Closing Bell: Nifty around 21,750, Sensex up 483 pts; Nifty Bank gains 1.4%

-330

February 13, 2024· 16:25 IST

https://www.moneycontrol.com/markets/global-indices/

Indian benchmark indices ended higher on February 13 with Nifty above 21,700 led by banking stocks. At close, the Sensex was up 482.70 points or 0.68 percent at 71,555.19, and the Nifty was up 127.30 points or 0.59 percent at 21,743.30.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit for all the global market action.

-330

February 13, 2024· 16:24 IST

Mandar Bhojane, Research Analyst at Choice Broking

In the recent session, the Indian equity market recovered most of its losses and closed higher, with the Nifty surpassing 21,700, driven by strength in banking stocks. At the closing bell, the Sensex recorded a gain of 482.70 points or 0.68 percent at 71,555.19, while the Nifty rose by 127.30 points or 0.59 percent, closing at 21,743.30. The Nifty Bank index also rebounded, closing at 45,502.40, reflecting a gain of 1.38 percent.

On the daily chart, the Nifty displayed a reversal from the bottom level and formed a hammer candlestick pattern with substantial volume, closing above the daily trendline. The Relative Strength Index (RSI) exhibited an upward slope at 53.2, indicating sideways bullish momentum. Immediate support levels are identified at 21,500-21,400, while hurdles are anticipated at 21,900 and 22,000.

Among sectors, all indices, except for metals (down 2 percent), concluded in the green, with banking, healthcare, information technology, and capital goods showing gains ranging from 0.4 to 1.5 percent.

The India VIX (Volatility Index) experienced an intraday decrease of 15.80 percent, settling at 16.06, suggesting heightened market volatility.

Upon analyzing the Open Interest (OI) data, the call side displayed the highest OI at 21,900, followed by the 22,000 strike prices. On the put side, the maximum OI was observed at the 21,500 strike price.

-330

February 13, 2024· 16:23 IST

Rupak De, Senior Technical Analyst, LKP Securities

The Nifty exhibited volatility throughout the day, mostly fluctuating within the range of 21650 and 21750. The prevailing sentiment is expected to persist in a sideways to bearish direction as long as the index stays below 21850. On the downside, a short-term support level is identified at 21500. A significant decline below 21500 could potentially initiate a correction towards 21270/21000. Conversely, on the upside, a decisive breakthrough above 21850 might trigger a rally towards 22200.

-330

February 13, 2024· 16:22 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets traded volatile in a narrow range and finally ended with gains of nearly half a percent. After the flat start, Nifty oscillated in the band, tracking a mixed trend in heavyweights and settled at the 21,743.25 level. All key sectors, barring metal, participated in the rebound wherein recovery in the banking and financial majors played a critical role in helping the index to end in the green. The broader indices too settled witnessed respite and settled marginally higher.

The recent price action in the index shows indecisiveness among the participants thus traders should continue with stock-specific approach and wait for clarity. Besides, we suggest utilizing further rebound to reduce longs, especially in the PSUs and other overbought sectors/themes.

-330

February 13, 2024· 16:15 IST

-330

February 13, 2024· 16:07 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty opened on a flat note and witnessed volatile price action. It swung in both directions and ultimately closed up ~127 points. On the daily charts we can observe that Nifty has found buying interest from the zone of 21540 – 21520. The intraday bounce was restricted in the zone 21760 – 21730 where the key hourly moving averages are placed. Thus, it’s a narrow rangebound move though the intraday volatility has been high. The broader market witnessed buying interest from their respective support zone and closed in the green which indicates that some stability is likely over the next few trading sessions.

Bank Nifty witnessed a sharp pullback from the 200-day moving average ( 44900 ) and closed closed in the green. The pullback can continue towards, 46100 – 46200. The daily momentum indicator has a positive crossover which is a buy signal and hence intraday dips should be bought into.

-330

February 13, 2024· 16:06 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The bulls made a strong comeback, defending the critical support level of 44800 for Bank Nifty, which now serves as a cushion for further upside. The index remains in a buy mode as long as the mentioned support holds, and any dips should be utilized to add long positions. The immediate resistance on the upside is situated at 46000, where the highest open interest is built up on the call side, indicating a potential target for the bullish momentum.

-330

February 13, 2024· 16:04 IST

Jateen Trivedi, VP Research Analyst, LKP Securities

The rupee traded within a narrow range of 82.98-83.03, maintaining its sideways trend. Market focus shifted to the upcoming US CPI data scheduled for release later in the evening. If the data aligns with expectations of 2.90%, or lower than the previous 3.3%, it could exert downward pressure on the dollar, leading to positive movements in other currencies. Conversely, if the data exceeds 3.00%, the dollar may experience volatility, ranging between 103.80-104.50, as the market expectation for CPI is lower.

-330

February 13, 2024· 16:02 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

Although markets ended in positive territory, it was mainly due to recovery in banking stocks which were hammered in recent sessions due to mixed earnings in financial space and central banks delaying rate cuts. Volatility is likely to persist as most of the hurdles such as geo-political worries coupled with stretched valuations of local stocks and FII selling will continue to keep investors at bay.

-330

February 13, 2024· 15:54 IST

Vinod Nair, Head of Research, Geojit Financial Services

The domestic market largely recovered from yesterday's losses, driven by gains in the banking sector. Improved sentiment stemmed from a decline in domestic inflation, which is expected to boost rural demand. Despite this, broader markets continued to underperform compared to frontline indices due to high valuations. However, investors remained cautious ahead of U.S. inflation data, anticipating a moderation, pivotal for the Fed's interest rate trajectory.

-330

February 13, 2024· 15:32 IST

Rupee Close:

Indian rupee ended flat at 83.01 per dollar versus previous close of 83.00.

-330

February 13, 2024· 15:30 IST

Market Close:

Indian benchmark indices ended higher on February 13 with Nifty above 21,700 led by banking stocks.

At close, the Sensex was up 482.70 points or 0.68 percent at 71,555.19, and the Nifty was up 127.30 points or 0.59 percent at 21,743.30. About 1284 shares advanced, 1994 shares declined, and 62 shares unchanged.

Hindalco Industries, Grasim Industries, BPCL, Divis Laboratories and UltraTech Cement were among the top losers on the Nifty, while gainers included Coal India, UPL, Axis Bank, SBI Life Insurance and ICICI Bank.

Among sectors, except metal (down 2 percent), all other indices ended in the green with bank, healthcare, Information technology and capital goods up 0.4-1.5 percent.

The BSE midcap index added 0.6 percent and the smallcap index rose 0.2 percent.

-330

February 13, 2024· 15:29 IST

Stock Market LIVE Updates | Bosch Q3 Earnings

Net profit up 62.4 percent at Rs 518 crore versus Rs 318.9 crore and revenue up 14.9 percent atRs 4,205.2 crore versus Rs 3,659.9 crore, YoY

-330

February 13, 2024· 15:24 IST

Stock Market LIVE Updates | Lupin launches Bromfenac Ophthalmic Solution

Lupin announced the launch of Bromfenac Ophthalmic Solution, 0.075%, after having received an approval from the United States Food and Drug Administration (U.S. FDA).

-330

February 13, 2024· 15:23 IST

Stock Market LIVE Updates | ITI Q3 Results:

Net loss of Rs 101.3 crore versus loss of Rs 87.6 crore and revenue up 0.9 percent at Rs 258.8 crore versus Rs 256.4 crore, YoY.

-330

February 13, 2024· 15:21 IST

Stock Market LIVE Updates | Goldman Sachs View On Thermax

-Sell call, target Rs 2,410 per share

-Company reported slightly weaker results in Q3

-Revenue 2 percent below estimate & EBIT (pre-exceptional) 4 percent below estimate

-Management attributed the miss to execution on a large de-sulphurization projects

-Profitability across most segments otherwise improving

-Believe benefit of easing commodity prices

-Stabilisation of some newer businesses will help margins

-Margins in industrial products & chemicals may have peaked

-Stock is trading at 48x FY26e P/E vs its long-term normalised median of 35x

-330

February 13, 2024· 15:18 IST

Consequent upon successful commissioning and due approvals, first part capacity of 14 MW out of 40 MW Ayodhya Solar PV Project (Uttar Pradesh) of NTPC Green Energy Limited (a wholly-owned subsidiary of NTPC Limited), is declared on Commercial Operation w.e.f. 27.01.2024.

-330

February 13, 2024· 15:15 IST

Stock Market LIVE Updates | Goldman Sachs View On Amber Enterprises

-Buy call, target Rs 3,820 per share

-Q3 below expectations with a topline decline of -4 percent YoY, 18 percent below estimate

-Disappointment in broad-based across segments

-Margins improved 30 bps YoY, but below estimates

-During the quarter, company acquired 60 percent stake in ascent circuits to expand its PCBA capabilities

-Company entered into a JV with Titagarh Wagons for improving railway subsystems’ offerings

-Capex guidance has been raised

-330

February 13, 2024· 15:14 IST

Sensex Today | Dollar nears 150 yen ahead of US inflation data; sterling edges up

The yen fell close to the psychological 150 per dollar level on Tuesday ahead of a key reading on U.S. inflation due later in the day, while the pound rose to an almost six-month high against the euro after stronger-than-forecast wage data.

The Swiss franc dropped to multi-week lows versus the euro and dollar after lower-than-forecast consumer prices spurred rate cut bets.

The greenback rose to an 11-week high of 149.695 yen, edging toward the closely-watched 150 level that analysts said would likely trigger further jawboning from Japanese officials in an attempt to support the currency.

-330

February 13, 2024· 15:12 IST

Stock Market LIVE Updates | Jefferies View On PI Industries

-Buy call, target Rs 4,165 per share

-Q3 revenue was in-line, driven by volume growth in CSM with firm EBITDA margin leading to estimate beat

-A portfolio of early stage molecules in growth phase should keep growth steady over FY24-25

-Domestic formulation was below estimate & likely remains weak in Q4FY24

-Pharma would fare better in H2FY24 but miss earlier guidance

-330

February 13, 2024· 15:11 IST

Stock Market LIVE Updates | Bombay Burmah Q3 Results:

Net profit at Rs 450 crore versus Rs 157 crore and revenue up 1.3 percent at Rs 4,336 crore versus Rs 4,280 crore, YoY.

-330

February 13, 2024· 15:10 IST

Stock Market LIVE Updates | Power Mech Q3:

Net profit up 21.5 percent at Rs 61.5 crore versus Rs 50.6 crore and revenue up 22.2 percent at Rs 1,107.4 crore versus Rs 909.1 crore, YoY.

-330

February 13, 2024· 15:07 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas

Indian Rupee traded on a flat note with a slight negative bias on a positive tone in the US Dollar and a rise in crude oil prices. However, positive domestic markets and FII inflows supported Rupee at lower levels. Favorable macroeconomic data from India also supported Rupee earlier in the day. India’s CPI declined to 5.1% in January 2024 vs 5.69% in December 2023 and in line with street estimates. Industrial production increased by 3.8% in December 2023 vs 2.4% in November 2023. US Dollar traded with minor gains ahead of US inflation report.

We expect Rupee to trade with a slight positive bias positive Asian markets and fresh foreign inflows. However, positive tone in the greenback and rising crude oil prices may cap sharp gains. Escalation of geopolitical tensions in the Middle East after Israel forces launched airstrikes in Rafah may also weigh on riskier currencies. Traders may take cues from US inflation data. US CPI is expected is expected to cool down to 2.9% from 3.4% in the previous month while core CPI is expected to cool down to 3.7% from 3.9%. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.20.

-330

February 13, 2024· 15:03 IST

Stock Market LIVE Updates | Jefferies View On Bharat Forge

-Underperform call, target cut to Rs 950 per share

-Q3 consolidated EBITDA rose 56 percent YoY, +8 percent QoQ but was 5 percent below estimate

-Company gave a cautious outlook as it expects growth momentum to moderate

-While like company’s structural story, concerned on cyclical headwinds in exports & Indian trucks

-Concerned on rich valuations

-Cut FY24-26 EPS by 7-10 percent

-330

February 13, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was up 466.62 points or 0.66 percent at 71,539.11, and the Nifty was up 120.30 points or 0.56 percent at 21,736.30. About 1420 shares advanced, 1841 shares declined, and 69 shares unchanged.

-330

February 13, 2024· 15:01 IST

Stock Market LIVE Updates | Goldman Sachs View On SJVN

-Sell call, target Rs 72.5 per share

-Q3 adjusted PAT of Rs 160 crore, missed consensus estimate by 45 percent

-Adjusted PAT missed estimate due to weaker than expected hydro generation during the quarter

-Management expects to recover this shortfall by approaching the central electricity regulator for relief

-Company maintained completion target of Jun-Sep’24 for Buxar power plant

-Arun-3 hydro project was postponed to Feb’25

-At 2.6x P/BV FY26, find risk reward unfavorable

-330

February 13, 2024· 14:55 IST

Sensex Today | Nifty PSU Bank index up 1.5 percent led by PNB, ICICI Bank, Axis Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 122.15 | 3.3 | 68.70m |

| ICICI Bank | 1,022.00 | 2.6 | 13.12m |

| Axis Bank | 1,066.65 | 1.91 | 6.03m |

| Bank of Baroda | 259.30 | 1.81 | 16.26m |

| Kotak Mahindra | 1,738.50 | 1.69 | 2.97m |

| IDFC First Bank | 80.25 | 1.33 | 26.58m |

| IndusInd Bank | 1,460.40 | 0.92 | 3.74m |

| SBI | 712.85 | 0.7 | 18.43m |

| HDFC Bank | 1,398.60 | 0.62 | 21.66m |

| Federal Bank | 147.10 | 0.31 | 6.40m |

-330

February 13, 2024· 14:54 IST

Stock Market LIVE Updates | Panacea Biotec Q3 results:

Net loss at Rs 2.2 crore versus profit of Rs 19.4 crore and revenue up 30.6 percent at Rs 150.5 crore versus Rs 115.2 crore, YoY.

-330

February 13, 2024· 14:52 IST

Stock Market LIVE Updates | Morgan Stanley View On Bharat Forge

-Overweight call, target Rs 1,346 per share

--Stock reaction overdone

Standalone business revenue was 3 percent ahead of estimate

-Revenue driven by a beat in domestic non-auto business

-Domestic and export auto business was in line with estimates

-Defense business revenue and EBITDA were 28 percent and 14 percent ahead of estimate

-EV business was weaker while casting was in line

-International subsidiary margins improved by 100 bps QoQ to 1.7 percent versus estimate of 2 percent

-Management has guided for moderation in growth momentum across industries in Q4FY24 & FY25

-330

February 13, 2024· 14:49 IST

Stock Market LIVE Updates | BHEL Q3 Earnings:

Net loss at Rs 163 crore versus profit of Rs 31 crore and revenue up 4.6 percent at Rs 5,504 crore versus Rs 5,263 crore, YoY.

-330

February 13, 2024· 14:46 IST

Sensex Today | Marksans Pharma Q3 Earnings:

Net profit up 31.2 percent at Rs 83.2 crore versus Rs 63.4 crore and revenue up 22.2 percent at Rs 586.1 crore versus Rs 479.8 crore, YoY.

-330

February 13, 2024· 14:43 IST

Stock Market LIVE Updates | Eicher Motors Q3 net profit at Rs 996 crore and revenue at Rs 4,179 crore

-330

February 13, 2024· 14:42 IST

Stock Market LIVE Updates | Allcargo Logistics Q3 profit tanks 88% YoY to Rs 17.4 crore

Allcargo Logistics has reported a 88% on-year decline in consolidated profit at Rs 17.4 crore for third quarter of FY24, impacted by lower topline and operating numbers. Revenue from operations fell by 22.2% YoY to Rs 3,211.6 crore for the quarter.

-330

February 13, 2024· 14:41 IST

-330

February 13, 2024· 14:38 IST

Stock Market LIVE Updates | Info Edge reports Q3 earnings

--Net profit at Rs213.5 cr vs loss of Rs84.2 cr (YoY)

--Revenue up 7.2% at Rs595.3 cr vs Rs555.1 cr (YoY)

--EBITDA up 11% at Rs240.6 cr vs Rs216.7 cr (YoY)

--Margin at 40.4% vs 39% (YoY)

-330

February 13, 2024· 14:35 IST

Stock Market LIVE Updates | PG Electro reports Q3 earnings

--Net Profit up 40.1% at Rs19.2 cr vs Rs13.7 cr (YoY)

--Revenue up 16% at Rs532 cr vs Rs459 cr (YoY)

--EBITDA up 14.8% at Rs42 cr vs Rs36.6 cr (YoY)

--Margin at 7.9% vs 8% (YoY)

-330

February 13, 2024· 14:33 IST

Stock Market LIVE Updates | KRBL reports Q3 earnings

--Net Profit down 35% at Rs133.8 cr vs Rs205.4 cr (YoY)

--Revenue down 6.4% at Rs1,437 cr vs Rs1,536 cr (YoY)

--EBITDA down 36.2% at Rs178 cr vs Rs278.7 cr (YoY)

--Margin at 12.4% vs 18.1% (YoY)

-330

February 13, 2024· 14:31 IST

Stock Market LIVE Updates | Arvind Fashion reports Q3 earnings

--Net Profit up 14% at Rs30.1 cr vs Rs26.4 cr (YoY)

--Revenue up 4.9% at Rs1,125.1 cr vs Rs1,072.8 cr (YoY)

--EBITDA up 28% at Rs143.2 cr vs Rs112 cr (YoY)

--Margin at 12.7% vs 10.4% (YoY)

-330

February 13, 2024· 14:26 IST

Stock Market LIVE Updates | Rishabh Instruments slipped 16% after reporting Q3 numbers

Net profit of Rishabh Instruments declined 53.71% to Rs 7.61 crore in the quarter ended December 2023 as against Rs 16.44 crore during the previous quarter ended December 2022.

-330

February 13, 2024· 14:19 IST

-330

February 13, 2024· 14:10 IST

Stock Market LIVE Updates | Coal India: Unions to call one day all India strike on Feb 16

-330

February 13, 2024· 14:07 IST

Stock Market LIVE Updates | Siemens reports Q1SY24 earnings

-- Net profit at Rs505.4 crore Vs CNBCTV Poll of Rs449 crore

-330

February 13, 2024· 14:02 IST

-330

February 13, 2024· 13:59 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Swaraj Suiting | 123.50 | 111.10 | -12.40 0 |

| Kothari Petro | 127.05 | 117.95 | -9.10 56.78k |

| Apollo Sindoori | 2,149.95 | 2,000.40 | -149.55 1.11k |

| Motor and Gen F | 39.80 | 37.75 | -2.05 252 |

| RBM Infracon | 674.00 | 640.00 | -34.00 1.25k |

| Dynamic Service | 125.45 | 120.00 | -5.45 0 |

| DUGLOBAL | 69.00 | 66.20 | -2.80 39.86k |

| Times Guaranty | 126.10 | 121.50 | -4.60 250 |

| Shri Techtex | 79.90 | 77.10 | -2.80 6.96k |

| Cineline India | 129.50 | 125.00 | -4.50 100.24k |

-330

February 13, 2024· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Borosil | 337.00 | 394.00 | 57.00 12.22k |

| Coral India Fin | 49.25 | 54.00 | 4.75 8.80k |

| Magadh Sugar | 631.20 | 673.00 | 41.80 273 |

| Homesfy Realty | 416.50 | 439.95 | 23.45 1.15k |

| Maxposure | 92.00 | 97.00 | 5.00 - |

| Beardsell | 46.10 | 48.50 | 2.40 2.46k |

| Vertoz Advertis | 728.80 | 766.10 | 37.30 495 |

| Deccan Cements | 605.40 | 635.95 | 30.55 978 |

| Salona Cotspin | 323.75 | 339.10 | 15.35 510 |

| KCP Sugar | 36.65 | 38.35 | 1.70 123.56k |

-330

February 13, 2024· 13:57 IST

Stock Market LIVE Updates | Hindalco Q3 net profit up 68.3% at Rs 838 crore versus Rs 498 crore, YoY.

-330

February 13, 2024· 13:56 IST

Stock Market LIVE Updates | HSBC View On Aurobindo Pharma

-Buy call, target cut to Rs 1,240 per share from Rs 1,370 per share

-Q3FY24 results came in-line with estimates

-EBITDA margin at 21.8 percent grew 234 bps QoQ mainly on gRevlimid

-Production halt at Eugia 3 plant to result in a loss of USD 20 million in sales in Q4 per ARBP

-Timely FDA resolution key ahead

-330

February 13, 2024· 13:52 IST

Stock Market LIVE Updates | Zee Entertainment Enterprises seeks shareholder nod for appointment of Uttam Prakash Agarwal, Shishir Desai & PV Ramana Murthy as independent directors for the first term of 3 years i.e from December 17, 2023 to December 16, 2026.

-330

February 13, 2024· 13:51 IST

Stock Market LIVE Updates | The Board of Directors of Coal India at its meeting held on 12th Feb’24 has appointed Shri Mukesh Agrawal, Director (Finance) as the CFO of Coal India Limited (CIL) vice Shri S.K Mehta, ED (Finance) w.e.f 13.02.2024.

-330

February 13, 2024· 13:49 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Indian Railway | 148.10 | 152.50 128.00 | 15.7% |

| Rail Vikas | 247.60 | 256.35 223.30 | 10.88% |

| Jindal Stainles | 582.05 | 583.80 526.55 | 10.54% |

| NHPC | 85.16 | 87.83 77.38 | 10.05% |

| Redington | 197.80 | 202.70 179.95 | 9.92% |

| Neyveli Lignite | 233.00 | 235.40 212.00 | 9.91% |

| 360 ONE WAM | 687.00 | 687.95 626.25 | 9.7% |

| Housing & Urban | 178.20 | 185.80 162.70 | 9.53% |

| Aegis Logistics | 392.00 | 396.00 358.40 | 9.38% |

| Patanjali Foods | 1,531.05 | 1,560.00 1,402.30 | 9.18% |

-330

February 13, 2024· 13:47 IST

Stock Market LIVE Updates | Gold ticks up ahead of US inflation data

Gold prices edged up on Tuesday, ahead of a U.S. inflation report that could give fresh perspective on the timing of the Federal Reserve's first rate cut.

Spot gold was up 0.2% to $2,023.89 per ounce (Oz), after briefly slipping to a more than two-week low of $2,011.72/Oz on Monday.

U.S. gold futures also ticked up 0.2% to $2,037.50/Oz.

-330

February 13, 2024· 13:45 IST

Stock Market LIVE Updates | HSBC View On PI Industries

-Buy call, target Rs 4,100 per share

-Q3FY24 beat expectations on margins

-CSM revenue growth tapers but still offsets a weak domestic performance

-Outlook positive

-Robust cash generation/solid balance sheet provide foundation for growth, pharma on track

-330

February 13, 2024· 13:43 IST

Stock Market LIVE Updates | Tilaknagar Industries Q3 profit falls 42% YoY to Rs 43.8 crore

Tilaknagar Industries has recorded consolidated net profit at Rs 43.8 crore for quarter ended December FY24, falling 42.3% on high base as profit in Q3FY23 was boosted by exceptional gain. Revenue from operations (excluding excise duty) grew by 24.4% YoY to Rs 376.7 crore for the quarter.

-330

February 13, 2024· 13:42 IST

Stock Market LIVE Updates | Ingersoll Rand Q3 Results:

Net profit jumped 15 percent at Rs 55.1 crore versus Rs 48 crore and revenue up 3.1 percent at Rs 329.2 crore versus Rs 319.2 crore, YoY.

-330

February 13, 2024· 13:40 IST

Stock Market LIVE Updates | TVS Srichakra Q3 Results:

Net profit rose 23 percent at Rs 24.1 crore versus Rs 19.6 crore and revenue down 1.7 percent at Rs 719 crore versus Rs 731.3 crore, YoY.

-330

February 13, 2024· 13:38 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Oracle Fin Serv | 7619.95 | 7619.95 | 7,503.00 |

| HDFC AMC | 3778.80 | 3778.80 | 3,770.60 |

| Chalet Hotels | 848.60 | 848.60 | 835.25 |

| Apollo Hospital | 6742.40 | 6742.40 | 6,714.95 |

| Reliance | 2957.80 | 2957.80 | 2,938.35 |

| Aster DM Health | 460.00 | 460.00 | 444.90 |

| Max Healthcare | 909.00 | 909.00 | 879.50 |

| Bajaj Auto | 7938.35 | 7938.35 | 7,861.05 |

| Dr Reddys Labs | 6411.45 | 6411.45 | 6,337.15 |

| Bosch | 25655.85 | 25655.85 | 25,423.65 |

-330

February 13, 2024· 13:37 IST

Stock Market LIVE Updates | Sterlite Power gets Rs 2,400 crore funding from REC arm for Beawar project

Sterlite Power has secured Rs 2,400 crore funding from state-owned REC Power Development and Consultancy Ltd (RECPDCL) for its Beawar transmission project in Rajasthan.

In a statement, Sterlite Power said "it has has successfully achieved financial closure for its Beawar Transmission Limited (BTL) project." This accomplishment comes within four months of Sterlite Power acquiring the project.

"Financial closure is an important milestone in an infrastructure project's lifecycle. Achieving this in a short span will help us in expediting the delivery of this critical project - an integral part of the larger Green Energy Corridor that will help evacuate around 20 GW of renewable energy," Pratik Agarwal, Managing Director, Sterlite Power said.

Sterlite Power acquired the BTL SPV in September 2023 to execute the inter-state green energy transmission project on BOOT (build, own, operate, transfer) basis, for a period of 35 years. Read More

-330

February 13, 2024· 13:33 IST

Sensex Today | Oil prices edge up on Middle East risk

Oil prices rose on Tuesday on fears Middle East tensions could disrupt supply, but uncertainty about the pace of potential U.S. interest rate cuts and the ensuing impact on fuel demand capped gains.

Brent futures edged up 31 cents, or 0.4%, to $82.31 a barrel as of 0725 GMT. U.S. West Texas Intermediate (WTI) crude rose 36 cents, or 0.5%, to $77.28 a barrel.

Oil prices were near flat in Monday's trade, after gaining 6% last week.

-330

February 13, 2024· 13:31 IST

Stock Market LIVE Updates | West Coast Q3 Results:

Net profit down 48.4 percent at Rs 136 crore versus Rs 263.7 crore and revenue down 15.7 percent at Rs 1,045 crore versus Rs 1,239 crore, YoY.

-330

February 13, 2024· 13:30 IST

Stock Market LIVE Updates | HEG Q3 profit plunges 58% YoY to Rs 43.7 crore

HEG has recorded consolidated net profit at Rs 43.7 crore for third quarter of FY24, falling 58.3% compared to corresponding period of last fiscal. Revenue from operations increased 6% YoY to Rs 562.4 crore for the quarter.

-330

February 13, 2024· 13:27 IST

Stock Market LIVE Updates | Lemon Tree Hotels signs License Agreement for new hotel in Telangana

Lemon Tree Hotels has signed a License Agreement for new hotel in Marpalle, Telangana, under its brand – Lemon Tree Resort. This hotel will be spread over 5 acres and have 50 rooms including 14 villas of which 5 would be water villas. This hotel is expected to be operational in FY27.

-330

February 13, 2024· 13:25 IST

Stock Market LIVE Updates | MTNL Q3 Results:

Net loss at Rs 839 crore versus loss of Rs 793 crore and revenue down 3 percent at Rs 192 crore versus Rs 198 crore, QoQ.

-330

February 13, 2024· 13:21 IST

Stock Market LIVE Updates | Deccan Cements Q3 Earnings:

Net profit up 26.2 percent at Rs 15.4 crore versus Rs 12.2 crore and revenue up 2.8% at Rs 216.9 crore versus Rs 211 crore, YoY.

-330

February 13, 2024· 13:19 IST

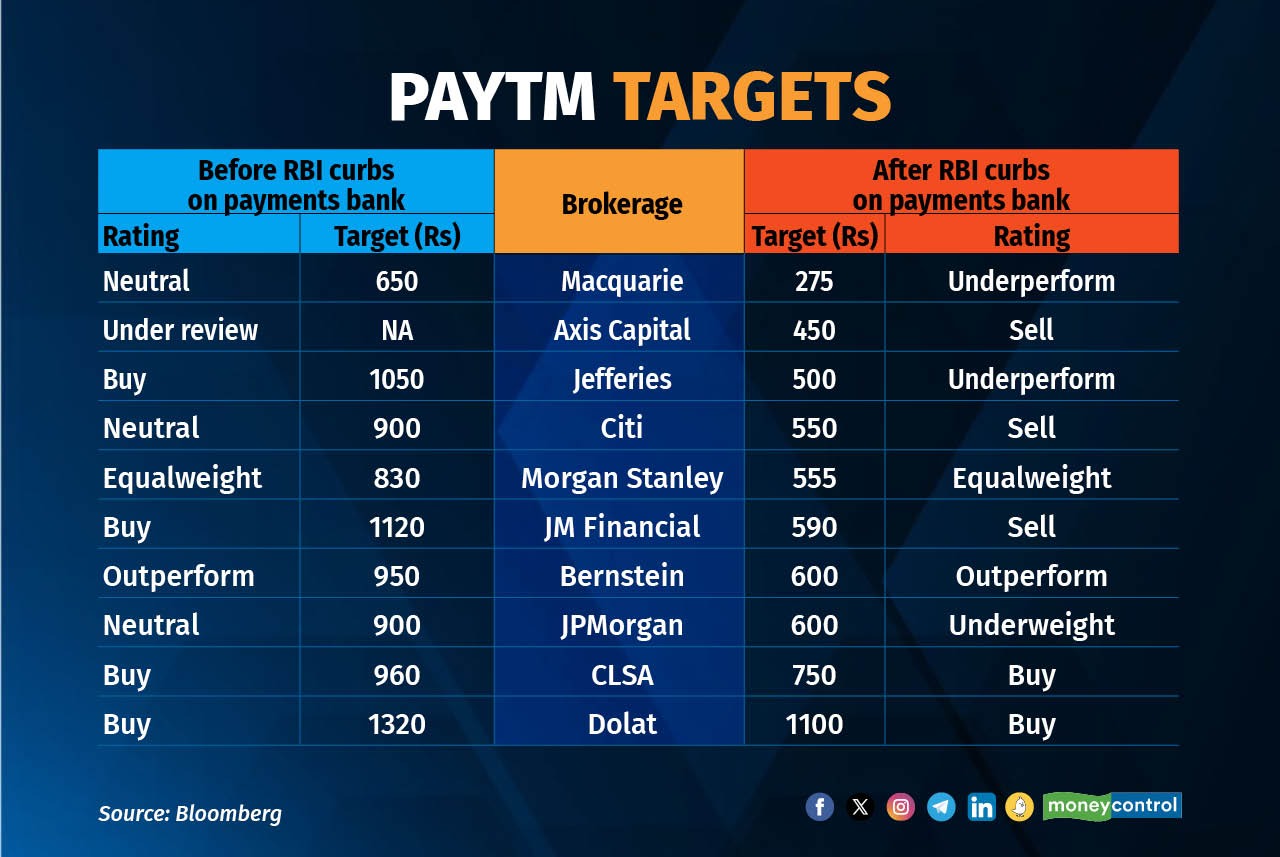

Foreign brokerages cut Paytm's target price between 20-60 percent after RBI diktat on Paytm Payments Bank.

-330

February 13, 2024· 13:16 IST

Sensex Today | Nifty PSU Bank index up 0.3 percent led by Bank of Maharashtra, Central Bank of India, Punjab National Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Mah | 56.95 | 2.98 | 50.90m |

| Central Bank | 61.45 | 2.5 | 46.60m |

| PNB | 121.20 | 2.49 | 51.99m |

| Punjab & Sind | 61.40 | 2.42 | 5.45m |

| UCO Bank | 55.85 | 1.36 | 41.96m |

| Bank of India | 129.80 | 1.01 | 14.06m |

| Canara Bank | 547.80 | 0.38 | 6.65m |

| Bank of Baroda | 255.65 | 0.37 | 12.97m |

| SBI | 708.45 | 0.08 | 14.95m |

-330

February 13, 2024· 13:12 IST

Stock Market LIVE Updates | Borosil Q3 Results:

Net profit at Rs 37.3 crore against Rs 15.9 crore and revenue up 45.9% at Rs 302 crore against Rs 207 crore, YoY.

-330

February 13, 2024· 13:10 IST

Stock Market LIVE Updates | CLSA View On Bharat Forge

-Sell call, target Rs 977 per share

-Q3 above estimates but growth momentum to slow

-Management expects growth momentum to moderate in both domestic & export markets

-Subsidiaries continue to be in red, which is dragging down consolidated profit growth

-330

February 13, 2024· 13:07 IST

Sensex Today | Pankaj Shrestha - Head of Investment Services, at Prabhudas Lilladher

Sovereign Gold Bond (SGB) can be an ideal investment avenue for long term investors who are willing to hold onto their investments for 5-8 years. One of the significant advantages is that there is no tax on the capital gains if investment is held till maturity.

Apart from this, SGB provide additional assured annual interest of 2.50% until maturity, over and above gold returns. These benefits are unique to SGB’s and are not available in any other form of gold investments.

SGB has become more attractive investment option after withdrawal of Long-Term Capital Gains (LTCG) benefit from Gold ETF & Gold Mutual Funds w.e.f. 1st April’23.

-330

February 13, 2024· 13:03 IST

Trading resumed at 1 p.m. The delayed start was attributed to the slow processing and generation of backend files for the members. We apologize for any inconvenience caused - MCX Spokesperson

-330

February 13, 2024· 13:02 IST

Stock Market LIVE Updates | HPL Electric bags order worth Rs 181 crpre for supply of Smart Meters

HPL Electric & Power Limited has received an order of Worth Rs 181 crores (inclusive of tax) from leading AMISP client for the supply of smart meters in the normal course of business, which is to be executed as per the terms & conditions of Letter of Award (LoA).

-330

February 13, 2024· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was up 373.46 points or 0.53 percent at 71,445.95, and the Nifty was up 92.10 points or 0.43 percent at 21,708.10. About 1226 shares advanced, 1992 shares declined, and 69 shares unchanged.

-330

February 13, 2024· 13:00 IST

| Company | Price at 12:00 | Price at 12:34 | Chg(%) Hourly Vol |

|---|---|---|---|

| Parshva Enterpr | 185.95 | 165.05 | -20.90 0 |

| Binayaka Tex | 937.40 | 848.25 | -89.15 4 |

| Frontline Trans | 42.23 | 38.53 | -3.70 63 |

| Sri Nachammai | 35.62 | 32.50 | -3.12 427 |

| Mansi Financ | 49.84 | 45.50 | -4.34 183 |

| Super Sales | 1,412.05 | 1,290.00 | -122.05 220 |

| Sarthak Ind | 27.39 | 25.13 | -2.26 43 |

| Choksi Imaging | 71.70 | 66.20 | -5.50 104 |

| Mohite Ind | 39.88 | 37.01 | -2.87 2 |

| Medicamen Bio | 564.30 | 528.05 | -36.25 15.49k |

-330

February 13, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:34 | Chg(%) Hourly Vol |

|---|---|---|---|

| Tokyo Finance | 19.75 | 21.68 | 1.93 0 |

| Centennial Sutu | 92.90 | 101.85 | 8.95 52 |

| United Credit | 21.46 | 23.41 | 1.95 363 |

| Quest Capital | 300.00 | 326.95 | 26.95 402 |

| Betex | 286.00 | 311.00 | 25.00 2 |

| Suryo Food | 19.37 | 21.00 | 1.63 361 |

| Suryaamba Spin | 158.00 | 169.55 | 11.55 630 |

| VJTF | 137.00 | 146.00 | 9.00 401 |

| Brahma Infra | 66.00 | 69.98 | 3.98 4.89k |

| JMJ Fintech | 22.60 | 23.89 | 1.29 486 |

-330

February 13, 2024· 12:56 IST

Stock Market LIVE Updates | Repco Home Finance Q3 profit jumps 23% YoY to Rs 99 crore

Repco Home Finance has registered a 23.1% on-year increase in net profit at Rs 99.44 crore for third quarter of current financial year 2023-24. Net interest income grew by 17.8% year-on-year to Rs 163.5 crore during the quarter.

-330

February 13, 2024· 12:54 IST

Stock Market LIVE Updates | Shrikant Chouhan on PSUs

-After the correction we can expect a good rebound from lower levels

-Multiples for some PSUs like IOC, BPCL, RVNL or NHPC are at crazy levels

-Prospects for most PSUs look good over the next 2-3 years

-Correction could be a good opportunity for investors who have missed the rally

-Look for adding stocks from PSU banks

-Need to be stock specific; expect selective activity in PSUs hereon

-Expect some railway stocks to do very well going forward

-Like RITES, Railtel; correction in Railtel will not last for more than 1-2 weeks

-Like IRCTC; can look to add on corrections

-NHPC has rallied quite substantially from its OFS price

-NHPC should stabilise around the OFS price of Rs 75

-If market starts to look for fair value; NHPC may correct to Rs 60 levels

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IRFC | 146.70 | 10.3 | 25.78m |

| Rail Vikas | 246.10 | 7.09 | 5.08m |

| KIOCL | 396.40 | 6.42 | 136.62k |

| Ircon Internati | 205.20 | 5.5 | 2.90m |

| NLC India | 226.00 | 5.44 | 821.03k |

| ITI | 294.05 | 4.29 | 433.89k |

| Coal India | 450.00 | 3.91 | 1.69m |

| Cochin Shipyard | 830.00 | 3.02 | 235.55k |

| NHPC | 83.39 | 2.91 | 32.24m |

| Bank of Mah | 56.98 | 2.78 | 5.76m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NBCC (India) | 123.10 | -7.55 | 6.45m |

| SJVN | 105.65 | -6.09 | 12.71m |

| MMTC Ltd | 77.35 | -5 | 46.98k |

| BHEL | 206.90 | -4.35 | 1.36m |

| SAIL | 117.85 | -4.11 | 4.96m |

| BEML | 2,775.00 | -3.76 | 55.81k |

| New India Assur | 240.20 | -2.71 | 351.91k |

| LIC India | 996.35 | -2.54 | 275.25k |

| HUDCO | 175.75 | -2.5 | 4.16m |

| NALCO | 140.00 | -2.34 | 1.89m |

-330

February 13, 2024· 12:48 IST

Stock Market LIVE Updates | Time Technoplast Q3 profit surges 50% YoY to Rs 92 crore

Time Technoplast has clocked consolidated net profit at Rs 91.6 crore for October-December period of FY24, rising 49.55% over corresponding period of last fiscal. Revenue from operations grew by 17.4% YoY to Rs 1,324.65 crore for the quarter.

-330

February 13, 2024· 12:45 IST

Stock Market LIVE Updates | Shrikant Chouhan on Bharat Forge

-Some more selloff is likely

-Company failing to deliver on EBITDA front

-Can drop to Rs 850 where it has fair value

-330

February 13, 2024· 12:43 IST

Sensex Today | India narrows gap with China in key MSCI index with weight hitting new high

India has narrowed the gap with China in MSCI's Global Standard index, which tracks emerging market stocks for investors, after the latest revision.

Index provider MSCI raised India's weightage in the index to an all-time high of 18.2% on Tuesday, which could lead to inflows of about $1.2 billion, analysts said.

In comparison, China's weight in the index fell to 25.4% after the February revision, from 26.6% a year ago.

The convergence of weights between Indian and Chinese stocks has intensified since August 2020, when China's weightage was five times that of India's.

MSCI's revisions will come into effect after market close on Feb. 29. Indian shares had a 17.9% weight on the index ahead of the February review.

The gain for India can be attributed to a sustained rally in equities and relative underperformance of other emerging markets, especially China, Nuvama Alternative & Quantitative Research said in a note on Tuesday.

India could surpass a 20% weight on the MSCI index by early 2024, on consistent flows from domestic institutional investors and steady foreign portfolio investor participation, Nuvama said.

-330

February 13, 2024· 12:40 IST

Stock Market LIVE Updates | CLSA View On Hindustan Aeronautics

-Outperform call, target Rs 3,225 per share

-Key message from Q3 was the wait for its biggest engine order of USD 3.6 billion

-The order has lengthened with hopes now pinned on Q4FY24

-Company reported Q3 EBITDA- up 6 percent, but its margin saw a 31 bps decline

-PAT was supported by a 44 percent rise in treasury income

-Its cash pile swelled to USD 2.6 billion, +27 percent YoY along with lower depreciation charges

-Company’s backlog remained flat YoY in Q3

-Its decadal pipeline remains at USD 45 billion

-A shift in key aerospace programs to PPP mode would be a risk

-330

February 13, 2024· 12:36 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Bayer Cropscien | 6,039.45 | 6,049.90 5,915.90 | -0.17% |

| Coromandel Int | 1,089.80 | 1,093.70 1,071.80 | -0.36% |

| Torrent Pharma | 2,622.25 | 2,632.45 2,589.00 | -0.39% |

| Honeywell Autom | 37,773.85 | 37,950.00 37,608.80 | -0.46% |

| Tube Investment | 3,499.00 | 3,515.00 3,470.00 | -0.46% |

| Endurance Techn | 1,815.15 | 1,825.00 1,768.15 | -0.54% |

| United Brewerie | 1,727.90 | 1,737.35 1,709.00 | -0.54% |

| Ashok Leyland | 172.00 | 172.95 169.85 | -0.55% |

| Shriram Finance | 2,312.35 | 2,325.45 2,237.20 | -0.56% |

| Voltas | 1,079.70 | 1,086.00 1,071.00 | -0.58% |

-330

February 13, 2024· 12:34 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Kajaria Ceramic | 1,235.85 | 1,236.00 1,188.00 | -0.01% |

| GE T&D India | 799.95 | 800.10 761.00 | -0.02% |

| Punjab Chemical | 975.60 | 975.90 945.35 | -0.03% |

| Hester Bio | 1,419.10 | 1,419.70 1,402.80 | -0.04% |

| PG Electroplast | 1,898.15 | 1,899.30 1,813.10 | -0.06% |

| Kirloskar Ind | 3,984.85 | 3,987.75 3,945.00 | -0.07% |

| Bannariamman | 2,480.00 | 2,481.85 2,455.00 | -0.07% |

| Deep Ind | 235.05 | 235.25 226.85 | -0.09% |

| Dr Lal PathLab | 2,476.40 | 2,478.65 2,434.70 | -0.09% |

| NGL Fine Chem | 1,835.15 | 1,837.00 1,790.00 | -0.1% |

-330

February 13, 2024· 12:31 IST

Reliance Industries on February 13 became India's first company to surpass Rs 20 lakh crore in market capitalisation after its shares rallied over 14 percent so far in 2024. The stock hit a fresh record high of Rs 2,957.80 on the BSE and gained as much as 1.8 percent intraday on February 13.

-330

February 13, 2024· 12:28 IST

Stock Market LIVE Updates | IndusInd Bank inks MoU with UP government to foster livestock welfare

IndusInd Bank and Bharat Financial Inclusion Limited (100% subsidiary of IndusInd Bank) have signed a Memorandum of Understanding (MoU) with the State Government of Uttar Pradesh to focus on livestock healthcare management and welfare in the Western Uttar Pradesh region through their social initiative, Bharat Sanjeevani Program.

-330

February 13, 2024· 12:23 IST

Stock Market LIVE Updates | KIOCL Q3 Results:

Net profit Rs 39 crore versus loss of Rs 34 crore and revenue up 91 percent at Rs 549.5 crore versus Rs 287.9 crore, YoY.

-330

February 13, 2024· 12:23 IST

-330

February 13, 2024· 12:21 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Kajaria Ceramic | 1,232.75 | 1,233.65 1,188.00 | -0.07% |

| BASF | 3,380.00 | 3,383.00 3,212.50 | -0.09% |

| Poly Medicure | 1,523.30 | 1,524.80 1,481.35 | -0.1% |

| Minda Corp | 402.25 | 402.65 386.95 | -0.1% |

| Metropolis | 1,693.55 | 1,695.45 1,649.25 | -0.11% |

| HDFC Asset Mana | 3,761.05 | 3,765.90 3,625.00 | -0.13% |

| Garware Technic | 3,502.00 | 3,507.95 3,420.15 | -0.17% |

| Bayer Cropscien | 6,039.45 | 6,049.90 5,915.90 | -0.17% |

| Asian Paints | 2,968.90 | 2,974.00 2,945.60 | -0.17% |

| HUL | 2,395.80 | 2,400.30 2,380.35 | -0.19% |

-330

February 13, 2024· 12:18 IST

Stock Market LIVE Updates | NHPC stock surges 8% after firm announces interim dividend

NHPC shares surged 8 percent on February 13 after the company announced an interim dividend of Rs 1.4 a share for the financial year 2023-24.

Despite a weak third quarter, analysts remain bullish on the counter due to a 2.5 percent dividend yield.

The stock of this hydropower player has surged 24 percent in the past month against a percent decline in the benchmark Sensex. Read More

-330

February 13, 2024· 12:14 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| KOTAK PSUBK ETF | 664.00 -0.29% | 102.94k 3,158.80 | 3,159.00 |

| Cambridge Tech | 88.24 17.42% | 347.83k 14,496.80 | 2,299.00 |

| Sunteck Realty | 452.45 -0.72% | 719.35k 30,890.80 | 2,229.00 |

| Le Lavoir | 105.00 1.06% | 60.45k 3,557.60 | 1,599.00 |

| Constronics Inf | 23.03 4.97% | 17.83k 1,702.60 | 947.00 |

| Medicamen Bio | 554.10 14.06% | 23.48k 2,540.00 | 824.00 |

| ICICINV20 | 134.39 0.07% | 42.57k 4,759.60 | 794.00 |

| Ansal Housing | 17.06 1.73% | 1.75m 232,822.60 | 650.00 |

| Autoline Ind | 156.15 13.07% | 313.16k 42,464.20 | 637.00 |

| Purshottam Invt | 38.52 4.99% | 38.16k 5,469.80 | 598.00 |

-330

February 13, 2024· 12:12 IST

Stock Market LIVE Updates | GR Infraprojects Q3 profit declines 25% YoY to Rs 243 crore

GR Infraprojects has reported consolidated net profit at Rs 242.9 crore for quarter ended December FY24, falling 25% compared to year-ago period, impacted by weak topline and operating numbers. Revenue from operations fell 2.6% YoY to Rs 2,134 crore for the quarter. Meanwhile, the board has approved acquisition of 100% equity shares of Pachora Power Transmission, a wholly owned subsidiary of REC Power Development and Consultancy. After this acquisition, Pachora Power Transmission will become wholly owned subsidiary company of GR Infraprojects.

-330

February 13, 2024· 12:08 IST

-330

February 13, 2024· 12:05 IST

Sensex Today | Nikkei soars, dollar steady ahead of US inflation report

Japanese shares touched a 34-year peak on Tuesday, while the dollar held steady, keeping the yen perilously close to 150 per dollar level ahead of a key U.S. inflation report that could help shape the Federal Reserve's rates outlook.

Bitcoin remained strong after crossing $50,000 for the first time in over two years, thanks to inflows into exchange traded funds backed by the digital asset. It was last at $49,897.

Japan's Nikkei continued to advance, climbing to 38,010 on Tuesday, not far from the record high of 38,957 the benchmark touched on Dec. 29, 1989. The Nikkei has gained more than 13% so far this year, after rising 28% in 2023.

-330

February 13, 2024· 12:03 IST

-330

February 13, 2024· 12:00 IST

Sensex Today | Market at 12 PM

The Sensex was up 432.77 points or 0.61 percent at 71,505.26, and the Nifty was up 107.80 points or 0.50 percent at 21,723.80. About 1350 shares advanced, 1841 shares declined, and 70 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ICICI Bank | 1,015.25 | 1.97 | 75.34k |

| Reliance | 2,951.00 | 1.66 | 135.17k |

| NTPC | 320.80 | 1.5 | 225.69k |

| Axis Bank | 1,060.70 | 1.32 | 58.13k |

| Bajaj Finserv | 1,576.90 | 1.26 | 24.07k |

| Larsen | 3,332.35 | 1 | 14.44k |

| Maruti Suzuki | 10,789.85 | 0.75 | 2.40k |

| Kotak Mahindra | 1,722.00 | 0.7 | 36.93k |

| Bajaj Finance | 6,619.40 | 0.67 | 20.10k |

| Nestle | 2,473.00 | 0.6 | 3.83k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Wipro | 498.50 | -0.58 | 120.87k |

| HCL Tech | 1,657.00 | -0.55 | 16.38k |

| M&M | 1,651.20 | -0.53 | 16.08k |

| IndusInd Bank | 1,440.50 | -0.51 | 25.15k |

| ITC | 405.90 | -0.23 | 681.79k |

| Tata Motors | 909.15 | -0.23 | 155.19k |

| Tech Mahindra | 1,315.60 | -0.19 | 8.65k |

| Infosys | 1,676.80 | -0.18 | 26.31k |

| Power Grid Corp | 269.85 | -0.09 | 279.25k |

| UltraTechCement | 9,956.60 | -0.05 | 1.38k |

-330

February 13, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| HRH Next | 35.10 | 31.60 | -3.50 - |

| Globesecure | 72.45 | 67.80 | -4.65 1.11k |

| Flexituff Ventu | 40.95 | 38.60 | -2.35 3.07k |

| Maxposure | 97.35 | 92.05 | -5.30 - |

| Aurionpro Solut | 2,120.00 | 2,005.20 | -114.80 17.34k |

| Perfect Infra | 39.80 | 37.80 | -2.00 32.70k |

| Akanksha Power | 102.50 | 98.40 | -4.10 - |

| Fonebox Retail | 175.00 | 168.00 | -7.00 6.96k |

| ABM Inter | 61.45 | 59.00 | -2.45 761 |

| Beta Drugs | 1,300.00 | 1,250.00 | -50.00 336 |

-330

February 13, 2024· 11:58 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Medicamen Bio | 495.05 | 569.95 | 74.90 5.43k |

| Phantom Digital | 432.00 | 475.10 | 43.10 22.82k |

| TRF | 466.25 | 497.00 | 30.75 571.17k |

| Kandarp Digi | 27.60 | 29.35 | 1.75 16.87k |

| P E Analytics | 282.00 | 299.45 | 17.45 5.11k |

| Elgi Rubber | 56.60 | 60.00 | 3.40 21.71k |

| RBZ Jewellers | 160.55 | 170.00 | 9.45 80.57k |

| GeeCee Ventures | 279.55 | 295.90 | 16.35 9.27k |

| Aptech | 225.15 | 237.65 | 12.50 269.96k |

| Supreme Infra | 68.15 | 71.90 | 3.75 79.22k |

-330

February 13, 2024· 11:56 IST

Results Today

-330

February 13, 2024· 11:53 IST

Stock Market LIVE Updates | IRFC, PFC line up bonds to raise Rs 3,500 crore

Indian Railway Finance Corporation (IRFC) and Power Finance Corporation (PFC) plan to raise up to Rs 3,500 through bonds, money market sources said. Both the bonds have a maturity of 10 years.

IRFC will raise up to Rs 3,000 crore, which includes Rs 2,500 crore in greenshoe and PFC will raise up Rs 500 crore, including Rs 400 crore in greenshoe.

The greenshoe option is a provision in an underwriting agreement that grants the underwriter the right to sell investors more bonds than initially planned by the issuer if the demand for a security issue proves higher than expected.

The bidding for PFC's bonds will take place on February 13 between 10:30am and 11:30am on the electronic bidding platform of the BSE. While, IRFC bond bidding will take place on February 14 between 10am and 11am on the BSE’s bidding platform. Read More

-330

February 13, 2024· 11:52 IST

-330

February 13, 2024· 11:51 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,395.25 0.34 | 431.17k | 60.03 |

| SBI | 710.15 0.32 | 497.20k | 35.34 |

| Reliance | 2,950.20 1.63 | 94.89k | 27.83 |

| ITC | 404.95 -0.47 | 646.24k | 26.37 |

| Tata Steel | 137.30 -0.07 | 1.59m | 21.73 |

| Tata Motors | 911.80 0.06 | 145.35k | 13.27 |

| Bajaj Finance | 6,613.50 0.58 | 19.89k | 13.14 |

| Bharti Airtel | 1,122.95 0.36 | 92.48k | 10.35 |

| Asian Paints | 2,970.00 0.45 | 30.84k | 9.13 |

| Power Grid Corp | 269.05 -0.39 | 274.39k | 7.32 |

-330

February 13, 2024· 11:50 IST

Stock Market LIVE Updates | Phoenix Mills Q3 profit surges 58% YoY to Rs 279 crore

Phoenix Mills has recorded consolidated net profit at Rs 279.4 crore for October-December period of FY24, growing 58.4% over corresponding period of previous fiscal. Revenue from operations increased by 44.2% YoY to Rs 986 crore for the quarter. Meanwhile, Anuraag Srivastava has resigned as Chief Financial Officer of the company, with effect from March 18, 2024.