Closing Bell: Nifty at 21,150, Sensex tanks 931 pts in sharp fall; all sectors in the red

-330

December 20, 2023· 16:29 IST

Benchmark indices ended in the red on December 20 with Nifty around 21,150. At close, the Sensex was down 930.88 points or 1.30 percent at 70,506.31, and the Nifty was down 302.90 points or 1.41 percent at 21,150.20

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

December 20, 2023· 16:27 IST

-330

December 20, 2023· 16:25 IST

Deven Mehata, Research Analyst at Choice Broking:

After a gap up opening, Nifty went down below the support levels and closed the session near to its day’s low today. Bank nifty traded negative for the day and closed near to its day low below 47500 levels which was the strong support.

The market has traded Negative with the Sensex losing 1.30 percent and closed at 70506.31 and Nifty was down by 1.41 percent intraday and closed at 21150.15 levels whereas Bank Nifty closed negative, down by 0.89 percent and settled at 47445.30.

All the sectors closed in red with Nifty PSU Bank, Nifty Metal and Nifty AUTO losing the highest by 4.04%, 3.82% and 2.28% respectively. In Nifty stocks, ONGC, Tata Consumer Product and Britannia were the top gainers, while Adani Ports, Adani Enterprise and UPL were the prime laggards.

India VIX was positive by 4.18 percent intraday and settled at 14.45.

Index has a support around 21000-20900 zone.

Coming to the OI Data, on the call side, the highest OI observed at 21500 followed by 21400 strike prices while on the put side, the highest OI is at 21000 strike price. On the other hand, Bank Nifty has support at 47100-46900 while resistance is placed at 47700 and 48000 levels.

-330

December 20, 2023· 16:23 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index experienced intense selling pressure, resulting in the formation of a bearish engulfing candle on the daily chart. The immediate resistance for the index is situated at the 47600-47700 zone, and a breakthrough above this level could pave the way for further upside, targeting 48000. However, the overall sentiment remains bearish, suggesting a cautious approach with a preference for selling on any upward movements.

-330

December 20, 2023· 16:18 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets witnessed a bout of profit taking and lost nearly one and a half percent, in continuation to the prevailing corrective phase. After the initial uptick, Nifty hovered in a range in the first half however a sharp cut in the heavyweights across sectors completely turned the tone. It eventually settled closer to the day’s low at 21,150 levels. Among the key sectors, metal, energy and realty were among the top losers. Besides, the broader indices too felt the heat and lost over 3.5% each.

This is the first serious slide in the Nifty index after the seven weeks of up move and it may result in further dip. However, it is too early to conclude the uptrend has faded until the Nifty breaks 20,700 i.e. 20 EMA on the daily chart. We reiterate our preference for index majors and suggest accumulating quality names during this phase. At the same time, the pressure could be higher in the midcap and smallcap space so participants should reduce their positions and maintain strict stop losses in remaining trades.

-330

December 20, 2023· 16:13 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty experienced a sharp correction as bearish sentiment persisted. It failed to sustain above 21500, resulting in increased call writing at the 21500 strike, subsequently leading to a significant downturn. At its lowest point, the Nifty dropped just below 21100 before recovering to close above that level. Looking ahead, there might be a consolidation phase for the Nifty in the near term. Resistance is expected around 21500, while support is anticipated at 21100.

-330

December 20, 2023· 16:09 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The domestic market saw a sharp and abrupt sell-off in the second half, despite the positive trend in global peers. This is attributable to profit booking from the recent sharp rally stretching valuations of mid- and small-cap stocks. The recent uptick in crude prices prompted investors to book profits. Most of the sectors witnessed decline, with the least fall in FMCG, banking, and IT.

-330

December 20, 2023· 16:04 IST

Parth Nyati, founder of Tradingo:

Euphoria turned into a gut punch for the market today, as the Nifty tumbled 500 points from its peak to finish over 300 points lower. While the reason for the sudden reversal remains unclear, several factors could be at play. The easy money sentiment buoyed by a buoyant primary market may have set the stage for a correction. Additionally, tight liquidity among HNIs due to their involvement in IPOs could have contributed to the selling pressure. The recent rise in COVID cases may also be serving as a convenient excuse for some investors to exit.

Technically, the Nifty is attempting to fill the gap formed around 21,000 following the Fed meeting. This zone between 21,000 and 20,950 is likely to act as strong support, with the 20-DMA at 20,700 offering further downside protection. For long-term investors, this dip presents a potential buying opportunity, while traders should remain cautious and wait for a clear direction to emerge.

-330

December 20, 2023· 15:54 IST

Aditya Gaggar Director of Progressive Shares:

With full force, bears struck back and dominated today's trading session. After registering another high of 21,593, the Index was unable to hold higher levels and started to correct which led to a bearish divergence in RSI. Selling pressure intensified in the second half of the trading session and breached all its near-term key support levels in one go to end the session at 21,150.15 with a loss of 302.95 points.

All the sectors ended the day in red with Media and PSU Banking being the major laggards. A weak link for the market was the broader indices as both Mid and Smallcaps plunged over 3.20%.

With a strong bearish candle at record levels, it seems that the short-term trend turned in favor of bears but in the lower timeframe, it is developing a possibility of a hidden bullish divergence, and if the index reverses from the support zone of 21,040- 21,080, we can expect a recovery in the markets which will be restricted to 21,380.

-330

December 20, 2023· 15:43 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Markets were on a record setting spree for a while and have been in an overbought zone, so hiccups were expected in the form of profit-taking which came to the fore today. Redemption was seen across the sectors, and even mid & small-cap stocks came under the grip of a strong bear hammering. Crude oil could emerge as a major short-term challenge in view of recent attacks on ships in the Red Sea, which may fuel volatility in this commodity price.

-330

December 20, 2023· 15:33 IST

Rupee Close:

Indian rupee ended at 83.17 per dollar on Wednesday against Tuesday's close of 83.18.

-330

December 20, 2023· 15:30 IST

Market Close:

Benchmark indices ended in the red on December 20 with Nifty at 21,150.

At close, the Sensex was down 930.88 points or 1.30 percent at 70,506.31, and the Nifty was down 302.90 points or 1.41 percent at 21,150.20. About 577 shares advanced, 2721 shares declined, and 57 shares unchanged.

The biggest Nifty losers included Adani Ports, Adani Enterprises, UPL, Tata Steel and Coal India, while gainers were ONGC, Tata Consumer Products, Britannia Industries and HDFC Bank.

All the sectoral indices ended in the red, with auto, capital goods, metal, pharma, oil & gas, power and realty down 2-4 percent.

BSE Midcap and Smallcap indices declined more than 3 percent each.

-330

December 20, 2023· 15:27 IST

Sensex Today | BLS E-Services, Jyoti CNC Automation, Popular Vehicles get SEBI approval to float IPOs

BLS E-Services, Jyoti CNC Automation, and Popular Vehicles & Services have received approval from the capital markets regulator Securities and Exchange Board of India (SEBI) to raise funds through an initial public offering.

The SEBI issued observation letters to Jyoti CNC Automation and Popular Vehicles & Services on December 15, while BLS E-Services received the said letter on December 12.

The issuance of an observation letter means the SEBI has allowed the company to go ahead with its IPO plans. Read More

-330

December 20, 2023· 15:25 IST

Stock Market LIVE Updates | Morgan Stanley View On Manappuram Finance

-Overweight call, target Rs 210 per share

-Liked company's intent to protect 20% RoE with 20% loan growth sustainably

-For gold loans, company’s focus remains its core small-ticket short-tenor segment

-Targeting 8% growth with 21- 22% yield

-Its first-ever detailed discussion of non-gold businesses should help improve investor confidence

-330

December 20, 2023· 15:23 IST

-330

December 20, 2023· 15:21 IST

Stock Market LIVE Updates | Macquarie On Delhivery

-Outperform call, target Rs 520 per share

-H2 poised for better growth

-Maintains its view of 15%+ GMV growth for overall e-commerce

-Within 15%+ GMV growth, company believes that it has atleast maintained if not grown market share

-Company noting >15% peak/peak growth this season

-Company sees scope for market share gains given its lowest cost structure & high service levels

-330

December 20, 2023· 15:15 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas:

Indian Rupee appreciated on Wednesday on positive domestic equities and positive Asian currencies. A soft US Dollar in early trades also supported Rupee. However, surge in crude oil prices and FII outflows over the past two sessions capped sharp gains. US Dollar declined on Tuesday on expectations of rate cut by Fed in 2024.

We expect Rupee to trade with a slight positive bias on rise in risk appetite in global markets. However, positive US Dollar amid weak Euro and Pound may cap sharp upside in rupee. Dollar recovered in the European session as UK’s CPI was lower than forecast. Traders may take cues from current account, CB consumer confidence and existing home sales data from US. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.50.

-330

December 20, 2023· 15:12 IST

Stock Market LIVE Updates | CLSA On Ashok Leyland

-Buy call, target Rs 238 per share

-CV upcycle to continue as indicated by strong freight rates

-Tonnage growth in trucks is higher than volume growth

-Double-digit increase in freight rates & e-way bill

-Building in a 6/10% YoY growth in heavy truck volumes for Ashok Leyland

-330

December 20, 2023· 15:07 IST

Canara Bank called BGR Energy Systems to clear entire outstanding liability of Rs 562.27 crore immediately.

-330

December 20, 2023· 15:04 IST

Stock Market LIVE Updates | Jefferies View On Varun Beverages

-Buy call, target Rs 1,100 per share

-Announced acquisition of the beverage company in South Africa

-On expected lines given past communications

-Deal fastracks its plans with ready capacity network

-While target has its own brand portfolio, which is in category-B

-Expect excessive focus on Pepsico brands which should also be margin accretive

-Target adds 7-15% on cons EBITDA/volumes

-330

December 20, 2023· 15:00 IST

Sensex Today | Market at 3 PM:

The Sensex was down 695.51 points or 0.97 percent at 70,741.68, and the Nifty was down 229.80 points or 1.07 percent at 21,223.30. About 783 shares advanced, 2497 shares declined, and 70 shares unchanged.

-330

December 20, 2023· 14:58 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Holmarc Opto Me | 114.00 | 100.50 | -13.50 - |

| HMT | 57.35 | 53.00 | -4.35 4.68k |

| KHFM HOSPITALIT | 53.40 | 49.50 | -3.90 0 |

| Ashoka Metcast | 23.60 | 21.90 | -1.70 2.74k |

| PRITIKA | 67.00 | 63.00 | -4.00 1.20k |

| Welspun Invest | 615.55 | 580.95 | -34.60 207 |

| Ameya Precision | 54.00 | 51.00 | -3.00 800 |

| INFOLLION | 238.00 | 225.00 | -13.00 560 |

| Akash Infraproj | 35.65 | 33.80 | -1.85 4.11k |

| Sahana Systems | 593.00 | 562.40 | -30.60 31.61k |

-330

December 20, 2023· 14:57 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Dynamic Service | 120.50 | 128.00 | 7.50 2.40k |

| HEC Infra Proje | 79.00 | 83.00 | 4.00 45.85k |

| Agni Green | 25.00 | 26.15 | 1.15 12.06k |

| Felix Industrie | 175.00 | 183.00 | 8.00 14.79k |

| Rajgor Castor | 48.10 | 50.00 | 1.90 2.31k |

| Mah Seamless | 890.80 | 925.75 | 34.95 71.28k |

| Gujarat Apollo | 230.00 | 238.75 | 8.75 19.25k |

| Nitin Spinners | 320.90 | 331.25 | 10.35 34.20k |

| InfoBeans Tech | 454.80 | 468.30 | 13.50 13.46k |

| Gallantt Ispat | 120.70 | 124.25 | 3.55 263.70k |

-330

December 20, 2023· 14:56 IST

Breaking: SAT quashes SEBI order on Future Retail

-330

December 20, 2023· 14:55 IST

Sensex Today | Prashanth Tapse, Sr. VP Research, Mehta Equities:

Given the positive secondary market environment and ample liquidity along with strong subscription demand, INOX India is expected to see a solid listing premium over and above 75% gain against the issue price of Rs 660/- per share.

Despite valuations being fully priced into all near term growth, a solid listing is justified on the back of the company's strategic position in the niche market with global footprint and commitment to innovations which is commanding higher valuation multiple.

Hence we recommend allotted short term investors to book profits over and above 75% gain on listing day while long term investors can HOLD considering healthy long term growth in leading supplier and exporter of cryogenic equipment and solutions. For those investors who failed to get allotments in the public offer can accumulate on every dips post listing for decent long term returns.

-330

December 20, 2023· 14:47 IST

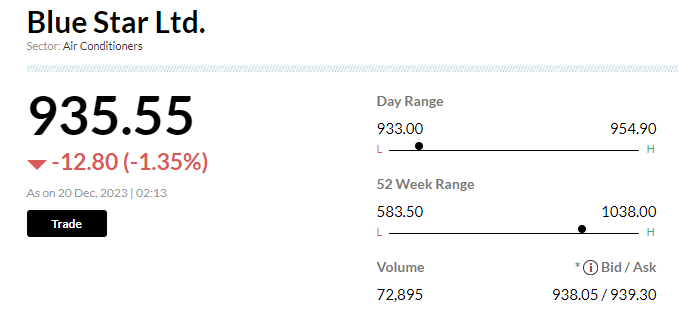

Stock Market LIVE Updates | Blue Star fell 1.4% after it got Rs 5.63 crore GST demand, penalty and interest

-330

December 20, 2023· 14:40 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 17624.80 -1.72 | 39.75 -1.64 | 5.05 36.84 |

| NIFTY IT | 35177.90 -0.47 | 22.91 6.38 | 8.63 22.95 |

| NIFTY PHARMA | 16236.95 -0.94 | 28.89 0.59 | 2.72 28.68 |

| NIFTY FMCG | 54778.70 0 | 24.01 1.04 | 4.24 19.88 |

| NIFTY PSU BANK | 5589.55 -3.06 | 29.43 -0.10 | 10.24 29.57 |

| NIFTY METAL | 7496.00 -2.86 | 11.49 -0.43 | 10.70 11.05 |

| NIFTY REALTY | 738.65 -2.25 | 71.06 -0.68 | 6.90 68.76 |

| NIFTY ENERGY | 32392.20 -1.95 | 25.21 1.82 | 14.51 21.69 |

| NIFTY INFRA | 7065.35 -1.67 | 34.52 0.71 | 10.07 30.70 |

| NIFTY MEDIA | 2361.60 -3.51 | 18.55 -3.64 | 4.40 13.43 |

-330

December 20, 2023· 14:35 IST

Stock Market LIVE Updates | BLS E-Services, Jyothi CNC and Popular Vehicles has received approval from SEBI for IPO

-330

December 20, 2023· 14:27 IST

-330

December 20, 2023· 14:19 IST

Sensex Today | Prashanth Tapse, Senior VP (Research), Mehta Equities:

As expected and recommended for healthy listing gains only, DOMS listed well in line with our expectations. Post listing, we believe valuations would go over stretched discounting next one-year earnings growth.

Hence we recommend allotted investors to book profits while those investors who failed to get allotments in the public offer can wait and watch for reasonable dips post listing to accumulate for decent long term returns.

-330

December 20, 2023· 14:16 IST

Stock Market LIVE Updates | Buy Manappuram Finance; target of Rs 205: Motilal Oswal

To mitigate the cyclicality in the gold loan segment, the company has been actively diversifying into non-gold segments, with the share of non-gold products in the company's AUM mix at 47% (vs. 37% YoY).

The company presented its non-gold businesses have successfully navigated Covid and have reverted to pre-Covid business level. It also exhibited its readiness to deliver healthy AUM growth and profitability in its non-gold businesses.

The management has stated that it will not pursue loan growth at the cost of a compression in spreads, which we believe will continue to be a driver for higher profitability.

The stock trades at 1.0x Sep’25E P/BV and there is a scope for a re-rating in valuation multiples for a franchise that can deliver a sustainable RoE of ~20%. Risk-reward for the stock is favorable and maintain buy rating with a revised Target Price of Rs 205 (based on 1.2x Sep’25E consolidated BVPS)

-330

December 20, 2023· 14:11 IST

-330

December 20, 2023· 14:09 IST

Stock Market LIVE Updates | Morgan Stanley View On Oil & Gas

-Windfall tax was lowered for oil production and diesel fuel exports

-Windfall tax was lowered following the decline in oil prices

-Jet fuel taxes were reintroduced while gasoline remains unchanged with zero export tax

-Prefer RIL, HPCL, ONGC, Oil India, IOCL and GAIL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ONGC | 207.30 | 3.44 | 2.74m |

| Reliance | 2,580.00 | 0.84 | 295.31k |

| IGL | 408.50 | 0.32 | 186.96k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HINDPETRO | 375.10 | -1.51 | 534.76k |

| GAIL | 142.65 | -1.25 | 1.18m |

| Petronet LNG | 213.60 | -1.09 | 107.52k |

| IOC | 123.60 | -0.88 | 1.50m |

| Adani Total Gas | 1,017.45 | -0.82 | 92.00k |

| BPCL | 448.50 | -0.16 | 157.96k |

| Linde India | 5,630.05 | -0.15 | 512 |

-330

December 20, 2023· 14:07 IST

Sensex Today | BSE Smllacap index shed more than 1,500 points from the day's high:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Andrew Yule | 32.60 | -10.49 | 910.22k |

| SpiceJet | 60.00 | -9.2 | 12.58m |

| Texmaco Infra | 106.30 | -8.72 | 435.38k |

| PTC India Fin | 40.85 | -8.28 | 290.45k |

| Dish TV | 19.24 | -8.07 | 6.78m |

| Arihant Super | 254.00 | -8.07 | 4.24k |

| Arihant Capital | 70.45 | -7.84 | 19.47k |

| Indiabulls Real | 88.76 | -7.8 | 2.71m |

| Rattanindia Ent | 76.90 | -7.76 | 1.44m |

| Jaiprakash Asso | 20.25 | -7.7 | 2.79m |

-330

December 20, 2023· 14:02 IST

Sensex Today | BSE Midcap index shed more than 1,100 points from the day's high:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IOB | 43.22 | -7.31 | 3.27m |

| Piramal Enter | 907.45 | -5.57 | 154.23k |

| UCO Bank | 39.54 | -5.43 | 3.18m |

| SJVN | 86.36 | -5.42 | 4.53m |

| Rajesh Exports | 364.30 | -5.34 | 120.74k |

| REC | 413.15 | -5.14 | 786.05k |

| IRCTC | 838.00 | -4.91 | 556.53k |

| Power Finance | 389.00 | -4.82 | 379.92k |

| JSW Energy | 411.00 | -4.68 | 101.96k |

| NHPC | 61.82 | -4.66 | 1.31m |

-330

December 20, 2023· 14:00 IST

Sensex Today | Market at 2 PM

The Sensex was down 313.80 points or 0.44 percent at 71,123.39, and the Nifty was down 103.60 points or 0.48 percent at 21,349.50. About 759 shares advanced, 2505 shares declined, and 63 shares unchanged.

-330

December 20, 2023· 13:59 IST

| Company | Price at 13:00 | Price at 13:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pramara Promoti | 102.90 | 91.00 | -11.90 - |

| Felix Industrie | 194.90 | 175.00 | -19.90 12.87k |

| Art Nirman | 69.85 | 63.25 | -6.60 2.63k |

| Graphisads | 90.45 | 82.10 | -8.35 56.50k |

| Sikko Industrie | 81.20 | 73.75 | -7.45 7.53k |

| Kotyark | 988.95 | 900.00 | -88.95 957 |

| Shivam Auto | 41.00 | 37.35 | -3.65 30.87k |

| Spectrum Talent | 115.00 | 105.00 | -10.00 4.89k |

| Tokyo Plast | 115.60 | 106.05 | -9.55 3.39k |

| Crest Ventures | 321.50 | 295.20 | -26.30 17.72k |

-330

December 20, 2023· 13:57 IST

| Company | Price at 13:00 | Price at 13:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Karnika Industr | 123.50 | 130.40 | 6.90 - |

| Panache Digilif | 76.95 | 79.95 | 3.00 2.85k |

| Palash Securiti | 118.30 | 121.85 | 3.55 198 |

| Weizmann | 114.40 | 116.80 | 2.40 620 |

| GRP | 4,714.30 | 4,806.55 | 92.25 1 |

| Holmarc Opto Me | 112.00 | 114.00 | 2.00 - |

| Ausom Enterp | 68.05 | 69.20 | 1.15 625 |

| Nakoda Group | 41.65 | 42.30 | 0.65 5.19k |

| Bafna Pharma | 98.00 | 99.50 | 1.50 318 |

| Keynote Finance | 119.50 | 121.25 | 1.75 204 |

-330

December 20, 2023· 13:56 IST

Stock Market LIVE Updates | Glenmark Pharma shares trade lower as Nirma to acquire majority stake in Glenmark Life

Glenmark Pharmaceuticals shares initially rose by 1.4 percent but later reversed their gains to trade in the negative on December 20. This shift occurred after the Competition Commission of India (CCI) approved Nirma's acquisition of the majority shareholding in the subsidiary Glenmark Life Sciences. Read More

-330

December 20, 2023· 13:52 IST

Stock Market LIVE Updates | Can Fin Homes board approves interim dividend of Rs 2 per share

-330

December 20, 2023· 13:48 IST

Sensex Today | Mufti parent Credo Brand's IPO subscribed 4 times on Day 2

The initial public offering (IPO) of Credo Brands Marketing Limited, best known for the Mufti clothing brand, was subscribed 4.6 times on December 20, the second day of bidding, with bids coming in for 6.3 crore shares against an offer size of 1.37 crore.

Retail investors bought over 6 times their allotted quota of shares and high net-worth individuals picked 6.5 times the shares set aside for them. Qualified institutional buyers were still to warm up to the issue and had picked only 25 percent of their reserved portion.

-330

December 20, 2023· 13:45 IST

-330

December 20, 2023· 13:43 IST

Sensex Today | Suraj Estate Developers IPO subscribed 5 times, retail portion booked 6 times on final day

Suraj Estate Developers IPO was subscribed five times by December 20 afternoon, the final day of bidding, with investors sending in bids for 4.11 crore shares against the offer size of 82.35 lakh.

Retail investors bought 6.4 times and high net-worth individuals (HNIs) picked 8.2 times their allotted quota of shares. Qualified institutional buyers (QIBs) had picked only 14 percent of their reserved portion.

Suraj Estate Developers is looking to raise Rs 400 crore through the IPO, a fresh issue of 1.11 crore shares. The price band has been fixed at Rs 340-360 a share with a lot size of 41 shares.

-330

December 20, 2023· 13:42 IST

Sensex Today | Azad Engineering IPO fully subscribed, HNI portion booked 2.5 times on Day 1

Azad Engineering’s Rs 74o-crore initial public offering (IPO) was fully subscribed within hours of opening on December 20, with investors bidding for 1.5 crore shares against the issue size of 1 crore.

The retail portion was booked 1.8 times and high net-worth individuals picked 2.5 times of their allotted quota of shares. Qualified institutional buyers were yet to bid for the offer.

The offer, which closes December 22, comprises fresh issues of shares worth Rs 240 crore and an offer for sale (OFS) of shares worth Rs 500 crore by stakeholders.

-330

December 20, 2023· 13:40 IST

Sensex Today | Happy Forgings IPO subscribed 5 times, retail portion booked 6 times on Day 2

Happy Forgings’ Rs 1,009-crore initial public offering (IPO) was subscribed 5 times by the morning of December 20, the second day of bidding, with bids for 4 crore shares against an issue size of 83.65 lakh.

Retail investors bought 5.6 times and high net-worth individuals picked 9.3 times their allotted quota of shares. Qualified institutional buyers had picked only 6 percent of the shares set aside for them.

-330

December 20, 2023· 13:39 IST

Sensex Today | RBZ Jewellers IPO subscribed 5 times, HNI portion fully subscribed on Day 2

The public issue of RBZ Jewellers was subscribed 5 times on the second day of bidding on December 20 with bids for 3.8 crore shares against an offer size of 79 lakh shares.

Retail investors bought 9.6 times and high net-worth individuals picked up close to 2 times the allotted quota, while qualified institutional buyers picked just 1 percent of the quota reserved for them.

-330

December 20, 2023· 13:38 IST

-330

December 20, 2023· 13:32 IST

Sensex Today | Kinjal Shah, Vice President & Co-Group Head - Corporate Ratings, ICRA:

The Indian commercial vehicle (CV) industry registered de-growth of 2% in retail sales volumes on a YoY basis and a sequential drop of 5% in November 2023. The drop was on the back of a high base last year, and a slowdown in rural sentiment exacerbated by unseasonal rains and state elections, which impacted the volumes after the robust sales in the festive period.

During 8M FY2024 (April-November 2023), the domestic wholesale volumes grew by 3.5% on a YoY basis, in line with ICRA’s expectation of 2-4% growth for the full year, supported by steady freight demand and the Government’s focus on infrastructure spending.

Going forward, volumes are expected to remain subdued on a YoY basis driven by the pause in infrastructure activities as the model code of conduct kicks in Q4 FY2024, as also the high base of Q4 FY2023 due to pre-buying prior to the implementation of BS VI 2.0 emission norms.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 3,855.30 | 0.79 | 15.05k |

| Bajaj Auto | 6,428.80 | 0.1 | 2.49k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Apollo Tyres | 450.25 | -1.12 | 137.21k |

| M&M | 1,684.50 | -0.9 | 36.67k |

| Bosch | 21,711.30 | -0.89 | 276 |

| Balkrishna Ind | 2,497.50 | -0.53 | 5.54k |

| Tata Motors | 726.85 | -0.32 | 242.53k |

| Maruti Suzuki | 10,202.60 | -0.32 | 20.33k |

| Tube Investment | 3,591.05 | -0.15 | 2.67k |

| Sundram | 1,241.60 | -0.07 | 1.17k |

| Cummins | 1,977.30 | -0.01 | 11.70k |

-330

December 20, 2023· 13:30 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Titan Company | 3,647.20 | 3,651.00 3,606.05 | -0.1% |

| HUL | 2,567.85 | 2,571.25 2,550.80 | -0.13% |

| HDFC Bank | 1,665.00 | 1,668.00 1,655.05 | -0.18% |

| UltraTechCement | 10,090.90 | 10,121.00 10,026.45 | -0.3% |

| Reliance | 2,587.90 | 2,597.85 2,560.30 | -0.38% |

| IndusInd Bank | 1,572.70 | 1,581.00 1,567.50 | -0.52% |

| Larsen | 3,495.70 | 3,514.90 3,492.85 | -0.55% |

| ITC | 456.60 | 459.25 456.50 | -0.58% |

| Asian Paints | 3,338.00 | 3,359.65 3,325.35 | -0.64% |

| Bharti Airtel | 986.65 | 994.15 986.10 | -0.75% |

-330

December 20, 2023· 13:27 IST

Sensex Today | BSE Power index down 1 percent dragged by Adani Power, JSW Energy, NHPC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Power | 522.05 | -2.57 | 187.79k |

| JSW Energy | 422.20 | -2.09 | 61.60k |

| NHPC | 63.65 | -1.84 | 826.68k |

| Adani Green Ene | 1,505.80 | -1.65 | 37.28k |

| Adani Energy | 1,058.25 | -1.62 | 72.28k |

| NTPC | 305.90 | -1.26 | 495.33k |

| CG Power | 450.15 | -1.08 | 39.16k |

| Suzlon Energy | 37.08 | -1.07 | 2.50m |

| ABB India | 4,793.80 | -0.94 | 5.23k |

| Power Grid Corp | 232.00 | -0.81 | 538.29k |

-330

December 20, 2023· 13:23 IST

Stock Market LIVE Updates | Axis Securities View on Varun Beverages:

Research house believe company's acquisition of BevCo provides a much-needed thrust to expand its geographical footprint in Africa coupled with the expansion of other businesses – Energy Business, Dairy and Juice would be key growth drivers for the company in the coming years.

Moreover, company is a strong candidate in the entire FMCG space on account of 1) Normalcy of operations and market share gains in newlyacquired territories (post COVID-19 disruptions), 2) The management’s continued focus on the efficient go-to-market execution in acquired and underpenetrated territories especially in rural markets, 3) Expansion of its distribution reach to 3.5 million outlets in CY23 from 3 milion currently, 4) Focus on expanding high-margin sting energy drink across outlets coupled with increased focus on expansion of value-added Dairy, Sports drink (Gatorade), and Juice segment.

The company has been in top picks portfolio since long and we continue to remain positive on the stock on a mid to long-term basis.

It estimate Revenue/EBITDA/PAT CAGR of 23%/30%/35% over CY22-25E as revised CY24-25 PAT estimates upwards by 5%/12% based on the abovementioned rationales.

Maintain buy rating on the stock with the revised Target Price of Rs 1,450/share (47x CY25EPS) versus the earlier Target Price of Rs 1,200/share (45x CY25 EPS), implying an upside of 24% from the CMP.

-330

December 20, 2023· 13:22 IST

Sensex, Nifty off record highs; trade flat; metal, auto, power under pressure

-330

December 20, 2023· 13:16 IST

Paytm CEO on CNBC-TV18:

Expects to hit full operating profit in under a year

Hiring 50,000 sales people, revamping wealth products

Overhauling suite of products to tap growing wealth among young users

Sales people to sign up more merchants across smaller Indian cities & towns

-330

December 20, 2023· 13:13 IST

Stock Market LIVE Updates | Salasar Techno recommends bonus issue:

The board of directors of Salasar Techno Engineering in their meeting held on December 20, 2023 recommended the issue of bonus shares in the proportion of 4:1, subject to / shareholders and other statutory approvals.

-330

December 20, 2023· 13:08 IST

Sensex Today | Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox:

Option data reveals selling pressure over 48000 – 48100 levels, suggesting heavy writing in both of these CE. The trend on the weekly expiry remains negative, with Bank Nifty expected to close below 48000 mark.

The highest OI concentration can be seen in 48000 CE, 48100 CE and 48200 CE, implying a writing scenario. Traders may expect a slide once the index breached spot 47900-mark. We recommend to take long position in 48100 PE in the range of 110 – 100 holding 60 as support level and a target of 180 – 220 range.

Technically, the index may slide towards 47800 and if it fails to show rebound, it could further decline to 47600 level. The resistance on the expiry day stays at 48050 mark.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| AU Small Financ | 767.90 | 5 | 3.67m |

| HDFC Bank | 1,665.40 | 0.76 | 7.06m |

| IndusInd Bank | 1,576.40 | 0.63 | 1.37m |

| Federal Bank | 157.75 | 0.22 | 5.43m |

| Kotak Mahindra | 1,847.00 | 0.02 | 2.33m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bandhan Bank | 246.00 | -1.03 | 3.72m |

| PNB | 90.65 | -0.82 | 22.70m |

| Axis Bank | 1,112.70 | -0.67 | 4.13m |

| ICICI Bank | 1,011.60 | -0.38 | 7.79m |

| SBI | 653.20 | -0.34 | 10.23m |

| Bank of Baroda | 225.95 | -0.07 | 10.56m |

-330

December 20, 2023· 13:03 IST

Stock Market LIVE Updates | Aurobindo Pharma received EIR from USFDA

The Andhra Pradesh unit has received Establishment Inspection Report classifying the facility as "Voluntary Action Indicated" (VAI).

The US Food and Drug Administration (FDA) had conducted an inspection at the Unit IV, a Formulation manufacturing facility, of APL Healthcare Limited, a wholly owned subsidiary of the company, situated at Menakuru Village, Naidupeta Mandal, Tirupati District, Andhra Pradesh, from September 13 to September 19, 2023.

-330

December 20, 2023· 13:00 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Arvind and Comp | 67.80 | 65.00 | -2.80 2.46k |

| Inspirisys Solu | 92.00 | 88.20 | -3.80 22.01k |

| Maheshwari Logi | 86.05 | 82.55 | -3.50 26.84k |

| P E Analytics | 233.10 | 224.10 | -9.00 1.61k |

| BGR Energy | 112.10 | 107.80 | -4.30 177.03k |

| Guj Raffia Ind | 57.25 | 55.25 | -2.00 1.08k |

| Aurangabad Dist | 303.00 | 292.90 | -10.10 1.92k |

| Compucom Soft | 33.40 | 32.30 | -1.10 11.95k |

| Hi-Green Carbon | 189.00 | 183.00 | -6.00 - |

| Rajgor Castor | 50.00 | 48.50 | -1.50 0 |

-330

December 20, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pramara Promoti | 85.50 | 102.90 | 17.40 - |

| Capital Trust | 97.50 | 115.95 | 18.45 1.18k |

| Coffee Day | 63.05 | 67.40 | 4.35 1.23m |

| Cellecor | 245.00 | 259.00 | 14.00 - |

| Mahalaxmi Rub | 290.00 | 304.20 | 14.20 13.50k |

| Inox Wind | 428.15 | 448.00 | 19.85 201.55k |

| Indo Borax | 199.30 | 208.20 | 8.90 190.40k |

| Tainwala Chem | 143.85 | 150.20 | 6.35 6.11k |

| Emkay Global | 146.75 | 152.80 | 6.05 274.81k |

| Pudumjee Paper | 51.05 | 53.15 | 2.10 304.22k |

-330

December 20, 2023· 12:59 IST

-330

December 20, 2023· 12:51 IST

Stock Market LIVE Updates | Sharekhan View on PVR INOX

Being the largest multiplex network operator, PVRINOX is a key beneficiary of the continuing strong BO collections, led by strong content pipeline across languages.

Improved traction in operational metrics and merger synergies are expected to lead to strong cash flow generation.

Broking house maintain Buy on PVR INOX with an unchanged Price Target of Rs 2,200, as it believe the strong content pipeline across languages is expected to continue to drive BO collections and assist in gaining further traction in operational metrics, while merger-related revenue and cost synergies would aid in achieving strong cash flows, leading to likely debt reduction.

At the CMP, the stock trades at 22.9x its FY26E EPS and 11.3x FY26E EV/ EBITDTA.

Key Risks:

(1) Emerging competition from OTT players, (2) Deterioration of content quality might affect footfalls and advertisement revenue growth, (3) Inability to take adequate price hikes at the right time would affect margins in the food and beverage (F&B) segment on account of rising input costs, and (4) Rise in COVID-19 infections.

-330

December 20, 2023· 12:47 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| HDFC Bank | 1,665.80 | 1,667.00 1,655.00 | -0.07% |

| IndusInd Bank | 1,578.95 | 1,581.00 1,566.10 | -0.13% |

| Kotak Mahindra | 1,848.30 | 1,864.00 1,845.00 | -0.84% |

| AU Small Financ | 765.35 | 772.15 734.90 | -0.88% |

| SBI | 654.60 | 660.40 652.35 | -0.88% |

| Axis Bank | 1,113.40 | 1,123.85 1,110.85 | -0.93% |

| Federal Bank | 157.70 | 159.30 157.50 | -1% |

| ICICI Bank | 1,011.60 | 1,022.00 1,007.55 | -1.02% |

| IDFC First Bank | 90.05 | 91.20 89.85 | -1.26% |

| Bank of Baroda | 225.80 | 229.50 225.10 | -1.61% |

-330

December 20, 2023· 12:42 IST

Sensex Today | Mufti parent Credo Brand's IPO subscribed 3.92 times on Day 2

The initial public offering (IPO) of Credo Brands Marketing Limited, best known for the Mufti clothing brand, was subscribed 3.92 times on December 20, the second day of bidding, with bids coming in for 5.39 crore shares against an offer size of 1.37 crore.

Retail investors bought 5.62 times their allotted quota of shares and high net-worth individuals picked 4.86 times the shares set aside for them. Qualified institutional buyers portion booked 25 percent.

-330

December 20, 2023· 12:40 IST

-330

December 20, 2023· 12:38 IST

Sensex Today | Muthoot Microfin IPO subscribed 4.35 times, retail portion bought 5.58 times on Day 3

The Muthoot Microfin IPO has been subscribed 4.35 times so far on December 20, with bids coming in for 10.63 crore shares against the issue size of 2.43 crore shares.

Retail investors bought 5.58 times the allotted quota of shares. The portion set aside for non-institutional investors was subscribed 6.67 times, and the employees' portion was booked 3.57 times.

The qualified institutional buyers bought 50 percent of the allotted quota.

-330

December 20, 2023· 12:36 IST

UK Data Watch | November CPI up 3.9% and Core CPI up 5.1% YoY

-330

December 20, 2023· 12:36 IST

Sensex Today | Motisons Jewellers IPO issue subscribed 83.40 times, retail portion at 90 times

The initial public offering of Motisons Jewellers was subscribed 83.40 times on December 20, the final day of bidding. It received bids for 174.77 crore shares against an issue size of 2.08 crore shares.

Retail investors portion booked at 90.43 times, high net-worth individuals picked up 137.04 times, and qualified institutional buyers bought 6.45 times of the allotted quota.

-330

December 20, 2023· 12:35 IST

Sensex Today | Suraj Estate Developers IPO: Issue booked 4.5 times on final day

Suraj Estate Developers IPO was subscribed 5.50 times on December 20, the final day of bidding, with bids coming in for 3.72 crore shares against the issue size of 82.35 lakh.

The retail portion was booked 6.06 times and high net worth individuals (HNIs) bought 6.76 percent of their allotted quota of shares. Qualified institutional buyers had picked 14 percent of the portion set aside for them.

-330

December 20, 2023· 12:32 IST

Sensex Today | Azad Engineering IPO subscribed 59%, HNI portion booked 76% on Day 1

Azad Engineering’s Rs 74o-crore initial public offering (IPO) was subscribed 59 percent within hours of opening on December 20, with investors bidding for 59 lakh shares against the issue size of 1 crore.

The retail portion was booked at 84 percent and high net-worth individuals picked 76 percent of their allotted quota of shares. Qualified institutional buyers were yet to bid for the offer.

-330

December 20, 2023· 12:29 IST

-330

December 20, 2023· 12:26 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Kaynes Tech | 2,899.95 | 2,900.00 2,774.60 | 0% |

| Thermax | 3,093.00 | 3,093.75 3,000.00 | -0.02% |

| Metro Brands | 1,329.20 | 1,329.65 1,312.40 | -0.03% |

| Garware Technic | 3,322.55 | 3,325.00 3,288.70 | -0.07% |

| Pfizer | 4,251.60 | 4,255.00 4,225.00 | -0.08% |

| Tata Coffee | 297.40 | 297.65 288.65 | -0.08% |

| Triveni Turbine | 410.25 | 410.60 400.95 | -0.09% |

| Cipla | 1,242.10 | 1,243.50 1,231.35 | -0.11% |

| Natco Pharma | 786.15 | 787.00 779.85 | -0.11% |

| Privi Special | 1,248.50 | 1,250.00 1,244.40 | -0.12% |

-330

December 20, 2023· 12:25 IST

Stock Market LIVE Updates | Nazara Technologies unveils partnerships with four distinguished Indian game studios

The eclectic mix of games selected for publication includes 'Gravity Shooter' by Smash Head Studios, a thrilling 2D action game; 'World Cricket League' from Wandermind Labs, offering a 3D multiplayer cricket experience; 'Hacked: Password Puzzle' by Pixcell Play, a challenging puzzle game; and ATG Studios' 'Laser Tanks' and 'Paperly', both promising unique gaming experiences across varied genres.

-330

December 20, 2023· 12:21 IST

-330

December 20, 2023· 12:18 IST

Sensex Today | Way2wealth View on Happy Forgings IPO

Happy Forgings’s diversified product portfolio, coupled with its focus on margin- accretive and value-additive products, has contributed to its transition from a forging-led business to a leading player in the machined components manufacturing industry.

It also serves a wide range of industries, including automotive, farm equipment, off - highway vehicles, and industrial machinery for oil and gas, power generation, railways, and wind turbine sectors.

At the upper price band, company is valuing at P/E of 38.3x with a market cap of Rs 86,161 million post issue of equity shares and return on net worth of 21.12%. On the valuation front, broking house believe that the company is fairly priced. Thus, recommend a “Subscribe” rating to the IPO.

-330

December 20, 2023· 12:16 IST

Sensex Today | BSE Midcap index rose 0.5 percent supported by Oil India, Voltas, Nippon Life India Asset Management:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oil India | 390.65 | 14.64 | 1.63m |

| Voltas | 952.00 | 6.17 | 229.59k |

| Nippon | 472.30 | 5 | 18.23m |

| AU Small Financ | 766.10 | 4.74 | 117.43k |

| Supreme Ind | 4,603.10 | 3.85 | 4.27k |

| Gujarat Fluoro | 3,462.85 | 3.51 | 10.39k |

| CG Consumer | 305.55 | 3.17 | 224.18k |

| Delhivery | 374.90 | 2.99 | 97.34k |

| Sun TV Network | 713.15 | 2.86 | 87.45k |

| United Brewerie | 1,745.15 | 2.86 | 3.85k |

-330

December 20, 2023· 12:10 IST

Stock Market LIVE Updates | Oil India at an all-time high

Oil India share price rose 14 percent to hit fresh high, as the stock registered a biggest move in 4 years.

Antique believes company is on track to drive 21% increase in oil production and 51% jump in gas production in the medium-term and increase its refining capacity 3x.

IT hikes target price to Rs 419 from Rs 375.

-330

December 20, 2023· 12:04 IST

Stock Market LIVE Updates | AVG Logistics acquires fleet of 50+ Cold Chain vehicles from Global MNCs

AVG Logistics is strengthening its fleet operations by acquiring 50+ fleet of cold chain vehicles to enhance its cold chain capabilities. Bulk of this high-quality fleet was previously owned by a multinational logistics company amongst others.

-330

December 20, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was up 200.60 points or 0.28 percent at 71,637.79, and the Nifty was up 74.60 points or 0.35 percent at 21,527.70. About 1752 shares advanced, 1444 shares declined, and 83 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Wipro | 445.95 | 1.68 | 169.08k |

| Reliance | 2,586.90 | 1.11 | 239.98k |

| TCS | 3,848.00 | 0.94 | 30.83k |

| Titan Company | 3,644.55 | 0.9 | 18.32k |

| UltraTechCement | 10,100.00 | 0.88 | 1.38k |

| Bajaj Finserv | 1,723.15 | 0.76 | 36.49k |

| IndusInd Bank | 1,577.50 | 0.72 | 21.73k |

| Infosys | 1,567.35 | 0.66 | 61.70k |

| HDFC Bank | 1,663.00 | 0.6 | 190.40k |

| Power Grid Corp | 234.90 | 0.43 | 398.02k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HCL Tech | 1,468.00 | -1.35 | 39.34k |

| Sun Pharma | 1,235.85 | -0.77 | 20.70k |

| Tata Steel | 134.55 | -0.63 | 1.09m |

| Axis Bank | 1,112.95 | -0.57 | 27.86k |

| ICICI Bank | 1,010.35 | -0.44 | 71.34k |

| Nestle | 25,385.00 | -0.39 | 2.37k |

| HUL | 2,553.20 | -0.32 | 46.47k |

| M&M | 1,695.00 | -0.29 | 28.35k |

| SBI | 653.80 | -0.27 | 415.74k |

| Tech Mahindra | 1,278.80 | -0.21 | 61.54k |

-330

December 20, 2023· 11:59 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kiduja India | 206.70 | 187.10 | -19.60 1.70k |

| Vivid Mercant | 59.48 | 54.22 | -5.26 296 |

| Mihika Ind | 24.65 | 22.57 | -2.08 1 |

| EVERFIN | 65.00 | 60.50 | -4.50 76 |

| Beryl Securitie | 33.19 | 31.00 | -2.19 4.14k |

| National Ind | 80.00 | 75.05 | -4.95 4 |

| Global Longlife | 48.05 | 45.20 | -2.85 2.00k |

| U. Y. Fincorp | 25.83 | 24.30 | -1.53 49.37k |

| Balgopal Commer | 37.00 | 34.91 | -2.09 1.40k |

| Indo Tech Trans | 639.00 | 603.55 | -35.45 32 |

-330

December 20, 2023· 11:56 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shree Hari Chem | 74.80 | 85.80 | 11.00 581 |

| Kiri Industries | 398.00 | 445.20 | 47.20 50.85k |

| LWS Knitwear | 24.32 | 26.88 | 2.56 15.94k |

| Soni Medicare | 26.20 | 28.90 | 2.70 28 |

| Ashirwad Steel | 43.50 | 47.65 | 4.15 642 |

| CIL Nova Petro | 26.40 | 28.72 | 2.32 1.52k |

| Ceeta Industrie | 30.51 | 33.00 | 2.49 1.01k |

| Saptarishi Agro | 19.31 | 20.85 | 1.54 910 |

| Ambo Agritec | 25.10 | 27.01 | 1.91 4.00k |

| HCP Plastene | 266.00 | 284.00 | 18.00 275 |

-330

December 20, 2023· 11:53 IST

SpiceJet planned fundraising details:

The company will raise a total of Rs 2,241 crore in 2 tranches, Rs 1,591 in 1st tranche & Rs 650 crore in 2nd

1st tranche fund raising will be completed by June 2024 & 2nd by July 2025

Rs 504 crore to be used for TDS, GST & PF dues, Rs 400 crore for past dues of creditors

Rs 500 crore to be used for uplifting current fleet & acquiring new fleet

Rs 200 crore to be used to meet ATF expenses & Rs 78.5 crore for employee expenses

Rs 559 crore will be used for general corporate purposes

-330

December 20, 2023· 11:49 IST

Stock Market LIVE Updates | Transformers and Rectifiers India bags order from Power Grid

Transformers and Rectifiers (India) has been awarded orders of total contract value of Rs 219 crores from Power Grid Corporation of India Limited.

-330

December 20, 2023· 11:47 IST

Stock Market LIVE Updates | RVNL wins Rs 123 crore order in Kerala

Rail Vikas Nigam and Kerala Rail Development Corporation JV emerged as the lowest bidder to upgrade and redevelop the Varkala Sivagiri Railway station in Kerala. The project costs Rs 123.26 crore and the time period for the project is 30 months.

-330

December 20, 2023· 11:44 IST

Shrey Jain, Founder and CEO SAS Online:

The benchmark indices have reached new all-time highs and show signs of sustaining their upward momentum, propelled by positive global indicators. Nifty is currently trading above 21,500, while Bank Nifty has surpassed the critical level of 48,000.

In the context of today's weekly expiry, the 48,000 Call option has attracted substantial Open Interest (OI) for Bank Nifty. Therefore, if Bank Nifty can uphold levels above 48,000, it is expected to advance towards the 48,500 levels.

The Nifty is expected to sustain its bullish trend as long as it consistently holds above 21,350. Resistance from call writers is foreseen on the upside, particularly around the 21,500 mark.

-330

December 20, 2023· 11:40 IST

-330

December 20, 2023· 11:37 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Reliance | 2,590.00 1.23 | 215.56k | 55.73 |

| HDFC Bank | 1,661.90 0.54 | 178.41k | 29.67 |

| SBI | 655.70 0.02 | 370.10k | 24.33 |

| Maruti Suzuki | 10,255.00 0.19 | 14.54k | 14.92 |

| Tata Steel | 134.85 -0.41 | 932.23k | 12.63 |

| Tata Motors | 728.85 -0.05 | 169.62k | 12.40 |

| HUL | 2,552.90 -0.34 | 44.11k | 11.30 |

| ITC | 457.75 0.36 | 234.26k | 10.73 |

| TCS | 3,841.90 0.78 | 27.89k | 10.80 |

| NTPC | 311.00 0.39 | 339.71k | 10.61 |

-330

December 20, 2023· 11:35 IST

Stock Market LIVE Update | RBZ Jewellers IPO oversubscribed by 3.28x on Day 2, led by retail investors

Non-institutional investors (NIIs) subscribe 1.04x, retail investors subscribe 6.77x, but no interest seen from QIBs, as of 11:35 am.

-330

December 20, 2023· 11:32 IST

Stock Market LIVE Update | Azad Engineering IPO subscribed 0.48 times (x) so far on Day 1, led by retail investors

NIIs subscribed 0.6x, retail investors subscribe 0.7x, and employees at 0.4x on day 1, as of 11:30 am.

-330

December 20, 2023· 11:22 IST

Stock Market LIVE Update | AVG Logistics shares surge as company acquires over 50 cold chain vehicles

-330

December 20, 2023· 11:16 IST

Stock Market LIVE Update | Venus Remedies unveils new consumer health division 'Reset'; stock gains

-330

December 20, 2023· 11:08 IST

Stock Market LIVE Update | Ashok Leyland shares surge as global brokerage firm CLSA sees another 33% upside

-330

December 20, 2023· 11:00 IST

The 39 th Annual General Meeting of the members of SpiceJet will be held on Wednesday, the January 10, 2024.

-330

December 20, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shri Krishna | 50.18 | 45.65 | -4.53 442 |

| TechNVision | 500.00 | 455.65 | -44.35 0 |

| Vinayak Polycon | 27.19 | 25.02 | -2.17 0 |

| CBPL | 154.75 | 143.10 | -11.65 10.00k |

| Enterprise Intl | 23.00 | 21.30 | -1.70 2.20k |

| Innovative Idea | 27.89 | 25.85 | -2.04 5.00k |

| KJMC Fin Ser | 59.96 | 55.80 | -4.16 758 |

| SHRYDUS IND | 31.35 | 29.20 | -2.15 10.33k |

| KJMC Corporate | 58.00 | 54.40 | -3.60 11.30k |

| YOGI | 32.23 | 30.23 | -2.00 4.52k |

-330

December 20, 2023· 10:56 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Emkay Global | 135.90 | 151.50 | 15.60 17.04k |

| Jindal Leasefin | 36.22 | 39.90 | 3.68 100 |

| Adhbhut Infra | 57.10 | 62.75 | 5.65 1.22k |

| Eiko PP | 20.15 | 22.00 | 1.85 11.44k |

| Golkunda Diamon | 123.00 | 132.10 | 9.10 3.25k |

| Comfort Comm | 22.08 | 23.50 | 1.42 5.34k |

| JMJ Fintech | 20.27 | 21.57 | 1.30 281 |

| Fortune Intl | 32.21 | 34.25 | 2.04 273 |

| Lorenzini Appar | 246.90 | 262.10 | 15.20 78 |

| Inter Globe Fin | 31.20 | 33.10 | 1.90 51 |

-330

December 20, 2023· 10:55 IST

Stock Market LIVE Updates | Quest Investment Advisors picks 1.4% stake in Ajmera Realty

Quest Investment Advisors bought 5,01,443 equity shares or 1.4% stake in Ajmera Realty & Infra India via open market transactions. However, Fahrenheit Fun and Games sold 7 lakh shares in the company at a price of Rs 425 per share. Fahrenheit held 7.05% stake or 25 lakh shares in the company as of September 2023.

-330

December 20, 2023· 10:51 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Varun Beverages | 1380.45 | 1380.45 | 1,296.55 |

| Oil India | 364.35 | 364.35 | 363.35 |

| Nippon | 486.80 | 486.80 | 476.10 |

| Voltas | 954.95 | 954.95 | 949.30 |

| NESCO | 906.10 | 906.10 | 898.40 |

| ABSL AMC | 488.50 | 488.50 | 488.50 |

| HDFC AMC | 3263.05 | 3263.05 | 3,236.35 |

| Sun TV Network | 719.50 | 719.50 | 718.30 |

| Equitas Bank | 113.85 | 113.85 | 109.49 |

| Jubilant Food | 586.00 | 586.00 | 581.40 |

-330

December 20, 2023· 10:46 IST

Stock Market LIVE Updates | White Iris Investment offloads 4.5% stake in Apollo Tyres

Foreign portfolio investor White Iris Investment sold 2,85,79,542 equity shares or 4.5% stake in Apollo Tyres via open market transaction at a price of Rs 448.35 per share, which valued at Rs 1,281.4 crore.

However, Nippon India Mutual Fund picked 1,20,44,000 equity shares or 1.9% stake at same price, amounting to Rs 540 crore. As of September 2023, White Iris Investment held 8.04% stake or 5,10,54,445 equity shares in Apollo Tyres.

-330

December 20, 2023· 10:44 IST

CNBC-TV18 Exclusive: Sources Say:

Life insurers met yesterday to discuss IRDAI’s paper on increasing surrender value

Life insurers aligned with IRDAI’s suggestion of better surrender value

Life insurers to send their feedback to IRDAI

Life insurers feel IRDAI proposal would increase surrenders in industry and lead to drop in industry persistence level

Life insurers feel distinction should be made between long & short-term policies

Life insurers feel that surrender value shouldn’t be increased in long-term policies

Higher surrender value could raise surrender in long-term policies

Higher surrender value could create asset-liability mismatch

Life insurers also seek to have threshold limit in form of a percent of total premium

IRDAI has proposed to have threshold limit in the form of an absolute value

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ICICI Prudentia | 524.75 | 0.92 | 382313 |

| LIC India | 802 | 1 | 745435 |

| HDFC Life | 672.05 | 0.9 | 709018 |

| SBI Life Insura | 1434.75 | 0.72 | 252945 |

-330

December 20, 2023· 10:43 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 21556.70 0.48 | 19.06 3.01 | 9.46 17.25 |

| NIFTY BANK | 47992.65 0.25 | 11.65 1.91 | 10.11 10.69 |

| NIFTY Midcap 100 | 45893.60 0.84 | 45.65 2.11 | 9.65 42.90 |

| NIFTY Smallcap 100 | 15049.55 0.66 | 54.65 2.68 | 8.48 50.19 |

| NIFTY NEXT 50 | 52735.90 0.67 | 25.00 2.85 | 12.88 21.71 |

-330

December 20, 2023· 10:39 IST

Stock Market LIVE Updates | Adani Properties sells 40,389 equity shares in ABC India

Adani Properties sold 40,389 equity shares in the logistics company at a price of Rs 160.67 per share. As of September 2023, Adani Properties held 65,000 equity shares or 1.2% stake in ABC India.

-330

December 20, 2023· 10:38 IST

Stock Market LIVE Updates | Foreign investor Cresta Fund offloads Rs 85.82 crore shares in Jindal Saw

Foreign portfolio investor Cresta Fund has offloaded 20 lakh equity shares or 0.6% stake in Jindal Saw at a price of Rs 429.1 per share, which valued at Rs 85.82 crore. Cresta held 2.77% stake or 88.67 lakh shares in the company as of September 2023.