Tech Mahindra is set to unveil its Q1 FY25 earnings on July 25 and analysts have predicted a sequential uptick in both net profit and revenue of the IT company, driven by portfolio shifts, volume growth, and cost management.

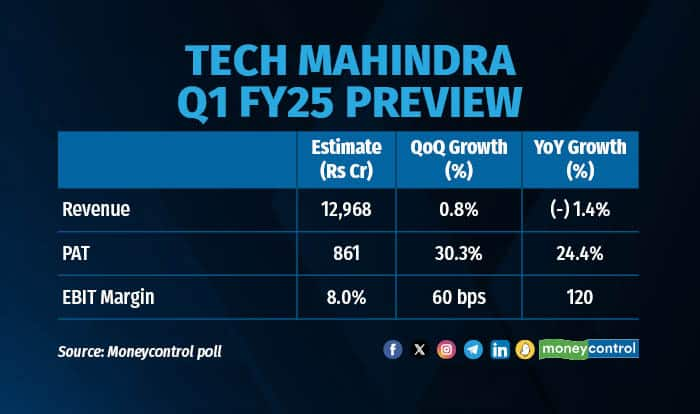

According to the average of 10 estimates compiled by Moneycontrol, Tech Mahindra's net profit is projected to increase over 30 percent quarter-over-quarter, reaching Rs 861 crore in Q1 FY25.

Revenue from operations is expected to rise 0.8 percent QoQ to Rs 12,968 crore on the reversal of furloughs of the March quarter and stabilisation of the mortgage business. The growth, however, could be impacted marginally due to seasonal softness in its subsidiary-Comviva-a mobile application firm acquired from Bharti Group by Tech Mahindra in 2012.

Tech Mahindra Q1 FY25 Preview

Tech Mahindra Q1 FY25 Preview

The EBIT margin is anticipated to improve by 60 basis points to 8 percent, reflecting the company’s operational efficiencies and cost control measures.

Tech Mahindra's net profit for Q4 FY24 fell 40.9 percent YoY to Rs 661 crores, due to slowdowns in telecom, communications, media, and entertainment sectors.

What factors are driving the earnings?

1. Volume Growth, Portfolio Reshuffling: Tech Mahindra's margins are likely to expand due to strong growth in volume and reshuffling of the portfolio, said Axis Securities.

2. Cost Management and Operational Efficiencies: The company's cost-saving initiatives, including 'Project Fortius', are projected to enhance operational efficiencies. Analysts expect these measures to contribute to a rise in EBIT margins. Project Fortius is a three-year plan unveiled by Tech Mahindra in April to achieve a 15 percent operating margin by FY27.

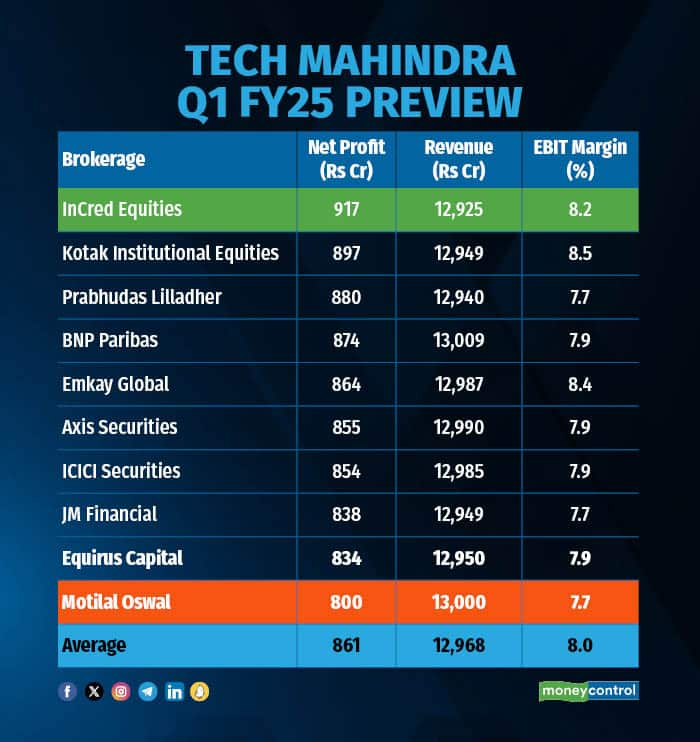

Tech Mahindra Q1 FY25 Brokerage Estimates

Tech Mahindra Q1 FY25 Brokerage Estimates

3. Communication and Enterprise Segments: Performance in the communication segment, which may experience seasonal softness and growth in the enterprise vertical will be crucial. The latter is expected to partially offset any weakness in the communication segment, Prabhudas Lilladher said in a research report.

What to look out for in the quarterly show?

Analysts will be paying attention to several key areas such as the total contract value (TCV) of new deals, pipeline, cost control measures, the new CEO's strategy, and updates on the 5G rollout.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.