Mid-cap and small-cap stocks have come under intense selling pressure since the start of December, pulling back sharply after months of strong outperformance.

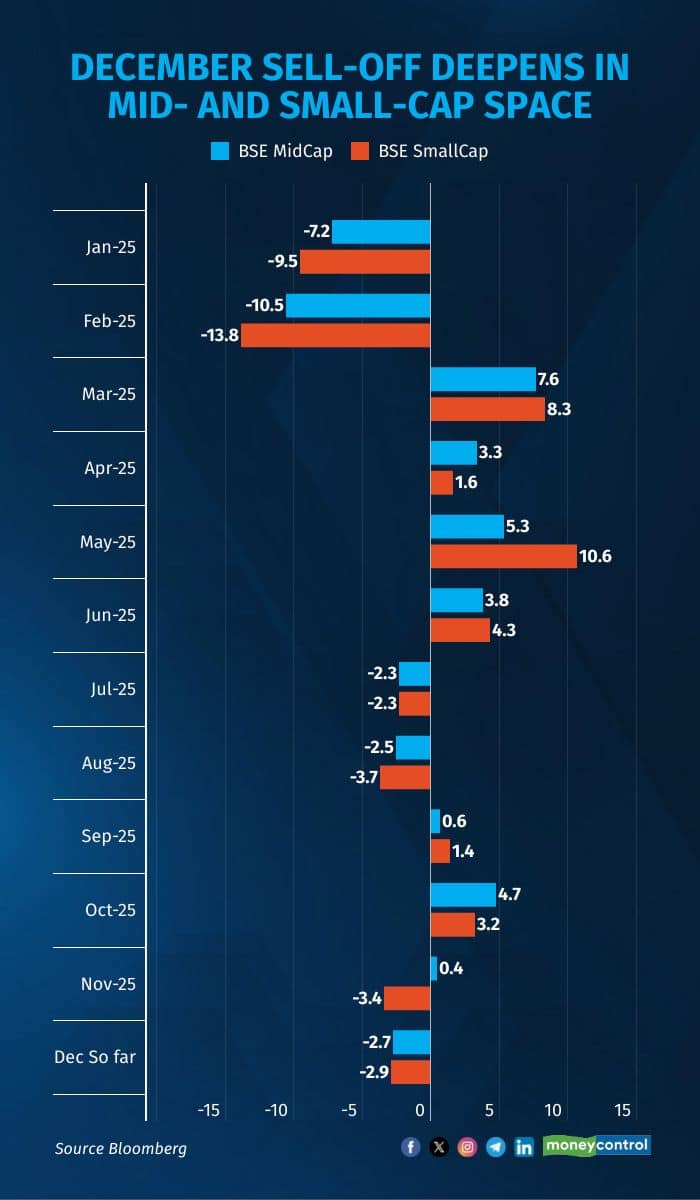

The BSE MidCap index has dropped 2.7 percent so far this month—its steepest fall since February 2025—while the BSE SmallCap index has slipped an identical 2.8 percent, marking its second consecutive month of decline. Meanwhile benchmark Sensex and Nifty fell 1 percent each.

The correction has emerged despite a reasonable pickup in earnings across sectors and broadly healthy balance sheets, with experts attributing the downturn largely to retail fatigue after muted returns over the past year compared with the strong gains seen earlier.

Aniruddha Naha, CIO – Alternates at PGIM India Asset Management, said the unwinding of Margin Trading Facility positions has further intensified the pressure on the broader market, though exposure to MTF has since reduced.

He noted that by end-November, the return differential between large-caps and small-caps had widened to nearly 18 percent—a divergence rarely seen since 2008, typically occurring when small-cap earnings were too subdued to justify outperformance.

Experts said valuations have come under scrutiny amid global uncertainty and impending macro triggers. The December pullback, they added, represents a necessary reset after a strong run, with both the BSE MidCap and SmallCap indices having gained about 21 percent and 25 percent respectively between March and October 2025.

The BSE MidCap index is currently trading at 25.23 times its one-year forward earnings, well above its 10-year average valuation of 23.29 times. The BSE SmallCap index is also trading at elevated levels, at 22.6 times one-year forward PE compared with its long-term average of 18.97 times.

Aakash Shah, research analyst at Choice Broking, said the latest decline has been driven by profit-booking, stretched valuations and a risk-off sentiment shaped by global central bank commentary. Mid- and small-cap stocks, he said, had run significantly ahead of fundamentals, prompting traders to book gains.

Stretched valuations and global volatility also weighed on domestic equities, leading to sharper corrections in high-beta pockets compared with large-caps.

Technically, both indices now trade below key EMAs, signalling a shift toward a bearish-to-neutral structure. Small-caps have slipped into oversold territory based on RSI readings, indicating exhaustion but not yet a confirmed reversal, while mid-caps remain weak with downward-sloping EMAs and distribution-heavy trading volumes.

Markets are expected to move into a consolidation phase in early 2026 as global and domestic cues stabilise. Analysts said improving earnings visibility, cyclical recovery and sectoral expansion could support a renewed uptrend later in the year. While short-term weakness may persist, deeper corrections could offer accumulation opportunities for investors with a medium-term view.

Ajay Garg, director and CEO at SMC Global Securities, said mid- and small-cap stocks may remain volatile in early 2026 as liquidity and earnings trends evolve. However, he added that the correction has made valuations healthier, and quality mid-cap companies with strong balance sheets could see gradual improvement as economic conditions stabilise. Although a broad-based rally seems unlikely, selective long-term opportunities may emerge through staggered allocations and a focus on fundamentally strong businesses.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.