The Nifty 50 has been marching higher to new peaks in recent sessions on the back of sustained flow of domestic funds, strong macro conditions and the Q4 earnings season. In such a setup, Motilal Oswal Financial Services chalked out five sectors, retail private banks, automobile, telecom and media, as those that are still trading at a discount to their historical long-period averages.

Aside from these five, which constitute one-third of the overall market, all other sectors are trading at a premium to their historical long-period averages, MOFSL noted.

Meanwhile, most of the sectors trading at a discount are also riding high on expectations of strong growth. While private banks are expected to gain from their strong deposit growth, automobiles are likely to benefit from the growing premiumisation and an uptick in demand. Telecom, on the other hand, also stands to benefit from tariff hikes and the 5G rollouts.

Regardless, concerns over stretched valuations have not been able to significantly hinder the uptrend in the market in recent times as the Nifty 50 closed higher for the third straight month in April, after scaling a new record high despite the bouts of volatility.

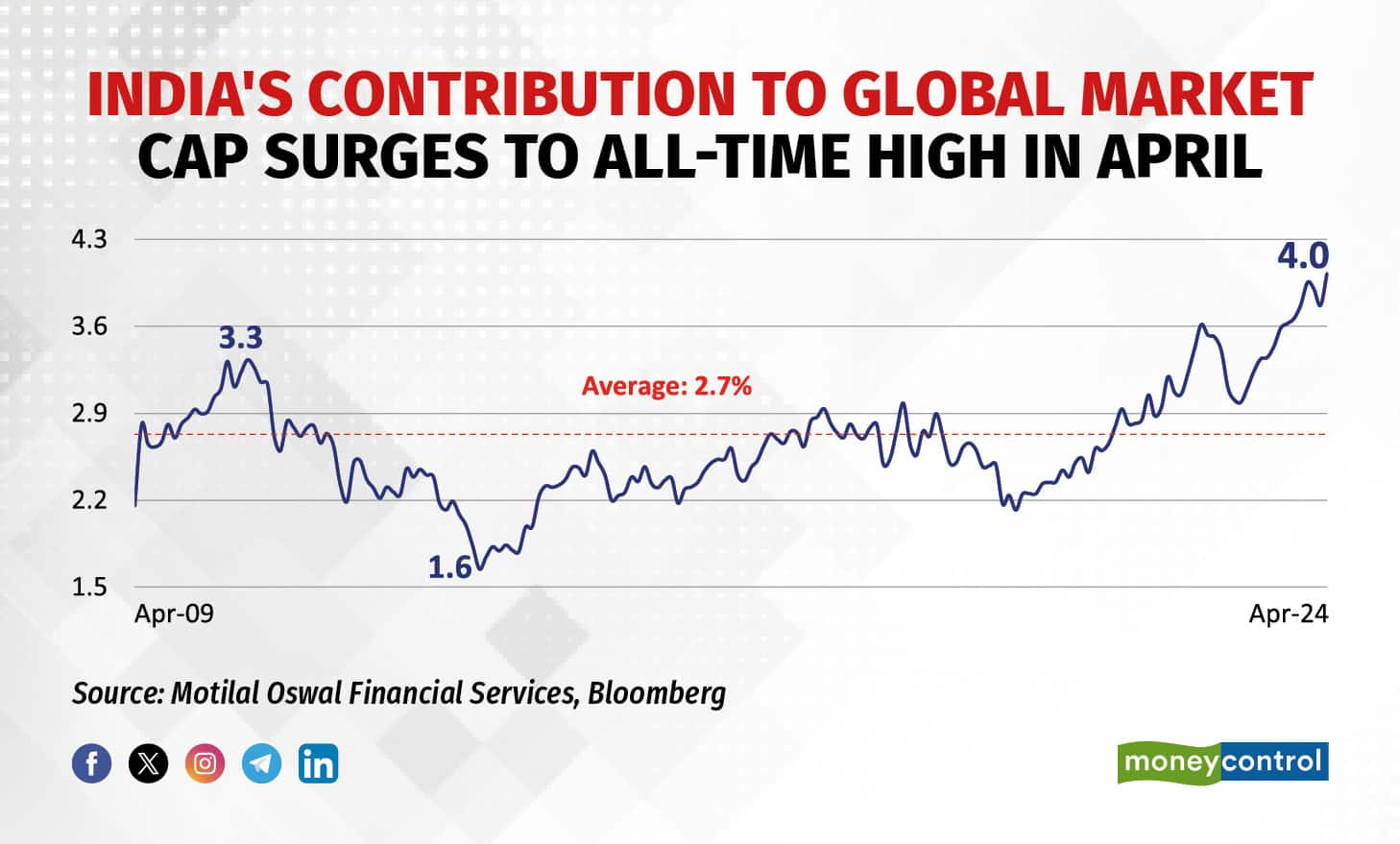

In addition, India's share in the global market capitalisation also soared to an all-time high of 4 percent in April. "Over the last 12 months, the global market cap increased 11 percent to $11.4 trillion, whereas India’s market cap surged 44 percent," MOFSL highlighted.

Along with it, the MSCI India index also outperformed the 7 percent spike in the MSCI Emerging Markets index by delivering over 36 percent returns. MOFSL also noted the significant outperformance by a whopping 213 percent by the MSCI India index when compared to the MSCI EM index.

The unstoppable rise of Indian equities has also driven the benchmark Nifty 50 to scale a fresh record high of 22,794 on May 3 before profit booking brought the benchmark below the 22,500 level.

Going ahead, MOFSL points out three important factors that will dominate investor conversations, namely, political continuity in the wake of the Lok Sabha elections, consumption slowdown particularly in rural India, and institutional flows.

General ElectionsWith the election results slated to be out in June and multiple opinion polls hinting at a resounding return of the BJP to power, investors are hoping to see sustained economic reforms and continued policy momentum, with a focus on capex, manufacturing, and infrastructure development. However, MOFSL feels this can keep the equity market multiples elevated.

Sluggish consumptionThe brokerage also sheds light on several macro and micro indicators that suggest a persistent weakness in consumption, particularly noticeable in rural India. But MOFSL remains hopeful that the consumption trend will bottom out soon and start contributing to growth from the second half of FY25. This trend reversal according to the brokerage will be led by a normal monsoon coupled with election spending.

Institutional FlowsThirdly, institutional flows in the market will also be a topic of hot discussion. Collective flows from domestic as well as institutional investors stood at $50.50 billion in FY24, the highest ever in any fiscal.

"Along with that, the continued rise in retail participation, increasing SIP contributions and the addition of new demat accounts amid the ongoing trend of financialisation of savings, has supported the markets in the face of global volatility," MOFSL said. The firm also expects this trend to keep supporting the Indian equity market in the coming time as well.

Painting a rosy picture of Indian equities for the near-to-medium term, MOFSL chose to be 'overweight' on financials, consumption, industrials and real estate themes.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.