Rakesh Jhunjhunwala’s biggest bet Titan Company is set to report its earnings for the first quarter of the fiscal year 2026 on August 7, 2025. The firm is likely to see healthy double-digit growth in watches, eyewear, and other businesses.

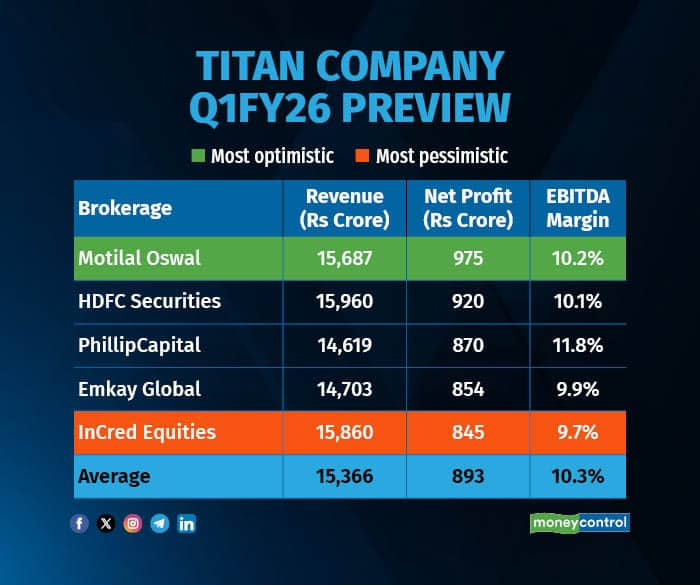

According to a Moneycontrol poll of five brokerages, the CaratLane parent is likely to report a 16 percent revenue growth at Rs 15,366 crore. Net profit is likely to come in at Rs 893 crore, jumping 25 percent from Rs 715 crore in the corresponding quarter last year.

There is a serious divergence in the earnings estimates of different analysts polled by Moneycontrol as some analysts. The most optimistic estimate sees net profit rising 36.3 percent, while the most pessimistic estimate, rolled out by InCred Equities, sees profit rising 18.1 percent.

What factors are impacting the earnings?MarginsKotak Institutional Equities estimated like-for-like recurring standalone jewelry EBIT margin to decline 40 bps YoY to 10.8 percent largely due to gold price increase and decline in studded share. The recent surge in gold metal loan interest rates is expected to have some impact at PAT-level.

Segment PerformanceTitan Company will see an 18 percent growth in the jewellery segment and 23 percent growth in the watches segment. Eyecare and emerging business is expected to grow 12 percent/36 percent YoY respectively, noted InCred Equities.

JM Financial said the overall standalone sales is expected to grow ~12 percent YoY (~21 percent ex-bullion) led by jewelry business growth at ~22 percent YoY, Watches at 16 percent and Eyewear at 15 percent.

Low DemandIn 1QFY26, gold prices surged ~30-35 percent YoY and ~15 percent QoQ, breaching the Rs 1,00,000 mark (per 10gm) in the retail market, driven by ongoing geopolitical tensions. Motilal Oswal said, "This sharp and rapid increase has led to consumer budget constraints, with many customers choosing to delay purchases in anticipation of a price correction or stabilization, leading to demand softness in 1QFY26."

Emkay Global noted its checks suggest that the growth trends in Q1 will see a moderation versus prevailing trends of 15-20 percent SSG across listed players. "Our checks suggest a dip in customer growth/grammage per bill, led by significant gold price inflation and entry of new players in select pockets. With low footfalls at stores, the high-margin studded sales are also under pressure which otherwise see better traction in periods of rise in gold price," the brokerage added.

What to look out for in the quarterly show?Analysts will closely monitor purchase trends in Q2 of the current year, with more wedding dates and festivals to boost demand. Additionally, they will also pay attention to gold prices since gold prices have been recording fresh highs.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.