Wipro, India's fourth largest IT services firm, is likely to report a subdued quarter (Q2 FY23-24) on October 18. A sequential revenue decline is likely on account of delays in conversion of deals. However, profits are expected to rise, thanks to the manufacturing vertical.

The IT major’s operating margins are likely to remain stable because of its cost-optimisation measures, such as deferring wage hikes by a quarter.

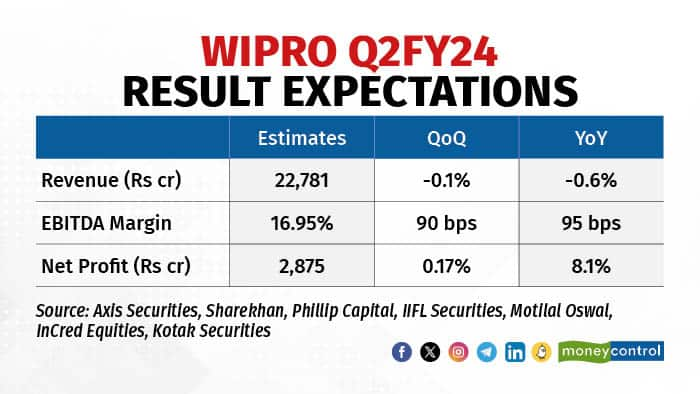

Revenues to be hitSequentially, Wipro’s revenue in rupee terms is estimated to decline marginally, by around 0.1 percent. Year-on-year (YoY), revenue is forecast to dip 0.6 percent to Rs 22,781 crore, according to the average estimate of seven brokerages. “Wipro's revenue will be impacted by weakness in the BFSI and hi-tech verticals, and weakness in its consulting business,” said Phillip Capital.

Motilal Oswal, a brokerage, said the decline may be attributed to the growing intensity of adverse macroeconomic conditions, leading to demand softness in verticals beyond BFSI and consumer. The consulting business is expected to be weak owing to the cut in discretionary spends and reprioritisation of projects.

In constant currency (CC) terms, Wipro’s revenue is expected to decline 0.8 percent quarter-on-quarter (QoQ), at the lower end of the company’s guided range of 1 to 2 percent.

Also Read: Jubilant Foodworks Q2 PAT may dip 29% YoY to Rs 84.7 cr: Nirmal BangMargins to remain stableThe Bengaluru-headquartered company’s earnings before interest and tax (EBIT) margin is likely to expand by 90 basis points (bps) QoQ to 16.95 percent, aided by operational efficiencies, productivity improvement, and lack of one-off losses on IT products. "Tailwinds to margins include improved utilisation and management of fixed costs, and greater use of automation,” said Nirmal Bang Equities in its report.

Unlike its peers, since Wipro did not announce any large deals in the July-September period, brokerages expect muted TCV ( total contract value) and ACV (annual contract value) numbers. “The larger issue for Wipro is the conversion of TCV to revenue, which seems to be more acute than its peers,” said Nirmal Bang.

Wipro’s net profit is rising sequentially and YoY due to momentum in the manufacturing vertical. Profit after tax (PAT) is estimated to grow 8.1 percent YoY to Rs 2,875 crore, per the average estimate of seven brokerages. Analysts expect the growth pullback to continue in the mortgage business under the BFSI vertical.

Also Read | IndusInd Bank Q2 profit may rise 14% YoY on stable asset quality; muted margin trend on cards: Analysts

Key monitorablesWipro's deal TCV and deal pipeline will be among the key monitorables, along with the pricing and outlook on new deals. Management commentary in regard to the demand outlook of the company's consulting and mortgage businesses will be scrutinised. Wipro's situation in cost takeout deals will also be keenly watched.

"We will watch out for large deal wins, commentary around the deal pipeline and demand, 3QFY23-24 guidance, and margins levers," said IIFL Securities in its report. According to the brokerages, Wipro's outlook for discretionary spending will be in focus, given its exposure to consulting. Comments on recent senior management exits will also be watched.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.