Closing Bell: Market rises on 6th day; Nifty above 26,000, Sensex jumps 388 pts

Bajaj Auto, Tata Consumer, Eicher Motors, Max Healthcare, Maruti Suzuki were among major gainers on the Nifty, while losers were TMPV, Adani Enterprises, Jio Financial, Interglobe Aviation, UltraTech Cement. All the other sectoral indices ended in the green with auto, bank, realty, capital goods, consumer durables, PSU Bank up 0.5-1%. BSE Midcap and smallcap indices rose 0.6% each.

-330

November 17, 2025· 16:19 IST

Market Close | Sensex up 388 pts, Nifty above 26,000; all sectors in the green

Indian benchmark indices ended on a positive note with Nifty above 26,000 on November 17. At close, the Sensex was up 388.17 points or 0.46 percent at 84,950.95, and the Nifty was up 103.40 points or 0.40 percent at 26,013.45.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

November 17, 2025· 16:16 IST

Vatsal Bhuva, Technical Analyst at LKP Securities

Bank Nifty had been consolidating at higher levels, indicating a brief pause in its ongoing rally. On Monday, a breakout from this consolidation zone was witnessed on the daily chart, confirming renewed bullish momentum. This breakout highlights the strong grip of bulls on the index. As long as the index sustains above 58,000, where its 20-day EMA is positioned, it remains a buy-on-dip candidate.

Immediate support lies at 58,200, while potential resistance is expected around 59,300 and 59,500 levels.

-330

November 17, 2025· 16:11 IST

Hrishikesh Yedve, AVP Technical and Derivative Research, Asit C. Mehta Investment Interrmediates

The Nifty index opened on a positive note, witnessed buying interest, and eventually settled the session on the positive note at 26,013. Technically, on the daily chart, Nifty has formed a bullish candle, indicating underlying strength. In the near term, support for the Nifty is placed around 25,710, aligning with the bullish gap zone. On the upside, the 26,100 and 26,280 will act as key resistance points. Therefore, traders are advised to remain cautious at higher levels mentioned above.

The Bank Nifty index opened on a gap up note, continued buying interest and ultimately settled positively at 58,963. Technically, the Bank Nifty index has formed a Bullish candle on the daily chart, signalling bullish momentum. Immediate support for the index is seen near 58,580, while resistance is placed around 59,200, where the trend line hurdle is placed. Thus, traders are advised to buy near support and book profit near resistance levels mentioned above.

-330

November 17, 2025· 16:06 IST

Ajit Mishra – SVP, Research, Religare Broking

Markets edged higher on Monday, with the Nifty 50 extending its winning streak to a sixth straight session and closing near the 26,013 mark amid a firm undertone. The index opened positively and maintained its upward bias throughout the day. Sectorally, most indices attracted buying interest, with auto and banking leading the gains, while metals and IT ended on a muted note. The broader markets also remained buoyant, as both midcap and smallcap indices delivered healthy gains, reflecting improving market breadth.

The up-move was supported by optimism around stable domestic macroeconomic conditions and a strong close to the Q2 earnings season. However, despite the domestic strength, investors should remain attentive to global developments, especially in light of increased volatility in the US markets, which could spill over in the near term.

With the weekly expiry ahead and the Nifty now approaching its previous swing high near 26,100, some resistance at higher levels cannot be ruled out. That said, the broader undertone remains positive. A decisive breakout above 26,100 could open the doors for a move toward the 26,300–26,500 zone. On the downside, support is placed at 25,900 and 25,700, and dips toward these levels are likely to attract buying interest.

We continue to favor sectors such as banking, auto, and metal, which have shown consistent strength, while selectively identifying opportunities in other pockets.

-330

November 17, 2025· 16:01 IST

Taking Stock: Market rally continues for 6th straight day; Bank Nifty, midcap index at record highs

Broader indices have outperformed the main indices with Nifty Midcap hitting fresh record high of 61,211.05, while Nifty smallcap index rose 0.52 percent....Read More

-330

November 17, 2025· 15:59 IST

Sudeep Shah, Head - Technical and Derivatives Research at SBI Securities

The benchmark index Nifty continued its northward trajectory, closing above the psychological 26000 level with a gain of 0.40%, reinforcing bullish sentiment in the market. Adding to the optimism, Bank Nifty broke out of its consolidation phase and scaled a fresh all-time high on Monday, signalling strength in the banking space.

Among Nifty constituents, Eternal and Tata Consumer emerged as the top gainers, while TMPV and UltraTech Cement were the major laggards. A key highlight of the session was that all sectoral indices ended in the green, underscoring broad-based buying. Nifty PSU Bank, Consumer Durables, and Private Bank indices led the charge, posting robust gains.

The broader market also mirrored this positive tone. Nifty Midcap 100 continued its upward journey, hitting a new all-time high, while Nifty Smallcap 100 closed with a healthy gain of 0.52%. Market breadth remained firmly positive, with the Advance/Decline ratio tilted in favour of advancers. From the Nifty 500 universe, 328 stocks ended higher, reflecting strong participation across segments.

Nifty View

Considering the current chart structure, the Nifty is likely to continue its northward journey and test the level of 26150, followed by 26300 in the short term. While on the downside, the support is shifted higher in the zone of 25900-25880 level.

Bank Nifty View

The Bank Nifty index has delivered a decisive breakout from its consolidation phase on the daily chart, signalling renewed strength in the banking space. This technical development suggests that the index is poised to extend its upward trajectory in the short term. Based on the current chart structure, Bank Nifty is likely to test 59500 initially, followed by the 59900 level.

On the downside, the support zone has shifted higher to 58700–58600, which is expected to act as a strong cushion for any pullback. The breakout aligns with the broader bullish sentiment in the market, as financials continue to lead the rally.

-330

November 17, 2025· 15:56 IST

Rupak De, Senior Technical Analyst at LKP Securities

The index moved up after a few days of consolidation on the daily timeframe. Besides, it has been sustaining above the 21EMA, which is a critical short-term moving average. The RSI is in a bullish crossover on the daily chart.

In addition, the formation of a higher bottom indicates a rising market. The trend is likely to remain strong in the short term, with the potential to move towards 26,200/26,350. On the lower side, support is placed at 25,800.

-330

November 17, 2025· 15:48 IST

Abhinav Tiwari, Research Analyst at Bonanza

Today, the Indian equities ended on a positive note, with the Sensex surging over 388 points and the Nifty testing the 26,000 mark, led by a broad-based rally across sectors. The positive momentum was primarily driven by the NDA’s decisive victory in Bihar, which boosted investor confidence in policy continuity and market stability. Additional support came from softer inflation data, progress in India-US trade negotiations, and a sharp recovery in the banking sector, especially PSU banks, which led the gains.

The rupee also strengthened against the dollar, closing at 88.65, further adding to the positive sentiment. Kotak Mahindra Bank, Eternal, Tata Consumer, Shriram Finance, Eicher Motors, and Max Healthcare were among the top gainers, while IT and metal stocks saw mild profit booking.

Going forward, we will closely monitor further developments in India-US trade talks. The positive momentum is expected to continue, supported by stable domestic fundamentals and improving corporate earnings. However, volatility may persist due to ongoing global uncertainties and the potential for further foreign selling. Investors are advised to remain selective, focusing on quality stocks and sectors that have shown resilience and strong fundamentals.

-330

November 17, 2025· 15:39 IST

Vinod Nair, Head of Research, Geojit Investments

The market has maintained its positive momentum, hovering near the key psychological level of 26,000, as investors anticipate a strong catalyst for further upward movement. A potential trade deal remains a crucial trigger that participants are closely monitoring. Currently, the risk-reward ratio is largely favorable, bolstered by stronger-than-expected Q2 earnings from Midcaps, which have reinforced confidence in growth revival and point to potential future earnings upgrades.

-330

November 17, 2025· 15:31 IST

Currency Check | Rupee closes higher

Indian rupee ended higher by 11 paise at 88.63 per dollar on Monday versus Friday's close of 88.74.

-330

November 17, 2025· 15:30 IST

Market Close | Nifty above 26,000, Sensex jumps 388 pts; all sectors in the green

Indian benchmark indices ended on a positive note with Nifty above 26,000 on November 17.

At close, the Sensex was up 388.17 points or 0.46 percent at 84,950.95, and the Nifty was up 103.40 points or 0.40 percent at 26,013.45. About 1862 shares advanced, 2068 shares declined, and 155 shares unchanged.

Bajaj Auto, Tata Consumer, Eicher Motors, Max Healthcare, Maruti Suzuki were among major gainers on the Nifty, while losers were TMPV, Adani Enterprises, Jio Financial, Interglobe Aviation, UltraTech Cement.

All the other sectoral indices ended in the green with auto, bank, realty, capital goods, consumer durables, PSU Bank up 0.5-1%.

BSE Midcap and smallcap indices rose 0.6% each.

-330

November 17, 2025· 15:27 IST

Sensex Today | Infosys unveils AI-first GCC model

Infosys today unveiled its AI-First GCC Model, a specialized offering that accelerates the setup and transformation of Global Capability Centers (GCCs) into AI-powered hubs for innovation and growth. This new offering empowers enterprises to reimagine their GCCs as strategic assets that drive innovation, agility, and competitive advantage in an AI-first world.

-330

November 17, 2025· 15:21 IST

Sensex Today | Power Grid to raise Rs 3800 crore vis bonds

The ‘Committee of Directors for Bonds’ in their meeting held today i.e. on 17th November, 2025, has approved the raising of Bonds as Unsecured, Non-convertible, Non-cumulative, Redeemable, Taxable POWERGRID Bonds - LXXXIII (83rd) Issue 2025-26 (for an amount upto Rs 3,800 crore) on Private Placement.

Power Grid Corporation of India was quoting at Rs 273.35, up Rs 2.05, or 0.76 percent.

It has touched an intraday high of Rs 273.95 and an intraday low of Rs 270.10.

It was trading with volumes of 265,480 shares, compared to its five day average of 701,023 shares, a decrease of -62.13 percent.

In the previous trading session, the share closed up 0.50 percent or Rs 1.35 at Rs 271.30.

The share touched a 52-week high of Rs 345.25 and a 52-week low of Rs 247.50 on 25 November, 2024 and 28 February, 2025, respectively.

Currently, the stock is trading 20.83 percent below its 52-week high and 10.44 percent above its 52-week low.

Market capitalisation stands at Rs 254,232.01 crore.

-330

November 17, 2025· 15:19 IST

Sensex Today | Nomura maintains ‘neutral’ rating on Exide Industries, target price at Rs 404

#1 Q2 revenue & EBITDA miss

#2 Demand deferred due to GST cuts, exports weak

#3 EBITDA margin falls to 9.4 percent vs estimated 12.4 percent

-330

November 17, 2025· 15:16 IST

Sensex Today | Saatvik Green Energy arm gets order of Rs 177.50 crore

Saatvik Solar Industries has received and accepted order aggregating to INR 177.50 Crores from one renowned Independent Power producers/EPC Players

for supply of solar PV modules.

-330

November 17, 2025· 15:13 IST

Sensex Today | Jefferies keeps ‘buy’ rating on Voltas, target price at Rs 1,635

#1 September quarter miss on margin

#2 Higher ad costs, poor operating leverage & new facilities weigh

#3 RAC market share improves to 18.5 percent vs 16 percent in March quarter

#4 Recovery expected with new BEE norms & summer stocking

-330

November 17, 2025· 15:10 IST

Q2 Results impact: Ahluwalia Contracts, Ajax Engg shares jump up to 14%, VIP Industries down 3%

Ajax Engineering shares extended gains for the second consecutive session, rising nearly 18 percent since releasing its results for Q2 FY26....Read More

-330

November 17, 2025· 15:08 IST

Sensex Today | Jefferies keeps ‘hold’ rating on Concord Biotech, target price at Rs 1,500

#1 Q2 well below estimates due to regulatory delays, procurement shifts & tender holds

#2 Near-term earnings under pressure from new injectables facility

#3 Cuts FY26-28 EPS 6-10 percent

-330

November 17, 2025· 15:05 IST

Kunal Kamble, Sr. Technical Research Analyst at Bonanza

Nifty Bank hit a fresh all-time high near 58,957, breaking decisively above its recent consolidation range between 57,500–58,800, confirming a strong bullish continuation. The index is trading comfortably above the 20 & 50 EMA, both of which are rising and reinforcing the ongoing uptrend.

With the breakout validated by a strong candle and sustained momentum, the immediate resistance zone now lies at 59,200–59,500, and a move beyond this could open upside targets toward 60,200and 61,000–61,200. On the downside, 58,300–58,000 acts as the first important support and a healthy retest area, followed by strong support at 57,545–57,572—the lower boundary of the previous range. A break below this may trigger a deeper pullback toward the 50-EMA (56,709), while the long-term structural support remains near 53,850. RSI is hovering around 71, indicating overbought conditions, but in strong bull markets, such readings often sustain for extended periods.

Overall, the trend remains firmly bullish as long as the index holds above 58,000, and the breakout suggests further upside potential in the coming sessions.

-330

November 17, 2025· 15:03 IST

Markets@3 | Sensex up 360 points, Nifty above 26000

The Sensex was up 367.21 points or 0.43 percent at 84,929.99, and the Nifty was up 100.40 points or 0.39 percent at 26,010.45. About 1859 shares advanced, 2047 shares declined, and 157 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 996.45 0.69 | 13.14m | 1,304.98 |

| TMPV | 372.45 -4.79 | 28.95m | 1,079.43 |

| Bharti Airtel | 2,113.40 0.6 | 5.12m | 1,082.30 |

| Kotak Mahindra | 2,101.30 1.04 | 4.27m | 898.80 |

| ICICI Bank | 1,378.70 0.42 | 6.02m | 829.90 |

| Infosys | 1,506.50 0.25 | 6.45m | 968.38 |

| Reliance | 1,518.30 -0.04 | 4.72m | 715.57 |

| SBI | 973.10 0.54 | 6.26m | 608.64 |

| TCS | 3,105.20 -0.03 | 1.92m | 595.20 |

| M&M | 3,734.30 0.97 | 1.85m | 690.63 |

| Eternal | 309.25 1.81 | 22.73m | 695.08 |

| Max Healthcare | 1,122.70 1.78 | 4.59m | 508.52 |

| Bajaj Finance | 1,027.40 0.87 | 4.99m | 512.95 |

| Shriram Finance | 815.95 0.82 | 6.21m | 509.95 |

| Axis Bank | 1,249.90 0.67 | 3.52m | 441.58 |

| Bharat Elec | 424.65 -0.52 | 11.39m | 484.20 |

| Larsen | 4,026.90 0.56 | 1.03m | 411.95 |

| Tata Steel | 173.20 -0.61 | 23.25m | 403.14 |

| Maruti Suzuki | 15,874.00 1.21 | 243.58k | 385.19 |

| Adani Enterpris | 2,451.40 -2.6 | 2.03m | 496.48 |

-330

November 17, 2025· 14:58 IST

Sensex Today | Capillary Technologies India IPO Subscribed at 0.44 times at 2:57 PM (Day 2)

QIB – 0.29 times

NII - 0.44 times

Retail – 0.88 times

Employee Reserved - 1.76 times

Overall – 0.44 times

-330

November 17, 2025· 14:56 IST

Sensex Today | Convatec selects LTIMindtree for strategic, AI-Powered SAP S/4HANA transformation

LTIMindtree has announced its selection as a strategic partner by Convatec, a leading global medical products and technologies company, for the implementation of SAP’s Digital Core – S/4HANA. As part of this engagement, LTIMindtree will support Convatec to implement SAP’s Digital Core – S/4HANA across its Convatec’s business operations.

-330

November 17, 2025· 14:54 IST

Sensex Today | October exports down 11.8%, imports up 16%

Exports down 11.8% at USD 34.38 billion against USD 38.98 billion, YoY

Imports rose 16.64% at USD 76.06 billion versus USD 65.21 billion, YoY

-330

November 17, 2025· 14:52 IST

Sensex Today | Fujiyama Power Systems IPO Subscribed at 1.64 times at 2:48 PM (Day 3)

QIB – 4.48 times

NII - 0.40 times

Retail – 0.64 times

Employee Reserved - 1.26 times

Overall – 1.64 times

-330

November 17, 2025· 14:48 IST

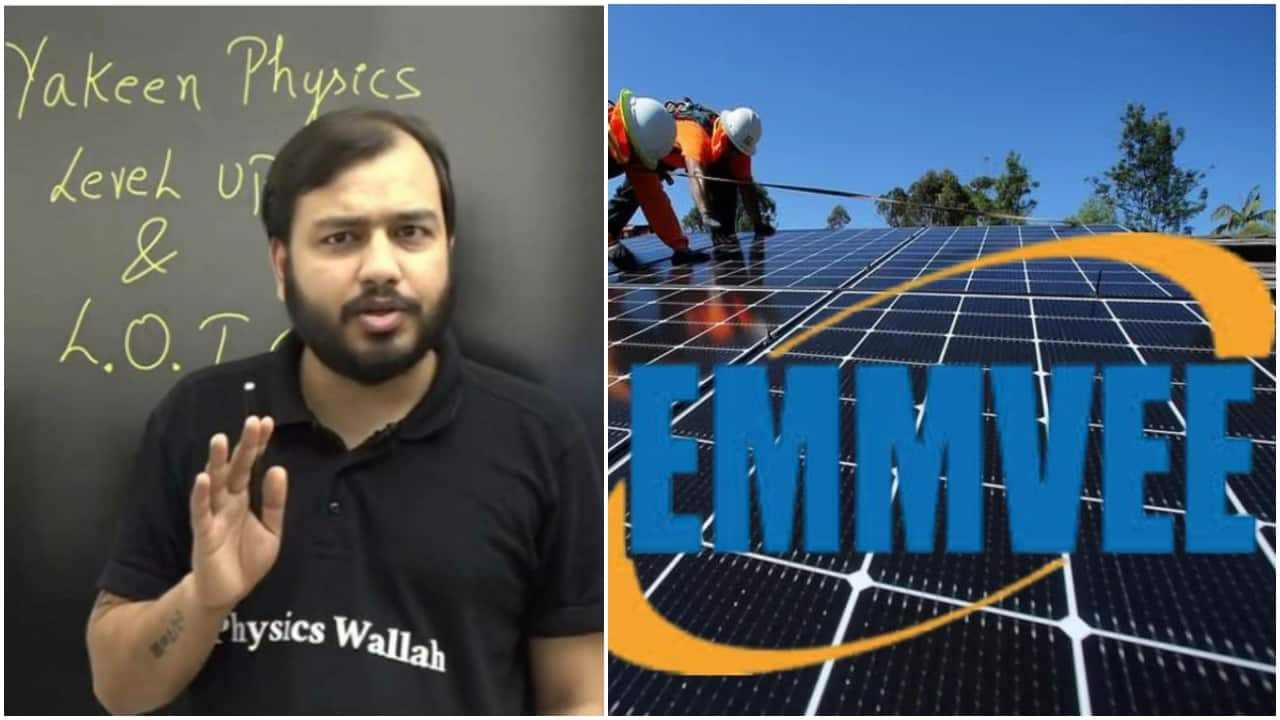

PhysicsWallah, Emmvee Photovoltaic IPO shares to list tomorrow; here's what latest GMP suggests

PhysicsWallah and Emmvee Photovoltaic Power Ltd are set to debut on the stock exchanges on November 18....Read More

-330

November 17, 2025· 14:45 IST

Sensex Today | Puravankara signs agreement to lease with IKEA

Puravankara today announced the signing of an Agreement to Lease (ATL) with IKEA India for leasing of two floors of retail space at the Purva Zentech Park, located on Kanakapura Road, Bengaluru.

Puravankara was quoting at Rs 253.40, down Rs 7.10, or 2.73 percent.

It has touched an intraday high of Rs 262.50 and an intraday low of Rs 253.

It was trading with volumes of 11,408 shares, compared to its five day average of 6,440 shares, an increase of 77.14 percent.

In the previous trading session, the share closed down 0.02 percent or Rs 0.05 at Rs 260.50.

The share touched a 52-week high of Rs 463.00 and a 52-week low of Rs 205.05 on 17 December, 2024 and 09 May, 2025, respectively.

Currently, the stock is trading 45.27 percent below its 52-week high and 23.58 percent above its 52-week low.

Market capitalisation stands at Rs 6,009.37 crore.

-330

November 17, 2025· 14:41 IST

Sensex Today | BSE Consumer Durables index up 0.5%, rises on 6th consecutive session

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Voltas | 1,378.45 | 2.03 | 74.95k |

| Dixon Technolog | 15,600.50 | 1.18 | 14.47k |

| Titan Company | 3,869.00 | 1.17 | 9.69k |

| Havells India | 1,482.95 | 0.95 | 7.20k |

| PG Electroplast | 583.30 | 0.93 | 165.35k |

| Blue Star | 1,782.00 | 0.78 | 2.53k |

| Amber Enterpris | 7,433.00 | 0.74 | 10.13k |

| Kalyan Jeweller | 496.95 | 0.34 | 48.55k |

-330

November 17, 2025· 14:37 IST

Sensex Today | Nomura keeps ‘buy’ rating on LG Electronics, target price at Rs 1,900

#1 Play on affordable premiumisation

#2 Q2 slight miss, growth from new launches, B2B, exports & localisation

#3 Market share gains across categories

#4 Premium appliances lead Q3 recovery

-330

November 17, 2025· 14:31 IST

The house always wins: Stock exchanges consistently beat their benchmarks worldwide

Global 20-year return data shows that almost every listed stock exchange has outperformed its benchmark index, underscoring the long-term strength of the exchange business model....Read More

-330

November 17, 2025· 14:26 IST

Sensex Today | NBCC wins construction order worth nearly Rs 500 crore in Jharkhand; Stock gains

-330

November 17, 2025· 14:21 IST

Sensex Today | Convatec selects LTIMindtree for strategic, AI-powered SAP S/4HANA transformation

-330

November 17, 2025· 14:08 IST

-330

November 17, 2025· 14:02 IST

Markets@2 | Sensex, Nifty trade higher

The Sensex was up 346.99 points or 0.41 percent at 84,909.77, and the Nifty was up 89.80 points or 0.35 percent at 25,999.85. About 1887 shares advanced, 1976 shares declined, and 166 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY Auto | 27490.75 0.92 | 20.39 2.35 | 0.96 19.97 |

| NIFTY IT | 36375.85 0.21 | -16.06 1.93 | 4.08 -14.19 |

| NIFTY Pharma | 22836.40 0.07 | -2.46 2.04 | 2.62 4.99 |

| NIFTY FMCG | 55662.20 0.18 | -2.00 0.59 | -1.69 -0.22 |

| NIFTY PSU Bank | 8500.10 1.19 | 29.96 1.91 | 11.28 30.92 |

| NIFTY Metal | 10494.75 0 | 21.33 0.10 | 2.90 18.87 |

| NIFTY Realty | 945.40 0.45 | -10.16 0.13 | 1.25 -0.16 |

| NIFTY Energy | 36418.20 0.43 | 3.50 1.38 | 2.89 -1.70 |

| NIFTY Infra | 9639.85 0.22 | 13.90 2.32 | 3.23 14.31 |

| NIFTY Media | 1493.25 0.92 | -17.86 1.30 | -1.73 -22.40 |

-330

November 17, 2025· 14:00 IST

Sensex Today | European indices trade flat; Dow Futures up 110 points

-330

November 17, 2025· 13:58 IST

Currency Check | Rupee trades higher at 88.64

Indian rupee is trading higher at 88.64 per dollar versus Friday's close of 88.74.

-330

November 17, 2025· 13:56 IST

Sensex Today | EID Parry share price gains most in 18 weeks

EID Parry (India) was quoting at Rs 1,061.95, up Rs 35.95, or 3.50 percent.

It has touched an intraday high of Rs 1,062.65 and an intraday low of Rs 1,028.05.

It was trading with volumes of 7,575 shares, compared to its five day average of 12,242 shares, a decrease of -38.12 percent.

In the previous trading session, the share closed down 1.79 percent or Rs 18.65 at Rs 1,026.00.

The share touched a 52-week high of Rs 1,246.45 and a 52-week low of Rs 639.30 on 31 July, 2025 and 03 March, 2025, respectively.

Currently, the stock is trading 14.8 percent below its 52-week high and 66.11 percent above its 52-week low.

Market capitalisation stands at Rs 18,887.99 crore.

-330

November 17, 2025· 13:54 IST

Sensex Today | Rajesh Power Services bags order of Rs 85 crore

The company has received orders for supply, installation, testing & commissioning of 220kV underground cable at proposed 220kV Dholera substation from Gujarat Energy Transmission Corporation Limited (GETCO) and design, supply, erection, testing & commissioning of 132kV transmission line and associated line bays at GSS Nabinagar (in Joint Venture with a Private Company) from East Central Railway.

The total contract value is Rs 85.24 crore.

-330

November 17, 2025· 13:51 IST

Sensex Today | Alembic Pharmaceuticals gets USFDA approval for Diltiazem Hydrochloride tablets

The company has received final approval from the US Food & Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) for Diltiazem Hydrochloride tablets.

Diltiazem Hydrochloride tablets are indicated for the management of chronic stable angina.

-330

November 17, 2025· 13:42 IST

Sensex Today | Nifty Private Bank index rises nearly 1%, extend gains on 7th day

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Yes Bank | 23.13 | 2.8 | 118.85m |

| Kotak Mahindra | 2,101.30 | 1.04 | 3.12m |

| Axis Bank | 1,252.40 | 0.87 | 2.96m |

| IDFC First Bank | 81.11 | 0.85 | 20.81m |

| Federal Bank | 238.15 | 0.8 | 2.43m |

| Bandhan Bank | 155.73 | 0.74 | 3.83m |

| IndusInd Bank | 854.30 | 0.71 | 2.78m |

| RBL Bank | 320.25 | 0.5 | 1.66m |

| HDFC Bank | 994.00 | 0.44 | 7.77m |

| ICICI Bank | 1,378.20 | 0.38 | 4.12m |

-330

November 17, 2025· 13:40 IST

Sensex Today | IRB Infrastructure Developers arm gets LoA from NHAI

IRB Infrastructure Trust, the Private InvIT sponsored by IRB Infrastructure Developers, has received the Letter of Award (LoA) from the National Highways Authority of India (NHAI) for the TOT-17 Bundle, covering 366 km of the Lucknow–Ayodhya–Gorakhpur Corridor on NH-27 and part of the Lucknow–Varanasi Corridor on NH-731 in Uttar Pradesh, for a revenue-linked concession period of 20 years.

The Trust will pay an upfront bid concession fee of Rs 9,270 crore to NHAI for the revenue-linked concession period of 20 years.

IRB Infrastructure Developers was quoting at Rs 45.04, up Rs 2.13, or 4.96 percent.

It has touched an intraday high of Rs 45.93 and an intraday low of Rs 44.25.

It was trading with volumes of 4,965,903 shares, compared to its five day average of 785,234 shares, an increase of 532.41 percent.

In the previous trading session, the share closed up 1.32 percent or Rs 0.56 at Rs 42.91.

The share touched a 52-week high of Rs 61.98 and a 52-week low of Rs 40.54 on 10 December, 2024 and 26 September, 2025, respectively.

Currently, the stock is trading 27.33 percent below its 52-week high and 11.1 percent above its 52-week low.

Market capitalisation stands at Rs 27,199.66 crore.

-330

November 17, 2025· 13:36 IST

Sensex Today | HSBC retains ‘hold’ rating on Vishal Mega Mart, target price at Rs 149

#1 Revenue/EBITDA beat by 3 percent/2 percent

#2 SSSg at 11 percent with 150 bps boost from festive timing

#3 Operating leverage supports margin

-330

November 17, 2025· 13:33 IST

Sensex Today | BSE PSU index rises 0.5%, extend gains on second day

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ircon Internati | 168.70 | 3.31 | 701.51k |

| Bank of Mah | 59.84 | 3.17 | 1.38m |

| IOB | 39.98 | 3.12 | 905.07k |

| Chennai Petro | 1,060.00 | 3.04 | 49.80k |

| Engineers India | 205.75 | 2.95 | 571.67k |

| MRPL | 176.70 | 2.85 | 290.98k |

| Punjab and Sind | 30.90 | 2.73 | 131.80k |

| Central Bank | 38.90 | 2.61 | 1.96m |

| Canara Bank | 149.60 | 2.43 | 1.62m |

| HUDCO | 233.10 | 2.39 | 374.86k |

| Rail Vikas | 327.70 | 2.1 | 536.21k |

| UCO Bank | 31.36 | 2.08 | 1.56m |

| Indian Bank | 885.80 | 1.93 | 79.82k |

| Gujarat Gas | 410.35 | 1.66 | 8.19k |

| Union Bank | 154.90 | 1.44 | 222.75k |

| BHEL | 285.65 | 1.37 | 749.81k |

| BPCL | 375.85 | 1.31 | 369.41k |

| IFCI | 55.41 | 1.24 | 580.32k |

| IRCTC | 714.10 | 1.23 | 76.88k |

| PNB | 123.55 | 1.19 | 576.09k |

-330

November 17, 2025· 13:30 IST

Sensex Today | Angel One shares rises on fifth consecutive session

Angel One was quoting at Rs 2,851.05, up Rs 105.35, or 3.84 percent.

It has touched an intraday high of Rs 2,859.35 and an intraday low of Rs 2,748.05.

It was trading with volumes of 250,113 shares, compared to its five day average of 33,853 shares, an increase of 638.83 percent.

In the previous trading session, the share closed up 1.17 percent or Rs 31.80 at Rs 2,745.70.

The share touched a 52-week high of Rs 3,502.60 and a 52-week low of Rs 1,942.00 on 09 December, 2024 and 13 March, 2025, respectively.

Currently, the stock is trading 18.6 percent below its 52-week high and 46.81 percent above its 52-week low.

Market capitalisation stands at Rs 25,889.74 crore.

-330

November 17, 2025· 13:27 IST

Sensex Today | KEC International wins new orders of Rs 1,016 crore

KEC International has secured new orders of Rs 1,016 crores across various businesses.

KEC International was quoting at Rs 784.10, down Rs 7.55, or 0.95 percent.

It has touched an intraday high of Rs 796.75 and an intraday low of Rs 782.25.

It was trading with volumes of 20,177 shares, compared to its five day average of 130,794 shares, a decrease of -84.57 percent.

In the previous trading session, the share closed up 0.93 percent or Rs 7.30 at Rs 791.65.

The share touched a 52-week high of Rs 1,312.00 and a 52-week low of Rs 605.05 on 04 December, 2024 and 07 April, 2025, respectively.

Currently, the stock is trading 40.24 percent below its 52-week high and 29.59 percent above its 52-week low.

Market capitalisation stands at Rs 20,872.74 crore.

-330

November 17, 2025· 13:25 IST

Sensex Today | Capillary Technologies India IPO Subscribed at 0.41 times at 1:21 PM (Day 2)

QIB – 0.29 times

NII - 0.40 times

Retail – 0.75 times

Employee Reserved - 1.60 times

Overall – 0.41 times

-330

November 17, 2025· 13:22 IST

Sensex Today | Fujiyama Power Systems IPO Subscribed at 0.71 times at 1:18 PM (Day 3)

QIB – 1.32 times

NII - 0.27 times

Retail – 0.54 times

Employee Reserved - 1.13 times

Overall – 0.71 times

-330

November 17, 2025· 13:20 IST

Tenneco Clean Air India IPO allotment: How to check status on registrar, BSE and NSE; check latest GMP

Tenneco Clean Air India IPO shares will be listed on both NSE and BSE on November 19, following a 59 times subscription to its Rs 3,600-crore issue....Read More

-330

November 17, 2025· 13:16 IST

Sensex Today | Asian markets end mixed; Hang Seng down 0.7%, Kospi up 1.9%

-330

November 17, 2025· 13:14 IST

Sensex Today | Jefferies initiates ‘buy’ rating on Torrent Power, target price at Rs 1,485

#1 Unique utility with steady growth, high RoE & low leverage

#2 60 percent of EBITDA from distribution growing 8 percent CAGR with over 16 percent RoE

#3 40 percent from generation, rising 1.6x over FY26–30 driven by renewables

-330

November 17, 2025· 13:07 IST

Groww founder Lalit Keshre, a farmer’s son, becomes billionaire after stellar IPO

Keshre currently holds 55.91 crore shares, representing a 9.06 percent stake in Groww. With the stock trading at record Rs 169 a share, his holding is valued at Rs 9448 crore, placing him around the us $1 billion mark. ...Read More

-330

November 17, 2025· 13:05 IST

Sensex Today | Hero MotoCorp, Canara Bank, Marico, among others hit 52-week high

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Hero Motocorp | 5775.00 | 5775.00 | 5,762.40 |

| Marico | 764.85 | 764.85 | 761.20 |

| City Union Bank | 282.95 | 282.95 | 277.35 |

| Canara Bank | 150.35 | 150.35 | 149.60 |

| Asahi India | 996.00 | 996.00 | 990.60 |

| Indian Bank | 891.60 | 891.60 | 888.95 |

| Laurus Labs | 1020.50 | 1020.50 | 1,019.00 |

| UPL | 772.95 | 772.95 | 770.05 |

| PNB | 124.85 | 124.85 | 123.80 |

| BPCL | 381.60 | 381.60 | 375.80 |

| MCX India | 9795.00 | 9795.00 | 9,750.00 |

| Bank of India | 150.05 | 150.05 | 147.80 |

| Muthoot Finance | 3763.80 | 3763.80 | 3,749.85 |

| SBI | 976.20 | 976.20 | 972.10 |

| Can Fin Homes | 913.50 | 913.50 | 888.95 |

| Navin Fluorine | 6169.45 | 6169.45 | 6,018.95 |

| Asian Paints | 2926.00 | 2926.00 | 2,900.00 |

| Star Health | 533.90 | 533.90 | 520.65 |

-330

November 17, 2025· 13:01 IST

Markets@1 | Sensex, Nifty at day's high

-330

November 17, 2025· 12:56 IST

Sensex Today | Maruti Suzuki India recalls 39,506 units of Grand Vitara

The leading carmaker has announced a recall of 39,506 units of the Grand Vitara, manufactured from December 9, 2024, to April 29, 2025. It is suspected that the fuel level indicator and warning light in the speedometer assembly (Part) in some of these vehicles may not accurately reflect the fuel status as intended.

-330

November 17, 2025· 12:52 IST

Sensex Today | Morgan Stanley keeps ‘overweight’ rating on Brainbees Solutions, target price at Rs 417

#1 Q2 margin beat across businesses, topline miss driven by Globalbees

#2 Sequential growth recovery expected in H2FY26

-330

November 17, 2025· 12:49 IST

Sensex Today | Gabriel India shares extend fall on 5th day; down most in 20 weeks

Gabriel India was quoting at Rs 1,050.85, down Rs 117.05, or 10.02 percent.

It has touched an intraday high of Rs 1,167.90 and an intraday low of Rs 1,029.25.

It was trading with volumes of 119,827 shares, compared to its five day average of 16,504 shares, an increase of 626.04 percent.

In the previous trading session, the share closed down 5.03 percent or Rs 61.80 at Rs 1,167.90.

The share touched a 52-week high of Rs 1,386.45 and a 52-week low of Rs 387.05 on 08 October, 2025 and 28 January, 2025, respectively.

Currently, the stock is trading 24.21 percent below its 52-week high and 171.5 percent above its 52-week low.

Market capitalisation stands at Rs 15,094.82 crore.

-330

November 17, 2025· 12:47 IST

Sensex Today | CLSA keeps ‘buy’ rating on IRB Infrastructure, target price at Rs 72

#1 Tolling strong, construction weak on early monsoons & lack of new wins

#2 Mumbai–Pune expressway toll up 4 percent YoY despite rain

#3 Other roads see 13 percent YoY growth

#4 Company wins USD 1.9 billion concessions over FY23-24 & leads bidding for USD 1.1 billion more

#5 Company well-positioned in India’s asset monetisation pipeline

-330

November 17, 2025· 12:44 IST

Sensex Today | Nifty Midcap 100 index hits fresh high

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IRB Infra | 45.40 | 5.68 | 75.15m |

| Bank of Mah | 60.12 | 3.64 | 24.16m |

| Yes Bank | 23.19 | 3.07 | 105.89m |

| Marico | 760.00 | 2.88 | 2.68m |

| AU Small Financ | 914.50 | 2.68 | 1.01m |

| One 97 Paytm | 1,330.60 | 2.42 | 1.51m |

| GMR Airports | 97.94 | 2.37 | 9.37m |

| Indian Bank | 887.60 | 2.21 | 847.89k |

| HUDCO | 232.32 | 2.12 | 2.84m |

| Rail Vikas | 326.85 | 1.81 | 10.39m |

| FSN E-Co Nykaa | 264.55 | 1.7 | 3.21m |

| Escorts Kubota | 3,609.20 | 1.64 | 43.91k |

| Biocon | 417.85 | 1.63 | 1.84m |

| HINDPETRO | 488.40 | 1.49 | 1.46m |

| Voltas | 1,370.90 | 1.48 | 1.04m |

| UPL | 769.40 | 1.42 | 1.82m |

| MM Financial | 313.00 | 1.41 | 408.82k |

| Max Healthcare | 1,118.10 | 1.36 | 2.85m |

| Oracle Fin Serv | 8,335.00 | 1.36 | 35.37k |

| Union Bank | 154.83 | 1.36 | 5.83m |

-330

November 17, 2025· 12:42 IST

Tuhin Kanta Pandey, Chairman, CII Financing Summit

We see the rise of domestic investors. India story is not built on bubble, government spending is good, private sector is also investing. There will always be external risk, we have to look at our internal economy, which is strong and will act as shield.

-330

November 17, 2025· 12:39 IST

Sensex Today | Rico Auto shares hit 52-week high; extend gains on 7th day

Rico Auto was quoting at Rs 112.07, up Rs 13.33, or 13.50 percent.

It has touched a 52-week high of Rs 114.28.

It has touched an intraday high of Rs 114.28 and an intraday low of Rs 99.00.

It was trading with volumes of 2,116,076 shares, compared to its five day average of 29,548 shares, an increase of 7,061.39 percent.

It was trading with volumes of 2,116,076 shares, compared to its thirty day average of 59,359 shares, an increase of 3,464.90 percent.

In the previous trading session, the share closed up 0.58 percent or Rs 0.57 at Rs 98.74.

Market capitalisation stands at Rs 1,516.14 crore.

-330

November 17, 2025· 12:37 IST

Sensex Today | CLSA retains ‘hold’ rating on Oil India, target price at Rs 420

#1 Q2 PAT below estimate as higher costs & FX losses offset strong realisations

#2 Refinery margins improve sharply

#3 Upstream stays soft on lower crude output & mild gas recovery

-330

November 17, 2025· 12:31 IST

Sensex Today | Nifty Auto index up nearly 1%, snaps 2-day fall

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 5,760.00 | 4 | 1.15m |

| TVS Motor | 3,445.80 | 1.75 | 722.32k |

| Balkrishna Ind | 2,365.80 | 1.55 | 30.24k |

| Bajaj Auto | 8,976.50 | 1.51 | 156.74k |

| Tube Investment | 3,098.30 | 1 | 47.29k |

| Eicher Motors | 6,761.00 | 0.99 | 242.46k |

| Maruti Suzuki | 15,811.00 | 0.81 | 134.57k |

| M&M | 3,726.60 | 0.76 | 622.01k |

| Bosch | 37,230.00 | 0.74 | 13.15k |

| Ashok Leyland | 148.46 | 0.13 | 5.34m |

| MOTHERSON | 109.94 | 0.09 | 6.40m |

| Exide Ind | 381.15 | 0.04 | 1.38m |

-330

November 17, 2025· 12:28 IST

Sensex Today | NBCC gets order of Rs 498.3 crore

The company has received an order of Rs 498.3 crore from Damodar Valley Corporation for construction of integrated township at Chandrapura Thermal Power Station, Chandrapura, Jharkhand.

-330

November 17, 2025· 12:24 IST

Q2 results impact: Marico shares jump 3% as analysts see EBITDA growth in H2; should you buy, sell or hold?

Marico share price: JM Financial kept a ‘Buy’ call on the stock, and raised its target price to Rs 850 per share from Rs 825 per share....Read More

-330

November 17, 2025· 12:22 IST

Tuhin Kanta Pandey, Chairman, SEBI, at CII Financial Summit

Risk capital is flowing into startups and other sectors, which was earlier unimaginable. New Centralised KYC mechanism is in works for in interoperability in KYC across regulators.

Working on easing FPI registration process, trying to bring it down to few days, which is possible through usage of digital signatures.

-330

November 17, 2025· 12:21 IST

Sensex Today | CLSA keeps ‘outperform’ rating on Tata Motors PV, target price at Rs 450

#1 JLR EBIT margin at -8.6 percent vs -2 percent expected

#2 Complete production loss in September, October output at 17,000 units

#3 India PV EBITDA margin at 5.8 percent

#4 GST cuts support positive outlook for small-to-mid SUVs

#5 JLR lowers FY26 guidance: EBIT 0–2 percent (from 5–7)

-330

November 17, 2025· 12:16 IST

Sensex Today | ideaForge Technology bags order worth Rs 32 cr

ideaForge Technology has received an order worth approximately Rs 32 crores (all inclusive) to supply Hybrid UAVs with accessories to Ministry of Defence.

-330

November 17, 2025· 12:15 IST

Sensex Today | HSBC keeps ‘buy’ rating on Marico, target price at Rs 870

#1 In-line quarter with 7 percent industry-leading volume growth

#2 Temporary slowdown in foods but long-term story intact

#3 Confident of double-digit EBITDA growth from H2FY26

-330

November 17, 2025· 12:07 IST

Sensex Today | Marksans Pharma's UK arm receives marketing authorization for its products

Marksans Pharma announced that its wholly owned subsidiary Relonchem Limited in UK has received marketing authorization for 1. Mefenamic Acid 250 mg Film-Coated Tablets 2. Mefenamic Acid 500 mg Film-Coated Tablets from UK MHRA.

-330

November 17, 2025· 12:05 IST

Sensex Today | Nomura maintains ‘neutral’ rating on Hero MotoCorp, target price at Rs 5,817

#1 Steady performance expected

#2 Q2 in-line, post-festive demand better

#3 ABS implementation a risk

#4 Expects 5-6 percent growth in FY26, trades at fair value zone

-330

November 17, 2025· 12:03 IST

Markets@12 | Sensex rises 220 points, Nifty above 25950

The Sensex was up 229.52 points or 0.27 percent at 84,792.30, and the Nifty was up 56.45 points or 0.22 percent at 25,966.50. About 1902 shares advanced, 1826 shares declined, and 198 shares unchanged.

-330

November 17, 2025· 12:00 IST

Groww shares rise 10%, hit fresh high, extend post-listing gains to 46% in 4 sessions; mcap rises to Rs 1 lakh crore

Groww shares have gained 44 percent since listing on November 12. ...Read More

-330

November 17, 2025· 11:58 IST

Sensex Today | Loyal Equipments gets purchase order from IOC

Loyal Equipments has received a Purchase Order from Indian Oil Corporatio, for supply of Air Fin Cooler Assembly.

Loyal Equipments was quoting at Rs 205.95, down Rs 0.35, or 0.17 percent.

It has touched an intraday high of Rs 207.65 and an intraday low of Rs 197.05.

It was trading with volumes of 10,126 shares, compared to its five day average of 3,780 shares, an increase of 167.88 percent.

It was trading with volumes of 10,126 shares, compared to its thirty day average of 15,343 shares, a decrease of -34.00 percent.

In the previous trading session, the share closed down 0.39 percent or Rs 0.80 at Rs 206.30.

The share touched a 52-week high of Rs 363.90 and a 52-week low of Rs 184.90 on 07 July, 2025 and 12 March, 2025, respectively.

Currently, the stock is trading 43.4 percent below its 52-week high and 11.38 percent above its 52-week low.

Market capitalisation stands at Rs 210.07 crore.

-330

November 17, 2025· 11:57 IST

Sensex Today | Kotak Mahindra Bank shares gain as board to consider stock split this week

Kotak Mahindra Bank was quoting at Rs 2,102.00, up Rs 26.85, or 1.29 percent.

It has touched an intraday high of Rs 2,119.65 and an intraday low of Rs 2,091.95.

It was trading with volumes of 62,997 shares, compared to its five day average of 140,308 shares, a decrease of -55.10 percent.

In the previous trading session, the share closed up 0.02 percent or Rs 0.50 at Rs 2,075.15.

The share touched a 52-week high of Rs 2,301.55 and a 52-week low of Rs 1,700.00 on 22 April, 2025 and 18 November, 2024, respectively.

Currently, the stock is trading 8.67 percent below its 52-week high and 23.65 percent above its 52-week low.

Market capitalisation stands at Rs 418,010.05 crore.

-330

November 17, 2025· 11:55 IST

Sensex Today | Narayana Hrudayala Q2 consolidated profit jumps 29 percent

#1 Profit spikes 29.6 percent to Rs 258.3 crore Vs Rs 199.3 crore

#2 Revenue increases 20.3 percent to Rs 1,643.8 crore Vs Rs 1,366.7 crore

-330

November 17, 2025· 11:50 IST

Sensex Today | Jefferies keeps ‘buy’ rating on GMR Airports, target price raised to Rs 115

#1 Delivers standout EBITDA beat despite soft traffic

#2 EBITDA boosted by new tariffs, strong non-aero growth & adjacent business scaling

#3 Traffic softness due to Delhi upgrades & airline capacity cuts

#4 Recovery expected in H2

#5 Retail & duty-free tailwinds support yields

#6 Raises EBITDA estimates by 3-7 percent

-330

November 17, 2025· 11:48 IST

Sensex Today | Nifty Media index up nearly 1%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PVR INOX | 1,108.50 | 2.33 | 147.88k |

| Network 18 | 47.19 | 1.99 | 2.17m |

| Sun TV Network | 573.45 | 1.85 | 241.67k |

| Tips Music | 495.75 | 1 | 62.35k |

| Hathway Cable | 13.29 | 0.45 | 752.79k |

| DB Corp | 260.50 | 0.31 | 96.24k |

-330

November 17, 2025· 11:44 IST

Currency Check | Rupee trades higher

Indian rupee has extended the early gains and trading higher at 88.62 per dollar versus Friday's close of 88.74.

-330

November 17, 2025· 11:36 IST

Sensex Today | Jefferies keeps 'underperform' rating on Tata Motors PV, target price at Rs 300

#1 EBITDA loss in September quarter due to JLR cyberattack disruptions

#2 Impact to continue in Q3, normalisation expected by Q4

#3 Multiple JLR headwinds: competition, China consumption tax, higher discounts, BEV transition &aging models

#4 India PV stronger but insufficient to offset JLR weakness

-330

November 17, 2025· 11:22 IST

Fujiyama Power Systems IPO receives 49% subscription on day 3 so far; check latest GMP

Greater Noida-based Fujiyama Power Systems is a manufacturer of products and solution provider in the rooftop solar industry, including on-grid, off-grid and hybrid solar systems...Read More

-330

November 17, 2025· 11:17 IST

Stock Market LIVE Updates | Paras Defence secures Rs 71 crore order from IRDE-DRDO

-330

November 17, 2025· 11:12 IST

Stock Market LIVE Updates | ACME Solar's arm secures Rs 47 crore as change in law compensation

-330

November 17, 2025· 11:06 IST

SpiceJet shares rise 5% as airline expects operational fleet to double by 2025-end

SpiceJet share price: The airline said that higher capacity and better aircraft utilisation are expected to materially improve CASK and lift overall profitability....Read More

-330

November 17, 2025· 11:03 IST

Sensex Today | Nomura upgrades Siemens to maintains ‘neutral’ rating, target price raises to Rs 3,325

#1 Q4FY25 operational beat

#2 Revenue up 16 percent YoY, beating estimates by 14 percent

#3 Adjusted EBITDA 19 percent above estimate, driven by MO segment margin expansion

#4 Raises FY26-27 earnings by 3 percent

#5 Forecasts sales/EBITDA/PAT CAGR of 14 percent/16 percent/16 percent over FY25–28

#6 Expects sales growth at 2x GDP on mobility & electrification capex tailwinds

-330

November 17, 2025· 11:01 IST

Markets@11 | Sensex up 150 pts, Nifty around 25950

The Sensex was up 156.57 points or 0.19 percent at 84,719.35, and the Nifty was up 32.30 points or 0.12 percent at 25,942.35. About 1979 shares advanced, 1668 shares declined, and 196 shares unchanged.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| VLS Finance | 245.60 | 21.90 | 201.47 |

| Safe Enterprise | 290.30 | 21.36 | 239.20 |

| Universal Cable | 878.65 | 21.18 | 725.10 |

| Aarvi Encon | 143.67 | 20.61 | 119.12 |

| S P Apparels | 866.50 | 19.64 | 724.25 |

| GE Power India | 354.15 | 19.28 | 296.90 |

| Service Care | 50.00 | 19.05 | 42.00 |

| Vindhya Telelin | 1,624.00 | 18.50 | 1,370.50 |

| Precision Wires | 271.70 | 17.64 | 230.96 |

| Macpower | 954.70 | 17.51 | 812.45 |

| Rico Auto | 109.25 | 17.40 | 93.06 |

| CSL Fin | 312.40 | 16.89 | 267.25 |

| Unihealth Hospi | 187.00 | 16.88 | 160.00 |

| Nitiraj Enginee | 216.13 | 16.61 | 185.34 |

| Hilton Metal | 48.86 | 16.56 | 41.92 |

| Bhagyanagar Ind | 160.80 | 16.22 | 138.36 |

| Soma Textile | 138.93 | 15.76 | 120.02 |

| Sri Adhikari | 1,030.15 | 15.75 | 889.95 |

| Indo Thai Secu | 423.00 | 15.73 | 365.50 |

| Allcargo | 13.74 | 15.66 | 11.88 |

-330

November 17, 2025· 10:57 IST

Sensex Today | HSBC keeps ‘buy’ rating on Rainbow Childrens Medicare, target price at Rs 1,520

#1 Muted Q2 on lower seasonal illness volumes

#2 Professional CEO to join from January 2026

#3 On track for 38 percent bed addition by FY29

-330

November 17, 2025· 10:52 IST

SpiceJet shares rise 5% as airline expects operational fleet to double by 2025-end

SpiceJet share price: The airline said that higher capacity and better aircraft utilisation are expected to materially improve CASK and lift overall profitability....Read More

-330

November 17, 2025· 10:48 IST

Sensex Today | Shilpa Medicare launches NODUCATM for the first time in India

Shilpa Medicare Limited is proud to announce the launch of NODUCATM (Nor Ursodeoxycholic Acid (NorUDCA)), a first-in-class therapy for the first time in India or anywhere in the world, following the historic approval granted in August 2025 by the Central Drugs Standard Control Organisation (CDSCO), India.

The drugs ushers in a new line of treatment for patients suffering from metabolic dysfunction-associated fatty liver disease (MAFLD), previously referred to as non-alcoholic fatty liver disease (NAFLD).

-330

November 17, 2025· 10:45 IST

Digital gold sales nosedive 60% in October as lack of regulation worries investors

The purchase of digital gold by value fell 61 percent while volume plunged by 80 percent...Read More

-330

November 17, 2025· 10:43 IST

Sensex Today | Morgan Stanley view on NMDC

#1 increases iron ore prices by Rs 50/t for lumps to Rs 5,600/t

#2 Fines price remains unchanged at Rs 4,750/t

#3 Domestic iron ore fines discount to import parity at 57 percent

#4 Price hike likely anticipates stronger post-monsoon demand as steel output rises

#5 Uncertainty over steel safeguard duty, an extension would support prices

#6 Simandou shipments begin, adding downside risk amid China’s year-end steel cuts

-330

November 17, 2025· 10:39 IST

Sensex Today | Nifty PSU Bank index jumps 1%, extend gains on second day

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| UCO Bank | 31.79 | 3.48 | 10.23m |

| Central Bank | 39.21 | 3.43 | 3.83m |

| Punjab and Sind | 31.10 | 3.19 | 1.89m |

| Bank of Mah | 59.77 | 3.03 | 14.80m |

| Canara Bank | 150.13 | 2.78 | 18.49m |

| IOB | 39.69 | 2.32 | 2.18m |

| Bank of India | 149.52 | 2.05 | 4.52m |

| Union Bank | 155.43 | 1.75 | 3.52m |

| PNB | 124.23 | 1.65 | 5.40m |

| Bank of Baroda | 291.45 | 1.64 | 4.74m |

| Indian Bank | 878.15 | 1.12 | 257.78k |

| SBI | 973.40 | 0.57 | 2.29m |

-330

November 17, 2025· 10:36 IST

Sensex Today | Nuvama keeps ‘buy’ rating on NBCC, target price at Rs 146

#1 Revenue up 18 percent YoY, PAT up 26 percent YoY

#2 Order book strong at Rs 1.3 lakh crore

#3 Guides for Rs 20,000 crore order intake, 20 percent FY26 revenue growth & 6–6.5 percent margin

-330

November 17, 2025· 10:33 IST

Sensex Today | Ahluwalia Contracts' Q2 EBITDA jumps 76% and margin up at 11%, YoY

Ahluwalia Contracts India was quoting at Rs 981, up Rs 98.70, or 11.19 percent.

It has touched an intraday high of Rs 1,028.90 and an intraday low of Rs 953.95.

It was trading with volumes of 71,864 shares, compared to its five day average of 1,405 shares, an increase of 5,014.88 percent.

In the previous trading session, the share closed up 0.18 percent or Rs 1.55 at Rs 882.30.

The share touched a 52-week high of Rs 1,175 and a 52-week low of Rs 620.65 on 10 December, 2024 and 18 February, 2025, respectively.

Currently, the stock is trading 16.51 percent below its 52-week high and 58.06 percent above its 52-week low.

Market capitalisation stands at Rs 6,571.48 crore.

-330

November 17, 2025· 10:32 IST

Sensex Today | VLS Finance share price rises 17%, extend gains on third day

VLS Finance was quoting at Rs 245.00, up Rs 36.15, or 17.31 percent.

It has touched an intraday high of Rs 248.65 and an intraday low of Rs 230.00.

It was trading with volumes of 13,813 shares, compared to its five day average of 4,050 shares, an increase of 241.08 percent.

It was trading with volumes of 13,813 shares, compared to its thirty day average of 2,136 shares, an increase of 546.80 percent.

In the previous trading session, the share closed up 1.41 percent or Rs 2.90 at Rs 208.85.

The share touched a 52-week high of Rs 398.25 and a 52-week low of Rs 189.50 on 19 November, 2024 and 04 March, 2025, respectively.

Currently, the stock is trading 38.48 percent below its 52-week high and 29.29 percent above its 52-week low.

Market capitalisation stands at Rs 833.25 crore.

-330

November 17, 2025· 10:30 IST

Sensex Today | Rail Vikas Nigam share price gains most in 11 weeks

Rail Vikas Nigam was quoting at Rs 333.95, up Rs 13.00, or 4.05 percent.

It has touched an intraday high of Rs 335.75 and an intraday low of Rs 321.50.

It was trading with volumes of 298,275 shares, compared to its five day average of 258,405 shares, an increase of 15.43 percent.

In the previous trading session, the share closed up 2.15 percent or Rs 6.75 at Rs 320.95.

The share touched a 52-week high of Rs 501.55 and a 52-week low of Rs 295.25 on 01 February, 2025 and 07 April, 2025, respectively.

Currently, the stock is trading 33.42 percent below its 52-week high and 13.11 percent above its 52-week low.

Market capitalisation stands at Rs 69,629.25 crore.

-330

November 17, 2025· 10:27 IST

Sensex Today | UBS keeps ‘sell’ rating on Bharat Forge, target price raised to Rs 1,230

#1 Autos weak, defence strong in Q2

#2 Healthy margin aided by strong cost control

#3 Near-term outlook remains tepid

#4 Management prioritising growth in India business, with plans to expand through inorganic opportunities

#5 Defence order book stands at Rs 1,100 crore, excluding a Rs 140 crore domestic carbine order

#6 Evaluation of EU steel restructuring is ongoing, with updates anticipated by FY26-end

#7 Management expects Q3FY26 to remain soft, with recovery likely from Q4FY26

#8 Company expects strong aerospace growth of around 40 percent in FY26, with similar rates over next 3-4 years

#9 Defence business currently around 10–12 percent of revenue, with plans to reach mid-20s by FY30

-330

November 17, 2025· 10:24 IST

Sensex Today | GMM Pfaudler, Surya Roshni, Gopal Snacks among others trade ex-dividend today

Arfin India

Balrampur Chini Mills

EPL

GMM Pfaudler

Gopal Snacks

HB Portfolio

Pearl Global Industries

Surya Roshni

-330

November 17, 2025· 10:22 IST

Sensex Today | BSE Oil & Gas index up 1%, breaks two-day losing streak

-330

November 17, 2025· 10:18 IST

Sensex Today | Andhra Pradesh Government and Kings Infra sign MoU for a ₹2,500 crore

Kings Infra Ventures has signed a Memorandum of Understanding (MoU) with Government of Andhra Pradesh to develop the Rs 2,500 crore, 500-acre Kings Maritime Aquaculture Technology Park near Srikakulam, close to Visakhapatnam.

-330

November 17, 2025· 10:13 IST

Sensex Today | Karnataka Bank appoints new MD & CEO

The bank has appointed Raghavendra S Bhat as the new Managing Director & CEO, effective November 16, for a period of one year.

Karnataka Bank was quoting at Rs 178.60, up Rs 4.50, or 2.58 percent.

It has touched an intraday high of Rs 179.70 and an intraday low of Rs 175.55.

It was trading with volumes of 97,170 shares, compared to its five day average of 88,902 shares, an increase of 9.30 percent.

In the previous trading session, the share closed down 1.42 percent or Rs 2.50 at Rs 174.10.

The share touched a 52-week high of Rs 231.20 and a 52-week low of Rs 162.20 on 11 December, 2024 and 04 March, 2025, respectively.

Currently, the stock is trading 22.75 percent below its 52-week high and 10.11 percent above its 52-week low.

Market capitalisation stands at Rs 6,753.26 crore.

-330

November 17, 2025· 10:10 IST

Bank Nifty hits fresh record high again today, climbs above 58,900 in early trade

Bank Nifty hit a fresh record high again today, climbing above 58,900 for the first time. The advance comes after a steady upswing in the Bank Nifty over recent sessions, supported by sustained buying in heavyweight private lenders and firm sectoral sentiment....Read More