Large-cap companies accounted for 73 percent of Nifty 500 profits in 2QFY26, down from 77 percent in 2QFY25 and 79 percent in 2QFY24, latest data shows. Despite this gradual decline in large-cap dominance, overall Nifty 500 earnings grew 15 percent year-on-year, driven largely by metals and oil, gas & consumable fuels.

A recent Moneycontrol report had also highlighted that state-run oil marketing companies (OMCs) emerged as the biggest contributors in Q2FY26, with Hindustan Petroleum Corporation Ltd, Bharat Petroleum Corporation Ltd, and Indian Oil Corporation together adding Rs 15,700 crore to the profit pool, where they accounted for a quarter of the Rs 61,000 crore rise. When Reliance Industries and Oil and Natural Gas Corporation are factored in, the oil and gas segment’s contribution jumps to over 60 percent, the Moneycontrol report added.

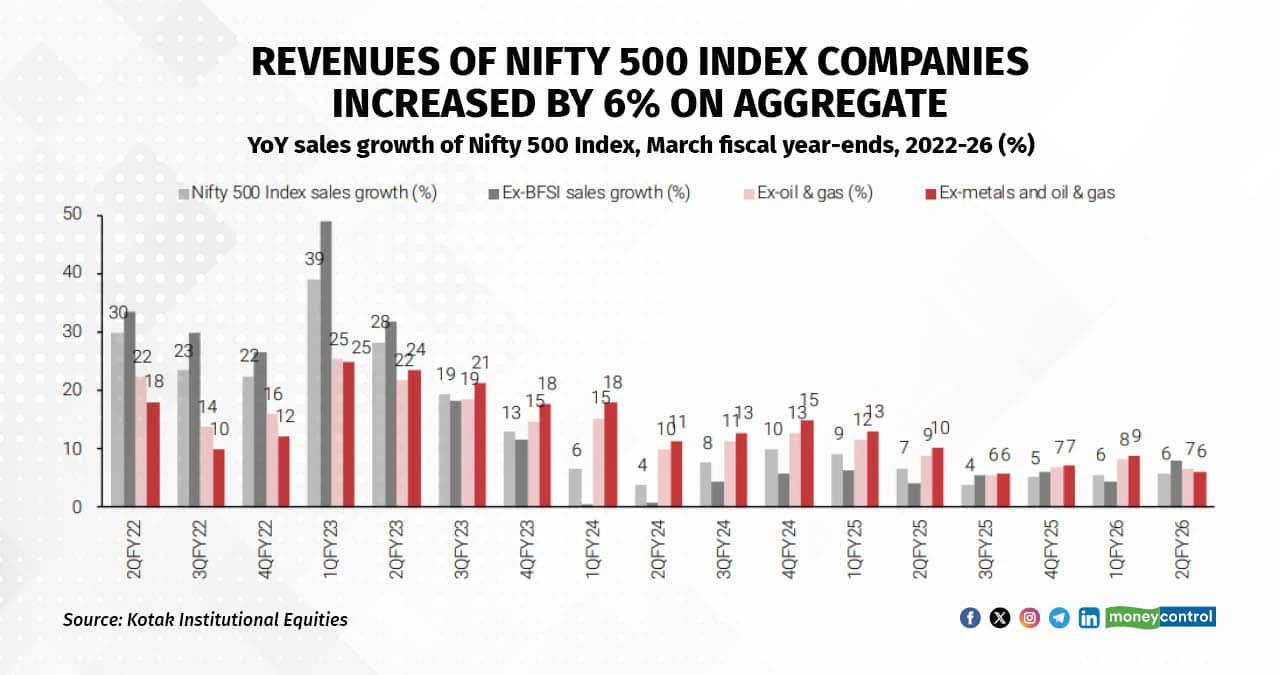

Kotak Institutional Equities analysts noted that revenues for the index increased 5.9 percent YoY (Year-on-year), slightly higher than the 5.5 percent recorded in 1QFY26, although demand remained subdued across multiple sectors, resulting in uneven recovery. They explained that the top 100 companies continued to contribute around 70 percent of total Nifty 500 revenue, but their share of profits slipped to 73 percent. Sales growth was subdued across large-cap firms, while mid- and small-cap companies posted stronger EBITDA and PAT growth, often aided by low-base effects. Additionally, 10 of 19 mid-cap sectors and seven of 14 small-cap sectors recorded low-base-driven growth, helping offset weakness in larger firms.

Commodity-linked sectors were the clear contributors in 2QFY26, the report suggested. For example, metals and mining delivered 11 percent revenue growth, up from 4.2 percent in 1QFY26 and a decline of 1.4 percent in 2QFY25. EBITDA rose 21 percent YoY, with a sequential growth of 16 percent, while PAT increased 36 percent YoY and 30 percent QoQ (Quarter on Quarter). Oil, gas & consumable fuels posted more modest revenue growth of 3.7 percent YoY, down 1 percent sequentially, but recorded a 46 percent rise in EBITDA YoY and 17 percent QoQ, alongside a 54 percent jump in PAT YoY and 26 percent sequentially. Kotak observed that, excluding metals and oil & gas, overall Nifty 500 earnings growth moderates sharply to 8 percent YoY.

Across other sectors, revenue performance was mixed, with pockets of strength emerging in certain areas. Internet software & services led the pack with a 122 percent revenue surge, compared with 51 percent in 1QFY26 and 46 percent in 2QFY25, while autos rebounded with 6.3 percent revenue growth, after a flat 0.2 percent in 1QFY26 and a 2.5 percent decline a year earlier. Construction materials accelerated to 17 percent revenue growth, up from 14 percent in 1QFY26 and 4 percent in 2QFY25, while insurance reversed sharply, declining 27 percent following growth of 9.4 percent in 1QFY26 and 25 percent a year ago.

Profitability trends showed similar variation across sectors. Construction materials delivered a 48 percent increase in EBITDA and a 283 percent surge in PAT, compared with 36 percent and 52 percent, respectively, in 1QFY26, and declines in 2QFY25. Telecommunications posted the largest gains, with PAT soaring 3,570 percent, up from 884 percent in 1QFY26 and 102 percent a year ago. Electronic manufacturing services’ PAT accelerated to 159 percent from 60 percent QoQ and 60 percent YoY, while internet software & services recovered to 51 percent growth from a 17 percent decline in 1QFY26. Autos, however, continued to struggle, with EBITDA falling 23 percent and PAT slipping 19 percent, extending the declines from previous quarters.

During the quarter, Nifty 500 margins expanded 130 basis points YoY but contracted 17 basis points sequentially. Kotak noted that excluding BFSI, metals, and oil & gas, margins fell 40 basis points YoY and 70 basis points QoQ, with the overall improvement primarily attributed to lower raw material costs, even as employee expenses continued to rise steadily.

Looking ahead, earnings expectations appear to be stabilizing, particularly for large- and mid-cap stocks over the past two months, supported by modest upgrades in oil & gas, banking, metals & mining, and IT services, the report suggests. However, several small-cap sectors continue to face downgrades. Kotak added that going forward, the Street anticipates broad-based earnings growth across sectors in the second half of FY26, assuming demand conditions do not worsen and commodity-linked sectors maintain momentum.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.