Closing Bell: New highs for market, Sensex surges 1384 pts, Nifty around 20,700

-330

December 04, 2023· 16:41 IST

Benchmark indices ended at fresh record highs on December 4 with Nifty above 20,650. At close, the Sensex was up 1383.93 points or 2.05 percent at 68,865.12, and the Nifty was up 418.9 points or 2.07 percent at 20,686.80.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

December 04, 2023· 16:37 IST

-330

December 04, 2023· 16:35 IST

Mandar Bhojane, Research Analyst at Choice Broking

On December 4, benchmark indices reached new record highs, with the Nifty surpassing 20,650 and Banknifty achieving a record high, gaining 1617.20 points. The Nifty closed the day with a substantial gain of 418.9 points or 2.07 percent, settling at 20,686.80.

At the close, the Sensex experienced a significant surge, rising by 1383.93 points or 2.05 percent, reaching 68,865.12. This positive market momentum reflected an overall sense of optimism and confidence in the financial markets.

Bulls demonstrated strong dominance in today's trade, propelling the index higher right from the beginning. Except for the Media and Pharma sectors, all others concluded the day with gains, with Banking and Energy emerging as the top performers. However, mid and smallcap indices underperformed as buying was concentrated in index-based stocks.

On the daily chart, the Nifty sustained its upward momentum after a gap-up opening of 300 points, forming a robust bullish candle indicative of a strong uptrend. However, a closer examination of lower time frames, particularly the hourly charts, revealed an extremely overbought condition. A correction, either in terms of time or price, seems warranted, suggesting that one should consider entering positions on dips for a more favorable risk-reward profile.

-330

December 04, 2023· 16:31 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty kicked off with a gap up, propelled by BJP's exceptional performance in the state election. Technically, the Nifty had already surged past the critical resistance level of 19850. Since then, there has been a significant shift in Put positions towards higher strike prices, foreseeing a robust upward rally in the near future. The overall sentiment appears highly bullish, until Nifty fall below 20400. On the higher end, the index might move towards 21000."

-330

December 04, 2023· 16:28 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty bulls made a strong comeback, surpassing the all-time high levels and dispelling the bearish sentiment. The momentum is anticipated to persist, with robust support identified at the 46000-45800 zone, serving as a cushion for the bulls. The ongoing momentum rally has the potential to propel the index higher towards the levels of 47000/48000.

-330

December 04, 2023· 16:25 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The benchmark index hits at its all-time high following the landslide victory of BJP in elections in three states. It spurred a rally with an anticipation that the country will witness a stable government post the General election. All the sectors have broadly participated in the rally with an optimism that the FIIs will continue its value buying, indicating positive commentary on the Global inflation data and stable domestic Marco economics.

-330

December 04, 2023· 16:16 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

The rally was on expected lines as the ruling party's strong performance in state elections gave confidence to investors that culminated into a massive upsurge with key benchmarks scaling record highs.

India's strong growth prospects going ahead along with moderating inflation and return of foreign investors should augur well for domestic markets in the run up to the Union Budget in February.

Despite overbought technical conditions, the good news is that the short-term technical outlook for Nifty continues to be in favor of the bulls, with support placed at 20529-20321 levels and resistance at 20750-21051.

-330

December 04, 2023· 16:13 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened with a huge gap up and after consolidating during the first half it witnessed a fresh round of buying interest which helped the Nifty close around the highs for the day. On the daily charts we can observe that after breaking and closing above the previous swing high of 20222, Nifty today has witnessed follow-through buying interest. The Nifty managed to hold on to the gains and also built upon it which indicates that there is more steam left in the rally.

On the upside we expect it to stretch higher till 21500. Daily momentum indicator has a positive crossover and thus in case of a dip/consolidation towards the support zone of 20550 – 20500, it should be used as a buying opportunity.

Bank Nifty was the leader in today’s upmove as it was up ~3.5% for the day. It has closed at an all-time high and we expect the momentum to continue. On the upside, 47000 – 47200 shall be the immediate short-term target and any dip towards 46200 – 46000 should be used as a buying opportunity.

-330

December 04, 2023· 16:01 IST

Rupee Close:

Indian rupee ended lower at 83.37 per dollar on Monday against Friday's close of 83.29.

-330

December 04, 2023· 16:01 IST

Shrey Jain, Founder and CEO SAS Online:

The market has delivered its verdict evident in today's closing trends. Following a substantial gap-up in Nifty, Bank Nifty ended even higher towards the end of the session. At the closing bell, Nifty concluded at 20,686.80, showcasing an impressive gain of 418.90 points or 2.07%. Simultaneously, Bank Nifty soared to 46,430.85, registering an ascent of 1,616.65 points or 3.61%.

With the exception of Nifty Pharma and Media, all other sectoral indices concluded in positive territory.

The surge in foreign investor inflows, a decline in US bond yields, robust GDP growth, and the optimistic anticipation of no further rate hikes, in addition to the outcomes of state elections, have collectively contributed to these gains. Given these developments, it is recommended to consider buying on dips.

-330

December 04, 2023· 16:00 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Markets witnessed fireworks at the beginning of the week and gained two percent, in continuation of the prevailing uptrend. Upbeat domestic cues combined with robust global markets triggered a gap start in the Nifty, which further strengthened as the day progressed. It eventually ended around the day’s high at 20684.80 levels. All sectors participated in the move wherein banking majors contributed the maximum to the gains. The broader indices also rose over a percent each.

The buoyancy in the banking pack is leading from the front now while others are playing a supportive role and we feel the same trend could continue in the coming days. Besides, cues are favorable from the global front too, further adding to traders’ comfort. On the index front, Nifty may take a breather around the 20,750 zone and expect the 20,300-20,400 zone to act as a cushion in case of any profit taking. We recommend staying with the trend and utilizing a dip or consolidation as a buying opportunity.

-330

December 04, 2023· 15:48 IST

Aditya Gaggar Director of Progressive Shares

Bulls have shown their strong dominance in today's trade and right from the beginning, the Index kept soaring higher and ended the session at a fresh high of 20,686.80 with gains of 418.90 points. Except for the Media and Pharma, all other sectors ended the day with gains where Banking and Energy were the top performers. Mid and smallcap indices underperformed as buying was seen in the index-based stocks only.

On the daily chart, the Index has posted a strong bullish candle which signifies a strong uptrend while looking at the lower time frame i.e. hourly charts, an extremely overbought condition was witnessed. Time or price-wise correction is warranted and one should enter on dips only.

-330

December 04, 2023· 15:47 IST

Mandar Pitale, Head- Treasury, SBM Bank India

Overall data prints released after October MPC are supportive for MPC to continue with its current “withdrawal of accommodation” stance. MPC is also likely to maintain the status quo on rates in the forthcoming policy announcement.

The present liquidity dynamic prevailing in the market is governed by shallowness in the systemic liquidity with the overnight rates hovering near the upper band of the policy rate corridor (MSF) supporting effective transmission of the past rate actions. The average monthly liquidity absorption for the last 2 months is well below Rs 1 Lakh crore. Since the present liquidity equation is expected to continue for the foreseeable future, RBI may not be required to resort to structural liquidity suction tools such as OMO sale in coming months.

Forward guidance on inflation, comments on behaviour of systemic liquidity going ahead as well as any explanation on not using the structural liquidity tools such as OMO Sales as touched upon in the previous MPC will be keenly watched by the market participants.

-330

December 04, 2023· 15:31 IST

Market Close:

Benchmark indices ended at fresh record highs on December 4 with Nifty above 20,650.

At close, the Sensex was up 1383.93 points or 2.05 percent at 68,865.12, and the Nifty was up 418.9 points or 2.07 percent at 20,686.80.

Eicher Motors, Adani Enterprises, Adani Ports, BPCL and ICICI Bank were among the biggest gainers on the Nifty, while losers included HDFC Life, Britannia Industries, Wipro, Sun Pharma and Titan Company.

Except Nifty Pharma and Media, all other sectoral indices ended in the green.

Among broader indices BSE Midcap and Smallcap rose 1 percent each, to test respective record highs.

-330

December 04, 2023· 15:24 IST

ALERT | Nifty poised for best day since October 2022 and Nifty Bank since April 2022.

-330

December 04, 2023· 15:23 IST

Stock Market LIVE Updates | Kotak Institutional Equities On Interglobe Aviation

-Buy call, target Rs 3,300

-Current high yields for airlines may sustain due to growing choices for airlines to place aircraft

-Current high yields for airlines may sustain due to capacity constraints

-Customers refraining from flocking away to lower-cost AC rail options

-Environment is quite fertile for airlines to see healthy load factors on incremental capacity and to pass on cost increases

-330

December 04, 2023· 15:16 IST

Sensex Today | Parijat Agrawal, Head – Fixed Income, Union Asset Management Company:

We are going into the policy with an improved domestic macroenvironment and benign external factors. Q2 FY24 GDP surprised on the upside, and therefore we expect RBI to revise the projections up for the full year. The US 10-year has corrected meaningfully from the peak in line with the incoming data and the central bank narrative. Concerns around oil prices have reduced and have been close to around $80 for a few weeks now.

Although MPC will emphasise on bringing inflation to the 4% target, we expect MPC to remain on pause on rates and stance. Markets will keenly look for guidance on systemic liquidity and Open Market Operations (OMO). We may also hear a bit more about the retail/unsecured credit environment.

-330

December 04, 2023· 15:12 IST

Stock Market LIVE Updates | Morgan Stanley View On Multi Commodity Exchange of India:

-Underweight call, target Rs 1,955 per share

-Average daily traded value (ADTV) is a key driver of company's profits & share price

-In November-23, ADTV (futures + 42 percent*options) was down 9 percent MoM to Rs 58,200 crore

-ADTV was down in November probably due to platform migration

-Platform migration probably helped company’s stock at 37 percent MoM versus 5 percent for Sensex

-Platform migration probably helped in strength in capital market stocks

-330

December 04, 2023· 15:10 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas:

Indian Rupee depreciated marginally by 1 paise on Monday losing early gains amid a recovery in the US Dollar index. Rupee gained earlier in the day as both the domestic indices surged to record highs. FII inflows also supported the local currency. US Dollar declined on Friday on dovish comments by US Federal Reserve Chair, Jerome Powell which raised rate cut bets in 2024. Other economic data from the US was mixed to negative with ISM manufacturing PMI contracting for the thirteenth consecutive month.

We expect the Rupee to trade with a slight positive bias on positive domestic markets and expectations of fresh foreign inflows after surprising results from the state election results. The decline in crude oil prices and bolstering rate cut bets by the Fed may also support Rupee. However, the buying of Dollars by RBI may cap sharp gains. Traders may take cues from US factory orders. Investors may remain cautious ahead of RBI’s monetary policy decision later this week. USDINR spot price is expected to trade in a range of Rs 83 to Rs 83.60.

-330

December 04, 2023· 15:08 IST

Stock Market LIVE Updates | Jefferies On Newgen Software

-Buy call, target raised to Rs 1,740 per share

-Annual meet takeaways show management highlighted a strong growth outlook

-Strong growth outlook driven by India and middle east

-India is witnessing strong traction

-Deal sizes have increased by 40 percent over the last year

-Company’s trade finance product has had 9 large deal wins

-Company provides strong growth visibility in future

-Raise EPS estimates by 2-4 percent

-330

December 04, 2023· 15:06 IST

Sesnex Today | Market at 3 PM

The Sensex was up 1299.23 points or 1.93 percent at 68,780.42, and the Nifty was up 425.3 points or 2.10 percent at 20,693.20. About 2134 shares advanced, 1201 shares declined, and 125 shares unchanged.

-330

December 04, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Mangalam Worldw | 125.00 | 113.55 | -11.45 9.16k |

| Jeena Sikho | 661.00 | 633.00 | -28.00 825 |

| Navkar Corp | 93.70 | 90.35 | -3.35 70.16k |

| Archidply Ind | 82.90 | 80.05 | -2.85 1.88k |

| Manomay Tex Ind | 124.00 | 120.00 | -4.00 538 |

| AXISCETF | 92.47 | 89.50 | -2.97 34 |

| Par Drugs | 230.50 | 223.55 | -6.95 220 |

| Nandani Creatio | 76.65 | 74.40 | -2.25 336 |

| Emami Realty | 143.00 | 138.85 | -4.15 185.45k |

| Nitiraj Enginee | 121.50 | 118.00 | -3.50 2.47k |

-330

December 04, 2023· 14:58 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| ROX Hi-Tech | 182.80 | 195.75 | 12.95 68.33k |

| ABM Inter | 42.60 | 45.60 | 3.00 0 |

| AARTIPP | 295.00 | 311.15 | 16.15 7 |

| Robust Hotels | 124.75 | 130.50 | 5.75 18.25k |

| Anlon Technolog | 258.15 | 269.95 | 11.80 1.19k |

| CESC | 104.75 | 109.35 | 4.60 3.18m |

| Swaraj Suiting | 94.00 | 98.00 | 4.00 0 |

| CARE Ratings | 927.40 | 964.00 | 36.60 5.52k |

| Vital Chemtech | 88.50 | 91.95 | 3.45 4.32k |

| Weizmann | 118.30 | 122.90 | 4.60 606 |

-330

December 04, 2023· 14:57 IST

Stock Market LIVE Updates | Citi View On Larsen & Toubro:

-Buy call, target raised to Rs 4,000 per share from Rs 3,550 per share

-Company remains top pick on continuing strong capex growth in India

-Company has stronger capex growth in Middle East

-Company has increasing visibility on government of India’s capex program over next few years

-Company also exhibiting strong execution capabilities

-Strong execution capabilities evident from very large order wins in Middle East and India

-Believe company is near the end of margin pressure due to legacy pre-covid orders

-Company is set to see strong earnings growth over next few years

-330

December 04, 2023· 14:53 IST

Sensex Today | Shiv Sharma, India-Head, Stocktwits:

With the overhang of state poll results now behind us, investors are likely to bet big on a major policy push in the run-up to General Elections next year, which is likely to reflect well on domestic equity markets amid strong (and growing) retail investor participation.

The recent macro data numbers along with global rating agencies upgrading growth forecasts indicate India remains a bright spot in a still challenging global economy. While flows from retail investors have been good so far, the overall long-term growth prospects could drive the momentum going ahead.

-330

December 04, 2023· 14:49 IST

-330

December 04, 2023· 14:45 IST

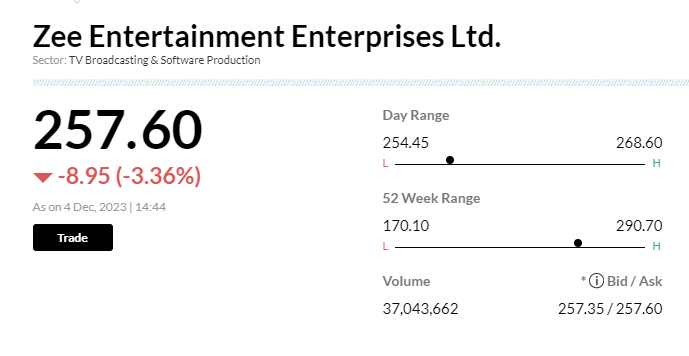

Stock Market LIVE Updates | Zee Entertainment fell 3.5% amid higher volumes

Shares of Zee Entertainment Enterprises Ltd fell 3.5 percent on the back of higher volumes. According to BSE filing, Sprucegrove sold 2.3 percent stake in the firm between February-November. Sprucegrove had 7.3 percent stake in the firm while currently after selling it hold 4.99 percent stake.

-330

December 04, 2023· 14:40 IST

-330

December 04, 2023· 14:33 IST

Stock Market LIVE Updates | Thomas Cook shares rally 5% as promoter Fairbridge Capital completes OFS valued at Rs558 crore

-330

December 04, 2023· 14:21 IST

-330

December 04, 2023· 14:19 IST

Sensex Today | BSE Bank index up 3 percent supported by Canara Bank, ICICI Bank, Bank of Baroda:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Canara Bank | 427.15 | 4.13 | 664.90k |

| ICICI Bank | 983.25 | 3.9 | 931.53k |

| Bank of Baroda | 209.40 | 3.74 | 1.51m |

| Federal Bank | 153.75 | 3.43 | 798.03k |

| SBI | 590.60 | 3.28 | 2.36m |

| IndusInd Bank | 1,504.50 | 2.97 | 138.42k |

| Kotak Mahindra | 1,801.00 | 2.87 | 314.52k |

| HDFC Bank | 1,598.95 | 2.79 | 1.11m |

| AU Small Financ | 751.60 | 1.29 | 70.00k |

| Axis Bank | 1,116.50 | 1.15 | 373.56k |

-330

December 04, 2023· 14:17 IST

Stock Market LIVE Updates | Tarun Baldua resigns as Chief Executive Officer of steel operations at Surya Roshni

Tarun Baldua has resigned as Chief Executive Officer (CEO) of steel operations and the key managerial personnel of Surya Roshni with effect from November 30.

-330

December 04, 2023· 14:14 IST

Stock Market LIVE Updates | Salasar Techno Engineering bags EPC contract worth Rs 364 crore

Salasar Techno Engineering has bagged an EPC contract worth Rs 364 crore from Tamil Nadu Generation and Distribution corporation (TANGEDCO). The contract is expected to be completed within 36 months.

-330

December 04, 2023· 14:12 IST

Sensex Today | Manish Chowdhury, Head of Research, StoxBox:

With the results of state elections giving a big victory to BJP in three states and some in-roads in Telangana as well, markets have been on a strong footing today. We further expect markets to cement gains and won’t we surprised to see markets closer to the 22,000 levels before the general elections in 2024. The image of the BJP as a pro-reformist and the performance of the economy on various fronts, especially during the COVID period and gloomy global economic situation, have provided market participants confidence that a dual-aided right-wing government is beneficial in the longer term.

As we move closer to the 2024 general elections, we believe that the decisive win by the BJP in key states has sent a strong message to investors betting on India’s rising growth potential and position the country on a stronger footing as compared to its peers.

-330

December 04, 2023· 14:10 IST

Stock Market LIVE Updates | Citi View On Nuvama Wealth Management:

-Initiate buy call, target Rs 4,110 per share

-Company positions it in a sweet spot on growing formalisation of managed wealth in India

-Capital markets business provides a flywheel impact

-Capital markets business has multiple synergies w/wealth even as it poses earnings volatility risks

-Alternate focused AMC, with a strong product pipeline and multiple distributor tie-ups

-AMC is scaling up

-Rising competitive pressure in mid-market wealth

-Earnings volatility in capital markets pose downside risks

-330

December 04, 2023· 14:06 IST

Stock Market LIVE Updates | Shapoorji Pallonji makes full payment against indemnity claim amount of Rs 342.87 crore to Sterling and Wilson Renewable Energy:

Shapoorji Pallonji and Company has made the full payment against the indemnity claim amount of Rs 342.87 crore to Sterling and Wilson Renewable Energy. This amount has been utilised towards repayment of loans, including the loan defaulted by the company.

-330

December 04, 2023· 14:04 IST

Sensex Today | Pranav Haridasan, MD & CEO, Axis Securities:

The assembly election results for key states of Madhya Pradesh, Rajasthan, Chhattisgarh, and Telangana have thrown a positive surprise for the markets, with the markets now assigning a greater probability of continuation of existing government policies beyond 2024 and decisive election mandates.

This development removes a significant short-term overhang from the markets. We believe that the near-term markets are likely to see strong interest, led by a rebound in industrial growth and a benign interest rate trajectory. Yesterday’s events have lowered risk for investors in the short term, and they can expect a good closing for the calendar year. In the medium term, critical market risks remain higher than historical valuation levels and potential global slowdowns, especially in the US, China, and Europe.

-330

December 04, 2023· 13:59 IST

| Company | Price at 13:00 | Price at 13:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| NDL Ventures | 163.65 | 155.55 | -8.10 20.69k |

| Weizmann | 123.30 | 118.30 | -5.00 92 |

| MBL Infra | 45.90 | 44.50 | -1.40 19.82k |

| Whirlpool | 1,370.00 | 1,328.40 | -41.60 95.65k |

| Shanthala | 114.40 | 111.00 | -3.40 - |

| S P Apparels | 646.00 | 627.50 | -18.50 6.11k |

| Onelife Capital | 20.85 | 20.30 | -0.55 6.15k |

| Aurangabad Dist | 336.85 | 328.15 | -8.70 1.79k |

| Anlon Technolog | 265.00 | 258.15 | -6.85 320 |

| Ethos | 2,027.40 | 1,975.10 | -52.30 10.77k |

-330

December 04, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| De Neers | 235.10 | 252.90 | 17.80 5.41k |

| AYM Syntex | 68.75 | 73.60 | 4.85 3.51k |

| SINDHUTRAD | 27.10 | 28.85 | 1.75 231.00k |

| Bhageria Indu | 164.15 | 174.30 | 10.15 4.05k |

| Pulz Electronic | 127.00 | 134.75 | 7.75 6.99k |

| Nitiraj Enginee | 115.20 | 121.50 | 6.30 1.84k |

| Pansari Develop | 81.90 | 86.00 | 4.10 125 |

| Cupid | 830.00 | 865.00 | 35.00 1.60k |

| Jocil | 215.20 | 223.75 | 8.55 737 |

| Bajaj Holdings | 7,557.05 | 7,805.50 | 248.45 5.86k |

-330

December 04, 2023· 13:57 IST

Stock Market LIVE Updates | UBS View On GSPL

-Downgrade to neutral, target cut to Rs 310 per share from Rs 350 per share

-Downgrade given risks to future tariffs

-Detailed scenario analysis suggests tariffs could decline 20 percent from current levels

-DCF-based tariff calculation (at 12 percent post-tax IRR) could be adversely impacted

-Impact due to lower future capex and opex considerations

-Impact can also be due to increase in authorised capacity (volume acts as a divisor in DCF)

-Higher-for-longer spot LNG prices lead to cut FY25-27 volumes 13-18 percent

-Reduce FY25- 27 earnings 22-25 percent

-330

December 04, 2023· 13:55 IST

Stock Market LIVE Updates | GMM Pfaudler subsidiary completes acquisition of Professional Mixing Equipment Inc

GMM Pfaudler's subsidiary GMM Pfaudler US Inc has completed the acquisition of Professional Mixing Equipment Inc (MixPro) via acquisition of 100% share capital of its holding company 2012875 Ontario Inc.

-330

December 04, 2023· 13:54 IST

Stock Market LIVE Updates | GPT Infraprojects receives arbitration amounts from IRCON International

GPT Infraprojects has said that the joint venture company GPT Rahee JV with 57% shareholding has received arbitration amounts from IRCON International. The amount settled under the Vivad Se Vishwas II (the contractual disputes settlement scheme) stood at Rs 11.74 crore in the two Ganga bridge fabrication contracts.

-330

December 04, 2023· 13:52 IST

Stock Market LIVE Updates | Mahindra EPC Irrigation receives contract for supply of micro irrigation systems

Mahindra EPC Irrigation has received a contract worth Rs 2.45 crore for supply of micro irrigation systems from the office of the Chief Engineer, Micro Irrigation Programme.

-330

December 04, 2023· 13:50 IST

Stock Market LIVE Updates | BlackRock increases stake in Suzlon Energy to over 5%

BlackRock Inc has increased its stake in Suzlon Energy to 5.01%, from 4.99% earlier as it bought 24.73 lakh equity shares in the company via open market transactions on November 30.

-330

December 04, 2023· 13:47 IST

Stock Market LIVE Updates | Nomura On Federal Bank

-Initiate buy call, target Rs 190 per share

-Expect company to deliver a strong 22 percent core PPOP CAGR over FY24-26

-An undervalued franchise moving into higher gear

-Company’s impending management transition is a key near-term monitorable

-Company’s second level of management should be up to task

-Value co at 1.2x Dec-25 BVPS, with subsidiaries contributing Rs 8 per share

-330

December 04, 2023· 13:45 IST

Stock Market LIVE Updates | Artefact Projects bags consultancy services project from NHAI

Artefact Projects has received the project from National Highway Authority of India for consultancy services as independent engineering for four-laning road contract on HAM under Bharatmala Pariyojna in Andra Pradesh. The company has received the Letter of Award for the said project from NHAI. The contracted fees for the project is Rs 5.40 crore.

-330

December 04, 2023· 13:42 IST

-330

December 04, 2023· 13:31 IST

Stock Market LIVE Updates | Brigade Enterprises launches residential project Brigade Sanctuary in Bengaluru

Brigade Enterprises has launched a residential project Brigade Sanctuary. Brigade Sanctuary is a joint development comprising 1,275 units with 1, 3 & 4 bedroom homes and has a gross revenue potential of Rs 2,000 crore. The total development area will be around 2 million square feet.

-330

December 04, 2023· 13:28 IST

Stock Market LIVE Updates | RSWM to acquire assets of spinning, knitting and processing of Ginni Filaments for Rs 160 crore

RSWM, the yarn manufacturer has signed a binding term sheet with Ginni Filaments for acquisition of its spinning, knitting and processing undertaking at Mathura on slump sale basis at an enterprise value of Rs 160 crore. The transaction is expected to be completed within 90 days of execution of term sheet.

-330

December 04, 2023· 13:24 IST

Sensex Today | BSE Auto index up 0.6 percent supported by Eicher Motors, Bajaj Auto, UNO Minda:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Eicher Motors | 4,103.00 | 5.45 | 27.03k |

| Bajaj Auto | 6,165.55 | 1.97 | 6.06k |

| UNO Minda | 669.65 | 1.89 | 12.71k |

| Cummins | 1,950.80 | 1.61 | 7.53k |

| M&M | 1,648.40 | 1.33 | 79.78k |

| Hero Motocorp | 3,797.00 | 1.02 | 18.27k |

| Apollo Tyres | 446.65 | 0.98 | 81.13k |

| Tube Investment | 3,323.70 | 0.98 | 6.04k |

| Balkrishna Ind | 2,565.80 | 0.26 | 114.69k |

| Tata Motors | 707.45 | 0.25 | 469.35k |

-330

December 04, 2023· 13:22 IST

Stock Market LIVE Updates | Bajel Projects bags Rs 142 crore contract from PowerGrid Energy Services

Bajaj Electricals' power transmission business operator Bajel Projects has received contract worth Rs 142.28 crore for supply of plant and installation service from PowerGrid Energy Services, the subsidiary Power Grid Corporation of India, in Pulwama and Awantipura districts of J&K.

-330

December 04, 2023· 13:20 IST

Stock Market LIVE Updates | KPI Green Energy gets new orders of 4.40 MW for executing solar power projects

KPI Green Energy's subsidiary Sun Drops Energia has received new orders of 4.40 MW for executing solar power projects under the captive power producer (CPP) segment. With this new order, its cumulative orders of solar power projects, till date have crossed 148+ MW under CPP segment.

-330

December 04, 2023· 13:15 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| HINDPETRO | 379.40 | 379.40 | 375.75 |

| NLC India | 189.85 | 189.85 | 181.20 |

| Cyient | 2149.60 | 2149.60 | 2,123.20 |

| GAIL | 145.05 | 145.05 | 143.25 |

| BPCL | 464.70 | 464.70 | 462.30 |

| Adani Power | 495.00 | 495.00 | 463.60 |

| Prestige Estate | 1124.10 | 1124.10 | 1,086.30 |

| ABB India | 4680.00 | 4680.00 | 4,629.35 |

| NBCC (India) | 79.50 | 79.50 | 78.41 |

| ONGC | 205.75 | 205.75 | 203.90 |

-330

December 04, 2023· 13:14 IST

Stock Market LIVE Updates | Som Distilleries gets Karnataka Excise Dept approval for supply of premium beer brands in Tamil Nadu

Som Distilleries and Breweries received official approval from the Karnataka Excise Department for the supply of our premium beer brands—Hunter, Blackfort, and Woodpecker to the state of Tamil Nadu.

-330

December 04, 2023· 13:12 IST

Stock Market LIVE Updates | NMDC Steel to added in BSE PSU index

The BSE has added NMDC Steel in its S&P BSE PSU index. The changes will be effective from December 18.

-330

December 04, 2023· 13:11 IST

Sensex Today | BSE Midcap index rose 1 percent led by HPCL, ACC, Oil India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| HINDPETRO | 376.15 | 8.89 | 1.15m |

| ACC | 2,019.90 | 6.29 | 108.07k |

| Oil India | 326.30 | 5.33 | 351.45k |

| Union Bank | 114.50 | 5.24 | 2.13m |

| Supreme Ind | 4,663.15 | 4.55 | 4.73k |

| Canara Bank | 426.75 | 4.03 | 541.42k |

| Federal Bank | 154.20 | 3.73 | 689.24k |

| SJVN | 87.80 | 3.32 | 2.52m |

| REC | 386.10 | 3.3 | 650.75k |

| LIC Housing Fin | 508.35 | 3.19 | 125.41k |

-330

December 04, 2023· 13:08 IST

Stock Market LIVE Updates | Suzlon Energy to be included in BSE Power index

The BSE has included Suzlon Energy in its S&P BSE Power index. The changes will be effective from December 18.

-330

December 04, 2023· 13:05 IST

Stock Market LIVE Updates | Sundaram Fastners to replace UNO Minda in BSE Auto index

Sundaram Fastners is going to replace UNO Minda in the S&P BSE Auto index, with effect from December 18.

-330

December 04, 2023· 13:00 IST

ALERT | MCX Gold futures hit a fresh lifetime high, topping the Rs 64,000 per ten grams mark for the first time ever

-330

December 04, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kernex Micro | 565.00 | 539.00 | -26.00 3.17k |

| G-Tec Jainx | 100.25 | 96.00 | -4.25 391 |

| Shree Vasu | 171.00 | 165.00 | -6.00 34 |

| HEC Infra Proje | 57.70 | 55.70 | -2.00 727 |

| Peria Karamalai | 298.00 | 288.00 | -10.00 74 |

| Vaidya Sane | 239.95 | 233.05 | -6.90 400 |

| Wealth First Po | 400.80 | 390.10 | -10.70 1 |

| Shriram Pistons | 1,057.60 | 1,030.00 | -27.60 7.76k |

| Themis Medicare | 184.55 | 180.05 | -4.50 74.83k |

| Maitreya Medica | 148.50 | 145.00 | -3.50 4.04k |

-330

December 04, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Essar Shipping | 19.45 | 20.80 | 1.35 183.71k |

| Pentagon Rubber | 124.00 | 132.50 | 8.50 1.78k |

| Madhya Bharat A | 286.00 | 300.10 | 14.10 816 |

| Uma Converter | 29.00 | 30.40 | 1.40 16.65k |

| Som Distillerie | 284.65 | 298.00 | 13.35 28.45k |

| Kontor Space | 82.25 | 86.00 | 3.75 - |

| Tata Tech | 1,167.50 | 1,218.80 | 51.30 871.33k |

| Indo Borax | 167.60 | 174.55 | 6.95 5.67k |

| Onelife Capital | 20.05 | 20.85 | 0.80 8.75k |

| Quick Heal Tech | 355.45 | 369.60 | 14.15 7.86k |

-330

December 04, 2023· 12:58 IST

Stock Market LIVE Updates | Jindal Stainless to replace NALCO in BSE Metal index

Jindal Stainless will be replacing National Aluminium Company in the S&P BSE Metal index, with effect from December 18.

-330

December 04, 2023· 12:56 IST

Stock Market LIVE Updates | Swan Energy to replace Indiabulls Real Estate in BSE Realty index

Swan Energy is going to replace Indiabulls Real Estate in S&P BSE Realty index. The changes will be effective from December 18.

-330

December 04, 2023· 12:52 IST

Stock Market LIVE Updates | Kotak Institutional Equities View On Life Insurance Corporation of India:

-Buy call, target Rs 1,040 per share

-Company rallies 10 percent in the past one week, likely after the rally in PSU finance stocks

-Rally due to hype around its new non-par product ‘Jeevan Utsav’

-Company’s IRRs are a tad lower than peers

-A strong marketing pitch can improve volume growth and margin

-Valuations remain inexpensive, providing big headroom

-330

December 04, 2023· 12:48 IST

Sensex Today | BSE Smallcap index up 1 percent led by Aarti Pharmalabs, Sukhjit Starch and Chemicals, Sangam (India):

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sangam India | 376.55 | 20 | 116.85k |

| AARTIPHARM | 479.15 | 12.56 | 161.47k |

| Sukhjit Starch | 466.70 | 11.53 | 15.69k |

| Paisalo Digital | 91.00 | 10.45 | 520.45k |

| GSFC | 213.80 | 10.35 | 1.46m |

| Inox Wind | 315.90 | 9.74 | 256.46k |

| IFCI | 27.45 | 9.15 | 14.01m |

| BCL Industries | 58.73 | 8.6 | 293.92k |

| Zuari Agro Chem | 182.80 | 8.17 | 93.15k |

| DMCC | 308.40 | 8.15 | 11.68k |

-330

December 04, 2023· 12:43 IST

Stock Market LIVE Updates | KK Rajeev Nambiar resigns as Chief Executive officer & Managing Director of Shree Digvijay Cement

KK Rajeev Nambiar has resigned as Chief Executive officer & Managing Director of Shree Digvijay Cement with effect from December 15, 2023 due to personal reasons. Nambiar was re-appointed as a CEO & MD of the company for three years upto July 31, 2024. Now, the board appointed Ramanujan Krishnakumar as an Additional Director and Chief Executive Officer & Managing Director of the company, for 5 years with effect from December 16, 2023. Ramanujan is currently working as Senior Vice President (Manufacturing).

-330

December 04, 2023· 12:41 IST

Stock Market LIVE Updates | Lemon Tree Hotels shares up nearly 2% on opening two hotel properties in Maharashtra, Karnataka

Lemon Tree Hotels' share price added nearly 2 percent in early trade on December 4 after the company announced the opening of a hotel at Hubli in Karnataka.

This is the tenth property in Maharashtra under the company’s umbrella, which features 50 well-appointed rooms, a restaurant, a bar, banquet spaces, a swimming pool, a fitness center, and other public areas.

The company also announced the opening of Lemon Tree Hotel, Hubli, which is the eighth property of the group in Karnataka. Read More

-330

December 04, 2023· 12:37 IST

Sensex Today | BSE Metal index up 1 percent led by Coal India, NALCO, JSW Steel:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coal India | 356.80 | 2.96 | 903.93k |

| NALCO | 96.39 | 2.88 | 714.10k |

| JSW Steel | 822.00 | 1.34 | 166.01k |

| NMDC | 183.80 | 0.96 | 350.08k |

| SAIL | 93.96 | 0.83 | 1.94m |

| Vedanta | 241.20 | 0.79 | 352.73k |

| Tata Steel | 130.95 | 0.77 | 1.12m |

| Hindalco | 519.30 | 0.4 | 168.26k |

| APL Apollo | 1,644.30 | 0.04 | 14.02k |

-330

December 04, 2023· 12:36 IST

Stock Market LIVE Updates | ASK Automotive Q2 profit drops 15% YoY to Rs 41.2 crore

ASK Automotive has reported consolidated net profit at Rs 41.2 crore for quarter ended September FY24, declining 15.3% compared to year-ago period impacted by lower operating numbers with higher input cost, finance cost and other expenses.

Revenue from operations grew by 6.5% YoY to Rs 794 crore supported by increase of volume in aluminium light weighting precision solutions and safety control cable segment. EBITDA during the quarter dropped 10.8% YoY to Rs 74.5 crore with margin falling 180 bps at 9.4%.

-330

December 04, 2023· 12:33 IST

-330

December 04, 2023· 12:31 IST

Stock Market LIVE Updates | Updater Services appoints Radha Ramanujan as Chief Financial Officer after resignation of Balaji Swaminathan

Updater Services said the board of directors has appointed Radha Ramanujan as Chief Financial Officer and key managerial personnel of the company. Balaji Swaminathan has resigned as Chief Financial Officer and Key Managerial Personnel of the company with effect from December 30, 2023, while the board approved the promotion and appointment of C R Saravanan, as Chief Operating Officer of the company with effect from the January 1, 2024.

-330

December 04, 2023· 12:27 IST

Stock Market LIVE Updates | Amansa Holdings offloads Rs 148 crore shares in Ceat

Amansa Holdings sold 7 lakh shares of Ceat, which is equivalent to 1.73 percent of paid up equity. These shares were sold by Amansa at an average price of Rs 2,115.86 per share, amounting to Rs 148.11 crore.

-330

December 04, 2023· 12:24 IST

Sensex Today | Colin Shah, MD, Kama Jewelry:

This is a welcome move and a much-needed one for the sanity of India’s gems & jewellery sector. The disclosures of Ultimate Beneficial Owners (UBOs) by their trading partners will ensure the last-mile eradication of malpractices like money laundering and terror funding. Along with this, it will also safeguard the interests of exporters and other ancillaries of the industry. Overall, this is a win-win move that will also boost the confidence of overseas players to do hassle-free business in India, thereby enhancing the foreign currency inflow in the country.

-330

December 04, 2023· 12:20 IST

Sensex Today | Santosh Meena, Head of Research, Swastika Investmart:

Nifty's immediate target is 20,750, with the auspicious level of 21,000 easily within reach. The previous breakout level of 20,222 will serve as the market's floor, and with the pre-election rally underway, Nifty could climb towards 22,500 ahead of the general election.

Banknifty is assuming leadership with a breakout of an inverse head and shoulder pattern, setting an immediate target of 46,400 and a subsequent target of 47,500. 45,000 will now act as the base.

The Fear of Missing Out (FOMO) and There Is No Alternative (TINA) factors will further fuel the market rally. With clear signs of political stability and India shining as a bright spot in the macroeconomic landscape, FIIs are left feeling compelled to invest, fearing they will miss out on the opportunities India presents.

-330

December 04, 2023· 12:18 IST

Stock Market LIVE Updates | GAIL files arbitration against SEPE Marketing in London Court Of International Arbitration

GAIL (India) company has filed an arbitration case against SEPE Marketing & Trading Singapore Pte Ltd in the London Court Of International Arbitration. The quantum of claims stands at up to $1.817 billion and alternative reliefs including non-monetary reliefs. The dispute is related to non-supply of LNG cargoes to GAIL under long term LNG contract.

Gail India touched a 52-week high of Rs 143.90 and quoting at Rs 142.40, up Rs 6.25, or 4.59 percent.

-330

December 04, 2023· 12:02 IST

Stock Market LIVE Update | Market at 12 PM

The S&P BSE Sensex was up 1.45 percent or 976.62 points at 68,457.81 levels led by gains in Larsen & Toubro (L&T), SBI, Ultratech Cement, Kotak Mahindra Bank, among others. Nifty50, on the other hand, was up 303 points or 1.5 percent to 20,571 levels. The top 5 Nifty50 gainers at this hour were Adani Enterprises, Adani Ports, BPCL, L&T, and ONGC.

-330

December 04, 2023· 11:53 IST

Stock Market LIVE Update | Greaves Cotton EV division Greaves Electric Mobility forays Nepal market

-330

December 04, 2023· 11:48 IST

Stock Market LIVE Update | L&T Finance Holdings completes merger with subsidiaries

Mumbai-based non-banking finance company L&T Finance Holdings (LTFH) announced the successful merger with its subsidiaries, L&T Finance, L&T Infra Credit, and L&T Mutual Fund Trustee. READ MORE

-330

December 04, 2023· 11:44 IST

Stock Market LIVE Update | BCL Industries to supply ethanol worth Rs 516 cr to OMCs, shares jump over 7%

-330

December 04, 2023· 11:37 IST

Stock Market LIVE Update | Adani group stocks boost investor wealth by Rs 1.76 lakh crore in a week

Adani Group stocks extended its gains on December 4 from its rally last week as investors responded positively to court observations, sparking a relief rally, analysts said. Stocks have been rising since last week following the Supreme Court's conclusion of hearings in a lawsuit where market regulator SEBI is investigating extensive allegations of corporate wrongdoing against the conglomerate, analysts added. READ MORE

-330

December 04, 2023· 11:33 IST

Stock Market LIVE Update | Hunt for a new 'Adani' in the next bull market cycle, says Amit Jeswani of Stallion Asset

The current leg of the bull market will be led by the power sector stocks, as participants bet on a stable BJP-led government formation in 2024 after Prime Minister Narendra Modi’s party swept three out of the four state elections, said Amit Jeswani, Founder and CIO of Stallion Asset. READ MORE

-330

December 04, 2023· 11:23 IST

-330

December 04, 2023· 11:22 IST

Stock Market LIVE Updates | Open offer for Cupid from Columbia Petro Chem and Aditya Halwasiya

Cupid submitted a letter of offer for open offer for acquisition of up to 34,67,880 fully paid-up equity shares of face value of Rs 10 representing 26% of Cupid Limited from the Public Shareholders of the company by Columbia Petro Chem Private Limited (Acquirer 1) and Mr. Aditya Halwasiya (Acquirer 2).

-330

December 04, 2023· 11:18 IST

Stock Market LIVE Updates | Ashish Kacholia picks nearly 1% shares in Brand Concepts

Ace investor Ashish Rameshchandra Kacholia has picked 1 lakh shares or 0.94% stake in Brand Concepts via open market transactions. These shares were bought at an average price of Rs 657.55 per share, amounting to Rs 6.57 crore. In addition, RBA Finance also bought 94,192 equity shares in Brand Concepts at an average price of Rs 657.55 per share, whereas Tanam Investment Services offloaded 2 lakh shares in the company at same price.

-330

December 04, 2023· 11:16 IST

-330

December 04, 2023· 11:13 IST

Stock Market LIVE Updates | Ashish Kacholia picks nearly 1% shares in Brand Concepts

Ace investor Ashish Rameshchandra Kacholia has picked 1 lakh shares or 0.94% stake in Brand Concepts via open market transactions. These shares were bought at an average price of Rs 657.55 per share, amounting to Rs 6.57 crore. In addition, RBA Finance also bought 94,192 equity shares in Brand Concepts at an average price of Rs 657.55 per share, whereas Tanam Investment Services offloaded 2 lakh shares in the company at same price.

-330

December 04, 2023· 11:10 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Chennai Meenaks | 45.55 | 49.64 | 30.44 |

| PCS | 21.57 | 45.06 | 14.87 |

| Natural Biocon | 14.91 | 43.50 | 10.39 |

| Bhartiya Inter | 342.10 | 43.44 | 238.50 |

| Him Teknoforge | 190.10 | 29.58 | 146.70 |

| Intec Capital | 19.49 | 27.55 | 15.28 |

| Natura Hue | 12.44 | 26.42 | 9.84 |

| Keshav Cements | 186.50 | 26.01 | 148.00 |

| Objectone Info | 20.14 | 25.56 | 16.04 |

| Emami Realty | 138.00 | 23.71 | 111.55 |

-330

December 04, 2023· 11:08 IST

Stock Market LIVE Updates | Inox Wind Energy completes infusion of Rs 800 cr into Inox Wind:

Inox Wind Limited (IWL) today announced the completion of infusion of ~ Rs 800 crores (before taxes and fees) into the company by its promoter Inox Wind Energy Limited (IWEL).

-330

December 04, 2023· 11:06 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 20555.40 1.42 | 13.53 3.84 | 6.89 9.94 |

| NIFTY BANK | 45685.85 1.95 | 6.28 4.38 | 5.47 5.99 |

| NIFTY Midcap 100 | 43865.15 1.11 | 39.21 4.32 | 10.81 34.69 |

| NIFTY Smallcap 100 | 14435.00 1.37 | 48.34 4.39 | 11.34 43.21 |

| NIFTY NEXT 50 | 49267.60 1.61 | 16.78 5.71 | 9.76 12.17 |

-330

December 04, 2023· 11:03 IST

Stock Market LIVE Updates | TVS Srichakra gets tax demand notice of Rs 11.02 crore from Principal Commissioner of Customs, Mumbai

TVS Srichakra has received an adverse order from the office of the Principal Commissioner of Customs, Mumbai with a tax demand of Rs 11.02 crore, along with interest, penalties amounting to Rs 1.10 core, and redemption fine of Rs 3.84 crore, for the disputed tax period October 13, 2017 to January 10, 2019.

-330

December 04, 2023· 10:58 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Mahaan Foods | 36.50 | 32.50 | -4.00 1.50k |

| Sri Nachammai | 36.87 | 33.31 | -3.56 0 |

| Vapi Ent. | 110.00 | 101.05 | -8.95 0 |

| Citadel Realty | 31.91 | 29.32 | -2.59 510 |

| SecUR Credentia | 23.50 | 21.63 | -1.87 1.31k |

| VIDLI Rest. | 64.79 | 60.15 | -4.64 1.61k |

| Trident Lifelin | 204.05 | 190.00 | -14.05 600 |

| Graviss Hosp | 48.81 | 45.66 | -3.15 138 |

| Guj Poly AVX | 77.90 | 73.08 | -4.82 779 |

| Sejal Glass | 271.50 | 255.00 | -16.50 85 |

-330

December 04, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sangam India | 323.75 | 370.25 | 46.50 443 |

| Walchand People | 178.25 | 202.90 | 24.65 845 |

| Photoquip India | 21.20 | 23.90 | 2.70 2 |

| Emami Realty | 122.60 | 137.25 | 14.65 49.81k |

| Khoday India | 105.55 | 116.65 | 11.10 0 |

| Keshav Cements | 169.00 | 186.50 | 17.50 788 |

| Rita F&L | 18.36 | 20.15 | 1.79 83 |

| Real Eco-Energy | 29.66 | 32.48 | 2.82 2.41k |

| Munjal Auto Ind | 80.40 | 87.20 | 6.80 16.96k |

| SMIFS LIMITED | 47.56 | 51.40 | 3.84 2.67k |

-330

December 04, 2023· 10:55 IST

-330

December 04, 2023· 10:53 IST

Sensex Today | Brigade Enterprises gains on launch of residential project in Bengaluru

Shares of Brigade Enterprises traded up 1.5 percent at Rs 850.20 early on December 4 after the company launched the Brigade Sanctuary residential project in Bengaluru.

The project is spread across 14 acres on the Whitefield-Sarjapur Road.

Brigade Sanctuary is a joint development project comprising 1,275 units with 1, 3 and 4 bedroom homes and has a gross revenue potential of Rs 2,000 crore and the total development area will be around 2 million sq. ft. Read More

-330

December 04, 2023· 10:48 IST

Stock Market LIVE Updates | Maruti Suzuki share price dips on tepid November numbers, drop in production

Shares of Maruti Suzuki India Limited saw a nearly 1 percent decline, reaching Rs 10,525 in early trade on December 4 following the release of the company's November sales data, which indicated a marginal increase of 3.3 percent.

During the month, the country's leading automobile manufacturer sold 164,439 units in November 2023 as compared to 159,044 units in the same month last year, the company said in an exchange filing on December 1. Read More

-330

December 04, 2023· 10:45 IST

Stock Market LIVE Updates | Strides Pharma Science associate company announces closure of transaction with Syngene International

Strides Pharma Science's associate company, Stelis Biopharma has announced closure of its transaction with Syngene International. Stelis and Syngene have executed the final agreements to transfer its Unit 3 multi-modal facility in Bengaluru to Syngene. The agreements finalised with certain changes like the gross consideration adjusted from Rs 702 crore to Rs 617 crore. Stelis has received a payment of Rs 395 crore and the balance amount will be received on completion of certain post-closing actions and final adjustments, if any which is expected in December 2023.

-330

December 04, 2023· 10:42 IST

Sensex Today | Nifty PSU Bank index rose more than 3 percent led by Central Bank of India, Union Bank of India, Punjab National Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Central Bank | 46.70 | 5.42 | 15.60m |

| Union Bank | 113.45 | 4.27 | 22.28m |

| PNB | 83.80 | 3.84 | 52.64m |

| Canara Bank | 425.30 | 3.66 | 5.16m |

| Bank of Baroda | 209.15 | 3.62 | 18.62m |

| Punjab & Sind | 42.35 | 3.42 | 2.10m |

| SBI | 590.55 | 3.29 | 11.77m |

| Bank of Mah | 45.65 | 2.93 | 14.94m |

| Bank of India | 110.25 | 2.56 | 10.51m |

| IOB | 40.55 | 2.4 | 11.50m |

-330

December 04, 2023· 10:41 IST

Stock Market LIVE Updates | Lemon Tree Hotels shares up nearly 2% on opening two hotel properties in Maharashtra, Karnataka

Lemon Tree Hotels' share price added nearly 2 percent in early trade on December 4 after the company announced the opening of a hotel at Hubli in Karnataka.

This is the tenth property in Maharashtra under the company’s umbrella, which features 50 well-appointed rooms, a restaurant, a bar, banquet spaces, a swimming pool, a fitness center, and other public areas.

The company also announced the opening of Lemon Tree Hotel, Hubli, which is the eighth property of the group in Karnataka.

The hotel offers 65 rooms and suites, Citrus Café – a multi-cuisine coffee shop, Republic of Noodles and Pool Bar & Grill as well as conference spaces to meet all business requirements. Read More

-330

December 04, 2023· 10:36 IST

Stock Market LIVE Updates | Salasar Techno Engineering up 3% on winning Rs 364-crore EPC contract

The share price of Salasar Techno Engineering gained 3 percent in early trade on December 4 after the company bagged a contract worth Rs 364 crore.

The company has bagged an EPC contract worth Rs 364 crore from Tamil Nadu Generation and Distribution corporation (TANGEDCO). The project will be executed in successive phases within 36 months.

Under the contract, the company is entrusted with the supply, erection, and installation of feder segregation, high-voltage distribution system, separation of double distribution transformer, and augmentation of 33KV lines. Read More

-330

December 04, 2023· 10:34 IST