Closing Bell: Sensex tanks 750 pts, Nifty closes below 24,550; Q1 results drag Ultratech, BPCL 3-4%, lifts Infosys 2%

-330

July 19, 2024· 15:54 IST

Avdhut Bagkar Technical and Derivatives Analyst, StoxBox

Indian shares traded lower on Friday due to weak global market cues and fears of new U.S.-China trade tensions. Despite opening at record highs, the Nifty 50 and Sensex quickly slipped into the red and fell sharply later in the session. India's benchmark stock indices ended their rally by hitting downward trends after a fresh record high for the fourth consecutive session on Friday. Sectors like Metal, Auto, Financial Services, and Energy saw significant declines. Brokerages' Stocks Fall As Microsoft Outage Impacts Operation. On the stock-specific front, Infosys shares rose after posting better-than-expected Q1 FY25 results and raising its FY25 revenue growth forecast to 3-4%. Other top gainers included Asian Paints, LTIMindtree, and Titan Company. In contrast, Persistent Systems fell nearly 7% after its Q1 profit missed estimates.

The benchmark index initially opened 52 points higher but quickly faced selling pressure. After reaching a peak of 24854, it dropped over 100 points in the first few minutes of trading, accompanied by high volume, setting the tone for the day. The index continued to trend lower as selling pressure intensified, closing 269 points lower. Despite a significant correction and adverse market and momentum breadth, the index showed resilience by not dropping below the prior day’s low and closing above the psychological mark of 24500. Going forward, it will be crucial for the index to maintain support in the range of 24500-24200 to sustain bullish momentum.

-330

July 19, 2024· 15:49 IST

Riya Singh – Research Analyst, Commodities and Currency , Emkay Global

Gold and silver prices experienced a sharp decline following the sentiment that the anticipated bullish phase might have occurred earlier than expected, leading to profit-taking. A recent slowdown in seasonal demand could exert downward pressure on prices if ETF flows do not persist or if tactical investors retreat due to high prices. U.S. data revealed the largest increase in initial jobless claims since early May, indicating a cooling labor market. This development supports a potential rate cut by the Federal Reserve in September. Despite the recent dip, gold remains nearly 20% higher, and silver over 15% higher since the beginning of the year. Additionally, uncertainty in the U.S. political landscape is contributing to short-term volatility. This temporary decline is seen as a necessary adjustment, providing central bankers an opportunity to regain purchase traction. For Gold support is placed at $2385 - $2350 whereas for silver it is at $29. - $28.85

On the other hand, oil prices have continued to decline, influenced by weak demand from China and pressure from a stronger dollar. China's economy grew at a much slower pace than expected in the second quarter, countering the narrative of tight supply. However, the significant drawdown in U.S. stockpiles and improved compliance with production cuts by OPEC members are expected to keep the market undersupplied by more than a million barrels, thereby providing support for crude oil prices. West Texas Intermediate (WTI) prices are expected to find support around $78 to $80 per barrel.

Meanwhile, the USD/INR is trading at an all-time low due to a stronger dollar and widespread weakness across Asian currencies. According to the latest bulletin released by the Reserve Bank of India (RBI), the central bank purchased $4.2 billion of forex. Additionally, the market is closely monitoring the Union budget for FY 2024-25, to be held on July 23rd, for a clearer picture of economic growth. Earlier this week, the International Monetary Fund (IMF) raised India's growth projection from 6.8% to 7%. The rupee is expected to respect the resistance of 83.75 – 83.85 levels, with a potential retracement to the 83.50 level.

-330

July 19, 2024· 15:42 IST

Parth Nyati, Founder, Tradingo

An Anti-virus Crowdstrike faced a technical glitch after an update that affected the Microsoft servers and PCs where this anti-virus was installed. This anti-virus is also installed on Microsoft servers provided by Azure as a part of their cloud infrastructure. Azure accounts for 25% market share amongst cloud services. Hence a lot of large organizations, airlines, stock exchanges globally who use Azure had technical glitches. The Crowdstrike team is currently working to resolve the issue.

-330

July 19, 2024· 15:42 IST

Wipro Q1 net profit rises to Rs 3,003 crore, beats estimates

Wipro Ltd on 19 July reported its Q1 FY25 net profit rose from a year ago to Rs 3,003 crore, beating market expectations. The IT company’s April-June consolidated revenue fell to Rs 21,964 crore.

A Moneycontrol poll of brokerage estimates had pegged Wipro’s fiscal first quarter net profit to rise to Rs 2,953 crore, and revenue to fall to Rs 22,229 crore.

-330

July 19, 2024· 15:36 IST

Rupee close

Rupee ends at record low of 83.66/$ against the US dollar, lower than Thursday’s close of 83.65/$

-330

July 19, 2024· 15:31 IST

Market close

Profit booking seeped across the market ahead of the Union Budget 2024, to be tabled on July 23. Caution ahead of the event also triggered a bout of strong profit booking, pulling all major indices down in the red.

At close, the Sensex was down 755.48 points or 0.93 percent at 80,587.98, and the Nifty was down 275.20 points or 1.11 percent at 24,525.60. About 756 shares advanced, 2618 shares declined, and 74 shares unchanged.

All sectors witnessed selling and ended with losses.

-330

July 19, 2024· 15:27 IST

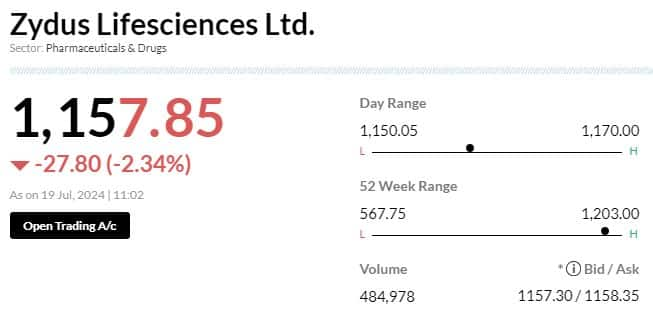

Stock Market LIVE Updates | US FDA issues 2 observations for Zydus Life's transdermal mfg site at SEZ in Ahmedabad

-330

July 19, 2024· 15:19 IST

Stock Market LIVE Updates | Metal stocks crack under pressure; JSW Steel, Tata Steel, Hindalco slump 4-5%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NMDC | 229.68 | -5.05 | 10.14m |

| Tata Steel | 158.18 | -4.92 | 67.59m |

| JSW Steel | 891.30 | -4.31 | 2.45m |

| Jindal Steel | 948.65 | -4.17 | 2.68m |

| Hindalco | 662.85 | -3.93 | 5.15m |

| MOIL | 489.00 | -3.9 | 1.39m |

| SAIL | 142.97 | -3.33 | 28.98m |

| Coal India | 489.65 | -3.09 | 8.82m |

| Welspun Corp | 633.20 | -2.94 | 754.74k |

| NALCO | 187.16 | -2.65 | 17.14m |

-330

July 19, 2024· 15:13 IST

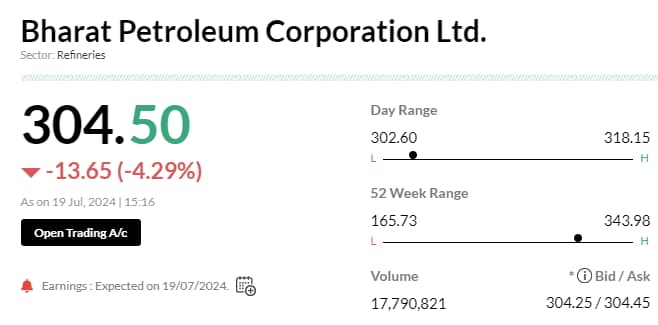

Stock Market LIVE Updates | BPCL Q1 net profit falls 29% to Rs 3,015 crore

#1 Net Profit down 28.6% At Rs 3,015 Cr Vs Rs 4,224 Cr (QoQ)

#2 Revenue down 2.6% At Rs 1.13 Lk Cr Vs Rs 1.16 Lk Cr (QoQ)

#3 EBITDA falls 38.7% At Rs 5,650 Cr Vs Rs 9,211 Cr (QoQ)

#4 Margin At 5% Vs 8% (QoQ)

-330

July 19, 2024· 15:04 IST

Markets@3 PM | Indices at day's low; Sensex drops 680 pts, Nifty breaks 24,550

| Company | CMP Chg(%) | F.F MarketCap (Rs cr) | Contribution |

|---|---|---|---|

| Infosys | 1,793.55 2.02% | 632,984 | 1248.97 |

| ITC | 474.2 0.84% | 414,788 | 344.43 |

| Asian Paints | 2,946.2 0.5% | 141,299 | 70.04 |

| LTIMindtree | 5,768.35 0.2% | 170,843 | 33.81 |

| Britannia | 5,878.95 0.13% | 141,605 | 17.89 |

| HCL Tech | 1,593.95 -0.04% | 173,017 | -6.49 |

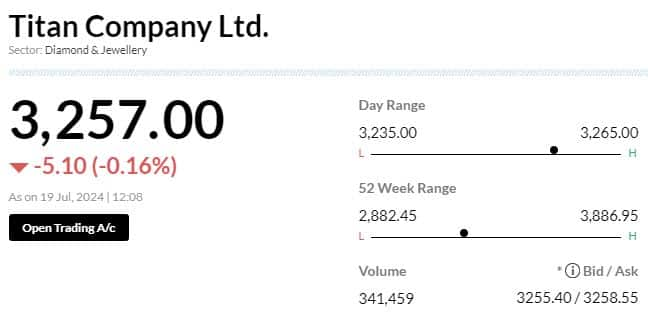

| Titan Company | 3,260.7 -0.04% | 289,480 | -12.39 |

| ICICI Bank | 1,249.9 -0.03% | 879,692 | -28.06 |

| Dr Reddys Labs | 6,634.55 -0.49% | 83,013 | -41.1 |

| Kotak Mahindra | 1,822.45 -0.24% | 181,162 | -42.61 |

-330

July 19, 2024· 14:53 IST

Stock Market LIVE Updates | UltraTech reports Q1 net profit at Rs 1,695 cr

UltraTech Cement reported a weak set of Q1 FY25 results, with consolidated net profit flattish on-year at Rs 1,695 crore, missing estimates. April-June quarter consolidated revenue rose to Rs 18,069 crore.

A Moneycontrol poll estimated India’s largest cement maker’s fiscal first quarter consolidated net profit at Rs 1,733 crore and revenue at Rs 17,962 crore, representing small rises on a year-on-year basis.

-330

July 19, 2024· 14:45 IST

Stock Market LIVE Updates | BSE not impacted due to Microsoft issue; 'Our operations are running normal,' says spokesperson

-330

July 19, 2024· 14:43 IST

Stock Market LIVE Updates | Blue Dart net profit declines 13% in June quarter

#1 Net profit down 12.9% at Rs 53.4 cr vs Rs 61 cr (YoY)

#2 Revenue up 8.5% at Rs 1,343 cr vs Rs 1,237.5 cr (YoY)

#3 EBITDA up 5.8% at Rs 202.2 cr vs Rs 191.2 cr (YoY)

#4 Margin at 15.1% vs 15.4% (YoY)

-330

July 19, 2024· 14:38 IST

Stock Market LIVE Updates | HAL, BEL, other defence stocks slump on profit booking ahead of Budget 2024

Shares of Hindustan Aeronautics Ltd (HAL) extended losses, falling over 3 percent despite the aerospace and defence firm announcing a revised Memorandum of Understanding (MoU) with the Aeronautical Development Agency (ADA), bolstering their collaboration on the LCA AF Mk-2 program.

A sales note from InCred citing valuation concerns within defence stocks like HAL has likely spooked investors.

The brokerage compared HAL with its global peer Dassault Aviation. Dassault reported revenue of $5.19 billion with a profit of $974 million in the last financial year, while HAL posted revenue of $3.67 billion with a profit of $921 million during the same period. Read More

-330

July 19, 2024· 14:28 IST

Stock Market LIVE Updates | Atul Ltd Q1 net profit rises 8.4% to Rs 112 crore

Net Profit up 8.4% At Rs 112 Cr Vs Rs 103.3 Cr (YoY)

Revenue up 12% At Rs 1,322 Cr Vs Rs 1,182 Cr (YoY)

EBITDA up 22.5% At Rs 223 Cr Vs Rs 182 Cr (YoY)

Margin At 16.9% Vs 15.4% (YoY)

-330

July 19, 2024· 14:18 IST

Umang Dairies, Keynote Financial Services among other locked at lower circuit

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Umang Dairies | 64791.00 | 144.39-10 | 484090549510.25 |

| Keynote Finance | 4093.00 | 253.44-10 | 3943533051.40 |

| GTL Infra | 86343004.00 | 2.57-5.17 | 458848820181481397.00 |

| GVK Power | 32883413.00 | 8.68-5.03 | 14121743697276.85 |

| Century Extr | 548546.00 | 27.23-5.02 | 114500494262.45 |

| GMRP&UI | 280547.00 | 95.81-5.01 | 29699085080439.00 |

| Servotech Power | 244086.00 | 111.18-5.01 | 16831072571965.15 |

| Windsor | 4388.00 | 157.19-5 | 163749816891.00 |

| GKW | 83.00 | 3249.45-5 | 7702316.75 |

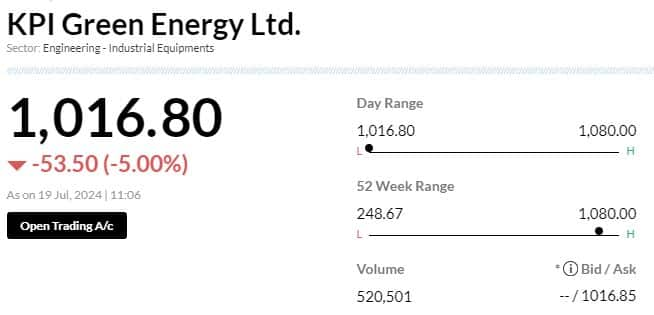

| KPIGREEN | 146013.00 | 1016.80-5 | 588893562280.90 |

-330

July 19, 2024· 14:12 IST

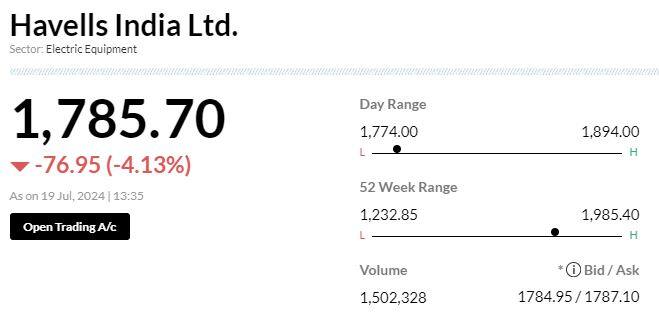

Brokerage Call | Nomura keeps 'neutral' rating on Havells India, target Rs 1,900

#1 Q1 margin miss on weaker mix

#2 Maintain 20 percent/17 percent revenue growth for FY25/26 (18 percent/14 percent ex-Lloyd)

#3 Price hikes & stable commodity should support margin

#4 Stock trades at 54x FY26 EPS, which believe factors in expected earnings recovery

-330

July 19, 2024· 14:08 IST

Jubilant Pharmova Q1 net profit at Rs 482 crore VS Rs 6.4 crore, YoY

-330

July 19, 2024· 14:07 IST

Wipro Q1 Earnings Preview: Macro issues to play spoilsport again; new deals a breather

According to the average of nine estimates compiled by Moneycontrol, Wipro's consolidated net profit for the quarter ended June is expected to rise over 4 percent QoQ to Rs 2,953 crore, while revenue from operations is likely to remain flat....Read More

-330

July 19, 2024· 13:57 IST

RIL Q1 Results Preview: Telecom, retail, oil & gas to drive earnings growth, offset O2C decline

Analysts will monitor user additions and ARPU growth in Reliance Industries' telecom business, as well as footfalls and store additions in the retail segment....Read More

-330

July 19, 2024· 13:55 IST

IPO Check | Sanstar IPO subscribed 2.4 times on opening day, NII portion booked nearly 4x

Sanstar Limited's initial public offering (IPO) was subscribed 2.4 times on the first day of bidding on July 19 with non-institutional investors leading the charge. The Rs 510.15-crore public offer attracted bids for 7.7 crore equity shares, surpassing the offer size of 3.8 crore equity shares, according to exchange data.

The public offer, which opened for subscription today, has a price band set at Rs 90-95 per share. The bidding is scheduled to close on July 23, 2024.

Non-institutional investors displayed the most enthusiasm, bidding nearly 4 times their allotted quota. Retail investors followed closely, subscribing 2.4 times of their reserved portion. The portion set aside for qualified institutional buyers (QIBs) was subscribed 1 percent.

-330

July 19, 2024· 13:54 IST

Trading Strategy | F&O Setup and how to position for Budget Day?

Mantri believes that sectors like PSU banks, FMCG, and Oil & Gas are expected to perform well in the coming days....Read More

-330

July 19, 2024· 13:52 IST

Brokerage Call | Morgan Stanley keeps 'underweight' call on L&T Technologies, target Rs 4,300

#1 Despite the miss, company has strong deal pipeline & maintained revenue & margin guidance for FY25

#2 Ask rate to meet revenue guidance is high, & continued estimate cuts could limit positive triggers

-330

July 19, 2024· 13:50 IST

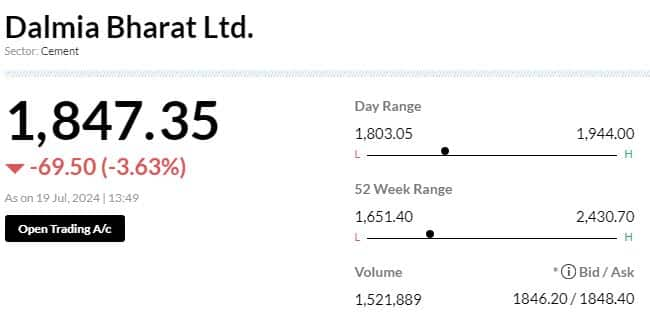

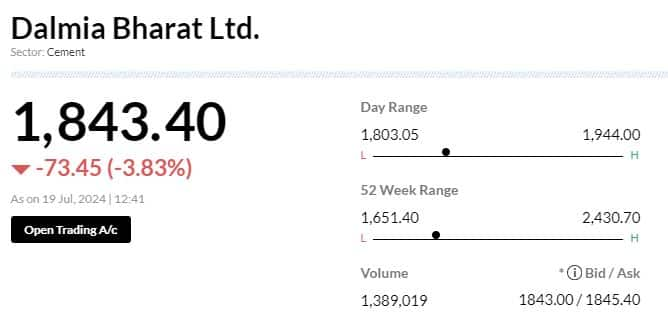

Brokerage Call | Morgan Stanley keeps 'equal-weight' call on Dalmia Bharat, target Rs 1,900

#1 Small EBITDA beat in Q1 while key positive was better realisations

#2 Opex/t was broadly in-line with estimate

#3 Weak volumes, however, were a key negative

-330

July 19, 2024· 13:48 IST

Brokerage Call | Goldman Sachs keeps 'sell' rating on Tata Technologies; target cut to Rs 950

#1 Q1FY25 was a miss with revenue/EBITDA -2.5 percent/-8 percent QoQ & were -5 percent/-9 percent below consensus

#2 Softness was due to phasing of customer business in the smaller technology solutions segment

#3 Softness was due to Vinfast customer related QoQ moderation in revenue in core services (auto) business

#4 Going forward, management expects a return to sequential growth in the business in Q2-Q3-Q4 Of FY25

-330

July 19, 2024· 13:41 IST

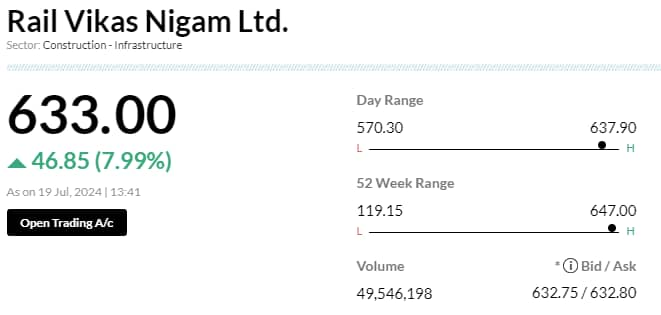

Stock Market LIVE Updates | RVNL signs MoU with United Construction

RVNL has signed Memorandum of Understanding (MoU) with M/s United Construction Limited, Israel to co-operate with each other to get projects in the field of Railways, MRTS, Tunnels, Roads (Highways & Expressways), Bridges, Building Works, Airports, Ports, Irrigation, Power Transmission and Distribution Sector, Solar Sector, Wind Sector in Israel.

In another development in dispute settellment between Krishnapatnam Railway Company Limited (KRCL) (a JV/SPVof RVNL with RVNL's share of 49.76%) and Ministry of Railway, the Hon'ble tribunal has passed an award of Rs. 584.22 crores in favour of the claimant (KRCL).

-330

July 19, 2024· 13:38 IST

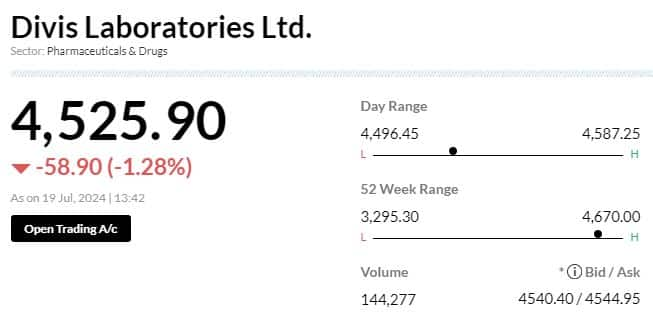

Stock Market LIVE Updates | USFDA conducts cGMP inspection at Divis Lab

Divis Laboratories informed that the US Food and Drug Administration (US-FDA) conducted a general cGMP inspection of the Company's Unit-II manufacturing facility at Chippada Village, Bheemunipatnam Mandal, Visakhapatnam, Andhra Pradesh from July 11, 2024 to July 19, 2024.

The US-FDA inspection is successfully completed with one procedural observation, which will be addressed in the stipulated period of time.

-330

July 19, 2024· 13:36 IST

Brokerage Call | Jefferies keeps 'hold' rating on Havells India, target Rs 1,880

#1 Q1 was in-line with estimates

#2 Strong sale (+20 percent YoY) was driven by good offtake in summer products, B2B offtake, albeit with interim election impact

#3 Lloyd posted EBIT margin at +3.5 percent in Q1 (+2.8 percent In Q4FY24)

#4 Cut FY25-27 EPS by 1-2 percent

-330

July 19, 2024· 13:33 IST

Stock Market LIVE Updates | JTL Industries' QIP opens, floor price at Rs 221.57

The company has opened its qualified institutions placement (QIP) issue on July 18. The floor price has been fixed at Rs 221.57 per share.

-330

July 19, 2024· 13:30 IST

Stock Market LIVE Updates | Tata Consumer Products to consider rights issue price

The Capital Raising Committee of the board will meet on July 23 to consider the rights issue price and related payment mechanisms, rights entitlement ratio, the record date, and the timing of the issue. The board had approved a rights issue worth Rs 3,000 crore in January 2024.

-330

July 19, 2024· 13:27 IST

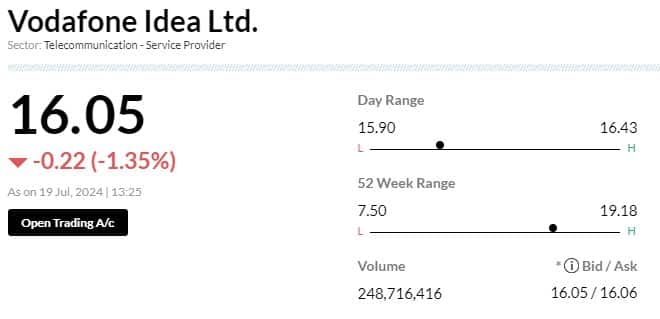

Stock Market LIVE Updates | Vodafone Idea to allot 41.52 crore shares to Nokia Solutions and Networks India and Ericsson India

The Capital Raising Committee of the board has approved the second tranche of the allotment of 41,52,02,701 equity shares worth Rs 614.5 crore at an issue price of Rs 14.80 per share, to Nokia Solutions and Networks India and Ericsson India, vendors of the company, on a preferential basis.

-330

July 19, 2024· 13:21 IST

Brokerage Call | Nirmal Bang downgrade defence sector rating to ‘sell’ on super rich valuations

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Krishna Defence | 800.45 | 2.39 | 22000 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharat Dynamics | 1470.9 | -4.89 | 1807961 |

| Paras Defence | 1315 | -2.97 | 117753 |

| Zen Tech | 1360 | -2.34 | 326621 |

| Astra Microwave | 899.6 | -2.08 | 319210 |

-330

July 19, 2024· 13:18 IST

Sensex Today | BSE Auto index slips 2%; Apollo Tyres, Cummins, Samvardhana Motherson among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cummins | 3,573.65 | -5.87 | 8.50k |

| MOTHERSON | 194.00 | -5.16 | 952.74k |

| Apollo Tyres | 527.55 | -4.06 | 207.85k |

| MRF | 128,011.65 | -3.24 | 394 |

| Bosch | 34,152.25 | -2.75 | 284 |

| Tata Motors | 999.95 | -2.45 | 472.76k |

| Bajaj Auto | 9,407.15 | -2.27 | 6.82k |

| Hero Motocorp | 5,386.15 | -2.15 | 6.53k |

| Tube Investment | 4,002.55 | -2.08 | 2.42k |

| Eicher Motors | 4,844.80 | -1.92 | 2.91k |

-330

July 19, 2024· 13:15 IST

Sensex Today | Jaykay Enterprises and Shrydus Industries trade ex-rights

-330

July 19, 2024· 13:13 IST

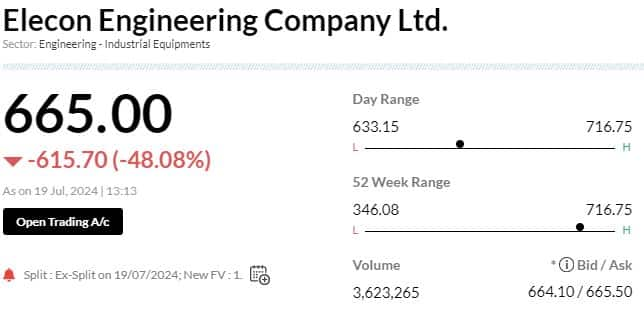

Stock Market LIVE Updates | Elecon Engineering Company stock trades ex-split

-330

July 19, 2024· 13:10 IST

Sensex Today | BSE Bank index down 0.7%; Yes Bank, Federal Bank, Canara Bank among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Yes Bank | 25.12 | -2.48 | 14.50m |

| Federal Bank | 193.10 | -1.71 | 118.21k |

| Canara Bank | 114.00 | -1.55 | 1.03m |

| IndusInd Bank | 1,435.00 | -1.39 | 102.80k |

| Bank of Baroda | 251.90 | -1.37 | 252.41k |

| Axis Bank | 1,297.70 | -0.87 | 55.66k |

| HDFC Bank | 1,605.70 | -0.55 | 261.68k |

| ICICI Bank | 1,243.00 | -0.54 | 91.29k |

| Kotak Mahindra | 1,818.00 | -0.28 | 97.13k |

| SBI | 890.95 | -0.27 | 242.47k |

-330

July 19, 2024· 13:04 IST

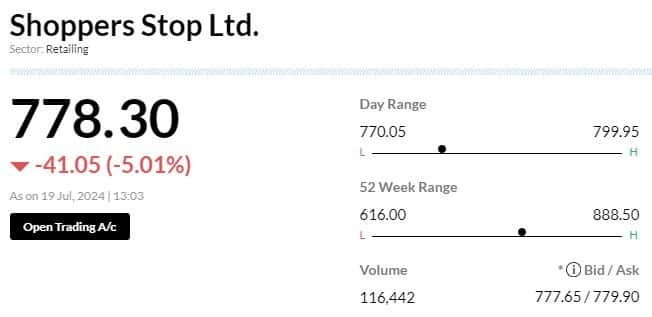

Stock Market LIVE Updates | Shoppers Stop shares down 5% on posting losses in Q1

#1 Net loss at Rs 22.7 crore Vs profit at Rs 14.5 crore, YoY

#2 Revenue increases 7.6% to Rs 1,069.3 crore Vs Rs 993.6 crore, YoY

-330

July 19, 2024· 13:02 IST

Markets@1 | Sensex down 500 pts, Nifty at 24,600

The Sensex was down 518.40 points or 0.64 percent at 80,825.06, and the Nifty was down 197.10 points or 0.79 percent at 24,603.70.

-330

July 19, 2024· 12:58 IST

Big tech shares lose lustre as US market rocked by violent rotation

Small-cap stocks surge in expectation they will benefit disproportionately from a Fed interest rate cut...Read More

-330

July 19, 2024· 12:56 IST

Sensex Today | Nifty Realty index down 2.5%; Phoenix Mills, DLF, Hemisphere Properties India among top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 3,942.30 | -3.74 | 106.48k |

| Hemisphere | 216.14 | -3.29 | 965.59k |

| DLF | 817.55 | -3.24 | 3.07m |

| Sobha | 1,873.60 | -2.99 | 31.42k |

| Equinox India | 131.26 | -2.57 | 3.37m |

| Sunteck Realty | 600.75 | -2.44 | 611.33k |

| Oberoi Realty | 1,676.85 | -2.43 | 555.93k |

| Godrej Prop | 3,284.65 | -2.32 | 207.43k |

| Prestige Estate | 1,743.90 | -0.72 | 368.70k |

| Brigade Ent | 1,272.85 | -0.1 | 90.59k |

-330

July 19, 2024· 12:53 IST

Brokerage Call | Nomura maintains ‘buy’ rating on Infosys, target raises to Rs 1,950

#1 Q1FY25 was an all-round beat

#2 Surprise revenue guidance driven by strong start, deal wins, & acquisition integration

#3 Project maximus’ impact on margin continues to play out

#4 Raise our FY25-26 EPS by nearly 2-3%, reiterate as top pick

-330

July 19, 2024· 12:51 IST

SpiceJet stock jumps 5% as board to consider fundraising via QIP on July 23

SpiceJet said the company will hold a board meeting on July 23 to consider raising fresh capital through qualified institutional placement (QIP) basis....Read More

-330

July 19, 2024· 12:50 IST

Sensex Today | BSE Smallcap index sheds 2%; Chennai Petro, Avantel ,Bharat Bijlee among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Chennai Petro | 1,051.15 | -9.86 | 212.70k |

| Avantel | 181.85 | -8.89 | 2.48m |

| Bharat Bijlee | 4,366.35 | -8.27 | 42.24k |

| AARTIPHARM | 581.10 | -7.21 | 19.89k |

| Hester Bio | 2,562.35 | -6.56 | 1.72k |

| Cosmo First | 821.30 | -6.14 | 11.78k |

| Tanfac Ind | 2,080.00 | -6.12 | 12.11k |

| Rallis India | 320.00 | -6.06 | 152.51k |

| Apar Ind | 8,090.00 | -5.71 | 4.64k |

| Dhunseri Ventur | 363.05 | -5.7 | 9.87k |

-330

July 19, 2024· 12:49 IST

Aether Industries Q1 net profit flat at Rs 30 crore, YoY

-330

July 19, 2024· 12:48 IST

Stock Market LIVE Updates | Sagar Cements Q1 net loss narrows; stocks trade flat

#1 Net loss narrows to Rs 28.4 crore Vs loss at Rs 39.8 crore, YoY

#2 Revenue rises 3.9% to Rs 560.6 crore Vs Rs 539.7 crore, YoY

-330

July 19, 2024· 12:46 IST

Sensex Today | BSE Midcap index down 2%; Cummins, Persistent Systems, Samvardhana Motherson among top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Persistent | 4,616.90 | -5.64 | 39.12k |

| Cummins | 3,588.60 | -5.48 | 7.92k |

| MOTHERSON | 194.55 | -4.89 | 905.75k |

| New India Assur | 267.85 | -4.53 | 176.45k |

| CG Power | 658.55 | -4.45 | 112.82k |

| NMDC | 231.45 | -4.32 | 556.79k |

| BHEL | 296.40 | -3.94 | 850.74k |

| Max Healthcare | 896.75 | -3.93 | 13.58k |

| Solar Ind | 10,845.60 | -3.83 | 1.72k |

| Castrol | 250.90 | -3.8 | 215.57k |

-330

July 19, 2024· 12:43 IST

Arvinder Singh Nanda, Senior Vice President, of Master Capital Services

The fiscal deficit target for FY25 is likely to stay at 5.1% of GDP as per the interim budget. Emphasis will be on job creation through capital expenditure, targeted social spending, and the 'Viksit Bharat' initiative.

The budget may also outline a roadmap for fiscal consolidation beyond FY26. While no reduction in personal income tax rates is expected, there could be tax relief for middle-income taxpayers.

Key sectors to watch include agriculture, start-ups, housing, railways, defence, electronics, and renewables.

Changes in short-term capital gains tax rates are anticipated, but significant hikes in long-term capital gains tax rates are not expected.

-330

July 19, 2024· 12:41 IST

Stock Market LIVE Updates | Dalmia Bharat shares down 3% on flat Q1 profit

#1 Profit rises 0.7% to Rs 145 crore Vs Rs 144 crore, YoY

#2 Revenue drops 0.2% to Rs 3,621 crore Vs Rs 3,627 crore, YoY

-330

July 19, 2024· 12:39 IST

Stock Market LIVE Updates | CEAT shares down 2.5% despite Q1 profit rises

#1 Profit jumps 7% to Rs 154.2 crore Vs Rs 144 crore, YoY

#2 Revenue increases 8.8% to Rs 3,192.8 crore Vs Rs 2,935.2 crore, YoY

-330

July 19, 2024· 12:36 IST

Wipro Q1 Earnings Preview: Macro issues to play spoilsport again; new deals a breather

According to the average of nine estimates compiled by Moneycontrol, Wipro's consolidated net profit for the quarter ended June is expected to rise over 4 percent QoQ to Rs 2,953 crore, while revenue from operations is likely to remain flat....Read More

-330

July 19, 2024· 12:32 IST

-330

July 19, 2024· 12:27 IST

Stock Market LIVE Updates | CIE Automotive India Q1 shares fall post Q1 earnings

#1 Profit increases 1.3% to Rs 216.4 crore Vs Rs 213.6 crore, YoY

#2 Revenue drops 1.2% to Rs 2,292.7 crore Vs Rs 2,320.3 crore, YoY

-330

July 19, 2024· 12:17 IST

Capital Trust, VST Industries among others witness volume surge

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Capital Trust | 136.64 15.53% | 1.52m49,522.80 | 2,971.00 |

| VST | 4,819.75 16.7% | 484.33k17,724.80 | 2,632.00 |

| MAGOLD | 73.39 -0.53% | 1.56m85,900.40 | 1,717.00 |

| Orchid Pharma | 1,288.00 10.68% | 641.62k45,568.80 | 1,308.00 |

| AIA Engineering | 4,279.60 1.25% | 531.15k46,656.00 | 1,038.00 |

| Krebs Biochem | 119.16 16.73% | 2.97m264,019.60 | 1,025.00 |

| Kilitch Drugs | 360.90 10% | 86.67k9,451.00 | 817.00 |

| Shemaroo Ent | 169.09 6.08% | 633.77k71,161.80 | 791.00 |

| Vertexplus Tech | 177.50 -4.98% | 19.20k2,280.00 | 742.00 |

| Apex Frozen | 244.81 5.96% | 1.69m245,208.40 | 589.00 |

-330

July 19, 2024· 12:16 IST

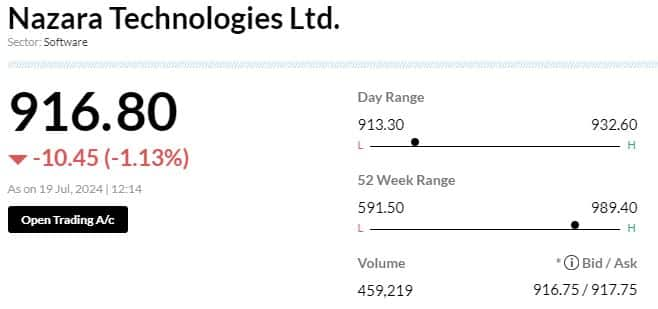

Sensex Today | Nazara Technologies acquires stake in Paper Boat Apps

Nazara Technologies board approved to make strategic investment by way of secondary acquisition of 5,157 equity shares of Rs 10 each, representing 48.42% of the equity share capital of Paper Boat Apps Private Limited, a subsidiary of the company, from its existing founder shareholders (i.e. Mr. Anupam Dhanuka and Ms. Anshu Dhanuka), at a total consideration not exceeding Rs 300 crore, to be paid in cash.

-330

July 19, 2024· 12:11 IST

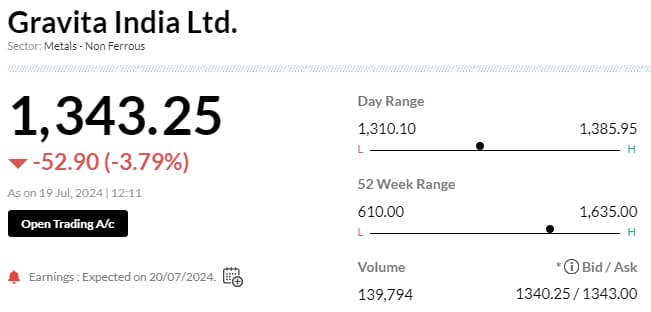

Sensex Today | Gravita India's step-down subsidiary Recyclers Costa Rica S.A. situated in Costa Rica closes

-330

July 19, 2024· 12:09 IST

Sensex Today | CaratLane Trading becomes wholly-owned subsidiary of the Titan Company with effect from 18th July 2024

-330

July 19, 2024· 12:07 IST

Option strategy of the day| Long build up in Nifty IT index, Bull Call Spread in Mphasis recommended

The Nifty IT Index has surpassed its all-time high levels of 39,446, entering a new bullish zone. The momentum indicator MACD has turned to buy mode across all timeframes, from monthly to daily charts....Read More

-330

July 19, 2024· 12:04 IST

Sensex Today | Reliance Industries, Wipro, UltraTech Cement among others to announce results today

Reliance Industries, Wipro, UltraTech Cement, Bharat Petroleum Corporation, JSW Steel, Union Bank of India, ICICI Lombard General Insurance Company, One 97 Communications (Paytm), Patanjali Foods, Aether Industries, Atul, BEML Land Assets, Blue Dart Express, CreditAccess Grameen, Fedbank Financial Services, Indian Hotels, JSW Energy, Jubilant Pharmova, Mahindra EPC Irrigation, Nippon Life India Asset Management, Oberoi Realty, Orissa Minerals Development Company, PVR Inox, Route Mobile, RPG Life Sciences, Supreme Petrochem, Stanley Lifestyles, Tejas Networks, Transformers and Rectifiers (India), and Vipul Organics will release their quarterly earnings on July 19.

-330

July 19, 2024· 11:56 IST

Kotak Bank Q1 preview: Loan growth to drive profit, NII; margin pressure likely

Kotak Bank is expected to clock up to 13 percent YoY growth in NII to Rs 7,087 crore in Q1FY25, said analysts...Read More

-330

July 19, 2024· 11:55 IST

Sensex Today | Nifty Bank index down 0.5%; Bandhan Bank, Federal Bank, IDFC First Bank among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bandhan Bank | 192.30 | -1.85 | 4.24m |

| Federal Bank | 193.04 | -1.81 | 2.77m |

| IDFC First Bank | 76.38 | -1.75 | 13.52m |

| IndusInd Bank | 1,433.40 | -1.61 | 985.93k |

| PNB | 117.07 | -1.49 | 17.52m |

| Bank of Baroda | 251.75 | -1.45 | 6.45m |

| Axis Bank | 1,298.70 | -0.82 | 1.60m |

| SBI | 889.45 | -0.46 | 5.49m |

| Kotak Mahindra | 1,818.70 | -0.44 | 1.12m |

| AU Small Financ | 630.60 | -0.39 | 548.02k |

-330

July 19, 2024· 11:53 IST

Sensex Today | BSE Midcap and Smallcap underperform

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 80962.72-0.47 | 12.070.55 | 4.6920.66 |

| BSE 200 | 11300.45-1.16 | 17.24-0.54 | 3.3132.46 |

| BSE MIDCAP | 46240.77-2.35 | 25.52-2.67 | 0.8956.18 |

| BSE SMALLCAP | 52508.96-2.17 | 23.05-2.79 | 2.1754.27 |

| BSE BANKEX | 60259.70-0.55 | 10.820.20 | 3.0617.03 |

-330

July 19, 2024· 11:52 IST

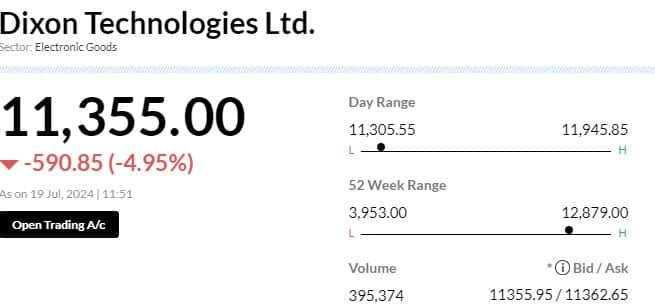

Stock Market LIVE Updates | CCI approves to acquire 56% stake in Ismartu India by Dixon

The Competition Commission of India (CCI) has approved the acquisition of up to 56% shareholding of Ismartu India by Dixon Technologies.

-330

July 19, 2024· 11:47 IST

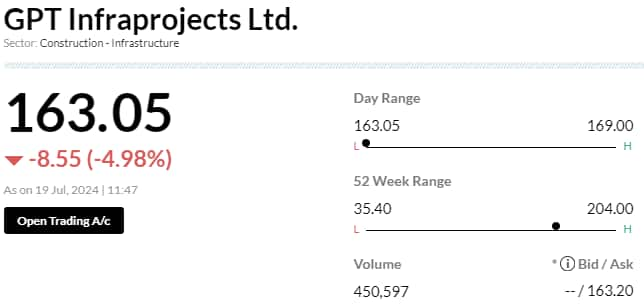

Stock Market LIVE Updates | GPT Infraprojects bags order worth Rs 103 crore

The company has received an order worth Rs 103 crore from NHAI, New Delhi, and Eastern Railway, Kolkata. The contract is an enhancement of the existing contract with NHAI and Eastern Railway, Kolkata.

-330

July 19, 2024· 11:44 IST

Sensex Today | 1.07 million shares of Tata Steel traded in block: Bloomberg

-330

July 19, 2024· 11:42 IST

Stock broking app like IIFL, Angel One, 5 paisa were facing issue

-330

July 19, 2024· 11:36 IST

Paytm concall -Waiting approval to start onboarding of new UPI users

Awaiting Approval To Start Onboarding Of New UPI Users

Seeing A Rebound In Our Merchant Operating Metrics

Confident In Our Trajectory Towards Sustained Growth Going Forward

Full Financial Impact Of The Recent Disruptions Is Visible In Q1FY25

Rev & Profitability Expected To Improve Going Forward

-330

July 19, 2024· 11:30 IST

Stock Market LIVE Update | All key indices swim in losses; Nifty Midcap, Smallcap tanks over 2%

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 24651.65-0.6 | 13.440.61 | 4.8324.30 |

| NIFTY BANK | 52311.45-0.59 | 8.320.06 | 1.7814.54 |

| NIFTY Midcap 100 | 55906.65-2.11 | 21.06-2.22 | 1.7451.76 |

| NIFTY Smallcap 100 | 18423.15-2.16 | 21.66-2.78 | 1.4761.54 |

| NIFTY NEXT 50 | 71540.50-2.15 | 34.11-2.97 | 0.0161.08 |

-330

July 19, 2024· 11:20 IST

Earnings Call | Paytm net loss swells up to Rs 839 crore in Q1

Cons net loss at Rs 839 cr vs loss Of Rs 357 cr (YoY)

Cons revenue falls 36 percent to Rs 1,502 cr vs Rs 2,342 cr (YoY)

-330

July 19, 2024· 11:15 IST

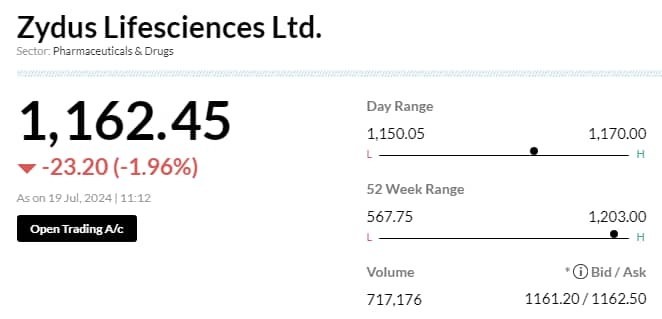

Stock Market LIVE Updates | Zydus Lifesciences stock falls 3% after US FDA classifies Jarod unit as OAI

Zydus Lifesciences shares fell 3 percent on July 19 after the company's Jarod injectables manufacturing facility got classified as 'Official Action Indicated' (OAI) by the United States Food and Drug Administration (USFDA).

This comes after the US drug regulator inspected the facility from April 15-23 this year. The inspection was followed by the US FDA issuing 10 observations for the facility under review. The observations issued by the US FDA were likely not rectified by the drugmaker, leading to the OAI classification of the facility.

The drugmaker also received US FDA approval for Zituvimet extended-release tablets today. Zituvimet is used as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes.

-330

July 19, 2024· 11:09 IST

Stock Market LIVE Updates | Caplin Steriles gets USFDA approval for Ephedrine Sulfate Injection USP

Caplin Steriles, a subsidiary company of Caplin Point Laboratories has been granted final approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) Ephedrine Sulfate injection USP, 50 mg/mL Single Dose vial, a generic therapeutic equivalent version of the Reference Listed Drug (RLD) AKOVAZ, from Exela Pharma Sciences LLC.

-330

July 19, 2024· 11:07 IST

Stock Market LIVE Updates | KPI Green Energy bags 100 MW Captive Solar Power Project

KPI Green Energy received a new order for a 100 MW Hybrid Captive Solar Power Project from Aether Industries under the Captive Power Producer (CPP) segment of the company.

-330

July 19, 2024· 11:04 IST

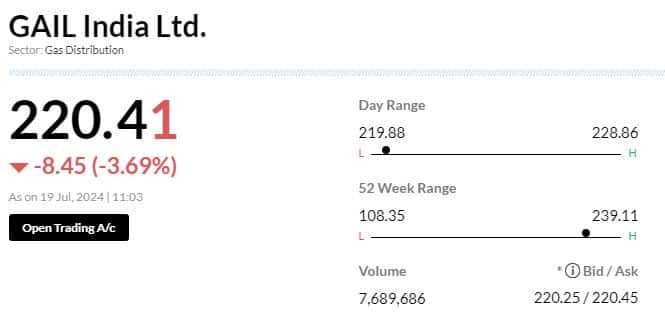

Sensex Today | 1.15 million shares of Gail India traded in a block: Bloomberg

-330

July 19, 2024· 11:03 IST

Stock Market LIVE Updates | USFDA classifies inspection at Zydus Lifesciences as OAI

The United States Food and Drug Administration (USFDA) has conducted an inspection at the company's injectables manufacturing facility at Jarod, Gujarat, from April 15 to April 23 this year.

The USFDA has determined that the inspection classification of this facility is Official Action Indicated (OAI).

-330

July 19, 2024· 11:00 IST

Markets@11 | Sensex, Nifty at day's low

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Infosys | 1,809.50 | 2.93 | 19.01m |

| ITC | 477.65 | 1.57 | 8.11m |

| HCL Tech | 1,610.35 | 0.99 | 2.12m |

| Asian Paints | 2,958.85 | 0.93 | 776.10k |

| Britannia | 5,925.40 | 0.92 | 221.91k |

| TCS | 4,337.95 | 0.52 | 1.92m |

| Dr Reddys Labs | 6,685.95 | 0.28 | 57.98k |

| LTIMindtree | 5,764.40 | 0.13 | 406.03k |

| Nestle | 2,629.50 | 0.09 | 183.62k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BPCL | 305.00 | -4.13 | 7.36m |

| Tata Steel | 160.84 | -3.32 | 20.21m |

| Hindalco | 667.90 | -3.2 | 2.05m |

| ONGC | 322.75 | -2.7 | 11.24m |

| Coal India | 491.80 | -2.66 | 3.32m |

| Eicher Motors | 4,824.60 | -2.36 | 144.71k |

| JSW Steel | 910.45 | -2.25 | 898.80k |

| Tech Mahindra | 1,505.00 | -2.23 | 921.72k |

| Wipro | 560.70 | -2.18 | 6.91m |

| UltraTechCement | 11,423.60 | -1.92 | 96.48k |

-330

July 19, 2024· 10:57 IST

Stock Market LIVE Updates | Tech Mahindra to merge its step-down subsidiary with its parent co

The company has approved a plan to merge its step-down subsidiary, vCustomer Philippines (Cebu) Inc., with its parent company, vCustomer Philippines Inc.

vCustomer Philippines Inc. is a wholly owned subsidiary of Tech Mahindra.

The merger is subject to regulatory approvals in the country of incorporation.

-330

July 19, 2024· 10:54 IST

Sensex Today | Nifty Smallcap underperforms

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 24668.90-0.53 | 13.520.68 | 4.9024.38 |

| NIFTY BANK | 52353.35-0.51 | 8.410.14 | 1.8614.64 |

| NIFTY Midcap 100 | 56096.50-1.78 | 21.47-1.88 | 2.0852.27 |

| NIFTY Smallcap 100 | 18466.00-1.93 | 21.94-2.55 | 1.7161.91 |

| NIFTY NEXT 50 | 71823.70-1.76 | 34.64-2.59 | 0.4061.71 |

-330

July 19, 2024· 10:50 IST

IPO Check | Subscribe Sanstar, says Master Capital Service

Sanstar is looking to payoff its debt and strengthen its balance and invest into building additional capacity to fuel their growth. Post the proposed expansion, the capacity will almost double from current levels creating a huge headroom for growth.

The current capacity is already 90% filled and the capex for expansion has already started. The valuation of the IPO is at par with the listed peers, but given the growth rospects, we advise to subscribe to the IPO keeping a long term view.

-330

July 19, 2024· 10:48 IST

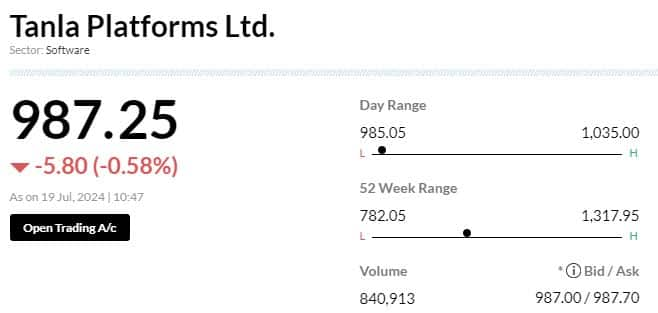

Stock Market LIVE Updates | Tanla Platforms Q1 profit rises; stock trades lower

#1 Profit increases 4.3% to Rs 141.2 crore Vs Rs 135.4 crore, YoY

#2 Revenue grows 10% to Rs 1,002.2 crore Vs Rs 911.1 crore, YoY

-330

July 19, 2024· 10:43 IST

Kotak Bank Q1 preview: Loan growth to drive profit, NII; margin pressure likely

Kotak Bank is expected to clock up to 13 percent YoY growth in NII to Rs 7,087 crore in Q1FY25, said analysts...Read More

-330

July 19, 2024· 10:40 IST

Sensex Today | Nifty Media index down 1.3%; TV18 Broadcast, TV TodayNetwork, Zee Entertainment among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TV18 Broadcast | 41.03 | -2.29 | 2.73m |

| TV TodayNetwork | 234.73 | -1.91 | 26.64k |

| Zee Entertain | 139.80 | -1.84 | 8.24m |

| Sun TV Network | 791.50 | -1.21 | 135.93k |

| DB Corp | 358.90 | -1.06 | 199.24k |

| Network 18 | 79.79 | -0.66 | 433.65k |

| Dish TV | 14.93 | -0.6 | 5.76m |

| PVR INOX | 1,404.90 | -0.52 | 141.08k |

| JagranPrakashan | 98.66 | -0.29 | 436.15k |

-330

July 19, 2024· 10:38 IST

Stock Market LIVE Updates | Go Digit stock jumps 7% after Citi initiates coverage with 'buy'; eyes 25% upside

Shares of Go Digit General Insurance surged 7 percent intraday to Rs 363 in the morning trade on July 19 after international brokerage Citi initiated coverage with a 'buy' call as it sees multiple levers of growth for the company.

Analysts have assigned a price target of Rs 425, implying an upside potential of 25 percent from the current market levels. Citi expects the company's Return on Equity (RoE) to increase to 15-16 percent in FY26-27 from nearly 7 percent in FY24.

A steady 13 percent annual growth in non-life premiums (excluding crop insurance), driven by health and B2B business is also anticipated, Citi said in a recent note on the company.

-330

July 19, 2024· 10:29 IST

HDFC Bank Q1 results preview: Soft growth in loans, deposits to limit NII, profit gain QoQ

HDFC Bank's NII is pegged to grow up to 27 percent YoY to Rs 29,621 crore in Q1FY24, while profit is estimated to jump by 32 percent YoY to Rs 15,905 crore...Read More

-330

July 19, 2024· 10:26 IST

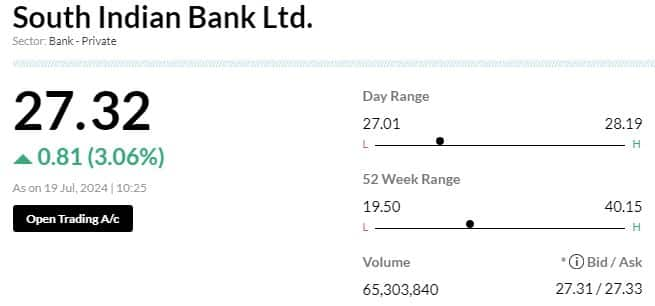

Stock Market LIVE Updates | South Indian Bank shares gain 3% after profit up 45%

#1 Profit surges 45.4% to Rs 294.1 crore Vs Rs 202.4 crore, YoY

#2 Net interest income increases 7.2% to Rs 865.8 crore Vs Rs 807.7 crore, YoY

#3 Gross NPA flat QoQ at 4.50%, YoY

#4 Net NPA falls QoQ to 1.44% Vs 1.46%, YoY

-330

July 19, 2024· 10:23 IST

Sensex Today | BSE Oil & Gas index sheds 2%; Oil India, BPCL, Gail among major losers

-330

July 19, 2024· 10:21 IST

Stock Market LIVE Updates | Persistent Systems shares fall 5% as Q1 profit declines

#1 Profit drops 2.8% to Rs 306.4 crore Vs Rs 315 crore, QoQ

#2 Revenue rises 5.7% to Rs 2,737.2 crore Vs Rs 2,590.5 crore, QoQ

#3 EBIT grows 2.6% to Rs 384 crore Vs Rs 374.4 crore, QoQ

#4 EBIT margin dips 50 bps to 14% Vs 14.5%, QoQ

-330

July 19, 2024· 10:16 IST

Sahaj Solar makes bumper debut, lists with 90 premium over IPO price

Shares of Sahaj Solar Limited made a robust start on its stock market debut on July 19, listing at Rs 342, commanding a premium of 90 percent over the issue price of Rs 180 per share.

The Rs 52.56-crore public offer came firing out of the blocks during the subscription period as investors subscribed a massive 506 times. Non-institutional investors were the most active, buying 862 times their allotted quota. Retail investors followed, purchasing 534 times while qualified institutional buyers roped in 214 times the portion reserved.

-330

July 19, 2024· 10:14 IST

Stock Market LIVE Updates | L&T Technology shares fall post Q1 results

#1 Profit declines 8% to Rs 313.6 crore Vs Rs 340.9 crore, QoQ

#2 Revenue slips 3% to Rs 2,461.9 crore Vs Rs 2,537.5 crore, QoQ

#3 EBIT dips 10.4% to Rs 383.6 crore Vs Rs 428.2 crore, QoQ

#4 Margin drops to 15.6% Vs 16.9%, QoQ

#5 Revenue in dollar terms down 3.3% at $295.2 million Vs $305.1 million, QoQ

#6 Revenue in constant currency down 3.1%, QoQ

-330

July 19, 2024· 10:11 IST

HDFC Bank Q1 results preview: Soft growth in loans, deposits to limit NII, profit gain QoQ

HDFC Bank's NII is pegged to grow up to 27 percent YoY to Rs 29,621 crore in Q1FY24, while profit is estimated to jump by 32 percent YoY to Rs 15,905 crore...Read More

-330

July 19, 2024· 10:09 IST

Commodity Check | Gold slips but set for fourth weekly rise on US rate cut prospects

Gold prices slipped on Friday, but were on track for a fourth straight weekly gain as expectations that the Federal Reserve will cut interest rates in September lifted bullion's appeal.

Spot gold fell 0.8% to $2,424.34 per ounce. It has risen 0.7% so far this week, hitting an all-time high of $2,483.60 on Wednesday. U.S. gold futures fell 1.2% to $2,426.10.

-330

July 19, 2024· 10:07 IST

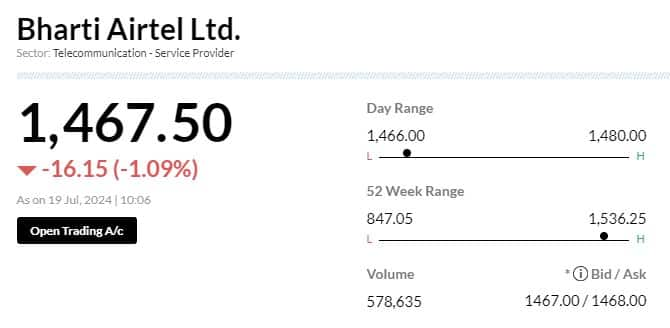

Stock Market LIVE Updates | Bharti Airtel bags multi-year contract from CBDT for providing network solutions

The Central Board of Direct Taxes (CBDT) on Thursday signed a multi-year contract with telecom major Bharti Airtel, under which the latter will provide network and connectivity solutions for CBDT's Taxnet-2.0 programme.

This contract is an extension as Airtel has been the network partner to CBDT since 2008 in Taxnet-1.0.

"The formal Letter of Award was handed over to Bharti Airtel by the Central Board of Direct Taxes (CBDT) and the Letter of Acceptance has been given by Bharti Airtel to CBDT. The occasion was graced by Mr. Sunil Bharti Mittal, Founder and Chairman, Bharti Enterprises, and Mr Ravi Agarwal, Chairman, CBDT," Airtel said in a statement. Read More

-330

July 19, 2024· 10:03 IST

Brokerages remain neutral on Havells India following Q1 show, see 5% downside

Further price hikes coupled with stable commodity prices should support Havells India's margins going ahead, said Nomura....Read More

-330

July 19, 2024· 09:57 IST

Sensex Today | BSE Information Technology index up 0.5%; Cyient, Intellect Design Arena among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cyient | 1,909.35 | 3.22 | 23.54k |

| Intellect Desig | 1,103.20 | 2.99 | 4.11k |

| Datamatics Glob | 656.55 | 2.81 | 37.58k |

| Infosys | 1,808.15 | 2.79 | 472.68k |

| Subex | 32.10 | 2.69 | 420.66k |

| Kellton Tech | 163.65 | 2.57 | 142.67k |

| KSolves | 1,222.60 | 2.53 | 1.79k |

| KPIT Tech | 1,902.15 | 2.46 | 21.70k |

| MphasiS | 2,876.90 | 1.55 | 23.58k |

| Nucleus Softwar | 1,496.25 | 0.9 | 2.30k |

-330

July 19, 2024· 09:55 IST

Sensex Today | HDFC Bank, Kotak Mahindra Bank, RBL Bank, Yes Bank among others to announce results on July 20

HDFC Bank, Kotak Mahindra Bank, RBL Bank, Yes Bank, Poonawalla Fincorp, Aarti Surfactants, Arihant Capital Markets, Can Fin Homes, Gravita India, JK Cement, Kirloskar Pneumatic, Motisons Jewellers, Netweb Technologies India, Rossari Biotech, Seshasayee Paper & Boards, Shakti Pumps, Sportking India, and Zenith Health Care will announce their quarterly results on July 20.

-330

July 19, 2024· 09:53 IST

Sensex Today | BSE Oil & Gas index shed 1%; Oil India, BPCL, Gail India among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oil India | 566.60 | -3.13 | 264.24k |

| BPCL | 309.40 | -2.72 | 171.50k |

| GAIL | 223.80 | -2.23 | 374.36k |

| ONGC | 325.50 | -1.72 | 474.47k |

| Petronet LNG | 341.35 | -1.59 | 25.03k |

| HINDPETRO | 352.40 | -1.45 | 48.59k |

| IOC | 167.55 | -1.21 | 357.46k |

| Reliance | 3,141.35 | -0.91 | 49.67k |

| IGL | 531.00 | -0.52 | 17.35k |

| Adani Total Gas | 886.75 | -0.33 | 11.23k |

-330

July 19, 2024· 09:51 IST

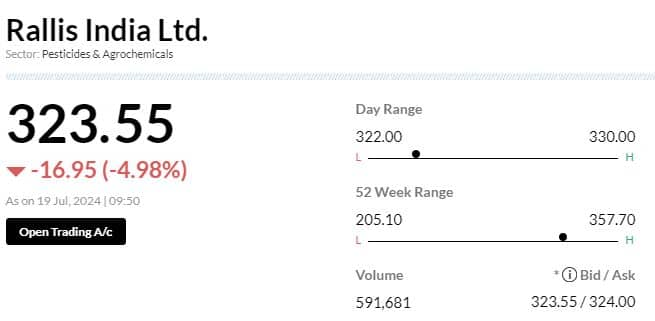

Stock Market LIVE Updates | Rallis India shares fall 5% post Q1 profit down 23%

#1 Profit declines 23.8% to Rs 48 crore Vs Rs 63 crore, YoY

#2 Revenue rises 0.1% to Rs 783 crore Vs Rs 782 crore, YoY

-330

July 19, 2024· 09:46 IST

Stock Market LIVE Updates | Dr Reddy’s signs patent licensing agreement with Takeda Pharma

The pharma company signed a non-exclusive patent licensing agreement with Takeda Pharmaceutical Company to commercialize Vonoprazan tablets in India. Vonoprazan is a novel, orally active potassium-competitive acid blocker (PCAB) used to treat reflux esophagitis and other acid peptic disorders.

-330

July 19, 2024· 09:43 IST

Brokerage Call | Bernstein keeps ‘outperform’ rating on Infosys, target raises to Rs 2,100

#1 Delivered its strongest beat in 10 quarters in Q1 across revenue, margin & EPS

#2 FY 25 revenue guidance was raised to 3 percent to 4 percent YoY CC (from 1 percent to 3 percent)

#3 Deal momentum was strong at USD 4.1 billion TCV with net new of 57

#4 See beginning of an upcycle trend as growth recovers, BFSI inflects & ai deals scale up

-330

July 19, 2024· 09:38 IST

Sensex Today | Nifty Pharma index fell nearly 1%; Zydus Life, Torrent Pharma, Sun Pahrma among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Zydus Life | 1,162.30 | -1.97 | 233.01k |

| Torrent Pharma | 3,019.50 | -1.27 | 13.69k |

| Sun Pharma | 1,580.00 | -0.89 | 121.81k |

| Alkem Lab | 5,227.65 | -0.86 | 6.90k |

| Cipla | 1,494.85 | -0.78 | 96.72k |

| Divis Labs | 4,559.40 | -0.55 | 11.95k |

| Lupin | 1,807.60 | -0.53 | 40.60k |

| Dr Reddys Labs | 6,653.45 | -0.21 | 13.39k |

| Biocon | 343.15 | -0.01 | 301.25k |

-330

July 19, 2024· 09:36 IST

Sensex Today | Reliance Industries, Wipro, UltraTech Cement among others to announce results today

Reliance Industries, Wipro, UltraTech Cement, Bharat Petroleum Corporation, JSW Steel, Union Bank of India, ICICI Lombard General Insurance Company, One 97 Communications (Paytm), Patanjali Foods, Aether Industries, Atul, BEML Land Assets, Blue Dart Express, CreditAccess Grameen, Fedbank Financial Services, Indian Hotels, JSW Energy, Jubilant Pharmova, Mahindra EPC Irrigation, Nippon Life India Asset Management, Oberoi Realty, Orissa Minerals Development Company, PVR Inox, Route Mobile, RPG Life Sciences, Supreme Petrochem, Stanley Lifestyles, Tejas Networks, Transformers and Rectifiers (India), and Vipul Organics will release their quarterly earnings on July 19.

-330

July 19, 2024· 09:34 IST

RIL Q1 Results Preview: Telecom, retail, oil & gas to drive earnings growth, offset O2C decline

Analysts will monitor user additions and ARPU growth in Reliance Industries' telecom business, as well as footfalls and store additions in the retail segment....Read More