Closing Bell: Market ends flat amid volatility; realty, oil & gas stocks gain

-330

November 23, 2023· 16:22 IST

-330

November 23, 2023· 16:17 IST

Rupak De, Senior Technical analyst at LKP Securities:

Nifty remained range bound while encountering resistance around 19850. On the hourly chart, an ascending triangle is forming, suggesting a probable upside breakout.

Sentiment is anticipated to stay sideways as long as it holds above 19700. However, a drop below 19700 might exert downward pressure on the Nifty. Resistance at the higher end is established at 19850; a significant move beyond this level could trigger a rally towards 20200 in the short term.

-330

November 23, 2023· 16:13 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index maintained its sideways momentum, crucially holding the support level at 43,300, which stands as a make-or-break point for the index. The immediate hurdle for further upside is positioned at 43,700, and a breakthrough above this level is anticipated to lead to additional gains toward 44,000, where substantial call writing is evident. Conversely, a breach of the support level may result in further corrective moves towards 42,800-42,700 levels."

-330

November 23, 2023· 16:07 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Markets were extremely lacklustre on the back of thin volumes. It looks like a lot of capital has been making its way into the IPO market over the last few days, and investors including retail ones don't want to miss the bus. Once the current IPO rush is over, we may see investors returning to secondary markets, provided there are no major hiccups in global markets.

-330

November 23, 2023· 16:04 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened on a positive note however it could not build upon it and witnessed selling pressure at higher levels. It closed the day on a negative note down ~10 points. On the daily charts we can observe that Nifty made an attempt to break above 19850 however today it was unable to do so. The structure is still positive and unless it does not breach below 19700 we can expect the Nifty to target 19930 from a short-term perspective.

Daily momentum indicator has a positive crossover which is a buy signal and hence intraday dips should be bought into. In terms of levels 19850 – 19875 is the immediate hurdle while 19720 – 19700 is the crucial support zone from a short-term perspective.

Bank Nifty after witnessing around 1200 points correction has found support around 43200 which coincides with the 200-dma and has started the pullback of the fall. We expect it to continue till 44000 – 44200. On the downside 43300 is the crucial support that should not be breached for the pullback to continue.

-330

November 23, 2023· 16:00 IST

Aditya Gaggar Director of Progressive Shares:

Indian markets started the weekly expiry on a firm note at its stiff hurdle of 19,840 but then pressure in the Pharma and IT counters dragged the Index lower and witnessed a range-bound activity for the rest of the day.

With a minuscule loss of 9.85 points, Nifty50 settled at 19,802.00. Among the sectors, Realty sector gained over 1% while from the Energy space, OMC's stocks demonstrated signs of strength.

The Auto sector remained in a range but 2-wheeler stocks were seen strengthening their uptrend.

In today's trade, the Index tried to violate 19,840, but failed to do so. To start a fresh round of rally, a compelling close above the mentioned level is a must. The positive side is that the support levels are shifted upwards and forming an Ascending Triangle Formation on an hourly chart. Currently, the immediate support is placed at 19,740.

-330

November 23, 2023· 15:51 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

It turned out to be a dull session as the benchmark ended unchanged after trading in a narrow band. After the initial uptick, Nifty slipped lower in no time and remained in a tight range till the end. A mixed trend continued on the sectoral front wherein realty, oil & gas and metal edged higher while pharma and IT closed in the red. The broader trend also traded in sync wherein smallcap managed to gain over half a percent.

Nifty attempted to overcome the hurdle at 19850 but failed again due to divergence among the heavyweights. We maintain our positive view amid consolidation in the index and suggest continuing with a “buy on dips” approach. Traders should focus on sectors/themes that are attracting noticeable traction and avoid laggards.

-330

November 23, 2023· 15:49 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Range-bound momentum continued on main indexes as the market looked for new triggers for a decisive move beyond the 19800 level. However, broad markets’ undercurrent is strong and rapid buying has emerged in the mid- and small-cap counters as bargaining strategy arose on recent underperforming stocks. The declining oil prices and ease in US bond yields are the key positives for a broader recovery for the market. The European market was mixed ahead of the ECB minutes and the release of manufacturing index data.

-330

November 23, 2023· 15:33 IST

Rupee Close:

Indian rupee ended flat at 83.34 per dollar versus previous close of 83.32.

-330

November 23, 2023· 15:30 IST

Market Close:

Indian benchmark indices ended on a flat note in the volatile session on November 23.

At close, the Sensex was down 5.43 points or 0.01 percent at 66,017.81, and the Nifty was down 9.80 points or 0.05 percent at 19,802. About 1748 shares advanced, 1407 shares declined, and 120 shares unchanged.

Hero MotoCorp, Bajaj Auto, BPCL, Eicher Motors and IndusInd Bank were among the top gainers on the Nifty, while losers were Cipla, UltraTech Cement, LTIMindtree, SBI Life Insurance and Larsen & Toubro.

A mixed trend was seen on the sectoral front, with healthcare index down 1 percent and Information Technology index down 0.5 percent. On the other hand, realty and oil & gas indices added 1 percent each and auto index up 0.4 percent.

The BSE midcap index ended with marginal gains, while smallcap index up 0.4 percent.

-330

November 23, 2023· 15:27 IST

Sensex Today | IREDA IPO: Issue subscribed 31.79 times, retail portion booked 7.1 times on final day

The Indian Renewable Energy Development Agency's IPO was subscribed 31.79 times by the afternoon of November 23, the final day of bidding. Investors sent bids for 1,497 crore equity shares against the offer size of 47.09 crore.

Qualified institutional buyers (QIBs) and high networth individuals (HNIs) bought 82.05 times and 22.84 times their allotted quota of shares. The public sector undertaking (PSU) has reserved 50 percent of the offer for QIBs and 15 percent for HNIs.

The remaining 35 percent of the net offer has been set aside for retail investors, who booked 7.1 times their allotted quota. Employees had bid 8.79 times for their reserved portion. The Mini-Ratna PSU has set aside 18.75 lakh shares for its employees.

-330

November 23, 2023· 15:25 IST

Sensex Today | Flair Writing Industries IPO Day 2: Issue subscribed 4.87 times, retail portion booked 5.87 times

Flair Writing Industries’ Rs 593 crore IPO has been subscribed 4.87 times so far on November 23, the second day of bidding, receiving bids for 7.01 crore shares against the issue size of 1.44 crore shares. Retail investors bought 5.87 times, non-institutional investors picked 7.25 times and qualified institutional buyers bought 1.33 times the allotted quota.

-330

November 23, 2023· 15:23 IST

-330

November 23, 2023· 15:22 IST

Stock Market LIVE Updates | Morgan Stanley View SBI Cards & Payment Services

-Overweight call, target Rs 950 per share

-Industry spending was up 38 percent YoY in October & 26 percent MoM

-Company’s spending grew faster than industry levels, up 52 percent YoY & up 42 percent MoM

-There is a timing difference in the festival season YoY

-Assess that festive spending was strong

-Q3FY24 spending is likely to rise 30 percent YoY versus 25 percent YoY for H1FY24

-330

November 23, 2023· 15:20 IST

Sensex Today | Fedbank Financial Services IPO Day 2: Issue booked 76%, retail portion fully subscribed

Fedbank Financial Services IPO has been subscribed 76 percent on November 23, the second day of bidding, with bids coming in for 4.26 crore shares against the issue size of 5.6 crore shares.

Retail investors have bought 1.05 times the allotted quota of shares, non-institutional investors (NIIs) picked up 35 percent while qualified institutional buyers (QIBs) have subscribed for 56 percent shares.

The firm has reserved Rs 10 crore worth of shares for its employees who will get them at a discount of Rs 10 to the final offer price. Employees have bought 67 percent of their allotted quota.

-330

November 23, 2023· 15:19 IST

Sensex Today | Gandhar Oil Refinery IPO Day 2: Issue subscribed 12.33 times, retail portion booked 14.24 times

Gandhar Oil Refinery IPO has been subscribed 12.33 times so far on November 23, the second day of bidding, with bids coming in for 26.18 crore shares against 2.12 crore shares offered.

Non-institutional investors (NIIs) took the lead, booking 19.85 times their quota of shares. The portion set aside for retail investors was booked 14.24 times and that of qualified institutional buyers 3.04 times.

The company has reserved 50 percent of the net issue for QIBs, 15 percent for NIIs and the remaining 35 percent for retail investors.

-330

November 23, 2023· 15:17 IST

Stock Market LIVE Updates | Morgan Stanley View On Bajaj Auto

-Overweight call, target Rs 6,229 per share

-Triumph sales are ramping up better than expected

-Company ramping up production & distribution to 10,000 units/month

-See strong ramp up chetak EV segment

-New model launch planned next month

-Chetak EV capacity ramp up to 20,000/month over next few months

-Domestic bikes 125cc+ portfolio grew at 50 percent+ YoY during the festive season

-Total company growth of 20 percent+ YoY in the festive season

-3-wheelers business has maintained 80 percent+ mkt share

-3-wheelers business growing well through its focus on CNG & EVs

-See a gradual recovery in exports

-330

November 23, 2023· 15:15 IST

Sensex Today | Tata Technologies IPO Day 2: Issue booked 12.34 times, HNI portion subscribed 24.62 times

Investors continued to be bullish on the Tata Technologies IPO with 55.57 crore equity shares being bought by the second day of bidding against an offer size of 4.5 crore, leading to an 12.34 times subscription till November 23.

This is the first IPO from the Tata Group in more than 19 years. Tata Consultancy Services, the country's largest IT services company, was the last public issue from the conglomerate in 2004.

The response remained strong from all categories of investors with high net-worth individuals subscribing 24.62 times the allotted quota and retail investors 9.78 times. The reserved portion of qualified institutional buyers was booked 6.88 times.

-330

November 23, 2023· 15:08 IST

Stock Market LIVE Updates | CLSA On Jubilant FoodWorks

-Sell call, target Rs 503 per share

-See its dominance in pizza being challenged by new competitors

-Expanding store network strategy risks high fixed costs in a weak demand environment

-Company’s other restaurants have not been as successful as Domino’s

-Estimate Popeye’s to emerge as a significant growth driver

-330

November 23, 2023· 15:05 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

The Indian Rupee erased early gains and depreciated on demand from importers and selling pressure from FIIs. However, a soft US Dollar and a decline in crude oil prices cushioned the downside. Economic data from the US on Wednesday was better than expected, raising some hawkishness.

We expect Rupee to trade with a slight positive bias on IPO-driven Dollar inflows and a weak tone in US Dollar. Dollar eased on strong Euro which rose on the back of better-than-expected PMI data out of Germany and the Eurozone. However, bargain buying by importers and FII outflows may cap a sharp upside. USDINR spot price is expected to trade in a range of Rs 83 to Rs 83.60.

-330

November 23, 2023· 15:03 IST

Stock Market LIVE Updates | CLSA View On Metals

-Chinese steel spreads have now corrected to $100/t

-Chinese steel spreads lowest in at least past 15 years

-Chinese steel spreads fall driven by a recent uptick in iron ore & coal prices

-See upside risk to regional spreads

-Domestic steel prices are still at a premium to import parity

-Any uptick in regional prices could lend near-term support to Indian prices

-Believe Indian steel prices unlikely to trade at a high premium

-Large capacity additions over next 3 years

-Prefer Tata Steel & Hindalco

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| APL Apollo | 1,684.00 | 1.42 | 32.65k |

| NMDC | 173.40 | 1.14 | 542.20k |

| SAIL | 90.18 | 1.05 | 423.69k |

| JSW Steel | 774.55 | 0.81 | 36.24k |

| Tata Steel | 127.05 | 0.75 | 3.20m |

| Hindalco | 502.00 | 0.36 | 86.59k |

| Jindal Steel | 653.25 | 0.28 | 17.23k |

| Coal India | 332.90 | 0.26 | 404.91k |

-330

November 23, 2023· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was down 24.00 points or 0.04 percent at 65,999.24, and the Nifty was down 17.90 points or 0.09 percent at 19,793.90. About 1726 shares advanced, 1429 shares declined, and 101 shares unchanged.

-330

November 23, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Advance Life | 47.87 | 44.33 | -3.54 1 |

| Visco Trade Ass | 145.00 | 135.45 | -9.55 69 |

| Link Pharmachem | 46.98 | 44.00 | -2.98 65 |

| Kimia Bio | 38.40 | 36.25 | -2.15 0 |

| Classic Filamen | 36.70 | 34.70 | -2.00 0 |

| WH Brady | 428.85 | 405.55 | -23.30 204 |

| Laffans Petro | 44.79 | 42.51 | -2.28 100 |

| Pioneer Invest | 34.70 | 33.01 | -1.69 3 |

| Venkatesh Ref | 110.80 | 105.50 | -5.30 1000 |

| Sunil Agro Food | 197.40 | 188.00 | -9.40 0 |

-330

November 23, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sreeleathers | 301.60 | 330.00 | 28.40 0 |

| Hawa Engineers | 111.06 | 121.50 | 10.44 418 |

| Euro Leder | 19.05 | 20.79 | 1.74 5 |

| Maiden Forgings | 116.99 | 127.00 | 10.01 5.93k |

| GTV Engineering | 410.00 | 444.30 | 34.30 284 |

| Photoquip India | 20.32 | 21.99 | 1.67 15 |

| Jindal Leasefin | 32.37 | 34.90 | 2.53 58 |

| Walchand People | 161.60 | 174.00 | 12.40 0 |

| Sicagen India | 56.50 | 60.25 | 3.75 4.51k |

| York Exports | 41.20 | 43.90 | 2.70 0 |

-330

November 23, 2023· 14:57 IST

Sensex Today | Tata Technologies IPO Day 2: Issue booked 12.17 times, HNI portion subscribed 24.2 times

Investors continued to be bullish on the Tata Technologies IPO with 54.81 crore equity shares being bought by the second day of bidding against an offer size of 4.5 crore, leading to an 12.17 times subscription till November 23.

This is the first IPO from the Tata Group in more than 19 years. Tata Consultancy Services, the country's largest IT services company, was the last public issue from the conglomerate in 2004.

The response remained strong from all categories of investors with high net-worth individuals subscribing 24.20 times the allotted quota and retail investors 9.65 times. The reserved portion of qualified institutional buyers was booked 6.87 times.

-330

November 23, 2023· 14:55 IST

Stock Marekt LIVE Updates | Nirmal Bang View On Tata Consumer Products

Broking hosue not made any changes to its FY24E/FY25E EPS after the meeting. It remain positive about Tata Consumer Products over the medium to long term on the back of: (1) Improvement in margins and gradual recovery in volume growth in the core business for both India Foods business as well as India Beverages business (2) Premiumisation initiatives (particularly in Salt) and (3) Robust growth in new engines.

At CMP, the stock is trading at ~45x FY25E EPS. Maintain Buy on Tata Consumer Product with a Target Price of Rs 1,100 (Rs1,045 earlier), valuing it at 45x on Dec’25E EPS.

-330

November 23, 2023· 14:50 IST

Stock Market LIVE Updates | Jefferies View On Piramal Pharma

-Buy call, target Rs 135 per share

-Remain confident of co generating 13 percent revenue CAGR to Rs 10,200 crore

-40 percent EBITDA CAGR to Rs 1,730 crore over FY23-26e

-Expect shares to reach March 2025 fair value of Rs 180-185

-March 2025 fair value of Rs 180-185 via both multiple based & DCF based valuation

-September 2024 price target is Rs 135 per share

-330

November 23, 2023· 14:44 IST

Stock Market LIVE Updates | IREDA IPO subscribed 15 times, retail portion booked 6.38 times

State-owned financial institution Indian Renewable Energy Development Agency's IPO has received strong response from investors considering the growth potential in the renewable energy industry, as the issue has garnered bids for 717.47 crore equity shares, which is 15.24 times higher than the offer size of 47.09 crore equity shares on November 23, the final day of bidding.

All kind of investors supported the issue with qualified institutional buyers and high networth individuals looking aggressive amongst them, buying 29.48 times and 17.04 times the allotted quota which is 50 percent and 15 percent of the net issue size, respectively

-330

November 23, 2023· 14:39 IST

-330

November 23, 2023· 14:34 IST

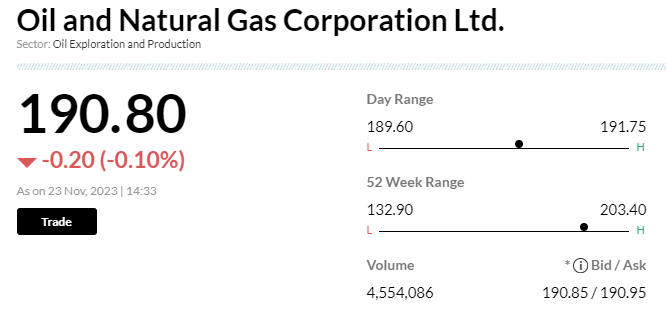

Stock Market LIVE Updates | Govt plans to ask ONGC to consider rights issues to fund HPCL

India plans to ask state-run Oil and Natural Gas Corp to consider launching a rights issue to help fund green projects at refining arm Hindustan Petroleum Corp, according to Reuters report, an exercise that could raise about $1.9 billion. The comments come after India’s finance minister announced a plan this year to provide equity of 300 billion rupees ($3.6 billion) to help the big state oil refiners move towards cleaner energy.

The government is weighing options for HPCL, including directly providing loans at preferential rates, said the sources, who have direct knowledge of the matter. They sought anonymity as they were not authorised to speak with the media. The oil ministry is awaiting a response from the finance ministry on the plan for ONGC to launch a rights issue, one of the sources said.

-330

November 23, 2023· 14:28 IST

-330

November 23, 2023· 14:22 IST

Sensex Today | Gold gains as lower US dollar, bond yields lift sentiment

Gold prices rose on Thursday, hovering close to a key $2,000 per ounce level as a weaker U.S. dollar and lower Treasury yields buoyed demand for bullion.

Spot gold was up 0.4% at $1,996.84 per ounce, as of 0747 GMT, after hitting a three-week high of $2,007.29 on Tuesday.

-330

November 23, 2023· 14:20 IST

-330

November 23, 2023· 14:14 IST

Stock Market LIVE Updates | InCred View On Bharat Dynamics:

-Add call, target Rs 1,300 per share

-Won new orders worth Rs 1,660 crore in H1FY24

-Total orderbook as of September 2023 at Rs 20,800 crore, 9.6x TTM sales

-Total orderbook includes export orders worth Rs 2,600 crore

-Maintains its guidance of achieving revenue of Rs 3,200 crore

-Maintains its guidance of EBITDA margin of 20-23 percent

-Although Q2 execution reflects initial signs of improvement

-Company must enhance execution capabilities to achieve its FY24 targets

-Trades at 24x 1-year forward earnings, in-line with its 3-year average P/E

-330

November 23, 2023· 14:11 IST

Flair Writing Industries IPO Day 2: Issue subscribed 4.48 times, retail portion booked 5.63 times

Flair Writing Industries’ Rs 593 crore IPO has been subscribed 4.48times so far on November 23, the second day of bidding, receiving bids for 6.46 crore shares against the issue size of 1.44 crore shares.

Retail investors bought 5.63 times, non-institutional investors picked 6.84 times and qualified institutional buyers bought 0.72 times the allotted quota.

-330

November 23, 2023· 14:10 IST

Sensex Today | Fedbank Financial Services IPO Day 2: Issue booked 74%, retail portion fully subscribed

Fedbank Financial Services IPO has been subscribed 74 percent on November 23, the second day of bidding, with bids coming in for 4.15 crore shares against the issue size of 5.6 crore shares.

Retail investors have bought 100 percent of their allotted quota of shares, non-institutional investors (NIIs) picked up 34 percent while qualified institutional buyers porton booked at 56 percent.

The firm has reserved Rs 10 crore worth of shares for its employees who will get them at a discount of Rs 10 to the final offer price. Employees have bought 65percent of their allotted quota.

-330

November 23, 2023· 14:09 IST

Gandhar Oil Refinery IPO Day 2: Issue subscribed 11.34 times, retail portion booked 13.52 times

Gandhar Oil Refinery IPO has been subscribed 11.34 times so far on November 23, the second day of bidding, with bids coming in for 24.09 crore shares against 2.12 crore shares offered.

Non-institutional investors (NIIs) took the lead, booking 18.93 times their quota of shares. The portion set aside for retail investors was booked 13.52 times and that of qualified institutional buyers 1.5 times.

-330

November 23, 2023· 14:04 IST

Sensex Today | Tata Technologies IPO issue booked 11 times, HNI portion subscribed 22 times

Investors continued to be bullish on the Tata Technologies IPO with 49.74 crore equity shares being bought by the second day of bidding against an offer size of 4.5 crore, leading to an 11 times subscription till November 23.

This is the first IPO from the Tata Group in more than 19 years. Tata Consultancy Services, the country's largest IT services company, was the last public issue from the conglomerate in 2004.

The response remained strong from all categories of investors with high net-worth individuals subscribing 22.96 times the allotted quota and retail investors 9.22 times. The reserved portion of qualified institutional buyers was booked 4.15 times.

-330

November 23, 2023· 14:01 IST

Sensex Today | IREDA IPO issue subscribed 15 times, retail portion booked 6.38 times on Final Day

State-owned financial institution Indian Renewable Energy Development Agency's IPO has received strong response from investors considering the growth potential in the renewable energy industry, as the issue has garnered bids for 717.47 crore equity shares, which is 15.24 times higher than the offer size of 47.09 crore equity shares on November 23, the final day of bidding.

All kind of investors supported the issue with qualified institutional buyers and high networth individuals looking aggressive amongst them, buying 29.48 times and 17.04 times the allotted quota which is 50 percent and 15 percent of the net issue size, respectively.

Retail investors have subscribed 6.39 times the portion set aside for them which is 35 percent of the net offer, while employees have bid 7.87 times the reserved portion.

-330

November 23, 2023· 13:54 IST

| Company | Price at 13:00 | Price at 13:52 | Chg(%) Hourly Vol |

|---|---|---|---|

| KN Agri | 129.85 | 145.00 | 15.15 7.39k |

| Indiabulls Real | 81.20 | 87.60 | 6.40 417.39k |

| Nectar Life | 28.90 | 30.95 | 2.05 128.16k |

| Rico Auto | 92.90 | 98.15 | 5.25 57.55k |

| Archies | 24.00 | 25.35 | 1.35 5.36k |

| Hubtown | 75.35 | 78.20 | 2.85 56.96k |

| Almondz Global | 87.95 | 91.10 | 3.15 31.07k |

| Transindia Real | 49.40 | 51.00 | 1.60 146.04k |

| Keynote Finance | 118.00 | 121.70 | 3.70 223 |

| Holmarc Opto Me | 113.85 | 117.40 | 3.55 - |

-330

November 23, 2023· 13:50 IST

SBI sold 2.18% stake in SEPC between November 11-23, 2023 and brings down its stake to 4.97 percent, reported CNBC-TV18.

-330

November 23, 2023· 13:44 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Indiabulls Real | 198951 | 86.35 | 1.72 |

| Indiabulls Real | 386363 | 86.7 | 3.35 |

| Kotak Mahindra | 20001 | 1740 | 3.48 |

| Maruti Suzuki | 2076 | 10428.35 | 2.16 |

| Vodafone Idea | 500003 | 13.65 | 0.68 |

| Bajaj Finance | 1792 | 7071.6 | 1.27 |

| Emami | 44878 | 494.25 | 2.22 |

| HDFC Bank | 21303 | 1522 | 3.24 |

| Indiabulls Real | 144320 | 86.05 | 1.24 |

| Indiabulls Real | 118564 | 86.1 | 1.02 |

-330

November 23, 2023· 13:40 IST

Sensex Today | TVS Motor Company enters Vietnam with launch of two-wheelers

TVS Motor Company has entered into Vietnam in collaboration with Minh Long Motors – its distribution partner. The company will offer a range of scooters and underbone motorcycles, across multiple price points. Last week the company announced its entry into Europe starting with France.

-330

November 23, 2023· 13:36 IST

Sensex Today | Power Grid Corporation approves investment of Rs 367.1 crore for two projects

Power Grid Corporation of India said that the Committee of Directors on Investment on Projects has approved an investment of Rs 142.69 crore for augmentation of transformation capacity at Maheshwaram (PG) substation in Telangana, and Rs 224.41 crore for transmission system for evacuation of power from potential RE zone in Khavda area of Gujarat.

-330

November 23, 2023· 13:34 IST

Sensex Today | BlinkX announces the dawn of ‘ClienTech’ era

BlinkX, an elementally born tech driven company, from the house of JM Financial, announces the beginning of the ‘ClienTech’ era.

The company, which is currently in the broking and financial sector, is betting big on the underlying technology which is robust enough to fit into any spectrum of a customer-product engagement lifecycle.

-330

November 23, 2023· 13:30 IST

Stock Market LIVE Updates | Macquarie On Aurobindo Phrama

-Outperform call, target Rs 1,000 per share

-Multiple growth levers across different businesses

-Strong generics as well as biosimilar pipeline for US & Europe markets

-Multiple growth levers in Niche API product such as penicillin G

-Restructuring is paving the way for faster growth

-Strong capacity addition coming up for core business

-330

November 23, 2023· 13:27 IST

Jefferies On RBI Governer Speech

-Governer stated that while the going is good for banks & NBFCs

-RBI can strengthen risk management & build buffers for future

-Suggests banks & NBFCs avoid exuberance & focus on ALM

-Suggests NBFCs to broad-base funds, lenders to cautiously ramp-up fintech partnerships

-Suggests MFIs to keep rates/NIM reasonable

-RBI tightened norms on unsecured loans

-330

November 23, 2023· 13:25 IST

Affle India has additionally filed 10 new patents in India on November 22, 2023.

-330

November 23, 2023· 13:23 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Bharti Airtel | 980.70 | 980.70 | 978.65 |

| NTPC | 255.70 | 255.70 | 253.85 |

| Titan Company | 3441.75 | 3441.75 | 3,407.55 |

-330

November 23, 2023· 13:17 IST

Sensex Today | Fedbank Financial Services IPO Day 1: Issue subscribed 57%, retail portion booked 98%

Fedbank Financial Services’ Rs 1,092-crore IPO was subscribed 57 percent on November 22 with bids coming in for 3.17 crore shares against the issue size of 5.6 crore shares.

Retail investors bought 0.98 times their quota of shares, non-institutional investors picked up 33 percent, while the portion set aside for qualified institutional buyers still to warm up to the issue.

-330

November 23, 2023· 13:16 IST

Sensex Today | Flair Writing IPO subscribed 4.19 times, retail portion booked 5.3 times on Day 2

Flair Writing Industries’ Rs 593 crore IPO was subscribed 4.19 times on November 23, the second day of bidding, receiving bids for 6 crore shares against the issue size of 1.44 crore shares.

Retail investors bought 5.3 times, non-institutional investors picked 6.36 times and qualified institutional buyers bought 62 perent the allotted quota.

-330

November 23, 2023· 13:14 IST

Sensex Today | IREDA IPO sees 11.66 times subscription on Day 3

The Rs 2,150-crore initial public offering of Indian Renewable Energy Development Agency (IREDA) has seen a subscription 11.66 times on the last day of bidding, November 23 as investors have bid 549 crore equity shares against offer size of 47.09 crore shares.

All investors participated in the offer since the beginning of public issue with high networth individuals buying 15.05 times the allotted quota and retail investors 6.08 times.

The portion set aside for qualified institutional buyers was subscribed 18.96 times and that of employees 7.44 times.

-330

November 23, 2023· 13:11 IST

Sensex Today | Sharekhan View on Finolex Cables

Q2FY2024 performance has been healthy, driven by decent volume growth in electrical cables. Broking firm expect the company’s long-term growth momentum to continue, backed by demand from key sectors such as auto, construction, and industrials. Further, the government’s push through the Bharat Net programme would boost demand for the company’s communication cables.

The company is also expanding capacity in all its product categories and backward integrating in OFC, which shall help the company increase volumes and margins in the long run. Finolex’s debt-free balance sheet and strong cash position provide us comfort.

The company’s focus on strengthening its dealer/distributor channels across geographies and enhancing its product availability will likely yield the desired results. Family feud and court cases have created an overhang on the stock, thus reducing target multiple to 22x and has lowered ou target price to Rs, 1,100, while maintaining Buy rating on the stock. Any clarity on the resolution of this issue could result in a significant run-up in the stock.

-330

November 23, 2023· 13:03 IST

Sensex today | Market at 1 PM

The Sensex was up 53.41 points or 0.08 percent at 66,076.65, and the Nifty was up 4.20 points or 0.02 percent at 19,816. About 1805 shares advanced, 1282 shares declined, and 120 shares unchanged.

-330

November 23, 2023· 12:52 IST

Stock Market LIVE Updates | Axita Cotton bags orders worth Rs 89 crore for supplying cotton bales

Axita Cotton has secured a new sales order worth Rs 89.22 crore from multiple vendors, for supplying cotton bales in Indian raw cotton categories.

-330

November 23, 2023· 12:50 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Home First | 877.15 -4.04% | 9.28m 3,597.00 | 257,776.00 |

| Polylink Polyme | 25.30 9.24% | 2.31m 31,186.80 | 7,318.00 |

| Franklin Ind | 39.10 0.26% | 191.56k 8,908.00 | 2,050.00 |

| KPT Industries | 512.85 19.99% | 43.47k 3,057.60 | 1,322.00 |

| Nandan Denim | 30.09 14.98% | 563.08k 44,796.20 | 1,157.00 |

| WPIL | 3,125.00 0.16% | 62.82k 5,206.40 | 1,107.00 |

| Sunteck Realty | 492.10 5.09% | 308.06k 28,634.40 | 976.00 |

| Selan Explore | 510.00 6.56% | 68.95k 6,593.80 | 946.00 |

| United Brewerie | 1,600.30 0.13% | 50.15k 4,926.60 | 918.00 |

| DBOL | 163.55 5.69% | 57.12k 5,720.80 | 898.00 |

-330

November 23, 2023· 12:43 IST

Sensex Today | InterGlobe Aviation receives orders for demand of Rs 1,664 crore from the Commissioner of Income Tax Appeals

InterGlobe Aviation has received orders for demand of Rs 739.68 crore and Rs 927.03 crore from the Commissioner of Income Tax Appeals, for the Assessment year 2016-17 and 2017-18, respectively. The company will contest the same and will take appropriate legal remedies.

-330

November 23, 2023· 12:40 IST

Stock Market LIVE Updates | Jefferies On Honasa Consumer

-Buy call, target Rs 530 per share

-Reported a strong Q2 on both topline and margin

-There was a growth deceleration from Q1

-Management attributed QoQ deceleration to ERP changeover

-Hence, H1 growth of more than 35 percent reflects true picture

-New brands are scaling up well

-Dr Sheth now the fourth brand to cross Rs 150 cr ARR

-Mamaearth H1 growth was also in double-digits

-Management sounded confident on both growth & margin

-Upgrade EPS estimate by 5-6 percent

-330

November 23, 2023· 12:32 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Home First | 881.85 -3.53 | 9.27m | 807.73 |

| Yes Bank | 19.67 2.45 | 23.17m | 45.21 |

| Reliance | 2,395.85 0.34 | 146.56k | 35.16 |

| CG Power | 476.05 1.5 | 717.83k | 34.36 |

| Tata Steel | 127.00 0.71 | 2.51m | 31.80 |

| Suzlon Energy | 39.18 4.98 | 7.06m | 26.16 |

| Shree Cements | 25,938.10 -0.31 | 10.10k | 26.19 |

| Cipla | 1,184.85 -6.83 | 162.58k | 19.62 |

| Vodafone Idea | 13.63 1.04 | 14.09m | 19.17 |

| IEX | 146.05 1.74 | 1.29m | 19.06 |

-330

November 23, 2023· 12:30 IST

Sensex Today | Ashish Kacholia offloads 1.1% stake in SJS Enterprises

Ace investor Ashish Rameshchandra Kacholia sold 3.47 lakh equity shares, equivalent to 1.1% of paid-up equity in SJS Enterprises via open market transaction, at an average price of Rs 627.77 per share. Ashish held 3.23% stake in SJS as of September 2023.

-330

November 23, 2023· 12:23 IST

Sensex Today | Shaily Engineering Plastics turns ex-split on November 23

Shaily Engineering Plastics turned ex-split with effect from November 23. The company announced sub-division of one equity share of the nominal value of Rs 10 each into five equity shares having a nominal value of Rs 2 each fully paid-up.

-330

November 23, 2023· 12:16 IST

e-ticket booking is temporarily affected due to technical reasons. Technical team is working on it & online booking will be made available soon, said IRCTC.

-330

November 23, 2023· 12:15 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| PRO CLB GLOBAL | 11.30 | 67.90 | 6.73 |

| Natura Hue | 12.44 | 65.65 | 7.51 |

| Shashank Trader | 12.60 | 57.50 | 8.00 |

| Natural Biocon | 14.91 | 37.93 | 10.81 |

| Emami Realty | 110.63 | 30.69 | 84.65 |

| Syncom Formula | 12.71 | 28.77 | 9.87 |

| Forbes Gokak | 855.55 | 27.69 | 670.00 |

| Rishi Techtex | 46.50 | 27.05 | 36.60 |

| Sunita Tools | 208.40 | 25.09 | 166.60 |

| IP Rings | 170.00 | 24.95 | 136.05 |

-330

November 23, 2023· 12:13 IST

Sensex Today | Procter & Gamble Health trades ex-dividend on November 23

Procter & Gamble Health trading ex-dividend with effect from November 23. It has announced final dividend of Rs 50 per share. Amrutanjan Health Care, and Premco Global will also trade ex-dividend with effect from same date.

-330

November 23, 2023· 12:11 IST

Sensex Today | Tata Technologies issue booked 9.92 times, retail portion subscribed 8.3 times on Day 2

Investors continued to be bullish on the Tata Technologies IPO with 44.68 crore equity shares being bought by the second day of bidding against an offer size of 4.5 crore, leading to an 9.92 times subscription till November 23.

The response remained strong from all categories of investors with high net-worth individuals subscribing 19.84 times the allotted quota and retail investors 8.34 times. The reserved portion of qualified institutional buyers was booked 4.13 times.

-330

November 23, 2023· 12:09 IST

Sensex Today | Fedbank Financial Services IPO booked 54%, retail portion subscribed 93% on Day 2

Fedbank Financial Services IPO had been subscribed 54 percent by the morning of November 23, the second day of bidding, with bids coming in for 3 crore shares against the issue size of 5.6 crore.

Retail investors have bought 93 percent of their allotted quota of shares, non-institutional investors (NIIs) picked up 31 percent while qualified institutional buyers (QIBs) are yet to warm up to the issue.

The firm has reserved Rs 10 crore worth of shares for its employees who will get them at a discount of Rs 10 to the final offer price. Employees have bought 59 percent of their allotted quota.

-330

November 23, 2023· 12:05 IST

Sensex Today | Gandhar Oil Refinery issue subscribed 8.5 times, retail portion booked 10 times on Day 2

Gandhar Oil Refinery IPO had been subscribed 8.5 times by November 23 monrning, the second day of bidding, with bids coming in for 18.04 crore shares against 2.12 crore offered.

Non-institutional investors (NIIs) took the lead, booking 12.96 times their quota of shares. The portion set aside for retail investors was booked 10.45 times and that of qualified institutional buyers 1.5 times.

The company has reserved 50 percent of the net issue for QIBs, 15 percent for NIIs and the remaining 35 percent for retail investors.

-330

November 23, 2023· 12:03 IST

Stock Market LIVE Updates | Santosh Kumar Yadav resigns as IT Head of Singer India

Santosh Kumar Yadav has resigned as IT Head of Singer India in order to pursue other interests. He resigned with effect from November 22.

-330

November 23, 2023· 12:00 IST

Sensex Today | Market at 12 PM

The Sensex was down 3.05 points or 0.00 percent at 66,020.19, and the Nifty was down 10.80 points or 0.05 percent at 19,801. About 1821 shares advanced, 1235 shares declined, and 115 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 3,535.90 | 3.58 | 1.01m |

| Bajaj Auto | 5,908.25 | 2.72 | 752.56k |

| Eicher Motors | 3,898.75 | 1.69 | 406.06k |

| IndusInd Bank | 1,493.70 | 1.58 | 1.89m |

| Wipro | 402.85 | 0.65 | 2.69m |

| Tata Steel | 126.80 | 0.56 | 11.02m |

| BPCL | 403.85 | 0.44 | 3.18m |

| Asian Paints | 3,145.00 | 0.38 | 314.89k |

| HDFC Bank | 1,518.20 | 0.37 | 3.43m |

| JSW Steel | 771.15 | 0.35 | 426.12k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cipla | 1,180.50 | -7.16 | 3.47m |

| Divis Labs | 3,647.80 | -1.46 | 91.65k |

| UltraTechCement | 8,642.75 | -1.34 | 160.47k |

| SBI Life Insura | 1,414.00 | -1.13 | 270.80k |

| Hindalco | 495.95 | -0.86 | 3.60m |

| Apollo Hospital | 5,485.75 | -0.84 | 151.90k |

| Larsen | 3,058.25 | -0.78 | 485.48k |

| Power Grid Corp | 210.25 | -0.64 | 5.71m |

| ONGC | 190.10 | -0.47 | 1.99m |

| Maruti Suzuki | 10,450.55 | -0.42 | 184.06k |

-330

November 23, 2023· 11:58 IST

| Company | Price at 11:00 | Price at 11:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Crayons | 174.05 | 166.00 | -8.05 52.09k |

| Pritika Auto | 29.80 | 28.70 | -1.10 317.45k |

| Sahana Systems | 639.70 | 618.00 | -21.70 36.67k |

| Kody Technolab | 351.50 | 340.00 | -11.50 740 |

| Mangalam Alloys | 53.75 | 52.10 | -1.65 2.13k |

| Softtech Engine | 231.50 | 225.00 | -6.50 2.21k |

| NINtec SYSTEMS | 450.00 | 437.65 | -12.35 561 |

| BGR Energy | 91.15 | 88.70 | -2.45 519.01k |

| Cipla | 1,214.40 | 1,183.00 | -31.40 829.27k |

| Guj Raffia Ind | 33.25 | 32.40 | -0.85 126 |

-330

November 23, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Capital Trust | 98.60 | 106.00 | 7.40 4.79k |

| Archidply Decor | 88.00 | 94.30 | 6.30 2 |

| Sundaram Brake | 600.00 | 634.95 | 34.95 71 |

| Texmaco Infra | 106.35 | 112.40 | 6.05 174.13k |

| SAR Televenture | 113.50 | 119.40 | 5.90 - |

| Aatmaj Health | 39.35 | 41.30 | 1.95 12.00k |

| Suryalakshmi Co | 64.30 | 67.40 | 3.10 3.26k |

| Nahar Spinning | 295.40 | 309.20 | 13.80 66.58k |

| Arvind and Comp | 55.40 | 57.95 | 2.55 4.75k |

| Ganges Securiti | 125.40 | 131.05 | 5.65 1.64k |

-330

November 23, 2023· 11:54 IST

Rajan Shinde, Research Analyst, Mehta Equities:

We believe the Flair writing IPO offer gives investors an opportunity to invest in a leading four-decade old player in writing instruments which is the flagship brand "Flair". We think Flair holds a significant position in writing and creative instruments with a diverse product portfolio spanning various price points that would cater to a diverse consumer base and a strategic approach to market penetration.

We also believe with extensive sales network and global presence would ensure wide-reaching product availability and effective market penetration across diverse geographical areas. We also think with strategic partnership with global brands and high quality manufacturing with innovation capabilities showcases reliability and credibility, and also highlight their ability to customize products for OEM and corporate clients.

By looking at the financials Flair writing has delivered a healthy growth in revenue from operations of 16.9%/19.47% in FY22/23 and healthy profit growth of 5471% in FY 2022 and 114% in FY 2023. On valuation per se at upper price band of Rs. 304/- and based on annualized earnings and fully diluted post-IPO paid-up capital, the issue is asking for a Market Cap of Rs. 3204 crore with P/E of 25x on consolidated basis, which seems the issue is fully priced by looking at the expected growth in revenue.

Being among the top 3 players in the overall writing instrument industry with a market share of 9% in the overall writing and creative instruments industry in India, we believe the company is strategically positioned coupled with a track record of sustained growth. Hence, we recommend investors to “Subscribe” to IPO with Long term perspective.

-330

November 23, 2023· 11:52 IST

Sensex Today | BSE Smallcap index up 0.5 percent led by Syncom Formulations, Man Infraconstruction, 3i Infotech

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Syncom Formula | 12.65 | 14.58 | 7.58m |

| Man Infra | 181.55 | 14.36 | 1.09m |

| 3i Infotech | 46.25 | 10.73 | 1.10m |

| Kellton Tech | 90.40 | 10.59 | 195.21k |

| Uttam Sugar | 514.80 | 9.8 | 46.97k |

| PCBL | 266.30 | 9.72 | 340.57k |

| DCM Shriram Ind | 156.60 | 9.59 | 80.09k |

| Nahar Spinning | 306.00 | 8.45 | 12.28k |

| GE Power India | 238.00 | 8.08 | 69.50k |

| Avadh Sugar | 797.40 | 7.98 | 14.54k |

-330

November 23, 2023· 11:47 IST

Stock Market LIVE Updates | CE Info Systems surges as board plans to consider fund-raising plan

-330

November 23, 2023· 11:39 IST

Stock Market LIVE Updates | Genesys International inks pact with Survey of India for 3D mapping

-330

November 23, 2023· 11:35 IST

Stock Market LIVE Updates | Cipla tanks almost 7% as USFDA's warning letter flags data issues at Madhya Pradesh unit

The Cipla stock was trading almost 7 percent lower on November 23 after CNBC-TV18 reported details of the warning letter issued to the firm’s Madhya Pradesh unit by the United States Food and Drug administration. READ MORE

-330

November 23, 2023· 11:30 IST

Stock Market LIVE Updates | What makes CSB Bank a preferred bet?

Given the bank’s small, restructured book, robust provision coverage ratio, and contingency provision, there seems little risk to future earnings, even if asset quality slips slightly on non-gold portfolio. READ MORE

-330

November 23, 2023· 11:25 IST

Stock Market LIVE Updates | Mastek gains despite facing heat over delay in listing compliance

-330

November 23, 2023· 11:18 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 66045.45 0.03 | 8.55 0.56 | 0.99 7.53 |

| BSE 200 | 8738.22 0.02 | 11.29 0.73 | 2.21 10.69 |

| BSE MIDCAP | 33580.55 0.19 | 32.65 1.40 | 5.33 33.17 |

| BSE SMALLCAP | 39816.28 0.6 | 37.64 1.44 | 4.23 38.62 |

| BSE BANKEX | 49109.78 0.17 | 0.42 -1.87 | -0.15 1.25 |

-330

November 23, 2023· 11:13 IST

Stock Market LIVE Updates | Geojit View on The Ramco Cements

The Ramco Cements capacity expansions, coupled with GoI’s strong focus on Infra & Housing, will aid future volumes. Now, lower input costs coupled with a shifting focus to deleveraging post FY24 will support valuation.

The stock currently trades at ~14x 1Yr Fwd EV/EBITDA.

Broking house valued TRCL at ~15x FY25E EV/EBITDA and arrived at a target price of Rs 1,119, maintain BUY rating considering strong volumes and deleveraging.

-330

November 23, 2023· 11:11 IST

Stock Market LIVE Updates | Exchanges levied Rs 11.68 lakh fine on Mastek for delayed compliance with listing regulations

Mastek has received notice from BSE and National Stock Exchange of India for delayed compliance with listing regulations during the quarter ended September 2023. Both the exchanges have levied a fine of Rs 5,84,000 each plus GST on the company.

-330

November 23, 2023· 11:07 IST

Stock Market LIVE Updates | BSE, NSE levied Rs 10.85 lakh fine on Balmer Lawrie & Company

The BSE and National Stock Exchange of India have imposed a fine of Rs 5,42,800 respectively on Balmer Lawrie & Company for non-compliance of listing regulations and rules with respect to composition of board of directors.

-330

November 23, 2023· 11:01 IST

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Modipon | 43.59 | 39.34 | -4.25 2 |

| Lerthai Finance | 237.00 | 214.60 | -22.40 9 |

| Raj Tube | 33.00 | 30.84 | -2.16 48 |

| Kanishk Steel | 27.45 | 25.82 | -1.63 310 |

| Saptarishi Agro | 23.40 | 22.05 | -1.35 0 |

| Alacrity Sec | 27.55 | 26.00 | -1.55 0 |

| Contil India | 115.00 | 108.55 | -6.45 118 |

| Vantage Knowled | 123.80 | 117.55 | -6.25 102 |

| Regency Ceramic | 41.00 | 39.00 | -2.00 411 |

| SBL Infratech | 32.95 | 31.35 | -1.60 0 |

-330

November 23, 2023· 10:58 IST

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sunrise Efficie | 104.00 | 119.00 | 15.00 0 |

| Samor Reality | 76.95 | 85.00 | 8.05 12.50k |

| Rishi Techtex | 40.80 | 44.90 | 4.10 45.66k |

| SpiceJet | 43.93 | 48.16 | 4.23 9.27m |

| United Van Hors | 185.00 | 200.90 | 15.90 733 |

| Artson Engg | 178.20 | 192.95 | 14.75 238 |

| Sicagen India | 53.02 | 57.26 | 4.24 10.26k |

| Nilachal Refra | 39.00 | 41.85 | 2.85 0 |

| Digjam | 74.11 | 79.49 | 5.38 0 |

| Munjal Showa | 131.95 | 141.50 | 9.55 4.46k |

-330

November 23, 2023· 10:58 IST

Stock Market LIVE Updates | Rakesh Parekh resigns as Chief Financial Officer of Sandu Pharmaceuticals

Rakesh Parekh has resigned from the Post of Chief Financial Officer of Sandu Pharmaceuticals with effect from December 31 due to personal reasons. The company is in the process of appointing a new Chief Financial Officer.

-330

November 23, 2023· 10:54 IST

Sensex Today | IREDA IPO sees 5.49 times subscription on Day 3

The Rs 2,150-crore initial public offering of Indian Renewable Energy Development Agency (IREDA) has seen a subscription 5.49 times on the last day of bidding, November 23 as investors have bid 258.57 crore equity shares against offer size of 47.09 crore shares.

All investors participated in the offer since the beginning of public issue with high networth individuals buying 10.15 times the allotted quota and retail investors 5.08 times.

The portion set aside for qualified institutional buyers was subscribed 2.71 times and that of employees 5.76 times.

-330

November 23, 2023· 10:50 IST

Sensex Today | Gandhar Oil IPO subscribed 7.4 times on Day 2

State-run Gandhar Oil Refinery's 198-crore initial public offering (IPO) was subscribed 7.4 times on day 2, with bids coming in for 15.79 crore shares as against a total of 2.12 crore million offered shares.

The public issue was subscribed by a total of 7.4 times, retail portion booked at 9.12 times and non-institutional investors (NIIs) booked 11.18 of the public issue.

A minimal spark was seen among qualified institutional buyers (QIBs) as they subscribed 1.49 times.

-330

November 23, 2023· 10:48 IST

Sensex Today | Fedbank Financial Services issue booked 41%, retail portion subscribed 72% on Day 2:

Fedbank Financial Services IPO had been subscribed 41 percent by the morning of November 23, the second day of bidding, with bids coming in for 2.3 crore shares against the issue size of 5.6 crore.

Retail investors have bought 72 percent of their allotted quota of shares, non-institutional investors (NIIs) picked up 22 percent while qualified institutional buyers (QIBs) are yet to warm up to the issue.

The firm has reserved Rs 10-crore worth of shares for its employees who will get them at a discount of Rs 10 to the final offer price. Employees have bought 42 percent of their allotted quota.

-330

November 23, 2023· 10:44 IST

Stock Market LIVE Updates | Honasa Consumer Q2 profit jumps 94% YoY to Rs 29 crore

Shares of Honasa Consumer, the owner of beauty and personal care brand Mamaearth soared 20 percent to Rs 387 per share on November 23 after the company reported robust Q2 financial results with the net profit doubling to Rs 30 crore.

Post Q2 results, Honasa Consumer earned favourable reactions from Jefferies, which has put a ‘buy’ rating on the stock. Jefferies has set a share price target of Rs 530 on the stock, which implies 50 percent upside from the last close of Rs 352. Read More

-330

November 23, 2023· 10:43 IST

Sensex Today | Flair Writing IPO subscribed 2.69 times, retail portion booked 3.5 times on Day 2

Flair Writing Industries’ Rs 593 crore IPO was subscribed 2.69 times on November 22, the second day of bidding, receiving bids for 3.87 crore shares against the issue size of 1.44 crore shares.

Retail investors bought 3.5 times, non-institutional investors picked 3.58 times and qualified institutional buyers bought 0.53 times the allotted quota.

-330

November 23, 2023· 10:41 IST

Stock Market LIVE Updates | BSE, NSE levied Rs 10.85 lakh fine on Shipping Corporation of India

Shipping Corporation of India has received a notice from BSE Limited and National Stock Exchange of India, levying fine of Rs 5,42,800 each for non-compliance of regulations with respect to composition of board of directors. SCI is taking all appropriate actions for appointment of requisite number of independent directors on the board.

-330

November 23, 2023· 10:37 IST

Stock Market LIVE Updates | Lupin launches fixed-dose triple combination drug, Vilfuro-G in India

Lupin has launched the world’s first fixed-dose triple combination drug (FDC) under the brand name Vilfuro-G for the effective management of chronic obstructive pulmonary disease (COPD) in India.

-330

November 23, 2023· 10:35 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Reliance | 2,394.25 0.25 | 1.79m | 429.23 |

| HDFC Bank | 1,519.90 0.49 | 2.18m | 330.81 |

| Bajaj Auto | 5,917.00 2.88 | 552.59k | 325.86 |

| TCS | 3,525.90 -0.12 | 676.12k | 238.86 |

| Hero Motocorp | 3,504.95 2.68 | 521.63k | 181.58 |

| Cipla | 1,219.60 -4.08 | 1.32m | 162.90 |

| IndusInd Bank | 1,488.10 1.2 | 1.04m | 153.91 |

| Tata Motors | 680.15 -0.15 | 1.98m | 135.31 |

| Infosys | 1,459.40 0.11 | 922.16k | 134.65 |

| Bajaj Finance | 7,125.00 -0.05 | 185.02k | 132.07 |

-330

November 23, 2023· 10:31 IST

Stock Market LIVE Updates | CE Info Systems to consider fund raising on November 27

CE Info System said the Board of Directors will be meeting on November 27 to consider the proposal of raising the funds via issuance of equity shares.

-330

November 23, 2023· 10:29 IST

Stock Market LIVE Updates | Survey of India and Genesys International Corporation sign strategic partnership for 3D Digital Twin Mapping Program in India

Genesys International Corporation has signed strategic partnership with Survey of India to create Digital Twins of major cities and towns. This collaboration is aligned with India's National Geospatial Policy 2022, promoting self-reliance in geospatial data production and usage.

-330

November 23, 2023· 10:27 IST

Stock Market LIVE Updates | BCPL Railway Infrastructure bags project under Gati Shakti Sealdah division of Eastern Railway

BCPL Railway Infrastructure has received an electrification project under Gati Shakti Sealdah Division of Eastern Railway. The total project cost comprises of Rs 3.26 crore and it is expected to be executed over a period of 12 months.

-330

November 23, 2023· 10:23 IST

-330

November 23, 2023· 10:21 IST

Sensex Today | Nifty PSU Bank index up 0.5 percent led by Bank of Baroda, SBI, PNB:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Baroda | 196.20 | 0.8 | 1.77m |

| SBI | 563.00 | 0.72 | 1.62m |

| PNB | 76.85 | 0.65 | 6.00m |

| Canara Bank | 396.10 | 0.37 | 858.89k |

| Bank of India | 104.35 | 0.34 | 1.43m |

| JK Bank | 110.80 | 0.32 | 578.62k |

| UCO Bank | 37.80 | 0.27 | 1.78m |

| IOB | 39.40 | 0.25 | 3.35m |

| Central Bank | 44.45 | 0.23 | 2.40m |

| Indian Bank | 412.15 | 0.19 | 303.27k |

-330

November 23, 2023· 10:17 IST

Stock Market LIVE Updates | Shalby executes Amendment Agreement for construction of new hospital in Mumbai

Shalby has executed the Amendment Agreement to the Operation and Management Agreement with The Santacruz Residents Association

and Bhikhubai Chandulal Jalundwala General Hospital (BCJ) for construction of new hospital building at Santacruz, Mumbai. This project will be executed upon receipt of approval from the Charity Commissioner, Mumbai. The company will construct 175 beded new hospital at Santacruz, Mumbai.

-330

November 23, 2023· 10:15 IST

Sensex Today | BSE Healthcare index down 0.4 percent dragged by Cipla, Lupin, Gufic Biosciences:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cipla | 1,231.15 | -3.18 | 34.53k |

| Lupin | 1,197.70 | -1.74 | 13.59k |

| Gufic Bio | 303.95 | -1.71 | 2.53k |

| Aurobindo Pharm | 1,037.30 | -1.69 | 14.22k |

| RPG Life | 1,455.00 | -1.44 | 171 |

| Glenmark | 767.15 | -1.2 | 16.07k |

| Lincoln Pharma | 646.40 | -1.17 | 940 |

| Vijaya Diagnost | 604.00 | -1.06 | 1.83k |

| Ipca Labs | 1,078.50 | -0.97 | 1.93k |

| Torrent Pharma | 2,095.00 | -0.88 | 2.69k |