Closing Bell: Nifty at 18,850 on expiry day, Sensex falls 901 pts; metal, realty worst hit

-330

October 26, 2023· 16:51 IST

-330

October 26, 2023· 16:47 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Domestic equity continued with its profit booking for the 6th consecutive day with Nifty slipping below 19k mark and closing near days’ low at 18857 levels (-1.4%). While Nifty tanked 257 points to 4 month low, Sensex plunged 900 points to settle at 63148 levels. All the sectors were down 1-2%.

Tensions in Middle East, coupled with sticky US Treasury yields at around 5%, triggered risk-off sentiment. Further mixed Q2 results, continued FIIs selling, rising oil price and near record high USDINR to above 83, have also dented the investor sentiments.

Given the global uncertainties, there could be higher volatility in the near term and thus giving long term investors an opportunity to accumulate quality stocks at lower levels. We suggest to make higher allocation towards large caps as valuations are comfortable along with steady growth prospects.

-330

October 26, 2023· 16:35 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Once again, bears remain at the helm as the Nifty slipped below 19,000 for the first time in four months, indicating a rising bearish condition. The bearish crossover in the momentum indicator also supports the negative momentum. In the current scenario, supports are appearing very fragile and vulnerable. Despite the recent sharp decline, further correction from the current level seems highly possible. Support on the lower end is visible at 18,600-18,645, while resistance is positioned at 18,950-19,000.

-330

October 26, 2023· 16:32 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap down and continued to drift lower throughout the day to close in the red down ~265 points. Since last three trading sessions the Nifty has corrected 700 points and is appearing oversold on the hourly time frame chart. The Nifty has now reached the support cluster of 18860 – 18740 where support in the form of the 40 week moving the weekly lower Bollinger band is placed.

Considering that Nifty has reached a support zone and is appearing oversold on the hourly charts, we can expect a pullback till 19000 – 19050 however it is likely to be only a temporary pause in the overall downtrend. On the downside the Nifty is likely to drift towards 18500 levels in the short term and the intermediate pullbacks should be used as a selling opportunity. In terms of levels, 18700 – 18650 shall act as a crucial support zone while 19000 – 19050 is the immediate hurdle zone.

Bank Nifty is heading towards the psychological support of the 42000. The fall has been very sharp and is appearing oversold which increases the probability of a pullback. The pullback can be expected till 42500 – 42600 however it is unlikely to result into a trend reversal. Overall, the trend is negative and we expect it to target levels of 40850 from short term perspective.

-330

October 26, 2023· 16:27 IST

Deepak Jasani, Head of Retail Research, HDFC Securities:

Nifty fell again for the sixth consecutive session on October 26 even as a series of poor corporate results in the US cast a shadow on the global risk appetite already impacted by the conflict in the Middle east. At close, Nifty was down 1.39% or 264.9 points at 18857.3. Volumes on the NSE expanded suggesting the amount of selling pressure matched by bottom fishing by bulls. Broad market indices fell less than the Nifty even as the advance decline ratio improved to 0.75:1.

Asian stocks slid to 11-month lows and European shares dropped on Thursday, hit by a rise in U.S. Treasury yields, a slew of weak earnings reports with an ECB meeting and the release of U.S. GDP to come later in the day.

Shares of fertiliser companies in India have declined after the government slashed subsidies for the upcoming Rabi season. On Wednesday, the government approved a Rs 22,303 crore nutrient-based fertiliser subsidy. The revised subsidy rates for nitrogen have been reduced 39%, while those for phosphorus fertilisers have been cut 49%, potassium fertiliser subsidies have seen a 85% cut, driven by falling input prices.

Nifty continues to fall relentlessly. On Thursday it fell with a down-gap and is now close to its 200 DEMA of 18830. The upgap support at 18829 is also close by. It could now bottom out for the time being over the next 1-2 days and 18691-18829 could be a support while 18972 could be the initial resistance.

-330

October 26, 2023· 16:19 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index experienced continued heavy selling, resulting in a 1.29% decline. It is currently trading below its 200-day Exponential Moving Average (200EMA) placed at 43,264. This situation maintains a bearish undertone.

The next immediate support level on the downside is at 42,000, where fresh put writing is evident. A breach below this level could lead to further declines, potentially targeting the 41,500-41,200 range.

-330

October 26, 2023· 16:12 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets plunged sharply lower for the third successive session and lost nearly one and a half percent. After the gap-down start, the Nifty gradually drifted lower as the day progressed and finally settled around the day’s low at 18,857.25 level. All sectors traded in sync and closed in the red wherein auto, metal and banking were among the top losers. Meanwhile, the broader indices traded mixed as a sharp recovery in the smallcap index helped the index to close flat while midcap shed nearly a percent.

Nifty has reached closer to the crucial support zone of 18,800 i.e. long term moving average (200 EMA) and might take a breather after the recent slide. However, pressure on the heavyweights across sectors may cap the rebound. We thus suggest continuing with the “sell on rise” approach and reiterate our preference for index majors over others.

-330

October 26, 2023· 16:06 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Till date, the actual domestic Q2 results are below par in comparison to the excited earnings forecasted. Similar disappointments are visible in developed economies. Downgrade in earnings and valuation is arising due to risk of further slowdown of the economy due to geopolitical and elevated interest rates. Also selling pressure intensified due to expiry-led volatility influencing investors to stay cautious.

-330

October 26, 2023· 16:04 IST

Aditya Gaggar Director of Progressive Shares:

The markets continued their downward journey breaching the psychological support of 19,000 in the very first hour of trade itself. The selling spree extended in the heavyweights but in the broader markets, bulls took charge, and a steep recovery was witnessed in the Mid and Smallcap indices. With a loss of 264.90 points, the benchmark Index ended the monthly expiry session at 18,857.25. All the sectors remained in red with Metal and Auto being the major laggards.

One more red candle was made in the Nifty50 daily chart which indicates a total control of the bears; however, the majority of damage seems to be done as per the Head and shoulder breakout target. A zone of 18,600-18,660 will offer a strong support area that converges with 200DMA as well as 3-year-old trendline support while the level of 19,000 will act as a psychological barrier.

-330

October 26, 2023· 15:55 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

In the backdrop of weak global cues, investors shunned local equities at will on the monthly F&O expiry day with benchmark Nifty closing below the crucial 19k mark amid sell-off in frontline banking, automobile and IT stocks.

Investors are worried about the simmering West Asia conflict, economic uncertainty and rate hike woes, and hence maintained their bearish stance for the sixth straight session.

Technically, a bearish candle on daily charts and weak intraday formation is indicating further weakness from the current levels. As long as the index is trading below 19000, the weak sentiment is likely to continue till 18800-18725 levels. On the flip side, one relief rally is possible only after the dismissal of 19000 and above the same, the index could move up till 19100-19150.

-330

October 26, 2023· 15:33 IST

Rupee Close:

Indian rupee ended marginally lower at 83.23 per dollar versus previous close of 83.18.

-330

October 26, 2023· 15:30 IST

Market Close

: Indian equity indices fell more than 1 percent and extended the losing streak for the sixth consecutive session on October 26.

At close, the Sensex was down 900.91 points or 1.41 percent at 63,148.15, and the Nifty was down 264.90 points or 1.39 percent at 18,857.30. About 1211 shares advanced, 1943 shares declined, and 101 shares unchanged.

Biggest losers on the Nifty included M&M, Bajaj Finance, Asian Paints, UPL and Bajaj Finserv, while gainers were Axis Bank, HCL Technologies, Adani Ports, IndusInd Bank and ITC.

BSE Midcap index down 1 percent and Smallcap index down 0.3 percent.

Except power, all other sectoral indices are trading in the red.

-330

October 26, 2023· 15:22 IST

Stock Market LIVE Updates | Shriram Finance Q2 Earnings:

Net profit up 12.9% at Rs 1,751 crore versus Rs 1,555.1 crore and NII up 18% at Rs 4,934 crore versus Rs 4,174 crore, YoY.

-330

October 26, 2023· 15:21 IST

Stock Market LIVE Updates | HSBC View On Tech Mahindra:

-Hold call, target cut to Rs 970 per share from Rs 1,100 per share

-Company reported another poor quarter

-Q2 revenue & margin both missed already muted expectations

-New CEO gave glimpses of changes he intends to drive

-Recovery seems likely to be very gradual

-Cut estimate to factor in lower margins as clean-up continues

-330

October 26, 2023· 15:18 IST

Sensex Today | Paragon Fine and Speciality Chemical IPO booked 5.57 times on Day 1 despite market meltdown

Paragon Fine and Speciality Chemical's initial public offering (IPO) got a healthy response from investors as it opened for subscription on October 26 despite the market meltdown.

The IPO was subscribed 5.57 times with bids coming for 2.05 crore equity shares against the issue size of 36.96 lakh. Retail investors bought 9.09 times their allotted quota of shares and the portion set aside for high networth individuals was booked 5.02 times. The shares set aside for qualified institutional investors were bought 1.3 times.

The Ahmedabad-based company that makes products for pharma, electronics, paper, leather and plastics firms is looking to raise Rs 51.66 crore through the issue of 51.66 lakh equity shares at the upper end of price band of Rs 95-100 a share. The offer is purely a fresh issue. Read More

-330

October 26, 2023· 15:15 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee declined by six paise on Thursday on weak domestic markets and a strong Dollar. Surge in global crude oil prices also put pressure on Rupee. However, a reports of selling of Dollars by RBI cushioned the downside. US Dollar gained on safe haven demand and upbeat economic data from US. US new home sales increased by 12.3% to 759,000 in September 2023 vs 676,000 in August 2023.

We expect Rupee to trade with a slight negative bias on risk aversion in global markets after risk sentiments deteriorated on fears over escalation of geopolitical tensions in the Middle East. Traders may eye the GDP, weekly unemployment claims and durable goods orders data from US later in the day. Investors may also take cues from ECB’s monetary policy outcome. Markets expect ECB to keep interest rates unchanged at 4.5%. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.60.

-330

October 26, 2023· 15:12 IST

Stock Market LIVE Updates | Morgan Stanley View On Jubilant FoodWorks:

-Equal-weight call, target Rs 493 per share

-Q2 weak quarter on topline growth, as expected

-Sequential improvement in operating metrics

-Gross margins were positives but overall growth remains slow

-EBITDA margin was down 340 bps YoY and 20 bps QoQ to 20.9 percent (versus estimate of 21 percent)

-EBITDA margin was down due to investments in new regions

-EBITDA margin was down due to investments in technology & higher employee spends

-Cut F24-F26 estimate by 9-12 percent as factor in weaker topline in Q2 & lower margin outlook

-330

October 26, 2023· 15:07 IST

-330

October 26, 2023· 15:05 IST

Stock Market LIVE Updates | Morgan Stanley View On Nestle India

-Underweight call, target Rs 18,910 per share

-Analyst meet takeaways- liked CEO’s articulation of large F&B opportunity

-Liked company's growth strategy

-It is CEO’s endeavour to grow company faster or at least maintain volume growth seen in recent years

-330

October 26, 2023· 15:03 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

Participatory note investments normally track FPI investments. From April through September FPI investment in India has been steadily rising. India now has the best growth among large emerging economies. Since China’s growth is fading, foreign investors are now focusing more on India.

However, the rising bond yields in the US has become a temporary headwind for foreign capital inflows. FPI have been sellers in October and this is likely to be reflected in Participatory notes, too, in October.

-330

October 26, 2023· 15:00 IST

Sensex Today | Market at 3 PM

The Sensex was down 821.92 points or 1.28 percent at 63,227.14, and the Nifty was down 248.90 points or 1.30 percent at 18,873.30. About 1164 shares advanced, 1973 shares declined, and 103 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,467.40 -1.94 | 24.57m | 3,612.14 |

| ICICI Bank | 907.70 -0.92 | 18.28m | 1,654.51 |

| Axis Bank | 974.10 1.95 | 15.12m | 1,461.49 |

| Reliance | 2,228.15 -1.32 | 5.98m | 1,336.84 |

| BSE Limited | 1,803.15 0.81 | 5.99m | 1,028.85 |

| Zomato | 106.80 -1.34 | 100.37m | 1,043.74 |

| SBI | 547.05 -1.65 | 16.17m | 885.27 |

| Kotak Mahindra | 1,698.85 -1.69 | 4.96m | 845.48 |

| Bajaj Finance | 7,428.65 -3.45 | 1.05m | 784.19 |

| Larsen | 2,875.10 -1.41 | 2.63m | 756.67 |

-330

October 26, 2023· 14:58 IST

Stock Market LIVE Updates | Nomura On Tech Mahindra

-Buy call, target Rs 1,320 per share

-FY24 to be a kitchen-sinking year

-New CEO’s strategy to be unveiled in Apr-24

-Q2 FY24 revenue misses estimates due to sharp portfolio rationalisation

-EBIT margin contracted sharply by 200 bps QoQ to 4.7 percent (versus consensus of 5.8 percent)

-EBIT margin was partly impacted by 260 bps from portfolio rationalisation costs

-A saving grace was a dividend of Rs 12 per share

-330

October 26, 2023· 14:56 IST

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| NAVINIFTY | 197.99 | 189.10 | -8.89 42 |

| Focus Lighting | 158.55 | 152.45 | -6.10 24.66k |

| Bafna Pharma | 86.65 | 83.35 | -3.30 584 |

| WE WIN | 67.00 | 64.50 | -2.50 176 |

| Proventus Agro | 1,057.00 | 1,018.00 | -39.00 542 |

| Inspire Films | 65.00 | 62.70 | -2.30 - |

| Rishabh Instru. | 482.30 | 465.90 | -16.40 46.31k |

| Precision | 39.95 | 38.70 | -1.25 1.27k |

| Ritco Logistics | 242.00 | 235.00 | -7.00 2.62k |

| Innovana | 500.00 | 486.00 | -14.00 150 |

-330

October 26, 2023· 14:55 IST

| Company | Price at 14:00 | Price at 14:51 | Chg(%) Hourly Vol |

|---|---|---|---|

| Jindal Saw | 343.50 | 383.60 | 40.10 120.30k |

| Times Guaranty | 65.90 | 72.75 | 6.85 3.59k |

| Murudeshwar Cer | 57.00 | 61.85 | 4.85 23.52k |

| Magnum Ventures | 48.75 | 52.80 | 4.05 559 |

| Emami Realty | 80.70 | 87.40 | 6.70 5.78k |

| Garden Reach Sh | 698.70 | 755.75 | 57.05 211.34k |

| Prakash Ind | 157.70 | 170.35 | 12.65 6.91k |

| Univastu India | 120.00 | 128.55 | 8.55 9.49k |

| Jupiter Wagons | 276.30 | 294.80 | 18.50 159.27k |

| SKM Egg Product | 382.35 | 407.85 | 25.50 9.16k |

-330

October 26, 2023· 14:53 IST

Stock Market LIVE Updates | Coromandel International Q2 Results:

Net profit up 2.2% at Rs 756.9 crore versus Rs 741 crore and revenue down 30.9% at Rs 6,988.1 crore versus Rs 10,113.4 crore, YoY.

-330

October 26, 2023· 14:51 IST

Stock Market LIVE Updates | Morgan Stanley View On InterGlobe Aviation:

-Overweight call, target Rs 3,217 per share

-Winter 2023 schedule for domestic flight operations approved by DGCA implies 4 percent growth

-Approval implies 4 percent growth over summer 2023 (+8 percent YoY)

-Indigo's share in weekly flights now stands at 55 percent versus 50 percent in summer 2023

-Indigo's share in weekly flights now stands at 55 percent versus 46 percent in winter 2022

-330

October 26, 2023· 14:48 IST

-330

October 26, 2023· 14:46 IST

Stock Market LIVE Updates | Westlife Foodworld Q2 Results:

Net profit down 32 percent at Rs 21.9 crore versus Rs 32 crore and revenue up 7.4 percent at Rs 615 crore versus Rs 572.4 crore, YoY.

-330

October 26, 2023· 14:45 IST

Sterlite Technologies Q2 Results:

Net profit down 37 percent at Rs 34 crore versus Rs 54 crore and revenue down 2 percent at Rs 1,494 crore versus Rs 1,522 crore, QoQ.

-330

October 26, 2023· 14:40 IST

-330

October 26, 2023· 14:35 IST

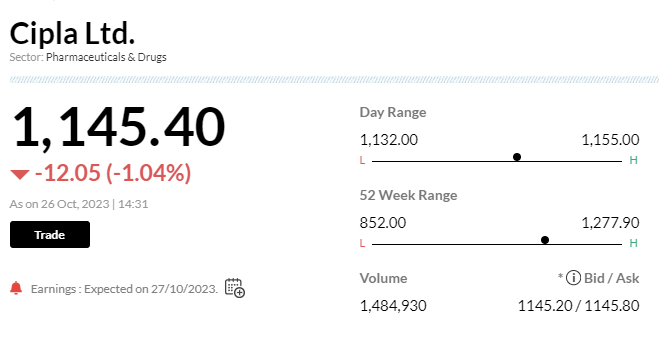

Stock Market LIVE Updates | Cipla says US FDA issues no observations for InvaGen' manufacturing facility at New York

-330

October 26, 2023· 14:30 IST

-330

October 26, 2023· 14:24 IST

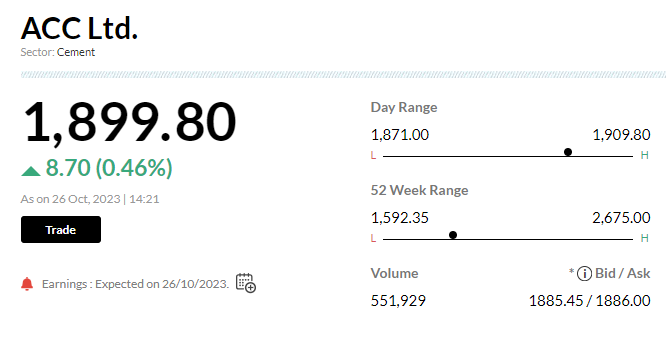

Stock Market LIVE Updates | ACC reports Q2 earnings

- Revenue at Rs4,435 cr vs CNBC-TV18 poll of Rs4,549 cr

- Net profit at Rs384 cr vs CNBC-TV18 poll of Rs389 cr

-330

October 26, 2023· 14:19 IST

-330

October 26, 2023· 14:15 IST

Stock Market LIVE Updates | Westlife Food reports Q2 earnings

- Net profit down 32% at Rs 21.9 cr vs Rs 32 cr (YoY)

- Revenue up 7.4% at Rs 615 cr vs Rs 572.4 cr (YoY)

- EBITDA up 0.9% at Rs 100 cr vs Rs 99 cr (YoY)

- Margin at 16.2% vs 17.3% (YoY)

-330

October 26, 2023· 14:09 IST

-330

October 26, 2023· 14:05 IST

Stock Market LIVE Updates | Apollo Pipes Q2 results:

Net profit at Rs 13 crore versus loss of Rs 4.8 crore and revenue up 20.5% at Rs 249.5 crore against Rs 207 crore, YoY.

-330

October 26, 2023· 14:04 IST

Sensex Today | Blue Jet Healthcare IPO fully subscribed on second day of bidding

The Blue Jet Healthcare IPO has received good response from investors despite consistent selling pressure in the equity markets, backed by retail investors and high networth individuals (HNIs) on October 26, the second day of bidding.

The offer has subscribed 1.02 times with receiving bids for 1.73 crore against issue size of 1.7 crore, as per the subscription data available with the exchanges.

Retail investors have bought 1.13 times the allotted quota and HNIs 2.1 times the portion set aside for them, while qualified institutional buyers have bid 1 percent shares of the reserved portion.

Half of the total offer size has been reserved for qualified institutional buyers, and 15 percent for HNIs. And the remaining 35 percent shares are reserved for retail investors. Read More

-330

October 26, 2023· 14:01 IST

Sensex Today | Market at 2 PM

The Sensex was down 866.53 points or 1.35 percent at 63,182.53, and the Nifty was down 270.20 points or 1.41 percent at 18,852. About 765 shares advanced, 2355 shares declined, and 103 shares unchanged.

-330

October 26, 2023· 14:00 IST

Stock Market LIVE Updates | Indian Bank Q2 Results

Net profit rose 62.2% to Rs 1,987.8 crore versus Rs 1,225 crore and Net Interest Income up 22.5% at Rs 5,740.2 crore versus Rs 4,684 crore, YoY.

-330

October 26, 2023· 13:56 IST

| Company | Price at 13:00 | Price at 13:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Uniinfo Telecom | 23.00 | 22.20 | -0.80 187 |

| Vels Film | 116.00 | 112.25 | -3.75 2.94k |

| Karnika Industr | 79.45 | 77.00 | -2.45 - |

| Manaksia Coated | 24.80 | 24.05 | -0.75 3.39k |

| Crop Life Sci. | 38.70 | 37.60 | -1.10 1.11k |

| Kokuyo Camlin | 141.00 | 137.00 | -4.00 5.86k |

| Holmarc Opto Me | 112.00 | 109.00 | -3.00 - |

| Dishman Carboge | 145.00 | 141.55 | -3.45 31.59k |

| Shera Energy | 172.00 | 168.00 | -4.00 2.83k |

| Jindal Poly Inv | 709.45 | 692.95 | -16.50 4.83k |

-330

October 26, 2023· 13:55 IST

| Company | Price at 13:00 | Price at 13:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| AB Money | 86.25 | 95.50 | 9.25 14.08k |

| WE WIN | 61.45 | 67.40 | 5.95 253 |

| RKEC Projects | 67.90 | 73.20 | 5.30 9.77k |

| BLACK BOX | 209.45 | 222.85 | 13.40 20.96k |

| Premier Explo | 1,121.00 | 1,192.00 | 71.00 3.65k |

| Aaron Industrie | 262.50 | 278.80 | 16.30 812 |

| E Factor Experi | 137.20 | 145.00 | 7.80 - |

| Manorama Indust | 2,017.30 | 2,119.55 | 102.25 364 |

| Shigan Quantum | 92.80 | 97.50 | 4.70 1.41k |

| Dev Information | 129.80 | 135.85 | 6.05 1.01k |

-330

October 26, 2023· 13:50 IST

Stock Market LIVE Updates | Sharekhan View on Nestle India

Company’s strong positioning in the domestic food market, innovative product portfolio, and improving out-of-home consumption with a thrust on improving penetration in rural markets will help it drive consistent double-digit earnings growth in the long run.

Company is supporting its consistent growth agenda through increased investments in capacity enhancement, strong brand support, and better R&D initiatives.

The stock price continues to trade at premium valuation of 77x and 67x its CY2023E and CY2024E earnings, respectively. In view of the limited upside from current levels, broking firm maintained Hold recommendation on the stock with a revised Price Target of Rs 26,805.

-330

October 26, 2023· 13:45 IST

Stock Market LIVE Updates | Asian Paints Q2 Results

Net profit up 53.3% at Rs 1,232 crore against Rs 803.8 crore and revenue up at Rs 8,479 crore versus Rs 8,457.6 crore, YoY.

-330

October 26, 2023· 13:42 IST

Stock Market LIVE Updates | Punjab National Bank Q2 Earnings:

Net profit at Rs 1,756 crore and Net Interest Income (NII) at Rs 9,923 crore.

Gross NPA at Rs 65,563 crore against Rs 70,899.3 crore and Net NPA at Rs 13,114 crore versus Rs 17,129.5 crore, QoQ.

-330

October 26, 2023· 13:37 IST

Stock Market LIVE Updates | ACC Q2 Results:

Net profit at Rs 384 crore versus loss of Rs 87 crore and revenue up 11.2% at Rs 4,435 crore versus Rs 3,987 crore, YoY.

-330

October 26, 2023· 13:34 IST

Stock Market LIVE Updates | Infosys inks five-year collaboration with smart Europe GmbH to bring sustainable electric mobility to customers

Infosys has signed a five-year collaboration with automotive marquee smart Europe GmbH to refine its Direct-to-Customer (D2C) business model in Europe and provide enhanced customer experience, data-driven personalization and engagement for the existing model smart #1, the newly announced smart #3, and other upcoming all-electric models from the iconic brand.

Through this strategic collaboration, Infosys will help smart Europe GmbH redefine the online EV buying experience and apply state-of-the-art Machine Learning (ML) models to accurately forecast sales and aftersales demand.

-330

October 26, 2023· 13:33 IST

Sensex Today | Mukesh Kochar, National Head of Wealth at AUM Capital

:

The market was looking for some reason to correct as the valuation was not comfortable and finally, that correction happened. The main reason for correction can be attributed to the worsening of geo-political tension, rising US yield and profit booking before the upcoming election.

FII has also increased their pace of selling and that might continue in the short term until rates pick out there. Long-term investors do not need to do much and the only thing they can do is to add on in dip and stay with quality. The market may look reasonable in terms of the valuation if it corrects 300-400 points more from here and geo-political risk stablises although no one can predict the top or bottom in the short term.

-330

October 26, 2023· 13:30 IST

-330

October 26, 2023· 13:27 IST

Stock Market LIVE Updates | Gulf Oil Lubricants India Q2 profit surges 41% YoY to Rs 73.6 crore

Gulf Oil Lubricants India has registered a 41.2% on-year growth in profit at Rs 73.63 crore for July-September period of FY24. Revenue from operations stood at Rs 802.30 crore, growing 11.51% YoY and EBITDA jumped 25.2% on-year to Rs 100.48 crore during the same period.

-330

October 26, 2023· 13:23 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Guj Amb Exports | 332.45 | 336.70 308.90 | 7.62% |

| Sterling Wilson | 278.00 | 279.75 259.00 | 7.34% |

| Apar Ind | 4,880.10 | 4,972.45 4,550.00 | 7.25% |

| Prism Johnson | 129.40 | 132.50 120.65 | 7.25% |

| Cochin Shipyard | 928.00 | 928.00 871.50 | 6.48% |

| ITI | 267.30 | 269.70 251.45 | 6.3% |

| NCC | 144.95 | 145.70 136.55 | 6.15% |

| Minda Corp | 331.15 | 337.00 312.75 | 5.88% |

| Angel One | 2,373.55 | 2,387.65 2,242.00 | 5.87% |

| Lemon Tree Hote | 106.65 | 107.00 100.75 | 5.86% |

-330

October 26, 2023· 13:19 IST

Stock Market LIVE Updates | Somany Ceramics board approves share buyback up to Rs 125 crore

The board of directors of Somany Ceramics at its meeting held today, i.e., October 26, 2023 has considered and approved the proposal for buyback of fully paid up equity shares of the company having a face value of Rs 2 from all shareholders / beneficial owners of the equity shares of the company, at a price of Rs 850, payable in cash, for an aggregate amount not exceeding Rs 125 crore.

-330

October 26, 2023· 13:13 IST

Stock Market LIVE Updates | Canara Bank Q2 Earnings:

Net profit up 42.8% at Rs 3,606 crore versus Rs 2,525.5 crore Net Interest Income (NII) 19.8 percent at Rs 8,903 crore versus Rs 7,433.8 crore, YoY.

-330

October 26, 2023· 13:10 IST

-330

October 26, 2023· 13:08 IST

Stock Market LIVe Updates | Steel Strips Wheels Q2 Results:

Net profit down 4 percent at Rs 52.3 crore versus Rs 54.6 crore and revenue up 5 percent at Rs 1,132 crore versus Rs 1,081 crore, YoY.

-330

October 26, 2023· 13:07 IST

Apar Industries Q2 Results:

Net profit 69 percent at Rs 174 crore versus Rs 103 crore and revenue up 21 percent at Rs 3,926 crore versus Rs 3,235 crore, YoY.

-330

October 26, 2023· 12:56 IST

| Company | Price at 12:00 | Price at 12:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Oriental Carbon | 777.30 | 739.85 | -37.45 653 |

| Innovana | 519.80 | 500.00 | -19.80 1000 |

| Beta Drugs | 936.95 | 904.05 | -32.90 243 |

| Agni Green | 27.45 | 26.60 | -0.85 13.14k |

| Starteck Financ | 161.00 | 156.10 | -4.90 250 |

| Swastik Pipe | 117.00 | 113.60 | -3.40 8.36k |

| Uniinfo Telecom | 23.05 | 22.40 | -0.65 265 |

| Talbros Auto | 1,018.50 | 993.00 | -25.50 5.44k |

| Pioneer | 51.50 | 50.25 | -1.25 2.66k |

| Vasa Denticity | 460.00 | 449.00 | -11.00 4.34k |

-330

October 26, 2023· 12:55 IST

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Somi Conveyor | 71.85 | 83.00 | 11.15 28.47k |

| Aurionpro Solut | 1,385.00 | 1,500.80 | 115.80 2.28k |

| Jindal Photo | 658.75 | 711.25 | 52.50 2.65k |

| Bajaj Hindustha | 23.15 | 24.80 | 1.65 2.22m |

| Nirman Agri | 212.10 | 226.95 | 14.85 1.52k |

| 63 Moons Tech | 243.45 | 259.00 | 15.55 5.57k |

| Zeal Global | 175.05 | 186.00 | 10.95 1.50k |

| Shakti Pumps | 1,009.65 | 1,072.30 | 62.65 33.98k |

| ICE Make Refrig | 614.00 | 652.05 | 38.05 3.81k |

| Jindal Poly Inv | 636.80 | 672.00 | 35.20 1.04k |

-330

October 26, 2023· 12:52 IST

Stock Market LIVE Updates | Government nominates Kartikeya Misra as Director on the board of Indian Overseas Bank

The Government of India has nominated Kartikeya Misra as Director on the board of Indian Overseas Bank, in place of Annie George Mathew with immediate effect and until further orders. Annie George Mathew ceases to be Director on the board of the bank with immediate effect.

-330

October 26, 2023· 12:49 IST

Stock Market LIVE Updates | BSE Smallcap index fell nearly 2 percent dragged by Welspun India, Cressanda Solution, Oriental Carbon and Chemicals

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Welspun India | 129.40 | -9.07 | 1.12m |

| Cressanda Sol | 20.56 | -8.26 | 2.89m |

| Oriental Carbon | 740.00 | -7.18 | 1.82k |

| SIS | 402.45 | -6.97 | 6.87k |

| RamkrishnaForge | 592.55 | -6.27 | 61.81k |

| Pennar Inds | 96.70 | -6.21 | 290.13k |

| Udaipur Cement | 29.88 | -5.83 | 996.63k |

| Anup Eng | 1,991.05 | -5.82 | 4.59k |

| Safari Ind | 3,659.20 | -5.6 | 7.44k |

| Kama Holdings | 2,987.95 | -5.58 | 7.53k |

-330

October 26, 2023· 12:46 IST

Stock Market LIVE Updates | CLSA View On Axis Bank

-Buy call, target Rs 1,200 per share

-Q2 NIM performance better than peers, deposit traction needs to pick up

-Key positives - stable NIM QoQ (vs 25-35 bps declines for ICICI/Kotak)

-Key + positives include lower net slippages in retail & corporate loans & accretion to tier-I capital

-Key negatives - sluggish deposit traction (especially CASA) & higher ‘other’ Opex

-Given operating leverage offset by normalising credit costs, arrive at 1.7 percent RoA

-17-18 percent RoE over medium-term

-330

October 26, 2023· 12:41 IST

Sensex Today | BSE Midcap index down 1 percent dragged by Coromandel International, Supreme Industries, Jubilant FoodWorks:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coromandel Int | 1,060.00 | -5.08 | 5.70k |

| Supreme Ind | 4,192.55 | -4.77 | 8.30k |

| Jubilant Food | 505.05 | -4.42 | 305.13k |

| IOB | 37.33 | -4.09 | 5.10m |

| Polycab | 4,823.40 | -4 | 37.03k |

| REC | 262.60 | -3.92 | 1.19m |

| Max Healthcare | 548.65 | -3.75 | 31.97k |

| Power Finance | 228.40 | -3.67 | 344.46k |

| UCO Bank | 35.38 | -3.47 | 2.59m |

| Piramal Enter | 941.85 | -3.45 | 54.44k |

-330

October 26, 2023· 12:38 IST

-330

October 26, 2023· 12:36 IST

Stock Market LIVE Updates | DB Corp Q2 Results:

Net profit at Rs 100.2 crore versus Rs 48.8 crore and revenue up 8.8 percent at Rs 586 crore versus Rs 538 crore, YoY.

-330

October 26, 2023· 12:33 IST

Stock Market LIVE Updates | Symphony Q2 Earnings:

Net profit up 9.4 percent at Rs 35 crore versus Rs 32 crore and revenue up 0.4 percent at Rs 275 crore versus Rs 274 crore, YoY.

-330

October 26, 2023· 12:30 IST

Sensex Today | BSE Power index fell 1 percent dragged by Adani Power, Adani Green Energy, CG Power:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Power | 299.00 | -4.37 | 809.69k |

| Adani Green Ene | 841.85 | -3.99 | 147.08k |

| CG Power | 363.60 | -2.38 | 94.59k |

| Adani Energy | 704.80 | -1.81 | 25.80k |

| NHPC | 49.19 | -1.54 | 378.72k |

| Tata Power | 233.20 | -1.44 | 329.63k |

| ABB India | 3,890.15 | -1.03 | 4.41k |

| Power Grid Corp | 197.80 | -0.85 | 425.76k |

| Siemens | 3,393.85 | -0.81 | 4.73k |

| NTPC | 230.95 | -0.52 | 345.09k |

-330

October 26, 2023· 12:21 IST

Sensex Today | Unmesh Sharma, Executive Vice President, Head of Institutional Equities, HDFC Securities:

Markets are not in a free fall. It is a healthy correction

Rising bonds yields is among the reasons for correction as there is less incentive to invest in equities when you get a 5% return in debt.

Equity markets are having a sudden realisation that two wars are going on, and crude price is rising.

FII selling is persistent and the DII support has petered off as well. So it is difficult to hold the market

-330

October 26, 2023· 12:17 IST

Stock Market LIVE Updates | Sadhana Nitro Chem receives Maharashtra Pollution Control Board approval

Sadhana Nitro Chem announced that the company has received approval from the Maharashtra Pollution Control Board (MPCB) for consent to establish the production of Para Aminophenol (pAP).

The company is pleased to announce the successful transition to commercial production at its Para Aminophenol (pAP) plant, now operating in a continuous mode. This facility is the world's second plant to manufacture pAP from Nitrobenzene.

-330

October 26, 2023· 12:14 IST

Stock Market LIVE Updates | Maharashtra GST department conducts inspection at JB Chemicals registered office

JB Chemicals and Pharmaceuticals has informed that an inspection pursuant to Maharashtra Goods and Services Tax Act by the Authorities had commenced yesterday i.e October 25, 2023 at company’s registered office and corporate office.

The company is fully cooperating with the officials of the GST Department and are responding to the queries raised by them. The business operations of the company continue as usual and operations are not impacted.

-330

October 26, 2023· 12:12 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Torrent Power | 711.90 | 712.00 691.95 | -0.01% |

| Rajesh Exports | 428.80 | 429.00 413.50 | -0.05% |

| Schaeffler Ind | 2,988.55 | 2,991.25 2,940.65 | -0.09% |

| Latent View | 408.35 | 408.90 398.50 | -0.13% |

| Carborundum | 1,095.00 | 1,096.95 1,067.10 | -0.18% |

| Chemplast | 437.90 | 438.80 428.80 | -0.21% |

| HUL | 2,469.45 | 2,474.95 2,455.65 | -0.22% |

| Capri Global | 748.20 | 750.00 735.60 | -0.24% |

| CreditAccess Gr | 1,520.10 | 1,523.95 1,458.75 | -0.25% |

| Bosch | 19,562.45 | 19,619.60 19,480.00 | -0.29% |

-330

October 26, 2023· 12:06 IST

Stock Market LIVE Updates | Antony Waste Handling Cell bags order from Panvel Municipal Corporation

Antony Waste Handling Cell's material subsidiary, AG Enviro Infra Projects Private Limited has been awarded contract of Door-to-Door Collection and Transportation of Municipal Solid Waste by Panvel Municipal Corporation.

-330

October 26, 2023· 12:00 IST

Sensex Today | Market at 12 PM

The Sensex was down 805.90 points or 1.26 percent at 63,243.16, and the Nifty was down 249.20 points or 1.30 percent at 18,873. About 502 shares advanced, 2579 shares declined, and 82 shares unchanged.

-330

October 26, 2023· 11:59 IST

Stock Market LIVE Updates | Deccan Gold Mine gets ‘Letter Of Intent’ for Bhalukona-Jamnidih Mine block in Chhattisgarh

Deccan Gold Mines has received ‘Letter of Intent’ for the Bhalukona — Jamnidih Nickel, Chromium and Associated PGE Block in Chhattisgarh from the Directorate of Geology & Mining, Government of Chhattisgarh.

-330

October 26, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| SecMark Consult | 80.05 | 75.00 | -5.05 2.34k |

| Rajdarshan Ind | 37.30 | 35.00 | -2.30 70 |

| Wonder Elect. | 277.10 | 262.05 | -15.05 13 |

| Auro Impex | 67.50 | 64.00 | -3.50 1.60k |

| Bhartiya Inter | 238.30 | 228.05 | -10.25 8.28k |

| Digispice Tech | 28.50 | 27.50 | -1.00 17.42k |

| Industrial Inv | 133.15 | 129.00 | -4.15 1.48k |

| Sejal Glass | 250.00 | 242.25 | -7.75 0 |

| Radhika Jewel | 42.30 | 41.00 | -1.30 268.96k |

| Total Transport | 117.90 | 114.30 | -3.60 2.35k |

-330

October 26, 2023· 11:55 IST

| Company | Price at 11:00 | Price at 11:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Archidply Decor | 81.00 | 88.75 | 7.75 181 |

| Avalon Technolo | 464.00 | 498.90 | 34.90 98.13k |

| Innovana | 485.00 | 519.80 | 34.80 2.15k |

| SHUBHLAXMI | 78.00 | 83.40 | 5.40 409 |

| BSE Limited | 1,672.30 | 1,783.20 | 110.90 1.68m |

| Somi Conveyor | 68.65 | 73.00 | 4.35 20.38k |

| AMD Industries | 59.30 | 62.85 | 3.55 10.14k |

| V-Marc | 103.85 | 109.30 | 5.45 33.27k |

| Solex Energy | 539.95 | 566.95 | 27.00 533 |

| South West Pinn | 164.30 | 172.45 | 8.15 21.35k |

-330

October 26, 2023· 11:52 IST

Stock Market LIVe Updates | Macquarie On Indus Tower

-Outperform call, target Rs 200 per share

-Impressive tower adds, but Q2 margin moderation & higher receivables

-Indus sustained strong tower addition with total tower count over 2 lakh

-EBITDA margin declined 120 bps QoQ at 48.5 percent (consensus 50.7 percent)

-EBITDA margin decline explained by higher power & fuel costs and lower revenue per tower

-Accounts receivable increased 17 percent QoQ (78 A/R days versus 67 in Jun-Quarter)

-Accounts receivable related to dues from Vodafone-Idea

-330

October 26, 2023· 11:50 IST

Stock Market LIVE Updates | English Court crystalises amount payable by defendants including GVK Power and Infrastructure at $2.19 billion

The English Court has crystalised the amount payable by the Defendants including GVK Power and Infrastructure at $2.19 billion including the amounts towards interest.

GVK Power had provided corporate guarantee to an extent of 49% of the overall loan amount of $1.13 billion, to GVK Coal Developers Pte Limited, Singapore for the acquisition and pre-development costs for the Australian coal project. The said loan was classified as non-performing in the FY2015-16.

The lenders had also filed a claim in the High Court of Justice Business and Property Courts of England and Wales Commercial Courts (England Court) in November 2020 and have sought to recover the amounts so advanced to GVK Coal Developers.

-330

October 26, 2023· 11:48 IST

Sensex Today | Nifty Information Technology index down 1 percent dragged by Tech Mahindra, Persistent Systems, LTIMindtree:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Persistent | 5,719.65 | -3.03 | 194.10k |

| Tech Mahindra | 1,110.50 | -2.77 | 4.20m |

| LTIMindtree | 5,098.00 | -2.04 | 160.23k |

| L&T Technology | 4,142.15 | -1.58 | 73.62k |

| MphasiS | 2,099.10 | -1.34 | 422.92k |

| TCS | 3,349.50 | -1.2 | 881.26k |

| COFORGE LTD. | 4,860.05 | -0.8 | 305.77k |

| Wipro | 380.30 | -0.41 | 2.84m |

-330

October 26, 2023· 11:46 IST

-330

October 26, 2023· 11:41 IST

Stock Market LIVE Updates | RIL Q2 net profit may jump led by all-round growth in oil, Jio telecom, retail businesses

According to a Moneycontrol survey of 10 brokerages, RIL’s consolidated net sales are expected to come in at Rs 2.31 lakh crore in Q2 FY24, up 0.5 percent year-on-year, and 11 percent quarter-on-quarter. READ MORE

-330

October 26, 2023· 11:41 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Ceejay Finance | 146.75 -2.26 | 155.60 -5.69 | 0 |

| LWS Knitwear | 13.25 -1.12 | 14.10 -6.03 | 0 |

| Chordia Food | 83.20 -0.05 | 89.45 -6.99 | 0 |

| Radix Ind | 107.20 -4.20 | 117.50 -8.77 | 0 |

-330

October 26, 2023· 11:32 IST

Stock Market LIVE Updates | Rising bond yields creates pressure on EMs like India, says Amit Gupta, fund manager, ICICI Securities

So I think one important macro is when the bond yields in US they go very sharply higher than the emerging markets, they generally come under pressure and that is what we are seeing right now. It's almost hitting 4.95-5 percent, and I think this is where you are seeing the FII outflows happening now in the last few sessions.

-330

October 26, 2023· 11:20 IST

Stock Market LIVE Updates | Chalet Hotels down 3% after Q2 earnings miss estimates

The Chalet Hotels stock gave up early gains to fall 3 percent in the morning trade on October 26. The hotel chain reported healthy growth in the September quarter, with the consolidated profit gaining 131.4 percent from the year-ago quarter but still fell short of analysts' expectations. READ MORE

-330

October 26, 2023· 11:08 IST

Sensex Today | BSE Oil & Gas index shed 1 percent dragged by Adani Total Gas, Indraprastha Gas, HPCL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Total Gas | 526.60 | -4.31 | 48.16k |

| IGL | 389.50 | -2.47 | 20.49k |

| HINDPETRO | 240.45 | -2.26 | 33.55k |

| BPCL | 333.10 | -1.91 | 30.48k |

| IOC | 85.92 | -1.9 | 253.39k |

| Gujarat Gas | 400.45 | -1.49 | 39.59k |

| GAIL | 118.20 | -1.21 | 361.74k |

| Petronet LNG | 217.50 | -1.2 | 30.11k |

| Reliance | 2,232.00 | -1.15 | 161.14k |

| ONGC | 181.90 | -1.09 | 78.21k |

-330

October 26, 2023· 11:06 IST

Stock Market LIVE Updates | TCS helps VIAVI Build O-RAN test solutions to accelerate launch of innovative new 5G products

Tata Consultancy Services (TCS) has helped VIAVI Solutions, a global network test, monitoring, and assurance solutions provider, transform its 5G O-RAN (Open Radio Access Network) test solutions that enable device manufacturers and others to launch 5G innovations faster.

VIAVI partnered with TCS to co-create an end-to-end test framework solution for interoperability testing of O-RAN devices for successful integration with key equipment manufacturers globally.

As a part of this co-innovation, TCS built an intuitive platform-agnostic solution, simplifying testing operations and reimagining the user experience for system testers, field engineers, and technology partners. TCS is also helping VIAVI demonstrate and operate customized test suites as per the end customer’s requirements.

-330

October 26, 2023· 11:03 IST

-330

October 26, 2023· 11:01 IST

Sensex Today | Market at 11 AM

The Sensex was down 786.82 points or 1.23 percent at 63,262.24, and the Nifty was down 243.90 points or 1.28 percent at 18,878.30. About 387 shares advanced, 2634 shares declined, and 73 shares unchanged.

-330

October 26, 2023· 11:00 IST

| Company | Price at 10:00 | Price at 10:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Rodium Realty | 59.99 | 53.10 | -6.89 4 |

| Starlog Enter | 29.90 | 27.05 | -2.85 1.02k |

| SHRYDUS IND | 32.30 | 29.30 | -3.00 1.45k |

| Precision Elec | 52.55 | 47.68 | -4.87 255 |

| Glance Fin | 67.18 | 61.50 | -5.68 17 |

| Innovassynth | 28.35 | 26.00 | -2.35 2.13k |

| Blue Chip Tex | 138.75 | 128.45 | -10.30 8 |

| Bharat Bhushan | 31.95 | 29.60 | -2.35 1.18k |

| Tyroon Tea | 89.70 | 83.12 | -6.58 5 |

| Kemistar Corp | 43.80 | 40.70 | -3.10 11 |

-330

October 26, 2023· 10:56 IST

| Company | Price at 10:00 | Price at 10:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Optimus Finance | 72.90 | 82.01 | 9.11 32 |

| Hindusthan Urba | 1,980.00 | 2,218.95 | 238.95 15 |

| Oswal Agro | 29.56 | 32.63 | 3.07 660 |

| Hind Aluminium | 57.10 | 62.46 | 5.36 21.93k |

| Solid Stone | 31.70 | 34.50 | 2.80 44 |

| Krishanveer For | 56.00 | 60.75 | 4.75 99 |

| Photoquip India | 19.30 | 20.90 | 1.60 875 |

| OXYGENTA PHARMA | 26.30 | 28.35 | 2.05 6.80k |

| SUPRAPFSL | 24.10 | 25.95 | 1.85 771 |

| Sambandam Spin | 157.00 | 168.90 | 11.90 1 |

-330

October 26, 2023· 10:53 IST

Stock Market LIVE Updates | Rallis India Q2 profit grows 14% YoY to Rs 82 crore

Rallis India has recorded net profit at Rs 82 crore for July-September period of FY24, rising 14% over a year-ago period despite fall in topline, driven by healthy EBITDA & margin. Revenue from operations slips by 12.5% on-year to Rs 832 crore during the quarter.

-330

October 26, 2023· 10:50 IST

Stock Market LIVE Updates | Sona BLW Precision Forgings Q2 profit jumps 34% YoY to Rs 124 crore, orderbook at Rs 22,100 crore

Sona BLW Precision Forgings has registered a 34% on-year growth in consolidated profit at Rs 124.06 crore for the quarter ended September FY24. Revenue from operations during the same period increased by 20.6% on-year to Rs 787.5 crore, with electrical vehicle programs contributing 78% to the net order book of Rs 22,100 crore as of September 2023.

-330

October 26, 2023· 10:47 IST

-330

October 26, 2023· 10:42 IST

Stock Market LIVE Updates | Sonata Software gains 2% on Q2FY24 earnings

Shares of Sonata Software gained nearly 1 percent at open on October 26 on the NSE after the IT services provider announced its Q2FY24 earnings. By 10 am, the stock was trading at Rs 1,072.40, nearly 2.24 percent higher than close on October 25.

In a regulatory filing, Sonata Software reported a consolidated profit of Rs 124.2 crore for July-September period, a 3.4 percent gain over the previous quarter. Revenue from operations during the quarter slipped by 5.1 percent sequentially to Rs 1,912.6 crore. The company also announced an interim dividend of Rs 7 per share for current financial year and has received board approval for bonus issue in the ratio of 1:1. Read More

-330

October 26, 2023· 10:39 IST

Sensex Today | Nifty Bank index shed 1 percent dragged by PNB, Bank of Baroda, Federal Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 68.00 | -2.16 | 22.28m |

| Bank of Baroda | 190.60 | -2.16 | 5.19m |

| Federal Bank | 139.00 | -2.01 | 3.65m |

| AU Small Financ | 692.20 | -1.99 | 423.76k |

| Bandhan Bank | 214.20 | -1.86 | 3.16m |

| IDFC First Bank | 85.90 | -1.43 | 13.25m |

| HDFC Bank | 1,475.70 | -1.39 | 7.46m |

| SBI | 549.20 | -1.26 | 4.39m |

| ICICI Bank | 905.20 | -1.19 | 5.15m |

| Kotak Mahindra | 1,709.40 | -1.08 | 1.20m |

-330

October 26, 2023· 10:36 IST

Stock Market LIVE Updates | Sharekhan View on Axis Bank

Axis Bank currently trades at 1.9x/1.6x its FY2024E/FY2025E core BV estimates. Broking house believe marginal NIM pressure along with elevated cost ratios in the near term would be offset by strong asset quality, in turn lowering credit costs. The investment thesis remains strong for Axis Bank, led by sustained improvement in the business franchise as the balance sheet mix has significantly improved for the bank in the last few years, which Sharekhan believe is positive for its profitability and sustainable growth going forward.

-330

October 26, 2023· 10:28 IST

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

IRM Energy, an emerging player in the city gas distribution (CGD) segment, made its stock market debut today at Rs 477.25 per share, a discount of around 7% against its issue price of Rs 505.

The IPO was well-received by investors, and oversubscribed by 27 times. However, the current market condition could be a reason behind such a poor listing.

IRM Energy is a relatively new company, but it has a diversified customer portfolio, distribution network, and strong customer relationships. Additionally, the company is well-positioned to benefit from the growing demand for natural gas in India.

However, the current market sentiment is not favorable for its listing, so investors may keep the stop loss at 455 and exit if the stock breaks this level.

-330

October 26, 2023· 10:24 IST

Stock Market LIVE Updates | Gulf Oil Lubricants gains as Q2 profit zooms 41%

Gulf Oil Lubricants was trading almost 7 percent higher in the morning trade on October 26, a day after the oil lubricant company reported its Q2FY24 earnings.

Gulf Oil Lubricants reported a 41.2 percent year-on-year (YoY0 growth in profit at Rs 73.63 crore in the September quarter. Revenue from operations stood at Rs 802.30 crore, a 11.51 percent YoY growth.

Earnings, before, interest, taxes, depreciation and amortisation jumped 25.2 percent YoY to Rs 100.48 crore, the first time the company’s EBITDA crossed Rs 100 crore in a single quarter. Read More

-330

October 26, 2023· 10:21 IST

Sensex Today | BSE Auto index down 1 percent dragged by UNO Minda, M&M, Cummins India

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| UNO Minda | 554.50 | -2.45 | 8.54k |

| M&M | 1,531.80 | -2.35 | 10.72k |

| Cummins | 1,667.55 | -2.09 | 3.66k |

| Ashok Leyland | 166.25 | -1.92 | 252.82k |

| Balkrishna Ind | 2,547.65 | -1.71 | 8.39k |

| Tube Investment | 2,895.20 | -1.65 | 601 |

| Tata Motors | 629.00 | -1.39 | 434.13k |

| Apollo Tyres | 370.30 | -1.2 | 44.83k |

| Maruti Suzuki | 10,477.30 | -1.12 | 3.98k |

| Eicher Motors | 3,345.90 | -1.09 | 1.71k |

-330

October 26, 2023· 10:17 IST

Stock Market LIVE Updates | Jefferies View On Sona BLW Precision Forgings

-Buy call, target Rs 700 per share

-Delivered good Q2 with EBITDA and profit up 35-39 percent YoY, 7-13 percent above estimate

-Company emphasised its expanding focus to address evolving trends in mobility

-Company added several components across differentials, motors & sensors to its roadmap

-Sona secured new orders worth Rs 600 crore in Q2

-While net order book was flattish QoQ, estimate rev potential on full ramp-up

-Order book was up 5 percent QoQ

-330

October 26, 2023· 10:14 IST

Sensex Today | Results on October 26:

Asian Paints, ACC, Punjab National Bank, Canara Bank, Colgate-Palmolive (India), Aavas Financiers, Vodafone Idea, Aditya Birla Sun Life AMC, Allsec Technologies, Apar Industries, Apollo Pipes, Coromandel International, Dixon Technologies, Home First Finance Company, Indian Bank, Jindal Saw, Laxmi Organic Industries, Max India, Medplus Health Services, NLC India, Prudent Corporate Advisory Services, RailTel Corporation of India, Shriram Finance, Sterlite Technologies, Symphony, Tata Teleservices (Maharashtra), and Westlife Foodworld.