Closing Bell: Sensex gains 820 pts, Nifty above 24,350; all sectors in the green

-330

August 09, 2024· 16:02 IST

Market Close | Sensex, Nifty gain 1% each

Indian benchmark indices strong on August 9 with Nifty above 24,350. At close, the Sensex was up 819.69 points or 1.04 percent at 79,705.91, and the Nifty was up 250.50 points or 1.04 percent at 24,367.50.

We wrap up today's edition of the Moneycontrol live market blog, and will be back Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

August 09, 2024· 16:01 IST

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

After showing weakness from the overhead resistance of 24350 levels on Thursday, bulls came back into action again on Friday with a sustainable upmove of 250 points amidst a range bound action. After opening with an upside gap of 270 points, the market shifted into a narrow range movement that lasted for the whole session. Nifty finally closed near the day's high and the opening upside gap remains unfilled.

A small candle was formed on the daily chart with minor upper and lower shadow and with gap up opening. Nifty is currently placed at the edge of the key resistance of around 24350-24380 levels, which is a lower end of previous sharp opening downside gap of 5th Aug. Hence, further upmove from here could possibly result in complete filling of the said gap around 24690 levels.

The range movement of few sessions is now on the verge of upside breakout. A decisive move above 24450 levels could pull Nifty towards the next hurdle of 24700 levels in the near term. Immediate support is at 24100 levels.

-330

August 09, 2024· 15:58 IST

Market This Week

#1 Market ends lower for 2nd consecutive week, indices fall more than 1%

#2 All sectoral indices ex-pharma, FMCG & media end lower, nifty metal falls the most

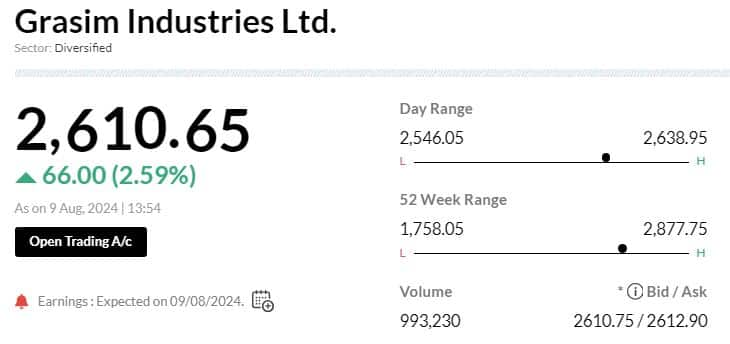

#3 37 out of 50 nifty stocks end in the red, Grasim, Tata Steel, BPCL top losers

-330

August 09, 2024· 15:57 IST

Earnings Watch | Honasa Consumer Q1 net profit up 62.7% at Rs 40.2 crore Vs Rs 24.7 crore, YoY

-330

August 09, 2024· 15:57 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

Nifty opened gap up today and consolidated to close with gains of ~248 points. On the daily charts we can observe that the Nifty has witnessed a fall from 25100 – 23900 and is now in the process of retracing that fall. It can rally towards 24520 – 24651 where the 50% and 61.82% Fibonacci retracement levels of the fall are placed. The immediate support on the downside is placed at 24200 – 24150 where the 40-day average is placed.

The Bank Nifty also witnessed a consolidation and managed to close in the green. PSU banks saw a sharp surge in trade today. Overall, the Bank Nifty can also move in tandem with the overall market and witness a pullback towards 50750 – 50800. Immediate support is placed at 50100 – 50000.

-330

August 09, 2024· 15:51 IST

Ajit Mishra – SVP, Research, Religare Broking

The markets started strong, gaining over a percent, buoyed by positive global cues. Following an initial gap-up, Nifty traded within a range and closed at 24,370. Most sectors contributed to the rally, with banking, auto, and IT leading the gains. Broader indices also performed well, adding about half a percent.

Global volatility is leading to erratic market swings, keeping traders on edge. We recommend a cautious approach until Nifty decisively closes above the 24,500 level. In the meantime, certain sectors and themes are showing resilience, so traders should adjust their positions accordingly.

-330

August 09, 2024· 15:45 IST

Vinod Nair, Head of Research, Geojit Financial Services

Positive US jobless claims data eased the fears of recession and provided a favourable broader market reaction. The IT index outperformed in expectation of improved spending. Though the sentiment is gaining traction, a lack of fresh triggers and subdued earnings will be a deterrent for higher valuation. To safeguard the sentiment, investors are advised to shift their focus from growth stocks to value stocks.

-330

August 09, 2024· 15:32 IST

Currency Check | Rupee closes flat

Indian rupee ended flat at 83.95 per dollar on Friday against Thursday's close of 83.96.

-330

August 09, 2024· 15:30 IST

Market Close | Sensex, Nifty end higher; all sectors in the green

Indian benchmark indices strong on August 9 with Nifty above 24,350.

At close, the Sensex was up 819.69 points or 1.04 percent at 79,705.91, and the Nifty was up 250.50 points or 1.04 percent at 24,367.50. About 2049 shares advanced, 1305 shares declined, and 88 shares unchanged.

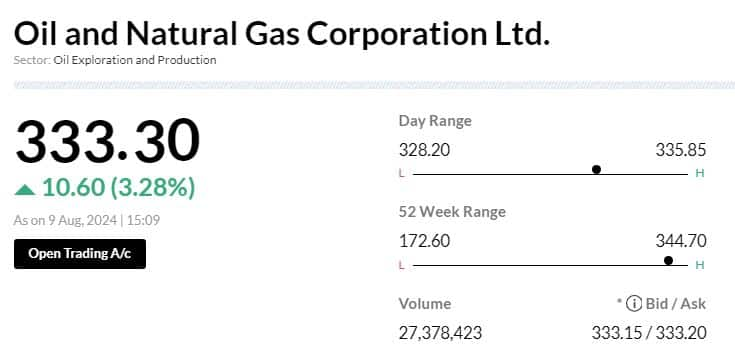

Eicher Motors, ONGC, Tech Mahindra, Tata Motors and Shriram Finance were among the top gainers on the Nifty, while losers were BPCL, HDFC Life, Kotak Mahindra Bank, Divis Labs and Sun Pharma.

All the sectoral indices are trading in the green with auto, capital goods, IT, power, realty, PSU Bank and media up 1-2 percent.

Broader indices performed in line with main indices. BSE Midcap index up 1 percent and Smallcap index up 0.8 percent.

-330

August 09, 2024· 15:29 IST

Earnings Watch | Insecticides India Q1 net profit up at Rs 49 crore Vs Rs 29 crore, YoY

-330

August 09, 2024· 15:21 IST

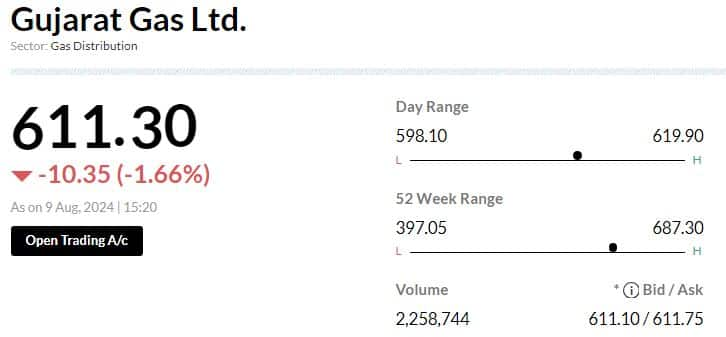

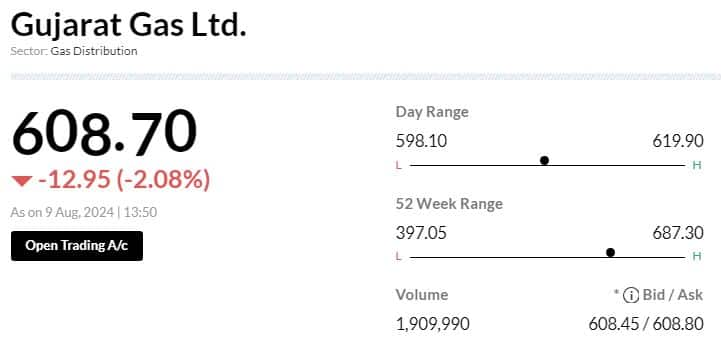

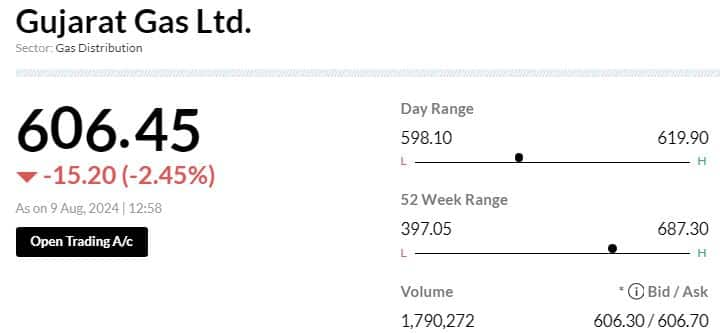

Brokerage Call | Nomura keeps 'reduce' rating on Gujarat Gas, target Rs 470

#1 Q1 below estimates, impacted by lower-than-anticipated margin

#2 Overall volume growth guidance cut to 6-7 percent; Morbi to decline 30-40 percent in Q2

#3 Company remains amongst most expensive gas utility company globally currently trading at 22.6x FY26 P/E

-330

August 09, 2024· 15:18 IST

Nifty 50 hits record highs but is the market overvalued?

Market valuations suggest it's not overvalued despite elevated levels. Sector valuations show mixed signals...Read More

-330

August 09, 2024· 15:15 IST

Sensex Today | BSE Power index rises 1%; CG Power, Suzlon Energy, BHEL among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| CG Power | 714.95 | 5.37 | 103.42k |

| Suzlon Energy | 76.59 | 4.99 | 23.35m |

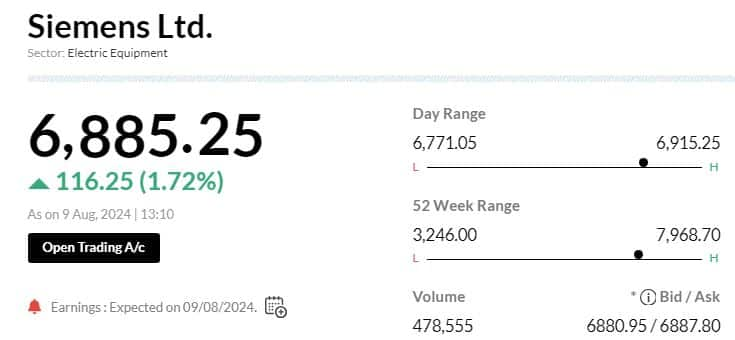

| Siemens | 6,901.10 | 1.71 | 22.57k |

| BHEL | 302.15 | 1.44 | 890.58k |

| Power Grid Corp | 346.50 | 1.18 | 156.59k |

| JSW Energy | 707.05 | 1.07 | 106.99k |

| Adani Power | 698.00 | 1.01 | 155.83k |

| Adani Energy | 1,108.95 | 0.66 | 133.14k |

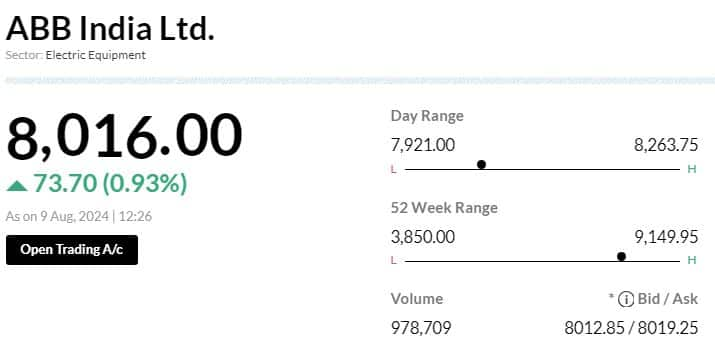

| ABB India | 7,975.00 | 0.49 | 28.02k |

| NTPC | 408.65 | 0.31 | 403.26k |

-330

August 09, 2024· 15:12 IST

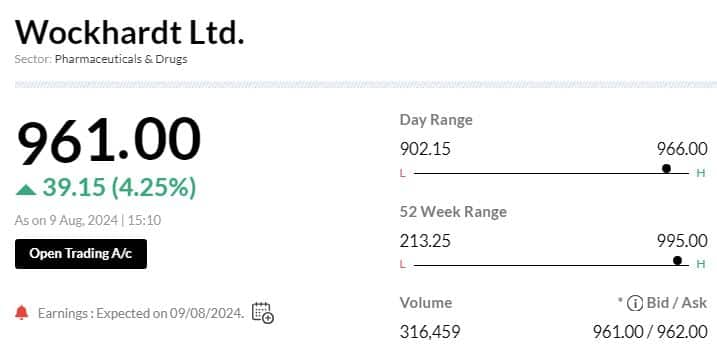

Earnings Watch | Wockhardt Q1 loss at Rs 14 crore Vs Rs 134 crore, YoY

-330

August 09, 2024· 15:09 IST

Brokerage Call | Morgan Stanley keeps 'overweight' call on ONGC, target raises to Rs 430 from Rs 302

#1 Top quartile dividend growth in energy globally and improving incremental return on capital employed offers a good basis for next leg

#2 Recovering cash flows in international assets offers good basis for next leg of USD 12 billion in value creation

#3 Key risks include any decline in oil price below long-term base case of USD 70/bbl and potential reduction in government stake

-330

August 09, 2024· 15:05 IST

Nifty faces selling pressure from 24,400 zone; Choppy price action expected until 24,400 breached

Options data suggests that significant put writing is evident across the 24,000 to 24,250 levels, providing crucial support for the day...Read More

-330

August 09, 2024· 15:01 IST

Markets@3 | Sensex gains 870 pts, Nifty above 24350

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,066.80 | 2.44 | 524.52k |

| JSW Steel | 907.45 | 2.37 | 64.04k |

| Tech Mahindra | 1,501.15 | 2.37 | 38.10k |

| M&M | 2,744.75 | 2.32 | 65.94k |

| HCL Tech | 1,589.00 | 1.98 | 92.09k |

| Infosys | 1,773.45 | 1.86 | 112.07k |

| Reliance | 2,946.85 | 1.77 | 185.67k |

| SBI | 821.25 | 1.68 | 521.12k |

| TCS | 4,235.30 | 1.54 | 70.37k |

| Bajaj Finserv | 1,560.90 | 1.26 | 29.91k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Kotak Mahindra | 1,766.20 | -0.38 | 73.14k |

| IndusInd Bank | 1,345.35 | -0.19 | 239.59k |

| Maruti Suzuki | 12,202.85 | -0.09 | 15.78k |

| Asian Paints | 2,999.85 | -0.04 | 34.09k |

-330

August 09, 2024· 14:56 IST

Brokerage Call | Morgan Stanley keeps 'underweight' call on SAIL, target Rs 110

#1 Q1 earnings showed a miss on EBITDA

#2 Q1 volumes were 4.0 mt, +3 percent YoY & -12 percent QoQ, broadly in-line

#3 Revenue was slightly above forecast of 1 percent

#4 EBITDA of Rs 222 crore, 9 percent below estimate

-330

August 09, 2024· 14:51 IST

Sensex Today | BSE IT index rises 1%; Quick Heal Tech, Genesys International, Affle India, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Genesys Int | 685.30 | 7.25 | 11.89k |

| Quick Heal Tech | 579.85 | 6.97 | 13.88k |

| Affle India | 1,558.85 | 4.88 | 250.88k |

| Rategain Travel | 814.90 | 4.51 | 30.09k |

| Oracle Fin Serv | 10,479.20 | 4.28 | 3.19k |

| Aurionpro Solut | 1,720.80 | 3.95 | 11.73k |

| KPIT Tech | 1,757.40 | 2.94 | 14.44k |

| 63 Moons Tech | 361.85 | 2.7 | 34.02k |

| MphasiS | 2,712.65 | 2.54 | 9.56k |

| Tech Mahindra | 1,502.50 | 2.46 | 35.71k |

-330

August 09, 2024· 14:48 IST

Brokerage Call | Kotak Institutional Equities keeps 'sell' rating on MRF, target Rs 7,000

#1 Q1 EBITDA 7 percent above estimate due to better-than- estimate revenue print & cost-control measures

#2 Expect demand trends to remain steady & coupled with market share gain, augurs well for company

#3 Current uptick in raw material basket will continue to weigh on margin

#4 Stock trading at 28x FY26 consolidated EPS, which believe is expensive

-330

August 09, 2024· 14:44 IST

Earning Watch | Berger Paints Q1 net profit down 0.2% at Rs 353.6 crore Vs Rs 354 crore, YoY

-330

August 09, 2024· 14:34 IST

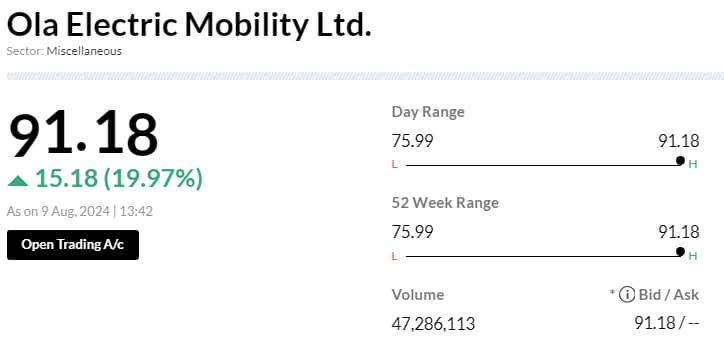

Ola Electric share jumps 20% after listing, locked in upper circuit on stock market debut

Ola Electric Mobility's Rs 6,154-crore IPO was subscribed 4.27 times. The public issue was a combination of a mix of fresh issue and an offer-for-sale....Read More

-330

August 09, 2024· 14:27 IST

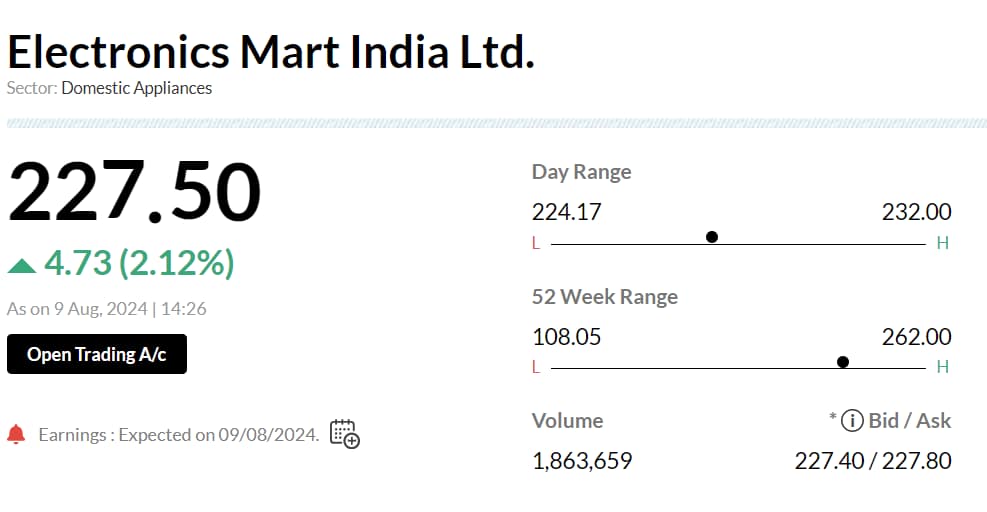

Earnings Watch | Electronics Mart Q1 net Profit Up 20.3% At Rs72.4 Cr Vs Rs60 Cr (YoY)

#1 Revenue Up 17.3% At Rs1,974.9 Cr Vs Rs1,683.6 Cr (YoY)

#2 EBITDA Up 18.2% At Rs153.6 Cr Vs Rs130 Cr (YoY)

#3 Margin At 7.8% Vs 7.7% (YoY)

-330

August 09, 2024· 14:19 IST

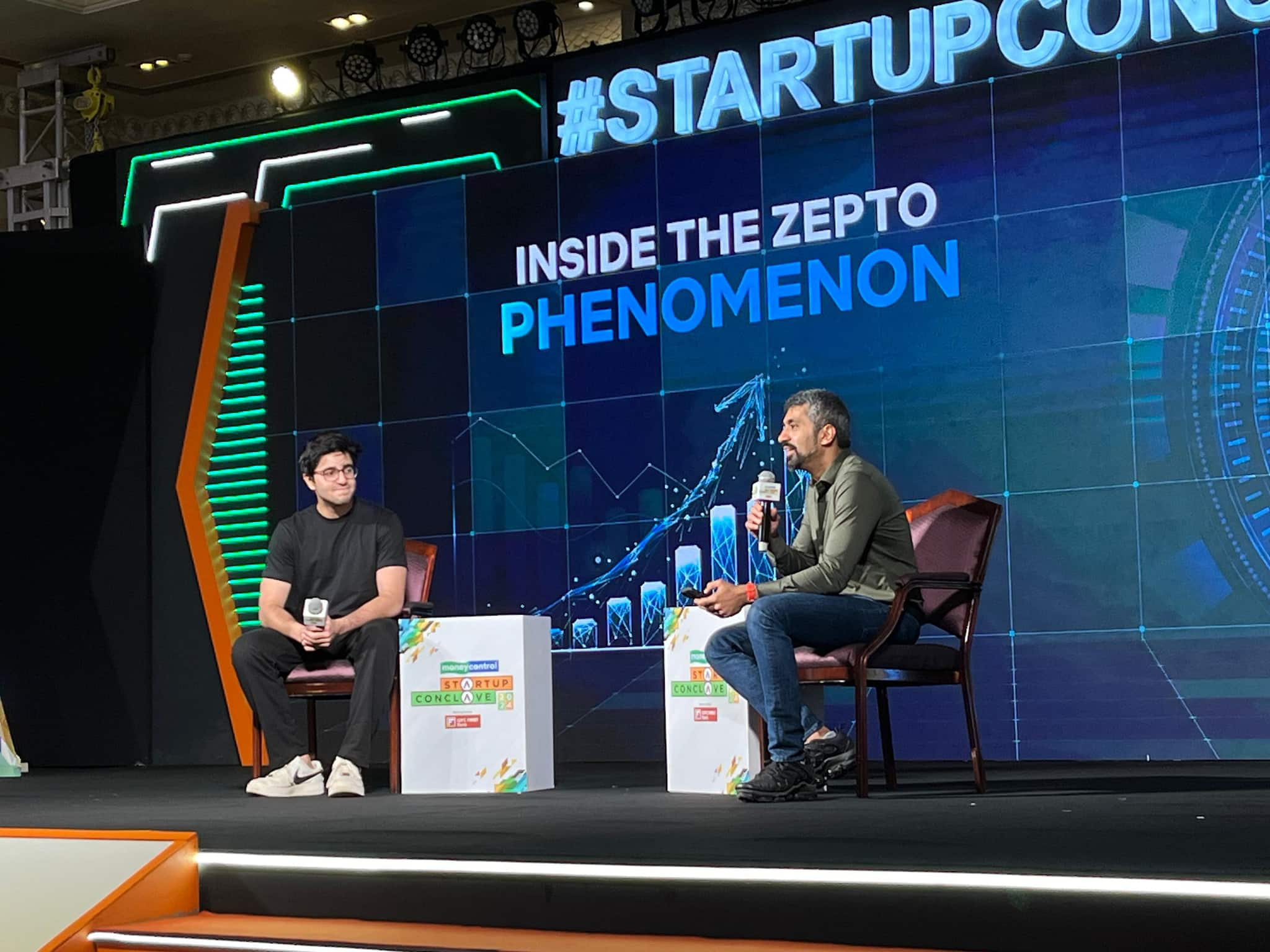

We are where Amazon was in the 90s, may hit a $50-80 billion outcome: Zepto co-founder Aadit Palicha

We are sitting on the right macro and the right business model to create something that is very large. And if we just nail this we are sitting on a $50-80 billion outcome," he said...Read More

-330

August 09, 2024· 14:13 IST

Earnings Watch | Precision Camshafts Q1 net profit at Rs11.7 Cr Vs Rs4 Cr (YoY)

#1 Revenue up 2.8% At Rs255.3 Cr Vs Rs262.7 Cr (YoY)

#2 EBITDA up 7.6% At Rs24.2 Cr Vs Rs22.5 Cr (YoY)

#3 Margin At 9.5% Vs 8.6% (YoY)

-330

August 09, 2024· 14:06 IST

Earnings Watch | IRB Infra Q1 net profit Rs 140 crore, up 4.5% YoY

#1 Revenue Rs 1850 cr, up 13% YoY

#2 Total costs Rs 1690 cr, up 15% YoY

#3 Other income Rs 119 cr, up 7.2% YoY

#4 EBITDA Rs 976 crore, up 9.8% YoY

#5 Dividend per share Rs0.1 a share

-330

August 09, 2024· 14:00 IST

Markets@2 | Sensex gains 800 pts, Nifty at 24350

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 57300.551.62 | 35.69-1.11 | -2.3962.02 |

| BSE CAP GOODS | 72489.311.32 | 30.27-1.35 | -4.0366.44 |

| BSE FMCG | 22533.000.3 | 10.090.68 | 5.0119.60 |

| BSE Metal | 31095.421.06 | 15.21-2.52 | -7.1341.83 |

| BSE Oil & Gas | 31769.420.76 | 38.00-1.68 | 4.4065.90 |

| BSE REALTY | 8028.802.11 | 29.77-0.86 | -8.7887.70 |

| BSE IT | 39803.181.48 | 10.53-2.04 | 3.3927.53 |

| BSE HEALTHCARE | 41086.010.39 | 30.230.68 | 6.8644.23 |

| BSE POWER | 8293.531.4 | 42.53-2.09 | 2.4596.30 |

| BSE Cons Durables | 58294.350.72 | 16.59-2.92 | -1.2035.18 |

-330

August 09, 2024· 13:58 IST

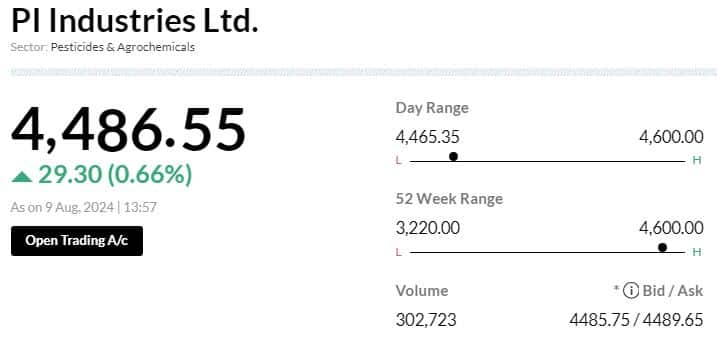

Brokerage Call | Jefferies keeps 'buy' rating on PI Industries, target raises to Rs 5,100 from Rs 4,750

#1 Positive developments on Pyroxasulfone patent should allay investor concerns

#2 Robust growth outlook of new product (Fluindapyr) should aid growth

#3 Raise FY25/26 EBITDA estimates by 2 percent

#4 Company remains top pick in chemical space

-330

August 09, 2024· 13:54 IST

Earnings Watch | Grasim Industries Q1 net loss at Rs 52.1 crore and revenue at Rs 6,893.7 crore

-330

August 09, 2024· 13:53 IST

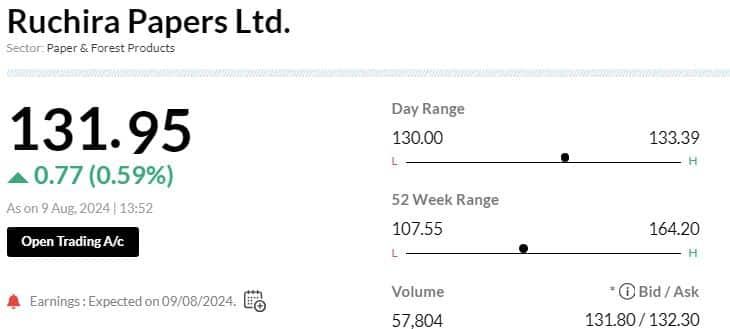

Earnings Watch | Ruchira Papers Q1 net profit down 32% at Rs 15 crore Vs Rs 22 crore , YoY

-330

August 09, 2024· 13:52 IST

Earnings Watch | Precision Camshafts Q1 net profit at Rs 11.7 crore Vs Rs 4 crore, YoY

-330

August 09, 2024· 13:51 IST

Brokerage Call | Jefferies maintain 'underperform' rating on Gujarat Gas, target cut to Rs 450 from Rs 460

#1 Morbi volume has declined 50 percent in July after latest price hike

#2 Focus shifts to defending the margin

#3 Cut FY25/26 volumes by 4 percent, in-line with lowered company’s guidance of 5-7 percent

#4 Cut FY25/26 EPS estimates by 6 percent/5 percent

-330

August 09, 2024· 13:45 IST

Stock Market LIVE Updates | 1.77 million shares of Hatsun Agro traded in a block: Bloomberg

-330

August 09, 2024· 13:44 IST

Sensex Today | Ola Electric Mobility gains 20%, after a flat listing

-330

August 09, 2024· 13:42 IST

Brokerage Call | Jefferies maintains 'buy' on Eicher Motors, target cut to Rs 5,500 from Rs 6,000

#1 Recent weakness in RE volumes is a concern

#2 Company should be a key beneficiary of 2-W premiumisation

#3 Toughest phase of competition is behind

#4 Cut FY25-27 EPS estimates by 2-4 percent

-330

August 09, 2024· 13:40 IST

Lalit Keshre of Groww, at Startup Conclave

India is not just metros. The biggest error we can make is sitting in Bengaluru office and guessing what everyone wants. As a company we have visited 150 cities. The biggest (finding) is that the access was missing and internet. Multiple things came together and created a path internet, Aadhaar, eKYC, access that was once available only to HNIs. We were lucky to take advantage of this.

Luck is the biggest thing, but for Groww in particular we kept listening to the customers. If we understand them well, we can built what they want. Our customers are vocal too, we are just so lucky about it.

-330

August 09, 2024· 13:37 IST

Sensex Today | BSE Telecom index up 0.7%; Optiemus Infra, Vodafone Idea, Tata Comm, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Optiemus Infra | 518.30 | 8.14 | 104.60k |

| Vodafone Idea | 16.22 | 2.21 | 22.72m |

| Tata Comm | 1,888.45 | 1.83 | 10.24k |

| Railtel | 464.50 | 1.45 | 102.06k |

| Bharti Airtel | 1,467.50 | 1.11 | 125.25k |

| Sterlite Techno | 140.80 | 0.64 | 114.75k |

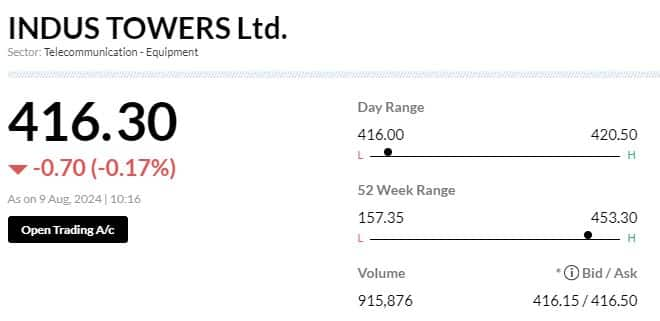

| INDUS TOWERS | 419.00 | 0.46 | 151.24k |

| Vindhya Telelin | 2,728.75 | 0.26 | 4.09k |

-330

August 09, 2024· 13:32 IST

Lalit Keshre of Groww, at Startup Conclave

Hardly 15 percent of customers do trading. Trading is a zero-sum game. If you are trading better be skilled. From a business point of view, it's a multi-product (business). Ultimately what matters is the betterment of customers.

We started based on customer feedback from friends and family. Everything we have done so far is based on what customers have said. There are a lot go example, like this content team was one of them. We started doing a lot of educational stuff. Likewise, all our products that we launch are based on what customers that we want, like when they said they want direct mutual funds and all the features also.

-330

August 09, 2024· 13:30 IST

30% of BSE 500, BSE MidCap stocks still below June 4 levels despite market rebound

Around 159 stocks from the BSE 500 Index and 41 stocks from the BSE MidCap firms remain in negative territory. Among the 102 listed PSU stocks, 49 are yet to recover from the June 4 decline. In the SmallCap segment, over 23 percent, or 220 stocks are still down. ...Read More

-330

August 09, 2024· 13:24 IST

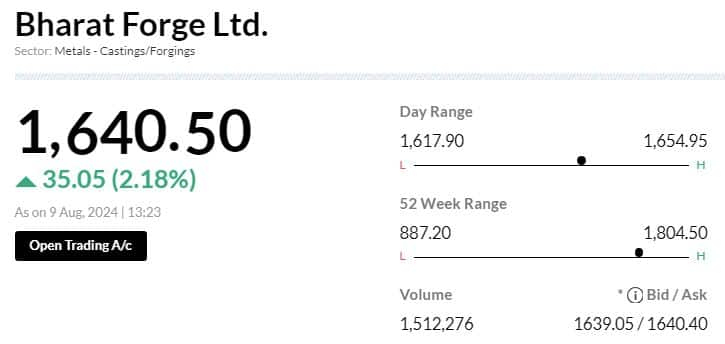

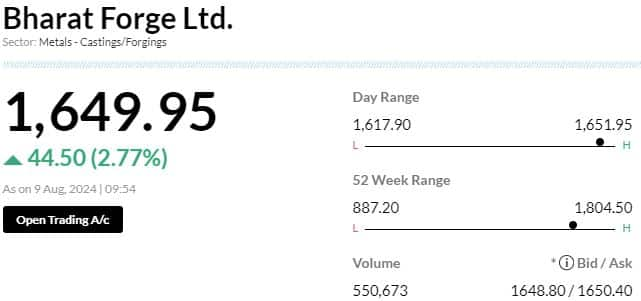

Brokerage Call | Citi keeps 'sell' rating on Bharat Forge, target raises to Rs 900 from Rs 850

#1 Slight operational beat in Q1; domestic segment better than exports

#2 PAT was supported by higher non-operating income

#3 Domestic revenue growth was much better than estimate, driven by non-auto segment

#4 Exports revenue was weaker, especially in the PV segment

#5 Outlook remains positive, management is optimistic on demand momentum in India

#6 Downside risks to export revenue, & current valuations provide little margin of error

#7 Continue to value the stock at 29xSep’25e EPS

-330

August 09, 2024· 13:20 IST

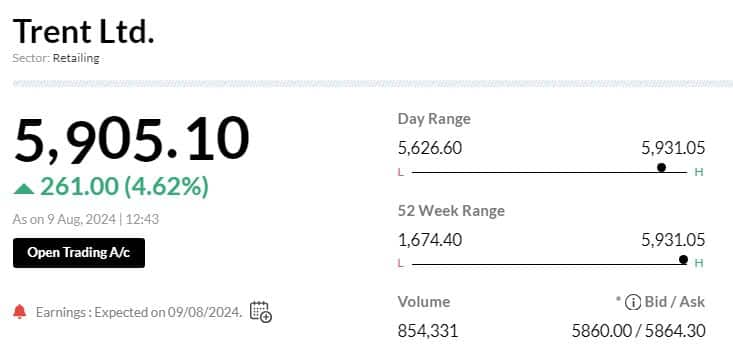

Trent Q1 results: Net profit more than doubles to Rs 393 crore, beats estimates; stock jumps

Trent Ltd Q1 FY25 Results Update: The Tata group company stock jumped 6.5 percent after the first quarter net profit jumped far higher than anticipated....Read More

-330

August 09, 2024· 13:19 IST

Earnings Watch | Matrimony.com Q1 net profit flat at Rs 14 crore, YoY

-330

August 09, 2024· 13:15 IST

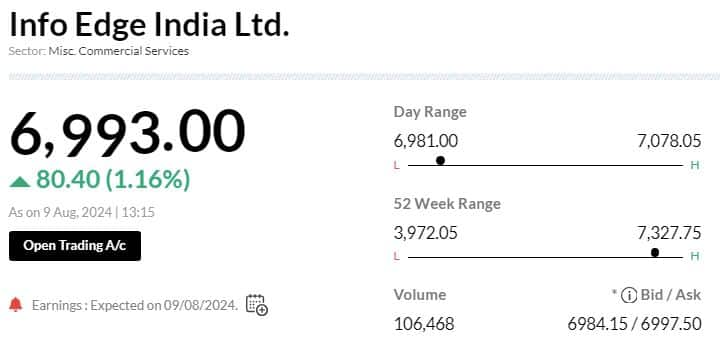

Earnings watch | Info Edge Q1 profit at Rs 232 crore Vs Rs 159 crore

-330

August 09, 2024· 13:13 IST

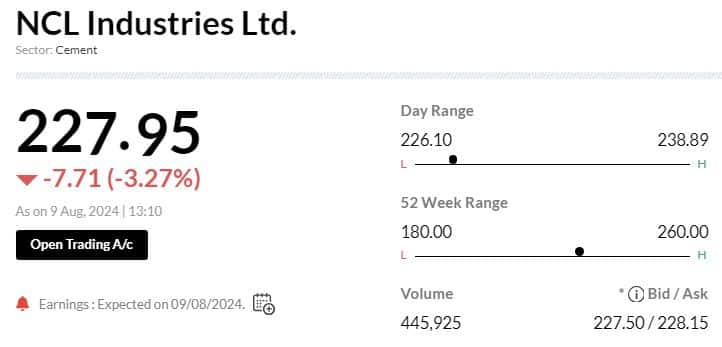

Earnings Watch | NCL Industries Q1 profit down at Rs 13 crore Vs Rs 31 crore, YoY

-330

August 09, 2024· 13:11 IST

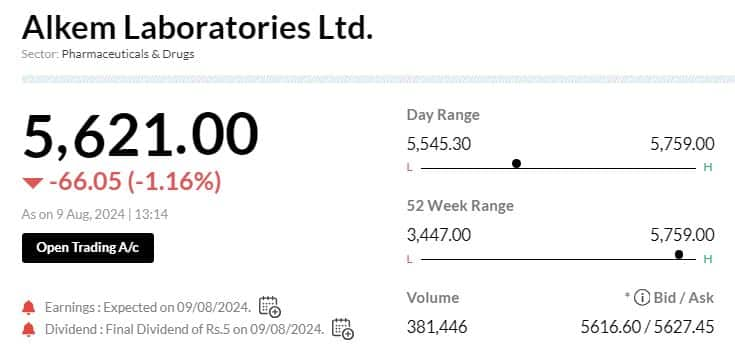

Earnings Watch | Alkem Labs Q1 net profit down 97% at Rs 545 crore Vs Rs 277 crore, YoY

-330

August 09, 2024· 13:10 IST

Stock Market LIVE Updates | Siemens share trade higher ahead quarterly earnings

-330

August 09, 2024· 13:09 IST

Sensex Today | Nifty PSE index up 1%; Oil India, ONGC, Power Finance among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oil India | 642.10 | 4.77 | 15.68m |

| ONGC | 330.10 | 2.29 | 19.01m |

| Power Finance | 500.25 | 1.65 | 6.81m |

| BHEL | 302.10 | 1.43 | 8.62m |

| Bharat Elec | 301.50 | 1.09 | 11.08m |

| Power Grid Corp | 345.90 | 0.95 | 5.30m |

| Hindustan Aeron | 4,711.60 | 0.94 | 653.18k |

| REC | 587.50 | 0.68 | 4.20m |

| NALCO | 173.40 | 0.42 | 7.24m |

| NTPC | 409.30 | 0.39 | 6.23m |

-330

August 09, 2024· 13:03 IST

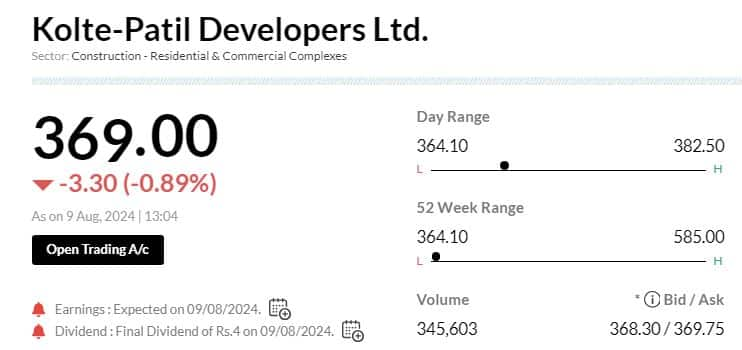

Earnings Watch | Kolte Patil Q1 net profit down 86.5% at Rs 6.2 crore Vs Rs 46 crore, YoY

-330

August 09, 2024· 13:01 IST

Markets@1 | Sensex up 760 points, Nifty at 24350

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 25340.501.7 | 36.11-1.45 | -1.8763.63 |

| NIFTY IT | 39007.151.45 | 9.83-1.82 | 3.5526.07 |

| NIFTY PHARMA | 22226.500.51 | 32.051.48 | 7.6641.60 |

| NIFTY FMCG | 62102.000.1 | 8.980.58 | 4.9318.96 |

| NIFTY PSU BANK | 6902.900.59 | 20.82-4.09 | -5.8552.17 |

| NIFTY METAL | 9027.150.65 | 13.15-3.09 | -8.6535.18 |

| NIFTY REALTY | 1022.901.61 | 30.63-1.37 | -9.2491.32 |

| NIFTY ENERGY | 43071.500.9 | 28.69-2.85 | 1.0863.59 |

| NIFTY INFRA | 9167.550.99 | 25.52-2.26 | -1.0452.12 |

| NIFTY MEDIA | 2099.201.71 | -12.10-0.05 | 2.54-0.12 |

-330

August 09, 2024· 12:59 IST

Brokerage Call | CLSA keeps 'underperform' call on Gujarat Gas, target Rs 420

#1 Q1 standalone net profit 6 percent below expectations

#2 Q1 profit below estimate as disappointment in margin overshadowed healthy beat on volumes

#3 Management guided for 40 percent QoQ decline in Q2 volumes from Morbi

#4 Management guided for decline from Morbi facility due to weak business environment for ceramic tile industry

-330

August 09, 2024· 12:56 IST

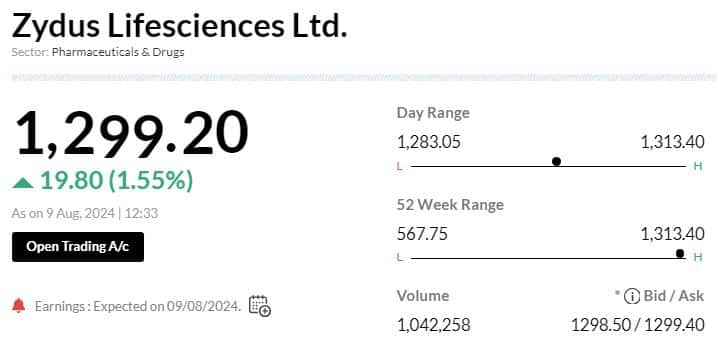

Earnings Watch | Zydus Life Q1 net profit at Rs 1,419.9 crore

-330

August 09, 2024· 12:55 IST

Sensex Today | Nifty Media index up 2%; Network 18, TV18 Broadcast, PVR Inox among top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Network 18 | 100.73 | 4.59 | 6.99m |

| TV18 Broadcast | 47.44 | 3.81 | 10.81m |

| PVR INOX | 1,491.25 | 2.48 | 211.23k |

| Sun TV Network | 903.20 | 2.14 | 638.26k |

| TV TodayNetwork | 267.40 | 1.48 | 197.26k |

| DB Corp | 340.80 | 1.31 | 83.77k |

| Zee Entertain | 139.20 | 0.69 | 3.38m |

| Dish TV | 15.04 | 0.67 | 4.66m |

-330

August 09, 2024· 12:52 IST

Sensex Today | 1% equity of Aster DM change hands in 2 bunches

-330

August 09, 2024· 12:48 IST

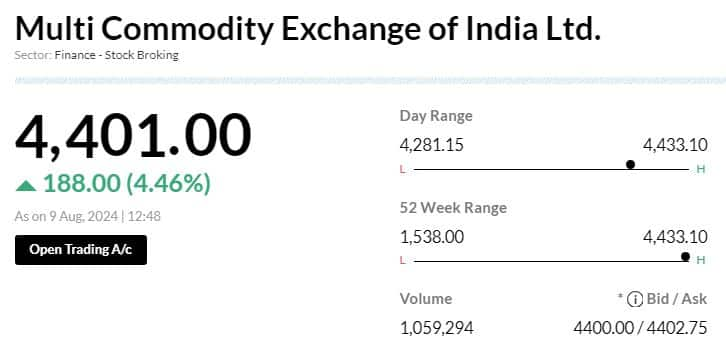

Stock Market LIVE Updates | SEBI approves to appoint Praveena Rai as MD & CEO of MCX India

The Securities and Exchange Board of India (SEBI) has approved the appointment of Praveena Rai as the Managing Director & Chief Executive Officer of Multi Commodity Exchange of India (MCX). Praveena's appointment is subject to her acceptance of the offer and approval from the shareholders of MCX.

-330

August 09, 2024· 12:45 IST

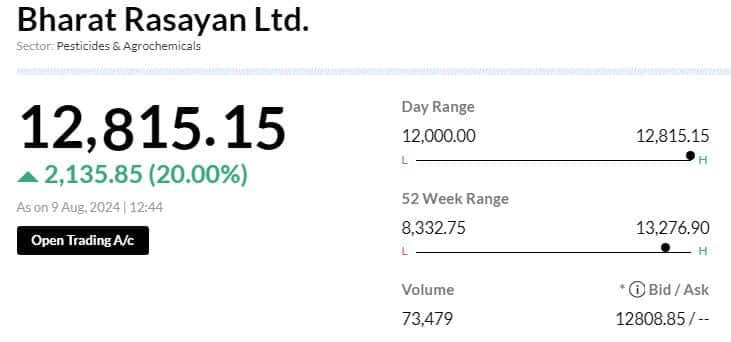

Stock Market LIVE Updates | Bharat Rasayan locked at 20% upper circuit post robust Q1 numbers

#1 Profit surges 508.2 percent to Rs 43.1 crore Vs Rs 7.09 crore, YoY

#2 Revenue grows 18 percent to Rs 282.2 crore Vs Rs 239.2 crore, YoY

-330

August 09, 2024· 12:43 IST

Earnings Watch | Trent Q1 net profit at Rs 391.2 crore Vs Rs 166.7 crore, YoY

-330

August 09, 2024· 12:42 IST

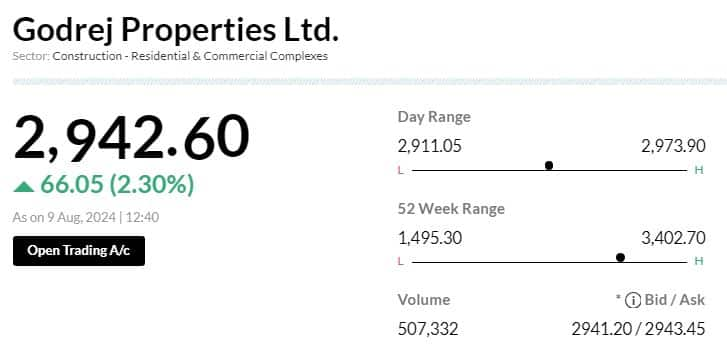

Stock Market LIVE Updates | Godrej Properties emerges as highest bidder for 2 land parcels in Greater NOIDA

Godrej Properties today announced that it has participated in an e-auction conducted by the Greater Noida Industrial Development Authority (GNIDA) for Residential Group Housing Plots, where GPL has emerged as the highest bidder for 2 land parcels with a total combined bid value of Rs 842 crore.

-330

August 09, 2024· 12:41 IST

Stock Market LIVE Updates | Sunshield Chemicals approves fund raise plan

The Board of Directors of the company at its meeting held on 9th

August, 2024 approves raising of funds through the issuance of equity shares by way of rights issue for an amount not exceeding Rs 200 crore.

-330

August 09, 2024· 12:38 IST

Stock Market LIVE Updates | BSE Sensex outperform other main indices

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 79702.321.03 | 10.33-1.58 | -0.8120.77 |

| BSE 200 | 11290.910.96 | 17.14-1.44 | -0.4432.57 |

| BSE MIDCAP | 47057.610.93 | 27.74-1.30 | -1.0254.30 |

| BSE SMALLCAP | 53659.500.88 | 25.74-1.78 | -0.9251.37 |

| BSE BANKEX | 57499.480.82 | 5.74-1.69 | -4.6514.13 |

-330

August 09, 2024· 12:37 IST

Stock Market LIVE Updates | Sobha shares gain nearly 3% post Q1 earnings

#1 Profit plunges 49.8 percent to Rs 6.1 crore Vs Rs 12.05 crore, YoY

#2 Revenue falls 29.5 percent to Rs 640.4 crore Vs Rs 907.9 crore, YoY

-330

August 09, 2024· 12:35 IST

Stock Market LIVE Updates | Granules India gets USFDA approval for Trazodone tablets

Granules India announced today that the US Food & Drug Administration (US FDA) has approved its Abbreviated New Drug Application (ANDA) for Trazodone Hydrochloride Tablets USP, 50 mg, 100 mg, 150 mg, and 300 mg. It is bioequivalent and therapeutically equivalent to the reference listed drug, Desyrel Tablets, 50 mg, 100 mg, 150 mg, and 300 mg, of Pragma

Pharmaceuticals, LLC.

-330

August 09, 2024· 12:33 IST

Stock Market LIVE Updates | Zydus receives final approval from USFDA for Valbenazine Capsules

Zydus Lifesciences has received final approval from the United States Food and Drug Administration (USFDA) to market Valbenazine Capsules, 40 mg, 60 mg, and 80 mg.

-330

August 09, 2024· 12:33 IST

Option strategy of the day | Long build up in Alkem; Protective put recommended

The stock has seen a significant long buildup in its futures data for the August series. ...Read More

-330

August 09, 2024· 12:31 IST

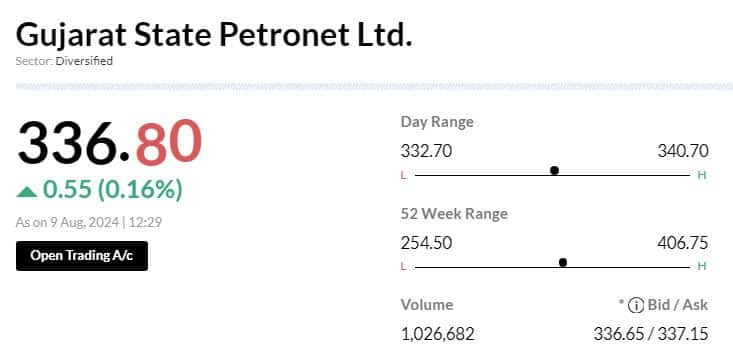

Stock Market LIVE Updates | Gujarat State Petronet shares trade flat post Q1 earnings

#1 Profit grows 21.3 percent to Rs 526.5 crore Vs Rs 434 crore, YoY

#2 Revenue (excluding excise duty) increases 15 percent to Rs 4,727 crore Vs Rs 4,108.3 crore, YoY

-330

August 09, 2024· 12:28 IST

Suzlon's market-cap blazes past Rs 1 lakh crore for the first time ever

As of close on August 8, 98 companies had a market-capitalisation over the Rs 1 lakh crore mark. Over the past five sessions, the stock has surged over nine percent, while soaring over 280 percent in the past 12 months. ...Read More

-330

August 09, 2024· 12:28 IST

Stock Market LIVE Updates | ABB India shares gain post profit surges 50%

#1 Profit surges 50 percent to Rs 443.5 crore Vs Rs 295.6 crore, YoY

#2 Revenue increases 12.8 percent to Rs 2,830.9 crore Vs Rs 2,508.6 crore, YoY

#3 Board declares an interim dividend of Rs 10.66 per share

-330

August 09, 2024· 12:24 IST

Sensex Today | BSE Realty index up 1%; Macrotech Developers, Sobha among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Macrotech Dev | 1,238.00 | 4.21 | 19.49k |

| Sobha | 1,743.60 | 2.96 | 23.41k |

| Oberoi Realty | 1,792.65 | 2.76 | 4.01k |

| Godrej Prop | 2,944.40 | 2.37 | 10.97k |

| Prestige Estate | 1,702.80 | 2.08 | 11.20k |

| Phoenix Mills | 3,364.40 | 1.81 | 3.41k |

| Swan Energy | 687.20 | 0.87 | 50.70k |

-330

August 09, 2024· 12:23 IST

Sensex Today | Siemens, Suven Pharma, Trent, and Wockhardt, among others to announce quarterly earnings today

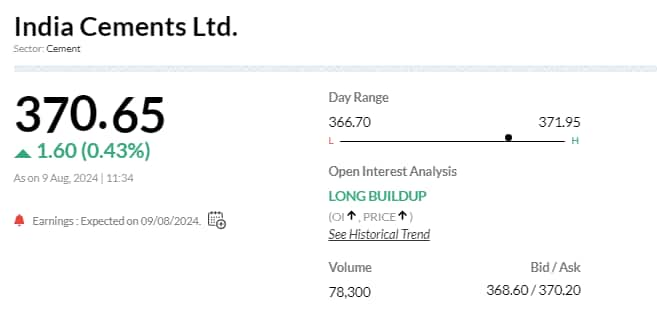

Grasim Industries, Alkem Laboratories, Honasa Consumer, Siemens, Zydus Lifesciences, Apollo Micro Systems, Bajaj Consumer Care, Balkrishna Industries, Bharat Dynamics, Berger Paints India, Concord Biotech, Engineers India, General Insurance Corporation of India, India Cements, Inox Wind, IRB Infrastructure Developers, Jubilant FoodWorks, Info Edge India, SJVN, Sundaram-Clayton, Sun TV Network, Suven Pharmaceuticals, Trent, and Wockhardt will release their quarterly earnings on August 9.

-330

August 09, 2024· 12:22 IST

Sensex Today | Aurobindo Pharma, Advanced Enzyme, APL Apollo Tubes, among others to announce results on August 10

Aurobindo Pharma, Advanced Enzyme Technologies, APL Apollo Tubes, EMS, Finolex Cables, Flair Writing Industries, Jyoti CNC Automation, Lumax Auto Technologies, Metropolis Healthcare, PNC Infratech, Stove Kraft, TVS Electronics, West Coast Paper Mills, and Zuari Industries will announce their June quarter earnings on August 10.

-330

August 09, 2024· 12:21 IST

Stock Market LIVE Updates | SJVN Subsidiary commissions 90 MW Omkareshwar Floating Solar Project

Subsidiary SJVN Green Energy has commissioned the 90 MW Omkareshwar Floating Solar Project. With the commissioning of this project, the total installed capacity of SJVN has increased to 2,466.50 MW.

-330

August 09, 2024· 12:16 IST

Brokerage Call | Citi keeps sell rating on GSPL, target raises to Rs 315

1QFY25 below expectations on both volumes & tariffs

Transmission vols increased 9 percent QoQ To 36 mmscmd, 6 percent below our estimates

Realised tariffs were also below well expectations.

Lower our FY25-27e standalone EBITDA estimate by 1-2 percent on minor adjusted to our volume & tariff estimate

Target hikes as we mark-to-market the value of the company’s holding in GGAS

-330

August 09, 2024· 11:54 IST

Sensex Today | BSE Bank index up nearly 1%; Federal Bank, Axis Bank, Canara Bank top cobtributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Federal Bank | 196.80 | 1.55 | 97.83k |

| Axis Bank | 1,152.70 | 1.32 | 115.61k |

| Canara Bank | 108.55 | 1.26 | 667.24k |

| HDFC Bank | 1,660.00 | 1.09 | 163.08k |

| Yes Bank | 24.17 | 1.05 | 6.63m |

| ICICI Bank | 1,174.05 | 0.81 | 87.19k |

| Bank of Baroda | 242.95 | 0.7 | 177.54k |

| SBI | 811.60 | 0.49 | 187.26k |

| IndusInd Bank | 1,351.20 | 0.25 | 40.99k |

| Kotak Mahindra | 1,774.90 | 0.12 | 53.43k |

-330

August 09, 2024· 11:46 IST

Baba Kalyani of Bharat Forge to CNBC-TV18

#1 Executed Rs 1,200-1,300 crore defence orders in FY24

#2 Will execute Rs 2,200 crore defence orders in FY25

#3 We are going to launch more than 30-40 products in defence in the near future

#4 We want to expand our Indian manufacturing, hence will raise funds

#5 CV business is slow due to headwinds in Europe & US

#6 Expect CV business to bounce back in a big way next year

#7 Overseas subsidiaries will be profitable next year

-330

August 09, 2024· 11:40 IST

July Mutual Fund Data:

#1 Net equity inflow at Rs 37,082.4 crore vs Rs 40,573 crore, MoM

#2 Large cap fund inflow at Rs 670 crore vs Rs 970.5 crore, MoM

#3 Small Cap fund inflow at Rs 2,109.2 crore vs Rs 2,263 crore, MoM

#4 Midcap fund inflow at Rs 1,644.2 crore vs Rs 2,528 crore, MoM

-330

August 09, 2024· 11:39 IST

Earnings Alert | India Cements total income drops to Rs 1,042 crore in Q1FY25 vs Rs 1,443 in Q1FY24

Net profit at Rs 58 crore in Q1FY25 from a loss of Rs 87 crore in Q1FY24

-330

August 09, 2024· 11:38 IST

Sensex Today | Nifty major indices trade higher

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 24347.200.95 | 12.04-1.50 | -0.3524.01 |

| NIFTY BANK | 50501.500.69 | 4.57-1.65 | -3.9312.52 |

| NIFTY Midcap 100 | 57233.800.97 | 23.93-1.17 | 0.2750.47 |

| NIFTY Smallcap 100 | 18458.700.83 | 21.89-1.82 | -2.6356.10 |

| NIFTY NEXT 50 | 72403.200.8 | 35.73-1.26 | -1.9861.08 |

-330

August 09, 2024· 11:36 IST

Earnings watch | India Cements Q1 consolidated net profit at Rs 58.5 crore Versus loss of Rs 87.4 crore, YoY

-330

August 09, 2024· 11:29 IST

Stock Market LIVE Updates | Markets can see time-wise correction, says Sridhar Sivaram of Enam Holdings

In a conversation with CNBC-TV18, Sridhar Sivaram, Investment Director at Enam Holdings highlighed the following points:

#1 Market could see a time correction

#2 Bit cautious at this stage, market has to absorb a lot of negative global news

#3 Macro environment looks stable right now

#4 Expect credit cost to go up by 25-30 bps this year

#5 Think financial sector earnings will be muted this year with 8-10% growth

#6 Think India is underinvested in power; bullish on power equipment space

#7 Power demand will go up multi-fold fuelled by AI & data centers

-330

August 09, 2024· 11:17 IST

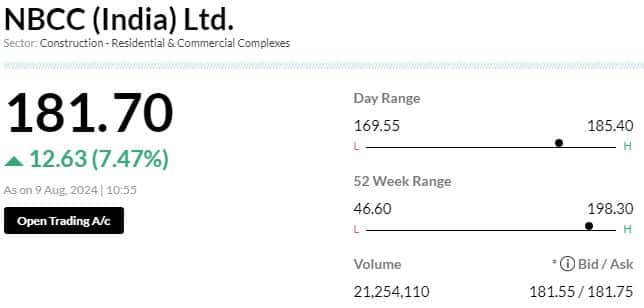

Stock Market LIVE Updates | NBCC shares rise 7% as firm gets Rs 15,000-crore order from Srinagar Development Authority

NBCC shares surged 7 percent on August 9 after the firm said it received Rs 15,000-crore order from Srinagar Development Authority. In a stock exchange filing, NBCC said name of work is "development of Satellite Township spread over 406 acres at Rakh-e-Gund Akshah, Bemina, Srinagar ( J&K)". READ MORE

-330

August 09, 2024· 11:11 IST

Stock Market LIVE Updates | LIC mulls higher ticket size products to absorb impact of new surrender value norms

Insurance giant Life Insurance Corporation of India (LIC) expressed confidence in managing the impact of the new surrender value norms. In their Q1FY25 investors' conference call, the management outlined plans to develop higher ticket size products with lower surrender value behavior to minimise any impact on margins. READ MORE

-330

August 09, 2024· 11:01 IST

Markets@11 | Sensex up 780 pts, Nifty at 24350

-330

August 09, 2024· 10:55 IST

Stock Market LIVE Updates | NBCC bags order worth Rs 15000 crore

Srinagar Development Authority has awarded contract worth Rs 15000 crore for Development of Satellite Township spread over 406 acres at Rakh-e-Gund Akshah, Bemina, Srinagar ( J&K).

-330

August 09, 2024· 10:54 IST

Stock Market LIVE Updates | Va Tech Wabag shares trade lower despite profit rises

#1 Profit increases 10.5 percent to Rs 54.8 crore Vs Rs 49.6 crore, YoY

#2 Revenue rises 13.3 percent to Rs 626.5 crore Vs Rs 552.8 crore, YoY

-330

August 09, 2024· 10:50 IST

Stock Market LIVE Updates | Container Corporation shares fall post Q1 results

#1 Profit grows 5.8 percent to Rs 259.4 crore Vs Rs 245.2 crore, YoY

#2 Revenue rises 9.4 percent to Rs 2,103.1 crore Vs Rs 1,922.8 crore, YoY

-330

August 09, 2024· 10:45 IST

Stock Market LIVE Updates | IRCON International shares fall 2% post Q1 earnings

#1 Profit grows 19.6 percent to Rs 224 crore Vs Rs 187.4 crore, YoY

#2 Revenue declines 17.2 percent to Rs 2,287.1 crore Vs Rs 2,763.8 crore, YoY

-330

August 09, 2024· 10:41 IST

Eicher Motors zooms 6% as investors unfazed by cautious brokerage views

Royal Enfield sold 2,27,736 motorcycles in Q1 FY 2024-25, slightly up from the 2,25,368 motorcycles sold during the same period in FY 2023-24. ...Read More

-330

August 09, 2024· 10:36 IST

Sensex Today | Nifty Bank index pup 0.5%; IDFC First Bank, Federal Bank, Axis Bank, among top contributors

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IDFC First Bank | 73.06 | 1.43 | 8.60m |

| Federal Bank | 195.97 | 1.13 | 1.41m |

| Axis Bank | 1,150.95 | 1.12 | 2.19m |

| HDFC Bank | 1,656.40 | 0.83 | 4.76m |

| ICICI Bank | 1,174.10 | 0.82 | 1.79m |

| Bank of Baroda | 243.05 | 0.7 | 3.54m |

| Bandhan Bank | 200.29 | 0.56 | 2.80m |

| SBI | 811.95 | 0.48 | 3.24m |

| Kotak Mahindra | 1,775.35 | 0.15 | 576.14k |

| PNB | 114.11 | 0.08 | 7.05m |

-330

August 09, 2024· 10:34 IST

Stock Market LIVE Updates | SAIL share price falls 2% on weak earnings

#1 Profit sinks 61.6 percent to Rs 81.5 crore Vs Rs 212.5 crore, YoY

#2 Revenue falls 1.5 percent to Rs 23,997.81 crore Vs Rs 24,359.1 crore, YoY

#3 Exceptional loss of Rs 311.8 crore due to employee allowances payment Vs Nil, YoY

#4 Other income drops to Rs 177 crore Vs Rs 463.7 crore, YoY

-330

August 09, 2024· 10:31 IST

Stock Market LIVE Updates | Gateway Distriparks gets board approval to appoint Sundaram Aiyer as CFO

The company has received board approval for the appointment of Sundaram Aiyer as Chief Financial Officer, effective August 8.

-330

August 09, 2024· 10:25 IST

Afcom Holdings makes a stellar debut, lists at 90% premium on BSE SME platform

The funds are earmarked for acquiring two new aircraft on a lease basis, repaying or prepaying existing borrowings, meeting working capital requirements, and covering general corporate expenses....Read More

-330

August 09, 2024· 10:23 IST

Shivani Nyati, Head of Wealth, Swastika Investmart

Ola Electric Mobility Ltd., the electric vehicle pioneer, made a its debut on the stock market, listing at its issue price of Rs 76 per share. This flat performance, coupled with a mere 4.45 times subscription, underscores the challenges the company faces in gaining investor confidence.

While Ola Electric's vision for the EV market is ambitious, the company's current financial performance, marked by consistent losses, and the highly competitive landscape have tempered investor enthusiasm. The negative grey market sentiment prior to listing further reflected these concerns.

The flat listing highlights the need for Ola Electric to demonstrate a clear path to profitability and navigate the complexities of the EV market effectively. Investors are suggested to exit and book a minor profit, but those who want to take risks may hold their position by keeping a stop loss below 70.

-330

August 09, 2024· 10:22 IST

Sensex Today | Hindalco Industries, BPCL, Alkem Laboratories, HPCL, among others stock turn ex-dividend

Hindalco Industries, Bharat Petroleum Corporation, Alkem Laboratories, Hindustan Petroleum Corporation, Arvind Fashions, ASK Automotive, B&A Packaging India, Bombay Burmah Trading, Bharat Heavy Electricals, Black Rose Industries, CEAT, City Union Bank, Cube Highways Trust, Endurance Technologies, Equitas Small Finance Bank, Indag Rubber, International Travel House, Jammu & Kashmir Bank, JK Lakshmi Cement, Joindre Capital Services, Kalyan Jewellers India, Kaycee Industries, KEC International, Kolte-Patil Developers, KPIT Technologies, Mafatlal Industries, Magna Electro Castings, Mangalore Refinery & Petrochemicals, Nath Bio-Genes, Netweb Technologies India, QGO Finance, Ramco Cements, Ramco Industries, REC, R K Swamy, Sportking India, TAJGVK Hotels & Resorts, Tega Industries, Vaibhav Global, Varun Beverages, Wonderla Holidays

-330

August 09, 2024· 10:17 IST

Stock Market LIVE Updates | Indus Towers stock trades ex-buyback

-330

August 09, 2024· 10:15 IST

Stock Market LIVE Updates | Swiss Military Consumer Goods stock trades ex-rights

-330

August 09, 2024· 10:08 IST

Listing Today | Ola Electric Mobility lists at 76 per share

The Rs 6,146-crore Ola Electric Mobility IPO has received healthy response from investors, with the issue garnering a subscription of 4.27 times.

Investors picked 198.79 crore equity shares against the offer size of 46.51 crore shares, subscription details from stock exchanges showed. Both Qualified Institutional Buyers (QIBs) as well as the retail category provided maximum support, subscribing 5.31 times and 3.92 times the allotted quota respectively, while non-institutional investors (High Networth Individuals) bid 2.4 times the portion set aside for them, on August 6.

Employees also recorded healthy participation in the public issue, buying 11.99 times the reserved portion. The electric vehicle maker has reserved Rs 5.5 crore worth shares for its employees who will get these shares at a discount of Rs 7 per share to the final issue price.

-330

August 09, 2024· 10:06 IST

Sensex Today | Nifty Smallcap 100 index up 1%; CDSL, Edelweiss Financial, Cochin Shipyard, among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Edelweiss | 78.16 | 9.62 | 10.28m |

| Cochin Shipyard | 2,443.10 | 5.66 | 1.66m |

| CDSL | 2,581.55 | 5.23 | 1.49m |

| Godfrey Phillip | 4,334.85 | 5.02 | 112.53k |

| Avanti Feeds | 694.90 | 4 | 558.22k |

| CAMS | 4,416.00 | 3.79 | 263.81k |

| MCX India | 4,359.90 | 3.49 | 245.85k |

| Mazagon Dock | 5,053.75 | 3.45 | 970.47k |

| Just Dial | 1,286.05 | 3.41 | 386.95k |

| Affle India | 1,528.35 | 3.11 | 816.01k |

-330

August 09, 2024· 10:03 IST

Sensex Today | Suzlon Energy crosses Rs 1 lakh crore market cap

-330

August 09, 2024· 10:02 IST

Markets@10 | Sensex up 870 points, Nifty above 24350

-330

August 09, 2024· 09:55 IST

Brokerage Call | Jefferies maintain 'underperform' rating on Bharat Forge, target raises to Rs 1,200 from Rs 1,075

#1 Defence business is scaling well & subsidiaries showing signs of improvement

#2 Like company’s structural initiatives but concerned on cyclical headwinds in exports

#3 Valuations are rich at current levels

#4 Raise FY25-27 EPS estimates by 2-3 percent

-330

August 09, 2024· 09:52 IST

Analyst Call Tracker: TCS, HCLTech most upgraded IT stocks; brokerages optimistic on long-term recovery

HCLTech, despite a revenue decline and margin drop, remains hopeful for a Q2FY25 rebound, with expectations of sequential growth across most verticals, except financial services....Read More