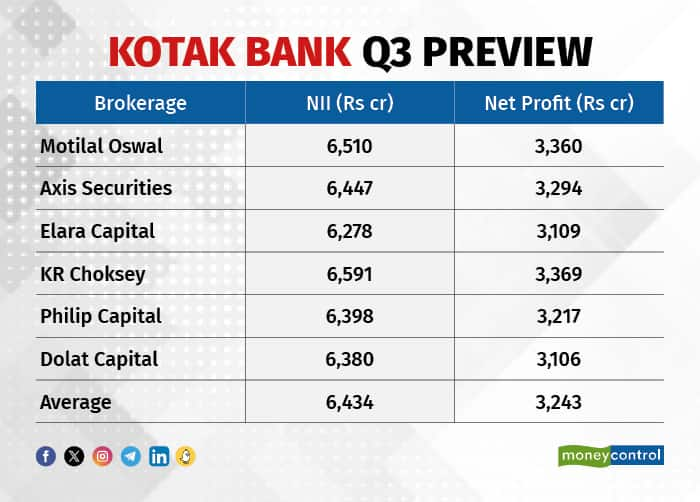

Kotak Mahindra Bank on January 20 is expected to reported 16 percent year-on-year growth in standalone net profit at Rs 3,243 crore for the quarter ended December 2023. As per a poll of brokerages, net interest income is expected to come in at Rs 6,434 crore, jumping 14 percent from from year-ago period.

This will be Kotak Bank's first quarterly results announcement with Ashok Vaswani at the helm. The veteran banker assumed charge as the managing director and chief executive officer of the bank on January 1, 2024.

Unlike HDFC Bank (and like ICICI Bank), Kotak Mahindra Bank does not come out with a quarterly business update, so the Street will be keenly eyeing deposit and advances growth.

KRChoksey expects strong loan growth of 18.8 percent year-on-year, led by healthy growth in the retail segment across all the segments. "The deposits are expected to grow by 20.5 percent YoY, with an increasing contribution from its new product segment, ActivMoney," it added.

Also Read: ICICI Bank Q3 preview: Net profit may rise 20%, loan growth to get retail & SME boost

With this, the Street believes that the CASA ratio will remain relatively stable sequentially at 48 percent. CASA (current accounts, savings account) is a relatively cheap source of funds for banks. The higher the share of CASA in deposits, the lower is the cost of funds.

Net interest margins and asset qualityAxis Securities expects margin contraction to continue, as deposits get repriced. It sees NIMs contracting by ~10-15 basis points. One basis point is one-hundredth of a percentage point.

"Cost ratios to remain stable supporting operational profitability. Stable credit costs to aid earnings, asset quality to remain steady," said Axis in its earnings preview report.

According to Motilal Oswal Financial Services, asset quality will improve from the quarter-ago period. GNPA is seen at 1.63 percent and NNPA at 0.34 percent, against 1.72 percent and 0.37 percent in Q3 FY23, respectively.

GNPA is gross non-performing assets and NNPA is net non-performing assets.

Also Read: HDFC Bank: Good opportunity for long-term investors amid 11% slide

Peer performance and stock movementSo far, banking sector's performance has been mixed with HDFC Bank disappointing the Street while IndusInd Bank beating analyst estimates. A clear industry trend will emerge after ICICI Bank and Kotak Bank announce their results on January 20.

In the October-December quarter, Kotak Bank surged seven percent, outperforming the Bank Nifty index that rose 4 percent. In the past year, Kotak Bank has remained flat while banking index has gained 7 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.