Closing Bell: Nifty below 22,050, Sensex falls 199 pts; IT drags, metals shine

-330

January 16, 2024· 16:19 IST

Benchmark indices broke five-day gaining momentum and ended lower amid volatility on January 16. At close, the Sensex was down 199.17 points or 0.27 percent at 73,128.77, and the Nifty was down 65.20 points or 0.30 percent at 22,032.30.

We wrap up today's edition of the Moneycontrol live market blog, and will be back on Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

January 16, 2024· 16:17 IST

-330

January 16, 2024· 16:14 IST

Kunal Shah, Senior Technical & Derivative Analyst, LKP Securities:

The Nifty index experienced a day of mixed market dynamics, with bulls dominating the first half and bears taking control in the second half. For a sustained upward movement towards 22300 levels, the index needs to decisively break above the 22150 mark. On the downside, the immediate support is located at 21950, and a clear break below this level could trigger further corrections towards the 21800 mark.

The Bank Nifty index displayed a doji candle, signaling a struggle between bulls and bears in the current market scenario. To witness a continuation of the rally towards 49000/50000, the index must sustain above the crucial level of 48300. Conversely, the immediate lower-end support lies in the 47800-47700 zone, and a conclusive break below this level could pave the way for further downside movements.

-330

January 16, 2024· 16:12 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

After the initial positivity, Nifty oscillated in a range and finally settled at 22,028 levels. On the sectoral front, the profit taking in the IT, realty and energy majors were weighing on the sentiment while metal and FMCG showed resilience. The broader indices too inched lower and lost nearly half a percent each.

Indications are in favor of further consolidation in the index and expect Nifty to hold the 21,750-21,900 zone. However, traders should maintain extra caution in stock selection now citing volatility due to earnings. Besides, the current positioning of the midcap and smallcap index is not reflecting the correct picture of deterioration in the broader trend so plan trades accordingly.

-330

January 16, 2024· 16:09 IST

Jateen Trivedi, VP Research Analyst, LKP Securities:

Rupee experienced losses, falling below 83.09 with a decline of 0.20. This decline was influenced by the rise in the dollar index, reaching near 102.95$. Additionally, the increase in Crude prices above 73.25 further pressured the rupee to dip below 83.00 after a few days of a positive rally.

The rupee continues to trade within a broad range, fluctuating between 82.80 and 83.40. Tomorrow's economic data, including China's GDP and Industrial Production, as well as the US Retail Sales data in the evening, are anticipated to keep the markets active with reactions to the released information.

-330

January 16, 2024· 15:57 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened on a weak note and witnessed a day of consolidation. It traded in a narrow range and ended the day on a negative note down 65 points. On the daily charts we can observe that the Nifty has faced resistance around the psychological level of 22000. The hourly momentum indicator has triggered a negative crossover indicating loss of momentum on the upside.

Considering the current price and momentum setup we expect Nifty to consolidate within the range 21900 – 22200 from short term perspective. Stock specific action and sector rotation is likely during this period of consolidation. Aggressive longs should be avoided and adherence to strict stoploss levels for the long positions is advised.

Bank Nifty has witnessed a consolidation today which is a brief pause in the overall uptrend. We expect the momentum to continue on the upside over the next few trading sessions. On the upside target 48650 – 49000 from short term perspective.

-330

January 16, 2024· 15:56 IST

L&T Technology Services Q3 net profit at Rs 336.2 crore and rupee revenue at Rs 2,422 crore.

-330

January 16, 2024· 15:55 IST

ALERT | HDFC Bank Q3 net profit at Rs 16,372 crore

-330

January 16, 2024· 15:51 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Key indices scaled record highs, but failed to capitalise as lack of cues due to closure of US markets on Monday saw investors book profit in IT, telecom, realty and power stocks, which halted the recent upsurge. Weak Asian and European market cues coupled with a sharp fall in rupee against the dollar also dented the sentiment, which prompted investors to trim their equity exposure.

-330

January 16, 2024· 15:48 IST

Aditya Gaggar Director of Progressive Shares:

Indian equities started the day on a tepid note and profit-booking led correction in the IT and Pharma stocks mounted pressure on the Index to trade lower. After a rangebound mid-session, a steep fall was seen across the board mainly due to bearish divergence in Mid and Smallcap indices; however, late buying in the Metal stocks (China stimulus news) helped the Index to recover and to end the session at 22,032.30 with a loss of 65.15 points.

On the daily chart, Index has formed a spinning top candlestick pattern with a probability of a bearish divergence. For the time being, level of 22,120 will act as resistance while the downside seems to be protected at 21,930.

-330

January 16, 2024· 15:41 IST

Vinod Nair, Head of Research, Geojit Financial Services:

The broad market exhibited profit booking following a good performance by the IT sector amid weak global cues. Investors are contemplating whether the current euphoria in markets has gone farfetched, especially with elevated domestic valuations in mid & small caps. FII flows are mixed due to a lack of fresh triggers. Oil prices stayed firm amid undeterred geopolitical tensions. The latest IIP growth signals near-term softness.

-330

January 16, 2024· 15:33 IST

Rupee Close:

Indian rupee ended 19 paise lower at 83.07 per dollar on Tuesday versus Monday's close of 82.88.

-330

January 16, 2024· 15:30 IST

Market Close

: Benchmark indices broke five-day gaining momentum and ended lower amid volatility on January 16.

At close, the Sensex was down 199.17 points or 0.27 percent at 73,128.77, and the Nifty was down 65.20 points or 0.30 percent at 22,032.30. About 1192 shares advanced, 2315 shares declined, and 61 shares unchanged.

Top losers on the Nifty included Divis Laboratories, HCL Technologies, Wipro, NTPC and SBI Life Insurance, while gainers included BPCL, Tata Steel, Titan Company, ITC and Maruti Suzuki.

Among sectors, metal and oil & gas indices gained nearly 1 percent each, while power, realty, healthcare and Information Technology down 0.5-1.5 percent each.

BSE Midcap and Smallcap indices lost 0.3 percent each.

-330

January 16, 2024· 15:25 IST

Sensex Today | Dollar hits one-month high as rate-cut bets fall

The dollar rose on Tuesday as investors tempered their expectations for a March rate cut from the Federal Reserve, while the pound and yen fell as inflationary pressures subsided.

Against a basket of currencies, the dollar rose 0.47%to 103.13, a one-month high. It gained 0.2% overnight in subdued trading during a U.S. public holiday on Monday.

The euro fell 0.54% to $1.0892, set for its steepest one-day percentage drop in two weeks.

-330

January 16, 2024· 15:23 IST

Stock Market LIVE Updates | UBS View On Paytm

-Initiate buy, target Rs 900 per share

-Continued monetisation and EBITDA break-even to drive re-rating

-Payment leader with strength across merchants and customers

-Expect a moderating 21 percent topline CAGR in FY24- 28

-Operating leverage plays out as marketing expense requirements ease

-EBITDA margin to gradually reach 20 percent

-330

January 16, 2024· 15:19 IST

GQG raises stake in ITC to 2.79% % in December quarter from 1.58% in September quarter

-330

January 16, 2024· 15:15 IST

Sensex Today | Nifty Metal index up 1 percent supported by MOIL, SAIL, NALCO:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MOIL | 333.30 | 7.36 | 14.02m |

| SAIL | 119.50 | 4.23 | 56.30m |

| NALCO | 138.95 | 2.7 | 90.66m |

| Jindal Steel | 750.35 | 2.08 | 2.43m |

| Tata Steel | 137.35 | 1.82 | 50.62m |

| Ratnamani Metal | 3,399.10 | 1.63 | 32.51k |

| NMDC | 212.65 | 1.55 | 16.68m |

| Welspun Corp | 540.00 | 1.15 | 1.69m |

| Hindalco | 579.85 | 0.9 | 4.74m |

| JSW Steel | 832.30 | 0.87 | 1.79m |

-330

January 16, 2024· 15:12 IST

Stock Market LIVE Updates | Macquarie On LIC Housing Finance

-Outperform call, target Rs 650 per share

-There are three main changes in RBI regulations on deposit restrictions

-Company is fine on all aspects of RBI regulations on deposit restrictions

-Company’s deposits as a percent of total funds is just 5 percent

-Deposits are less than 0.5x of net-owned funds, way below RBI limit of 1.5x

-Company already has more than 15 percent of deposits in liquid securities

-Company trades at 0.8x FY25E P/BV for 14 percent RoE

-330

January 16, 2024· 15:09 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

The Indian Rupee depreciated on the strong Dollar and weak domestic markets. A rise in crude oil prices also put downside pressure on Rupee. However, favourable macroeconomic data prevented a sharp fall in the Rupee. India’s trade deficit narrowed to $19.8 billion in December 2023 compared to $20.58 billion in November 2023. The US Dollar gained on ‘safe-haven’ demands after Houthis hit a US commercial vessel which has dented global risk sentiments. The US Department of Transportation has issued a warning to ships to avoid the South Red Sea area.

We expect Rupee to trade with a slight negative bias on risk aversion in the global markets amid escalating geopolitical tensions in the Middle East. Rising crude oil prices may also weigh on Rupee. However, any bounce back in domestic markets may support Rupee at lower levels. USDINR spot price is expected to trade in a range of Rs 82.60 to Rs 83.40.

-330

January 16, 2024· 15:07 IST

Stock Market LIVE Updates | CLSA View On Jio Financial Services

-Company reported quarterly profit of Rs 300 crore which is irrelevant since company is largely starting up

-Company said it is taking a calibrated approach to the RBI measures on unsecured lending

-Company taking calibrated approach to those products & focusing on growing secured loan products

-Company will also introduce leasing as a new product in FY24

-Beyond lending, company is scaling up in other segments such as insurance broking & payments

-Company awaits regulatory approval for the mutual fund business

-330

January 16, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was down 186.47 points or 0.25 percent at 73,141.47, and the Nifty was down 62.20 points or 0.28 percent at 22,035.30. About 1056 shares advanced, 2226 shares declined, and 47 shares unchanged.

-330

January 16, 2024· 15:00 IST

| Company | Price at 14:00 | Price at 13:23 | Chg(%) Hourly Vol |

|---|---|---|---|

| SHRYDUS IND | 27.97 | 25.20 | -2.77 21 |

| Aspira Pathlab | 36.95 | 34.00 | -2.95 448 |

| Golechha Global | 21.67 | 20.16 | -1.51 753 |

| Ras Resorts | 46.99 | 44.23 | -2.76 42 |

| Continent Petro | 88.00 | 83.00 | -5.00 2.01k |

| Mercury Ev-Tech | 110.60 | 105.00 | -5.60 74.31k |

| Mish Designs | 150.00 | 142.60 | -7.40 7.49k |

| Tiger Logistics | 790.70 | 754.05 | -36.65 3.85k |

| Longview Tea | 34.85 | 33.25 | -1.60 152 |

| Som Datt Fin | 121.65 | 116.15 | -5.50 222 |

-330

January 16, 2024· 14:57 IST

| Company | Price at 14:00 | Price at 13:23 | Chg(%) Hourly Vol |

|---|---|---|---|

| Filtra Consult | 78.20 | 87.00 | 8.80 1.63k |

| Pan Electroncis | 30.08 | 33.24 | 3.16 19 |

| Promax Power | 58.30 | 63.40 | 5.10 0 |

| Globe Commercia | 24.01 | 26.00 | 1.99 299 |

| JAFINANCE | 31.06 | 33.55 | 2.49 1 |

| Betex | 278.10 | 299.90 | 21.80 21 |

| Bombay Oxygen | 16,000.00 | 17,213.00 | 1,213.00 8 |

| Gokak Textiles | 119.50 | 128.15 | 8.65 1.13k |

| Ravi Leela Gran | 36.22 | 38.80 | 2.58 59 |

| Synthiko Foils | 101.50 | 107.95 | 6.45 186 |

-330

January 16, 2024· 14:50 IST

Sensex Today | China weighs more stimulus with $139 billion of special bonds, Bloomberg reports

-330

January 16, 2024· 14:43 IST

Stock Market LIVE Updates | ITI zooms 18% to touch new high amid high volumes; stock up 245% in one year

Shares of ITI jumped 18 percent on January 16 on high volumes to hit a fresh 52-week high of Rs 374.80 on NSE. A total of 2 crore shares changed hands on BSE and NSE combined, way more than that 1-week and 1-month average of 30 lakh and 39 lakh shares respectively. The multibagger telecom stock has been on a roll this year, rising 18 percent in January so far. The stock has surged over 245 percent in the last one year, more than tripling investors' money.

-330

January 16, 2024· 14:36 IST

-330

January 16, 2024· 14:31 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18713.45 -0.28 | 0.51 1.05 | 3.74 46.79 |

| NIFTY IT | 36714.70 -1.31 | 3.38 5.92 | 2.61 25.46 |

| NIFTY PHARMA | 17316.35 -1.16 | 2.88 -0.17 | 7.02 36.79 |

| NIFTY FMCG | 56604.60 -0.09 | -0.67 0.06 | 4.46 28.63 |

| NIFTY PSU BANK | 5918.05 0 | 3.58 4.15 | 2.70 36.14 |

| NIFTY METAL | 7960.10 1.22 | -0.22 1.94 | 2.91 17.42 |

| NIFTY REALTY | 867.75 -1.76 | 10.82 0.12 | 13.13 103.79 |

| NIFTY ENERGY | 35300.05 -0.42 | 5.47 3.14 | 8.35 35.63 |

| NIFTY INFRA | 7621.70 -0.26 | 4.36 2.54 | 6.73 46.50 |

| NIFTY MEDIA | 2397.65 -0.08 | 0.40 0.41 | -1.62 23.24 |

-330

January 16, 2024· 14:26 IST

Stock Market LIVE Updates | Newgen Software hits upper circuit on strong Q3 show

Newgen Software stock price jumped five percent in trade on January 16 as the software player’s net profit for the quarter ended December 31 clocked in at Rs 68.3 crore, notching an on-year rise of 44.4 percent.

The firm reported its revenue from operations at Rs 324 crore for the third quarter of the current fiscal, higher by 27 percent YoY from Rs 255 crore in the corresponding quarter of the previous year.

The EBITDA rose 35 percent on a sequential basis to Rs 77 crore from Rs 57 crore in the quarter ended September. The margins came in at 23.8 percent, up 440 basis points from 19.4 percent in Q2FY24.

-330

January 16, 2024· 14:21 IST

Stock Market LIVE Updates | Sharekhan View on Tata Consumer Products

Tata Consumer Products has maintained its focus on scaling up its domestic foods and beverage business through organic and inorganic initiatives. Some of the recent acquisitions such as Soulfull are scaling up well and likely to reach revenues of Rs. 1,000 crore by FY24E.

Sharekhan expect the acquisition of Capital Foods and Organic India to add strong value to the product portfolio and earnings in the coming years.

The stock is currently trading at 58x/52x its FY2025E/26E earnings.

Broking house maintain a Buy on the stock with revised price target of Rs 1,315 (rolling it over to FY2026E earnings with earning accretion of mid-single digit from potential acquisitions). TCPL remains one of Top Picks in the consumer goods space with strong growth prospects in the medium to long run.

-330

January 16, 2024· 14:14 IST

Stock Market LIVE Updates | CE Info Systems Q3 Earnings:

Net profit up 4.1% at Rs 30.8 crore versus Rs 29.6 crore and revenue up 35.9% at Rs 92 crore versus Rs 67.7 crore, YoY.

-330

January 16, 2024· 14:12 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Bayer Cropscien | 5,835.45 | 5,836.00 5,770.00 | -0.01% |

| Ramco Cements | 992.30 | 992.45 978.75 | -0.02% |

| Fortis Health | 418.10 | 418.45 413.90 | -0.08% |

| Tata Steel | 137.05 | 137.20 134.05 | -0.11% |

| Vinati Organics | 1,736.50 | 1,738.50 1,722.95 | -0.12% |

| SAIL | 117.35 | 117.50 114.00 | -0.13% |

| SRF | 2,364.50 | 2,367.85 2,342.55 | -0.14% |

| Chola Invest. | 1,306.90 | 1,308.90 1,277.15 | -0.15% |

| Escorts Kubota | 2,943.10 | 2,947.80 2,902.85 | -0.16% |

| Garware Technic | 3,460.00 | 3,466.35 3,444.75 | -0.18% |

-330

January 16, 2024· 14:06 IST

Stock Market LIVE Updates | Jefferies View On Jio Financial Services

-Company reported Q3FY24 profit of Rs 290 crore, down 56 percent QoQ

-Management is focused on consumer loans (secured & unsecured) & supply chain finance

-Company has expanded its client base in insurance broking to 27

-Company is ramping up its payments bank & payments platforms

-See the company taking a balanced approach to growth

-Despite initial concern about increased competition from company, see limited risk for BAF & banks

-330

January 16, 2024· 14:01 IST

Sensex Today | Market at 2 PM

The Sensex was down 162.74 points or 0.22 percent at 73,165.20, and the Nifty was down 54.00 points or 0.24 percent at 22,043.50. About 958 shares advanced, 2295 shares declined, and 50 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Titan Company | 3,828.15 | 1.85 | 25.55k |

| Maruti Suzuki | 10,200.00 | 1.13 | 15.06k |

| Larsen | 3,576.55 | 0.96 | 27.33k |

| Tata Motors | 819.95 | 0.94 | 333.50k |

| Asian Paints | 3,303.65 | 0.9 | 57.39k |

| JSW Steel | 831.45 | 0.8 | 26.81k |

| Tata Steel | 135.60 | 0.48 | 3.35m |

| Bajaj Finance | 7,512.50 | 0.48 | 22.83k |

| Axis Bank | 1,124.00 | 0.38 | 66.64k |

| UltraTechCement | 9,990.00 | 0.37 | 2.25k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HCL Tech | 1,553.85 | -2.13 | 143.19k |

| Wipro | 485.55 | -1.82 | 652.48k |

| NTPC | 312.50 | -1.54 | 403.69k |

| Sun Pharma | 1,309.60 | -1.43 | 9.25k |

| Tech Mahindra | 1,320.40 | -1.32 | 68.33k |

| IndusInd Bank | 1,670.35 | -1.09 | 19.48k |

| Infosys | 1,634.10 | -1.08 | 79.76k |

| TCS | 3,865.25 | -0.95 | 20.14k |

| Power Grid Corp | 239.15 | -0.81 | 200.37k |

| Bharti Airtel | 1,094.50 | -0.66 | 30.91k |

-330

January 16, 2024· 13:59 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Aarvee Denim | 31.10 | 28.80 | -2.30 3.19k |

| Avonmore Cap | 97.50 | 92.45 | -5.05 6.58k |

| DB (Int) Stock | 39.50 | 37.55 | -1.95 815 |

| Steel City Secu | 79.00 | 75.10 | -3.90 2.19k |

| Rategain Travel | 785.65 | 748.75 | -36.90 141.25k |

| Marinetrans Ind | 42.50 | 40.60 | -1.90 0 |

| Deep Energy Res | 202.00 | 193.10 | -8.90 1.90k |

| Aurum Proptech | 155.35 | 148.70 | -6.65 20.38k |

| Balkrishna | 42.10 | 40.30 | -1.80 7.34k |

| Bedmutha Ind | 219.55 | 210.25 | -9.30 2.45k |

-330

January 16, 2024· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pramara Promoti | 130.10 | 145.00 | 14.90 - |

| G-Tec Jainx | 85.30 | 93.90 | 8.60 1.03k |

| SINDHUTRAD | 26.00 | 27.40 | 1.40 92.98k |

| Dredging Corp | 801.10 | 837.50 | 36.40 159.13k |

| TARACHAND | 176.00 | 181.70 | 5.70 0 |

| V2 Retail | 319.40 | 328.90 | 9.50 6.32k |

| PNB Housing Fin | 822.95 | 847.40 | 24.45 78.49k |

| Aaron Industrie | 279.35 | 287.00 | 7.65 637 |

| Hatsun Agro | 1,149.75 | 1,179.25 | 29.50 1.83k |

| Jindal Stainles | 591.00 | 606.00 | 15.00 79.46k |

-330

January 16, 2024· 13:57 IST

Stock Market LIVE Updates | Motilal Oswal View on PNB Housing Finance:

PNB Housing Finance has pivoted from consolidation to growth mode, and expect it to deliver a healthy CAGR of 18% in AUM and ~25% in PAT over FY24-26, with RoA/RoE of 2.5%/13.5% by FY26.

The company trades at 1.1x FY26E P/BV, and believe that risk-reward is favorable for a further re-rating in the valuation multiple as investors gain more confidence in the company’s sustained execution in retail (both prime and affordable).

PNBHF is top pick in NBFC/HFC coverage with a Target Price of Rs 1,025 (based on 1.4x FY26E P/BV).

Key risks: a) inability to drive NIM expansion amid aggressive competitive in mortgages, b) slowdown in economy leading to lower demand for housing and moderation in loan growth, and c) subsequent seasoning in the affordable loan book leading to asset quality deterioration.

-330

January 16, 2024· 13:53 IST

-330

January 16, 2024· 13:48 IST

Sensex Today | BSE Smallcap index down 1.2 percent dragged by Angel One, Sukhjit Starch, DB Realty:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Angel One | 3,389.00 | -12.54 | 84.34k |

| Sukhjit Starch | 529.00 | -7.03 | 10.08k |

| DB Realty | 229.05 | -6.41 | 698.15k |

| Centrum Capital | 32.18 | -5.93 | 125.17k |

| Tracxn Tech | 113.50 | -5.81 | 150.35k |

| Suven Life Sci | 112.78 | -5.79 | 61.68k |

| Panacea Biotec | 171.10 | -5.78 | 151.76k |

| Ent Network Ind | 233.00 | -5.71 | 29.58k |

| Vascon Engineer | 79.28 | -5.63 | 876.64k |

| Hardwyn | 45.25 | -5.59 | 24.44k |

-330

January 16, 2024· 13:39 IST

Stock Market LIVE Updates | Kotak Mahindra Bank to consider fund raise via debentures on Jan 20

The Board of Directors of Kotak Mahindra Bank Limited, at their meeting to be held on Saturday, January 20, 2024, will also consider a proposal for raising funds by way of issuance of Unsecured, Redeemable, Non-Convertible Debentures, on a private placement basis, in one or more tranches / series, during FY 2024-25, subject to the approval of the members of the Bank and any other approvals as may be necessary.

-330

January 16, 2024· 13:37 IST

Stock Market LIVE Updates | Genesys International appoints Pavan Tsunduru as COO

Pavan Tsunduru is appointed as Chief Operating Officer (COO) of the company w.e.f January 16, 2024.

-330

January 16, 2024· 13:34 IST

Sensex Today | BSE Midcap index down 0.5 percent dragged by Vodafone Idea, SJVN, Oracle Financial Services Software

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Vodafone Idea | 15.62 | -5.16 | 44.12m |

| SJVN | 97.75 | -4.6 | 3.15m |

| Oracle Fin Serv | 4,883.15 | -3.85 | 14.89k |

| Castrol | 171.40 | -3.44 | 119.90k |

| JSW Energy | 457.00 | -3.41 | 59.12k |

| Gillette India | 6,540.65 | -3.27 | 1.52k |

| Oberoi Realty | 1,524.15 | -2.99 | 20.11k |

| IRCTC | 938.65 | -2.96 | 189.59k |

| Indian Hotels | 463.30 | -2.89 | 133.32k |

| Power Finance | 397.70 | -2.88 | 530.41k |

-330

January 16, 2024· 13:32 IST

Newgen Software Q3 earnings:

Cons net profit rose 43% at Rs 68.3 crore against Rs 48 crore and revenue up 11% at Rs 324 crore versus Rs 293 crore, QoQ.

-330

January 16, 2024· 13:23 IST

Stock Market LIVE Updates | Usha Martin gains after Thai subsidiary acquires stake in a wire company

Shares of Usha Martin Limited gained almost 2 percent on January 16 after the company announced that its Thailand-based subsidiary, Usha Siam Steel Industries Public Company Ltd (USSIPCL), has inked an agreement to acquire a 50 percent stake in Tesac Usha Wirerope Company Ltd (TUWCL). Read More

-330

January 16, 2024· 13:18 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 73105.27 -0.3 | 1.20 2.41 | 2.27 21.65 |

| BSE 200 | 9804.84 -0.45 | 1.72 1.87 | 3.18 26.18 |

| BSE MIDCAP | 37836.37 -0.77 | 2.71 1.16 | 4.53 50.83 |

| BSE SMALLCAP | 44116.05 -0.98 | 3.38 0.67 | 4.83 53.02 |

| BSE BANKEX | 54233.01 -0.03 | -0.27 1.83 | -0.19 13.24 |

-330

January 16, 2024· 13:14 IST

Sensex Today | Medi Assist Healthcare IPO subscribed 68%, retail portion fully booked on Day 2

The public issue of Medi Assist Healthcare was subscribed 68 percent on January 16, the second day of bidding, with bids for 1.3 crore shares against an issue size of 1.96 crore shares.

The retail portion has been fully subscribed, with investors buying 1.1 times their portion. High net worth individuals (HNI) bought 57 percent of the allotted quota, though Qualified Institutional Buyers or QIBs were yet to subscribe to the issue.

-330

January 16, 2024· 13:11 IST

-330

January 16, 2024· 13:07 IST

Government issues show cause notice to IndiGo, Mumbai Airport after passengers seen eating on tarmac

-330

January 16, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| SAR Televenture | 257.00 | 242.60 | -14.40 - |

| Vinsys IT | 295.80 | 283.00 | -12.80 7.76k |

| Digikore Studio | 443.80 | 425.00 | -18.80 - |

| Jupiter Wagons | 390.45 | 373.95 | -16.50 33.69k |

| Perfect Infra | 40.35 | 38.65 | -1.70 53.74k |

| Naga Dhunseri | 2,500.00 | 2,401.00 | -99.00 152 |

| Srivasavi | 149.90 | 144.00 | -5.90 6.58k |

| Manaksia Steels | 57.55 | 55.45 | -2.10 46.21k |

| Ginni Filaments | 37.50 | 36.15 | -1.35 70.83k |

| Manaksia Alumin | 30.90 | 29.80 | -1.10 18.08k |

-330

January 16, 2024· 12:58 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pentagon Rubber | 132.00 | 139.00 | 7.00 334 |

| Kriti Ind | 118.45 | 123.70 | 5.25 9.93k |

| Himadri Special | 378.95 | 393.50 | 14.55 45.83k |

| Nidan Laborator | 36.85 | 38.25 | 1.40 4.00k |

| AstraZeneca | 6,210.00 | 6,426.85 | 216.85 992 |

| Viviana Power | 260.00 | 269.00 | 9.00 0 |

| Sangani HOSP | 39.50 | 40.85 | 1.35 0 |

| Inspire Films | 61.10 | 62.95 | 1.85 - |

| Manomay Tex Ind | 196.65 | 202.45 | 5.80 3.20k |

| AMD Industries | 71.55 | 73.55 | 2.00 5.18k |

-330

January 16, 2024· 12:51 IST

-330

January 16, 2024· 12:48 IST

Stock Market LIVE Updates | Federal Bank Q3 Results

Net profit up 25.3% at Rs 1,007 crore versus Rs 803.6 crore and NII up 8.5% at Rs 2,123.4 crore versus Rs 1,956.5 crore, YoY.

-330

January 16, 2024· 12:46 IST

Stock Market LIVE Updates | Elara Capital View on Just Dial

With Rs 42.05 billion cash (56% of the market cap), the core business is trading at an attractive 16.7x.

Broking house value the stock via an average of P/E and DCF and roll forward to Dec-24E, raising Target Price to Rs 1,060 from Rs 1,000 before.

On P/E, value the stock on one-year forward target P/E of 28x (in line with pre-pandemic five-year average).

Elara Capital reiterate buy on:1) strong cash chest, 2) improving operational parameters and 3) robust deferred revenue growth, indicating better revenue growth outlook.

-330

January 16, 2024· 12:41 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| ITI | 377.00 | 377.00 | 371.65 |

| IRFC | 146.69 | 146.69 | 142.59 |

| Aster DM Health | 449.75 | 449.75 | 429.70 |

| JM Financial | 110.75 | 110.75 | 108.15 |

| Yes Bank | 26.25 | 26.25 | 25.83 |

| IOC | 144.35 | 144.35 | 143.80 |

| LIC India | 900.00 | 900.00 | 888.10 |

| BLS Internation | 412.90 | 412.90 | 403.50 |

| PNC Infratech | 420.85 | 420.85 | 400.95 |

| Ircon Internati | 211.95 | 211.95 | 209.30 |

-330

January 16, 2024· 12:37 IST

Stock Market LIVE Updates | Himadri Speciality Chemical Q3 Results:

Net profit was up 66.9% at Rs 108.8 crore versus Rs 65.2 crore and revenue up 1.5% at Rs 1,052.5 crore versus Rs 1,037.4 crore, YoY.

-330

January 16, 2024· 12:33 IST

Stock Market LIVE Updates | Capri Global surges 12% on getting corporate agency licence

Capri Global Capital Ltd (CGCL) surged 12 percent on January 16 morning after the company announced that it received the licence to distribute life, general, and health insurance products.

The composite Corporate Agency licence given by the Insurance Regulatory and Development Authority of India (IRDAI) will help it to further diversify its product offerings and strengthen its fee income, the non-banking finance company said in a regulatory filing. Read More

-330

January 16, 2024· 12:25 IST

-330

January 16, 2024· 12:22 IST

Sensex Today | BSE Oil & Gas index up 1.6 percent led by IOC, BPCL, Petronet LNG:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IOC | 143.95 | 4.58 | 1.95m |

| BPCL | 477.65 | 3.83 | 928.80k |

| Petronet LNG | 236.95 | 2 | 302.84k |

| HINDPETRO | 458.50 | 1.98 | 217.00k |

| ONGC | 237.00 | 1.48 | 1.10m |

| GAIL | 167.60 | 1.39 | 962.93k |

| Linde India | 5,568.20 | 0.54 | 898 |

-330

January 16, 2024· 12:17 IST

Stock Market LIVE Updates | NLC India appoints Prasanna Kumar Acharya as Director (Finance) for 5 years

Prasanna Kumar Acharya assumed the charge of Director (Finance) of NLC India with effect from January 15. The Central government had approved the appointment of Prasanna Kumar Acharya as Director (Finance) of the company for five years, in December last year.

-330

January 16, 2024· 12:13 IST

Sensex Today | BSE Healthcare inde down 0.5 percent dragged by Aster DM Healthcare, Sasta Sundar Ventures, Bliss GVS Pharma:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Aster DM Health | 429.70 | 7.73 | 170.86k |

| Sasta Sundar | 443.20 | 6.03 | 7.71k |

| Bliss GVS | 135.45 | 2.81 | 20.27k |

| Sigachi Ind | 69.60 | 2.37 | 290.32k |

| Mankind Pharma | 2,232.70 | 2.05 | 7.26k |

| Themis Medicare | 218.90 | 1.93 | 3.73k |

| Tarsons Product | 518.95 | 1.84 | 4.66k |

| Biocon | 285.80 | 1.73 | 182.75k |

| Ajanta Pharma | 2,285.60 | 1.58 | 2.58k |

| Caplin Labs | 1,470.55 | 1.36 | 3.38k |

-330

January 16, 2024· 12:06 IST

Stock Market LIVE Updates | Route Mobile to provide corporate guarantee in favour of ICICI Bank & ICICI Bank Plc for loan facility by UK subsidiary

Route Mobile said the board of directors has approved to provide the corporate guarantee in favour of lenders ICICI Bank and ICICI Bank (UK) Plc, for term loan facility proposed to be taken by company's subsidiary Route Mobile (UK) of $31.50 million.

-330

January 16, 2024· 12:02 IST

Sensex Today | Market at 12 PM

The Sensex was up 21.64 points or 0.03 percent at 73,349.58, and the Nifty was up 8.50 points or 0.04 percent at 22,106. About 1553 shares advanced, 1638 shares declined, and 65 shares unchanged.

-330

January 16, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Supreme Power | 178.00 | 164.95 | -13.05 741.33k |

| Marvel Decor Lt | 98.00 | 92.10 | -5.90 7.20k |

| ARHAM | 233.75 | 222.30 | -11.45 0 |

| DUGLOBAL | 60.00 | 57.20 | -2.80 5.96k |

| NDL Ventures | 135.50 | 130.15 | -5.35 3.17k |

| Oriana Power | 567.95 | 547.00 | -20.95 6.85k |

| Prolife Industr | 291.00 | 280.60 | -10.40 1.40k |

| Shigan Quantum | 144.10 | 139.05 | -5.05 2.40k |

| Wonder Elect. | 353.80 | 342.00 | -11.80 377 |

| AMD Industries | 74.00 | 71.55 | -2.45 3.69k |

-330

January 16, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Vaishali Pharma | 178.25 | 193.50 | 15.25 2.99k |

| Power & Instrum | 62.20 | 66.35 | 4.15 12.87k |

| Times Guaranty | 124.05 | 130.70 | 6.65 7.25k |

| Tainwala Chem | 147.85 | 155.75 | 7.90 311 |

| Shemaroo Ent | 163.60 | 171.80 | 8.20 15.09k |

| Shree OSFM | 91.00 | 95.00 | 4.00 - |

| Hemisphere | 174.15 | 181.50 | 7.35 328.79k |

| Securekloud Tec | 52.10 | 54.25 | 2.15 11.07k |

| Valiant Laborat | 177.85 | 185.20 | 7.35 13.60k |

| Servotech Power | 81.70 | 84.90 | 3.20 86.93k |

-330

January 16, 2024· 11:54 IST

Stock Market LIVE Updates | NBCC bags orders of Rs 138.95 crore:

-330

January 16, 2024· 11:49 IST

Stock Market LIVE Updates | Bank of Maharashtra Q3 Results:

Net profit up 34 percent at Rs 1,035 crore versus Rs 775 crore and Net Interest Income up 24.5% at Rs 2,465 crore versus Rs 1,980 crore, YoY.

-330

January 16, 2024· 11:46 IST

Stock Market LIVE Updates | Morgan Stanley View On Autos

-Overall Industry growth moderates but EV growth will accelerate

-Benign commodity prices, coupled with supportive policy will be a tailwind to earnings

-Tata Motors, Mahindra & Ashok Leyland are preferred OEM overweight

-Downgrade Eicher Motors to underweight from equal-weight, target cut to Rs 3,209 from Rs 3,552 per share

-Growth & market share challenges, see limited margin upside & valuations

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 4,433.00 | 1.39 | 479.58k |

| Maruti Suzuki | 10,201.05 | 1.13 | 256.45k |

| Tata Motors | 821.20 | 1.08 | 4.68m |

| MRF | 137,351.00 | 1.03 | 3.96k |

| Ashok Leyland | 177.00 | 0.4 | 4.02m |

| Bosch | 23,463.85 | 0.27 | 10.20k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sona BLW | 589.05 | -1.74 | 518.72k |

| Balkrishna Ind | 2,634.85 | -1.65 | 69.78k |

| Bharat Forge | 1,240.00 | -1.38 | 153.07k |

| Eicher Motors | 3,808.30 | -0.62 | 307.22k |

| M&M | 1,628.00 | -0.46 | 851.57k |

| Tube Investment | 3,985.50 | -0.4 | 225.65k |

| Bajaj Auto | 7,309.00 | -0.32 | 115.15k |

| MOTHERSON | 109.45 | -0.18 | 7.34m |

| TVS Motor | 2,020.85 | -0.04 | 289.97k |

-330

January 16, 2024· 11:39 IST

-330

January 16, 2024· 11:34 IST

Stock Market LIVE Updates | LIC shares cross listing price of Rs867 for the first time

-330

January 16, 2024· 11:26 IST

-330

January 16, 2024· 11:22 IST

Stock Market LIVE Updates | Maruti Suzuki increases prices across models effective Janruary 16

Maruti Suzuki today announced increase in prices across models. An estimated weighted average of increase across models stands at around 0.45%.

This indicative figure is calculated using Ex Showroom prices of models in Delhi and will come into effect from 16th January, 2024.

-330

January 16, 2024· 11:21 IST

Sensex Today | Medi Assist Healthcare IPO subscribed 68%, retail portion fully booked on Day 2

The public issue of Medi Assist Healthcare was subscribed 68 percent on January 16, the second day of bidding, with bids for 1.3 crore shares against an issue size of 1.96 crore shares.

The retail portion has been fully subscribed, with investors buying 1.1 times their portion. High net worth individuals (HNI) bought 57 percent of the allotted quota, though Qualified Institutional Buyers or QIBs were yet to subscribe to the issue.

-330

January 16, 2024· 11:17 IST

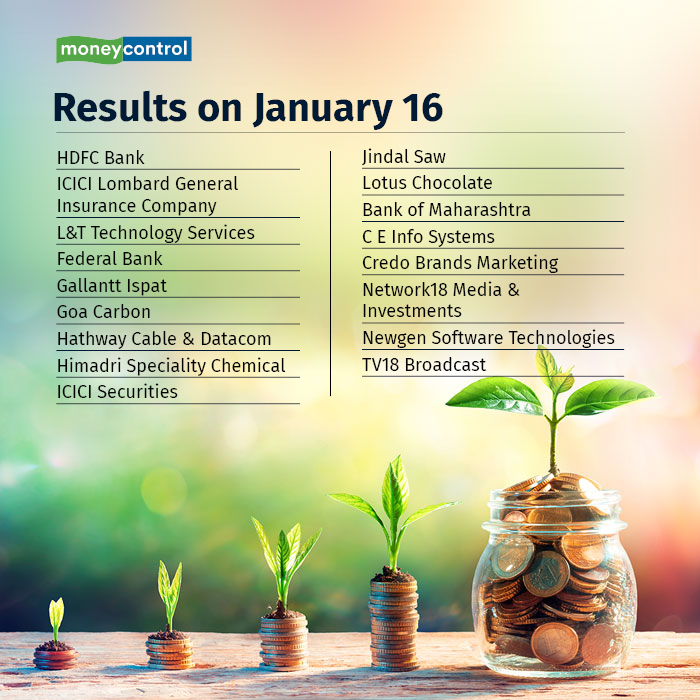

Results Today:

-330

January 16, 2024· 11:12 IST

Sensex Today | BSE Auto index up 0.4 percent led by Hero MotoCorp, Maruti Suzuki, Tata Motors:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 4,437.85 | 1.54 | 11.59k |

| Maruti Suzuki | 10,213.55 | 1.26 | 3.41k |

| Tata Motors | 821.00 | 1.06 | 199.79k |

| MOTHERSON | 110.50 | 0.78 | 758.30k |

| MRF | 136,969.95 | 0.75 | 134 |

| TVS Motor | 2,034.35 | 0.6 | 9.68k |

| Apollo Tyres | 474.70 | 0.57 | 21.31k |

| Ashok Leyland | 177.25 | 0.57 | 221.37k |

-330

January 16, 2024· 11:08 IST

Stock Market LIVE Updates | Promoter Ajay Kumar & Sons offloads 1.75% stake in Hi-Tech Pipes

Promoter Ajay Kumar & Sons sold 24 lakh equity shares, or equivalent to 1.75% stake in Hi-Tech Pipes at an average price of Rs 148.5 per share. However, Bandhan Core Equity Fund picked 14 lakh equity shares in the company at same price.

-330

January 16, 2024· 11:06 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 22115.00 0.08 | 1.77 2.65 | 3.07 23.58 |

| NIFTY BANK | 48274.70 0.24 | -0.04 2.18 | 0.27 14.48 |

| NIFTY Midcap 100 | 48006.35 0.35 | 3.95 2.21 | 5.31 53.61 |

| NIFTY Smallcap 100 | 15644.90 0.22 | 3.31 1.53 | 5.10 61.81 |

| NIFTY NEXT 50 | 55020.85 0.15 | 3.14 1.96 | 5.90 30.61 |

-330

January 16, 2024· 10:59 IST

Stock Market LIVE Updates | L&T Construction secures mega contract from Japanese agency

The Railways Strategic Business Group of L&T Construction has secured a Mega Contract from an authorised Japanese agency to construct 508 Route Km of High-Speed Electrification System Works (Package No: EW 1) for the Mumbai-Ahmedabad High-Speed Rail (MAHSR) Project, popularly referred to as the Bullet Train Project.

The scope of this package includes Design, Manufacture, Supply, Construction, Installation, Testing and Commissioning of 2 x 25 kV Power Supply Electrification System including Traction Substations, High Speed Overhead Equipment and MV/LV Power Distribution Equipment Works on Design-Build Lump Sum Price basis.

-330

January 16, 2024· 10:58 IST

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| MRP Agro | 48.50 | 43.25 | -5.25 6.00k |

| Parshwanath | 44.15 | 40.01 | -4.14 0 |

| Gowra Leasing | 41.79 | 38.08 | -3.71 92 |

| Jhandewalas Foo | 39.67 | 36.31 | -3.36 0 |

| JAFINANCE | 33.65 | 31.06 | -2.59 1 |

| Bazel Internati | 34.02 | 31.51 | -2.51 50 |

| Madhav Marbles | 75.00 | 70.00 | -5.00 30 |

| Mahaan Foods | 45.85 | 43.01 | -2.84 2.06k |

| Cybele Ind | 45.00 | 42.24 | -2.76 51 |

| Sri Nachammai | 37.39 | 35.10 | -2.29 99 |

-330

January 16, 2024· 10:57 IST

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Rathi Bars | 33.35 | 37.59 | 4.24 12.47k |

| Pan Electroncis | 30.10 | 33.24 | 3.14 196 |

| Apoorva Leasing | 28.36 | 31.31 | 2.95 337 |

| Global Surfaces | 244.55 | 266.30 | 21.75 7.87k |

| Motisons Jewell | 198.00 | 215.50 | 17.50 329.54k |

| DIC India | 506.00 | 548.00 | 42.00 2 |

| KJMC Fin Ser | 49.80 | 53.88 | 4.08 5 |

| Pasupati Spin | 31.65 | 34.18 | 2.53 704 |

| IGC Foils | 39.00 | 42.00 | 3.00 0 |

| Solid Stone | 31.42 | 33.80 | 2.38 138 |

-330

January 16, 2024· 10:52 IST

Stock Market LIVE Updates | Patanjali Foods records a single digit sequential & YoY growth in volumes during Q3FY24

In Q3FY24, the company registered an uptick in the value over Q2 with an incremental growth while the EBITDA margin aligned with the business projections. There was a single digit sequential as well as YoY growth in the volumes during the quarter. Branded sales continue to contribute 75% of the total edible oil sales volume.

In the December quarter, the revenue of the Food & FMCG segment, which accounted for 32% of total revenues, was stable, while the Biscuits portfolio grew by over 20% YoY.

-330

January 16, 2024· 10:51 IST

-330

January 16, 2024· 10:48 IST

Sensex Today | Nifty PSU Bank index up nearly 1 percent led by Bank of India, Union Bank of India, UCO Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of India | 134.75 | 2.94 | 14.91m |

| Union Bank | 137.05 | 2.2 | 15.76m |

| UCO Bank | 42.50 | 2.04 | 14.99m |

| Central Bank | 53.60 | 2 | 28.24m |

| Indian Bank | 442.15 | 1.83 | 943.31k |

| IOB | 45.20 | 1.69 | 14.09m |

| Punjab & Sind | 45.85 | 1.1 | 3.13m |

| Bank of Mah | 50.80 | 0.79 | 35.08m |

| JK Bank | 133.35 | 0.76 | 1.63m |

| PNB | 98.90 | 0.71 | 24.06m |

-330

January 16, 2024· 10:45 IST

Sensex Today | Shrey Jain, Founder and CEO SAS Online:

The market commenced the day on a steady note, with the Sensex experiencing a marginal decline of 13.46 points or 0.02 percent at 73,314.48, while the Nifty with a decrease of 10.55 points or 0.05 percent at 22,086.90.

There is a likelihood that the Nifty will consolidate around its current levels, showing restrained downward movement, as the levels of 22,000 and 21,900 are anticipated to act as immediate support. For Bank Nifty, the option data indicates that the 48,000 Put strike boasts a sizable OI, likely to curtail downside potential, while the 48,500 level is poised to act as a resistance.

The overall market sentiment remains optimistic, suggesting that adopting a "buy on every dip" strategy could be a prudent approach.

-330

January 16, 2024· 10:42 IST

-330

January 16, 2024· 10:38 IST

Sensex Today | BSE Realty index down 0.7 percent dragged by Prestige Estate, Macrotech Developers, DLF:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Prestige Estate | 1,324.20 | -2.21 | 18.09k |

| Macrotech Dev | 1,197.90 | -1.46 | 11.34k |

| DLF | 795.70 | -1.35 | 50.96k |

| Phoenix Mills | 2,450.30 | -1.23 | 3.71k |

| Oberoi Realty | 1,560.30 | -0.69 | 6.53k |

-330

January 16, 2024· 10:36 IST

Stock Market LIVE Updates | Sarda Energy & Minerals bags contract worth Rs 150 crore

Sarda Energy & Minerals has received a contract for installation of solar power plant of 50 MW DC in Chhattisgarh for meeting the captive requirements of the production and mining facilities. The contract is worth Rs 150 crore.

-330

January 16, 2024· 10:33 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,669.65 -0.19 | 3.07m | 511.85 |

| Tata Motors | 820.40 0.98 | 3.97m | 326.79 |

| ONGC | 237.75 1.82 | 13.35m | 314.79 |

| Bajaj Finance | 7,553.30 1.01 | 373.46k | 282.42 |

| Wipro | 484.50 -2.04 | 5.70m | 277.50 |

| Reliance | 2,779.55 -0.31 | 977.28k | 271.38 |

| HCL Tech | 1,546.30 -2.64 | 1.73m | 268.40 |

| Infosys | 1,645.00 -0.43 | 1.53m | 250.75 |

| SBI | 641.65 0.24 | 3.54m | 227.20 |

| HDFC Life | 614.15 -0.05 | 3.44m | 210.57 |

-330

January 16, 2024· 10:30 IST

-330

January 16, 2024· 10:25 IST

Stock Market LIVE Updates | UBS View On Syngene International:

-UBS downgrades Syngene to sell from buy, cuts target price on to Rs 700 versus Rs 875

-Challenging global environment; risk of earnings cuts

-Earlier thesis of easing headwinds for discovery & dedicated segments not playing out

-Subdued VC funding in biotech space to persist for most of 2024

-Challenges for large pharma to persist for most of 2024

-Market not fully pricing in headwinds; risk-reward unattractive

-Brace for soft H2 FY24e and uncertainties in FY25 guidance

-330

January 16, 2024· 10:24 IST

-330

January 16, 2024· 10:20 IST

Stock Market LIVE Updates | Shakti Pumps to consider fund raising via QIPs on January 18

Shakti Pumps (India) said the board of directors will be meeting on January 18 to consider the raising of funds through issuance of securities by way of a preferential allotment or a private placement (including one or more qualified institutions placements (QIP) or further public issue of equity shares).

-330

January 16, 2024· 10:18 IST

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

Jyoti CNC Automation, the Indian leader in CNC machine manufacturing, made its debut on the stock market, listing at Rs 370 per share, an 11.8% premium over its issue price of Rs 331.

While Jyoti CNC's strong brand presence and robust market share are undeniable, the financial concerns and hefty valuation necessitate a cautious approach.

Jyoti CNC's listing debut was positive but overshadowed by concerns. Thus we recommend investors book profit and exit their position; however, those who still want to hold it should keep a stop loss at around issue price.

-330

January 16, 2024· 10:16 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Dredging Corp | 807.90 | 29.53 | 623.70 |

| WE WIN | 92.75 | 27.14 | 72.95 |

| Tourism Finance | 180.15 | 26.33 | 142.60 |

| Tera Software | 78.85 | 25.66 | 62.75 |

| Laxmi Cotspin | 33.00 | 21.55 | 27.15 |

| Intense Tech | 126.55 | 20.35 | 105.15 |

| Shalimar Paints | 216.30 | 19.80 | 180.55 |

| Baid Finserv | 31.20 | 19.77 | 26.05 |

| Lorenzini Appar | 318.25 | 19.42 | 266.50 |

| SBC Exports | 36.70 | 18.01 | 31.10 |

-330

January 16, 2024· 10:12 IST

-330

January 16, 2024· 10:08 IST

Stock Market LIVE Updates | Nalco, Hind Copper gain 5% on lithium mining venture with Argentinian major

Shares of National Aluminium Co Ltd and Hindustan Copper Ltd gained nearly 5 percent each after Khanij Bidesh India Ltd (Kabil), a joint venture among the two with Mineral Exploration Company Ltd, inked a deal with Argentina's Camyen SE for lithium exploration and mining.

Under the agreement, Khanij Bidesh India Ltd (Kabil) has the exclusive rights for evaluating, prospecting, and exploring lithium in Argentina. Upon discovery, it gained exploitation rights for commercial production in five lithium brine blocks in Argentina's Catamarca province. These blocks, including Cortadera-I, Cortadera-VII, Cortadera-VIII, Cateo-2022-01810132, and Cortadera-VI, span 15,703 hectares and entail a cost of Rs 200 crore, as per an exchange filing by Nalco. Read More

-330

January 16, 2024· 10:06 IST

Sensex Today | Jyoti CNC Automation makes decent debut, lists at 12% premium to IPO price

Jyoti CNC Automation made a decent debut, listing at a 12.3 percent premium over the IPO price on January 16. The stock opened at Rs 370 on NSE and Rs 372 on BSE against the issue price of Rs 331.

Analysts were expecting the stock to list with a 15-18 percent premium between Rs 380 and Rs 390.

-330

January 16, 2024· 10:00 IST

Sensex Today | Market at 10 AM

The Sensex was down 53.37 points or 0.07 percent at 73,274.57, and the Nifty was down 18.80 points or 0.09 percent at 22,078.70. About 1760 shares advanced, 1265 shares declined, and 90 shares unchanged.

-330

January 16, 2024· 09:59 IST

| Company | Price at 09:00 | Price at 09:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sonalis Consume | 507.70 | 30.00 | -477.70 - |

| DYNPROPP | 450.00 | 149.50 | -300.50 - |

| CLOUDPP | 123.00 | 46.85 | -76.15 - |

| Arvind Fash-PP | 135.00 | 66.95 | -68.05 23.66k |

| Viaz Tyres | 68.95 | 41.00 | -27.95 - |

| National Oxygen | 45.40 | 37.40 | -8.00 - |

| Angel One | 3,875.70 | 3,444.00 | -431.70 62.37k |

| M K Proteins | 43.20 | 38.90 | -4.30 136.32k |

| RBZ Jewellers | 249.25 | 229.10 | -20.15 1.01m |

| Motisons Jewell | 215.00 | 198.60 | -16.40 2.75m |

-330

January 16, 2024· 09:58 IST

| Company | Price at 09:00 | Price at 09:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Info Drive Soft | 0.65 | 332.80 | 332.15 - |

| Mold-Tek-PP | 1.25 | 391.15 | 389.90 750 |

| COASTPP1 | 10.00 | 137.35 | 127.35 0 |

| Rushil Decor-PP | 10.00 | 122.85 | 112.85 - |

| Satin Credi PP1 | 10.00 | 67.30 | 57.30 23.38k |

| Kesoram Ind PP | 5.00 | 28.40 | 23.40 - |

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Satin Creditcar | 10.00 | 27.55 | 17.55 20.05k |

| BTML-RE | 10.00 | 21.55 | 11.55 - |

| RIL Partly Paid | 982.05 | 1,870.80 | 888.75 538.40k |

-330

January 16, 2024· 09:56 IST

-330

January 16, 2024· 09:53 IST

Stock Market LIVE Updates | Usha Martin's subsidiary to acquire 50% share capital of Tesac Usha Wirerope Company

Usha Siam Steel Industries Public Company (USSIPCL), a subsidiary of Usha Martin in Thailand, has entered into an agreement to acquire 50% of the share capital of Tesac Usha Wirerope Company (TUWCL), a step-down joint venture of the company, from Kobelco Wire Company. The cost of acquisition is Baht 74.45 million.