LiveNow

Closing Bell: Nifty below 22,400, Sensex down 201 points; media, metal, realty top drag

Market Close | Nifty below 22,400, Sensex down 201 pts

Indian equity indices ended on a negative note with Nifty below 22,400 on March 13. At close, the Sensex was down 200.85 points or 0.27 percent at 73,828.91, and the Nifty was down 73.30 points or 0.33 percent at 22,397.20.

We wrap up today's edition of the Moneycontrol live market blog, and will be back Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

Ajit Mishra – SVP, Research, Religare Broking

On the weekly expiry day, markets remained range-bound and closed slightly lower. While positive global cues initially drove an uptick, selling pressure in heavyweight stocks across sectors pulled the Nifty into the red, eventually settling at 22,397.20. Barring the banking sector, all major indices ended lower, with realty, auto, and metal stocks leading the decline. The broader indices followed suit, losing nearly a percent each.

The ongoing consolidation in the Nifty index has kept participants cautious, but a decisive breakout from the 22,250-22,650 range is expected soon. In the meantime, traders should maintain a stock-specific approach while managing position sizes carefully. We continue to advise against adding to loss-making positions, particularly in the midcap and smallcap segments, given the likelihood of sustained underperformance.

Sundar Kewat, Technical and Derivatives Analyst, Ashika Institutional Equity

Domestic economic data played a key role in shaping market sentiment today. Retail inflation eased more than expected, falling below the RBI’s target range for the first time in six months, fueling optimism about potential interest rate cuts. Additionally, industrial output surged beyond expectations in January, further boosting investor confidence.

The Nifty opened on a positive note at 22,541 but faced early selling pressure before recovering to an intraday high of 22,558. However, renewed selling dragged the index to an intraday low of 22,377 (as of 15:06). The session was marked by high volatility, with sharp fluctuations before the index settled near the day's low. Sector-wise, Capital Goods, Power, and Healthcare exhibited strength, while weakness was observed in Oil & Gas, Financial Services, Auto, and IT.

Prashanth Tapse, Senior VP (Research), Mehta Equities

The moderating inflation and uptick in GDP numbers failed to cheer investors, as markets ended weak in late selling pressure with mixed European and Asian cues coupled with FII selling dominating the mood. Investors are nervous about the likely imposition of tariffs on Indian goods by the Trump administration and its overall impact going ahead, hence caution with a negative bias could prevail for some more time.

Rupak De, Senior Technical Analyst at LKP Securities

Nifty has been forming a symmetrical triangle pattern on the hourly chart, which is a continuation pattern. For the past three days, Nifty has largely remained within the range of 22,350–22,550. A decisive move above 22,550 could trigger a meaningful rally in the short term. Conversely, a decisive fall below 22,350 could weaken sentiment in the short term.

Market This Week

Market gives up last week's gains, Nifty down nearly 1%

Broader markets underperform with Midcap index falling nearly 3%

Dilip Parmar, Research Analyst, HDFC Securities

The Indian rupee gained ahead of the long weekend. The rupee's recovery was fueled by better-than-expected economic data (CPI below RBI's mandate and strong IIP growth) , which could provide room for the RBI in easing rates. Additionally, the decline in crude oil prices and the strengthening of regional currencies provided further support to the rupee.

In the near term, the spot USD/INR faces support at 86.48 and resistance at 87.40.

Vinod Nair, Head of Research, Geojit Financial Services

Shortened trading week and sell-off in the US short market are providing a hiccup to the global market. However, India is withstanding with resilience and healthy outperformance, by a narrow negative trend. Even concerns that the US may have to bear a recession are not impacting the Indian market due to signs of recovery in fundamentals led by moderation in inflation, future rate cuts, and improvement in the economy in FY26 led by government spending and improvement in consumer income. However, if US policy continues to be tepid, it will become a point of concern.

Currency Check | Rupee closes 21 paise higher

Indian rupee ended 21 paise higher at 87 per dollar on Thursday versus Wednesday's close of 87.21.

Market Close | Nifty below 22,400, Sensex down 201 pts; media, metal, realty top drag

Indian equity indices ended on a negative note with Nifty below 22,400 on March 13.

At close, the Sensex was down 200.85 points or 0.27 percent at 73,828.91, and the Nifty was down 73.30 points or 0.33 percent at 22,397.20. About 1463 shares advanced, 2348 shares declined, and 123 shares unchanged.

Shriram Finance, Tata Motors, Hero MotoCorp, IndusInd Bank, Hindalco Industries were among major losers on the Nifty, while gainers included Bharat Electronics, SBI, ICICI Bank, Cipla, NTPC.

BSE Midcap and smallcap indices shed 0.5 percent each.

On the sectoral front, auto, IT, metal, media, realty down 0.5-1 percent each, while PSU Bank index up 0.5 percent.

Sensex Today | Nifty Bank index erase nearly 300 points from day's high

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Kotak Mahindra | 1,986.40 | 1,993.35 1,969.55 | -0.35% |

| ICICI Bank | 1,250.50 | 1,255.60 1,245.30 | -0.41% |

| SBI | 728.15 | 731.45 724.50 | -0.45% |

| Axis Bank | 1,010.45 | 1,016.00 1,005.10 | -0.55% |

| HDFC Bank | 1,708.35 | 1,720.80 1,700.05 | -0.72% |

| PNB | 87.11 | 87.85 86.34 | -0.84% |

| Canara Bank | 82.70 | 83.48 82.16 | -0.93% |

| Bank of Baroda | 205.46 | 207.95 202.30 | -1.2% |

| Federal Bank | 176.76 | 179.34 176.25 | -1.44% |

| AU Small Financ | 502.65 | 514.40 501.00 | -2.28% |

| IDFC First Bank | 53.49 | 54.98 53.36 | -2.71% |

| IndusInd Bank | 672.60 | 706.90 667.65 | -4.85% |

Brokerage Call | Nomura retain 'buy' rating on BEL, target price Rs 363

#1 As expected, ordering activities have picked up significantly in Q4FY25

#2 Company received order inflows worth Rs 72 bn till now in Q4FY25 vs Rs 98 bn in 9MFY25

#3 Total order inflows till now in FY25 have reached Rs 170 bn vs guidance of Rs 250 bn

#4 BEL is on track to achieve its guided order inflows

#5 Company is currently in final stages of multiple negotiations with customers

#6 Increasing defence spending by Europe could be positive for BEL

#7 BEL has strong collaborations with major OEMs

#8 Stock trades at 35x/30x FY26/FY27 EPS

Stock Market LIVE Updates | MPIDC sanctions 113 acre land to Shakti Pumps' subsidiary

The Madhya Pradesh Industrial Development Corporation Limited (MPIDC) has sanctioned 113 Acre land to wholly owned subsidiary company i.e. Shakti Energy Solutions.

This land will be utilized for setting up a solar cell and PV module manufacturing facility, using wafers as input material.

Brokerage Call | Jefferies view on cement stocks

#1 Tamil Nadu govt notified a new Rs 160/t tax on limestone mining

#2 On cement basis, this implies Rs 140-160/t of additional cost on cement produced in the state

#3 This announcement is specific to Tamil Nadu as of now, while may set a precedent for other states

#4 For South-Focused players, we estimate Rs 40-70/t impact on Dalmia/Ramco’s EBITDA

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Jaiprakash Asso | 3.88 | -5.13 | 12526225 |

| Everest Ind | 479.9 | -3.33 | 7362 |

| JK Lakshmi Cem | 708.5 | -3.06 | 63147 |

| India Cements | 272.4 | -2.92 | 356158 |

| Shree Digvijay | 67.25 | -2.71 | 223116 |

| Ramco Cements | 799.1 | -2.56 | 745903 |

| Dalmia Bharat | 1601.75 | -2.4 | 264704 |

| J. K. Cement | 4263.95 | -1.99 | 42295 |

| Mangalam Cement | 723.45 | -1.88 | 47858 |

| Visaka Ind | 59.4 | -2.06 | 345592 |

| Nuvoco Vistas | 294 | -1.16 | 68570 |

| Anjani Portland | 105 | -1.28 | 48777 |

| Kakatiya Cement | 139.94 | -0.93 | 3429 |

| Udaipur Cement | 24.36 | -0.73 | 298436 |

| Ambuja Cements | 485.65 | -0.73 | 1483581 |

| UltraTechCement | 10454 | -0.63 | 172949 |

| ACC | 1854.8 | -0.58 | 553690 |

| Ramcoind | 226.06 | -0.54 | 54545 |

| NCL Industries | 187.45 | -0.49 | 41476 |

| Star Cement | 204.91 | -0.22 | 216006 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| A B Infrabuild | 91.96 | 7.29 | 316609 |

| Niraj Cement | 48.62 | 4.25 | 43612 |

| Barak Vally Cem | 40.29 | 4.95 | 20757 |

| KCP | 190.48 | 2 | 166448 |

| Heidelberg Cem | 193.52 | 1.12 | 54759 |

| Sahyadri Ind | 247.21 | 0.89 | 3974 |

| Deccan Cements | 818.8 | 0.65 | 20940 |

| Andhra Cement | 56.9 | 0.28 | 43485 |

| Orient Cement | 347.25 | 0.06 | 615475 |

Anuj Choudhary – Research Analyst at Mirae Asset Sharekhan

Indian Rupee recovered today on upbeat macroeconomic data and a soft US Dollar. India’s CPI inflation cooled off to a 7-month low at 3.61% in February from 4.26% in February and forecast of 4%. Industrial production IIP also rose sharply by 5% in January vs forecast of 3.5%. US CPI cooled off to 2.8% in February vs forecast of 2.9% while core CPI slowed down to 3.1% vs estimates of 3.2%. However, weak domestic markets capped sharp gains.

We expect Rupee to trade with a slight positive bias on optimism over better than expected data and overall weakness in crude oil prices. However, weak domestic markets, the ongoing trade tariff issue and FII outflows may cap sharp upside. Traders may take cues from PPI and weekly jobless claims data from the US. USDINR spot price is expected to trade in a range of Rs 86.80 to Rs 87.25.

Sensex Today | 1.11 million shares of Power Grid traded in a block: Bloomberg

Brokerage Call | Morgan Stanley keeps 'overweight' rating on SBI Life, target price rs 1,910

#1 Management confident of achieving early teens individual APE growth in FY25 & sustaining that in FY26

#2 This would be led by strong agency growth (25 percent+)

#3 Expects SBI channel APE to grow only 10 percent in FY26

#4 It did cite focus on product mix away from ULIP to higher-margin products

#5 It expects an FY26 VNB margin of 26.5-28 percent

#6 Positive impact of product mix shift is likely to be offset by higher agency mix

#7 Its pure protection product on SBI's YONO app is seeing good traction

#8 It Is looking to raise sum assured to Rs 5-7 mn from Rs 2-4 mn

Currency Check | Rupee trades 26 paise higher

Indian rupee is trading 26 paise higher at 86.95 per dollar on Thursday versus Wednesday's close of 87.21.

Markets@3 | Sensex sheds 220 points, Nifty below 22400

The Sensex was down 226.13 points or 0.31 percent at 73,803.63, and the Nifty was down 86.35 points or 0.38 percent at 22,384.15. About 1354 shares advanced, 2182 shares declined, and 104 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| IndusInd Bank | 672.20 -1.83 | 29.23m | 1,999.62 |

| HDFC Bank | 1,704.00 -0.42 | 6.50m | 1,113.31 |

| Bharti Airtel | 1,633.15 -0.59 | 6.70m | 1,100.14 |

| Infosys | 1,579.60 -0.71 | 6.63m | 1,048.91 |

| Bharat Elec | 280.30 1.25 | 35.13m | 993.19 |

| Reliance | 1,245.10 -0.95 | 7.79m | 978.15 |

| Bajaj Finance | 8,413.60 -0.84 | 1.07m | 903.78 |

| ICICI Bank | 1,250.00 0.49 | 6.36m | 795.98 |

| Kotak Mahindra | 1,984.50 0.1 | 3.99m | 791.68 |

| Tata Motors | 655.30 -1.95 | 12.09m | 796.14 |

| Tata Steel | 150.85 0.37 | 42.67m | 646.60 |

| M&M | 2,646.75 -0.25 | 2.05m | 541.29 |

| TCS | 3,511.10 0.14 | 1.28m | 446.84 |

| Larsen | 3,182.45 -0.35 | 1.20m | 384.53 |

| Trent | 5,028.55 0.26 | 731.95k | 369.54 |

| SBI | 726.65 0.5 | 4.78m | 347.99 |

| HUL | 2,167.35 -1.17 | 1.49m | 325.65 |

| ONGC | 225.10 0.31 | 14.02m | 319.20 |

| Axis Bank | 1,009.20 -0.2 | 2.99m | 302.20 |

| ITC | 412.80 0.1 | 7.14m | 294.61 |

Stock Market LIVE Updates | Kolte-Patil board approves preferential allotment of 1.26 crore shares at Rs 329 to Blackstone entity BREP Asia III

Sensex Today | BSE Consumer Durables index snaps 2-day gains

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| CG Consumer | 345.20 | -3.54 | 38.19k |

| Voltas | 1,404.80 | -2.8 | 30.28k |

| Havells India | 1,455.95 | -1.59 | 8.51k |

| Aditya Birla F | 240.00 | -1.23 | 37.33k |

| Kalyan Jeweller | 422.10 | -1.17 | 250.57k |

| Blue Star | 2,038.35 | -0.42 | 23.97k |

| Titan Company | 3,006.00 | -0.4 | 11.35k |

| Supreme Ind | 3,349.65 | -0.19 | 44.80k |

Sensex Today | 1.73 million shares of Bharti Airtel traded in a block: Bloomberg

Global Markets | European Markets trade mixed; DAX down 0.5%

Sensex Today | JSW Energy signs a Power Purchase Agreement with West Bengal State Electricity Distribution Company

The company has signed a Power Purchase Agreement with West Bengal State Electricity Distribution Company Limited for a greenfield 1,600 MW (2 x 800 MW) super / ultra super critical thermal power plant.

Additionally, in respect of the Utkal thermal power plant (2 x 350 MW), the company has received Commercial Operation Date certificate for Unit 2.

Sensex Today | Nifty Metal index down 0.7%; Hindalco, Nalco top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ratnamani Metal | 2,480.00 | -2.37 | 28.91k |

| Hindalco | 676.50 | -1.94 | 3.98m |

| NALCO | 187.92 | -1.89 | 3.51m |

| APL Apollo | 1,380.05 | -1.63 | 773.69k |

| Welspun Corp | 808.15 | -1.49 | 516.33k |

| Hind Copper | 216.24 | -1.43 | 2.68m |

| Jindal Steel | 891.50 | -1.28 | 795.38k |

| NMDC | 64.02 | -1.19 | 11.39m |

| Adani Enterpris | 2,226.40 | -0.69 | 622.81k |

| JSW Steel | 1,003.95 | -0.64 | 909.86k |

| Jindal Stainles | 634.25 | -0.45 | 398.37k |

| Vedanta | 443.80 | -0.26 | 4.04m |

Sensex Today| Aster DM Health Gets in-principle approval from stock exchanges (NSE & BSE) to issue 1.86 cr shares of on preferential basis

Sensex Today| InfoBeans Technologies collaborates with Canada’s standards developing organisation to drive its AI-powered transformation

Sensex Today| Tata Motors plans to sell upto Rs 2000 crore bond

Sensex Today| HDFC Life says IT implemented enhanced security protocols

#1 HDFC Life IT incident did not result in material adverse impact

Sebi not in favour of entry barriers for investors in equity F&O segment

The so-called 'product suitability framework' has not come up for discussions in recent meetings at Sebi, and there has been no indication that the capital market regulator may propose limiting retail participants in F&O based on skill or capital....Read More

Markets@2 | Sensex, Nifty flat

The Sensex was down 45.07 points or 0.06 percent at 73,984.69, and the Nifty was down 33.80 points or 0.15 percent at 22,436.70. About 1458 shares advanced, 2027 shares declined, and 119 shares unchanged.

Brokerage Call | Morgan Stanley keeps 'overweight' rating on ICICI Lombard, target price Rs 1,910

#1 Management expects industry premium growth of 8.5 percent in FY26

#2 Company should deliver 100-200 bps higher led by growth in fire, commercial lines & retail health

#3It expects motor third party price hikes to be muted on a headline basis, with hikes & cuts in select segments

#4 Management expects many insurers to likely lower commissions or lower growth in segments

#5 With higher commissions as they need to comply with EOM limits in F26

#6 Expects to improve the combined ratio from the current 102 percent over time

#7 It could help it migrate from a sustainable 16-18 percent ROE to 18-20 percent

Stock Market LIVE Updates | BEML signs MoU with Siemens India, Dragflow S.R.L

The company has signed a non-binding Memorandum of Understanding (MoU) with Siemens India to jointly explore opportunities in the semi-high-speed and suburban passenger train segments, as well as in the metro and commuter rail markets. Additionally, the company has signed an MoU with Dragflow S.R.L., Italy Forge, to strengthen indigenous dredging solutions.

Stock Market LIVE Updates | Infosys announces expansion of strategic collaboration with Citizens

The digital services and consulting company announced the expansion of its long-standing strategic collaboration with NYSE-listed Citizens (one of the oldest and largest financial institutions in the US). Citizens will leverage Infosys’ deep domain expertise in financial services and its innovative technologies, including AI, cloud, and automation, to develop cloud-native domain platforms and achieve a data center exit.

Stock Market LIVE Updates | Retail shares in focus

Stock Market LIVE Updates | IIFL Finance to raise Rs 700 crore via NCDs

Global Markets | Asian Markets end weak; Taiwan Weighted down 1.4%

Stock Market LIVE Updates | VA Tech Wabag secures order worth Rs 340 crores

VA Tech Wabag secured order worth ~ Rs 340 crores towards Design, Build, Operate (DBO) of a 450 cum/hr UF & RO based Effluent Recycle Plant, Evaporator based Zero Liquid Discharge (ZLD) Plant and new Waste Water Treatment Plant & augmentation of existing Waste Water Treatment Plant, for GAIL (India) Limited’s (GAIL) integrated petrochemical complex at Pata, Uttar Pradesh.

Stock Market LIVE Updates | Ola Electric Mobility announces Holi flash sale offers for its electric scooters.

The pure-play electric vehicle company announced Holi flash sale offers for its S1 range of electric scooters. It will provide discounts of up to Rs 26,750 on the S1 Air and Rs 22,000 on the S1 X+ (Gen 2). It is also offering discounts of up to Rs 25,000 on the rest of its S1 range, including the S1 Gen 3 range, and additional benefits worth up to Rs 10,500.

Stock Market LIVE Updates | HPL Electric & Power wins smart meters orders worth Rs 369.90 crore

Sensex Today | Nifty50 index falls 130 points from day's high

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Dr Reddys Labs | 1,105.10 | 1,106.85 1,095.05 | -0.16% |

| SBI | 729.95 | 731.45 724.50 | -0.21% |

| Sun Pharma | 1,678.75 | 1,682.90 1,663.45 | -0.25% |

| Kotak Mahindra | 1,983.90 | 1,988.95 1,969.55 | -0.25% |

| ICICI Bank | 1,252.30 | 1,255.60 1,245.30 | -0.26% |

| Cipla | 1,461.45 | 1,465.70 1,445.65 | -0.29% |

| Maruti Suzuki | 11,650.00 | 11,685.00 11,580.00 | -0.3% |

| Asian Paints | 2,247.60 | 2,257.20 2,233.00 | -0.43% |

| ITC | 412.50 | 414.40 408.20 | -0.46% |

| Axis Bank | 1,011.20 | 1,016.00 1,005.10 | -0.47% |

| TCS | 3,500.00 | 3,524.30 3,484.10 | -0.69% |

| HDFC Bank | 1,708.75 | 1,720.80 1,707.70 | -0.7% |

| UltraTechCement | 10,445.65 | 10,520.00 10,380.10 | -0.71% |

| Coal India | 380.00 | 383.00 378.75 | -0.78% |

| Larsen | 3,206.10 | 3,233.15 3,183.75 | -0.84% |

| Reliance | 1,253.05 | 1,264.15 1,252.05 | -0.88% |

| HCL Tech | 1,533.60 | 1,547.95 1,529.45 | -0.93% |

| BPCL | 264.08 | 266.67 262.01 | -0.97% |

| Nestle | 2,190.10 | 2,211.75 2,184.10 | -0.98% |

| Bharat Elec | 283.00 | 285.80 279.42 | -0.98% |

Stock Market LIVE Updates | Coromandel International to acquire a 53% shareholding in NACL Industries

Coromandel is set to acquire a 53% shareholding in NACL Industries for Rs 820 crore at a price of Rs 76.7 per share from the current promoter, KLR Products.

Coromandel also proposes to make an open offer to the public to acquire up to 26% of the equity share capital of NACL.

Stock Market LIVE Updates | Bharat Electronics signs contract with the Ministry of Defence

The company has signed a contract with the Ministry of Defence valued at Rs 2,463 crore for the supply and services of Ashwini radars to the Indian Air Force. With this, the company has accumulated orders totaling Rs 17,030 crore in the current financial year.

Sensex Today | Wonderla Holidays receives sanction letter from Tourism Department, Government of Odisha

The company has received sanction letter from the Tourism Department, Government of Odisha, towards capital investment subsidy of Rs 20 crores as per 2022–2027 Tourism Policy of the state for successful completion of Bhubaneswar Park within the timelines specified in the policy.

Brokerage Call | Gross SIP flows remained resilient: HSBC view on AMCs

#1 Net flows in equity & hybrid funds for the industry declined MoM in Feb’25

#2 Large AMCs are gaining market share in their top schemes

#3 Relative scheme performance and distribution key differentiator

#4 Equity AUM growth outlook remains weak for sector, pressure on net flows, muted MTM gains

Markets@1 | Sensex, Nifty flat

The Sensex was up 24.59 points or 0.03 percent at 74,054.35, and the Nifty was down 12.25 points or 0.05 percent at 22,458.25. About 1578 shares advanced, 1869 shares declined, and 113 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sasken Tech | 1,407.05 | -3.19 | 520 |

| Rategain Travel | 454.00 | -3.09 | 22.20k |

| KSolves | 348.20 | -2.68 | 8.93k |

| Mastek | 2,252.40 | -2.65 | 1.99k |

| Axiscades Tech | 833.00 | -2.62 | 10.36k |

| Zensar Tech | 650.10 | -2.38 | 20.02k |

| Subex | 12.37 | -1.67 | 385.45k |

| Vakrangee | 12.03 | -1.64 | 2.72m |

| Happiest Minds | 675.25 | -1.49 | 36.74k |

| KPIT Tech | 1,218.15 | -1.27 | 10.37k |

| COFORGE LTD. | 7,300.00 | -1.26 | 4.61k |

| Wipro | 265.05 | -1.25 | 176.25k |

| Persistent | 5,101.00 | -1.24 | 3.07k |

| C. E. Info Syst | 1,603.25 | -1.22 | 3.98k |

| BLACK BOX | 334.25 | -1.18 | 42.52k |

| Cigniti Tech | 1,338.45 | -1.18 | 1.02k |

| Affle India | 1,422.90 | -1.18 | 18.35k |

| Tanla Platforms | 432.05 | -1.14 | 31.34k |

| Magellanic | 50.04 | -1.05 | 95.94k |

| LT Technology | 4,353.50 | -0.94 | 3.88k |

Sensex Today | BSE IT index down 0.5%; extend fall on fifth day

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sasken Tech | 1,407.05 | -3.19 | 520 |

| Rategain Travel | 454.00 | -3.09 | 22.20k |

| KSolves | 348.20 | -2.68 | 8.93k |

| Mastek | 2,252.40 | -2.65 | 1.99k |

| Axiscades Tech | 833.00 | -2.62 | 10.36k |

| Zensar Tech | 650.10 | -2.38 | 20.02k |

| Subex | 12.37 | -1.67 | 385.45k |

| Vakrangee | 12.03 | -1.64 | 2.72m |

| Happiest Minds | 675.25 | -1.49 | 36.74k |

| KPIT Tech | 1,218.15 | -1.27 | 10.37k |

| COFORGE LTD. | 7,300.00 | -1.26 | 4.61k |

| Wipro | 265.05 | -1.25 | 176.25k |

| Persistent | 5,101.00 | -1.24 | 3.07k |

| C. E. Info Syst | 1,603.25 | -1.22 | 3.98k |

| BLACK BOX | 334.25 | -1.18 | 42.52k |

| Cigniti Tech | 1,338.45 | -1.18 | 1.02k |

| Affle India | 1,422.90 | -1.18 | 18.35k |

| Tanla Platforms | 432.05 | -1.14 | 31.34k |

| Magellanic | 50.04 | -1.05 | 95.94k |

| LT Technology | 4,353.50 | -0.94 | 3.88k |

Stock Market LIVE Updates | Shangar Decor, Shalimar Agencies shares trade ex-split

Sensex Today | Nifty Realty index down 1%; Phoenix Mills, Brigade Enterprises among top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 1,551.40 | -3.13 | 346.39k |

| Brigade Ent | 949.95 | -2.71 | 171.52k |

| Raymond | 1,233.40 | -1.48 | 126.64k |

| Godrej Prop | 1,993.00 | -1.25 | 206.72k |

| Oberoi Realty | 1,553.35 | -1.11 | 198.21k |

| Macrotech Dev | 1,073.15 | -0.79 | 620.28k |

| Sobha | 1,211.65 | -0.45 | 35.65k |

| DLF | 667.65 | -0.16 | 1.43m |

Stock Market LIVE Updates | Gensol Engineering to seek shareholder nod to issue convertible bond/ADR/GDR for up to USD 50 mn

Sensex Today | Leo Puri resigns as independent director of HUL

Leo Puri has tendered his resignation as the independent director of the company, with effect from close of business hours on 30th June, 2025

Stock Market LIVE Updates | Swelect Energy Systems secures orders of over 150 MW

The company has secured orders for over 150 MW for its TOPCon Bi-facial solar PV modules. Additionally, the Swelect Group has successfully raised Rs 290 crore in funding through non-convertible debentures (NCDs) via a private placement with India Infradebt.

Sensex Today | BSE PSU index rises 0.5%; MRPL, ITI, Chennai Petroleum, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MRPL | 120.65 | 7.44 | 490.15k |

| ITI | 255.25 | 4.74 | 44.84k |

| Chennai Petro | 576.15 | 4.28 | 85.80k |

| Mazagon Dock | 2,331.55 | 3.39 | 86.84k |

| BEML | 2,559.65 | 2.85 | 16.51k |

| Oil India | 376.85 | 2.77 | 163.04k |

| Garden Reach Sh | 1,329.95 | 2.42 | 52.13k |

| Engineers India | 159.80 | 2.27 | 253.65k |

| Bharat Elec | 282.90 | 2.22 | 846.91k |

| Mishra Dhatu | 270.15 | 1.98 | 8.69k |

| Bank of Baroda | 206.20 | 1.88 | 245.24k |

| Bharat Dynamics | 1,113.85 | 1.74 | 99.75k |

| Gujarat Gas | 392.10 | 1.69 | 12.40k |

| SAIL | 108.40 | 1.55 | 718.72k |

| REC | 407.50 | 1.36 | 95.41k |

| Guj Mineral | 254.25 | 1.07 | 30.73k |

| Cochin Shipyard | 1,292.65 | 1 | 37.12k |

| HUDCO | 183.00 | 0.99 | 255.70k |

| Hindustan Aeron | 3,447.50 | 0.98 | 75.28k |

| BHEL | 195.35 | 0.9 | 218.29k |

Stock Market LIVE Updates | Rollatainers board approves to cancel preferential issue

The Board has approved the withdrawal and cancellation of the preferential issue of 11.76 crore warrants convertible into equity shares of the company. This preferential issue was approved by the Board on April 20, 2024.

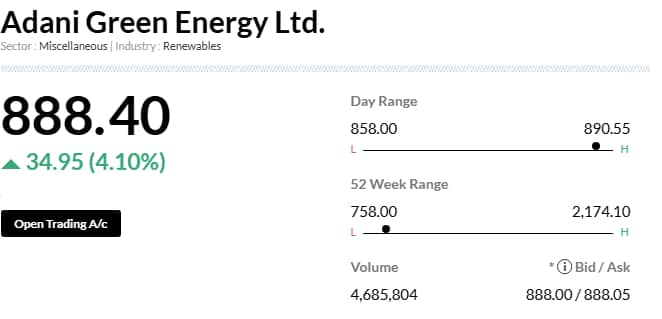

Brokerage Call | Macquarie initiates 'outperform' rating on Adani Green Energy, target price Rs 1,200

#1 Leading India's energy transition with targeted 50GW capacity by FY30 vs 12GW now

#2 More conservative pathway implies 25 percent EBITDA CAGR over next 5 years

#3 Build in steady blended realisations

#4 Recent decline in PPA tariffs is offset by increasing share of higher-tariff merchant capacities

#5 Heavy capex backed by steady cash flows

#6 Expect company to generate USD 1.8 billion annual operating cash flow against a cumulative capex requirement of over USD 10 billion through FY30

#7 Despite this high capex, expect net debt/EBITDA declining to 5x by FY30 vs 7x now

Stock Market LIVE Updates | Zydus Lifesciences arm announces investment in Illexcor Therapeutics.

Zynext Ventures USA LLC, the venture capital arm of Zydus, announced its investment in biopharmaceutical company Illexcor Therapeutics. Illexcor is developing next-generation oral therapies for sickle cell disease (SCD). This investment underscores Zynext Ventures' commitment to supporting disruptive healthcare innovations that address significant unmet medical needs.

Sensex Today | India Volatility index rises 7%

Sensex Today | Mineral Bearing Land Tax likely to have an impact of about Rs 130 crore per annum: Dalmia Bharat

The Hon'ble National Company Law Tribunal, Guwahati Bench (NCLT) has approved the Scheme of Arrangement between Dalmia Cement (North East), a material subsidiary of Dalmia Bharat, Vinay Cement and their respective shareholders and creditors, involving demerger and transfer of the cement and mining business operation undertaking of the Vinay Cement to the Dalmia Cement (North East), with effect from the Appointed Date i.e. March 31, 2023 under Sections 230 to 232 of the Companies Act, 2013.

Stock Market LIVE Updates | SP Apparels re-appoints Sundararajan Shantha and Sundararajan Chenduran as Joint MDs

The Board has re-appointed Sundararajan Shantha and Sundararajan Chenduran as Joint Managing Directors of the company, for a period of three years, effective August 11, 2025.

Markets@12 | Sensex, Nifty trade flat

The Sensex was down 56.46 points or 0.08 percent at 73,973.30, and the Nifty was down 36.45 points or 0.16 percent at 22,434.05. About 1553 shares advanced, 1835 shares declined, and 118 shares unchanged.

Global Markets | Asian Markets trade lower; Haag Seng, Taiwan Weighted down 1.4% each

Asian equities edged lower, continuing two weeks of heightened volatility that inflicted losses on hedge funds and caused strategists across Wall Street to cut their forecasts for US stocks.

Sensex Today | Satin Creditcare Network raises USD 100 million social loan via ECB

Satin Creditcare Network has successfully raised its first syndicated social term loan of USD 100 million via External Commercial Borrowing (ECB) under the automatic route of the Reserve Bank of India (RBI).

Stock Market LIVE Updates | Nitco completes sale of wind energy business undertaking to Siva Green Energy

The company has completed the sale, assignment, transfer, and conveyance of wind energy business undertaking of the company as a going concern

on a slump sale basis to Siva Green Energy India and parties have executed the wind energy business transfer agreement on March 12, 2025.

Stock Market LIVE Updates | Angel One declares second interim dividend

The board of directors of the company approved declaration of 2nd Interim Dividend for the financial year 2024-25 at the rate of Rs 11 per equity share of face value of Rs 10 per share of the company.

Stock Market LIVE Updates | Sensex falls 400 points from day's high

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| HDFC Bank | 1,718.00 | 1,720.50 1,708.40 | -0.15% |

| Axis Bank | 1,012.95 | 1,016.05 1,005.00 | -0.31% |

| Kotak Mahindra | 1,982.15 | 1,989.20 1,970.00 | -0.35% |

| ICICI Bank | 1,250.35 | 1,255.95 1,244.85 | -0.45% |

| Larsen | 3,215.85 | 3,233.95 3,184.00 | -0.56% |

| ITC | 412.40 | 414.95 408.20 | -0.61% |

| Maruti Suzuki | 11,600.00 | 11,673.80 11,586.00 | -0.63% |

| Reliance | 1,254.95 | 1,264.00 1,253.30 | -0.72% |

| HUL | 2,193.85 | 2,210.70 2,178.00 | -0.76% |

| SBI | 725.85 | 731.45 724.35 | -0.77% |

| Sun Pharma | 1,669.00 | 1,682.25 1,663.35 | -0.79% |

| HCL Tech | 1,533.00 | 1,547.45 1,533.00 | -0.93% |

| Nestle | 2,186.60 | 2,207.65 2,183.65 | -0.95% |

| TCS | 3,488.00 | 3,524.15 3,486.00 | -1.03% |

| Titan Company | 3,017.95 | 3,049.55 3,003.55 | -1.04% |

| Bharti Airtel | 1,645.50 | 1,664.95 1,644.00 | -1.17% |

| NTPC | 330.15 | 334.45 330.00 | -1.29% |

| Asian Paints | 2,238.30 | 2,267.45 2,233.05 | -1.29% |

| Bajaj Finance | 8,444.00 | 8,560.00 8,437.00 | -1.36% |

| Adani Ports | 1,120.90 | 1,139.00 1,115.20 | -1.59% |

Stock Market LIVE Updates | Yatra Online’s Group Chief Financial Officer resigns

Rohan Purshottamdas Mittal has resigned as Group Chief Financial Officer of the company to pursue new opportunities.

Sensex Today | BSE Realty extend fall on second day; Brigade Enterprises down 3%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Brigade Ent | 943.25 | -3.27 | 3.86k |

| Phoenix Mills | 1,569.65 | -1.86 | 943 |

| Godrej Prop | 1,989.70 | -1.39 | 3.33k |

| Sobha | 1,207.70 | -0.84 | 1.84k |

| Anant Raj | 494.35 | -0.79 | 66.08k |

| Macrotech Dev | 1,073.25 | -0.73 | 7.44k |

| Oberoi Realty | 1,560.00 | -0.71 | 2.60k |

| DLF | 665.55 | -0.45 | 16.60k |

Sensex Today | Nazara Technologies' chief operating officer Sudhir Kamath resigns effective April 1, 2025

Stock Market LIVE Updates | Firstsource Solutions incorporates new wholly owned subsidiary

The company's subsidiary, Firstsource Group USA Inc., has incorporated a new wholly owned subsidiary, Firstsource Solutions Limited Colombia S.A.S.

Stock Market LIVE Updates | PB Fintech shares extend losses to nearly 10% in 2 days as Rs 696 crore healthcare investment fails to cheer investors

PB Fintech shares extended losses to nearly 10 percent in the last two trading sessions after the company's proposal to infuse Rs 696 crore in its healthcare arm failed to cheer investors.

Stock Market LIVE Updates | TVS Motor partners with Petronas Lubricants for the supply of premium semi & full synthetic oils

Stock Market LIVE Updates | Tata Steel shares rise 2% after JPMorgan lifts price target, forecasts 20% upside

Shares of Tata Steel rose 2 percent to emerge as one of the top gainers on the Nifty 50 on March 13, buoyed by JPMorgan's upward revision in its target price for the stock.

International brokerage JPMorgan raised its price target for the stock to Rs 180, reflecting an upside potential of around 20 percent from Wednesday's closing price. That aside, the firm retained its 'overweight' call on the stock.

JPMorgan sees multiple positive catalysts supporting earnings growth for Tata Steel’s European business, with investor interest in the stock increasing during recent marketing events in Hong Kong and Singapore. However, the brokerage believes that some investors have yet to fully recognize the potential upside from key developments, including Germany’s infrastructure fund announcement and the sharp rise in European steel spreads.

Stock Market LIVE Updates | How sectoral indices fared so far?

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 22501.80 0.14 | -4.83 -0.19 | -2.30 2.29 |

| NIFTY BANK | 48252.10 0.41 | -5.13 -0.77 | -2.24 2.70 |

| NIFTY Midcap 100 | 48497.75 0.02 | -15.21 -1.72 | -4.68 5.50 |

| NIFTY Smallcap 100 | 14987.25 -0.38 | -20.15 -2.68 | -6.18 4.84 |

| NIFTY NEXT 50 | 59598.50 0.54 | -12.34 -0.86 | -2.21 4.29 |

Markets@11 | Sensex, Nifty trade higher

Stock Market LIVE Updates | L&T wins order in the range of Rs 2500-5000 crore

The Water & Effluent Treatment (WET) Business of L&T along with Lantania of Spain has signed a Contract with ACWA Power, a major developer in the Middle East to build the Ras Mohaisen Desalination plant in the Kingdom of Saudi Arabia.

WET had won the order in a joint venture with Lantania of Spain, wherein it happens to be the lead partner.

Stock Market LIVE Updates | NTPC Green Energy commissions final part of 105 MW Shajapur solar project

The company has successfully commissioned the second and final part of the capacity (50 MW) out of the 105 MW Shajapur solar project (Unit-1) of its subsidiary, NTPC Renewable Energy.

The first part capacity of 55 MW was already declared to be in commercial operation, effective November 29, 2024.

Sensex Today | Nifty Midcap erases previous session losses, up 0.4%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharat Dynamics | 1,145.00 | 4.69 | 734.21k |

| Oil India | 380.65 | 3.78 | 1.71m |

| MRPL | 115.06 | 2.65 | 1.10m |

| Mazagon Dock | 2,312.20 | 2.5 | 1.01m |

| Prestige Estate | 1,143.00 | 2.17 | 238.62k |

| Oracle Fin Serv | 7,453.10 | 2.15 | 54.24k |

| Dixon Technolog | 13,348.00 | 2.06 | 78.14k |

| Cummins | 2,873.25 | 1.93 | 88.10k |

| Indian Hotels | 763.75 | 1.92 | 979.43k |

| Cochin Shipyard | 1,306.10 | 1.86 | 369.20k |

| MphasiS | 2,266.30 | 1.85 | 171.64k |

| SAIL | 108.61 | 1.83 | 10.44m |

| Hind Zinc | 435.40 | 1.81 | 514.09k |

| JSW Infra | 266.90 | 1.68 | 493.11k |

| Max Healthcare | 1,004.25 | 1.47 | 792.79k |

| INDUS TOWERS | 329.30 | 1.43 | 1.97m |

| Solar Ind | 9,916.80 | 1.39 | 13.69k |

| Mankind Pharma | 2,196.35 | 1.38 | 216.31k |

| HUDCO | 183.63 | 1.35 | 1.51m |

| Tube Investment | 2,955.00 | 1.27 | 100.26k |

Sensex Today | Paytm, PB Fintech extend fall on second consecutive session

Stock Market LIVE Updates | Swiggy shares break 4-day losing streak

Stock Market LIVE Updates | Zomato share price snaps 6-day losing streak

Global Markets | Asian markets trade mostly lower; Taiwan Weighted down 1%

Asian equities traded in a tight range Thursday after two weeks of heightened volatility inflicted losses on hedge funds and caused strategists across Wall Street to cut their forecasts for US stocks.

Stock Market LIVE Updates | NHPC board meet on March 19

The Board will meet on March 19 to consider the borrowing plan for raising debt for the financial year 2025-26.

Sensex Today | Nifty PSU Bank index rises 1%; Bank of Baroda, Punjab & Sind Bank, Union Bank of India, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Baroda | 206.98 | 2.26 | 2.36m |

| Punjab and Sind | 39.85 | 1.48 | 161.76k |

| Union Bank | 115.05 | 1.28 | 1.71m |

| Bank of India | 95.00 | 1.11 | 1.86m |

| SBI | 730.85 | 1.08 | 1.38m |

| PNB | 87.59 | 0.79 | 3.80m |

| UCO Bank | 35.96 | 0.78 | 707.14k |

| Canara Bank | 82.96 | 0.61 | 2.90m |

| Central Bank | 42.03 | 0.57 | 875.40k |

| IOB | 42.30 | 0.5 | 693.06k |

| Bank of Mah | 46.62 | 0.24 | 2.31m |

Stock Market LIVE Updates | Premier Explosives receives export order of Rs 21.45 crore

The company has received an order for supply of Defence Explosives from International Clients.

Sensex Today | Adani Green gains in opening trade as Macquarie initiates coverage

Adani Green stocks gained over 4 percent with Macquarie's initiation of coverage on the stock on March 13, rating it as 'outperform' at a price target of Rs 1,200 at a 40 percent potential upside from Wednesday's closing figures.

Brokerage Call | CLSA keeps 'outperform' rating on IndusInd Bank, target price cut to Rs 900 from Rs 1,300

#1 Past few days have been tumultuous with a one-year extension for MD

#2 Net worth hit of Rs 15 bn due to an accounting gap

#3 Investors, naturally, fear there is more to come

#4 Over the next 2-3 quarters, there will be lingering uncertainty over more skeletons in the closet & management continuity

#5 If a PSU banker is appointed, there would be even more negative sentiment for stock

#6 A potential invoking of promoter’s stock pledge by its lenders would add to the uncertainty

#7 Over time, believe its fundamentals will take over

#8 Two fundamental positives in near term are a recovery in microfinance

#9 Respite for margin from better banking system liquidity & rate cuts

Stock Market LIVE Updates | Rajiv Kumar resigns VP - Operations of Tata Steel

Rajiv Kumar has resigned as Vice President - Operations of Tata Steel Kalinganagar, effective March 12.

Markets@10 | Sensex up 230 pts, Nifty above 22500

The Sensex was up 233.39 points or 0.32 percent at 74,263.15, and the Nifty was up 60.10 points or 0.27 percent at 22,530.60. About 1743 shares advanced, 1309 shares declined, and 130 shares unchanged.

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Gandhi Spl Tube | 687.25 8.69% | 48.91k 2,521.80 | 1,840.00 |

| Destiny Logisti | 75.10 -5% | 60.00k 6,000.00 | 900.00 |

| GTPL Hathway | 113.89 7.23% | 633.69k 73,039.40 | 768.00 |

| Adani Green Ene | 885.45 3.75% | 4.03m 480,592.20 | 739.00 |

| Data Patterns | 1,663.40 4.86% | 667.37k 106,334.40 | 528.00 |

| MTNL | 49.45 14.36% | 34.55m 6,435,471.00 | 437.00 |

| Kamat Hotels | 323.85 1.73% | 245.22k 48,750.80 | 403.00 |

| Jindal Drilling | 921.95 2.36% | 167.69k 34,854.60 | 381.00 |

| Career Point | 355.20 2.05% | 98.10k 22,536.80 | 335.00 |

| Birla Corp | 1,003.30 -2.04% | 393.57k 95,271.80 | 313.00 |

| Carysil | 618.35 2.36% | 802.56k 196,146.80 | 309.00 |

| India Tourism D | 601.10 -2.32% | 156.84k 40,428.00 | 288.00 |

| IndusInd Bank | 674.40 -1.5% | 13.50m 3,162,162.20 | 327.00 |

| Gensol Eng | 262.25 -5% | 891.14k 294,568.20 | 203.00 |

| Diamond Power | 88.11 -0.09% | 17.97k 6,800.40 | 164.00 |

| Palred Tech | 51.32 1.26% | 11.52k 4,610.60 | 150.00 |

| Praxis Home Ret | 12.05 -3.52% | 153.55k 62,437.80 | 146.00 |

| Johnson Control | 1,824.75 4.8% | 61.90k 26,744.40 | 131.00 |

| Starteck Financ | 291.00 0.52% | 4.44k 2,048.60 | 117.00 |

| Nacl Industries | 77.54 -2.56% | 1.34m 580,492.80 | 131.00 |

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| SEPC | 16.90 | 27.16 | 13.29 |

| Carysil | 618.00 | 20.51 | 512.80 |

| MTNL | 49.80 | 20.17 | 41.44 |

| Kolte-Patil | 332.45 | 16.28 | 285.90 |

| ARSS Infra | 36.17 | 15.74 | 31.25 |

| Nacl Industries | 77.67 | 15.24 | 67.40 |

| Polysil Irrigat | 19.70 | 15.20 | 17.10 |

| Manomay Tex Ind | 185.26 | 14.23 | 162.18 |

| Himatsingka Sei | 145.61 | 13.70 | 128.06 |

| United Polyfab | 143.34 | 12.80 | 127.08 |

| Gokaldas Export | 879.70 | 12.01 | 785.40 |

| Redtape | 152.73 | 11.23 | 137.31 |

| Godfrey Phillip | 5,671.80 | 11.01 | 5,109.10 |

| Hindustan Media | 83.09 | 10.95 | 74.89 |

| India Tourism D | 603.00 | 10.78 | 544.30 |

| IRIS Business S | 438.90 | 10.65 | 396.65 |

| Stallion India | 85.07 | 10.49 | 76.99 |

| Tata Comm | 1,515.10 | 10.33 | 1,373.20 |

| Giriraj Civil D | 281.10 | 10.24 | 255.00 |

| Vadivarhe Speci | 26.70 | 10.10 | 24.25 |