Titan Company crossed the Rs 3 lakh crore market share on November 21. The stock has seen a strong momentum through this year, gaining 34 percent and about 6 percent in November alone. It hit a fresh 52-week high of Rs 3,441.45 on the National Stock Exchange (NSE) on November 23. Can this momentum continue?

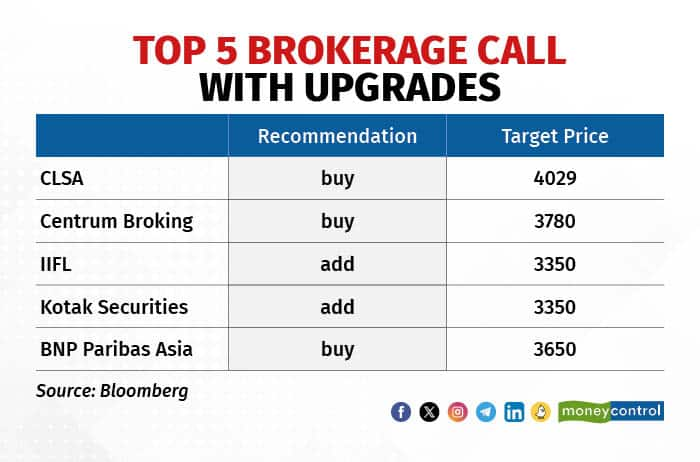

Most analysts are bullish on Titan, what with its impressive growth in the jewellery business and its premium position in the sector. There are, however, some cautious voices. They point out that low diamond prices might put pressure on profitability.

In its Q2FY24 results, the company’s consolidated net profit rose 9.7 percent on-year to Rs 916 crore, while consolidated revenue jumped 36 percent to Rs 12,529 crore. The jewellery business grew, driven by India operations, and domestic sales were aided by a double-digit growth of buyers and average bill value per buyer.

Follow our market blog to catch all the live action

Outlook

Analysts believe that Titan's core domestic business has a long runway for growth. Going ahead, market expansion, buoyant gold prices, and robust demand during the wedding season, will boost profitability.

Titan has taken some price correction in solitaires and this impact should be evident in the coming 7-8 months, said Jefferies in a report.

According to the international brokerage, Titan is a structural growth story. Buoyant gold prices, share gains, higher wedding budgets for jewellery, and cost focus are among the key catalysts for the stock. However, concerns remain over steep valuations.

Margins to improve

In the quarter gone by, the benefits of low-cost inventory faded out completely and plain gold jewellery sales increased. This impacted margins. The management has allayed investor concerns on the margin impact from the recent correction in diamond prices.

"The impact would be limited to the solitaire portfolio, which has a low salience in Titan's studded business. The management, in its guidance, reiterated that it is aiming for 12-13 percent margins on an annual basis,” Jefferies added.

According to Dolal Capital, an increase in studded jewellery contribution would help improve EBITDA margin. Going ahead, the company expects 12-13 percent steady-state margins in the jewellery business (ex-bullion sales). Aggressive pricing by the company is expected to ease, leading to improved margins in the future, according to B&K Securities analysts.

Also Read | Titan stock extends gains on CCI nod to acquire additional stake in CaratLane

Market expansion

The company continues to expand its jewellery store reach. During the quarter that ended in September 2023, Titan added 52 stores for its jewellery brands Tanishq, Mia, CaratLane and Zoya. The company also said it was looking to add 15 stores for Zoya by next Diwali.

According to analysts at CLSA, this expansion is likely to be a key source of surprise for Titan's revenue growth, opening up levers of growth that were not available even 2-3 years back.

Growth

Titan is concentrating on increasing its market share by expanding its store network, enhancing inventory, and offering competitive pricing.

The company has established ambitious long-term goals across various segments with a primary focus on profitability. With the watches and eyewear divisions complementing the jewellery business, Titan’s long-term growth outlook appears promising, according to B&K Securities. "We remain optimistic about Titan from a stable, long-term perspective," the brokerage said.

Analysts at Dolat Capital expect Titan's profitability in the second quarter of FY24 to remain under pressure due to low diamond prices. The jewellery business has seen a sharp acceleration in new store additions, across formats over the past four quarters.

Going ahead, the jewellery business is estimated to post double-digit revenue growth, and will be a bedrock for growth for the company.

Also Read | CDSL jumps 3% as demat accounts cross 10-crore mark

Valuations

JM Financial Services expects Titan to continue commanding a premium valuation, more so given the scarcity of ‘growth businesses' in the space at this point.

It maintained a ‘buy’ rating on the stock with a target price of Rs 3,705 per share. Jefferies, meanwhile, has maintained a 'hold' rating with a base case target price of Rs 2,950 per share, given the lofty valuations.

"At 43x FY26, Titan trades at a 10 percent premium to our consumer coverage. However, we believe Titan can grow significantly faster over FY23-26E and beyond as it makes further inroads into the rapidly growing luxury market as well as for the Indian jewellery market overseas," said CLSA as it maintained a 'buy' rating on the stock with a target price of Rs 3,338.25.

Its core domestic business and several of its new categories have a long runway for growth. This means investors should pay growth multiples for several more years, the brokerage added.

Meanwhile, B&K Securities has maintained its 'buy' rating on the counter with a revised DCF-based target price of Rs 3,350 from Rs 3,000 earlier. Dolat remained bearish on the stock as it put a 'sell' rating on the counter with a target price of Rs 3,185 per share.

With the recent rise in the share price, the best target price for the stock has already been achieved. The stock is now just below Jefferies' upside target price of Rs 4,500 per share.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.