Pharmaceutical major Dr Reddy's Laboratories is expected to report a healthy jump in net profit on the back of a decent sales growth when it announce its July-September quarter earnings on October 27.

The Hyderabad-based company's revenue is expected to see high single-digit on-year growth as it continues to benefit from the robust sales of the blockbuster cancer drug Revlimid in the US.

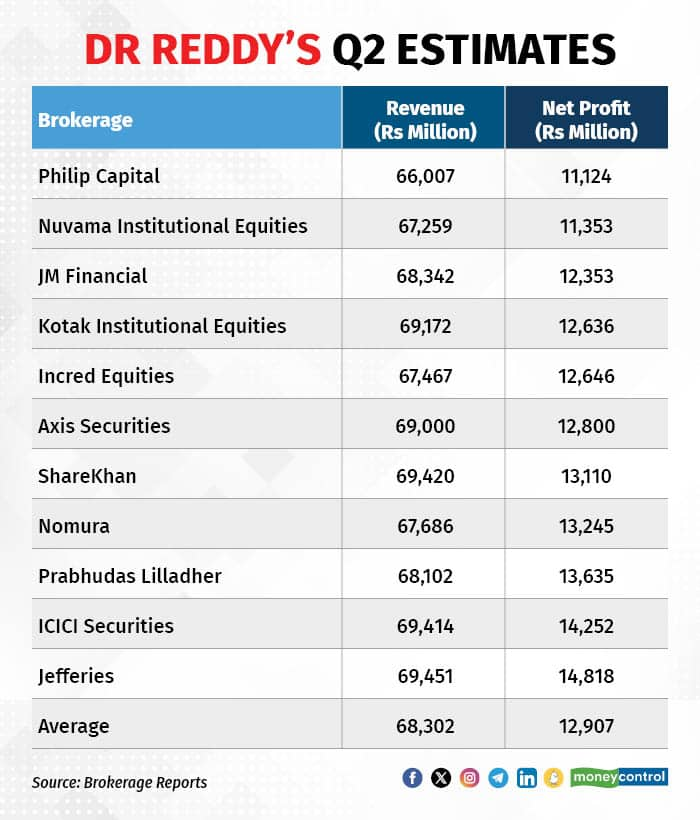

According to a poll of brokerages collated by Moneycontrol, Dr Reddy’s is likely to report a net profit of Rs 1,481.80 crore, up 34.7 percent from a year ago. Its revenue is expected to be at Rs 6,945.10 crore, rising 9.6 percent from the same quarter of the previous fiscal.

Sequential, Dr Reddy’s is likely to see a cooling of Revlimid sales and weakness in the domestic market. The company delivered a topline of Rs 6,757.90 crore and a bottomline of Rs 1,400.70 crore in the previous quarter.

US growth to hold up in Q2

Growth in Dr Reddy's US business is expected to remain resilient as sales Revlimid remain strong when compared to peers despite some moderation. A ramp-up of Nuvaring, a contraception ring, constipation drug Amitiza, Suboxone, which is used to treat opioid use disorder, Vascepa that reduces the risk of heart attack and stroke and Remoduli, which is for treating pulmonary arterial hypertension, will also aid US sales.

Brokerage firm Philip Capital has forecast strong US sales for Dr Reddy's at $355 million, led by the continued benefit of Revlimid, pegged at nearly $100 million, and integration of acquired Mayne Pharma's operation with sales of over $25 million.

India business weak

A slowdown in the domestic pharma market due lower offtake in acute sales on the back of a sporadic monsoon and slower uptick in viral infections is likely to weigh down Dr Reddy's growth in the domestic market.

Brokerage firm Nuvama Institutional Equities sees Dr Reddy's India business delivering a mere 5 percent growth on-year due to a season of weak so-called acute season as well as lost sales from divested brands.

Acute therapies are anti-infective drugs but because monsoon was sporadic and late this year, these infections didn't see a spike, impacting sale of acute drugs.

Other markets like Europe and Russia are expected to deliver double-digit growth in Q2.

Pressure on margins likely

The moderation in sales of high-margin drug Revlimid and a change in product mix is expected to be a major drag on Dr Reddy's profitability sequentially.

According to Kotak Institutional Equities, a sequential decline of 80 basis points (bps) in gross margins and 220 (bps) in the EBITDA margin is likely . The firm also expects consolidated EBITDA to grow 3 percent on year to Rs 1,950 crore.

EBITDA is short for earnings before interest, taxes, depreciation, and amortisation. One basis points is one-hundredth of a percentage point.

Aside from the earnings show, stakeholders will also be watching the management's commentary on margins and US sales excluding those of Revlimid. The drugmaker's pipeline and research and development costs will also be followed closely.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!