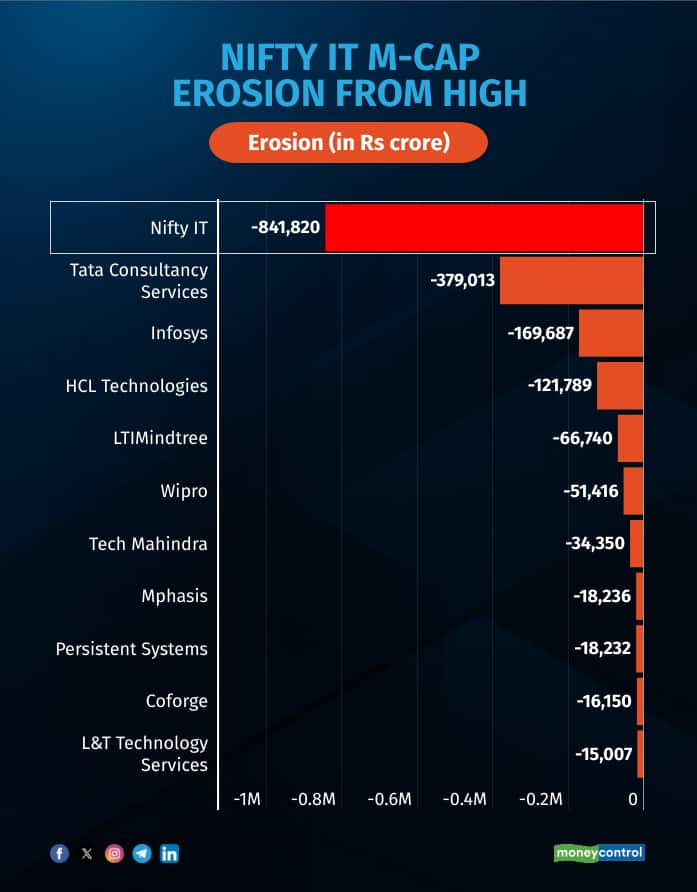

The benchmark gauge for information and technology stocks, the Nifty IT index, has slipped into the bear market territory after the sharp fall in the previous session. From its high, the index has tumbled over 21 percent, with almost three percent of the losses reported in trade yesterday. The fall in the Nifty IT index has led to around Rs 8.4 lakh crore in wealth being wiped out.

Further, nine of the 10 constituents in the Nifty IT index have also entered the bear market territory as bulls rush to offload their holdings. Among the hardest hit, LTIMindtree's stock price has cracked 34 percent, while blue-chips Infosys and TCS have reported losses to the tune of 24 percent.

Out of all the constituents, the sole outlier for the bear market fall remains Wipro. The IT services firm has slipped around 17 percent from its high, making its fall so far a correction - not bear market.

The fall in TCS shares has wiped off Rs 3.8 lakh crore in value, while Infosys' fall resulted in Rs 1.7 lakh crore being eroded in market capitalisation.

LTTS and Coforge have eroded the least in wealth, with their respective market capitalisations falling Rs 15,000 crore and Rs 16,000 crore from their respective 52-week highs.

Follow our market blog to catch all the live updates

The fall has been exacerbated as a result of the global volatility and uncertainty, especially as a result of US President Donald Trump's tariff policies.

President Donald Trump’s tariffs have spooked investors, with fears of an economic downturn driving a stock market sell-off that has wiped out $4 trillion from the S&P 500’s peak last month, when Wall Street was cheering much of Trump's agenda.

With reduced business and consumer confidence, investors are more uncertain regarding the growth outlook of the Indian IT landscape, that depends on US for a large chunk of its revenue.

International brokerage Morgan Stanley suggested that global macroeconomic shifts and technological changes pose rising risks to the domestic information technology sector, potentially impacting valuations and revenue growth.

The brokerage noted that uncertainties in the global environment create strong downside risks for IT sector growth, leading it to cut target prices for major domestic IT firms. As a result, it slashed its rating and target prices for a slew of IT companies, with Infosys being the hardest hit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.