Closing Bell: Sensex down 260 pts, Nifty below 21,600; bank, power, metals shine

-330

January 20, 2024· 16:16 IST

Benchmark indices ended lower in the volatile session on January 20 with Nifty around 21,600. At close, the Sensex was down 259.58 points or 0.36 percent at 71,423.65, and the Nifty was down 36.70 points or 0.17 percent at 21,585.70.

We wrap up today's edition of the Moneycontrol live market blog, and will be back on Tuesday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

January 20, 2024· 16:05 IST

-330

January 20, 2024· 15:58 IST

Rupak De, Senior Technical Analyst, LKP Securities

The Nifty opened higher and remained volatile throughout the day. The overall consolidation phase may persist for the next few days or until the Nifty stays within the range of 21500-21700. Only a decisive breakout on either side could initiate a directional move. A significant decline below 21500 might trigger a correction towards 21300 and below. Conversely, a robust breakout above 21700 is needed for a resumption of the uptrend.

-330

January 20, 2024· 15:52 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The BankNifty index displayed resilience by forming a higher low on the daily chart while maintaining the immediate support zone of 45700-45600. To resume the uptrend, the index needs to overcome the immediate resistance at 46300, a breakthrough that could trigger short-covering, propelling it towards 46500/46800 levels. However, a close below the crucial support of 45600 might instigate a substantial downside correction towards 44000.

-330

January 20, 2024· 15:43 IST

Vinod Nair, Head of Research, Geojit Financial Services

Amid rising optimism about AI, US markets surged over the weekend. However, domestic markets exhibited a subdued trend influenced by extended holidays, low volumes, and weekly option expiration. Profit booking was noted in IT and FMCG, while private banks witnessed selective buying post the recent sharp correction and stable Q3 earnings. Next week, the interest rate decisions of the BoJ and ECB, along with US GDP data, are anticipated to drive the market dynamics.

-330

January 20, 2024· 15:42 IST

Aditya Gaggar Director of Progressive Shares

The markets started the session on a strong note but soon bulls started to loosen their grip and the Index entered into negative territory. Select heavyweights dragged the Index further lower to end the session at 21,571.80 with a loss of 50.60 points.

Banking indices (especially PSU Banks) delivered a strong performance while FMCG and Tech sectors were the laggards. A robust move was witnessed in the Tyre stocks while a rally in Railway counters extended further.

Lacklustre trade was seen in the Broader markets as Mid and Smallcaps remained in a range; however, managed to outperform the Benchmark Index. Nifty50 has made a bearish engulfing candlestick pattern on the daily chart. We feel that the Index will oscillate in the range of 21,500-21,700.

-330

January 20, 2024· 15:40 IST

Sensex Today | ICICI Bank Q3 Results:

Net profit at Rs 10,272 crore and Net Interest Income (NII) at Rs 18,679 crore

ICICI Bank shares ended at Rs 1,011.50, up Rs 12.40, or 1.24 percent on the BSE.

-330

January 20, 2024· 15:30 IST

Market Close:

Benchmark indices ended lower in the volatile session on January 20 with Nifty around 21,600.

At close, the Sensex was down 259.58 points or 0.36 percent at 71,423.65, and the Nifty was down 36.70 points or 0.17 percent at 21,585.70. About 1971 shares advanced, 1706 shares declined, and 87 shares unchanged.

Top losers on the Nifty included HUL, M&M, TCS, IndusInd Bank and HCL Technologies, while gainers were Coal India, Adani Ports, Adani Enterprises, Kotak Mahindra Bank and ICICI Bank.

On the sectoral front, bank, metal, power indices up 0.5-1 percent, while FMCG, Information Technology, pharma and realty down 0.4-1 percent.

BSE Midcap and Smallcap indices gained 0.4 percent each.

-330

January 20, 2024· 15:26 IST

Stock Market LIVE Updates | Tatva Chintan Pharma Q3 Results:

Net profit down 69.8% at Rs 3.5 crore against Rs 11.6 crore and revenue down 30.2% at Rs 84.2 crore versus Rs 120.6 crore, YoY.

-330

January 20, 2024· 15:22 IST

Stock Market LIVE Updates | Jefferies On Polycab India

-Maintain buy call, target cut to Rs 5,870 from Rs 7,000 per share

-Margin missed due to lower exports & higher ad-spend

-Lower FY24-26 EPS estimates by 4%

-Await further clarity on the issue of income tax search

-330

January 20, 2024· 15:17 IST

Stock Market LIVE Updates | Jefferies On UltraTech Cement

-Buy rating, target is at Rs 11,560 per share

-Reported in-line Q3 with EBITDA growing 39%/28% YoY/QoQ

-Clocked Rs 1,200+ EBITDA/tonne after 5 quarters

-Weak volumes offset by strong pricing/lower costs

-Company increased capex guidance to Rs 9,000 crore from Rs 6,500 crore for FY24

-Q4 will benefit from operating leverage and energy cost decline

-Maintain FY24/FY25 EBITDA & raise FY26 EBITDA by 3% on higher volumes

-330

January 20, 2024· 15:12 IST

Sensex Today | BSE Smallcap index up 0.5 percent supported by IFCI, Andrew Yule and Company, Salasar Techno Engineering:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IFCI | 38.53 | 19.99 | 20.12m |

| Andrew Yule | 47.50 | 19.98 | 6.23m |

| Salasar Techno | 94.42 | 18.95 | 2.06m |

| Ircon Internati | 269.05 | 18.19 | 6.88m |

| Rama Steel Tube | 47.95 | 17.7 | 7.96m |

| Responsive Ind | 322.25 | 17.44 | 96.95k |

| Railtel | 446.95 | 15.55 | 2.28m |

| Arihant Super | 394.70 | 13.93 | 65.69k |

| India Nippon | 647.55 | 13.78 | 22.06k |

| Ceat | 2,932.00 | 13.08 | 57.40k |

-330

January 20, 2024· 15:08 IST

Stock Market LIVE Updates | CESC Q3 profit declines 12% YoY to Rs 281 crore

CESC has registered a 11.91% on-year decline in consolidated profit at Rs 281 crore for the quarter ended December FY24, impacted by lower operating numbers and tepid revenue growth. Revenue from operations grew by 3.7% to Rs 3,244 crore during the quarter, compared to Rs 3,129 crore in year-ago period.

-330

January 20, 2024· 15:04 IST

Stock Market LIVE Updates | Seshasayee Paper and Boards Q3

Consolidated net profit down 38.4% at Rs 69 crore versus Rs 112 crore and revenue down 15% at Rs 473.5 crore versus RS 556 crore, YoY.

-330

January 20, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was down 232.76 points or 0.32 percent at 71,450.47, and the Nifty was down 40.40 points or 0.19 percent at 21,582. About 1796 shares advanced, 1470 shares declined, and 55 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coal India | 398.80 | 4.06 | 21.40m |

| Adani Ports | 1,189.30 | 3.2 | 2.00m |

| Adani Enterpris | 2,989.20 | 2.52 | 1.68m |

| Kotak Mahindra | 1,806.55 | 2.39 | 5.14m |

| ICICI Bank | 1,009.55 | 1.04 | 7.76m |

| Hindalco | 562.30 | 0.93 | 1.32m |

| Apollo Hospital | 6,145.25 | 0.83 | 228.37k |

| Power Grid Corp | 237.30 | 0.81 | 5.27m |

| Britannia | 5,174.00 | 0.69 | 201.40k |

| SBI | 632.00 | 0.68 | 9.18m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HUL | 2,471.00 | -3.68 | 2.01m |

| TCS | 3,866.95 | -1.93 | 416.51k |

| HCL Tech | 1,542.90 | -1.6 | 742.18k |

| IndusInd Bank | 1,538.30 | -1.46 | 2.68m |

| M&M | 1,632.00 | -1.42 | 512.53k |

| Nestle | 2,482.00 | -1.28 | 355.82k |

| Wipro | 479.20 | -1.21 | 5.33m |

| JSW Steel | 807.50 | -1.12 | 387.71k |

| Bajaj Finserv | 1,582.70 | -1.11 | 327.06k |

| HDFC Life | 609.50 | -1.04 | 979.37k |

-330

January 20, 2024· 15:00 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| South Asian Ent | 38.00 | 35.15 | -2.85 0 |

| Ladderup Fin | 31.75 | 29.65 | -2.10 18 |

| Pasupati Spin | 34.00 | 32.00 | -2.00 16 |

| Seshasayee Pape | 373.05 | 353.05 | -20.00 2.37k |

| Savera Ind | 153.50 | 146.00 | -7.50 58.67k |

| Salem Erode Inv | 46.90 | 44.61 | -2.29 19 |

| Continent Petro | 82.00 | 78.01 | -3.99 835 |

| Silverpoint | 26.26 | 25.00 | -1.26 5.14k |

| National Tech | 441.05 | 420.00 | -21.05 45 |

| Chowgule Steam | 22.00 | 20.99 | -1.01 8.31k |

-330

January 20, 2024· 14:56 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| AVAILABLE FINAN | 169.90 | 196.00 | 26.10 311 |

| Mangalam Seeds | 235.00 | 260.15 | 25.15 493 |

| Precision Elec | 53.77 | 59.43 | 5.66 165 |

| Suryavanshi Spg | 29.39 | 32.28 | 2.89 0 |

| Archidply Decor | 85.25 | 93.50 | 8.25 1 |

| Adani Energy | 1,046.00 | 1,140.75 | 94.75 6.75k |

| CIL Securities | 42.50 | 46.35 | 3.85 9.53k |

| Citizen Info | 22.20 | 24.00 | 1.80 0 |

| Centennial Sutu | 105.35 | 113.75 | 8.40 126 |

| IDBI Bank | 72.30 | 78.05 | 5.75 1.77m |

-330

January 20, 2024· 14:55 IST

Stock Market LIVE Updates | Fortis Healthcare subsidiary Agilus gets notice from Anti-Corruption Branch of Delhi government

Agilus Diagnostics, a material subsidiary of Fortis Healthcare, has received a notice from the Anti-Corruption Branch, Government of National Capital Territory of Delhi, in respect of alleged anomalies in diagnostics test conducted in Aam Aadmi Mohalla Clinic. Agilus has rendered services for total amount of Rs 20.40 crore till December 2023, which is less than 2% of its consolidated revenue. However, as on date, Agilus has only received a sum of Rs 3.30 Crores from the Directorate General of Health Services- Delhi Government.

-330

January 20, 2024· 14:52 IST

Adani Group stocks gain between 2-8 percent

-330

January 20, 2024· 14:49 IST

Sensex Today | BSE Information Technology index down 0.9 percent dragged by Mastek, Genesys International Corporation, Onward Technologies:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Genesys Int | 487.80 | -4.46 | 12.23k |

| Mastek | 2,788.00 | -4.28 | 2.44k |

| Onward Tech | 600.05 | -3.16 | 9.68k |

| BLACK BOX | 288.50 | -2.86 | 3.81k |

| Newgen Software | 812.00 | -2.81 | 20.80k |

| KSolves | 1,317.55 | -2.77 | 4.83k |

| Quick Heal Tech | 482.00 | -2.7 | 136.87k |

| Oracle Fin Serv | 6,688.50 | -2.68 | 15.83k |

| COFORGE LTD. | 6,289.80 | -2.11 | 5.57k |

| Affle India | 1,237.00 | -2.07 | 14.06k |

-330

January 20, 2024· 14:47 IST

-330

January 20, 2024· 14:41 IST

Stock Market LIVE Updates | Views of Prabhudas Lilladher on Kotak Mahindra Q3 earnings

NIM was a beat yet again at 5.34% (PL estimates 5.09%) QoQ due to better yields and lower cost of funds

Credit growth was a miss at 15.7% YoY (PL est 17.7%) due to IBPC sell down of Rs129bn in Q3’24 (Rs87.3bn last quarter)

Unsecured share continues to inch up (+43bps QoQ) and touched 11.2% of gross credit

Deposit accretion was also a miss at ~18.6% YoY and quarterly accretion was largely led by TD

Provisions were a miss at Rs5.8bn (PL est Rs4.2bn) due to AIF provisioning of Rs1.9bn and Rs0.65bn of NPI re-classified from MTM loss (PBT neutral)

Core PAT at Rs28.9bn was 1.2% ahead of PLe. PAT was a miss at Rs30.05bn (PLe Rs31.6bn)

At CMP of Rs1,820 stock trades at P/core ABV of 2.7/2.4x on FY25/26E

-330

January 20, 2024· 14:35 IST

-330

January 20, 2024· 14:30 IST

Stock Market LIVE Updates | JK Cement reports Q3 net profit at Rs 284 cr vs CNBC-TV18 poll of Rs 253 cr

-330

January 20, 2024· 14:25 IST

Stock Market LIVE Updates | Bharti Hexacom files draft papers for IPO with SEBI

Bharti Hexacom, subsidiary of Bharti Airtel has filed a draft papers with Securities Exchange Board of India to raise funds via initial public offerings. The IPO will be a pure offer for sale. The OFS consists of upto 100 million shares by Telecommunications Consultants India Ltd.

-330

January 20, 2024· 14:19 IST

Stock Market LIVE Updates | Union Bank of India reports Q3 results

Union Bank of India reports net profit of Rs 3590 crore in December quarter, up 60 percent year on year. Bloomberg estimated net profit of Rs 3414 crore for the quarter. Provisions fell 1.1 percent sequentially to Rs 1750 crore. Operating profit of the lender up 10 percent to Rs 7280 crore.

-330

January 20, 2024· 14:11 IST

-330

January 20, 2024· 14:06 IST

Rajratan Global Wire Q3

Net profit down 10.5% at Rs 19.7 crore versus Rs 22 crore and revenue up 16.4% at Rs 232.7 crore versus Rs 200 crore, YoY.

-330

January 20, 2024· 14:01 IST

Sensex Today | Market at 2 PM

The Sensex was up 8.40 points or 0.01 percent at 71,691.63, and the Nifty was up 8.80 points or 0.04 percent at 21,631.20. About 1885 shares advanced, 1363 shares declined, and 53 shares unchanged.

-330

January 20, 2024· 13:59 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shree Ajit Pulp | 253.65 | 237.00 | -16.65 498 |

| Chordia Food | 99.50 | 94.00 | -5.50 213 |

| Modipon | 44.49 | 42.05 | -2.44 178 |

| Balgopal Commer | 36.24 | 34.52 | -1.72 0 |

| Garnet Construc | 26.20 | 25.00 | -1.20 901 |

| Chowgule Steam | 22.00 | 21.00 | -1.00 30 |

| Indo Cotspin | 49.25 | 47.01 | -2.24 9 |

| Inducto Stl | 55.65 | 53.30 | -2.35 858 |

| Gothi Plascon | 49.89 | 48.00 | -1.89 1.09k |

| Ashnoor Text | 51.94 | 50.00 | -1.94 304 |

-330

January 20, 2024· 13:57 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Andrew Yule | 42.76 | 47.50 | 4.74 590.59k |

| Mukesh Babu Fin | 136.20 | 151.00 | 14.80 704 |

| Savera Ind | 136.50 | 151.00 | 14.50 88 |

| Pan Electroncis | 30.25 | 32.89 | 2.64 157 |

| Jaiprakash Asso | 18.91 | 20.42 | 1.51 536.28k |

| NG Industries | 180.00 | 193.30 | 13.30 0 |

| Balkrishna | 41.96 | 44.76 | 2.80 12 |

| Avonmore Cap | 100.00 | 106.55 | 6.55 5.78k |

| AI Champdany | 51.80 | 55.00 | 3.20 1.05k |

| Continent Petro | 77.25 | 81.90 | 4.65 2.94k |

-330

January 20, 2024· 13:55 IST

Stock Market LIVE Updates | Can Fin Homes Q3 Results:

Net profit up 32% at Rs 200 crore versus Rs 151 crore and net interest income up 30.6% at Rs 329 crore versus Rs 252 crore, YoY.

-330

January 20, 2024· 13:53 IST

Stock Market LIVE Updates | CLSA View On Reliance Industries

-Buy rating, target at Rs 3,060 per share

-Inline EBITDA/EBIT but capex falls to an 8-quarter low

-Exhibiting operating leverage, retail EBITDA/sqf rose for second quarter

-Any jump in subscribers due to wireless broadband would be a key surprise

-330

January 20, 2024· 13:45 IST

Sensex Today | BSE Midcap index up 0.6 percent led by NHPC, SJVN, IRCTC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NHPC | 81.00 | 10.25 | 11.55m |

| SJVN | 111.99 | 6.13 | 5.05m |

| IRCTC | 1,042.10 | 5.93 | 691.67k |

| IDBI Bank | 72.72 | 4.38 | 2.70m |

| Balkrishna Ind | 2,756.00 | 4.33 | 5.48k |

| Max Healthcare | 755.15 | 3.76 | 8.28k |

| REC | 468.10 | 3.61 | 976.48k |

| MRF | 143,827.70 | 3.14 | 480 |

| Container Corp | 887.00 | 3 | 55.14k |

| Power Finance | 424.00 | 2.84 | 476.27k |

-330

January 20, 2024· 13:38 IST

IREDA Q3 Results:

Net profit rose 67.2% at Rs 335.5 crore versus Rs 200.7 crore and revenue up 44.2% at Rs 1,252.9 crore versus Rs 868.7 crore, YoY.

-330

January 20, 2024· 13:33 IST

IDBI Bank Q3

Net profit up 57.3% at Rs 1,458.2 crore versus Rs 927.3 crore and NII up 17.4% at Rs 3,434.5 crore versus RS 2,925.3 crore, YoY.

-330

January 20, 2024· 13:31 IST

DB Corp touched 52-week high of Rs 347.50.

-330

January 20, 2024· 13:25 IST

Stock Market LIVE Updates | Prabhudas Lilladher View on HUL

The broking house cut FY25/26EPS by 4.2%/4.5% factoring in 1) sustained pressure on volumes 2) lower pricing element to support growth & ward off competition from local/regional players and 3) higher investments in A&P and capability building for LT growth.

HC & BPC (75% of sales) continue to grow volumes in mid-single digits while F&R is under pressure due to volatile commodity prices and consumer downgrading. Rural growth is showing signs of pickup; however, a lot depends upon outlook for new crop. While long term growth story led by lower penetration and superior value proposition remains intact, near term growth challenges are likely to persist.

Factor in GM/EBITDAM expansion of 90/30bps over FY24-26 as HUL invests gains from better mix and commodity pricing in advertising, royalty and innovations.

Prabhudas Lilladher estimate CAGR of 9.2% in sales and 8.8% in PAT over FY24-26 and assign a DCF based target price of Rs 2724 (Rs 2786 earlier) and expect slow and modest recovery resulting in tepid growth in near term which will provide back ended returns. Retain Hold.

-330

January 20, 2024· 13:22 IST

Sensex Today | Coal India is the top gainers on the Nifty; stock up nearly 4 percnet:

-330

January 20, 2024· 13:21 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 42623.96 -0.2 | 0.94 0.15 | 6.71 46.43 |

| BSE CAP GOODS | 57475.72 0.11 | 3.29 1.88 | 8.05 64.85 |

| BSE FMCG | 20269.95 -0.66 | -0.97 -0.50 | 3.25 26.98 |

| BSE Metal | 26340.34 0.96 | -2.41 -0.39 | 4.90 21.26 |

| BSE Oil & Gas | 25272.31 0.13 | 9.78 4.32 | 15.37 20.43 |

| BSE REALTY | 6824.36 -0.58 | 10.30 -2.04 | 17.23 100.06 |

| BSE IT | 37557.53 -0.7 | 4.29 1.18 | 6.36 27.47 |

| BSE HEALTHCARE | 32789.79 0.03 | 3.93 0.47 | 9.06 43.51 |

| BSE POWER | 6013.52 0.98 | 3.35 -1.15 | 8.38 33.00 |

| BSE Cons Durables | 51326.32 0.01 | 2.65 0.01 | 6.24 35.25 |

-330

January 20, 2024· 13:16 IST

Stock Market LIVE Updates | Motilal Oswal View on Hindustan Zinc:

The performance has been largely in line with the estimates. To account for lower CoP ahead and improved demand outlook, broking house slightly increased FY25/FY26 EBITDA estimates by 1%/4%.

The stock currently trades at 6.7x FY26E EV/EBITDA and believe all positives are priced in at current levels.

Reiterate Neutral rating on the stock with a Target Price of Rs 310 (premised on 6x FY26E EV/EBITDA).

-330

January 20, 2024· 13:11 IST

AstraZeneca Pharma India Limited has received permission to import pharmaceutical formulations of new drug for sale or for distribution in Form CT-20 from Central Drugs Standard Control Organisation for Andexanet alfa powder for solution for infusion 200 mg (Andexxa).

-330

January 20, 2024· 13:05 IST

Stock Market LIVE Updates | Balkrishna Industries up nearly 3 percent.Currently, the stock is trading 0.33 percent below its 52-week high and 41.9 percent above its 52-week low.

-330

January 20, 2024· 13:02 IST

Stock Market LIVE Updates | Aarti Surfactants Q3 Results:

Net profit up 67.5% at Rs 6.7 crore versus Rs 4 crore and revenue up 3.9% at RS 138.8 crore versus Rs 133.6 crore, YoY.

-330

January 20, 2024· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was up 58.87 points or 0.08 percent at 71,742.10, and the Nifty was up 27.70 points or 0.13 percent at 21,650.10. About 1868 shares advanced, 1357 shares declined, and 51 shares unchanged.

-330

January 20, 2024· 12:55 IST

| Company | Price at 12:00 | Price at 12:49 | Chg(%) Hourly Vol |

|---|---|---|---|

| Chordia Food | 91.10 | 99.50 | 8.40 1.00k |

| Kaka Industries | 211.50 | 231.00 | 19.50 51.19k |

| Alfred Herbert | 1,207.00 | 1,309.95 | 102.95 2 |

| IFCI | 35.10 | 38.09 | 2.99 2.35m |

| Prima Ind | 21.25 | 22.95 | 1.70 707 |

| Solid Stone | 31.51 | 33.75 | 2.24 79 |

| Ajcon Global | 42.00 | 44.92 | 2.92 85 |

| Shipping Corp | 172.60 | 184.50 | 11.90 16.29k |

| UP Hotels | 1,100.05 | 1,175.00 | 74.95 54 |

| Acknit Industri | 270.35 | 288.00 | 17.65 180 |

-330

January 20, 2024· 12:55 IST

Stock Market LIVE Updates | Morgan Stanley View On RBL Bank

-Underweight call, target at Rs 250 per share

-Core PPoP grew 40% YoY & is 3% above our estimate

-Both NII & fee income growth are strong YoY

-Margin missed our estimate by 8 bps

-Expect retail loan growth to remain strong

-Stay underweight as profitability recovery looks gradual

-Reduce FY24 & F25 ests on one-time contingency provisions

-330

January 20, 2024· 12:45 IST

Stock Market LIVE Updates | Morgan Stanley View On UltraTech Cement

-Maintain overweight, target at Rs 12,000 per share

-Q3 EBITDA ahead of both our estimate and consensus

-Earnings are even better adjusted for higher ‘other’ opex

-Demand recovery should support prices

-Demand recovery & fuel cost moderation should drive margin

-330

January 20, 2024· 12:39 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

There is a sudden change in the strategy of the FPIs starting 17th January. They turned massive sellers in the cash market having sold equity worth Rs 24147 crores in three days from 17th through 19th January.

There are two main reasons why FPIs turned sellers. One, the US bond yield started rising with the 10-year yield rising from the recent level of 3.9% to 4.15% triggering capital outflows from emerging markets. It is important to understand that FPIs were big sellers in other emerging markets too like Taiwan, South Korea and Hongkong. Two, since the valuations in India are high, FPIs used the excuse of less-than-expected results from HDFC Bank to press massive sales. FPIs increased their short positions, too.

But the FPI strategy of pushing the market down is not working since their selling is countered with buying by DIIs and individual investors.

FPIs have been buying IT stocks this month after the management commentary following the Q3 results of IT managers indicated optimism of demand revival in the sector.

-330

January 20, 2024· 12:30 IST

Stock Market LIVE Updates | Kotak Mahindra Bank Q3 Results:

Net profit up 7.6% at Rs 3,005 crore against Rs 2,791.9 crore and Net Interest Income (NII) up 15.9% at Rs 6,554 crore versus Rs 5,652.9 crore, YoY.

-330

January 20, 2024· 12:28 IST

Stock Market LIVE Updates | IFCI up 17 percent

-330

January 20, 2024· 12:24 IST

Stock Market LIVE Updates | RITES bags order worth Rs 414 crore for construction work at IIT Bhubaneswar

RITES has been declared top scorer (H-1) bidder and eligible for award of work as Project Management Consultancy (PMC) for the construction of various infrastructure works at IIT- Bhubaneswar to be undertaken under EPC mode III. The MoU with IIT-Bhubaneswar will be executed with mutually agreed terms & conditions.

The estimated project cost including PMC fees is estimated to be Rs 414 crore excluding GST.

-330

January 20, 2024· 12:23 IST

Stock Market LIVE Updates | ICICI Bank trade higher ahead of Q3 earnings:

ICICI Bank, the country's second largest private lender, is likely to report a 20 percent year-on-year (YoY) growth in standalone net profit at Rs 9,946 crore for the December quarter of the current financial year.

According to a poll of brokerages, net interest income is set to rise 12 percent from the year-ago period to Rs 18,431 crore when the private lender reports its numbers on January 20.

While most brokerages expect a varied performance across banks, the consensus view is that ICICI Bank will showcase better performance among all, along with IndusInd Bank. If the numbers meet Street expectations, then it will come as a big relief after HDFC Bank's disappointing quarter. Read More

-330

January 20, 2024· 12:19 IST

Sensex Today | Nifty Bank index added 0.5 percent led by AU Small Finance Bank, Bandhan Bank, PNB:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| AU Small Financ | 749.35 | 2.57 | 1.20m |

| Bandhan Bank | 230.80 | 2.03 | 8.69m |

| PNB | 103.45 | 1.22 | 19.66m |

| HDFC Bank | 1,485.35 | 1 | 7.31m |

| Kotak Mahindra | 1,777.85 | 0.77 | 1.12m |

| ICICI Bank | 1,003.00 | 0.38 | 3.27m |

| IDFC First Bank | 86.00 | 0.35 | 11.84m |

| Axis Bank | 1,117.95 | 0.13 | 1.61m |

-330

January 20, 2024· 12:16 IST

Stock Market LIVE Updates | Shares of RVNL is trading in the green for the 10th day in a row on January 20. The stock zoomed 10 percent to a lifetime high of Rs 320.35 on the NSE on high trading volumes. In the last one year, the stock has risen 317 percent. Its three-year returns stand at a whopping 936 percent.

-330

January 20, 2024· 12:14 IST

Sensex Today | Power index gained 1 percent; NHPC rises 11 percent:

-330

January 20, 2024· 12:13 IST

Stock Market LIVE Updates | Railway Stocks trade higher with Ircon International up 13 percent:

-330

January 20, 2024· 12:12 IST

-330

January 20, 2024· 12:10 IST

Sensex Today | BSE Realty index down 0.7 percent dragged by Phoenix Mills, Godrej Properties, DLF:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 2,507.20 | -2.15 | 2.01k |

| Godrej Prop | 2,300.55 | -1.81 | 3.69k |

| DLF | 771.30 | -1.76 | 32.11k |

| Mahindra Life | 559.20 | -1.25 | 4.98k |

| Oberoi Realty | 1,502.00 | -1.08 | 5.05k |

-330

January 20, 2024· 12:05 IST

Stock Market LIVE Updates | HSBC View On HUL

-Downgrade to reduce, target cut to Rs 2,350 from Rs 2,700 per share

-Q3 performance below our expectations

-Weak earnings do not appear to be just a symptom of macro weakness

-Past growth engines like home care & BPC have seen muted growth

-Outlook appears uncertain and growth is lacklustre

-330

January 20, 2024· 11:57 IST

| Company | Price at 11:00 | Price at 11:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sovereign Diam | 37.79 | 33.82 | -3.97 65.61k |

| Ace Men Engg Wo | 53.40 | 48.50 | -4.90 153 |

| Guj Containers | 181.00 | 167.00 | -14.00 100 |

| S V Global Mill | 104.36 | 97.01 | -7.35 25 |

| KG Petrochem | 216.95 | 202.20 | -14.75 3 |

| UP Hotels | 1,180.00 | 1,100.05 | -79.95 239 |

| Inani Sec | 32.75 | 30.55 | -2.20 163 |

| Shree Hari Chem | 88.00 | 83.00 | -5.00 84 |

| Sofcom Systems | 52.50 | 49.53 | -2.97 2.54k |

| Polylink Polyme | 33.90 | 32.00 | -1.90 1.58k |

-330

January 20, 2024· 11:55 IST

| Company | Price at 11:00 | Price at 11:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shree Precoated | 19.71 | 21.64 | 1.93 200 |

| Real Eco-Energy | 27.35 | 29.98 | 2.63 1.26k |

| PTC India Fin | 49.00 | 53.19 | 4.19 372.95k |

| Golechha Global | 20.72 | 22.30 | 1.58 53 |

| Elin Electronic | 165.50 | 177.10 | 11.60 4.40k |

| Greaves Cotton | 157.65 | 168.00 | 10.35 16.61k |

| Beryl Drugs | 23.10 | 24.48 | 1.38 549 |

| Markolines | 135.30 | 143.00 | 7.70 4.00k |

| Emmessar Biotec | 26.01 | 27.48 | 1.47 10 |

| Bhilwara Spin | 105.00 | 110.90 | 5.90 1.43k |

-330

January 20, 2024· 11:46 IST

Morgan Stanley View On RBL Bank

Underweight call, target at Rs 250 per share

Core PPoP grew 40% YoY & is 3% above our estimate

Both NII & fee income growth are strong YoY

Margin missed our estimate by 8 bps

Expect retail loan growth to remain strong

Stay underweight as profitability recovery looks gradual

Reduce FY24 & F25 ests on one-time contingency provisions

-330

January 20, 2024· 11:38 IST

Stock Market LIVE Updates | PVR gains over 2% after Elara upgrades the stock to buy

Shares of PVR gains over 2 percent after Elara Capital upgrades stock to buy with a target of Rs 1,900 (28% Upside). Favorable risk-reward ratio, expecting content pipeline improvement in CY25. Cautious on CY24. Overdone concerns; healthy medium-term outlook. Currently trading at a premium of 16.5x FY25E EV/EBITDA. PVR to host live broadcast of Ayodhya Ram Temple consecration ceremony, as per news report.

-330

January 20, 2024· 11:33 IST

Stock Market LIVE Updates | HDFC Bank rebounds 1% post 3-day slump

HDFC Bank gains over 1 percent first time in three day's losses. The stock in the last three sessions declined around 13 percent after weak earnings. CLSA shared a "buy" call on India's largest private sector lender, with a target price of Rs 2,025, implying an upside of 34 percent from current levels.

Investors dumped HDFC Bank after its December quarter numbers financials showed a strain on margin, sluggish deposit growth and decadal low earnings per share (EPS). The fall sent This ripples across on Bank Nifty, which lost 5 percent in two days as the lender commands around 40 percent weightage in the 12-pack index.

CLSA analysts said they interacted with more than 20 clients since HDFC Bank's Q3 results and found that its domestic clients were unhappy with the lender's performance. However, many foreign investors said they were nearing the end of "EPS cuts" cycle for HDFC Bank.

-330

January 20, 2024· 11:26 IST

Stock Market LIVE Updates | ICICI Bank trades flat ahead of Q3 earnings

ICICI Bank, the country's second largest private lender, is likely to report a 20 percent year-on-year (YoY) growth in standalone net profit at Rs 9,946 crore for the December quarter of the current financial year.

According to a poll of brokerages, net interest income is set to rise 12 percent from the year-ago period to Rs 18,431 crore when the private lender reports its numbers on January 20.

While most brokerages expect a varied performance across banks, the consensus view is that ICICI Bank will be better of all along with IndusInd Bank. If the numbers meet Street expectations, then it will come as a big relief after HDFC Bank's disappointing quarter.

-330

January 20, 2024· 11:20 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18684.90 -0.05 | 0.36 -0.16 | 6.63 47.22 |

| NIFTY IT | 36950.10 -0.32 | 4.04 1.17 | 6.36 25.13 |

| NIFTY PHARMA | 17330.20 -0.33 | 2.96 -0.10 | 7.50 37.47 |

| NIFTY FMCG | 56266.35 -0.66 | -1.26 -0.39 | 3.06 28.17 |

| NIFTY PSU BANK | 5954.90 0.16 | 4.23 1.61 | 7.63 40.79 |

| NIFTY METAL | 7752.15 0.26 | -2.83 -1.85 | 4.45 13.91 |

| NIFTY REALTY | 862.75 -0.66 | 10.18 -2.08 | 17.01 101.84 |

| NIFTY ENERGY | 35339.60 1.01 | 5.59 1.06 | 9.92 35.22 |

| NIFTY INFRA | 7696.80 0.4 | 5.39 1.79 | 9.88 46.40 |

| NIFTY MEDIA | 2405.00 1.48 | 0.71 -1.68 | 3.56 27.36 |

-330

January 20, 2024· 11:11 IST

-330

January 20, 2024· 11:06 IST

Sensex Today | Market at 11 AM

The Sensex was up 140.90 points or 0.20 percent at 71,824.13, and the Nifty was up 47.40 points or 0.22 percent at 21,669.80. About 1886 shares advanced, 1243 shares declined, and 79 shares unchanged.

-330

January 20, 2024· 10:58 IST

Sensex Today | Shrey Jain, Founder and CEO SAS Online:

The Indian stock market witnessed a commendable recovery driven by positive global sentiments yesterday. This optimistic trend has extended into today as well. Following a gap-up opening, it is expected that the Nifty will consolidate around its current levels, with significant Open Interest (OI) observed at the 21500 Put and 21800 Call strikes.

Turning to Bank Nifty, the 46000 Call strike exhibits a meaningful OI of approximately 25 lakh shares, whereas the 46000 Put strike holds a significant OI of around 17 lakh shares. Even with possible short-term ups and downs, the larger trend indicates that it's a good idea to sell when prices are going up.

-330

January 20, 2024· 10:48 IST

Stock Market LIVE Updates | Zee Entertainment issues clarification on a media report

Zee Entertainment Enterprises has issued clarification on a media report - "Sony board to take call on $10 bn merger with company today’, saying it is not aware of, and cannot comment on, any board meeting held or proposed to be held by Culver Max Entertainment (formerly Sony Pictures Networks India). Zee is committed to the merger with Sony and is continuing to work towards a successful closure of the proposed merger. It engaged in good faith negotiations with Sony with a view to discuss the extension of the date required to make the Scheme effective, by a reasonable period of time.

-330

January 20, 2024· 10:35 IST

Stock Market LIVE Updates | Morgan Stanley View On Reliance Industries

-Overweight call, target at Rs 2,821 per share

-Reported the slowest investment capex in two years

-Pointed to the completion of 5G rollout

-Gas production drove earnings beat

-330

January 20, 2024· 10:28 IST

Stock Market LIVE Updates | CreditAccess Grameen Q3 profit jumps 64% YoY to Rs 353 crore

CreditAccess Grameen has recorded a 63.8% on-year growth in net profit at Rs 353 crore for the quarter ended December FY24. Net interest income increased by 41.6% YoY to Rs 802.4 crore for the quarter, with gross loan portfolio rising 31.5% to Rs 23,382 crore. Pre-provision operating profit grew by 58.6% YoY to Rs 601.8 crore during the quarter.

-330

January 20, 2024· 10:24 IST

Stock Market LIVE Updates | Godawari Power receives approval from Chhattisgarh Environment Conservation Board

Chhattisgarh Environment Conservation Board has accorded its “Consent To Operate” for enhanced capacity of Sponge Iron Division (SID) from 4,95,000 Metric Tons per annum to 5,94,000 Metric Tons per annum on trial basis at existing plant site at Siltara Industrial Area, Raipur, Chhattisgarh valid upto 31.08.2024, subject to further renewal.

-330

January 20, 2024· 10:19 IST

Sensex Today | BSE Power index up 1 percent led by NHPC, Adani Power, Power Grid Corporation:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NHPC | 77.16 | 5.02 | 2.90m |

| Adani Power | 530.60 | 2.13 | 53.90k |

| Power Grid Corp | 239.90 | 1.89 | 158.67k |

| NTPC | 313.10 | 1.51 | 211.48k |

| JSW Energy | 506.75 | 1.08 | 50.15k |

| Adani Green Ene | 1,585.40 | 0.98 | 8.83k |

| CG Power | 455.55 | 0.3 | 7.47k |

-330

January 20, 2024· 10:17 IST

Stock Market LIVE Updates | HFCL bags a purchase order worth Rs 623 crore from a domestic telecom service provider

HFCL has received a purchase order worth Rs 623 crore for supply of indigenously manufactured telecom networking equipment for 5G network of one of the domestic telecom service providers.

-330

January 20, 2024· 10:13 IST

Stock Market LIVE Updates | Prabhudas Lilladher View on Jindal Stainless:

Broking house believes that JDSL deserves to trade at higher multiples, as the company has maintained its per ton EBITDA guidance for next few quarters.

With 15%+ CAGR in Stainless Steel volumes over FY23-26E, broking house expect Revenue/EBITDA/PAT growth of 14%/26%/29% respectively.

At CMP, the stock is trading at 7.9x/6.5x EV of FY25E/FY26E EBITDA. Maintain ‘Accumulate’ rating with revised Target Price of Rs 660 (earlier Rs 583) valuing at 7x EV of Mar’26E EBITDA (earlier 6.5x) on consistency of EBITDA per ton compared to its peers in carbon steel.

-330

January 20, 2024· 10:11 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 71637.21 -0.06 | -0.83 -1.28 | 1.60 18.17 |

| BSE 200 | 9691.55 -0.03 | 0.55 -0.81 | 3.88 24.21 |

| BSE MIDCAP | 38276.85 0.19 | 3.90 1.06 | 9.19 53.08 |

| BSE SMALLCAP | 44572.48 0.3 | 4.45 0.15 | 9.03 55.68 |

| BSE BANKEX | 51882.80 0.1 | -4.59 -3.56 | -3.13 7.58 |

-330

January 20, 2024· 10:08 IST

Earnings Today:

-330

January 20, 2024· 10:05 IST

Sensex Today | Market at 10 AM

The Sensex was down 1.78 points or 0.00 percent at 71,681.45, and the Nifty was up 6.80 points or 0.03 percent at 21,629.20. About 1857 shares advanced, 1163 shares declined, and 88 shares unchanged.

-330

January 20, 2024· 09:54 IST

Stock Market LIVE Updates | Morgan Stanley View On HUL

-Equal-weight call, target cut to Rs 2,464 from Rs 2,502 per share

-Earnings below our estimates for the fourth quarter in a row

-Weaker topline growth due to lower volume growth

-Negative pricing growth remains a headwind

-330

January 20, 2024· 09:53 IST

Stock Market LIVE Updates | KPI Green Energy subsidiary bags order to execute solar power project of 5.60 MW from Shree Varudi Paper Mill

KPI Green Energy's subsidiary KPIG Energia has received new order of 5.60 MW for executing solar power project, from Shree Varudi Paper Mill LLP. The projects are scheduled to be completed in the financial year 2024-25, in various tranches as per the terms of the order.

-330

January 20, 2024· 09:51 IST

-330

January 20, 2024· 09:47 IST

Stock Market LIVE Updates | SIS India up 13% as Private Security Guards Deployed at Shri Ram Janmabhoomi

SIS surges 13% after news report said renowned private security group, SIS India, deploys guards in Ayodhya's Shri Ram Janmabhoomi complex and its adjacent areas. The agreement with SIS India was signed by the Ram Mandir Trust to assist devotees in reaching the complex.

-330

January 20, 2024· 09:42 IST

Stock Market LIVE Updates | Railway stocks trades higher amid higher volumes

Railway stocks trading higher. Rail Vikas Nigam (RVNL) up 9 percent, Indian Railway Finance Corporation (IRFC) gained 10 percent, IRCON International jumped 11 percent, RailTel Corporation of India advanced 8 percent and Texmaco Rail & Engineering gained 6 percent.

-330

January 20, 2024· 09:38 IST

-330

January 20, 2024· 09:38 IST

-330

January 20, 2024· 09:32 IST

Stock Market LIVE Updates | Sunteck Realty posts Q3 loss at Rs 9.7 crore on operating performance, lower topline

Sunteck Realty has reported net loss at Rs 9.7 crore for the quarter ended December FY24, impacted by weak operating performance with higher input cost and dismal topline performance. In year-ago period, profit stood at Rs 2.07 crore. Revenue from operations fell by 52.5% YoY to Rs 42.45 crore during the same quarter.

-330

January 20, 2024· 09:31 IST

Stock Market LIVE Updates | Tejas Networks Q3 loss widens to Rs 44.9 crore on higher input cost. Revenue surges 104% YoY

Tejas Networks has posted consolidated net loss at Rs 44.9 crore October-December FY24 quarter, widening from loss of Rs 15.2 crore in year-ago period, impacted by higher input cost. However, revenue from operations grew by 104% YoY to Rs 560 crore for the quarter.

-330

January 20, 2024· 09:29 IST

-330

January 20, 2024· 09:27 IST

Stock Market LIVE Updates | Paytm Q3 loss narrows to Rs 219.8 crore, revenue jumps 38% YoY

One 97 Communication (Paytm) has posted net loss at Rs 219.8 crore for October-December FY24 quarter, narrowing from loss of Rs 392 crore in same period last year. Revenue from operations surged 38.2% year-on-year to Rs 2,850.5 crore for the quarter. Revenue from payment services grew by 45% YoY to Rs 1,730 crore, partly boosted by timing of festive season, and net payment margin was up 63% YoY at Rs 748 crore and gross merchandise value (GMV) increased 47% YoY to Rs 5.1 lakh crore.

-330

January 20, 2024· 09:25 IST

Stock Market LIVE Updates | RBL Bank Q3 profit misses estimates, grows 12% YoY to Rs 233 crore

RBL Bank has recorded standalone profit at Rs 233 crore for the quarter ended December FY24, rising 12% YoY but missed analysts estimates. Excluding contingent provision on AIF investments, net profit grew 53% YoY to Rs 319 crore. Net interest income increased by 21% YoY to Rs 1,546 crore for the quarter. On the asset quality front, gross NPA was flat at 3.12% QoQ, but net NPA rose 2 bps QoQ to 0.80% during the quarter.

-330

January 20, 2024· 09:21 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| BHEL | 52678 | 224.95 | 1.18 |

| BHEL | 47789 | 225 | 1.08 |

| Engineers India | 42430 | 249.9 | 1.06 |

| Engineers India | 44047 | 248.95 | 1.1 |

| HDFC Bank | 8373 | 1483.15 | 1.24 |

| HDFC Bank | 9431 | 1482.05 | 1.4 |

| HDFC Bank | 10051 | 1482.85 | 1.49 |

| HUL | 4388 | 2507.1 | 1.1 |

| HUL | 4249 | 2504.35 | 1.06 |

| Indian Renew | 72587 | 143.75 | 1.04 |

-330

January 20, 2024· 09:19 IST

Stock Market LIVE Updates | Hindustan Unilever Q3 profit rises 0.6% YoY to Rs 2,519 crore, revenue drops 0.3%

Hindustan Unilever has recorded a 0.6% on-year increase in standalone net profit at Rs 2,519 crore for October-December quarter of FY24, due to weak topline and muted margin growth (of 10 bps YoY). Revenue from operations fell by 0.3% to Rs 15,188 crore compared to year-ago period due to decline in growth of home care and beauty & personal care segments.

-330

January 20, 2024· 09:18 IST

Stock Market LIVE Updates | Reliance Industries Q3 profit grows 10.9% YoY to Rs 19,641 crore

Reliance Industries has reported healthy numbers for the quarter ended December FY24 with consolidated net profit growing by 10.9% on-year to Rs 19,641 crore and EBITDA increasing sharply by 16.7% on-year to Rs 44,678 crore, boosted by retail, digital (Jio) and oil & gas businesses. Consolidated revenue at Rs 2,48,160 crore for the quarter grew by 3.2% YoY supported by continued growth momentum in consumer businesses. The EBITDA margin expanded by 210 bps YoY to 18% for the quarter.

-330

January 20, 2024· 09:15 IST

Market Opens:

Indian indices opened higher on January 20 with Nifty around 21,700.

The Sensex was up 300.63 points or 0.42 percent at 71,983.86, and the Nifty was up 91.80 points or 0.42 percent at 21,714.20. About 1785 shares advanced, 360 shares declined, and 65 shares unchanged.

Power Grid Corporation, NTPC, Grasim Industries, HDFC Bank and Axis Bank were among major gainers on the Nifty, while loser was HUL.

-330

January 20, 2024· 09:11 IST

-330

January 20, 2024· 09:07 IST

Sensex Today | Aditya Gaggar, Director of Progressive Shares

A rebound trade was seen on the 19th January and the Index ended the session higher at 21,622.40 and gave an indication of a trend reversal with a hidden bullish divergence in RSI. For the time being, we believe that the Index will oscillate in the range of 21,300-22,000.

Banking stocks remained a weak link as the index failed to hold higher levels; however, the future direction will largely depend upon the Q3 earnings of the heavyweights. The Energy segment is performing as per our expectation; and we remain bullish on the same.

PFC and REC from the Power segment have given a breakout from the continuation pattern i.e. Symmetrical Triangle formation which indicates an extension of the current underlying uptrend. Investors should keep an eye on the Paper stocks as some of the counters have given a strong breakout with considerable volumes (JKPaper). The trend of the Railway stocks is strong but currently it is extremely overstretched; hence, it is advised to book partial profits.

-330

January 20, 2024· 09:05 IST

Market at pre-open: Benchmark indices are trading higher in the pre-opening session.

-330

January 20, 2024· 08:59 IST

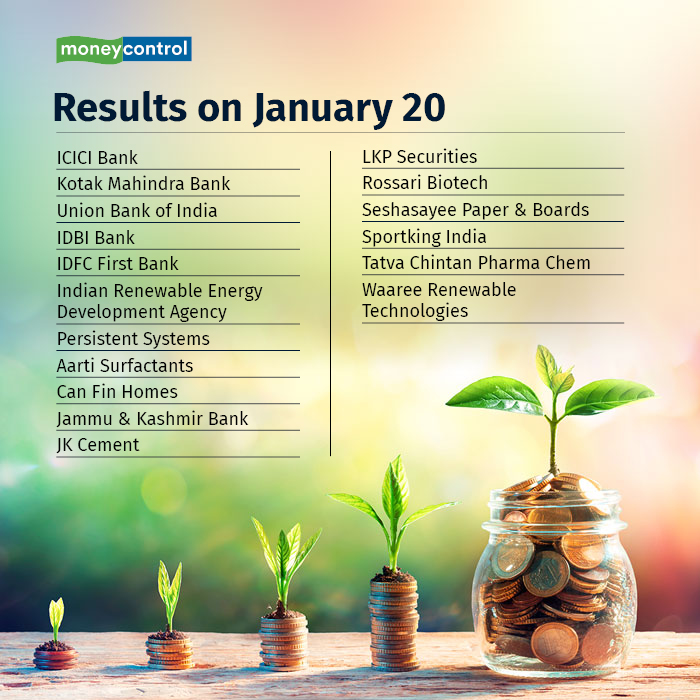

Results on January 20:

ICICI Bank, Kotak Mahindra Bank, Union Bank of India, IDBI Bank, IDFC First Bank, Indian Renewable Energy Development Agency, Persistent Systems, Aarti Surfactants, Can Fin Homes, Jammu & Kashmir Bank, JK Cement, LKP Securities, Rossari Biotech, Seshasayee Paper & Boards, Sportking India, Tatva Chintan Pharma Chem, and Waaree Renewable Technologies will be in focus ahead of quarterly earnings on January 20.