Closing Bell: Sensex down 354 pts, Nifty below 21,800; bank, FMCG drag, auto, metals shine

-330

February 05, 2024· 16:29 IST

Benchmark indices ended lower in the volatile session on February 5 with Nifty below 21,800. At close, the Sensex was down 354.21 points or 0.49 percent at 71,731.42, and the Nifty was down 82.10 points or 0.38 percent at 21,771.70.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

February 05, 2024· 16:25 IST

-330

February 05, 2024· 16:24 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Sluggish mood in global markets contributed to the overall weakness in local shares, as investors booked profit in select stocks amid dimming hopes of a rate cut in the near term. With the US Fed indicating that rate cut may not happen immediately, RBI is also expected to follow suit and maintain the status quo.

Besides, rise in the US bond yields, persistent geopolitical tensions, and China's economic woes added to existing woes. Technically, Nifty’s biggest support is placed at 21407 mark, and the landscape will be positive as long as Nifty trades above the 21137 mark with aggressive targets at 22127 mark.

-330

February 05, 2024· 16:22 IST

Shrey Jain, Founder and CEO SAS Online

The domestic benchmark indices, Sensex and Nifty, had a volatile day, ultimately closing in the red. The BSE Sensex ended down 380.32 points or 0.53% at 71,705.31, while the Nifty saw a decline of 87.95 points or 0.40% to 21,765.85.

Upon analyzing the daily charts, it's evident that the Nifty faced sustained selling pressure upon hitting the upper boundary at 22,000. Meanwhile, the Bank Nifty's overall trend seems sideways, with consolidation likely between 45,000 and 47,000. This consolidation phase is expected to persist until a definitive close emerges, providing clarity on market direction.

-330

February 05, 2024· 16:20 IST

Kuanl Shah, Senior Technical & Derivative Analyst, LKP Securities

The Nifty index has formed a double top pattern on the daily chart, signaling a potential cautionary stance for traders. The resistance level is identified at 22,200, and a decisive break above this on a closing basis could invalidate the bearish outlook. Conversely, the support for the index is situated at 21,650, coinciding with its 20DMA (20-day moving average). A breach below this support level might intensify selling pressure in the market.

The Bank Nifty index is currently in a bearish territory, encountering formidable resistance at 46,500. The index's immediate support is positioned at 45,400, and a breach below this level is anticipated to trigger additional selling pressure. The index persists in a "sell on rise" mode unless it convincingly surpasses the 46,500 mark on a closing basis.

-330

February 05, 2024· 16:18 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets started the week on a subdued note and shed nearly half a percent. After the flat opening, the Nifty oscillated in a narrow range however a sharp dip in the final hours pushed the index lower. Meanwhile, traction continued in pharma, auto and energy packs while FMCG, financials and IT were slightly on the back foot. It was a muted session for the broader indices too as both ended flat.

Indications are in favor of consolidation to continue and expect Nifty to respect the 21,450-21,600 zone, in case the profit taking extends. Interestingly, the prevailing buoyancy in the PSU pack and broader indices has not been impacted so far but we feel traders should now maintain caution while chasing the momentum and keep an exit plan in place.

-330

February 05, 2024· 15:58 IST

Vinod Nair, Head of Research, Geojit Financial Services

The Indian market witnessed a sharp fall during the final hours of today's trading. The robust US job data for January indicates that the expected rate cuts from the Fed in the coming year may be less imminent. This is reflected in the recent sharp climb in US bond yields to above 4% levels, which prompted investors to book profit from the post interim Budget rally amidst elevated valuations. However, the current drop in crude prices, provides support and restrains the decline.

-330

February 05, 2024· 15:55 IST

Bharti Airtel Q3 net profit at Rs 2,442.2 crore and revenue at Rs 37,899.5 crore

-330

February 05, 2024· 15:44 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty opened on a positive note however during the day it witnessed selling pressure and ended the day on a negative note down ~82 points. On the daily charts we can observe that the Nifty has witnessed follow-through selling pressure from the upper boundary (22000). On the hourly momentum indicator, we could witness a negative divergence which indicated loss of momentum on the upside. Overall, the range bound trading action is likely to continue until we get a decisive close below the extremes of the broad range 22000 – 21200.

The momentum setup on the daily and hourly time frames are providing divergent signals which again suggests sideways price action. Thus, parameters are suggesting that the consolidation is likely to continue. Stock specific action and sector rotation is likely to continue during this period of consolidation. Key support levels are 21640 – 21600 while immediate hurdle zone is placed at 21950 - 22000.

Bank Nifty witnessed follow through selling pressure from the previous trading session. It closed below the key averages indicating weakness. Overall, the Trend remains sideways and the range of consolidation is likely to be 45000 – 47000.

-330

February 05, 2024· 15:43 IST

Aditya Gaggar Director of Progressive Shares:

The Index remained rangebound after commencing the week steadily around 21,920. A sudden drop in the last session dragged the Index lower to end the day at 21,771.70 with a loss of 82.10 points. Buying in the frontline Pharma stocks helped the Index to be the top gainer of the day while FMCG continued to remain a laggard. The Auto and Energy sectors extended their uptrend by gaining over 1% each.

Back-to-back bearish candles have been formed, first Shooting Star candle and now Bearish Engulfing which indicates a strong resistance at the higher levels. The zone of 21,640-21,700 will act as a strong support zone while the upside seems to be capped at 21,960. It is too premature to say that if the Index violates the support zone then the ongoing correction may extend to 21,350 to form a Bullish Cypher pattern.

-330

February 05, 2024· 15:33 IST

Rupee Close:

Indian rupee ended 14 paise lower at 83.06 per dollar on Monday against Friday's close of 82.92.

-330

February 05, 2024· 15:32 IST

Stock Market LIVE Updates | Avanti Feeds Q3 Results:

Net profit up 16% at Rs 72.5 crore versus Rs 62.5 crore and revenue up 13.7% at Rs 1,253.2 crore versus Rs 1,102.6 crore, YoY.

-330

February 05, 2024· 15:30 IST

Market Close

: Benchmark indices ended lower in the volatile session on February 5 with Nifty below 21,800.

At close, the Sensex was down 354.21 points or 0.49 percent at 71,731.42, and the Nifty was down 82.10 points or 0.38 percent at 21,771.70. About 1528 shares advanced, 1858 shares declined, and 103 shares unchanged.

Top losers on the Nifty included UPL, Bharti Airtel, Bajaj Finance, HDFC Life and Grasim Industries, while gainers were Tata Motors, Coal India, BPCL, Sun Pharma and Cipla.

On the sectoral front, bank, capital goods, Information Technology and FMCG down 0.3-0.9 percent, while auto, pharma, metal, oil & gas and realty up 1 percent each.

The BSE midcap and smallcap indices ended on flat note.

-330

February 05, 2024· 15:27 IST

Sensex Today | BSE Capital Goods index down nearly 1 percent

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Rail Vikas | 281.50 | -4.4 | 1.01m |

| ABB India | 4,369.05 | -2.53 | 9.49k |

| AIA Engineering | 4,355.00 | -2.32 | 2.04k |

| Carborundum | 1,092.70 | -2.14 | 6.22k |

| Schaeffler Ind | 3,060.00 | -2 | 982 |

| Elgi Equipments | 593.40 | -1.97 | 7.38k |

| Grindwell Norto | 2,252.40 | -1.75 | 909 |

| CG Power | 440.45 | -1.67 | 56.24k |

| Bharat Elec | 181.80 | -1.46 | 769.40k |

| Hindustan Aeron | 2,937.20 | -1.14 | 92.43k |

-330

February 05, 2024· 15:25 IST

Sensex Today | Dollar hits two-month high as Fed rate cut bets recede

The dollar rose to a two-month high against its major peers on Monday as traders clawed back bets for aggressive rate cuts by the Federal Reserve this year.

The Fed repricing has followed Friday's blockbuster U.S. jobs report that far exceeded market expectations and sent U.S. bond yields soaring, boosting the country's currency.

Treasury yields rose further on Monday after Fed Chair Jerome Powell said the central bank could "give it some time" before cutting interest rates.

Japan's yen fell to its lowest since early December in early Asia trade at 148.82 per dollar, before steadying to stand at 148.43.

Meanwhile, the euro was last down 0.26% at $1.0762, around its lowest since mid-December.

-330

February 05, 2024· 15:23 IST

Stock Market LIVE Updates | Jefferies View On SBI

-Buy call, target Rs 810 per share

-Profit of Rs 9,200 crore, -35 percent YoY, missed estimate due to one-off wage costs

-Q3 core results were in-line

-NIMs were managed well & aided NII growth

-Loan growth improved to 14 percent with uptick in corporate loans

-Unsecured retail is normalising down

-Asset quality is doing better than estimate

-CET-1 at 10.4 percent offers limited buffer, but high RoE/MTM gains may help

-330

February 05, 2024· 15:20 IST

Stock Market LIVE Updates | Bank of India shares slip 9%

-330

February 05, 2024· 15:17 IST

Stock Market LIVE Updates | Nomura View On SBI

-Buy call, target Rs 755 per share

-Soft NIM and chunky one-off expenses

-Strong loan growth delivery, though NIM was softer than expectations

-Company is well placed amid tight liquidity

-Opex was controlled excluding impact of elevated wage revision provisions

-Cut FY24 EPS by 13 percent

-330

February 05, 2024· 15:12 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas

Indian Rupee declined by 0.18% on strong US Dollar and surge in US bond yields. However, positive domestic markets and weak crude oil prices cushioned the downside. Upbeat macroeconomic data from India also supported Rupee at lower levels. India’s Composite PMI expanded to 61.2 in January vs 58.5 in December while Services PMI expanded to 61.8 from 59 during the same period. US Dollar rose on Friday on hotter than expected non-farm payrolls report. US added 353,000 jobs in January 2024 vs 333,000 in December 2023. The December numbers was revised significantly higher from 216,000 jobs, thereby reducing chances of a rate cut by the US Federal Reserve in the near term.

Average hourly earnings rose by 0.6% in January 2024 vs 0.4% in December 2023. It was the biggest increase in 2 years. Unemployment rate was printed at 3.7% in in January 2024, unchanged as compared to December 2023. UoM consumer sentiment was revised higher to 79 in unchanged in January 2024 vs initial estimates of 78.8. However, factory orders increased by 0.2% in January 2024, at a slower pace as compared to 2.6% in December 2023.

We expect Rupee to trade with a slight negative bias on strength in the US Dollar and weak Asian markets. FII outflows due to profit booking may also weigh on Rupee. However, weak crude oil prices may support Rupee at lower levels. Traders may take cues from US ISM services PMI data USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.30.

-330

February 05, 2024· 15:09 IST

-330

February 05, 2024· 15:07 IST

Stock Market LIVE Updates | Jefferies View On Interglobe Aviation

-Underperform call, target Rs 2,500 per share

-Q3 results were a beat driven by strong QoQ improvement in yields

-EBITDA for Q3 increased 65 percent YoY to Rs 5,100 crore versus estimate of Rs 4,500 crore

-Company said that it is likely to exceed its FY24 capacity growth target

-Company expects yields to stay stronger for the next 6 months

-Believe yields may come under pressure

-Yields may come under pressure as air India's large fleet comes online through the year

-Recent sedate industry growth is another concern

-330

February 05, 2024· 15:05 IST

Sensex Today | BSE FMCG index down 0.8 percent dragged by Tilaknagar Industries, Godfrey Phillips India, Foods and Inns

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tilaknagar Ind | 231.70 | -7.85 | 420.00k |

| Foods and Inns | 137.45 | -5.14 | 62.67k |

| Godfrey Phillip | 2,421.00 | -4.78 | 3.28k |

| BCL Industries | 70.33 | -4.08 | 350.91k |

| Kaveri Seed | 648.05 | -3.84 | 46.49k |

| DCM Shriram Ind | 185.80 | -3.83 | 32.00k |

| Chaman Lal Seti | 238.35 | -3.79 | 6.56k |

| United Brewerie | 1,777.00 | -3.72 | 16.70k |

| Bombay Burmah | 1,647.60 | -3.39 | 4.45k |

| Prataap Snacks | 1,268.60 | -3.05 | 9.43k |

-330

February 05, 2024· 15:04 IST

Stock Market LIVE Updates | JPMorgan On View Torrent Pharma

-Neutral call, target raised to Rs 2,690 per share

-Q3 revenues/EBITDA In-line driven by healthy growth in India, Brazil & Germany

-Margins ahead of consensus with improved cost efficiency measures

-Company expects 31.8 percent margins to be new base

-Company guided for 50-100 bps of annual improvement going forward

-On US business, company is aiming to return to profitable growth

-Target of 7-8 new launches in US in FY25

-330

February 05, 2024· 15:00 IST

Sensex Today | Market at 3 PM

The Sensex was down 464.84 points or 0.64 percent at 71,620.79, and the Nifty was down 121.30 points or 0.56 percent at 21,732.50. About 1475 shares advanced, 1906 shares declined, and 100 shares unchanged.

-330

February 05, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:48 | Chg(%) Hourly Vol |

|---|---|---|---|

| Urja Global | 41.84 | 37.86 | -3.98 321.12k |

| Bajaj Hindustha | 35.38 | 32.54 | -2.84 1.27m |

| Hind Constr | 46.67 | 42.93 | -3.74 365.34k |

| Simbhaoli Sugar | 35.63 | 32.78 | -2.85 35.03k |

| Fervent Synergi | 23.68 | 21.85 | -1.83 1.93k |

| Andrew Yule | 68.11 | 63.11 | -5.00 308.07k |

| Beryl Securitie | 26.78 | 24.93 | -1.85 372 |

| Euro Leder | 26.00 | 24.23 | -1.77 847 |

| Balmer Invest | 785.00 | 733.50 | -51.50 2.53k |

| Sterling Green | 42.00 | 39.25 | -2.75 524 |

-330

February 05, 2024· 14:58 IST

| Company | Price at 14:00 | Price at 14:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Unichem Labs | 484.55 | 561.35 | 76.80 3.31k |

| Skipper RE | 91.15 | 98.10 | 6.95 15.26k |

| MRO-TEK | 64.50 | 67.80 | 3.30 2.70k |

| Shalimar Paints | 189.10 | 198.50 | 9.40 87.78k |

| Reliance Chemo | 257.30 | 270.00 | 12.70 242 |

| Dynamic Service | 117.50 | 122.95 | 5.45 3.73k |

| Navkar Corp | 107.75 | 112.50 | 4.75 109.57k |

| Sangani HOSP | 38.60 | 40.25 | 1.65 858 |

| Sanghvi Movers | 804.00 | 834.00 | 30.00 7.47k |

| Sah Polymers | 109.00 | 113.00 | 4.00 643 |

-330

February 05, 2024· 14:57 IST

Sensex Today | Barbeque Nation Hospitality Q3 net profit down 33.3% at Rs 4 crore versus Rs 6 crore, YoY.

-330

February 05, 2024· 14:57 IST

Stock Market LIVE Updates | Morgan Stanley View On Delhivery

-Overweight call, target Rs 455 per share

-Q3 revenue slightly below estimate

-Reported EBITDA better than estimate

-Company reported positive PAT helped by better than-expected other income

-330

February 05, 2024· 14:53 IST

Sensex Today | BSE Smallcap Index erased day's gain; down 0.3 percent:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| JagsonpalPharma | 305.00 | -17.09 | 68.21k |

| IFGL Refractory | 703.15 | -12.77 | 27.96k |

| Mangalore Chem | 125.00 | -11.69 | 511.92k |

| Andhra Paper | 530.15 | -9.22 | 42.54k |

| Spencer Retail | 111.25 | -9.07 | 75.07k |

| Tilaknagar Ind | 230.85 | -8.19 | 416.95k |

| Dhanuka Agritec | 1,043.20 | -7.8 | 22.09k |

| Guj Heavy Chem | 535.50 | -7.59 | 41.17k |

| Vakrangee | 27.03 | -7.46 | 4.50m |

| Savita Oil Tech | 393.40 | -7.27 | 35.21k |

-330

February 05, 2024· 14:51 IST

Stock Market LIVE Updates | Kansai Nerolac Q3 Results:

Net profit up 41.6% at Rs 154.3 crore versus Rs 109 crore and revenue up 5% at Rs 1,918.7 crore versus Rs 1,826.8 crore, YoY.

-330

February 05, 2024· 14:48 IST

Sensex Today | Nifty Bank index down 0.5 percent dragged by PNB, Bandhan Bank, SBI

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 121.25 | -3.31 | 81.24m |

| Bandhan Bank | 222.90 | -2.62 | 9.54m |

| SBI | 641.95 | -1.19 | 24.83m |

| Kotak Mahindra | 1,805.80 | -0.94 | 2.87m |

| HDFC Bank | 1,438.40 | -0.54 | 16.07m |

| AU Small Financ | 625.80 | -0.51 | 3.14m |

| Axis Bank | 1,065.20 | -0.17 | 9.96m |

| ICICI Bank | 1,022.90 | -0.11 | 10.71m |

-330

February 05, 2024· 14:45 IST

Stock Market LIVE Updates | Jefferies View On Tata Motors

-Buy call, target raised to Rs 1,100 per share

-Q3 EBITDA grew 59 percent YoY up 12 percent QoQ to a new high

-EBITDA rose QoQ across JLR & India CV/PV, while net auto debt fell 25 percent QoQ to 19-quarter low

-Company expects a better Q4 led by seasonality and improving supplies at JLR

-See some industry demand concerns in India in CY24, but like company’s strong PV launch pipeline

-Raise FY24-26 EPS by 7-11percent

-330

February 05, 2024· 14:40 IST

Stock Market LIVE Updates | IndiGo promoter Rakesh Gangwal likely to sell another tranche of shares soon, CNBC-TV18 reports

CNBC-TV18 reported citing sources that IndiGo promoter Rakesh Gangwal was looking to offload another tranche of shares in the low-cost carrier soon. Roadshows are also likely underway to gauge investor interest for the stake sale.

The lock-in period for the Gangwals before they further pare stake in the company ends on February 13. The promoter family sold a total of over 12 percent equity in the company in three tranches. As of December end, the Gangwals held a 25.2 percent stake in IndiGo operator InterGlobe Aviation.

-330

February 05, 2024· 14:38 IST

-330

February 05, 2024· 14:27 IST

Stock Market LIVE Updates | Unichem Lab reports Rs 84 crore net profit in Q3 against loss last year

Unichem Lab recorded a net profit of Rs 84 crore in Q3 as against a loss of Rs 63.90 crore in the year ago period. Its revenue grew nearly 44 percent on year to Rs 434.40 crore while EBITDA margin stood at 8.8 percent.

-330

February 05, 2024· 14:23 IST

Stock Market LIVE Updates | Alembic Pharma Q3 net profit soars 48%, revenue rises 8%

Alembic Pharma posted a stellar 48 percent jump in its Q3 net profit to Rs 180.50 crore on a topline of Rs 1,630.60 crore which grew 8.1 percent from the year-ago period.

Operational performance also remained steady as EBITDA margin stood at 16.3 percent in Q3, largely at par with the level seen in the base period.

-330

February 05, 2024· 14:19 IST

Stock Market LIVE Updates | LIC soars 7%, market-cap crosses Rs 6 lakh crore

Life Insurance Corporation of India’s share price rose 7 percent on February 5, surpassing the IPO price of Rs 949 yet again, pushing the market capitalisation of the insurer above the Rs 6-lakh crore mark.

In mid-January, LIC overtook the State Bank of India and became the most valued public sector undertaking. The SBI share price on Monday fell 1.11 percent to Rs 643.2 and its market cap stood at Rs 5.77 lakh crore. The LIC stock has surged more than 55 percent in the past three months.

The digital transformation of Life Insurance Corporation of India (LIC) could "really spur... (it) into becoming a very smart organisation", Tuhin Kanta Pandey, secretary to the Department of Investment and Public Asset Management, told Moneycontrol.

-330

February 05, 2024· 14:08 IST

Stock Market LIVE Updates | Sundaram Finance Q3 net profit at Rs 427 crore against Rs 333 crore, YoY.

-330

February 05, 2024· 14:07 IST

Stock Market LIVE Updates | DAM Capital View On UPL

-Downgrade to sell, target Rs 462 per share

-Q3 way weaker than already muted expectations

-Q3 weaker on significant price compression combined with continued demand weakness

-Management had earlier guided to a recovery from H2FY24 onwards

-Consolidated revenues degrew led by -24 percent value growth, -5 percent volume growth & +1 percent Fx growth

-Realisations continued to be under significant pressure

-330

February 05, 2024· 14:00 IST

Sensex Today | Market at 2 PM

The Sensex was up 184.76 points or 0.26 percent at 72,270.39, and the Nifty was up 86.30 points or 0.39 percent at 21,940.10. About 1789 shares advanced, 1575 shares declined, and 103 shares unchanged.

-330

February 05, 2024· 14:00 IST

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| SGBNV29VII | 6,235.00 | 5,664.85 | -570.15 2 |

| Ahmedabad St | 46.87 | 43.10 | -3.77 103 |

| Solid Stone | 39.00 | 36.30 | -2.70 603 |

| Bervin Invest | 33.97 | 31.68 | -2.29 13 |

| Advance Life | 45.00 | 42.01 | -2.99 35 |

| Oasis Sec | 100.50 | 94.00 | -6.50 0 |

| Northern Spirit | 264.50 | 248.00 | -16.50 2.43k |

| AMJ Land | 42.50 | 40.11 | -2.39 16.00k |

| Terai Tea Co | 88.00 | 83.12 | -4.88 298 |

| Man Infra | 248.00 | 234.35 | -13.65 8.00k |

-330

February 05, 2024· 13:59 IST

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| CIL Securities | 46.00 | 52.06 | 6.06 117 |

| Artson Engg | 140.85 | 155.65 | 14.80 6.61k |

| Lerthai Finance | 416.00 | 457.00 | 41.00 10 |

| Simbhaoli Sugar | 32.75 | 35.50 | 2.75 9.30k |

| Sparc Electrex | 29.05 | 31.35 | 2.30 14.94k |

| SMC Global Secu | 113.50 | 122.10 | 8.60 2.79k |

| Hilton Metal | 134.10 | 144.00 | 9.90 1.26k |

| Euro Leder | 24.23 | 26.00 | 1.77 813 |

| KIFS Financial | 161.10 | 172.00 | 10.90 31 |

| Superior Ind | 45.05 | 47.99 | 2.94 1 |

-330

February 05, 2024· 13:58 IST

Stock Market LIVE Updates | Bajaj Electricals Q3 net profit down 38.8% at Rs 37.4 crore and revenue down 6.2% at Rs 1,228.2 crore

-330

February 05, 2024· 13:57 IST

Stock Market LIVE Updates | Sun Pharma Advanced Research Company Q3 consolidated loss at Rs 99 crore from 86 crore, QoQ.

-330

February 05, 2024· 13:54 IST

Stock Market LIVE Updates | TCS selected as a strategic partner by Europ Assistance

Tata Consultancy Services has been selected as a strategic partner by Europ Assistance, a leading global assistance and travel insurance company, to help reimagine its global IT operating model for enhanced resilience, scalability and user experience.

-330

February 05, 2024· 13:53 IST

Stock Market LIVE Updates | NCSL chooses Intellect Design arm to Implement iGCB in its core banking system

Intellect Global Consumer Banking (iGCB), the consumer banking arm of Intellect Design Arena Limited, recently announced that NASFUND Contributors Savings & Loan Society Ltd (NCSL), one of the largest savings and loan societies in Papua New Guinea (PNG) and South Pacific, has chosen to implement iGCB’s awardwinning core banking system, IDC.

-330

February 05, 2024· 13:49 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| HDFC Bank | 1,450.50 | 1,450.80 1,434.05 | -0.02% |

| Sun Pharma | 1,457.30 | 1,457.55 1,425.00 | -0.02% |

| Tata Steel | 143.20 | 143.25 139.40 | -0.03% |

| ICICI Bank | 1,025.35 | 1,026.65 1,012.30 | -0.13% |

| TCS | 4,009.95 | 4,015.00 3,973.60 | -0.13% |

| M&M | 1,704.90 | 1,707.80 1,665.05 | -0.17% |

| Infosys | 1,696.40 | 1,700.50 1,683.90 | -0.24% |

| ITC | 442.25 | 443.80 439.70 | -0.35% |

| Tech Mahindra | 1,345.85 | 1,352.90 1,336.50 | -0.52% |

| Reliance | 2,924.35 | 2,940.00 2,888.85 | -0.53% |

-330

February 05, 2024· 13:49 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Kama Holdings | 2,684.45 | 2,685.00 2,603.00 | -0.02% |

| Guj State Petro | 366.55 | 366.75 352.75 | -0.05% |

| BASF | 3,070.00 | 3,072.00 3,030.35 | -0.07% |

| Mishtann Foods | 25.18 | 25.20 22.00 | -0.08% |

| Man Infra | 249.20 | 249.40 236.00 | -0.08% |

| Paramount Comm | 111.35 | 111.45 109.00 | -0.09% |

| Firstsource Sol | 203.80 | 204.00 200.00 | -0.1% |

| Poonawalla Fin | 486.75 | 487.25 470.70 | -0.1% |

| Heidelberg Cem | 225.30 | 225.55 219.05 | -0.11% |

| Escorts Kubota | 2,977.60 | 2,980.90 2,930.00 | -0.11% |

-330

February 05, 2024· 13:46 IST

Stock Market LIVE Updates | Morgan Stanley View On Mahindra & Mahindra Financial Services

-Equal-weight call, target Rs 300 per share

-Q3 disbursements were -9.4 percent MoM, up 11 percent YoY

-Gross assets rose 25 percent YoY (+1.4percent MoM)

-Have assumed higher growth (12.5 percent YoY) in Q4FY23

-If disbursements do not pick up, there could be risks to AUM forecast

-GS2 and GS3 remained range bound vs Dec’23

-330

February 05, 2024· 13:41 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| SJVN | 170.45 | 170.45 | 169.20 |

| Punjab & Sind | 77.50 | 77.50 | 75.99 |

| UCO Bank | 60.65 | 60.65 | 59.03 |

| IOB | 65.99 | 65.99 | 64.60 |

| General Insuran | 438.00 | 438.00 | 428.40 |

| NHPC | 115.84 | 115.84 | 112.04 |

| IDBI Bank | 98.56 | 98.56 | 96.42 |

| MMTC Ltd | 92.49 | 92.49 | 92.49 |

| New India Assur | 266.10 | 266.10 | 266.10 |

| Bank of Mah | 63.75 | 63.75 | 63.06 |

-330

February 05, 2024· 13:37 IST

Stock Market LIVE Updates | UBS View On Interglobe Aviation

-Buy call, target raised to Rs 3,900 per share

-Strong beat across board; yield surprise can continue

-Outlook remains robust; 136 aircraft will need inspection

-Indigo indicated 30-35 more aircraft grounded in Q4FY24

-Total fleet on the ground is in mid-70s (slightly below earlier expectations)

-Company is guiding for ASK decline of 6 percent QoQ as new aircraft addition remains strong

-330

February 05, 2024· 13:34 IST

-330

February 05, 2024· 13:32 IST

Sensex Today | BSE Smallcap index hits fresh high supported by Fino Payments Bank, Mishtann Foods, Punjab & Sind Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Fino Payments | 372.30 | 20 | 135.81k |

| Mishtann Foods | 25.20 | 20 | 71.31m |

| Punjab & Sind | 75.84 | 16.8 | 2.54m |

| Tourism Finance | 242.40 | 15.95 | 506.30k |

| Ent Network Ind | 275.95 | 14.5 | 85.64k |

| Hathway Cable | 27.14 | 13.13 | 4.86m |

| ConfidencePetro | 96.99 | 11.91 | 1.19m |

| Everest Kanto | 154.00 | 11.59 | 584.18k |

| SMC Global Secu | 121.00 | 11.47 | 215.03k |

| Bajaj Hindustha | 34.40 | 10.26 | 8.56m |

-330

February 05, 2024· 13:29 IST

Stock Market LIVE Updates | CLSA View On LIC Housing Finance

-Downgrade to outperform from buy, target raised to Rs 725 per share

-Q3 spreads high, but will normalise

-Stage 2 loans improve and credit costs high due to increasing PCR

-Rerating potential limited given sluggish growth and 12 percent -13 percent normalised RoE

-330

February 05, 2024· 13:28 IST

Sensex Today | Jana Small Finance Bank IPO to open on February 7

The Bengaluru-based small finance bank will also open its Rs 570-crore public issue on February 7 and the closing date will be February 9. The price band has been set at Rs 393-414 per share.

The IPO comprises a fresh issues of shares worth Rs 462 crore and an OFS of 26,08,629 equity shares worth Rs 108 crore by six investors including Client Rosehill, CVCIGP II Employee Rosehill, Global Impact Funds, and Hero Enterprise Partner Ventures.

The bank will utilise net fresh issue proceeds mainly for augmenting its Tier - 1 capital base to meet its future capital requirements.

-330

February 05, 2024· 13:24 IST

Stock Market LIVE Updates | Jefferies View On Torrent Pharma

-Buy call, target raised to Rs 2,930 per share

-Q3 revenue/EBITDA were in-line

-India's revenue grew 12 percent YoY while Brazil/Germany witnessed further recovery

-Margin improvement in India & international ops should drive 15 percent EBITDA CAGR over FY24-26e

-Strong operating performance should bridge the valuation gap with peers

-Increase FY25-26E EBITDA by 1-2 percent

-330

February 05, 2024· 13:22 IST

Sensex Today | Man Infraconstruction Q3 Results:

Net profit down 4.5% at Rs 86.5 crore versus Rs 90.6 crore and revenue down 47.1% at Rs 149.1 crore versus Rs 456.9 crore, YoY.

-330

February 05, 2024· 13:22 IST

Sensex Today | Aurionpro Solutions Q3 Earnings:

Net profit rose 50% at Rs 37.5 crore versus Rs 25 crore and revenue up 37% at Rs 231 crore versus Rs 168 crore, YoY.

-330

February 05, 2024· 13:19 IST

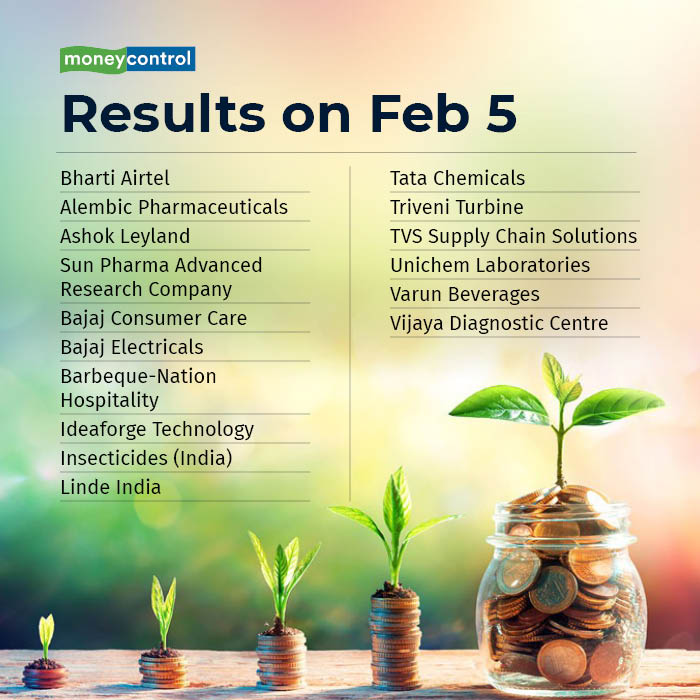

Results Today:

-330

February 05, 2024· 13:16 IST

Sensex Today | BLS E-Services to debut on February 6

Business correspondence services provider BLS E-Services will be the only company from the mainboard segment making its debut on the bourses on February 6, after healthy subscription numbers. The issue price for the Rs 311-crore offer, which was subscribed 162.47 times, has been fixed at Rs 135 per share.

-330

February 05, 2024· 13:15 IST

Stock Market LIVE Updates | InCred View On UPL

-Upgrade to add call, target Rs 694 per share

-Agrochemical majors are being hit hard by high channel inventory

-At this time of the cycle, it’s imperative to save balance sheet and vendor base

-UPL is doing right thing by not increasing receivables and saving its vendors

-Value UPL at 20x FY26F P/E; stock remains volatile at cusp of cycle change

-Buy aggressively on dips

-330

February 05, 2024· 13:14 IST

Sensex Today | BSE Midcap index touched new high led by SJVN, UCO Bank, Indian Overseas Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SJVN | 165.60 | 16.41 | 10.40m |

| UCO Bank | 58.85 | 16.12 | 20.14m |

| IOB | 63.95 | 13.89 | 16.06m |

| NHPC | 111.63 | 10.93 | 29.94m |

| IDBI Bank | 96.37 | 10.28 | 6.44m |

| New India Assur | 266.10 | 9.98 | 248.49k |

| GlaxoSmithKline | 2,463.95 | 7.25 | 8.36k |

| SAIL | 134.90 | 5.14 | 4.87m |

| Lupin | 1,580.00 | 5.13 | 47.43k |

| Torrent Pharma | 2,643.50 | 4.71 | 11.58k |

-330

February 05, 2024· 13:12 IST

Stock Market LIVE Updates | L&T bags order from IndianOil Adani Ventures

The Hydrocarbon vertical of Larsen & Toubro (L&T) has recently secured a large onshore project from IndianOil Adani Ventures Limited.

The scope of work includes engineering, procurement, construction, and commissioning of Offsite Tankages, Bullets and other associated facilities on Lump Sum Turnkey basis.

-330

February 05, 2024· 13:11 IST

Stock Market LIVE Updates | Man Industries board approved issue of upto 68,11,945 fully paid-up equity shares of face value Rs 5 each for cash at a price of Rs 367 per Equity Share including a premium of Rs 362 per Equity Share for an amount upto Rs 249,99,83,815 to the non-promoter proposed allottee(s), on a preferential basis.

-330

February 05, 2024· 13:08 IST

Stock Market LIVE Updates KPR Mill Q3 Earnings:

Net profit rose 7.5% at Rs 187 crore against Rs 174 crore and revenue down 12.1% at Rs 1,269 crore versus Rs 1,444 crore, YoY.

-330

February 05, 2024· 13:06 IST

Sensex Today | Taj GVK Q3 Results:

Net profit up 39.9% at Rs 24.2 crore versus Rs 17.3 crore and revenue up 5.4% at Rs 111.1 crore versus Rs 105.4 crore, YoY.

-330

February 05, 2024· 13:04 IST

Stock Market LIVE Updates: JK Lakshmi Cement on February 8, to consider proposals to raise funds through Term Loan(s)/ issue of Debt Securities/ Bonds or any combination thereof to part finance the Company’s proposed Expansion Projects and for funding its various growth opportunities including inorganic growth, subject to requisite regulatory /statutory approvals, as may be required.

And declare Interim Dividend, if any, on equity shares of Rs 5/- each of the company for the Financial Year 2023-24.

-330

February 05, 2024· 13:01 IST

Sensex Today | Alpex Solar SME IPO opens on February 8

Alpex Solar will be the only IPO from SME (small and medium enterprise) segment, opening on February 8 and closing on February 12. The solar panels manufacturer is planning to mobilise Rs 74.52 crore through its maiden public issue of 64.8 lakh equity shares, at the upper price band.

The price band for the offer, which comprises only a fresh issue, is Rs 109-115 per share.

The IPO funds will be utilised mainly for upgradation and expansion of the existing solar module manufacturing facility by increasing 750 MW, setting up of a new manufacturing unit for aluminum frame for the solar module, and working capital requirements.

Meanwhile, Indore-based confectionery products maker Italian Edibles will be closing its Rs 27-crore IPO on February 7. It is a fixed price issue.

-330

February 05, 2024· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was up 175.73 points or 0.24 percent at 72,261.36, and the Nifty was up 76.90 points or 0.35 percent at 21,930.70. About 1781 shares advanced, 1568 shares declined, and 101 shares unchanged.

-330

February 05, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shree Precoated | 22.95 | 21.06 | -1.89 200 |

| Ravi Leela Gran | 39.95 | 37.00 | -2.95 1.45k |

| Parshva Enterpr | 193.70 | 180.00 | -13.70 23 |

| Guj Credit | 29.50 | 27.62 | -1.88 205 |

| Acrow India | 829.00 | 777.00 | -52.00 262 |

| Longview Tea | 35.80 | 33.58 | -2.22 489 |

| Skipper RE | 91.05 | 85.50 | -5.55 2.29k |

| Atishay | 72.80 | 68.52 | -4.28 45.88k |

| KIFS Financial | 171.00 | 161.10 | -9.90 810 |

| Aditya Spinners | 29.86 | 28.20 | -1.66 457 |

-330

February 05, 2024· 12:58 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Acceleratebs | 160.30 | 184.90 | 24.60 640 |

| Polymac Thermo | 36.50 | 40.95 | 4.45 856 |

| Soni Medicare | 25.95 | 28.65 | 2.70 1 |

| Samor Reality | 105.70 | 116.10 | 10.40 25 |

| Sayaji Hotels | 305.10 | 332.00 | 26.90 190 |

| Swarnsarita Jew | 36.95 | 40.20 | 3.25 20.23k |

| Capital India | 135.50 | 146.50 | 11.00 1.49k |

| ConfidencePetro | 90.61 | 97.83 | 7.22 23.09k |

| GM | 167.00 | 179.50 | 12.50 8.26k |

| Bervin Invest | 31.64 | 33.97 | 2.33 448 |

-330

February 05, 2024· 12:57 IST

Sensex Today | Rashi Peripherals IPO opens on Feb 7 for subscription

The Mumbai-based information and communication technology (ICT) products distributor is planning to raise Rs 600 crore through its public issue during February 7-9. The IPO consists of only a fresh issue by the company and there is no OFS component in the offer.

The price band for the offer has been fixed at Rs 295-311 per share.

The Pansari and Choudhary-family promoted company will utilise Rs 326 crore of the net fresh issue proceeds for repaying debts and Rs 220 crore for working capital requirements.

-330

February 05, 2024· 12:56 IST

Stock Market LIVE Updates | JPMorgan View on SBI

-Overweight call, target Rs 725 per share

-Q3 headline PAT was impacted by Rs 7,100 crore one-time impact on pension liabilities

-Adjusted PAT was up 2 percent YoY with 16 percent RoE, in-line with expectations

-Core NIMs were down 12 bps QoQ driven by deposit repricing

-Credit costs were lower with core loan loss offset against account level upgrades

-Asset quality remains strong with net slippage at just 0.4 percent

-Q4 will likely see another wage revision hike

-FY25 should benefit from moderation in wage costs driving up operating leverage

-330

February 05, 2024· 12:53 IST

Sensex Today | BSE Metal index rose 2 percent led by Coal India, NMDC, SAIL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coal India | 443.20 | 5.64 | 610.94k |

| SAIL | 135.25 | 5.42 | 4.75m |

| NMDC | 245.95 | 4.44 | 1.20m |

| Tata Steel | 142.05 | 2.42 | 4.90m |

| Vedanta | 276.05 | 1.32 | 406.05k |

| Jindal Stainles | 598.25 | 0.29 | 76.25k |

| Hindalco | 585.15 | 0.2 | 243.83k |

-330

February 05, 2024· 12:51 IST

-330

February 05, 2024· 12:49 IST

Stock Market LIVE Updates | Kalyani Steels Q3 profit at Rs 65 crore against Rs 39 crore, YoY

-330

February 05, 2024· 12:48 IST

Stock Market LIVE Updates | Macquarie View On Aurobindo Pharma

-Outperform call, target Rs 1,300 per share

-Eugia 3 inspection ends with nine observations

-Eugia 3 is biggest injectable plant in company’s network with 17 production lines

-Estimate plant contributes close to 10 percent of revenue & mid-teens EBITDA contribution

-Total number of observations look high, nature of observations remains unknown

-Believe worst case outcome, import alert, is a low probability event

-330

February 05, 2024· 12:46 IST

Stock Market LIVE Updates | Morgan Stanley View On Interglobe Aviation

-Overweight call, target raised to Rs 4,145 per share

-Strong balacesheet & healthy vendor relationships helping company offset hit from aircraft grounding

-Earnings growth tapering off but business moats getting stronger

-330

February 05, 2024· 12:44 IST

Sensex Today | BSE Realty index gaiend 1.5 percent supported by Phoenix Mills, Mahindra Lifespace Developers, Macrotech Developers

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Mahindra Life | 619.05 | 9.13 | 46.74k |

| Phoenix Mills | 2,589.10 | 4.75 | 7.51k |

| Macrotech Dev | 1,146.90 | 3.04 | 23.50k |

| DLF | 802.05 | 1.52 | 38.93k |

| Oberoi Realty | 1,300.00 | 1.38 | 6.45k |

| Brigade Ent | 1,031.65 | 1.26 | 1.97k |

| Sobha | 1,416.00 | 0.82 | 3.93k |

-330

February 05, 2024· 12:42 IST

Stock Market LIVE Updates | Metropolis Healthcare Q3 profit tanks 25% YoY to Rs 27 crore

Metropolis Healthcare has reported a 25% on-year decline in net profit at Rs 27 crore for quarter ended December FY24, impacted by tepid topline growth and weak operating numbers. Revenue from operations for the quarter increased by 2.1% to Rs 291 crore, while core business revenue (excluding covid & covid allied, PPP contracts business) grew by 12.6% to Rs 286 crore compared to same period last year.

-330

February 05, 2024· 12:39 IST

Stock Market LIVE Updates | KPI Green Energy subsidiary bags order for 15 MW from Aether Industries

KPIG Energia, a wholly owned subsidiary of KPI Green Energy, has received new order of 15 MW for executing solar power project, under captive power producer (CPP) segment, from Aether Industries. The projects are scheduled to be completed in FY25, in various tranches.

-330

February 05, 2024· 12:38 IST

Sensex Today | BSE Power index up 2 percent led by NHPC, Power Grid, BHEL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NHPC | 111.82 | 11.12 | 29.86m |

| Power Grid Corp | 288.90 | 4.41 | 427.96k |

| BHEL | 243.00 | 3.98 | 1.18m |

| JSW Energy | 501.65 | 3.84 | 198.71k |

| Tata Power | 399.60 | 2.53 | 975.42k |

| NTPC | 339.70 | 2.17 | 686.86k |

| Suzlon Energy | 49.38 | 1.63 | 9.35m |

| Siemens | 4,167.10 | 0.14 | 8.30k |

-330

February 05, 2024· 12:35 IST

Stock Market LIVE Updates | Bharti Airtel shares fall 3% ahead of Q3 earnings:

Brokerages largely expect Bharti Airtel to report a steady December quarter aided by average revenue per user (ARPU) expansion and continued strong performance of the non-mobile segment.

The company will report its third quarter numbers later on February 5.

Net profit is likely to rise 47 percent year-on-year and 14 percent sequentially to Rs 3,308.50 crore, an average of seven analysts polled by Moneycontrol shows.

Consolidated revenue is expected to rise 6 percent year-on-year and 2.3 percent quarter-on-quarter to Rs 37,551.30 crore. Read More

-330

February 05, 2024· 12:32 IST

Sensex Today | Dollar notches fresh highs as Fed cut bets recede

The dollar rose to an eight-week top against its major peers on Monday as traders clawed back bets for aggressive rate cuts by the Federal Reserve this year in view of a still-resilient U.S. economy.

The yen as well as the Australian and New Zealand dollars, meanwhile, tumbled to two-month lows in early Asia trade, while the euro bottomed at a more than one-month trough of $1.07675. The single currency last bought $1.0782.

Sterling similarly edged 0.18% lower to $1.2610, having earlier bottomed at $1.25985, its lowest since Jan. 17.

-330

February 05, 2024· 12:31 IST

Sensex Today | Mayank Cattle Food stock lists at 7% premium over IPO price on BSE SME

Mayank Cattle Food listed at a 7.4 percent premium over the IPO price on February 5. The stock opened at Rs 116 against the issue price of Rs 156 on the BSE SME platform.

In listing was along expected lines. Mayank Cattle Food was trading at an 8 percent premium in the grey market, an unofficial ecosystem where shares start trading before the allotment in an IPO and continue till the listing day. Most investors track the grey market premium (GMP) to get an idea of the listing price. Read More

-330

February 05, 2024· 12:29 IST

Stock Market LIVE Updates | MOIL Q3 profit jumps 37% YoY to Rs 54 crore

MOIL has registered a 37% year-on-year growth in net profit at Rs 54.1 crore for October-December period of FY24, driven by healthy operating numbers. Revenue from operations increased by 1.4% to Rs 306.3 crore compared to year-ago period.

-330

February 05, 2024· 12:27 IST

Sensex Today | BSE Healthcare index up 1.5 percent supported by Torrent Pharma, GlaxoSmithKline Pharmaceuticals, Gujarat Themis Biosyn

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| GlaxoSmithKline | 2,462.95 | 7.21 | 8.28k |

| Torrent Pharma | 2,675.75 | 5.98 | 10.17k |

| Guj Themis | 355.45 | 4.99 | 142.29k |

| Lupin | 1,576.85 | 4.92 | 44.56k |

| Sasta Sundar | 449.45 | 4.63 | 23.05k |

| Biocon | 286.00 | 4.11 | 381.49k |

| Unichem Labs | 483.85 | 3.81 | 3.96k |

| AstraZeneca | 6,664.05 | 3.4 | 257 |

| Ipca Labs | 1,142.85 | 3.14 | 6.23k |

| Max Healthcare | 790.00 | 3.1 | 26.28k |

-330

February 05, 2024· 12:25 IST

Sensex Today | Rajan Shinde, Research Analyst, Mehta Equities:

We believe Apeejay Surrendra Park Hotels Ltd IPO gives investors an opportunity to invest in 8th largest hotel chain with asset ownership in India. We like the company’s diversified portfolio while strategically positions itself in key markets, leveraging an asset-light model which focuses on scalability and brand presence across diverse geographies.

We also like the company’s impressive occupancy rates and RevPAR figures, reflecting its operational efficiency and portfolio optimization strategies. We believe the F&B and entertainment segment form an integral part of ASPH business, which offers stability and resilience to earnings.

By looking at the financials, the company has shown a strong growth in FY2022 and FY 2023 with 42.6%/98.5% in revenue from operations and strong recovery in net profit from loss of Rs28.2 crore in FY 2022 to profit of Rs 48.06 crore in FY 2023.

On valuation parse at the upper band of Rs 155, the issue is asking for a Market Cap of Rs 3307 crore. Based on annualised FY24 earnings and fully diluted post-IPO paid up capital, given the company's historic losses and recovering back to profitability, relying solely on P/E valuation may not be a practical approach. Instead, if we analyse it based on Price to Book Value, which stands at ~3x of FY24 annualized, compared to the industry average of ~5-8x which seems this IPO is reasonably priced to its peers. Hence, considering industrial and company’s future growth rationales along with the primary objective of reducing the debt which could lighten interest burdens which can improve the bottom lines in coming years.

With its established brands, strategic growth initiatives, and resilient business model the company is well-positioned to capitalize on emerging market trends. Hence, we recommend investors to “Subscribe” the Apeejay Surrendra Park Hotels Ltd IPO for long term perspective.

-330

February 05, 2024· 12:23 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Servotech Ent | 24.60 4.99% | 135.42k 4,298.20 | 3,051.00 |

| Satin Credit | 266.20 7.84% | 729.22k 33,338.00 | 2,087.00 |

| Real Eco-Energy | 37.00 11.18% | 498.53k 30,350.80 | 1,543.00 |

| Dhruv Consultan | 83.91 19.99% | 272.85k 20,447.20 | 1,234.00 |

| Sir Shadi Lal | 273.10 9.99% | 199.61k 15,503.80 | 1,187.00 |

| Ventura Text | 16.44 4.98% | 15.89k 1,235.80 | 1,186.00 |

| URAVI | 335.75 5.25% | 19.61k 1,531.80 | 1,180.00 |

| KCP Sugar | 48.60 19.38% | 1.44m 119,061.00 | 1,106.00 |

| Ladderup Fin | 33.20 13.62% | 97.63k 9,470.80 | 931.00 |

| Inspirisys Solu | 120.00 0.8% | 67.29k 6,706.00 | 903.00 |

-330

February 05, 2024· 12:20 IST

Stock Market LIVE Updates | Quant Mutual Fund buys 0.66% shares in Tourism Finance Corporation

Quant Mutual Fund has bought 6 lakh equity shares or 0.66% stake in Tourism Finance at an average price of Rs 208.57 per share. Aatman Innovations picked 5 lakh shares in TFCI at an average price of Rs 204.3 per share.

-330

February 05, 2024· 12:18 IST

Stock Market LIVE Updates | Cochin Shipyard sails in the green on Rs 150-crore deal with Indian Navy

Shares of Cochin Shipyard traded in the green on February 5 after the company signed a contract with the Indian Navy for undertaking Medium Refits of two naval vessels.

This Rs 150-crore contract is for dry-docking and refit as well as upgradation of equipment on board the ships.

The company's net profit zoomed 121 percent on-year to Rs 244.4 crore, and revenue from operations jumped 64 percent YoY to Rs 1,056.4 crore during the quarter ended December 2023. The board of directors of the company also recommended its second interim dividend of Rs 3.50 per share of Rs 5 each fully paid (70 percent) for the FY24. The board had fixed February 12, as the record date for the interim dividend. Read More

-330

February 05, 2024· 12:14 IST

-330

February 05, 2024· 12:11 IST

Stock Market LIVE Updates | Varun Beverages Q4 Earnings:

Net profit up 77% at Rs 132 crore versus Rs 75 crore and revenue up 21% at Rs 2,731 crore versus Rs 2,257 crore, YoY.

-330

February 05, 2024· 12:09 IST

Stock Market LIVE Updates | Birlasoft launches Generative AI platform Cogito

Birlasoft introduces a comprehensive Generative AI platform Cogito.

Birlasoft Cogito has been strategically crafted to empower enterprises to revolutionize their businesses through Generative AI capabilities.

-330

February 05, 2024· 12:07 IST

Stock Market LIVE Updates | LIC m-cap crosses Rs 6-lakh crore; trades above IPO price

Life Insurance Corporation of India’s share price rose 7 percent on February 5, surpassing the IPO price of Rs 949 yet again, pushing the market capitalisation of the insurer above the Rs 6-lakh crore mark.

In mid-January, LIC overtook the State Bank of India and became the most valued public sector undertaking. The SBI share price fell 1.11 percent to Rs 643.2 and its market cap stood at Rs 5.77 lakh crore.

The LIC stock has surged more than 55 percent in the past three months months.

The country's largest insurer, LIC listed on the exchanges on May 2022. The government sold over 22.13 crore shares, or a 3.5 percent stake, in the company through an offer-for-sale. The price band for the issue was fixed at Rs 902-949 a share.

-330

February 05, 2024· 12:06 IST

Stock Market LIVE Updates | Greaves Cotton partners with Zero21 for sale & distribution of Zero21's electric autorickshaws & EV parts

AutoEVmart, a multi-brand EV retail store by Greaves Retail, the retail and distribution unit of Greaves Cotton Ltd., announced its partnership with Zero21, an energy solutions company based in Hyderabad.

The partnership aims to accelerate the sales and distribution of Zero21's electric autorickshaws and associated EV spare parts, which are now available across Greaves Retail's multi-brand AutoEVMart stores and spares distribution network.

-330

February 05, 2024· 12:04 IST

Kerala government increases excise duty on Indian-Made Foreign Liquor by Rs 10 per litre: PTI

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Jagatjit Ind | 216.95 | 4.98 | 40705 |

| Northern Spirit | 261.8 | 4.72 | 9000 |

| Radico Khaitan | 1719.7 | 2.16 | 22417 |

| Sula Vineyards | 648.25 | 1.18 | 35813 |

| Som Distillerie | 265.9 | 0.91 | 142894 |

| Khoday India | 116.25 | 0 | 9131 |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tilaknagar Ind | 232.35 | -7.6 | 331012 |

| Silver Oak | 53.25 | -5 | 144 |

| United Brewerie | 1799.9 | -2.48 | 6778 |

| Assoc Alcohol | 475.4 | -0.77 | 3462 |

| United Spirits | 1076.55 | -0.76 | 24886 |

| GM Breweries | 646.25 | -0.25 | 1148 |

| Globus Spirits | 801.6 | -0.19 | 7653 |

| Piccadilly Agro | 307.7 | -0.1 | 98804 |

-330

February 05, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| R M Drip & Spri | 113.10 | 102.60 | -10.50 4.36k |

| DCI | 243.90 | 231.00 | -12.90 13.56k |

| Spectrum Electr | 1,689.00 | 1,601.00 | -88.00 4.05k |

| Newjaisa Tech | 123.10 | 117.10 | -6.00 - |

| Nakoda Group | 67.45 | 64.50 | -2.95 33.16k |

| Marshall Machin | 41.60 | 39.80 | -1.80 12.56k |

| Starteck Financ | 312.00 | 299.05 | -12.95 18 |

| MCON Rasayan | 151.40 | 145.40 | -6.00 1.31k |

| Viviana Power | 303.00 | 291.00 | -12.00 1.25k |

| S J Logistics | 234.00 | 225.00 | -9.00 - |

-330

February 05, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kandarp Digi | 16.50 | 21.00 | 4.50 4.00k |

| Moxsh Overseas | 108.00 | 121.00 | 13.00 320 |

| Pattech Fitwell | 57.10 | 62.50 | 5.40 0 |

| PTL Enterprises | 49.35 | 53.00 | 3.65 120.72k |

| General Insuran | 407.55 | 433.85 | 26.30 2.03m |

| Tourism Finance | 227.35 | 241.90 | 14.55 4.98m |

| Committed Cargo | 58.50 | 62.20 | 3.70 6.46k |

| Kothari Sugars | 63.25 | 67.25 | 4.00 729.54k |

| Aarvee Denim | 39.50 | 41.90 | 2.40 355.23k |

| Inspirisys Solu | 117.05 | 124.05 | 7.00 11.30k |

-330

February 05, 2024· 11:58 IST

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

BLS e-Services Limited, a digital service provider offering business communication solutions to major Indian banks, is gearing up for its stock market debut soon. Excitement surrounds the IPO, as we can expect a strong listing fueled by robust fundamentals, positive investor sentiment, and a flourishing industry.

The GMP currently sits at a healthy Rs 159, indicating a potential listing price of around Rs 135, which represents a premium of around 117% over the issue price.

BLS e-Services boasts several key strengths. The company enjoys a long-standing partnership with leading banks, ensuring a stable revenue stream and recurring business. It operates in a high-growth industry driven by increased digitization and financial inclusion initiatives. Additionally, the IPO is strategically priced, further enhancing its appeal to investors.

With its strong fundamentals, positive investor sentiment, and promising outlook, the company is poised for a positive market debut. Remember, however, that careful evaluation and risk management are crucial for every investment.