Closing Bell: Sensex rises 847 pts, Nifty at 21,900 led by IT, realty, oil & gas

-330

January 12, 2024· 16:30 IST

Benchmark indices ended at record levels and extended the winning streak for the fourth consecutive session on January 12 with Nifty around 21,900 led by Information Technology stocks. At close, the Sensex was up 847.27 points or 1.18 percent at 72,568.45, and the Nifty was up 247.30 points or 1.14 percent at 21,894.50.

We wrap up today's edition of the Moneycontrol live market blog, and will be back on Monday morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

January 12, 2024· 16:29 IST

-330

January 12, 2024· 16:28 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

A sharp rally in IT stocks coupled with rupee slipping below 83-mark propelled benchmark indices to fresh highs even as both software heavyweights TCS and Infosys reported muted Q3 earnings. The earnings were mostly in line with expectations considering weak IT spending by major global clients in view of challenging macro headwinds. Investors are hoping that likely rate cuts by the Fed later this year would improve the scenario for the IT sector, which will enable big clients to increase spending on IT sourcing.

-330

January 12, 2024· 16:20 IST

Jateen Trivedi, VP Research Analyst, LKP Securities:

Rupee kept positive moves after the US CPI data which came in higher at 3.4% against 3.1%, this higher data did not override the interest rate reduction hype from March 24' from FED. As the over all trend of inflation is still weak in recent months. FED can be expected to be moving towards no hike in upcoming policy and projection of cuts can be seen in statement provided the data does not go higher in coming months for CPI in US.

RBI still seems to be in much control of rupee as 83.30-83.40 has been held by rupee and intervention is visible at lower levels on rupee. The short term trend in rupee is now positive as we are now above 82.95 after almost 4 months after Sep 23'. Going ahead rupee can be seen in range 82.70-83.15.

-330

January 12, 2024· 16:15 IST

Shrey Jain, Founder and CEO SAS Online:

Propelled by a surge in IT stocks, major indices achieved unprecedented highs today, as both Sensex and Nifty surpassed their previous all-time peaks. Sensex demonstrated a robust rally, climbing over 800 points to reach a new pinnacle of 72,720, while Nifty breached the 21,900 level for the first time, concluding the day at 21,894.55. The Nifty IT index reached a new 52-week high driven by in-line results from IT majors, posting an impressive gain of over 5 percent during intra-day trade.

The key question is whether the thrilling stock market surge will persist. Looking ahead, data suggests that Nifty might exceed 22,000 as early as Monday. The market is backed by a steady inflow of funds into mutual funds and active buying from local investors. The ongoing earnings season for the December quarter is anticipated to be a decisive factor in shaping the market's performance in the coming days.

-330

January 12, 2024· 16:06 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Market ended a 2-week long consolidation phase on Friday and gained over a percent. Buoyancy in the IT heavyweights triggered a firm start, which further strengthened with buying in heavyweights across sectors. Consequently, the Nifty index settled around the day’s high at 21,894.55; up by 1.14%. Apart from the IT pack, realty and PSU also posted decent gains while auto and pharma traded subdued. Amid all, the broader indices underperformed the benchmark but still managed to end with modest gains.

We are now eyeing 22,150 in Nifty however selective participation from banking could keep the momentum in check. We suggest focusing on other key sectors and using any pause or dip to accumulate quality names. Needless to say, the volatility would remain high due to earnings and mixed global cues so plan the overnight trades accordingly.

-330

January 12, 2024· 15:58 IST

Aditya Gaggar, Director of Progressive Shares

Benchmark Index (Nifty) has not only ended the week at record levels but also given a bullish Flag and Pole Formation breakout on the daily chart which indicates an extension of the current underlying uptrend. As per the pattern, the target is 22,330. In Bank Nifty, a strong close above 48,250 is much needed to resume its bull run, and in the case of a breakout, the target comes to 49,000 (IDFC First Bank- On the verge of a triangle breakout, SBIN- completed pullback).

From the Auto sector, we continue to remain bullish on Hero MotoCorp; however, several pockets are also strong but with an extremely overbought condition (Bajaj Auto and TVS Motors); buy on dips would be an ideal strategy.

Consolidation of almost 2 years in Energy giant Reliance comes to an end with a Cup and Handle Formation breakout. Going forward, we expect that the stock will lead the sector as well as the Index rally.

Not only the IT sector but almost all its components have also given a breakout from the bullish Flag and Pole Formation which suggests a continuation of the underlying uptrend.

With a hidden bullish divergence in RSI, a strong reversal can be anticipated in the PSU Banking space. We have a technical coverage on Bank of India & Union Bank of India and will stick with the same. Looking at the chart, it's better to cash in some profits from the Realty stocks as they are in an extremely overbought territory.

-330

January 12, 2024· 15:53 IST

Vinod Nair, Head of Research, Geojit Financial Services:

Indian markets soared to new heights in a powerful rally, driven by IT heavyweights. Green shoots of recovery in the IT sector on the back of an improved outlook for BFSI in FY25 positively influenced market sentiments. The robust performance of PSU banking stocks is underscored by the inherent synergy between their loan portfolios and the prevailing business cycle. Noteworthy is the fact that this upward surge remained resilient amid mixed global cues on account of higher-than-expected US inflation and positive job data, which tempered expectations for an imminent rate cut by the US Fed.

-330

January 12, 2024· 15:49 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap up and traded with a positive bias throughout the day to close with gains of ~260 points. On the Daily charts, we can observe that the Nifty has decisively broken out of the 21500 – 21850 range on the upside. The breakout suggests a resumption of trending moves on the upside. We expect the Nifty to target levels of 22000 immediately and above that 22300. On the downside, the zone of 21750 – 21700 shall act as an immediate support as per the role reversal principle.

Bank Nifty started to form higher tops and higher bottoms on the daily charts indicating trend reversal from down to up. We expect the positive momentum to continue till 48000 on an immediate basis and above that it can extend till 48500

-330

January 12, 2024· 15:46 IST

Kunal Shah, Senior Technical & Derivative Analyst, LKP Securities:

The Nifty index exhibited significant strength, securing a notable breakout on the daily chart as it surpassed the key resistance level of 21,800. This bullish move positions the index for potential short-term targets of 22,000 and 22,200. Traders are advised to consider buying opportunities on any dips toward the support level. The momentum indicator RSI has also provided a buy crossover, further confirming the bullish sentiment in the market.

The Bank Nifty index displayed strength by overcoming the initial hurdle at 47,500, signaling potential upward movement towards the next resistance level at 48,000. A decisive breach of 48,000 is crucial, as it could trigger substantial short covering, propelling the index towards the 50,000 mark. The lower support is evident at 47,000, a level marked by significant put writing.

-330

January 12, 2024· 15:43 IST

Wipro Q3 Results:

IT Services rupee revenue down 1.1 percent at Rs 22,151 crore against Rs 22,395.8 crore, QoQ

The IT Services EBIT at Rs 3,542.6 crore and EBIT Margin at 16%.

-330

January 12, 2024· 15:41 IST

MARKET THIS WEEK

Market regains losses of last week, led by big surge in IT

Nifty IT gains the most amongst indices followed by Realty & Infra

Sensex & Nifty up nearly 1% each while Nifty Bank falls 1%

-330

January 12, 2024· 15:33 IST

Rupee Close:

Indian rupee ended higher by 11 paise at 82.92 per dollar on Friday against Thursday's close of 83.03.

-330

January 12, 2024· 15:30 IST

Market Close

: Benchmark indices ended at record levels and extended the winning streak for the fourth consecutive session on January 12 with Nifty around 21,900 led by Information Technology stocks.

At close, the Sensex was up 847.27 points or 1.18 percent at 72,568.45, and the Nifty was up 247.30 points or 1.14 percent at 21,894.50. About 1940 shares advanced, 1323 shares declined, and 67 shares unchanged.

Biggest gainers on the Nifty included Infosys, ONGC, Tech Mahindra, LTIMindtree and TCS, while losers were Cipla, Apollo Hospitals, Power Grid Corporation, UltraTech Cement and Bajaj Finserv.

Among sectors, except auto, power and healthcare, all other sectoral indices ended in the green with IT index rose 5 percent, realty and oil & gas indices up 2 percent each.

BSE midcap and smallcap indices up 0.4 percent each.

-330

January 12, 2024· 15:25 IST

Stock Market LIVE Updates HCLTech Q3 profit seen growing 6% QoQ driven by Verizon deal, ASAP acquisition; stock hits 52-week high

HCLTech is likely to report better earnings performance than peers, growing both fiscal third quarter revenue and net profit in mid-single digits from the previous quarter.

According to a Moneycontrol poll of six analysts, HCLTech is expected to report a sequential revenue growth of 4.18 percent in the October-December quarter to Rs 27,787 crore, helped by $50-million incremental revenue from the Verizon deal, and additional income from Germany’s ASAP post-acquisition.

Net profit for Q3FY24 is expected to grow 6.03 percent quarter-on-quarter to Rs 4,063 crore, riding on the back of revenue growth. HCLTech’s earnings before interest and taxes (EBIT) is expected to rise 5.47 percent sequentially to Rs 5,204 crore, and EBIT margin to improve 13 basis points. Read More

-330

January 12, 2024· 15:22 IST

Stock Market LIVE Updates | Wipro share price gained 4 percent ahead of December quarter earnings today:

-330

January 12, 2024· 15:21 IST

Stock Market LIVE Updates | Morgan Stanley View On HDFC Asset Management Company

-Equal-weight call, target raised to Rs 3,000 per share

-Trim FY24 & FY25 EPS, driven by a higher tax rate

-Sustained growth in SIP flows and strong markets drive higher AUM forecasts and offsets lower equity yields

-Raise P/E target price to reflect near-term momentum & sentiment

-Remain equal-weight given structural pressure on equity yields

-330

January 12, 2024· 15:19 IST

-330

January 12, 2024· 15:16 IST

Sensex Today | BSE Smallcap index up 0.5 percnet led by Ashiana Housing, Accelya Solutions India, Hardwyn India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ashiana Housing | 308.85 | 13.82 | 180.59k |

| Accelya | 1,740.00 | 11.46 | 55.48k |

| Hardwyn | 47.90 | 11.27 | 446.15k |

| Avanti Feeds | 545.00 | 11.25 | 810.29k |

| Zuari Agro Chem | 230.40 | 10.93 | 342.43k |

| Firstsource Sol | 209.75 | 10.42 | 2.03m |

| DB Realty | 222.50 | 9.99 | 434.85k |

| Sanghi Ind | 142.80 | 9.97 | 192.41k |

| Coffee Day | 66.55 | 9.28 | 1.19m |

| Infibeam Avenue | 26.38 | 8.96 | 35.78m |

-330

January 12, 2024· 15:13 IST

Stock Market LIVE Updates | Jefferies View On Macrotech Developers:

-Buy call, target Rs 1,290 per share

-Opening of Mumbai Trans Harbor Link is the first mega project start

-Trans Harbor link is a USD 70 billion+ infra upgrade boosting connectivity in Mumbai

-Lodha's large 4,300+ acre land bank in city outskirts are well-placed to benefit

-Land prices have doubled in 3 years, but there is potential upside long-term

-Affordable housing policy boost to residential sales is also likely soon

-330

January 12, 2024· 15:10 IST

Stock Market LIVE Updates | CLSA View On Oil & Gas Cos

-Downgrade Petronet to underperform from buy, target Rs 240 per share

-Downgrade GSPL to outperform from buy, target raised to Rs 360 per share

-Buy call on ONGC, target raised to Rs 240 per share

-Buy call on Oil India, target raised to Rs 435 per share

-IGL & MGL top bets in city gas cos

-Recently downgraded HCLP, BPCL, IOC to sell & downgraded Gail to underperform

-A tight crude market, but refining & LNG appear oversupplied

-Oil marketing margins to normalise; project completions & EV transition in focus

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ONGC | 223.50 | 5.55 | 1.28m |

| GAIL | 162.60 | 2.26 | 1.60m |

| IOC | 135.50 | 1.69 | 1.89m |

| HINDPETRO | 450.40 | 1.15 | 320.29k |

| Reliance | 2,739.20 | 0.77 | 529.08k |

| IGL | 428.15 | 0.73 | 42.13k |

| Linde India | 5,549.50 | 0.29 | 1.04k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Petronet LNG | 229.35 | -0.41 | 68.70k |

| Adani Total Gas | 1,059.00 | -0.27 | 47.43k |

| Linde India | 5,532.00 | -0.03 | 990 |

-330

January 12, 2024· 15:05 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee gained for the seventh consecutive day today on strong domestic markets and a weak US Dollar. Domestic markets touched fresh all-time highs today which could lead to fresh FII inflows. However, the surge in crude oil prices amid the escalation of tensions in the Middle East capped sharp gains. WTI crude oil prices are up nearly 2.5%. The US Dollar declined as markets are still pricing in six rate cuts in 2024 despite an uptick in inflation. US CPI and core rose to 3.4% and 3.9% in December 2023 vs forecast of 3.2% and 3.8% respectively.

We expect Rupee to trade with a slight positive bias on soft US dollars and positive markets. Fresh inflows from foreign investors may also support the Rupee. However, a rise in global crude oil prices may cap sharp gains. Traders may remain cautious ahead of inflation and IIP data from India today. USDINR spot price is expected to trade in a range of Rs 82.55 to Rs 83.20.

-330

January 12, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was up 945.51 points or 1.32 percent at 72,666.69, and the Nifty was up 266.90 points or 1.23 percent at 21,914.10. About 1848 shares advanced, 1413 shares declined, and 61 shares unchanged.

-330

January 12, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Bharat Bijlee | 5,221.30 | 4,755.30 | -466.00 80.77k |

| Mega Flex | 45.95 | 43.00 | -2.95 3.00k |

| VLEGOV | 73.80 | 70.30 | -3.50 121.61k |

| Vaidya Sane | 226.30 | 217.50 | -8.80 934 |

| Globe Internati | 52.00 | 50.05 | -1.95 3.30k |

| Shreeoswal Seed | 54.30 | 52.50 | -1.80 64.68k |

| Shah Alloys | 91.65 | 88.70 | -2.95 47.80k |

| GP Petroleums | 59.75 | 58.05 | -1.70 20.41k |

| Aurangabad Dist | 311.95 | 303.30 | -8.65 400 |

| GE T&D India | 642.75 | 625.00 | -17.75 - |

-330

January 12, 2024· 14:58 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Service Care | 58.20 | 67.00 | 8.80 10.80k |

| Manomay Tex Ind | 166.90 | 191.00 | 24.10 5.28k |

| Perfect Infra | 35.15 | 38.65 | 3.50 28.95k |

| Mitcon Cons | 99.95 | 106.70 | 6.75 19.68k |

| Sampann Utpadan | 22.60 | 24.00 | 1.40 10.95k |

| Navkar Corp | 114.65 | 121.50 | 6.85 409.00k |

| INFOLLION | 245.50 | 260.00 | 14.50 4.22k |

| Lorenzini Appar | 252.00 | 266.50 | 14.50 4.01k |

| Marvel Decor Lt | 92.00 | 97.00 | 5.00 9.08k |

| Latteys Industr | 23.85 | 25.00 | 1.15 182.66k |

-330

January 12, 2024· 14:55 IST

Stock Market LIVE Updates | HSBC View On HDFC AMC

-Hold call, target raised to Rs 3,410 per share

-Healthy operating performance in Q3FY24

-Q3 performance was supported by mkt share gains and strong ind tailwinds

-Income yields over FY25-26 remain under pressure

-EPS growth is likely to be slower than AUM growth

-Expect EPS CAGR of 9 percent and average RoE of 28 percent over FY25/26

-330

January 12, 2024· 14:48 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18692.35 -0.33 | 0.40 1.55 | 5.45 46.38 |

| NIFTY IT | 36531.50 5.17 | 2.86 4.82 | 9.07 27.20 |

| NIFTY PHARMA | 17362.60 -0.1 | 3.15 0.02 | 8.76 37.02 |

| NIFTY FMCG | 56496.10 0.48 | -0.86 -2.03 | 4.94 28.50 |

| NIFTY PSU BANK | 5877.85 3.05 | 2.88 0.67 | 5.81 39.18 |

| NIFTY METAL | 7916.10 0.51 | -0.78 0.56 | 6.08 16.69 |

| NIFTY REALTY | 881.20 1.82 | 12.53 4.36 | 20.39 107.27 |

| NIFTY ENERGY | 34968.05 0.55 | 4.48 2.20 | 10.65 36.06 |

| NIFTY INFRA | 7559.55 0.76 | 3.51 2.19 | 8.88 44.97 |

| NIFTY MEDIA | 2454.60 -0.3 | 2.78 -0.54 | 0.56 25.20 |

-330

January 12, 2024· 14:41 IST

-330

January 12, 2024· 14:35 IST

Stock Market LIVE Updates | HDFC Life 3Q net profit at Rs 365 crore, net premium income Rs 15240 crore

-330

January 12, 2024· 14:30 IST

-330

January 12, 2024· 14:25 IST

Stock Market LIVE Updates | Indian rupee hit 82.89 a dollar, its higest level since September 2023, up 0.2 percent from previous close

-330

January 12, 2024· 14:20 IST

Stock Market LIVE Updates | Macrotech Developers soars 6% on Jefferies 'buy' call, higher target

Shares of Lodha, listed as Macrotech Developers, soared around 6 percent on January 12 after Jefferies assigned a “buy” rating to the stock, citing a positive outlook for sales of residential projects.

Land prices have doubled in three years. However, there is potential upside in the long term, the brokerage said, as it revised the target price to Rs 1,290 from Rs 884.

According to analysts at Jefferies, the opening of the Mumbai Trans Harbour Link would boost connectivity in the city Mumbai and will be good for Macrotech Developers. Read More

-330

January 12, 2024· 14:17 IST

Sensex Today | BSE Healthcare index down 0.6 percent dragged by Metropolis Healthcare, Aarti Pharmalabs, Medicamen Biotech:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Metropolis | 1,497.00 | -6.72 | 30.95k |

| AARTIPHARM | 534.10 | -3.33 | 17.25k |

| Medicamen Bio | 558.05 | -2.62 | 3.92k |

| Global Health | 1,019.95 | -2.57 | 16.75k |

| Sasta Sundar | 423.25 | -1.93 | 948 |

| Dr Lal PathLab | 2,455.50 | -1.93 | 4.84k |

| Sigachi Ind | 67.00 | -1.92 | 249.26k |

| Vimta Labs | 451.85 | -1.88 | 3.89k |

| Unichem Labs | 462.15 | -1.8 | 5.84k |

| Gufic Bio | 348.25 | -1.71 | 9.28k |

-330

January 12, 2024· 14:13 IST

Stock Market LIVE Updates | Cyient enters into MoU with Japanese firm SkyDrive Inc

Cyient has entered into a memorandum of understanding with SkyDrive Inc., a leading Japanese eVTOL aircraft manufacturer.

As per the MoU, both companies have agreed to work in partnership across product development, engineering, manufacturing, and digital services.

-330

January 12, 2024· 14:10 IST

Stock Market LIVE Updates | Elara Capital View on Infosys:

The company's Q3 results reflect: 1) persistent revenue leakage; 2) weak discretionary demand and 2) disparity between deal wins and revenue growth.

Broking house find no green-shoots in management commentary regarding revenue growth outlook and assess limited room to utilize traditional margin levers (utilization at 82.7%).

With two quarters of revenue decline in H2FY24 (revised guidance implies a 0.7% QoQ revenue dip in Q4E at mid-point), the company has had a very weak start to FY25.

Elara Capital estimate 3.4% YoY CC revenue growth and 5.1% EPS growth for FY25E and mildly raise company’s FY25E EPS ~1% and nudge Target Price to Rs 1,260 from Rs 1,210 on unchanged 18.5x Dec-25E P/E (five-year average with adjusted standard deviation of 4.8).

-330

January 12, 2024· 14:05 IST

Stock Market LIVE Updates | Kolte Patil Q3 Operational Update:x

-330

January 12, 2024· 13:57 IST

| Company | Price at 13:00 | Price at 13:18 | Chg(%) Hourly Vol |

|---|---|---|---|

| Intl Travel | 727.00 | 636.05 | -90.95 6.33k |

| Suryavanshi Spg | 30.00 | 28.26 | -1.74 616 |

| Nakoda Group | 62.60 | 59.95 | -2.65 29.71k |

| SPML Infra | 110.00 | 106.00 | -4.00 6.69k |

| Arex Industries | 148.00 | 143.00 | -5.00 45 |

| Hind Hardy | 593.90 | 575.00 | -18.90 26 |

| Rasandik Engg | 120.65 | 117.00 | -3.65 144 |

| Bombay Cycle | 1,555.00 | 1,510.00 | -45.00 30 |

| Sri Nachammai | 34.99 | 34.00 | -0.99 193 |

| KJMC Fin Ser | 49.90 | 48.50 | -1.40 124 |

-330

January 12, 2024· 13:56 IST

| Company | Price at 13:00 | Price at 13:18 | Chg(%) Hourly Vol |

|---|---|---|---|

| Preeti Sec | 22.51 | 24.68 | 2.17 1.10k |

| Jayshree Tea | 113.30 | 120.50 | 7.20 705 |

| Gujarat Natural | 21.25 | 22.34 | 1.09 3.46k |

| Bemco Hydraulic | 898.00 | 935.50 | 37.50 64 |

| Amal | 377.30 | 393.00 | 15.70 1.58k |

| Kwality Pharmac | 444.00 | 462.00 | 18.00 7.39k |

| Yarn Syndicate | 29.01 | 30.13 | 1.12 4.23k |

| Jay Ushin | 727.00 | 754.95 | 27.95 56 |

| Lords Ishwar | 19.50 | 20.23 | 0.73 349 |

| VEDAVAAG System | 56.80 | 58.85 | 2.05 13.48k |

-330

January 12, 2024· 13:54 IST

Sensex Today | Oil prices rise 2% after US, Britain strike Houthi targets

Oil prices rose 2% on Friday as the United States and Britain carried out air and sea strikes on Houthi military targets in Yemen in response to attacks by the Iran-backed group on shipping in the Red Sea.

The attack added to market concerns about the potential impact a broader conflict in the Middle East would have on oil supplies from the region, especially those moving through the critical Straits of Hormuz.

-330

January 12, 2024· 13:51 IST

Sensex Today | BSE Bank index up nearly 1 percent led by Bank of Baroda, SBI, ICICI Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Baroda | 231.50 | 2.41 | 874.40k |

| SBI | 631.45 | 1.8 | 633.11k |

| ICICI Bank | 1,004.50 | 1.37 | 259.90k |

| IDFC First Bank | 87.60 | 1.13 | 1.87m |

| IndusInd Bank | 1,672.40 | 0.86 | 66.59k |

| AU Small Financ | 782.80 | 0.81 | 18.97k |

| Kotak Mahindra | 1,834.50 | 0.7 | 68.67k |

| Federal Bank | 151.15 | 0.57 | 140.86k |

-330

January 12, 2024· 13:47 IST

ALERT | Sensex, Nifty at fresh record high

-330

January 12, 2024· 13:46 IST

Sensex Today | Gold gains as Middle East tensions lift safe-haven appeal

Gold prices rose on Friday as international strikes on Yemen added to fears of further escalation in the Middle East conflict, pushing up bullion's safe-haven appeal.

Spot gold was up 0.3% at $2,034.84 per ounce, as of 0701 GMT. However, it has fallen 0.5% so far this week.

U.S. gold futures rose 1% to $2,039.10.

-330

January 12, 2024· 13:43 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 18689.50 -0.35 | 0.38 1.54 | 5.43 46.36 |

| NIFTY IT | 36445.70 4.92 | 2.62 4.57 | 8.81 26.90 |

| NIFTY PHARMA | 17349.35 -0.18 | 3.07 -0.05 | 8.68 36.92 |

| NIFTY FMCG | 56446.65 0.39 | -0.95 -2.12 | 4.85 28.39 |

| NIFTY PSU BANK | 5880.95 3.1 | 2.93 0.73 | 5.87 39.26 |

| NIFTY METAL | 7929.95 0.68 | -0.60 0.74 | 6.26 16.90 |

| NIFTY REALTY | 880.15 1.7 | 12.40 4.24 | 20.25 107.02 |

| NIFTY ENERGY | 34964.20 0.54 | 4.47 2.19 | 10.63 36.05 |

| NIFTY INFRA | 7546.50 0.59 | 3.33 2.01 | 8.69 44.72 |

| NIFTY MEDIA | 2464.20 0.09 | 3.18 -0.15 | 0.95 25.69 |

-330

January 12, 2024· 13:41 IST

Stock Market LIVE Updates | HSBC View On Infosys & TCS

-Hold TCS, target Rs 3,630 per share

-Buy Infosys, target Rs 1,620 per share

-Q3 season started with a bit of positivity as TCS & Infosys both reported decent deal wins

-TCS outperformed on margins, while Infosys was in-line with expectations

-Demand commentaries were noncommittal for both TCS & Infosys

-330

January 12, 2024· 13:34 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| ONGC | 221.60 | 222.00 212.35 | 4.36% |

| Infosys | 1,609.10 | 1,615.60 1,555.40 | 3.45% |

| LTIMindtree | 6,214.90 | 6,230.00 6,015.00 | 3.32% |

| Hero Motocorp | 4,382.40 | 4,383.60 4,242.65 | 3.29% |

| Tech Mahindra | 1,302.90 | 1,308.90 1,267.00 | 2.83% |

| Wipro | 465.85 | 469.00 455.00 | 2.38% |

| TATA Cons. Prod | 1,145.80 | 1,161.75 1,123.85 | 1.95% |

| Bharti Airtel | 1,071.75 | 1,072.85 1,051.60 | 1.92% |

| TCS | 3,893.30 | 3,905.25 3,821.60 | 1.88% |

| HCL Tech | 1,526.05 | 1,537.90 1,498.50 | 1.84% |

-330

January 12, 2024· 13:29 IST

Stock Market LIVE Updates | Nomura View On Infosys

-Neutral call, target Rs 1,500 per share

-Q3 showed good execution & net new deal wins

-No signs of discretionary demand revival

-Strong execution in Q3FY24, tightens FY24 revenue growth guidance band

-Project maximus bears fruit on the margins front

-Tweak FY24-26 EPS by less than 1 percent

-330

January 12, 2024· 13:26 IST

Sensex Today | Alkem Laboratories appoints Nitin Agrawal as Chief Financial Officer

The Board of Directors of Alkem Laboratories at its meeting held today has appointed Mr. Nitin Agrawal as the Chief Financial Officer of the Company w.e.f. 01st February, 2024.

-330

January 12, 2024· 13:22 IST

Sensex Today | BSE Oil & Gas index up 1 percent led by ONGC, GAIL, Indraprastha Gas:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ONGC | 221.35 | 4.53 | 1.03m |

| GAIL | 163.25 | 2.67 | 1.43m |

| IGL | 429.40 | 1.02 | 35.92k |

| Reliance | 2,737.75 | 0.71 | 284.03k |

| IOC | 133.65 | 0.3 | 1.03m |

| Linde India | 5,547.00 | 0.24 | 915 |

| Adani Total Gas | 1,061.95 | 0.01 | 39.16k |

-330

January 12, 2024· 13:16 IST

Stock Market LIVE Updates | GHCL signed two MOUs, at the Vibrant Gujarat Summit, for investing Rs 3450 crores in Gujarat.

-330

January 12, 2024· 13:13 IST

Stock Market LIVE Updates | KPI Green Energy hits new high on fresh order, stock up 250% in a year

Shares of KPI Green Energy jumped more than 3 percent to a fresh 52-week high after its arm, KPIG Energia Pvt Ltd, received an order for a solar power projects.

Sanwariya Processors Pvt Ltd has asked KPIG Energia to build 2 MW solar power projects, which are to be completed by FY25, in various tranches as per the terms of the order. Read More

-330

January 12, 2024· 13:10 IST

Stock Market LIVE Updates | M&M approves investment up to Rs 630 crore in Mahindra Electric Automobile via rights issue

Mahindra and Mahindra has approved investment up to Rs 630 crore in Mahindra Electric Automobile (MEAL) via rights issue. The proceeds will be utilised by MEAL to meet its fund requirement for business operations.

-330

January 12, 2024· 13:07 IST

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| DB Realty | 561671.00 | 222.65 9.98 | 10253543 2087265.70 |

| Sanghi Ind | 464177.00 | 142.90 9.97 | 3649313 - |

| Century Extr | 324543.00 | 24.45 9.89 | 1149244 598527.55 |

| FCS Software | 5855984.00 | 4.85 8.99 | 31775540 25676929.50 |

| Impex FerroTech | 248470.00 | 5.25 5 | 94953 - |

| Kamat Hotels | 148079.00 | 300.00 4.99 | 453725 68539.15 |

| Magnum Ventures | 43664.00 | 64.40 4.97 | 417495 - |

| Infomedia Press | 76940.00 | 7.40 4.96 | 1695 - |

| Omaxe | 886968.00 | 96.35 4.96 | 1256233 437182.65 |

| Art Nirman | 13999.00 | 80.75 4.94 | 11005 33597.65 |

-330

January 12, 2024· 13:02 IST

Sensex Today | Market at 1 PM

The Sensex was up 771.90 points or 1.08 percent at 72,493.08, and the Nifty was up 206.20 points or 0.95 percent at 21,853.40. About 1918 shares advanced, 1300 shares declined, and 63 shares unchanged.

-330

January 12, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| KRISHCA | 256.00 | 244.80 | -11.20 10.40k |

| Marvel Decor Lt | 95.95 | 92.05 | -3.90 1000 |

| SPML Infra | 114.00 | 110.00 | -4.00 33.87k |

| Madhya Pradesh | 41.35 | 40.00 | -1.35 0 |

| Shigan Quantum | 151.00 | 146.35 | -4.65 8.82k |

| Hubtown | 83.85 | 81.30 | -2.55 8.49k |

| Fidel Softech | 140.20 | 136.00 | -4.20 2.57k |

| Navkar Corp | 117.15 | 113.70 | -3.45 159.02k |

| Shera Energy | 185.00 | 180.20 | -4.80 12.27k |

| NDL Ventures | 147.95 | 144.15 | -3.80 712 |

-330

January 12, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| AB Money | 128.80 | 145.85 | 17.05 193.22k |

| Avanti Feeds | 512.15 | 576.45 | 64.30 227.28k |

| Nakoda Group | 56.40 | 62.45 | 6.05 127.11k |

| Apex Frozen | 258.40 | 281.85 | 23.45 128.66k |

| Indian Terrain | 71.50 | 76.95 | 5.45 85.47k |

| Coastal Corp | 328.30 | 351.30 | 23.00 4.32k |

| Mega Flex | 43.00 | 45.95 | 2.95 36.17k |

| Robust Hotels | 161.70 | 171.55 | 9.85 1.65k |

| Shah Alloys | 86.15 | 91.30 | 5.15 780 |

| G-Tec Jainx | 92.70 | 97.60 | 4.90 3.09k |

-330

January 12, 2024· 12:54 IST

-330

January 12, 2024· 12:52 IST

Stock Market LIVE Updates | LIC shares fall on receiving income tax demand notices worth Rs 3,528.75 crore

LIC shares fell one percent in early trade on January 12 as the state-owned insurer received two demand orders worth Rs 3,528.75 crore from the income tax authorities in Mumbai.

For the AY 2012-13, 2013-14, 2014-15, 2016-17, 2017-18, 2018-19 and 2019-20, the Income Tax Department has issued an intimation for a refund of Rs 25,464.46 crore, following an order from Income Tax Appellate Tribunal (ITAT).

The Income Tax Appellate Tribunal (ITAT) had directed the assessing officer to examine LIC’s utilization of surplus, related to an interim bonus mentioned in the assessment order. After reconsideration, the assessing officer disallowed the interim bonus, leading to a tax effect of Rs 2,133.67 crore. Read More

-330

January 12, 2024· 12:47 IST

-330

January 12, 2024· 12:45 IST

Stock Market LIVE Updates | Venus Remedies gets new manufacturing authorisations for Docetaxel & Gemcitabine

Venus Remedies announced the successful receipt of new marketing authorizations for DOCETAXEL in concentrations of 160MG/8ML, 20MG/1 ML and 80MG/4ML(SingleVlal), as well as GEMCITABINE 1G from Malta, Europe.

-330

January 12, 2024· 12:42 IST

Sensex Today | Amit Jeswani, Founder of Stallion Asset:

It's crucial to support minimum 15% growth rates, and currently, we don't observe that in the Information technology space. Consequently, we are keeping our distance. We seek robust growth of 20-25%, and the modest 2%, 3% growth, even if it surpasses estimates by 1%, 0.5%, doesn't align with our investment framework. As a result, we have refrained from tech investments for a while. However, we hold a positive view on companies like Persistent and Coforge.

Having said that, there’s no need to look at companies growing at less than 10-15% as focus is on assembling a high-performance portfolio akin to a cricket team with only 25 players. With a plethora of 5000 listed companies, the approach is selective.

Even established players like Infosys or TCS, though maintaining similar growth rates as pre-COVID levels, currently trade at a substantial 40% valuation premium compared to their pre-pandemic levels. This reinforces our preference for companies with robust growth prospects rather than settling for marginal performers in the market.

-330

January 12, 2024· 12:38 IST

Sensex Today | BSE Realty index up 2 percent supported by Macrotech Developers, Phoenix Mills, Sobha:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Macrotech Dev | 1,192.95 | 5.55 | 56.89k |

| Phoenix Mills | 2,497.00 | 2.13 | 10.56k |

| Sobha | 1,357.10 | 2.09 | 17.60k |

| Brigade Ent | 962.45 | 2.02 | 14.95k |

| Oberoi Realty | 1,572.70 | 1.74 | 16.72k |

| Prestige Estate | 1,397.80 | 1.5 | 11.82k |

| Godrej Prop | 2,278.25 | 1.36 | 12.59k |

| Mahindra Life | 579.10 | 1.36 | 11.06k |

| DLF | 807.20 | 1.24 | 45.10k |

-330

January 12, 2024· 12:34 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Oracle Fin Serv | 4592.00 | 4592.00 | 4,586.00 |

| Union Bank | 131.35 | 131.35 | 130.35 |

| Bank of India | 128.00 | 128.00 | 127.65 |

| Persistent | 7745.00 | 7745.00 | 7,644.60 |

| Nippon | 520.00 | 520.00 | 516.00 |

| L&T Technology | 5540.00 | 5540.00 | 5,508.85 |

| Max Healthcare | 759.90 | 759.90 | 755.85 |

| Oberoi Realty | 1578.80 | 1578.80 | 1,573.15 |

| Godrej Prop | 2286.50 | 2286.50 | 2,278.25 |

| IRCTC | 958.00 | 958.00 | 951.95 |

-330

January 12, 2024· 12:31 IST

Stock Market LIVE Updates | Shalby Academy signs memorandum of understanding with Kaushalya

Shalby Academy, a division of Shalby, signed a memorandum of understanding with Kaushalya, The Skill University of the Government of Gujarat. Shalby Academy will specifically offer certificate, diploma, and post-graduate diploma programs focusing on clinical paramedical and allied health science segments.

-330

January 12, 2024· 12:28 IST

Stock Market LIVE Updates | UltraTech Cement to acquire 26% equity shares in Amplus Ages for Rs 49 crore

UltraTech Cement has entered into Share Subscription and Shareholders Agreement to acquire 26% equity shares of Amplus Ages for Rs 49 crore. Amplus Ages is engaged in generation and transmission of renewable energy. The acquisition is for the purposes of meeting the company’s green energy needs, optimising energy cost and comply with regulatory requirements for captive power consumption under electricity laws.

-330

January 12, 2024· 12:23 IST

Sensex Today | Prashanth Tapse, Senior VP (Research), Mehta Equities:

Better than expected earnings from frontline IT firms have boosted investors’ confidence, triggering an upsurge in Infosys, TCS and software stocks. Despite a seasonally weak quarter exacerbated by global macroeconomic headwinds, Indian IT majors reported neutral to better earnings in their Q3 earnings. Comparatively, TCS performed well across various metrics, while Infosys did some adjustment in their future guidance. Post the results we continue to remain optimistic on the sector for the long term.

-330

January 12, 2024· 12:19 IST

Stock Market LIVE Updates | Bernstein View On Infosys

-Outperform call, target Rs 1,740 per share

-This quarter was less about results but the set up for FY25

-Came out positive on a revenue beat, in-line margins & large deals

-While guidance was narrowed (1.5-2 percent YoY)

-See growth acceleration in FY25 (Easing Comps) as macro recovers

-Expect Q3 to be close to bottom

-330

January 12, 2024· 12:12 IST

Stock Market LIVE Updates | RPSG Ventures board to consider raising of funds on January 17

RPSG Ventures said the board of directors will meet on January 17 to consider the proposal for raising of funds via issue of one or more instruments/ securities and determination of issue price thereof.

-330

January 12, 2024· 12:08 IST

Stock Market LIVE Updates | Prashant Utreja resigns as Chief Executive Officer of Reliance Home Finance

Prashant Utreja has ceased to be the Chief Executive Officer and key managerial personnel of Reliance Home Finance as he resigned with effect from January 11.

-330

January 12, 2024· 12:02 IST

Sensex Today | Market at 12 PM

The Sensex was up 642.55 points or 0.90 percent at 72,363.73, and the Nifty was up 175.80 points or 0.81 percent at 21,823. About 1914 shares advanced, 1281 shares declined, and 59 shares unchanged.

-330

January 12, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kore Digital | 788.90 | 740.00 | -48.90 3.96k |

| Regency Ceramic | 45.90 | 43.70 | -2.20 1.94k |

| Nandani Creatio | 70.85 | 67.50 | -3.35 6.65k |

| Mega Flex | 45.00 | 43.00 | -2.00 8.09k |

| Latteys Industr | 25.30 | 24.20 | -1.10 630.39k |

| Indo Tech Trans | 850.40 | 814.90 | -35.50 31.04k |

| Auro Impex | 102.00 | 98.00 | -4.00 21.56k |

| INFOLLION | 247.70 | 238.00 | -9.70 13.14k |

| Sahana Systems | 968.00 | 934.90 | -33.10 5.96k |

| Shradha Infra | 73.00 | 70.55 | -2.45 13.38k |

-330

January 12, 2024· 11:58 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| TPL Plastech | 53.95 | 59.70 | 5.75 64.06k |

| Ester Ind | 97.30 | 106.00 | 8.70 25.93k |

| Madhav Copper | 41.50 | 44.95 | 3.45 45.37k |

| Ashiana Housing | 294.20 | 317.80 | 23.60 429.41k |

| Lloyds Luxuries | 92.20 | 97.50 | 5.30 0 |

| Uma Converter | 34.00 | 35.90 | 1.90 19.47k |

| BLAL | 209.95 | 221.50 | 11.55 41.16k |

| eClerx Services | 2,663.95 | 2,801.85 | 137.90 48.10k |

| Zodiac Clothing | 135.45 | 142.45 | 7.00 2.21k |

| Kundan Edifice | 223.80 | 234.95 | 11.15 - |

-330

January 12, 2024· 11:56 IST

Stock Market LIVE Updates | Quess Corp signs MoU with Department of Gujarat Technical University

Quess Corp has signed a Memorandum of Understanding (MoU) with the Department of Gujarat Technical University. The focus would be on services of skill assessment, employment enablement, entrepreneurship development program, and technology integration to bridge the skill gap of the employee in line with the industry requirement.

-330

January 12, 2024· 11:47 IST

Sensex Today | BSE Auto index slipped 0.7 percent dragged by Balkrishna Industries, M&M, Sundram Fasteners:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Balkrishna Ind | 2,618.10 | -1.76 | 1.69k |

| Sundram | 1,248.00 | -1.76 | 1.66k |

| M&M | 1,605.25 | -1.51 | 67.57k |

| Tube Investment | 3,841.50 | -1.49 | 1.02k |

| MOTHERSON | 108.60 | -1.14 | 681.12k |

| Eicher Motors | 3,855.15 | -0.83 | 2.35k |

| TVS Motor | 2,070.60 | -0.82 | 290.46k |

| Maruti Suzuki | 9,962.95 | -0.45 | 126.26k |

| Cummins | 2,022.50 | -0.39 | 1.67k |

| Bajaj Auto | 7,271.15 | -0.32 | 13.00k |

-330

January 12, 2024· 11:42 IST

Stock Market LIVE Update | TCS strengthens AI readiness, launches new AI Experience Zone

-330

January 12, 2024· 11:33 IST

Stock Market LIVE Update | IT earnings off to a mixed start, commentary remains cautious

Two of India’s top two IT companies were off to a mixed start in Q3FY24, marked by high seasonal furloughs, fewer work days, and no immediate impact of interest rate cuts. Management, while addressing their respective press conferences, indicated that the global macroeconomic environment is still subdued and discretionary spending is still off the hook. READ MORE

-330

January 12, 2024· 11:21 IST

Stock Market LIVE Updates | Container Corporation Q3 EXIM volumes grow 8.25%

Container Corporation of India recorded total volumes of 11,50,808 TEUs (twenty feet equivalent units), up 6.05% YoY, with EXIM volumes rising 8.25% to 9,02,582 TEUs, while domestic volumes fell 1.25% YoY to 2,48,226 TEUs for the quarter ended December FY24.

-330

January 12, 2024· 11:17 IST

Stock Market LIVE Updates | Jefferies View On TCS

-Hold call, target Rs 4,000 per share

-Q3 earnings were broadly in-line

-However, broad-based weakness continues to prevail

-Deal bookings were soft

-Sharp headcount decline suggest that demand recovery is not yet in sight

-TCS' 70 bps margin expansion was the key positive surprise in Q3

-Expect company to deliver 6.7 percent CAGR in CC revenues & 10 percent EPS CAGR over FY24-26

-330

January 12, 2024· 11:13 IST

-330

January 12, 2024· 11:11 IST

Stock Market LIVE Updates | Jefferies View On Infosys

-Buy call, target Rs 1,740 per share

-Q3 growth and margin beat estimates

-Net new order book of USD 2.2 billion was impressive

-Company’s revised growth guidance of 1.5-2.0 percent YoY

-Continued headcount decline suggests that growth pick-up is unlikely in the near-term

-Raise estimates by up to 2 percent to factor the beat

-Strong deal wins provide comfort on our expectation of 13 percent EPS CAGR over FY24-26

-330

January 12, 2024· 11:03 IST

-330

January 12, 2024· 11:00 IST

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sanblue Corp | 41.95 | 38.02 | -3.93 39 |

| SPS Finquest | 70.90 | 65.43 | -5.47 205 |

| Finkurve Fin | 64.79 | 59.83 | -4.96 646 |

| Precision Elec | 59.53 | 55.00 | -4.53 120 |

| EP Biocompo | 200.60 | 185.50 | -15.10 0 |

| eMudhra | 505.00 | 469.40 | -35.60 3.88k |

| VBC Ferro | 43.00 | 40.33 | -2.67 4 |

| Bervin Invest | 34.10 | 32.00 | -2.10 50 |

| Aarey Drugs | 60.64 | 57.00 | -3.64 8.88k |

| Guj Terce Labs | 36.00 | 33.87 | -2.13 5.08k |

-330

January 12, 2024· 10:58 IST

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kesar Ent | 108.45 | 127.58 | 19.13 950 |

| Rodium Realty | 63.20 | 73.38 | 10.18 1.96k |

| Palred Tech | 183.55 | 208.20 | 24.65 1.18k |

| Jupiter Infomed | 44.89 | 50.20 | 5.31 21.44k |

| MPIL Corp | 882.85 | 975.75 | 92.90 5 |

| Xelpmoc Design | 118.00 | 130.00 | 12.00 4.41k |

| Mishka Exim | 33.01 | 36.21 | 3.20 655 |

| Bombay Cycle | 1,427.70 | 1,564.00 | 136.30 94 |

| AI Champdany | 51.81 | 56.75 | 4.94 110 |

| Infibeam Avenue | 25.04 | 27.33 | 2.29 1.36m |

-330

January 12, 2024· 10:54 IST

Stock Market LIVE Updates | Indian Overseas Bank hikes lending rates by 5-10 bps

Indian Overseas Bank has hiked marginal cost of funds based lending rate on most tenures (barring overnight and three-month) by 5-10 bps, with effect from January 15.

-330

January 12, 2024· 10:51 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Ashapuri Gold | 414916 | 17.45 | 0.72 |

| South Ind Bk | 201118 | 27.38 | 0.55 |

| DB Realty | 61031 | 222.2 | 1.36 |

| Vodafone Idea | 200901 | 16.02 | 0.32 |

| GTL Infra | 405000 | 1.93 | 0.08 |

| South Ind Bk | 210642 | 27.25 | 0.57 |

| GTL Infra | 500007 | 1.93 | 0.1 |

| IRFC | 109770 | 111.95 | 1.23 |

| GTL Infra | 360942 | 1.93 | 0.07 |

| GTL Infra | 500000 | 1.93 | 0.1 |

-330

January 12, 2024· 10:46 IST

Stock Market LIVE Updates | Goldman Sachs View On Zomato

-Buy call, target raised to Rs 160 per share from Rs 130 per share

-Raise FY24-FY30 net income estimate by up to 6 percent

-Forecast a 30 percent FY24-27 adjusted revenue CAGR

-Forecast online grocery & food delivery to be amongst largest TAMs within India internet

-Online grocery & food delivery growing at 29 percent & 20 percent FY24-30 CAGRs, respectively

-View Zomato as well positioned across both

-330

January 12, 2024· 10:42 IST

Sensex Today | BSE Auto index down 0.5 percent dragged by M&M, Balkrishna Industries, Tube Investments of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tube Investment | 3,835.45 | -1.64 | 754 |

| M&M | 1,605.85 | -1.47 | 44.86k |

| Balkrishna Ind | 2,628.65 | -1.36 | 921 |

| MOTHERSON | 108.60 | -1.14 | 498.42k |

| Sundram | 1,259.15 | -0.88 | 752 |

| TVS Motor | 2,072.85 | -0.71 | 286.75k |

| Apollo Tyres | 465.90 | -0.61 | 15.82k |

| Eicher Motors | 3,867.45 | -0.51 | 1.57k |

| Maruti Suzuki | 9,965.80 | -0.42 | 116.13k |

| Cummins | 2,023.75 | -0.33 | 1.17k |

-330

January 12, 2024· 10:36 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 21812.55 0.76 | 0.37 0.47 | 4.33 22.14 |

| NIFTY BANK | 47633.85 0.41 | -1.36 -1.09 | 1.14 13.19 |

| NIFTY Midcap 100 | 47503.00 0.35 | 2.86 0.23 | 6.61 51.48 |

| NIFTY Smallcap 100 | 15584.10 0.7 | 2.91 0.94 | 7.26 61.53 |

| NIFTY NEXT 50 | 54711.30 0.21 | 2.56 0.77 | 7.67 30.33 |

-330

January 12, 2024· 10:33 IST

Stock Market LIVE Updates | M&M declines after December exports skid 41%

Mahindra and Mahindra Limited shares slipped 1.5 percent on January 12, a day after the company reported a 41 percent decline in exports in December from the year-ago period.

The utility vehicle and tractor manufacturer exported 1,819 units in December 2023, down from 3,100 vehicles in the year-ago period, Mahindra and Mahindra said in an exchange filing on January 11. Read More

-330

January 12, 2024· 10:31 IST

Stock Market LIVE Updates | Bernstein View On TCS

-Outperform call, target Rs 4,170 per share

-Delivered a strong quarter with all-around beat on revenue & margin

-CC revenue growth was at 1.0 percent QoQ /1.7 percent YoY

-Overall deal TCV moderated to USD 8.1 billion but pipeline remained healthy

-TCS remains well positioned in a macro uncertain environment

-TCS positioning led by robust execution, margin leadership & OCF/FCF yields

-Market share gains & stable order book/improving pipeline sets up platform for FY25

-330

January 12, 2024· 10:27 IST

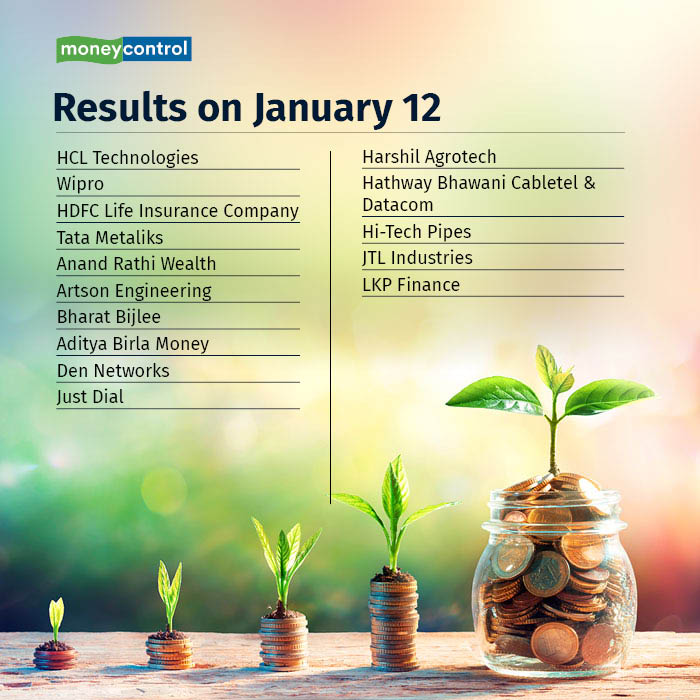

Earnings Today:

-330

January 12, 2024· 10:24 IST

Stock Market LIVE Updates | Bajel Projects gets LoI worth Rs 487.64 crore; share price up 3%

Bajel Projects share price rose 3.6 percent in early trade on January 12 after the company received a Letter of Intent (LoI) worth Rs 487.64 crore for supply and installation services of a transmission project.

"..... has received a LOI for supply of plant and installation services for engineering, procurement, construction & commissioning of transmission lines and GIS Substations by The Tata Power Company Limited for and on behalf of their project specific SPV i.e. M/s Jalpura - Khurja Power Transmission Limited," the company said in a release.

The project is situated at Greater Noida, Jalpura, Khurja in the state of Uttar Pradesh. Read More

-330

January 12, 2024· 10:20 IST

Stock Market LIVE Updates | HG Infra up nearly 4% on winning Rs 716-crore railway project

HG Infra Engineering share price gained nearly 4 percent in the early trade on January 12 after the company was picked as the lowest bidder by the Central Railway for a Rs 716.11-crore project.

The project is new broad gauge line between Dhule (Borvihir) and Nardana in Maharashtra. The project cost is Rs 716.11 crore and construction period is 30 months. Read More

-330

January 12, 2024· 10:18 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Infosys | 1,602.70 7.26 | 11.42m | 1,809.32 |

| TCS | 3,883.00 3.95 | 2.90m | 1,119.44 |

| Reliance | 2,714.70 -0.19 | 1.46m | 393.46 |

| Wipro | 467.25 4.25 | 8.00m | 370.61 |

| HCL Tech | 1,531.30 3.13 | 2.06m | 312.98 |

| Tech Mahindra | 1,303.45 4.33 | 2.28m | 294.35 |

| HDFC Bank | 1,655.40 0.39 | 1.48m | 244.81 |

| TATA Cons. Prod | 1,140.05 1.86 | 1.90m | 218.82 |

| HUL | 2,519.80 -0.65 | 844.12k | 212.68 |

| Tata Motors | 814.85 -0.1 | 2.41m | 196.39 |

-330

January 12, 2024· 10:12 IST

Stock Market LIVE Updates | Quess Corp signs MoU with Department of GTU; shares up 2%

Quess Corp share price gained 2 percent in opening trade on January 12 after the company signed a Memorandum of Understanding (MoU) with the Department of Gujarat Technical University (GTU).

".... has signed a Memorandum of Understanding (MoU) with the Department of Gujarat Technical University, the state’s largest public technical university, Govt. of Gujarat," the company said in its release.

The collaboration aims to contribute to the forecast, development, and identification of programmes to meet the skill requirement of the state, positively contributing to the increased investments and Gujarat’s Sustainable Vision for 2030. Read More

-330

January 12, 2024· 10:08 IST

Stock Market LIVE Updates | Concor shares dip as Q3 domestic volumes decrease by 1.25%, despite 8.25% growth in EXIM volumes

Shares of Container Corporation of India opened flat on January 12, a day after reporting a 8.25 percent year-on-year increase in Q3 EXIM volumes and a 1.25 percent YoY decline in domestic volumes. At 9:20 am, the stock was trading in the red at Rs 900 (0.3 percent lower).

In a regulatory filing on January 11, Container Corporation of India (CONCOR) recorded total volumes of 11,50,808 TEUs (twenty feet equivalent units) for the quarter ending December 2023, up by around 6.05 percent Year-on-Year. Of this, EXIM volumes grew 8.25 percent to 9,02,582 TEUs and domestic volumes fell 1.25 percent YoY to 2,48,226 TEUs. Read More

-330

January 12, 2024· 10:05 IST

Stock Market LIVE Updates | LIC receives demand orders worth Rs 3,529 crore from Income Tax Authorities, Mumbai

Life Insurance Corporation of India has received demand orders worth Rs 3,528.75 crore from Income Tax authorities, Mumbai. LIC will file an appeal before Commissioner (Appeals), Mumbai against the said orders.

-330

January 12, 2024· 10:01 IST

Sensex Today | Market at 10 AM

The Sensex was up 398.80 points or 0.56 percent at 72,119.98, and the Nifty was up 106.60 points or 0.49 percent at 21,753.80. About 1990 shares advanced, 1037 shares declined, and 78 shares unchanged.

-330

January 12, 2024· 09:59 IST

| Company | Price at 09:00 | Price at 09:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Sonalis Consume | 507.70 | 30.00 | -477.70 - |

| COASTPP | 225.00 | 65.00 | -160.00 - |

| DYNPROPP | 450.00 | 149.50 | -300.50 - |

| CLOUDPP | 123.00 | 46.85 | -76.15 - |

| Arvind Fash-PP | 135.00 | 66.95 | -68.05 23.66k |

| Viaz Tyres | 68.95 | 41.00 | -27.95 - |

| National Oxygen | 45.40 | 37.40 | -8.00 - |

| Silgo Retail | 40.85 | 36.65 | -4.20 100.36k |

| Plastiblends | 340.40 | 313.55 | -26.85 107.89k |

| M K Proteins | 58.50 | 54.00 | -4.50 368.38k |

-330

January 12, 2024· 09:59 IST

| Company | Price at 09:00 | Price at 09:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Info Drive Soft | 0.65 | 332.80 | 332.15 - |

| Mold-Tek-PP | 1.25 | 391.15 | 389.90 750 |

| COASTPP1 | 10.00 | 137.35 | 127.35 0 |

| Rushil Decor-PP | 10.00 | 122.85 | 112.85 - |

| Satin Credi PP1 | 10.00 | 67.30 | 57.30 23.38k |

| Kesoram Ind PP | 5.00 | 28.40 | 23.40 - |

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Satin Creditcar | 10.00 | 27.55 | 17.55 20.05k |

| BTML-RE | 10.00 | 21.55 | 11.55 - |

| RIL Partly Paid | 982.05 | 1,870.80 | 888.75 538.40k |

-330

January 12, 2024· 09:58 IST

Sensex Today | Rahul Kalantri, VP Commodities, Mehta Equities

Crude oil exhibited significant volatility as prices surged following Iran's seizure of an oil tanker and the U.S. launching an airstrike on Houthi-controlled areas. On Thursday, Iran seized a tanker carrying Iraqi crude bound for Turkey, retaliating against the U.S.'s confiscation of the same vessel and its oil last year, as reported by Iranian state media.

Subsequently, the U.S. military conducted airstrikes in multiple Houthi-controlled regions of Yemen, according to media reports. The heightened tensions in the Middle East bolstered crude oil prices, counteracting the impact of the surge in U.S. inflation.

Anticipating ongoing geopolitical tensions, we project crude oil prices to remain volatile in today's session. Crude oil finds support in the range of $73.10–72.40, with resistance expected at $74.65–75.10 for the current session. In terms of Indian Rupees (INR), crude oil is supported at Rs 5,940–5,870, while resistance is observed at Rs 6,110–6,190.