Closing Bell: Sensex down 188 pts, Nifty below 19,750; banks underperform

-330

November 17, 2023· 16:52 IST

-330

November 17, 2023· 16:51 IST

Kunal Shah, Senior Technical & Derivative analyst at LKP Securities:

Following the RBI's announcement of tightening provisions for consumer loans, the Bank Nifty opened with a gap down and sustained below the 44,000 mark. The index's next support is situated at the 43,300-43,250 zone, serving as a crucial line of defense for the bulls. If this level holds, it could pave the way for a potential recovery towards the 44,000 mark. However, a breach of the mentioned support may intensify selling pressure, leading the index further down towards the 42,700 level on the downside.

-330

November 17, 2023· 16:21 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets took a breather after two days of advance and ended marginally lower. After the initial downtick, Nifty hovered in a narrow band for most of the session and finally settled at 19731.80 levels. Meanwhile, mixed trends on the sectoral front kept the traders busy wherein pharma, FMCG and auto posted decent gains while banking and energy were on the back foot. Interestingly, the broader indices managed to extend their prevailing tone and ended flat.

The underperformance of the banking pack has started weighing on the sentiment again however buoyancy in other sectors is capping the damage. Going ahead, the performance of the global markets, especially the US, will remain in focus for cues. We suggest continuing with positive bias until Nifty breaches 19,450 and prefer sectors other than banking and financials for long trades.

-330

November 17, 2023· 16:09 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Selling in banking and oil & gas stocks led the fall in key benchmark indices, even as most of the global indices ended on a higher note. Investors booked profit in banking stocks as RBI's new norms on personal loans would hurt lending. Although risk on sentiment had returned to the markets in recent sessions, global uncertainty would continue to dictate trends and keep investors on tight leash.

-330

November 17, 2023· 16:06 IST

Rupak De, Senior Technical analyst at LKP Securities:

The Nifty has largely traded within a range, showing a predominantly bullish sentiment. Over the past two to three days, a 'buy on dips' approach has been loved by the street since the Nifty crossed the crucial 19,500 mark.

The trend is expected to stay positive as the Nifty consistently concludes trading sessions above the critical moving averages. Support levels are situated at 19,630/19,500 on the lower end, while resistance is placed at 19,850/ 20,000 on the higher end.

-330

November 17, 2023· 16:04 IST

Joseph Thomas, Head of Research, Emkay Wealth Management:

The domestic market remained subdued on the last trading day of the week after a significant surge over the last two days during the week. The surge was the result of lower inflation numbers, and the consequent expectations of a longer pause in central bank rate action. The fall in oil prices in international markets mainly driven by the suspected demand destruction also facilitated better markets. The fall in the Bank Nifty occasioned by the tightening of the risk weightage norms for banks and NBFCs to curtail the unrestricted growth in unsecured loans also resulted in a rather damp trading to close the week. The markets will certainly be influenced by overseas developments and could also gradually shift its focus on potential lower economic growth resulting from aggressive price stabilization policies.

-330

November 17, 2023· 15:38 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The RBI's action to raise risk weights for unsecured loans dampened banking stocks and caused a temporary disruption in the broader indices' resurgence. Despite this, a positive undercurrent prevails, buoyed by the conclusion of a robust earnings season.

Investors are awaiting eurozone inflation data later today, which is expected to show a softening trend. Sharp drop in oil prices, and the moderation of US yield will help the market to sustain buoyancy, in the short-term.

-330

November 17, 2023· 15:32 IST

Rupee Close:

Indian rupee ended marginally lower at 83.27 per dollar versus previous close of 83.23.

-330

November 17, 2023· 15:30 IST

Market Close:

Benchmark indices ended lower in the volatile session on November 17 with Nifty below 19,750.

At close, the Sensex was down 187.75 points or 0.28 percent at 65,794.73, and the Nifty was down 33.40 points or 0.17 percent at 19,731.80. About 1926 shares advanced, 1654 shares declined, and 138 shares unchanged.

SBI, Axis Bank, ONGC, BPCL and Bajaj Finance were among the top losers on the Nifty, while gainers included SBI Life Insurance, HDFC Life, Apollo Hospitals, Larsen & Toubro and Hero MotoCorp.

Among sectors, auto, capital goods, FMCG, pharma and realty up 0.5 percent each, while PSU Bank index shed 2.5 percent and oil & gas index down 1.3 percent.

BSE Midcap and Smallcap indices ended in the green.

-330

November 17, 2023· 15:27 IST

Sensex Today | Mohammed Imran - Research Analyst at Sharekhan by BNP Paribas:

We hold bearish view on crude oil amid softening demand from Asia and US that is visible through the surging US commercial inventories. WTI is headed towards fourth straight weekly decline and is trading near four-month lows. WTI December at USD 78.55 is holding gains on Friday following 5% fall in the previous session due to weaker economic data from US showing jump in weekly jobless claims and declining housing index.

Global oil demand tracker showed demand averaged 101.6 million barrels a day (bpd) in the first half of November, running 200,000 bpd lower than its projection for the month.

The supplies from Iraq, Nigeria and Angola is rising, the US production is standing at 13.2mbpd, while according to media report US energy co. are planning to ship Venezuelan oil to China, these developments will act as headwind for oil prices in medium term.

Expect WTI crude oil prices to see some more correction in coming weeks, we see prices trading below $70/b. We advise selling crude oil rallies for the lower targets. For the day resistance remains around $75 and expect to test the support of $70.

-330

November 17, 2023· 15:24 IST

Sensex Today | Citi On Financials:

-Risk weights increased on unsecured credit & banks’ lending to NBFCs

-Unsecured credit risk weight increase adversely impacts CET-1 by 75 bps for RBL

-Unsecured credit risk weight rise adversely impacts CET-1 by 50 bps for HDFC Bank

-Unsecured credit risk weight rise adversely impacts CET-1 by 42 bps for ICICI Bank

-Unsecured credit risk weight rise adversely impacts CET-1 by 36 bps for Axis Bank

-Unsecured credit risk weight rise adversely impacts CET-1 by 30 bps for KMB/AU SFB

-Unsecured credit risk weight rise adversely impacts CET-1 by 27 bps for SBI

-Unsecured credit risk weight rise adversely impacts CET-1 by 20 bps for IndusInd Bank

-Unsecured credit risk weight rise adversely impacts CET-1 By 11 bps for Federal Bank

-For NBFCs, it impacts CAR by >190 bps for Bajaj Finance

-More than 100 bps impact on CAR for PEL

-CAR impact of 55 bps for L&T Finance & 20-30 bps for SHMF/CIFC

-330

November 17, 2023· 15:18 IST

Sensex Today | Manu Rishi Guptha, Founder & CEO, MRG Capital:

Market response to RBI restrictions was very measured. While the banking and financial services indices saw major cuts, Pharma, Auto and Infra stocks were largely unscathed and saw buying interests.

Stock specific price actions clearly indicate, which are the most vulnerable ones among the banking and financial services companies. Cuts were severe in RBL and IDFC First banks where unsecured retail exposure is the highest. Among Financials; AB Capital, L&T Finance and Chola have seen the deepest cuts. In contrast, the housing finance companies which are unaffected by RBI actions saw positive momentum. Among public sector banks, SBI saw the deepest cut as the bank has high retail exposure at 14% of the book.

Though Bank Nifty has breached the first support level of 43800, next one at 43300 will most likely be respected today. RBI actions though restrictive, these most likely will have maximum impact on Fintech companies in the unlisted space which will see higher cost of funding. Big banks and financial companies with their decent capital ratios will ride over this minor hiccup and might actually gain market share from the Fintechs.

-330

November 17, 2023· 15:12 IST

Stock Market LIVE Updates | HSBC View On Kalyan Jewellers India:

-Buy call, target raised to Rs 370 per share

-Domestic sales were up 32 percent YoY, aided by a healthy 36 percent share of new customers

-13 showrooms opened in Q2

-Franchise-led expansion is gaining pace

-On track to open 65 showrooms in FY24, target set for around 80 in FY25

-Asset light network expansion strategy starts to deliver results

-330

November 17, 2023· 15:09 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee depreciated by nearly 5 paise today on weak domestic markets and corporate demand for US Dollar. However, while weak US Dollar index and overnight decline in crude oil prices cushioned the downside. The dollar declined amid disappointing economic data from the US. Weekly unemployment claims, industrial production and capacity utilization rate were weaker than forecast.

We expect Rupee to trade with a slight positive bias on weak US dollars and weak crude oil prices. However, the weak tone in Asian markets and Dollar demand may cap a sharp upside. Traders may take cues from housing starts and building permit data from the US. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.60.

-330

November 17, 2023· 15:04 IST

Stock Market LIVE Updates | Lupin gets USFDA nod for Ganirelix Acetate injection

Lupin has received approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application for Ganirelix Acetate Injection, 250 mcg/0.5 mL Single-Dose Prefilled Syringe, to market a generic equivalent to the reference listed drug (RLD), of Ganirelix Acetate Injection, 250 mcg/0.5 mL of Organon USA LLC.

Ganirelix is Lupin's first peptide-based injectable, strengthening the company’s commitment to innovative healthcare solutions. The product will be manufactured at Lupin’s Nagpur facility in India.

-330

November 17, 2023· 15:00 IST

Sensex Today | Market at 3 PM

The Sensex was down 203.28 points or 0.31 percent at 65,779.20, and the Nifty was down 39.30 points or 0.20 percent at 19,725.90. About 1669 shares advanced, 1532 shares declined, and 92 shares unchanged.

-330

November 17, 2023· 14:58 IST

Sensex Today| Dish TV on settlement reports

In this regard, we would like to state that the Company is neither aware of nor privy to the negotiations which have been referred in your communication, hence is not in a position to confirm or deny the same.

-330

November 17, 2023· 14:57 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Hb Stockhol | 68.90 | 81.65 | 12.75 4.69k |

| Pansari Develop | 75.60 | 81.90 | 6.30 36.41k |

| Aster DM Health | 336.05 | 362.00 | 25.95 9.42k |

| NOCIL | 230.95 | 248.40 | 17.45 14.65k |

| Sungarner | 191.00 | 203.40 | 12.40 4.71k |

| Vinsys IT | 261.00 | 275.15 | 14.15 24.19k |

| Allied Digital | 119.40 | 125.00 | 5.60 40.39k |

| IVP | 191.15 | 200.10 | 8.95 8.20k |

| GSEC10YEAR | 24.30 | 25.31 | 1.01 6 |

| Varroc Engineer | 526.90 | 547.50 | 20.60 628.23k |

-330

November 17, 2023· 14:52 IST

Elara Capital on Cement: Higher price to favorably impact Q3FY24 realisation

We remain positive on FY24 demand prospects, considering strong traction in government-backed projects led by General Elections in CY24. Thus, firms that have added capacity in the past two years may capitalise the most on buoyant demand. While fuel prices have witnessed an uptrend recently, this negative impact may be offset by the uptick in cement prices in September and October in several markets and benefit of operating leverage.

-330

November 17, 2023· 14:46 IST

-330

November 17, 2023· 14:39 IST

Sensex Today| BSE seeks clarification from Dish TV on settlement reports

-330

November 17, 2023· 14:32 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The immediate impact of the RBI action to increase the risk weight on certain categories of unsecured loans, loans to NBFCs and credit card loans is that this will increase the capital requirements of banks, which, in turn, will increase their cost of capital. Since the credit demand in segments like unsecured retail loans is robust, banks can easily pass on the increased cost to borrowers. So, there will be a marginal increase in the cost of credit to borrowers. The impact on banks’ profitability will be negligible. From the perspective of macro financial stability this is a welcome decision.

-330

November 17, 2023· 14:24 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Tata Inv Corp | 3,863.60 | 3,885.65 3,261.75 | 18.45% |

| Varroc Engineer | 525.90 | 543.05 476.75 | 10.31% |

| FSN E-Commerce | 167.75 | 167.90 152.60 | 9.93% |

| Ircon Internati | 166.95 | 169.50 154.00 | 8.41% |

| IRB Infra | 38.02 | 38.51 35.20 | 8.01% |

| PCBL | 239.20 | 244.90 221.90 | 7.8% |

| Solar Ind | 7,389.85 | 7,490.00 6,914.00 | 6.88% |

| Prism Johnson | 167.35 | 168.45 157.00 | 6.59% |

| Rail Vikas | 167.45 | 168.70 158.15 | 5.88% |

| General Insuran | 256.00 | 258.40 241.95 | 5.81% |

-330

November 17, 2023· 14:21 IST

Stock Market LIVE Updates | Sharekhan View on Puravankara

Puravankara continues to report strong sales bookings and collections, aided by sustenance sales and project launches. The launch pipeline for FY2024-FY2025 remains strong, along with improving operational outflows led by scaling up of execution.

Higher revenue recognition with improvement in net profitability is expected to follow suit over the next 2-3 years as strong pre-sales come up for deliveries.

The company is expected to maintain its current debt levels to focus on growth and improve execution. The company continues to scout for new business opportunities in Mumbai and Pune.

Retain positive view on the stock with an upside potential of 25%, factoring higher sales run-rate and increasing NAV premium considering its strong growth potential supported by regional diversification.

-330

November 17, 2023· 14:15 IST

-330

November 17, 2023· 14:13 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19761.65 -0.02 | 9.15 1.73 | -0.25 7.73 |

| NIFTY BANK | 43685.55 -1.08 | 1.63 -0.31 | -1.63 2.89 |

| NIFTY Midcap 100 | 41791.75 0.16 | 32.63 2.60 | 2.60 34.50 |

| NIFTY Smallcap 100 | 13883.40 0.1 | 42.67 3.88 | 6.35 43.67 |

| NIFTY NEXT 50 | 46777.05 0.4 | 10.88 2.30 | 2.61 9.17 |

-330

November 17, 2023· 14:08 IST

-330

November 17, 2023· 14:03 IST

Sensex Today | Market at 2 PM

The Sensex was down 133.41 points or 0.20 percent at 65,849.07, and the Nifty was down 18.70 points or 0.09 percent at 19,746.50. About 1670 shares advanced, 1523 shares declined, and 88 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| SBI | 563.85 -3.56 | 27.45m | 1,556.79 |

| HDFC Bank | 1,505.20 -0.21 | 8.30m | 1,246.71 |

| Bajaj Finance | 7,211.70 -2.05 | 1.70m | 1,223.36 |

| Yes Bank | 20.60 2.23 | 477.35m | 985.25 |

| Axis Bank | 993.35 -3.22 | 9.87m | 987.89 |

| Delhivery | 402.95 -2.63 | 21.08m | 850.32 |

| Tata Inv Corp | 3,819.00 17.24 | 2.03m | 747.41 |

| ICICI Bank | 926.35 -1.03 | 7.04m | 655.28 |

| IRFC | 76.55 4.72 | 84.41m | 639.42 |

| Indiabulls Hsg | 190.50 2.14 | 33.05m | 634.95 |

-330

November 17, 2023· 14:01 IST

| Company | Price at 13:00 | Price at 13:28 | Chg(%) Hourly Vol |

|---|---|---|---|

| Inter Globe Fin | 35.47 | 33.04 | -2.43 57 |

| Krishanveer For | 56.97 | 53.80 | -3.17 60 |

| National Oxygen | 119.80 | 113.75 | -6.05 68 |

| VMS Industries | 36.45 | 34.61 | -1.84 32.85k |

| MONIND | 21.85 | 20.76 | -1.09 244 |

| Chennai Meenaks | 30.14 | 28.68 | -1.46 3.71k |

| Phoenix Intl | 28.94 | 27.60 | -1.34 174 |

| Real Eco-Energy | 30.30 | 29.05 | -1.25 3.35k |

| BCC Fuba | 67.77 | 65.00 | -2.77 1.03k |

| D & H India | 81.95 | 78.60 | -3.35 4.19k |

-330

November 17, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:28 | Chg(%) Hourly Vol |

|---|---|---|---|

| Chartered Cap | 199.05 | 219.95 | 20.90 5 |

| Nalwa Sons | 2,889.25 | 3,141.60 | 252.35 118 |

| Innokaiz India | 103.10 | 111.50 | 8.40 1.22k |

| NHC Foods | 42.55 | 45.89 | 3.34 7.22k |

| Addi Industries | 47.81 | 51.09 | 3.28 136 |

| Precision Elec | 49.00 | 52.00 | 3.00 126 |

| Indo Cotspin | 37.75 | 40.00 | 2.25 0 |

| SP Capital Fin | 21.62 | 22.89 | 1.27 1.52k |

| Athena Global | 80.20 | 84.00 | 3.80 55 |

| BCPL Railway In | 98.14 | 102.60 | 4.46 53.95k |

-330

November 17, 2023· 13:55 IST

Sensex Today | Gold heads for first weekly gain in three on Fed pause hopes

Gold prices extended gains on Friday and were set for their first weekly rise in three, as investors stepped up bets that the U.S. Federal Reserve is done raising interest rates, pressuring the dollar and Treasury yields.

Spot gold was up 0.2% at $1,985.29 per ounce, as of 0745 GMT, after hitting its highest since Nov. 6 in the last session. U.S. gold futures were steady at $1,985.29.

-330

November 17, 2023· 13:51 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| SBI Life Insura | 1434.45 | 1434.45 | 1,429.80 |

| Apollo Hospital | 5493.35 | 5493.35 | 5,477.00 |

| Hero Motocorp | 3368.80 | 3368.80 | 3,344.30 |

| Bajaj Auto | 5674.95 | 5674.95 | 5,644.10 |

| Eicher Motors | 3898.00 | 3898.00 | 3,871.80 |

| Tata Motors | 687.65 | 687.65 | 684.65 |

| UltraTechCement | 8869.60 | 8869.60 | 8,819.80 |

| Sun Pharma | 1198.40 | 1198.40 | 1,194.05 |

| HCL Tech | 1325.75 | 1325.75 | 1,313.75 |

| Titan Company | 3366.00 | 3366.00 | 3,340.90 |

-330

November 17, 2023· 13:46 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The immediate impact of the RBI action to increase the risk weight on certain categories of unsecured loans, loans to NBFCs and credit card loans is that this will increase the capital requirements of banks, which, in turn, will increase their cost of capital. Since the credit demand in segments like unsecured retail loans is robust, banks can easily pass on the increased cost to borrowers. So, there will be a marginal increase in the cost of credit to borrowers. The impact on banks’ profitability will be negligible.

From the perspective of macro financial stability this is a welcome decision.

-330

November 17, 2023· 13:42 IST

Sensex Today | Oil prices head for fourth straight week of declines as supply grows

Oil prices were little changed on Friday but on track for their fourth straight week of losses after tumbling about 5% to a four month-low on Thursday on worries over global demand.

Brent futures edged up 7 cents, or 0.1%, to $77.49 a barrel at 0702 GMT. U.S. West Texas Intermediate crude (WTI) was at $72.96, up 6 cents, or 0.1%. Both have lost around a sixth of their value over the last four weeks.

-330

November 17, 2023· 13:38 IST

Stock Market LIVE Updates | CLSA View On Financials

-RBI’s measures indirectly telling banks to slow down on unsecured loans

-Estimate direct impact at 40-80 bps reduction in Tier I Capital for banks

-230 bps & 415 bps reductions in Tier I capital for Bajaj Finance & SBI Card

-Could also impact growth rates of fintech intermediaries like Paytm

-Do not think impact would be large on fintech intermediaries

-330

November 17, 2023· 13:31 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| IndusInd Bank | 1,508.35 | 1,509.00 1,485.95 | -0.04% |

| Abbott India | 23,532.45 | 23,543.40 23,233.95 | -0.05% |

| JB Chemicals | 1,503.30 | 1,504.00 1,486.00 | -0.05% |

| Ajanta Pharma | 1,965.00 | 1,967.00 1,933.00 | -0.1% |

| Indian Railway | 77.26 | 77.35 72.71 | -0.12% |

| Rail Vikas | 168.50 | 168.70 158.15 | -0.12% |

| HDFC Bank | 1,505.05 | 1,506.90 1,489.20 | -0.12% |

| REC | 340.50 | 340.95 330.25 | -0.13% |

| Power Finance | 317.50 | 317.95 310.50 | -0.14% |

| Westlife Food | 859.25 | 860.45 844.00 | -0.14% |

-330

November 17, 2023· 13:28 IST

-330

November 17, 2023· 13:19 IST

Stock Market LIVE Updates | KRChoksey View on Britannia Industries:

Britannia Industries has seen market share gains in the quarter, despite its prices still being ~20.0% higher than the pre-inflationary period, after taking corrective pricing of just ~1.5%. With the strong margins in Q2FY24, the company has the headroom to take further corrective pricing and invest in brands but will do so once they see some improvement in the market sentiment.

As a result, broking house expect the EBITDA margin to come off in H2FY24E from the levels seen in this quarter. With the competitive pricing actions and A&P spending, volumes should see an uptick in the later part of FY24E.

Maintain the estimates for FY24E/ FY25E with our Adjusted EPS estimates for the 2 years changing by just +1.8%/ -1.9%, respectively and expect a Revenue/ EBITDA/ Adj. PAT CAGR of 9.1%/ 12.7%/ 11.9% respectively over FY23-FY25E.

The stock is currently trading at 53.9x/ 46.7x our FY24E/ FY25E Adj. EPS estimate.

KRChoksey apply a P/E multiple of 50x to the FY25E EPS of Rs 101.1 and arrive at the target price of Rs 5,094 per share (unchanged), implying an upside of 8.1% over the CMP. Maintain “ACCUMULATE” rating on the shares of Britannia Industries.

-330

November 17, 2023· 13:15 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Natura Hue | 12.44 | 64.99 | 7.54 |

| PRO CLB GLOBAL | 11.30 | 64.72 | 6.86 |

| Bang Overseas | 72.97 | 54.79 | 47.14 |

| Starteck Financ | 256.05 | 44.87 | 176.75 |

| Modern Steels | 33.95 | 44.35 | 23.52 |

| BCPL Railway In | 98.46 | 43.28 | 68.72 |

| Natural Biocon | 14.91 | 40.93 | 10.58 |

| Remi Edelstahl | 84.00 | 31.95 | 63.66 |

| SSPDL | 19.83 | 30.20 | 15.23 |

| Palco Metals | 76.75 | 29.75 | 59.15 |

-330

November 17, 2023· 13:10 IST

-330

November 17, 2023· 13:06 IST

Stock Market LIVE Updates | Macquarie View On Asian Paints

-Outperform call, target Rs 3,800 per share

-Announces marginal 1 percent price cut effective 1-Nov-23

-Cut prices across its decorative portfolio with Rs 2/l cut across enamels

-Rs 3-4/L cut across economy emulsions & Rs 10/l reduction across waterproofing

-Price cuts suggests increased clarity on input cost trajectory

-330

November 17, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| S V J Ent. | 72.39 | 66.51 | -5.88 0 |

| Saumya Consult | 118.95 | 110.41 | -8.54 336 |

| Infronics Syst | 39.79 | 37.20 | -2.59 12 |

| Hindusthan Urba | 2,288.00 | 2,144.00 | -144.00 27 |

| Ceejay Finance | 167.70 | 158.30 | -9.40 99 |

| Shelter Pharma | 58.90 | 55.60 | -3.30 53.63k |

| Acrow India | 800.00 | 760.00 | -40.00 2 |

| Nalin Leasing | 36.88 | 35.12 | -1.76 23 |

| Phyto Chem | 40.93 | 39.00 | -1.93 1 |

| Franklin Ind | 39.95 | 38.10 | -1.85 100 |

-330

November 17, 2023· 12:58 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Garbi Finvest | 28.05 | 30.99 | 2.94 14.13k |

| NDA Securities | 19.01 | 20.96 | 1.95 14.62k |

| Ceeta Industrie | 29.60 | 32.48 | 2.88 113 |

| Exhicon Events | 345.00 | 375.90 | 30.90 2.85k |

| Veejay Lakshmi | 43.16 | 47.00 | 3.84 4.35k |

| Chennai Meenaks | 28.00 | 30.14 | 2.14 103 |

| Alliance Integ | 28.00 | 30.11 | 2.11 269 |

| HB Estate Dev | 43.05 | 45.90 | 2.85 321 |

| Medinova Diag | 26.27 | 27.99 | 1.72 218 |

| Machino Plastic | 162.40 | 171.50 | 9.10 557 |

-330

November 17, 2023· 12:56 IST

S&P says risk weights cut bank capital adequacy by 60 bps

-330

November 17, 2023· 12:55 IST

Sensex Today | BSE Healthcare inde up nearly 1 percent led by Narayana Hrudayalaya, Krsnaa Diagnostics, AMI Organics

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Narayana Hruda | 1,214.00 | 6.12 | 28.46k |

| Krsnaa Diagnost | 639.05 | 3.58 | 6.00k |

| AMI Organics | 1,117.65 | 3.32 | 2.53k |

| Aurobindo Pharm | 1,002.20 | 2.71 | 34.65k |

| RPG Life | 1,477.40 | 2.43 | 663 |

| Guj Themis | 195.05 | 2.23 | 53.44k |

| Granules India | 374.55 | 2.13 | 57.70k |

| Apollo Hospital | 5,455.45 | 2.13 | 13.96k |

| Rainbow Child | 1,074.35 | 2.01 | 1.60k |

| Syngene Intl | 732.25 | 1.94 | 8.41k |

-330

November 17, 2023· 12:49 IST

-330

November 17, 2023· 12:44 IST

Shrey Jain, Founder and CEO SAS Online:

On Friday, the Indian stock market experienced a mixed performance as a decline in financial stocks, following the tightening of consumer lending rules by the country's central bank, counteracted the positive impact of a rally fueled by a more favorable U.S. interest rate outlook and a decrease in oil prices. The central bank implemented a 25 percent increase in the risk weight on consumer loans issued by banks and non-banking financial companies (NBFCs).

In the case of Nifty, the support range is positioned between 19625 and 19700, with a robust buying range extending from 19525 to 19575. In the higher range, Nifty may encounter resistance levels at 19875-19950.

For Bank Nifty, the initial support zone is identified as 43900-44050, followed by a stronger support range at 43625-43800. In the higher range, a formidable resistance is anticipated at 44500-44700.

-330

November 17, 2023· 12:40 IST

Stock Market LIVE Updates | Macquarie On Financials

-RBI increases RWA, headwinds for sector

-Double whammy for NBFCs, banks loan growth should slow down

-Most private banks are well capitalised & can absorb impact well

-A bigger issue is PSU Banks which have lower CET1 ratios

-Note that eventual impact could be higher

-Even select NBFC exposures will attract more risk-weights for banks

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| L&T Finance | 142.05 | -5.05 | 1058100 |

| Sangam Finserv | 72.96 | -5 | 255 |

| YOGI | 30.4 | -5 | 11530 |

| Mansi Financ | 37.83 | -5 | 1283 |

| Indus Finance | 23.44 | -4.99 | 1690 |

| India Lease Dev | 7.53 | -4.92 | 1179 |

| Golechha Global | 23.1 | -4.86 | 100 |

| Lead Financial | 12.4 | -4.62 | 245 |

| Arman Financial | 2026 | -4.07 | 855 |

| SUPRAPFSL | 24 | -3.3 | 2775 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Goyal Associate | 2 | -4.76 | 891577 |

| Tata Inv Corp | 3870 | 18.92 | 47772 |

| Starteck Financ | 254.7 | 16.2 | 22467 |

| PTC India Fin | 36.95 | 11.3 | 2311665 |

| Marg Techno Pro | 21.4 | 0 | 296 |

| Williamson Mago | 32.49 | 9.99 | 47305 |

| Shardul Sec | 144.55 | 9.97 | 6806 |

| Finkurve Fin | 82.44 | 7.99 | 128685 |

| Optimus Finance | 85.5 | 0 | 2676 |

| Moneyboxx Finan | 299 | 6.01 | 127628 |

-330

November 17, 2023· 12:35 IST

-330

November 17, 2023· 12:31 IST

Sensex Today | BSE Capital Goods index up 0.7 percent led by Suzlon Energy, Praj Industries, GMR Airports Infrastructure:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Suzlon Energy | 43.98 | 4.56 | 12.76m |

| Praj Industries | 582.30 | 3 | 157.23k |

| GMR Airports | 59.08 | 2.59 | 232.05k |

| Carborundum | 1,112.85 | 1.39 | 1.30k |

| Lakshmi Machine | 12,950.00 | 1.3 | 320 |

| Thermax | 2,902.55 | 1.2 | 1.24k |

| Hindustan Aeron | 2,140.00 | 1.13 | 49.70k |

| ABB India | 4,278.35 | 1.07 | 3.72k |

| BHEL | 140.05 | 0.97 | 1.28m |

| Honeywell Autom | 37,337.00 | 0.86 | 71 |

-330

November 17, 2023· 12:23 IST

GMR Airports Infrastructure | Total October Passenger Traffic up 19% YoY & up 5% MoM at 98.4 lakh.

-330

November 17, 2023· 12:15 IST

Stock Market LIVE Updates | Motilal Oswal View on SAIL India

SAIL has earmarked Rs 1 trillion for expansions across all its facilities over the next decade.

As the intensity of capex is expected to pick up post FY25E, it would limit the deleveraging going ahead and thereby put pressure on the balance sheet and cash flow. In line with the increase in coal cost and capex guidance, broking house reduced EBITDA estimates for FY24/FY25 by 10%/1% .

SAIL trades at FY25E EV/EBITDA of 5.7x. Reiterate Neutral rating on the stock with an unchanged Target Price of Rs 85.

-330

November 17, 2023· 12:10 IST

Stock Market LIVE Updates | Manappuram Finance sinks 2 percent as RBI imposes Rs 43 lakh fine

Manappuram Finance was trading almost 3 percent lower in the morning session on November 17 after the Reserve Bank of India slapped a fine of Rs 42.78 lakh on the NBFC.

Manappuram Finance is also one of the many financial companies hit by the RBI's tightening of consumer lending norms, as the banking regulator increased the risk weight by 25 percentage points on consumer credit exposure of commercial banks and non-banking finance companies.

Manappuram Finance was fined for non-compliance of certain provisions of the “Non-Banking Financial Company - Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016,”, the central bank said.

-330

November 17, 2023· 12:08 IST

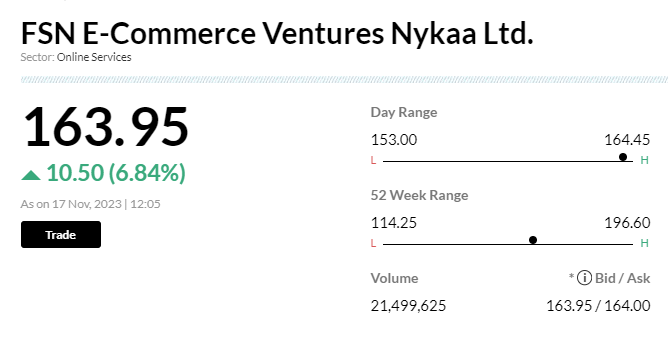

Stock Market LIVE Updates | Nykaa shares turned positive for 2023

Shares of FSN E-Commerce Ventures Ltd, which owns fashion brand Nykaa, surged more than 6% to hit its 11-month high on Friday. This is the best single-day gain for the stock since June this year. Friday's surge also enabled the stock to turn positive for 2023 after recovering all the losses made earlier. However, the stock is still below its adjusted IPO price of Rs187.

-330

November 17, 2023· 12:00 IST

Sensex Today | Market at 12 PM

The Sensex was down 83.93 points or 0.13 percent at 65,898.55, and the Nifty was down 4.40 points or 0.02 percent at 19,760.80. About 1787 shares advanced, 1330 shares declined, and 103 shares unchanged.

-330

November 17, 2023· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sadhana Nitro | 98.95 | 94.40 | -4.55 73.58k |

| Digikore Studio | 297.00 | 284.25 | -12.75 - |

| V-Marc | 161.50 | 155.00 | -6.50 32.31k |

| Swastik Pipe | 97.30 | 93.50 | -3.80 14.82k |

| Anlon Technolog | 270.00 | 260.00 | -10.00 1.07k |

| MCON Rasayan | 144.00 | 139.10 | -4.90 4.17k |

| Seshasayee Pape | 340.25 | 329.15 | -11.10 5.75k |

| Pioneer | 52.65 | 51.00 | -1.65 2.95k |

| Nidan Laborator | 36.50 | 35.40 | -1.10 1.26k |

| Tainwala Chem | 131.90 | 128.00 | -3.90 1.37k |

-330

November 17, 2023· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| DNL | 161.50 | 170.50 | 9.00 942 |

| Lasa Supergener | 25.55 | 26.90 | 1.35 2.53k |

| Rajgor Castor | 53.00 | 55.80 | 2.80 6.33k |

| Tata Inv Corp | 3,473.15 | 3,642.10 | 168.95 42.20k |

| Mangalam Worldw | 109.00 | 113.55 | 4.55 1.20k |

| Banaras Beads | 92.45 | 96.20 | 3.75 6.25k |

| Wealth First Po | 390.00 | 404.90 | 14.90 136 |

| Pansari Develop | 79.60 | 82.60 | 3.00 641 |

| Jyothy Labs | 440.60 | 456.40 | 15.80 204.64k |

| Alkali Metals | 109.70 | 113.55 | 3.85 2.64k |

-330

November 17, 2023· 11:59 IST

-330

November 17, 2023· 11:52 IST

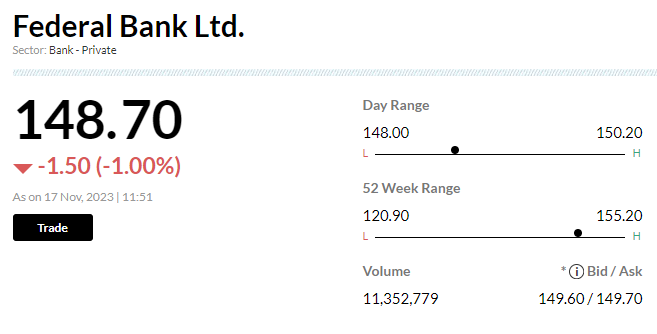

Stock Market LIVE Updates | Federal Bank fell 1% after huge block deal

Shares of Federal Bank lost 1 percent after a huge block deal. Around 1.52 million shares of the bank changed hands in a block deal, Bloomberg reported. However, details of the buyers and sellers were not known.

-330

November 17, 2023· 11:47 IST

-330

November 17, 2023· 11:42 IST

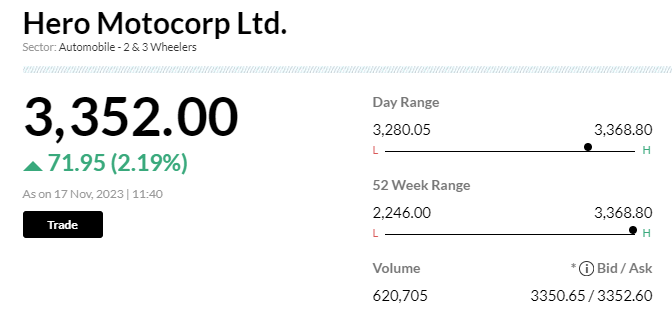

Stock Market LIVE Updates | Hero MotoCorp Surges on Record-Breaking Festive Season Retail Sales

Hero MotoCorp surged by 2.1%, following a 3.2% increase the previous day, after announcing its highest-ever retail sales during India's month-long festive season. The two-wheeler manufacturer revealed in a Thursday exchange filing that it sold over 1.4 million units in the retail market during the 32-day festive period, marking a 19% year-on-year growth.

-330

November 17, 2023· 11:35 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| SBI | 567.05 -2.97 | 861.16k | 48.92 |

| Bajaj Finance | 7,235.00 -1.78 | 56.97k | 41.10 |

| Reliance | 2,366.00 0.11 | 169.66k | 40.16 |

| TCS | 3,515.00 0.49 | 113.92k | 40.02 |

| HDFC Bank | 1,503.70 -0.31 | 213.31k | 32.02 |

| Tata Motors | 684.55 0.65 | 269.03k | 18.43 |

| Axis Bank | 996.30 -2.86 | 158.27k | 15.86 |

| Infosys | 1,444.30 0.03 | 101.38k | 14.63 |

| ICICI Bank | 927.50 -0.87 | 144.06k | 13.39 |

| M&M | 1,583.65 0.8 | 80.37k | 12.77 |

-330

November 17, 2023· 11:28 IST

Stock Market LIVE Updates | Kotak Mahindra Bank appoints Ashok Vaswani as Managing Director & CEO

The Board of Directors of Kotak Mahindra Bank at their meeting held today, appointed Mr. Ashok Vaswani as a Director and Managing Director and CEO and a Key Managerial Personnel of the Bank, for a period of three years, with effect from January 1, 2024, subject to the approval of the members of the Bank.

-330

November 17, 2023· 11:25 IST

Stock Market LIVE Updates | Sharekhan View on ISGEC Heavy Engineering

ISGEC Heavy Engineering's performance has seen a remarkable improvement in the last few quarters, driven by execution of high-margin projects and a decline in commodity prices from peak levels. Further, new orders are being taken at better margins, which should lead to better OPMs in the long term.

The company has guided for double-digit revenue growth and the order pipeline is promising with traction from segments like sugar, refinery, cement, and steel. Moreover, the

outlook on its subsidiary – Eagle Press and IHZL JV is also strong.

The company would also be commissioning the Philippines plant from December 2023, which holds promising prospects in the ethanol blending market.

Broking firm introduced FY2026E earnings and built in a revenue and PAT CAGR of ~13% and ~18%, respectively over FY2023-FY2026E. Stock is currently trading at ~17x/15x its FY2025E/FY2026E EPS.

Continue to maintain positive stance and expect an upside of 20% rolling forward our valuation to September 2025E earnings.

-330

November 17, 2023· 11:17 IST

Sensex Today | BSE Smallcap index touched fresh high of 39,689.94 supported by GE Power India, Titagarh Rail Systems, AGS Transact Technologies:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| GE Power India | 207.00 | 17.51 | 225.80k |

| TITAGARH | 911.00 | 8.63 | 376.52k |

| AGS Transact | 85.20 | 8.59 | 336.36k |

| Greenlam Ind | 581.50 | 7.71 | 37.46k |

| PTC India Fin | 35.72 | 7.59 | 1.21m |

| Varroc Engineer | 507.15 | 7.54 | 24.79k |

| Permanent Magne | 1,408.90 | 7.41 | 14.82k |

| Jayant Agro-Org | 245.70 | 7.36 | 19.71k |

| Steel Exchange | 9.29 | 7.03 | 997.77k |

| Tata Inv Corp | 3,478.05 | 6.88 | 8.74k |

-330

November 17, 2023· 11:12 IST

Stock Market LIVE Updates | Affle India files 5 new patents in India

Affle India on November 15, 2023 has filed 5 new patents in India, out of the set of patents that the company is working upon to further expand its tech IP assets. These newly filed 5 patents in India will power innovations in the domain of Artificial Intelligence and Automation.

The patent subject areas include 1. Systems and methods for ownership and biometric based authentication through Artificial Intelligent (AI) agent. 2. Systems and methods for managing a secure cloud based enclave without breach of user privacy.

3. Systems and methods for categorizing personal information into relevant categories corresponding to social engagement AI agents in a privacy and ad sensitive manner.

4. Systems and methods for augmenting responses/recommendations and generating enhanced decisions through resource sharing between AI agents. 5. Collaborative AI agent systems with coordinators/recommendations for shared applications and methods thereof.

-330

November 17, 2023· 11:07 IST

Stock Market LIVE Updates | Kalyani Cast Tech lists at 90% premium to issue price on BSE SME

Kalyani Cast Tech made a stellar market debut on November 17, listing at a 90 percent premium to the IPO price of Rs 139. The stock opened at Rs 264.1 BSE SME and within minutes jumped 100 percent to Rs 277.3 from the offer price.

Ahead of the listing, the stock was trading at a 68 percent premium to the issue price in the grey market, which is an unofficial ecosystem where shares start trading much before the allotment till the listing day. Most investors track the grey market premium (GMP) to get an idea of the listing price. Read More

-330

November 17, 2023· 10:59 IST

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Clara | 193.90 | 175.00 | -18.90 830 |

| RT Exports | 45.28 | 41.01 | -4.27 12 |

| Sangam Finserv | 79.90 | 72.96 | -6.94 3 |

| CaprolactumChem | 65.90 | 60.53 | -5.37 19 |

| Sainik Finance | 34.51 | 31.76 | -2.75 1.96k |

| Nalin Leasing | 37.94 | 35.06 | -2.88 135 |

| Quasar India | 31.10 | 29.00 | -2.10 10.44k |

| Ace Men Engg Wo | 58.40 | 54.50 | -3.90 28 |

| Medinova Diag | 27.99 | 26.22 | -1.77 118 |

| Athena Global | 85.45 | 80.20 | -5.25 1.00k |

-330

November 17, 2023· 10:59 IST

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Williamson Mago | 29.15 | 32.49 | 3.34 51 |

| Surana Solar | 26.05 | 29.00 | 2.95 22.16k |

| Reetech Intl. | 36.90 | 41.04 | 4.14 0 |

| Alkosign | 175.95 | 194.45 | 18.50 9.00k |

| Vadilal Enter | 3,414.00 | 3,769.00 | 355.00 0 |

| NDA Securities | 19.05 | 21.01 | 1.96 208 |

| Ceeta Industrie | 29.60 | 32.55 | 2.95 125 |

| YOGI | 30.57 | 33.50 | 2.93 1.28k |

| Precision Elec | 48.51 | 53.00 | 4.49 1 |

| S V J Ent. | 66.51 | 72.39 | 5.88 1.50k |

-330

November 17, 2023· 10:56 IST

-330

November 17, 2023· 10:49 IST

Stock Market LIVE Updates | Procter & Gamble Hygiene & Health Care to trade ex-dividend on November 17

Procter & Gamble Hygiene & Health Care will trade ex-dividend with effect from November 17, and the dividend is Rs 105 per share.

-330

November 17, 2023· 10:44 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Womancart | 188.00 | 72.71 | 108.85 |

| Bang Overseas | 72.45 | 53.82 | 47.10 |

| Ruchinfra | 18.70 | 50.20 | 12.45 |

| Starteck Financ | 256.80 | 45.25 | 176.80 |

| Norben Tea | 13.35 | 32.18 | 10.10 |

| NK Industries | 85.45 | 29.76 | 65.85 |

| Apollo Micro Sy | 154.00 | 26.96 | 121.30 |

| Apollo Micro Sy | 154.00 | 26.96 | 121.30 |

| Veranda Learn | 271.30 | 25.89 | 215.50 |

| Naga Dhunseri | 2,448.70 | 25.85 | 1,945.70 |

-330

November 17, 2023· 10:42 IST

Stock Market LIVE Updates | JSW Infrastructure receives project worth Rs 4,119 crore to develop Keni Port in Karnataka

JSW Infrastructure has received Letter of Award from Karnataka Maritime Board, Government of Karnataka for development of port at Keni in Karnataka on public private partnership basis. The estimated cost of the project is Rs 4,119 crore with an initial capacity of 30 MTPA.

-330

November 17, 2023· 10:36 IST

Stock Market LIVE Updates | HSBC View On Financials

-Banks & NBFCs will see an additional capital consumption of 40-80 bps

-Bajaj Finance, SBI Card, Ujjivans are outliers

-Pricing of loans to NBFCs, personal loans should go up; SBI Cards most impacted

-330

November 17, 2023· 10:27 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| PCBL | 244.90 | 244.90 | 237.85 |

| Solar Ind | 7450.00 | 7450.00 | 7,310.95 |

| General Insuran | 257.65 | 257.65 | 255.80 |

| Narayana Hruda | 1226.00 | 1226.00 | 1,199.20 |

| Brigade Ent | 762.70 | 762.70 | 749.15 |

| IRB Infra | 38.40 | 38.40 | 37.53 |

| SBI Life Insura | 1434.40 | 1434.40 | 1,422.15 |

| Suzlon Energy | 44.00 | 44.00 | 43.98 |

| ICICI Lombard | 1468.80 | 1468.80 | 1,452.60 |

| New India Assur | 155.00 | 155.00 | 154.00 |

-330

November 17, 2023· 10:23 IST

Stock Market LIVE Updates | AGS Transact locked at 10% upper circuit on order win of Rs 1,100 crore from SBI

AGS Transact Technologies share price locked at 10 percent upper circuit at Rs 86.20 in the early trade on November 17 after the company won an order worth Rs 1,100 crore.

The company announced the order win of Rs 1,100 crore over 7 years for deploying 2,500+ ATMs under the Outsourced/Managed Services portfolio from the State Bank of India (SBI).

The company will deploy these ATMs on a Transaction fee basis under the Total Outsourcing Model. Read More

-330

November 17, 2023· 10:19 IST

Sensex Today | Kalyani Cast-Tech to debut on the BSE SME on November 17

Kalyani Cast-Tech will list its equity shares on the BSE SME. The issue price is Rs 139 per share. The stock will be available in trade-for-trade segment for 10 trading days.

-330

November 17, 2023· 10:18 IST

Stock Market LIVE Updates | RBI imposes monetary penalty on Manappuram Finance

The Reserve Bank of India (RBI) has imposed a monetary penalty of Rs 42.78 lakh on Manappuram Finance for non-compliance with certain provisions of the Non-Banking Financial Company - Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions.

-330

November 17, 2023· 10:13 IST

Sensex Today | BSE FMCG index rose 0.8 percent led by Mishtann Foods, BCL Industries, Procter and Gamble Hygiene and Health Care:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Mishtann Foods | 16.78 | 5.53 | 13.34m |

| BCL Industries | 57.55 | 5.25 | 278.19k |

| P and G | 18,618.45 | 2.75 | 271 |

| Dodla Dairy | 834.25 | 2.67 | 4.34k |

| Manorama Indust | 2,155.90 | 2.55 | 47 |

| Marico | 529.05 | 2.3 | 34.90k |

| United Spirits | 1,062.55 | 2.09 | 28.09k |

| Bectors Food | 1,315.00 | 2.02 | 7.17k |

| Bajaj Hindustha | 32.93 | 1.86 | 286.64k |

| LT Foods | 203.40 | 1.85 | 81.16k |

-330

November 17, 2023· 10:09 IST

Stock Market LIVE Updates | JSW Steel withdraws decision, chooses to retain ownership of iron ore mine in Odisha

After considering the demand and supply scenario of iron ore in India, JSW Steel has withdrawn its application for the final mine closure plan for surrender of Jajang iron ore block in Keonjhar, Odisha. On September 1, 2023, due to un-economic operation, the company had submitted a notice for surrender of mining lease in respect of Jajang iron ore block before the Indian Bureau of Mines. It had acquired a total of four iron ore mining leases in Odisha, through auction in 2020.

-330

November 17, 2023· 10:06 IST

-330

November 17, 2023· 10:04 IST

Stock Market LIVE Updates | Morgan Stanley View On Financials

-RBI action on consolidated credit & bank funding could push up borrowing & lending rates

-Housing Finance stocks could be tactical beneficiaries, unaffected by new RBI norms

-Prefer Can Fin Homes, PNB Housing Finance, Aptus & Home First

-ABCL (EW), CIFC (EW) could see most EPS cut if bank funding costs rise ceteris paribus

-LTFH (UW) & MMFS (EW) could see most EPS cut if bank funding costs rise ceteris paribus

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IDFC | 118.2 | -3.15 | 3020251 |

| AAVAS Financier | 1461.5 | -1.84 | 46493 |

| APTUS VALUE | 297.2 | -1.48 | 103620 |

| HUDCO | 80.9 | -0.68 | 1368364 |

| Repco Home | 436.95 | -0.44 | 24436 |

| SRG Housing Fin | 267.75 | -0.17 | 1035 |

| Home First | 951.7 | -0.07 | 13427 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| L&T Finance | 142.05 | -5.11 | 7272617 |

| DCM Financial | 4.8 | 0 | 0 |

| Poonawalla Fin | 368.9 | -3.82 | 2162693 |

| Chola Invest. | 1128.45 | -3.16 | 780769 |

| Paisalo Digital | 79.7 | -3.04 | 263732 |

| Ugro Capital | 274.6 | -3.12 | 282606 |

| Arman Financial | 2059.65 | -2.52 | 8140 |

| Piramal Enter | 945.6 | -2.15 | 400898 |

| Manappuram Fin | 157.1 | -2.12 | 5951248 |

| Bajaj Finance | 7216.8 | -1.98 | 1024384 |

-330

November 17, 2023· 10:00 IST

Sensex Today | Market at 10 AM

The Sensex was up 25.81 points or 0.04 percent at 66,008.29, and the Nifty was up 31.30 points or 0.16 percent at 19,796.50. About 1872 shares advanced, 1027 shares declined, and 106 shares unchanged.

-330

November 17, 2023· 09:59 IST

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| DYNPROPP | 450.00 | 149.50 | -300.50 - |

| National Oxygen | 45.40 | 37.40 | -8.00 - |

| RBL Bank | 254.55 | 235.95 | -18.60 891.50k |

| Satin Credit | 267.05 | 250.55 | -16.50 42.20k |

| SBI Card | 772.55 | 729.05 | -43.50 107.83k |

| Pritish Nandy | 49.65 | 47.00 | -2.65 6.37k |

| AB Capital | 181.20 | 171.90 | -9.30 558.68k |

| L&T Finance | 149.70 | 142.25 | -7.45 - |

| Weizmann | 143.45 | 136.30 | -7.15 4.51k |

| Holmarc Opto Me | 120.80 | 114.80 | -6.00 - |

-330

November 17, 2023· 09:58 IST

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Info Drive Soft | 0.65 | 332.80 | 332.15 - |

| Kesoram Ind PP | 5.00 | 28.40 | 23.40 - |

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| ROX Hi-Tech | 83.00 | 148.80 | 65.80 12.80k |

| Bharat Gears RE | 103.25 | 172.05 | 68.80 - |

| Starteck Financ | 219.20 | 256.80 | 37.60 3.30k |

| Womancart | 156.70 | 183.50 | 26.80 - |

| GE Power India | 176.55 | 198.70 | 22.15 48.45k |

| Naga Dhunseri | 2,226.10 | 2,448.70 | 222.60 150 |

| Bang Overseas | 66.40 | 72.80 | 6.40 339.99k |

-330

November 17, 2023· 09:58 IST

-330

November 17, 2023· 09:56 IST

Stock Market LIVE Updates | Prabhudas Lilladher View on Steel Authority of India

Steel Authority of India (SAIL) reported weak operating performance in 2Q despite strong 14% YoY volume growth. The adjusted EBITDA of Rs 21.2 bn was below the estimates.

Going forward higher cost of imported coking coal prices would impact in 4Q EBITDA. SAIL has planned to increase its capacity from 20.2mtpa to 35mtpa by FY32 in phases however delays cannot be ruled out with its current pace of execution, debt on balance sheet and overall inefficiencies.

Detailed project report of IISCO plant which was supposed to get finalized by September is still under preparation & finalization. In near term, SAIL expects incremental volumes from debottlenecking initiatives at its multiple units such as ~1mt volumes in FY26E & FY27E from Bhilai & Rourkela as it is adding caster capacities. Bhilai would start delivering from FY25 onwards.

Broking house cut FY24/25E EBITDA estimates by 5%/2% on weaker 1H performance and expect SAIL to remain a play on steel prices in medium term as a) its volume growth would depend upon successful execution of its planned capex in phases and significant capacity addition would only come post FY28E; b) near term volume growth would remain 8-10% but margins can get affected by higher coking coal costs; c) however hardening Iron ore prices will keep SAIL’s strategic advantage intact vis a vis peers.

-330

November 17, 2023· 09:50 IST

Sensex Today | BSE Auto index up 0.8 percent supported by Bajaj Auto, Hero MotoCorp, Apollo Tyres:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Auto | 5,670.00 | 2.16 | 1.69k |

| Hero Motocorp | 3,350.15 | 2.13 | 15.12k |

| Apollo Tyres | 432.80 | 1.18 | 16.50k |

| Bosch | 20,816.00 | 1.13 | 245 |

| TVS Motor | 1,701.70 | 1.05 | 7.75k |

| Cummins | 1,857.20 | 1.02 | 745 |

| Eicher Motors | 3,873.90 | 0.98 | 3.72k |

| M&M | 1,584.90 | 0.88 | 22.01k |

| Tata Motors | 685.55 | 0.8 | 110.27k |

| Maruti Suzuki | 10,542.00 | 0.62 | 534 |

-330

November 17, 2023· 09:43 IST

-330

November 17, 2023· 09:41 IST

Stock Market LIVE Updates | PNB Housing Finance to consider raising Rs 3,500 crore via NCDs; shares gain

Shares of PNB Housing Finance gained 0.5 percent on November 17. The housing finance company is set to consider raising Rs 3,500 crore via NCDs.

In a regulatory filing, PNB Housing Finance said that the board of directors are scheduled to meet on November 24 to consider and approve the issuance of NCDs up to Rs 3,500 crore on a private placement basis, in tranches over the next six months. Read More

-330

November 17, 2023· 09:40 IST

Stock Market LIVE Updates | IDBI Bank tanks over 3% as stake sale likely to get delayed

IDBI Bank Limited slumped 3.66 percent in the early trade on November 17 after the DIPAM secretary said that stake sale may not be completed this year as some of the Reserve Bank of India's mandatory approvals were pending.

While the Department of Investment and Public Asset Management (DIPAM) said the transaction was on course, aspects such as RBI's fit and proper criteria still need to be complied with. Read More

-330

November 17, 2023· 09:36 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

There are some important trends which will impact the market in the near-term. One, the big macro driver of this two-day rally in the market - peaking and declining US bond yields - is very much in place. This will continue to impart resilience to the market. Two, the sharp decline in Brent crude to $ 77.5 is a positive for India’s macros and favourable for sectors that consume petroleum inputs like aviation, tyres and paints. Three, and this is a negative factor, the RBI action raising the risk weighting on unsecured loans is sentiment negative for financials.

It is important to understand that FIIs turning buyers is an important shift in tune with the declining bond yields in the US. In the near-term, IT, automobiles, telecom and construction-related segments will attract more buying since financials will see the temporary impact of the RBI action.

-330

November 17, 2023· 09:33 IST

Sensex Today | Nifty PSU Bank index shed 2 percent dragged by Punjab National Bank, State Bank of India, Union Bank of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 77.30 | -2.89 | 16.53m |

| SBI | 571.10 | -2.32 | 5.54m |

| Union Bank | 107.95 | -2.13 | 4.16m |

| Bank of India | 104.50 | -2.06 | 1.99m |

| Canara Bank | 397.60 | -2.06 | 2.14m |

| Bank of Mah | 45.25 | -1.52 | 4.45m |

| Central Bank | 46.10 | -1.5 | 2.37m |

| UCO Bank | 38.80 | -1.4 | 2.40m |

| JK Bank | 111.95 | -1.28 | 764.79k |

| IOB | 40.65 | -1.22 | 3.44m |

-330

November 17, 2023· 09:31 IST

Stock Market LIVE Updates | JSW Infrastructure soars 7% on winning project worth Rs 4,119 crore

Shares of JSW Infrastructure witnessed a more than 7 percent jump in early trade on November 17 following the company securing a project worth Rs 4,119 crore. At 9:15 am, the JSW Infrastructure stock was trading at Rs 217.12 on the NSE

JSW Infrastructure said on November 16 it received letter of award (LOA) for the development of Keni greenfield port in Karnataka. The estimated cost of the project is Rs 4,119 crore with initial capacity of 30 million tonnes per annum (MTPA), the company said in a press release. Read More

-330

November 17, 2023· 09:28 IST

Sensex Today | BSE Bank index down 0.7 percent dragged by SBI, Canara Bank, Axis Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SBI | 570.50 | -2.38 | 207.76k |

| Canara Bank | 397.00 | -2.19 | 35.94k |

| Axis Bank | 1,006.15 | -1.9 | 36.03k |

| Bank of Baroda | 195.80 | -1.34 | 153.43k |

| Federal Bank | 148.80 | -0.87 | 149.34k |

| HDFC Bank | 1,500.00 | -0.55 | 55.37k |

| AU Small Financ | 727.30 | -0.32 | 5.88k |

| ICICI Bank | 933.65 | -0.21 | 38.71k |

-330

November 17, 2023· 09:27 IST

Stock Market LIVE Updates | TVS Motor forges strategic partnership with Emil Frey for key European markets

TVS Motor Company announced its entry into Europe by signing an agreement for import and distribution with Emil Frey, the automobile importer and retailer in Europe. This partnership signifies a significant step towards global expansion for TVS Motor Company.

-330

November 17, 2023· 09:22 IST

Stock Market LIVE Updates | SJVN signs Power Purchase Agreement for 200 MW wind project with SECI

SJVN has signed a Power Purchase Agreement for 200 MW grid connected wind power project with Solar Energy Corporation of India (SECI). Its subsidiary SJVN Green Energy (SGEL) bagged 200 MW at a tariff of Rs 3.24 per unit on build own and operate (BOO) basis in open competitive tariff bidding process. With this project, the wind portfolio of the company now stands at 497.6 MW. The tentative cost for development of this project is Rs 1,400 crore and the project is expected to generate 482 million units in the first year.

-330

November 17, 2023· 09:21 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ugro Capital | 271.5 | -4.22 | 112038 |

| DCM Financial | 4.85 | 0 | 15300 |

| L&T Finance | 143.65 | -4.04 | 1926667 |

| Poonawalla Fin | 369.25 | -3.73 | 926413 |

| Chola Invest. | 1128.55 | -3.15 | 207832 |

| Industrial Inv | 175.55 | -2.8 | 177 |

| Edelweiss | 62.75 | -2.79 | 660769 |

| Piramal Enter | 943.75 | -2.34 | 153727 |

| Manappuram Fin | 157.2 | -2.06 | 1889379 |

| Indostar Capita | 169 | -2.11 | 3651 |

-330

November 17, 2023· 09:20 IST

Top banking and non-banking finance company stocks price were under pressure, a day after the Reserve Bank of India (RBI) raised credit risk weights on unsecured consumer loans to check the unbridled growth in this segment.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 76.65 | -3.71 | 8.12m |

| IDFC First Bank | 85.15 | -3.68 | 9.12m |

| SBI | 567.85 | -2.87 | 3.07m |

| Bandhan Bank | 218.15 | -1.82 | 1.01m |

| Bank of Baroda | 194.90 | -1.74 | 1.88m |

| Axis Bank | 1,008.85 | -1.71 | 1.56m |

| Federal Bank | 148.95 | -0.83 | 824.34k |

| HDFC Bank | 1,499.05 | -0.62 | 1.63m |

| ICICI Bank | 931.75 | -0.45 | 1.24m |

| AU Small Financ | 728.95 | -0.09 | 114.57k |

-330

November 17, 2023· 09:20 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Delhivery | 402.30 -2.79% | 19.35m 481,648.00 | 3,918.00 |

| MABFSIETF | 19.78 -1.4% | 456.01k 133,468.40 | 242.00 |

| Starteck Financ | 257.15 17.31% | 56.96k 20,741.20 | 175.00 |

| Naga Dhunseri | 2,399.00 7.77% | 3.71k 2,043.20 | 81.00 |

| OneClick | 80.25 4.97% | 16.80k 9,600.00 | 75.00 |

| SBI Card | 727.10 -5.88% | 1.61m 986,738.60 | 63.00 |

| Atal | 15.50 -2.21% | 334.99k 231,538.80 | 45.00 |

| Niraj Cement | 41.85 4.1% | 55.10k 36,500.60 | 51.00 |

| Orient Green | 21.85 3.8% | 26.52m 20,006,041.20 | 33.00 |

| Brigade Ent | 756.00 5.79% | 292.48k 304,775.00 | -4.00 |