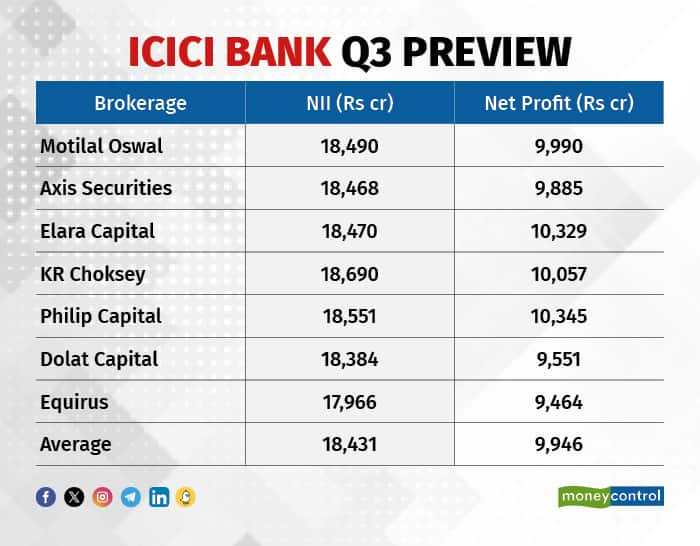

ICICI Bank, the country's second largest private lender, is likely to report a 20 percent year-on-year (YoY) growth in standalone net profit at Rs 9,946 crore for the December quarter of the current financial year.

According to a poll of brokerages, net interest income is set to rise 12 percent from the year-ago period to Rs 18,431 crore when the private lender reports its numbers on January 20.

While most brokerages expect a varied performance across banks, the consensus view is that ICICI Bank will showcase better performance among all, along with IndusInd Bank. If the numbers meet Street expectations, then it will come as a big relief after HDFC Bank's disappointing quarter.

"Advances growth expected to be healthy at around 18 percent YoY led by retail and SME segment, comments on slowdown in unsecured portfolio remain key monitorable," analysts at Axis Securities said.

Like Axis, most brokerages see advances growth between 18 and19 percent. Deposit growth, too, is pegged in the same range.

"Deposits are expected to grow by 19.2 percent YoY/ 3.3 percent QoQ, with CASA at 40.9 percent as of December 31, 2023," KRChoksey said.

Also Read: Sensex, Nifty caught in the red for 3rd day as heavyweight HDFC Bank slides

Net interest margins and asset quality

The Street will keep a close watch on net interest margins (NIMs), especially after bigger rival HDFC Bank disappointed on that front. Industry-wide bank margins have been under pressure for a year now after seeing a significant uptick. This is because of the lag in repricing of deposits compared to loans on the back of high interest rates.

Brokerage estimates indicate Q3 NIMs to compress 20-30 bps (basis points) YoY to around 4.3 percent.

One basis point is one-hundredth of a percentage point.

"We expect a compression of NIMs driven by a higher cost of funds. We expect PPoP (pre-provision operating profit) to grow by 7.6 percent YoY with a cost-to-income ratio of 41.5 percent versus 40.9 percent in Q2 FY24," KRChoksey said.

Philip Capital and Motilal Oswal Financial Services see no big change in asset quality, sequentially. Gross non-performing assets (GNPAs) and NNPAs expected at 2.5 percent and 0.4 percent, respectively.

"We expect credit costs to inch up slightly but there are adequate contingency buffers to add comfort. Traction in opex and deposit growth to be the key monitorable," Motilal Oswal Financial Services analysts said.

Stock performance

In the December quarter, ICICI Bank surged 6 percent against a 4 percent rise in Bank Nifty. In the past year, the stock has gained 13 percent, while banking index moved up 7 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!