Closing Bell: Nifty above 26,200, Sensex surges 1022 pts; all sectors in the green

BSE Midcap and smallcap indices rose 1.2% each. All the sectoral indices ended in the green with media, auto, private bank, oil & gas, power, PSU, realty, consumer durables, pharma metal and PSU Bank added 1-2%. Biggest Nifty gainers included JSW Steel, HDFC Life, Bajaj Finserv, Bajaj Finance, Jio Financial, while Bharti Airtel, Asian Paints, SBI Life Insurance were among top losers.

-330

November 26, 2025· 16:22 IST

Market Close | Nifty above 26,200, Sensex surges 1022 pts; mid, smallcaps rally

Indian equity indices ended on strong note with Nifty above 26,200 on November 26 amid buying across the sectors. At close, the Sensex was up 1,022.50 points or 1.21 percent at 85,609.51, and the Nifty was up 320.50 points or 1.24 percent at 26,205.30.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

November 26, 2025· 16:19 IST

Taking Stock: Nifty above 26,200, Sensex jumps 1022 pts on hopes on Fed rate cut

More than 100 stocks hit 52-week high, including MCX India, IIFL Finance, GMR Airports, Shriram Finance, Axis Bank, Reliance Industries, Max Financial, L&T, Canara Bank, PTC Industries, Bank of India, AU Small Finance Bank, Hero MotoCorp, SBI, Federal Bank, AIA Engineering, among others....Read More

-330

November 26, 2025· 16:16 IST

Abhinav Tiwari, Research Analyst at Bonanza

Today, the Indian equities closed higher, supported by broad buying across energy, financials, metals, and major large cap stocks. Better global cues and a drop in crude oil prices improved investor sentiment, helping Nifty close above 26,200 and pushing the Sensex toward the 85,600 by the close. Hopes of a potential US Fed rate cut also added to the positive mood.

Market participation widened beyond defensive sectors. Cyclical sectors like metals and banks led the gains, showing improved risk appetite. Gains in top index heavy stocks amplified the overall move. The fall in volatility and stable global cues indicated that investors were comfortable taking on more risk ahead of key economic data releases.

In the near term, the market will closely watch global rate cut expectations, crude oil prices, and foreign investor flows. If oil stays moderate and US Fed signals remain supportive, the positive trend may continue. Financials and select cyclical sectors are likely to stay in focus, backed by steady earnings and stable macro conditions.

-330

November 26, 2025· 16:10 IST

Sudeep Shah, Head - Technical and Derivatives Research at SBI Securities

On the first day of the December expiry series, Nifty staged a strong rebound, advancing steadily through the session to end at 26,205 with a gain of 1.14%.

An open = low candlestick formation was visible on the daily chart. This pattern typically indicates strong buying interest emerging right from the opening tick, with bulls defending the day’s first print as a key support zone.

This open-low formation occurring right near the 20-day EMA zone adds further strength to the setup. It shows that Nifty respected its short-term trend indicator, rebounded sharply from this dynamic support, and went on to form a sizeable bullish candle. With this move, the index also posted its second-highest daily close since 16th October, reinforcing a positive short-term undertone.

The rebound drew strong support from the top three heavyweights - HDFC Bank, Reliance, and ICICI Bank - which together account for nearly 30% of Nifty’s weight, cushioning the index and driving buying momentum.

Bank Nifty, post breaking out of the 58,550–58,650 zone on 17th November, moved in a sideways consolidation over the past seven trading sessions, oscillating in the 58,605–59,440 range. In today’s session, the index decisively broke out of this consolidation range and closed at 59,528, gaining 1.20% - marking its highest closing level since 1st October 2025. This breakout signals a likely continuation of the prevailing uptrend after a brief pause, suggesting that bullish momentum in banking stocks could extend in the coming sessions.

On the sectoral front, all the sectors ended in the green with Nifty Metal and Oil & Gas emerging as the top two sectoral gainers, gaining in the range of 1.7-2%. On the stock front, JSW Steel and HDFC Life ended up as the top gainers, while Bharti Airtel and Adani Enterprise emerged as the top two losers.

The Small Cap index staged a sharp rebound, climbing 1.36% and reclaiming the crucial 200-day EMA, a key long-term support zone. This recovery from a major trend indicator adds confidence to the underlying structure of the broader market. The Mid Cap index, after closing above its 20-day EMA in yesterday’s session, delivered a strong follow-through move today. It also closed well above the previous day’s high of 61,062, reinforcing the strength of its short-term trend and signaling renewed buying interest across the mid-cap space.

The market breadth improved significantly with the advance-decline ratio heavily skewed in the favor of bulls as a total of 417 stocks out of the Nifty 500 universe ended in green, indicating that the buying was broad based not limited to heavyweights as it was seen in last few sessions.

Nifty View

Looking at key levels, the zone of 26,270–26,300 is likely to act as an important resistance zone for the Index. Any sustained move above 26,300 could drive a fresh leg of rally in the index, potentially taking it higher towards 26500, followed by 26700. On the downside, the support has shifted higher in the zone of 26,050-26,000.

Bank Nifty View

Looking at key levels, the zone of 59,700–59,800 zone is likely to act as an important resistance zone for the Index. Any sustained move above 59,800 could potentially taking the price higher towards 60,200, followed by 60,500. On the downside, the support has shifted higher in the zone of 59,200-59,100.

-330

November 26, 2025· 15:55 IST

Ajit Mishra – SVP, Research, Religare Broking

Markets opened sharply higher on the first day of the new expiry and gained over a percent, fully engulfing the recent decline. The index remained upbeat from the start, with momentum strengthening as the session progressed. As a result, the Nifty settled near the day’s high around the 26,205 mark. Market participation was broad-based, with metals, energy and IT leading the gains. Mid-cap and small-cap indices also advanced over 1%, adding to the overall positive market breadth.

The rally was supported by a mix of domestic and global cues. Renewed optimism over a potential rate cut by the US Federal Reserve in December, along with expectations of a 25-basis-point repo rate cut by the Reserve Bank of India early next month, improved investor sentiment. Additionally, easing crude oil prices—driven by hopes of progress toward peace between Ukraine and Russia—provided further support.

From a technical standpoint, the Nifty has completely retraced the past three days of declines and is again approaching its record high. The rebound from the crucial 20-DEMA reinforces the prevailing uptrend.

We maintain our positive outlook and recommend continuing a “buy-on-dips” approach unless the index decisively breaks below 25,800. On the upside, we now expect the 26,300–26,500 zone to act as the next resistance.

With all key sectors contributing to the move, we advise focusing on stock selection with favourable risk–reward setups, while maintaining a preference for large-cap and large mid-cap names.

-330

November 26, 2025· 15:47 IST

Vinod Nair, Head of Research, Geojit Investments

Domestic equities experienced significant gains, driven by the festive "Santa Claus rally" in global markets. This uptrend was fuelled by robust retail and domestic institutional investor (DII) inflows, while foreign institutional investor (FII) flows remained modest. On a global scale, market sentiment improved with rising expectations of a U.S. Federal Reserve rate cut in December, alongside softer U.S. yields and a weaker dollar.

Additionally, a 1% decline in crude oil prices helped to ease inflationary concerns.

On the domestic policy front, the Reserve Bank of India (RBI) is widely anticipated to implement a 25-basis point rate cut in December, supported by moderating inflation and a dovish stance.

Furthermore, increasing optimism surrounding a potential truce between Russia and Ukraine is enhancing risk appetite, fostering a positive outlook for the upcoming year.

-330

November 26, 2025· 15:45 IST

Vatsal Bhuva, Technical Analyst at LKP Securities

Bank Nifty closed with a strong long bullish candlestick, suggesting that the bulls’ rest period is over and momentum is returning to the upside. The RSI entering into a bullish crossover further confirms strength in the index.

Going ahead, a buy-on-dip strategy should be maintained as long as the index sustains above support levels. Immediate support is placed at 59200, while 58800 serves as a positional support. On the upside, potential resistance is expected near the psychologically important 60000 level.

-330

November 26, 2025· 15:32 IST

Currency Check | Rupee closes lower

Indian rupee ended marginally lower at 89.27 per dollar on Wednesday versus previous close of 89.22.

-330

November 26, 2025· 15:30 IST

Market Close | Nifty above 26,200, Sensex surges 1022 pts; all sectors in the green

Indian equity indices ended on strong note with Nifty above 26,200 on November 26 amid buying across the sectors.

BSE Midcap and smallcap indices rose 1.2% each.

All the sectoral indices ended in the green with media, auto, private bank, oil & gas, power, PSU, realty, consumer durables, pharma metal and PSU Bank added 1-2%.

Biggest Nifty gainers included JSW Steel, HDFC Life, Bajaj Finserv, Bajaj Finance, Jio Financial, while Bharti Airtel, Asian Paints, SBI Life Insurance were among top losers.

-330

November 26, 2025· 15:28 IST

Sensex Today | European indices trade firm; Dow Futures up 100 pts

-330

November 26, 2025· 15:26 IST

Sensex Today | JSW Steel share price gain most in six months

JSW Steel was quoting at Rs 1,154.40, up Rs 42.60, or 3.83 percent.

It has touched an intraday high of Rs 1,155.60 and an intraday low of Rs 1,114.10.

It was trading with volumes of 66,177 shares, compared to its five day average of 19,291 shares, an increase of 243.05 percent.

In the previous trading session, the share closed up 0.52 percent or Rs 5.70 at Rs 1,111.80.

The share touched a 52-week high of Rs 1,223.75 and a 52-week low of Rs 879.60 on 29 October, 2025 and 13 January, 2025, respectively.

Currently, the stock is trading 5.67 percent below its 52-week high and 31.24 percent above its 52-week low.

Market capitalisation stands at Rs 282,303.21 crore.

-330

November 26, 2025· 15:23 IST

Sensex Today | Atlanta Electricals receives two orders from Gujarat Energy Transmission Corporation

Atlanta Electricals has received a two orders from Gujarat Energy Transmission Corporation (GETCO) worth Rs 297.71 crores. The orders comprise 25 transformers to be supplied that includes twenty-one 220/66 KV, 160 MVA Power Transformers, three 66/11.55 KV, 20 MVA Power Transformers and one 220/132 KV, 150 MVA Auto Transformer.

Atlanta Electricals was quoting at Rs 963.20, down Rs 7.20, or 0.74 percent.

It has touched an intraday high of Rs 977.85 and an intraday low of Rs 962.

In the previous trading session, the share closed up 1.10 percent or Rs 10.55 at Rs 970.40.

The share touched a 52-week high of Rs 1,093.50 and a 52-week low of Rs 781.45 on 07 November, 2025 and 30 September, 2025, respectively.

Currently, the stock is trading 11.92 percent below its 52-week high and 23.26 percent above its 52-week low.

Market capitalisation stands at Rs 7,406.68 crore.

-330

November 26, 2025· 15:21 IST

Sensex Today | Ganesha Ecosphere share price rise most in eight months

Ganesha Ecosphere was quoting at Rs 953.50, up Rs 80.65, or 9.24 percent.

It has touched an intraday high of Rs 962.35 and an intraday low of Rs 868.

It was trading with volumes of 34,835 shares, compared to its five day average of 12,588 shares, an increase of 176.73 percent.

In the previous trading session, the share closed up 2.51 percent or Rs 21.40 at Rs 872.85.

The share touched a 52-week high of Rs 2,480 and a 52-week low of Rs 830 on 02 December, 2024 and 21 November, 2025, respectively.

Currently, the stock is trading 61.55 percent below its 52-week high and 14.88 percent above its 52-week low.

Market capitalisation stands at Rs 2,555.00 crore.

-330

November 26, 2025· 15:19 IST

Sensex Today | Motilal Oswal initiates 'buy' rating on Century Plyboards, target price at Rs 958

Century Plyboards was quoting at Rs 816.20, up Rs 26.15, or 3.31 percent.

It has touched an intraday high of Rs 818 and an intraday low of Rs 770.10.

It was trading with volumes of 16,451 shares, compared to its five day average of 2,954 shares, an increase of 456.83 percent.

In the previous trading session, the share closed up 5.17 percent or Rs 38.85 at Rs 790.05.

The share touched a 52-week high of Rs 895 and a 52-week low of Rs 630 on 07 February, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 8.8 percent below its 52-week high and 29.56 percent above its 52-week low.

Market capitalisation stands at Rs 18,133.76 crore.

-330

November 26, 2025· 15:16 IST

Sensex Today | Motilal Oswal initiates 'neutral' rating on Cera Sanitaryware, target price at Rs 5,842

Cera Sanitaryware was quoting at Rs 5,546.55, up Rs 76.00, or 1.39 percent.

It has touched an intraday high of Rs 5,579.95 and an intraday low of Rs 5,434.55.

It was trading with volumes of 833 shares, compared to its five day average of 722 shares, an increase of 15.44 percent.

In the previous trading session, the share closed down 0.35 percent or Rs 18.95 at Rs 5,470.55.

The share touched a 52-week high of Rs 8,010 and a 52-week low of Rs 5,062 on 10 December, 2024 and 17 March, 2025, respectively.

Currently, the stock is trading 30.75 percent below its 52-week high and 9.57 percent above its 52-week low.

Market capitalisation stands at Rs 7,153.69 crore.

-330

November 26, 2025· 15:13 IST

Stock Market LIVE Updates | BSE Sensex rises 1000 points; 350 points away from record high

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Finserv | 2,085.65 | 2.72 | 37.57k |

| Bajaj Finance | 1,012.20 | 2.66 | 124.07k |

| Tata Steel | 169.70 | 2.01 | 1.73m |

| Reliance | 1,570.00 | 2.01 | 456.22k |

| Axis Bank | 1,290.60 | 1.94 | 107.93k |

| TMPV | 359.25 | 1.93 | 2.33m |

| Sun Pharma | 1,804.60 | 1.85 | 26.23k |

| Maruti Suzuki | 16,176.00 | 1.85 | 6.02k |

| Infosys | 1,558.15 | 1.84 | 183.48k |

| Larsen | 4,063.35 | 1.69 | 191.41k |

| Tech Mahindra | 1,520.40 | 1.69 | 62.62k |

| UltraTechCement | 11,763.40 | 1.66 | 1.67k |

| Adani Ports | 1,505.60 | 1.47 | 169.81k |

| Kotak Mahindra | 2,100.65 | 1.46 | 748.29k |

| Eternal | 306.95 | 1.45 | 873.49k |

| HDFC Bank | 1,003.85 | 1.41 | 1.58m |

| Bharat Elec | 415.70 | 1.35 | 294.78k |

| TCS | 3,162.00 | 1.35 | 143.16k |

| ICICI Bank | 1,375.00 | 1.25 | 1.04m |

| Titan Company | 3,897.00 | 1.16 | 4.79k |

-330

November 26, 2025· 15:09 IST

Brokerages meet SEBI to present case for status quo on research fee, raise concerns on MF proposal

SEBI has proposed a major overhaul of the Total Expense Ratio (TER) framework for mutual funds to improve transparency and lower costs for investors....Read More

-330

November 26, 2025· 15:06 IST

Sensex Today | Goldman Sachs retains ‘buy’ rating on Godrej Consumer Products, target price at Rs 1,425

#1 Ambition for high single-digit volume growth in India driven by high-growth categories

#2 Home insecticides growth driven by electrics & incense sticks

#3 Soaps mean reversion expected over the next 12 months

#4 High-growth categories scaling rapidly

#5 India’s margin recovery returning to normal levels

-330

November 26, 2025· 15:02 IST

Markets@3 | Sensex jumps 1000 points, Nifty above 26200

The Sensex was up 1,026.27 points or 1.21 percent at 85,613.28, and the Nifty was up 318.95 points or 1.23 percent at 26,203.75. About 2539 shares advanced, 1252 shares declined, and 131 shares unchanged.

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Capital Trust | 13.70 -5.06% | 3.05m 18,815.60 | 16,085.00 |

| Tarsons Product | 227.50 -0.07% | 5.78m 37,421.80 | 15,344.00 |

| Igarashi Motors | 502.00 15.35% | 3.62m 35,077.00 | 10,208.00 |

| Responsive Ind | 217.47 14.67% | 2.63m 26,439.40 | 9,845.00 |

| SMS Pharma | 322.25 17.8% | 10.37m 111,575.40 | 9,198.00 |

| Best Agrolife | 362.00 19.99% | 1.61m 21,774.80 | 7,284.00 |

| R M Drip Spri | 81.11 2.52% | 528.22k 9,800.00 | 5,290.00 |

| Krishival Foods | 476.10 0.8% | 45.21k 1,200.00 | 3,667.00 |

| Tata Inv Corp | 768.10 5.72% | 8.71m 352,738.00 | 2,370.00 |

| BEW Eng | 115.00 0.66% | 26.50k 1,125.00 | 2,256.00 |

| Orient Electric | 189.94 -4.77% | 8.15m 438,809.40 | 1,757.00 |

| Swaraj Suiting | 268.00 5.93% | 325.00k 18,000.00 | 1,706.00 |

| Atal | 23.15 -0.13% | 1.62m 100,889.20 | 1,504.00 |

| Carborundum | 875.50 4.83% | 6.58m 435,149.00 | 1,411.00 |

| UTKARSHBNK | 16.55 2.92% | 15.26m 1,045,114.80 | 1,360.00 |

| JHS Svendgaard | 11.32 6.29% | 1.01m 81,208.80 | 1,144.00 |

| Veekayem Fashio | 230.00 2.13% | 48.50k 4,100.00 | 1,083.00 |

| Fino Payments | 293.65 10.35% | 13.67m 1,161,911.80 | 1,077.00 |

| Take Solutions | 31.99 4.3% | 2.09m 149,296.60 | 1,301.00 |

| KCK Ind | 29.70 0.68% | 147.50k 13,600.00 | 985.00 |

-330

November 26, 2025· 14:57 IST

Sensex Today | Hi-Tech Pipes commences commercial production at Sanand, Gujarat

Hi-Tech Pipes announced the commencement of commercial production at its Sanand Unit II – Phase II (Gujarat) brownfield expansion.

Hi-Tech Pipes was quoting at Rs 102.55, up Rs 2.15, or 2.14 percent.

It has touched an intraday high of Rs 103.00 and an intraday low of Rs 100.35.

It was trading with volumes of 62,354 shares, compared to its five day average of 39,238 shares, an increase of 58.91 percent.

In the previous trading session, the share closed up 1.52 percent or Rs 1.50 at Rs 100.40.

The share touched a 52-week high of Rs 177.20 and a 52-week low of Rs 81.56 on 10 December, 2024 and 09 May, 2025, respectively.

Currently, the stock is trading 42.13 percent below its 52-week high and 25.74 percent above its 52-week low.

Market capitalisation stands at Rs 2,082.87 crore.

-330

November 26, 2025· 14:55 IST

Markets rally 1.2%: Sensex 350 pts away from all-time high, Nifty 65 pts; here's when fresh highs are possible

Stock markets today: An analyst said this rally has more legs and today's move is not just a temporary bounce...Read More

-330

November 26, 2025· 14:53 IST

Sensex Today | Nuvama initiates ‘buy’ rating on Premier Energies, target price at Rs 1,270

#1 Company pivots to capture strong j-curve growth in new energy while core solar stays solid

#2 Higher capacity, backward integration & stable DCR realisations drive FY26–28 revenue/EBITDA CAGR of 49%/43%

#3 Overcapacity fears are seen as exaggerated given tough funding conditions

#4 Margin may ease, but integration into wafers, BESS, transformers & inverters supports growth & lowers risk

#5 Early-stage, high-growth industry cycle justifies a higher valuation

-330

November 26, 2025· 14:50 IST

Indian retail investors dump stocks by most since 2023

Individual investors, including proprietary traders and those who buy stocks directly, have sold 197 billion rupees ($2.2 billion) of local shares on a net basis so far this quarter, according to data from the National Stock Exchange. ...Read More

-330

November 26, 2025· 14:47 IST

Sensex Today | H.G. Infra Engineering gets show cause notice from Goods and Service Tax Department

The Joint Commissioner, State Goods and Service Tax, Corporate Circle-I, Ghaziabad Zone-I, Ghaziabad, Uttar Pradesh issued show cause notice under section 74 CGST/SGST Act for the financial year 2022-23, amounting to Rs 220,03,80,368.36.

-330

November 26, 2025· 14:43 IST

Currency Check | Rupee trades lower at 89.27

Indian rupee is trading lower at 89.27 per dollar against previous close of 89.22.

-330

November 26, 2025· 14:41 IST

Sensex Today | Bajaj Auto launches e-rickshaw

Bajaj Auto today announced its entry into the e-rickshaw category with the launch of Bajaj Riki.

-330

November 26, 2025· 14:37 IST

Sensex Today | 100 stocks on the BSE hit 52-week high

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| MCX India | 10265.00 | 10265.00 | 10,260.75 |

| GMR Airports | 107.03 | 107.03 | 106.67 |

| Shriram Finance | 858.45 | 858.45 | 857.05 |

| IIFL Finance | 577.05 | 577.05 | 569.00 |

| Max Financial | 1734.95 | 1734.95 | 1,732.40 |

| Axis Bank | 1293.00 | 1293.00 | 1,290.00 |

| Reliance | 1568.45 | 1568.45 | 1,565.40 |

| Larsen | 4075.55 | 4075.55 | 4,055.70 |

| PTC Industries | 18597.45 | 18597.45 | 18,077.00 |

| Bank of India | 151.35 | 151.35 | 148.90 |

| Canara Bank | 152.50 | 152.50 | 150.40 |

| AU Small Financ | 962.60 | 962.60 | 953.85 |

| Hero Motocorp | 6144.35 | 6144.35 | 6,133.55 |

| AB Capital | 350.45 | 350.45 | 348.20 |

| SBI | 999.10 | 999.10 | 987.20 |

| Federal Bank | 258.75 | 258.75 | 255.65 |

| AIA Engineering | 3863.00 | 3863.00 | 3,789.75 |

-330

November 26, 2025· 14:31 IST

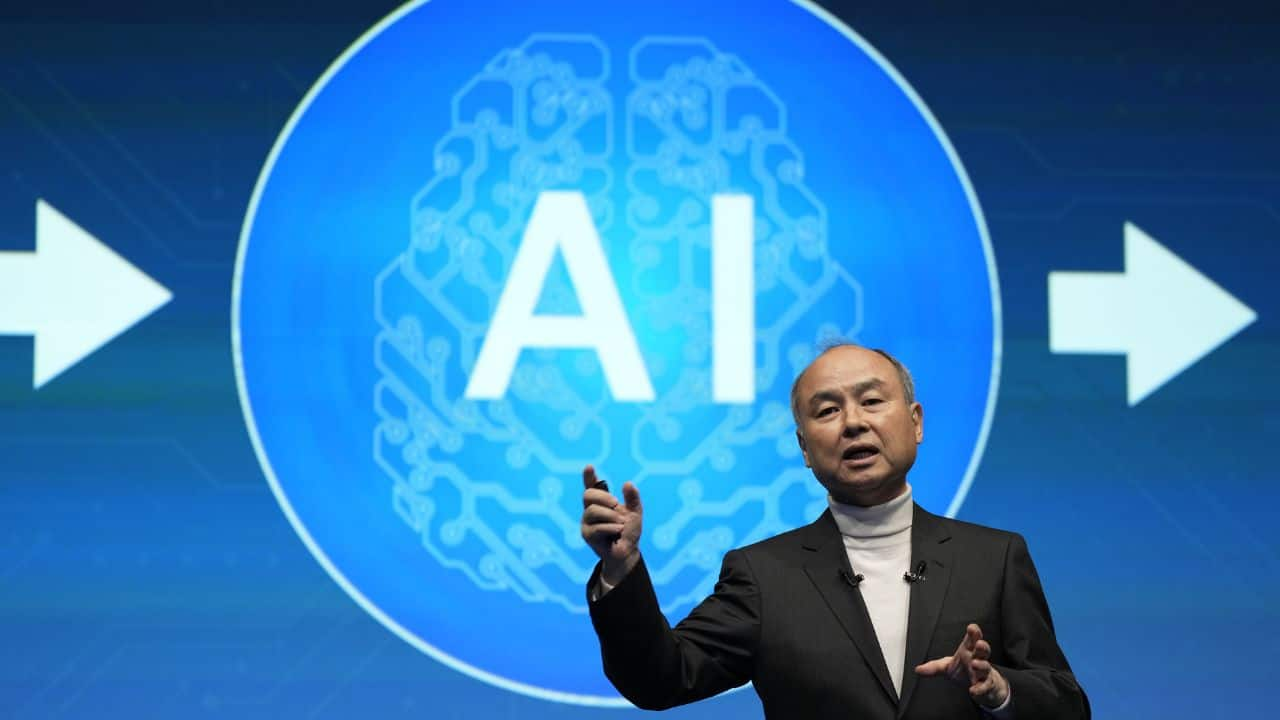

SoftBank’s 40% slide from peak shows worry over giant OpenAI bet

The Japanese tech investor sits at the forefront of a global AI selloff amid worries about new pressure on OpenAI following Alphabet Inc.’s Gemini 3.0 debut...Read More

-330

November 26, 2025· 14:21 IST

Japan's Nikkei surges after Wall Street's gains, tech leads charge

-330

November 26, 2025· 14:15 IST

Indian retail investors dump stocks by most since 2023

Individual investors, including proprietary traders and those who buy stocks directly, have sold 197 billion rupees ($2.2 billion) of local shares on a net basis so far this quarter, according to data from the National Stock Exchange. ...Read More

-330

November 26, 2025· 14:08 IST

Silver stockpile slump in China poses new risk to a hot market

Reflecting the tightness in China, near-term silver prices have topped later-dated contracts in Shanghai, a pattern known as backwardation that signals short-term pressure. ...Read More

-330

November 26, 2025· 14:01 IST

Markets@2 | Sensex jumps 950 pts, Nifty near 26200

The Sensex was up 956.89 points or 1.13 percent at 85,543.90, and the Nifty was up 302.80 points or 1.17 percent at 26,187.60. About 2537 shares advanced, 1203 shares declined, and 146 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Bharti Airtel | 2,128.00 -1.55 | 41.47m | 8,714.45 |

| Reliance | 1,566.20 1.72 | 8.12m | 1,266.58 |

| HDFC Bank | 1,005.80 1.62 | 11.83m | 1,179.18 |

| SBI | 988.00 0.45 | 9.00m | 892.82 |

| Bajaj Finance | 1,011.40 2.56 | 7.56m | 757.01 |

| ICICI Bank | 1,370.50 0.94 | 5.45m | 745.68 |

| Larsen | 4,052.00 1.38 | 1.39m | 564.04 |

| M&M | 3,695.50 0.71 | 1.59m | 587.37 |

| Adani Ports | 1,510.10 1.77 | 3.36m | 508.68 |

| Infosys | 1,553.00 1.46 | 3.73m | 576.96 |

| TCS | 3,174.50 1.77 | 1.28m | 402.03 |

| Shriram Finance | 856.15 2.14 | 4.57m | 388.28 |

| Kotak Mahindra | 2,090.10 0.98 | 1.77m | 368.66 |

| TMPV | 358.25 1.65 | 9.86m | 353.82 |

| Axis Bank | 1,290.40 1.9 | 2.72m | 350.28 |

| Maruti Suzuki | 16,174.00 1.79 | 200.81k | 323.06 |

| Trent | 4,303.00 1.39 | 619.57k | 267.33 |

| Eternal | 306.30 1.32 | 10.07m | 307.13 |

| ITC | 402.40 0.4 | 7.24m | 291.57 |

| Bharat Elec | 416.10 1.43 | 5.89m | 243.34 |

-330

November 26, 2025· 13:58 IST

Sensex Today | Thermax bags order of Rs 580 crore

Thermax Babcock & Wilcox Energy Solutions (TBWES), a wholly owned subsidiary of Thermax, has concluded an order for utility boilers and associated systems from a refinery and petrochemical complex in Nigeria.

-330

November 26, 2025· 13:57 IST

Currency Check | Rupee trades lower

Indian rupee erased all the intraday gains and is trading lower at 89.26 per dollar against previous close of 89.22.

-330

November 26, 2025· 13:55 IST

Sensex Today | Nifty Realty index rises 1% on second consecutive session

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oberoi Realty | 1,663.30 | 2.07 | 113.47k |

| Anant Raj | 606.15 | 1.98 | 4.94m |

| Phoenix Mills | 1,757.70 | 1.5 | 326.49k |

| Brigade Ent | 910.00 | 1.2 | 127.71k |

| Prestige Estate | 1,674.50 | 1.12 | 349.57k |

| DLF | 729.40 | 1.12 | 1.37m |

| Godrej Prop | 2,116.50 | 1.07 | 272.12k |

| Sobha | 1,557.90 | 0.58 | 30.99k |

| Lodha Developer | 1,162.40 | 0.19 | 544.56k |

| Raymond | 487.40 | 0.08 | 270.35k |

-330

November 26, 2025· 13:52 IST

Sensex rises 850 pts, Nifty above 26,150: Fed rate cut optimism among key factors behind market rally

Buying in heavyweight stocks like HDFC Bank and RIL, falling crude prices also contributed to the bullish sentiment on stock markets on November 26 ...Read More

-330

November 26, 2025· 13:50 IST

Sensex Today | 1.03 million shares of General Insurance Corporation of India traded in a block: Bloomberg

General Insurance Corporation of India was quoting at Rs 390.25, up Rs 8.20, or 2.15 percent.

It has touched an intraday high of Rs 391.80 and an intraday low of Rs 380.05.

It was trading with volumes of 12,658 shares, compared to its five day average of 16,606 shares, a decrease of -23.78 percent.

In the previous trading session, the share closed up 0.70 percent or Rs 2.65 at Rs 382.05.

The share touched a 52-week high of Rs 525 and a 52-week low of Rs 345.05 on 20 December, 2024 and 04 March, 2025, respectively.

Currently, the stock is trading 25.67 percent below its 52-week high and 13.1 percent above its 52-week low.

Market capitalisation stands at Rs 68,465.46 crore.

-330

November 26, 2025· 13:48 IST

Sensex Today | Nomura keeps ‘buy’ rating on Kaynes Technology, target price at Rs 8,478

#1 Eyeing growth catalysts, focus on broad-based growth to aid diversification

#2 OSAT/PCB on track, receivables to normalise by FY26

#3 Company targets positive OCF in FY26

#4 Company executes Rs 450 crore smart meter orders in H1, targets Rs 800-900 crore in FY26 with Rs 2,000 crore order book

-330

November 26, 2025· 13:43 IST

Sensex Today | Nifty less than 100 points away from its record high of 26,277.35

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| JSW Steel | 1,151.80 | 3.58 | 1.50m |

| Bajaj Finance | 1,011.50 | 2.57 | 7.34m |

| HDFC Life | 785.50 | 2.47 | 1.82m |

| Jio Financial | 307.40 | 2.19 | 6.06m |

| Bajaj Finserv | 2,074.20 | 2.17 | 434.81k |

| Grasim | 2,740.00 | 1.98 | 266.70k |

| Shriram Finance | 854.20 | 1.9 | 4.33m |

| Interglobe Avi | 5,883.00 | 1.87 | 244.48k |

| Axis Bank | 1,289.90 | 1.86 | 2.48m |

| Adani Ports | 1,511.50 | 1.86 | 3.17m |

| Maruti Suzuki | 16,178.00 | 1.82 | 178.73k |

| TCS | 3,174.80 | 1.78 | 1.20m |

| Coal India | 376.30 | 1.69 | 2.81m |

| TMPV | 358.30 | 1.66 | 9.68m |

| Tata Steel | 169.01 | 1.61 | 10.06m |

| Reliance | 1,563.10 | 1.52 | 7.45m |

| Trent | 4,307.40 | 1.5 | 600.37k |

| HCL Tech | 1,624.80 | 1.48 | 751.88k |

| HDFC Bank | 1,004.45 | 1.48 | 10.68m |

| Larsen | 4,053.80 | 1.43 | 1.29m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharti Airtel | 2,130.00 | -1.46 | 41.14m |

| Asian Paints | 2,872.60 | -0.11 | 299.22k |

-330

November 26, 2025· 13:42 IST

Sensex Today | Paras Defence signs licensing agreement with DRDO

A licensing agreement for transfer of technology of Driver Night Sight (DNS) for T-90 Tank has been signed between Defence Research & Development Organisation (DRDO), Ministry of Defence, Government of India and Paras Defence and Space Technologies (PARAS).

-330

November 26, 2025· 13:40 IST

Sensex Today | Desco Infratech bags contract from BPCL

The company has received the lowest bid confirmation at the L1 Stage being declared as the successful bidder for the Last Mile Connectivity (LMC) & Associated works along with DMA and Associated works for CGD projects in four geographical areas (GA) of BPCL in the State of Odisha, by Bharat Petroleum Corporation Limited (BPCL).

-330

November 26, 2025· 13:38 IST

Sensex Today | Nifty Private Bank index up 1%; RBL Bank, Axis Bank, IDFC First Bank, among top contributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| RBL Bank | 315.95 | 2.5 | 3.14m |

| Axis Bank | 1,289.70 | 1.85 | 2.43m |

| IDFC First Bank | 80.68 | 1.68 | 9.65m |

| IndusInd Bank | 853.55 | 1.63 | 1.66m |

| HDFC Bank | 1,003.95 | 1.43 | 10.57m |

| Kotak Mahindra | 2,092.80 | 1.11 | 1.60m |

| ICICI Bank | 1,371.20 | 0.99 | 4.95m |

| Yes Bank | 22.92 | 0.97 | 52.30m |

| Bandhan Bank | 150.50 | 0.58 | 2.87m |

-330

November 26, 2025· 13:36 IST

Pranay Aggarwal, Director and CEO of Stoxkart

Today’s positive market opening, led by metals and real estate, reflects strong domestic demand, supportive policy expectations, and improving global cues. Metal stocks are gaining momentum due to firm commodity prices and continued infrastructure spending, which is improving visibility for earnings across the sector. At the same time, the real estate space is benefiting from steady interest rates and rising housing demand, leading to improved sentiment around developers and allied industries.

This coordinated strength across cyclical sectors is lifting overall market confidence and encouraging a broader shift toward areas such as infrastructure, cement, and banking. Investor participation is widening beyond a few large names, indicating healthier market breadth. While technology and defensive sectors may witness temporary rotation as money flows into cyclicals, the sustainability of this rally will depend on how macro conditions evolve and whether earnings trends remain supportive. Overall, sentiment remains constructive, with investors selectively positioning for growth-linked opportunities.

-330

November 26, 2025· 13:33 IST

Large-cap profit share drops to 73% even as Nifty 500 earnings rise in Q2FY26

During the quarter, Nifty 500 margins expanded 130 basis points YoY but contracted 17 basis points sequentially. Kotak noted that excluding BFSI, metals, and oil & gas, margins fell 40 basis points YoY and 70 basis points QoQ, with the overall improvement primarily attributed to lower raw material costs, even as employee expenses continued to rise steadily. ...Read More

-330

November 26, 2025· 13:30 IST

Sensex Today | Motilal Oswal reiterates ‘buy’ rating on Kajaria Ceramics, target price at Rs 1,252

-330

November 26, 2025· 13:28 IST

Sensex Today | Goldman Sachs retains ‘buy’ rating on GCPL, target price at Rs 1,425

#1 Ambition for high single-digit volume growth in India driven by high-growth categories

#2 Home insecticides growth driven by electrics & incense sticks

#3 Soaps mean reversion expected over the next 12 months

#4 High-growth categories scaling rapidly

#5 India’s margin recovery returning to normal levels

-330

November 26, 2025· 13:26 IST

Sensex Today | NCC gets contract of Rs 2,062.71 crore

The company has received a Letter of Acceptance from the Public Works (Health & Education) Department, Assam, for the expansion and modernization of Gauhati Medical College & Hospital. The contract value is Rs 2,062.71 crore.

NCC was quoting at Rs 175.00, up Rs 1.70, or 0.98 percent.

It has touched an intraday high of Rs 180.65 and an intraday low of Rs 173.85.

It was trading with volumes of 640,525 shares, compared to its five day average of 164,727 shares, an increase of 288.84 percent.

In the previous trading session, the share closed up 0.61 percent or Rs 1.05 at Rs 173.30.

The share touched a 52-week high of Rs 326.55 and a 52-week low of Rs 169.95 on 06 December, 2024 and 03 March, 2025, respectively.

Currently, the stock is trading 46.41 percent below its 52-week high and 2.97 percent above its 52-week low.

Market capitalisation stands at Rs 10,987.32 crore.

-330

November 26, 2025· 13:23 IST

Sudeep Pharma IPO allotment today: How to check status on registrar, BSE and NSE; see latest GMP

Sudeep Pharma IPO GMP: The Rs 895-crore IPO closed for public bidding yesterday, after being subscribed nearly 94 times its offer size....Read More

-330

November 26, 2025· 13:21 IST

Sensex Today | Choice International shares gain most in 11 weeks

Choice International was quoting at Rs 806, up Rs 26.95, or 3.46 percent.

It has touched an intraday high of Rs 806 and an intraday low of Rs 780.50.

It was trading with volumes of 30,175 shares, compared to its five day average of 28,346 shares, an increase of 6.45 percent.

In the previous trading session, the share closed down 0.51 percent or Rs 4.00 at Rs 779.05.

The share touched a 52-week high of Rs 841 and a 52-week low of Rs 438 on 03 November, 2025 and 03 March, 2025, respectively.

Currently, the stock is trading 4.16 percent below its 52-week high and 84.02 percent above its 52-week low.

Market capitalisation stands at Rs 16,844.50 crore.

-330

November 26, 2025· 13:18 IST

MCX shares cross Rs 10,000-mark for the first-time ever; stock rallies 132% in 8 months: Here's why

MCX share price: MCX shares are overall up around 62% in 2025 so far, after jumping 95% in 2024 and around 106% in 2023....Read More

-330

November 26, 2025· 13:14 IST

Sensex Today | Jayant Infratech bags contract worth Rs 161.68 crore

The company has received a Letter of Acceptance from Konkan Railway Corporation for an engineering, procurement, and construction (EPC) contract worth Rs 161.68 crore.

The scope of work includes the design, supply, erection, testing, and commissioning for the upgradation of the existing 1x25 KV electric traction system into 2x25 KV, etc., in the projects being executed by Konkan Railway Corporation. The total value of the contract is Rs 161.68 crore.

-330

November 26, 2025· 13:09 IST

Sensex Today | Central Government appoints Prabhat Kiran as Executive Director of Bank Of Maharashtra

The Central Government has appointed Prabhat Kiran as Executive Director of the bank for three years, effective November 24.

Earlier, Prabhat Kiran was the Chief General Manager at Canara Bank.

-330

November 26, 2025· 13:04 IST

Sensex Today | Zen Technologies secures Rs 108 crore MoD order

Zen Technologies has been awarded a major contract from the Ministry of Defence, Government of India, totalling Rs 108 crore (including GST) for tank crew gunnery training simulators.

Zen Technologies was quoting at Rs 1,410.00, up Rs 12.70, or 0.91 percent.

It has touched an intraday high of Rs 1,443.05 and an intraday low of Rs 1,406.80.

It was trading with volumes of 19,691 shares, compared to its five day average of 35,288 shares, a decrease of -44.20 percent.

In the previous trading session, the share closed up 1.08 percent or Rs 14.90 at Rs 1,397.30.

The share touched a 52-week high of Rs 2,627.95 and a 52-week low of Rs 946.65 on 24 December, 2024 and 19 February, 2025, respectively.

Currently, the stock is trading 46.35 percent below its 52-week high and 48.95 percent above its 52-week low.

Market capitalisation stands at Rs 12,730.94 crore.

-330

November 26, 2025· 13:01 IST

Markets@1 | Sensex gains 900 pts, Nifty above 26150

The Sensex was up 916.93 points or 1.08 percent at 85,503.94, and the Nifty was up 286.85 points or 1.11 percent at 26,171.65. About 2553 shares advanced, 1123 shares declined, and 153 shares unchanged.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Bigbloc Constru | 65.10 | 26.11 | 51.62 |

| Best Agrolife | 360.15 | 20.11 | 299.85 |

| Jet Freight Log | 17.30 | 19.15 | 14.52 |

| Greenleaf Envir | 169.00 | 17.24 | 144.15 |

| Responsive Ind | 221.50 | 15.80 | 191.28 |

| Unihealth Hospi | 372.00 | 15.74 | 321.40 |

| Guj Raffia Ind | 57.67 | 15.73 | 49.83 |

| ANB Metal Cast | 343.40 | 15.72 | 296.75 |

| Flexituff Ventu | 15.14 | 15.66 | 13.09 |

| Igarashi Motors | 507.50 | 15.60 | 439.00 |

| VLS Finance | 304.31 | 15.37 | 263.78 |

| SHUBHLAXMI | 24.85 | 15.31 | 21.55 |

| Tourism Finance | 73.25 | 13.87 | 64.33 |

| Chetana Edu | 68.35 | 13.44 | 60.25 |

| Tirupati Forge | 37.70 | 12.98 | 33.37 |

| Karnataka Bank | 212.60 | 12.63 | 188.76 |

| Lumax Inds | 5,639.60 | 12.18 | 5,027.20 |

| SMS Pharma | 316.00 | 12.10 | 281.90 |

| Vishnu Chemical | 538.30 | 11.95 | 480.85 |

| Primo Chemicals | 24.64 | 11.54 | 22.09 |

-330

November 26, 2025· 12:55 IST

Sensex Today | Asian markets end higher; Kospi up 2.6%, Nikkei up 2%

-330

November 26, 2025· 12:53 IST

Sensex Today | Indian Overseas Bank receives Rs 8.35 billion tax refund order

Indian Overseas Bank was quoting at Rs 39.49, up Rs 0.64, or 1.65 percent.

It has touched an intraday high of Rs 40.30 and an intraday low of Rs 39.36.

It was trading with volumes of 1,859,104 shares, compared to its five day average of 464,105 shares, an increase of 300.58 percent.

In the previous trading session, the share closed up 0.94 percent or Rs 0.36 at Rs 38.85.

The share touched a 52-week high of Rs 59.90 and a 52-week low of Rs 33.01 on 05 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 34.07 percent below its 52-week high and 19.63 percent above its 52-week low.

Market capitalisation stands at Rs 76,044.28 crore.

-330

November 26, 2025· 12:52 IST

Sensex Today | RNIT AI Solutions to deploy AI-based facial recognition system

The company has received a project from the Telangana Social Welfare Residential Educational Institutions Society – Hyderabad, as the technology partner for deploying an AI-based facial recognition system to manage daily attendance for approximately 1,70,000 students per day across 268 institutions under the SaaS model.

RNIT AI Solutions was quoting at Rs 61.90, up Rs 1.73, or 2.88 percent.

It has touched an intraday high of Rs 62.45 and an intraday low of Rs 59.05.

It was trading with volumes of 260,138 shares, compared to its five day average of 447,399 shares, a decrease of -41.86 percent.

In the previous trading session, the share closed down 0.41 percent or Rs 0.25 at Rs 60.17.

The share touched a 52-week high of Rs 71.00 and a 52-week low of Rs 42.57 on 11 November, 2025 and 30 October, 2025, respectively.

Currently, the stock is trading 12.82 percent below its 52-week high and 45.41 percent above its 52-week low.

Market capitalisation stands at Rs 462.96 crore.

-330

November 26, 2025· 12:48 IST

Sensex Today | Nuvama keeps ‘reduce’ rating on Apollo Pipes, target price at Rs 198

#1 Focus shifts to gaining market share over maintaining margin

#2 Brownfield plant in South India could face a 6-9 month delay given industry challenges

Apollo Pipes was quoting at Rs 301.00, up Rs 0.35, or 0.12 percent.

It has touched an intraday high of Rs 303.05 and an intraday low of Rs 293.30.

It was trading with volumes of 2,604 shares, compared to its five day average of 3,153 shares, a decrease of -17.42 percent.

In the previous trading session, the share closed up 0.75 percent or Rs 2.25 at Rs 300.65.

The share touched a 52-week high of Rs 510.80 and a 52-week low of Rs 288.05 on 29 November, 2024 and 07 November, 2025, respectively.

Currently, the stock is trading 41.07 percent below its 52-week high and 4.5 percent above its 52-week low.

Market capitalisation stands at Rs 1,325.85 crore.

-330

November 26, 2025· 12:45 IST

Sensex Today | Concord Control Systems to issue shares worth Rs 50 crore on preferential basis

The company board approved the issue and allotment of up to 2,38,500 fully paid-up equity shares of the face value of Rs 10 each, on a preferential basis, at the issue price of Rs 2100 including a security premium of Rs 2090, aggregating up to Rs 50,08,50,000.

Concord Control Systems was quoting at Rs 2,260, up Rs 42.65, or 1.92 percent.

It has touched an intraday high of Rs 2,355 and an intraday low of Rs 2,260.

In the previous trading session, the share closed down 4.49 percent or Rs 104.35 at Rs 2,217.35.

The share touched a 52-week high of Rs 2,488.95 and a 52-week low of Rs 606.97 on 21 November, 2025 and 19 February, 2025, respectively.

Currently, the stock is trading 9.2 percent below its 52-week high and 272.34 percent above its 52-week low.

Market capitalisation stands at Rs 2,287.17 crore.

-330

November 26, 2025· 12:41 IST

Sensex Today | TV Today Network enters in to MoU with Abhijit Realtors to sell FM Radio Broadcasting operations

The company board approved the proposal for entering into Memorandum of Understanding (MOU) with Abhijit Realtors and Infraventures in relation to proposed sale/transfer of FM Radio Broadcasting Operations of the company (comprising of three FM radio stations in Mumbai, Delhi and Kolkata under the frequency 104.8 FM) [Radio Business] as a going concern, through Vibgyor Broadcasting, wholly owned subsidiary of the company, subject to fulfilment of contractual obligations.

-330

November 26, 2025· 12:37 IST

Sensex Today | BSE Bank index up 1%; IndusInd Bank, Axis Bank, IDFC First Bank, among top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 856.00 | 1.9 | 86.70k |

| Axis Bank | 1,288.10 | 1.75 | 72.71k |

| IDFC First Bank | 80.56 | 1.51 | 5.37m |

| HDFC Bank | 1,002.25 | 1.25 | 1.33m |

| ICICI Bank | 1,369.95 | 0.88 | 889.78k |

| Yes Bank | 22.87 | 0.75 | 5.38m |

| SBI | 990.40 | 0.73 | 155.75k |

| Bank of Baroda | 289.20 | 0.63 | 322.38k |

| Kotak Mahindra | 2,082.70 | 0.59 | 724.57k |

| Federal Bank | 256.90 | 0.41 | 265.40k |

-330

November 26, 2025· 12:35 IST

Sensex Today | VIP Industries share price most in 19 weeks

VIP Industries was quoting at Rs 369.50, up Rs 14.75, or 4.16 percent.

It has touched an intraday high of Rs 370.40 and an intraday low of Rs 354.80.

It was trading with volumes of 27,975 shares, compared to its five day average of 15,022 shares, an increase of 86.23 percent.

In the previous trading session, the share closed down 4.23 percent or Rs 15.65 at Rs 354.75.

The share touched a 52-week high of Rs 522.80 and a 52-week low of Rs 248.55 on 04 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 29.32 percent below its 52-week high and 48.66 percent above its 52-week low.

Market capitalisation stands at Rs 5,248.80 crore.

-330

November 26, 2025· 12:33 IST

Sensex Today | Pace Digitek receives order worth Rs 1,994.20 million

Lineage Power, material subsidiary of the company has received order worth Rs 1,994.20 million (including taxes) from Larsen & Toubro Limited, Construction for supply of battery energy storage systems including LiFePo4 Liquid cooling BESS integrated Container for Bihar State Power Generation Company Limited, Kajra.

-330

November 26, 2025· 12:31 IST

Sensex Today | Zydus and RK Pharma enter into licensing and commercialization agreement

Zydus Lifesciences has entered into an exclusive licensing and commercialization agreement with RK Pharma Inc of the US for a novel sterile injectable 505(b)(2) oncology supportive care product for the US market.

-330

November 26, 2025· 12:30 IST

Sensex Today | HCLTech collaborates with SAP on Physical AI

HCLTech today announced the expansion of its collaboration with SAP to advance Physical AI solutions that integrate intelligence into real-world operations across industries.

HCLTech and SAP will explore next-generation use cases that bring the power of AI into physical and industrial environments.

HCL Technologies was quoting at Rs 1,621.05, up Rs 20.35, or 1.27 percent.

It has touched an intraday high of Rs 1,622.90 and an intraday low of Rs 1,602.00.

It was trading with volumes of 17,039 shares, compared to its five day average of 290,329 shares, a decrease of -94.13 percent.

In the previous trading session, the share closed down 0.82 percent or Rs 13.25 at Rs 1,600.70.

The share touched a 52-week high of Rs 2,011.00 and a 52-week low of Rs 1,304.00 on 13 January, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 19.39 percent below its 52-week high and 24.31 percent above its 52-week low.

Market capitalisation stands at Rs 439,898.68 crore.

-330

November 26, 2025· 12:29 IST

Sensex Today | India volatility index down 3%

-330

November 26, 2025· 12:26 IST

Sensex Today | IIFL Finance board approves NCDs issue of up to Rs 2,000 crore

The board of directors of the company at their meeting held on November 26, 2025, approved the public issue of secured, rated, listed, redeemable non-convertible debentures, with the shelf limit of up to Rs 2,000 crore, including green shoe option, if any, in one or more tranches.

-330

November 26, 2025· 12:23 IST

Currency Check | Rupee trades marginally lower

Indian rupee is trading marginally lower at 89.26 per dollar against previous close of 89.22.

-330

November 26, 2025· 12:22 IST

Adani Enterprises stock edges up today, but slips over two days as Rs 24,930-cr rights issue opens at discount

Adani Enterprises is offering 13.85 crore partly paid-up equity shares in the rights issue, with an upfront payment requirement of Rs 900 per share and the remaining Rs 900 payable through two call payments of Rs 450 each....Read More

-330

November 26, 2025· 12:21 IST

Sensex Today | Danish Power bags order worth Rs 19.5 crore

The company has been awarded an order worth Rs 19.50 crore from leading renewable energy EPC company for supply of invertor duty transformers.

-330

November 26, 2025· 12:16 IST

Realty stocks rise, index gains 3% in two days amid optimism over RBI rate cut in Dec

Real estate is seen among the key beneficiaries to a rate cut by India's central bank....Read More

-330

November 26, 2025· 12:13 IST

Sensex Today | JTL Industries share price rises most in 12 weeks

JTL Industries was quoting at Rs 68.16, up Rs 4.79, or 7.56 percent.

It has touched an intraday high of Rs 68.50 and an intraday low of Rs 63.14.

It was trading with volumes of 98,110 shares, compared to its five day average of 60,962 shares, an increase of 60.94 percent.

In the previous trading session, the share closed up 1.20 percent or Rs 0.75 at Rs 63.37.

The share touched a 52-week high of Rs 112.07 and a 52-week low of Rs 57.27 on 09 January, 2025 and 11 November, 2025, respectively.

Currently, the stock is trading 39.18 percent below its 52-week high and 19.02 percent above its 52-week low.

Market capitalisation stands at Rs 2,679.24 crore.

-330

November 26, 2025· 12:10 IST

Sensex Today | Apollo Micro Systems enters into tri-party alliance with IIT–Chennai and the Indian Navy

The company has entered into a strategic tri-party alliance with IIT–Chennai and the Indian Navy to focus on addressing and solving present and future problem statements of the Armed Forces through indigenous research and development.

Apollo Micro Systems was quoting at Rs 271.35, down Rs 1.45, or 0.53 percent.

It has touched an intraday high of Rs 277.20 and an intraday low of Rs 270.00.

It was trading with volumes of 203,168 shares, compared to its five day average of 438,912 shares, a decrease of -53.71 percent.

In the previous trading session, the share closed up 4.98 percent or Rs 12.95 at Rs 272.80.

The share touched a 52-week high of Rs 354.65 and a 52-week low of Rs 92.50 on 17 September, 2025 and 23 December, 2024, respectively.

Currently, the stock is trading 23.49 percent below its 52-week high and 193.35 percent above its 52-week low.

Market capitalisation stands at Rs 9,286.78 crore.

-330

November 26, 2025· 12:05 IST

Sensex Today | Multi Commodity Exchange of India shares rise on third consecutive session; hits 52-week high

Multi Commodity Exchange of India was quoting at Rs 10,219.00, up Rs 347.35, or 3.52 percent.

It has touched a 52-week high of Rs 10,247.

It has touched an intraday high of Rs 10,247 and an intraday low of Rs 9,875.25.

It was trading with volumes of 37,054 shares, compared to its five day average of 17,024 shares, an increase of 117.66 percent.

In the previous trading session, the share closed up 0.07 percent or Rs 6.65 at Rs 9,871.65.

Market capitalisation stands at Rs 52,115.23 crore.

-330

November 26, 2025· 12:01 IST

Markets@12 | Sensex rises 820 points, Nifty at 26150

-330

November 26, 2025· 11:58 IST

Pravesh Gour, Senior Technical Analyst at Swastika Investmart

Indian equity markets witnessed a strong bounce in early trade, taking positive cues from global markets. Benchmarks moved higher after three consecutive sessions of decline, offering some relief to investors and traders.

One of the key drivers behind today’s rally is the strength in global markets. Asian indices traded firmly higher, while Wall Street ended on a positive note overnight. This improved global risk sentiment provided support to Indian equities and encouraged fresh buying at lower levels.

Another important positive trigger is renewed optimism around a possible interest rate cut by the U.S. Federal Reserve. Recent softer U.S. economic data has strengthened expectations that the Fed could begin easing monetary policy in the coming months. Lower interest rates in the U.S. generally improve liquidity conditions and increase the attractiveness of emerging markets such as India, prompting risk-on sentiment across equities.

The rally is also being supported by sector-specific buying, with gains seen across the board. Metal stocks and PSU banks are leading the move, supported by improving global commodity sentiment and selective value buying. Broader market participation indicates that the bounce is not limited to a single sector, lending strength to the overall market structure.

Overall, the combination of strong global cues, easing rate concerns, and broad-based buying has helped the market stabilize after recent weakness.

From a technical perspective, Nifty 50 has witnessed a rebound after testing lower levels around 20-SMA. The index is currently trading above its short-term moving averages (9-DMA and 20-DMA), indicating a short-term pullback rally. However, it is still hovering near a crucial resistance zone of 26,200–26,277, which coincides with the upper trendline and prior supply area. Sustaining above this level will be key for further upside toward 26,400–26,500 in the near term.

On the downside, 25,800–25,750 remains an important immediate support, followed by a stronger base near 25,500, where the 50-day moving average is placed. Momentum indicators also supporting the trend overall, the trend remains positive above key supports, but traders should adopt a buy-on-dips strategy until a decisive breakout above resistance confirms renewed strength.

-330

November 26, 2025· 11:55 IST

Sensex Today | SMS Pharmaceutical receives USFDA approval for its reformulated Ranitidine

The US Food and Drug Administration has approved SMS Pharmaceuticals' associate company VKT Pharma’s reformulated Ranitidine tablets in 150mg and 300mg strengths.

This approval marks the re-entry of this important acid-reducing medication into the US market after a five-year absence.

-330

November 26, 2025· 11:47 IST

Sensex Today | BSE IT index rises 1%; ASM Technologies, InfoBeans Technologies, VL E-Governance and IT Solutions, among top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ASM Tech | 3,465.90 | 5 | 33.44k |

| InfoBeans Tech | 587.25 | 5 | 2.59k |

| VLEGOV | 23.63 | 4.42 | 3.72k |

| Control Print | 760.55 | 4.36 | 2.76k |

| Expleo Solution | 1,098.00 | 4.3 | 246 |

| Subex | 12.46 | 4.18 | 74.78k |

| Rategain Travel | 714.50 | 3.81 | 28.28k |

| IRIS Business S | 321.80 | 3.76 | 259 |

| NELCO | 865.10 | 3.69 | 26.75k |

| Onward Tech | 281.10 | 3.31 | 2.51k |

| Sasken Tech | 1,376.50 | 2.79 | 74 |

| Zensar Tech | 732.95 | 2.47 | 136.23k |

| Dynacons Sys | 945.70 | 2.43 | 170 |

| TVS Electronics | 564.80 | 2.37 | 2.78k |

| Ceinsys Tech | 1,091.00 | 2.24 | 53.47k |

| Tanla Platforms | 570.70 | 2.21 | 26.28k |

| Kellton Tech | 19.25 | 1.96 | 52.23k |

| Aurionpro Solut | 1,088.70 | 1.9 | 2.66k |

| Intellect Desig | 1,107.90 | 1.87 | 3.72k |

| KSolves | 307.00 | 1.82 | 625 |

-330

November 26, 2025· 11:45 IST

Sensex Today | 4 million shares of IDFC First Bank traded in a block: Bloomberg

IDFC First Bank was quoting at Rs 80.56, up Rs 1.20, or 1.51 percent.

It has touched an intraday high of Rs 80.73 and an intraday low of Rs 79.50.

It was trading with volumes of 5,187,961 shares, compared to its five day average of 543,141 shares, an increase of 855.18 percent.

In the previous trading session, the share closed up 1.85 percent or Rs 1.44 at Rs 79.36.

The share touched a 52-week high of Rs 82.65 and a 52-week low of Rs 52.50 on 03 November, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 2.53 percent below its 52-week high and 53.45 percent above its 52-week low.

Market capitalisation stands at Rs 69,225.94 crore.

-330

November 26, 2025· 11:44 IST

Sensex Today | Welspun Corp files claim statement against Wasco Coatings and Wasco Energy

The company has filed a Statement of Claim amounting to $35.5 million to $43.5 million against Wasco Coatings and Wasco Energy under the Rules of Arbitration of the International Chambers of Commerce, London, regarding its investment opportunity lost in Wasco Qatar, along with other non-monetary claims and/or reliefs.

Around 2019, Wasco Coatings incorporated a company in Qatar engaged in concrete weight coating (Wasco Qatar) without giving the company an option notice.

The company and Wasco Energy had entered into a Shareholders Agreement on August 25, 2015, for the formation of a joint venture company, Welspun Wasco Coatings, in India.

-330

November 26, 2025· 11:39 IST

Deveya Gaglani, Senior Research Analyst - Commodities, Axis Securities

Comex Gold traded with volatility in the last trading session following several news flows. Rate cut probability increased after weaker-than-expected Core PPI data, while reports of Zelensky accepting the terms of a U.S. brokered peace deal kept prices range-bound. However, prices are trading on a positive note in the morning session as markets are now pricing in more than an 80% chance of a 25-bps cut, up from 50% a week earlier. In the domestic market Gold prices are back above 125000 level. We expect prices to trade with a positive bias as long as the 124000 level is intact on the downside.

-330

November 26, 2025· 11:32 IST

IPO supply to limit market gains, says Axis MF CIO; expects earnings recovery in large cap firms

Going ahead, India's relative underperformance against global peers, a theme of the current year, is likely to reverse. However, achieving significant absolute outperformance next year would be challenging due to prevailing valuations and the supply overhang....Read More

-330

November 26, 2025· 11:29 IST

Stock Market LIVE Updates | Bharti Airtel, HDFC Bank, RIL most active stocks at this hour

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Bharti Airtel | 2,127.80 -1.56 | 39.24m | 8,239.55 |

| HDFC Bank | 1,001.50 1.18 | 7.19m | 713.12 |

| Reliance | 1,562.40 1.47 | 3.94m | 612.57 |

| Bajaj Finance | 1,003.80 1.78 | 4.93m | 491.90 |

| ICICI Bank | 1,368.20 0.77 | 2.98m | 406.45 |

-330

November 26, 2025· 11:25 IST

Indian Oil, HPCL, BPCL stocks rebound after Tuesday’s fall, rise 1-2 percent as crude stays below $63/barrel

The recovery in Indian OMCs share prices tracked the continued softness in crude. Brent crude settled 1.4 percent lower on Tuesday, and saw only mild, technical gains on Wednesday....Read More

-330

November 26, 2025· 11:04 IST

Sensex Today | TCS extends partnership with ALDI SOUTH

Tata Consultancy Services (TCS) has extended its long-standing partnership with ALDI SOUTH — a leading international retailer, to manage their infrastructure and application services and improve stability and IT operations efficiency.

-330

November 26, 2025· 11:03 IST

Sensex Today | 1.09 million shares of Tata Motors Passenger Vehicles traded in a block: Bloomberg

Tata Motors Passenger Vehicles was quoting at Rs 357.65, up Rs 5.20, or 1.48 percent.

It has touched an intraday high of Rs 362.80 and an intraday low of Rs 354.20.

It was trading with volumes of 610,321 shares, compared to its five day average of 755,583 shares, a decrease of -19.23 percent.

In the previous trading session, the share closed down 1.62 percent or Rs 5.80 at Rs 352.45.

The share touched a 52-week high of Rs 493.17 and a 52-week low of Rs 325.53 on 09 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 27.48 percent below its 52-week high and 9.87 percent above its 52-week low.

Market capitalisation stands at Rs 131,698.58 crore.

-330

November 26, 2025· 11:01 IST

Markets@11 | Sensex rises 700 points, Nifty at 26100

The Sensex was up 716.62 points or 0.85 percent at 85,303.63, and the Nifty was up 224.95 points or 0.87 percent at 26,109.75. About 2542 shares advanced, 939 shares declined, and 161 shares unchanged.

-330

November 26, 2025· 10:59 IST

Sensex Today | Oriana Power bags contract of USD 2,487,170

The company has received a Letter of Award (LOA) for the design, supply, installation & commissioning of a 3.0 MW (AC) Grid-Tied Solar Photovoltaic System at Cheddi Jagan International Airport (CJIA), Timehri, Guyana.

-330

November 26, 2025· 10:54 IST

Sensex Today | Nifty Midcap index up 1%; SAIL, HUDCO, Bank of India, among top contributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SAIL | 136.99 | 3.58 | 18.90m |

| HUDCO | 237.27 | 2.82 | 2.63m |

| Bank of India | 150.56 | 2.28 | 5.76m |

| Ola Electric | 41.50 | 2.24 | 4.26m |

| Cummins | 4,405.60 | 2.19 | 99.93k |

| Union Bank | 156.14 | 2.15 | 7.28m |

| One 97 Paytm | 1,267.80 | 2.13 | 706.32k |

| Dixon Technolog | 14,700.00 | 2.08 | 100.32k |

| Kalyan Jeweller | 492.80 | 2.07 | 486.98k |

| Indian Renew | 144.15 | 1.97 | 1.70m |

| Motilal Oswal | 963.90 | 1.9 | 168.38k |

| HINDPETRO | 463.90 | 1.9 | 877.16k |

| Indian Bank | 889.60 | 1.89 | 404.18k |

| NMDC | 74.05 | 1.86 | 5.24m |

| NALCO | 258.59 | 1.82 | 3.78m |

| Aditya Birla F | 76.80 | 1.82 | 480.23k |

| Suzlon Energy | 55.17 | 1.81 | 17.62m |

| Solar Ind | 13,501.00 | 1.76 | 23.84k |

| IDFC First Bank | 80.74 | 1.75 | 4.90m |

| GMR Airports | 105.95 | 1.67 | 7.15m |

-330

November 26, 2025· 10:52 IST

Sensex Today | United Breweries launches Heineken Silver in New Delhi

The company has launched Heineken Silver in New Delhi, effective November 25. The current launch is focused on catering exclusively to the domestic market.

United Breweries was quoting at Rs 1,699.95, up Rs 1.65, or 0.10 percent.

It has touched an intraday high of Rs 1,708.00 and an intraday low of Rs 1,678.00.

It was trading with volumes of 2,115 shares, compared to its five day average of 13,447 shares, a decrease of -84.27 percent.

In the previous trading session, the share closed down 0.46 percent or Rs 7.90 at Rs 1,698.30.

The share touched a 52-week high of Rs 2,299.40 and a 52-week low of Rs 1,677.25 on 03 February, 2025 and 25 November, 2025, respectively.

Currently, the stock is trading 26.07 percent below its 52-week high and 1.35 percent above its 52-week low.

Market capitalisation stands at Rs 44,947.55 crore.

-330

November 26, 2025· 10:50 IST

New labour code to expand ESI coverage? Here’s what could change for employees

Under the new wage definition, social security contributions, including ESI, will be computed on 50% of CTC, which experts say could increase the number of employees eligible for ESI benefits...Read More

-330

November 26, 2025· 10:48 IST

Sensex Today | Vikram Solar's Vallam plant capacity increases to 9.5 GW

Vikram Solar today announced the commissioning of its state-of-the-art Vallam manufacturing facility in Tamil Nadu, adding 5 GW of advanced module production capacity.

With this next-gen expansion, the company now commands a total manufacturing capacity of 9.5 GW, reinforcing its role as a top-tier, scale-driven player in solar technology and underscoring its growing influence in shaping India’s solar future.

-330

November 26, 2025· 10:45 IST

Rahul Kalantri, VP Commodities, Mehta Equities

Gold and silver ended the session close to two-week high as delayed US economic data boosted expectations of a December Fed rate cut. September retail sales grew just 0.2%, signalling softer consumer demand, while PPI figures aligned with expectations.

Recent dovish remarks from Fed officials have further pushed market pricing for a 25 bps cut to over 80%. Meanwhile, the dollar index slipped below 100, lending additional support to bullion. However, upside momentum in gold was limited amid easing geopolitical risk after Ukrainian authorities reportedly agreed to a roadmap to end the conflict with Russia.

Gold has support at $4100-4065 while resistance at $4170-4195. Silver has support at $51.00-50.65 while resistance is at $51.85-52.20. In INR gold has support at Rs 1,24,350-1,23,580 while resistance at Rs 1,25,850-1,26,500. Silver has support at Rs 1,54,850-1,53,600 while resistance at Rs 1,57,110, 1,58,000.

-330

November 26, 2025· 10:43 IST

Sensex Today | Nifty Smallcap index rises on second consecutive session

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Natco Pharma | 879.65 | 5.47 | 1.32m |

| Reliance Power | 38.70 | 4.03 | 27.16m |

| Nuvama Wealth | 7,252.00 | 4.01 | 89.58k |

| CESC | 173.15 | 3.6 | 660.01k |

| PG Electroplast | 590.20 | 3.48 | 2.05m |

| Anant Raj | 613.50 | 3.21 | 1.41m |

| MCX India | 10,169.00 | 3.06 | 335.31k |

| CDSL | 1,616.60 | 2.7 | 936.96k |

| IIFL Finance | 572.00 | 2.62 | 926.64k |

| Hind Copper | 327.80 | 2.37 | 4.23m |

| Inox Wind | 137.76 | 2.27 | 2.48m |

| PNB Housing Fin | 901.10 | 2.23 | 166.94k |

| IFCI | 51.40 | 2.23 | 1.62m |

| Brainbees Solu | 314.45 | 2.14 | 209.19k |

| IDBI Bank | 103.28 | 2.06 | 4.60m |

| CG Consumer | 270.20 | 1.94 | 777.09k |

| GE Shipping | 1,083.60 | 1.84 | 65.24k |

| PVR INOX | 1,068.80 | 1.83 | 46.11k |

| Poonawalla Fin | 468.05 | 1.81 | 126.24k |

| IEX | 142.65 | 1.72 | 1.73m |

-330

November 26, 2025· 10:40 IST

Shivani Nyati, Head of Wealth at Swastika Investmart

Excelsoft Technologies Ltd. delivered a strong listing on Wednesday, debuting at Rs 135 per share, a 12.5% premium over its issue price of Rs 120. The stock further rallied up to 18% intraday, reflecting healthy investor sentiment toward the company’s scalable Vertical SaaS presence in the global EdTech and digital assessment ecosystem.

Excelsoft operates in the high‐growth learning and assessment SaaS segment, catering to educational institutions, corporate L&D, and government bodies. The company serves 76 global clients, including large names such as the Pearson Group, which provides predictable, recurring revenues through multi-year contracts.

Financially, the company has shown strong traction, with FY25 PAT growing by ~172%, supported by operating leverage and expanding digital adoption across markets. Its product suite, domain expertise, and long-term customer relationships continue to underpin steady visibility in revenue generation.

However, risks remain. A significant client concentration with Pearson (contributing ~59% of revenue) poses a major disruption risk in case of any contract loss or slowdown. Additionally, the IPO valuation appeared aggressive (Pre IPO P/E ~35), leaving limited room for sharp near-term upside.

Overall, while the debut was healthy, the listing largely aligns with expectations of modest listing gains.

Investors allotted shares may consider booking partial profits while holding the rest for medium-term growth, supported by the company’s SaaS model, global presence, and strong financial momentum. A stop-loss near Rs 130 is advisable to manage downside risk.

-330

November 26, 2025· 10:35 IST

Sensex Today | 1.37 million shares of HDFC Bank traded in a block: Bloomberg

HDFC Bank was quoting at Rs 998.60, up Rs 8.75, or 0.88 percent.

It has touched an intraday high of Rs 1,001.00 and an intraday low of Rs 983.00.

It was trading with volumes of 223,977 shares, compared to its five day average of 784,014 shares, a decrease of -71.43 percent.

In the previous trading session, the share closed down 0.92 percent or Rs 9.20 at Rs 989.85.

The share touched a 52-week high of Rs 1,020.35 and a 52-week low of Rs 812.13 on 23 October, 2025 and 13 January, 2025, respectively.

Currently, the stock is trading 2.13 percent below its 52-week high and 22.96 percent above its 52-week low.

Market capitalisation stands at Rs 1,535,824.65 crore.

-330

November 26, 2025· 10:31 IST

Sensex Today | 1.2 million shares of Exide Industries traded in a block: Bloomberg

Exide Industries was quoting at Rs 365.55, up Rs 3.90, or 1.08 percent.

It has touched an intraday high of Rs 366.05 and an intraday low of Rs 360.80.

It was trading with volumes of 1,218,755 shares, compared to its five day average of 62,692 shares, an increase of 1,844.04 percent.

In the previous trading session, the share closed down 0.48 percent or Rs 1.75 at Rs 361.65.

The share touched a 52-week high of Rs 472.70 and a 52-week low of Rs 327.95 on 12 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 22.67 percent below its 52-week high and 11.47 percent above its 52-week low.

Market capitalisation stands at Rs 31,071.75 crore.

-330

November 26, 2025· 10:30 IST

Sensex Today | 1.01 million shares of Ashok Leyland traded in a block: Bloomberg

Ashok Leyland was quoting at Rs 146.15, up Rs 0.35, or 0.24 percent.

It has touched an intraday high of Rs 147.00 and an intraday low of Rs 145.05.

It was trading with volumes of 101,576 shares, compared to its five day average of 1,116,222 shares, a decrease of -90.90 percent.

In the previous trading session, the share closed up 0.93 percent or Rs 1.35 at Rs 145.80.

The share touched a 52-week high of Rs 153.00 and a 52-week low of Rs 95.20 on 14 November, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 4.48 percent below its 52-week high and 53.52 percent above its 52-week low.

Market capitalisation stands at Rs 85,846.38 crore.

-330

November 26, 2025· 10:28 IST

Sensex Today | Natco Pharma share price gains most in 21 weeks

Natco Pharma was quoting at Rs 878.45, up Rs 44.50, or 5.34 percent.

It has touched an intraday high of Rs 879.70 and an intraday low of Rs 831.35.

It was trading with volumes of 70,112 shares, compared to its five day average of 120,355 shares, a decrease of -41.75 percent.

In the previous trading session, the share closed down 0.96 percent or Rs 8.10 at Rs 833.95.

The share touched a 52-week high of Rs 1,504.00 and a 52-week low of Rs 660.05 on 10 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 41.59 percent below its 52-week high and 33.09 percent above its 52-week low.

Market capitalisation stands at Rs 15,733.91 crore.

-330

November 26, 2025· 10:25 IST

Sensex | Brightcom Group atm enters into a strategic collaboration with HUMAN Security, Inc

Online Media Solutions (OMS), a wholly owned subsidiary of Brightcom Group, has entered into a strategic collaboration with HUMAN Security, Inc., a globally recognised leader in digital fraud prevention and cybersecurity solutions.

HUMAN is an innovator known for its advanced technology in detecting and preventing sophisticated forms of digital fraud, including bot activity, invalid traffic, and emerging threats across digital advertising and media ecosystems.