Closing Bell: Nifty above 19,200, Sensex up 283 pts; all sectors in the green

-330

November 03, 2023· 16:33 IST

Indian benchmark indices ended higher for the second consecutive session on November 3 with Nifty above 19,200. At close, the Sensex was up 282.88 points or 0.44 percent at 64,363.78, and the Nifty was up 97.30 points or 0.51 percent at 19,230.60.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

November 03, 2023· 16:31 IST

-330

November 03, 2023· 16:08 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

After a gap up opening Nifty faced resistance around 19250-19300 levels and we can see maximum put writing at 19200 levels which may act as strong support for Nifty while we can see maximum open interest in 19300 call option so, one should only be bullish on Nifty if it closes above its crucial 100 days moving average placed at 19300.

The Bank Nifty index had a strong opening but went into consolidation at higher levels. It encountered difficulty surpassing the immediate resistance level of 43,500, where a significant amount of call writing was observed. The lower-end support for the index is situated at 42,800, and a breach below this level could intensify selling pressure.

-330

November 03, 2023· 16:06 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Buoyancy in Asian equities boosted gains in local shares as falling US treasury yields and softening crude oil prices buoyed sentiment, despite weakness in the Gift Nifty index. Markets pared some of its early gains as investors resorted to selective buying due to uncertainty over higher inflation levels, simmering West Asian conflict and its impact on the global economy.

-330

November 03, 2023· 16:03 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets extended gains for yet another session and rose nearly half a percent. After the gap-up start, Nifty remained in a narrow range for most of the day and finally settled at 19,226.05 levels. All sectors contributed to the move wherein realty, oil & gas and banking posted decent gains. The broader indices too traded upbeat and moved up in the range of 0.60%-1.00%.

Nifty has penetrated the resistance zone after two days of advance and tested the immediate hurdle of 100 EMA around 19,276 as well. We reiterate a cautious view on the index and suggest awaiting a decisive break above 19,400 for a sustained recovery else the up move would fizzle out. However, there is no shortage of stock-specific opportunities so traders should maintain their focus on stock selection.

-330

November 03, 2023· 15:47 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The Indian market is resurging amidst a drop in investors' anxiety as Nifty VIX contracts generously. The optimism is buoyed by firm global clues, steady macro-economic data and strong domestic corporate earnings. Clues that FED is unlikely to hike rates in the future and modest decline in oil prices are adding to the optimism. While the ongoing Q2 results explore healthy expansion in Indian operating margin, leading to a strong bounce in earnings growth.

In the midst of the earnings season, large cap companies indicate a solid 40% growth in PAT on a YoY basis. And moderation in global inflation and steady domestic and external demand is lifting H2 corporate earnings outlook.

-330

November 03, 2023· 15:35 IST

Rupee Close:

Indian rupee ended marginally lower at 83.29 per dollar versus previous close of 83.24.

-330

November 03, 2023· 15:30 IST

Market Close:

Indian benchmark indices ended higher for the second consecutive session on November 3 with Nifty above 19,200.

At close, the Sensex was up 282.88 points or 0.44 percent at 64,363.78, and the Nifty was up 97.30 points or 0.51 percent at 19,230.60. About 2215 shares advanced, 1351 shares declined, and 124 shares unchanged.

Apollo Hospitals, Adani Ports, Eicher Motors, LTIMindtree and Titan Company were among major gainers on the Nifty while losers were Bajaj Finserv, Dr Reddy's Laboratories, SBI Life Insurance, IndusInd Bank and Tata Steel.

All the sectoral indices ended in the green with oil & gas, realty up 1-2 percent each.

BSE Midcap index rose 0.7 percent and smallcap index up 1 percent.

-330

November 03, 2023· 15:24 IST

Stock Market LIVE Updates | HSBC View On Britannia Industries

-Hold call, target Rs 4,700 per share

-Q2 sales at +0.8 percent, below estimate with flat volume growth for second consecutive quarter

-Q2 sales below estimate as weak rural demand persists

-Rising competition & falling commodity prices also portend phase of volume-led growth and portended little scope for margin uptick

-A phase of relatively muted earnings growth is ahead unless volume growth rebounds

-330

November 03, 2023· 15:21 IST

Stock Market LIVE Updates | Citi View On Dr Lal Path Labs

-Sell call, target Rs 2,290 per share

-Strong season & a better mix drive 2Q numbers

-Reported a healthy Q2 with 12.6 percent YoY revenue growth

-Company reported Q2 EBITDA margin at 29.6 percent (+270 bps YoY)

-Patient volume growth (7.7 percent YoY Ex-COVID) still appears subdued

-A strong season in DNCR and North/East India (dengue outbreak)

-Price increases & a better mix have helped co report 7 percent YoY growth in realisations

-330

November 03, 2023· 15:14 IST

Sensex Today | BSE Auto index rose 0.5 percent led by Eicher Motors, Tube Investments, TVS Motor:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Eicher Motors | 3,430.10 | 2.77 | 11.98k |

| Tube Investment | 3,206.90 | 2.59 | 2.06k |

| TVS Motor | 1,598.05 | 1.84 | 9.89k |

| Tata Motors | 648.00 | 1.76 | 2.09m |

| Hero Motocorp | 3,094.75 | 1.48 | 12.86k |

| Bajaj Auto | 5,362.30 | 0.88 | 1.83k |

| Cummins | 1,712.95 | 0.47 | 2.88k |

| Balkrishna Ind | 2,545.15 | 0.36 | 1.60k |

| Bosch | 19,507.95 | 0.29 | 239 |

-330

November 03, 2023· 15:09 IST

Stock Market LIVE Updates | Escorts Kubota Q2 Earnings:

Net profit at Rs 235 crore versus Rs 87 crore and revenue up 8.6% at Rs 2,046.2 crore versus Rs 1,883.5 crore, YoY.

-330

November 03, 2023· 15:05 IST

Stock Market LIVE Updates | CLSA View On Godrej Properties:

-Sell call target raised to Rs 1,520 per share

-Q2 had record presales but cash flow lags

-OCF margin was low & concern over profitability remains

-Believe company’s aggressive business development (plus balance & payments) coupled

-Volatile OCF are likely to further increase its debt

-330

November 03, 2023· 15:02 IST

Sensex Today | Market at 3 Pm

The Sensex was up 357.14 points or 0.56 percent at 64,438.04, and the Nifty was up 115.90 points or 0.61 percent at 19,249.20. About 2024 shares advanced, 1173 shares declined, and 96 shares unchanged.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| SEPC | 24.20 | 32.97 | 18.20 |

| Ruchinfra | 18.70 | 28.52 | 14.55 |

| Hind Rectifiers | 593.85 | 28.41 | 462.45 |

| Nagreeka Cap | 20.35 | 27.59 | 15.95 |

| Oil Country | 25.20 | 24.14 | 20.30 |

| Industrial Inv | 177.10 | 24.06 | 142.75 |

| Norben Tea | 13.35 | 23.04 | 10.85 |

| Kapston Service | 238.80 | 22.93 | 194.25 |

| Jaiprakash Asso | 18.40 | 21.85 | 15.10 |

| Tantia Const | 23.80 | 21.12 | 19.65 |

-330

November 03, 2023· 15:01 IST

Stock Market LIVE Updates

| Titan Company Q2

Net profit up 9.7 percent at Rs 940 crore versus Rs 857 crore and revenue up 33.6 percent at Rs 11,660 crore versus Rs 8,730 crore, YoY.

-330

November 03, 2023· 15:00 IST

Stock Market LIVE Updates |

Zomato Q2 Results:

Consolidated net profit at Rs 36 crore versus loss of Rs 251 crore and revenue up 72 percent at Rs 2,848 crore versus Rs 1,661 crore, YoY.

-330

November 03, 2023· 14:45 IST

-330

November 03, 2023· 14:44 IST

Sensex Today| Piramal Enterprises approves allottment of NCDs worth Rs 532 crore

The company said Administrative Committee (‘Committee’) of the Board of Directors of the Company held today, has approved the allotment of 53,29,030 secured, rated, listed, redeemable, non-convertible debentures of a face value of ₹1000/- each, aggregating up to ₹ 532,90,30,000/- by way of public issuance.

-330

November 03, 2023· 14:34 IST

Sensex Today| Aditya Birla Capital Q2 profit jumps 44% to Rs 705 crore

-330

November 03, 2023· 14:25 IST

Stock Market LIVE Updates | Zydus Lifesciences signs licensing agreement with Lupin

Zydus Lifesciences and Lupin have entered into a licensing and supply agreement to co-market, Saroglitazar Mg for the treatment of Non-Alcoholic Fatty Liver Disease (NAFLD) and Non-Alcoholic Steato Hepatitis (NASH) in India.

-330

November 03, 2023· 14:21 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Cressanda Sol | 600000 | 23.7 | 1.42 |

| Cressanda Sol | 400000 | 23.7 | 0.95 |

| Jaiprakash Pow | 402651 | 11 | 0.44 |

| Jaiprakash Pow | 255052 | 11 | 0.28 |

| Jaiprakash Pow | 282550 | 11 | 0.31 |

| Jaiprakash Pow | 2170610 | 11 | 2.39 |

| Jaiprakash Pow | 573254 | 10.99 | 0.63 |

| Jaiprakash Pow | 253890 | 10.95 | 0.28 |

| LLOYDS ENTER | 250000 | 40.5 | 1.01 |

| Jaiprakash Pow | 409824 | 10.98 | 0.45 |

-330

November 03, 2023· 14:14 IST

-330

November 03, 2023· 14:10 IST

Stock Market LIVE Updates | Macquarie View On Britannia Industries:

-Neutral call, target Rs 4,350 per share

-Company highlighted that its current premium versus peers is at higher end of a comfortable range

-Higher current premium remains vigilant of price-based competition

-There is possibility that H2 EBITDA margin moves closer to Q2 level of 19.7 percent

-The possibility is due to no comment on one-offs for Q2 gross margin

-Concerns on price-based competition/demand weakness make cautious on H2 performance

-330

November 03, 2023· 14:07 IST

Stock Market LIVE Updates | Electronics Mart India Q2 Results:

Profit up 54% at Rs 374 crore versus Rs 241 crore and revenue up 7% at Rs 1,313 crore versus Rs 1,228 crore, YoY.

-330

November 03, 2023· 14:05 IST

Stock Market LIVE Updates | Morgan Stanley View On Berger Paints

-Underweight call, target Rs 479 per share

-Q2 earnings missed our estimate and consensus by 5-6 percent

-Decorative demand in general was weak

-Despite weak decorative demand co generated double-digit volume growth

-Company also gained market share

-Management is confident about maintaining double-digit growth

-Management also confident about similar EBITDA margins in Q3

-330

November 03, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Godfrey Phillip | 2,392.90 | 2,161.05 | -231.85 7.07k |

| Transformers | 187.00 | 175.25 | -11.75 460.28k |

| SML Isuzu | 1,422.90 | 1,357.75 | -65.15 3.99k |

| Lorenzini Appar | 280.00 | 267.55 | -12.45 65 |

| Suryalakshmi Co | 66.40 | 63.70 | -2.70 8.67k |

| NRB Industrial | 30.90 | 29.75 | -1.15 2.11k |

| AFL | 361.00 | 347.60 | -13.40 512.16k |

| MMP Industries | 224.00 | 217.00 | -7.00 105 |

| Syrma SGS | 521.15 | 505.00 | -16.15 228.32k |

| Harsha Engineer | 429.00 | 416.00 | -13.00 355.68k |

-330

November 03, 2023· 13:57 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Nagreeka Cap | 18.30 | 20.45 | 2.15 2.47k |

| Hitech Corp | 251.80 | 275.10 | 23.30 2.77k |

| Sanginita Chemi | 23.90 | 25.55 | 1.65 13.04k |

| Archidply Decor | 80.35 | 85.30 | 4.95 0 |

| Sarda Energy | 210.95 | 220.70 | 9.75 16.73k |

| KAMOPAINTS | 143.95 | 149.85 | 5.90 2.40k |

| Amber Enterpris | 3,009.95 | 3,125.90 | 115.95 3.21k |

| Spectrum Electr | 1,032.50 | 1,069.95 | 37.45 358 |

| Silver Touch Te | 556.85 | 574.00 | 17.15 1.93k |

| Arvind and Comp | 66.00 | 68.00 | 2.00 12.18k |

-330

November 03, 2023· 13:56 IST

Sensex Today | UCO Bank Q2 Results:

Net profit down 20% at Rs 402 crore versus Rs 505 crore and net interest income up 8.3% at Rs 1,917 crore versus Rs 1,770 crore, YoY.

-330

November 03, 2023· 13:50 IST

Stock Market LIVE Updates | Godfrey Phillips India Q2 Results:

Profit flat at Rs 202 crore and revenue up 13.5% at Rs 1,158 crore versus Rs 1,020 crore, YoY.

-330

November 03, 2023· 13:48 IST

Stock Market LIVE Updates | SML Isuzu Q2 Results:

Net profit at Rs 21 crore loss of Rs 9.2 crore and revenue up 22% at Rs 499 crore versus Rs 410 crore, YoY.

-330

November 03, 2023· 13:45 IST

Chambal Fertilisers and Chemicals Q2 Earnings:

Net profit rose 39% at Rs 381 crore versus Rs 274.2 crore and revenue down 37.3% at Rs 5,385.5 crore versus Rs 8,587 crore, YoY.

-330

November 03, 2023· 13:43 IST

Stock Market LIVE Updates | Gabriel India Q2 Earnings:

Net profit up 27% at Rs 47 crore versus Rs 37 crore ad revenue up 8% at Rs 864 crore versus Rs 803 crore, YoY.

-330

November 03, 2023· 13:42 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Tata Motors | 651.40 2.35 | 18.49m | 1,207.87 |

| HDFC Bank | 1,488.60 0.8 | 5.90m | 877.95 |

| Reliance | 2,327.40 0.31 | 2.85m | 663.88 |

| Bajaj Finance | 7,433.80 -0.21 | 684.43k | 508.69 |

| Apollo Hospital | 5,125.05 4.87 | 940.40k | 479.42 |

| SBI | 578.00 1.03 | 7.78m | 449.04 |

| ICICI Bank | 932.00 1.31 | 4.69m | 436.93 |

| ITC | 433.25 0.49 | 9.41m | 407.10 |

| Maruti Suzuki | 10,285.00 -0.18 | 310.41k | 320.23 |

| Adani Enterpris | 2,230.50 0.69 | 1.43m | 320.87 |

-330

November 03, 2023· 13:34 IST

KPI Green Energy bagged new orders aggregating to 5.70 MW for executing solar power projects received by M/s. Sun Drops Energia Private Limited, a wholly owned subsidiary of the Company under ‘Captive Power Producer (CPP)’ Segment of the Company.

-330

November 03, 2023· 13:29 IST

-330

November 03, 2023· 13:27 IST

Stock Market LIVE Updates | Jefferies View On Tata Motors:

-Buy call, target Rs 800 per share

-Q2 EBITDA was 2.2x YoY (+1 percent QoQ) to a new high (broadly in-line with estimate)

-India CV and PV EBITDA improved 15-41 percent QoQ

-JLR EBITDA was down 9 percent QoQ from all-time high in Q1

-JLR EBITDA sustained at £1bn+ for third quarter in a row

-Net auto debt fell 7 percent QoQ to 18-quarter low

-JLR expects a better H2 with ramp-up in volumes

-JLR raised its FY24 EBIT margin guidance from 6 percent+ to 8 percent (estimate: 8.3 percent)

-330

November 03, 2023· 13:22 IST

Sensex Today | BSE Oil & Gas index added 1 percent led by Gujarat Gas, Indraprastha Gas, ONGC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Gujarat Gas | 420.40 | 3 | 97.34k |

| IGL | 399.05 | 2.32 | 95.39k |

| ONGC | 189.20 | 1.56 | 258.48k |

| GAIL | 123.95 | 1.52 | 591.27k |

| HINDPETRO | 258.20 | 1.2 | 45.46k |

| IOC | 95.83 | 0.74 | 3.43m |

| BPCL | 362.65 | 0.61 | 24.15k |

| Petronet LNG | 196.05 | 0.51 | 131.46k |

| Reliance | 2,327.05 | 0.31 | 269.95k |

| Adani Total Gas | 556.00 | 0.27 | 47.49k |

-330

November 03, 2023· 13:20 IST

-330

November 03, 2023· 13:18 IST

Stock Market LIVE Updates | Patel Engineering Company Q2 Results:

Net profit jumped 87% at Rs 37.6 crore versus Rs 20.1 crore and revenue up 23% at Rs 1,021 crore versus Rs 830 crore, YoY.

-330

November 03, 2023· 13:18 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| PCBL | 197.60 -0.50 | 199.50 -0.95 | 547,630 |

| Tanla Platforms | 942.30 -0.02 | 952.50 -1.07 | 151,241 |

| Udayshivakumar | 36.80 -0.27 | 37.20 -1.08 | 186,083 |

| Siddhika | 177.00 -0.03 | 179.00 -1.12 | 2,000 |

| Privi Special | 1,213.20 -0.51 | 1,228.30 -1.23 | 3,093 |

| Nexus Select | 125.66 -0.64 | 127.28 -1.27 | 94,867 |

| Jocil | 201.40 -0.30 | 204.10 -1.32 | 2,825 |

| Bajaj Finance | 7,386.00 -0.85 | 7,492.65 -1.42 | 582,231 |

| Rainbow Childre | 1,048.00 -0.29 | 1,063.15 -1.43 | 126,075 |

| Ipca Labs | 969.15 -0.63 | 983.75 -1.48 | 82,090 |

-330

November 03, 2023· 13:17 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| SEPC | 24.20 10.00 | 18.20 32.97 | 43,672,880 |

| Hind Rectifiers | 593.85 19.99 | 462.45 28.41 | 280,672 |

| Nagreeka Cap | 20.35 8.53 | 15.95 27.59 | 40,308 |

| Kapston Service | 238.90 1.66 | 194.25 22.99 | 89,794 |

| Burnpur Cement | 5.90 9.26 | 4.90 20.41 | 1,022,487 |

| AMD Industries | 82.00 5.06 | 68.15 20.32 | 195,389 |

| Radhika Jewel | 51.50 5.32 | 42.90 20.05 | 2,278,481 |

| Drone | 145.00 4.13 | 121.45 19.39 | 647,000 |

| Industrial Inv | 169.85 15.07 | 142.75 18.98 | 924,913 |

| DPSC | 17.00 5.59 | 14.45 17.65 | 1,242,473 |

-330

November 03, 2023· 13:12 IST

Stock Market LIVE Updates | Transformers and Rectifiers India Q2 Earnings:

Net profit down 86% at Rs 1.6 crore versus Rs 11.5 crore and revenue down 21% at Rs 257 crore versus Rs 325 crore, YoY.

-330

November 03, 2023· 13:10 IST

Stock Market LIVE Updates | Arvind Fashions to sell Arvind Beauty Brands to Reliance Beauty & Personal Care:

Arvind Fashions has entered into a share purchase agreement (SPA) with Reliance Beauty & Personal Care Limited, a wholly owned subsidiary of Reliance Retail Ventures Limited to sell and transfer the entire equity stake held by the company in the subsidiary company and upon completion of the formalities comprised under the SPA, the said subsidiary company would cease to be the subsidiary of the company.

-330

November 03, 2023· 13:08 IST

Stock Market Live Updates | Axis Securities View on Navin Fluorine International

Navin Fluorine International Ltd. (NFIL) numbers for Q2FY24 missed the estimates on all fronts as HPP and the shutdown of the specialty chemical plant affected production. The company reported revenue of Rs 472 crore against estimate of Rs 520 crore and was up 12.5%/-3.9% YoY/QoQ.

EBITDA halved from the last quarter due to negative operating leverage (up 4.8% but down 13.9% QoQ). EBITDA Margin fell to 20.84% (from 23%/22% in Q1FY24/Q2FY23). The company’s PAT stood at Rs 61 crore, up 4.8%/(1.5)% YoY/QoQ, led by higher depreciation and interest expense from the recent Capex.

NFIL has strong revenue visibility in the CDMO and Specialty Chemical segment, and well-planned Capex to support future growth trajectory. But with the recent abrupt exit of performing MD Radhesh Welling and no immediate visible talent to replace him, there is a vacuum in the top management for which target multiple revised downwards.

Nonetheless, NFIL’s strong track record of receiving international orders and collaborating in strong partnerships gives hope that it will sail this storm and maintain its good prospects in the long term.

Broking house revised estimates to incorporate the impact of the shutdown and revised the project stabilisation outlook. A revised target is Rs 3,880/share, implying an upside of 11% from the CMP.

-330

November 03, 2023· 13:03 IST

Stock Market LIVE Updates | WPIL Q2 Results:

Net profit up 47.4% at Rs 34.5 crore versus Rs 23 crore and revenue down 13.9% at Rs 348 crore versus Rs 404.3 crore, YoY.

-330

November 03, 2023· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was up 368.85 points or 0.58 percent at 64,449.75, and the Nifty was up 121.20 points or 0.63 percent at 19,254.50. About 2155 shares advanced, 980 shares declined, and 102 shares unchanged.

-330

November 03, 2023· 12:57 IST

Stock Market LIVE Updates | Bayer CropScience Q2:

Net profit up 37% at Rs 223 crore against Rs 163 crore and revenue up 11% at Rs 1,617 crore versus Rs 1,452 crore, YoY.

-330

November 03, 2023· 12:56 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Hisar Spinning | 41.07 | 45.39 | 4.32 0 |

| Harsha Engineer | 391.00 | 432.00 | 41.00 195 |

| CHL | 24.70 | 26.97 | 2.27 10 |

| Intense Tech | 83.65 | 91.15 | 7.50 6.99k |

| Digjam | 79.01 | 85.70 | 6.69 11 |

| AFL | 329.20 | 354.55 | 25.35 747 |

| Tinna Trade Lim | 26.50 | 28.50 | 2.00 334 |

| Pearl Global In | 1,220.00 | 1,301.00 | 81.00 163 |

| Ceeta Industrie | 30.10 | 31.90 | 1.80 1.58k |

| CM | 21.00 | 22.23 | 1.23 3.94k |

-330

November 03, 2023· 12:54 IST

-330

November 03, 2023· 12:53 IST

Stock Market LIVE Updates | Titan Company shares trade higher ahead of Q2 earnings:

Titan Company is expected to report strong on-year revenue growth in Q2, on the back of robust wedding purchases and high-value studded purchases. However, net profit growth is likely to be muted as margins take a hit on a high base. Titan Company will announce its Q2FY24 earnings on November 3.

Titan’s fiscal second-quarter net profit is likely to rise 1.9 percent year-on-year to Rs 889 crore according to a poll of analysts’ estimates. The jewellery-to-watch company is expected to deliver a revenue growth of 18.8 percent year-on-year to Rs 10,449 crore in the July-to-September quarter. Read More

-330

November 03, 2023· 12:52 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| CSB Bank | 331.00 2.32% | 830.48k 12,411.80 | 6,591.00 |

| Heidelberg Cem | 186.20 -0.13% | 276.47k 4,535.60 | 5,996.00 |

| Prime Sec | 149.50 1.36% | 153.39k 3,055.20 | 4,921.00 |

| HINDWAREAP | 466.00 -6.31% | 129.80k 2,990.60 | 4,240.00 |

| Intense Tech | 88.62 12.04% | 200.35k 7,017.40 | 2,755.00 |

| Container Corp | 708.90 3.9% | 237.24k 12,583.20 | 1,785.00 |

| Gallantt Ispat | 95.35 11.97% | 114.90k 8,020.60 | 1,333.00 |

| VEL | 16.92 3.49% | 20.11k 1,544.80 | 1,202.00 |

| Dr Lal PathLab | 2,587.00 4.94% | 66.68k 5,989.80 | 1,013.00 |

| Hind BioScience | 10.62 4.94% | 137.67k 13,531.80 | 917.00 |

-330

November 03, 2023· 12:48 IST

-330

November 03, 2023· 12:46 IST

Stock Market LIVE Updates | Prism Johnson Q2 Results:

Net profit at Rs 182.1 crore against loss of Rs 82.6 crore and revenue up 6% at Rs 1,730 crore versus Rs 1,633 crore, YoY.

-330

November 03, 2023· 12:45 IST

Sensex Today | BSE Smallcap index rose 1 percent supported by Transformers and Rectifiers India, Tilaknagar Industries, Gallantt Ispat:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Transformers | 188.85 | 15.33 | 450.69k |

| Gallantt Ispat | 95.60 | 12.26 | 114.59k |

| Tilaknagar Ind | 236.25 | 10.58 | 358.96k |

| SEPC | 24.28 | 9.96 | 11.16m |

| HLV | 23.08 | 9.96 | 270.27k |

| Vakrangee | 19.02 | 8.01 | 4.89m |

| JM Financial | 89.35 | 7.85 | 649.19k |

| Rategain Travel | 712.10 | 7.81 | 147.21k |

| BCL Industries | 51.00 | 7.8 | 143.74k |

| AFL | 350.45 | 7.67 | 15.47k |

-330

November 03, 2023· 12:42 IST

Stock Market LIVE Updates | MRF Q2 Earnings:

Net profit at Rs 572 crore against Rs 124 crore and revenue up 6.5% at Rs 6,088 crore versus Rs 5,719 crore, YoY.

-330

November 03, 2023· 12:41 IST

Just In | Infosys launches new proximity center in Sofia, Bulgaria for AI & Cloud-led operations

-330

November 03, 2023· 12:38 IST

Stock Market LIVE Updates | Indian Energy Exchange Q2 profit climbs 21% YoY to Rs 86.5 crore, revenue increases 14%

Indian Energy Exchange has recorded consolidated profit at Rs 86.5 crore for July-September period of FY24, growing 21.4% over corresponding period last fiscal, led by other income, topline and EBITDA margin. Revenue from operations grew by 14% YoY to Rs 108.5 crore during the quarter.

-330

November 03, 2023· 12:36 IST

-330

November 03, 2023· 12:32 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY MIDCAP 150 | 14825.15 0.72 | 24.73 2.15 | -2.34 23.70 |

| NIFTY SMLCAP 250 | 12264.60 1.11 | 29.36 1.99 | -0.35 30.49 |

| NIFTY CPSE | 3915.80 0.8 | 39.95 1.15 | 1.46 38.03 |

| NIFTY MIDSML 400 | 13934.15 0.86 | 26.38 2.09 | -1.64 26.04 |

| NIFTY AlphaLowVol 30 | 19920.75 0.6 | 17.11 1.91 | 0.72 13.67 |

-330

November 03, 2023· 12:29 IST

Sensex Today | ESAF Small Finance Bank IPO opens today: Should you subscribe to Rs 463 crore issue?

ESAF Small Finance Bank’s Rs 463 crore IPO opened for subscription on November 3. The price band for the issue, which will close on November 7, has been fixed at Rs 57-60 per share. Several analysts have assigned a ‘Subscribe’ rating to the issue owing to superlative return ratios and growing retail deposits.

The public offer comprises a fresh issue of 6.51 crore shares worth Rs 390.7 crore and an offer-for-sale of 1.2 crore shares worth Rs 72.3 crore. The promoters of ESAF Small Finance Bank are Kadambelil Paul Thomas and ESAF Financial Holdings Private Limited. Read More

-330

November 03, 2023· 12:26 IST

Stock Market LIVE Updates | Marksans Pharma arm gets EIR from USFDA

Marksans Pharma's wholly owned subsidiary Time-Cap Laboratories, Inc. has received Establishment Inspection Report (EIR) from US Food & Drugs Administration for the audit conducted in October 2023. No 483' s were issued during the Audit.

-330

November 03, 2023· 12:22 IST

-330

November 03, 2023· 12:20 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| HUL | 2,507.05 | 2,507.85 2,485.80 | -0.03% |

| Coromandel Int | 1,066.50 | 1,066.80 1,055.95 | -0.03% |

| Berger Paints | 550.75 | 551.00 541.15 | -0.05% |

| Shyam Metalics | 439.50 | 439.70 430.00 | -0.05% |

| Torrent Pharma | 1,962.90 | 1,963.80 1,932.65 | -0.05% |

| Navin Fluorine | 3,554.90 | 3,557.00 3,480.00 | -0.06% |

| KNR Construct | 268.70 | 268.90 264.55 | -0.07% |

| Delta Corp | 140.80 | 140.90 135.20 | -0.07% |

| Hindustan Aeron | 1,892.85 | 1,894.30 1,857.00 | -0.08% |

| KFin Tech | 471.00 | 471.40 462.25 | -0.08% |

-330

November 03, 2023· 12:18 IST

Stock Market LIVE Updates | Prabhudas Lilladher View on Cera Sanitaryware:

Cera Sanitaryware (CRS) upward revised its revenue growth guidance between 19-21% from 17-19% and expects 16%+ margins in the near term, given strong demand outlook from replacement (accounts 65% its revenue) and expansion in geographical penetration.

CRS’s Q2FY24 Revenue/PAT was 3.1%/3.0% above the estimates with healthy performance from faucetware segment & margin expansion of 60bps YoY. The company delivered revenue CAGR of 9.1% over 4years in Q2FY24 and strong growth guidance for H2FY24 considering seasonally better quarters. EBITDA margin improved to 16.5% and is expected to be at current level in near terms.

We believe demand scenario to remain healthy and capacity expansion in faucetware division will add to growth in coming quarters. Hence, expect positive momentum to continue.

Management guided revenue of ~Rs 29 billion by Sept-25 with ~16%+ sustainability in EBITDA margin.

Broking firm estimate Revenue/EBITDA/PAT CAGR of 17.5%/18.2%/18.5% over FY23-26E and upward revise FY26E earnings estimate by 1.5% and maintain FY24/FY25E earnings. Maintain ‘Accumulate’ rating with revised Target Price of Rs 8,926 (earlier Rs 8,857) valuing at 35x Sep’25 EPS.

-330

November 03, 2023· 12:15 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Suzlon Energy | 34.44 | 34.44 | 34.44 |

| Ratnamani Metal | 2983.10 | 2983.10 | 2,951.25 |

| Brigade Ent | 654.60 | 654.60 | 652.95 |

| Torrent Power | 767.85 | 767.85 | 759.10 |

| Shriram Finance | 2028.20 | 2028.20 | 2,021.50 |

| Godrej Prop | 1777.00 | 1777.00 | 1,769.55 |

| Blue Star | 960.00 | 960.00 | 956.65 |

| Angel One | 2750.60 | 2750.60 | 2,716.75 |

| TML - D | 449.65 | 449.65 | 444.10 |

| CreditAccess Gr | 1709.15 | 1709.15 | 1,668.00 |

-330

November 03, 2023· 12:11 IST

Stock Market LIVE Updates | Morgan Stanley View On Tata Motors

-Overweight call, target Rs 711 per share

-Impressive Q2; deleveraging in FY24, EV scale-up in FY25

-Q2 in-line with estimates at EBITDA level

-Net debt came down

-JLR raised FY24 margin guidance and India EV losses narrowed

-Sharper-than-expected global luxury slowdown in key downside risk to watch

-330

November 03, 2023· 12:08 IST

Stock Market LIVE Updates | Whirlpool of India Q2 Results

:

Net profit down 24% at Rs 36.6 crore versus Rs 48 crore and revenue down 6% at Rs 1,522 crore versus Rs 1,612 crore, YoY.

-330

November 03, 2023· 12:07 IST

Stock Market LIVE Updates | CONCOR Q2 net profit up 21% on-year; stock jumps 4%

Shares of Container Corporation of India jumped more than 4 percent in trade on November 3 post registering a 21.8 percent on-year growth in consolidated profits at Rs 481.76 crore.

The consolidated net profit of Container Corporation of India (CONCOR) jumped 21.8 percent on-year to Rs 481.76 crore in the second quarter of the fiscal year 2023-24 (Q2 FY24), according to the financial results declared by the public sector company on November 2.

In the year-ago period, CONCOR had reported a net profit of Rs 303.8 crore. Sequentially, the profit after tax has increased in the September 2023 quarter, as it stood at Rs 252.55 crore in Q1 FY24. Concor’s Q2 revenues rose 10.5 percent year-on-year (YoY) to Rs 2,194.87 crore, due to a 26.13 percent YoY growth in domestic volumes in the September quarter. Read More

-330

November 03, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was up 332.06 points or 0.52 percent at 64,412.96, and the Nifty was up 108.50 points or 0.57 percent at 19,241.80. About 2176 shares advanced, 936 shares declined, and 95 shares unchanged.

-330

November 03, 2023· 11:58 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Surani Steel Tu | 324.00 | 299.25 | -24.75 1.58k |

| Vinyas Innovati | 502.55 | 476.00 | -26.55 - |

| Quicktouch Tech | 220.70 | 210.00 | -10.70 64.50k |

| Pramara Promoti | 89.00 | 85.00 | -4.00 - |

| Cellecor Gadget | 228.00 | 220.00 | -8.00 - |

| Delta | 84.95 | 82.05 | -2.90 409 |

| Guj Raffia Ind | 32.50 | 31.40 | -1.10 39 |

| Baheti Recyclin | 205.95 | 199.00 | -6.95 1.50k |

| Windsor | 71.75 | 69.45 | -2.30 3.09k |

| Chola Invest. | 1,191.30 | 1,159.80 | -31.50 542.44k |

-330

November 03, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| P E Analytics | 239.00 | 258.45 | 19.45 14.48k |

| Prime Focus | 95.00 | 100.70 | 5.70 75.29k |

| Capital Trust | 99.30 | 105.20 | 5.90 1.24k |

| Intense Tech | 79.25 | 83.80 | 4.55 8.24k |

| EQUIPPP | 24.10 | 25.35 | 1.25 5.46k |

| Universal Cable | 517.10 | 541.50 | 24.40 6.31k |

| GTPL Hathway | 167.65 | 175.20 | 7.55 4.47k |

| Ambani Organics | 130.00 | 135.00 | 5.00 1000 |

| InfoBeans Tech | 405.00 | 420.55 | 15.55 10.42k |

| Ameya Precision | 53.00 | 55.00 | 2.00 3.41k |

-330

November 03, 2023· 11:54 IST

Sensex Today | Praveen Singh – Associate VP, Fundamental Currencies and Commodities, Sharekhan by BNP Paribas:

Yesterday, spot gold closed with a minor gain of 0.17% at USD 1985. Gold was up on weaker Dollar and lower US yields. As expected, the Bank of England kept the benchmark rate unchanged; however, it sees no growth next year and unemployment ticking higher. Previous estimate called for a growth of 0.50%.

The US initial jobless claims rose to 217k versus the forecast of 210k. Factory orders in September jumped by 2.80% versus the forecast of 2.30%. Final readings of durable goods orders (September) were a tad lower than the forecast.

Today's major data releases include US nonfarm payroll report for the month of October. Apart from that, focus will be on UK's services PMI and the Euro-zone's unemployment rate.

A robust US nonfarm payroll report will weigh on gold as the middle East conflict is mostly contained. Support is at $1970/$1962. Resistance is at $2000/$2010.

-330

November 03, 2023· 11:49 IST

Stock Market LIVE Updates | Raymond to incorporate a subsidiary for engineering business

To facilitate the restructuring in the engineering business, the board of directors of Raymond at its meeting held on November 03, 2023, have approved to incorporate a wholly owned subsidiary of the Company.

-330

November 03, 2023· 11:46 IST

Stock Market LIVE Updates | IFB Industries Q2 profit declines 10.7% YoY to Rs 21.5 crore on lower topline

IFB Industries has registered a 10.7% on-year decline in consolidated profit at Rs 21.53 crore for quarter ended September FY24, impacted by lower topline. Consolidated revenue from operations slipped 1.6% to Rs 1,101 crore compared to year-ago period.

-330

November 03, 2023· 11:45 IST

Stock Market LIVE Updates | Centrum View on Indraprastha Gas

During Q2FY24, Indraprastha Gas (IGL) reported marginal improvement in sequential performance with Revenues/ EBITDA/ PAT rising by 1.5%/ 2.3%/ 5.9%. Growth in operational performance was driven by 1.2% QoQ rise in volumes at 8.3mmscmd while EBITDA/ scm remained stable at Rs 8.6/ scm.

On Delhi EV Policy (yet to be notified), management cited that ~14-15% volumes are at risk. However, the impact is expected to be gradual. Degrowth due to policy would be partially compensated by growth in volumes in new geographical areas (GAs).

Also, the management guided to exit FY24E at 9.0mmscmd without providing any guidance for FY25E and to maintain EBITDA/ scm at ~Rs8.5/ scm.

Considering 1HFY24 numbers and management guidance on EBITDA/ scm, broking house raised FY24E/ FY25E earnings by 9.4%/ 6.5%. Stock reacted negatively post the news on Delhi EV policy. Based on our revised estimates considering lower volumes, Centrum upgrade the stock from Add to Buy with a revised SOTP based Target Price of Rs 447 (earlier Rs 523).

-330

November 03, 2023· 11:39 IST

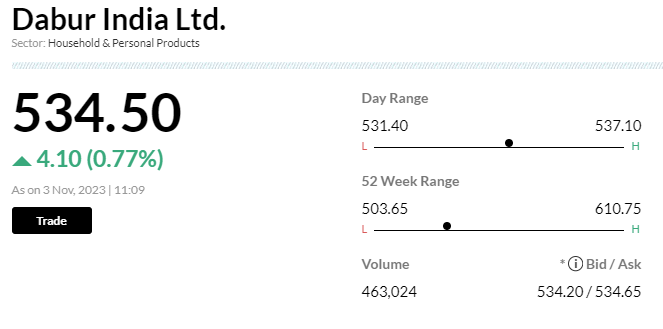

Stock Market LIVE Updates | Morgan Stanley View On Dabur India

-Overweight call, target Rs 608 per share

-Q2FY24: in-line, urban growth > rural growth

-Continued market share gains, easing inflation are positives

-Signs of recovery in October is also positive

-Weak growth in beverages and chyawanprash are negatives

-330

November 03, 2023· 11:36 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Amara Raja Batt | 622.65 | 622.70 618.55 | -0.01% |

| Asian Paints | 2,973.90 | 2,974.85 2,942.00 | -0.03% |

| ONGC | 188.90 | 188.95 185.80 | -0.03% |

| CAMS | 2,325.00 | 2,325.95 2,266.65 | -0.04% |

| HDFC Life | 624.65 | 625.00 619.60 | -0.06% |

| Pidilite Ind | 2,441.60 | 2,443.30 2,414.35 | -0.07% |

| Schaeffler Ind | 2,746.95 | 2,748.85 2,665.65 | -0.07% |

| Zydus Life | 587.50 | 588.00 579.10 | -0.09% |

| Hindustan Aeron | 1,887.75 | 1,889.50 1,857.00 | -0.09% |

| Honeywell Autom | 36,524.65 | 36,558.95 36,180.05 | -0.09% |

-330

November 03, 2023· 11:36 IST

-330

November 03, 2023· 11:34 IST

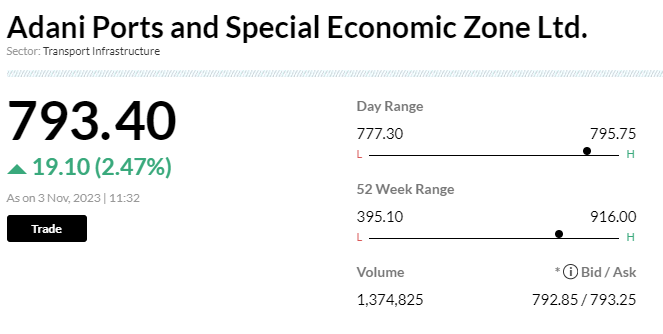

Stock Market LIVE Updates | Adani Ports October cargo volumes at 37 mt, up 48% YoY

-330

November 03, 2023· 11:30 IST

Stock Market LIVE Updates | Paragon Fine and Speciality Chemical off to a flyer, lists at 125% premium over issue price

Paragon Fine and Speciality Chemical made a stellar debut, listing at a 125 percent premium over the IPO price on November 3. The stock opened at Rs 225 against the issue price of Rs 100 on the NSE SME platform.

At 10.35 am, the stock was trading at Rs 213.75, up 113.75 percent from the offer price. The initial public offering (IPO ), which was open for subscription from October 26 to October 30, was subscribed 205 times. The price band for the offer was Rs 95-100 a share.

The company raised Rs 51.66 crore through the IPO, which was a fresh issue of 51.66 lakh shares. The company plans to use the proceeds to fund the construction work at its factory premises in Ahmedabad and for a new plant and machinery.

-330

November 03, 2023· 11:25 IST

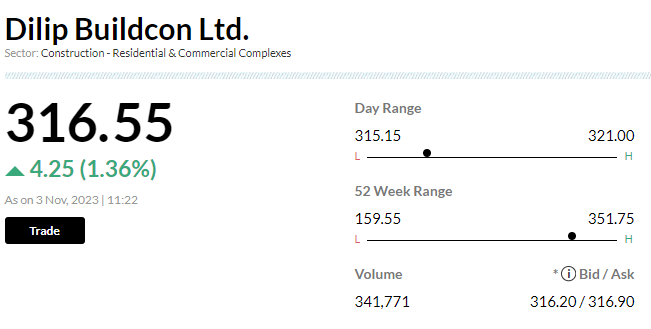

Stock Market LIVE Updates | Dilip Buildcon stock up after board considers fund raising

Shares of Dilip Builcon Limited traded over a percent higher to Rs 321 in morning trade on November 3 after the company declared that its board of directors would consider appropriate fund-raising options in the upcoming meeting scheduled for November 7.

In the last six months, the shares of the company have given 78 percent returns. The company is involved in developing infrastructure in a range of areas which include roads, bridges, transport corridors, and tunnels, among others.

-330

November 03, 2023· 11:21 IST

Sensex Today | Gains in the market remain broad-based as all sectoral indices trade in green

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16108.10 1 | 27.72 -0.38 | 0.73 21.45 |

| NIFTY IT | 30790.85 0.68 | 7.58 0.62 | -2.92 6.93 |

| NIFTY PHARMA | 14928.65 0.64 | 18.50 1.29 | -2.31 10.09 |

| NIFTY FMCG | 51902.40 0.61 | 17.50 0.99 | 1.13 16.21 |

| NIFTY PSU BANK | 5066.85 0.85 | 17.33 2.97 | -5.88 44.93 |

| NIFTY METAL | 6507.20 0.9 | -3.22 0.84 | -4.28 7.22 |

| NIFTY REALTY | 638.05 1.63 | 47.77 9.44 | 10.33 44.45 |

| NIFTY ENERGY | 27131.35 0.63 | 4.88 2.30 | 0.59 1.35 |

| NIFTY INFRA | 6181.35 0.66 | 17.69 2.18 | -0.83 18.05 |

| NIFTY MEDIA | 2264.60 1.28 | 13.68 3.86 | -1.15 8.95 |

-330

November 03, 2023· 11:16 IST

-330

November 03, 2023· 11:11 IST

Stock Market LIVE Updates | Dabur India shares gain as net profit rise 3% in Q2

Dabur India share price gained over one percent in early trade on November 3 as the FMCG player reported a consolidated net profit of Rs 507.04 crore for the second quarter of FY24, higher by 3.29 percent year-on-year.

The profit was higher on steady performances from the home & personal care (HPC) segment, along with the healthcare business, said the company. Revenue came in at Rs 3,203.84 crore, up 7.27 percent from Rs 2,986.49 crore in the year-ago quarter. Sequentially, the revenue increased 2.34 percent.

Morgan Stanley said that the earnings were in-line, with urban growth outpacing rural growth and that signs of recovery in October were positive. Dabur witnessed market share gains across 90 percent of its portfolio.

-330

November 03, 2023· 11:06 IST

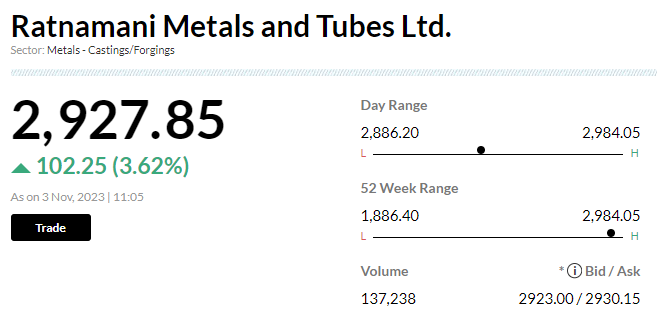

Stock Market LIVE Updates | Ratnamani Metals surges to 52-week high on robust Q2 earnings

Shares of Ratnamani Metals and Tubes surged nearly 6 percent to hit a 52-week high of Rs 2,984.05 in early trade on November 3 as investors rejoiced the company's robust performance in Q2.

The company's net profit for the quarter soared 66.3 percent on year to Rs 164.30 crore as against Rs 99 crore in the year ago period.

The strong bottomline growth was aided by a healthy topline which grew 25.7 percent to Rs 1,131.2 crore, up from Rs 899.8 crore in the base quarter.

-330

November 03, 2023· 11:00 IST

Sensex Today | Market at 11 AM

The Sensex was up 434.65 points or 0.68 percent at 64,515.55, and the Nifty was up 137.10 points or 0.72 percent at 19,270.40. About 2207 shares advanced, 808 shares declined, and 105 shares unchanged.

-330

November 03, 2023· 10:58 IST

| Company | Price at 10:00 | Price at 10:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Nirav Comm | 485.00 | 430.70 | -54.30 13 |

| Digjam | 86.00 | 78.26 | -7.74 0 |

| Precision Elec | 56.99 | 52.05 | -4.94 705 |

| Fine-line Circ | 74.75 | 68.50 | -6.25 300 |

| Alfa ICA | 53.24 | 49.00 | -4.24 441 |

| S V J Ent. | 68.95 | 64.00 | -4.95 9.00k |

| Jetking Info | 49.00 | 45.65 | -3.35 247 |

| Nalin Leasing | 36.41 | 33.95 | -2.46 209 |

| Vibrant Global | 73.44 | 68.61 | -4.83 0 |

| Innovassynth | 24.93 | 23.32 | -1.61 2.16k |

-330

November 03, 2023· 10:57 IST

Stock Market LIVE Updates | Marksans Pharma arm gets EIR from USFDA

Marksans Pharma's wholly owned subsidiary Time-Cap Laboratories, Inc. has received Establishment Inspection Report (EIR) from US Food & Drugs Administration for the audit conducted in October 2023. No 483' s were issued during the Audit.

-330

November 03, 2023· 10:53 IST

| Company | Price at 10:00 | Price at 10:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Misquita Engine | 37.75 | 42.95 | 5.20 2.00k |

| Orient Beverage | 231.00 | 255.00 | 24.00 18.23k |

| Acme Resources | 23.33 | 25.65 | 2.32 512 |

| Comfort Comm | 19.20 | 20.89 | 1.69 32 |

| Teesta Agro Ind | 84.40 | 91.60 | 7.20 7 |

| Photoquip India | 18.90 | 20.49 | 1.59 2 |

| Kakatiya Tex | 25.01 | 26.99 | 1.98 99 |

| Sanblue Corp | 31.57 | 33.80 | 2.23 5 |

| Transchem | 24.50 | 26.20 | 1.70 1.13k |

| MPDL | 23.20 | 24.80 | 1.60 505 |

-330

November 03, 2023· 10:49 IST

Stock Market LIVE Updates | JK Lakshmi Cement up 6% as Q2 profit zooms 55%

JK Lakshmi Cement jumped nearly 6 percent in the early trade on November 3, a day after reporting a 55 percent on-year growth in consolidated profit at Rs 96 crore for the July-September quarter of the current financial year.

The gains were driven by higher volume, better product & sales mix and a reduction in fuel costs, the company said in a filing on November 2.

Revenue increased 14.6 percent to Rs 1,574.5 crore, with sales volume rising 13.8 percent to 28.78 lakh tonnes. Read More

-330

November 03, 2023· 10:44 IST

Stock Market LIVE Updates | CLSA View On Tata Motors

-Buy call, target Rs 803 per share

-Q2 showed strong business momentum, raised guidance on JLR margins

-CV business: margin beat in Q2FY24

-PV business: EV drags down margins while ICE margins improve

-Catalysts include - an increase in production levels for JLR in H2FY24

-Market share gains in domestic PV business in FY25

-Maintaining a double-digit EBITDA margin in domestic CV business

-330

November 03, 2023· 10:41 IST

-330

November 03, 2023· 10:39 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Natural Biocon | 14.91 | 61.36 | 9.24 |

| Natura Hue | 12.44 | 49.88 | 8.30 |

| Pratiksha Chem | 24.73 | 34.77 | 18.35 |

| Bondada Eng. | 357.90 | 29.98 | 275.35 |

| SEPC | 23.53 | 28.86 | 18.26 |

| Orient Beverage | 250.05 | 28.49 | 194.60 |

| RIR Power Elect | 726.85 | 25.39 | 579.65 |

| Globalspace Tec | 25.95 | 25.06 | 20.75 |

| Jet Freight Log | 13.63 | 24.47 | 10.95 |

| Starlog Enter | 42.00 | 23.78 | 33.93 |

-330

November 03, 2023· 10:37 IST

Stock Market LIVE Updates | Mahindra Finance disburses around Rs 5,250 crore in Oct; shares gain 1%

Mahindra & Mahindra Financial Service shares gained one percent in trade on November 3 as the financial services company reported that its disbursements for the month of October amounted to around Rs 5,250 crore, a level similar to the previous year.

Year-to-date, the company’s disbursements came in at approximately Rs 30,700 crore, registering a growth of 16 percent year-on-year.

The collection efficiency was at 94 percent for October against 91 percent in the same month last year. Stage-3 and Stage-2 assets remained range-bound compared to September 2023. Read More

-330

November 03, 2023· 10:33 IST

JUST IN | India October Services PMI at 58.4 versus 61 and Composite PMI at 58.4 versus 61, MoM.

-330

November 03, 2023· 10:32 IST

Stock Market LIVE Updates | Sheela Foam trades lower on dismal Q2 numbers

Sheela Foam shares lost over 1.4 percent on the NSE at the open on November 3, a day after the polyurethane foam manufacturer announced its September quarter results.

Sheela Foam reported a consolidated profit of Rs 44.3 crore for the July-September quarter, down 17.3 percent from the year-ago period. Revenue declined 10.2 percent to Rs 613.2 crore.

The polyurethane foams manufacturer, known for bands like Sleepwell, in September closed its qualified institutions placement (QIP) allocating around 1.1 crore equity shares at an issue price of Rs 1,078 a share, which was at a discount of 4.94 percent to the floor price of Rs 1,133.99. The company raised Rs 1,200 crore from the QIP. Read More

-330

November 03, 2023· 10:29 IST

Sensex Today | BSE Realty index gained 1 percent supported by Indiabulls Real Estate, Prestige Estates Projects, Brigade Enterprises:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Indiabulls Real | 78.84 | 6.77 | 1.13m |

| Prestige Estate | 774.05 | 3.53 | 42.59k |

| Brigade Ent | 644.05 | 2.74 | 2.16k |

| Godrej Prop | 1,757.15 | 2.42 | 25.35k |

| DLF | 588.40 | 1.85 | 46.50k |

| Sobha | 760.85 | 1.77 | 10.61k |

| Oberoi Realty | 1,224.65 | 1.16 | 13.07k |

| Phoenix Mills | 1,998.00 | 0.98 | 2.05k |

| Mahindra Life | 486.25 | 0.35 | 3.50k |

| Macrotech Dev | 849.90 | 0.04 | 12.95k |

-330

November 03, 2023· 10:26 IST

Stock Market LIVE Updates | Adani Enterprises stock rises even as Q2 net profit halves, revenue declines

Adani Enterprises shares rose on November 3 even after the Adani group flagship reported a 51 percent on-year decline in net profit at Rs 227.8 crore in the September quarter due to decreasing coal prices. Its revenue from operations came in at Rs 22, 517 crore, falling 41 percent from the year-ago period.

According to analysts, Adani Enterprises has made significant progress in its strong incubation pipeline during the first half of FY24. "The company's result showcases the emergence of key incubating businesses, including green hydrogen integrated manufacturing ecosystem, airports and roads, which collectively contributed 48 percent of the overall EBITDA," said Shreyansh Shah, research analyst, StoxBox. Read More

-330

November 03, 2023· 10:23 IST

Stock Market LIVE Updates | Container Corporation of India Q2 profit grows 21.3% YoY to Rs 368.5 crore

Container Corporation of India has registered a 21.3% on-year growth in consolidated profit at Rs 368.5 crore for July-September period of FY24, supported largely by other income and topline, but sharp increase in rail freight expenses limited profitability and impacted EBITDA margin. Consolidated revenue from operations grew by 10.5% YoY to Rs 2,195 crore for the quarter.

-330

November 03, 2023· 10:21 IST

Sensex Today | Nifty Metal index up 1 percent supported by Ratnamani Metals and Tubes, Welspun Corp, Adani Enterprises:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ratnamani Metal | 2,920.00 | 3.34 | 116.75k |

| Welspun Corp | 447.60 | 2.8 | 354.05k |

| Adani Enterpris | 2,268.15 | 2.39 | 801.73k |

| Vedanta | 233.05 | 1.7 | 4.42m |

| Hind Zinc | 298.45 | 1.41 | 94.53k |

| Jindal Steel | 597.05 | 1.28 | 637.83k |

| Hindalco | 479.90 | 1.2 | 771.02k |

| JSW Steel | 741.50 | 1.11 | 306.95k |

| Coal India | 312.20 | 1.08 | 959.63k |

| NALCO | 93.85 | 0.48 | 894.87k |