On 1st August 2024, Nifty 50 made a new all-time high by touching the 25,000 levels but shortly after that, the market witnessed increased levels of volatility.

This brings us to the question: Is the market overvalued?

India is one of the top performing markets globally in a 1-year period even after adjusting for USD.

The number of unique investors in India has crossed the 9-cr mark with a base of just 3 crores in 2020.

Rapid growth of retail investors has led to a significant rise in the monthly SIPs which crossed the ₹20,000 crore per month mark.

At these all-time high levels let us look at the market valuations.

How can investors quantify market valuations? The Price to Earnings ratio is one indicator to get an idea of market valuations.

The PE ratio is a simple division of the price per share and earnings per share. This ratio moves in a range. A higher value indicates a higher valuation and lower value indicates undervaluation.

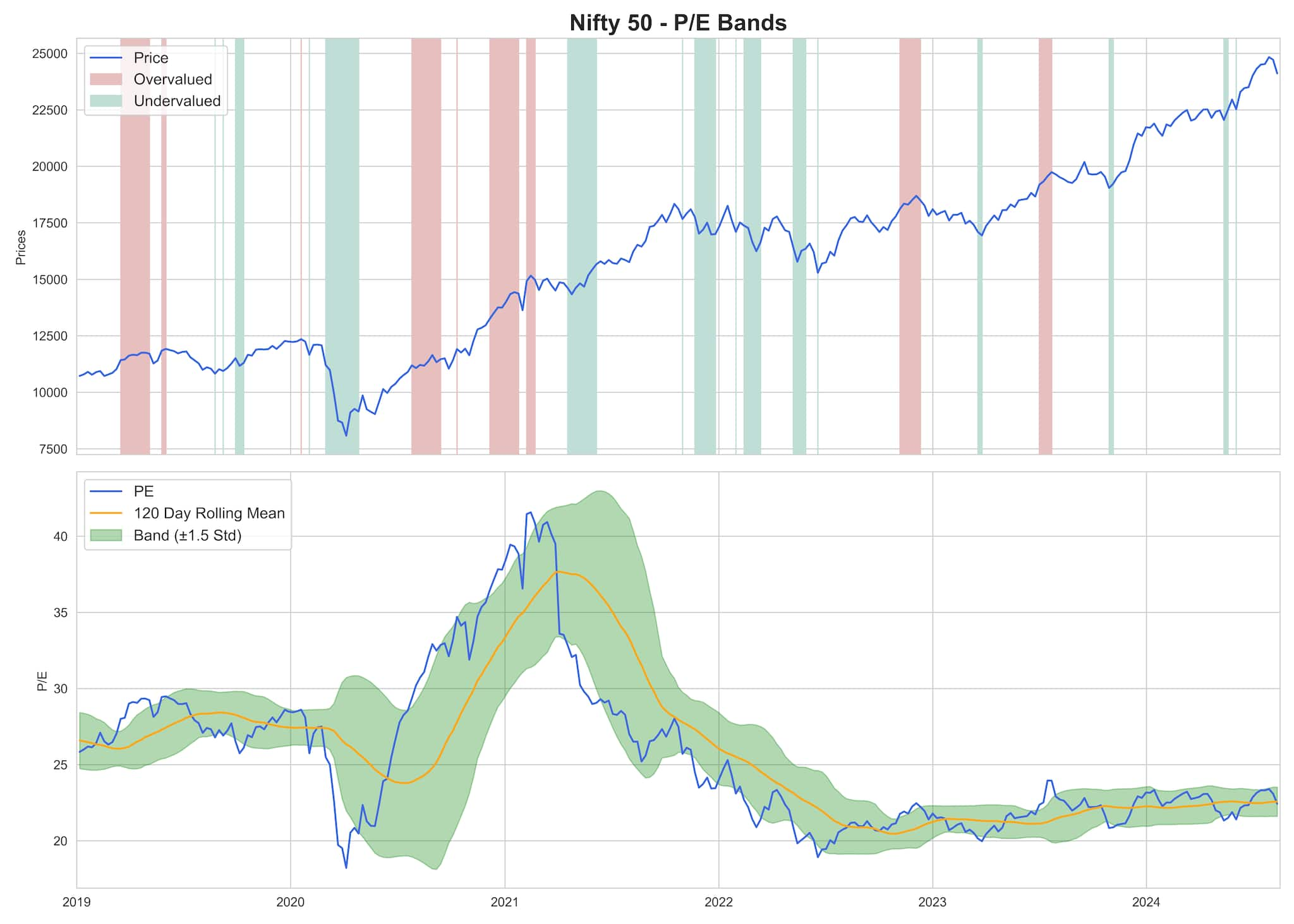

This is the Nifty 50 data since 2019 along with PE ratio bands of high and low valuations.

As you can see that on an Index level the Nifty 50 seems to be at higher price levels however not yet in the overvalued zone from a PE ratio perspective. Even though the price is high, the earnings have also grown which implies that the market is still not in the overvalued territory.

To dive deeper into the market let us look at the sector level valuations to see where there could be more room for upside.

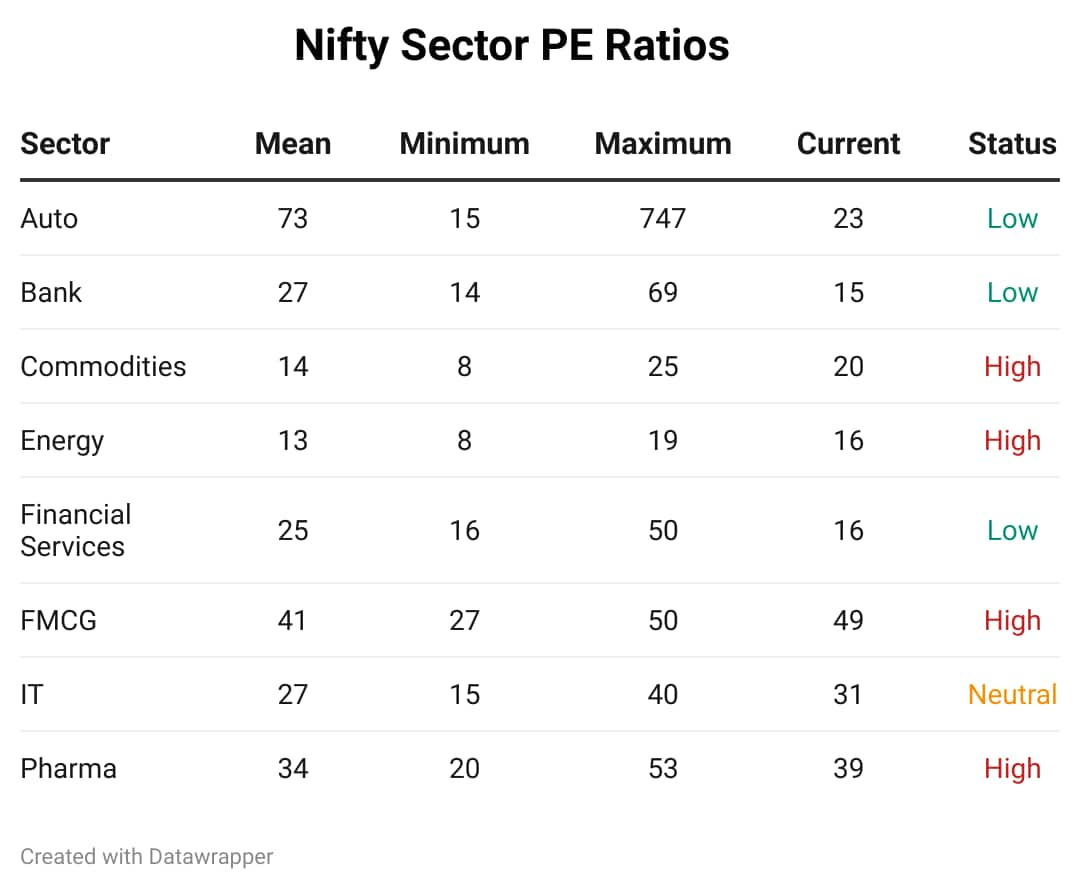

Below is the 5-year PE ratio statistics for different sectors:

It can be observed that Auto, Bank and Financial Services sectors are trading below their 5-year mean whereas, Commodities, Energy, FMCG and Pharma sectors are trading above their 5-year mean.

However, the point to note while looking at the data is that in 2020 the PE ratio values had shot up to unrealistic levels which distort the averages.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.