HCLTech is likely to report better earnings performance than peers, growing both fiscal third quarter revenue and net profit in mid-single digits from the previous quarter.

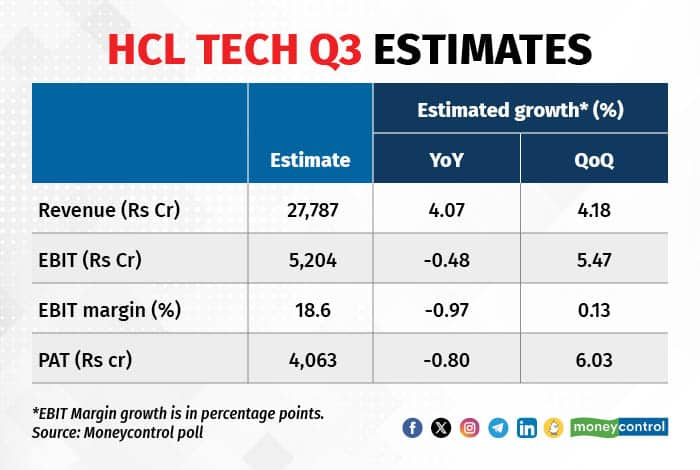

According to a Moneycontrol poll of six analysts, HCLTech is expected to report a sequential revenue growth of 4.18 percent in the October-December quarter to Rs 27,787 crore, helped by $50-million incremental revenue from the Verizon deal, and additional income from Germany’s ASAP post-acquisition.

Net profit for Q3FY24 is expected to grow 6.03 percent quarter-on-quarter to Rs 4,063 crore, riding on the back of revenue growth. HCLTech’s earnings before interest and taxes (EBIT) is expected to rise 5.47 percent sequentially to Rs 5,204 crore, and EBIT margin to improve 13 basis points.

“December is a seasonally strong quarter for the company,” said analysts at Kotak Institutional Equities in a note. “We expect 4.3 percent QoQ growth led by $50 million incremental revenues from Verizon contract, contribution of 1.5 percent to growth; $30 million incremental revenues from ASAP acquisition, driving 1 percent incremental contribution; and $70 million incremental revenues from products business (2.3 percent contribution) from seasonal strength in products.”

HCL Tech Q3 EBIT margin seen improving

Earlier last year, HCLTech signed a $2.1-billion deal with US telecom giant Verizon Communications. The IT firm also acquired a 100 percent stake in the German automotive engineering services company ASAP Group for 251.1 million euros.

Axis Capital said it expects 5.9 percent QoQ constant currency revenue growth aided by seasonal uptick in products business, consolidation of ASAP acquisition and ramp-up of Verizon deal, partly offset by higher furloughs in BFSI.

The company’s EBIT margin improvement is likely to be driven by contribution from products business, offset to some extent by wage revision and lower margin of Verizon contract, analysts said. Though they see margin to be in the range of 17.7 percent to 19.2 percent.

Previously, India’s third largest IT services firm posted 8.55 percent QoQ growth in profit to Rs 3,833 crore in Q2FY24. Deal total contract value (TCV) stood at $3.96 billion, an all time high in a quarter. Net profit for Q2FY24 stood at Rs 3,833 crore, growing at 6.14 percent QoQ. Its revenue for the quarter grew to Rs 26,672 crore.

What to watch in HCL Tech’s Q3 results: Deal wins and guidance

Kotak Securities said net new deal wins will likely moderate to $2-3 billion range after a strong Verizon-led showing in September 2023 quarter. The brokerage firm added that it expects the company to retain revenue growth guidance of 5-6 percent overall and 4-5 percent on an organic basis. The EBIT margin guidance band of 18-19 percent will also stay unchanged, it said.

Nuvama Institutional Equities also expects HCLTech to maintain its FY24 revenue (4.5–5.5 percent CC YoY growth in Services) and margin guidance.

In the last three months, HCL Tech stock jumped 18.26 percent to Rs xx, outperforming BSE Sensex, which has risen 8.44 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.