The market put up a seven-week rally for the first time in the last three years and continued forming higher highs, higher lows for three weeks in a row with healthy volumes. The momentum indicators RSI (at 75.87 levels) and MACD (moving average convergence divergence) also showed positive bias. Hence, the short-to-medium term seems to be strong for the market, but in the near term, given the RSI in the overbought zone and PCR (Put-Call ratio) reached the 1.5 mark, the consolidation or some pullback can't be ruled out, experts said, adding that the resistance for the Nifty 50 is likely to be at the 21,500-21,600 levels, with support at the 21,300-21,000 zone.

In the week ended December 15, the Nifty50 climbed 2.32 percent to end at a record closing high of 21,457 and formed a bullish candlestick pattern on the weekly charts, in addition to a 3.5 percent rally in the previous week, taking the total current month's gains to over 6.5 percent. On Friday, it was up 1.3 percent and formed a bullish candlestick pattern on the daily charts.

"The bulls certainly defy gravity, as there is no halt to their domination. From a technical point of view, as the Nifty index navigates into uncharted territory, defining resistance is a bit challenging," Osho Krishan, senior analyst for technical and derivative research at Angel One, said.

He, however, feels that with the broad-based participation and favourable global conditions, this looks very lucrative and that's where caution is required.

Simultaneously, with the existing overbought parameters, he advised to focus on risk management and to keep booking profits at regular intervals. On the downside, a series of support could be seen from the 21,300-21,200, followed by the 21,100 zone in the comparable period, he said.

Amol Athawale, vice president of technical research at Kotak Securities, too, is of the view that the current market texture is bullish but due to temporary-overbought conditions, one could see some profit booking at higher levels.

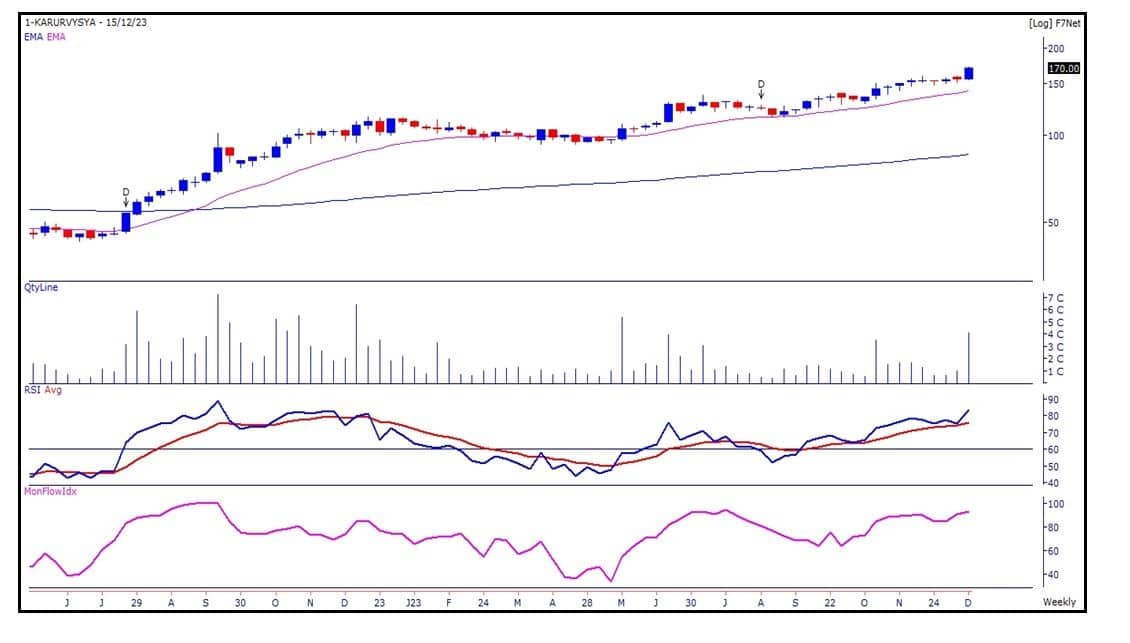

Moneycontrol collated a list of top 10 stock ideas from experts, which can give healthy return in the next 3-4 weeks. The closing price of December 15 considered for the calculation of stock returns.Expert: Nandish Shah, research analyst (technical and derivative) at HDFC SecuritiesKarur Vysya Bank: Buy | LTP: Rs 170 | Stop-Loss: Rs 160 | Target: Rs 181-192 | Return: 13 percentThe stock price has broken out on the weekly chart to close at all-time high levels with higher volumes. It has been forming bullish higher top higher bottom formation on the weekly chart. Momentum Indicators and oscillators are showing strength in the stock.

The stock price has broken out from the symmetrical triangle on the daily chart. It has broken out on the weekly chart with higher volumes. Cement stocks are looking strong on the short to medium term charts.

The stock price has broken out on the weekly chart by surpassing the resistance of Rs 4,950 odd levels. Primary trend of the stock remains positive as stock price is placed above important short term and long term moving averages. Momentum indicators and oscillators are showing strength in the stock.

The stock has shown a remarkable up move in the last few weeks. The stock is trading in a rising trend continuously and forming the higher lows series. The strong bullish momentum on daily and weekly scale suggest that the counter is likely to maintain bullish continuation chart formation in the coming horizon.

As long as the counter is trading above Rs 215, the bullish formation is likely to continue. Above which, the counter could move up to Rs 240.

After short-term correction from the higher levels, the counter was in the accumulation zone where it was trading in a rectangle formation. However, on the daily charts there is a range breakout in the counter along with decent volume activity, which suggests a new leg of bullish trend in the near term.

Unless it is trading below Rs 1,460, positional traders can retain an optimistic stance and look for a target of Rs 1,630.

On the weekly scale, the counter is into a rising channel chart formation with higher high and higher low series pattern. The technical indicators like ADX (average directional index) is also indicating further up trend from current levels, which could boost the bullish momentum in coming horizon.

As long as the stock is trading above Rs 130, the uptrend formation is likely to continue. Above which, the counter could move up to Rs 150. On the flip side, fresh sell off possible only after dismissal of Rs 130.

The stock has exhibited a robust uptrend, reaching fresh highs. The upswing post Rs 210 levels has been accompanied by exceptionally high volumes in each upward movement, indicating substantial long build-up.

The stock has emerged from a rounding base, marking the initiation of an upward trend. Looking forward, we anticipate further price increases up to Rs 575 mark, with a recommended stop-loss at Rs 491 on a daily closing basis.

Firstsource Solutions has broken out of a narrow consolidation phase which took place with dried volumes. Following the breakout from the rectangle pattern, the stock has experienced an upsurge in volumes, further confirmed by a rising window.

Trading above short-term averages, specifically the 12-period EMA (exponential moving average - daily), affirms the current uptrend. Future expectations include a continuation of the upward movement, potentially reaching Rs 215, with a suggested stop-loss at Rs 181 on a daily closing basis.

Glenmark has witnessed a notable surge in volumes recently, breaking out of a descending triangle pattern, signaling the onset of an upward trend. The MACD surpassing the zero-line indicates positive momentum building up.

Additionally, prices quoting above averages confirm the presence of an uptrend. Looking ahead, we foresee the stock moving higher, with a target set at Rs 915 and a recommended stop-loss at Rs 795 on a daily closing basis.

The stock surged impressively last week backed by heavy volumes after a period of steady consolidation.

The stock is holding above 40-day (EMA) signalling a positive momentum shift. The bullish momentum is likely to fill the gap above Rs 7,656 levels. In previous few trading sessions, relative strength index (RSI) has gradually surged from 49 to 58 level indicating strength in the stock. Additionally, rising trendline adds support to stock in daily chart.

Hence, based on the above technical structure, one can initiate a long position at Rs 7,515, for the target price of Rs 7,920. Stop-loss can be kept at Rs 7,270.

Apollo Tyres has recently marked an all-time high of Rs 475.70, while the stock took a breather and retrenched back towards its previous swing low with lower volumes. The stock remains steady around Rs 442-446 zone, which was its previous low, which aligns with the 20 EMA levels.

The daily stochastic indicator also supports a positive outlook signalling a potential for continued upward movement. The sustained positivity of the MACD indicator, on the weekly chart provides additional confirmation of the ongoing bullish trend.

We anticipate that the stock to scale higher towards Rs 490 levels. Stop-loss can be kept at Rs 428.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.