Closing Bell: Nifty below 19,700, Sensex down 551 pts; bank, power drag, pharma shines

-330

October 18, 2023· 16:37 IST

Indian equity indices ended on a negative note on October 18 with Nifty below 19,700 on the back of weak global cues. At close, the Sensex was down 551.07 points or 0.83 percent at 65,877.02, and the Nifty was down 140.40 points or 0.71 percent at 19,671.10.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

October 18, 2023· 16:35 IST

-330

October 18, 2023· 16:34 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty index experienced a bearish phase, encountering strong resistance at 44500, where the highest open interest is concentrated. The weak undertone in the market suggests a preference for selling on price rallies, and a breach of the 43800 support level is expected to lead to further selling pressure. The index's position below the 20DMA reinforces the bearish sentiment in the near term.

-330

October 18, 2023· 16:26 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened on a flat note and witnessed a sharp correction during the day. It continued to drift lower throughout the day and closed around the lows for the day. It closed in the negative down ~140 points. On the daily charts we can observe that Nifty has faced resistance from around the 61.82% fibonacci retracement level (19850 – 19885). On account of the correction, the Nifty has now reached the zone of 19670 – 19640 where support in the form of 20- and 40-day moving averages are placed. Bollinger bands are contracting, indicating that consolidation is likely over the next few trading sessions. In terms of levels, 19640 – 19600 shall act as a crucial support and 19770 – 19800 is an immediate hurdle zone for the Index.

Bank Nifty witnessed a sharp correction and in the process of retesting the previous swing low (44800). The fall appears overstretched on the downside and is also around support of the daily Bollinger band placed in the zone 43800 – 43700 which increases the probability that the fall might not worsen from current levels. Signs of a positive divergence on the daily charts are developing however it needs to be confirmed by price. Overall, we expect the Bank Nifty to witness a pullback over the next few trading sessions.

-330

October 18, 2023· 16:22 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Bears remain at the helm as the Nifty witnessed selling pressure throughout the day. The Nifty found resistance at 19,850, which led to a fall towards 19,650. Going forward, the index may witness a range-bound move until it breaks out in either direction. A fall below 19,650 might give bears more strength and the Nifty might fall down towards 19,250. On the higher end, a decisive move above 19,850 might open the way towards 20,200.

-330

October 18, 2023· 16:19 IST

Shrey Jain, Founder and CEO SAS Online:

The Indian stock market showed sluggish performance with both Sensex and Nifty dropping by 550 and 150 points, respectively. The Finance and Bank indices were heavily impacted, primarily due to Bajaj Finance missing profit estimates.

This decline was also influenced by concerns about quarterly earnings reports and tension in the Middle East, which continued to drive market dynamics. Worries about potential supply disruptions from the Middle East led to a surge in oil prices, reaching nearly $92 per barrel. This increase was exacerbated by an incident at a Gaza hospital, which dampened hopes of containing the Israel-Hamas military conflict.

From a technical standpoint, the next support level for Nifty is at 19,650, represented by the 40-day EMA. For Bank Nifty, the trend is negative, and the next support levels are at 43,600, with a further drop possible to 43,200.

-330

October 18, 2023· 16:16 IST

Mandar Bhojane, Equity Research Analyst at Choice Broking:

On October 18, the benchmark stock market indices concluded the day on a negative note. The Nifty closed below the 19,700 mark. The Sensex, a key index, wrapped up the day with a loss of 551.07 points, representing a decline of 0.83%, settling at 65,877.02.

Overall, both indices appear bearish. If Nifty breaks the support at 19,650, the next support levels to watch for are around 19,560-19,485. The immediate resistance for Nifty is seen at 19,850-19,900.

Bank Nifty formed a significant bearish Engulfing candle on the daily chart with substantial volume, indicating that further bearish pressure is likely to persist in the market. A crucial support level for Bank Nifty is at 43,800, and if this level is breached, the next support to look for is around 43,600.

Among sectors, except for auto and pharma, all other sectoral indices ended in the red, with power, information technology, oil & gas, realty, and the banking sector down by 0.5-1 percent each.

India VIX was positive by 2.52 percent intraday and settled at 10.9650. The index has support around the 19,600-19,500 zone.

Coming to the Open Interest (OI) data, on the call side, the highest OI was observed at 19,800 followed by 19,900 strike prices, while on the put side, the highest OI was at the 19,600 strike price. On the other hand, Bank Nifty has support at 43,600-43,400, while resistance is placed at 44,500-44,720 levels.

-330

October 18, 2023· 16:14 IST

Shrikant Chouhan, Head of Research (Retail), Kotak Securities:

Geopolitical tensions in the Middle-East due to the raging war between Israel and Hamas spooked Indian markets as investors turned risk-off and hammered stocks at will. The market is more concerned about surging crude oil prices as this could hurt inflation and may lead to interest rates remaining higher in the near to medium term. Already the market is facing FII money exodus from the domestic market and re-routing the funds into safe haven assets like gold and US dollar.

Technically, the Nifty faced resistance near 19850 level and corrected sharply. It has now formed double top formation on daily and intraday charts and bearish candle on daily charts, which is indicating further weakness from the current levels.

As long as the index is trading below 19800, the weak sentiment is likely to continue and could slip till 19600-19575. On the flip side, a minor pullback rally is possible if the index surpasses the intraday resistance of 19720, and above the same, we could see a one quick intraday rally till 19780.

-330

October 18, 2023· 16:10 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty ended on a weak note on October 18. At close, Nifty was down 0.73% or 143.9 points at 19667.2. Volumes on the NSE were a bit higher than recent average. Midcap index fell more than the Nifty even as the advance decline ratio fell sharply to 0.57:1.

Asia markets were mixed in choppy trading on Wednesday after economic data from China showed stronger-than-expected growth. European stocks inched lower on Wednesday as an explosion at a Gaza hospital complicated diplomatic efforts to rein in conflict in the Middle East.

Nifty faced resistance from the 19840-19850 band for the fourth time in last six days and reacted downwards. A breach of this band will lead to higher upsides while 19512-19635 band could provide support in the near term.

-330

October 18, 2023· 16:05 IST

Aditya Gaggar Director of Progressive Shares:

After facing resistance near 19,850, the markets witnessed a round of correction and ended the day at 19,671.10 declined by 140.40 points. Only the Pharma sector ended the day with considerable gains, while all the other sectors ended in red with Banking indices being the major laggard followed by Energy.

Broader markets also witnessed pressure as Midcap and Smallcap ended the session lower with a loss of 0.90% & 0.34% respectively. Nifty50 has not only made a strong bearish candle on the daily chart but also has given a breakdown from the rising trendline which indicates a short-term weakness in the market.

Today's breakdown can be considered as a whipsaw if the Index gives a closing above 19,800 in days to come. The immediate support for the Index stands at 19,580 while the resistance is placed at 19,780.

-330

October 18, 2023· 16:01 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets reversed Tuesday’s move and lost over half a percent, in continuation to the prevailing consolidation phase. After the flat start, the Nifty gradually drifted lower and finally settled closer to the day’s low at 19671.10 levels. Most sectors traded in sync with the benchmark and ended lower wherein banking, financials and energy were the top losers. The pressure was visible on the broader front too as both midcap and smallcap index shed in the range of 0.30%-0.95%.

Fresh weakness in banking and financial majors combined with a downtick in other heavyweights like Reliance is pointing towards further slide. On the index front, a decline below 19,600 in Nifty would again turn the bias on the negative side. We suggest maintaining hedged positions and advise keeping a check on position size citing the prevailing choppiness.

-330

October 18, 2023· 15:58 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Profit booking ensued in Indian markets, spurred by weak global sentiments and escalating Middle East tensions. A sudden rise in the tension has led to instability in energy prices; Brent prices rapidly rose above $92.5 by the day’s closing time. While the US bond yields was cautiously placed, awaiting the FED chair’s speech. The initial Q2 earnings disappointments by the IT & financials sector may have prompted attention in the domestic markets. All these all factors are presumed to be a knee jerk reaction as the total outlook on domestic market is stable, underpinned by healthy Q2 result forecast and favourable fiscal position.

-330

October 18, 2023· 15:39 IST

Bandhan Bank Q2 Earnings:

-330

October 18, 2023· 15:32 IST

Rupee Close:

Indian rupee ended flat at 83.27 per dollar versus previous close of 83.26.

-330

October 18, 2023· 15:30 IST

Market Close:

Benchmark indices ended on a weaker note on October 18 with Nifty below 19,700.

At close, the Sensex was down 551.07 points or 0.83 percent at 65,877.02, and the Nifty was down 140.40 points or 0.71 percent at 19,671.10. About 1424 shares advanced, 2144 shares declined, and 137 shares unchanged.

Biggest losers included Bajaj Finance, Bajaj Finserv, NTPC, HDFC Bank and Axis Bank, while gainers were Cipla, Dr Reddy's Laboratories, Tata Motors, Sun Pharma and SBI Life Insurance.

Among sectors, except auto and pharma, all other sectoral indices ended in the red with power, Information technology, oil & gas, metal, realty and bank down 0.5-1 percent each.

BSE Midcap index shed 0.8 percent and Smallcap index fell 0.3 percent.

-330

October 18, 2023· 15:29 IST

-330

October 18, 2023· 15:24 IST

Sensex Today | Arvinder Singh Nanda, Senior Vice President, of Master Capital Services:

The Government took a significant step in bolstering the oil industry by reducing the Special Additional Excise Duty (SAED) on crude petroleum to Rs 9,050/tonne. This deliberate reduction in SAED is poised to have a transformative impact on the profitability of oil exploration companies. By diminishing SAED on the export of crude petroleum and the sale of crude products within the domestic market, the government has primed these entities for increased financial resilience.

Additionally, this reduction is set to stimulate higher gross refining margins for refineries, fortifying their economic viability. While oil marketing companies, which engage in limited exports, might experience a milder impact, the overall effect of these tax cuts extends to the broader industry, positively benefiting diesel exports and the aviation sector. This strategic move is expected to enhance the adaptability and competitiveness of these businesses in the ever-evolving global energy landscape, ultimately fostering a more sustainable and dynamic future for the oil sector.

-330

October 18, 2023· 15:22 IST

Stock Market LIVE Updates | Jefferies View On Bajaj Finance

-Buy call, target price raised to Rs 9,470 per share

-In Q2, 28 percent YoY profit rise to Rs 3,600 crore was strong, but a tad below estimate

-AUM growth of 33 percent is strong & broad-based

-AUM growth is strong ex-rural markets where asset quality is weaker

-Entry into new segments is also aiding growth

-NIMs may compress over next 2-3 quarters by 25-30 bps

-NIMs may compress as BAF may not pass on rise in COF to clients

-NIMs should be made up by stronger growth & operating leverage

-Retain estimate of 26 percent profit CAGR for FY23-26

-330

October 18, 2023· 15:20 IST

Sensex Today | Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas:

Crude oil prices continue to command the risk premium as the conflict between Israel and Gaza is far from over, with tension escalated in the Middle East after hundreds were killed in a blast at a Gaza hospital, sparking concerns about potential oil supply disruptions from the region. API forecasted decline in crude oil reserves by 4 million barrels last week, ahead of the weekly inventory data from EIA, which also prompted a buying in the counter.

China’s economic data has infused optimism that world’s largest energy importing nation is seemingly has bottomed out with visible improvement on all fronts. The US economy is expected to grow at around 4% in Q3, as consumer spending and labour market remain strong.

Expect crude oil prices to remain buy on dips counter supported by US and Chinese economic data. The middle eastern concern also has added to risk premium. WTI December Finds support around $85 and resistance stays around $92.

-330

October 18, 2023· 15:18 IST

Stock Market LIVE Updates | InCred View On L&T Technology Services:

-Downgrade to hold, target price Rs 4,606 per share

-Company has lowered its FY24 revenue guidance to 17.5 percent-18.5 percent versus 20 percent+ earlier

-Company retains EBIT margin guidance of 17 percent

-OCF/EBITDA was at 61.4 percent in H1FY24 versus 60.4 percent in H1FY23

-EBIT margin-led solid execution is likely priced in, await better entry point

-330

October 18, 2023· 15:15 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee declined on Wednesday amid weak domestic markets and a jump in crude oil prices. However, softening of US Dollar cushioned the downside. US Dollar softened as US President Joe Biden landed in Israel raising expectations that the Hamas-Israel conflict may get contained. This waned safe haven demand for the US Dollar. Dovish comments from US Federal Reserve officials too weighed on the greenback. Economic data from US on Tuesday topped forecasts as retail sales and industrial production were better than market expectations.

We expect Rupee to trade with a slight positive bias as diplomatic efforts to contain the conflict in the Middle East may boost global risk sentiments. Softening of the US Dollar may further support the domestic currency. However, surge in global crude oil prices may cap the upside. Any further escalation in geopolitical tensions in the Middle East may weigh on Rupee at higher levels. Traders may take cues from housing market data and Beige Book from US. USDINR spot price is expected to trade in a range of Rs 82.90 to Rs 83.60.

-330

October 18, 2023· 15:12 IST

Stock Market LIVE Updates | Morgan Stanley View On Can Fin Homes

-Overweight call, target price Rs 1,000 per share

-Q2 reported profit beat estimate by 7 percent led by higher NIM & lower effective tax rate

-Calculated NIM expanded 29 bps QoQ to 3.9 percent

-Credit costs (annualised) of approximately 88 bps included approximately 48 bps fraud related provisions

-Credit costs (annualised) included management overlay of 21 bps

-GNPA was up 14 bps YoY & provision cover was stable

-330

October 18, 2023· 15:10 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Powergrid | 100.03 -0.02 | 100.13 -0.10 | 1,055,562 |

| Sona BLW | 558.05 -0.25 | 560.10 -0.37 | 400,045 |

| Ind Motor Parts | 789.85 -0.27 | 794.60 -0.60 | 2,144 |

| Hinduja Global | 993.30 -0.47 | 999.60 -0.63 | 13,268 |

| ICRA | 5,578.10 -0.07 | 5,616.55 -0.68 | 1,428 |

| DELPHI WORLD | 371.95 -0.03 | 374.50 -0.68 | 598 |

| HUL | 2,550.15 -0.23 | 2,569.45 -0.75 | 781,359 |

| UNO Minda | 595.35 -0.22 | 600.30 -0.82 | 111,430 |

| Biofil Chem | 50.15 -0.40 | 50.65 -0.99 | 45,878 |

| Linde India | 6,380.00 -0.35 | 6,446.30 -1.03 | 24,959 |

-330

October 18, 2023· 15:07 IST

Stock Market LIVE Updates | Morgan Stanley View On ICICI Prudential Life Insurance Company:

-Overweight call, target price cut to Rs 665 per share from Rs 685 per share

-VNB missed our estimate & consensus by about 8 percent

-VNB margin was lower due to product mix shift, some product level margin compression

-A positive was strong retail protection growth

-Focus will be on APE growth in non-ICICI Bank channels

-330

October 18, 2023· 15:04 IST

Stock Market LIVE Updates | WomanCart IPO sees 29.90 times subscription till final day of bidding

The public issue of WomanCart has garnered healthy response in the market with subscriptions of 29.90 times till the final day of bidding on October 18, as investors picked up 3.32 crore equity shares against an offer size of 11.12 lakh.

Retail investors looked more aggressive compared to high net-worth individuals (HNIs), buying 46.48 times the portion set aside for them, while HNIs have bid 16.67 times the allotted quota. Read More

-330

October 18, 2023· 14:58 IST

| Company | Price at 14:00 | Price at 14:52 | Chg(%) Hourly Vol |

|---|---|---|---|

| Igarashi Motors | 628.60 | 672.85 | 44.25 8.72k |

| Lakshmi Finance | 160.80 | 169.45 | 8.65 6.28k |

| Macpower | 332.75 | 350.25 | 17.50 2.29k |

| TARC | 88.10 | 92.70 | 4.60 33.36k |

| Service Care | 56.00 | 58.70 | 2.70 0 |

| Tega Industries | 881.70 | 922.00 | 40.30 16.83k |

| Udayshivakumar | 37.95 | 39.65 | 1.70 13.74k |

| HLE Glascoat | 538.95 | 562.50 | 23.55 8.90k |

| Godfrey Phillip | 2,249.50 | 2,340.45 | 90.95 6.03k |

| Cellecor Gadget | 178.90 | 185.65 | 6.75 - |

-330

October 18, 2023· 14:57 IST

| Company | Price at 14:00 | Price at 14:52 | Chg(%) Hourly Vol |

|---|---|---|---|

| Rajshree Sugars | 55.00 | 53.00 | -2.00 19.52k |

| Ratnamani Metal | 2,800.35 | 2,713.00 | -87.35 122.20k |

| RPG Life | 1,422.60 | 1,381.50 | -41.10 1.03k |

| Remsons Ind | 471.00 | 457.50 | -13.50 103 |

| Cell Point | 52.50 | 51.00 | -1.50 18.24k |

| Huhtamaki India | 315.95 | 307.05 | -8.90 767.82k |

| Ritco Logistics | 242.70 | 236.00 | -6.70 379 |

| Polycab | 5,449.45 | 5,299.10 | -150.35 31.57k |

| ITI | 298.70 | 290.55 | -8.15 2.74m |

| Tips Industries | 349.90 | 340.50 | -9.40 652.09k |

-330

October 18, 2023· 14:54 IST

Sensex Today | Blue Jet Healthcare IPO to open on Oct 25 with no fresh issue component

Blue Jet Healthcare, a speciality pharmaceutical and healthcare ingredients and intermediates company, is ready to launch its maiden public issue on October 25. This would be the second offer in the mainboard segment this month after IRM Energy.

The anchor book of the issue, which is a part of the QIB (qualified institutional buyers) portion, will be opened for a day on October 23, while the offer will close on October 27. The company will announce the issue price band and lot size on October 19.

The public issue comprises only an offer-for-sale (OFS) portion of 2.4 crore equity shares by promoters Akshay Bansarilal Arora, and his son Shiven Akshay Arora, while there is no fresh issue component. It is 100 percent owned by the Arora family. Read More

-330

October 18, 2023· 14:51 IST

Stock Market LIVE Updates | Wipro shares under pressure ahead of Q2 numbers

Wipro, India's fourth largest IT services firm, is likely to report a subdued quarter (Q2 FY23-24) on October 18. A sequential revenue decline is likely on account of delays in conversion of deals. However, profits are expected to rise, thanks to the manufacturing vertical.

The IT major’s operating margins are likely to remain stable because of its cost-optimisation measures, such as deferring wage hikes by a quarter. Read More

-330

October 18, 2023· 14:48 IST

Sensex Today | BSE Metal index shed 0.5 percent dragged by NMDC, SAIL, Jindal Steel:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NMDC | 162.00 | -1.91 | 613.16k |

| SAIL | 88.30 | -1.37 | 674.56k |

| Jindal Steel | 684.05 | -1.23 | 89.39k |

| APL Apollo | 1,758.40 | -0.97 | 35.49k |

| NALCO | 98.75 | -0.8 | 291.02k |

| JSW Steel | 786.85 | -0.41 | 30.31k |

| Tata Steel | 126.85 | -0.39 | 1.01m |

| Vedanta | 229.25 | -0.3 | 503.60k |

| Coal India | 316.65 | -0.22 | 189.95k |

-330

October 18, 2023· 14:44 IST

Stock Market LIVE Updates | InCred View On Bajaj Finance

-Add call, target price raised to Rs 9,850 per share

-Q2 NII grew at a slower pace compared to AUM growth amid margin pressure

-Managed healthy profitability as operating leverage kicked in

-BAF plans to raise Rs 8,800 crore of equity to support its next phase of growth

-BAF plans aided by new lending areas as well as penetration improving in current geographies

-Raised earnings estimates by 9.2 percent/8.1 percent for FY25/26

-330

October 18, 2023· 14:39 IST

Stock Market LIVE Updates | Polycab India Q2 Results:

Net profit up 59% at Rs 429.7 crore versus Rs 270.6 crore and revenue up 26.6% at Rs 4,217.6 crore versus Rs 3,332.3 crore, YoY.

-330

October 18, 2023· 14:32 IST

Sensex today| BSE has sought clarification from Orient Cement on news reports saying CK Birla tapping Adani for stake sale

-330

October 18, 2023· 14:28 IST

Sensex Today| Airtel launches India’s first integrated omni-channel cloud platform for CCaaS (Contact Center as a Service)

-330

October 18, 2023· 14:18 IST

-330

October 18, 2023· 14:07 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Cinevista | 23.75 15.85 | 16.85 40.95 | 2,929,659 |

| Sky Gold | 689.70 6.48 | 535.40 28.82 | 970,536 |

| Noida Toll | 9.00 7.14 | 7.00 28.57 | 4,337,916 |

| South West Pinn | 165.95 3.56 | 130.60 27.07 | 394,364 |

| Urban Enviro Wa | 185.00 4.99 | 145.65 27.02 | 314,400 |

| Newgen Software | 1,141.90 9.65 | 912.55 25.13 | 1,193,568 |

| Next Mediaworks | 7.60 3.40 | 6.15 23.58 | 305,783 |

| ISL | 109.35 16.21 | 89.80 21.77 | 19,951,968 |

| Tijaria Polypip | 7.60 9.35 | 6.25 21.60 | 20,424 |

| Huhtamaki India | 315.20 11.14 | 264.50 19.17 | 4,596,567 |

-330

October 18, 2023· 14:06 IST

Stock Market LIVE Updates | Exide Industries invests Rs 100 crore in subsidiary Exide Energy Solutions on rights basis

Exide Industries has invested Rs 100 crore in wholly owned subsidiary Exide Energy Solutions on a rights basis. There is no change in the shareholding percentage of the company in subsidiary.

-330

October 18, 2023· 14:01 IST

Sensex Today | Market at 2 PM

The Sensex was down 376.52 points or 0.57 percent at 66,051.57, and the Nifty was down 93.40 points or 0.47 percent at 19,718.10. About 1207 shares advanced, 1970 shares declined, and 108 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Motors | 666.65 | 1.66 | 769.69k |

| Sun Pharma | 1,153.40 | 1.54 | 35.58k |

| Infosys | 1,450.00 | 0.51 | 170.03k |

| Maruti Suzuki | 10,781.70 | 0.37 | 5.49k |

| Bharti Airtel | 954.55 | 0.05 | 62.51k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bajaj Finance | 7,922.90 | -2.08 | 22.85k |

| Bajaj Finserv | 1,631.00 | -1.59 | 40.20k |

| Axis Bank | 994.60 | -1.36 | 86.09k |

| HDFC Bank | 1,520.85 | -1.33 | 361.12k |

| ICICI Bank | 944.50 | -1.09 | 234.38k |

| Kotak Mahindra | 1,754.20 | -0.98 | 18.45k |

| NTPC | 243.55 | -0.98 | 180.27k |

| Reliance | 2,333.70 | -0.93 | 177.93k |

| Tech Mahindra | 1,186.35 | -0.91 | 185.01k |

| Power Grid Corp | 205.25 | -0.87 | 750.43k |

-330

October 18, 2023· 13:59 IST

Stock Market LIVE Updates | Syngene International Q2 profit rises 14% YoY to Rs 117 crore as revenue surges 18.5%

Syngene International has recorded a 14% year-on-year growth in profit at Rs 117 crore for July-September period FY24, with revenue from operations increasing 18.5% on-year to Rs 910 crore during the same period.

-330

October 18, 2023· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sky Gold | 641.95 | 694.75 | 52.80 27.39k |

| Goldstar Power | 21.30 | 22.90 | 1.60 99.00k |

| Ratnamani Metal | 2,652.35 | 2,808.60 | 156.25 1.32k |

| Renaissance | 118.50 | 124.25 | 5.75 47.94k |

| Sagardeep Alloy | 25.10 | 26.25 | 1.15 25.48k |

| R Systems Intl | 494.65 | 516.55 | 21.90 2.18k |

| Kody Technolab | 236.55 | 246.95 | 10.40 1.02k |

| Cellecor Gadget | 171.80 | 178.90 | 7.10 - |

| SecUR Credentia | 20.00 | 20.70 | 0.70 363.78k |

| TPL Plastech | 48.80 | 50.50 | 1.70 25.05k |

-330

October 18, 2023· 13:57 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Dollex Agrotech | 41.25 | 39.00 | -2.25 0 |

| ITI | 317.00 | 302.00 | -15.00 1.22m |

| Pricol | 367.20 | 352.60 | -14.60 2.00m |

| Cadsys India | 284.60 | 274.00 | -10.60 0 |

| Bombay Metrics | 122.95 | 118.60 | -4.35 58 |

| BEW Engineering | 1,714.00 | 1,665.00 | -49.00 0 |

| Marshall Machin | 55.55 | 54.00 | -1.55 5.17k |

| Beardsell | 42.80 | 41.75 | -1.05 1.50k |

| Swastik Pipe | 121.30 | 118.50 | -2.80 13.54k |

| Jai Corp | 312.15 | 305.20 | -6.95 276.98k |

-330

October 18, 2023· 13:52 IST

-330

October 18, 2023· 13:50 IST

Stock Market LIVE Updates | ABB flags slowdown in fourth-quarter revenue, shares slide

Swiss engineering group ABB (ABBN.S) flagged a slowdown in revenue growth in the fourth quarter and reported a continued decline in orders in China as it posted third-quarter earnings broadly in line with forecasts, sending its shares sharply down, reported Reuters

The maker of industrial drives and motors posted a 13% increase in its operational earnings before interest, tax and amortisation (EBITA) to $1.392 billion during the three months to Sept. 30, broadly in line with a company-gathered consensus of forecasts, it added.

-330

October 18, 2023· 13:48 IST

Stock Market LIVE Updates | Piramal Enterprises' NCD tranche I issue to open on October 19

Piramal Enterprises has filed Tranche I prospectus for public issue of secured, rated, listed, redeemable, non-convertible debentures of the face value of Rs 1,000 each. The base issue size is Rs 200 crores with a green shoe option of up to Rs 800 crores, aggregating up to Rs 1,000 crore.

The Tranche I Issue opens on October 19, 2023, and closes on November 2, 2023

The NCDs are proposed to be listed on BSE and NSE, with BSE being the Designated Stock Exchange for the Issue.

The NCDs have been rated [ICRA] AA (Stable by ICRA Limited and CARE AA; Stable by CARE Ratings Limited.

-330

October 18, 2023· 13:45 IST

Sensex Today | BSE Bank index fell 1 percent dragged by Canara Bank, Bank of Baroda, HDFC Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Canara Bank | 371.15 | -1.67 | 96.56k |

| Bank of Baroda | 203.95 | -1.62 | 1.13m |

| HDFC Bank | 1,520.65 | -1.34 | 354.87k |

| Axis Bank | 995.05 | -1.32 | 77.42k |

| Federal Bank | 146.65 | -1.15 | 265.15k |

| Kotak Mahindra | 1,751.60 | -1.12 | 18.14k |

| ICICI Bank | 944.55 | -1.09 | 144.54k |

| SBI | 572.20 | -0.73 | 231.29k |

| IndusInd Bank | 1,427.15 | -0.53 | 14.68k |

| AU Small Financ | 705.35 | -0.16 | 7.73k |

-330

October 18, 2023· 13:40 IST

Stock Market LIVE Updates | Department of Industrial Safety and Health, Kalyan permits Century Rayon plant to restart operations of carbon disulphide refining section

Grasim Industries: Department of Industrial Safety and Health (DISH), Kalyan has permitted the Century Rayon plant to restart the operations of carbon disulphide refining section, in Shahad. The company has also obtained requisite permission(s) from other concerned departments including Police Department and Maharashtra Pollution Control Board, Regional Office, Kalyan (MPCB).

-330

October 18, 2023· 13:38 IST

Stock Market LIVE Updates | Astra Microwave executes License - cum - ToT agreement between NSIL & IN-SPACe to utilize know how relating to MiniSAR: X band Airborne SAR

Astra Microwave Products has executed License - Cum - Transfer of Technology (ToT) agreement between NewSpace India (NSIL), Bengaluru and Indian National Space Promotion and Authorization Centre (IN-SPACe), Department of Space (DOS), Ahmedabad to utilize the know how relating to MiniSAR: X band Airborne SAR.

-330

October 18, 2023· 13:31 IST

Stock Market LIVE Updates | HSBC View On Bajaj Finance

-Buy rating, target price raised to Rs 9,620 per share from Rs 9,500 per share

-Q2 loan growth was broad-based

-Profitability guidance remains healthy, & earnings growth outlook is intact

-Increase FY24-26 EPS estimates 0.1-2.5 percent to reflect higher AUM growth outlook

-Company clarified that it does not have any inorganic aspirations on lending side

-330

October 18, 2023· 13:28 IST

Stock Market LIVE Updates | Bajaj Electricals bags service contract worth Rs 347.3 crore from Power Grid Corporation of India

-330

October 18, 2023· 13:27 IST

-330

October 18, 2023· 13:26 IST

Cabinet approves dearness allowance hike & MSP proposals: Sources to CNBC-TV18.a

-330

October 18, 2023· 13:25 IST

Stock Market LIVE Updates |

Cosmo First commenced implementation of project for manufacture of metallised film for capacitors

-330

October 18, 2023· 13:22 IST

Stock Market LIVE Updates | Heritage Foods Q2 Earnings:

Net profit up 18% at Rs 22.4 crore versus Rs 19 crore and revenue up 20% at Rs 979 crore versus Rs 816 crore, YoY.

-330

October 18, 2023· 13:21 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| ZFCVINDIA | 16,049.75 | 16,049.85 15,712.60 | 0% |

| PVR INOX | 1,773.40 | 1,773.95 1,756.30 | -0.03% |

| Grindwell Norto | 2,195.20 | 2,196.50 2,149.70 | -0.06% |

| Colgate | 2,065.00 | 2,066.25 2,047.55 | -0.06% |

| Britannia | 4,609.00 | 4,612.00 4,586.25 | -0.07% |

| Zydus Wellness | 1,572.80 | 1,574.05 1,561.70 | -0.08% |

| Berger Paints | 577.10 | 577.70 570.65 | -0.1% |

| Tube Investment | 3,011.75 | 3,016.35 2,964.50 | -0.15% |

| Timken | 3,047.40 | 3,052.00 3,033.75 | -0.15% |

| Asian Paints | 3,108.70 | 3,113.95 3,095.00 | -0.17% |

-330

October 18, 2023· 13:20 IST

Stock Market LIVE Updates | Morgan Stanley View On Tata Elxsi

-Underweight call, target price Rs 6,400 per share

-Q2 was strong with positive trends in healthcare

-Transportation & positive bias in management commentary on demand outlook

-Company will need strong execution to meet estimate & room for EPS to move up is limited

-This, along with premium valuation, makes risk-reward unfavorable

-330

October 18, 2023· 13:16 IST

Stock Market LIVE Updates | Mahanagar Gas signs joint venture agreement with Baidyanath LNG for LNG business

Mahanagar Gas has entered into a joint venture agreement (JVC) with Baidyanath LNG to incorporate a private limited company in India, for undertaking the business of liquefied natural gas (LNG). MGL and Baidyanath LNG will subscribe the initial share capital of JVC in the ratio of 51:49.

-330

October 18, 2023· 13:14 IST

-330

October 18, 2023· 13:12 IST

Stock Market LIVE Updates | Mphasis, WorkFusion partner to transform financial crime for enterprises

Mphasis announced strategic partnership with WorkFusion, to harness the power of WorkFusion's AI solutions to enhance and evolve its services in transforming financial crimes operations for its enterprise clients.

-330

October 18, 2023· 13:10 IST

Stock Market LIVE Updates | Kotak Securities signs agreement to sell entire stake in Entroq Technologies to Delente Technologies

Kotak Mahindra Bank's subsidiary Kotak Securities has entered into an agreement for sale of its entire shareholding of around 7.50% in Entroq Technologies to Delente Technologies, at Rs 508.06 per share. The Reserve Bank of India has imposed a monetary penalty of Rs 3.95 crore on Kotak Mahindra Bank for non-compliance with RBI Directions on ‘managing risks and code of conduct in outsourcing of financial services by banks’, ‘recovery agents engaged by banks’, ‘customer service in banks’, and ‘loans and advances - statutory and other restrictions’.

-330

October 18, 2023· 13:05 IST

Stock Market LIVE Updates | Nomura View On L&T Technology Services:

-Reduce call, target price Rs 3,450 per share

-Q2FY24 beats estimates at revenue and margin level

-Revenue growth guidance for FY24 lowered to 17.5-18.5 percent from 20.0 percent+ YoY earlier

-Margin target of 18 percent by H1FY26 remains intact

-Q3 seasonality to play out as usual

-Stock trading at 34.5x FY25 & 29.7x FY26 EPS

-330

October 18, 2023· 13:03 IST

Stock Market LIVE Updates | RBI imposes monetary penalty of Rs 12.19 crore on ICICI Bank

The Reserve Bank of India has imposed a monetary penalty of Rs 12.19 crore on ICICI Bank for contravention of sub-section (1) of Section 20 of the Banking Regulation Act.

-330

October 18, 2023· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was down 466.29 points or 0.70 percent at 65,961.80, and the Nifty was down 119.60 points or 0.60 percent at 19,691.90. About 1103 shares advanced, 2030 shares declined, and 127 shares unchanged.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16495.20 -0.17 | 30.79 1.97 | -0.41 29.55 |

| NIFTY IT | 31618.55 -0.55 | 10.47 -2.86 | -4.56 11.67 |

| NIFTY PHARMA | 15347.85 0.89 | 21.83 1.13 | -1.00 17.99 |

| NIFTY FMCG | 52489.25 -0.33 | 18.83 0.45 | 0.56 20.07 |

| NIFTY PSU BANK | 5042.05 -1.39 | 16.75 -1.62 | -3.36 58.95 |

| NIFTY METAL | 6861.90 -0.58 | 2.06 0.73 | -1.38 18.82 |

| NIFTY REALTY | 604.80 -1 | 40.06 -1.06 | 4.47 42.16 |

| NIFTY ENERGY | 27263.35 -0.9 | 5.39 0.97 | -0.99 5.76 |

| NIFTY INFRA | 6282.15 -0.72 | 19.61 -0.09 | 0.21 25.52 |

| NIFTY MEDIA | 2319.90 0.13 | 16.46 1.81 | 0.99 9.96 |

-330

October 18, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Real Touch Fin | 32.00 | 29.00 | -3.00 177 |

| Taylormade Rene | 538.90 | 492.00 | -46.90 7.92k |

| Alphalogic Tech | 59.55 | 54.75 | -4.80 24.16k |

| Aditya Spinners | 26.00 | 24.11 | -1.89 287 |

| Emmessar Biotec | 25.90 | 24.10 | -1.80 41 |

| Shardul Sec | 114.90 | 107.00 | -7.90 1 |

| Incap | 40.94 | 38.18 | -2.76 55 |

| Pritika Auto | 23.33 | 21.85 | -1.48 12.08k |

| Eiko PP | 25.00 | 23.45 | -1.55 0 |

| Jaipan Inds | 42.50 | 40.00 | -2.50 104 |

-330

October 18, 2023· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Spectrum Foods | 64.66 | 79.40 | 14.74 1.26k |

| Dynamic Portfol | 33.25 | 36.66 | 3.41 313 |

| Mishka Exim | 31.06 | 33.79 | 2.73 465 |

| ISL | 101.05 | 109.55 | 8.50 177.16k |

| Olympia Ind | 78.49 | 85.00 | 6.51 531 |

| Innovassynth | 25.00 | 26.75 | 1.75 1.41k |

| Sanblue Corp | 37.16 | 39.19 | 2.03 139 |

| Platinumone | 173.90 | 183.00 | 9.10 1.30k |

| Longview Tea | 24.90 | 26.20 | 1.30 40 |

| Inditrade Capit | 38.00 | 39.95 | 1.95 125 |

-330

October 18, 2023· 12:58 IST

Stock Market LIVE Updates |

BSE to invest Rs 30 crore in wholly owned subsidiary

The Board of Directors of BSE at its meeting held on October 18, 2023 considered and approved appointment of Shri Balaji Venketeshwar as Chief Information Security Officer (Key Management Personnel) with effect from November 1, 2023, in place of Shri Shivkumar Pandey and investment of an amount up to Rs 30,00,00,000 in BSE Investments Limited (Wholly owned Subsidiary).

-330

October 18, 2023· 12:57 IST

Stock Market LIVE Updates | Petromin to set up 1,000 Petromin Express Stations at HPCL retail outlets across India in 5 years

Petromin Corporation, Saudi Arabia, a part of the AI-Dabbagh group will be setting up 1,000 Petromin Express Stations (quick service vehicle care) at HPCL retail outlets across India in 5 years. The first set of 16 Petromin Express Stations in Bengaluru and Chennai were launched on October 16.

-330

October 18, 2023· 12:55 IST

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| GKW | 4375.00 | 1234.70 20 | 44707 441.85 |

| Nucleus Softwar | 79580.00 | 1317.65 10 | 174141 66873.55 |

| Tijaria Polypip | 43125.00 | 7.60 9.35 | 19839 24019.25 |

| Blue Coast | 10840.00 | 7.35 5 | 275 925.35 |

| Khandwala Sec | 1241.00 | 26.05 4.83 | 11880 16494.95 |

| Zenith SP&I | 1196703.00 | 6.60 4.76 | 160733 265971.80 |

| Rattan Power | 3379275.00 | 7.25 4.32 | 85319492 53567801.80 |

-330

October 18, 2023· 12:54 IST

Stock Market LIVE Updates | Avenue Supermarts receives tax demand with penalty notice of Rs 3.9 lakh from GST

The D-Mart operator has received a notice for tax demand and penalty of Rs 3.9 lakh from the Superintendent of Central Tax (GST), Kakinada, Andhra Pradesh.

-330

October 18, 2023· 12:48 IST

Sensex Today | BSE Midcap index shed 1 percent dragged by Biocon, L&T Technology, UCO Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Biocon | 240.40 | -5.48 | 199.65k |

| L&T Technology | 4,363.85 | -5.45 | 33.91k |

| UCO Bank | 39.89 | -3.01 | 950.03k |

| NMDC | 160.80 | -2.63 | 532.17k |

| Power Finance | 244.85 | -2.62 | 395.41k |

| IOB | 43.16 | -2.6 | 2.10m |

| Vodafone Idea | 11.64 | -2.51 | 22.45m |

| Nippon | 372.80 | -2.47 | 17.53k |

| Union Bank | 102.75 | -2.42 | 430.25k |

| New India Assur | 139.25 | -2.31 | 32.93k |

-330

October 18, 2023· 12:45 IST

Stock Market LIVE Updates | CLSA View On Bajaj Finance

-Buy call, target price Rs 9,500 per share

-Q2 showed company’s growth and profitability strong, asset quality normalising

-Bajaj delivered an RoE of 24 percent in Q2 & even after cap raise, should deliver 22 percent+ RoE

-Spreads declined 5-10 bps QoQ due to higher cost of funds

-Decline in spreads in-line with expectations but more is expected in coming quarters

-GNPL ratio was largely stable while net slippage ratio inched up a bit off a low base

-330

October 18, 2023· 12:40 IST

Stock Market LIVE Updates | Birlasoft appoints Selvakumaran Mannappan as Chief Operating Officer

Birlasoft has informed that Mr. Selvakumaran Mannappan has been appointed as the Chief Operating Officer and Senior Management Personnel of the company with effect from October 18, 2023.

-330

October 18, 2023· 12:38 IST

-330

October 18, 2023· 12:35 IST

Sensex Today | Oil jumps 2% as hospital blast increases Middle East tensions

Oil prices surged on Wednesday as tension escalated in the Middle East after hundreds were killed in a blast at a Gaza hospital, sparking concerns about potential oil supply disruptions from the region.

Brent crude futures advanced $1.75, or 2%, to $91.65 a barrel at 0609 GMT. West Texas Intermediate crude (WTI) futures were up $1.91, or 2.2%, at $88.57 a barrel.

In earlier trade, both benchmarks gained more than $2 to touch their highest levels in two weeks.

-330

October 18, 2023· 12:33 IST

Sensex Today | UK inflation stays elevated at 6.7% in September

British inflation remained elevated in September, official data showed Wednesday, dashing expectations of a dip as easing food and drink prices were offset by higher energy costs.

The Consumer Prices Index held at 6.7 percent last month, after unexpectedly slowing to the same level in August, the Office for National Statistics (ONS) said in a statement.

That dashed market predictions for a further slowdown to 6.6 percent. Read More

-330

October 18, 2023· 12:30 IST

Stock Market LIVE Updates | HSBC View On ICICI Prudential Life Insurance Company

-Buy call, target price cut to Rs 670 per share from Rs 710 per share

-Q2 showed change in product mix, pressure on group term business

-Q2 showed high operating costs led to moderation in margin

-Cut APE and margin estimates to factor in high share of linked products

-Slowdown in group term life business

-While FY24 will remain challenging, growth should normalise thereafter

-330

October 18, 2023· 12:26 IST

Sensex Today | BSE Smallcap index down 0.5 percent dragged by MMTC, HUDCO, KIOCL:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MMTC Ltd | 78.38 | -9.99 | 1.48m |

| HUDCO | 81.40 | -9.48 | 2.06m |

| KIOCL | 442.95 | -7.02 | 420.93k |

| Vakrangee | 20.13 | -7.02 | 8.95m |

| Syngene Intl | 725.25 | -6.9 | 53.94k |

| GRWRHITECH | 1,427.20 | -6.52 | 5.97k |

| Andrew Yule | 35.64 | -6.16 | 339.43k |

| India Tourism D | 465.00 | -5.5 | 20.85k |

| Jai Corp | 311.05 | -5.43 | 120.92k |

| PC Jeweller | 32.23 | -5.18 | 1.00m |

-330

October 18, 2023· 12:24 IST

Stock Market LIVE Updates | Morgan Stanley On L&T Technology Services

-Underweight, target price Rs 4,000 per share

-Q2 results were better than expectations

-Management commentary was balanced on demand

-However, cut in revenue growth guidance was a negative surprise

-Stock could underperform with premium valuation & strong stock performance since last results

-330

October 18, 2023· 12:21 IST

Stock Market LIVE Updates | Himadri Speciality Chemical Q2 profit jumps 246% YoY to Rs 101 crore despite drop in topline

Himadri Speciality Chemical has reported standalone net profit at Rs 101 crore for ended September FY24, rising 246.2% over a year-ago period despite 5.1% on-year decline in revenue at Rs 1,005 crore during the same period, driven by healthy EBITDA and margin expansion.

-330

October 18, 2023· 12:19 IST

Stock Market LIVE Updates: VST Industries stock sheds 2% on 17.6% decline in Q2 net profit

Shares of VST Industries declined around 2 percent on October 18 after the company's net profit for the second quarter of FY24 slumped 17.6 percent on-year.

The Hyderabad-based cigarette manufacturer reported a 17.6 percent on-year decline in net profit of Rs 75.95 crore, with tepid growth in topline and lower pre-tax profit and other incomes. Revenue from operations for the quarter increased 2.86 percent on a year-on-year basis to Rs 452.3 crore. Read More

-330

October 18, 2023· 12:17 IST

Sensex Today | BSE Power index down 1 percent dragged by ABB India, BHEL, Tata Power:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ABB India | 4,130.30 | -3.57 | 7.64k |

| BHEL | 129.45 | -2.19 | 640.11k |

| Tata Power | 252.40 | -1.73 | 233.40k |

| Siemens | 3,541.65 | -1.43 | 7.45k |

| Power Grid Corp | 204.50 | -1.23 | 379.35k |

| NTPC | 243.30 | -1.08 | 126.89k |

| JSW Energy | 398.70 | -1.07 | 38.33k |

| Adani Energy | 768.20 | -0.99 | 37.15k |

| Adani Power | 333.50 | -0.63 | 359.37k |

| NHPC | 52.77 | -0.62 | 683.90k |

-330

October 18, 2023· 12:11 IST

Stock Market LIVE Updates | CIE Automotive Q3 profit grows 11.4% YoY to Rs 186.7 crore

CIE Automotive India has recorded a 11.4% on-year growth in consolidated profit at Rs 186.7 crore for quarter ended September 2023, driven by better operating margin. Revenue from operations increased by 2.2% year-on-year to Rs 2,279.4 crore in Q3CY23.

-330

October 18, 2023· 12:06 IST

Stock Market LIVE Updates | Can Fin Homes Q2 profit grows 11.5% YoY to Rs 158 crore

Can Fin Homes has reported a 11.5% on-year growth in profit at Rs 158 crore for quarter ended September FY24 and net interest income during the same period grew by 26.1% to Rs 316.8 crore. Asset quality weakened with the gross non-performing assets (NPA) rising 13 bps sequentially to 0.76% and net NPA rising 9 bps QoQ to 0.43% for the quarter.

-330

October 18, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was down 436.98 points or 0.66 percent at 65,991.11, and the Nifty was down 109.30 points or 0.55 percent at 19,702.20. About 1160 shares advanced, 1940 shares declined, and 126 shares unchanged.

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| KIOCL | 438.00 | 32.39 | 330.85 |

| Cinevista | 22.30 | 32.34 | 16.85 |

| Industrial Inv | 152.00 | 32.17 | 115.00 |

| Fert and Chem | 714.00 | 30.24 | 548.20 |

| Accord Synergy | 34.00 | 28.30 | 26.50 |

| South West Pinn | 167.50 | 28.25 | 130.60 |

| Urban Enviro Wa | 185.00 | 27.02 | 145.65 |

| Signet Ind | 78.20 | 26.13 | 62.00 |

| Keynote Finance | 150.90 | 25.49 | 120.25 |

| Newgen Software | 1,138.80 | 24.79 | 912.55 |

-330

October 18, 2023· 11:58 IST

| Company | Price at 11:00 | Price at 11:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Yarn Syndicate | 37.10 | 33.31 | -3.79 82.50k |

| GRWRHITECH | 1,523.80 | 1,387.15 | -136.65 330 |

| S V Global Mill | 89.00 | 82.55 | -6.45 42 |

| Krishanveer For | 60.90 | 57.01 | -3.89 98 |

| Sanblue Corp | 39.62 | 37.16 | -2.46 184 |

| Margo Finance | 34.63 | 32.50 | -2.13 579 |

| Sita Enterprise | 25.30 | 23.78 | -1.52 394 |

| Alfa Transforme | 63.50 | 59.88 | -3.62 29.85k |

| Hindustan Media | 83.00 | 78.45 | -4.55 1.24k |

| One Global Serv | 51.25 | 48.50 | -2.75 975 |

-330

October 18, 2023· 11:58 IST

| Company | Price at 11:00 | Price at 11:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Crane Infra | 20.80 | 22.97 | 2.17 4.25k |

| Ironwood Edu. | 24.60 | 26.99 | 2.39 47 |

| Sri Nachammai | 35.03 | 38.20 | 3.17 3.64k |

| Jaipan Inds | 39.38 | 42.50 | 3.12 13 |

| TechNVision | 192.00 | 204.40 | 12.40 2 |

| Nimbus Projects | 30.72 | 32.70 | 1.98 102 |

| Indo US Bio-Tec | 195.00 | 207.50 | 12.50 1000 |

| Shardul Sec | 108.00 | 114.90 | 6.90 100 |

| JITF Infralogis | 452.00 | 479.00 | 27.00 517 |

| Salem Erode Inv | 38.50 | 40.80 | 2.30 75 |

-330

October 18, 2023· 11:58 IST

Stock Market LIVE Updates | CLSA View On Tata Motors

-Buy call, target price raised to Rs 803 per share from Rs 777 per share

-Tata Motors sells 9.9 percent stake in Tata Technologies, add Rs 26 per share in value

-New Launches: Tata Safari & Harrier, strong SUV launch momentum

-JLR: EBIT margin ahead of estimate for FY24

-330

October 18, 2023· 11:54 IST

Sensex Today | Nifty Pharma index rose 1 percent supported by Cipla, Dr Reddy's Laboratories and Sun Pharma:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cipla | 1,214.15 | 3.46 | 4.43m |

| Dr Reddys Labs | 5,653.00 | 1.96 | 297.12k |

| Sun Pharma | 1,158.00 | 1.86 | 1.04m |

| Divis Labs | 3,671.70 | 0.69 | 95.65k |

| Alkem Lab | 3,638.80 | 0.51 | 45.06k |

| Zydus Life | 593.00 | 0.46 | 259.36k |

| Lupin | 1,202.85 | 0.43 | 369.96k |

-330

October 18, 2023· 11:50 IST

Stock Market LIVE Updates | Lemon Tree Hotels signs franchise agreement for new hotel in Gujarat

Lemon Tree Hotels signed a Franchise Agreement for its upcoming 45-room hotel in Vadodara, Gujarat under the brand - Keys Select by Lemon Tree Hotels. The hotel is expected to be operational in FY26.

-330

October 18, 2023· 11:46 IST

AnandRathi View on CEAT:

Beating Rs 3.9 billion estimate, Ceat’s Q2 FY24 EBITDA shot up 125% y/y to Rs 4.6 billion, aided by less-than-expected RM costs. Demand has started to improve with Q2 volumes growing 7% y/y.

Broking firm expect healthy volume growth ahead, driven by recovery in replacements and exports. Ahead, AnandRathi factored in a ~150bp decline in the operating margin from Q2 levels considering higher crude prices.

Introducing FY26e with revenue/EBITDA/ PAT growth of 10%/11%/15%. It has applied a lower multiple (12x, from 13x) factoring in the margin pressure ahead. Owing to the stock price falling more than 10% in the last three months, raised rating to a Buy at a slightly lower 12-mth Target of Rs 2,550, 12x FY26e P/E (earlier Rs 2,600, 13x FY25e).

-330

October 18, 2023· 11:43 IST

-330

October 18, 2023· 11:41 IST

Stock Market LIVE Updates | Arvind appoints Nigam Shah as Chief Financial Officer

Nigam Shah has been appointed as the Chief Financial Officer of Arvind. He is a part of the senior management team.

-330

October 18, 2023· 11:36 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Rattan Power | 245136 | 7.26 | 0.18 |

| Balgopal Commer | 200000 | 22 | 0.44 |

| Balgopal Commer | 200000 | 22 | 0.44 |

| Bank of Baroda | 115701 | 206 | 2.38 |

| Vodafone Idea | 255672 | 11.73 | 0.3 |

| Newtime Infra | 250000 | 9.25 | 0.23 |

| Barbeque Nat | 23332 | 717.3 | 1.67 |

| SecUR Credentia | 200032 | 17.5 | 0.35 |

| Jaiprakash Pow | 200000 | 9.33 | 0.19 |

| Hindalco | 93336 | 490 | 4.57 |

-330

October 18, 2023· 11:33 IST

Stock Market LIVE Updates | India Extends Sugar Export Restrictions

India has prolonged sugar export restrictions beyond October 31 until further notice, as stated by the Director General of Foreign Trade. However, these restrictions do not apply to sugar exports to the EU and the US under the CXL and TRQ quota.

-330

October 18, 2023· 11:26 IST

-330

October 18, 2023· 11:20 IST

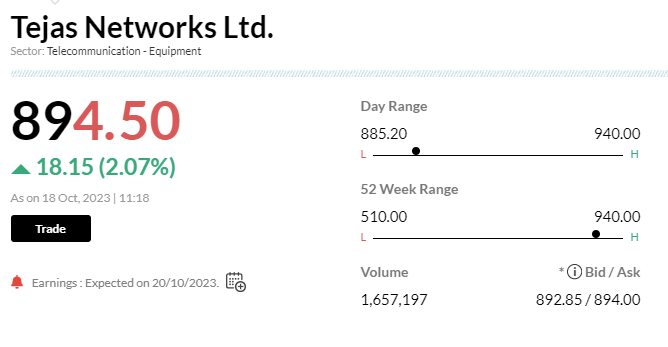

Stock Market LIVE Updates | Tejas Networks jumps 2%, scales to record high on FibreConnect partnership

Shares of Tejas Networks rallied 2 percent to Rs 895 apiece on BSE on October 18 after it inked a pact with FibreConnect for deployment of end-to-end optical network in Italy. The S&P BSE Sensex stood flat at 66,372 levels, as of 11:20 am.

In the past one month, the stock of this telecom equipment provider has surged 10 percent as against 2 percent decline in the Sensex benchmark.

The company, via an exchange filing dated October 17, stated that FibreConnect, a wholesale telecom infrastructure in Italy has successfully launched its broadband services in the country using its state-of-the-art telecom and networking products.

The management highlighted that they are the sole supplier of optical networking and broadband access products for FibreConnect’s country-wide FTTP (fiber-to-the-premise) rollout.

-330

October 18, 2023· 11:13 IST

-330

October 18, 2023· 11:07 IST

Stock Market LIVE Updates | IRM Energy IPO Day 1: Issue subscribed 0.14% times, retail portion booked 0.2 times so far

IRM Energy IPO opened for subscription on October 18. The issue has been subscribed 0.14 times so far, receiving bids for 10.5 lakh shares against the offer size of 76.24 lakh shares. Retail investors bid 0.2 times while high net-worth individuals bought 0.18 times the allotted quota.

The city gas distribution company aims to raise Rs 545.4 crore via IPO. Ahead of the issue, IRM Energy raised Rs 160.35 crore from anchor investors. Quant Mutual Fund, DSP Mutual Fund, HDFC Life Insurance Company, SBI General Insurance Company, PNB Metlife India Insurance Company, ITI Mutual Fund, Bank of India Mutual Fund, and Nippon India took part in the anchor book.

-330

October 18, 2023· 11:00 IST

Sensex Today | Market at 11 AM

The Sensex was down 228.85 points or 0.34 percent at 66,199.24, and the Nifty was down 46.70 points or 0.24 percent at 19,764.80. About 1433 shares advanced, 1608 shares declined, and 122 shares unchanged.

-330

October 18, 2023· 10:54 IST

| Company | Price at 10:00 | Price at 10:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sungarner | 215.00 | 200.00 | -15.00 6.40k |

| Simbhaoli Sugar | 33.75 | 32.00 | -1.75 24.82k |

| Ducol Organics | 179.00 | 169.90 | -9.10 14.40k |

| India Tourism D | 490.50 | 466.00 | -24.50 356.51k |

| Astra Microwave | 508.90 | 484.55 | -24.35 54.17k |

| Kohinoor Foods | 41.90 | 40.10 | -1.80 4.42k |

| Jindal Poly Inv | 724.00 | 694.00 | -30.00 126.71k |

| Tarmat | 91.90 | 88.15 | -3.75 26.48k |

| Kirl Electric | 126.40 | 121.25 | -5.15 115.32k |

| Mangalam Drugs | 111.65 | 107.45 | -4.20 2.51k |

-330

October 18, 2023· 10:54 IST

| Company | Price at 10:00 | Price at 10:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Plada Infotech | 53.20 | 58.55 | 5.35 3.00k |

| Nahar Spinning | 269.05 | 293.85 | 24.80 16.41k |

| Poddar Housing | 110.40 | 119.95 | 9.55 1.15k |

| Canarys Automat | 44.00 | 47.65 | 3.65 - |

| Ameya Precision | 51.00 | 55.00 | 4.00 0 |

| IRB Infra | 33.90 | 36.10 | 2.20 3.37m |

| Sagardeep Alloy | 24.20 | 25.70 | 1.50 3.09k |

| Sanginita Chemi | 24.00 | 25.35 | 1.35 9.86k |

| Inspirisys Solu | 71.30 | 75.10 | 3.80 5.46k |

| Orient Cement | 202.50 | 212.90 | 10.40 312.67k |