Closing Bell: Sensex, Nifty recover in last-hour buying as Trump tariff storm rages

Top Nifty gainers were Hero MotoCorp, Tech Mahindra, Wipro, Eternal, JSW Steel, while losers included Adani Enterprises, Adani Ports, Trent, Tata Motors and Grasim Industries. BSE Midcap index up 0.3 percent and smallcap index ended on flat note. All the sectoral indices recovered most of the intraday losses with IT, media, pharma rising 0.5-1 percent.

-330

August 07, 2025· 16:23 IST

Market Close | Sensex, Nifty gain in volatile session

Indian equity indices ended marginally higher with Nifty around 24,600 on August 7. At close, the Sensex was up 79.27 points or 0.10 percent at 80,623.26, and the Nifty was up 21.95 points or 0.09 percent at 24,596.15.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

August 07, 2025· 16:17 IST

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

Bulls have finally made a decisive comeback in the market on Thursday that witnessed a session of roller-coaster ride of up and down moves and Nifty finally closed the day on a positive note. After opening with a downside gap of 90 points, the market slipped into further weakness in the early to mid-part of the session. The sharp recovery has emerged from the low of 24344 from 1.40pm onwards and the strong upside momentum continued till the end. The opening downside gap has been filled completely.

A long bull candle was formed on the daily chart with lower shadow. Technically, this pattern shows an early sign of crucial bottom reversal pattern in the Nifty. Further follow-through upmove above the initial hurdle of 24750 could confirm the bottom reversal pattern. The crucial supports to be watched around 24350.

-330

August 07, 2025· 16:15 IST

Rupak De, Senior Technical Analyst at LKP Securities

Nifty witnessed a roller-coaster session as the index oscillated between 24,350 and 24,650. Although it briefly fell below 24,400, it did not sustain at lower levels and recovered smartly in the second half, closing near 24,600.

In the short term, the index may continue to recover; however, immediate resistance is seen at 24,660. A decisive move above this level could take the index towards 24,850. On the downside, support is placed at 24,400 on a closing or sustained basis.

-330

August 07, 2025· 16:01 IST

Taking Stock: Sensex, Nifty end higher amid last hour sharp recovery

More than 100 stocks touched their 52-week highs on the BSE, including Fortis Healthcare, Delhivery, JSW Steel, TVS Motor, JK Cement, Sarda Energy, Godfrey Phillips, among others....Read More

-330

August 07, 2025· 15:59 IST

Vaibhav Vidwani, Research Analyst at Bonanza

Today, Indian equity markets staged a remarkable recovery, with both benchmarks ending marginally higher despite facing significant headwinds from Trump's tariff announcements. The BSE Sensex closed at 80,396.79, gaining 79.27 points (0.10%), while the Nifty 50 ended at 24,574.20, up 37.20 points (0.15%). Importantly, the indices recovered nearly 750-800 points from their day's lows, demonstrating remarkable resilience in the face of global uncertainties.

The market's recovery was primarily driven by strong buying interest in banking heavyweights and select IT stocks. HDFC Bank and Reliance Industries led the recovery, while Hero MotoCorp emerged as a standout performer, surging 4% after reporting better-than-expected Q1 results despite weak sales.

The IT sector provided crucial support, with the Nifty IT index gaining 0.87%, as investors viewed the Trump tariff impact as potentially benefiting IT services through currency depreciation.

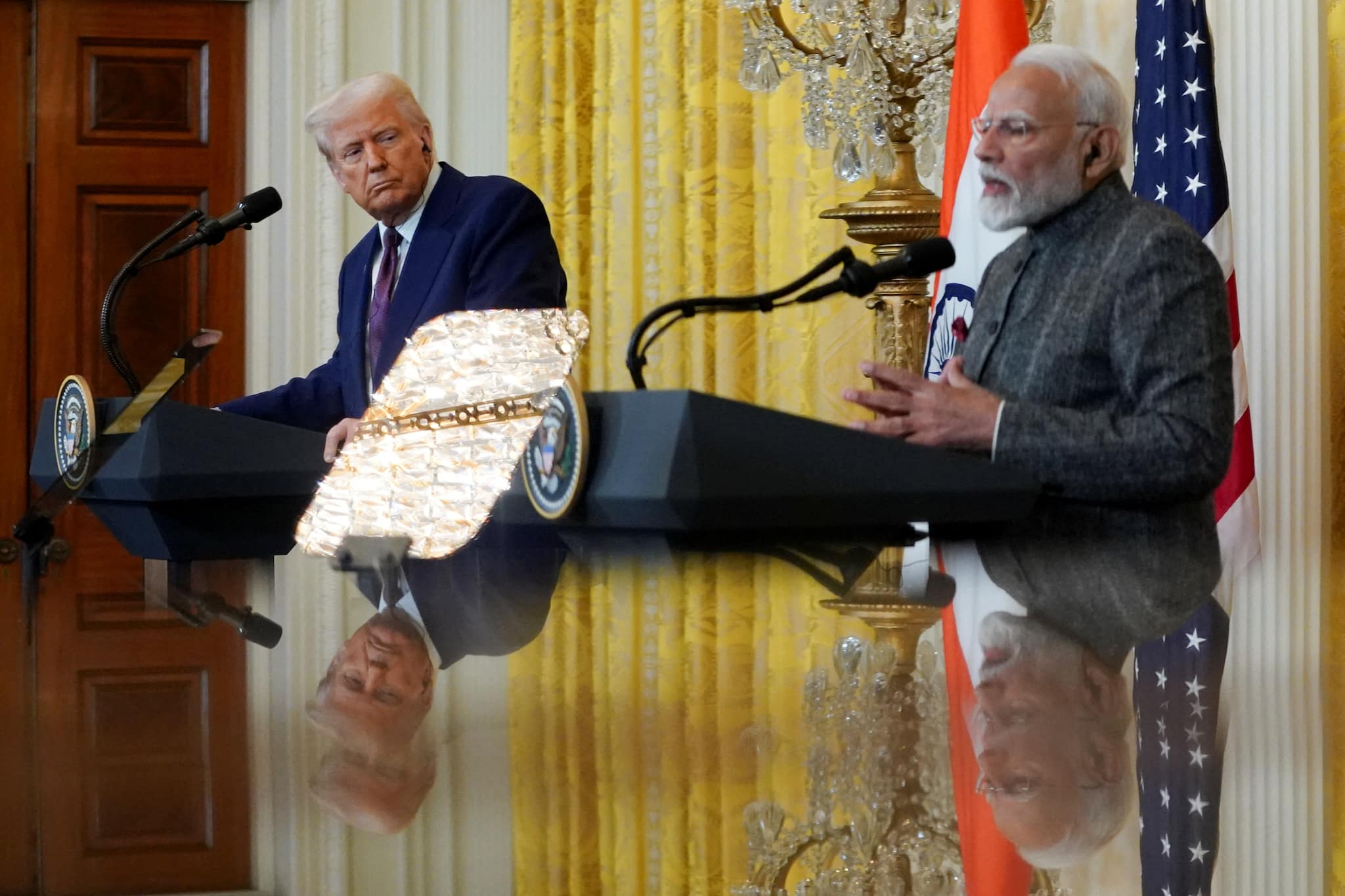

Markets initially opened under pressure following Trump's executive order doubling tariffs on Indian goods to 50%, citing India's continued oil purchases from Russia. The 21-day implementation window provided some relief, we believe this creates negotiation space between the two countries. Despite the tariff concerns, the market's ability to recover from intraday lows of nearly 700 points on the Sensex demonstrated underlying strength and buying appetite at lower levels.

-330

August 07, 2025· 15:52 IST

Vinod Nair, Head of Research, Geojit Investments

Domestic equities recovered sharply from the intraday lows amid a volatile weekly expiry day. Although the earlier trade was weighed down by broad-based selling following steep US tariff hikes on India, sentiment improved toward the close as reports of potential peace talks involving Trump, Putin, and Zelensky which raised hopes of a softer US stance on trade.

This renewed optimism triggered a strong rebound in the auto, pharma, metals, and energy sectors and aided the market in recalling its trajectory and concluding in the green.

-330

August 07, 2025· 15:50 IST

Dilip Parmar, Research Analyst, HDFC Securities

The Indian rupee closed on a flat note, after broadly trading within a narrow range. The rupee placed at the bottom of the regional pack, as most other Asian currencies have traded higher. A key factor influencing the rupee's weakness is the ongoing trade tension and the imposition of higher tariff on Indian goods by US.

The outlook and sentiment favour the US dollar versus rupee, driven by a continued imbalance in dollar demand and supply, as foreign funds persist with their selling of Indian assets. Looking ahead, the spot USDINR is expected to consolidate between 87.50 and 87.85 in the coming days.

-330

August 07, 2025· 15:45 IST

-330

August 07, 2025· 15:31 IST

Currency Check | Rupee closes flat

Indian rupee ended flat at 87.70 per dollar on Thursday versus previous close of 87.73.

-330

August 07, 2025· 15:30 IST

Market Close | Sensex, Nifty recover in last-hour buying as Trump tariff storm rages

Indian equity indices ended marginally higher with Nifty around 24,600 on August 7.

At close, the Sensex was up 79.27 points or 0.10 percent at 80,623.26, and the Nifty was up 21.95 points or 0.09 percent at 24,596.15. About 1716 shares advanced, 1996 shares declined, and 129 shares unchanged.

Top Nifty gainers were Hero MotoCorp, Tech Mahindra, Wipro, Eternal, JSW Steel, while losers included Adani Enterprises, Adani Ports, Trent, Tata Motors and Grasim Industries.

BSE Midcap index up 0.3 percent and smallcap index ended on flat note.

All the sectoral indices recovered most of the intraday losses with IT, media, pharma rising 0.5-1 percent.

-330

August 07, 2025· 15:26 IST

Sensex Today | Nifty IT index up 1%; Coforge, Mphasis, Persistent Systems top contributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| COFORGE LTD. | 1,705.90 | 4.13 | 2.47m |

| Persistent | 5,176.50 | 2.57 | 450.40k |

| MphasiS | 2,706.70 | 1.98 | 192.57k |

| Tech Mahindra | 1,485.20 | 1.8 | 1.51m |

| Wipro | 242.88 | 1.22 | 6.01m |

| HCL Tech | 1,478.30 | 1.03 | 1.45m |

| Oracle Fin Serv | 8,577.50 | 0.71 | 63.72k |

| TCS | 3,048.90 | 0.55 | 2.44m |

| LTIMindtree | 5,046.00 | 0.21 | 232.21k |

| Infosys | 1,437.80 | 0.08 | 9.63m |

-330

August 07, 2025· 15:21 IST

Earnings Watch | Dwarikesh Sugar Q1 net loss at Rs 9.4 crore versus loss of Rs 9.7 crore, YoY

Dwarikesh Sugar Industries was quoting at Rs 40.70, down Rs 0.58, or 1.41 percent.

It has touched an intraday high of Rs 42.09 and an intraday low of Rs 40.70.

It was trading with volumes of 72,428 shares, compared to its five day average of 37,352 shares, an increase of 93.91 percent.

In the previous trading session, the share closed down 3.33 percent or Rs 1.42 at Rs 41.28.

The share touched a 52-week high of Rs 80.33 and a 52-week low of Rs 33.01 on 01 October, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 49.33 percent below its 52-week high and 23.3 percent above its 52-week low.

Market capitalisation stands at Rs 754.18 crore.

-330

August 07, 2025· 15:19 IST

Earnings Watch | Solar Industries Q1 net profit up 18.2% at Rs 338.7 crore versus Rs 286.5 crore, YoY

lar Industries India was quoting at Rs 14,894.65, down Rs 119.55, or 0.80 percent.

It has touched an intraday high of Rs 15,062.10 and an intraday low of Rs 14,582.45.

It was trading with volumes of 6,363 shares, compared to its five day average of 6,748 shares, a decrease of -5.71 percent.

In the previous trading session, the share closed up 0.64 percent or Rs 96.20 at Rs 15,014.20.

The share touched a 52-week high of Rs 17,805.00 and a 52-week low of Rs 8,479.30 on 30 June, 2025 and 28 February, 2025, respectively.

Currently, the stock is trading 16.35 percent below its 52-week high and 75.66 percent above its 52-week low.

Market capitalisation stands at Rs 134,781.77 crore.

-330

August 07, 2025· 15:18 IST

Earnings Watch | NBCC Q1 net profit up 26.3% at Rs 132 crore versus Rs 104.6 crore, YoY

NBCC (India) was quoting at Rs 109.70, down Rs 0.40, or 0.36 percent.

It has touched an intraday high of Rs 110.65 and an intraday low of Rs 107.10.

It was trading with volumes of 678,703 shares, compared to its five day average of 415,469 shares, an increase of 63.36 percent.

In the previous trading session, the share closed down 0.32 percent or Rs 0.35 at Rs 110.10.

The share touched a 52-week high of Rs 139.83 and a 52-week low of Rs 70.82 on 28 August, 2024 and 03 March, 2025, respectively.

Currently, the stock is trading 21.55 percent below its 52-week high and 54.9 percent above its 52-week low.

Market capitalisation stands at Rs 29,619.00 crore.

-330

August 07, 2025· 15:17 IST

Earnings Watch | Savita Oil Q1 net profit jumps 40% at Rs 56 crore versus Rs 40 crore, YoY

Savita Oil Technologies was quoting at Rs 422.40, up Rs 23.40, or 5.86 percent.

It has touched an intraday high of Rs 474.15 and an intraday low of Rs 395.55.

It was trading with volumes of 38,127 shares, compared to its five day average of 2,216 shares, an increase of 1,620.84 percent.

In the previous trading session, the share closed down 2.00 percent or Rs 8.15 at Rs 399.00.

The share touched a 52-week high of Rs 634.20 and a 52-week low of Rs 295.00 on 27 August, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 33.4 percent below its 52-week high and 43.19 percent above its 52-week low.

Market capitalisation stands at Rs 2,895.99 crore.

-330

August 07, 2025· 15:16 IST

Sensex Today | Nifty recovers 250 points from day's low

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Hero Motocorp | 4,658.00 | 4,664.80 4,422.30 | 5.33% |

| Eternal | 301.85 | 302.80 288.40 | 4.66% |

| Bajaj Auto | 8,222.00 | 8,234.50 7,858.50 | 4.63% |

| Jio Financial | 324.60 | 325.55 316.80 | 2.46% |

| Tata Steel | 159.88 | 159.99 156.26 | 2.32% |

| IndusInd Bank | 807.35 | 808.00 789.10 | 2.31% |

| Adani Ports | 1,345.00 | 1,357.90 1,315.00 | 2.28% |

| Adani Enterpris | 2,251.50 | 2,295.00 2,202.80 | 2.21% |

| Tech Mahindra | 1,482.10 | 1,483.80 1,450.00 | 2.21% |

| Cipla | 1,491.30 | 1,499.80 1,464.10 | 1.86% |

| Sun Pharma | 1,599.80 | 1,605.40 1,571.00 | 1.83% |

| Trent | 5,305.50 | 5,440.00 5,210.50 | 1.82% |

| Hindalco | 686.50 | 687.90 674.35 | 1.8% |

| Eicher Motors | 5,685.00 | 5,694.50 5,588.00 | 1.74% |

| HCL Tech | 1,475.30 | 1,476.60 1,451.00 | 1.67% |

| Apollo Hospital | 7,169.50 | 7,197.50 7,053.50 | 1.64% |

| Maruti Suzuki | 12,632.00 | 12,654.00 12,429.00 | 1.63% |

| Reliance | 1,388.10 | 1,393.30 1,366.00 | 1.62% |

| Asian Paints | 2,506.60 | 2,509.00 2,466.90 | 1.61% |

| Tata Motors | 645.75 | 651.70 635.50 | 1.61% |

-330

August 07, 2025· 15:13 IST

Titan Q1 Preview: Soaring gold prices likely to impact demand, dent margins

According to a Moneycontrol poll, Titan Company is likely to report a 16 percent revenue growth at Rs 16,366 crore. ...Read More

-330

August 07, 2025· 15:10 IST

Stock Market LIVE Updates | Sensex recovers more than 700 points from day's low

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Eternal | 300.25 | 302.80 290.35 | 3.41% |

| Tata Steel | 159.70 | 159.90 156.25 | 2.21% |

| Adani Ports | 1,344.20 | 1,357.85 1,315.35 | 2.19% |

| Tech Mahindra | 1,477.00 | 1,479.40 1,447.35 | 2.05% |

| Maruti Suzuki | 12,634.65 | 12,639.95 12,431.35 | 1.64% |

| HCL Tech | 1,474.05 | 1,474.70 1,450.45 | 1.63% |

| Reliance | 1,388.30 | 1,393.00 1,366.25 | 1.61% |

| Infosys | 1,437.20 | 1,440.75 1,414.55 | 1.6% |

| Tata Motors | 645.95 | 651.30 635.80 | 1.6% |

| M&M | 3,211.00 | 3,229.85 3,162.00 | 1.55% |

| Asian Paints | 2,505.40 | 2,506.20 2,467.85 | 1.52% |

| Trent | 5,293.30 | 5,442.40 5,215.00 | 1.5% |

| Sun Pharma | 1,594.65 | 1,604.65 1,571.15 | 1.5% |

| Bajaj Finance | 879.65 | 879.75 867.00 | 1.46% |

| SBI | 804.45 | 805.00 793.30 | 1.41% |

| UltraTechCement | 12,266.85 | 12,274.00 12,113.05 | 1.27% |

| Larsen | 3,642.40 | 3,646.50 3,600.00 | 1.18% |

| TCS | 3,046.20 | 3,050.95 3,012.00 | 1.14% |

| Kotak Mahindra | 1,992.35 | 1,994.00 1,970.10 | 1.13% |

| Bharat Elec | 387.55 | 390.00 383.40 | 1.08% |

-330

August 07, 2025· 15:08 IST

Brokerage Call | Bernstein keeps ‘underperform’ rating Bajaj Finance, target price at Rs 640

#1 Stock has corrected 9 percent since announcement of its Q1 results

#2 Sees further downside risks ahead

#3 Risks are more fundamental than just a few quarters of elevated credit costs

#4 Profitability pressures are building

#5 Believe there are deeper structural issues that will constrain EPS growth going forward

-330

August 07, 2025· 15:05 IST

Car sales July 2025: Maruti, Hyundai, Tata lose market share, Mahindra gains

Urban demand for cars remained muted in July 2025 due to low enquiry and restrained customer sentiment....Read More

-330

August 07, 2025· 15:04 IST

Earnings Watch | Kilburn Engineering's Q1 net profit up 84% at Rs 21.3 crore versus Rs 11.6 crore, YoY

Kilburn Engineering was quoting at Rs 542.00, up Rs 4.45, or 0.83 percent.

It has touched a 52-week high of Rs 550.00.

It has touched an intraday high of Rs 550.00 and an intraday low of Rs 522.00.

It was trading with volumes of 298,144 shares, compared to its five day average of 103,087 shares, an increase of 189.22 percent.

In the previous trading session, the share closed down 0.68 percent or Rs 3.70 at Rs 537.55.

Market capitalisation stands at Rs 2,573.84 crore.

-330

August 07, 2025· 15:02 IST

Markets@3 | Sensex down 90 pts, Nifty at 24550

The Sensex was down 94.64 points or 0.12 percent at 80,449.35, and the Nifty was down 22 points or 0.09 percent at 24,552.20. About 1338 shares advanced, 2212 shares declined, and 111 shares unchanged.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| BGR Energy | 123.26 | 21.26 | 101.65 |

| Sandesh | 1,345.00 | 16.09 | 1,158.60 |

| Sri Adhikari | 1,256.20 | 15.76 | 1,085.20 |

| Sri Adhikari | 1,256.20 | 15.76 | 1,085.20 |

| Blue Coast | 61.36 | 15.75 | 53.01 |

| Ujaas Energy | 356.90 | 15.73 | 308.40 |

| Ujaas Energy | 356.90 | 15.73 | 308.40 |

| United Polyfab | 38.16 | 15.71 | 32.98 |

| Lincoln Pharma | 614.55 | 15.60 | 531.60 |

| Sumit Woods | 96.44 | 15.26 | 83.67 |

| IZMO | 407.50 | 13.38 | 359.40 |

| Manglam Infra | 23.65 | 12.62 | 21.00 |

| Banka Bioloo | 88.95 | 12.48 | 79.08 |

| BLB | 16.98 | 12.45 | 15.10 |

| Ginni Filaments | 52.43 | 12.39 | 46.65 |

| Shri Rama Multi | 45.71 | 11.95 | 40.83 |

| Godfrey Phillip | 10,025.50 | 11.60 | 8,983.50 |

| Centum Electron | 2,413.10 | 11.42 | 2,165.80 |

| Kamat Hotels | 269.09 | 10.85 | 242.76 |

| Prakash Ind | 184.88 | 10.58 | 167.19 |

-330

August 07, 2025· 15:00 IST

Earnings Watch | Page Industries' Q1 net profit up 22% at RS 201 crore versus Rs 165.2 crore, YoY

Page Industries was quoting at Rs 45,700.00, down Rs 561.20, or 1.21 percent.

It has touched an intraday high of Rs 46,753.90 and an intraday low of Rs 45,400.00.

It was trading with volumes of 314 shares, compared to its five day average of 371 shares, a decrease of -15.36 percent.

It was trading with volumes of 314 shares, compared to its thirty day average of 398 shares, a decrease of -21.15 percent.

In the previous trading session, the share closed up 1.21 percent or Rs 554.05 at Rs 46,261.20.

The share touched a 52-week high of Rs 50,470.60 and a 52-week low of Rs 38,909.60 on 27 June, 2025 and 11 March, 2025, respectively.

Currently, the stock is trading 9.45 percent below its 52-week high and 17.45 percent above its 52-week low.

Market capitalisation stands at Rs 50,973.20 crore.

-330

August 07, 2025· 15:00 IST

Earnings Watch | Apollo Pipes' Q1 net profit down 36% at Rs 8 crore versus Rs 12.5 crore, YoY

Apollo Pipes was quoting at Rs 394.80, down Rs 8.15, or 2.02 percent.

It has touched an intraday high of Rs 405.95 and an intraday low of Rs 388.60.

It was trading with volumes of 1,517 shares, compared to its five day average of 4,146 shares, a decrease of -63.41 percent.

It was trading with volumes of 1,517 shares, compared to its thirty day average of 12,314 shares, a decrease of -87.68 percent.

In the previous trading session, the share closed up 0.17 percent or Rs 0.70 at Rs 402.95.

The share touched a 52-week high of Rs 679.95 and a 52-week low of Rs 313.05 on 05 September, 2024 and 03 March, 2025, respectively.

Currently, the stock is trading 41.94 percent below its 52-week high and 26.11 percent above its 52-week low.

Market capitalisation stands at Rs 1,739.02 crore.

-330

August 07, 2025· 14:58 IST

IPO Check | Highway Infrastructure IPO subscribed at 258.84 times at 2:54 PM (Day 3)

QIB – 284.70 times

NII - 408 times

Retail – 139.43 times

Overall – 258.84 times

-330

August 07, 2025· 14:56 IST

Earnings Watch | Varroc Engineering's Q1 net profit up 22% at Rs 201 crore versus Rs 165.2 crore, YoY

Varroc Engineering was quoting at Rs 554.95, up Rs 25.10, or 4.74 percent.

It has touched an intraday high of Rs 575.00 and an intraday low of Rs 513.20.

It was trading with volumes of 30,185 shares, compared to its five day average of 9,050 shares, an increase of 233.52 percent.

In the previous trading session, the share closed down 1.91 percent or Rs 10.30 at Rs 529.85.

The share touched a 52-week high of Rs 649.00 and a 52-week low of Rs 365.00 on 02 January, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 14.49 percent below its 52-week high and 52.04 percent above its 52-week low.

Market capitalisation stands at Rs 8,478.88 crore.

-330

August 07, 2025· 14:55 IST

Global Markets | European markets trade higher; Dow Futures up 200 pts

-330

August 07, 2025· 14:49 IST

Earnings Watch | IOL Chemicals Q1 net profit up 13.3% at Rs 34 crore versus Rs 30 crore, YoY

IOL Chemicals and Pharmaceuticals was quoting at Rs 98.15, up Rs 3.00, or 3.15 percent.

It has touched an intraday high of Rs 98.75 and an intraday low of Rs 92.65.

It was trading with volumes of 200,422 shares, compared to its five day average of 522,736 shares, a decrease of -61.66 percent.

In the previous trading session, the share closed down 2.46 percent or Rs 2.40 at Rs 95.15.

The share touched a 52-week high of Rs 107.41 and a 52-week low of Rs 57.51 on 16 September, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 8.62 percent below its 52-week high and 70.67 percent above its 52-week low.

Market capitalisation stands at Rs 2,880.97 crore.

-330

August 07, 2025· 14:48 IST

Stock Market LIVE Updates | Coal India gets contract worth Rs 51.34 crore

Gurugram Metropolitan Development Authority has a EPC awarded a contract to Coal India worth Rs 51,34,00,000 for upgradation of existing 100 MLD STP and construction of 75 MLD Tertiary Treatment Plant (TTP) at Dhanwapur along with O&M for 5 years.

-330

August 07, 2025· 14:43 IST

Earnings Watch | Hikal Q1 net loss at Rs 22.4 crore versus profit of RS 5 crore, YoY

Hikal was quoting at Rs 289.20, down Rs 18.15, or 5.91 percent.

It has touched a 52-week low of Rs 281.55.

It has touched an intraday high of Rs 307.50 and an intraday low of Rs 281.55.

It was trading with volumes of 37,386 shares, compared to its five day average of 19,260 shares, an increase of 94.11 percent.

In the previous trading session, the share closed down 2.44 percent or Rs 7.70 at Rs 307.35.

Market capitalisation stands at Rs 3,565.86 crore.

-330

August 07, 2025· 14:42 IST

Sensex Today | Nifty PSU Bank index sheds 1%; Bank ofMaharashtra, Central Bank of India among top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Mah | 53.11 | -1.58 | 5.14m |

| Central Bank | 35.20 | -1.35 | 3.30m |

| IOB | 35.93 | -1.29 | 3.41m |

| Punjab and Sind | 28.14 | -0.6 | 985.71k |

| UCO Bank | 28.19 | -0.6 | 4.82m |

| Canara Bank | 108.17 | -0.55 | 9.29m |

| Bank of Baroda | 240.91 | -0.35 | 4.37m |

| Bank of India | 111.38 | -0.3 | 5.59m |

| SBI | 804.00 | -0.14 | 5.90m |

-330

August 07, 2025· 14:39 IST

Sensex Today | Waaree Energies to sell 12,50,000 equity shares of Indosolar

Waaree Energies Limited, being the promoter of Indosolar proposes to sell 12,50,000 equity shares of Indosolar

(representing 3% of its issued and paid-up capital) in order to comply with the minimum public shareholding requirement.

Indosolar was quoting at Rs 359.95, up Rs 17.10, or 4.99 percent. It has touched a 52-week high of Rs 359.95.

It has touched an intraday high of Rs 359.95 and an intraday low of Rs 359.95.

There were pending buy orders of 562,825 shares, with no sellers available.

In the previous trading session, the share closed up 4.99 percent or Rs 16.30 at Rs 342.85.

Market capitalisation stands at Rs 74.88 crore.

-330

August 07, 2025· 14:37 IST

Brokerage Call | Bernstein retains ‘outperform’ rating on Bajaj Auto, target price at Rs 11,000

#1 Q1 reaffirms its positioning as a stable business

#2 Company offers strong downside protection in a volatile demand environment

#3 Company continues to deliver through its balanced business model

#4 Leveraging a multi-powertrain portfolio, strong exports & a growing premium segment to offset domestic softness

#5 Headline performance was largely in-line

#6 Revenue, EBITDA & PAT exceeding expectations by 2–4 percent

#7 Margin contracted 50bps QoQ due to higher input costs & weaker dollar realisations

-330

August 07, 2025· 14:35 IST

Sensex Today | RBL Bank gets RBI bod to buy holding in Utkarsh Small Finance Bank (UTKARSHB)

RBI granted approval to acquire aggregate holding in Utkarsh Small Finance Bank Limited (USFBL), solely on account of amalgamation of Utkarsh Coreinvest Limited (UCL) with USFBL.

-330

August 07, 2025· 14:30 IST

Sensex Today | Tata Motors down 2% ahead of Q1 earnings tomorrow; Trump tariffs to hurt JLR sales

-330

August 07, 2025· 14:24 IST

Hero MotoCorp flags rare earth magnet shortage as industry-wide challenge, says Q2 production secured

Hero MotoCorp share price: The two-wheeler major noted that work is underway to explore long-term alternatives to mitigate the risk from rare earth magnet crunch....Read More

-330

August 07, 2025· 14:17 IST

Trump’s tariff threat can shave off 30-50 bps from India’s FY26 growth, fear economists

Policy experts see the move by US President as counterproductive, coming at a time when both nations are actively engaged in forging a long-term trade agreement....Read More

-330

August 07, 2025· 14:09 IST

Eternal shares see Rs 5,624 crore block deal as Antfin likely exits holding

Eternal shares slipped on Thursday after a Rs 5,624 crore block deal took place on the bourses, with Antfin likely fully exiting its stake. ...Read More

-330

August 07, 2025· 14:01 IST

Markets@2 | Sensex down 570 pts, Nifty below 24400

The Sensex was down 576.28 points or 0.72 percent at 79,967.71, and the Nifty was down 181.60 points or 0.74 percent at 24,392.60. About 961 shares advanced, 2558 shares declined, and 98 shares unchanged.

-330

August 07, 2025· 13:59 IST

Sensex Today | Emcure Pharma Q1 net profit up 44% at Rs 207 crore versus Rs 144 crore, YoY

Emcure Pharmaceuticals was quoting at Rs 1,394.05, down Rs 27.20, or 1.91 percent.

It has touched an intraday high of Rs 1,446.10 and an intraday low of Rs 1,341.05.

In the previous trading session, the share closed down 0.92 percent or Rs 13.25 at Rs 1,421.25.

The share touched a 52-week high of Rs 1,577.50 and a 52-week low of Rs 890.00 on 18 September, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 11.63 percent below its 52-week high and 56.63 percent above its 52-week low.

Market capitalisation stands at Rs 26,418.41 crore.

-330

August 07, 2025· 13:58 IST

Earnings Watch | Century Plyboard Q1 net profit up 51.2% at Rs 52 crore versus Rs 34.4 crore, YoY

Century Plyboards was quoting at Rs 747.70, down Rs 0.70, or 0.09 percent.

It has touched an intraday high of Rs 783.50 and an intraday low of Rs 738.00.

It was trading with volumes of 14,561 shares, compared to its five day average of 1,828 shares, an increase of 696.47 percent.

In the previous trading session, the share closed down 0.02 percent or Rs 0.15 at Rs 748.40.

The share touched a 52-week high of Rs 938.60 and a 52-week low of Rs 630.00 on 11 October, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 20.34 percent below its 52-week high and 18.68 percent above its 52-week low.

Market capitalisation stands at Rs 16,611.87 crore.

-330

August 07, 2025· 13:57 IST

Stock Market LIVE Updates | Zinka Logistics Solutions shares down most since IPO

Zinka Logistics Solutions was quoting at Rs 504.00, down Rs 56.30, or 10.05 percent.

It has touched a 52-week high of Rs 572.70.

It has touched an intraday high of Rs 572.70 and an intraday low of Rs 499.10.

In the previous trading session, the share closed up 15.66 percent or Rs 75.85 at Rs 560.30.

The share touched a 52-week high of Rs 570.95 and a 52-week low of Rs 248.25 on 06 August, 2025 and 27 November, 2024, respectively.

Currently, the stock is trading 11.73 percent below its 52-week high and 103.02 percent above its 52-week low.

Market capitalisation stands at Rs 9,029.01 crore.

-330

August 07, 2025· 13:56 IST

Sensex Today | Glenmark US to pay USD 37.75 mn in proposed class settlement

Glenmark USA has agreed to enter into a settlement with the putative direct purchaser class, for a total of $37.75 million (USD). The settlement is subject to approval by the court overseeing the litigation. The settlement is payable in two instalments, with $11,100,000 (USD) due after preliminary approval by the Court and the second payment, $26,650,000 (USD), due on or before April 1, 2026.

-330

August 07, 2025· 13:49 IST

Brokerage Call | CLSA keeps ‘underperform’ rating on BHEL, target price Rs 198

#1 Q1FY26 net loss up 114 percent YoY

#2 Operational turnaround was expected after 2 years of backlog growth but performance disappointed

#3 Net loss rose 114 percent, while 1Q execution grew just 4 percent YoY, missing consensus

#4 A positive was the resurgence in fossil orders, as India focuses on energy security

#5 Thermal business orders peaked at 26.6GW in FY25

-330

August 07, 2025· 13:42 IST

Sensex Today | Nifty Pharma index down 0.5%; Aurobindo Pharma, Mankind Pharma, Alkem Lab, among top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Aurobindo Pharm | 1,048.50 | -2.22 | 673.08k |

| Mankind Pharma | 2,505.00 | -2 | 515.72k |

| Alkem Lab | 4,799.50 | -1.47 | 50.62k |

| Biocon | 355.90 | -1.25 | 1.36m |

| Cipla | 1,469.20 | -1.18 | 1.43m |

| Divis Labs | 6,066.00 | -1.1 | 684.48k |

| Sun Pharma | 1,578.80 | -1.03 | 2.37m |

| Granules India | 434.85 | -1.02 | 1.49m |

| Laurus Labs | 830.25 | -0.71 | 1.08m |

| Dr Reddys Labs | 1,188.80 | -0.66 | 911.47k |

| Zydus Life | 928.95 | -0.4 | 674.53k |

| Ipca Labs | 1,382.60 | -0.34 | 80.40k |

| Abbott India | 32,540.00 | -0.2 | 2.80k |

| Gland | 1,956.40 | -0.06 | 192.67k |

-330

August 07, 2025· 13:37 IST

Titan Q1 Preview: Soaring gold prices likely to impact demand, dent margins

According to a Moneycontrol poll, Titan Company is likely to report a 16 percent revenue growth at Rs 16,366 crore. ...Read More

-330

August 07, 2025· 13:35 IST

Earnings Watch | Igarishi Motors Q1 net profit down 69.5% at Rs 2.5 crore versus Rs 8.2 crore, YoY

-330

August 07, 2025· 13:34 IST

Earnings Watch | Bajaj Electric Q1 net profit down 96.8% at Rs 0.9 crore versus Rs 28.1 crore, YoY

-330

August 07, 2025· 13:33 IST

Earnings Watch | 3M India Q1 net profit up 13.2% at Rs 177.7 crore versus Rs 157 crore, YoY

3M India was quoting at Rs 30,320.15, down Rs 562.45, or 1.82 percent.

It has touched an intraday high of Rs 30,820 and an intraday low of Rs 30,000.

In the previous trading session, the share closed up 0.17 percent or Rs 53.15 at Rs 30,882.60.

The share touched a 52-week high of Rs 38,240.00 and a 52-week low of Rs 25,714.35 on 12 August, 2024 and 03 March, 2025, respectively.

Currently, the stock is trading 20.71 percent below its 52-week high and 17.91 percent above its 52-week low.

Market capitalisation stands at Rs 34,155.86 crore.

-330

August 07, 2025· 13:32 IST

Earnings Watch | Rategain Travel Q1 net profit up 3.8% at Rs 47 crore versus Rs 45.3 crore, YoY

Rategain Travel Technologies was quoting at Rs 430.30, up Rs 2.55, or 0.60 percent.

It has touched an intraday high of Rs 443.10 and an intraday low of Rs 417.10.

In the previous trading session, the share closed down 2.70 percent or Rs 11.85 at Rs 427.75.

The share touched a 52-week high of Rs 853.30 and a 52-week low of Rs 365.00 on 11 November, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 49.57 percent below its 52-week high and 17.89 percent above its 52-week low.

Market capitalisation stands at Rs 5,080.87 crore.

-330

August 07, 2025· 13:31 IST

Earnings Watch | Caplin Point Q1 net profit up 23.2% at Rs 152.8 crore versus Rs 124 crore, YoY

Caplin Point Laboratories was quoting at Rs 2,031.95, up Rs 103.95, or 5.39 percent.

It has touched an intraday high of Rs 2,038.00 and an intraday low of Rs 1,886.55.

In the previous trading session, the share closed down 1.44 percent or Rs 28.25 at Rs 1,928.00.

The share touched a 52-week high of Rs 2,636.00 and a 52-week low of Rs 1,451.60 on 27 December, 2024 and 09 August, 2024, respectively.

Currently, the stock is trading 22.92 percent below its 52-week high and 39.98 percent above its 52-week low.

Market capitalisation stands at Rs 15,445.20 crore.

-330

August 07, 2025· 13:30 IST

Earnings Watch | Lincoln Pharmaceuticals Q1 net profit up 17% at Rs 28 crore versus Rs 24 crore, YoY

Lincoln Pharmaceuticals was quoting at Rs 570.00, up Rs 38.15, or 7.17 percent.

It has touched an intraday high of Rs 593.40 and an intraday low of Rs 522.80.

It was trading with volumes of 32,101 shares, compared to its five day average of 2,200 shares, an increase of 1,359.00 percent.

In the previous trading session, the share closed down 0.09 percent or Rs 0.50 at Rs 531.85.

The share touched a 52-week high of Rs 975.00 and a 52-week low of Rs 500.00 on 09 December, 2024 and 03 March, 2025, respectively.

Currently, the stock is trading 41.54 percent below its 52-week high and 14 percent above its 52-week low.

Market capitalisation stands at Rs 1,141.69 crore.

-330

August 07, 2025· 13:29 IST

Stock Market LIVE Updates | Puravankara receives Letter of Indent of Rs 83.51 crore

Starworth Infrastructure & Construction, a wholly owned material subsidiary of Puravankara has received a Letter of Indent for Rs

83,51,50,254 for construction of civil works of commercial project “Luxon” at Doddanekundi Industrial Area White Field Bangalore, Karnataka from “M/s Krishil WhiteAlpha Private Limited”.

-330

August 07, 2025· 13:26 IST

Passenger vehicles, two-wheelers take automobile sales to slow lane, drop 4% in July

The dealers’ body said the overall registration declined to 19,64,213 units in July, compared to 20,52,759 units recorded in the same period of the previous year...Read More

-330

August 07, 2025· 13:23 IST

Sensex Today | Godfrey Phillips, Fortis Healthcare, among others hit 52-week high

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Fortis Health | 904.75 | 904.75 | 888.00 |

| J. K. Cement | 7089.00 | 7089.00 | 7,039.15 |

| Sarda Energy | 608.40 | 608.40 | 563.20 |

| Godfrey Phillip | 11450.00 | 11450.00 | 10,015.00 |

-330

August 07, 2025· 13:20 IST

Sensex Today | Lodha Developers to consider fund raising via debt on August 11

A meeting of the board of directors of Lodha Developers is scheduled to be held on Monday, August 11, 2025, to consider the proposal for fund raising by way of issuance of Non-Convertible Debentures on private placement basis, in one or more tranches, to diversify pool of debt enabling continued reduction in cost of funds on targeted debt capital.

-330

August 07, 2025· 13:16 IST

Brokerage Call | CLSA keeps ‘outperform’ rating on Bajaj Auto, target price cut to Rs 9,971

#1 Q1 EBITDA margin of 19.7 percent was in-line

#2 Revenue grew 5.5 percent YoY, led by a richer product mix as volume remained flat YoY

#3 Export volume is recovering

#4 Management highlighted that the LATAM & ASEAN markets are driving growth

#5 Forecast 10 percent YoY 2W export volume growth for company versus guidance of 15–20 percent for FY26

#6 Company aims to gain market share through model refreshes, launches & pricing while maintaining profitability

-330

August 07, 2025· 13:08 IST

Tata Motors Q1 Preview: Net profit to fall over 30% as JLR feels heat from Trump tariffs, weaker margins

Tata Motors share price: Investors will watch for updates on JLR’s FY26 guidance, progress on cost-control initiatives, demand and discounting trends in key markets...Read More

-330

August 07, 2025· 13:04 IST

Currency Check | Rupee trades marginally lower

Indian rupee is trading marginally lower at 87.76 per dollar versus previous close of 87.73.

-330

August 07, 2025· 13:01 IST

Markets@1 | Sensex down 420 pts, Nifty around 24,450

The Sensex was down 420.55 points or 0.52 percent at 80,123.44, and the Nifty was down 140.75 points or 0.57 percent at 24,433.45. About 1088 shares advanced, 2388 shares declined, and 99 shares unchanged.

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| BGR Energy | 153340.00 | 123.26 9.99 | 189479 93250.40 |

| Asian Hotels | 299.00 | 288.65 4.98 | 3396 3486.35 |

| Mirae NYSEFANG | 432962.00 | 154.86 -0.85 | 69589 695285.70 |

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Vipul | 98213.00 | 10.65 -5.08 | 548541 332313.40 |

| Brightcom Group | 1100338.00 | 14.54 -5.03 | 22500646 23252285.60 |

| Kitex Garments | 1082484.00 | 180.21 -5 | 96735 486608.40 |

| Electrotherm | 8898.00 | 765.00 -5 | 21152 20641.30 |

-330

August 07, 2025· 12:59 IST

Sensex Today | Nifty FMCG index down 0.5%; Emami, HUL, United Spirits top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Emami | 584.40 | -2.58 | 306.00k |

| HUL | 2,501.80 | -1.33 | 298.42k |

| United Spirits | 1,295.20 | -0.99 | 246.05k |

| TATA Cons. Prod | 1,043.20 | -0.91 | 250.27k |

| Colgate | 2,228.60 | -0.55 | 66.39k |

| Marico | 711.50 | -0.44 | 440.87k |

| Patanjali Foods | 1,817.20 | -0.37 | 186.32k |

| Nestle | 2,225.00 | -0.37 | 265.60k |

| Varun Beverages | 497.75 | -0.29 | 2.05m |

-330

August 07, 2025· 12:54 IST

'What is good for India is good for Reliance': Full text of Mukesh Ambani's letter to shareholders

Mukesh Ambani said that the company is reimagining the future and that it has grown from an idea into one of the world’s most admired enterprises....Read More

-330

August 07, 2025· 12:50 IST

Sensex Today | All sectors trade lower; metal, oil & gas down 1% each

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 52753.93 -0.62 | 2.11 -0.28 | -1.47 -6.77 |

| BSE Cap Goods | 67189.13 -1.38 | -0.87 -1.54 | -6.68 -6.93 |

| BSE FMCG | 20268.55 -0.45 | -2.42 -1.45 | -1.02 -10.12 |

| BSE Metal | 30603.60 -1.2 | 5.92 -0.91 | -3.35 -2.54 |

| BSE Oil & Gas | 25837.54 -1.01 | -0.87 -3.58 | -9.17 -19.25 |

| BSE Realty | 6876.69 -0.93 | -16.49 -2.90 | -8.86 -13.61 |

| BSE IT | 33873.81 -0.1 | -21.57 -2.69 | -11.02 -15.21 |

| BSE Healthcare | 43157.93 -0.59 | -4.68 -4.88 | -3.83 5.69 |

| BSE Power | 6578.46 -1.14 | -5.56 -1.79 | -4.23 -20.31 |

| BSE Cons Durables | 59724.68 -0.34 | -7.31 0.43 | -2.17 1.98 |

-330

August 07, 2025· 12:47 IST

Sensex Today | Cyient arm Cyient Semiconductors partners with GlobalFoundries

Cyient Semiconductors announced a strategic Channel Partner Agreement with GlobalFoundries (GF), one of the world’s leading pure-play semiconductor foundries. Under the agreement, Cyient Semiconductors becomes an authorized reseller of GF’s semiconductor manufacturing services and technologies.

Cyient was quoting at Rs 1,182.40, down Rs 13.55, or 1.13 percent.

It has touched an intraday high of Rs 1,194.00 and an intraday low of Rs 1,167.00.

It was trading with volumes of 7,144 shares, compared to its five day average of 113,717 shares, a decrease of -93.72 percent.

It was trading with volumes of 7,144 shares, compared to its thirty day average of 39,070 shares, a decrease of -81.71 percent.

In the previous trading session, the share closed down 0.95 percent or Rs 11.45 at Rs 1,195.95.

The share touched a 52-week high of Rs 2,156.35 and a 52-week low of Rs 1,050.20 on 16 September, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 45.17 percent below its 52-week high and 12.59 percent above its 52-week low.

Market capitalisation stands at Rs 13,130.48 crore.

-330

August 07, 2025· 12:46 IST

Earnings Watch | Prism Johnson Q1 net loss at Rs 5.6 crore versus loss of Rs 18.3 crore, YoY

Prism Johnson was quoting at Rs 151.65, up Rs 5.75, or 3.94 percent.

It has touched an intraday high of Rs 152.00 and an intraday low of Rs 143.90.

It was trading with volumes of 47,690 shares, compared to its five day average of 8,626 shares, an increase of 452.88 percent.

In the previous trading session, the share closed down 2.90 percent or Rs 4.35 at Rs 145.90.

The share touched a 52-week high of Rs 246.10 and a 52-week low of Rs 108.00 on 11 September, 2024 and 04 March, 2025, respectively.

Currently, the stock is trading 38.38 percent below its 52-week high and 40.42 percent above its 52-week low.

Market capitalisation stands at Rs 7,633.40 crore.

-330

August 07, 2025· 12:45 IST

Results Today | Emcure Pharmaceuticals, General Insurance Corporation of India, Indigo Paints, among others to declares results today

Titan Company, Life Insurance Corporation of India, Hindustan Petroleum Corporation. Godrej Consumer Products, Biocon, Cummins India, Metropolis Healthcare, National Aluminium Company, Kalyan Jewellers India, Kalpataru Projects International, Aegis Logistics, Aegis Vopak Terminals, Apollo Tyres, Bajaj Electricals, Birlasoft, Data Patterns (India), Edelweiss Financial Services, Emcure Pharmaceuticals, General Insurance Corporation of India, Indigo Paints, CE Info Systems, Global Health, Medi Assist Healthcare Services, Page Industries, Ramco Cements, Shree Renuka Sugars, and Sai Life Sciences will release their quarterly earnings on August 7.

-330

August 07, 2025· 12:42 IST

Brokerage Call | ICICIdirect.com upgrades Bajaj Auto to 'buy' from 'hold', target Rs 9,500

Bajaj Auto was quoting at Rs 8,151.95, down Rs 25.10, or 0.31 percent.

It has touched an intraday high of Rs 8,225.00 and an intraday low of Rs 7,879.45.

In the previous trading session, the share closed down 0.64 percent or Rs 53.05 at Rs 8,177.05.

The share touched a 52-week high of Rs 12,772.15 and a 52-week low of Rs 7,088.25 on 27 September, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 36.17 percent below its 52-week high and 15.01 percent above its 52-week low.

Market capitalisation stands at Rs 227,649.41 crore.

-330

August 07, 2025· 12:38 IST

Stock Market LIVE Updates | Adani Group stocks dip; Adani Ports share price down most in 15 weeks

Adani Ports and Special Economic Zone was quoting at Rs 1,318.70, down Rs 47.95, or 3.51 percent.

It has touched an intraday high of Rs 1,357.85 and an intraday low of Rs 1,317.80.

It was trading with volumes of 58,722 shares, compared to its five day average of 79,797 shares, a decrease of -26.41 percent.

In the previous trading session, the share closed up 0.67 percent or Rs 9.10 at Rs 1,366.65.

The share touched a 52-week high of Rs 1,555.50 and a 52-week low of Rs 993.85 on 08 August, 2024 and 21 November, 2024, respectively.

Currently, the stock is trading 15.22 percent below its 52-week high and 32.69 percent above its 52-week low.

Market capitalisation stands at Rs 284,857.52 crore.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Green Ene | 922.70 | -3.64 | 1.47m |

| Adani Ports | 1,318.20 | -3.58 | 1.18m |

| Adani Enterpris | 2,223.30 | -3.35 | 587.13k |

| NDTV | 130.61 | -2.16 | 23.58k |

| AWL Agri | 248.85 | -1.60 | 489.89k |

| ACC | 1,804.20 | -1.43 | 276.65k |

| Adani Energy | 783.00 | -1.02 | 903.44k |

| Ambuja Cements | 584.05 | -0.99 | 561.41k |

| Sanghi Ind | 65.06 | -0.90 | 128.88k |

| Adani Total Gas | 583.80 | -0.88 | 321.39k |

| Orient Cement | 237.50 | -0.52 | 270.11k |

-330

August 07, 2025· 12:34 IST

IPO Check | Highway Infrastructure IPO subscribed at 150.82 times at 12:27 PM (Day 3)

QIB – 16.02 times

NII - 253.41 times

Retail – 113.22 times

Overall – 150.82 times

-330

August 07, 2025· 12:30 IST

Sensex Today | Bank Albilad chooses Intellect to transform cash management in KSA

Bank Albilad will partner with Intellect Design Arena to synergise its digital banking capabilities.

Bank Albilad is driving the evolution of wholesale banking in Saudi Arabia. With emerging technologies and intelligent platforms, the bank will deliver customer-centric and future-ready solutions.

Intellect Design Arena was quoting at Rs 936.50, down Rs 7.50, or 0.79 percent.

It has touched an intraday high of Rs 943.20 and an intraday low of Rs 923.90.

In the previous trading session, the share closed down 3.00 percent or Rs 29.20 at Rs 944.00.

The share touched a 52-week high of Rs 1,255.00 and a 52-week low of Rs 555.05 on 17 June, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 25.38 percent below its 52-week high and 68.72 percent above its 52-week low.

Market capitalisation stands at Rs 13,021.97 crore.

-330

August 07, 2025· 12:28 IST

Earnings Watch | Aegis Logistics Q1 net profit flat at Rs 121 crore, revenue up 7% at Rs 1,719 crore

Aegis Logistics was quoting at Rs 702, down Rs 10.30, or 1.45 percent.

It has touched an intraday high of Rs 712 and an intraday low of Rs 700.30.

In the previous trading session, the share closed down 1.14 percent or Rs 8.25 at Rs 712.30.

The share touched a 52-week high of Rs 1,035.70 and a 52-week low of Rs 610.50 on 08 January, 2025 and 28 January, 2025, respectively.

Currently, the stock is trading 32.22 percent below its 52-week high and 14.99 percent above its 52-week low.

Market capitalisation stands at Rs 24,640.20 crore.

-330

August 07, 2025· 12:27 IST

Stock Market LIVE Updates | Life Insurance Corporation of India shares trade lower ahead of earnings

Life Insurance Corporation of India was quoting at Rs 884.50, down Rs 8.20, or 0.92 percent.

It has touched an intraday high of Rs 896.95 and an intraday low of Rs 883.00.

It was trading with volumes of 11,813 shares, compared to its five day average of 32,645 shares, a decrease of -63.81 percent.

It was trading with volumes of 11,813 shares, compared to its thirty day average of 47,121 shares, a decrease of -74.93 percent.

In the previous trading session, the share closed up 0.08 percent or Rs 0.70 at Rs 892.70.

The share touched a 52-week high of Rs 1,159.60 and a 52-week low of Rs 715.35 on 09 August, 2024 and 03 March, 2025, respectively.

Currently, the stock is trading 23.72 percent below its 52-week high and 23.65 percent above its 52-week low.

Market capitalisation stands at Rs 559,446.05 crore.

-330

August 07, 2025· 12:23 IST

Results Today | Kalyan Jewellers, Kalpataru Projects, Aegis Logistics, Aegis Vopak Terminals, among others to declares results today

Titan Company, Life Insurance Corporation of India, Hindustan Petroleum Corporation. Godrej Consumer Products, Biocon, Cummins India, Metropolis Healthcare, National Aluminium Company, Kalyan Jewellers India, Kalpataru Projects International, Aegis Logistics, Aegis Vopak Terminals, Apollo Tyres, Bajaj Electricals, Birlasoft, Data Patterns (India), Edelweiss Financial Services, Emcure Pharmaceuticals, General Insurance Corporation of India, Indigo Paints, CE Info Systems, Global Health, Medi Assist Healthcare Services, Page Industries, Ramco Cements, Shree Renuka Sugars, and Sai Life Sciences will release their quarterly earnings on August 7.

-330

August 07, 2025· 12:21 IST

Sensex Today | BSE Telecom index down 1%; Bharti Hexacom, Indus Towers, Railtel Corp, among top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharti Hexacom | 1,745.00 | -2.77 | 5.10k |

| INDUS TOWERS | 333.55 | -2.18 | 69.91k |

| Railtel | 355.10 | -1.82 | 17.57k |

| Optiemus Infra | 584.25 | -1.45 | 3.86k |

| MTNL | 43.80 | -1.11 | 69.72k |

| Route | 870.05 | -0.94 | 6.79k |

| Tata Comm | 1,669.70 | -0.92 | 3.22k |

| Bharti Airtel | 1,912.55 | -0.89 | 33.41k |

| Tejas Networks | 566.60 | -0.61 | 40.60k |

| TataTeleservice | 56.93 | -0.37 | 70.80k |

| Vindhya Telelin | 1,518.70 | -0.21 | 42 |

-330

August 07, 2025· 12:19 IST

Currency Check | Rupee trades marginally higher

Indian rupee is trading marginally higher at 87.70 per dollar versus previous close of 87.73.

-330

August 07, 2025· 12:17 IST

Brokerage Call | CLSA retains ‘outperform’ rating on PVR INOX, target price at Rs 1,920

#1 Q1 revenue above estimates

#2 With ATP up 8 percent YoY, PVR Inox movies ticket sales were up 23 percent YoY

#3 In 1QFY26, PVR Inox bollywood & hollywood movies GBOC increased 38–72 percent YoY

#4 Management highlighted July has also been strong with an 18-month high in admissions

-330

August 07, 2025· 12:13 IST

Sensex Today | BSE Midcap index extend fall on third day

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BHEL | 224.75 | -6.22 | 743.87k |

| Bayer CropScien | 5,695.80 | -5.22 | 2.66k |

| Container Corp | 533.40 | -3.83 | 52.46k |

| Emami | 581.30 | -2.95 | 10.58k |

| Jindal Stainles | 712.40 | -2.94 | 63.64k |

| Gujarat Fluoro | 3,531.15 | -2.93 | 3.14k |

| Suzlon Energy | 63.36 | -2.9 | 2.39m |

| Godrej Ind | 1,105.05 | -2.82 | 2.21k |

| Thermax | 3,357.00 | -2.81 | 2.17k |

| Bharti Hexacom | 1,744.95 | -2.78 | 4.99k |

| Aarti Ind | 376.30 | -2.53 | 45.31k |

| Schaeffler Ind | 3,979.30 | -2.43 | 2.01k |

| GlaxoSmithKline | 2,649.60 | -2.3 | 2.05k |

| Max Healthcare | 1,243.45 | -2.25 | 12.27k |

| 3M India | 30,200.00 | -2.21 | 81 |

| Piramal Enter | 1,150.00 | -2.17 | 12.61k |

| Bank of Mah | 52.81 | -2.15 | 571.33k |

| Aurobindo Pharm | 1,050.60 | -2.07 | 31.36k |

| HINDPETRO | 393.35 | -2.01 | 125.63k |

| Solar Ind | 14,718.00 | -1.97 | 4.04k |

-330

August 07, 2025· 12:06 IST

Earnings Watch | Lumax Industries’ Q1 consolidated revenue falls 20%

#1 Profit grows 5.9 percent to Rs 36.2 crore Vs Rs 34.2 crore, YoY

#2 Revenue soars 20.5 percent to Rs 922.5 crore Vs Rs 765.8 crore, YoY

-330

August 07, 2025· 12:05 IST

Earnings Watch | Jindal Stainless’ Q1 consolidated profit, revenue rise

#1 Profit increases 10.2 percent to Rs 714.2 crore Vs Rs 648.1 crore, YoY

#2 Revenue rises 8.2 percent to Rs 10,207.1 crore Vs Rs 9,429.8 crore, YoY

-330

August 07, 2025· 12:01 IST

Markets@12 | Sensex sheds 460 pts, Nifty around 24400

The Sensex was down 463.08 points or 0.57 percent at 80,080.91, and the Nifty was down 146.85 points or 0.60 percent at 24,427.35. About 1098 shares advanced, 2315 shares declined, and 117 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Eternal | 298.45 -0.13 | 359.60m | 10,520.36 |

| Kotak Mahindra | 1,985.40 -0.85 | 13.05m | 2,568.53 |

| Trent | 5,340.00 -0.31 | 1.36m | 728.49 |

| HDFC Bank | 1,986.30 0.05 | 2.68m | 531.27 |

| Hero Motocorp | 4,559.00 1.88 | 970.26k | 439.72 |

| Reliance | 1,379.10 -0.98 | 3.18m | 439.42 |

| Infosys | 1,423.30 -0.93 | 3.07m | 438.68 |

| Tata Motors | 636.85 -2.45 | 6.49m | 415.64 |

| Bharti Airtel | 1,914.10 -0.81 | 2.07m | 397.94 |

| ICICI Bank | 1,432.80 -0.75 | 2.68m | 384.40 |

| M&M | 3,207.20 -0.63 | 1.20m | 383.44 |

| Sun Pharma | 1,574.20 -1.32 | 1.87m | 296.42 |

| TCS | 3,019.60 -0.42 | 841.64k | 254.28 |

| Axis Bank | 1,067.70 -0.31 | 2.30m | 245.47 |

| ITC | 412.35 0.08 | 5.74m | 237.37 |

| Jio Financial | 320.50 -1.85 | 7.18m | 231.87 |

| Bajaj Finance | 870.95 -0.65 | 2.25m | 196.04 |

| SBI | 798.60 -0.81 | 2.39m | 191.54 |

| Bharat Elec | 385.45 -1.09 | 4.96m | 192.47 |

| Bajaj Auto | 8,090.00 -1.08 | 233.29k | 188.51 |

-330

August 07, 2025· 12:00 IST

Stock Market LIVE Updates | LTIMindtree awarded PAN 2.0 project

LTIMindtree has been awarded a RS 792 crore mandate by Government of India’s Central Board of Direct Taxes (CBDT) to transform India’s PAN (Permanent Account Number) infrastructure.

As a part of the Government to Citizen (G2C) initiative, this PAN 2.0 project will consolidate all PAN and TAN services into a single, streamlined digital platform, making it easier for citizens and businesses to access and manage one of India’s core financial identity systems.

-330

August 07, 2025· 11:56 IST

Did additional 25% tariffs on India result in productive US-Russia talks? Here's Trump's response

Trump noted “a lot of progress” in US-Russia talks while suggesting India’s tariff hike may have played an indirect role....Read More

-330

August 07, 2025· 11:55 IST

Stock Market LIVE Updates | Monte Carlo Fashions shares extend fall on third day

Monte Carlo Fashions was quoting at Rs 568.90, down Rs 1.35, or 0.24 percent.

It has touched an intraday high of Rs 573.90 and an intraday low of Rs 554.55.

In the previous trading session, the share closed down 1.10 percent or Rs 6.35 at Rs 570.25.

The share touched a 52-week high of Rs 984.00 and a 52-week low of Rs 507.40 on 10 December, 2024 and 04 March, 2025, respectively.

Currently, the stock is trading 42.18 percent below its 52-week high and 12.12 percent above its 52-week low.

Market capitalisation stands at Rs 1,179.45 crore.

-330

August 07, 2025· 11:54 IST

Earnings Watch | Raymond Lifestyle’s Q1 consolidated losses narrow, revenue up 17%

#1 Loss narrows to Rs 19.8 crore Vs Rs 23.2 crore, YoY

#2 Revenue jumps 17.2 percent to Rs 1,430.4 crore Vs Rs 1,220.1 crore, YoY

-330

August 07, 2025· 11:49 IST

Earnings Watch | VIP Industries reports losses in Q1, revenue declines

#1 Loss stands at Rs 13.1 crore Vs Profit of Rs 4.04 crore, YoY

#2 Revenue declines 12.1 percent to Rs 561.4 crore Vs Rs 638.9 crore, YoY

-330

August 07, 2025· 11:47 IST

Sensex Today | Nifty Bank index sheds 0.5%; IDFC First Bank, IndusInd Bank, AU Small Finance Bank top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IDFC First Bank | 67.81 | -1.35 | 4.71m |

| IndusInd Bank | 795.00 | -1.04 | 1.06m |

| AU Small Financ | 728.20 | -0.95 | 282.48k |

| Kotak Mahindra | 1,984.50 | -0.89 | 13.00m |

| Canara Bank | 107.86 | -0.84 | 5.40m |

| SBI | 798.60 | -0.81 | 2.27m |

| Bank of Baroda | 239.87 | -0.78 | 2.09m |

| ICICI Bank | 1,432.90 | -0.74 | 2.44m |

| Federal Bank | 196.02 | -0.68 | 2.50m |

| PNB | 103.38 | -0.43 | 6.47m |

| Axis Bank | 1,069.10 | -0.18 | 1.60m |

| HDFC Bank | 1,984.80 | -0.03 | 2.33m |

-330

August 07, 2025· 11:46 IST

Nitant Darekar Research Analyst at Bonanza

The escalation from 25% to 50% tariffs will create sector-specific pressures rather than broad market disruption for Indian equities. The Nifty 50's limited 9% direct exposure to the US, primarily concentrated in IT services which remain exempt from goods-based duties, provides substantial insulation. However, stocks in gems and jewellery, apparel, textiles, and chemicals face immediate headwinds as these sectors represent the most vulnerable $8 billion export segment.

The 21 -day implementation window creates near-term volatility through currency weakness and reduced foreign flows, while pharmaceutical and semiconductor exporters maintain protection through tariff exemptions.

Large-scale manufacturing operations, particularly in electronics assembly, should see minimal impact due to specific exclusions. The market correction will likely be concentrated in export dependent sectors rather than broad-based, with potential government support measures expected for the most affected industries to cushion the blow on vulnerable stock segments.

-330

August 07, 2025· 11:45 IST

Sensex Today | BSE Capital Goods index down 1%; extends fall on second day

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BHEL | 224.85 | -6.18 | 727.09k |

| SKF India | 4,567.20 | -4.58 | 1.41k |

| Triveni Turbine | 513.55 | -3.05 | 52.41k |

| Carborundum | 862.75 | -2.6 | 3.40k |

| Elgi Equipments | 532.10 | -2.49 | 19.79k |

| Thermax | 3,375.20 | -2.29 | 2.08k |

| Kirloskar Oil | 896.30 | -2.28 | 27.49k |

| Apar Ind | 8,687.55 | -2.27 | 3.84k |

| Timken | 2,853.50 | -2.26 | 2.59k |

| Jyoti CNC Auto | 963.50 | -1.82 | 3.37k |

| Suzlon Energy | 64.09 | -1.78 | 1.89m |

| Supreme Ind | 4,114.00 | -1.54 | 421 |

| Cochin Shipyard | 1,683.00 | -1.36 | 34.86k |

| Inox Wind | 145.10 | -1.36 | 78.00k |

| PTC Industries | 14,837.85 | -1.32 | 718 |

| AIA Engineering | 3,148.10 | -1.29 | 275 |

| Cummins | 3,594.80 | -1.17 | 5.85k |

| ABB India | 5,043.00 | -1.08 | 7.99k |

| LMW | 15,201.00 | -1.06 | 57 |

| Finolex Cables | 853.60 | -0.97 | 3.90k |

-330

August 07, 2025· 11:43 IST

Earnings Watch | Bharat Heavy Electricals’ Q1 consolidated losses widen, revenue flat

#1 Loss widens to Rs 455.5 crore Vs loss of Rs 211.4 crore, YoY

#2 Revenue rises 0.03 percent to Rs 5,486.9 crore Vs Rs 5,484.9 crore, YoY

-330

August 07, 2025· 11:41 IST

Colin Shah, MD. Kama jewelry

The ad valorem duty imposition of 25% to the existing tariff is unfortunate and a major blow to the overall Indian exports ecosystem, especially the gems & jewellery sector. As a result, this will lead to a sharp rise in duty for studded gold jewellery exports from India, leading to a further massive decline in Indian jewellery exports to one of the biggest consumer markets. Along with this, the decline in the INR due to headwinds influenced by spike in tariff will further lead to a volatile scenario back in domestic economy as gold pricing will be volatile.

We hope the government will take up the much delayed SEZ reforms and take measures which boost ecommerce globally as the industry will have to take up market diversification urgently. We will also need FTA’s with other developing markets specially the BRICS. The government should also allocate large budgets for promoting the “Make in India” brand globally.

-330

August 07, 2025· 11:40 IST

Textile, shrimp stocks fall as Trump doubles tariff; Gokaldas Exports, KPR Mill, Avanti Feeds fall up to 4%

Textile makers Trident, Gokaldas Exports, Arvind, KPR Mill and Welspun Living lost 0.7%-3% on August 7...Read More

-330

August 07, 2025· 11:38 IST

Earnings Watch | Sula Vineyards’ Q1 consolidated profit down 86%

#1 Profit sinks 86.7 percent to Rs 1.94 crore Vs Rs 14.6 crore, YoY

#2 Revenue declines 7.9 percent to Rs 118.3 crore Vs Rs 128.4 crore, YoY

-330

August 07, 2025· 11:30 IST

Sensex Today| Gold on MCX hits record high at Rs1,01,539/10 gm

-330

August 07, 2025· 11:23 IST

Sensex Today| LTIMindtree gets order worth Rs 792 crore from India's CBDT Transform pan infra

-330

August 07, 2025· 11:16 IST

Prashant Khemka on Trump tariff uncertainty: Negotiation tactic, India will come out fine

2025 will remain a “normal” year; remain fully in invested, as always, said the founder of WhiteOak...Read More

-330

August 07, 2025· 11:10 IST

Sensex Today | India volatility index up nearly 2%

-330

August 07, 2025· 11:09 IST

Earnings Watch | IRCON International’s Q1 consolidated profit down 26%, revenue down 21%

#1 Profit drops 26.5 percent to Rs 164.6 crore Vs Rs 224 crore, YoY

#2 Revenue falls 21.9 percent to Rs 1,786.3 crore Vs Rs 2,287.1 crore, YoY

-330

August 07, 2025· 11:05 IST

TCS to roll out wage hikes after announcing plans to cut 12,000 jobs. Check details

The wage hikes are expected to cover around 80 percent of the staff, starting September 1...Read More

-330

August 07, 2025· 11:01 IST

Markets@11 | Sensex down 430 pts, Nifty below 24450

The Sensex was down 435.95 points or 0.54 percent at 80,108.04, and the Nifty was down 143.05 points or 0.58 percent at 24,431.15. About 1153 shares advanced, 2155 shares declined, and 129 shares unchanged.

-330

August 07, 2025· 10:59 IST

Sensex Today | BHEL shares fall over 6% as CLSA recommends 'Underperform' after net loss doubles

Shares of power plant equipment manufacturer BHEL were sharply lower by over 6 percent in early trade on August 7, reacting to the sharp widening of loss in the June quarter, with CLSA issuing an 'Underperform' call with a target price of Rs 198 per share, lower by over 17 percent compared to previous close.

State-owned Bharat Heavy Electricals (BHEL) said its net loss more than doubled to Rs 455.50 crore in the June quarter mainly due to higher expenses, compared to a net loss of Rs 211.40 crore a year ago. The total income rose slightly to Rs 5,658.07 crore in the quarter compared to Rs 5,581.78 crore a year ago. Read More