Closing Bell: Sensex, Nifty end flat on expiry day; auto, oil & gas, media gain

-330

July 25, 2024· 16:44 IST

Sensex, Nifty end flat on expiry day

Indian benchmark indices ended flat in the volatile session on July 25. At close, the Sensex was down 109.08 points or 0.14 percent at 80,039.80, and the Nifty was down 7.40 points or 0.03 percent at 24,406.10.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

-330

July 25, 2024· 16:07 IST

Ajit Mishra – SVP, Research, Religare Broking

Markets remained volatile on the monthly expiry day and ended nearly flat, continuing the current consolidation trend. Weak global cues and pressure on major banking stocks led to a gap-down start, but recovery in select heavyweights minimized losses. Ultimately, Nifty closed at 24,406.10. Sector-wise, energy, auto, and pharma performed well despite the choppiness, while metal and banking sectors ended lower. The broader indices remained almost unchanged.

Markets are showing significant resilience during this consolidation phase, so we continue to recommend looking for buying opportunities on dips as long as Nifty holds above the 24,200 level. Given the mixed trends across sectors, it is crucial to focus on stock selection. In addition to earnings reports, the performance of global indices, especially in the US, will be closely watched for further cues.

-330

July 25, 2024· 16:04 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Overnight slump in US equities caused a major slump in domestic markets in early trades due to heavy profit-taking in banking, IT, metals and realty stocks. However, markets recouped most of its losses towards the end with Sensex managing to close above the crucial 80k-mark amid buying in oil & gas and automobile stocks, indicating that investors are willing to bet on good fundamental sectoral stocks despite rising concerns of the stretched valuations of the Indian markets.

-330

July 25, 2024· 15:53 IST

Vinod Nair, Head of Research, Geojit Financial Services

After a volatile session, the Indian market concluded on a flat note, influenced by lower-than-expected earnings growth from major banks. Global indices also reacted pessimistically due to the disappointing results from top US tech companies. However, the government's commitment to improving consumption and bridging the gap for energy transition in the budget buoyed sectoral sentiments. Despite ongoing enthusiasm from retail investors in the broader market, the current high valuations are likely to prompt a shift towards large-cap stocks.

-330

July 25, 2024· 15:41 IST

Aditya Gaggar Director of Progressive Shares

Following weak global equities, Indian markets started the monthly expiry day on a tepid note with a loss of over 150 points. But, after a sharp cut, one-way recovery was seen throughout the day which supported the Index limiting its losses to 7.40 points to end the session at 24,406.10.

Among the sectors, auto was the biggest gainer followed by energy while metal and realty corrected the most.

Mid and Smallcaps recovered from their morning lows but underperformed the Benchmark Index.

As we are constantly mentioning that the level of 24,200 is a strong support and as long as the Index holds it, the uptrend will remain intact. On the flip side, a level of 24,560 is considered an immediate hurdle.

-330

July 25, 2024· 15:32 IST

Currency Check | Rupee closes flat

Indian rupee ended flat at 83.70 per dollar on Thursday against Wednesday's close of 83.71.

-330

July 25, 2024· 15:31 IST

Govt to sell 3.5% stake in Hindustan Zinc: Bloomberg

-330

July 25, 2024· 15:30 IST

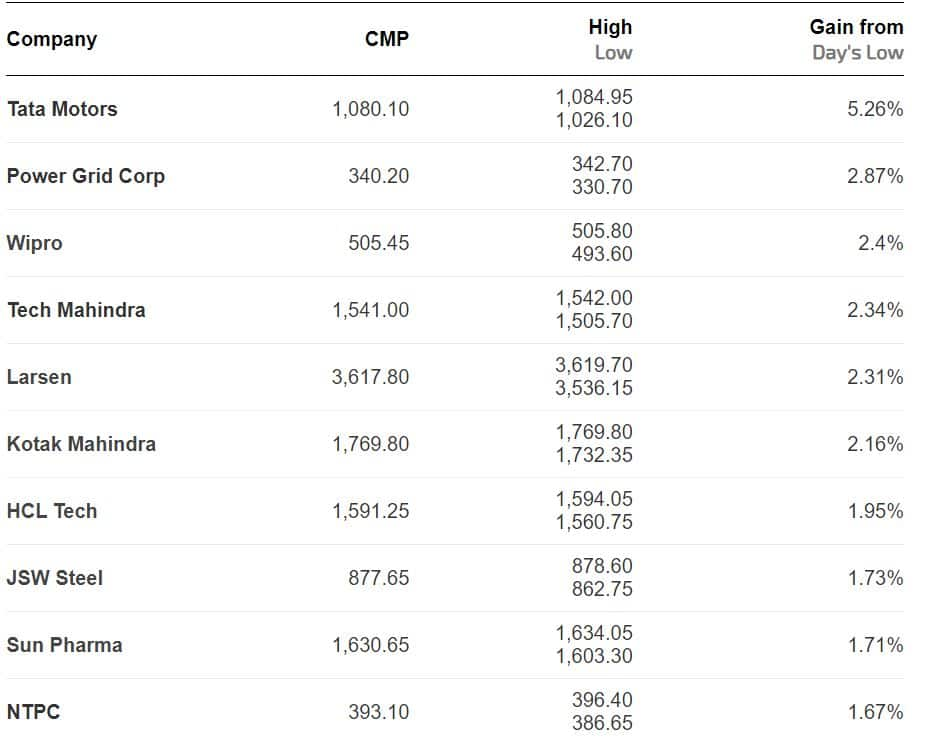

Market Close | Sensex, Nifty end flat on expiry day; auto, oil & gas, media gain

Indian benchmark indices ended flat in the volatile session on July 25.

At close, the Sensex was down 109.08 points or 0.14 percent at 80,039.80, and the Nifty was down 7.40 points or 0.03 percent at 24,406.10. About 1791 shares advanced, 1635 shares declined, and 77 shares unchanged.

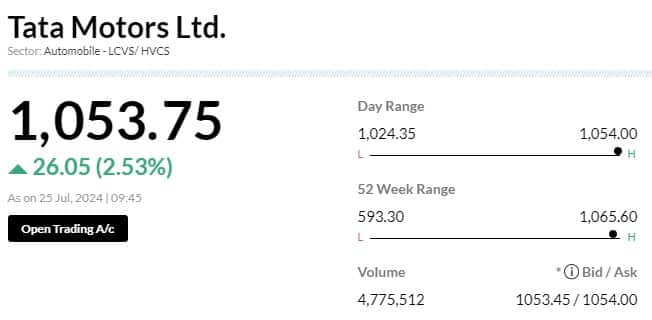

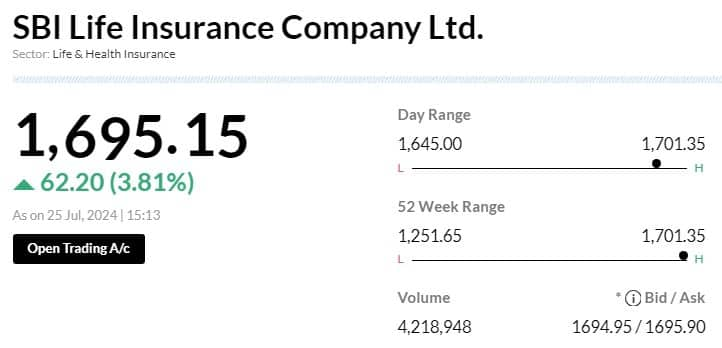

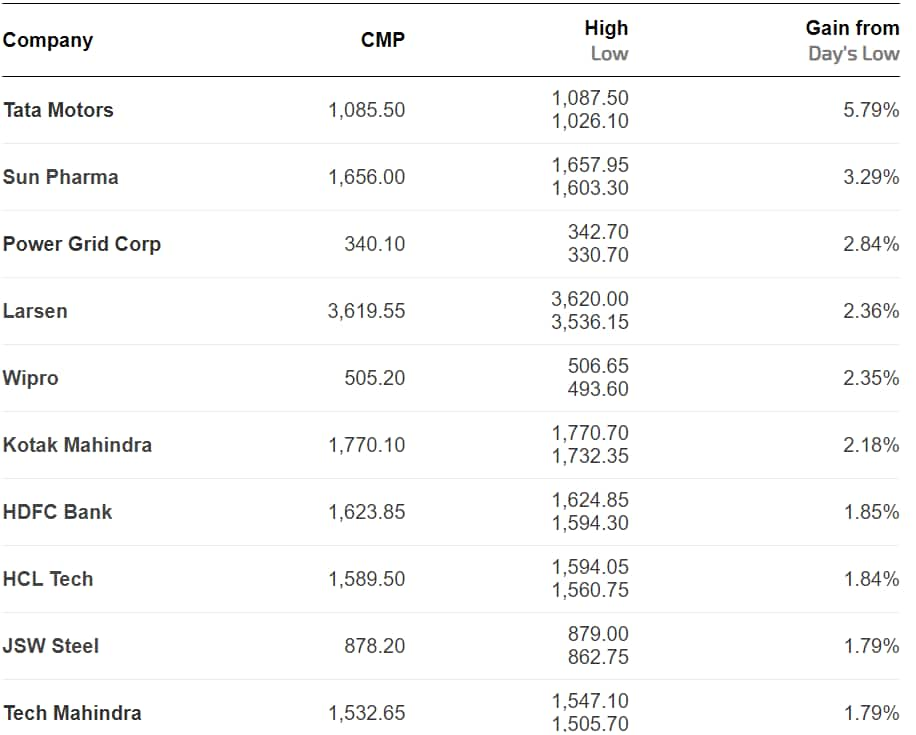

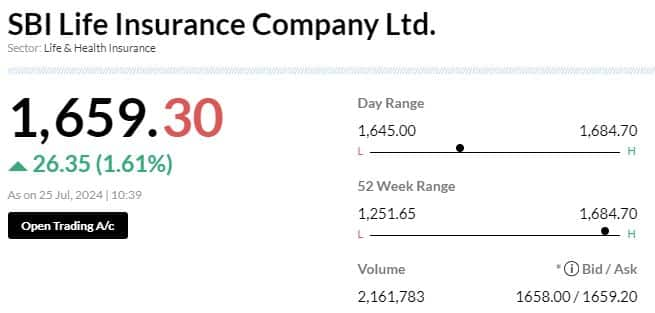

Top Nifty gainers included Tata Motors, ONGC, SBI Life Insurance, BPCL and Sun Pharma, while losers were Axis Bank, Nestle India, Titan Company, ICICI Bank and Tata Steel.

On the sectoral front, auto, capital goods, power, oil & gas, healthcare, media rose 0.5-3 percent, while bank, IT, metal, realty and telecom shed 0.5-1 percent.

The BSE midcap and smallcap indices ended marginally lower.

-330

July 25, 2024· 15:22 IST

Earnings Watch | Chennai Petroleum Q1 profit down at Rs 357 crore versus RS 628 crore, QoQ

-330

July 25, 2024· 15:21 IST

Earnings Watch | Westlife Foodworld Q1 net profit down 88.9% at Rs 3.2 crore Vs Rs 28.8 crore, YoY

-330

July 25, 2024· 15:20 IST

Adani Green Energy Q1 results: Net profit surges 95% to Rs 629 cr

Adani Green Energy Q1 results: Total income rises 22.5% to Rs 3,122 cr...Read More

-330

July 25, 2024· 15:18 IST

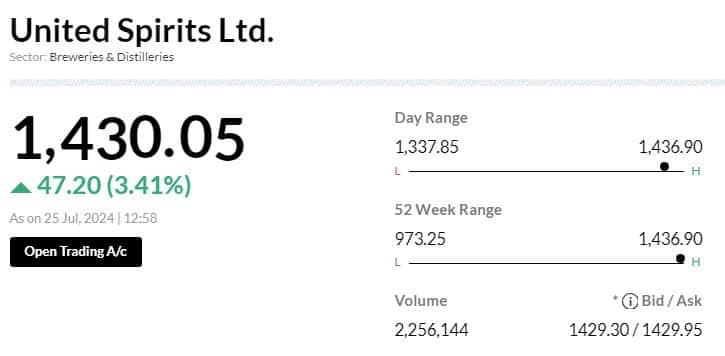

Brokerage Call | I-SEC maintains 'add' rating on United Spirits, target raises to Rs 1,480

#1 Q1 revenue growth of 8 percent YoY with 3 percent YoY volume growth was a good performance

#2 Double-digit revenue growth in P&A segment while popular segment declined by 3 percent YoY

#3 Premiumisation trend continued though at a moderate level

#4 Management maintained its guidance of double-digit revenue growth in FY25

#5 Management guided H2FY25 growth to be better than H1FY25

#6 H2FY25 growth to be driven by improvement in demand environment, scale-up of renovations and innovations

#7 Underlying gross and operating margins saw a strong expansion led by cost savings

-330

July 25, 2024· 15:15 IST

Brokerage Call | Nomura maintains 'buy' rating on SBI Life, target raises to Rs 1,835

#1 Q1 results showed stable quarter

#2 Q1 total/individual APE growth of 20 percent/23 percent YoY versus 17 percent/9 percent in Q4

#3 For comparison, total APE growth for ICICI Pru/HDFC Life was higher at 34 percent/23 percent YoY

#4 VNB margin declined nearly 210 bps YoY, leading to lower VNB growth of 12 percent YoY

-330

July 25, 2024· 15:10 IST

Sensex Today | BSE Energy index up 1 percent

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ConfidencePetro | 94.44 | 16.48 | 981.54k |

| Ganesh Benzo | 176.00 | 7.65 | 93.09k |

| Sanmit Infra | 15.85 | 4.97 | 314.08k |

| ONGC | 334.70 | 4.76 | 1.31m |

| HINDPETRO | 370.30 | 4.66 | 639.02k |

| Oil India | 567.00 | 4.43 | 1.17m |

| IOC | 175.90 | 4.24 | 2.19m |

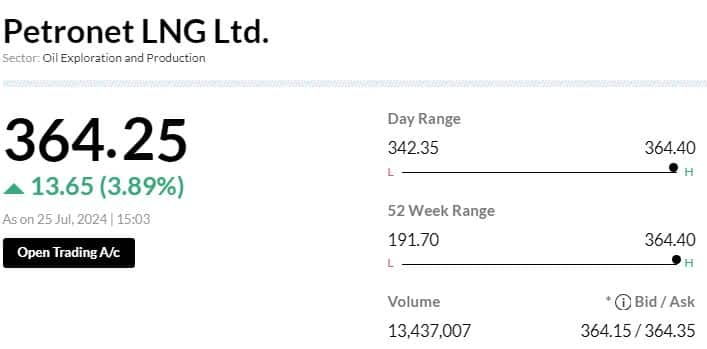

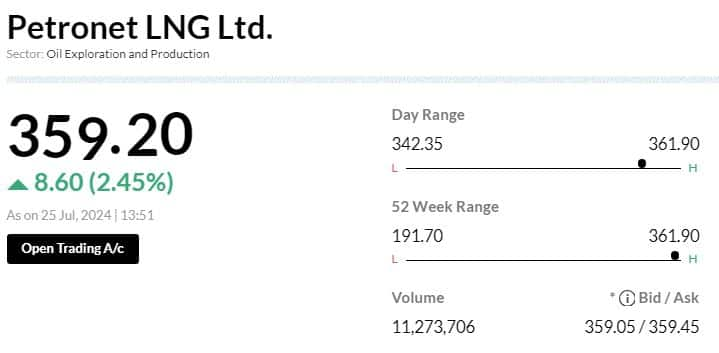

| Petronet LNG | 364.00 | 3.57 | 505.28k |

| Gulf Oil Lubric | 1,206.05 | 3.1 | 19.75k |

| HOEC | 261.05 | 2.94 | 537.05k |

-330

July 25, 2024· 15:07 IST

Earnings Watch | Adani Green Q1 net profit up 94.7% at Rs 629 crore Vs Rs 323 crore, YoY

-330

July 25, 2024· 15:04 IST

Brokerage Call | Nomura upgrades to 'buy' on Petronet LNG, target Rs 405 from Rs 300

#1 Robust Q1 above estimate results on higher volumes & margin

#2 Q1 EBITDA of Rs 156 crore increased a sharp 47 percent QoQ & 29 percent above estimates

#3 Reported margin on spot volumes jumped to USD 7.4/mmBtu versus estimate of USD 2.3/mmBtu

#4 Spot margin was still above estimates at USD 3/MmBtu

#5 Dahej terminal expansion project on track to complete in FY25

#6 Raise FY25F/26 EPS by 5 percent/8 percent

-330

July 25, 2024· 14:56 IST

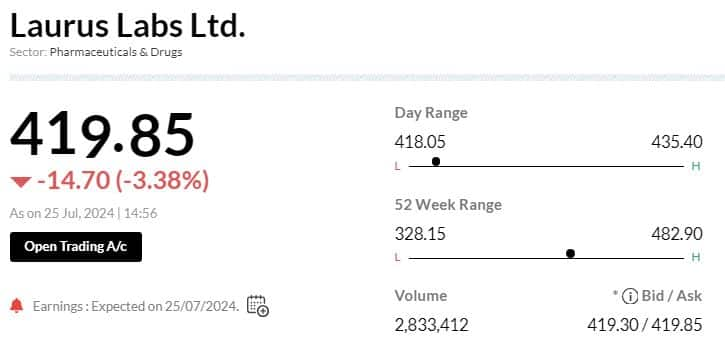

Earnings Watch | Laurus Labs Q1 profit down to Rs 12 crore from 28 crore, YoY

-330

July 25, 2024· 14:55 IST

Expect Rupee to trade with a slight negative bias: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee appreciated slightly on supposed intervention by the Reserve Bank of India (RBI) and overall weakness in crude oil prices. A decline in the US Dollar index also favoured the Rupee. Rupee fell to a record low earlier in the day on weak domestic markets and FII outflows over the past two days.

We expect Rupee to trade with a slight negative bias on a weak global markets and fresh FII outflows. However, weak US Dollar and declining crude oil prices may support the Rupee at lower levels. Intervention by the RBI may also support the Rupee.

Traders may take cues from US GDP, durable goods orders and weekly unemployment claims data from the US. USDINR spot price is expected to trade in a range of Rs 83.45 to Rs 84.

-330

July 25, 2024· 14:51 IST

Power Grid Q1 preview: Strong growth likely on the back of telecom, consultancy biz, capex

Net profit is also expected to grow to Rs 4,028.2 crore in the quarter ending June 2024 from Rs 3,382.8 crore in the quarter ending June 2023....Read More

-330

July 25, 2024· 14:50 IST

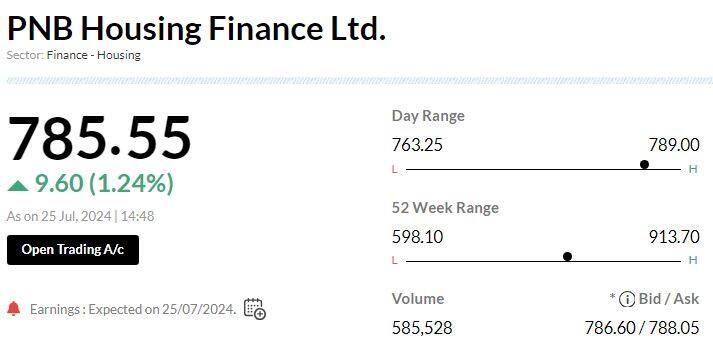

PNB Housing Finance Q1 net profit up 25% at Rs 433 crore Vs Rs 347.3 crore, YoY

-330

July 25, 2024· 14:44 IST

Earnings Watch |Mahindra Holidays reports Rs 5.9 crore net profit in Q1

#1 Net profit at Rs5.9 cr vs Rs0.2 cr (YoY)

#2 Revenue up 6.3% at Rs653 cr vs Rs614.3 cr (YoY)

#3 EBITDA up 25.7% at Rs105.5 cr vs Rs83.9 cr (YoY)

#4 Margin at 16.2% vs 13.6% (YoY)

-330

July 25, 2024· 14:35 IST

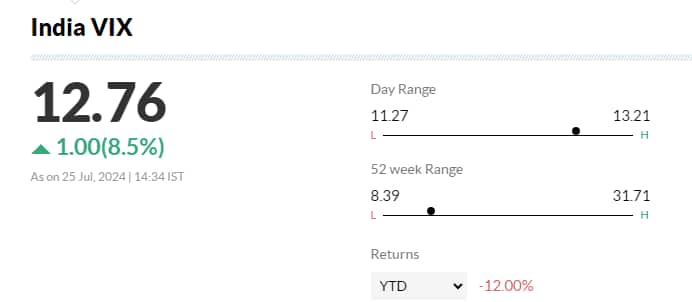

Sensex Today | India VIX up 8%

-330

July 25, 2024· 14:27 IST

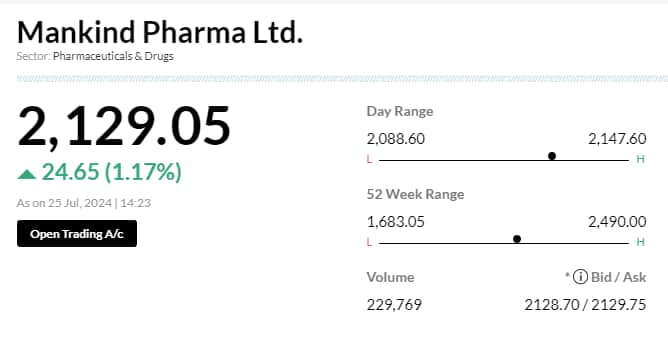

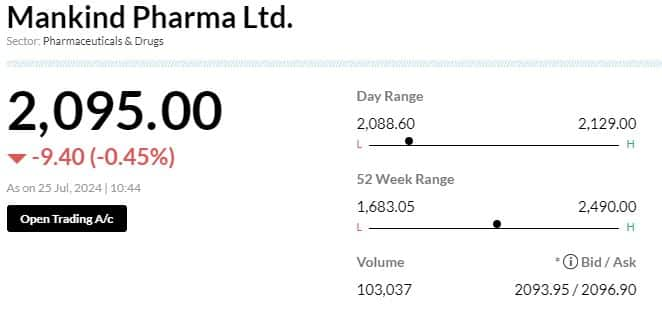

Sensex Today | Mankind Pharma to buy BSV Group for Rs 14000 crore: ET

-330

July 25, 2024· 14:21 IST

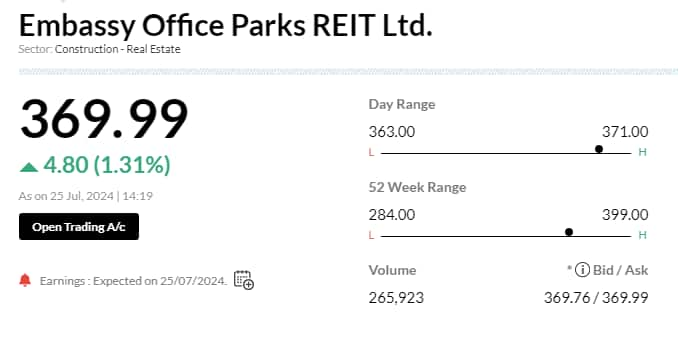

Earnings Watch | Embassy REIT 1Q net operating income Rs 758 crore, up 2.7% YoY

-330

July 25, 2024· 14:11 IST

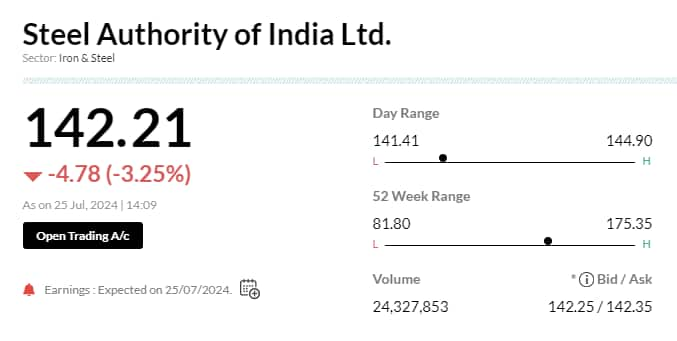

Sensex Today | Steel Authority of India approves raising Rs 2500 crore via private placement of bonds

-330

July 25, 2024· 14:08 IST

Stock Market LIVE Updates | Sensex off day's low

-330

July 25, 2024· 14:04 IST

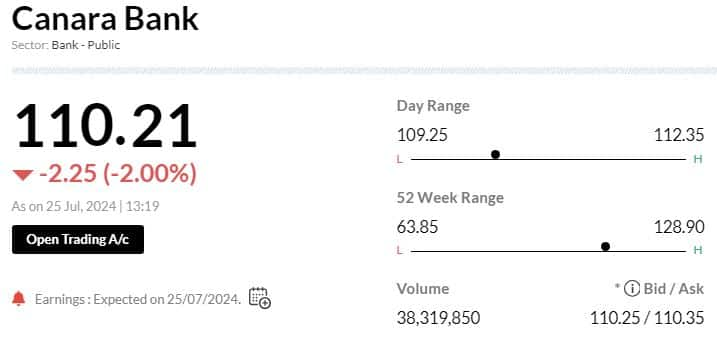

Canara Bank Q1 results| Net profit rises 11% to Rs 3,905.28 crore

Canara Bank Q1 earnings: Gross NPA ratio of the lender was at 4.14 percent in the June quarter against 5.15 percent in the year-ago period...Read More

-330

July 25, 2024· 14:00 IST

Markets@2 | Sensex, Nifty trade lower; banks under pressure

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,085.90 | 5.67 | 1.01m |

| Larsen | 3,617.60 | 2.79 | 99.71k |

| Sun Pharma | 1,649.60 | 1.84 | 59.74k |

| Kotak Mahindra | 1,767.75 | 1.24 | 36.38k |

| Wipro | 505.20 | 1.03 | 201.12k |

| HDFC Bank | 1,620.00 | 0.95 | 331.49k |

| Power Grid Corp | 339.55 | 0.71 | 407.66k |

| TCS | 4,327.50 | 0.49 | 47.95k |

| Bajaj Finance | 6,638.15 | 0.42 | 37.05k |

| M&M | 2,815.20 | 0.34 | 40.11k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axis Bank | 1,163.65 | -6.14 | 515.99k |

| Nestle | 2,468.15 | -2.97 | 87.49k |

| Titan Company | 3,400.00 | -2.1 | 31.58k |

| ICICI Bank | 1,199.70 | -1.88 | 112.70k |

| Tata Steel | 157.35 | -1.84 | 1.10m |

| IndusInd Bank | 1,375.40 | -1.56 | 327.89k |

| JSW Steel | 876.00 | -0.61 | 39.02k |

| SBI | 847.15 | -0.6 | 399.99k |

| Asian Paints | 2,895.40 | -0.57 | 10.39k |

| Bharti Airtel | 1,447.65 | -0.54 | 36.28k |

-330

July 25, 2024· 13:53 IST

Brokerage Call | CLSA keeps 'underperform' call on Petronet LNG, target Rs 250

#1 Q1 profit of 24 percent above estimate on large inventory gain & higher-than-expected other income

#2 Volumes at both Dahej & Kochi missed but higher trading gains resulted in an in-line EBITDA

#3 LNG consumption in Q1 rose 27 percent QoQ, led by jump in heatwave-driven demand

#4 Post Q1, gas demand from the power sector has come off notably

#5 Even inventory gains could see reversal if international gas prices see a cool-off hereon

#6 With this seasonal peak in LNG demand behind, Q1 may prove to be interim peak in volume & profit

-330

July 25, 2024· 13:48 IST

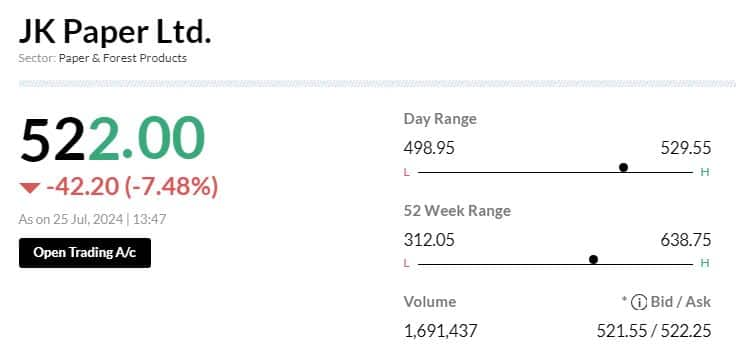

Sensex Today | JK Paper shares slip 7% as Q1 profit plunges 54%

#1 Profit plunges 54.7 percent to Rs 139.7 crore Vs Rs 308.7 crore

#2 Revenue rises 8.2 percent to Rs 1,713.7 crore Vs Rs 1,584.4 crore

-330

July 25, 2024· 13:45 IST

Dr Reddy's Labs Q1 Preview: Tepid US sales likely to put brakes on earnings growth

Analysts will focus on Dr Reddy's R&D expense and margin guidance for FY25. ...Read More

-330

July 25, 2024· 13:43 IST

Sensex Today | Nifty PSU Bank index falls 0.5%

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Union Bank | 132.26 | -1.68 | 6.87m |

| Bank of Baroda | 245.55 | -1.37 | 12.00m |

| SBI | 845.60 | -0.75 | 6.98m |

| Punjab & Sind | 64.92 | -0.54 | 3.64m |

| Indian Bank | 567.10 | -0.44 | 561.03k |

| Canara Bank | 112.00 | -0.41 | 59.13m |

| Bank of India | 120.19 | -0.12 | 3.05m |

-330

July 25, 2024· 13:39 IST

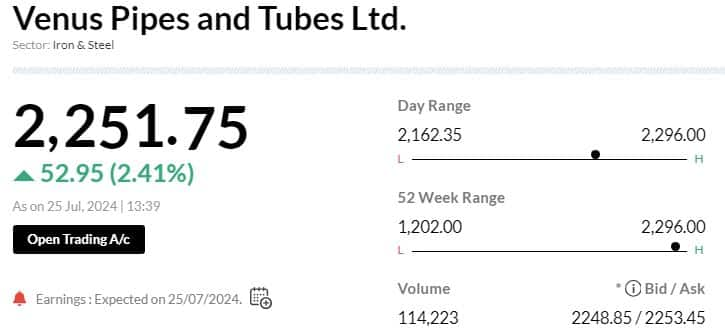

Earnings Watch | Venus Pipes Q1 profit rise to Rs 28 crore from Rs 17 crore, YoY

-330

July 25, 2024· 13:38 IST

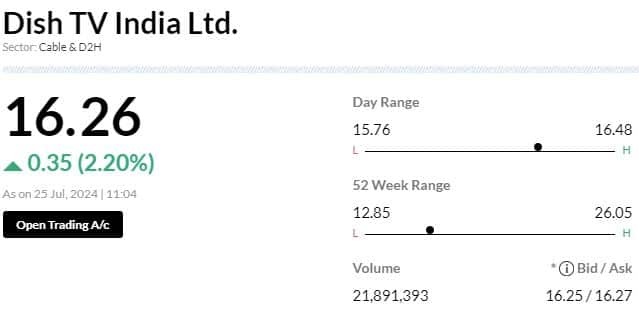

Sensex Today | Nifty Media up 1.3%; Zee Entertainment, TV TodayNetwork, Sun TV Network among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Zee Entertain | 141.30 | 3.37 | 11.87m |

| TV TodayNetwork | 244.00 | 1.39 | 140.96k |

| Sun TV Network | 817.75 | 1.32 | 1.10m |

| DB Corp | 355.20 | 1.28 | 181.34k |

| Dish TV | 16.07 | 1.01 | 30.48m |

| Network 18 | 84.00 | 0.72 | 1.63m |

| PVR INOX | 1,496.95 | 0.51 | 543.55k |

-330

July 25, 2024· 13:35 IST

Stock Market LIVE Updates | USFDA conducts surprise inspection of Gland Pharm;s Dundigal facility

The United States Food and Drug Administration (US FDA) has conducted surprise inspection of the Company’s Dundigal Facility at Hyderabad for Good Manufacturing Practices (GMP) between 22nd July, 2024 and 25th July, 2024.

The inspection was concluded with two 483 Observations. These observations are procedural in nature.

The corrective and preventive actions for these observations will be submitted to the US FDA within the stipulated period. The observations issued are neither repeated observations nor related to data integrity.

-330

July 25, 2024· 13:32 IST

Sensex Today | 1.1 million shares of Canara Bank traded in a bunch: Bloomberg

-330

July 25, 2024· 13:31 IST

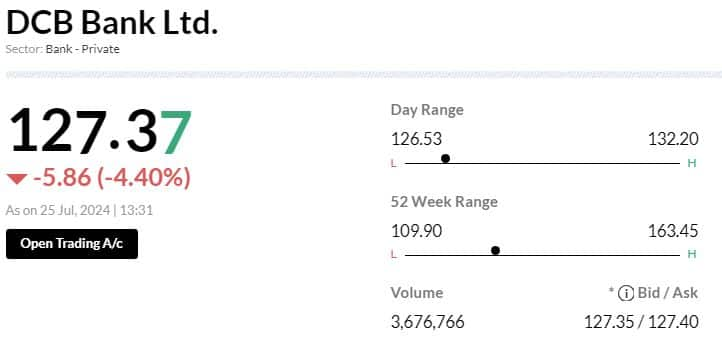

Stock Market LIVE Updates | DCB Bank shares tank 4% post Q1 results

#1 Profit increases 3.5 percent to Rs 131.4 crore Vs Rs 126.9 crore, YoY

#2 Net interest income grows 5.5 percent to Rs 496.6 crore Vs Rs 470.7 crore, YoY

#3 Gross NPA jumps to 3.33 percent Vs 3.23 percent, QoQ

#4 Net NPA rises to 1.18 percent Vs 1.11 percent, QoQ

-330

July 25, 2024· 13:29 IST

Sensex Today | BSE Auto index up 1 percent

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,085.70 | 5.65 | 946.09k |

| Cummins | 3,639.00 | 2.71 | 22.69k |

| Tube Investment | 4,034.95 | 2.07 | 4.79k |

| M&M | 2,826.90 | 0.75 | 35.31k |

| Bosch | 34,284.65 | 0.55 | 86 |

| Sundram | 1,411.05 | 0.51 | 654 |

| MOTHERSON | 190.65 | 0.42 | 302.82k |

| Balkrishna Ind | 3,146.15 | 0.4 | 1.46k |

| MRF | 137,500.40 | 0.26 | 641 |

| TVS Motor | 2,454.00 | 0.23 | 5.86k |

-330

July 25, 2024· 13:27 IST

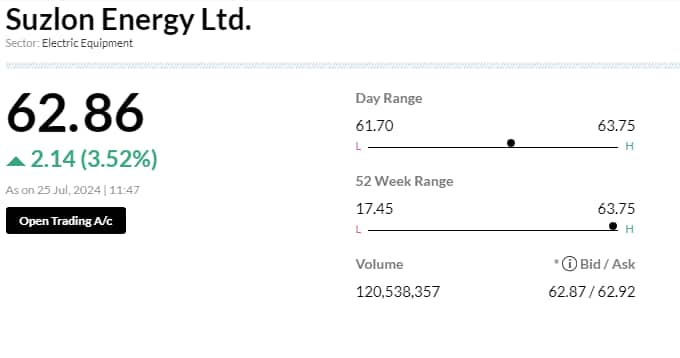

Suzlon at multi-year high as brokerages raise targets, shares zoom 227% in a year

In the FY24–26E period, Geojit Financial Services expects Suzlon’s revenue CAGR & ROE to surpass those of the industry peers....Read More

-330

July 25, 2024· 13:25 IST

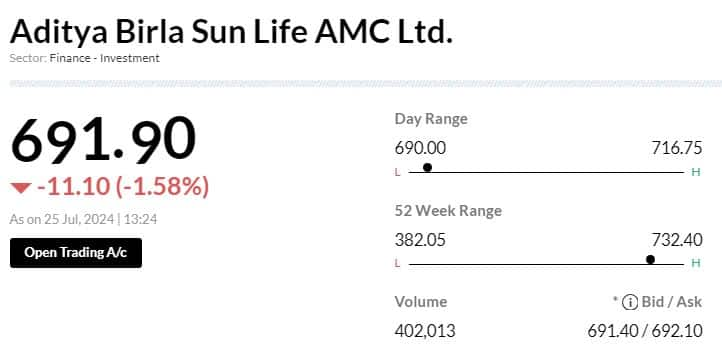

Sensex Today | Aditya Birla Sun Life AMC Q1 profit jumps; shares trade lower

#1 Profit jumps 27.7 percent to Rs 235.7 crore Vs Rs 184.6 crore, YoY

#2 Revenue rises 24.3 percent to Rs 386.6 crore Vs Rs 311.2 crore, YoY

-330

July 25, 2024· 13:23 IST

Foreigners sell nearly $1 billion in Indian equities in two days since budget

Foreign portfolio investors (FPIs) net sold shares worth 81.06 billion rupees ($968 million) on Tuesday and Wednesday, provisional data from the National Stock Exchange showed....Read More

-330

July 25, 2024· 13:19 IST

Earnings Watch | Canara Bank Q1 net profit at Rs 3,905 crore

-330

July 25, 2024· 13:17 IST

Hyundai Motor plans India IPO by end of 2024: Bloomberg

-330

July 25, 2024· 13:16 IST

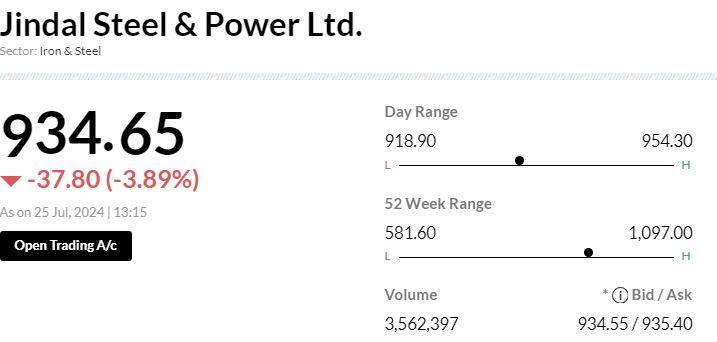

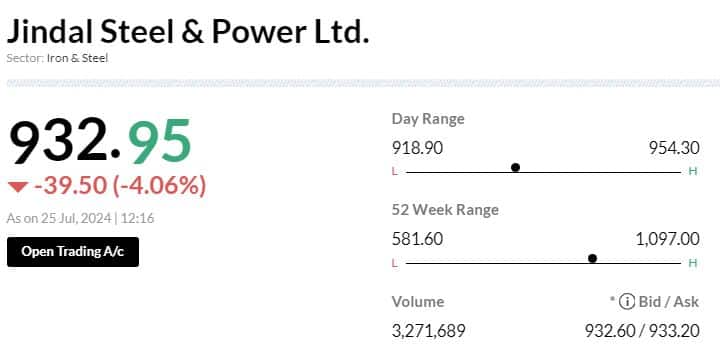

Sensex Today | Jindal Steel & Power shares decline 4% post Q1 numbers

#1 Profit declines 20.9 percent to Rs 1,337.9 crore Vs Rs 1,691.8 crore, YoY

#2 Revenue rises 8.2 percent to Rs 13,617.8 crore Vs Rs 12,588.3 crore, YoY

-330

July 25, 2024· 13:10 IST

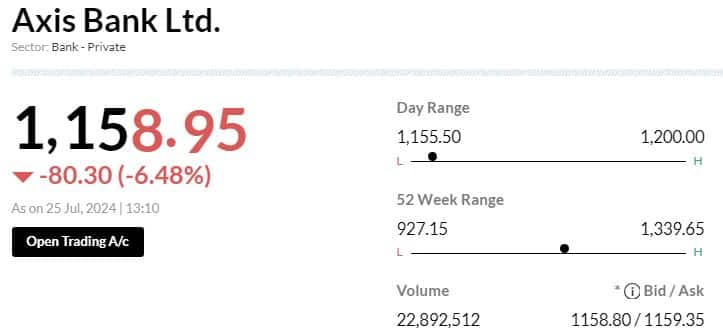

Stock Market LIVE Updates | Axis Bank shares fall 6.5% post Q1 results

Axis Bank on July 24 reported a net profit of Rs 6,035 crore for Q1 FY25, up from Rs 3,452 crore in the corresponding quarter previous year. This beat street expectations. An average estimate of 8 brokerages had expected a net profit of Rs 5,797 crore.

On a sequential basis, the profit of the bank dropped by 15 percent from Rs 7,130 crore.

-330

July 25, 2024· 13:08 IST

Earnings Watch | LT Foods Q1 net profit up 11.5% at Rs 152.3 crore Vs Rs 137.4 crore, YoY

-330

July 25, 2024· 13:07 IST

Stock Market LIVE Updates | Sensex recovers 540 points from day's low

-330

July 25, 2024· 13:01 IST

Earnings Watch | Ashok Leyland Q1 net profit down at Rs 525.6 crore and revenue up at Rs 8,599 crore

-330

July 25, 2024· 12:59 IST

Sensex Today | Motilal Oswal keeps neutral' rating on United Spirits

With consistent improvements in gross and EBITDA margin, increase FY25/FY26 EPS estimates by 3%/4%

Company sold a large part of its popular portfolio to concentrate on its global strategy for the premium portfolio.

The liquor industry is currently experiencing an upgrading trend, aligning well with company's renewed emphasis on P&A, which fits into the long-term liquor upgrading narrative in India.

Maintain Neutral rating on the stock. Target Price of Rs 1,400.

-330

July 25, 2024· 12:52 IST

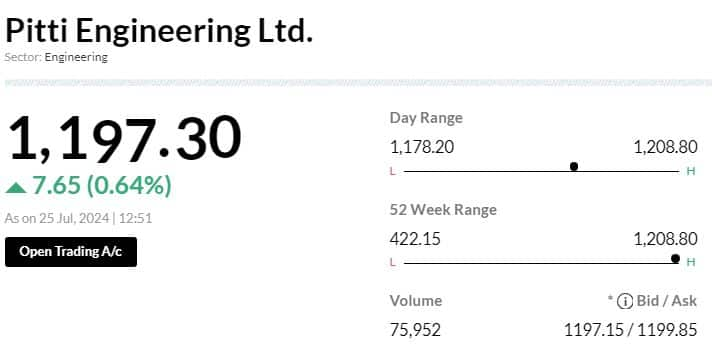

Sensex Today | Pitti Engg to acquire Dakshin Foundry for over Rs 153 crore

-330

July 25, 2024· 12:51 IST

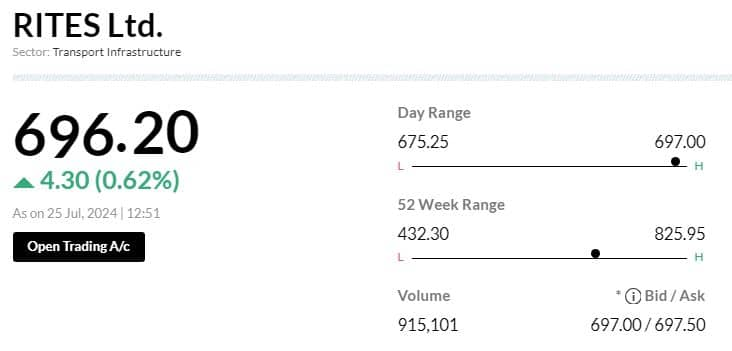

RITES gets LoI for a project worth Rs 392 crore from Directorate of Medical Education, Mumbai

-330

July 25, 2024· 12:48 IST

Sensex Today | Ujjivan Small Finance Bank Q1 net profit down 7.1% at Rs 301.1 crore Vs Rs 324.1 crore, YoY

-330

July 25, 2024· 12:42 IST

Brokerage Call | Morgan Stanley keeps 'equal-weight' call on SRF, target Rs 2,115

#1 Q1 results showed company had a weak start to fiscal with sustained agrochemical uncertainty

#2 Q1 showed intensifying competitive pressures

#3 Structural changes to refrigerant gas consumption patterns implies more bumpiness

#4 Specialty chemicals guidance unchanged, but not without downside risks

#5 Traction witnessed in recent launches, legacy products not out of the woods

#6 Customer sentiment across specialty chemicals remains subdued

-330

July 25, 2024· 12:39 IST

Sensex Today | BSE Realty index down 1 percent

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Mahindra Life | 609.90 | -2.49 | 6.89k |

| Phoenix Mills | 3,487.55 | -2.13 | 5.52k |

| Prestige Estate | 1,856.50 | -1.67 | 26.46k |

| DLF | 806.50 | -1.54 | 48.58k |

| Godrej Prop | 3,088.95 | -1.12 | 4.78k |

| Oberoi Realty | 1,723.70 | -1.1 | 7.40k |

| Macrotech Dev | 1,399.45 | -0.11 | 18.99k |

-330

July 25, 2024· 12:37 IST

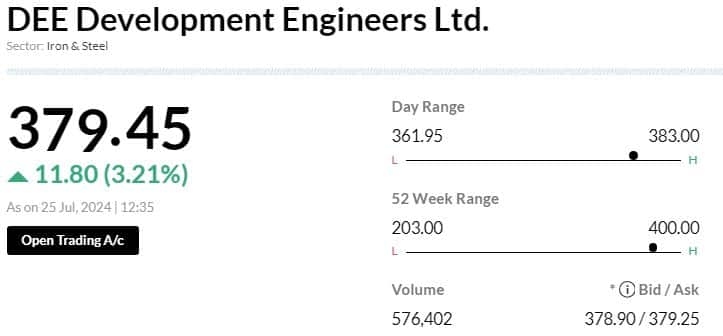

Stock Market LIVE Updates | DEE Development Engineers bags purchase order from Bharat Heavy Electricals

-330

July 25, 2024· 12:30 IST

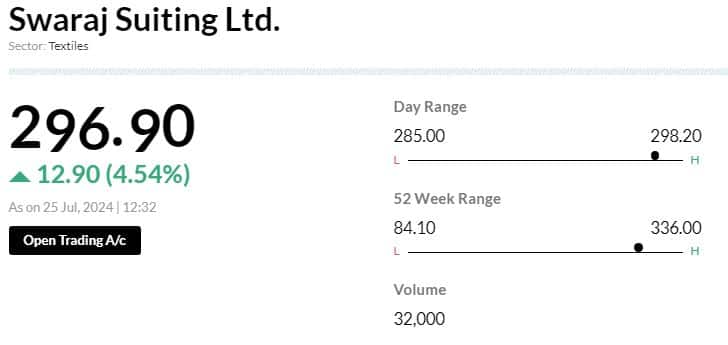

Stock Market LIVE Updates | Swaraj Suiting commences commercial production from MP unit

The company informed that the implementation of setting up of Weaving manufacturing unit and Expansion of Denim Division at B-24 to B-41, Industrial Area, Jhanjharwada, Neemuch, Madhya Pradesh has been completed and the commercial production of the said unit has commenced.

-330

July 25, 2024· 12:27 IST

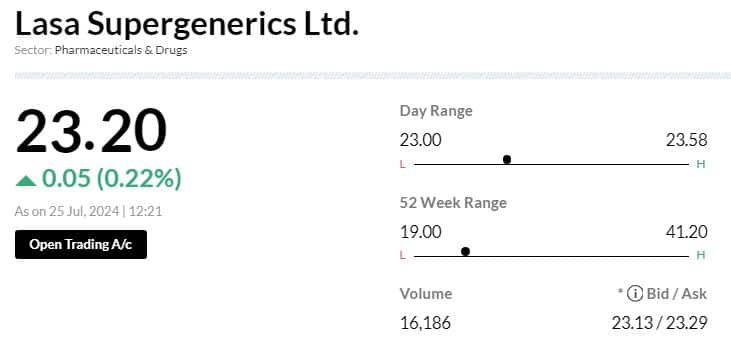

Varsha Pravin Joshi appointed as the Chief Financial Officer of Lasa Supergenerics

-330

July 25, 2024· 12:25 IST

Sensex Today | Airtel expands its Wi-Fi service across an additional 4.1 million households in Gujarat

-330

July 25, 2024· 12:25 IST

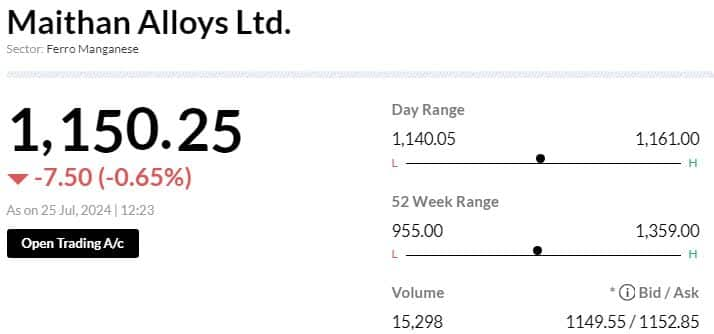

Maithan Alloys 594000 acquires shares of Jio Financial Services

-330

July 25, 2024· 12:19 IST

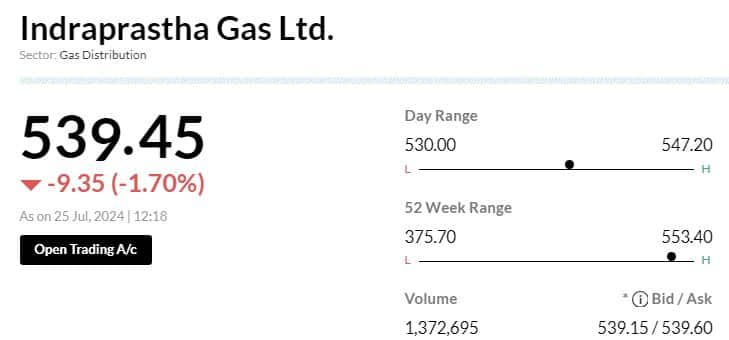

Stock Market LIVE Updates | Indraprastha Gas shares trade lower post Q1 earnings

#1 Profit grows 4.9 percent to Rs 401.5 crore Vs Rs 382.8 crore, QoQ

#2 Revenue falls 2.1 percent to Rs 3,520.6 crore Vs Rs 3,596.8 crore, QoQ

-330

July 25, 2024· 12:16 IST

Brokerage Call | Morgan Stanley keeps 'underweight' call on JSPL, target Rs 655

#1 Q1 standalone EBITDA slightly above estimate but missed consensus

#2 Q1 volumes were higher than expected

#3 Adjusted for volumes, EBITDA was lower than estimates

#4 Realisations were weaker, partially offset by better show on ‘other’ opex

#5 Some postponement in project execution timelines – execution is key

-330

July 25, 2024· 12:13 IST

Sensex Today | Nifty Midcap 100 recovers 500 points day's low

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oil India | 591.90 | 8.91 | 11.08m |

| CG Power | 737.10 | 5.74 | 6.57m |

| Fortis Health | 506.05 | 4.76 | 2.81m |

| HINDPETRO | 368.25 | 4.07 | 10.94m |

| Zee Entertain | 141.65 | 3.63 | 10.76m |

| Suzlon Energy | 62.68 | 3.23 | 123.54m |

| IDBI Bank | 100.35 | 2.92 | 101.34m |

| BSE Limited | 2,483.55 | 2.9 | 937.59k |

| Biocon | 356.90 | 2.56 | 4.14m |

| Syngene Intl | 763.25 | 2.35 | 1.89m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| KPIT Tech | 1,773.30 | -4.35 | 1.15m |

| M&M Financial | 288.00 | -3.58 | 1.24m |

| SAIL | 142.17 | -3.28 | 19.24m |

| LIC Housing Fin | 757.50 | -3.14 | 1.74m |

| Poonawalla Fin | 369.50 | -2.9 | 2.20m |

| Max Healthcare | 922.65 | -2.63 | 523.38k |

| Vodafone Idea | 15.17 | -2.63 | 294.17m |

| Mazagon Dock | 4,919.00 | -2.55 | 1.08m |

| PB Fintech | 1,465.60 | -2.15 | 177.31k |

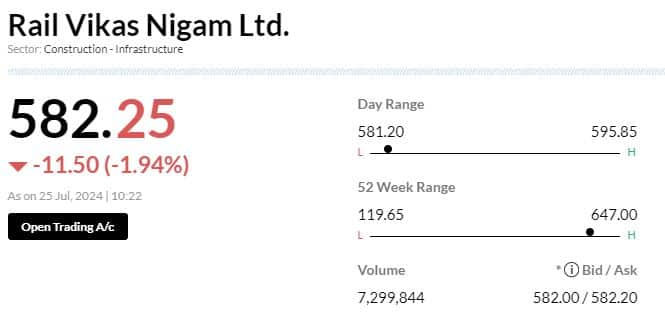

| Rail Vikas | 581.20 | -2.11 | 10.97m |

-330

July 25, 2024· 12:09 IST

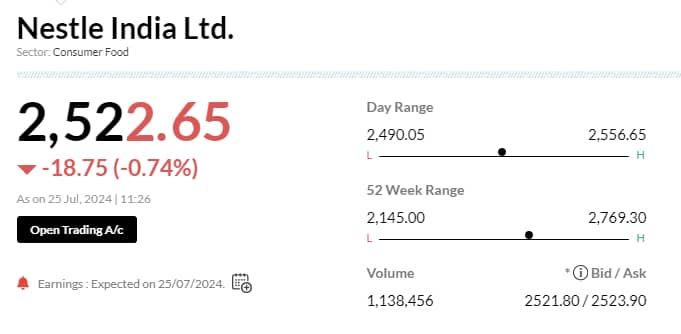

Stock Market LIVE Updates | Dr Reddy’s gains on transferring 49% stake in JV to Nestle

The pharma company has transferred 49% of its equity share capital in the joint venture company, Dr Reddy’s and Nestle Health Science, to Nestle India. After the transfer, Dr Reddy’s Labs holds 51% of the share capital, while Nestle India holds 49% of the share capital in the joint venture company.

-330

July 25, 2024· 12:02 IST

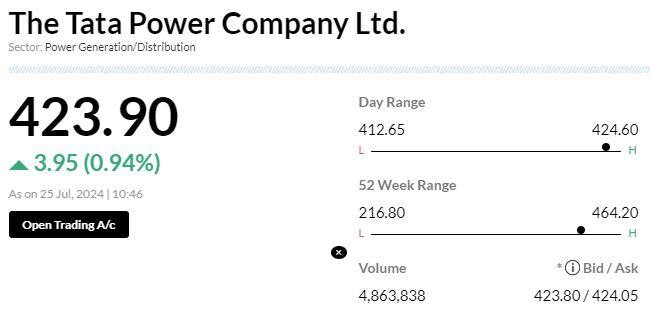

Sensex Today | BSE Power index up 1.4%; CG Power, Suzlon Energy among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| CG Power | 739.25 | 6.17 | 234.41k |

| Suzlon Energy | 62.85 | 3.52 | 11.44m |

| ABB India | 7,711.45 | 2.46 | 14.19k |

| Siemens | 6,915.00 | 2.13 | 3.37k |

| Adani Green Ene | 1,737.00 | 1.22 | 54.47k |

| Power Grid Corp | 340.65 | 1.04 | 312.34k |

| Tata Power | 422.70 | 0.7 | 385.93k |

| NTPC | 395.10 | 0.65 | 479.51k |

| BHEL | 311.10 | 0.65 | 421.75k |

| NHPC | 102.90 | 0.49 | 2.62m |

-330

July 25, 2024· 11:59 IST

IPO View | Book profits in Sanstar on listing day: Prashanth Tapse, Senior VP (Research), Mehta Equities

Despite valuations being slightly on the expensive side, Sanstar received a healthy response on the last day of the issue from all types of investors. We believe the investor demand has come considering an opportunity to invest in one of the leading Indian manufacturers of plant-based specialty products and ingredients derived from maize. We also believe there are high entry barriers in the maize-based specialty products industry and the B2B nature of their business create significant exit barriers for customers, ensuring a stable and loyal customer base.

Considering healthy subscription demand and unique business matrix, we expect a decent room for listing gain in the range of ~22-25% against the issue price of Rs 95 per share while looking at market mood post budget, we recommend allotted investors to book profits on listing day.

-330

July 25, 2024· 11:57 IST

Sensex Today | BSE Oil & Gas index up 2 percent; Oil India, HPCL, ONGC, among major gainers

-330

July 25, 2024· 11:53 IST

Earnings watch | Thangamayil Jewellery Q1 profit at Rs 57 crore

-330

July 25, 2024· 11:52 IST

Sensex Today | Expect Nifty to test support levels around 24300 to 24150: Shrey Jain Founder and CEO SAS Online

Indian market sentiment initially soured on budget day due to a proposed hike in capital gains tax. Now, sentiments have worsened further following a sharp global market downturn, highlighted by Nasdaq's 3.64% plunge, resulting in a significant gap-down opening today.

As of today’s monthly expiry, the Nifty is trading below its monthly Volume Weighted Average Price (VWAP) levels of 24400, indicating a negative bias. We expect the Nifty to potentially test support levels around 24300 to 24150. Meanwhile, the Bank Nifty has continued to underperform compared to the Nifty, primarily due to selling pressure in the private banking sector. Given the current high volatility, it would be wise to adopt a cautious approach and wait for clearer market signals before making any trading decisions.

-330

July 25, 2024· 11:49 IST

Stock Market LIVE Updates | Sun Pharmaceutical receives warning letter from the US FDA

The company received the warning letter from the US FDA for its Dadra facility on June 19. There is no impact on the company's financial, operational, or other activities. Sun Pharma will work with the US FDA and undertake all necessary steps to resolve the outstanding issues.

-330

July 25, 2024· 11:47 IST

Sensex Today | Geogit initiated buy rating on Suzlon Energy; ups target price by 20%

#1 Geogit initiated coverage on Suzlong Energy

#2 Ups target price to Rs 73, up 20% from CMP

-330

July 25, 2024· 11:44 IST

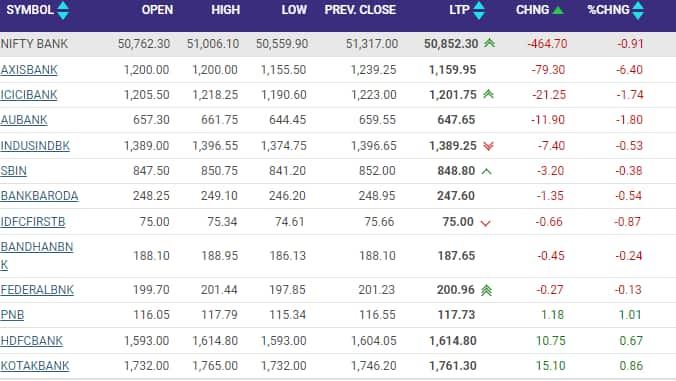

Sensex Today | Nifty Bank down 1% to 50852 points

-330

July 25, 2024· 11:37 IST

Sensex Today | Indian Hotels has 1.82 million shares traded in a block: Bloomberg

-330

July 25, 2024· 11:28 IST

Sensex Today | Nestle India faces record high Coffee, Cocoa prices amid commodity headwinds

#1 Nestle India's Commodity Outlook: Commodity prices are seeing unprecedented headwinds in coffee and cocoa with all-time high prices and an ongoing price rally. Cereals and grains are going through a structural cost increase backed by MSP. There is relative stability in milk prices, packaging and edible oils.

#2 Nestle India E-commerce: Continued to accelerate, with strong growth in quick commerce, driven by brands such as KITKAT, NESCAFÉ, MAGGI Masala-ae-Magic, MILKMAID and RTD

#3 E-commerce sustained its upward trajectory, contributing to 7.5% of domestic sales and growing

at double digit

-330

July 25, 2024· 11:23 IST

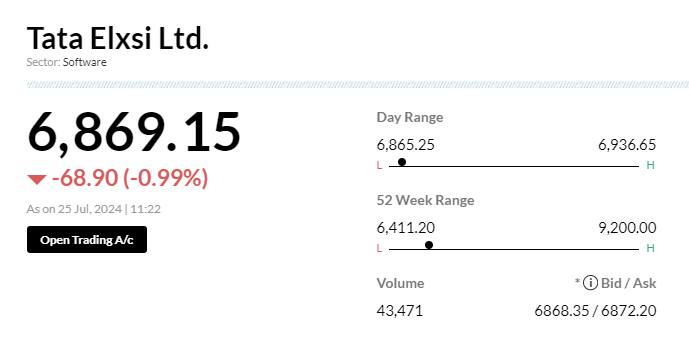

Sensex Today | Tata Elxsi selects Wind River Studio Developer for its software-defined vehicle Development

-330

July 25, 2024· 11:16 IST

Cipla Q1 Preview: Domestic business restructuring may moderate profit growth

Cipla's US sales are expected to remain on a strong footing in Q1, but a restructuring of the domestic trade generics business is expected to negatively impact revenue, potentially slowing the drugmaker's growth momentum....Read More

-330

July 25, 2024· 11:12 IST

Earnings Watch | Nestle India Q1 net profit at Rs 746.6 crore and revenue at Rs 4,814 crore

-330

July 25, 2024· 11:06 IST

Stock Market LIVE Updates | Dish TV shares gain 2% on fund raising plan

The company has received board approval for raising funds up to Rs 1,000 crore via equity shares or bonds, in one or more tranches. The board also approved the incorporation of a subsidiary in India to undertake the business of distributing products and services through a robust digital platform.

-330

July 25, 2024· 10:59 IST

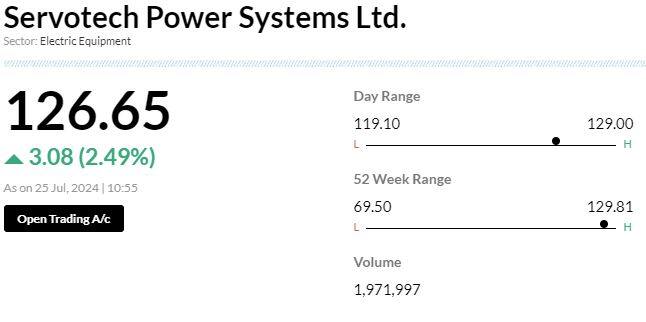

Sensex Today | Servotech gets additional order of 400 units of DC Fast EV Chargers

-330

July 25, 2024· 10:57 IST

Sensex Today | Kothari Products, STC India, Amines and Plasticizers witness volume surge

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Kothari Product | 193.30 20% | 411.94k23,556.40 | 1,649.00 |

| Amines Plast | 342.45 10.59% | 460.50k51,174.00 | 800.00 |

| STC India | 232.99 14.9% | 7.67m1,100,230.00 | 597.00 |

| Oswal ChemandFe | 39.48 15.68% | 2.55m377,563.20 | 575.00 |

| Worth Periphera | 137.75 13.17% | 355.23k53,210.60 | 568.00 |

| ILandFS | 14.64 10.24% | 5.81m892,057.60 | 551.00 |

| MSTC | 1,019.25 11.57% | 2.34m402,587.40 | 481.00 |

| Nacl Industries | 70.27 7.69% | 590.89k103,284.00 | 472.00 |

| Whirlpool | 2,049.85 2.08% | 660.63k124,672.80 | 430.00 |

| Prime Sec | 252.00 2.06% | 227.90k43,777.00 | 421.00 |

-330

July 25, 2024· 10:52 IST

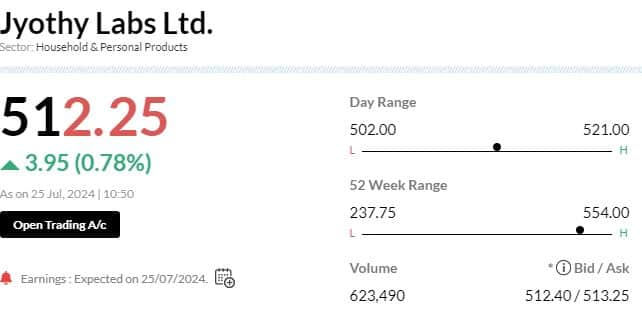

Earnings Watch | Jyothy Labs Q1 net orofit up 4.9% at Rs 101 crore Vs Rs 96 crore, YoY

-330

July 25, 2024· 10:51 IST

H.G. Infra Engineering bags order

H.G. Infra Engineering has been declared as L-1 bidder by the Ministry of Road Transport and Highways (MORTH) for the project of improvement and up-gradation in two lane with paved shoulders configuration of newly declared NH227B Bahuvan Madar Majha to Jagarnathpur (Design Km 160.200 to Km 224.040) “84 Kosi Parikrama Marg” in the State of Uttar Pradesh on Hybrid Annuity Mode Package V. The bid cost of the project is Rs 763.11 crore.

-330

July 25, 2024· 10:46 IST

Sensex Today | Tata Power’s Microgrid arm partners with National Dairy Development Board to solarize milk value chain

-330

July 25, 2024· 10:45 IST

Mankind Pharma said to be frontrunner in Bharat Serums takeover: Bloomberg

-330

July 25, 2024· 10:40 IST

Stock Market LIVE Updates | Motilal Oswal reiterates 'buy' rating on SBI Life Insurance Company, target Rs 1,900

The company reported a decent performance during the quarter, with APE and VNB in line with estimates (VNB margin contracted to 26.8% in 1QFY25).

New product launches are likely to kick-start the recovery in the protection segment.

Further, the impact of surrender charges is likely to be minimal.

Considering the seasonality, the SBI channel is anticipated to see recovery in growth in 2Q and 3Q.

SBILIFE continues to maintain its cost leadership and expect SBILIFE to deliver an 18% CAGR in APE/VNB over FY24-26, while RoEV is projected to remain ~20%.

-330

July 25, 2024· 10:35 IST

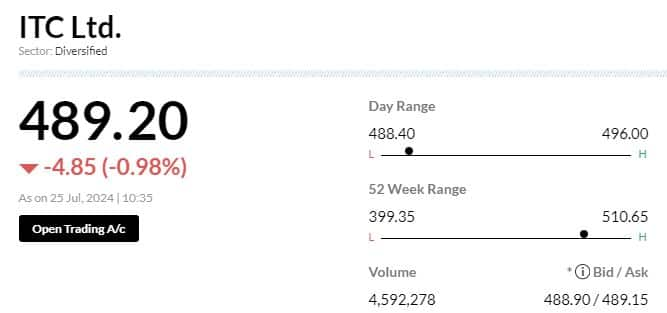

Stock Market LIVE Updates | ITC incorporates a wholly owned subsidiary in Italy

Subsidiary ITC Infotech India has incorporated a wholly owned subsidiary in Italy under the name ITC Infotech Italia s.r.l.

-330

July 25, 2024· 10:31 IST

Axis Bank Q1 FY25 – slower earnings trajectory ahead, warrants caution

We see a high possibility of RoA compression in the near term...Read More

-330

July 25, 2024· 10:27 IST

Sensex Today | BSE Bank index underperforms

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 79688.07-0.57 | 10.31-2.04 | 2.0920.09 |

| BSE 200 | 11219.78-0.5 | 16.40-1.86 | 1.9832.22 |

| BSE MIDCAP | 46450.34-0.79 | 26.09-1.90 | 0.9356.13 |

| BSE SMALLCAP | 53719.38-0.21 | 25.880.08 | 3.1856.71 |

| BSE BANKEX | 57748.69-1.76 | 6.20-4.69 | -3.4411.81 |

-330

July 25, 2024· 10:23 IST

Stock Market LIVE Updates | Rail Vikas Nigam bags order worth Rs 191 crore; shares fall

The company has received a Letter of Acceptance from SER HQ-Electrical/South Eastern Railway for a project worth Rs 191.53 crore.

The project involves the design, supply, erection, testing, and commissioning of a 132 KV traction substation, sectioning posts (SPs), and sub-sectioning posts (SSPs) in a 2x25KV system on the Rajkhaswan-Nayagarh-Bolani section of the Chakradharpur division of South Eastern Railway.

-330

July 25, 2024· 10:20 IST

Sensex Today | Nifty Bank underperforms

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 24287.35-0.52 | 11.76-2.07 | 2.3923.41 |

| NIFTY BANK | 50653.15-1.29 | 4.89-3.74 | -3.7110.49 |

| NIFTY Midcap 100 | 56525.75-0.61 | 22.40-1.02 | 2.0953.24 |

| NIFTY Smallcap 100 | 18624.90-0.53 | 22.99-1.09 | 2.1061.13 |

| NIFTY NEXT 50 | 71449.20-0.55 | 33.94-2.27 | 0.1260.89 |

-330

July 25, 2024· 10:17 IST

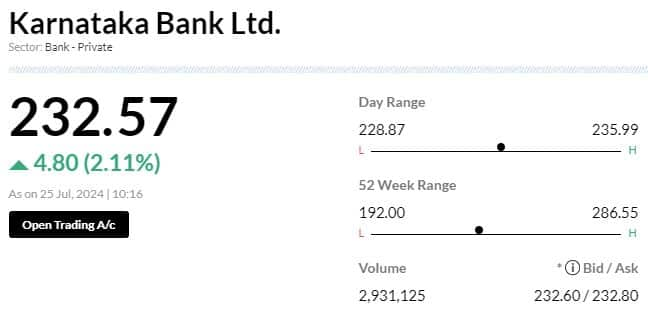

Stock Market LIVE Updates | Karnataka Bank shares rise 2% post Q1 earnings

#1 Profit grows 8 percent to Rs 400.3 crore Vs Rs 370.7 crore, YoY

#2 Net interest income increases 10.88 percent to Rs 903.4 crore Vs Rs 814.7 crore, YoY

#3 Gross NPA rises to 3.54 percent Vs 3.53 percent, QoQ

#4 Net NPA jumps to 1.66 percent Vs 1.58 percent, QoQ

-330

July 25, 2024· 10:16 IST

Ashish Kacholia trims holding in seven stocks, likely exited six companies in Q1

The firms where Kacholia trimmed his stake include PCBL Ltd, Walchandnagar Industries, Repro India, Sastasundar Ventures, Shaily Engineering Plastics, NIIT Learning Systems, and Aditya Vision Ltd. ...Read More

-330

July 25, 2024· 10:08 IST

Sensex Today | BSE Bank index sheds 1.5%; Axis Bank, ICICI Bank, Federal Bank among major losers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axis Bank | 1,167.45 | -5.83 | 221.89k |

| ICICI Bank | 1,198.00 | -2.02 | 60.28k |

| Federal Bank | 197.95 | -1.74 | 193.44k |

| Canara Bank | 110.95 | -1.38 | 432.48k |

| Yes Bank | 24.57 | -1.36 | 6.65m |

| IndusInd Bank | 1,379.80 | -1.24 | 36.93k |

| SBI | 843.50 | -1.03 | 155.72k |

| Bank of Baroda | 247.40 | -0.7 | 138.36k |

-330

July 25, 2024· 10:05 IST

Tech Mahindra Q1 earnings preview: Analysts forecast 30% profit boost, marginal revenue increase

According to the average of 10 estimates compiled by Moneycontrol, Tech Mahindra's net profit is projected to increase over 30 percent quarter-over-quarter, reaching Rs 861 crore in Q1 FY25....Read More

-330

July 25, 2024· 10:02 IST

Markets@10 | Sensex down 450 pts, Nifty below 24300

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 1,061.40 | 3.28 | 314.36k |

| Larsen | 3,577.35 | 1.65 | 54.68k |

| HCL Tech | 1,589.95 | 0.34 | 29.78k |

| HDFC Bank | 1,608.00 | 0.21 | 118.12k |

| Kotak Mahindra | 1,749.60 | 0.2 | 14.80k |

| Bajaj Finance | 6,618.05 | 0.12 | 15.91k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Axis Bank | 1,168.25 | -5.77 | 215.95k |

| ICICI Bank | 1,196.80 | -2.11 | 59.43k |

| Titan Company | 3,411.70 | -1.76 | 9.84k |

| Power Grid Corp | 332.40 | -1.41 | 150.57k |

| Tata Steel | 158.15 | -1.34 | 516.67k |

| IndusInd Bank | 1,380.15 | -1.22 | 34.19k |

| SBI | 843.25 | -1.06 | 151.40k |

| JSW Steel | 872.90 | -0.96 | 16.93k |

| UltraTechCement | 11,352.10 | -0.93 | 2.67k |

| Bharti Airtel | 1,444.40 | -0.77 | 14.43k |

-330

July 25, 2024· 10:00 IST

Ashish Kacholia trims holding in seven stocks, likely exited six companies in Q1

The firms where Kacholia trimmed his stake include PCBL Ltd, Walchandnagar Industries, Repro India, Sastasundar Ventures, Shaily Engineering Plastics, NIIT Learning Systems, and Aditya Vision Ltd. ...Read More

-330

July 25, 2024· 09:57 IST

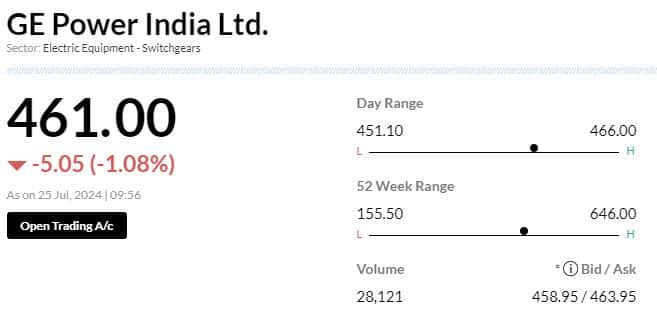

Sensex Today | GE Power India gets Letter of intent of Rs 1.75 crore from Gujarat State Electricity Corporation

-330

July 25, 2024· 09:56 IST

Stock Market LIVE Updates | Stocks turn ex-dividend today

Akzo Nobel India, Bhansali Engineering Polymers, Datamatics Global Services, Diamines & Chemicals, Hind Rectifiers, Magadh Sugar & Energy, MRF, Orient Electric, Pradeep Metals, Punjab Chemicals and Crop Protection, Radico Khaitan, Suryalata Spinning Mills, United Breweries, V-Guard Industries

-330

July 25, 2024· 09:53 IST

Stock Market LIVE Updates | KSB trades ex-split today

-330

July 25, 2024· 09:48 IST

Sensex Today | BSE Capital Goods index up nearly 1%; Suzlon Energy, CG Power, Timken among major gainers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Suzlon Energy | 63.44 | 4.5 | 6.90m |

| CG Power | 720.35 | 3.45 | 110.84k |

| Timken | 4,118.40 | 3.22 | 1.03k |

| Sona BLW | 705.30 | 2.65 | 25.40k |

| V-Guard Ind | 478.00 | 2.27 | 11.16k |

| Larsen | 3,590.90 | 2.03 | 47.14k |

| Polycab | 6,422.35 | 1.46 | 5.09k |

| Lakshmi Machine | 15,818.35 | 1.05 | 25 |

| KPIL | 1,342.55 | 0.98 | 3.08k |

| Honeywell Autom | 54,631.70 | 0.79 | 2 |

-330

July 25, 2024· 09:45 IST

Brokerage Call | Nomura upgrades Tata Motors to ‘buy’, target raises to Rs 1,294

#1 JLR’s execution can lead to significant upsides; demerger may unlock value for CVs

#2 Raise target multiple for JLR to 3.5x EV/EBITDA (from 2.75x) given potential upsides

#3 EBIT margin can rise 8.5 percent in FY25 (7.8 percent earlier) to 10.1 percent by FY27

#4 EBIT margin can have further potential to rise to 11- 12 percent by FY30

#5 Growth should be supported by the rundown of Jaguar ICE, success of new Jaguar EVs

#6 Stock is currently trading at 5.4x FY26 EV-EBITDA

#7 Key downside risks are sharp drop in demand in China/EU and rising incentives