Indian benchmark indices traded in a narrow range amid mixed global cues in morning trade on February 13. The Nifty is likely to find support for the day between 21,450 and 21,500, with resistance levels at 21,725 and 21,850. Experts predict that the Nifty is likely to trade in the 21,500-21,725 range.

The BSE Midcap index went down 0.4 percent, and the BSE Smallcap index 1.5 percent. On the sectoral front, the metal index witnessed a 3 percent decline, the power index 1 percent, and the indices for capital goods, IT, and realty were down by 0.5 percent each. In contrast, the Nifty Bank index edged up 0.5 percent.

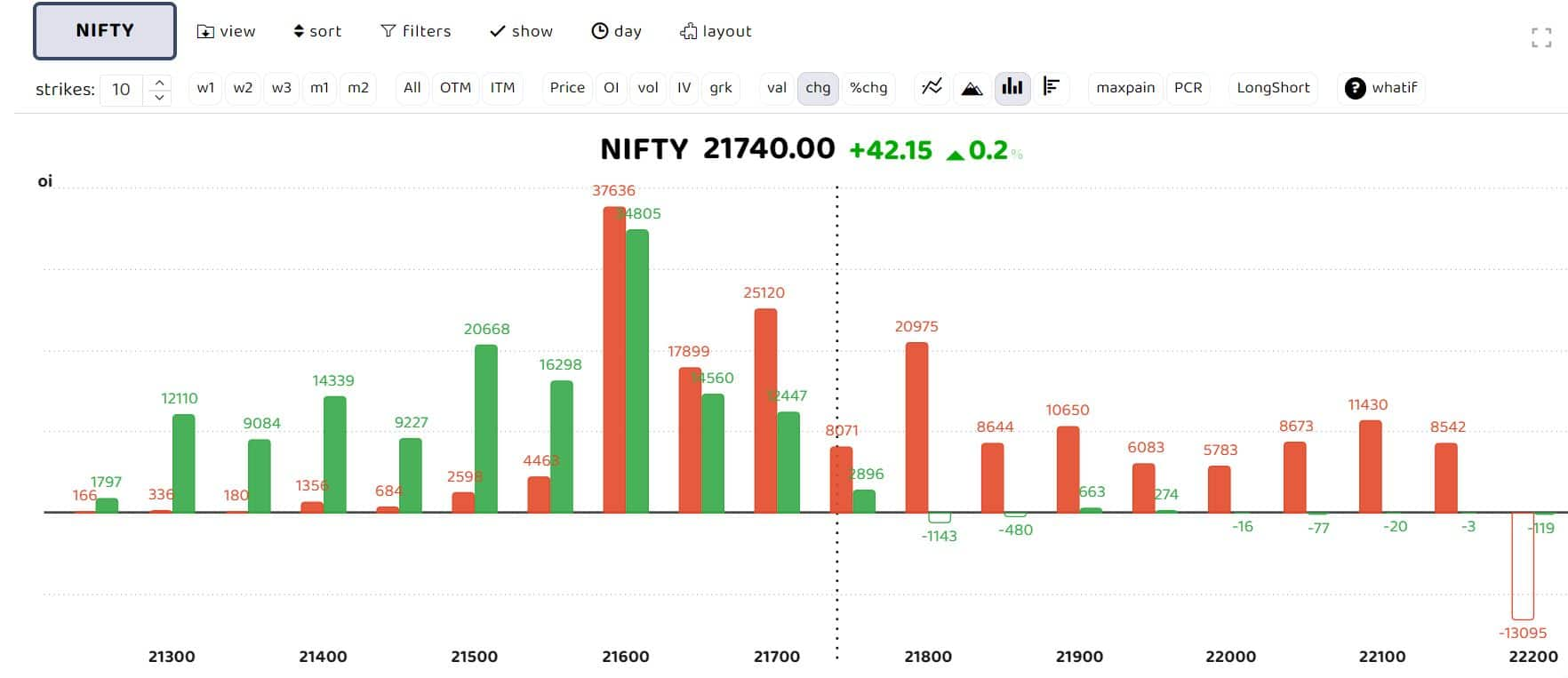

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Open interest data indicates that the 21,600 and 21,650 strikes constitute a crucial straddle position. The 21,500 put and 22,000 call options have garnered the highest Open Interest. There have been fresh additions to Open Interest in call writing, particularly at the lower strikes of 21,700 and 21,900, as the Nifty fell below 21,700. With a Put-Call Ratio (PCR) of 0.85 and an Implied Volatility (IV) of 0.6, it suggests substantial call positioning. Put writing has shifted to a lower strike at 20,800," stated Akshay Bhagwat, senior vice-president of derivatives research at JM Financial.

Bhagwat predicts that the Nifty is likely to trade within the range of 21,500-21,725 on February 13.

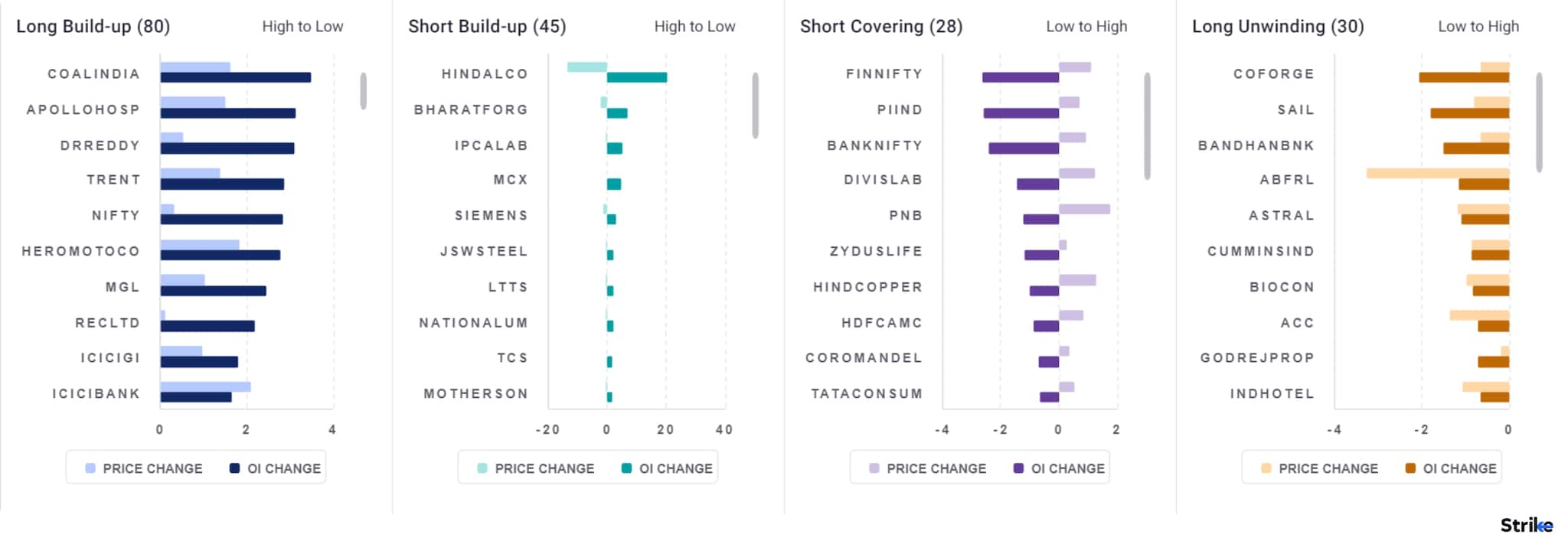

Among individual stocks, long build-up is observed in Coal India, Apollo Hospitals, Dr Reddy's and Trent. While short build-up can be seen in Hindalco, Bharat Forge and Ipca Labs.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!