Closing Bell: Nifty at 21,850, Sensex up 440 pts; oil & gas, IT, metal gain, banks fall

-330

February 02, 2024· 16:31 IST

Benchmark indices ended on a positive note in the volatile session on February 2 with Nifty around 21,850. At close, the Sensex was up 440.33 points or 0.61 percent at 72,085.63, and the Nifty was up 156.30 points or 0.72 percent at 21,853.80.

We wrap up today's edition of the Moneycontrol live market blog, and will be back on Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

February 02, 2024· 16:21 IST

-330

February 02, 2024· 16:19 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

It turned out to be a roller coaster ride for participants on Friday as the benchmark oscillated sharply on both sides and ended with modest gains. After the gap-up start, Nifty marched towards its record high but couldn’t hold that level for long and surrendered most of its gains. Among the key sectors, energy, metal and IT ended with strong gains while banking and FMCG closed in the red. The broader indices too traded mixed wherein smallcap managed to gain nearly a percent.

Nifty has retested its record high after consolidating for two weeks but we feel it is early to assume that we are set for the next leg of the up move. It needs sustainability above 22,150 to march towards 22,500+. Besides, consistency in the participation from the banking majors is also critical for a steady trend else the range-bound trend would continue. Traders should focus more on stock selection in the present scenario and maintain positions on both sides.

-330

February 02, 2024· 16:17 IST

Shrey Jain, Founder and CEO SAS Online

Despite the Federal Reserve's indication of no rate cuts until March '24, the benchmark equity indices ended positively. The NSE Nifty 50 concluded 156.35 points or 0.72% higher at 21,853.63, while the BSE Sensex rose by 440.33 points or 0.61% to 72,085.63. Midcap and smallcap stocks led the broader indices into green territory. However, the Bank Nifty index diverged, dropping 217.70 points or 0.47% to 45,970.95.

For Nifty, maintaining this level is pivotal for the index; failure could lead to a sideways trend. A successful hold above 22,125 could target 22,500 and 22,700 for the February se

-330

February 02, 2024· 16:07 IST

Vinod Nair, Head of Research, Geojit Financial Services:

A conservative interim budget had no slowdown effect on the market, which continued to grow on the pre-election rally. The drastic fall in the fiscal deficit target is leading to a reduction in bond yields, which will lead to lowering of corporate borrowing costs, increasing incentives to step up investment. Furthermore, the FOMC tempers expectations that the central bank will soon slash interest rates and that inflation in the US is continuing to cool.

-330

February 02, 2024· 16:04 IST

Stock Market LIVE Updates | Interglobe Aviation Q3 Earnings:

Net profit at Rs 2,998 crore versus Rs 1,423 crore and revenue up 30% at Rs 19,452 crore versus Rs 14,933 crore, YoY.

-330

February 02, 2024· 16:01 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty bears regained control as the index failed to surpass the crucial level of 46500 on a closing basis. The immediate support for the index is situated at 47700, and a breach below this level is anticipated to intensify selling pressure, potentially pushing the index towards the 45000 mark. Given the heightened volatility in the near term, traders are advised to approach the market with caution and implement strict risk management measures to navigate potential fluctuations.

-330

February 02, 2024· 15:57 IST

Jateen Trivedi, VP Research Analyst, LKP Securities

Rupee traded sideways to positive with gains of 0.07 at 82.91 even after two major events US Federal Reserve interest rate decision and Indian Interim budget were unable to shake rupee much. Focus remains high on Indian growth and funds flowing into Indian markets strongly. The well equipped Structure provides cushion to rupee. Broadly range rupee continues between 82.70-83.25.

-330

February 02, 2024· 15:46 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty opened on a positive note and touched a new all-time High of 22126.80. It, however, faced sharp selling pressure and witnessed a sharp selloff which pushed the Nifty lower and back within the broad range 21200 – 21900.

The daily and hourly momentum indicator provide a divergent signal and prices are stuck within a range. Bollinger bands are contracting indicating range bound price action. Thus, parameters are suggesting that the consolidation is likely to continue. Stock specific action and sector rotation is likely to continue during this period of consolidation. Key support levels are 21660 – 21600 while immediate hurdle zone is placed at 22100 - 22150.

Bank Nifty witnessed selling pressure from the 46900 – 47000 zone which coincided with the 61.82% Fibonacci retracement level of the entire fall it has witnessed from 48636 – 44429. The Bank Nifty is likely to enter into a consolidation phase in the range 47000 – 45500 from short term perspective.

-330

February 02, 2024· 15:45 IST

Rupak De, Senior Technical Analyst, LKP Securities

Nifty surpassed the 22,000 mark during the first half of the Friday session but subsequently formed a double top on the hourly chart. Confirmation of a bullish trend resumption would only occur with a decisive breakout above the double top, which is currently identified around 22,125.

Conversely, a break below the support level at 21,500 could indicate a bearish momentum. In the scenario of a breakout above 22,150, Nifty may experience upward momentum, potentially reaching levels such as 22,500 and beyond.

-330

February 02, 2024· 15:42 IST

Market This Week

Market snaps 2-wk losing streak, records biggest weekly gain in 2 months

Sensex & Nifty rise 2% Each, Nifty Bank up 2.4% & Midcap index 2.6%

Except Media, all sectoral indices post gains, PSU Bank top gaining index

-330

February 02, 2024· 15:33 IST

Rupee Close:

Indian rupee ended marginally higher at 82.92 per dollar on Friday against Thursday's close of 82.97.

-330

February 02, 2024· 15:30 IST

Market Close:

Benchmark indices ended on a positive note in the volatile session on February 2 with Nifty around 21,850.

At close, the Sensex was up 440.33 points or 0.61 percent at 72,085.63, and the Nifty was up 156.30 points or 0.72 percent at 21,853.80. About 1759 shares advanced, 1469 shares declined, and 67 shares unchanged.

Top gainers on the Nifty were BPCL, Power Grid Corporation, ONGC, Adani Ports and NTPC, while losers were Eicher Motors, Axis Bank, HDFC Life, HDFC Bank and HUL.

Among sectors, oil & gas index up 4 percent and Information Technology, metal, realty, power indices up 1-2 percent each, while bank index down 0.5 percent.

BSE Midcap index rose 0.8 percent and Smallcap index added 0.5 percent.

-330

February 02, 2024· 15:29 IST

Nifty Bank index shed 950 point from day's high

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axis Bank | 1,066.40 | -1.65 | 8.42m |

| HDFC Bank | 1,444.70 | -1.48 | 21.65m |

| IDFC First Bank | 82.50 | -1.08 | 31.29m |

| AU Small Financ | 629.20 | -0.91 | 2.59m |

| Federal Bank | 145.85 | -0.68 | 11.00m |

| IndusInd Bank | 1,533.00 | -0.53 | 3.39m |

| Bank of Baroda | 255.25 | -0.27 | 28.86m |

| Kotak Mahindra | 1,820.70 | -0.11 | 4.88m |

| ICICI Bank | 1,024.25 | -0.09 | 14.02m |

-330

February 02, 2024· 15:27 IST

Stock Market LIVE Updates | Jefferies View On Titan Company:

-Hold call, target Rs 3,600 per share

-Operating performance missed forecast, mainly due to lower-than-expected margin

-20 percent YoY growth appears good in the current context

-Jewellery margin remained in a band while watches & eyecare exhibit high volatility

-Management remains confident in its outlook

-Management displayed strong execution on growth

-330

February 02, 2024· 15:25 IST

-330

February 02, 2024· 15:23 IST

Stock Market LIVE Updates | JSW Infrastructure Q3 Earnings:

Net profit at Rs 250.7 crore versus Rs 114.9 crore and revenue up 17.9 percent at Rs 940.1 crore versus Rs 797.7 crore, YoY.

-330

February 02, 2024· 15:22 IST

Stock Market LIVE Updates | Engineers India Q3 Results:

Net profit at Rs 63.3 crore versus Rs 16.1 crore and revenue up 3 percent at Rs 867.6 crore versus Rs 842.2 crore, YoY.

-330

February 02, 2024· 15:20 IST

Stock Market LIVE Updates | HSBC View On Adani Ports

-Buy call, target raised to Rs 1,370 per share

-Strong container & dry bulk volumes led to record quarterly throughput & profit

-Met deleveraging target earlier than end-FY24 goal

-Robust cash flows should support future growth ambition

-Port EBITDA margin improved by 1.7 percent YoY to 71.3 percent

-EBITDA margin improvement driven by efficiency gains & better utilisation

-330

February 02, 2024· 15:14 IST

Sensex Today | Nifty Bank index shed 0.5 percent dragged by Axis Bank, HDFC Bank, IDFC First Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axis Bank | 1,065.20 | -1.76 | 7.92m |

| HDFC Bank | 1,446.50 | -1.35 | 20.76m |

| IDFC First Bank | 82.55 | -1.02 | 30.25m |

| AU Small Financ | 628.70 | -0.98 | 2.53m |

| Federal Bank | 145.85 | -0.68 | 10.72m |

| IndusInd Bank | 1,532.40 | -0.57 | 3.29m |

| Bank of Baroda | 255.35 | -0.23 | 28.81m |

| ICICI Bank | 1,024.05 | -0.11 | 14.00m |

| Kotak Mahindra | 1,821.45 | -0.07 | 4.75m |

-330

February 02, 2024· 15:13 IST

Stock Market LIVE Updates | Torrent Pharma approves interim dividend of Rs 22

The board of directors of the Torrent Pharma approved an interim dividend of Rs 22 (440%) per equity share of Rs 5 fully paid up.

The Board of Directors acceded to the desire of Sudhir Mehta to step down as the director of the company while continuing as Chairman Emeritus effective from 01-Apr-24.

-330

February 02, 2024· 15:09 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas.

Indian Rupee gained by 0.15% on strong domestic markets and a weak US Dollar. A decline in crude oil prices also supported the domestic unit. US Dollar declined on hawkish Bank of England monetary policy. Bank of England (BoE) kept interest rates unchanged at 5.25%. BoE Governor, Andrew Bailey said that there is more evidence required that inflation is set to fall to their target of 2% stay there before they start to cut rates.

We expect Rupee to trade with a slight positive bias on weak tone in the US Dollar and rise in risk appetite in global markets. Weakness in crude oil prices may also support Rupee. However, profit booking by FIIs may lead for outflows, which may cap sharp upside in Rupee. Any recovery in crude oil prices may also weigh on Rupee at higher levels. Traders may take cues from US non-farm payroll report and factory orders data. US is expected to add jobs but at a slower pace. USDINR spot price is expected to trade in a range of Rs 82.50 to Rs 83.20.

-330

February 02, 2024· 15:07 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 44299.37 0.3 | 4.90 3.95 | 6.51 46.54 |

| BSE CAP GOODS | 56047.81 -0.01 | 0.73 -1.50 | 2.06 65.82 |

| BSE FMCG | 19887.75 -0.24 | -2.83 -0.21 | -3.27 19.91 |

| BSE Metal | 27262.63 2.9 | 1.01 4.42 | 0.25 29.32 |

| BSE Oil & Gas | 26974.71 4.1 | 17.17 9.35 | 15.90 51.63 |

| BSE REALTY | 6795.24 1.49 | 9.83 4.42 | 10.54 108.18 |

| BSE IT | 38045.34 2.17 | 5.65 2.27 | 6.29 25.29 |

| BSE HEALTHCARE | 33760.16 0.15 | 7.01 2.37 | 4.69 51.09 |

| BSE POWER | 6477.30 1.85 | 11.32 5.66 | 11.33 74.79 |

| BSE Cons Durables | 50032.35 0.35 | 0.06 -0.44 | -0.49 33.38 |

-330

February 02, 2024· 15:04 IST

Stock Market LIVE Updates | Morgan Stanley View On Titan Company:

-Equal-weight call, target Rs 3,290 share

-Earnings missed estimate on weaker margin

-Eyecare business growth was weak

-Management remains optimistic

-330

February 02, 2024· 15:02 IST

Stock Market LIVE Updates | Century Plyboards Q3 Earnings:

Net profit down 23 percent at Rs 63 crore versus Rs 82 crore and revenue up 6 percent at Rs 937 crore versus Rs 883 crore, YoY.

Century Plyboards was quoting at Rs 777.05, down Rs 12.55, or 1.59 percent.

-330

February 02, 2024· 15:01 IST

Stock Market LIVE Updates | HIL Q3

Net loss at Rs 7 crore versus profit of Rs 12.5 crore and revenue up 2 percent at Rs 784 crore versus Rs 767 crore, YoY

At 15:01 hrs HIL was quoting at Rs 2,783.75, down Rs 125.80, or 4.32 percent on the NSE.

-330

February 02, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was up 522.16 points or 0.73 percent at 72,167.46, and the Nifty was up 181.40 points or 0.84 percent at 21,878.90. About 1783 shares advanced, 1429 shares declined, and 71 shares unchanged.

-330

February 02, 2024· 15:00 IST

Stock Market LIVE Updates | Bikaji Foods International Q3 Results

:

Net profit up 14.5 percent at Rs 46.6 crore versus Rs 40.7 crore and revenue up 23 percent at Rs 623.9 crore versus Rs 507.2 crore, YoY.

-330

February 02, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:51 | Chg(%) Hourly Vol |

|---|---|---|---|

| Dhanlaxmi Bank | 54.40 | 51.45 | -2.95 245.92k |

| Shanti Overseas | 23.40 | 22.25 | -1.15 14.36k |

| Bikaji Foods | 588.55 | 559.85 | -28.70 10.41k |

| Andhra Paper | 609.80 | 586.60 | -23.20 4.01k |

| Mono Pharmacare | 73.95 | 71.15 | -2.80 - |

| YCCL | 40.60 | 39.10 | -1.50 24.20k |

| Pramara Promoti | 132.95 | 128.10 | -4.85 - |

| Archies | 36.30 | 35.00 | -1.30 21.77k |

| Tainwala Chem | 152.20 | 147.00 | -5.20 1.36k |

| EQUIPPP | 32.90 | 31.80 | -1.10 4.98k |

-330

February 02, 2024· 14:58 IST

| Company | Price at 14:00 | Price at 14:51 | Chg(%) Hourly Vol |

|---|---|---|---|

| Agro Phos India | 50.35 | 54.90 | 4.55 38.69k |

| RKEC Projects | 85.70 | 92.55 | 6.85 23.73k |

| TPL Plastech | 63.80 | 68.90 | 5.10 167.02k |

| Pudumjee Ind | 36.25 | 38.75 | 2.50 3.56k |

| HMA Agro | 72.00 | 76.50 | 4.50 59.53k |

| Rategain Travel | 778.80 | 825.85 | 47.05 21.03k |

| R M Drip & Spri | 102.00 | 108.00 | 6.00 2.00k |

| Fiberweb India | 39.85 | 41.90 | 2.05 13.61k |

| Solex Energy | 563.10 | 590.00 | 26.90 4.57k |

| Reliance Chemo | 257.00 | 268.00 | 11.00 640 |

-330

February 02, 2024· 14:56 IST

Stock Market LIVE Updates | Nomura View On Dr Lal PathLabs

-Neutral call, target Rs 2,505 per share

-Q3 revenue below estimate, signals a weaker volume growth outlook

-Believe slowdown is more fundamental in nature due to competition in sector

-On a QoQ sequential basis, revenue declined 10.4 percent & EBITDA margin declined 348 bps

-Decline was on account of seasonality

-Q3 tends to be weaker due to festivals & Q2 tends to be strong due to monsoon

-330

February 02, 2024· 14:55 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Punjab & Sind | 63.55 | 17.14 | 41.12m |

| IOB | 55.80 | 7.2 | 136.33m |

| PNB | 126.25 | 6.23 | 148.60m |

| Central Bank | 62.40 | 4.79 | 79.58m |

| Bank of India | 151.95 | 4.5 | 39.75m |

| Indian Bank | 543.95 | 3.82 | 4.43m |

| UCO Bank | 50.65 | 3.58 | 95.21m |

| Union Bank | 149.10 | 3.11 | 35.01m |

| Canara Bank | 516.00 | 2.89 | 12.56m |

| Bank of Mah | 57.75 | 2.3 | 81.01m |

-330

February 02, 2024· 14:49 IST

Sensex Today| Mahindra Holidays jumps as it reports highest ever Q3 member additions at 4,708, up by 13%

-330

February 02, 2024· 14:46 IST

Sensex Today| Jubilant Pharmova reports profit for Q3

-Total Income grew by 10% YoY to Rs. 1,713 Cr.

-EBITDA grew by 63% YoY to Rs. 254 Cr. and EBITDA margins expanded by 490 bps YoY

-PAT at Rs. 66 Cr. on improved operating performance & higher share of profit from

associates ( Majority contributed by Sofie Biosciences Inc.)

-330

February 02, 2024· 14:32 IST

-330

February 02, 2024· 14:19 IST

Stock Market LIVE Updates | Adani Ports records 26% YoY jump in Jan’24 cargo volumes

In Jan’24, Adani Ports handled cargo volumes of 35.1 MMT, implying a robust 26% YoY increase. This growth is primarily guided by Dry Bulk (+46% YoY) and Container (+13%) cargo types. The company’s Gangavaram Port recorded its lifetime high monthly cargo volume at 4 MMT.

With 346.3 MMT of total cargo handling in the initial 10 months (Apr’23-Jan’24) of FY24, the company has already surpassed the total cargo volumes handled (~339 MMT) in the 12 months of FY23

Logistics volumes continue to witness record growth with YTD rail volumes of around 489,00 TEUs (+20% YoY) and GPWIS volumes of 16 MMT (+42%). In Jan’24, the GPWIS volumes continue to be at a record high of ~1.9 MMT.

-330

February 02, 2024· 14:16 IST

Stock Market LIVE Updates | Andhra Paper Q3 Results:

Net profit down 51.5% at Rs 82.5 crore versus Rs 170.2 crore and revenue down 16.5% at Rs 476.6 crore versus Rs 570.9 crore, YoY.

-330

February 02, 2024· 14:14 IST

Stock Market LIVE Updates | Rategain Travel Technologies Q3 Results

:

Net profit at Rs 40.4 crore versus Rs 13.2 crore and revenue up 82.6% at Rs 252 crore versus Rs 138 crore, YoY.

-330

February 02, 2024· 14:12 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NHPC | 99.60 | 8.97 | 28.59m |

| Power Grid Corp | 278.00 | 4.59 | 1.29m |

| NTPC | 331.75 | 3.11 | 1.01m |

| Siemens | 4,207.20 | 2.56 | 8.11k |

| BHEL | 232.25 | 2.09 | 1.57m |

| Suzlon Energy | 49.16 | 1.76 | 47.88m |

| Adani Green Ene | 1,681.40 | 0.97 | 41.28k |

| Tata Power | 390.55 | 0.44 | 611.33k |

-330

February 02, 2024· 14:09 IST

Stock Market LIVE Updates | Kirloskar Ferrous Q3 Results:

Net profit down 34.6% at Rs 76.3 crore against Rs 116.6 crore and revenue down 3.3% at Rs 1,548 crore versus Rs 1,600 crore, YoY.

At 14:08 hrs Kirloskar Ferrous Industries was quoting at Rs 605.00, down Rs 33.50, or 5.25 percent. It has touched a 52-week high of Rs 644.90.

-330

February 02, 2024· 14:06 IST

-330

February 02, 2024· 14:00 IST

Stock Market LIVE Updates | Torrent Pharma Q3 Earnings:

Net profit jumped 56.5% at Rs 443 crore versus Rs 283 crore and revenue up 9.7% at Rs 2,732 crore versus Rs 2,491 crore, YoY.

-330

February 02, 2024· 13:58 IST

| Company | Price at 13:00 | Price at 13:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sangam Finserv | 85.90 | 78.55 | -7.35 224 |

| Nutech Global | 30.70 | 28.26 | -2.44 44 |

| Oriental Carbon | 861.35 | 793.00 | -68.35 107 |

| Interactive Fin | 26.31 | 24.39 | -1.92 1.45k |

| Ceeta Industrie | 32.39 | 30.10 | -2.29 6 |

| Cybele Ind | 40.80 | 38.00 | -2.80 8 |

| EP Biocompo | 205.00 | 191.10 | -13.90 1.31k |

| Aro Granite | 63.00 | 58.76 | -4.24 270 |

| Jayant Infra | 293.50 | 275.50 | -18.00 750 |

| The Investment | 168.10 | 158.00 | -10.10 124 |

-330

February 02, 2024· 13:58 IST

| Company | Price at 13:00 | Price at 13:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Uniroyal | 18.31 | 20.20 | 1.89 0 |

| Himatsingka Sei | 163.35 | 175.30 | 11.95 1.27k |

| Mohit Paper Mil | 35.00 | 37.50 | 2.50 74 |

| Kanpur Plast | 132.00 | 141.10 | 9.10 1.70k |

| SEMAC CONSULT | 2,642.40 | 2,822.00 | 179.60 32 |

| Inducto Stl | 57.25 | 61.00 | 3.75 28 |

| Skipper RE | 95.00 | 101.00 | 6.00 10 |

| Quest Softech | 43.25 | 45.98 | 2.73 112 |

| Mukand | 184.10 | 195.45 | 11.35 2.08k |

| Brandbucket Med | 25.28 | 26.69 | 1.41 83.86k |

-330

February 02, 2024· 13:56 IST

Stock Market LIVE Updates | Nava Q3 Earnings:

Revenue up 6% at Rs 930 crore versus Rs 880 crore and net profit up 34% at Rs 328 crore versus Rs 245 crore, YoY.

At 13:56 hrs NAVA was quoting at Rs 512.00, up Rs 22.20, or 4.53 percent. It has touched a 52-week high of Rs 522.

-330

February 02, 2024· 13:56 IST

Stock Market LIVE Updates | Sundram Fasteners Q3 results

Net profit rose 10% at Rs 129 crore versus Rs 117 crore and revenue down 3% at Rs 1,367 crore versus Rs 1,403 crore, YoY.

-330

February 02, 2024· 13:53 IST

-330

February 02, 2024· 13:51 IST

Stock Market LIVE Updates | Mahindra Holidays Q3 net profit at Rs 11.6 crore against loss of Rs 11.9 crore, YoY.

-330

February 02, 2024· 13:51 IST

Stock Market LIVE Updates | Whirlpool of India Q3 Results

Net profit rose 12% at Rs 28 crore versus Rs 25 crore and revenue up 18% at Rs 1,536 crore versus Rs 1,302 crore, YoY.

-330

February 02, 2024· 13:44 IST

Sensex Today | Santosh Meena, Head of Research at Swastika Investmart

The Nifty has recently reached a new all-time high, reaching 22,126. However, for a sustained upward momentum, it's crucial for the index to maintain this level; otherwise, it might revert to a sideways trend. Should it successfully hold above 22,125, the next potential targets for the February series are identified at 22,500 and 22,700.

Conversely, on the downside, the range between 21,640 and 21,500 presents an immediate demand zone. Further down, the key demand zone is situated between 21,200 and 20,800.

-330

February 02, 2024· 13:41 IST

Stock Market LIVE Updates | Himatsingka Seide Q3 Earnings:

Net profit at Rs 31 crore versus Rs 2 crore and revenue down 2% at Rs 723 crore versus Rs 737 crore, YoY.

Himatsingka Seide was quoting at Rs 175.00, up Rs 9.70, or 5.87 percent on the BSE.

-330

February 02, 2024· 13:37 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Touchwood Enter | 152.05 -0.69% | 31.03k 1,978.20 | 1,468.00 |

| Damodar Ind | 64.35 5.75% | 1.03m 77,003.20 | 1,237.00 |

| Dhruv Consultan | 68.20 5.9% | 810.85k 63,199.80 | 1,183.00 |

| Karnika Ind | 136.80 -2.29% | 131.20k | 1,183.00 |

| SKP Bearing | 309.00 19.31% | 190.00k 18,800.00 | 911.00 |

| Royal Orchid | 382.00 7.79% | 1.19m 120,588.40 | 887.00 |

| Kitex Garments | 270.00 14.82% | 4.81m 589,572.00 | 717.00 |

| DSPQ50ETF | 212.77 0.83% | 22.87k 2,800.80 | 717.00 |

| Capital Trust | 116.70 4.57% | 109.26k 13,623.00 | 702.00 |

| Taj GVK Hotels | 296.75 8.86% | 3.22m 413,646.00 | 678.00 |

-330

February 02, 2024· 13:33 IST

Stock Market LIVE Updates | Alkyl Amines Q3 Earnings:

Net profit down 27% at Rs 33 crore versus Rs 46 crore and revenue down 17% at Rs 322 crore versus Rs 388 crore, YoY.

At 13:33 hrs Alkyl Amines Chemicals was quoting at Rs 2,324.30, down Rs 38.80, or 1.64 percent.

-330

February 02, 2024· 13:28 IST

Stock Market LIVE Updates | Kaveri Seeds Q3

Net profit down 69% at Rs 11.8 crore versus Rs 38 crore and revenue down 1% at Rs 143 crore versus Rs 144 crore, YoY.

At 12:40 hrs Kaveri Seed Company was quoting at Rs 705.15, down Rs 10.30, or 1.44 percent.

-330

February 02, 2024· 13:24 IST

Stock Market LIVE Updates | Century Textiles and Industries Q3 net profit at Rs 83.3 crore versus Rs 8.7 crore, YoY.

-330

February 02, 2024· 13:21 IST

Sensex Today | Nifty Information Technology index gained 1.6 percent supported by Coforge, TCS, LTIMindtree:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| COFORGE LTD. | 6,359.00 | 3.07 | 348.39k |

| TCS | 3,945.95 | 2.38 | 1.86m |

| LTIMindtree | 5,478.30 | 2.12 | 490.14k |

| Persistent | 8,451.80 | 1.88 | 114.38k |

| Infosys | 1,687.10 | 1.81 | 5.64m |

| Wipro | 479.10 | 1.64 | 5.53m |

| Tech Mahindra | 1,330.80 | 1.39 | 1.38m |

| L&T Technology | 5,532.50 | 0.49 | 66.00k |

| HCL Tech | 1,578.50 | 0.07 | 1.70m |

-330

February 02, 2024· 13:18 IST

Stock Market LIVE Updates | Bernstein View On Adani Ports

-Outperform call, target Rs 1,243 per share

-Another strong quarter on all fronts, from volume to net income

-Management has revised their guidance upwards for FY24

-Global turmoil in red sea could impact near-term performance

-Capex for first 9MFY24 is at Rs 5,500 crore versus initial guidance of Rs 4,500 crore for full year

At 13:17 hrs Adani Ports and Special Economic Zone was quoting at Rs 1,270.35, up Rs 51.40, or 4.22 percent. It has touched a 52-week high of Rs 1,287

-330

February 02, 2024· 13:10 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| BPCL | 555.00 | 556.00 516.00 | -0.18% |

| IOC | 163.15 | 163.45 151.05 | -0.18% |

| SRF | 2,319.85 | 2,325.00 2,302.00 | -0.22% |

| GAIL | 178.75 | 179.30 175.10 | -0.31% |

| Bajaj Holdings | 8,380.30 | 8,406.90 8,271.05 | -0.32% |

| Havells India | 1,330.30 | 1,335.00 1,308.20 | -0.35% |

| Berger Paints | 566.10 | 568.50 561.45 | -0.42% |

| ONGC | 256.05 | 257.20 249.00 | -0.45% |

| Dr Reddys Labs | 6,046.65 | 6,074.70 5,996.05 | -0.46% |

| Bajaj Finserv | 1,656.15 | 1,664.00 1,626.70 | -0.47% |

-330

February 02, 2024· 13:09 IST

Stock Market LIVE Updates | Castrol India Q4 profit jumps 25% YoY to Rs 242 crore

Castrol India has registered net profit at Rs 242 crore for fourth quarter of CY23, rising 25.15% over a year-ago period on account of healthy operating numbers. Revenue grew by 7.5% year-on-year to Rs 1,264 crore for the quarter.

At 13:08 hrs Castrol India was quoting at Rs 201.10, up Rs 11.30, or 5.95 percent after hitting 52-week high of Rs 208.

-330

February 02, 2024· 13:04 IST

Stock Market LIVE Updates | Panama Petrochem Q3 Earnings:

Net profit fell 12.8% at Rs 41 crore versus Rs 47 crore and revenue down 10.9% at Rs 511.8 crore versus Rs 574.4 crore, QoQ.

-330

February 02, 2024· 13:01 IST

Sensex Today | Market at 1 PM

The Sensex was up 540.34 points or 0.75 percent at 72,185.64, and the Nifty was up 179.60 points or 0.83 percent at 21,877.10. About 1793 shares advanced, 1381 shares declined, and 72 shares unchanged.

-330

February 02, 2024· 12:58 IST

Stock Market LIVE Updates | GMM Pfaudler Q3 profit surges 70% YoY to Rs 32 crore

GMM Pfaudler has recorded net profit at Rs 31.72 crore for quarter ended December FY24, growing 70% over a year-ago period despite single digit growth in topline. Revenue from operations increased 8% YoY to Rs 856 crore for the quarter. The order backlog stood at Rs 1,625 crore, while order intake was at Rs 756 crore for the quarter.

-330

February 02, 2024· 12:55 IST

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| One 97 Paytm | 842717.00 | 487.05 -20 | 369864 493588.25 |

| Digispice Tech | 165810.00 | 37.44 -5 | 14256 142532.50 |

| Timex Group Ind | 45425.00 | 152.00 -4.97 | 29732 54208.80 |

-330

February 02, 2024· 12:55 IST

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Garment Mantra | 129070.00 | 8.16 20 | 11705449 - |

| Bajel Projects | 2.00 | 204.85 9.55 | 187772 0.00 |

| India Tourism D | 96.00 | 834.10 9.23 | 157587 79398.45 |

| Sandur Manganes | 55234.00 | 562.90 10 | 34395 13008.55 |

| Take Solutions | 3434.00 | 30.94 9.99 | 303521 169955.40 |

| BLB | 959.00 | 37.30 9.77 | 155008 311753.65 |

| Zeal Aqua | 1051686.00 | 13.61 9.94 | 706662 - |

| FCS Software | 10305.00 | 6.38 9.25 | 17309275 11571380.50 |

| Shilchar Techno | 7564.00 | 3606.50 5 | 10261 15104.05 |

| Nandan Denim | 21021.00 | 32.35 5 | 33550 61549.55 |

-330

February 02, 2024· 12:54 IST

Stock Market LIVE Updates | Tata Motors shares trade marginally higher ahead of Q3 Results:

Tata Motors is likely to see a robust growth in net profit and revenue in the fiscal third quarter, on the back of strong growth in Jaguar Land Rover volumes, price hikes, and superior product mix. The automobile major will announce its Q3 FY24 results on February 2.

According to the average estimate of six brokerages, Tata Motors’ net profit is expected to grow 54 percent on-year to Rs 4,547 crore in the October-December quarter. Revenue may gain 22 percent on-year to Rs 1,08,169 crore. EBITDA margin too is expected to see a sharp jump of 273 basis points to 13.63 percent. Read More

-330

February 02, 2024· 12:49 IST

Stock Market LIVE Updates | Hester Biosciences Q3 Results:

Net profit declined 64% at Rs 40 crore against Rs 112 crore and revenue down 11% at Rs 670 crore versus Rs 749 crore, YoY.

-330

February 02, 2024· 12:48 IST

-330

February 02, 2024· 12:44 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Ideaforge Tech | 709.00 -0.27 | 723.50 -2.00 | 6,226 |

| DCX Systems | 339.90 -0.79 | 349.55 -2.76 | 48,684 |

| Cartrade | 720.50 -0.21 | 741.95 -2.89 | 1,772 |

| Butterfly | 977.90 -0.41 | 1,008.65 -3.05 | 793 |

| Vivanta Industr | 4.88 -0.20 | 5.06 -3.56 | 1,183,391 |

| Jyoti Resins | 1,479.95 -0.74 | 1,540.70 -3.94 | 12,846 |

| Garbi Finvest | 32.68 -1.24 | 34.12 -4.22 | 12,513 |

| Best Agrolife | 748.40 -2.23 | 783.65 -4.50 | 51,612 |

| Hitech Corp | 241.00 -1.15 | 253.00 -4.74 | 474 |

| Sigma Solve | 456.70 -0.59 | 479.80 -4.81 | 1,190 |

-330

February 02, 2024· 12:44 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Sir Shadi Lal | 248.30 9.99 | 136.60 81.77 | 25,807 |

| Svaraj Trading | 17.25 4.99 | 10.79 59.87 | 83,032 |

| Garment Mantra | 8.16 20.00 | 5.65 44.42 | 11,688,197 |

| NBCC(India) | 161.25 13.52 | 114.74 40.54 | 14,289,862 |

| Swiss Military | 31.55 4.99 | 22.57 39.79 | 1,919,140 |

| KPIGREEN | 2,096.45 5.00 | 1,510.90 38.76 | 26,528 |

| Hemisphere | 237.75 2.39 | 177.25 34.13 | 783,421 |

| Waaree Renewabl | 4,233.10 5.00 | 3,317.15 27.61 | 11,526 |

| CROPSTER AGRO | 671.10 5.00 | 525.95 27.60 | 163 |

| Jhandewalas Foo | 62.06 4.99 | 48.64 27.59 | 154,000 |

-330

February 02, 2024· 12:43 IST

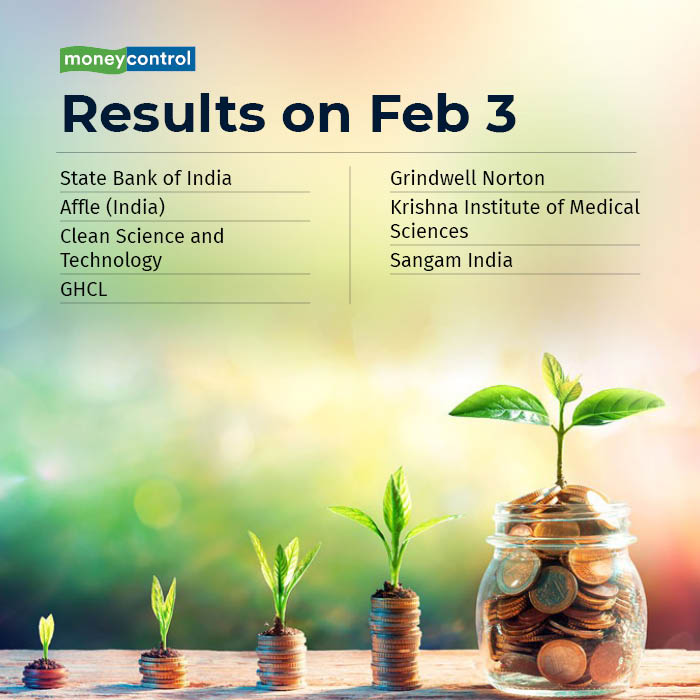

Earnings on February 3

-330

February 02, 2024· 12:36 IST

-330

February 02, 2024· 12:33 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 21889.75 0.89 | 0.73 2.52 | 1.03 24.30 |

| NIFTY BANK | 46384.05 0.42 | -3.95 3.38 | -2.88 14.05 |

| NIFTY Midcap 100 | 48486.60 0.39 | 4.99 2.71 | 4.52 59.32 |

| NIFTY Smallcap 100 | 16250.50 0.76 | 7.31 5.46 | 6.98 71.99 |

| NIFTY NEXT 50 | 55910.05 0.72 | 4.81 2.98 | 4.94 45.32 |

-330

February 02, 2024· 12:31 IST

Sensex Today | Gold set for best week in 9 as dollar softens ahead of US data

Gold prices were poised for their biggest weekly gain in nine on Friday as the dollar and Treasury yields retreated, while traders awaited key U.S. jobs data due later in the day for clues on when the Federal Reserve could start rate cuts.

Spot gold edged 0.1% higher to $2,056.00 per ounce. Bullion has climbed nearly 2% so far this week, set for its best weekly gain since early December.

U.S. gold futures edged 0.1% higher to $2,073.40.

-330

February 02, 2024· 12:28 IST

-330

February 02, 2024· 12:25 IST

Stock Market LIVE Updates | Jefferies View On Paytm:

-Underperform call, target Rs 500 per share

-Management clarified on payments business being the key driver of its guided 20-30 percent EBITDA hit

-Expect additional 20 percent hit led by impact on lending business from rising reputational concerns

-Believe recent events will drag company's growth and elongate profitability timelines

-330

February 02, 2024· 12:24 IST

Sensex Today | BSE Smallcap index added more than 1 percent supported by Punjab & Sind Bank, Kitex Garments, NBCC (India)

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Punjab & Sind | 63.84 | 17.98 | 1.89m |

| Kitex Garments | 271.75 | 15.66 | 188.87k |

| NBCC (India) | 161.60 | 13.76 | 13.09m |

| Texmaco Infra | 127.10 | 11.54 | 616.56k |

| Shipping Corp | 257.00 | 11.14 | 2.92m |

| SpiceJet | 71.02 | 11.07 | 21.39m |

| Sangam India | 619.85 | 10.5 | 34.34k |

| Andrew Yule | 62.37 | 10.12 | 1.85m |

| India Tourism D | 839.95 | 10 | 92.92k |

| Sandur Manganes | 562.90 | 10 | 34.39k |

-330

February 02, 2024· 12:23 IST

Stock Market LIVE Updates | Mphasis Q3 profit drops 4.7% QoQ to Rs 373.6 crore

Mphasis has recorded consolidated net profit at Rs 373.6 crore for October-December period of FY24, falling 4.7% compared to previous quarter, dented by weak operating numbers. Revenue from operations increased by 1.9% sequentially to Rs 3,338 crore for the quarter.

-330

February 02, 2024· 12:19 IST

Sensex Today | BSE Midcap index rose 1 percent led by SJVN, NHPC, Aditya Birla Capital:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SJVN | 143.25 | 12.35 | 5.37m |

| NHPC | 101.19 | 10.71 | 22.60m |

| AB Capital | 182.00 | 8.98 | 2.27m |

| Abbott India | 27,920.65 | 7.73 | 4.22k |

| GMR Airports | 84.65 | 7.1 | 3.34m |

| Bank of India | 155.25 | 6.77 | 1.62m |

| IOB | 55.32 | 6.2 | 10.67m |

| Castrol | 201.20 | 6.01 | 1.40m |

| HINDPETRO | 488.40 | 4.86 | 342.45k |

| Union Bank | 151.00 | 4.43 | 1.89m |

-330

February 02, 2024· 12:15 IST

Stock Market LIVE Updates | Citi View On Bata India

-Sell call, target Rs 1,330 per share

-Company reported flat Q3 revenue YoY despite delayed festive, soft base

-Flat Q3 revenue despite reach expansion leading to revenue/EBITDA/PAT missing estimate

-EBITDA margin declined by 278 bps YoY to 20.1 percent, down 210bps QoQ, down 1150 bps versus Q3FY20

-Margins adversely impacted due to significant investments made in branding & technology

-330

February 02, 2024· 12:12 IST

Stock Market LIVE Updates | Pricol Q3 profit climbs 27% YoY to Rs 34 crore

Pricol has registered a 27.1% on-year growth in consolidated net profit at Rs 34 crore for quarter ended December FY24, backed by healthy topline and operating earnings. Consolidated revenue from operations for the quarter increased by 21% to Rs 572.6 crore compared to corresponding period of last fiscal.

-330

February 02, 2024· 12:10 IST

Earnings Today:

-330

February 02, 2024· 12:09 IST

Stock Market LIVE Updates | Indian Hotels Company Q3 profit jumps 18% YoY to Rs 477 crore, revenue grows 16.5%

Indian Hotels Company has reported a 18.2% on-year growth in consolidated net profit at Rs 477 crore for third quarter of FY24, with healthy topline as well as operating numbers. Consolidated revenue grew 16.5% YoY to Rs 1,964 crore led by 21% growth in room revenue in December quarter.

-330

February 02, 2024· 12:04 IST

Sensex Today | BSE Oil & Gas index rose 3 percent supported by BPCL, IOC, HPCL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BPCL | 543.55 | 6.93 | 364.59k |

| IOC | 157.90 | 5.48 | 1.63m |

| HINDPETRO | 485.60 | 4.26 | 238.66k |

| ONGC | 256.05 | 3.39 | 732.63k |

| Reliance | 2,930.00 | 2.71 | 231.56k |

| GAIL | 177.90 | 2.45 | 813.54k |

| Petronet LNG | 270.75 | 2.02 | 92.85k |

| IGL | 444.95 | 1.23 | 96.79k |

| Linde India | 5,552.75 | 0.75 | 746 |

| Adani Total Gas | 1,010.20 | 0.57 | 119.75k |

-330

February 02, 2024· 11:58 IST

Stock Market LIVE Updates | Devyani International Q3 Results:

Net profit down 87% at Rs 9.6 crore versus Rs 71.6 crore and revenue up 6.6% at Rs 843 crore versus Rs 791 crore, YoY.

-330

February 02, 2024· 11:56 IST

Stock Market LIVE Updates | City Union Bank Q3 profit grows 16% YoY to Rs 253 crore

City Union Bank has registered net profit at Rs 253 crore for quarter ended December FY24, growing 16% year-on-year, but net interest income dropped 7.2% on-year to Rs 516 crore, with advances growing 2.3% YoY to Rs 44,017 crore and deposits rising 5.5% to Rs 52,726 crore for the quarter. Asset quality improved with the gross NPA declining 19 bps sequentially to 4.47% and net NPA down 15 bps to 2.19% for Q3FY24.

-330

February 02, 2024· 11:54 IST

Sensex Today | Nifty Bank index up over 1 percent led by PNB, Bandhan Bank, ICICI Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 125.20 | 5.34 | 89.25m |

| Bandhan Bank | 231.60 | 2.64 | 5.81m |

| ICICI Bank | 1,048.10 | 2.24 | 5.65m |

| SBI | 657.10 | 1.46 | 12.06m |

| IndusInd Bank | 1,562.25 | 1.37 | 1.13m |

| AU Small Financ | 642.10 | 1.13 | 1.30m |

| Kotak Mahindra | 1,840.00 | 0.95 | 2.48m |

| Federal Bank | 147.70 | 0.58 | 5.19m |

| HDFC Bank | 1,473.55 | 0.49 | 8.84m |

| Axis Bank | 1,088.45 | 0.39 | 2.94m |

-330

February 02, 2024· 11:53 IST

Stock Market LIVE Updates | NMDC's January sales up 18.8% at 4.56 million tonnes

NMDC has recorded iron ore production of 4.54 million tonnes (mt) in January this year, growing 8.09% over year-ago period, while sales grew by 18.8% year-to-year to 4.56 mt during the month.

-330

February 02, 2024· 11:48 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 4,747.15 | 3.49 | 14.70k |

| Bosch | 24,158.20 | 2.02 | 498 |

| TVS Motor | 2,035.20 | 1.92 | 21.73k |

| Tata Motors | 894.00 | 1.78 | 313.17k |

| M&M | 1,680.00 | 1.78 | 51.00k |

| Apollo Tyres | 542.40 | 1.59 | 19.61k |

| Bajaj Auto | 7,769.75 | 1.51 | 3.17k |

| Balkrishna Ind | 2,470.95 | 1.43 | 2.08k |

| MOTHERSON | 116.60 | 1.17 | 627.33k |

| Maruti Suzuki | 10,698.95 | 0.63 | 9.82k |

-330

February 02, 2024· 11:46 IST

Stock Market LIVE Updates | HFCL Q3 profit declines 19% YoY to Rs 82.4 crore, revenue drops 4.9%

HFCL has registered consolidated profit at Rs 82.43 crore for the quarter ended December FY24, falling 19% compared to year-ago period due to disappointment over the topline as well as operating numbers. Revenue from operations fell 4.9% year-on-year to Rs 1,032.3 crore in Q3FY24, while the order book increased to Rs 7,678 crore during the quarter, up from Rs 7,064 crore in Q3FY23.

-330

February 02, 2024· 11:44 IST

Stock Market LIVE Updates | Nifty hits fresh record high, Sensex surges 1,400 pts today; Nifty Bank up 1.5%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BPCL | 541.20 | 6.44 | 10.89m |

| Power Grid Corp | 280.85 | 5.66 | 17.59m |

| Adani Ports | 1,278.25 | 4.87 | 7.57m |

| Hero Motocorp | 4,750.00 | 3.56 | 480.28k |

| Infosys | 1,714.35 | 3.46 | 3.12m |

| TCS | 3,979.00 | 3.24 | 1.19m |

| ONGC | 255.55 | 3.19 | 13.07m |

| Reliance | 2,938.00 | 2.97 | 4.81m |

| Tech Mahindra | 1,350.95 | 2.93 | 867.05k |

| NTPC | 331.35 | 2.9 | 17.56m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Eicher Motors | 3,872.00 | -1.56 | 344.36k |

| HDFC Life | 583.25 | -0.66 | 1.29m |

-330

February 02, 2024· 11:39 IST

-330

February 02, 2024· 11:37 IST

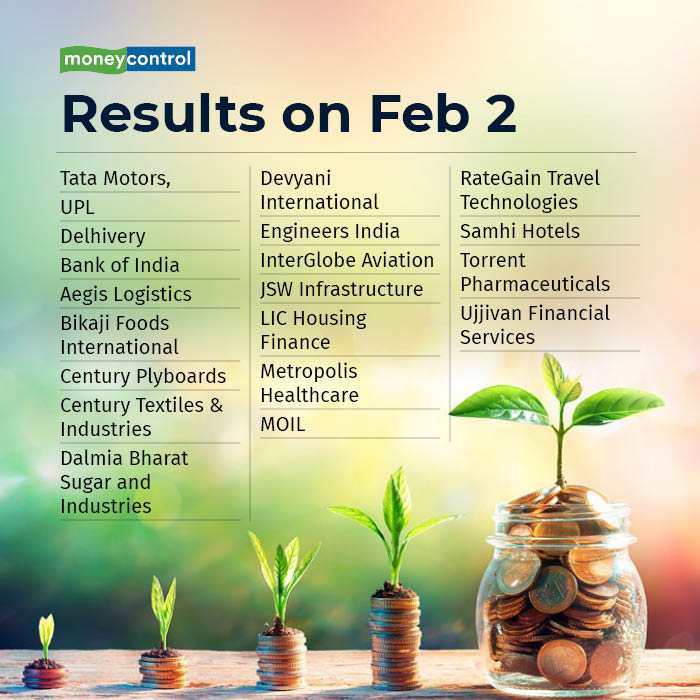

Sensex Today | Results on February 2:

Tata Motors, UPL, Delhivery, Bank of India, Aegis Logistics, Bikaji Foods International, Devyani International, Dhanlaxmi Bank, Engineers India, InterGlobe Aviation, JSW Infrastructure, LIC Housing Finance, Mahindra Lifespace Developers, Metropolis Healthcare, MOIL, Samhi Hotels, Satin Creditcare Network, Sundram Fasteners, Torrent Pharmaceuticals, and Ujjivan Financial Services will be in focus ahead of December quarter earnings on February 2.

-330

February 02, 2024· 11:35 IST

| Company | 52-Week Low | Day’s Low | CMP |

|---|---|---|---|

| Best Agrolife | 768.35 | 768.35 | 751.95 |

| Orient Bell | 376.15 | 376.15 | 370.30 |

| Rajratan Global | 680.00 | 680.00 | 661.95 |

| Butterfly | 995.95 | 995.95 | 975.00 |

-330

February 02, 2024· 11:32 IST

Stock Market LIVE Update | Abbott India shares scale 52-week high after solid Q3 earnings show

Shares of Abbott India soared 9 percent in early trade on February 2 after the company reported a solid set of earnings for the December quarter. The company recorded a net profit of Rs 311 crore in Q3, up 26 percent on year from Rs 246.8 crore of the corresponding quarter last year.

-330

February 02, 2024· 11:21 IST

Stock Market LIVE Update | ONDC to woo Metro rail operators with single app for all urban commute

Metro rail passengers may soon have a single app to purchase QR-code tickets, recharge their travel smart cards, and also book their last-mile commute through auto rickshaws or cabs. The government-backed Open Network for Digital Commerce (ONDC) is partnering with Metro rail operators in cities like Chennai, Bengaluru and Kochi to facilitate seamless end-to-end digital ticketing. ONDC is likely to announce the partnership with Chennai Metro Rail Limited (CMRL) on February 2. READ MORE

-330

February 02, 2024· 11:17 IST

Stock Market LIVE Update | Adani Ports surges 5% to 52-week high on robust Q3 results

Adani Ports shares jumped around 5 percent on February 2 to hit a fresh 52-week high of Rs 1,287.20, a day after the company's Q3 earnings beat estimates. READ MORE

-330

February 02, 2024· 11:15 IST

Stock Market LIVE Update | Green Energy stocks rally after the Budget day, RIL hit all time high

Green energy stocks rallied after the budget day as BSE Sensex jumped more than 800 points and Nifty gained more than 240 points. Shares of KPI Green, KPEL Energy, Waree Renewables, Orient Green power, Websol Energy Systems and Gensol Engineering are seen locked in the upper circuit while Suzlon shares are up by more than 3 percent. READ MORE

-330

February 02, 2024· 11:11 IST

Stock Market LIVE Update | HUDCO, NBCC zoom up to 16% to fresh highs on budget boost to housing

Shares of Housing & Urban Development Corporation Ltd (HUDCO) and NBCC India jumped up to 16 percent each on February 2, a day after Finance Minister Nirmala Sitharaman in her Budget 2024 speech promised two crore houses to be developed over the next five years under the PM Awas Yojana (PMAY) Grameen. READ MORE

-330

February 02, 2024· 10:59 IST

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Gogia Capital | 108.50 | 95.10 | -13.40 1 |

| TCFC Finance | 59.79 | 54.60 | -5.19 22.39k |

| Sanblue Corp | 41.94 | 38.56 | -3.38 104 |

| Soni Medicare | 27.10 | 25.08 | -2.02 103 |

| Shukra Pharma | 160.70 | 150.00 | -10.70 65 |

| Kalyani Forge | 455.55 | 425.45 | -30.10 45 |

| Axel Polymers | 67.95 | 63.66 | -4.29 629 |

| Chordia Food | 98.99 | 93.14 | -5.85 153 |

| Insolation Ener | 1,269.00 | 1,195.00 | -74.00 0 |

| Apollo Finvest | 1,099.00 | 1,035.00 | -64.00 8 |

-330

February 02, 2024· 10:57 IST

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Mirc Electronic | 22.16 | 25.11 | 2.95 313.55k |

| Valson Ind | 38.50 | 42.99 | 4.49 23 |

| KM Sugar Mills | 32.79 | 36.53 | 3.74 5.48k |

| Adinath Exim | 26.41 | 29.07 | 2.66 1.51k |

| Nutech Global | 28.00 | 30.80 | 2.80 514 |

| Prithvi Exc | 154.95 | 169.95 | 15.00 261 |

| United Credit | 22.23 | 24.30 | 2.07 211 |

| Deep Polymers L | 98.51 | 106.99 | 8.48 74.12k |

| Damodar Ind | 62.00 | 67.00 | 5.00 755 |

| Indong Tea | 19.00 | 20.49 | 1.49 0 |