The spot price of gold was hovering just above $4,100 per ounce for 24-carat purity on November 20, as of 6:40 a.m. That's up 0.49 percent from yesterday's close at $4,080.

"Gold prices pared gains after the release of the Fed’s latest meeting minutes, with market participants keeping an eye on update regarding Japan and economic data points which is again being delayed. A sharply lower the US trade deficit and reduced rate-cut expectations have strengthened the Dollar Index back toward the 100 mark, limiting bullion’s upside," said Manav Modi, Precious Metal Research and Analyst, Motilal Oswal Financial Services Ltd.

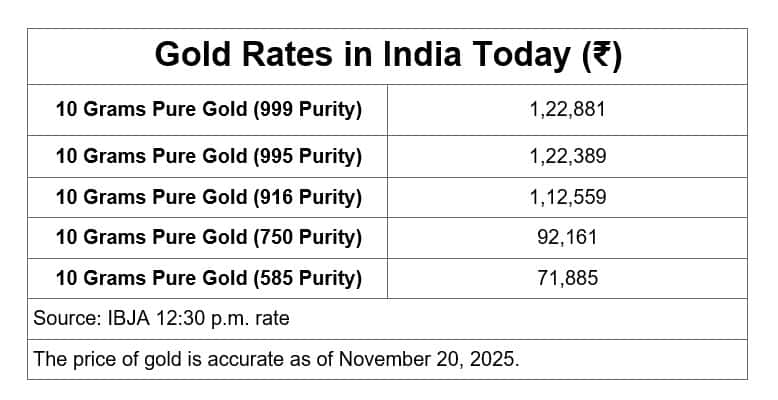

In India, the price of physical yellow metal stood at Rs 1,22,881 per 10 grams of 999 purity, as per Indian Bullion and Jewelers Association (IBJA) in their 12:30 p.m. rate session. That’s around 0.81 percent dip from yesterday’s close at Rs 1,22,180 in the 18:30 p.m. rate session.

The price of gold in the domestic market peaked at Rs 1,26,554 per 10 grams of 999 purity on November 13, 2025.

“Prices for 24-carat gold have increased slightly, supported primarily by wedding season purchases and investors' continued interest. While concerns about getting interest-rate cuts globally have decreased, the demand for the yellow metal remains strong. Jewelry purchases are expected to increase moderately due to weddings, and investors should look at gold as a hedge against uncertainty. The upward movement is not extreme but exists due to the domestic purchasing sustained by precautionary global sentiment,” said Aksha Kamboj, Vice President, IBJA.

Silver, on the other hand, continues to shine not just as a household essential but also as a key investment and industrial metal. The spot price of silver was hovering just above $51. That is down 5.56 percent from its highest peak on November 13, when it was trading just around $55.

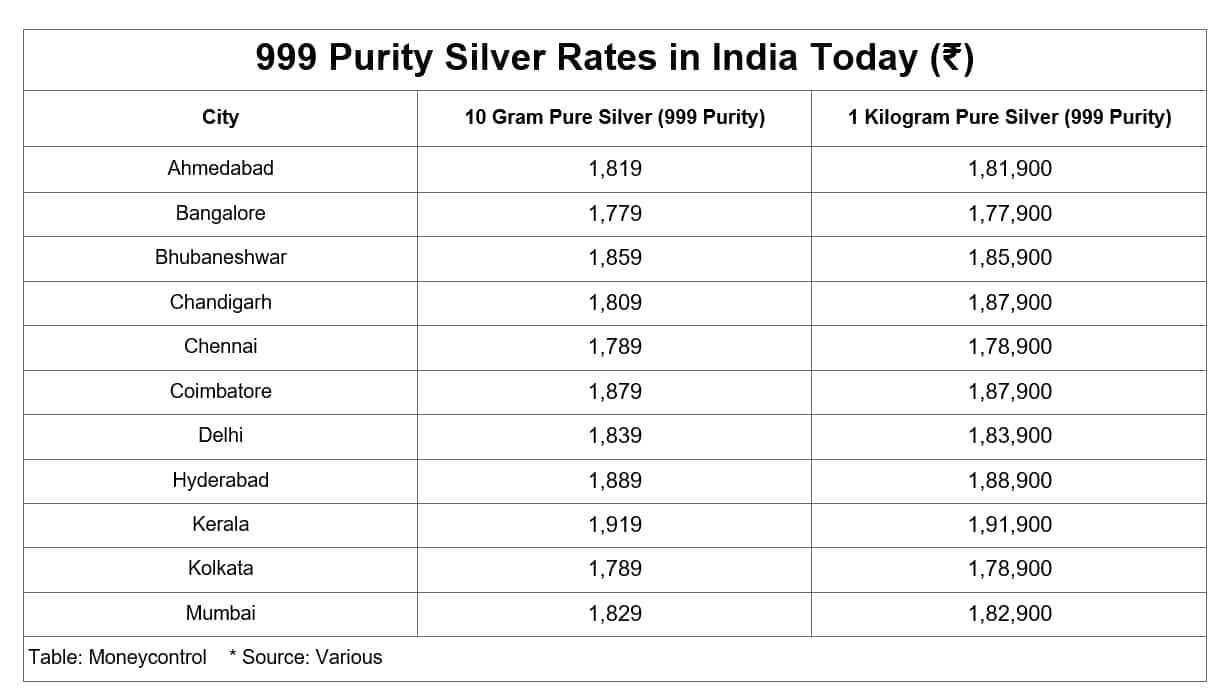

In the domestic market, the price of silver stood at Rs 1,55,840 per kilogram of 999 purity on November 20, as of 12:30 p.m. That’s down 1.44 percent from yesterday’s close at Rs 1.58,120 in the 18:30 p.m., according to IBJA data on precious metal prices.

The price of silver in the domestic market peaked at Rs 1,63,808 per 1 kg of 999 purity on November 13, 2025.

“Global cues remain mixed and there will likely be volatility; however, the white-metal market is holding steady. While it is a small bump, a combination of safe-haven demand and seasonal interest will help support silver's present levels,” said Kamboj.

Silver prices vary by city. Check out below to see the prices of 999 purity silver where you live.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.