Tata Motors is likely to see a robust growth in net profit and revenue in the fiscal third quarter, on the back of strong growth in Jaguar Land Rover volumes, price hikes, and superior product mix. The automobile major will announce its Q3 FY24 results on February 2.

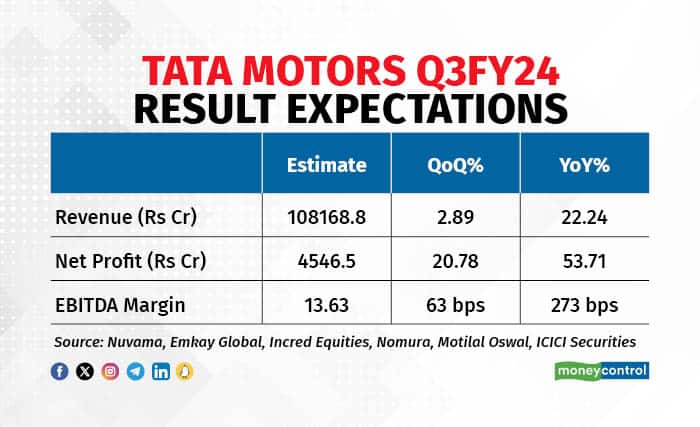

According to the average estimate of six brokerages, Tata Motors’ consolidated net profit is expected to grow 54 percent on-year to Rs 4,547 crore in the October-December quarter. Revenue may gain 22 percent on-year to Rs 1,08,169 crore. EBITDA margin too is expected to see a sharp jump of 273 basis points to 13.63 percent.

The wholesale volumes ex-China of JLR have grown 27 percent on-year to 1,01,043 units in the quarter. This is also the highest figure for the company in 11 quarters.

Also read: Tata Motors total vehicle sales climb to 86,125 units in January

Premium pricing to improve Tata Motors’ profitability

According to Nomura, the company might focus on transforming JLR into a more premium brand as they launch the new Jaguar EV at a price point of about GBP 100,000. The brokerage expects that the company’s focus on Average Selling Price (ASP) and margin would increase profitability if the new launches are successful. Nomura expects this is the correct strategy for the EV market as the market will become more competitive at the lower price point.

Motilal Oswal also expects the JLR volumes to be strong going forward due to easing chip shortages and traction for the new launches.

Brokerages are also eyeing a strong EBITDA margin for Tata Motors in Q3 due to better pricing. Nuvama expects EBITDA margin to expand by 210 bps due to improvement in JLR and India CV division. Emkay Global also says the margins will expand due to better scale and pricing in the JLR segment.

Also read: Tata Motors surges 5 percent to hit all time high, crosses Maruti Suzuki in market capitalisation

Commercial vehicles on a smooth ride

The commercial vehicles segment, especially the MHCV (medium-heavy CV) segment, is also expected to be a growth lever for Tata Motors. Nomura expects a positive MHCV cycle for the company to continue due to positive capex and continued infrastructure push by the government. Prabhudas Lilladher also said the demand for M&HCV trucks will aid the company’s revenue growth in the quarter.

Shares of Tata Motors rallied 24 percent in the October-December quarter, beating Nifty 50, which rose 10.7 percent during the same time. The stock also hit a new high on January 31 ahead of its results announcement.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.