Closing Bell: Nifty above 19,800, Sensex up 92 pts; power gains, metals drag

-330

November 22, 2023· 16:33 IST

-330

November 22, 2023· 16:26 IST

Rupak De, Senior Technical analyst at LKP Securities

The Nifty traded sideways for most of the session except for the last hour, during which it recovered from the day's low. The overall sentiment remains positive as the index has held above the crucial support level of 19,500. Resistance is positioned at 19,850 on the higher end; a breakthrough could potentially propel the Nifty towards the 20,200 mark.

-330

November 22, 2023· 16:12 IST

Kunal Shah, Senior Technical & Derivative analyst at LKP Securities:

The Bank Nifty index experienced persistent selling pressure, resulting in a decline of 0.52%, accompanied by significant volumes. However, the index successfully maintained the crucial support zone of 43,300-43,200, and a breach below this level could pave the way for further downside.

On the upside, immediate resistance is positioned at 43,600-43,700, and a breakthrough above this range is expected to initiate moves toward the 44,000 level, where the highest open interest is concentrated on the call side.

-330

November 22, 2023· 16:04 IST

Prashanth Tapse, Research Analyst, Sr VP Research, Mehta Equities

Markets exhibited some volatility in early trades and turned range bound with a positive bias for the rest of the trading session. Investors are following global markets which are mostly sluggish with a mixed bias. Due to lack of fresh positive triggers, investors are trading cautiously and taking selective bets. Technically, Nifty needs to reclaim the 19889 mark for fresh upside, while the support is placed at 19471 mark.

-330

November 22, 2023· 15:59 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets remained range-bound and settled almost unchanged, in line with the global peers. After the flat start, the Nifty oscillated in a range and finally settled around the day’s high at 19,812.80 level. Meanwhile, a mixed trend continued on the sectoral front wherein IT, pharma and auto edged higher while metal, banking and realty ended in the red. \We had a similar trend on the broader front too as midcap closed marginally in the green and smallcap index lost over a percent.

The move in the index was largely in continuation to the prevailing trend wherein weakness in banking continued to weigh on the sentiment and buying in other heavyweights capped the damage. Amid all the choppiness, we reiterate our positive view and suggest preferring sectors other than banking for long trades.

-330

November 22, 2023· 15:56 IST

Aditya Gaggar Director of Progressive Shares:

With a swing on both sides, Nifty50 ended the volatile day at 19,811.85 with gains of 28.45 points. Among the sectors, IT and Pharma posted decent gains of more than 0.60% while a corrective move extended in the PSU Banking space. The Metal sector was also added to the list of underperformers. From the Auto segment, 2W wheeler stocks performed well.

A mixed trend was seen in the Broader markets with the Midcap sector outperforming the Frontline Index while Smallcaps underperformed. It appears that the Nifty is trying to violate its immediate hurdle of 19,850 while a level of 19,700 will continue to act as a support. A strong convincing close above the same will open doors for 20,050.

-330

November 22, 2023· 15:44 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Despite FED adopting a cautious stance in its minutes and refraining from indicating a rate cut, the market recovered from the day’s correction and ended with mild gain. On the other hand, the broad market witnessed some profit booking as investors' focus shifted to the primary market, marked by a set of IPOs scheduled for this week. However, the undercurrent is positive, with a cooling of inflation and an easing US bond yield supporting a short- to medium-term rally.

-330

November 22, 2023· 15:33 IST

Rupee Close:

Indian rupee ended flat at 83.32 per dollar on Wednesday against Tuesday's close of 83.35.

-330

November 22, 2023· 15:30 IST

Market Close

: Benchmark indices ended higher with Nifty above 19,800.

At close, the Sensex was up 92.47 points or 0.14 percent at 66,023.24, and the Nifty was up 28.40 points or 0.14 percent at 19,811.80. About 1581 shares advanced, 1981 shares declined, and 133 shares unchanged.

Top gainers on the Nifty were BPCL, Cipla, NTPC, Infosys and Power Grid Corporation, while losers included IndusInd Bank, Hindalco Industries, Kotak Mahindra Bank, Adani Enterprises and Adani Ports.

Mixed trend seen on the sectoral front with bank, metal and realty down 0.5 percent each, while IT, capital goods, oil & gas, power, healthcare and FMCG up 0.3-1 percent.

BSE Midcap index rose 0.3 percent, while smallcap index down 0.3 percent.

-330

November 22, 2023· 15:27 IST

Stock Market LIVE Updates | CLSA View On Tata Motors

-Buy Call, Target Rs 841 per share

-JLR posted a 14.1 percent YoY improvement in retail volumes in October 2023

-UK & EU volumes up 65 percent & 29 percent YoY

-JLR’s 3QFY23 volumes are tracking marginally lower than Q2 but are at healthy levels

-Discounts have risen but, not significantly enough in land rover

-JLR’s net debt declined by £300 m & JLR looks set to turn net cash by FY25

-330

November 22, 2023· 15:23 IST

Sensex Today | Flair Writing IPO Day 1: Issue subscribed 1.50 times, retail portion booked 2 times

Flair Writing Industries’ Rs 593 crore IPO has been subscribed 1.50 times so far on November 22, the first day of bidding, receiving bids for 2.15 crore shares against the issue size of 1.44 crore shares. Retail investors bought 2 times, non-institutional investors picked 1.60 times and qualified institutional buyers bought 0.52 times the allotted quota.

-330

November 22, 2023· 15:21 IST

Sensex Today | BSE Smallcap index down 0.6 percent dragged by LT Foods, Jindal Saw, Motilal Oswal:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| LT Foods | 206.65 | -5.81 | 240.26k |

| Jindal Saw | 452.65 | -5.76 | 60.97k |

| Motilal Oswal | 1,132.60 | -5.73 | 44.60k |

| Stove Kraft | 488.60 | -5.59 | 4.98k |

| Orient Green | 20.90 | -5 | 3.56m |

| Vikas Life | 5.13 | -5 | 7.35m |

| Apollo Micro Sy | 132.09 | -5 | 73.34k |

| Rattan Power | 9.13 | -4.99 | 27.55m |

| SEPC | 20.56 | -4.99 | 1.66m |

| Suzlon Energy | 37.32 | -4.99 | 27.98m |

-330

November 22, 2023· 15:19 IST

Stock Market LIVE Updates | Bernstein View On Divis Laboratories

-Underperform call, target Rs 3,064 per share

-Cross-reads from global peers indicate continued pricing pressure in generics

-Generics pricing pressure could affect order inflow & margin for rest of the year

-Have guided to two new CS projects scaling up in the next few quarters

-Visibility remains poor

-Continue to believe that market exuberance is unwarranted

-330

November 22, 2023· 15:17 IST

Sensex Today | Gandhar Oil IPO booked 4 times on day 1; retail investors booked 5 times

State-run Gandhar Oil Refinery's 198-crore initial public offering (IPO) was fully subscribed on day 1, with bids coming in for 8.62 crore shares as against a total of 2,12 crore offered shares.

The public issue was subscribed by a total of 4 times NIIs booked 5.23 times of the public issue, retail investors booked 5 times.

The portion set aside for qualified institutional buyers (QIBs) saw subscription of 1.32 times.

-330

November 22, 2023· 15:15 IST

Sensex Today | Fedbank Financial Services IPO Day 1: Issue subscribed 29% so far, retail portion booked 50%

Fedbank Financial Services’ Rs 1,092-crore IPO was subscribed 29 percent on Day 1 of the subscription, with bids coming in for 1.59 crore shares against the issue size of 5.6 crore.

Retail investors bought 50 percent their quota of shares, non-institutional investors picked up 14 percent, while the portion set aside for qualified institutional buyers still to warm up to the issue.

-330

November 22, 2023· 15:12 IST

Sensex Today | IREDA IPO: Issue sees 3.54 times subscription on Day 2

The Rs 2,150-crore initial public offering of Indian Renewable Energy Development Agency (IREDA) has seen a subscription 3.54 times on the second day of bidding, November 22 as investors have bid 166.92 crore equity shares against offer size of 47.09 crore shares.

All investors participated in the offer since the beginning of public issue with high networth individuals buying 6.01 times the allotted quota and retail investors 3.66 times.

The portion set aside for qualified institutional buyers was subscribed 1.49 times and that of employees 4.15 times.

-330

November 22, 2023· 15:08 IST

Sensex Today | Tata Technologies IPO subscribed 5.11 times on day 1, HNI portion booked 8.5 times

Tata Technologies’ Rs 3,042.51-crore IPO, the first public issue in over 20 years from the Tata Group, opened for subscription on November 22. The offer has been subscribed 5.11 times, with investors buying 23 crore equity shares against an offer size of 4.5 crore.

Retail investors had bid 4.2 times their quota of shares, while the portion set aside for high-networth individuals (HNIs) was subscribed 8.5 times and qualified institutional buyers (QIB) bid 3.96 times, the subscription data available with the exchanges showed.

The part set aside for employees of Tata Technologies was booked 0.82 times, while that of Tata Motors' shareholders was booked 6.87 times.

-330

November 22, 2023· 15:07 IST

Stock Market LIVE Updates | Jefferies View On Coal India

-Buy call, target Rs 334 per share

-Strong emphasis on delivering sustained volume growth

-Government's high focus on ensuring adequate coal supply for power plants

-believes it is on track to produce 780 mt in FY24 vs est of 774 mt

-Targeting 850 mt in FY25, estimate at 820 mt

-Has taken multiple cost reduction initiatives

-Expects employee count to fall at ~5 percent annually over next 10 years

-330

November 22, 2023· 14:58 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| M K Proteins | 85.15 | 80.80 | -4.35 131.10k |

| Nakoda Group | 42.10 | 39.95 | -2.15 1.55k |

| Niraj Cement | 44.50 | 42.50 | -2.00 8.16k |

| Womancart | 170.00 | 163.00 | -7.00 - |

| Touchwood Enter | 190.15 | 183.00 | -7.15 0 |

| Ameya Precision | 53.85 | 52.00 | -1.85 0 |

| Sanginita Chemi | 27.35 | 26.45 | -0.90 19.20k |

| Starteck Financ | 230.15 | 222.65 | -7.50 7.63k |

| Canarys Automat | 41.25 | 40.00 | -1.25 - |

| Pudumjee Ind | 29.90 | 29.00 | -0.90 10.19k |

-330

November 22, 2023· 14:57 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Uniinfo Telecom | 30.20 | 32.75 | 2.55 4.68k |

| Railtel | 266.20 | 282.30 | 16.10 288.58k |

| Crop Life Sci. | 39.70 | 41.80 | 2.10 0 |

| Lambodhara Text | 156.15 | 163.85 | 7.70 3.77k |

| Shiva Texyarn | 150.50 | 157.30 | 6.80 3.47k |

| ABM Inter | 42.10 | 44.00 | 1.90 0 |

| Onward Tech | 579.25 | 604.80 | 25.55 3.54k |

| Anik Industries | 52.05 | 54.20 | 2.15 7.40k |

| Newjaisa Tech | 156.00 | 161.70 | 5.70 - |

| Morepen Lab | 41.40 | 42.90 | 1.50 562.06k |

-330

November 22, 2023· 14:55 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas:

Indian Rupee strengthened slightly today on IPO related inflows. However, a recovery in the US Dollar and weak domestic markets capped sharp gains. US Dollar recovered after FOMC was slightly hawkish. Though the minutes showed most members holding rates, they left the door open for more tightening if the progress on inflation falters.

We expect Rupee to trade with a slight positive bias towards Dollar inflows due to IPOs in the domestic markets. However, a positive tone in US Dollar and expectations that crude oil prices may also surge may cap sharp upside. Traders may take cues from weekly unemployment claims and durable goods orders data from the US. USDINR spot price is expected to trade in a range of Rs 83 to Rs 83.60.

-330

November 22, 2023· 14:51 IST

Stock Market LIVE Updates | HSBC On Tractor Companies

-Buy call on M&M, target Rs 1,800 per share

-Reduce call on Escorts, target Rs 2,500 per share

-Tractor industry volumes have doubled in 10 years

-Penetration is still at 40 percent of addressable land-parcels

-FY25 is likely to be a weak year

-Long-term CAGR should still be mid-to-high single digits

-Healthy return ratio warrants higher valuation, despite cyclicality

-330

November 22, 2023· 14:46 IST

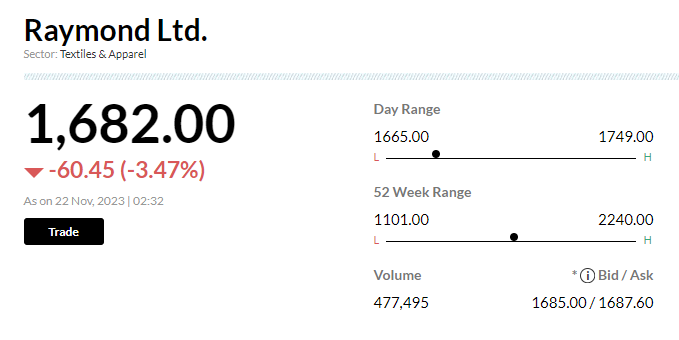

Stock Market LIVE Updates | Raymond extends losses for the seventh day, erases Rs1,500 crore market cap

-330

November 22, 2023· 14:39 IST

Stock Market LIVE Updates | India's banking system hits 5-year liquidity deficit peak due to tax outflows

India's banking system faced its largest liquidity deficit in five years due to increased tax outflows. The deficit reached Rs1.57 trillion on Tuesday, marking the highest level since December 2018.

-330

November 22, 2023· 14:33 IST

-330

November 22, 2023· 14:27 IST

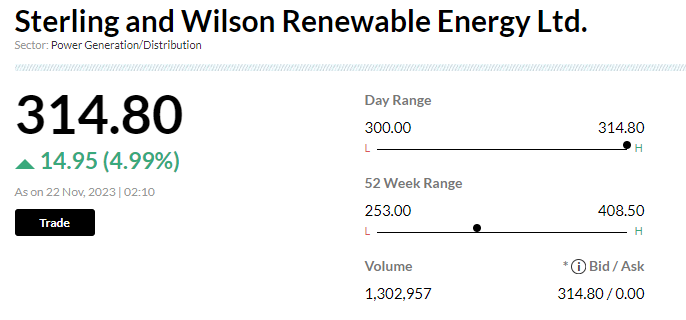

Stock Market LIVE Updates | Sterling and Wilson Renewable gains 5% after award win

Shares of Sterling and Wilson Renewable Energy Ltd surged 5 percent after CNBC reported its joint venture was awarded a $2.2 billion order by the Nigerian government.

-330

November 22, 2023· 14:19 IST

-330

November 22, 2023· 14:17 IST

Sensex Today | Tata Technologies IPO subscribed 4.22 times on day 1, HNI portion booked 6.77 times

Tata Technologies’ Rs 3,042.51-crore IPO, the first public issue in over 20 years from the Tata Group, opened for subscription on November 22. The offer has been subscribed 4.22 times, with investors buying 19 crore equity shares against an offer size of 4.5 crore.

Retail investors had bid 3.48 times their quota of shares, while the portion set aside for high-networth individuals (HNIs) was subscribed 6.77 times and qualified institutional buyers (QIB) bid 3.56 times, the subscription data available with the exchanges showed.

The part set aside for employees of Tata Technologies was booked 0.70 times, while that of Tata Motors' shareholders was booked 5.48 times.

-330

November 22, 2023· 14:15 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| SG FINSERVE | 28694 | 500 | 1.43 |

| Easy Trip | 475973 | 38.9 | 1.85 |

| SG FINSERVE | 50000 | 495 | 2.48 |

| KBC Global | 200000 | 2.16 | 0.04 |

| KBC Global | 500000 | 2.16 | 0.11 |

| G G Engineering | 250000 | 1.46 | 0.04 |

| G G Engineering | 304324 | 1.45 | 0.04 |

| Rajnish Wellnes | 960000 | 10.5 | 1.01 |

| G G Engineering | 300000 | 1.45 | 0.04 |

| Rajnish Wellnes | 350000 | 10.55 | 0.37 |

-330

November 22, 2023· 14:12 IST

Stock Market LIVE Updates | Morgan Stanley View On Indraprastha Gas

-Underweight call, target Rs 432 per share

-LNG trucking is seeing its ecosystem slowly develop from a nascent stage

-Tie up with a logistics operator should help improve the ecosystem

-If successful, does provide a new demand growth area

-LNG trucking not priced in by markets

-Fuel retailers (HPCL, BPCL & IOCL) could be bigger beneficiaries

-330

November 22, 2023· 14:08 IST

Stock Market LIVE Updates | Jefferies View On NTPC

-Despite supply constraints, increase in power demand is being met, CEO says

-Power capex is set for a 4-5 years uptrend at least

-Power capex set to cater to the rising demand from industries & households

-NTPC should be a major beneficiary of the capex uptick

-330

November 22, 2023· 14:06 IST

Sensex Today | Veerhealth Care bags order from Morocco-based F & G Branding Co, for CALORAL toothpaste

Veerhealth Care has launched additional brand CALORAL toothpaste in the oral care segment in Morocco market. It has received Rs 17 lakh worth order from F & G Branding Co, Casablanca, Morocco, North West Africa for CALORAL toothpaste. It is expecting additional growth in turnover with this new order.

-330

November 22, 2023· 14:02 IST

Sensex Today | Market at 2 PM

The Sensex was down 147.36 points or 0.22 percent at 65,783.41, and the Nifty was down 41.90 points or 0.21 percent at 19,741.50. About 1293 shares advanced, 1853 shares declined, and 98 shares unchanged.

-330

November 22, 2023· 13:59 IST

| Company | Price at 13:00 | Price at 13:44 | Chg(%) Hourly Vol |

|---|---|---|---|

| Photoquip India | 22.75 | 20.05 | -2.70 0 |

| CCL Internation | 24.30 | 22.56 | -1.74 0 |

| Comfort Comm | 23.60 | 22.00 | -1.60 8.78k |

| Pioneer Invest | 33.99 | 32.25 | -1.74 0 |

| Softsol India | 236.00 | 224.35 | -11.65 346 |

| Margo Finance | 38.75 | 37.00 | -1.75 11 |

| UP Hotels | 899.80 | 860.00 | -39.80 0 |

| Ahasolar Tech | 245.50 | 235.00 | -10.50 0 |

| Advance Meter | 29.80 | 28.55 | -1.25 132 |

| Hindusthan Urba | 2,190.00 | 2,100.00 | -90.00 0 |

-330

November 22, 2023· 13:59 IST

| Company | Price at 13:00 | Price at 13:44 | Chg(%) Hourly Vol |

|---|---|---|---|

| Rishi Techtex | 37.10 | 41.00 | 3.90 4.01k |

| Cochin Malabar | 81.05 | 87.89 | 6.84 902 |

| Alacrity Sec | 24.80 | 26.53 | 1.73 0 |

| B and A | 360.20 | 382.80 | 22.60 6.48k |

| Shanthi Gears | 505.00 | 533.40 | 28.40 2.69k |

| Lumax Inds | 2,526.45 | 2,651.00 | 124.55 175 |

| JITF Infralogis | 547.00 | 573.90 | 26.90 1.60k |

| Bonlon Industri | 34.89 | 36.60 | 1.71 1.27k |

| Kreon Fin Serv | 37.65 | 39.48 | 1.83 1 |

| Hardcastle | 493.00 | 516.80 | 23.80 344 |

-330

November 22, 2023· 13:59 IST

Sensex Today | Tata Technologies IPO subscribed 3.64 times on day 1, HNI portion booked 5.68 times

Tata Technologies’ Rs 3,042.51-crore IPO, the first public issue in over 20 years from the Tata Group, opened for subscription on November 22. The offer has been subscribed 3.64 times, with investors buying 16.37 crore equity shares against an offer size of 4.5 crore.

Retail investors had bid 3.13 times their quota of shares, while the portion set aside for high-networth individuals (HNIs) was subscribed 5.68 times and qualified institutional buyers (QIB) bid 2.78 times, the subscription data available with the exchanges showed.

The part set aside for employees of Tata Technologies was booked 0.65 times, while that of Tata Motors' shareholders was booked 4.98 times.

-330

November 22, 2023· 13:51 IST

Sensex Today | Motilal Oswal Financial Services View On Tata Technologies:

Motilal Oswal Financial Services like Tata Technologies and recommend Subscribe given its niche presence, strong parentage and strategic partnership with marquee clients.

This along with TTL’s focus on diversifying its offerings and clients, puts it in a sweet spot to tap huge outsourcing opportunity in ER&D space.

The IPO is attractively priced at 29x 1HFY24 P/E (on annualized basis) which is at a discount to its peers. Tata Group is coming with an IPO after a gap of 19 years, catching investors fancy and hence could see listing gains as well.

-330

November 22, 2023· 13:47 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Suzlon Energy | 37.32 -4.99 | 26.30m | 98.22 |

| SpiceJet | 42.55 5.69 | 14.28m | 60.23 |

| KPIT Tech | 1,455.25 -3.4 | 394.68k | 57.19 |

| Guj Mineral | 428.55 9.18 | 977.42k | 41.34 |

| Reliance Power | 20.87 -2.39 | 18.56m | 39.03 |

| Rattan Power | 9.13 -4.99 | 27.52m | 25.13 |

| Jaiprakash Pow | 13.23 -2.65 | 17.02m | 22.58 |

| Wardwizard Inno | 52.64 0.73 | 3.25m | 17.19 |

| KPR Mill | 890.25 3.98 | 174.56k | 15.80 |

| IEX | 141.85 -0.04 | 1.10m | 15.55 |

-330

November 22, 2023· 13:44 IST

Siddarth Pai, Founding Partner 3one4 Capital & Co-Chair of the Regulatory Affairs Committee, IVCA

The Securities and Exchange Board of India (SEBI) issued a circular on June 21, 2023 directing all Alternative Investment Funds (AIFs) to dematerialized their Units in a phased manner. AIFs above Rs 500Cr should demat their units by Nov 1, 2023 and other AIFs by April 30, 2024, with certain exceptions.The AIF Industry is happy to announce that out of 301 AIFS above Rs 500Cr, over 99% have obtained the International Securities Identification Numbers (ISINs from the Depositories. This was done due to concerted efforts by the Depositories, NSDL and CDSL and the AIF Industry bodies, Indian Venture and Alternate Capital Association (IVCA) and Private Equity Venture Capital Chief Financial Officer Association (PEVCCFOA).

The entire operating framework, manner of dematerialization and guidelines were done in consultation with industry and under the guidance of SEBI in a collaborative manner. Dematerialization will help increase the guardrails for Investor Protection and allow for easier onboarding and KYC of investors into AIFs.

IVCA expresses gratitude to SEBI for actively engaging with the industry through IVCA, PEVCCFOA, Depositories and other stakeholders for facilitating smooth implementation of the circular. PEVCCFOA would like to thank its members and IVCA for their efforts in ensuring this level of adherence. The consultative approach adopted by SEBI has driven the success of this endeavour.

-330

November 22, 2023· 13:39 IST

Sensex Today | Tata Technologies IPO subscribed 3.2 times on day 1, HNI portion booked 5 times

Tata Technologies’ Rs 3,042.51-crore IPO, the first public issue in over 20 years from the Tata Group, opened for subscription on November 22. The offer has been subscribed 3.21 times, with investors buying 14.43 crore equity shares against an offer size of 4.5 crore.

Retail investors had bid 2.83 times their quota of shares, while the portion set aside for high-networth individuals (HNIs) was subscribed 5.15 times and qualified institutional buyers (QIB) bid 2.19 times, the subscription data available with the exchanges showed.

The part set aside for employees of Tata Technologies was booked 0.59 times, while that of Tata Motors' shareholders was booked 4.47 times.

-330

November 22, 2023· 13:34 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Crompton Greave | 469.00 | 469.00 386.00 | 21.5% |

| Tube Investment | 3,600.00 | 3,660.00 3,177.55 | 13.29% |

| eClerx Services | 2,574.70 | 2,635.30 2,334.35 | 10.3% |

| Vardhman Text | 416.60 | 422.00 378.50 | 10.07% |

| Carborundum | 1,159.90 | 1,182.25 1,088.45 | 6.56% |

| Aegis Logistics | 326.75 | 330.05 307.00 | 6.43% |

| New India Assur | 173.80 | 177.60 164.00 | 5.98% |

| Hitachi Energy | 4,816.75 | 4,830.00 4,545.25 | 5.97% |

| Sterling Wilson | 314.80 | 314.80 299.50 | 5.11% |

| Rainbow Childre | 1,147.10 | 1,159.20 1,098.05 | 4.47% |

-330

November 22, 2023· 13:32 IST

Fedbank Financial Services IPO Day 1: Issue subscribed 24%, retail portion booked 42%

The Rs 1,092.26-crore IPO of Fedbank Financial Services was subscribed 24 percent on November 22, the first day of bidding, with bids coming in for 1.31 croe shares against the issue size of 5,59,23,660.

Retail investors bought 42 percent their quota of shares, non-institutional investors picked 11 percent times and qualified institutional buyers yet to be buyer.

-330

November 22, 2023· 13:28 IST

Stock Market LIVE Updates | KRChokey View on Anupam Rasayan India

The Company experienced muted revenue growth in this quarter because of a lack of demand from major clients in the export market and it is expected that there will be increased demand in the upcoming two quarters (H2FY24E) and sales will be aligned with the previous year.

Profitability margins had a slight dip due to an increase in operating expenses, where the guidance for EBITDA is around 26.0%-28.0%.

Currently, the stock is trading at PE multiples of 48.9x/33.6x based on FY24E/FY25E EPS estimates, respectively.

Broking firm estimate that the revenue will grow at 16.2% CAGR over FY23-FY25E and PAT will grow at 25.6% CAGR over FY23-FY25E with the pickup in the sales for the upcoming quarters and the Company can maintain a stable profitability margin.

It declined FY25E EPS by 20.4% from previous estimates as there was a drop in the margins in the current quarter, and arrive at a target price of Rs 990/share (P/E multiple of 35.7x to FY25E EPS) and downgrade rating to ACCUMULATE from BUY to factor the decline in EPS and the stock will provide an upside of 6.1%.

-330

November 22, 2023· 13:21 IST

Sensex Today | Gandhar Oil IPO booked 2.5 times; retail portion booked 3 times

State-run Gandhar Oil Refinery's Rs 198-crore initial public offering (IPO) was fully subscribed on day 1, with bids coming in for 5.38 crore shares as against a total of 2.12 crore offered shares.

The public issue was subscribed by a total of 2.53 times, with retail portion subscribed 3.18 times and non-institutional investors (NIIs) pat booked at 3 times.

However, qualified institutional buyers (QIBs) portion booked at 1 times on day 1.

-330

November 22, 2023· 13:17 IST

Sensex Today | BSE Power index up 1 percent led by CG Power, JSW Energy, Power Grid Corporation:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| CG Power | 469.00 | 19.99 | 734.76k |

| JSW Energy | 410.85 | 2.62 | 145.29k |

| Power Grid Corp | 211.60 | 1.29 | 212.38k |

| NTPC | 251.55 | 0.68 | 88.62k |

| NHPC | 54.36 | 0.04 | 1.88m |

| BHEL | 139.70 | 0.04 | 818.00k |

-330

November 22, 2023· 13:04 IST

Stock Market LIVE Updates | JK Tyre & Industries appoints Jorg Nohl as additional director

Dr Jorg Nohl has been appointed as an additional director in the category of lndependent director, for five consecutive years with effect from November 21, subject to requisite approval of the members of the company.

-330

November 22, 2023· 13:01 IST

Sensex Today | Market at 1 PM

The Sensex was down 165.73 points or 0.25 percent at 65,765.04, and the Nifty was down 45.60 points or 0.23 percent at 19,737.80. About 1228 shares advanced, 1899 shares declined, and 99 shares unchanged.

-330

November 22, 2023· 12:58 IST

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shigan Quantum | 109.00 | 103.10 | -5.90 587 |

| One Point One S | 54.50 | 51.90 | -2.60 241.38k |

| Emkay Taps | 650.00 | 622.00 | -28.00 1.13k |

| Pritika Auto | 30.55 | 29.25 | -1.30 107.09k |

| Srivasavi | 129.85 | 125.00 | -4.85 5.17k |

| Anup Eng | 2,878.40 | 2,775.05 | -103.35 603 |

| Frog Cellsat | 200.00 | 192.90 | -7.10 11.78k |

| DUGLOBAL | 40.95 | 39.55 | -1.40 6.29k |

| Tridhya Tech | 39.50 | 38.15 | -1.35 13.04k |

| Madhav Copper | 32.60 | 31.50 | -1.10 25.20k |

-330

November 22, 2023· 12:56 IST

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| CG Power | 396.70 | 469.35 | 72.65 998.34k |

| Tube Investment | 3,194.35 | 3,620.40 | 426.05 26.79k |

| Shanthi Gears | 457.25 | 506.75 | 49.50 1.27k |

| Carborundum | 1,094.30 | 1,158.90 | 64.60 8.73k |

| Securekloud Tec | 35.40 | 37.20 | 1.80 585 |

| Bharat Gears | 114.10 | 118.95 | 4.85 1.06k |

| Magnum Ventures | 47.75 | 49.30 | 1.55 885 |

| Starteck Financ | 223.80 | 230.95 | 7.15 2.17k |

| Infinium Pharma | 241.00 | 247.95 | 6.95 435 |

| Arihant Capital | 66.60 | 68.50 | 1.90 24.26k |

-330

November 22, 2023· 12:53 IST

Sensex Today | Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox:

The Banknifty is displaying weakness on its expiry day, exhibiting writing in 43600 CE, 43700 CE and 43800 CE. The highest OI stands in favor of CALL writers implying a sell on rise strategy.

On the downside, 43500 is acting as a support base; however, any dip below the same with the price staying under for 15 minutes may accelerate the selling pressure.

Aggressive traders may opt to go long in 43600 PE around 100, holding 40 as a support base and aiming for 170 – 200 levels.

Technically, the 200-simple moving average (SMA) located at 43300 shall provide crucial support for any major selling pressure. On the upside, Banknifty must deliver a robust close over 44500 to recoup the losing bias.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,470.00 | -2.13 | 1.78m |

| PNB | 76.55 | -1.92 | 18.72m |

| IDFC First Bank | 83.20 | -1.65 | 13.80m |

| Kotak Mahindra | 1,743.25 | -1.36 | 2.52m |

| Bank of Baroda | 193.70 | -1.05 | 10.01m |

| ICICI Bank | 917.00 | -0.98 | 5.55m |

| Bandhan Bank | 212.35 | -0.72 | 5.84m |

| SBI | 557.50 | -0.71 | 6.72m |

| AU Small Financ | 714.75 | -0.7 | 840.93k |

| Federal Bank | 145.85 | -0.58 | 4.13m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axis Bank | 993.10 | 0.13 | 3.37m |

-330

November 22, 2023· 12:50 IST

Sensex Today | Flair Writing IPO Day 1: Issue subscribed 0.71 times, retail portion booked 1.1 times

Flair Writing Industries’ Rs 593-crore IPO had been subscribed 0.71 times by noon on November 22, the first day of bidding, with bids coming in for 1.01 crore shares against the issue size of 1.44 crore. Retail investors bought 1.1 times their allotted quota, while non-institutional investors picked 0.73 times the shares set aside for them.

The company mobilised Rs 177.9 crore from investors through its anchor book on November 21. Marquee names like Theleme India Master Fund, Natixis International Funds, Troo Capital, Winro Commerical, SBI Mutual Fund, HDFC Mutual Fund, Kotak Mahindra Trustee, Aditya Birla Sun Life Trustee, Tata Mutual Fund, Mirae Asset Mutual Fund, ICICI Prudential Life Insurance Company, and Carnelian Structure Shift Fund invested in the company via anchor book. Read More

-330

November 22, 2023· 12:48 IST

Stock Market LIVE Updates | PFC Consulting incorporates SPV for developing intra-state transmission system in West Bengal

Power Finance Corporation said its subsidiary PFC Consulting has incorporated wholly owned subsidiary (special purpose vehicle - SPV) namely Ramakanali B Panagarh Transmission for developing the intra-state transmission system at Ramakanali and Panagarh along with associated transmission line.

-330

November 22, 2023· 12:44 IST

Sensex Today | Gandhar Oil IPO sails through on Day 1, fully booked at 1.7x led by retail investors and NIIs

State-run Gandhar Oil Refinery's 198-crore initial public offering (IPO) was fully subscribed on day 1, with bids coming in for 37 million shares as against a total of 21 million offered shares.

The public issue was subscribed by a total of 1.8 times (x) led by retail and non-institutional investors (NIIs), as of 12:30 pm. While NIIs booked 2.32x of the public issue, retail investors booked 2.58x, data suggested.

However, no interest sparked among qualified institutional buyers (QIBs) on day 1 of the IPO subscription, showed data.

-330

November 22, 2023· 12:39 IST

-330

November 22, 2023· 12:33 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Suzlon Energy | 37.32 -4.99 | 22.84m | 85.30 |

| Yes Bank | 19.12 -3.14 | 27.77m | 53.96 |

| KPIT Tech | 1,431.00 -5.01 | 348.90k | 50.58 |

| Hero Motocorp | 3,399.05 0.6 | 130.24k | 44.52 |

| Vodafone Idea | 13.43 -3.03 | 27.41m | 37.20 |

| SJVN | 80.84 -0.85 | 4.22m | 34.45 |

| Zomato | 115.60 -0.77 | 2.31m | 26.80 |

| IRFC | 75.61 -1.68 | 3.30m | 25.37 |

| TCS | 3,506.00 -0.12 | 66.41k | 23.25 |

| CG Power | 469.00 19.99 | 408.97k | 18.19 |

-330

November 22, 2023· 12:26 IST

Stock Market LIVE Updates | Sharekhan View on Bosch:

Post reporting below-expected operational performance in Q2FY2024, management hopes for a healthy recovery across segments during the festive season along with

recovery in exports.

Broking firm believe steady growth in the CV segment along with implementation of new emission norms would improve content per vehicle and gradually increase capex to support its EBITDA margin expansion on the shift in opex to capex in the medium term.

The company’s strong brand positioning, focus on technology, and electrification of vehicles will enable its high-growth visibility. Given its technological expertise and support from its parent, Sharekhan continue to believe Bosch would be a key beneficiary of the implementation of stringent emission norms in the domestic automotive market as the increase in complexity offers it an opportunity to enhance its content per vehicle.

Gradually Bosch has been emerging as the preferred complete power train solution provider for OEMs. This enables for a regular order inflow and visibility of business. The company’s strong brand positioning, focus on technology, and electrification of vehicles will enable its high growth visibility.

Maintain Buy rating on the stock with a revised price target (PT) of Rs 23,692 on expectation of rise in localisation, increased content per vehicle, and emerging opportunity in alternative power train.

-330

November 22, 2023· 12:17 IST

Stock Market LIVE Updates | Genus Power Infrastructures incorporates 2 SPVs for execution of advanced metering infrastructure service provider contract

Genus Power Infrastructures has incorporated two wholly-owned step-down subsidiaries, namely Himachal Pradesh C Zone Smart Metering, and Garhwal Smart Metering, as special purpose vehicle (SPV) for execution of advanced metering infrastructure service provider (AMISP) contract.

-330

November 22, 2023· 12:11 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| GV Films | 485973 | 0.47 | 0.02 |

| PMC Fincorp | 200000 | 2.77 | 0.06 |

| Axis Bank | 10500 | 990.9 | 1.04 |

| GTL Infra | 480333 | 1.07 | 0.05 |

| GTL Infra | 1000000 | 1.07 | 0.11 |

| Hero Motocorp | 60465 | 3424.85 | 20.71 |

| Hindalco | 39752 | 503 | 2 |

| Vodafone Idea | 220890 | 13.62 | 0.3 |

| Zomato | 102593 | 117.6 | 1.21 |

| Rajnish Wellnes | 330000 | 10.63 | 0.35 |

-330

November 22, 2023· 12:08 IST

Stock Market LIVE Updates | CG Power files application with IT Ministry seeking approval to set up OSAT facility

CG Power and Industrial Solutions has today filed an application with Ministry of Electronics and Information Technology (MeitY), Government of India seeking approval to set up an Outsourced Semiconductor Assembly and Test (OSAT) facility and the grant of subsidy for the said project under the Modified scheme for setting up of Compound Semiconductors / Silicon Photonics / Sensors Fab/ Discrete Semiconductors Fab and Semiconductor Assembly, Testing, Marking and Packaging (ATMP)/ Outsourced Semiconductor Assembly and Test (OSAT) facilities in India.

-330

November 22, 2023· 12:05 IST

Sensex Today | Flair Writing Industries IPO issue subscribed 0.7%, Retail investors buys 1 times on Day 1

The initial public offer (IPO) of Flair Writing Industries was subscribed 69 percent times on November 22, the first day of bidding, with bids coming in for 98.75 lakh shares against the issue size of 1.44 crore.

Retail investors bought 1 times their quota of shares, non-institutional investors picked 0.70 percent, while qualified institutional yet to pick any stake.

-330

November 22, 2023· 12:00 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Classic Filamen | 39.36 | 35.97 | -3.39 124 |

| Ashnoor Text | 62.89 | 58.05 | -4.84 3.07k |

| Softsol India | 237.90 | 220.00 | -17.90 313 |

| Modern Home | 32.80 | 30.44 | -2.36 1.96k |

| Nutech Global | 37.50 | 35.00 | -2.50 1.01k |

| Sanblue Corp | 35.00 | 32.80 | -2.20 22 |

| Mercury Ev-Tech | 81.80 | 76.75 | -5.05 773.63k |

| Blue Cloud | 83.87 | 79.10 | -4.77 2.60k |

| Incap | 48.00 | 45.31 | -2.69 127 |

| Ausom Enterp | 70.84 | 67.00 | -3.84 38 |

-330

November 22, 2023· 11:59 IST

Sensex Today | Fedbank Financial Services IPO sees 16% subscription on Day 1

The non-banking financial services company Fedbank Financial Services' initial public offering (IPO) was subscribed 16 percent on November 22, the first day of bidding, with bids coming in for 91.85 crore shares against the issue size of 5.59 crore.

Retail investors bought 30 percent of their quota, non-institutional investors picked only 7 percent, while qualified institutional buyers yet to pick any.

The employee portion seen subscription of 15 percent of their reserved portion.

The company has mopped up Rs 324.68 crore through its anchor book on November 21. The price band for the offer has been fixed at Rs 133-140 per share.

-330

November 22, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ceeta Industrie | 30.00 | 32.97 | 2.97 51 |

| Nakoda Group | 39.61 | 43.30 | 3.69 775 |

| Sainik Finance | 32.54 | 35.50 | 2.96 24 |

| Objectone Info | 18.54 | 20.18 | 1.64 19.77k |

| ACCEDERE | 62.03 | 67.39 | 5.36 126 |

| Longview Tea | 25.09 | 27.00 | 1.91 9 |

| Shristi Infra | 26.02 | 28.00 | 1.98 1 |

| Roopa Ind | 46.26 | 49.54 | 3.28 694 |

| Anik Industries | 49.50 | 53.00 | 3.50 6.99k |

| Titan Biotech | 410.05 | 437.80 | 27.75 6.88k |

-330

November 22, 2023· 11:53 IST

Sensex Today | IREDA IPO issue subscribed 2.83 times, QIB portion booked 1.35 times on Day 2

The initial public offer (IPO) of Indian Renewable Energy Development Agency (IREDA) was subscribed 2.83 times on November 22, the second day of bidding, with bids coming in for 133 crore shares against the issue size of 47.09 crore.

Retail investors bought 2.94 times their quota of shares, non-institutional investors picked 4.56 times and qualified institutional buyers bid 1.35 times their allotted portion.

The 67.19-crore-share initial public offering comprises a fresh issue of 40.32 crore shares and an offer-for-sale of 26.88 crore shares by the government of India.

-330

November 22, 2023· 11:50 IST

Sesnex Today | Tata Technologies IPO subscribed 1.88 times, HNI portion booked 2.6 times

Tata Technologies’ Rs 3,042.51-crore IPO, the first public issue in over 20 years from the Tata Group, opened for subscription on November 22. Within hours, the offer had been subscribed 1.88 times, with investors buying 8.44 crore equity shares against an offer size of 4.5 crore.

Retail investors had bid 1.56 times their quota of shares, while the portion set aside for high-networth individuals (HNIs) was subscribed 2.62 times and qualified institutional buyers (QIB) bid 1.98 times, the subscription data available with the exchanges showed.

The part set aside for employees of Tata Technologies was booked 0.28 times, while that of Tata Motors' shareholders was booked 2.25 times.

The Pune-based global engineering services company has reserved 20.28 lakh shares for its employees and 60.85 lakh for the shareholders of Tata Motors, the promoter. The IPO excluding the reserved portion of employees and shareholders is the net issue.

-330

November 22, 2023· 11:49 IST

Sensex Today | Nifty Bank index down 0.7 percent dragged by IndusInd Bank, IDFC First Bank, Kotak Mahindra Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,480.05 | -1.46 | 1.27m |

| IDFC First Bank | 83.45 | -1.36 | 10.47m |

| Kotak Mahindra | 1,744.35 | -1.29 | 1.84m |

| AU Small Financ | 710.50 | -1.29 | 578.45k |

| PNB | 77.30 | -0.96 | 10.87m |

| ICICI Bank | 918.25 | -0.85 | 3.80m |

| HDFC Bank | 1,509.05 | -0.59 | 4.30m |

| Bandhan Bank | 213.20 | -0.33 | 4.69m |

| Bank of Baroda | 195.25 | -0.26 | 6.14m |

| SBI | 560.70 | -0.14 | 4.36m |

-330

November 22, 2023· 11:48 IST

Sensex Today | Colin Shah, MD, Kama Jewelry:

It’s a welcome move for the jewellery manufacturers with revenue of below 25 crores and are holders of TRQ (tariff rate quote) licence holders. This will strengthen them to import gold from UAE under the FTA, and empower them to export finished products to other international markets, ultimately playing a role of a coveted contributory towards the Indian economy.

The details on the SOPs are still awaited. However, with the ongoing geo-political situation, it is important to keep a check on demand trajectory to avoid pile-up of the inventory. Having said that, the domestic demand was robust during the festive sales and will continue to strengthen with onset of the wedding season.

-330

November 22, 2023· 11:46 IST

Stock Market LIVE Updates | Motilal Oswal View on UltraTech Cement:

Broking firm estimate company's consolidated volume to report ~10% CAGR over FY23-26 and EBITDA/t at Rs 1,110/Rs 1,210/Rs 1280 in FY24/FY25/FY26 versus Rs 1,005 in FY23 (EBITDA/t was at Rs 1,225 in FY22).

Company's net debt increased to Rs 49 billion as of Sep’23 from Rs 27 billion in Mar’22, due to higher capex and dividend payout. However, estimate its net debt to reduce in 2HFY24 due to improvement in profitability and reduction in working capital.

The company has been generating strong cash flows (estimated cumulative OCF at Rs 406 billion over FY23-26), which will support its robust capex plan.

The stock trades at 15.5x/13.0x FY25E/FY26E EV/EBITDA and value the stock at 16x Sep’25E EV/EBITDA to arrive at Target Price of Rs10,100. Maintain BUY rating on the stock.

-330

November 22, 2023· 11:37 IST

Stock Market LIVE Updates | Industrial manufacturing poised for breakout; ABB India a top pick

Technical charts indicate a recovery in the industrial manufacturing sector after the underperformance in the previous month, with the overall structure remaining robust. A standout stock in the sector, poised for outperformance, is ABB India. READ MORE

-330

November 22, 2023· 11:30 IST

Stock Market LIVE Updates | Wipro inks pact with NVIDIA for AI in healthcare

-330

November 22, 2023· 11:26 IST

Stock Market LIVE Updates | Morgan Stanley 'overweight' on Interglobe Aviation, shares target price of Rs 3,217 per share

Morgan Stanley said that the near-term demand and airfare trends remain supportive. "We maintain that IndiGo would be a beneficiary of the industry consolidation. IndiGo's valuation appears attractive as it trades at 7.3 times (x) EV EBITDA against pre-Covid mean of 8.5x," the brokerage firm added.

-330

November 22, 2023· 11:19 IST

Stock Market LIVE Updates | Power Finance arm incorporates SPV; shares erase morning gains

Power Finance shares gained one percent in early trade, but erased all its morning wins on November 22. The power financier’s subsidiary PFC Consulting Limited incorporated a new special purpose vehicle (SPV) for developing an intra-state transmission system.

PFC Consulting has been nominated as the 'Bid Process Coordinator' (BPC). The firm will select developers through tariff-based competitive bidding for the Independent Transmission Projects (ITPs) by the Ministry of Power. Read More

-330

November 22, 2023· 11:13 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Cipla | 1283.55 | 1283.55 | 1,275.40 |

| Hero Motocorp | 3427.70 | 3427.70 | 3,418.05 |

| Titan Company | 3429.00 | 3429.00 | 3,421.00 |

| Sun Pharma | 1214.80 | 1214.80 | 1,209.65 |

| Bajaj Auto | 5722.45 | 5722.45 | 5,718.15 |

-330

November 22, 2023· 11:04 IST

Sensex Today | Tata Technologies IPO subscribed 0.25 times, HNI portion booked 0.48 times

Tata Technologies’ Rs 3,042.51-crore IPO, the first public issue in over 20 years from the Tata Group, opened for subscription on November 22. Within hours, the offer had been subscribed 0.25 times, with investors buying 1.1 crore equity shares against an offer size of 4.5 crore.

Retail investors had bid 0.28 times their quota of shares, while the portion set aside for high-networth individuals (HNIs) was subscribed 0.48 times, the subscription data available with the exchanges showed.

The part set aside for employees of Tata Technologies was booked 0.03 times, while that of Tata Motors' shareholders was booked 0.33 times. Read More

-330

November 22, 2023· 11:00 IST

Sensex Today | Market at 11 AM

The Sensex was up 53.31 points or 0.08 percent at 65,984.08, and the Nifty was up 19.90 points or 0.10 percent at 19,803.30. About 1609 shares advanced, 1409 shares declined, and 116 shares unchanged.

-330

November 22, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| OK Play | 164.30 | 149.30 | -15.00 11.64k |

| Sainik Finance | 35.80 | 32.54 | -3.26 63 |

| Rita F&L | 23.00 | 21.15 | -1.85 300 |

| Ravi Leela Gran | 37.97 | 35.00 | -2.97 1 |

| Deco Mica | 75.90 | 70.00 | -5.90 121 |

| Shristi Infra | 28.20 | 26.02 | -2.18 650 |

| Roopa Ind | 49.84 | 46.26 | -3.58 51 |

| Bhilwara Spin | 74.75 | 69.71 | -5.04 0 |

| PH CAPITAL | 91.45 | 85.71 | -5.74 439 |

| Chemtech Ind | 58.96 | 55.83 | -3.13 4.33k |

-330

November 22, 2023· 10:54 IST

| Company | Price at 10:00 | Price at 10:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Panchmahal Stee | 136.00 | 155.15 | 19.15 292 |

| Coral India Fin | 46.26 | 51.35 | 5.09 1.63k |

| Indo Cotspin | 34.30 | 37.73 | 3.43 0 |

| Silver Oak | 52.16 | 56.78 | 4.62 5 |

| IP Rings | 155.65 | 168.50 | 12.85 20.95k |

| Technopack | 80.01 | 86.50 | 6.49 14.00k |

| Starlog Enter | 32.50 | 34.89 | 2.39 1.32k |

| Guj Mineral | 395.30 | 423.80 | 28.50 51.69k |

| Titan Secu | 23.60 | 25.25 | 1.65 3.43k |

| CM | 26.65 | 28.50 | 1.85 901 |

-330

November 22, 2023· 10:51 IST

-330

November 22, 2023· 10:48 IST

Stock Market LIVE Updates | Morgan Stanley View On Interglobe Aviation:

-Overweight call, target Rs 3,217 per share

-Near-term demand & airfare trends remain supportive

-Maintain that airline will be a beneficiary of industry consolidation

-Valuation at 7.3x EV EBITDA against pre-COVID median of 8.5x appears attractive

-330

November 22, 2023· 10:43 IST

-330

November 22, 2023· 10:39 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19811.20 0.14 | 9.42 0.69 | 1.37 8.59 |

| NIFTY BANK | 43543.50 -0.33 | 1.30 -1.49 | -0.41 2.56 |

| NIFTY Midcap 100 | 41905.45 0.05 | 32.99 1.21 | 5.08 34.87 |

| NIFTY Smallcap 100 | 13795.45 -0.45 | 41.76 0.04 | 6.71 43.11 |

| NIFTY NEXT 50 | 46797.40 0.17 | 10.93 0.80 | 5.05 10.18 |

-330

November 22, 2023· 10:36 IST

Stock Market LIVE Updates | GMR Power stock jumps 5% on additional stake acquisition in GMR Energy

Shares of GMR Power and Urban Infrastructure rallied 5 percent to Rs 42 per share on November 22 after the company acquired an additional 29.2 percent stake in subsidiary - GMR Energy. The S&P BSE Sensex was trading mildly in green at 66,011 levels, as of 9:50 am.

In an exchange filing dated November 22, the current acquisition consolidates the existing stake of GMR Power in GMR Energy from 57.7 percent, held by itself and its subsidiaries, to about 86.9 percent. Read More

-330

November 22, 2023· 10:31 IST

-330

November 22, 2023· 10:28 IST

Sensex Today | BSE Realty Index down nearly 1 percent dragged by Phoenix Mills, Oberoi Realty, Brigade Enterprises:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 2,192.40 | -2.42 | 2.82k |

| Oberoi Realty | 1,378.00 | -2.01 | 26.06k |

| Brigade Ent | 736.00 | -1.6 | 1.15k |

| Godrej Prop | 1,873.00 | -1 | 3.88k |

| Macrotech Dev | 854.35 | -0.81 | 17.89k |

| DLF | 630.35 | -0.72 | 19.98k |

-330

November 22, 2023· 10:24 IST

Stock Market LIVE Updates | Texmaco Rail launches QIP, to raise Rs 750 crore

Texmaco Rail & Engineering launched its qualified institutions placement (QIP) issue on November 21. The floor price for the issue has been fixed at Rs 135.90 per share. The meeting of the Board of Directors will be held on November 24 to consider the issue price, including a discount if any.

-330

November 22, 2023· 10:19 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,517.80 -0.01 | 2.70m | 409.34 |

| Reliance | 2,388.00 0.38 | 1.57m | 374.54 |

| TCS | 3,514.40 0.12 | 630.09k | 220.42 |

| Kotak Mahindra | 1,755.85 -0.64 | 1.25m | 219.71 |

| BPCL | 399.45 2.95 | 5.16m | 205.76 |

| ICICI Bank | 922.05 -0.44 | 2.22m | 205.06 |

| Tata Motors | 682.50 0.12 | 2.47m | 169.20 |

| Axis Bank | 994.50 0.27 | 1.63m | 161.59 |

| SBI | 563.25 0.31 | 2.54m | 143.04 |

| Bajaj Finance | 7,101.50 -0.02 | 199.07k | 141.29 |

-330

November 22, 2023· 10:16 IST

Stock Market LIVE Updates | Ritco Logistics to consider allotment of convertible share warrants

Ritco Logistics said the Board of Directors will be meeting on November 24 to consider the allotment of the convertible share warrants issued on preferential basis.

-330

November 22, 2023· 10:10 IST

Stock Market LIVE Updates | Texmaco Rail launches Rs 750-crore QIP issue, shares may extend rally

Shares of Texmaco Rail may extend previous session rally on November 22 as the company has launched its Qualified Institutional Placement (QIP) to raise Rs 750 crore at a floor price Rs 135.90 a share. The issue also includes a green shoe option of Rs 200 crore.

Qualified institutional placements are a way to issue shares to the public without going through standard regulatory compliance. Qualified institutional buyers (QIBs) are the only entities allowed to purchase QIPs. Green shoe option typically allows underwriters to sell more shares than the original issue amount. Read More

-330

November 22, 2023· 10:08 IST

-330

November 22, 2023· 10:05 IST

Sensex Today | Market at 11 AM

The Sensex was up 94.49 points or 0.14 percent at 66,025.26, and the Nifty was up 31.40 points or 0.16 percent at 19,814.80. About 1736 shares advanced, 1148 shares declined, and 117 shares unchanged.

-330

November 22, 2023· 10:00 IST

Stock Market LIVE Updates | Jio Financial seeks RBI nod to convert from NBFC to CIC

Jio Financial Services, the demerged entity of Reliance Industries, has submitted an application to the Reserve Bank of India (RBI) for converting to a core investment company (CIC) from a non-banking financial company (NBFC) following a regulatory mandate.

In an exchange filing dated November 21, the company notified that it submitted an application for conversation to CIC from NBFC to change its shareholding pattern and control after demerger from Reliance Industries, as per the RBI mandate. Read More

-330

November 22, 2023· 09:58 IST

| Company | Price at 09:00 | Price at 09:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| DYNPROPP | 450.00 | 149.50 | -300.50 - |

| DRC Systems | 66.95 | 61.60 | -5.35 2.27k |

| Ambani Organics | 133.85 | 127.15 | -6.70 500 |

| Orient Green | 21.95 | 20.85 | -1.10 811.38k |

| Apollo Micro Sy | 139.00 | 132.05 | -6.95 23.73k |

| A G Universal | 87.95 | 83.55 | -4.40 1000 |

| Bohra Industrie | 44.05 | 41.85 | -2.20 12 |

| Suzlon Energy | 39.30 | 37.35 | -1.95 5.18m |

| SEPC | 21.65 | 20.60 | -1.05 75.07k |

| Poddar Housing | 148.15 | 141.20 | -6.95 0 |

-330

November 22, 2023· 09:58 IST

| Company | Price at 09:00 | Price at 09:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kesoram Ind PP | 5.00 | 28.40 | 23.40 - |

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Bharat Gears RE | 103.25 | 172.05 | 68.80 - |

| Genesys Int | 309.15 | 355.55 | 46.40 2.53k |

| Global Vectra | 91.95 | 103.00 | 11.05 9.91k |

| Emkay Global | 106.35 | 118.15 | 11.80 9.22k |

| Dhunseri Invest | 1,216.70 | 1,349.90 | 133.20 14.55k |

| North Eastern | 29.35 | 32.50 | 3.15 363.52k |

| Compucom Soft | 24.10 | 26.60 | 2.50 9.09k |

| Nitin Spinners | 317.25 | 349.85 | 32.60 30.32k |

-330

November 22, 2023· 09:54 IST

Stock Market LIVE Updates | LIC raises stake over 5% in Bank of Baroda

Life Insurance Corporation of India has increased its stake in Bank of Baroda to over 5%. LIC bought 24.39 lakh shares in the bank, taking the total stake to 5.031%, against 4.984% earlier.

-330

November 22, 2023· 09:51 IST

Sensex Today | Geojit View on Tata Technologies IPO

At the upper price band of Rs 500, Tata Technologies is available at P/E of 28.8x (FY24E annualised EPS), which appears to be reasonably priced compared to peers. Its strong brand legacy, extensive automotive expertise, diversified global presence and strategic partnership with industry leaders provide a distinct advantage that aligns well with its growth ambitions. Hence, assign a “Subscribe” rating on a medium to long-term basis.

-330

November 22, 2023· 09:49 IST

Sensex Today | Nifty Pharma index up 1 percent led by Cipla, Biocon, Alkem Lab:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cipla | 1,277.85 | 1.96 | 445.91k |

| Biocon | 237.10 | 1.45 | 534.33k |

| Alkem Lab | 4,549.15 | 1.36 | 101.20k |

| Dr Reddys Labs | 5,705.00 | 1.04 | 63.46k |

| Zydus Life | 645.15 | 0.95 | 87.25k |

| Sun Pharma | 1,208.10 | 0.56 | 221.98k |

| Lupin | 1,228.25 | 0.55 | 190.87k |

| Torrent Pharma | 2,130.85 | 0.53 | 20.88k |

| Aurobindo Pharm | 1,031.10 | 0.37 | 388.93k |

| Divis Labs | 3,735.50 | 0.37 | 73.13k |

-330

November 22, 2023· 09:45 IST

Stock Market LIVE Updates | State GST Officer imposes a penalty of Rs 1 lakh on Colgate Palmolive after search operations at Chennai warehouse

The State Goods and Service Tax Officer has conducted a search at Chennai Warehouse of Colgate Palmolive during November 16-17. The business operations of the company continued as usual. The penalty of Rs 1 lakh was levied for minor procedural non-compliance under Section 125 of CGST Act and SGST Act and is not specific to any suppression or willful misstatement done by the company.

-330

November 22, 2023· 09:43 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| SRG Housing Fin | 289.85 9.5% | 50.44k 2,669.60 | 1,790.00 |

| Genesys Int | 355.00 14.83% | 598.33k 33,604.00 | 1,681.00 |

| Nitin Spinners | 350.45 10.46% | 1.28m 196,076.80 | 550.00 |

| Euro Panel | 187.00 10.98% | 42.00k 8,000.00 | 425.00 |

| Global Vectra | 103.80 12.89% | 182.92k 38,109.20 | 380.00 |

| Aegis Logistics | 325.20 3.91% | 1.55m 379,159.20 | 308.00 |

| Vardhman Text | 410.00 6.72% | 838.90k 241,790.60 | 247.00 |

| KPR Mill | 910.90 6.46% | 1.62m 493,594.20 | 229.00 |

| 21st Cen Mgt | 21.70 1.88% | 12.77k 3,965.80 | 222.00 |

| Dhunseri Invest | 1,351.40 11.07% | 99.68k 32,175.80 | 210.00 |

-330

November 22, 2023· 09:42 IST

-330

November 22, 2023· 09:39 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The uptrend in the market is intact with global support coming from the easing US bond yields. The US 10-year bond yield at 4 percent is a strong pillar of support for equity markets.

Resilience in large-caps like RIL, Bharti and HDFC Bank can continue to support the uptrend. An important market technique is that the daily market range is getting narrower. This may preclude sharp moves in the market. Today the focus of the market will be on the opening of the four IPOs. Lot of money is likely to go into the high quality Tata Technology IPO. Investors can continue to accumulate high quality large-caps, particularly in banking and autos where the margin of safety is high.