Closing Bell: Nifty below 22,500, Sensex falls 733 points; metals outshine

-330

May 03, 2024· 16:20 IST

In the volatile session the Indian benchmark indices ended lower with Nifty below 22,500 amid selling across the sectors barring metals. At close, At close, the Sensex was down 732.96 points or 0.98 percent at 73,878.15, and the Nifty was down 172.40 points or 0.76 percent at 22,475.80.

We wrap up today's edition of the Moneycontrol live market blog, and will be back Monday morning with all the latest updates and alerts. Please visit www.moneycontrol.com/markets/global-indices for all the global market action.

-330

May 03, 2024· 16:19 IST

-330

May 03, 2024· 16:11 IST

Nifty likely to trade between 22,160- 22,770, says Aditya Gaggar, Director of Progressive Shares

Both the timeframes i.e. Weekly (DOJI) and Daily (Bearish Engulfing) indicate a trend reversal in the Index with a negative divergence in the RSI. We believe that the Index is likely to oscillate in the range of 22,160- 22,770.

With a Shooting Star candlestick pattern, BankNifty reversed from the higher end of the rising channel; suggesting a correction in it. The Auto and Metal counters are moving on expected lines which boosts our confidence to remain bullish on the same.

From the Energy segment, Coal India- Inverted Head & Shoulder Breakout, PowerGrid- Symmetrical Triangle Breakout, Tata Power-Flag, and Pole Breakout.

A strong outperformance can be expected from the Pharma sector once it gives a consolidation breakout. Extreme volatility can be anticipated due to result-oriented activities as well as the progress of the general election.

-330

May 03, 2024· 16:02 IST

Sensex Today | Vinod Nair, Head of Research, Geojit Financial Services

Profit booking and a degree of caution ahead of the release of the US non-farm payroll resulted in selling pressure in the market. However, the absence of significant negative surprises in Q4 earnings thus far, along with a decline in oil prices, might help to mitigate the downside. Though the correction was broad-based, the large-cap stock was the key underperformer due to the moderation of FII's exposure to the domestic market.

-330

May 03, 2024· 16:01 IST

Sensex Today | Ajit Mishra – SVP, Research, Religare Broking

Once again, the markets experienced significant volatility, ending the day with a loss of nearly one percent. Despite a positive start driven by strong global cues, profit-taking in heavyweight stocks not only wiped out early gains but also pushed the index into negative territory. Ultimately, the Nifty settled around the 22,456.65 mark, down by 0.85%. Major sectors such as auto, IT, and realty were among the primary losers. Additionally, broader indices also saw a decline of almost half a percent each.

The sharp drop in the index has nullified the gains made over the past four sessions, although it managed to hold above the support zone represented by the short-term moving average i.e. 20 DEMA. We recommend a selective approach and suggest considering hedged positions if the Nifty fails to maintain the 22,400 level. Besides domestic factors, it's crucial for traders to closely monitor the performance of the US markets for further guidance

-330

May 03, 2024· 15:50 IST

Market This Week

#1 Market posts gains for 2nd straight week, Sensex & Nifty up 0.3 percent each

#2 Broader markets outperform this week, Nifty Bank up 2 percent & Midcap index up 1 percent

#3 25 out of 50 Nifty stocks give positive returns, M&M, Grasim & Coal India top gainers

-330

May 03, 2024· 15:32 IST

Currency Check | Rupee closes marginally higher

Indian rupee ended marginally higher at 83.43 per dollar on Friday versus previous close of 83.47.

-330

May 03, 2024· 15:30 IST

Market Close | Sensex ends 770 pts lower, Nifty below 22,500

In the volatile session the Indian benchmark indices ended lower with Nifty below 22,500 amid selling across the sectors barring metals.

At close, the Sensex was down 732.96 points or 0.98 percent at 73,878.15, and the Nifty was down 172.40 points or 0.76 percent at 22,475.80. About 1241 shares advanced, 2013 shares declined, and 79 shares unchanged.

Biggest Nifty losers were L&T, Maruti Suzuki, Reliance Industries, Nestle India and Bharti Airtel, while gainers included Coal India, Grasim Industries, ONGC, Dr Reddy's Laboratories and Hindalco Industries.

Among sectors, except metal, all other sectoral indices ended in the red with capital goods, realty, telecom and PSU Bank down 1 percent each, while oil & gas, auto, Information Technology and Media down 0.5 percent each.

The broader indices also came under pressure after hitting fresh highs in the early part of the session. The BSE midcap index fell 0.2 percent and smallcap index down 0.5 percent.

-330

May 03, 2024· 15:23 IST

Sensex Today | Nifty Bank index recovers 270 points from day's low

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| SBI | 832.55 | 836.20 820.00 | 1.53% |

| PNB | 135.90 | 139.30 134.25 | 1.23% |

| Federal Bank | 166.00 | 169.50 164.00 | 1.22% |

| AU Small Financ | 645.00 | 655.55 639.50 | 0.86% |

| Axis Bank | 1,143.45 | 1,163.25 1,134.10 | 0.82% |

| HDFC Bank | 1,518.50 | 1,540.60 1,507.20 | 0.75% |

| Bank of Baroda | 276.05 | 282.50 274.25 | 0.66% |

| IDFC First Bank | 80.95 | 82.15 80.50 | 0.56% |

| IndusInd Bank | 1,481.05 | 1,517.95 1,473.05 | 0.54% |

| ICICI Bank | 1,141.45 | 1,157.40 1,135.45 | 0.53% |

-330

May 03, 2024· 15:20 IST

Brokerage Call | Morgan Stanley keeps 'overweight' rating on Havells, target Rs 1,826 per share

#1 Earnings were 15-20 percent above estimates

#2 Core revenue growth should be stronger in FY25-26, driven by real estate cycle and C&W capacity

#3 Company’s strategy of ‘deeper into home’ is a sustainable growth driver

-330

May 03, 2024· 15:18 IST

-330

May 03, 2024· 15:16 IST

Sensex Today | 1.46 million shares of Gujarat State Petronet traded in a bunch: Bloomberg

-330

May 03, 2024· 15:12 IST

Sensex Today | BSE Metal index up 0.6%; Coal India, NMDC, SAIL top gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coal India | 473.50 | 4.47 | 1.81m |

| NMDC | 268.60 | 3.93 | 851.27k |

| SAIL | 167.65 | 1.33 | 4.36m |

| Hindalco | 647.15 | 0.9 | 128.58k |

| Vedanta | 413.50 | 0.68 | 697.31k |

| Jindal Stainles | 733.95 | 0.01 | 43.67k |

-330

May 03, 2024· 15:10 IST

Brokerage Call | Jefferies maintains 'buy' rating on ONGC, target Rs 390 per share

#1 Investor interactions indicate broad consensus on better profitability and attractive valuation

#2 Key concerns include skepticism around production growth

#3 Key concerns include whether KG Basin production will be profitable given high Opex

#4 See ramp-up in KG Basin production in Q3FY25

-330

May 03, 2024· 15:08 IST

Geopolitical tension remain in focus, says Prashanth Tapse, Senior VP (Research), Mehta Equities

India VIX is trading high near the 15 level, indicating risk returning back to market after continuous rally of 1000 points in benchmark Nifty. I feel geopolitical tension would make headlines again giving traders an option to go short on markets.

Overall, Q4 earnings are neutral to positive and not so impressive. There are few reports which suggest that FIIs have reduced holding in large caps stocks like HDFC Bank and ITC. For the short term the trend remains cautious and focus would be on fresh geopolitical headlines. Hence, we advise traders to remain light on positions.

-330

May 03, 2024· 15:05 IST

Market at 3 PM | Nifty below 22,500, Sensex down 760 points

The Sensex was down 761.68 points or 1.02 percent at 73,849.43, and the Nifty was down 185.20 points or 0.82 percent at 22,463.00. About 1179 shares advanced, 2056 shares declined, and 80 shares unchanged.

-330

May 03, 2024· 15:03 IST

Sensex Today | BSE Smallcap index down 0.6%; Coforge, Voltamp Transformers, Bliss GVS Pharma top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| COFORGE LTD. | 4,522.00 | -9.31 | 126.94k |

| Voltamp Trans | 9,982.45 | -8.96 | 9.03k |

| Bliss GVS | 119.05 | -7.86 | 90.90k |

| Arvind Smart | 670.00 | -7.62 | 15.28k |

| PDS | 431.40 | -7.49 | 18.54k |

| Aptech | 240.90 | -6.88 | 82.88k |

| Lloyds Engineer | 64.05 | -6.78 | 3.32m |

| Kirloskar Pneum | 1,073.70 | -6.75 | 30.12k |

| Dhani Services | 51.70 | -6.37 | 859.73k |

| Genesys Int | 572.50 | -5.98 | 40.49k |

-330

May 03, 2024· 15:01 IST

Sensex Today | Europen markets trade 0.5% higher

-330

May 03, 2024· 14:59 IST

Sensex Today | BSE Capital Goods index down 1%; Carborundum Universal, GMR Airports, L&T top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Carborundum | 1,431.00 | -5.1 | 22.71k |

| GMR Airports | 85.20 | -3.31 | 1.23m |

| Larsen | 3,496.30 | -2.82 | 91.14k |

| Bharat Forge | 1,246.65 | -2.2 | 18.43k |

| Rail Vikas | 283.05 | -1.97 | 375.92k |

| SKF India | 4,626.20 | -1.93 | 877 |

| AIA Engineering | 3,727.45 | -1.42 | 4.05k |

| Finolex Cables | 1,051.60 | -1.27 | 9.07k |

| Grindwell Norto | 2,097.80 | -1.25 | 1.10k |

| Praj Industries | 541.25 | -1.23 | 64.22k |

-330

May 03, 2024· 14:54 IST

Expect rupee to trade with a negative bias, says Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas

Indian Rupee gained by 6 paise on Friday on weak US Dollar and a decline in crude oil prices. However, weak domestic markets and FII outflows capped sharp gains. US Dollar declined on strong Yen.

Economic data from US was supportive for the Dollar. Weekly unemployment claims, trade balance and factory orders were better than forecast. Yen rose to a three-week high as Japanese authorities intervened in the forex markets to support the falling Yen.

We expect Rupee to trade with a slight negative bias on weak domestic markets and selling pressure from foreign investors. However, weak tone and soft US Dollar may support the Rupee at lower levels.

Traders may remain cautious ahead of non-farm payrolls report and ISM services PMI data from US today. Encouraging non-farm payrolls may support the Dollar while dismal data may weigh on the greenback. USDINR spot price is expected to trade in a range of Rs 83.20 to Rs 83.60.

-330

May 03, 2024· 14:51 IST

Sensex Today | HFCL Q4 net profit jumps 53.2% at Rs 110 crore versus Rs 71.8 crore, YoY

-330

May 03, 2024· 14:48 IST

Stock Market LIVE Updates | JSW Infrastructure shares gain 2% as Q4 profit jumps 10%

#1 Net profit up 10 percent at Rs 330 crore versus Rs 300 crore, YoY

#2 Revenue up 20 percent at Rs 1,096.4 crore versus Rs 915.3 crore, YoY

-330

May 03, 2024· 14:45 IST

Brokerage Call | Morgan Stanley keeps 'equal-weight' call on Federal Bank, target raised to Rs 180

#1 Core PPoP growth was 4 percent YoY adjusted for one-offs in costs/fees

#2 Asset quality was strong and credit costs stayed low

#3 RoAs Should stay strong, with no likely rate cuts in the near term

#4 Valuation appears fair

-330

May 03, 2024· 14:42 IST

Sensex Today | Oil prices set for steepest weekly drop in 3 months

Oil prices edged higher on Friday, but headed for their steepest weekly loss in three months as uncertainty about demand and high interest rates drove a sell-off limited by the prospect OPEC+ will continue to curb output.

Brent crude futures for July rose 31 cents, or 0.4%, to $83.98 a barrel. US West Texas Intermediate crude for June was up 26 cents, or 0.3%, to $79.21 per barrel.

-330

May 03, 2024· 14:38 IST

Sensex Today | Kotak Mahindra Bank hits 52-week low

-330

May 03, 2024· 14:38 IST

Brokerage Call | Jefferies keeps 'buy' rating on Adani Ports, target raised to Rs 1,640

#1 Q4 EBITDA 5 percent lower than expectations as realisations were tad lower

#2 Management commentary was confident on double digit growth

#3 FY25 volume guidance at 460-480 mt (10-14 percent rise YoY) is in line

#4 Market share gains continue

#5 Dedicated freight corridor commissioning at Mundra also helping

-330

May 03, 2024· 14:35 IST

Sensex Today | Market at 2.30 PM

The Sensex was down 945.40 points or 1.27 percent at 73,665.71, and the Nifty was down 236.80 points or 1.05 percent at 22,411.40. About 1018 shares advanced, 2209 shares declined, and 73 shares unchanged.

Reliance Industries, L&T, Maruti Suzuki, Nestle India and Bharti Airtel were among major losers on the Nifty, while gainers were Coal India, Dr Reddy's Labs, Bajaj Finance, Grasim Industries and ONGC.

BSE midcap and smallcap indices down 0.5 percent each. except metal, all other sectoral indices are trading in the red.

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Grasim | 2484.80 | 2484.80 | 2,480.00 |

| ONGC | 292.95 | 292.95 | 286.15 |

| Shriram Finance | 2658.00 | 2658.00 | 2,588.35 |

| M&M | 2210.00 | 2210.00 | 2,189.45 |

| SBI | 836.20 | 836.20 | 827.45 |

| Tata Steel | 170.75 | 170.75 | 166.55 |

| NTPC | 380.40 | 380.40 | 361.95 |

| Company | 52-Week Low | Day’s Low | CMP |

|---|---|---|---|

| Kotak Mahindra | 1587.90 | 1587.90 | 1,552.95 |

-330

May 03, 2024· 14:32 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Infosys | 1,411.00 | 1,424.30 1,403.10 | -0.93% |

| HUL | 2,210.70 | 2,235.55 2,204.00 | -1.11% |

| SBI | 826.55 | 836.00 820.10 | -1.13% |

| Sun Pharma | 1,517.20 | 1,537.10 1,506.95 | -1.29% |

| M&M | 2,181.00 | 2,210.00 2,175.35 | -1.31% |

| ITC | 432.75 | 439.90 431.50 | -1.63% |

| Wipro | 453.80 | 461.65 453.30 | -1.7% |

| ICICI Bank | 1,137.70 | 1,157.55 1,135.50 | -1.71% |

| Power Grid Corp | 310.60 | 316.05 309.95 | -1.72% |

| Axis Bank | 1,141.00 | 1,162.60 1,137.50 | -1.86% |

-330

May 03, 2024· 14:32 IST

Brokerage Call | Morgan Stanley keeps 'overweight' rating on Dabur, target Rs 604 per share

#1 Q4 broadly in line

#2 Continued share gains & rural growth outpacing urban growth are positives

#3 Weaker top-line growth momentum was a negative

-330

May 03, 2024· 14:24 IST

Earnings Alert | Adani Green Energy net profit, revenue falls in Q4FY24

Adani Green Energy reported its fourth-quarter consolidated net profit after tax at Rs 310 crore, a decrease from Rs 507 crore in the year-ago period. Its revenue stood at Rs 2,810 crore rupees compared to Rs 2,990 crore in the previous year, while EBITDA was recorded at Rs 1,850 billion crore, down from Rs 2,264 crore in Q4FY23. The EBITDA margin declined to 73.25 percent from 75.77 percent in the year-ago period.

-330

May 03, 2024· 14:16 IST

Earnings Alert | Go Fashion's net profit falls 13% YoY in Q4FY24

The company reported et profit at Rs 13 crore, down 13.3 percent on-year. Its revenue, however, rose 16.7 percent YoY to Rs 182 crore.

Its EBITDA jumped 13 percent YoY to Rs 54.2 crore, and margin came in at 30 percent compared to 31 percent in the year-ago period.

-330

May 03, 2024· 14:11 IST

Earnings Alert | Firstsource Solutions PAT falls 5.5% YoY to Rs 133 crore in Q4FY24

Firstsource Solutions total income rose by 6% YoY to Rs 1,673 crore in Q4FY24

-330

May 03, 2024· 14:00 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Grasim | 2484.80 | 2484.80 | 2,479.10 |

| ONGC | 292.95 | 292.95 | 285.90 |

| Shriram Finance | 2658.00 | 2658.00 | 2,600.10 |

| M&M | 2210.00 | 2210.00 | 2,176.90 |

| Tata Steel | 170.75 | 170.75 | 165.95 |

-330

May 03, 2024· 13:57 IST

-330

May 03, 2024· 13:56 IST

Brokerage Call | HSBC keeps 'buy' rating on Adani Ports, target Rs 1,560 per share

#1 FY25 guidance implies 10-14 percent growth which think is achievable

#2 Forecast 15 percent EBITDA CAGR in FY24-27

#3 FY25 estimate EBITDA is 4 percent above top-end of company’s guidance range

#4 Company has strongest ports & logistics ecosystem in our Asia transport coverage

-330

May 03, 2024· 13:53 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Grasim | 2,476.70 | 2,484.80 2,438.80 | -0.33% |

| Apollo Hospital | 5,997.20 | 6,020.00 5,960.05 | -0.38% |

| Dr Reddys Labs | 6,354.85 | 6,381.05 6,258.00 | -0.41% |

| Cipla | 1,418.75 | 1,434.00 1,415.20 | -1.06% |

| HUL | 2,210.25 | 2,235.65 2,204.00 | -1.14% |

| SBI | 826.65 | 836.20 820.00 | -1.14% |

| Infosys | 1,408.40 | 1,424.80 1,403.20 | -1.15% |

| Hero Motocorp | 4,523.85 | 4,579.95 4,516.85 | -1.22% |

| Britannia | 4,720.05 | 4,781.10 4,707.90 | -1.28% |

| Eicher Motors | 4,589.40 | 4,655.60 4,580.00 | -1.42% |

-330

May 03, 2024· 13:52 IST

-330

May 03, 2024· 13:50 IST

Stock Market LIVE Updates | Go Fashion shares fall 4% as Q4 profit declines

#1 Net Profit down 13.3 percent at Rs 13 crore versus Rs 15 crore, YoY

#2 Revenue up 16.7 percent at Rs 182 crore versus Rs 156 crore, YoY

-330

May 03, 2024· 13:48 IST

Brokerage Call | Jefferies keeps ‘buy’ rating on Bajaj Finance, target Rs 9,260

#1 RBI lifts restrictions it had imposed on company’s eCom & digital EMI cards

#2 View this positively, as resolution has come within just 6 months of imposition

#3 Company saw an impact of more than 10 percent on new loans booked & 4 percent on consol

#4 PBT in Q4 due to this & self-imposed restrictions on physical EMI cards

#5 This improves visibility of growth, see 24 percent profit CAGR over FY24-27

-330

May 03, 2024· 13:46 IST

Sensex Today | Indian Volatility Index rises 13%

-330

May 03, 2024· 13:35 IST

Sensex Today | KPI Green Energy to consider stock split

A meeting of the board of directors of KPI Green Energy is scheduled to be held on Thursday, May 23, 2024, to consider and approve the proposal for alteration in the capital of the Company by subdivision/split of existing equity shares of the Company having a face value of Rs 10 each, fully paid up.

-330

May 03, 2024· 13:33 IST

Brokerage Call | Jefferies maintains 'buy' rating on Coal India, target Rs 520 per share

#1 Q4 reported EBITDA & PAT grew 21-26 percent YoY

#2 EBITDA, PAT rise includes effect of accounting policy changes for stripping activity costs

#3 Q4 cash EBITDA, excluding noncash stripping activity adjustment, rose 14 percent YoY

#4 Q4 cash EBITDA 18 percent below estimate due to sharp QoQ rise in staff & other expenses

#5 Dispatch volumes grew 8 percent YoY while cash EBITDA/ton rose 6 percent YoY

-330

May 03, 2024· 13:30 IST

Stock Market LIVE Updates | Firstsource Solutions shares fall despite better Q4 nos

Net profit rose 3.7% at Rs 133.5 crore versus Rs 128.7 crore, and revenue up 4.6% at Rs 1,670.4 crore versus Rs 1,596.6 crore, QoQ.

-330

May 03, 2024· 13:29 IST

Stock Market LIVE Updates | Wipro to implement Independent Health's Medicare Prescription Payment Plan platform

Independent Health, the Western New York’s Medicare Advantage Plan, has selected Wipro to implement Wipro’s Medicare Prescription Payment Plan platform for the upcoming open enrollment period. The platform will help Independent Health in streamlining the payment process to seamlessly integrate these new provisions, simplifying prescription cost management for Medicare recipients in Western New York.

-330

May 03, 2024· 13:26 IST

Stock Market LIVE Updates | Raymond Q4 profit up 18%; shares trade lower

#1 Revenue up 21 percent at Rs 2,609 crore versus Rs 2,150 crore, YoY

#2 Net profit up 18 percent at Rs 229 crore versus Rs 194 crore, YoY

-330

May 03, 2024· 13:15 IST

Sensex Today | Bajaj Auto tol CNBC-TV18

-330

May 03, 2024· 13:11 IST

Earnings Update | Rane Brake shares jumps 15% as Q4 profit rises 28%

#1 Net profit up 28 percent at Rs 15.4 crore versus Rs 12 crore, YoY

#2 Revenue up 12.8 percent at Rs 186.2 crore versus Rs 165 crore, YoY

#3 EBITDA up 39 percent at Rs 28.1 crore versus Rs 20.20 crore, YoY

#4 Margin at 15.1 percent versus 12.2 percent, YoY

-330

May 03, 2024· 13:05 IST

Stock Market LIVE Updates | Godfrey Phillips stock soars 7% on signing product supply pact with Ferrero India

Shares of Godfrey Phillips India surged around 7 percent on May 3, a day after the company announced that it has signed an agreement with Ferrero India Pvt. Ltd for the distribution and resale of select sweet-packaged food products manufactured by Ferrero through select channels.

Per the agreement, Godfrey Phillips India will procure products from Ferrero India Private Limited and distribute or re-sell them through its select channels across its distribution network.

The initial agreement pertains to the distribution of Ferrero products in the domestic market in India for two years, the company informed the bourses. Read More

-330

May 03, 2024· 13:04 IST

Market at 1 PM | Sensex falls 940 pts, Nifty at 22,400

The Sensex was down 947.70 points or 1.27 percent at 73,663.41, and the Nifty was down 241.70 points or 1.07 percent at 22,406.50. About 1126 shares advanced, 2062 shares declined, and 83 shares unchanged.

Except metal, all other sectoral indices are trading in the red with auto, bank, IT, telecom, realty, media down 1 percent each.

BSE midcap and smallcap indices down 0.5 percent each.

Bharti Airtel, Reliance Industries, Nestle India, HCL Technologies, L&T were top losers on the Sensex, while gainers included Bajaj Finance, Bajaj Finserv, M&M.

-330

May 03, 2024· 12:55 IST

Earnings Update | MRF Q4 net profit down 7.6%, EBITDA up 5%

#1 net profit down 7.6% at Rs 379.6 crore against Rs 410.7 crore, YoY)

#2 Revenue up 8.6 percent at Rs 6,215.1 crore versus Rs 5,725.4 crore, YoY

#3 EBITDA rose 5 percent at Rs 885.7 crore against Rs 843.1 crore, YoY

#4 Margin at 14.3 percent against 14.7 percent, YoY

-330

May 03, 2024· 12:52 IST

Earnings Update | Godrej Properties Q4 profit up 14%, revenue jumps 13%

#1Net profit up 14.3% at Rs 471 crore versus Rs 412 crore, YoY

#2 Revenue up 13.4 % at Rs 1,426.1 crore versus Rs 1,646.3 crore, YoY

#3 EBITDA down 64.6 % at Rs 122.6 crore versus Rs 346 crore, YoY

#4 Margin at 8.6 percent versus 21 percent, YoY

FY25 guidance

#1 Booking value growth seen at 20 percent versus 161 percent in FY24

#2 Cash collections growth seen at 31 percent versus 114 percent in FY24

-330

May 03, 2024· 12:51 IST

Brokerage Call | InCred downgrades Coforge to ‘reduce’, target cut to Rs 4,431 per share

#1 Cigniti acquisition drives 6 percent cut in FY24-26 EPS CAGR

#2 Although acquisition adds capabilities, geography & vertical diversification

#3 Associated dilution outweighs gains from integration

-330

May 03, 2024· 12:47 IST

Stock Market LIVE Updates | Indian Energy Exchange reports 14.1% growth in total volume; shares gain

Indian Energy Exchange has achieved overall volume of 9,044 million units (MU) in April 2024, growing 14.1 percent over a year-ago month. The market clearing price in day ahead market during the month at Rs 5.1 per unit reduced approximately 6 percent year-on-year.

The real-time electricity market (RTM) continued its growth trajectory in April, increasing 22.1 percent YoY to 2,629 MU.

-330

May 03, 2024· 12:44 IST

-330

May 03, 2024· 12:42 IST

Stock Market LIVE Updates | Voltamp Transformers shares down 9% despite Q4 profit climbs 22%

Voltamp Transformers has recorded net profit at Rs 93.5 crore for March FY24 quarter, rising 22.1 percent over corresponding period of previous fiscal despite weak operating margin, with higher other income and topline.

Revenue from operations soared 14.6 percent on-year to Rs 504.2 crore for the quarter.

-330

May 03, 2024· 12:40 IST

Commodity Check | Oil prices set for steepest weekly drop in 3 months

Oil prices edged up on Friday on the prospect of OPEC+ continuing output cuts, but the crude benchmarks were headed for the steepest weekly losses in three months on demand uncertainty and easing tensions in the Middle East reducing supply risks.

Brent crude futures for July rose 14 cents to $83.82 a barrel. U.S. West Texas Intermediate crude for June was up 16 cents, or 0.2%, to $79.11 per barrel.

-330

May 03, 2024· 12:35 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Amara Raja | 11066 | 1113.9 | 1.23 |

| DLF | 12182 | 877 | 1.07 |

| IRFC | 108400 | 156.65 | 1.7 |

| REC | 19801 | 560.1 | 1.11 |

| Vedanta | 31514 | 414.8 | 1.31 |

| Britannia | 2429 | 4732.6 | 1.15 |

| Ircon Internati | 44042 | 244.15 | 1.08 |

| Kotak Mahindra | 12219 | 1559.4 | 1.91 |

| SRF | 4736 | 2598.2 | 1.23 |

| SRF | 4007 | 2600 | 1.04 |

-330

May 03, 2024· 12:31 IST

Brokerage Call | Jefferies maintains 'buy' rating on Coal India, target Rs 520 per share

#1 Q4 reported EBITDA & PAT grew 21-26 percent YoY

#2 EBITDA, PAT rise includes effect of accounting policy changes for stripping activity costs

#3 Q4 cash EBITDA, excluding noncash stripping activity adjustment, rose 14 percent YoY

#4 Q4 cash EBITDA 18 percent below estimate due to sharp QoQ rise in staff & other expenses

#5 Dispatch volumes grew 8 percent YoY while cash EBITDA/ton rose 6 percent YoY

-330

May 03, 2024· 12:28 IST

Sensex Today | BSE Telecom index shed 1%; Railtel Corporation of India, GTL Infrastructure, Bharti Airtel down 2% each

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Railtel | 395.45 | -2.6 | 134.99k |

| GTL Infra | 1.72 | -2.27 | 33.84m |

| Bharti Airtel | 1,278.45 | -2.12 | 124.62k |

| Vindhya Telelin | 2,492.75 | -1.98 | 1.64k |

| ITI | 298.75 | -1.94 | 41.62k |

| HFCL | 101.70 | -1.83 | 1.34m |

| Tejas Networks | 1,094.00 | -1.61 | 61.74k |

| Sterlite Techno | 137.80 | -1.4 | 200.22k |

| TataTeleservice | 80.98 | -1.23 | 136.54k |

| Tata Comm | 1,727.90 | -0.81 | 7.66k |

-330

May 03, 2024· 12:22 IST

Stock Market LIVE Updates | CIE Automotive shares fall despite Q4 profit grows 4.5%

CIE Automotive India has reported consolidated net profit at Rs 230.2 crore for March FY24 quarter, rising 4.5 percent over same period previous fiscal despite weak topline and operating numbers, supported by higher other income.

Revenue from operations declined 0.5 percent on-year to Rs 2,426.8 crore for the quarter.

-330

May 03, 2024· 12:21 IST

Sensex Today | Nifty Bank index down nearly 700 points from day's high

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| HDFC Bank | 1,522.15 | 1,540.60 1,513.85 | -1.2% |

| ICICI Bank | 1,141.85 | 1,157.40 1,136.60 | -1.34% |

| IDFC First Bank | 80.95 | 82.15 80.80 | -1.46% |

| SBI | 823.60 | 836.20 820.00 | -1.51% |

| AU Small Financ | 642.55 | 653.20 641.55 | -1.63% |

| Axis Bank | 1,143.00 | 1,163.25 1,138.15 | -1.74% |

| Kotak Mahindra | 1,560.00 | 1,587.90 1,554.00 | -1.76% |

| IndusInd Bank | 1,489.65 | 1,517.95 1,482.65 | -1.86% |

| Bank of Baroda | 276.45 | 282.50 275.60 | -2.14% |

| Bandhan Bank | 187.70 | 192.55 187.25 | -2.52% |

-330

May 03, 2024· 12:17 IST

Stock Market LIVE Updates | Healthcare Global promoter shortlists 4 bidders

Healthcare Global Enterprises' promoter CVC has shortlisted 4 bidders for the final round of deal process. The final bidders included Bain Capital, TPG Capital, Multiples & Burjeel, according to CNBC-TV18 Sources.

-330

May 03, 2024· 12:12 IST

Stock Market LIVE Updates | Shriram Properties acquires 4 acre land parcel near Electronic City, Bengaluru

Shriram Properties (SPL) announced acquisition of a prime 4 acre land parcel nestled in the coveted micro market of Chandapura, close to Electronic City in Bengaluru.

Shriram Properties envisions crafting a landmark residential project on this land parcel, encompassing around 4 lakh square feet of aggregate saleable area, comprising approximately 350 meticulously designed apartments. This Project has revenue potential of over Rs 250 crores and is expected to be developed over the next 3 years. The company is targeting to launch the Project during the current financial year (FY25), company said in its release.

-330

May 03, 2024· 12:08 IST

Sensex Today | India Volatility Index surges 10%

-330

May 03, 2024· 11:59 IST

Sensex Today | Bajaj Finance shares trade higher after RBI lifts restrictions on eCom & insta EMI card

-330

May 03, 2024· 11:56 IST

Sensex Today | Bulls stumble at highs; Nifty shaves off over a percent from day's high to break below 22,500

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Larsen | 3,522.00 | -2.15 | 1.48m |

| Reliance | 2,871.05 | -2.12 | 2.62m |

| Maruti Suzuki | 12,535.10 | -2.11 | 329.41k |

| Bharti Airtel | 1,279.55 | -1.88 | 4.30m |

| Nestle | 2,465.55 | -1.86 | 387.03k |

| JSW Steel | 875.40 | -1.68 | 1.47m |

| Adani Ports | 1,318.35 | -1.53 | 2.11m |

| Asian Paints | 2,931.25 | -1.48 | 729.72k |

| TCS | 3,809.15 | -1.4 | 1.22m |

| IndusInd Bank | 1,484.30 | -1.39 | 803.50k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coal India | 464.45 | 2.32 | 28.49m |

| Bajaj Finance | 7,018.40 | 1.97 | 4.06m |

| ONGC | 288.15 | 1.89 | 19.44m |

| Bajaj Finserv | 1,641.80 | 1.63 | 3.29m |

| Grasim | 2,471.30 | 1.39 | 401.39k |

| TATA Cons. Prod | 1,105.00 | 1.27 | 1.26m |

| Dr Reddys Labs | 6,357.10 | 1.11 | 275.93k |

| Apollo Hospital | 6,004.70 | 0.77 | 282.94k |

| Bajaj Auto | 9,178.00 | 0.74 | 278.81k |

| Shriram Finance | 2,600.30 | 0.7 | 893.25k |

-330

May 03, 2024· 11:52 IST

Commodity Check | Oil prices set for steepest weekly drop in 3 months

Oil prices edged up on Friday on the prospect of OPEC+ continuing output cuts, but the crude benchmarks were headed for the steepest weekly losses in three months on demand uncertainty and easing tensions in the Middle East reducing supply risks.

Brent crude futures for July rose 24 cents to $83.91 a barrel. U.S. West Texas Intermediate crude for June was up 19 cents, or 0.3%, to $79.19 per barrel.

-330

May 03, 2024· 11:48 IST

Stock Market LIVE Updates | KEI Industries shares gain as Q4 profit jumps 22%

KEI Industries has registered a 22 percent on-year growth in consolidated net profit at Rs 168.6 crore for the quarter ended March FY24, with healthy growth in topline and operating numbers. Revenue from operations grew by 18.8 percent year-on-year to Rs 2,319.3 crore during the quarter.

-330

May 03, 2024· 11:41 IST

-330

May 03, 2024· 11:31 IST

Stock Market LIVE Updates | Reliance, HDFC Bank, ICICI Bank weigh Sensex over 900 points down

-330

May 03, 2024· 11:20 IST

Stock Market LIVE Updates | Bajaj Auto launches new Bajaj Pulsar NS400 all-new 400cc

#1 Bajaj will offer the NS400 in four dual-tone colour schemes - Glossy Ebony Black, Metallic Pearl White, Cocktail Wine Red and Pewter Grey

#2 The front end is dominated by a single-pod projector headlamp flanked by lightning-shaped LED DRL on each side

-330

May 03, 2024· 11:16 IST

Stock Market LIVE Updates | Cholamandalam Finance gains on strong FY25 guidance; brokerages bullish on stock

#1 Motilal Oswal shares a 'buy' call on Cholamandalam Finance, with a target price of Rs 1,500 per share

#2 Management guided for FY25 disbursement growth of ~20-25 percent and AUM growth of ~25-30 percent

#3 Kotak Institutional Equities revised to 'add' rating from 'buy' and raised target price to Rs 1,375 from Rs 1,350 per share

-330

May 03, 2024· 11:10 IST

-330

May 03, 2024· 11:05 IST

-330

May 03, 2024· 11:02 IST

Market at 11 AM | Nifty breaks 22,600, Sensex down 340 pts

The Sensex was down 344.52 points or 0.46 percent at 74,266.59, and the Nifty was down 62.90 points or 0.28 percent at 22,585.30. About 1385 shares advanced, 1694 shares declined, and 101 shares unchanged.

-330

May 03, 2024· 11:00 IST

Stock Market LIVE Updates | Max Estates extends gain as co inks mega development deal

Shares of Max Estates Ltd jumped as much as 8 percent on 3 May to hit a new 52-week high of Rs 374.90 on the NSE, after the company signed an agreement for development of a Rs 9,000-crore residential development project in Gurugram.

Max Estates' share price has gained 36 percent in the last six months, outperforming Nifty 50 which has risen 18 percent during the same period.

The real estate arm of the Max group signed binding agreements for the development of a group housing residential property on 18.23 acres of land, with around 4 million square feet of development area, said the company in an exchange filing. Read More

-330

May 03, 2024· 10:54 IST

Stock Market LIVE Updates | Bajaj Auto to launch new flagship Pulsar today; shares extend gains

Pune-headquartered Bajaj Auto share price advanced over a percent to Rs 9,242 in morning trade on May 3 as the company is set to launch new variant of its every-popular motorcycle, Pulsar, later today.

It's been a staggering FY24 for the Pulsar for two main reasons — clocking the highest-ever volume during the year and becoming a massive Rs 10,000-crore brand.

In a conference call after declaring the Q4 results, the company highlighted that it will launch six new models in the first half of FY25, beginning with the new NS400 Pulsar, which will come in its biggest engine avatar yet at 373cc, ensuring that the company sets a "relentless pace and is always top of mind of this customer." Read More

-330

May 03, 2024· 10:49 IST

-330

May 03, 2024· 10:46 IST

Sensex Today | BSE Realty index down 0.3%; Oberoi Realty, DLF, Swan Energy top losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oberoi Realty | 1,504.25 | -1.8 | 11.21k |

| DLF | 885.00 | -1.21 | 37.07k |

| Swan Energy | 600.20 | -1.1 | 23.65k |

| Phoenix Mills | 3,102.45 | -0.98 | 1.60k |

| Macrotech Dev | 1,233.00 | -0.81 | 6.73k |

| Mahindra Life | 621.90 | -0.35 | 4.60k |

| Brigade Ent | 1,035.20 | -0.04 | 2.97k |

-330

May 03, 2024· 10:44 IST

Sensex Today | April North America Class 8 truck orders down 18% MoM & up 16% YoY

-330

May 03, 2024· 10:42 IST

Stock Market LIVE Updates | Suzlon Energy board approves scheme of amalgamation with subsidiary; shares trade lower

The board of directors of Suzlon Energy at its meeting held on May 2, 2024, approved the scheme of amalgamation involving merger by absorption of Suzlon Global Services Limited, a wholly owned subsidiary of the company, with Suzlon Energy Limited.

-330

May 03, 2024· 10:39 IST

Stock Market LIVE Updates | Gujarat Industries signs Rs 2,832 crore loan agreement with NaBFID

Gujarat Industries Power Company has entered into Rs 2,832 crore loan agreement with National Bank For Financing Infrastructure And Development (NaBFID).

-330

May 03, 2024· 10:35 IST

Brokerage Call | Jefferies downgrades Coforge to ‘underperform’, target cut to Rs 4,290 per share

#1 Q4 missed estimate on lower than expected margin

#2 Company did not offer growth guidance for FY25, implying higher uncertainty

#3 Large acquisition adds another layer of execution risk, warranting a de-rating

#4 Imminent QIP should be an overhang as well

#5 Cut estimate by 11-16 percent

-330

May 03, 2024· 10:31 IST

Stock Market LIVE Updates | Manish Mundra resigns as CFO of Goodyear India; shares trade higher

Manish Mundra has resigned as Chief Financial Officer and Whole Time Director of Goodyear India, for exploring professional growth opportunities outside the organization.

He will cease to be the key managerial personnel of the company with effect from June 30, 2024.

-330

May 03, 2024· 10:27 IST

Sensex Today | Godfrey Phillips India trades near day's high, shares up 6%

-330

May 03, 2024· 10:24 IST

Earnings Watch | Kotak Mahindra Bank, Avenue Supermarts, among others to report Q4 results tomorrow

Kotak Mahindra Bank, Mahindra & Mahindra Financial Services, Avenue Supermarts, IDBI Bank, Birla Corporation, Jammu & Kashmir Bank, Kansai Nerolac Paints, Nagarjuna Fertilizers and Chemicals, Zen Technologies, and High Energy Batteries (India) will announce January-March quarter earnings on May 4.

-330

May 03, 2024· 10:17 IST

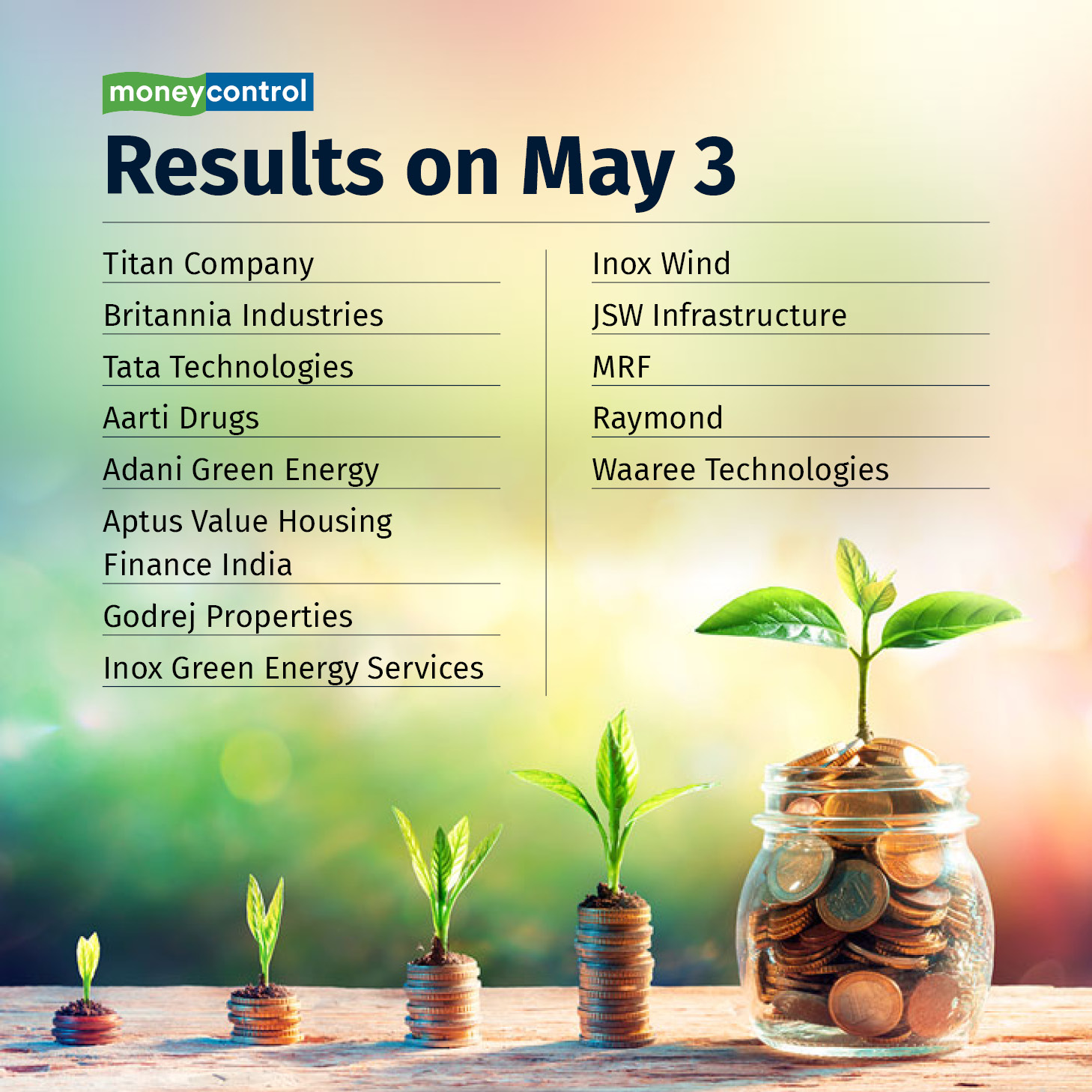

Earnings Watch | Titan Company, Britannia, among others to report Q4 results today

Titan Company, Britannia Industries, Tata Technologies, Aarti Drugs, Adani Green Energy, Aptus Value Housing Finance India, Godrej Properties, Inox Green Energy Services, Inox Wind, JSW Infrastructure, MRF, Raymond, and Waaree Technologies will release March FY24 quarter earnings on May 3.

-330

May 03, 2024· 10:15 IST

Stock Market LIVE Updates | MOIL's manganese ore production in April 2024 jumps 22%; shares gain

MOIL has informed that the manganese ore production in April 2024 increased by 22% year-on-year to 1.60 lakh tonnes, while sales grew by 17% on-year to 1.15 lakh tonnes during the month.

-330

May 03, 2024· 10:13 IST

Sensex Today | Nifty Information Technology index down 0.4%; Coforge shares fall 8%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| COFORGE LTD. | 4,595.05 | -7.84 | 2.71m |

| Tech Mahindra | 1,259.60 | -0.58 | 317.79k |

| Infosys | 1,410.00 | -0.31 | 1.04m |

| LTIMindtree | 4,681.25 | -0.24 | 45.20k |

| HCL Tech | 1,359.95 | -0.06 | 911.02k |

-330

May 03, 2024· 10:11 IST

Stock Market LIVE Updates | M&M shares gain on receiving 674 patents in FY24

Mahindra & Mahindra has received a record 674 patents in FY24, the most of any Indian 4-wheeler automobile/farm equipment manufacturer. This is a 380% increase in the number of patents issued to M&M over FY23.

-330

May 03, 2024· 10:07 IST

Stock Market LIVE Updates | Adani Enterprises received 2 show cause notices from Sebi; shares trade lower

Adani Enterprises on Thursday said that the company received two show cause notices from markets regulator Securities and Exchange Board of India (Sebi) as part of its ongoing investigation in Hindenburg's report against the conglomerate.

In its Q4 earnings release, Adani Enterprises said that during the quarter ended March 31, 2024, the company received notices from Sebi alleging non-compliance with provisions of the Listing Agreement and LODR (Listing Obligations and Disclosure Requirements) Regulations pertaining to related-party transactions with respect of certain transactions with third parties as well as the validity of peer review certificates of statutory auditors with respect to earlier years.

-330

May 03, 2024· 09:55 IST

Stock Market LIVE Updates | Jubilant Pharmova appoints Harsher Singh as CEO of radiopharma business; shares gain

Jubilant Pharmova has approved the appointment of Harsher Singh as CEO of radiopharma business. Earlier, Harsher was working with Amneal Pharmaceuticals.

Meanwhile, the company also announced the superannuation of Pramod Yadav, the CEO at Jubilant radiopharma. Pramod will continue as an adviser till June 30 this year.

-330

May 03, 2024· 09:53 IST

Sensex Today | 4.66 million shares of GMR Airports Infrastructure traded in two bunches: Bloomberg

-330

May 03, 2024· 09:51 IST

Sensex Today | 2.07 million shares of Zoamto traded in a bunch: Bloomberg

-330

May 03, 2024· 09:48 IST

Sensex Today | Nifty Midcap 100 index hits fresh high; BHEL, Prestige Estate, Hindustan Zinc up 3-5%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BHEL | 309.30 | 5.67 | 24.97m |

| Hind Zinc | 448.60 | 3.82 | 1.59m |

| Prestige Estate | 1,450.05 | 3.51 | 227.32k |

| Power Finance | 480.80 | 2.77 | 8.10m |

| Ramco Cements | 789.00 | 2.29 | 101.66k |

| Shriram Finance | 2,638.95 | 2.2 | 380.97k |

| SAIL | 169.00 | 2.15 | 18.47m |

| Nippon | 595.80 | 2.14 | 216.72k |

| Sona BLW | 619.50 | 1.85 | 703.08k |

| Fortis Health | 448.20 | 1.79 | 303.08k |

-330

May 03, 2024· 09:44 IST

Brokerage Call | CLSA keeps ‘buy’ rating on Vedanta, Hindalco; Metal index up 1%

#1 Have a resilient outlook for aluminium

#2 Demand recovery to support prices; Indian smelters well placed

#3 Buy call On Hindalco, target raised to Rs 770 from Rs 635 per share

#4 Raise Hindalco’s FY24-26 EBITDA by 4 percent-13 percent on higher aluminium price assumptions

#5 Raise profitability estimate for Novelis slightly

#6 Buy call on Vedanta, target raised to Rs 430 per share

#7 Believe Vedanta is well placed to benefit from commodity upcycle given its diversified exposure

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SAIL | 170.25 | 2.9 | 1.13m |

| Vedanta | 417.05 | 1.55 | 101.16k |

| Jindal Steel | 956.00 | 1.5 | 30.58k |

| Tata Steel | 169.85 | 1.49 | 773.43k |

| NMDC | 261.90 | 1.33 | 68.04k |

| JSW Steel | 901.20 | 1.19 | 23.25k |

| Hindalco | 646.90 | 0.86 | 58.57k |

| Coal India | 456.00 | 0.61 | 226.83k |

| APL Apollo | 1,596.40 | 0.32 | 5.00k |

-330

May 03, 2024· 09:41 IST

Sensex Today | BSE Smallcap index hits fresh high; IFCI, Godfrey Phillips, Taj GVK Hotels & Resorts, Inox India up 6-10%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Taj GVK Hotels | 412.85 | 10.03 | 12.82k |

| IFCI | 53.59 | 6.97 | 3.47m |

| Godfrey Phillip | 3,507.05 | 6.6 | 2.39k |

| Inox India | 1,438.45 | 5.99 | 9.54k |

| ADF Foods | 230.80 | 5.1 | 2.26k |

| Shakti Pumps | 2,177.00 | 5 | 12.30k |

| Waaree Renewabl | 2,734.70 | 5 | 30.60k |

| Netweb | 1,853.65 | 5 | 2.97k |

| GMRP&UI | 70.58 | 5 | 941.60k |

| Gallantt Ispat | 324.70 | 5 | 6.33k |

-330

May 03, 2024· 09:39 IST

Sensex Today | Earnings On May 4

-330

May 03, 2024· 09:37 IST

Sensex Today | Earnings On May 3

-330

May 03, 2024· 09:34 IST

Sensex Today | BSE Midcap index touches fresh high; Ajanta Pharma, BHEL, SAIL up 3-10%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ajanta Pharma | 2,470.20 | 10.62 | 24.60k |

| BHEL | 305.00 | 4.22 | 559.41k |

| SAIL | 170.25 | 2.9 | 925.94k |

| Power Finance | 479.10 | 2.4 | 425.60k |

| NHPC | 100.00 | 2.03 | 3.60m |

| M&M Financial | 269.55 | 1.83 | 140.28k |

| Emami | 493.65 | 1.74 | 6.24k |

| Tata Tech | 1,108.55 | 1.71 | 19.67k |

| Supreme Ind | 4,888.90 | 1.65 | 1.37k |

| New India Assur | 243.00 | 1.61 | 14.99k |