Titan Company is expected to report strong on-year revenue growth in Q2, on the back of robust wedding purchases and high-value studded purchases. However, net profit growth is likely to be muted as margins take a hit on a high base. Titan Company will announce its Q2FY24 earnings on November 3.

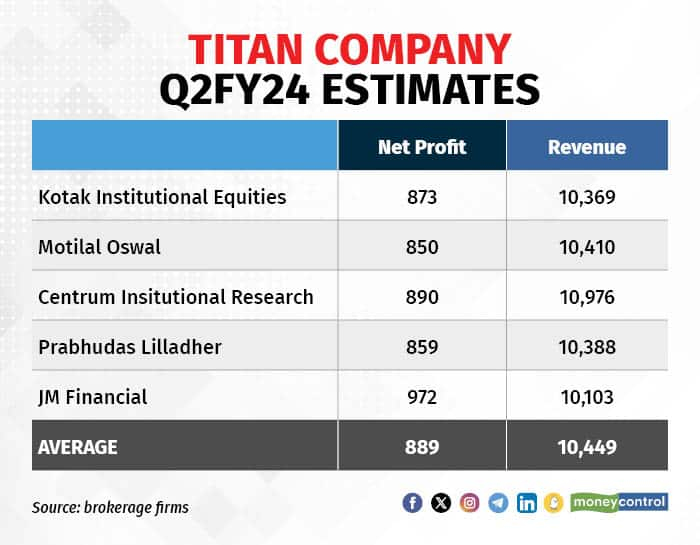

Titan’s fiscal second-quarter net profit is likely to rise 1.9 percent year-on-year to Rs 889 crore according to a poll of analysts’ estimates. The jewellery-to-watch company is expected to deliver a revenue growth of 18.8 percent year-on-year to Rs 10,449 crore in the July-to-September quarter.

Titan’s operating profit margins for Q2 FY24 are likely to fall by 178 basis points year-on-year to 12.48 percent. Margins will be impacted by a higher base due to studded inventory gains last year and higher consumer activations and promotions, said domestic brokerage firm Prabhudas Lilladher.

Titan’s business segments’ performance expectation

Titan Company’s jewellery segment is estimated to grow 19 percent year-on-year in Q2 FY24, said Motilal Oswal. Analysts say that the company’s gold exchange programme and consumer offers helped Titan in maintaining momentum in the jewellery segment. Caratlane, Titan’s diamond brand is expected to grow 45 percent year-on-year, said Centrum Institutional Research.

Jewellery has shown a mixed pick-up in demand due to softening gold prices. The demand has picked up despite a delayed marriage and festival season, said Prabhudas Lilladher. “Some softness in gold prices since June and stability thereafter for the last three months helped domestic demand,” said Kotak Institutional Equities.

Revenue from the eye-care segment is expected to grow 12 percent year-on-year in the July-September quarter, said Centrum Institutional Research. The brokerage firm expects growth in eye care to be driven by Titan Eye+ as it has improved its contribution to overall Titan sales.

Titan Q2 business update

Earlier, in its Q2 FY24 update, Titan said that it expects revenue from the jewellery segment to grow 19 percent YoY, which was led by growth in the domestic business and lower primary outgo from India to the international entities. The jewellery maker said that studded activations, new collection launches, robust golden harvest sales, healthy weddings and high-value studded purchases were the key enablers propelling growth in the quarter.

The watches and wearables segment grew 32 percent YoY due to strong demand for analogue watches. Growth in analogue watches was powered by healthy consumer sales in the mid to premium watches segment.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.