Personal loan is a popular type of loan available in India. This loan is not limited to any specific usage, that is, it can be used for meeting any type of personal financial needs such as marriage expenses, emergency medical expenses, home renovation, travel abroad plans, etc.

Principal Amount

Interest Amount

| Monthly EMI: | |

| Principal Amount: | |

| Interest Amount: | |

| Total Amount Payable: | |

| Fixed ROI: |

Your Amortization Details (Yearly/Monthly)

How it Works and Formula

Technically there are two types of personal loan interest calculations: the flat interest rate method and the reducing balance method.

In this method, personal loan interest is calculated on the entire amount that you have borrowed. What it means is that even while you are paying the EMIs, the lender continues to charge interest on the original principal amount. The total interest is divided across EMIs throughout the loan tenure.

Total Interest = (Loan Amount × Interest Rate × Loan Tenure) / 100

In this method, the interest is calculated on the remaining principal amount after deducting each EMI as you pay it. This means the interest component of the EMI decreases as the outstanding principal reduces.

EMI = [P × r × (1+r)^n] / [(1+r)^n – 1]

Using the formula shown above, the EMI will be ₹11,122 and the total interest paid will be ₹1,67,320 which is lower than the one charged in the flat interest rate method.

Most lenders in India offer loans with the reducing balance method, which is more favorable for borrowers as it results in lower overall interest payments.

The interest rate on a personal loan can vary based on the lender's policies and factors such as your credit score, income, employment status, etc. Currently, personal loan interest rates start at around 10% to 12% per annum.

Fixed interest rates remain the same throughout the tenure of your personal loan. They are opted by people who want to have a predictable EMI payment. Floating interest rates vary depending on the Marginal Cost of Funds-based Lending Rate (MCLR). In India, lenders generally offer fixed interest rate personal loans.

Personal loan eligibility is decided based on factors such as credit score, age, income, and your repayment capacity. Before applying for a personal loan, you should check whether you meet the eligibility criteria set by the lender to avoid any rejections.

You can find personal loan eligibility factors online that take into account following parameters:

Lenders usually prefer salaried applicants who have a minimum monthly income of ₹15,000 to ₹30,000. The amount can be higher for self-employed individuals. The exact income criteria may change based on the lender’s policies.

You need to enter the amount of your existing loans and EMIs in the eligibility calculator. This information is used by lenders to check your Debt-to-Income (DTI) ratio which basically compares your monthly debt payments to your gross monthly income.

The personal loan calculator requires you to enter the tenure of repayment you are most comfortable with.

Based on the details entered by you, the personal loan calculator will show a tentative personal loan amount you can apply for. The actual personal loan amount is decided by the lender based on a detailed analysis of your application.

Having a higher and steady income can increase your chances of personal loan approval and help you become eligible for better personal loan interest rates.

A consistent repayment history indicates you are a reliable borrower. It can help you get a personal loan at lower interest rates.

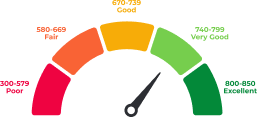

A high credit score is an indicator of your creditworthiness. A credit score above 750 can help secure the best personal loan rates and offers.

The ratio of your current liabilities to your gross income, also known as the debt-to-income ratio plays a big role in determining your risk profile. Lenders prefer a low debt-to-income ratio.

If you have a history of any loan default mentioned on your credit report, you may struggle getting a personal loan approval or a loan with good interest rates.

Personal loan is made available by almost all banks and NBFCs in India. You can check your options online to compare the interest rates, flexibility of repayment and documentation required before choosing a lender. Following are some of the best personal loan offers you can consider:

Apply for a personal from these top lenders directly via the Moneycontrol app and website.

Instant disbursal

Instant disbursal Minimal documentation

Minimal documentation 100% digital process

100% digital processHere’s to apply for a personal loan on Moneycontrol

Enter your Personal details

Enter your Personal details Complete your KYC

Complete your KYC Set up EMI repayment

Set up EMI repayment

Applying for a personal loan in India is a straightforward process, especially when you apply through a digital lending platform.

Here are the general steps you need to follow to apply for a personal loan through any platform:

Do a thorough research on the different personal loan options you have and compare the offerings based on interest rates, processing fees, ease of application and more.

Typically, you’ll need the following documents to apply for a personal loan:

The easiest way to apply for a personal loan is via the online method. If you prefer applying for a loan offline, you can visit the branch of your chosen lender. Next, you need to fill out the application form, submit or upload your documents, and wait for an approval.

When your application is approved, the loan amount will be disbursed to your bank account or UPI ID.

Know your Credit Score for FREE

Explore Top Lenders for Instant Loan upto

This Fixed Deposit (FD) Calculator helps you find out how much interest you can earn on an FD and the value of your invesment (Principal) on Maturity.

Choose the right income tax regime & discover your tax savings

100% Digital, Instant Disbursal

Get FREE credit score and credit report

Get Instant loan ₹50 lakhs with Zero Paperwork from our Top Lenders

100% Digital

100% Digital Quick Disbursal

Quick Disbursal Low Interest Rates

Low Interest Rates