Closing Bell: Sensex down 169 pts, Nifty around 21,400; realty drags, pharma gains

-330

December 18, 2023· 16:32 IST

Indian benchmark indices broke 3-day winning run and ended in the red with Nifty around 21,400. At close, the Sensex was down 168.66 points or 0.24 percent at 71,315.09, and the Nifty was down 38.00 points or 0.18 percent at 21,418.70.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

December 18, 2023· 16:31 IST

-330

December 18, 2023· 16:30 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index encountered resistance around the 48000 level, resulting in an inability to sustain at those higher levels, leading to some selling pressure. The immediate support for the index is positioned at 47800. A breach below this level could intensify the selling pressure, potentially pushing the index towards the 47400/47000 marks.

-330

December 18, 2023· 16:28 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Markets took a breather as benchmark indices languished in negative territory due to profit-taking in select frontline stocks on the back of weak Asian and European cues. The rally was swift and robust last week and markets were already in overbought positions and hence some amount of profit-taking was on expected lines. While undertone remains bullish in view of strong economic fundamentals, select bouts of profit-taking cannot be ruled out.

-330

December 18, 2023· 16:21 IST

Deven Mehata, Research Analyst at Choice Broking

After a flat opening, the Nifty traded erratic today, and closed the session at the opening level forming a kind of doji on daily chart. Bank Nifty traded negative for the day and closed near to its day low.

The market has traded Negative with the Sensex losing 0.24 percent and closed at 71315.09 and Nifty was down by 0.18 percent intraday and closed at 21418.65 levels whereas Bank Nifty closed negative, down by 0.57 percent and settled at 47867.70.

Among sectors Nifty Pharma, Nifty Metal and Nifty Media ended in green while Nifty PSU Bank, Nifty PVT Bank and Nifty FMCG ended on the lower side. In Nifty stocks, Bajaj Auto, Hindalco and Adani Ports were the top gainers while Power Grid, ICICI Bank and ITC were the prime laggards.

India VIX was Positive by 5.86 percent intraday and settled at 13.90.

Index has a support around 21300-21220 zone.

Coming to the OI Data, on the call side, the highest OI observed at 21500 followed by 21600 strike prices while on the put side, the highest OI is at 21300 strike price. On the other hand, Bank Nifty has support at 47650-47500 while resistance is placed at 48100 and 48200 levels.

-330

December 18, 2023· 16:16 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets started the week on a muted note and ended marginally lower, taking a breather after the recent surge. After the initial downtick, the Nifty oscillated in a narrow range and finally settled at 21418.65 levels. Meanwhile, a mixed trend across sectors kept the traders occupied wherein pharma and metal performed well while realty, banking and IT witnessed profit taking. We had a similar trend on the broader front too wherein midcap closed flat and smallcap gained over half a percent.

We maintain our bullish view and suggest focusing on buying opportunities amid consolidation. At the same time, traders shouldn’t get carried away with the prevailing momentum and stick with the fundamentally sound counters. Apart from the preferred set viz. banking and IT, we feel stocks from FMCG, pharma and metal can do well so align trades accordingly.

-330

December 18, 2023· 16:08 IST

Rupak De, Senior Technical Analyst at LKP Securities:

On the daily chart, the Nifty has formed a Bearish Harami candlestick pattern, suggesting a potential interruption in the ongoing rally. Additionally, the RSI indicator on the hourly timeframe has undergone a bearish crossover within the oversold zone, hinting at a waning bullishness in the market. A decline below 21350 could lead a correction towards 21220/21100 in the short term. Conversely, resistance is anticipated at 21500 on the higher end.

-330

December 18, 2023· 16:03 IST

Vinod Nair, Head of Research at Geojit Financial Services

The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment. On the global front, attention will be directed towards BOJ monetary policy and UK inflation data.

We expect a near-term consolidation in the market due to an unfavourable risk reward after the recent rapid performance, concerns over El Nino, and a slowdown in world GDP.

-330

December 18, 2023· 15:56 IST

IRCTC shares posted third bet day ever

-330

December 18, 2023· 15:51 IST

Aditya Gaggar Director of Progressive Shares

A rangebound trade comes to an end at 21,418.65 with a loss of 38 points. Among the sectors, Media and Pharma were the outperformers while Realty and Banking indices have experienced a corrective move in the form of profit booking. With gains of 0.22% and 0.56%, Mid and Smallcaps outperformed the Benchmark Index.

On the daily timeframe, the Index has formed an Inside Bar DOJI candlestick pattern which indicates a rangebound activity can be expected with the downside being protected at 21,330 while 21,500 will act as a resistance level.

-330

December 18, 2023· 15:42 IST

Vedanta board approves interim dividend of Rs 11 per share, worth Rs 4,089 crore

-330

December 18, 2023· 15:33 IST

Rupee Close:

Indian rupee ended marginally lower at 83.06 per dollar on Monday versus Friday's close of 83.00.

-330

December 18, 2023· 15:30 IST

Market Close:

Indian benchmark indices broke 3-day winning run and ended in the red with Nifty around 21,400.

At close, the Sensex was down 168.66 points or 0.24 percent at 71,315.09, and the Nifty was down 38.00 points or 0.18 percent at 21,418.70. About 1886 shares advanced, 1478 shares declined, and 124 shares unchanged.

Top losers on the Nifty were Power Grid Corporation, JSW Steel, ICICI Bank, ITC and Tech Mahindra, while gainers were Bajaj Auto, Adani Ports, Sun Pharma, Hindalco Industries and Reliance Industries.

Among sectors, pharma index up 1 percent, capital goods index up 0.7 percent, while realty index down 1 percent and bank index down 0.5 percent

Broader indices outperformed the main indices with BSE Midcap index rose 0.3 percent and smallcap index gained 0.5 percent.

-330

December 18, 2023· 15:27 IST

Stock Market LIVE Updated | Citi On HCL Technologies

-Neutral call, target Rs 1,295 per share

-Discretionary spends saw pressure at start of the year – bottomed out in AMJ quarter

-ER&D business saw 2 quarters of revenue decline

-Layoffs in clients and a higher impact on vendors resulted in ER&D business

-JAS quarter saw QoQ increase in organic revenues in ER&D

-There is hardly any budget flush; furloughs are higher than any of the previous 2 years

-Difficult to call out when demand situation will improve

-Medium term growth outlook remains low double-digit growth

-2.6% to 3.8% CQGR across the balance 2 quarters factor in no impact in discretionary spends

-330

December 18, 2023· 15:23 IST

Stock Market LIVE Updated | Citi View On Infosys

-Neutral call, target Rs 1,565 per share

-Mega deal wins will lead to better foundation for future growth

-Pace of decline in discretionary spends has slowed versus start for the year, don’t see stabilisation yet

-H2 is seasonally soft given larger share of financial services & US

-No significant changes in furloughs in Q3 versus prior years

-Discretionary spends have come under pressure in last few quarters

-Clients are looking to optimise costs – visible in the mega deals that are announced

-Challenged verticals – financial services (capital markets, investment banking, cards)

-Challenged verticals – telecom, some parts of hi-tech and retail

-Europe has been behind the curve on outsourcing – market is opening up

-330

December 18, 2023· 15:21 IST

Stock Market LIVE Updates | Aurionpro partners with Vix Technology to unveil Next-gen Mobility Solutions

Aurionpro Transit, an Aurionpro company and a leading global provider of smart ticketing and payment solutions for transit, announces its partnership with Vix Technology.

As part of this collaboration, Aurionpro Transit will design and develop state-of-the-art All-in-One Driver Console (DC120) and Mobile Data Terminal (MDT10), innovative in-bus solutions which will streamline transit operations by providing a central on-vehicle hub for various functions from ticketing to communications.

-330

December 18, 2023· 15:18 IST

Stock Market LIVE Updates | Citi View On TCS

-Sell call, target Rs 3,170 per share

-Deal wins continue to be good – more than USD 10 billion deal wins in the past 3 quarters

-No significant change in decision making & deal closures

-Ramp-Up are happening as expected

-On the existing business, clients are pausing or reprioritising spends, looking at ROI

-Clients are neutralising the benefit of deal ramp ups

-Uncertainty remains given the leakage

-Difficult to call out when overall business will improve

-Normal seasonality in Q3 and furloughs are inline vs the historic past

-330

December 18, 2023· 15:17 IST

Stock Market LIVE Updates | Citi View On Eicher Motors

-Buy call, target raised to Rs 4,700 per share

-Despite elevated competition, Royal Enfield’s volume print has been steady

-Nov’23 Saw 5% MoM decline (+13%YoY) in overall volumes

-Nov’23 saw 7% MoM decline in domestic volumes (+19% YoY)

-MoM decline reflected festive-related seasonality

-Increase target multiple for standalone business slightly to 29x from 28x

-330

December 18, 2023· 15:14 IST

Stock Market LIVE Updates | GMR Airports November passenger traffic up 15% YoY & 0.4% MoM at 98.84 lakh

-330

December 18, 2023· 15:12 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas:

Indian Rupee depreciated on Monday on strong US Dollar and weak domestic markets. A positive tone in crude oil prices also weighed on Rupee. However, FII inflows cushioned the downside. US Dollar gained as US Federal Reserve official John Williams played down rate cut expectations. Raphael Bostic said that Fed can begin reducing interest rates sometime in Q3 2024 if inflation falls in line with projections. Dollar also on weak Euro and Pound which fell on disappointing PMI data. Economic data from US was mixed.

We expect Rupee to trade with a slight negative bias on risk aversion in global markets and a positive tone in the greenback. However, FII inflows may support Rupee at lower levels. Traders may remain cautious ahead Bank of Japan’s monetary policy decision tomorrow. USDINR spot price is expected to trade in a range of Rs 82.70 to Rs 83.35.

-330

December 18, 2023· 15:10 IST

Stock Market LIVE Updates | Anant Raj board to consider issue price of issuing shares on preferential basis on December 20

A meeting of the Finance and Investment Committee of the company is scheduled to be held on Wednesday, December 20, 2023 to consider and approve the issue price for equity shares and Fully Convertible Warrants, being issued on the preferential basis.

-330

December 18, 2023· 15:08 IST

Stock Market LIVE Updates | Genesys International bags order worth RS 22 crore

Genesys International has secured a transformative order to deploy its state-of-the-art Digital Twin mapping technology for the redevelopment of Dharavi.

The order is valued at Rs 22 crores (excluding GST), and has been awarded by Porter House, a testament to Genesys' reputation as a leading force in mapping innovation.

The project is anticipated to be completed within a timeframe of 9 months, promising a revolutionary transformation of Dharavi's landscape and urban planning.

-330

December 18, 2023· 15:06 IST

Sensex Today | AnandRathi View on Credo Brands Marketing IPO:

Credo Brands Marketing has strong brand equity with presence across categories and a multi-channel pan-India distribution network with a strong in-house design competencies to deliver innovative and high-quality products with end-to-end tech-enabled supply chain capabilities and an asset light model.

At the upper price band company is valuing at P/E of 23.22x, with a market cap of Rs 18,004 million post issue of equity shares and return on net worth of 29.98%.

Since financials of the company are strong and valuations of the company are reasonable in comparison to its listed peers, hence believe that company is fairly priced and recommend a “Subscribe” rating to the IPO.

-330

December 18, 2023· 15:02 IST

Sensex Today | Market at 2 PM

The Sensex was down 148.02 points or 0.21 percent at 71,335.73, and the Nifty was down 30.50 points or 0.14 percent at 21,426.20. About 1918 shares advanced, 1444 shares declined, and 112 shares unchanged.

-330

December 18, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:41 | Chg(%) Hourly Vol |

|---|---|---|---|

| Vadivarhe Speci | 45.70 | 41.75 | -3.95 0 |

| AKG Exim | 29.65 | 28.20 | -1.45 16.00k |

| Geojit Fin | 82.80 | 79.10 | -3.70 3.76m |

| Welspun Invest | 643.70 | 618.65 | -25.05 39 |

| Dynamic Service | 130.00 | 125.00 | -5.00 0 |

| Sky Gold | 1,152.05 | 1,109.95 | -42.10 5.59k |

| C P S Shapers | 430.00 | 416.55 | -13.45 - |

| Mangalam Alloys | 54.80 | 53.15 | -1.65 712 |

| 63 Moons Tech | 507.60 | 493.00 | -14.60 10.58k |

| Shanthala | 104.95 | 102.10 | -2.85 - |

-330

December 18, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:41 | Chg(%) Hourly Vol |

|---|---|---|---|

| Aarvee Denim | 28.10 | 30.50 | 2.40 196.74k |

| Vishnusurya Pro | 333.00 | 357.40 | 24.40 134.04k |

| DELPHI WORLD | 391.00 | 414.00 | 23.00 2.94k |

| Cyber Media Res | 168.75 | 177.00 | 8.25 9.23k |

| Hindcon Chemica | 39.10 | 41.00 | 1.90 86.88k |

| Deepak Fert | 667.95 | 699.20 | 31.25 50.19k |

| IRCTC | 843.95 | 882.50 | 38.55 3.68m |

| ANI Integrated | 61.00 | 63.45 | 2.45 1.80k |

| PC Jeweller | 34.45 | 35.80 | 1.35 706.36k |

| Indian Card | 259.95 | 270.00 | 10.05 3.13k |

-330

December 18, 2023· 14:57 IST

Stock Market LIVE Updates | Citi View On LTIMindtree

-Sell call, target Rs 4,660 per share

-Generally, clients get their budget in Q1

-Q2/Q3 sees scaling up and in Q4, some savings are anticipated

-CY23 has been complete cautiousness throughout the year

-Client conversations remain cautious, no line of sight as of now

-Fed event will likely be a sentiment booster going ahead

-Cross sell/up sell key – company has 9 capabilities and current at 3 to 3.5 in clients

-GCCs are doing a lot of investments but not impacting company

-330

December 18, 2023· 14:55 IST

Stock Market LIVE Updates | Jefferies View On Aviation

-In Nov’23, domestic air passenger traffic grew 9% YoY to 1.3 crore

-Domestic air passenger traffic saw a drop to single digit growth after 20 months

-IndiGo’s passengers grew 21% YoY

-IndiGo's market share slipped to 61.8% in November versus 62.6% MoM (+610 bps YoY)

-Air India group's share declined by approximately 30 bps MoM to 26.5% — reflecting drop for Vistara

-MoM share gains were only for SpiceJet, by 120 bps to 6.2%

-Slower growth in passenger could be combination of high air fares & constrained capacity

-Recent fall in ATF/Crude is a positive

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Global Vectra | 113.35 | 2.77 | 268429 |

| Interglobe Avi | 2974.75 | 2.07 | 433612 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Jet Airways | 58.1 | -0.85 | 44497 |

-330

December 18, 2023· 14:52 IST

Stock Market LIVE Updates | Welspun Corp subsidiary Sintex BAPL finalises investment of Rs 807 crore for manufacturing unit in Telangana

Welspun Corp said its subsidiary Sintex BAPL has finalised an investment of upto Rs 807 crore to set up manufacturing unit in Telangana through a wholly owned step down subsidiary, Sintex Advance Plastics (SAPL).

This investment will be spread over the next three financial years starting from FY25. The project will be funded through a combination of debt and equity. The proposed investment is for manufacturing 59 KMTPA of plastic pipes, 5,300 MTPA of water storage tanks and 8,900 MTPA sandwich moulded tanks.

-330

December 18, 2023· 14:47 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TataTeleservice | 96.00 | 5.32 | 20.79m |

| Zydus Life | 676.80 | 4.78 | 5.72m |

| NALCO | 115.70 | 4.52 | 69.87m |

| SAIL | 115.90 | 3.99 | 70.17m |

| Laurus Labs | 401.05 | 3.98 | 3.75m |

| Yes Bank | 22.70 | 3.42 | 477.60m |

| Clean Science | 1,529.65 | 3.36 | 259.81k |

| Prestige Estate | 1,144.00 | 2.7 | 553.88k |

| Varun Beverages | 1,122.30 | 2.12 | 1.32m |

| Sona BLW | 563.85 | 2 | 1.56m |

-330

December 18, 2023· 14:38 IST

-330

December 18, 2023· 14:33 IST

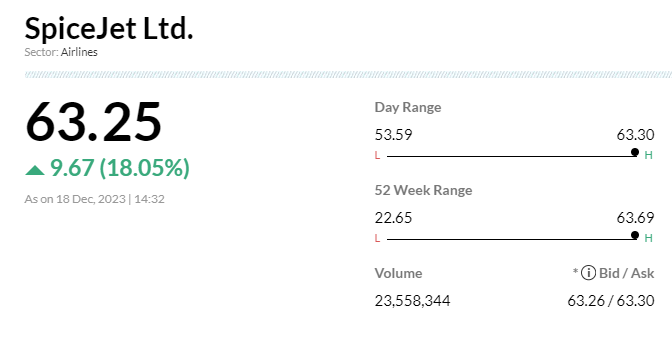

Stock Market LIVE Updates | SpiceJet soars 17% amid interest in acquiring bankrupt Go First

SpiceJet Ltd surged 17 percent after news report suggested it along with Sharjah-based Sky One company, and Africa-focused Safrik Investments have reportedly shown interest in buying the bankrupt carrier Go First.

-330

December 18, 2023· 14:24 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18067.75 0.16 | 43.26 1.21 | 6.87 41.43 |

| NIFTY IT | 35720.40 -0.17 | 24.80 6.58 | 10.96 24.45 |

| NIFTY PHARMA | 16338.85 0.98 | 29.70 1.86 | 3.38 29.30 |

| NIFTY FMCG | 53979.40 -0.38 | 22.20 0.00 | 2.32 19.11 |

| NIFTY PSU BANK | 5743.95 -0.32 | 33.01 3.42 | 13.41 32.53 |

| NIFTY METAL | 7778.50 0.56 | 15.69 4.55 | 14.32 16.83 |

| NIFTY REALTY | 759.05 -1.04 | 75.79 1.89 | 9.58 72.59 |

| NIFTY ENERGY | 32557.20 -0.07 | 25.85 1.67 | 14.99 23.78 |

| NIFTY INFRA | 7153.45 0.17 | 36.20 2.31 | 11.26 33.37 |

| NIFTY MEDIA | 2472.25 1.44 | 24.11 1.88 | 8.63 18.15 |

-330

December 18, 2023· 14:19 IST

Sensex Today | Muthoot Microfin IPO booked 45%, retail portion 77%

The Muthoot Microfin IPO has been subscribed 45 percent so far on the first day of bidding, December 18, with bids coming in for 1.09 crore shares as against an issue size of 2.43 crore shares.

Retail investors bought 77 percent of their allotted quota of shares. The portion set aside for non-institutional investors was subscribed 27 percent, the employees' portion was booked 77 percent, while qualified institutional buyers were yet to buy.

Ahead of the opening of the issue, anchor investors bought Rs 285 crore worth of shares in the microfinance institution.

-330

December 18, 2023· 14:15 IST

Sensex Today | Inox India IPO subscribed 25.28 times, retail portion books at 12.46 times

Inox India's Rs 1,459.32 crore IPO has been subscribed 25.28 times so far on December 18, the final day of bidding. The offer received bids for 39.12 crore shares against the issue size of 1.55 crore shares.

High net-worth individuals (HNIs) took the lead, picking 41.26 times their allotted quota of shares. The portion set aside for retail investors was bought 12.46 times and that of qualified institutional buyers (QIBs) was booked 35.73 times.

-330

December 18, 2023· 14:08 IST

Sensex Today | Motisons Jewellers IPO issue subscribed 7 times, retail portion booked 11.26x on debut

Motisons Jewellers' Rs 151.09 crore IPO has been subscribed 7.17 times so far on the first bidding day, December 18. The issue received bids for 14.97 crore shares against the issue size of 2.08 crore shares.

Retail investors remained at the forefront, booking 11.26 times, high net-worth individuals picked 5.39 times and qualified institutional buyers bought 0.02 times the allotted quota.

-330

December 18, 2023· 14:03 IST

Sensex Today | Market at 2 PM

The Sensex was down 116.97 points or 0.16 percent at 71,366.78, and the Nifty was down 24.70 points or 0.12 percent at 21,432. About 1935 shares advanced, 1405 shares declined, and 108 shares unchanged.

-330

December 18, 2023· 14:03 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Arvind and Comp | 67.95 | 65.00 | -2.95 48.33k |

| ANI Integrated | 63.75 | 61.00 | -2.75 0 |

| Shri Rama Multi | 34.15 | 33.00 | -1.15 15.24k |

| Quicktouch Tech | 217.00 | 210.00 | -7.00 7.69k |

| Baheti Recyclin | 188.00 | 182.00 | -6.00 8.65k |

| Pyramid Techno | 204.00 | 198.00 | -6.00 259.02k |

| Sical Logistics | 239.75 | 233.20 | -6.55 2.48k |

| Cyber Media | 31.80 | 31.00 | -0.80 26.21k |

| Kontor Space | 80.00 | 78.05 | -1.95 - |

| The Western Ind | 164.00 | 160.00 | -4.00 755 |

-330

December 18, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Arihant Super | 267.70 | 285.90 | 18.20 649 |

| Sanginita Chemi | 24.40 | 26.00 | 1.60 4.63k |

| Emkay Global | 124.25 | 132.30 | 8.05 59.88k |

| Simbhaoli Sugar | 29.10 | 30.95 | 1.85 158.33k |

| Rel Ind Infra | 1,263.40 | 1,338.00 | 74.60 724.12k |

| Party | 113.05 | 119.50 | 6.45 1.43k |

| Subex | 36.05 | 37.90 | 1.85 2.16m |

| Cyber Media Res | 160.90 | 168.75 | 7.85 3.18k |

| Welspun Invest | 618.00 | 643.70 | 25.70 0 |

| Prince Pipes | 725.05 | 753.70 | 28.65 29.17k |

-330

December 18, 2023· 13:54 IST

-330

December 18, 2023· 13:52 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Bothra Metals | 14.25 | 58.33 | 9.00 |

| PRO CLB GLOBAL | 11.30 | 46.56 | 7.71 |

| Times Guaranty | 99.03 | 43.65 | 68.94 |

| ILandFS | 13.90 | 42.71 | 9.74 |

| Smart Finsec | 13.18 | 42.33 | 9.26 |

| Natura Hue | 12.44 | 40.09 | 8.88 |

| Ajcon Global | 36.80 | 35.05 | 27.25 |

| Shubham Polyspi | 40.63 | 33.04 | 30.54 |

| Essar Shipping | 35.40 | 33.03 | 26.61 |

| Cyber Media | 31.93 | 32.65 | 24.07 |

-330

December 18, 2023· 13:45 IST

Stock Market LIVE Updates | Elara Capital revises rating of Balrampur Chini to Buy from Accumulate

Further clarification for ethanol procurement brings major relief to juice-based ethanol firms, such as Balrampur Chini Mills. Elara Capital reiterate the recent changes in ethanol procurement are one-off event and valid between November 2023 and October 2024; hence, it will impact only H2FY24-H1FY25 financials.

It expect normalization from H2FY25. Since this exceptional event has significantly dented FY25 financials, broking house continue to value the stock on FY26 financials.

It increase EBITDA by 55% and PAT by 72% for FY24E and EBITDA by 11% and PAT by 20% for FY25E.

It has revised rating to Buy from Accumulate with a higher Target Price of Rs 483 from Rs 431 based on a SOTP method.

The SOTP assumes the sugar segment valuation at 8.5x (unchanged) FY26E EV/EBITDA and distillery at 10.0x (unchanged) FY26E EV/EBITDA.

-330

December 18, 2023· 13:42 IST

Sensex Today | AnandRathi View on Venus Pipes and Tubes:

Broking firm expect revenue/EBITDA to register 31.5%/51.9% CAGRs over FY23-FY26 and initiate coverage on the company with a Buy rating and a target price of Rs 1,700, 25% potential (23x FY26e P/E).

The PE multiple attributed to value the company is on par with peer Ratnamani Metals’ five-year average P/E, which is fair due to excellent return ratios and structural rise in margins

Key risks are export-related weakness due to ongoing war, tough peer competition and policy change shocks.

-330

December 18, 2023· 13:34 IST

Sensex Today | Inox India IPO subscribed 15.5 times so far, HNI portion booked 32x on final day

Inox India's Rs 1,459.32 crore IPO has been subscribed 15.54 times so far on December 18, the final day of bidding. The offer received bids for 24 crore shares against the issue size of 1.55 crore shares.

High net-worth individuals (HNIs) took the lead, picking 32.94 times their allotted quota of shares. The portion set aside for retail investors was bought 11.51 times and that of qualified institutional buyers (QIBs) was booked 9.56 times.

-330

December 18, 2023· 13:27 IST

-330

December 18, 2023· 13:25 IST

Stock Market LIVE Updates | VIP Industries clarifies on news of promoters selling stake

VIP Industries clarified on the news reported by Zee Business on December 18, 2023 that the promoters of the company are selling their stake in the company.

In this context, the company clarified that this news is a mere rumor, and the promoters of the company are not involved in any discussion regarding selling their stake in the company.

-330

December 18, 2023· 13:22 IST

Stock Market LIVE Updates | Vermont Taxes Department imposes penalty of $255.5 on Persistent Systems subsidiary

The Vermont State Department of Taxes has imposed penalty of $255.5 on Persistent Systems' subsidiary for shortfall of tax payment for FY21-22, due to adjustment of previous year overpayment amount against liability of earlier year by the Department.

-330

December 18, 2023· 13:20 IST

SEBI gives NSE a list of conditions it needs to fulfil before filing for IPO: Sources to CNBC-TV18

-SEBI asks NSE to strengthen tech infra & go glitch free for at least 1 year and to improve its corporate governance structure & clear legal matters

-NSE looking at diluting less than minimum requirement of 5% in the IPO

-NSE filed for consent with SEBI in Trade Access Point (TAP) bypass matter

-330

December 18, 2023· 13:18 IST

IRCTC shares at 20-month high

-330

December 18, 2023· 13:12 IST

Stock Market LIVE Updates | BofA Securities Europe SA sells 0.6% stake in Updater Services

Foreign investor BofA Securities Europe SA sold 4 lakh shares in Updater Services via open market transactions, at an average price of Rs 303.5 per share. BofA held 1.88% stake or 12.52 lakh shares in the company as of September 2023.

-330

December 18, 2023· 13:09 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Yes Bank | 254079 | 22.68 | 0.58 |

| Yes Bank | 400001 | 22.64 | 0.91 |

| HUDCO | 92606 | 110.45 | 1.02 |

| Advik Capital | 200215 | 2.19 | 0.04 |

| Yes Bank | 200392 | 22.63 | 0.45 |

| Advik Capital | 562778 | 2.2 | 0.12 |

| Container Corp | 12025 | 867 | 1.04 |

| Vodafone Idea | 217508 | 14.3 | 0.31 |

| BHEL | 79999 | 182.65 | 1.46 |

| Zydus Life | 23054 | 672 | 1.55 |

-330

December 18, 2023· 13:07 IST

Stock Market LIVE Updates | Siemens board begins exploratory steps on demerger proposal of energy biz, approves to incorporation a subsidiary

Promoters of Siemens, namely Siemens Aktiengesellschaft, Germany, Siemens International Holding B.V. and Siemens Energy Holding B.V., and also Siemens Energy Aktiengesellschaft, which is the ultimate parent company of Siemens Energy Holding B.V., have each requested the Board of Directors of the Company to consider, evaluate and thereafter start taking exploratory steps towards a potential demerger of the company’s energy business into a separate entity.

The company board on December 18 2023, took note of the above and authorized the company’s management to commence exploratory steps as may be required to examine a potential demerger of the company’s energy business, which shall be subject to further consideration and deliberation to be carried out by the BoD (including Committee(s) thereof) at the relevant point in time and the procedures to be followed by the company as per applicable laws.

Further, the BoD has approved the immediate incorporation of a wholly owned subsidiary in Mumbai, India, on the basis that the proposed subsidiary may be required if and when the board decides to implement the aforesaid demerger.

-330

December 18, 2023· 13:06 IST

Sensex Today | Muthoot Microfin IPO issue subscribed 29%, retail portion booked 51% on debut

Muthoot Microfin IPO has been subscribed 29 percent so far on the first day of bidding, December 18, with bids coming in for 70.54 lakh shares against the issue size of 2.43 crore shares.

Retail investors bought 51 percent of their allotted quota of shares. The portion set aside for non-institutional investors was subscribed 14 percent, employees portion was booked 53 percent, while qualified institutional buyers were off to a slow start.

-330

December 18, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| RBM Infracon | 392.00 | 367.00 | -25.00 334 |

| Cyber Media Res | 170.00 | 160.90 | -9.10 640 |

| Jainam Ferro | 134.45 | 128.20 | -6.25 400 |

| Shree Vasu | 182.55 | 176.20 | -6.35 2.70k |

| Avro India | 116.75 | 113.00 | -3.75 1.74k |

| Quicktouch Tech | 224.00 | 217.00 | -7.00 5.89k |

| Balkrishna | 36.10 | 35.00 | -1.10 5.69k |

| Nirman Agri | 311.90 | 303.30 | -8.60 2.72k |

| Bohra Industrie | 29.00 | 28.20 | -0.80 3.10k |

| ARHAM | 220.00 | 214.00 | -6.00 843 |

-330

December 18, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Arvind and Comp | 59.95 | 68.25 | 8.30 6.60k |

| Hind Nat Glass | 21.70 | 23.95 | 2.25 26.29k |

| Pyramid Techno | 191.05 | 204.05 | 13.00 15.34k |

| Rel Ind Infra | 1,192.00 | 1,267.95 | 75.95 42.59k |

| Vinyas Innovati | 517.20 | 547.80 | 30.60 - |

| Sandur Manganes | 2,407.70 | 2,544.95 | 137.25 13.81k |

| Quick Heal Tech | 362.50 | 383.05 | 20.55 23.18k |

| Sheetal Cool Pr | 330.00 | 348.50 | 18.50 1.87k |

| Poddar Pigments | 352.40 | 369.00 | 16.60 936 |

| ALLSEC Tech | 644.45 | 671.70 | 27.25 1.70k |

-330

December 18, 2023· 12:58 IST

Stock Market LIVE Updates | Motilal Oswal View on VRL Logistics:

VRL Logistics' transition into a pure-play GT player, integration of additional branches, expansion of fleet capacity, growing customer base, and market share gains from less-organized competitors position the company favorably for a steady volume and sustainable earnings growth.

Broking house expect company to report 14% volume CAGR over FY23-26, with faster addition of branches in untapped regions and anticipate the company to deliver a revenue/EBITDA/PAT CAGR of 16%/18%/23% over FY23-26.

Reiterate BUY rating with a Target Price of Rs 910 (based on 26x FY26E EPS).

-330

December 18, 2023· 12:52 IST

Indian Sugar Mills Association: October 1 to December 15 sugar output at 7.4 mt versus 8.3 mt, YoY.

-330

December 18, 2023· 12:49 IST

Sandur Manganese and Iron Ores approves bonus issue

The Board of Directors of Sandur Manganese and Iron Ores on December 18, 2023 approved issue of bonus shares to the equity shareholders of the company in the ratio of 5:1 i.e., 5 new fully paid-up equity shares of Rs 10 each for every 1 existing fully paidup equity share of Rs 10 each held by the eligible shareholders as on the record date (to be determined by the Board and to be intimated to the Exchanges in due course) upon obtaining approval of the shareholders.

-330

December 18, 2023· 12:48 IST

Sensex Today | Aditya Gaggar, Director of Progressive Shares:

With a higher top higher bottom formation, Tata Steel is in the primary uptrend and recently, it has given a breakout from a V-shaped pattern which was confirmed with a positive crossover in MACD. A reading of 29 in ADX is also indicating the presence of a strong underlying trend. As per the pattern breakout, the target arrives at Rs 155.

-330

December 18, 2023· 12:45 IST

Sensex Today | Citi On Tech Mahindra

-Sell call, target Rs 1,000 per share

-CFO meet takeaways show focus on 6 regions, including, US’ communications, tech & media, diversified industry, Europe, Asia (Ex-India) and India

-Central delivery center managed by COO versus region wise delivery system earlier and will likely help company to drive productivity and synergy

-Focus on top accounts

-Top 30 accounts will have dedicated delivery

-Client partners and similar structure for next 50 accounts

-Most of the leadership hiring is behind

-Hired BFSI heads in America and Europe, chief marketing officer

-Chief people office likely to be hired by January 2024

-330

December 18, 2023· 12:39 IST

Sensex Today | BSE Realty index down nearly 1 percent dragged by Godrej Properties, Swan Energy, Oberoi Realty:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Godrej Prop | 1,998.90 | -2.63 | 24.27k |

| Swan Energy | 503.00 | -2.13 | 108.97k |

| Oberoi Realty | 1,445.60 | -2.09 | 8.69k |

| Phoenix Mills | 2,257.50 | -1.63 | 2.64k |

| DLF | 696.75 | -1.23 | 70.58k |

| Macrotech Dev | 929.55 | -0.64 | 11.99k |

| Mahindra Life | 535.55 | -0.6 | 8.68k |

-330

December 18, 2023· 12:34 IST

Stock Market LIVE Updates | Citi View On Wipro

-Sell call, target Rs 360 per share

-CFO meet takeaways show there is no change in Q3 visibility versus start of the quarter

-More intense furloughs in Q3 – BFSI and tech are the usual verticals

-Discretionary spends are being scaled down

-Replenishment of large transformation coming to an end is not happening

-Consulting business (10-15% of the revenues) is discretionary in nature

-More productivity built in at the time of renewal

-Difficult to interpret correlation between bookings

-Revenues largely due average duration and uncertainty in discretionary spends

-Company is not going to campus for hiring next year unless demand environment changes

-330

December 18, 2023· 12:29 IST

Alert | Market cap of Sun Pharma crosses Rs 3 lakh crore:

-330

December 18, 2023· 12:28 IST

Sensex Today | BSE Bank index down 0.4 percent dragged by ICICI Bank, AU Small Finance Bank, IndusInd Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ICICI Bank | 1,018.70 | -1.77 | 127.89k |

| AU Small Financ | 748.10 | -1.13 | 35.80k |

| IndusInd Bank | 1,561.80 | -0.58 | 31.59k |

| Axis Bank | 1,116.45 | -0.36 | 124.94k |

| Kotak Mahindra | 1,848.00 | -0.11 | 21.53k |

-330

December 18, 2023· 12:25 IST

Stock Maket LIVE Updates | USFDA completes GMP inspection at Granules' Virginia subsidiary with 5 observations

The US FDA has completed a GMP inspection of the facility of Granules Pharmaceuticals, Inc, a wholly-owned foreign subsidiary of the company at Virginia, USA during December 11-15, with five observations. Granules Pharmaceuticals does not anticipate any disruptions to its business.

-330

December 18, 2023· 12:24 IST

-330

December 18, 2023· 12:18 IST

Stock Market LIVE Updates | Sterling and Wilson Renewable Energy zooms 5% after promoter dilutes over 2% stake

Shares of Sterling and Wilson Renewable Energy zoomed 5 percent after promoter Shapoorji Pallonji and Company sold 39,14,279 equity shares or 2.06 percent stake in the company.

On December 15, the Sterling and Wilson Renewable Energy promoters sold stakes worth 2.06 percent or 39,14,279 equity shares through open market transactions at a price of Rs 415.46 per share. Plutus Wealth Management LLP bought 25 lakh shares or 1.3 percent stake in the company at a price of Rs 410 per share at the same time. As of September 2023, promoter holding in the company was 67.56 percent with Shapoorji Pallonji holding 18.3 percent. With this sale, their share will now be around 16.24 percent. Read More

-330

December 18, 2023· 12:09 IST

Sensex Today | Geojit View on Muthoot Microfin IPO:

At the upper price band of Rs291, Muthoot Microfin is available at a P/B of 1.9x (FY24E annualised), which appears to be reasonably priced. Going forward, the microfinance industry will continue to exhibit strong growth on the back of the government’s continued focus on strengthening the rural financial ecosystem, robust credit demand, and higher-ticket loans disbursed by microfinance lenders.

Based on its diversified lending products, focus on digital transformation, and expanding geographical footprint, Geojit assign a “Subscribe” rating for Muthoot Microfin on a medium- to long-term basis.

-330

December 18, 2023· 12:04 IST

-330

December 18, 2023· 12:00 IST

Sesnex Today | Market at 12 PM

The Sensex was down 49.06 points or 0.07 percent at 71,434.69, and the Nifty was down 6.90 points or 0.03 percent at 21,449.80. About 1999 shares advanced, 1262 shares declined, and 127 shares unchanged.

-330

December 18, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| United Polyfab | 106.05 | 99.35 | -6.70 13.80k |

| Agri-Tech | 204.00 | 194.95 | -9.05 1.15k |

| Viviana Power | 194.05 | 186.05 | -8.00 1.81k |

| Welspun Invest | 644.40 | 618.00 | -26.40 43 |

| Deep Energy Res | 198.00 | 190.00 | -8.00 131.88k |

| V-Marc | 183.40 | 176.30 | -7.10 8.97k |

| Fine Organics | 4,749.95 | 4,570.00 | -179.95 65.47k |

| Ausom Enterp | 68.80 | 66.25 | -2.55 74 |

| Srivasavi | 163.00 | 157.05 | -5.95 4.65k |

| Agni Green | 28.90 | 27.85 | -1.05 0 |

-330

December 18, 2023· 11:56 IST

| Company | Price at 11:00 | Price at 11:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Nakoda Group | 39.30 | 43.00 | 3.70 620 |

| Presstonic | 135.00 | 147.00 | 12.00 - |

| Kellton Tech | 96.20 | 104.70 | 8.50 1.50m |

| Felix Industrie | 150.00 | 161.10 | 11.10 9.56k |

| Arihant Academy | 153.00 | 161.40 | 8.40 47.05k |

| Vaidya Sane | 210.05 | 221.25 | 11.20 2.16k |

| Peninsula Land | 49.00 | 51.50 | 2.50 173.35k |

| Pentagon Rubber | 120.00 | 125.95 | 5.95 1.19k |

| Shree Vasu | 174.00 | 182.55 | 8.55 708 |

| Shriram Propert | 120.05 | 125.70 | 5.65 483.95k |

-330

December 18, 2023· 11:53 IST

Stock Markety LIVE Updates | Morgan Stanley View On Telecom

-Jio launches new prepaid plans where key observations include higher price point

-Higher price point relative to its existing plans bundling more benefit

-Different strategies by different players

-More data benefits for same price versus more OTTs with same data benefits at slightly higher prices

-View current plans by Reliance Jio indicate a strategy towards premiumisation

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| TataTeleservice | 95.91 | 5.25 | 1063283 |

| MTNL | 35.44 | 4.7 | 2022693 |

| Vodafone Idea | 14.09 | 0.36 | 32937992 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Reliance Comm | 2.37 | -4.82 | 347651 |

| Bharti Airtel | 984.95 | -0.81 | 59391 |

-330

December 18, 2023· 11:51 IST

Stock Market LIVE Updates | Kellton Tech Solutions bags multi-year project from LIC

Kellton Tech Solutions announced securing a groundbreaking multi-year project from India's largest insurance provider, the Life Insurance Corporation of India (LIC) recently.

-330

December 18, 2023· 11:47 IST

Sensex Today | Shrey Jain, Founder and CEO SAS Online:

At the beginning of the week, the stock market is not showing much movement and is trading flat. Nifty, which went up by 500 points last week, almost reached 21,500. This boost was mainly because Foreign Portfolio Investors (FPIs) put a lot of money into the market. Right now, the market seems quite positive. But, there's a chance that in the next few sessions, things might slow down a bit or there could be a small correction.

For Nifty, the support range is identified at 21,000-21,075, with resistance evident at 21,500. A breach of this resistance level could potentially trigger a further rally in the Nifty. Meanwhile, for the banking index, we anticipate the levels between 47,575 - 47,750 to serve as mid-term support.

-330

December 18, 2023· 11:45 IST

Stock Market LIVE Updates | Plenty Private Equity offloads Rs 322 crore worth shares in PVR INOX

Plenty Private Equity Fund I, and Plenty Private Equity FII I have offloaded 18,38,757 equity shares or 1.87% of paid-up equity in PVR INOX via block deals, at a price of Rs 1,753 per share. These shares are valued at Rs 322.33 crore. However, Norges Bank on Account of the Government Pension Fund Global bought some of these shares, picking 6,66,183 shares or 0.68% stake at same price.

-330

December 18, 2023· 11:39 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Sapphire Foods | 1,410.55 0.28 | 3.81m | 533.75 |

| Yes Bank | 22.82 4.06 | 45.24m | 102.25 |

| IRFC | 94.84 0.16 | 8.59m | 80.71 |

| IRCTC | 815.90 4.48 | 749.23k | 60.32 |

| SBI | 653.05 0.72 | 711.31k | 46.21 |

| Sterling Wilson | 441.15 5 | 1.03m | 45.30 |

| Vodafone Idea | 13.96 -0.57 | 31.24m | 44.14 |

| Tata Power | 337.90 1.41 | 1.28m | 43.22 |

| Zomato | 128.75 4.12 | 3.30m | 41.28 |

| Infosys | 1,579.05 -0.01 | 243.36k | 38.31 |

-330

December 18, 2023· 11:35 IST

Stock Market LIVE Update | Mankind Pharma raises stake in therapeutics firm; shares gain

Mankind Pharma shares traded with gains of one percent on December 18. The pharma player increased its holding in Actimed Therapeutics by purchasing a stake of 1.29 percent. Following the acquisition, Mankind Pharma held 10.19 percent of Actimed Therapeutics shares. For Mankind, this is a strategic investment in the field of treatment of cancer cachexia, amyotrophic lateral sclerosis, and other muscle-wasting disorders.

-330

December 18, 2023· 11:30 IST

Stock Market LIVE Update | Jefferies picks Indian hospitals as top growth sector for FY24-26 amidst anticipated capacity surge

The sector will be characterised by sharp bursts of growth and periods of slow growth but will see a big capacity expansion and rise in average revenue per occupied bed. India’s hospital sector is expected to see a significant jump into new capacities, leading to a sharp rise in net income, Jefferies said in recent report. READ MORE

-330

December 18, 2023· 11:25 IST

Stock Market LIVE Update | Manoj Purohit, Partner & Leader - FS Tax, Tax & Regulatory services, BDO India

The recent pullout by the US on Federal rate hikes have been one of the catalysts to keep the Indian market flooded with cash flows from the FPI fraternity. FPIs have reversed their position and turned as net buyers in the first week of December 2023. Additionally, the state election results in India and RBI’s monetary policy outcome on maintaining status quo on rates also made FPI’s stand on India markets positive. The other factors contributing FPIs to pump liquidity in India market are RBI’s inflation forecast at 5.4%, positive signs on improved capex and valuations. The Sensex touching an all time high also acted as an icing on the cake. All in all, the momentum for the Indian cash equities market reflects a promising wind up of 2023 and a strong base for 2024 to start with, taking the foreign investments inflows to a new horizon.

-330

December 18, 2023· 11:15 IST

Stock Market LIVE Update | Harsha Upadhyaya, Chief Investment Officer - Equity, Kotak MF

The medium to long-term investors can expect decent returns; however rising valuations could mean higher volatility. We advise investors to exercise caution in small cap and illiquid stocks due to liquidity-driven spikes. Large caps, particularly in BFSI space, look good for investment with reasonable valuations and potential stability. IT sector rally linked to 2024 Fed rate cut expectations, prompting valuation re-rating. We favour capex beneficiaries over consumption due to weak rural trends and deficient monsoon. On the other hand, we recommend cautious approach to new tech firms as each company should be analysed individually based on underlying business and valuations.

-330

December 18, 2023· 11:11 IST

Stock Market LIVE Update | SIX Partners with TCS to Transform its Swiss Post Trade Market Infrastructure

-330

December 18, 2023· 11:03 IST

Stock Market LIVE Update | NBCC India bags order worth Rs 30 crore to construct composite regional centre in Jammu

-330

December 18, 2023· 11:00 IST

Sensex Today | Market at 11 AM

The Sensex was down 4.59 points or 0.01 percent at 71,479.16, and the Nifty was up 4.50 points or 0.02 percent at 21,461.20. About 1974 shares advanced, 1223 shares declined, and 132 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Auto | 6,460.00 | 2.94 | 491.34k |

| Sun Pharma | 1,262.00 | 2.12 | 881.01k |

| Tech Mahindra | 1,332.00 | 1.98 | 1.26m |

| Eicher Motors | 4,122.40 | 1.54 | 385.48k |

| Reliance | 2,527.00 | 1.26 | 3.11m |

| Divis Labs | 3,742.95 | 1.24 | 268.25k |

| Wipro | 451.90 | 1.2 | 5.68m |

| Hero Motocorp | 3,942.00 | 1.17 | 210.60k |

| LTIMindtree | 6,198.10 | 1.12 | 157.99k |

| HCL Tech | 1,507.85 | 1.11 | 1.14m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Power Grid Corp | 233.05 | -1.81 | 7.48m |

| ITC | 450.75 | -1.63 | 5.37m |

| ICICI Bank | 1,022.35 | -1.45 | 2.67m |

| JSW Steel | 854.85 | -1.42 | 2.47m |

| Coal India | 345.40 | -1.31 | 3.74m |

| Grasim | 2,107.60 | -0.94 | 81.10k |

| ONGC | 199.45 | -0.8 | 3.18m |

| Bharti Airtel | 984.70 | -0.79 | 1.49m |

| IndusInd Bank | 1,558.40 | -0.79 | 421.28k |

| HDFC Life | 669.00 | -0.61 | 892.23k |

-330

December 18, 2023· 10:56 IST

| Company | Price at 10:00 | Price at 10:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| HCP Plastene | 283.50 | 257.00 | -26.50 0 |

| Lynx Machinery | 109.05 | 98.90 | -10.15 0 |

| Shree Steel Wir | 38.69 | 35.16 | -3.53 4.59k |

| First Custodian | 60.00 | 54.58 | -5.42 339 |

| Trans Freight | 24.40 | 22.35 | -2.05 906 |

| SRG Housing Fin | 311.65 | 286.65 | -25.00 1.52k |

| Starlog Enter | 37.99 | 34.98 | -3.01 120 |

| OXYGENTA PHARMA | 32.00 | 29.50 | -2.50 442 |

| Pharmasia | 29.26 | 27.10 | -2.16 18 |

| Dhanlaxmi Roto | 121.90 | 113.00 | -8.90 524 |

-330

December 18, 2023· 10:54 IST

| Company | Price at 10:00 | Price at 10:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kemistar Corp | 36.31 | 42.10 | 5.79 2.10k |

| Sarla Performan | 49.51 | 57.20 | 7.69 11.51k |

| Howard Hotels | 19.02 | 21.00 | 1.98 1.17k |

| BGR Energy | 101.09 | 109.45 | 8.36 77.80k |

| Rama Paper Mill | 21.81 | 23.50 | 1.69 500 |

| U. H. Zaveri | 55.15 | 59.35 | 4.20 43.39k |

| GG Dandekar | 131.10 | 141.00 | 9.90 1.28k |

| Citizen Info | 25.11 | 27.00 | 1.89 560 |

| Modipon | 41.31 | 44.40 | 3.09 298 |

| Hawa Engineers | 125.55 | 133.95 | 8.40 1.34k |

-330

December 18, 2023· 10:49 IST

Stock Market LIVE Updates | General Atlantic Singapore Fund offloads Rs 851 crore shares in KFin Technologies

Foreign promoter General Atlantic Singapore Fund Pte Ltd has sold 1.7 crore equity shares, equivalent to nearly 10% of paid-up equity, in KFin Technologies, the registrar and transfer agency in the financial sector, via open market transactions. These shares were sold at a price of Rs 500.5 per share, valuing at Rs 850.85 crore. However, ICICI Prudential Life Insurance Company, ICICI Prudential Mutual Fund, Societe Generale, and Unifi Capital - Blended Rangoli were buyer for some of the shares sold by General Atlantic, purchasing 70,41,842 equity shares or 4.13% stake in KFin at a price of Rs 500 per share. IIFL Securities Limited Error Account also picked 29.55 lakh shares in the company at a price of Rs 504.41 per share.

-330

December 18, 2023· 10:45 IST

-330

December 18, 2023· 10:42 IST

Stock Market LIVE Updates | Infosys stock falls as investors book profit; unveils development centre in Nagpur

Shares of Infosys slipped on December 18 morning trade as investors booked profit after the stock closed 5 percent higher in the previous trading session. Additionally, the IT major unveiled a state-of-the-art development centre in Nagpur, Maharashtra on December 15.

In the past month, the Infosys stock has surged 12 percent as against the 11 percent rise in the Nifty IT index. Earlier, Infosys shares touched a 52-week high of Rs 1,620 apiece on February 9. Read More

-330

December 18, 2023· 10:34 IST

Sensex Today | BSE Smallcap index hit fresh record high of 42337.17 led by Geojit Financial Services, MM Forgings, TeamLease Services:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Geojit Fin | 79.41 | 11.83 | 267.04k |

| MM Forgings | 1,029.05 | 11.76 | 26.42k |

| TeamLease Ser. | 3,002.20 | 10.87 | 4.78k |

| R Systems Intl | 576.00 | 8.83 | 28.68k |

| Swaraj Engines | 2,476.00 | 8.77 | 2.47k |

| Arihant Capital | 78.49 | 8.67 | 25.07k |

| SpiceJet | 57.85 | 7.97 | 7.98m |

| Bajaj Hindustha | 30.16 | 7.83 | 2.48m |

| Bigbloc Constru | 170.30 | 7.51 | 20.87k |

| AARTIPHARM | 509.80 | 7.47 | 20.34k |

-330

December 18, 2023· 10:30 IST

Stock Market LIVE Updates | Mazagon Dock Shipbuilders signs $42 million contract with European client

Mazagon Dock Shipbuilders has signed individual shipbuilding contracts with the European client for construction of three units of 7,500 DWT multi-purpose hybrid powered vessels. The contract is valued at approximately $42 million.

-330

December 18, 2023· 10:27 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Solar Ind | 6,717.00 | 6,739.95 6,155.35 | 9.12% |

| Fine Organics | 4,838.65 | 4,895.35 4,500.00 | 7.53% |

| UTI | 879.70 | 879.80 824.05 | 6.75% |

| HFCL | 78.82 | 79.07 74.25 | 6.15% |

| IDBI Bank | 70.70 | 71.34 66.70 | 6% |

| Metropolis | 1,639.95 | 1,660.60 1,550.05 | 5.8% |

| Muthoot Finance | 1,487.80 | 1,492.00 1,411.05 | 5.44% |

| Jubilant Pharmo | 526.50 | 529.85 499.95 | 5.31% |

| Central Bank | 50.62 | 51.17 48.07 | 5.3% |

| JSW Energy | 435.35 | 438.00 414.75 | 4.97% |

-330

December 18, 2023· 10:22 IST

Stock Market LIVE Updates | Droneacharya Aerial Innovations bags contract from Defence Ministry for supply pf drone lab equipment

DroneAcharya Aerial Innovations has secured a contract from the Ministry of Defense, Department of Military Affairs, Bhalra, Jammu & Kashmir for the supply of Drone Lab Equipments aimed at facilitating Drone Simulator training.

This significant endeavor is in tandem with the contract awarded to DroneAcharya for supplying Drone Simulators. The supply and implementation of these components will take place at NCPITS (CBS) Bhalra, Jammu & Kashmir.

-330

December 18, 2023· 10:18 IST

-330

December 18, 2023· 10:14 IST

Stock Market LIVE Updates | Tata Power Solar Systems signs Rs 418 crore contract with NTPC

Tata Power Solar Systems, a wholly owned subsidiary of Tata Power Renewable Energy, has signed a contract to supply 152 MWp DCR solar PV modules for NTPC's Nokh solar PV project in Rajasthan. The project order value is approximately Rs 418 crore. NTPC is developing 3*245 MW (735 MW) Nokh Solar Park at Pokaran, Rajasthan.

-330

December 18, 2023· 10:09 IST

PSU bank shares in focus on December 18, following the previous session's stellar rally, after a government document doing rounds on social media triggered speculation about possible mergers between Union Bank and UCO Bank, and Bank of India and Bank of Maharashtra.

-330

December 18, 2023· 10:08 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Zensar Tech | 634.10 | 634.10 | 626.50 |

| Zydus Life | 674.45 | 674.45 | 674.40 |

| IRB Infra | 42.60 | 42.60 | 42.32 |

| IRCTC | 809.75 | 809.75 | 809.00 |

| Yes Bank | 23.00 | 23.00 | 22.64 |

| Bajaj Auto | 6485.10 | 6485.10 | 6,456.50 |

| SAIL | 114.71 | 114.71 | 114.51 |

| Bharat Dynamics | 1449.90 | 1449.90 | 1,423.65 |

| Mastek | 2850.00 | 2850.00 | 2,802.25 |

| Hitachi Energy | 5216.15 | 5216.15 | 5,161.70 |

-330

December 18, 2023· 10:05 IST

Sense Today | Geojit View on Suraj Estate Developers IPO

At the upper price band of Rs.360, Suraj Estate Developers is available at a P/Bv of 3.3x (FY24E Annualised), which appears to be fairly priced. Considering its consistent growth in both topline and bottomline, healthy return ratios, asset light business model, redevelopment opportunities and promising industry outlook, assign a “Subscribe” rating on a short to medium term basis.

-330

December 18, 2023· 10:02 IST

Sensex Today | Jefferies View On Industrials

-Q2FY24 order flows rose 67% YoY led by L&T’s strong 72% YoY growth

-Operating leverage helped 256 bps YoY margin expansion for ABB, Siemens, Thermax combined in Q2

-Industrial stocks in our universe, barring Voltas, have outperformed Nifty over 1 & 2-years period

-Maintain that infra+ industrial capex should see 16% CAGR in FY23-FY26, versus 6% in FY11-20

-Top Picks - L&T, Siemens, Thermax and KEI Industries

-330

December 18, 2023· 10:00 IST

Sensex Today | Market at 10 AM

The Sensex was down 110.43 points or 0.15 percent at 71,373.32, and the Nifty was down 21.20 points or 0.10 percent at 21,435.50. About 1919 shares advanced, 1190 shares declined, and 114 shares unchanged.