find themselves in a comfort zone....Read More

-330

February 01, 2025· 16:34 IST

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

After showing a sustainable upmove in the last four sessions, Nifty witnessed high volatility on the day of presentation of Union Budget 2025 in the Parliament on a special trading session of Saturday and the Nifty closed the day lower by 26 points amidst high volatility. Nifty opened on a positive note and moved up further till 11am. After the beginning of Budget speech by FM, the volatility has emerged in the mid part of the session. However, upside recovery was seen towards the end and Nifty finally closed off the days low.

A small negative candle was formed on the daily chart with upper and lower shadow. Technically, this pattern indicates a high wave type candle pattern which indicates high volatility in the market. The 200day EMA has acted as a strong hurdle for the market at 23620 levels and that resulted in selling pressure from the highs.

Nifty on the weekly chart formed a long bull candle, that has engulfed the previous two weeks candle formation. This bullish engulfing pattern on the weekly chart signal possible formation of near-term bottom reversal in the Nifty at the low of 22786 levels.

The underlying trend of Nifty remains positive and the market is facing stiff resistance around 23500-23600 levels. A decisive move above this hurdle could open further upside towards 24000 levels in the near term. Immediate support is placed at 23300 levels.

-330

February 01, 2025· 16:31 IST

Shrikant Chouhan, Head Equity Research, Kotak Securities

In the last week, the benchmark indices bounced back sharply. The Nifty ended 1.74 percent, whereas the Sensex was up over 1300 points. Among sectors, the Realty index outperformed, rallying over 11 percent, whereas the Capital Market and IT indices lost the most, with the Capital Market index shed 5 percent and the IT index down by 3.25 percent.

During the week, the market slipped below 23,000/75500 but, due to oversold conditions, it bounced back sharply. After forming a promising reversal pattern, the market held its positive momentum throughout the week. Technically, on weekly charts, it has formed a long bullish candle and is currently trading comfortably above its 20-day Simple Moving Average (SMA), which is largely positive.

We are of the view that the short-term market texture is bullish, but due to temporary overbought conditions, we could see range-bound action in the near future. For traders, the 20-day SMA or 23,270/77000 and 23,100/76500 would act as key support zones, while the 50-day SMA or 23,810 /78500 and 23,900/78800 could be the key resistance areas for the bulls. For Bank Nifty, as long as it is trading above its 20-day SMA or 49,000, the bullish formation is likely to continue. On the higher side, 50,250 and 50,500 would be the key resistance zones for the traders.

-330

February 01, 2025· 16:29 IST

Vinod Nair, Head of Research, Geojit Financial Services

The market has responded to the Union budget with a mixed view, primarily due to the modest 10% YoY increase in capex for FY26, falling short of expectations. Sectors like railways, defense, and infra are affected on which the market relies for the performance, dampening the sentiment. On the other hand, consumption-based sectors, which are expected to benefit the most, had a low effect on the broad market due to their modest market mix position. However, the market will begin to factor in the broader benefits to the economy and corporations over the course of the year due to a rapid increase in disposable income and boost in ease in business.

-330

February 01, 2025· 16:25 IST

Union Budget raises Ayushman Bharat allocation for next fiscal by 24% to Rs 9,406 crore

Finance Minister Nirmala Sitharaman also said that gig workers will be provided healthcare under the government’s flagship Ayushman Bharat scheme....Read More

-330

February 01, 2025· 16:22 IST

Jagannarayan Padmanabhan, Senior Director & Global Head, Consulting - Transport, Mobility and Logistics, Crisil Intelligence

The constitution of a sector-focussed fund for the maritime sector will help both major and non-major ports and the ecosystem to tap into project-based financing, moving away from balance sheet financing. Also, shipbuilding, which has been included in the harmonised list, will generate competitive sources of funds with longer tenure. The ship repair segment also stands to benefit. Among other infrastructure sectors, roads and railways have got more than 50% of the budgetary provisions, though increase in budgetary spend has been maintained at last year’s level.

-330

February 01, 2025· 16:11 IST

Market to stay in consolidation mode, but sector-specific upsides likely: Rohit Srivastava

Budget 2025 Impact: Market consolidation will likely persist for another week before headline indices manage to stage a sustainable breakout, says Rohit Srivastava....Read More

-330

February 01, 2025· 16:09 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

While the Budget failed to cheer the markets, sectoral stocks from consumer durables, FMCG, and automobile space attracted significant buying interest after the government announced major income tax relief for the salaried class. With salaried income up to Rs 12 lakh per annum exempted from any tax, consumption is expected to get a major boost which is reflected positively across most of the consumption-related sectors.

Also, will the RBI soften its stance and announce any rate cut in next week's credit policy will be interesting to watch out for. However, investors need to watch out for global developments, as any uptick in US bond yields and FII selling could dampen sentiment.

-330

February 01, 2025· 16:04 IST

Taking Stock: Markets end flat amid volatility; realty, auto, FMCG get major boost from Budget

L&T, Bharat Electronics, Power Grid Corp, Grasim Industries, Cipla are among the top losers on the Nifty, while gainers included Trent, Maruti Suzuki, Tata Consumer, Eicher Motors, Bajaj Auto. ...Read More

-330

February 01, 2025· 16:01 IST

Anand Vardarajan, Chief Business Officer, Tata Asset Management

Tourism was one of the significant contributor to services in GDP in FY24. The announcement of developing 50 top tourist destination in a holistic way is a big step to boost this sector even further. We are seeing a surge in travel led by leisure, business, pilgrimage or even medical tourism. Specific interventions could further bolster prospects for this sector. We have a Tourism fund which strives to take advantage of such opportunities that the sector presents.

Additionally, the increase in tax exemption limit upto Rs. 12 lacs undoubtedly puts more money in the pockets of the individual. This is now nearly 6 times the per capita GDP up from nearly 3 times in the past. This may possibly find its way into either spending or investment. Some of the additional income can now be squirrelled into SIPs for long term investment and this bodes well for individuals to consider this as an option.

-330

February 01, 2025· 15:58 IST

Ajit Mishra – SVP, Research, Religare Broking

Markets showed volatility during the special trading session for the Union Budget and ultimately closed nearly flat, taking a pause after the recent rally. Following a subdued start, the Nifty gained early momentum but struggled to break past the key resistance at the long-term 200-day exponential moving average (DEMA), closing at 23,482.15. Sector-wise, the consumption-driven sectors such as FMCG, auto, and real estate saw decent buying interest, largely in response to the budget's tax relief measures. However, stocks in defense, energy, and infrastructure showed signs of disappointment. Broader indices followed a mixed trend, with no clear direction.

The impact of the Union Budget could linger in the next session, particularly in the consumption sectors. The Nifty may remain around its current levels as market participants await the next decisive move above the critical hurdle of 200 DEMA i.e. 22.620 level. Additionally, with the earnings season set to take center stage again, traders should focus on stock selection and align their positions accordingly.

-330

February 01, 2025· 15:53 IST

Sundararaman Ramamurthy, MD & CEO, BSE

The focus areas rightly aim at accelerating growth, securing inclusive development, invigorating ease of doing business and employment generation via reforms, uplifting household consumption, and enhancing spending power of India's aspirational middle class.

While the highlight of the budget remains the increased basic income tax exemption limit to Rs 12 lakh, the honourable Finance Minister's 8th straight Budget follows up from the previous budget in July 2024 with specific focus on garib, yuva, nari, and annadata. Various schemes such as agriculture, EVs, manufacturing, shipbuilding, power, infrastructure, tourism, MSME, and insurance, makes it an overall balanced budget.

-330

February 01, 2025· 15:46 IST

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty has witnessed a roller-coaster ride during the Budget session. On the daily chart, a small-bodied candle has formed, indicating indecision. Nifty has support at 23,280, and as long as it remains above this level, the trend might stay positive.

On the higher end, the index could move towards 23,700–24,000 in the short term. However, a fall below 23,280 might trigger panic in the market.

-330

February 01, 2025· 15:30 IST

Market Close | Sensex, Nifty end flat amid Budget-day volatility; realty, FMCG shine

Indian equity indices ended flat in the volatile session on February 1 (Budget day).

At close, the Sensex was up 5.39 points or 0.01 percent at 77,505.96, and the Nifty was down 26.25 points or 0.11 percent at 23,482.15. About 2001 shares advanced, 1752 shares declined, and 121 shares unchanged.

L&T, Bharat Electronics, Power Grid Corp, Grasim Industries, Cipla are among the top losers on the Nifty, while gainers included Trent, Maruti Suzuki, Tata Consumer, Eicher Motors, Bajaj Auto.

Among sectors, Consumer Durables index was up 3 percent, realty index added 3.3 percent, auto index jumped 1.9 percent, Media index up 2 percent and FMCG index rose 3 percent. On the other hand, capital goods, power, PSU indices shed 2-3 percent and metal, IT, energy down 1-2 percent.

BSE midcap index shed 0.5 percent, while smallcap index added 0.3 percent.

-330

February 01, 2025· 15:29 IST

Sensex Today | BSE Oil & Gas index down 1%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HINDPETRO | 345.15 | -3.63 | 264.74k |

| IGL | 195.05 | -3.37 | 142.39k |

| Oil India | 410.65 | -2.48 | 93.21k |

| IOC | 125.55 | -2.33 | 955.54k |

| Petronet LNG | 308.95 | -2.26 | 29.19k |

| BPCL | 256.25 | -1.9 | 874.41k |

| ONGC | 257.85 | -1.77 | 336.06k |

| Adani Total Gas | 634.00 | -1.48 | 61.09k |

| GAIL | 175.80 | -0.79 | 941.51k |

-330

February 01, 2025· 15:28 IST

Mahendra Kumar Jajoo, CIO - Fixed Income, Mirae Asset Investment Managers (India)

The budget is expected to provide a major boost to consumption with the massive reliefs on income tax front for the lower and middle class. At a time when the economic moment was slowing down and incremental capex was beginning to generate a declining multiplier factor on the margin, as was desired by most analysts, budget has delivered this mega booster for renewed consumption boost.

Along with sustained capex, economy is expected to regain the lost momentum in quick time. Continuing to adhere to the guided fiscal consolidation path even while providing tax relief is another positive feature which should help improve India's rating upgrade prospect. RBI is also likely to take note of the same and a progressively more accommodative monetary policy is to be expected in the near term.

-330

February 01, 2025· 15:24 IST

Brokerage Call | HSBC keeps 'buy' rating on IndusInd Bank, target cut to Rs 1,150

#1 Most metrics remain under pressure, more stress likely to follow

#2 Value may only be realised in the medium to long-term

#3 Cut FY26-27 EPS estimates 12-16 percent on expectations of lower loan growth

#4 Pressure on almost all earnings metrics, but at 1x FY26 BV, risk-reward ratio is favourable

-330

February 01, 2025· 15:20 IST

Brokerage Call | HSBC keeps 'buy' rating on Sun Pharma, target at Rs 2,280

#1 Lower R&D led to EBITDA margin beat in Q3

#2 Outlook for specialty product sales remains healthy

#3 Next update on Leqselvi (Alopecia Drug) litigation in April 2025

-330

February 01, 2025· 15:16 IST

Raghvendra Nath, MD, Ladderup Wealth Management

After a long time, the middle class has a reason to cheer. By moving the tax exemption to Rs.12 lacs, the current income tax proposal is going to leave a lot of money in the hands of the middle class. While the government is foregoing Rs.1 lac crore of Income Tax, we think the increase in consumption can help offset some of the exchequer loss. On the fiscal side a budget estimate of 4.4% is tad on the higher side. I think the government recognizes the recent slowdown and the importance of govt expenditure to maintain the growth momentum.

Bringing the gig workers into its notice, atleast through some medical relief, is a step in the right direction as 1 crore gig workers is a very large segment of the population and also the fastest growing portion of the employment pool. Overall the budget has balanced the large goals of Economic Development and the Social responsibility of the government.

-330

February 01, 2025· 15:15 IST

Earnings Watch | Vinati Organics Q3 net profit down 10.2% at Rs 93.7 crore Vs Rs 104.4 crore, YoY

-330

February 01, 2025· 15:14 IST

Sensex Today | January GST collections up 12.3% YoY at Rs 1.96 lakh crore

-330

February 01, 2025· 15:13 IST

Sensex Today | NMDC share price falls despite iron ore production rises 12.3%

NMDC's January iron ore production up 12.3% at 5.1 mt Vs 4.54 mt and iron ore sales down 1.8% at 4.48 mt Vs 4.56 mt, YoY

-330

February 01, 2025· 15:11 IST

Brokerage Call | HSBC retains 'buy' rating on Biocon, target at Rs 430

#1 Q3 below estimates, though sequential pick-up in revenue across segments is reassuring

#2 Company is well placed for operational turnaround, led by execution of high-value biosimilars

#3 Launch of insulin Aspart from Malaysia is next catalyst

-330

February 01, 2025· 15:07 IST

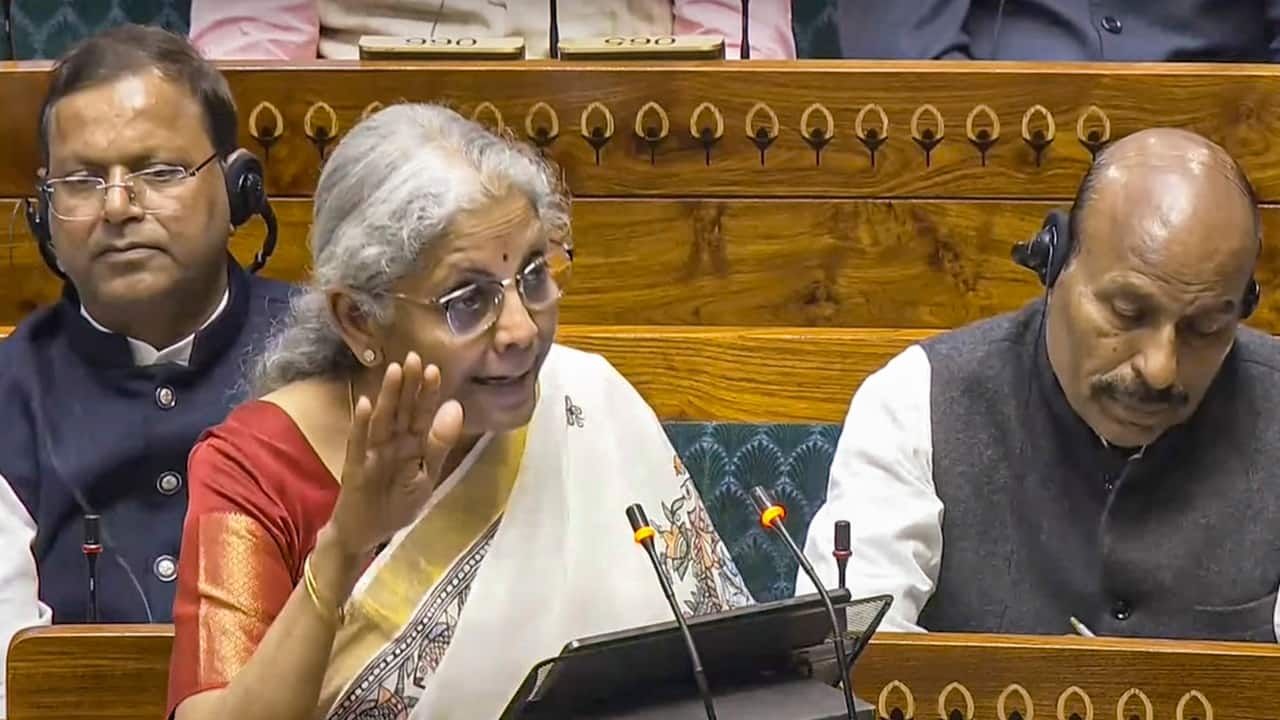

FM Nirmala Sitharaman bets on salaried middle class to power economy

No taxes upto Rs 12 lakh annual income set to boost consumption spending; stays the path on fiscal consolidation with fiscal deficit target of 4.4 pc in FY26; farm economy in FM’s focus too with a slew of measures....Read More

-330

February 01, 2025· 15:03 IST

Markets@3| Sensex, Nifty flat amid volatility

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY Auto | 23309.90 1.93 | 2.08 5.14 | 0.74 20.60 |

| NIFTY IT | 42042.55 -1.45 | -2.99 -3.40 | -3.07 15.08 |

| NIFTY Pharma | 21309.85 -0.6 | -8.98 -2.57 | -9.16 19.46 |

| NIFTY FMCG | 58449.45 3.1 | 2.90 4.24 | 2.51 5.86 |

| NIFTY PSU Bank | 6236.30 -1.28 | -4.65 1.35 | -4.74 -3.56 |

| NIFTY Metal | 8309.15 -1.08 | -3.94 -1.54 | -3.83 5.30 |

| NIFTY Realty | 951.30 3.25 | -9.60 11.45 | -8.59 12.16 |

| NIFTY Energy | 33189.60 -2.08 | -5.68 -0.22 | -6.32 -10.08 |

| NIFTY Infra | 8255.45 -1.11 | -2.46 0.14 | -2.88 5.49 |

| NIFTY Media | 1613.85 2.13 | -11.22 -1.80 | -11.94 -24.15 |

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 23486.95 -0.09 | -0.67 1.71 | -1.08 8.25 |

| NIFTY BANK | 49551.55 -0.07 | -2.57 2.45 | -2.96 7.28 |

| NIFTY Midcap 100 | 53536.30 -0.33 | -6.40 0.51 | -6.81 10.85 |

| NIFTY Smallcap 100 | 16982.25 0.42 | -9.52 0.15 | -10.43 5.30 |

| NIFTY NEXT 50 | 63588.15 0.73 | -6.47 1.75 | -6.83 14.55 |

-330

February 01, 2025· 15:00 IST

No compensation announced for LPG under-recovery in Budget 2025; OMCs shares tank

Budget 2025: For 2024-25, the government allocated Rs 14,700 crore for total LPG subsidy to the OMCs, showed budget documents. The OMCs have been allocated Rs 12,100 crore for 2025-26 for LPG subsidy....Read More

-330

February 01, 2025· 14:59 IST

Shrikant Chouhan, Head Equity Research, Kotak Securities

The Union Budget 2025-26 exempts annual income up to Rs 12 lakh from income tax, boosting consumer spending and adding focus on urban consumption. The Dhan Dhanya Krishi Yojana will support 1.7 crore farmers and enhance rural employment. Additionally, 36 life-saving drugs will have no Basic Customs Duty, and there are plans to develop 50 tourism destinations and promote medical tourism with the "Heal-in-India" initiative.

Overall, the budget prioritizes labour-intensive sectors like tourism, textiles, footwear, and startups, balancing fiscal responsibility (fiscal deficit target of 4.4% for FY26) while benefiting the middle class and driving long-term investments.

-330

February 01, 2025· 14:54 IST

Sensex Today | TVS Motor's sales up 17% in January 2025

TVS Motor Company recorded monthly sales of 397,623 units in January 2025 with a growth of 17% as against 339,513 units in the month of January 2024.

Total two-wheelers registered a growth of 18% with sales increasing from 329,937 units in January 2024 to 387,671 units in January 2025.

EV sales registered a growth of 55% with sales increasing from 16,276 units in January 2024 to 25,195 units in January 2025.

-330

February 01, 2025· 14:51 IST

Core sector stocks decline as Budget 2025 falls short on capex allocation

The budget allocated Rs 11.2 lakh crore for capital expenditure for FY26 is lower than the Rs 11.5 lakh crore allocation of FY25. ...Read More

-330

February 01, 2025· 14:49 IST

Sensex Today | BSE PSU Index down 2%; snaps 3-day gain

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Mishra Dhatu | 299.65 | -8.74 | 75.27k |

| Rail Vikas | 438.95 | -7.87 | 5.85m |

| Ircon Internati | 204.25 | -7.81 | 2.71m |

| IRFC | 142.15 | -5.83 | 8.38m |

| Bharat Dynamics | 1,234.30 | -5.47 | 276.74k |

| REC | 430.05 | -4.4 | 481.51k |

| HINDPETRO | 342.85 | -4.27 | 226.73k |

| Hindustan Aeron | 3,786.70 | -3.93 | 283.76k |

| Container Corp | 750.20 | -3.86 | 70.18k |

| Mazagon Dock | 2,403.00 | -3.8 | 265.97k |

| BEML | 3,698.60 | -3.76 | 31.57k |

| HUDCO | 221.10 | -3.72 | 1.43m |

| Gujarat Gas | 468.00 | -3.68 | 9.85k |

| Power Finance | 407.00 | -3.68 | 547.16k |

| IFCI | 54.19 | -3.66 | 1.52m |

| Cochin Shipyard | 1,478.45 | -3.52 | 239.06k |

| Indian Renew | 195.10 | -3.49 | 3.13m |

| Bharat Elec | 282.70 | -3.45 | 6.14m |

| BHEL | 201.00 | -3.44 | 1.73m |

| Power Grid Corp | 291.55 | -3.41 | 479.97k |

-330

February 01, 2025· 14:47 IST

Siddarth Bhamre, Asit C Mehta

The highlight and headlines for this budget definitely will be the tax benefits to the middle class. This will certainly boost consumption which augurs well for sectors like FMCG, Paints, Auto, etc. However one should look beyond these measures to see the big picture.

This budget gives a glimpse of nation building. The way FM has structured and presented this budget is out of the economics text books. Focus is not just on giving immediate reliefs but also to provide skill-set, platform and capital for sustainable growth. It's like "Give a man a fish, and you will feed him for a day; teach a man how to fish and you feed him for lifetime". In short, Atmanirbhar.

Focus on sectors like agriculture, power, labour intensive industries, capital availability for MSMEs was much needed. Also attention towards urban development has come at a time when urban growth has been slowing down.

This budget is providing immediate relief to tax payers to boost consumption and at the same time taking steps to achieve long term goals by host of reforms which may not appear big ticket but will create a momentum which may thrive on its own over a period of time.

-330

February 01, 2025· 14:45 IST

Brokerage Call | CLSA maintains 'outperform' rating on IndusInd Bank, target at Rs 1,300

#1 Muted quarter given stress in MFI industry

#2 PpOP was largely in-line while credit costs were 20-25 bps higher

#3 MFI slippages increased sequentially, while non-MFI retail slippages were marginally better

#4 Silver lining here is that December was much better Oct/Nov in terms of early delinquencies

#5 Overall loan growth was modest while NIM contracted another 15 bps QoQ

-330

February 01, 2025· 14:33 IST

Poonam Upadhyay, Director, Crisil Ratings

The proposed hike in tax collected at source threshold on remittances under the Reserve Bank of India's Liberalised Remittance Scheme from Rs 7 lakh to Rs 10 lakh should benefit the travel and foreign exchange sectors.

It will provide tailwinds for the outbound tourism and airline sector. Students and individuals seeking medical treatment will also benefit.

-330

February 01, 2025· 14:32 IST

Sensex Today | BSE Energy index down 1.5%; HPCL, Gujarat Gas, Aegis Logistics among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HINDPETRO | 343.35 | -4.13 | 221.88k |

| Gujarat Gas | 469.95 | -3.28 | 8.37k |

| Aegis Logistics | 679.95 | -2.94 | 40.25k |

| IGL | 196.60 | -2.6 | 120.73k |

| Guj State Petro | 337.90 | -2.33 | 20.40k |

| Petronet LNG | 309.00 | -2.25 | 26.46k |

| BPCL | 255.50 | -2.18 | 819.01k |

| Coal India | 387.50 | -2.1 | 280.96k |

| Oil India | 412.55 | -2.03 | 77.52k |

| IOC | 126.00 | -1.98 | 848.22k |

| ONGC | 257.40 | -1.94 | 270.34k |

| ConfidencePetro | 67.48 | -1.58 | 30.30k |

| Savita Oil Tech | 471.95 | -1.53 | 749 |

| Jindal Drilling | 896.45 | -1.27 | 67.44k |

| Mahanagar Gas | 1,361.85 | -1.27 | 18.62k |

| Adani Total Gas | 636.95 | -1.03 | 54.16k |

| Ganesh Benzo | 123.55 | -0.96 | 5.01k |

| Chennai Petro | 537.60 | -0.74 | 30.34k |

| GAIL | 176.35 | -0.48 | 860.53k |

| Castrol | 176.55 | -0.48 | 196.78k |

-330

February 01, 2025· 14:30 IST

FM Nirmala Sitharaman bets on salaried middle class to power economy

No taxes upto Rs 12 lakh annual income set to boost consumption spending; stays the path on fiscal consolidation with fiscal deficit target of 4.4 pc in FY26; farm economy in FM’s focus too with a slew of measures....Read More

-330

February 01, 2025· 14:26 IST

Banking stocks fell after Budget 2025 increases gross borrowings by 6% to Rs 15 lakh crore in FY26

Analysts had said that with more tax exemptions, people would have more money in hand, which could improve deposit and credit growth for banks....Read More

-330

February 01, 2025· 14:16 IST

Sensex Today | India VIX Drops Significantly

India VIX, the fear index that measures expected market volatility, has corrected sharply for the third consecutive session after several days of an upward trend, especially ahead of the budget. On Budget day, at 14:12 hours IST, the VIX fell by 11.91% to 14.32, providing strong comfort for bulls after falling nearly 7% in each of the previous two weeks.

In fact, with the VIX falling below all key moving averages, it reached a comfort zone for bulls on Saturday.

-330

February 01, 2025· 14:12 IST

Brokerage Call | Jefferies maintains 'hold' rating on Biocon, target at Rs 400

#1 Q3 missed estimates due to soft performance from generics & biosimilars division

#2 Growth is expected to pick-up here on with new launches in UK/EU & US

#3 Key to monitor is market share gains in new launches

#4 Key to monitor is FCF generation given high capex intensity

#5 Cut FY26/27 EBITDA by 4 percent/5 percent

-330

February 01, 2025· 14:05 IST

Shri Ashishkumar Chauhan, MD & CEO, NSE

The budget builds on India’s growth momentum with strong development measures, continued fiscal prudence, increased capex and reduced tax burden. Increase in disposable income enhances consumption growth and provides further wealth creation opportunities to Indian households through the markets.

More and more people will join the pool of current 11 crore unique investors and will become stakeholders and beneficiaries of India’s growth journey thereby supporting a virtuous cycle of economic growth, capital formation and job creation. Through a slew of social welfare measures on employment, education, healthcare, women empowerment and with special support to youth, farmers, MSMEs and startups - the budget focuses on India’s most important resource - its people

-330

February 01, 2025· 14:01 IST

Markets@2 | Sensex, Nifty trade flat

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Trent | 6,162.00 | 7.11 | 1.35m |

| Maruti Suzuki | 12,941.60 | 5.13 | 926.79k |

| Britannia | 5,343.20 | 4.16 | 414.23k |

| ITC | 466.05 | 4.15 | 25.64m |

| Eicher Motors | 5,400.00 | 3.96 | 496.26k |

| TATA Cons. Prod | 1,061.70 | 3.62 | 2.44m |

| HUL | 2,556.20 | 3.54 | 2.24m |

| Bajaj Auto | 9,140.00 | 3.3 | 312.40k |

| M&M | 3,085.70 | 3.21 | 2.11m |

| Asian Paints | 2,370.90 | 3.05 | 1.00m |

| Titan Company | 3,592.70 | 2.94 | 1.15m |

| IndusInd Bank | 1,016.25 | 2.53 | 5.21m |

| Hero Motocorp | 4,437.05 | 2.26 | 987.96k |

| Bajaj Finance | 8,061.80 | 2.24 | 1.18m |

| Nestle | 2,361.75 | 2.1 | 936.95k |

| Axis Bank | 999.70 | 1.38 | 3.92m |

| Apollo Hospital | 6,902.55 | 1.35 | 100.30k |

| Bajaj Finserv | 1,752.15 | 0.92 | 2.11m |

| Sun Pharma | 1,754.50 | 0.6 | 1.22m |

| Kotak Mahindra | 1,909.70 | 0.44 | 870.53k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharat Elec | 280.40 | -4.19 | 50.28m |

| Larsen | 3,420.05 | -4.13 | 2.94m |

| Power Grid Corp | 290.45 | -3.71 | 4.56m |

| Cipla | 1,432.35 | -3.18 | 906.10k |

| BPCL | 253.75 | -2.82 | 8.51m |

| Coal India | 386.55 | -2.36 | 5.22m |

| Grasim | 2,451.50 | -2.29 | 370.12k |

| ONGC | 256.80 | -2.21 | 9.53m |

| Shriram Finance | 533.45 | -1.89 | 2.76m |

| Tech Mahindra | 1,645.95 | -1.7 | 273.85k |

| JSW Steel | 930.05 | -1.58 | 1.16m |

| HCL Tech | 1,698.60 | -1.56 | 392.47k |

| Tata Steel | 132.56 | -1.53 | 15.72m |

| SBI | 761.55 | -1.47 | 7.06m |

| HDFC Life | 628.70 | -1.47 | 7.91m |

| UltraTechCement | 11,321.55 | -1.44 | 390.16k |

| Wipro | 307.75 | -1.33 | 4.81m |

| Infosys | 1,854.90 | -1.32 | 883.60k |

| Adani Ports | 1,087.85 | -1.05 | 3.87m |

| TCS | 4,071.50 | -0.99 | 262.86k |

-330

February 01, 2025· 13:59 IST

Colin Shah, MD, Kama Jewelry

The reduction of Jewellery duty from 25% to 20% is a welcome move. For a country like India who is known for its high jewellery consumption, this will definitely boost the demand in the domestic market specially in luxury. Similarly, slashing of duty on platinum finding from 25% to 5% is yet another bold move which will prove beneficial for the entire gems and jewellery industry.

One of the biggest positives of the budget was the government acknowledging the MSME sector as one of the four engines that will power India's growth. Under this, increasing the MSME turnover limit from Rs. 250 to Rs. 500 Cr is another bold announcement which will propel the growth and strengthen the MSMEs.

The budget also provided some rejoice to the diamond sector by removing IGCR condition for import of duty free LGD (Lab Grown Diamond) seeds which will further increase the appeal of LGDs and boost its demand.

Provision of a separate HS code for platinum and gold alloys is another positive step that will prevent malpractices and ensure fair play in the industry.

-330

February 01, 2025· 13:57 IST

Sensex Today | Nifty Auto index up 2%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Maruti Suzuki | 12,961.05 | 5.28 | 916.16k |

| TVS Motor | 2,558.10 | 4.08 | 1.48m |

| Eicher Motors | 5,398.95 | 3.94 | 491.30k |

| Exide Ind | 387.90 | 3.58 | 7.21m |

| M&M | 3,088.95 | 3.31 | 2.08m |

| Bajaj Auto | 9,124.50 | 3.13 | 302.86k |

| Hero Motocorp | 4,434.65 | 2.2 | 971.35k |

| MOTHERSON | 142.60 | 0.95 | 4.40m |

| Balkrishna Ind | 2,797.00 | 0.93 | 60.61k |

| Bosch | 28,787.00 | 0.2 | 7.98k |

| MRF | 113,690.00 | 0.05 | 2.80k |

-330

February 01, 2025· 13:53 IST

Stock Market LIVE Updates | Rail stocks under pressure after no major reforms for sector in Budget

-330

February 01, 2025· 13:48 IST

Brokerage Call | Nomura keeps 'buy' rating on Marico, target at Rs 800

#1 Good performance in Q3, on way to becoming better

#2 Sales above estimates; EBITDA in-line

#3 New price hikes in parachute to support growth & margin

#4 Growth business sees strong growth, on track to be profitable

-330

February 01, 2025· 13:47 IST

Stock Market LIVE Updates | Defence stocks fall as as FY26 defence outgo seen at Rs 4.917 lakh crore

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Zen Tech | 1783 | 2.41 | 664218 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Paras Defence | 1068 | -5.98 | 458066 |

| Bharat Dynamics | 1232 | -5.59 | 1833697 |

| Krishna Defence | 670 | -4.46 | 50000 |

| Astra Microwave | 722.5 | -2.72 | 158370 |

-330

February 01, 2025· 13:44 IST

Stock Market LIVE Updates: Nifty Realty index up 2% after TDS threshold limit on rent hiked to Rs 6 lakh

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 1,755.00 | 6.89 | 330.63k |

| Prestige Estate | 1,438.45 | 5.81 | 2.39m |

| Macrotech Dev | 1,259.70 | 4.58 | 813.98k |

| Sobha | 1,370.00 | 3.33 | 247.17k |

| DLF | 762.90 | 2.4 | 1.94m |

| Godrej Prop | 2,383.05 | 2.3 | 378.69k |

| Oberoi Realty | 1,853.45 | 2.25 | 405.32k |

| Raymond | 1,515.00 | 0.24 | 133.26k |

-330

February 01, 2025· 13:42 IST

Oneeka Medh, Research Analyst, Samco Securities

The Union Budget’s announcement of a Rs 20,000 crore allocation for a dedicated Nuclear Energy Mission in 2025-26, alongside the development of Bharat Small Reactors (BSRs) in 2024-25, is a game-changer for India’s energy landscape. Companies like Larsen & Toubro (L&T) and Bharat Heavy Electricals Limited (BHEL) are set to benefit from this initiative.

This mission aims to operationalize five SMRs by 2033, significantly advancing India’s nuclear energy capabilities. It also aligns with the goal of generating 100GW of nuclear energy by 2047, reducing reliance on fossil fuels and helping meet the nation’s growing energy needs in a sustainable manner. The focus on indigenous development of SMRs and the broader push for nuclear energy will not only boost India’s energy security but also foster advancements in technology and innovation. This will create high-skilled job opportunities in research, engineering, and manufacturing, while positioning India as a global leader in clean energy.

-330

February 01, 2025· 13:40 IST

Stock Market LIVE Updates | Jewellery stocks rally after FM exempts income tax up to Rs 12 lakh

Jewellery stocks were glittering in trade on February 1 after the Finance Minister Nirmala Sitharaman announced that under the new tax system, those earning up to Rs 12 lakh would not be obliged to pay taxes. This is expected to increase household consumption, savings, and investment.

-330

February 01, 2025· 13:38 IST

Nuclear Energy stocks gain as FM announces 100GW nuclear energy target

Additionally, for an active partnership with the private sector towards this goal, amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act will be taken up. ...Read More

-330

February 01, 2025· 13:36 IST

Shripal Shah, MD&CEO, Kotak Securities

The Union Budget 2025 is clearly focused on stimulating consumer demand to accelerate growth while ensuring fiscal stability. With economic expansion slowing over the past two quarters, the newly announced measures aim to reignite momentum.

A major relief in personal income tax has been introduced, allowing individuals earning up to ₹12 lakh to pay zero income tax. This move is expected to ease the financial burden on the middle class, cushion the impact of rising prices, and drive higher consumer spending as well as investments. Additionally, several reforms in the TDS and TCS regime have been well received.

A series of measures for the agriculture sector aims to boost self-reliance and strengthen commodity markets, which will, in turn, fuel rural demand.

While we await more details , the government's decision to keep capital gains tax and Securities Transaction Tax (STT) unchanged will ensure stability in tax regimes for capital market investors.

Furthermore, the launch of an Export Promotion Mission and the simplification of the customs duty structure are expected to enhance India's global trade competitiveness. These initiatives will support exports, improve the balance of payments, and strengthen foreign exchange reserves, ultimately contributing to rupee stability.

-330

February 01, 2025· 13:35 IST

Stock Market LIVE Updates | Sensex recovers 360 points from day's low

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Zomato | 234.80 | 234.90 215.60 | 8.91% |

| Bajaj Finserv | 1,730.35 | 1,753.80 1,620.00 | 6.81% |

| Maruti Suzuki | 12,960.05 | 13,140.25 12,242.45 | 5.86% |

| ITC | 464.95 | 471.30 439.50 | 5.79% |

| HUL | 2,566.55 | 2,600.00 2,434.80 | 5.41% |

| Titan Company | 3,573.80 | 3,601.00 3,417.60 | 4.57% |

| UltraTechCement | 11,291.75 | 11,789.55 10,800.15 | 4.55% |

| Nestle | 2,353.05 | 2,360.45 2,259.00 | 4.16% |

| IndusInd Bank | 1,010.00 | 1,022.90 973.75 | 3.72% |

| Asian Paints | 2,366.85 | 2,387.95 2,285.45 | 3.56% |

| Bajaj Finance | 8,030.00 | 8,034.40 7,782.50 | 3.18% |

| M&M | 3,078.45 | 3,094.10 2,994.55 | 2.8% |

| Adani Ports | 1,079.25 | 1,117.60 1,062.20 | 1.61% |

| Tata Motors | 710.85 | 724.85 701.40 | 1.35% |

| Tata Steel | 132.10 | 135.75 130.35 | 1.34% |

| Kotak Mahindra | 1,892.75 | 1,916.90 1,871.90 | 1.11% |

| Axis Bank | 992.10 | 1,004.85 982.00 | 1.03% |

| NTPC | 324.25 | 330.80 321.00 | 1.01% |

| Bharti Airtel | 1,625.55 | 1,644.15 1,610.50 | 0.93% |

| Power Grid Corp | 291.30 | 305.45 288.65 | 0.92% |

-330

February 01, 2025· 13:26 IST

Swiggy, Zomato shares rise up to 7% from day's low amid income tax relief in Budget 2025

In a major change in direct tax slabs, Sitharaman announced that no income tax will be payable on income of up to Rs 12 lakh...Read More

-330

February 01, 2025· 13:24 IST

Aravind Venugopal, Partner, Khaitan & Co:

The proposal to increase FDI in insurance to 100% is a timely and much-needed reform. This move will significantly boost capital inflow into the sector and enhance insurance penetration, aligning with the regulatory vision of ‘Insurance for All’ by 2024. The announcement to simplify regulations is also a welcome step.

However, a detailed review of the fine print—particularly regarding the requirement that the entire premium must be invested in India—is essential. We also await further operational guidance from IRDAI on the way forward.

-330

February 01, 2025· 13:22 IST

Stock Market LIVE Updates | Dixon Technologies share price breaks two-day gaining streak

-330

February 01, 2025· 13:15 IST

Sensex Today | Nifty PSU Bank index down nearly 2%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of India | 107.11 | -4.81 | 5.68m |

| Indian Bank | 534.90 | -3.75 | 891.08k |

| Union Bank | 111.92 | -3.09 | 5.90m |

| Punjab & Sind | 47.15 | -2.46 | 720.09k |

| PNB | 98.79 | -2.38 | 20.02m |

| SBI | 754.85 | -2.34 | 5.81m |

| Central Bank | 51.17 | -1.69 | 2.80m |

| Bank of Mah | 50.46 | -1.62 | 6.27m |

| Canara Bank | 91.84 | -1.53 | 11.74m |

| UCO Bank | 42.95 | -1.29 | 3.32m |

| IOB | 50.42 | -1.14 | 3.69m |

| Bank of Baroda | 211.47 | -0.9 | 8.80m |

-330

February 01, 2025· 13:13 IST

Brokerage Call | MOSL keeps 'neutral' rating on Vedanta, target at Rs 500

#1 Operational performance in-line; lower tax outgo drives profit beat

#2 Management targets to maintain strong growth in earnings

#3 Company remains firm on its deleveraging plans

#4 Going forward, higher cash flows will support both expansion plan & deleveraging efforts

-330

February 01, 2025· 13:10 IST

Nilesh Shah, MD - Kotak Mahindra AMC

The budget delivers on the expectations of Triveni sangam of reduction in fiscal deficit, support to urban consumption through tax cuts and increase in Capex through center, state and PSUs allocation.

-330

February 01, 2025· 13:09 IST

Sensex Today | Ambika Cotton Mills gains after launching 5-year mission to boost cotton production

-330

February 01, 2025· 13:07 IST

Sensex Today | Tata Motors registered total sales of 80,304 units in January 2025

#1 Total CV sales of 31,988 units

#2 Total PV sales of 48,316 units, -11% YoY

-330

February 01, 2025· 13:04 IST

Stock Market LIVE Updates | Eicher Motors total sales increase 20% at 8,489 units

-330

February 01, 2025· 13:01 IST

Markets@1 | Sensex down 160 points, Nifty around 23400

-330

February 01, 2025· 13:00 IST

Anitha Rangan, Economist, Equirus

While adhering to fiscal consolidation, the budget sets a reform centric longer term vision by including all stakeholders viz. states, and public private partnership. Fiscal deficit at 4.4% for FY26 and 4.8% balances the fiscal deficit while at the same time, several progressive reforms in agriculture, rural, MSME, employment is constructive. With a special focus on long term investment encompassing, people, economy and innovation, the fund mechanism of funding will encompass private participation.

In addition, there is focus on urban development and revitalization of asset monitisation along with clean energy which suggests more longer term focus. While capex growth does not look very robust, implicit capex via long term reforms shows promise. Simplification of DT reforms will be announced in a week, but the icing in the cake came in the end with income tax relief to middle class (with direct tax foregone of Rs.1 lac crores).

Overall, policy centric, consumption centric, strong focus on execution should follow the strong intent.

-330

February 01, 2025· 12:59 IST

Stock Market LIVE Updates | Insurance stocks under pressure

-330

February 01, 2025· 12:57 IST

Agri stocks rise after Budget 2025 announces measures to boost agriculture, farmer incomes

Budget 2025: The agri sector was hoping for continued policy support to boost rural economy, farmers income and crop productivity....Read More

-330

February 01, 2025· 12:51 IST

Stock Market LIVE Updates | Avanti Feeds, Mukka Proteins shares in focus

Government will bring in enabling framework for sustainable harness of fisheries in India's exclusive economic zones

-330

February 01, 2025· 12:49 IST

Stock Market LIVE Updates | Hyundai Motor India January sales stands at 65,603 units

Hyundai Motor India Limited (HMIL) recorded total monthly sales of 65,603 units in January 2025, comprising domestic sales of 54,003 units and export sales of 11,600 units.

-330

February 01, 2025· 12:48 IST

Stock Market LIVE Updates | Apar Industries shares gain on capacity expansion

Apar Industries informed about the proposed capacity addition by way of setting up of additional line for processing of Aluminum Rod which will be used in the manufacture of Conductors and Cables.

-330

February 01, 2025· 12:44 IST

Bharat Gianani, Research Analyst, Moneycontrol Research

Government has lowered the tax liability under the Income tax. Under the old regime, the nil tax slab has been raised from Rs 7 lakh earlier to Rs 12 lakh. Under the new tax regime, tax slabs and liability has been lowered providing benefit of Rs 70,000 to Rs 1.1 lakh for income earners in Rs 12 lakh to Rs 25 lakh bracket.

Lower taxes would increase disposable incomes in hands of consumers. This is positive for discretionary consumption plays such as Trent Limited, Aditya Birla Fashion & Retail in apparel; Metro Brands, Campus Activewear in footwear; quick service restaurant companies such as Jubilant Foodworks, Devyani International as well as jewellery stocks like Senco Gold, Titan Company and Goldiam International.

-330

February 01, 2025· 12:42 IST

Brokerage Call | CLSA maintains 'outperform' call on Vedanta, target at Rs 530

#1 Q3 EBITDA was above estimates on better aluminium profitability

#2 Aluminium cost of production was up on higher purchased alumina cost

#3 COP was sequentially lower for zinc for both India and International

#4 Debt repayment to parent Vedanta Resources can be managed via brand fees/dividend

-330

February 01, 2025· 12:39 IST

T Manish, Research Analyst, SAMCO Securities

Considering the slow economic growth and boost it back on track the reduction in taxes would be a key factor to drive domestic consumption.

A lower tax rate is expected to boost revenue, while an increase in the Sec 80C investment limit would raise disposable income. This would directly benefit FMCG companies like HUL, ITC, Dabur, and Nestle, with indirect gains for their suppliers such as Polyplex and Uflex.

Additionally, higher savings could drive inflows into equity markets, benefiting financialization-focused firms like depositories, AMCs, and stockbrokers. Increased disposable income may also support discretionary spending and premiumization plays, including stocks like Ethos, Landmark cars, and KDDL.

These significant changes in the new tax regime in the basic exemption limits would impact the individuals’ pockets happily.

-330

February 01, 2025· 12:38 IST

Sensex Today | Government announces Rs11.2 lakh crore capital expenditure for FY26 compared to Rs 11.5 lakh crore last year

-330

February 01, 2025· 12:36 IST

Sensex Today | BSE Auto index rises 1.5%; Maruti Suzuki, TVS Motor, Hero MotoCorp, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Maruti Suzuki | 12,971.75 | 5.39 | 12.40k |

| TVS Motor | 2,545.05 | 3.56 | 17.68k |

| Hero Motocorp | 4,468.50 | 2.94 | 39.70k |

| Sundram | 1,073.70 | 2.83 | 2.51k |

| Bajaj Auto | 9,100.55 | 2.82 | 7.87k |

| Eicher Motors | 5,323.65 | 2.44 | 9.57k |

| UNO Minda | 964.65 | 1.98 | 18.79k |

| M&M | 3,044.00 | 1.75 | 37.44k |

| Exide Ind | 380.00 | 1.48 | 350.71k |

| Bosch | 28,850.00 | 0.4 | 585 |

| MOTHERSON | 141.70 | 0.39 | 259.45k |

-330

February 01, 2025· 12:30 IST

Consumer Durables index, Whirlpool, Blue Star, Kalyan Jewellers stocks gain as no income tax up to Rs 12 lakhs announced in Budget 2025

FM Nirmala Sitharaman announced that no income tax will be payable on income up to Rs 12 lakh, boosting consumption stocks. ...Read More

-330

February 01, 2025· 12:28 IST

Vishal Sharma, Co-founder & CEO of AdvaRisk

Finance Minister Nirmala Sitharaman's Budget proposal to raise Kisan Credit Cards (KCC) loan limit to Rs 5 lakh is much needed revision to uplift the condition of our annadatas. We had expected this in the Budget given the government's focus on empowerment of marginalised communities. The move will ensure farmers are able to procure enough credit to increase the productivity, which will give boost to rural economic growth. Additionally, the loan cap within the revised interest subvention scheme will be raised from Rs 3,000 to Rs 5,000 for KCC loans, which will enhance financial assistance for agricultural activities to small farmers, who are most susceptible to risks in farming activities.

We believe the KCC loan limit should be periodically revised in the coming years as well to account for rising inflation. We also need to focus on swift disbursal of these loans, where technology such as AI can be great enablers. Automating KCC loans increase efficiency and satiate the need of farmers on time, reducing the risk of crop failures due to lack of finance during sowing.

-330

February 01, 2025· 12:27 IST

Sensex Today | BSE FMCG index up 3%; Kaveri Seed, ITC, Britannia top contributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Kaveri Seed | 974.20 | 8.32 | 44.24k |

| Mukka Proteins | 39.10 | 6.83 | 328.60k |

| Godrej Consumer | 1,186.05 | 5.77 | 36.86k |

| Godrej Agrovet | 759.00 | 4.19 | 22.97k |

| ITC | 465.75 | 4.07 | 781.40k |

| Godfrey Phillip | 4,698.90 | 3.99 | 4.07k |

| Britannia | 5,326.10 | 3.87 | 11.87k |

| Avanti Feeds | 733.85 | 3.73 | 109.70k |

| HUL | 2,559.50 | 3.57 | 71.55k |

| Bikaji Foods | 714.50 | 3.33 | 17.33k |

| Chaman Lal Seti | 330.10 | 3.14 | 5.35k |

| Bannariamman | 3,721.00 | 2.97 | 6 |

| Colgate | 2,898.80 | 2.75 | 3.36k |

| VST | 328.35 | 2.58 | 9.16k |

| Dabur India | 542.70 | 2.51 | 49.74k |

| Varun Beverages | 549.85 | 2.45 | 75.68k |

| Emami | 602.75 | 2.4 | 5.57k |

| Guj Amb Exports | 116.70 | 2.37 | 40.90k |

| TATA Cons. Prod | 1,048.40 | 2.32 | 41.71k |

| Parag Milk Food | 174.45 | 2.26 | 29.96k |

-330

February 01, 2025· 12:20 IST

Sensex Today | Railway stocks under pressure

-330

February 01, 2025· 12:19 IST

Income Tax Slabs 2025: No income tax upto Rs 12 lakhs, check new slab rates here

Check the key income tax changes in Budget 2025, including revised tax slabs, updated standard deduction limits, and major tax policy announcements impacting taxpayers....Read More

-330

February 01, 2025· 12:16 IST

Sensex Today | BSE FMCG index recovers more than 500 points from day's low

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| GRM Overseas | 233.55 | 240.00 193.05 | 20.98% |

| Chaman Lal Seti | 329.25 | 330.70 310.00 | 6.21% |

| Mukka Proteins | 38.99 | 41.08 36.72 | 6.18% |

| Kaveri Seed | 975.25 | 1,020.70 922.05 | 5.77% |

| ITC | 462.30 | 462.55 439.50 | 5.19% |

| Godrej Consumer | 1,160.70 | 1,160.70 1,104.10 | 5.13% |

| Venkys | 1,801.55 | 1,825.55 1,736.05 | 3.77% |

| Parag Milk Food | 173.60 | 174.70 167.30 | 3.77% |

| Godfrey Phillip | 4,608.85 | 4,640.00 4,451.15 | 3.54% |

| DCM Shriram Ind | 172.60 | 177.15 167.05 | 3.32% |

| Colgate | 2,886.80 | 2,892.45 2,794.70 | 3.3% |

| HUL | 2,514.50 | 2,515.00 2,434.80 | 3.27% |

| Gulshan Poly | 198.00 | 208.05 192.20 | 3.02% |

| Avanti Feeds | 731.15 | 762.00 710.00 | 2.98% |

| Jyothy Labs | 403.35 | 405.10 391.80 | 2.95% |

| Vadilal Ind | 3,855.40 | 3,855.40 3,745.00 | 2.95% |

| Dabur India | 538.40 | 538.70 523.00 | 2.94% |

| Heritage Foods | 439.45 | 448.85 427.15 | 2.88% |

| LT Foods | 388.80 | 394.30 378.05 | 2.84% |

| Bikaji Foods | 707.45 | 713.35 687.95 | 2.83% |

-330

February 01, 2025· 12:15 IST

Sensex Today | Auto, Consumer Durables stocks shine as FM announces no income tax till Rs 12 lakh income under new income tax regime

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Exide Ind | 387.15 | 3.39 | 303.26k |

| Sundram | 1,075.00 | 2.95 | 2.40k |

| Maruti Suzuki | 12,620.90 | 2.54 | 5.76k |

| Bajaj Auto | 8,990.00 | 1.57 | 3.36k |

| MOTHERSON | 143.00 | 1.31 | 249.39k |

| TVS Motor | 2,482.00 | 1 | 7.28k |

| M&M | 3,013.10 | 0.72 | 28.24k |

| MRF | 113,625.00 | 0.02 | 96 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Blue Star | 1,868.90 | 2.78 | 18.59k |

| Whirlpool | 1,167.00 | 2.37 | 27.05k |

| Kalyan Jeweller | 514.00 | 2.29 | 1.35m |

| Voltas | 1,280.50 | 1.55 | 104.86k |

| Dixon Technolog | 15,209.70 | 1.45 | 11.38k |

| Supreme Ind | 4,008.90 | 0.96 | 2.95k |

| CG Consumer | 344.60 | 0.48 | 12.19k |

| Titan Company | 3,500.00 | 0.3 | 14.90k |

| Havells India | 1,567.05 | 0.03 | 6.50k |

-330

February 01, 2025· 12:14 IST

Sensex today | FM proposes no income tax up to Rs 12 lakh

-330

February 01, 2025· 12:12 IST

Sensex today | FM proposes to extend period of incorporation of startups to 5 years

-330

February 01, 2025· 12:11 IST

Sensex today | FM propose to exempt withdrawals made under National Savings Scheme (NSS) accounts from tax