Closing Bell: Sensex, Nifty end lower amid volatility; power stocks rally

-330

December 07, 2023· 16:25 IST

Benchmark indices broke seven-day winning streak and ended lower in the volatile session on December 7. At close, the Sensex was down 132.04 points or 0.19 percent at 69,521.69, and the Nifty was down 36.50 points or 0.17 percent at 20,901.20.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

December 07, 2023· 16:23 IST

-330

December 07, 2023· 16:23 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Markets finally snapped a 7-day winning streak as weak global cues fueled selective profit-taking in domestic stocks after the recent upsurge. Investors preferred to book some profit in some richly valued stocks ahead of tomorrow's monetary policy announcement. Despite today's weakness the market undertone remains bullish on the back of revival in FII flows and rising hopes that the US Fed may not tinker with rates amid moderating inflation and growth. If today’s uninspiring session is any indication, then Nifty will waver and trade choppy in tomorrow's session with biggest hurdles now seen at the psychological 21,000 mark, while the biggest support is placed at 19521 mark.

-330

December 07, 2023· 16:08 IST

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty remained sideways during the session, hovering within the bands of 20850-20950. Sentiment remains somewhat cautious ahead of the RBI policy meet. The near-term trend remains sideways to weak as long as it stays below 21000, a psychologically crucial level. A decisive breakout above 21000 might induce a resumption of the uptrend. Until then, we anticipate weakness over the near term.

-330

December 07, 2023· 16:03 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty index exhibited sideways momentum in the session preceding the RBI policy announcement. The lower-end support for the index is situated at 46500-46400, and as long as it maintains levels above this zone, the stance remains in a buy-on-dip mode. Immediate resistance on the upside is identified at 47000, and a decisive breakthrough at this level is anticipated to propel the index further upwards towards the 47500 mark.

-330

December 07, 2023· 16:00 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The market took a breather, the investors are in a wait-and-watch mode ahead of the monetary policy announcement. A better-than-estimated Q2 GDP growth, ease in global oil prices and drop in global bond yield will be the silver lining for the MPC. However, the expectation of a rise in domestic November inflation, drop in Rabi cultivation and increase in foodgrain prices will influence RBI to adopt a cautious approach in the short-term.

-330

December 07, 2023· 15:55 IST

Aditya Gaggar Director of Progressive Shares:

Indian equities began the weekly expiry day on a tepid note but a substantial recovery in the Banking stocks delivered support to the Index to recover from the lower levels; however, towards the end of the day, the Index was unable to hold higher levels, and finally settled at 20,901.15 with a loss of 36.55 points. With gains of over 1%, the Energy sector (Power stocks largely dominated today's trade) was the top performer followed by Media and Pharma while a corrective move was observed in the FMCG and Metal segments.

It appeared that the market participants returned to the Broader markets as Mid and Smallcaps gained over 0.35% and outperformed the Frontline Index. Nifty50 has made a small bearish candle on the daily chart which indicates a contraction of the range. For the past 2 days, the Index has been stuck in the range of 20,960-20,850, a breakout on either side will give a proper direction.

-330

December 07, 2023· 15:42 IST

Pankaj Pandey, Head Retail Research ICICIdirect:

It seems challenging for the IT sector to outperform the Nifty in terms of earnings growth, especially if there's a recovery in the US. While there might be some incremental gains, structurally, IT doesn't appear poised for significant outperformance. However, what looks promising are the banks. We are comfortable with both PSUs and private banks. For instance, HDFC Bank seems favourable to us. If the margin recovery from 3.4% to 4% materializes, it could perform well, with a target price of 2050.

Similarly, we hold a positive outlook on SBI. Given the response observed for Bank of India, SBI also appears appealing, especially considering its available valuation at 1.2 times book with expected ROAs reaching 1%. Comparatively, Bank of India is trading at 0.8 times book with an ROA of 0.8. Hence, SBI might undergo similar valuation shifts.

Additionally, there are smaller subsegments within BFSI that appear attractive. On the infrastructure side, L&T looks promising due to its substantial order book of 4.5 lakh crores. The government's consistent capex template suggests the entire infrastructure segment should perform well. Infrastructure and banking seem quite attractive for the next few months.

-330

December 07, 2023· 15:33 IST

Rupee Close:

Indian rupee ended marginally lower at 83.36 per dollar on Thursday against Wednesday’s close of 83.32.

-330

December 07, 2023· 15:30 IST

Market Close:

Benchmark indices broke seven-day winning streak and ended lower in the volatile session on December 7.

At close, the Sensex was down 132.04 points or 0.19 percent at 69,521.69, and the Nifty was down 36.50 points or 0.17 percent at 20,901.20. About 1893 shares advanced, 1342 shares declined, and 81 shares unchanged.

Top losers on the Nifty were Bharti Airtel, HUL, ONGC, Apollo Hospitals and Tata Steel, while gainers included Power Grid Corporation, Adani Ports, UltraTech Cement, Cipla and Grasim Industries.

A mixed trend was seen on the sectoral front with auto, healthcare up 0.5 percent each, oil & gas index up 1 percent and power index rose nearly 3 percent, while FMCG and Metal indices down 0.5 percent each.

BSE midcap index rose 0.7 percent and Smallcap index up 0.3 percent.

-330

December 07, 2023· 15:29 IST

ALERT | Governement asks mills to not use sugarcane juice for ethanol output '23-24

-330

December 07, 2023· 15:27 IST

Stock Market LIVE Updates | Jefferies View On Hindustan Unilever:

-Hold call, target Rs 2,720 per share

-Channel checks & industry interactions indicate October demand trends remained similar to Q2

-Much anticipated growth pick-up during festive season not materialising

-Rural continues to be a drag

-The impact of weak monsoon becomes evident, with real wages under pressure

-Competition continues to stay high, which should reflect in adspends

-330

December 07, 2023· 15:26 IST

-330

December 07, 2023· 15:23 IST

Sensex Today | Oil stages small recovery as weak economic outlook lingers

Oil prices reclaimed some ground on Thursday after tumbling to a six-month low the previous day but investors remained concerned about sluggish demand in the United States and China.

Brent crude futures were up 76 cents, or 1%, to $75.06 a barrel at 0924 GMT. U.S. West Texas Intermediate crude futures was up 67 cents, also 1%, to $70.05 a barrel.

-330

December 07, 2023· 15:21 IST

Sensex Today | Euro sags, yen jumps as investors bet on BOJ shift

The euro grazed a three-week low on Thursday, driven by mounting expectations that the European Central Bank (ECB) may cut rates as early as March, while the prospect of a shift in Japanese policy gave the yen its biggest one-day boost since January.

The euro is heading for its biggest weekly fall since May, fuelled by a dramatic repricing of interest rate expectations for 2024, although caution around Friday's U.S. non-farm payrolls has kept trading volatility subdued.

Meanwhile, the yen was the clear outperformer on Thursday, rising more than 1% to its strongest against the dollar in three months.

The Bank of Japan has been the lone holdout among central banks, by maintaining a policy of ultra-low rates that sent the yen to its weakest in decades against the dollar and sparked speculation that monetary authorities could intervene to prop up the currency.

-330

December 07, 2023· 15:17 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee traded on a flat note today. Positive US Dollar and weak domestic markets weighed on Rupee. However, weak crude oil prices and FII inflows supported Rupee at lower levels. US Dollar gained on decline in Euro and Pound. Euro slipped on rate-cut expectations by ECB in early 2024. Economic data was mixed. US ADP Non-Farm Employment Change added 103,000 jobs in November 2023 compared to 106,000 jobs in October 2023. US trade balance fell to $-64.3 bn in October 2023 as compared to $-61.2 bn in September 2023.

We expect Rupee to trade with a slight negative bias on positive tone in the US Dollar and risk aversion in global markets. However, weak tone in crude oil prices and foreign inflows may support Rupee at lower levels. Traders may take cues from US weekly unemployment change and Challenger job cuts data. Investors may remain cautious ahead of RBI’s monetary policy decision on Friday. USDINR spot price is expected to trade in a range of Rs 83.00 to Rs 83.70.

-330

December 07, 2023· 15:15 IST

Stock Market LIVE Updates | Morgan Stanley View On Power Grid Corporation of India:

-Overweight call, target Rs 235 per share

-Company has won two tariff-based competitive bidding (TBCB) projects

-The TBCB projects cumulatively have an estimated cost of Rs 8,700 crore

-Total TBCB wins as on FY24 YTD is Rs 19,700 crore

-Total TBCB works at hand has increased to Rs 28,500 crore

-Estimate these projects to generate revenue & EBITDA of Rs 850 crore & Rs 750 crore, respectively

-330

December 07, 2023· 15:10 IST

Pankaj Pandey, Head Retail Research ICICIdirect:

Regarding the Nifty, our fundamental target stands at 21,400, based on FY25 figures. However, we anticipate a decent upside once we introduce FY26 numbers. What's promising is that, over the next two quarters, we anticipate an improved margin profile for tier 1 Nifty companies. In the first half, we achieved approximately a 19% margin, compared to last year's 16% in H2. This base effect should support companies in delivering strong numbers.

As for FII flows, despite the re-cent decline, we expect inflows to eventually recover. Looking at the setup, especially in large caps, particularly BFSI, we foresee positive performance. Moreover, as political anxieties are being addressed, we anticipate better prospects for the infrastructure sector. These sectors seem poised for both price performance and increased inflows. However, while we maintain a structurally positive outlook on the market, considering the recent 1000-point market rally, some consolidation at current levels should not be a cause for concern.

-330

December 07, 2023· 15:07 IST

Stock Market LIVE Updates | Morgan Stanley View On HCL Technologies:

-Overweight call, target Rs 1,400 per share

-Announces extension of strategic partnership with nordics-based manufacturing group

-Could be an extension of existing biz relationship with the client group

-Extends scope of services & taking partnership to next level

-330

December 07, 2023· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was down 187.80 points or 0.27 percent at 69,465.93, and the Nifty was down 49.70 points or 0.24 percent at 20,888. About 1887 shares advanced, 1341 shares declined, and 76 shares unchanged.

-330

December 07, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| HLV | 29.15 | 28.20 | -0.95 2.09m |

| V-Marc | 196.50 | 190.40 | -6.10 4.75k |

| Asian Hotels | 232.00 | 225.10 | -6.90 9 |

| Proventus Agro | 1,184.95 | 1,150.00 | -34.95 96 |

| Murudeshwar Cer | 58.85 | 57.25 | -1.60 3.55k |

| DCM | 80.15 | 78.00 | -2.15 8.21k |

| Industrial Inv | 189.00 | 184.00 | -5.00 6.14k |

| Bang Overseas | 58.95 | 57.40 | -1.55 850 |

| Lorenzini Appar | 261.50 | 255.00 | -6.50 147 |

| ITI | 311.00 | 303.30 | -7.70 2.51m |

-330

December 07, 2023· 14:57 IST

Stock Market LIVE Updates | PSP Projects bags work order worth Rs 101.67 crore

PSP projects is in receipt of work order worth Rs 101.67 crores (excl. GST) for the project “Construction and Maintenance of Main Building of GBRC” for Gujarat Biotechnology Research Centre (GBRC) at GIFT City Gandhinagar, Gujarat in Government Category.

The project is to be completed within a period of 18 months.

With receipt of above orders, the total order inflow for the financial year 2023-24 till date amounts to Rs 1060.30 crore.

-330

December 07, 2023· 14:53 IST

Stock Market LIVE Updates | Natco Pharma's operations at Manali unit in Chennai temporarily disrupted due to cyclone

Natco Pharma has informed that the operatoons at the company's factory located at Manali Industrial Area, Chennai, Tamil Nadu have been temporarily disrupted due to cyclone with flooding / water logging of the factory premises. After following the required step process & safety measures, the factory operations have been shut down temporarily.

-330

December 07, 2023· 14:46 IST

-330

December 07, 2023· 14:40 IST

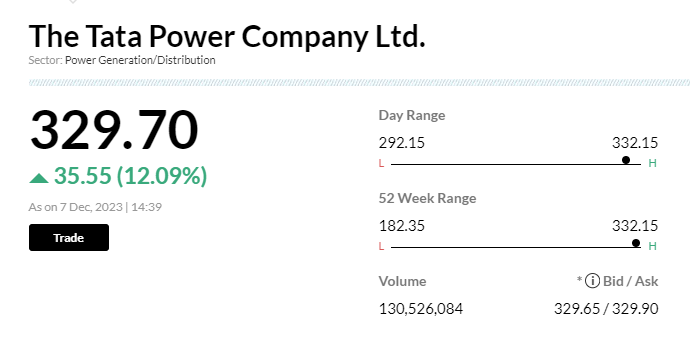

Stock Market LIVE Updates | Tata Power becomes the sixth Tata Group company to cross Rs1 lakh-crore m-cap

-330

December 07, 2023· 14:31 IST

-330

December 07, 2023· 14:25 IST

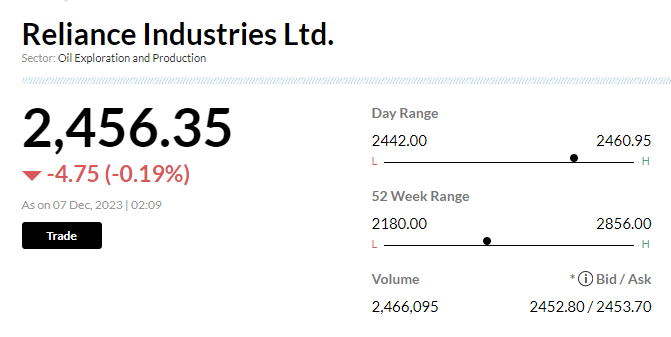

Stock Market LIVE Updates | RIL sees huge block deal

Shares of Reliance Industries Ltd were trading 0.1 percent lower after a huge block deal. Around 2.75 million shares of the company changed hands, according to Bloomberg. However, details of the buyers and sellers were not known.

-330

December 07, 2023· 14:15 IST

-330

December 07, 2023· 14:10 IST

Sensex Today | Gold gains on softer dollar, focus on US jobs data for Fed cues

Gold prices rose on Thursday as the dollar slipped, while investors looked forward to the crucial U.S. payrolls data later this week that could offer more clues on the Federal Reserve's interest rate trajectory.

Spot gold rose 0.3% to $2,030.20 per ounce by 0748 GMT. U.S. gold futures was steady at $2,047.10.

The U.S. dollar index fell 0.3% against its rivals, making gold less expensive for other currency holders, while yields on 10-year Treasury notes hovered near a three-month low.

-330

December 07, 2023· 14:06 IST

Sensex Today | Pankaj Pandey, Head Retail Research, ICICIdirect:

We used to track sugar, and historically, many companies were available at single-digit multiples, which seemed attractive. However, currently, most are available in double digits. Structurally, the situation looks positive, with blending expected to increase from around 12% to 15% and potentially to 20%. Yet, the inconsistent monsoons might pose challenges. Also, recent increases in sugar prices, coupled with potential government measures, could impact future profitability. Stocks have already rallied significantly, so we're not inclined to re-initiate or chase these stocks at this time.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Dhampure Specia | 71.89 | 2.1 | 7381 |

| Davangere Sugar | 92.85 | 1.2 | 889 |

| Dharani Sugars | 8.63 | 0 | 3461 |

| Bannariamman | 2510 | 0.27 | 433 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Uttam Sugar | 410.9 | -7.79 | 97046 |

| Dalmia Sugar | 411.75 | -4.96 | 147165 |

| EID Parry | 536.5 | -4.99 | 104673 |

| Ugar Sugar Work | 84.19 | -4.18 | 258542 |

| Avadh Sugar | 697 | -3.9 | 47357 |

| Triveni Engg | 352.1 | -3.08 | 155255 |

| DCM Shriram Ind | 161.65 | -2.88 | 41525 |

| KCP Sugar | 34.7 | -2.86 | 159305 |

| Balrampur Chini | 416.25 | -3.49 | 707662 |

| Dwarikesh Sugar | 87.51 | -2.78 | 782821 |

-330

December 07, 2023· 13:59 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| AARTIPP | 306.00 | 293.00 | -13.00 0 |

| Pioneer | 52.40 | 50.50 | -1.90 2.66k |

| Khandwala Sec | 23.45 | 22.60 | -0.85 1.15k |

| HLV | 30.00 | 29.05 | -0.95 1.64m |

| DNL | 196.25 | 191.05 | -5.20 1.94k |

| Palash Securiti | 121.65 | 118.55 | -3.10 138 |

| Sagardeep Alloy | 26.45 | 25.80 | -0.65 1.19k |

| All E Technolog | 252.00 | 246.00 | -6.00 1.01k |

| Ambani Organics | 128.00 | 125.05 | -2.95 0 |

| MMP Industries | 228.00 | 223.00 | -5.00 13.37k |

-330

December 07, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Baba Food Proce | 64.10 | 70.35 | 6.25 12.89k |

| G-Tec Jainx | 92.20 | 98.50 | 6.30 263 |

| Manomay Tex Ind | 131.00 | 138.50 | 7.50 2.52k |

| Agarwal Float | 60.55 | 64.00 | 3.45 600 |

| Kody Technolab | 316.00 | 332.00 | 16.00 0 |

| Kotyark | 790.10 | 830.00 | 39.90 1.18k |

| Cybertech | 166.15 | 174.30 | 8.15 36.13k |

| TIPSFILMS | 720.00 | 750.45 | 30.45 1.44k |

| Prime Focus | 106.25 | 110.40 | 4.15 21.71k |

| Sarda Energy | 252.50 | 262.15 | 9.65 11.89k |

-330

December 07, 2023· 13:55 IST

Stock Market LIVE Updates | Motilal Oswal View on Paytm:

Paytm mentioned that the scale-down in postpaid business is primarily prudential in nature and is to preempt any asset quality issues in coming quarters. Asset quality metrics remain steady and the pick-up in high-ticket personal loans and merchant loans, along with the increase in the number of lending partners, should support steady growth in the medium term. While the longevity of these measures and the outlook in low-ticket unsecured loans remains under watch, Motilal oswal trim FY24/FY25 disbursement estimates by 15%-18%, resulting in an 11-16% cut in adjusted EBITDA over FY24E/FY25E.

Broking house value Paytm at 20x FY28E EV/EBITDA and discount the same to FY25E at a discount rate of ~14%. Value the stock at Rs 1,025, which implies 4.5x Sep’25E P/Sales. Maintain Buy rating on the stock.

-330

December 07, 2023· 13:54 IST

Sensex Today | Nifty Metal index down 0.6 percent dragged by Welspun Corp, Ratnamani Metal, Hindalco Industries:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Welspun Corp | 536.75 | -3.27 | 627.10k |

| Ratnamani Metal | 3,673.10 | -1.8 | 37.40k |

| Hindalco | 515.85 | -1.37 | 2.41m |

| Tata Steel | 130.40 | -1.1 | 20.84m |

| Coal India | 349.15 | -0.85 | 4.54m |

| Hind Zinc | 323.75 | -0.58 | 676.78k |

| Jindal Steel | 683.00 | -0.56 | 1.24m |

| NALCO | 98.70 | -0.55 | 6.34m |

| JSW Steel | 821.00 | -0.45 | 850.98k |

| SAIL | 99.15 | -0.2 | 18.72m |

-330

December 07, 2023· 13:50 IST

Sensex Today | Morgan Stanley View On Aditya Birla Capital:

-Equal-weight call, target Rs 195 per share

-See scaling down of small-ticket loans sourced from Paytm

-Poses downside risks to forecasts for loan growth & earnings, likely manageable

-Asset quality, steady so far, needs to be monitored

-Sentiment could be weak in near term

-330

December 07, 2023· 13:48 IST

Sensex Today | WiseX launches Navratna Securitized Debt Instrument

WiseX launches Securitised Debt Instrument (SDI) through its debut opportunity - Navratna SDI. The SDI securities have received an ‘A’ rating from Acuité Ratings & Research Limited and have been listed in the BSE Stock Exchange.

The company aims to raise Rs 15 crores through this Navratna SDI opportunity, which will be used to meet the funding requirements of a leading Engineering, Procurement and Construction (EPC) and Operations & Maintenance (O&M) provider, Svaryu Energy.

-330

December 07, 2023· 13:46 IST

Stock Market LIVe Updates | ONGC shares slide 3% as Brent crude prices tank to a 5-month low

Shares of Oil and Natural Gas Corporation slipped 3 percent in early trade on December 7 on the back of a steep fall in Brent crude prices to five-month lows.

Brent crude prices have declined 11 percent in the last five sessions to below $75 a barrel on the back of a surge in US gasoline inventories which, along with prevailing concerns over lagging demand, dented sentiment.

Upstream oil companies like ONGC stand to be hit negatively by a fall in crude prices as it reduces their refining margins. Hence, shares of ONGC, along with other oil refiners like Oil India and Hindustan Oil Exploration Company struggled with losses in today's session. Read More

-330

December 07, 2023· 13:42 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Ajcon Global | 28.49 -3.23% | 12.57k 1,083.80 | 1,060.00 |

| Andhra Cement | 97.91 3.58% | 52.85k 5,409.00 | 877.00 |

| ABC India | 108.48 13.14% | 43.51k 6,708.60 | 548.00 |

| Alembic | 92.57 8.55% | 508.61k 121,029.20 | 320.00 |

| Artson Engg | 203.20 0.87% | 85.66k 26,172.60 | 227.00 |

| Advance Life | 44.00 -0.14% | 3.59k 1,336.20 | 169.00 |

| Assoc Alcohol | 473.75 1.49% | 14.35k 6,056.40 | 137.00 |

| AB Capital | 167.85 -2.98% | 545.92k 254,273.40 | 115.00 |

| Imagicaaworld | 57.37 1.58% | 554.05k 281,080.80 | 97.00 |

| Action Const | 829.15 3.76% | 42.61k 22,881.00 | 86.00 |

-330

December 07, 2023· 13:38 IST

Stock Market LIVe Updates | REC plans to raise up to Rs 6,000 crore through bonds

Rural Electrification Corporation (REC) Limited, a Central Public Sector Enterprise under the Ministry of Power, which finances and promotes rural electrification projects, plans to raise up to Rs 6,000 crore by issuing two bonds, people familiar with the matter said. REC plans to raise up to Rs 4,000 crore through the first bond, which includes Rs 3,300 crore in a greenshoe option. The bond matures in 15 years or on November 30, 2038, said the people cited above.

A greenshoe option is a provision in an underwriting agreement that grants the underwriter the right to sell investors more shares than initially planned by the issuer, if the demand for a security issue proves higher than expected.

Through the second bond, the company will raise up to Rs 2,000 crore, which includes Rs 1,500 crore in a greenshoe option. This bond matures in 1 year and 11 months or on November 29, 2025, said one of the people quoted above.

-330

December 07, 2023· 13:33 IST

Avinash Gorakshakar, Head-Research at Profitmart Securities

SpiceJet appears to be significantly undervalued when compared to its peers in the Indian aviation industry. “A substantial equity infusion into the airline can turn around the fortunes of the 18-year-old airline,” said an expert. For reference, the market capitalization of IndiGo is INR 1.1 lakh crore. This stark difference in market capitalization, positions SpiceJet as an attractive investment opportunity, offering substantial growth potential and attractive returns for investors.

SpiceJet's current share prices present an advantageous entry point for investors looking to capitalise on potential upward movements. SpiceJet holds coveted slots and routes at all important Indian and international airports like Dubai, providing a competitive edge in the market and contributing to its potential for sustained growth. The airline has a significant plane order, indicating a commitment to expanding its fleet and market presence. We believe it stands out as the best bet among Indian aviation companies for growth and returns.

-330

December 07, 2023· 13:29 IST

-330

December 07, 2023· 13:25 IST

Stock Market LIVE Updates | Dr Reddy's up 2% after subsidiary collaborates with COYA for ALS drug

Shares of Dr Reddy's Laboratories Limited traded 2 percent higher to Rs 5,849 in morning trade on December 7 after the company announced that Dr.Reddy's Laboratories SA, a wholly-owned subsidiary, has entered into an exclusive collaboration for the development and commercialisation of COYA 302 for the treatment of amyotrophic lateral sclerosis (ALS).

"Under the Agreement, Dr. Reddy’s will obtain commercialization rights for COYA 302 in the United States, Canada, the European Union and the United Kingdom, for patients with ALS," the pharma major said in a regulatory filing on December 6. Read More

-330

December 07, 2023· 13:19 IST

-330

December 07, 2023· 13:15 IST

Sensex Today | BSE FMCG index down 0.6 percnet dragged by Uttam Sugar, Dalmia Sugar, Ugar Sugar Work:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Uttam Sugar | 412.25 | -7.48 | 93.02k |

| Dalmia Sugar | 413.00 | -4.67 | 140.88k |

| Ugar Sugar Work | 84.97 | -3.29 | 233.83k |

| Balrampur Chini | 418.00 | -3.08 | 649.72k |

| Radico Khaitan | 1,625.00 | -2.91 | 24.49k |

| Avadh Sugar | 704.25 | -2.9 | 44.48k |

| Tasty Bite | 14,222.45 | -2.88 | 351 |

| Triveni Engg | 352.90 | -2.86 | 151.24k |

| Dwarikesh Sugar | 87.54 | -2.74 | 748.44k |

| DBOL | 153.15 | -2.67 | 48.20k |

-330

December 07, 2023· 13:13 IST

Stock Market LIVE Updates | Tata Power surges 9% to record high after JM Financial upgrades stock, raises target price

Shares of Tata Power soared around 9 percent on December 7 to hit a fresh record high after brokerage firm JM Financial upgraded the stock to 'buy' rating from hold earlier. The brokerage also raised its price target on the stock by 40 percent to Rs 350 from the earlier target of Rs 220. The revised price target implies a potential rally of 24 percent over the next 12 months.

In its most recent report, JM Financial highlighted four key elements of Tata Power's strategic recalibration plan. These include capitalizing on the lucrative group captive renewables opportunity, divesting from low-value businesses, entering the brownfield hydro storage sector, and extending the transmission business beyond distribution.

The brokerage firm envisions a positive resolution for Tata Power regarding the Mundra issue. Read More

-330

December 07, 2023· 13:06 IST

Stock Market LIVE Updates | SpiceJet to consider raising fresh capital through the issue of equity shares

SpiceJet, on December 7, announced that its board is considering options for raising fresh capital through the issuance of equity or convertible securities on a preferential basis.

Shares of SpiceJet skyrocketed 20 percent to hit upper circuit and 52-week high of Rs 52.29 per share after the announcement.

As per an exchange filing on December 6, SpiceJet said that it will meet on December 11 to discuss and consider options for raising fresh funds through issuing equity shares or convertible securities on a preferential basis in accordance with the relevant provisions of applicable laws and subject to approval of the shareholders of the company.

On December 5 National Company Law Tribunal (NCLT) dismissed a plea to initiate solvency proceedings against the airline filed by aircraft lessor Willis Lease Finance over unpaid dues. Read More

-330

December 07, 2023· 13:04 IST

-330

December 07, 2023· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was down 97.04 points or 0.14 percent at 69,556.69, and the Nifty was down 23.00 points or 0.11 percent at 20,914.70. About 1894 shares advanced, 1278 shares declined, and 92 shares unchanged.

-330

December 07, 2023· 12:58 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sharp Chucks | 77.55 | 75.00 | -2.55 - |

| Jayaswal Neco | 45.40 | 44.00 | -1.40 132.14k |

| Uma Converter | 30.90 | 30.00 | -0.90 1.14k |

| SGBOCT25IV | 6,393.00 | 6,207.00 | -186.00 12 |

| Mohini Health & | 69.00 | 67.00 | -2.00 1.25k |

| Patel Eng | 59.10 | 57.40 | -1.70 2.55m |

| Sasta Sundar | 456.00 | 444.00 | -12.00 13.78k |

| Orbit Exports | 175.45 | 170.85 | -4.60 31.46k |

| Netweb Technolo | 1,015.40 | 989.00 | -26.40 59.71k |

| HLV | 30.75 | 29.95 | -0.80 5.68m |

-330

December 07, 2023· 12:57 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Oil Country | 23.15 | 25.70 | 2.55 2.15k |

| Nagreeka Export | 64.90 | 69.65 | 4.75 131.50k |

| Venus Remedies | 389.90 | 415.90 | 26.00 9.23k |

| ANI Integrated | 58.10 | 61.55 | 3.45 1000 |

| Basilic Fly | 288.90 | 304.50 | 15.60 - |

| Mold Tek Tech | 272.50 | 286.80 | 14.30 36.24k |

| Ishan Intl. | 72.00 | 75.60 | 3.60 19.75k |

| Ritco Logistics | 273.00 | 286.60 | 13.60 14.67k |

| Manomay Tex Ind | 123.60 | 129.00 | 5.40 237 |

| Cords Cable Ind | 111.95 | 116.50 | 4.55 3.98k |

-330

December 07, 2023· 12:55 IST

-330

December 07, 2023· 12:51 IST

Sensex Today | HUL slips 2% on Jefferies 'hold' call and lower target price

Shares of Hindustan Unilever (HUL) declined 2.6 percent on December 7 morning after global brokerage firm Jefferies shared a “hold” rating on the counter and reduced the target price to Rs 2,563 from Rs 2,720, saying growth pick-up remained elusive for the FMCG major.

The stock has declined over a percent this year, underperforming the benchmark Sensex which has gained 14 percent during the time.

"Our channel checks and industry interactions indicate that October demand trends remained similar to Q2 as festive growth pick-up did not materialise as expected,” Jefferies’ analysts wrote in a note.

The rural trend continues to be a drag, as the impact of a weak monsoon becomes evident, with real wages also under pressure. Read More

-330

December 07, 2023· 12:46 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 20917.70 -0.1 | 15.53 3.90 | 7.79 12.70 |

| NIFTY BANK | 46824.60 -0.02 | 8.93 5.27 | 7.06 8.65 |

| NIFTY Midcap 100 | 44409.00 0.4 | 40.94 3.50 | 10.88 37.45 |

| NIFTY Smallcap 100 | 14561.40 0.37 | 49.63 2.75 | 9.96 44.93 |

| NIFTY NEXT 50 | 50897.75 0.75 | 20.65 5.99 | 11.63 15.96 |

-330

December 07, 2023· 12:35 IST

Sensex Today | Dollar firm, euro at three-week lows as rate cut bets rise

The euro eased to its lowest in over three weeks on Thursday as traders intensified bets that the European Central Bank (ECB) would start cutting rates starting in March 2024, while the dollar was steady ahead of crucial payrolls data this week.

The euro inched 0.07% lower to $1.0757, its lowest point since Nov. 14. The single currency is down 1% this week and is on course for the steepest weekly decline since May.

The dollar index, which measures the U.S. currency against six rivals, was 0.038% higher at 104.17, just shy of the two-week high of 104.23 it touched on Wednesday. The index is up 0.9% this week, set for its strongest weekly performance since July.

-330

December 07, 2023· 12:23 IST

Sensex Today | Oil rebounds from six-month-low but demand concerns linger

Oil prices reclaimed some ground on Thursday after tumbling to a six-month low in the previous session but investors remained concerned about sluggish demand and economic slowdowns in the U.S. and China.

Brent crude futures rose 27 cents, or 0.4%, to $74.56 a barrel by 0613 GMT. U.S. West Texas Intermediate crude futures rose 24 cents, also 0.4%, to $69.62 a barrel.

-330

December 07, 2023· 12:19 IST

Stock Market LIVe Updates | Morgan Stanley View On Bharat Electronics:

-Overweight call, target Rs 164 per share

-Company has won orders worth Rs 3,915 crore

-Rs 3,915 crore orders include Rs 580 crore contract for radar maintenance from the Indian army

-Another Rs 3,335 crore of AMC orders for AEW&C sys, uncooled TI sights, SWIR payload etc

-Total order inflow for FY24 to date is Rs 18,298 crore – 91 percent of guidance

-330

December 07, 2023· 12:15 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Tata Power | 322.30 | 322.30 | 319.65 |

| Home First | 1016.45 | 1016.45 | 1,009.65 |

| NHPC | 63.58 | 63.58 | 63.32 |

| Container Corp | 837.50 | 837.50 | 834.95 |

| LIC India | 787.95 | 787.95 | 780.00 |

| MRPL | 132.80 | 132.80 | 131.15 |

| KEI Industries | 3058.85 | 3058.85 | 3,022.60 |

| Patanjali Foods | 1665.00 | 1665.00 | 1,642.85 |

| NLC India | 195.65 | 195.65 | 189.80 |

| NCC | 177.50 | 177.50 | 175.05 |

-330

December 07, 2023· 12:12 IST

-330

December 07, 2023· 12:08 IST

Stock Market LIVE Updates | Morgan Stanley picks Rs 32.87 crore shares in Kesoram Industries

Morgan Stanley Asia Singapore Pte has bought 21.32 lakh shares, which is equivalent to 0.68% of paid-up equity at an average price of Rs 154.17 per share.

-330

December 07, 2023· 12:06 IST

Stock Market LIVE Updates | 2I Capital PCC offloads Rs 151 crore shares in Swan Energy

Foreign investor 2I Capital PCC has offloaded Rs 151.04 crore worth shares in Swan Energy via open market transactions. It sold 15.9 lakh shares at an average price of Rs 437.51 per share, and 19 lakh shares at an average price of Rs 428.81 per share. In total, it offloaded 1.32% stake. In addition, in the past, 2I Capital already offloaded 30 lakh shares on December 5 and another 20 lakh shares on November 13. As of September 2023, it held 8.7% or 2.29 crore shares in Swan.

-330

December 07, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was down 88.10 points or 0.13 percent at 69,565.63, and the Nifty was down 19.10 points or 0.09 percent at 20,918.60. About 1880 shares advanced, 1260 shares declined, and 97 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Power Grid Corp | 229.60 | 2.32 | 574.15k |

| UltraTechCement | 9,320.00 | 1.19 | 3.83k |

| Maruti Suzuki | 10,744.45 | 1.12 | 9.80k |

| Bajaj Finserv | 1,714.95 | 0.87 | 22.90k |

| Nestle | 25,108.35 | 0.59 | 3.32k |

| Titan Company | 3,566.40 | 0.55 | 5.95k |

| Kotak Mahindra | 1,830.30 | 0.55 | 17.63k |

| NTPC | 282.65 | 0.53 | 338.90k |

| TCS | 3,620.40 | 0.47 | 19.26k |

| Asian Paints | 3,267.00 | 0.46 | 14.45k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharti Airtel | 1,002.00 | -2.14 | 16.78m |

| HUL | 2,519.10 | -1.83 | 35.01k |

| Tata Steel | 130.65 | -0.87 | 734.31k |

| Larsen | 3,365.80 | -0.76 | 14.55k |

| Sun Pharma | 1,231.65 | -0.67 | 9.94k |

| ICICI Bank | 997.05 | -0.59 | 64.20k |

| ITC | 460.40 | -0.56 | 157.32k |

| Reliance | 2,450.45 | -0.42 | 92.64k |

| Infosys | 1,468.60 | -0.37 | 41.19k |

| M&M | 1,697.10 | -0.31 | 27.15k |

-330

December 07, 2023· 12:00 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Gogia Capital | 111.30 | 100.00 | -11.30 35 |

| CHL | 29.90 | 27.50 | -2.40 576 |

| Sam Ind | 68.49 | 64.22 | -4.27 118 |

| Colab Cloud | 52.00 | 49.00 | -3.00 2 |

| MBL Infra | 44.64 | 42.27 | -2.37 3.23k |

| Orbit Exports | 185.70 | 176.00 | -9.70 1.16k |

| BNR Udyog | 60.00 | 56.90 | -3.10 2.31k |

| Longview Tea | 26.99 | 25.60 | -1.39 1.87k |

| Colinz Labs | 41.60 | 39.50 | -2.10 32 |

| Gujchem Distill | 69.15 | 65.70 | -3.45 10 |

-330

December 07, 2023· 11:58 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Goblin India | 43.50 | 49.00 | 5.50 63.96k |

| Avro India | 109.05 | 119.40 | 10.35 35 |

| Nagreeka Export | 59.44 | 64.54 | 5.10 2.25k |

| YASH INNO | 47.00 | 51.00 | 4.00 10 |

| Innovassynth | 20.80 | 22.55 | 1.75 160 |

| Apoorva Leasing | 27.00 | 29.26 | 2.26 690 |

| One Global Serv | 36.57 | 39.59 | 3.02 223 |

| Comfort Comm | 20.30 | 21.90 | 1.60 1.55k |

| West Leisure | 176.50 | 190.00 | 13.50 4 |

| Nirav Comm | 480.10 | 515.00 | 34.90 93 |

-330

December 07, 2023· 11:57 IST

Stock Market LIVE Updates | BofA Securities Europe SA pick 7.73% stake in Cantabil Retail

BofA Securities Europe SA, a subsidiary of Bank of America Corporation, has bought 12.63 lakh shares or 7.73% stake in Cantabil Retail India at an average price of Rs 225 per share. However, Authum Investment & Infrastructure sold 10 lakh shares or 6.12% stake in the company at an average price of Rs 225.27 per share.

-330

December 07, 2023· 11:53 IST

Stock Market LIVE Updates | Jefferies View On SBI Cards & Payment Services:

-Buy call, target Rs 1,020 per share

-Management expects card spending growth to be healthy

-Company has tightened filters for new card sourcing

-Tightened filters may also affect revolver mix slightly

-Increase in EMI mix can partly offset the impact on yields

-Change in risk weight norms can push CoF slightly

-Management says, broader stress in credit cards can keep credit costs elevated near term

-330

December 07, 2023· 11:46 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Vikas Ecotech | 252787 | 3.3 | 0.08 |

| Yes Bank | 579822 | 20.22 | 1.17 |

| Tube Investment | 3055 | 3488 | 1.07 |

| GTL Infra | 352401 | 1.08 | 0.04 |

| GTL Infra | 248623 | 1.08 | 0.03 |

| GTL Infra | 500000 | 1.08 | 0.05 |

| GTL Infra | 500000 | 1.08 | 0.05 |

| Ashapuri Gold | 200000 | 12.4 | 0.25 |

| HLV | 280993 | 30.48 | 0.86 |

| SEACOAST SS | 401400 | 2.6 | 0.1 |

-330

December 07, 2023· 11:39 IST

Sensex Today | BSE Oil & Gas index rose 1 percent supported by Adani Total Gas, Gail India, IOC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Total Gas | 1,150.90 | 9.23 | 1.45m |

| GAIL | 143.60 | 2.17 | 447.84k |

| IOC | 121.80 | 2.1 | 1.75m |

| Petronet LNG | 214.00 | 1.28 | 303.16k |

| IGL | 405.55 | 1.17 | 70.10k |

| BPCL | 475.90 | 0.66 | 165.84k |

| HINDPETRO | 386.15 | 0.51 | 306.51k |

-330

December 07, 2023· 11:35 IST

Sensex Today | Suman Bannerjee, CIO, Hedonova:

I anticipate the RBI to maintain a cautious stance, keeping the repo rate at 6.5%, despite the high GDP growth of 7.6% in the July-September quarter. There might be a marginal upward revision in the annual growth forecast, with the central bank's continued focus on liquidity management and credit growth.

-330

December 07, 2023· 11:33 IST

Stock Market LIVE Updates | Societe Generale picks 1% stake in JTL Industries

Pranav Vijay Singla, the part of promoter group, has bought 9.14 lakh equity shares or 0.53% stake in JTL Industries via open market transactions at an average price of Rs 200.62 per share, and Europe-based financial services group Societe Generale purchased 17 lakh shares or 1 percent stake at an average price of Rs 196.78 per share. However, corporate entity Build Ash Constructions LLP exited the company by selling entire shareholding of 50 lakh shares at an average price of Rs 195.82 per share.

High networth individual (HNI) Shilpa Bansal also exited JTL by selling 13.45 lakh shares at an average price of Rs 196.99 per share, and 32 lakh shares at an average price of Rs 204.03 per share. Among other HNIs, Mukesh Kumar has offloaded 50 lakh shares in JTL at an average price of Rs 199.23 per share, Kusum Bansal 13.8 lakh shares at an average price of Rs 196.36 per share, and Mohinder Pal sold 19.08 lakh shares at an average price of Rs 200.25 per share, while foreign portfolio investor BNP Paribas Arbitrage sold 9.59 lakh shares at an average price of Rs 200.29 per share.

-330

December 07, 2023· 11:26 IST

Stock Market LIVE Update | ONGC shares slip over 2% as Brent crude prices tank to 5-month low

-330

December 07, 2023· 11:16 IST

Stock Market LIVE Update | SpiceJet shares hit 20% upper circuit as board plans to mull fund raise options on Dec 11

-330

December 07, 2023· 11:09 IST

Stock Market LIVE Update | Primary market to remain buoyant, riding on D-St bulls until elections

The momentum in the primary market is expected to continue into 2024 with a host of IPOs in the pipeline, armed with the Sebi go-ahead, said Prashant Rao, director and head of equity capital markets at Anand Rathi Investment Banking, in an exclusive interview with Moneycontrol. Pre-elections, he expects at least 10 IPOs to hit the Street. READ MORE

-330

December 07, 2023· 10:58 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Essar Shipping | 29.50 | 27.20 | -2.30 27.77k |

| EQUIPPP | 28.25 | 26.25 | -2.00 21.41k |

| Fidel Softech | 123.40 | 115.00 | -8.40 3.00k |

| Shiva Texyarn | 158.60 | 147.90 | -10.70 19.43k |

| Shanthala | 111.00 | 105.45 | -5.55 - |

| Homesfy Realty | 390.00 | 371.50 | -18.50 0 |

| Sahana Systems | 605.00 | 582.00 | -23.00 14.50k |

| BCL Industries | 73.25 | 70.50 | -2.75 6.28m |

| SAR Televenture | 198.00 | 192.00 | -6.00 - |

| Felix Industrie | 102.00 | 99.00 | -3.00 0 |

-330

December 07, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Balkrishna | 32.20 | 37.65 | 5.45 9.67k |

| Emami Realty | 133.65 | 144.10 | 10.45 87.16k |

| Indowind Energy | 19.45 | 20.80 | 1.35 63.45k |

| Reliance Infra | 210.90 | 225.25 | 14.35 27.75k |

| Uttam Sugar | 396.30 | 423.00 | 26.70 205.03k |

| Power & Instrum | 41.20 | 43.90 | 2.70 603 |

| Bajaj Hindustha | 28.40 | 30.25 | 1.85 11.34m |

| Priti Internati | 232.30 | 246.95 | 14.65 18.15k |

| AMD Industries | 77.65 | 82.30 | 4.65 11.52k |

| AVG Logistics | 332.65 | 352.00 | 19.35 17.94k |

-330

December 07, 2023· 10:54 IST

Stock Market LIVE Updates | Morgan Stanley View On Paytm

-Equal-weight call, target Rs 830 per share

-Company announces scaling down of its low-ticket post-paid lending business

-Company will increase focus on higher-ticket personal loans

-Disbursements run-rate will drop in the near-term

-Management expects ltd earnings impact as higher-ticket loans & other financial business scale up

-330

December 07, 2023· 10:52 IST

-330

December 07, 2023· 10:50 IST

Stock Market LIVE Updates | Ircon shares tank 8% as govt's OFS issue kicks off; stock up 166% YTD

Shares of Ircon International fell nearly 8 percent on December as the Government is selling an 8 percent stake, or 7.52 crore equity shares, in the infrastructure company via offer-for-sale (OFS) on December 7-8.

The OFS, with a floor price of Rs 154 per share, comprises a base issue size of 4 percent and a greenshoe option of 4 percent of shares. The issue opens for non-retail investors on December 7 and will open for retail investors on December 8. The OFS, if fully subscribed, would fetch about Rs 1,100 crore to the exchequer. Read More

-330

December 07, 2023· 10:48 IST

Stock Market LIVE Updates | Mahindra & Mahindra to hike prices of passenger, commercial vehicles from January 2024

Mahindra and Mahindra (M&M) will hike prices of its passenger and commercial vehicle model range from January next year. This adjustment is in response to the rising costs due to inflation and increased commodity prices, the company said in a statement. The PTI reported.

-330

December 07, 2023· 10:45 IST

-330

December 07, 2023· 10:41 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| One 97 Paytm | 672.55 -17.28 | 23.55m | 1,580.48 |

| Adani Green Ene | 1,594.50 1.99 | 6.70m | 1,094.10 |

| Tata Power | 312.65 6.29 | 34.21m | 1,042.45 |

| Adani Energy | 1,191.50 2.34 | 8.52m | 1,029.91 |

| Adani Enterpris | 2,883.05 -0.03 | 3.24m | 938.52 |

| Adani Total Gas | 1,136.40 7.89 | 7.58m | 861.07 |

| Bharti Airtel | 1,002.90 -2.1 | 7.96m | 801.55 |

| Adani Ports | 1,039.00 2.07 | 6.39m | 662.22 |

| Adani Power | 558.25 -0.39 | 9.40m | 530.48 |

| HUL | 2,512.95 -2.13 | 1.98m | 498.15 |

-330

December 07, 2023· 10:38 IST

Stock Market LIVE Updates | RITES to develop a logistics projects in Meghalaya, stock price rises

RITES share price gained 1 percent in the early trade on December 7 a day after company entered into a memorandum of understanding (MoU) with Meghalaya Industrial Development Corporation Ltd (MIDC) to develop multi-modal logistics projects in Meghalaya.

As part of the MoU, RITES will be offering its expertise as a project management consultant and shall undertake a comprehensive range of services for developing multi-modal logistics projects in Meghalaya.

The collaboration is set to improve logistics infrastructure within Meghalaya and enhance trade and transport opportunities, fostering economic development and easing access to the region, company said.

-330

December 07, 2023· 10:35 IST

Stock Market LIVE Updates | Adani Ports to consider issuance of non-convertible debentures on December 12

Adani Ports and Special Economic Zone said the Board of Directors will be meeting on December 12 to consider the issuance of non-convertible debentures and issuance/ renewal of non-cumulative redeemable preference shares, on private placement basis/ preferential basis, in

one or more tranches.

-330

December 07, 2023· 10:31 IST

Stock Market LIVE Updates | Servotech Power files two patents for innovative EV charger technology to revolutionize EV charging infrastructure

Servotech Power Systems has filed two patents in the realm of EV charger technology to revolutionize EV charging infrastructure. These patents enable users to fast charge any GB/T Bharat DC 001 vehicle based on 72v/96VDC through a CCS2 connector using a small additional gadget.

-330

December 07, 2023· 10:27 IST

Stock Market LIVE Updates | Kothari Petrochemicals says operations at Manali plant in Chennai temporarily disrupted due to cyclone

Kothari Petrochemicals' factory at Manali Industrial Area in Chennai have been temporarily disrupted due to cyclone. The company is taking necessary steps to drain out the water logging and it will take another couple of days to drain out the water and re-start the plant operations likely by December 12. There is no material impact on the financial position of the company. The factory is adequately covered by insurance, machinery damages if any would be claimed through the policy coverage.

-330

December 07, 2023· 10:21 IST

Sensex Today | Nifty Auto index gained 0.5 percent led by Sona BLW, Eicher Motors, MRF:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MRF | 118,536.25 | 3.9 | 4.27k |

| Balkrishna Ind | 2,649.50 | 2.59 | 100.46k |

| Eicher Motors | 4,118.50 | 1.77 | 239.92k |

| Sona BLW | 581.40 | 1.58 | 225.49k |

| TVS Motor | 1,916.65 | 1.48 | 206.89k |

| Tube Investment | 3,378.40 | 1.32 | 1.03m |

| Maruti Suzuki | 10,758.05 | 1.25 | 141.82k |

| Hero Motocorp | 3,788.75 | 0.74 | 79.27k |

| Bosch | 21,724.00 | 0.61 | 2.19k |

| Bajaj Auto | 6,106.50 | 0.6 | 111.40k |

-330

December 07, 2023· 10:12 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

There are three factors that can keep the market resilient. One, steady decline in U.S. bond yields (10-year around 4.1% now) has created a global environment favourable for equities. Two, India’s GDP growth rate is improving and inflation is coming down. The steadily declining crude price is another big positive. Three, political uncertainty surrounding the 2024 General elections appears to be out of the way after the crucial state election results. These factors have emboldened the bulls and bears have been forced to cover their short positions.

In spite of these favourable factors, there will be dips in the market triggered by profit booking at higher levels.

-330

December 07, 2023· 10:09 IST

Stock Market LIVE Updates | Brigade Enterprises signs Joint Development Agreement to develop premium A Grade office space in the Central Business District of Bengaluru

Brigade Enterprises has entered into a Joint Development Agreement with the land owner to develop a premium ‘A Grade’ office space in the Central Business District (CBD) of Bengaluru. The project will have a developable area of around 0.20 million square feet with a gross development value (GDV) of about Rs 500 crore.

-330

December 07, 2023· 10:00 IST

Sensex Today | Market at 10 AM

The Sensex was down 264.07 points or 0.38 percent at 69,389.66, and the Nifty was down 64.40 points or 0.31 percent at 20,873.30. About 1706 shares advanced, 1199 shares declined, and 110 shares unchanged.

-330

December 07, 2023· 10:00 IST

Stock Market LIVE Updates | Alok Industries enters into facility agreements with SBI for term loan of Rs 1,750 crore for repayment of existing loans

Alok Industries has entered into facility agreements with State Bank of India for a term loan of Rs 1,750 crore for repayment of existing loans from banks as a part of financial restructuring. It also signed agreements with SBI for working capital facility of Rs 90 crore for meeting working capital requirements.

-330

December 07, 2023· 09:55 IST

Sensex Today | BSE Power Index up 1.7 percent led by Adani Green Energy, Tata Power, Adani Energy:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Green Ene | 1,638.20 | 4.67 | 531.29k |

| Tata Power | 305.50 | 3.88 | 883.61k |

| Adani Energy | 1,206.60 | 3.81 | 343.40k |

| NHPC | 62.18 | 3.22 | 1.06m |

| Power Grid Corp | 226.25 | 0.82 | 179.85k |

| NTPC | 283.20 | 0.73 | 97.94k |

| ABB India | 4,770.30 | 0.64 | 1.24k |

| Adani Power | 563.85 | 0.59 | 1.02m |

| Siemens | 3,855.00 | 0.12 | 730 |

-330

December 07, 2023· 09:52 IST

Stock Market LIVE Updates | Shalimar Paints appoints Sachin Naik as Chief Financial Officer

Shalimar Paints has received board approval for appointment of Sachin Naik as the Chief Financial Officer and key managerial personnel of the company with effect from December 6.

-330

December 07, 2023· 09:48 IST

Sensex Today | Rahul Kalantri, VP Commodities, Mehta Equities:

Gold and silver displayed a mixed trend in the international markets, with silver prices taking a dip amidst a gloomy growth outlook for China. In contrast, gold prices rebounded, driven by a pessimistic sentiment in the U.S. The U.S. 10-year bond yields also saw a decline, slipping below 4.15%, thereby bolstering precious metals. However, the firm trading of the dollar index imposed constraints on the gains of precious metals. The forthcoming U.S. non-farm payrolls data, scheduled for release on Friday, holds the potential to guide further market direction, occurring just ahead of the U.S. central bank's policy meeting next week.

Anticipating today's session, we foresee gold and silver prices to remain volatile. Gold finds support at $2010-1994, with resistance at $2038-2051. Meanwhile, silver enjoys support at $23.62-23.40, and faces resistance at $24.05-24.22. In terms of INR, gold finds support at Rs 62,020-61,810, with resistance at Rs 62,580 and Rs 62,710. For silver, support is expected at Rs 74,350-73,880, while resistance is likely at Rs 75,470 and

-330

December 07, 2023· 09:45 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Adani Total Gas | 1,158.60 | 58.22 | 732.25 |

| Party Cruisers | 127.40 | 48.66 | 85.70 |

| Essar Shipping | 30.10 | 44.71 | 20.80 |

| Aakash Explorat | 10.50 | 41.89 | 7.40 |

| Adani Energy | 1,223.70 | 35.41 | 903.70 |

| NDTV | 295.80 | 31.44 | 225.05 |

| Country Club | 15.35 | 31.20 | 11.70 |

| Kohinoor Foods | 50.70 | 28.35 | 39.50 |

| Spencer Retail | 99.40 | 28.18 | 77.55 |

| Autoline Ind | 140.40 | 26.32 | 111.15 |

-330

December 07, 2023· 09:42 IST

Stock Market LIVE Updates | Sharda Cropchem says board appoints Shailesh Anant Mehendale as Chief Financial Officer

Sharda Cropchem said the board of directors has approved an appointment of Shailesh Anant Mehendale as Chief Financial Officer & key managerial personnel of the company, with effect from December 6. The board also appointed Mayur D Parmar, proprietor of M/s M D Parmar & Associates, Practising Company Secretaries, as scrutinizer for conducting the e-voting process in a fair and transparent manner.

-330

December 07, 2023· 09:40 IST

Sensex Today | Rahul Kalantri, VP Commodities, Mehta Equities:

Crude oil exhibited significant volatility, experiencing a continued decline on Wednesday. The drop to a 6-month low was attributed to the strengthening dollar index and concerns over Chinese demand. The dollar index saw further gains following Moody's revision of China's growth outlook. Reaching beyond the 104 marks once more, the dollar index was boosted by a modest increase in U.S. ADP non-farm employment. Nevertheless, crude oil inventories in the U.S. unexpectedly decreased by 4.6 million barrels last week, surpassing the anticipated 1.3 million barrel decline. This unexpected drawdown could provide some support to prices at lower levels. Anticipating ongoing volatility, we project crude oil prices to remain unpredictable in today's session. The support levels for crude oil stand at $68.85–68.10, with resistance at $70.70-71.40 for today's session. In terms of INR, crude oil finds support at Rs 5,740-5,660 and faces resistance at Rs 6,890-5,970.

-330

December 07, 2023· 09:38 IST

Sensex Today | BSE FMCG Index down 0.5 percent dragged by Uttam Sugar, Avadh Sugar, Dalmia Sugar

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Uttam Sugar | 391.90 | -12.05 | 30.98k |

| Avadh Sugar | 679.00 | -6.38 | 12.39k |

| Dalmia Sugar | 406.05 | -6.28 | 42.11k |

| Triveni Engg | 341.05 | -6.12 | 51.66k |

| Balrampur Chini | 405.70 | -5.94 | 158.15k |

| Bajaj Hindustha | 28.80 | -5.01 | 3.09m |

| Ugar Sugar Work | 83.75 | -4.68 | 64.34k |

| Dhampur Sugar | 247.50 | -4.64 | 65.72k |

| Dwarikesh Sugar | 86.03 | -4.42 | 276.66k |

| Shree Renuka | 47.15 | -4.26 | 585.89k |

-330

December 07, 2023· 09:34 IST

IDFC First Bank Large Trade | 13.5 core shares (2 percent equity) worth Rs 1,162.7 crore change hands at an average of Rs 86 per share, reported CNBC-TV18.

-330

December 07, 2023· 09:32 IST

Bharti Airtel Large Trade | 1.8 crore shares (0.8 percent equity) worth Rs 1,856 crore change hands via block, reported CNBC-TV18.

-330

December 07, 2023· 09:30 IST

Stock Market LIVE Updates | HCC sells land parcel in Maharashtra to Oak & Stone Construction

Hindustan Construction Company has entered into Deed of Conveyance for sale of its land admeasuring 2,35,870 square meters at Panvel, Raigad, Maharashtra, to Oak and Stone Construction for Rs 95 crore.

-330

December 07, 2023· 09:25 IST

Stock Market LIVE Updates | Madhivanan Balakrishnan resigns as Executive Director of IDFC First Bank

Madhivanan Balakrishnan has resigned as Executive Director and Key Managerial Personnel of IDFC First Bank, with effect from December 6. The board members discussed that the bank would evaluate a suitable internal candidate to be appointed as the Whole time Director (Executive Director).