Closing Bell: Nifty above 21,600, Sensex up 496 pts; all sectors in the green

-330

January 19, 2024· 16:28 IST

-330

January 19, 2024· 16:26 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap up and consolidated in a narrow range for the day. On the daily charts we can observe that the Nifty is witnessing a counter trend pullback of the fall from 22124 to 21285. The 50% and 61.82% fibonacci retracement levels are placed at 21705 – 21804 where we can expect the selling pressure to resume. The hourly momentum indicator has reached the equilibrium line indicating that the pullback is nearing completion, Overall, we believe that trend is negative, and this pullback should be used as a selling opportunity. In terms of levels, 21705 – 21804 is the immediate hurdle zone while 21570 – 21500 is the crucial support zone

Bank Nifty was comparatively weak today. It gave up most of the gains and ended marginally in the green. Overall, we believe that the Bank Nifty can consolidate in the range 46500 – 45500 from short term perspective. A breach of 45500 can lead to a further decline till 45200 – 45000.

-330

January 19, 2024· 16:16 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets witnessed some respite after 3 days of decline and gained over half a percent. Firm global cues triggered a gap-up start in Nifty, followed by range bound movement till the end. Meanwhile, a mixed trend on the sectoral front kept traders occupied wherein FMCG, metal and energy edged higher while banking continued to reel under pressure. The broader indices maintained their outperformance and gained over a percent each.

Nifty has reclaimed its short term moving average but lacks decisiveness. We reiterate our cautious view citing the prevailing underperformance of the banking and eyeing the 21,700-21,850 zone to act as a hurdle. Traders should continue stock-specific approach and prefer hedged trades.

-330

January 19, 2024· 15:49 IST

Vinod Nair, Head of Research, Geojit Financial Services:

A 'buy on dips' and encouraging global cues propelled the market's recovery. Today’s rebound was broad based; however, investors are disappointed and expect moderation in the rally. As FIIs persist with risk-off sparked by the likelihood that interest rates may not moderate and domestic earnings growth can slow down as per the initial Q3 results announced. Sector rotation is likely to propel going ahead.

-330

January 19, 2024· 15:43 IST

HUL Q3 earnings:

Net profit up 0.6% at Rs 2,519 crore versus Rs 2,505 crore, YoY.

-330

January 19, 2024· 15:38 IST

Shares of Rail Vikas Nigam (RVNL) ended with 19.5 percent gain on multiple block deals:

-330

January 19, 2024· 15:33 IST

Rupee Close:

Indian rupee ended higher at 83.06 per dollar on Friday against Thursday's close of 83.12.

-330

January 19, 2024· 15:32 IST

RBL Bank Q3 Results:

Net profit at Rs 233 crore and Net Interest Income (NII) at Rs 1,546 crore

-330

January 19, 2024· 15:30 IST

Market Close:

Benchmark indices ended higher on January 19 with Nifty above 21,600.

At close, the Sensex was up 496.37 points or 0.70 percent at 71,683.23, and the Nifty was up 160.10 points or 0.75 percent at 21,622.40. About 2183 shares advanced, 1043 shares declined, and 62 shares unchanged.

ONGC, Bharti Airtel, NTPC, Tech Mahindra and SBI Life Insurance were among the top gainers on the Nifty, while losers were IndusInd Bank, HDFC Bank, Kotak Mahindra Bank, Divis Lab and Adani Ports.

All the sectoral indices ended in the green with auto, capital goods, Information Technology, FMCG, metal, oil & gas and power up 1-2 percent each.

BSE Midcap and smallcap indices added 1% each.

-330

January 19, 2024· 15:26 IST

Stock Market LIVE Updates | Ramco Systems enters into non-exclusive arrangement with BDO India LLP to explore domestic & International opportunities

The Company has entered into a non-exclusive arrangement with BDO India LLP by way of a Memorandum of Understanding for exploring domestic and international opportunities. The partnership leverages the distinctive strengths of each entity, positioning Ramco as the Technology Platform Provider and BDO India as the Payroll & Managed Services Provider. The consideration will be decided on a case-to-case basis.

-330

January 19, 2024· 15:20 IST

Stock Market LIVE Updates | CLSA View On HDFC Bank

-Buy call, target Rs 2,025 per share

-Interacted with over 20 clients since company’s Q3 results

-Most domestic clients were unhappy with Q3 results

-Many of the foreign investors believe that we are near the end of ‘EPS Cuts’ cycle

-Key concerns were on deposits and NIM

-On deposits, some clients believed that it was a macro problem & not intrinsic to alone

-Expect RBI to reduce the USD 20 billion liquidity deficit by a mix of FX purchases

-Possible for 50 bps CRR cut and open market operations

-330

January 19, 2024· 15:15 IST

Sensex Today | BSE Power index up 1 percent supported by JSW Energy, BHEL, NTPC, NHPC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| JSW Energy | 503.50 | 5.26 | 358.29k |

| BHEL | 222.10 | 4.76 | 3.19m |

| NHPC | 73.89 | 3.98 | 8.93m |

| NTPC | 308.15 | 2.94 | 1.15m |

| Siemens | 4,137.80 | 2.35 | 6.00k |

| ABB India | 4,818.15 | 2.28 | 5.94k |

| Tata Power | 348.50 | 0.87 | 842.98k |

| Power Grid Corp | 235.20 | 0.75 | 779.50k |

| CG Power | 454.20 | 0.32 | 34.58k |

-330

January 19, 2024· 15:11 IST

Sensex Today | Epack Durable IPO: Issue subscribed 46%, retail portion booked 78% on Day 1

The Rs 640 crore-IPO of Epack Durable was subscribed 46 percent by the afternoon of January 19, the first day of bidding, as investors bought 91.19 lakh equity shares against the offer size of 1.99 crore.

Retail investors sent in bids for 78 percent of the shares set aside for them. Non-institutional investors (high networth individuals) picked 29 percent of their allotted quota, while qualified institutional buyers bought 0.08 percent of their portion of shares.

-330

January 19, 2024· 15:09 IST

Stock Market LIVE Updates | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas:

Indian Rupee appreciated by 0.03% on positive domestic markets and softness in US Dollar. However, recovery in crude oil prices and FII outflows over the past couple of sessions capped sharp gains. US Dollar has softened on rise in risk appetite in global markets. However, US weekly unemployment claims and data from the housing sector led to some hawkishness, and trimming rate cut expectations by Fed in March 2024.

We expect Rupee to trade with a slight positive bias on positive global equities and weak US Dollar. However, rise in crude oil prices amid geopolitical tensions in the Middle East may cap sharp gains. Any recovery in US Dollar on hawkish Fedspeak may support US Dollar and, in turn, weigh on Rupee at higher levels. Traders may remain cautious ahead of Michigan consumer sentiment and inflation expectations as well as existing home sales data from US. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.50.

-330

January 19, 2024· 15:06 IST

Stock Market LIVE Updates | Morgan Stanley View On Home First Finance Company India

-Overweight call, target Rs 1,250 per share

-Q3 PAT was 1 percent ahead of estimate, driven by higher assignment income & lower credit cost

-NII missed estimate by 4 percent, on lower-than-expected loan spreads

-NII missed estimates on higher liquidity levels

-Borrowing costs rose 6 bps QoQ

-Disbursements up 5 percent QoQ and AUM up 8 percent QoQ growth were strong

-330

January 19, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:50 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kapil Raj Finan | 22.31 | 20.21 | -2.10 58 |

| Vivid Mercant | 63.50 | 57.83 | -5.67 348 |

| Gogia Capital | 105.39 | 97.00 | -8.39 2 |

| Captain Poly | 53.69 | 50.00 | -3.69 78.81k |

| Vinayak Polycon | 26.25 | 24.61 | -1.64 117 |

| First Custodian | 60.60 | 57.00 | -3.60 31 |

| Naksh Precious | 25.50 | 24.07 | -1.43 91.36k |

| CJ Gelatine | 24.58 | 23.25 | -1.33 88 |

| Suryavanshi Spg | 28.32 | 26.88 | -1.44 2.96k |

| Bhilwara Spin | 109.00 | 103.79 | -5.21 498 |

-330

January 19, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:50 | Chg(%) Hourly Vol |

|---|---|---|---|

| Bengal Tea | 100.69 | 114.60 | 13.91 283 |

| Lerthai Finance | 320.20 | 352.65 | 32.45 35 |

| Beryl Securitie | 25.82 | 28.30 | 2.48 204 |

| Axtel Ind | 617.00 | 675.50 | 58.50 5.95k |

| Prime Sec | 176.25 | 191.50 | 15.25 140 |

| Artemis Elect | 53.65 | 58.10 | 4.45 85.20k |

| Mohit Paper Mil | 30.00 | 32.28 | 2.28 375 |

| Solid Stone | 32.10 | 34.19 | 2.09 22 |

| Fluidomat | 673.35 | 717.00 | 43.65 2.27k |

| IB Infotech Ent | 126.90 | 134.40 | 7.50 23 |

-330

January 19, 2024· 14:59 IST

Stock Market LIVE Updates | Prime Securities Q3 results:

Net profit at RS 7.9 crore versus Rs 3.9 crore and revenue up 11.6% at Rs 16.3 crore versus Rs 14.6 crore, YoY.

-330

January 19, 2024· 14:57 IST

Stock Market LIVE Updates | CLSA View On ICICI Prudential Life Insurance Company

-Buy call, target cut to Rs 630 per share

-New commission structures indicate lower steady-state VNB margins

-9MFY24 margins collapse due to cost absorption

-APE growth for quarter tepid, expect 2 percent growth for FY24

-Steady-state margins cut, consistent performance will lend better confidence

-330

January 19, 2024· 14:52 IST

Stock Market LIVE Updates | Surya Roshni wins Rs 52.96 crore order from HPCL

-330

January 19, 2024· 14:47 IST

-330

January 19, 2024· 14:42 IST

Stock Market LIVE Updates | JSPL CFO Ramkumar Ramaswamy resigns w.e.f. Jan 31, Sunil Kumar Agrawal to assume responsibilities of CFO

-330

January 19, 2024· 14:36 IST

-330

January 19, 2024· 14:29 IST

Stock Market LIVE Updates | ONGC has 1.17 mln shares traded in a bunch: Bloomberg

-330

January 19, 2024· 14:23 IST

-330

January 19, 2024· 14:21 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 21597.60 0.63 | -0.62 -1.36 | 0.67 19.27 |

| NIFTY BANK | 45621.90 -0.2 | -5.53 -4.38 | -4.70 7.78 |

| NIFTY Midcap 100 | 47615.55 1.09 | 3.10 0.22 | 4.62 51.91 |

| NIFTY Smallcap 100 | 15471.95 0.99 | 2.17 -0.47 | 3.48 60.77 |

| NIFTY NEXT 50 | 54483.85 0.99 | 2.14 -0.47 | 4.00 29.66 |

-330

January 19, 2024· 14:17 IST

Stock Market LIVE Updates | Morgan Stanley View On Aarti Industries

-Overweight call, target Rs 575 per share

-Company signs another contract worth Rs 6,000 crore

-The customer and the product under the contract are not new

-Signing of a longer-term contract does indicate the demand visibility for the product

-This is the second long-term contract announced by co in the last two months

-330

January 19, 2024· 14:10 IST

Sensex Today | Nifty Bank erase gains, trade flat:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 101.80 | 3.35 | 86.80m |

| ICICI Bank | 1,003.35 | 1.72 | 16.26m |

| Axis Bank | 1,112.55 | 1.37 | 9.29m |

| Bank of Baroda | 229.45 | 0.77 | 7.17m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,557.90 | -3.41 | 8.04m |

| IDFC First Bank | 85.05 | -1.56 | 34.56m |

| Kotak Mahindra | 1,761.00 | -0.91 | 3.15m |

| HDFC Bank | 1,474.05 | -0.81 | 39.76m |

| Bandhan Bank | 226.25 | -0.59 | 5.06m |

| Federal Bank | 146.00 | -0.58 | 8.37m |

| AU Small Financ | 730.05 | -0.55 | 3.45m |

| SBI | 627.05 | -0.2 | 8.38m |

-330

January 19, 2024· 14:09 IST

Stock Market LIVE Updates | Morgan Stanley View On IndusInd Bank

-Overweight call, target Rs 1,850 per share

-Q3 positives include steady margins, improving retail deposit mix & strong loan growth

-Q3 negatives include lower fees and higher slippages

-Credit costs were in-line, helped by utilisation of contingency provisions

-Trim EPS 0.5 percent for FY24, 1 percent for FY25

-330

January 19, 2024· 14:07 IST

Stock Market LIVE Updates | Panama Petrochem gets Letter of Acceptance from IOC

Panama Petrochem has received a Letter of Acceptance against Tender, for procurement of Base Oil, from Indian Oil Corporation. The total order value is Rs. 22,30,20,000.

-330

January 19, 2024· 14:04 IST

Stock Market LIVE Updates | JK Cement gets Rs 175.5 crore tax order for AY22 from I-T department

JK Cement has received an assessment order from Income tax department, wherein the department has raised a demand of Rs 175.47 crore pursuant to transfer pricing adjustments, primarily on power and railway infrastructure.

-330

January 19, 2024· 14:01 IST

Sensex Today | Market at 2 PM:

The Sensex was up 474.25 points or 0.67 percent at 71,661.11, and the Nifty was up 147.20 points or 0.69 percent at 21,609.50. About 2205 shares advanced, 998 shares declined, and 64 shares unchanged.

-330

January 19, 2024· 13:59 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Vinsys IT | 301.50 | 284.35 | -17.15 1.24k |

| Touchwood Enter | 163.45 | 154.35 | -9.10 317 |

| Onward Tech | 639.00 | 604.00 | -35.00 12.35k |

| Wendt | 14,429.80 | 13,786.30 | -643.50 34 |

| Prolife Industr | 281.00 | 270.00 | -11.00 0 |

| Sahana Systems | 1,040.00 | 1,002.20 | -37.80 1.20k |

| Shree Digvijay | 119.70 | 115.70 | -4.00 3.04m |

| Swaraj Suiting | 130.00 | 126.00 | -4.00 9.04k |

| Urban Enviro Wa | 389.00 | 377.65 | -11.35 420 |

| Viviana Power | 310.00 | 301.20 | -8.80 1.40k |

-330

January 19, 2024· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Drone | 159.50 | 170.00 | 10.50 2.54k |

| Auro Impex | 101.35 | 108.00 | 6.65 4.33k |

| SHUBHLAXMI | 85.50 | 91.00 | 5.50 0 |

| Pavna | 530.85 | 558.25 | 27.40 351 |

| Mindpool Techno | 67.40 | 70.75 | 3.35 500 |

| PAKKA | 354.25 | 371.65 | 17.40 80.47k |

| Damodar Ind | 59.20 | 62.00 | 2.80 10.83k |

| BEW Engineering | 1,560.00 | 1,630.00 | 70.00 739 |

| Xpro India | 1,124.00 | 1,174.00 | 50.00 5.92k |

| Maha Rasht Apex | 144.10 | 150.20 | 6.10 425 |

-330

January 19, 2024· 13:54 IST

-330

January 19, 2024· 13:51 IST

Sensex Today | Nifty FMCG index jumped 0.8 percent led by Godrej Consumer, Britannia Industries, ITC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Godrej Consumer | 1,145.70 | 3.79 | 1.00m |

| Britannia | 5,125.70 | 2.2 | 195.59k |

| ITC | 471.80 | 1.35 | 7.78m |

| Jubilant Food | 529.05 | 0.91 | 1.51m |

| TATA Cons. Prod | 1,154.50 | 0.67 | 634.40k |

| Varun Beverages | 1,236.40 | 0.51 | 2.23m |

| Marico | 527.05 | 0.49 | 439.48k |

| United Spirits | 1,073.15 | 0.35 | 439.78k |

| HUL | 2,555.00 | 0.27 | 795.56k |

| Dabur India | 540.65 | 0.22 | 1.29m |

-330

January 19, 2024· 13:49 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Pearl Global In | 620.45 | 620.50 593.85 | -0.01% |

| MPS | 1,698.40 | 1,698.50 1,671.85 | -0.01% |

| Shoppers Stop | 691.35 | 691.50 668.15 | -0.02% |

| Shiva Cement | 58.30 | 58.32 56.23 | -0.03% |

| Manappuram Fin | 178.35 | 178.40 170.30 | -0.03% |

| Pilani Invest | 2,993.00 | 2,993.75 2,947.15 | -0.03% |

| Sarda Energy | 249.05 | 249.15 245.10 | -0.04% |

| Authum Invest | 966.50 | 967.00 953.00 | -0.05% |

| Wonderla | 893.25 | 893.70 871.20 | -0.05% |

| Gulshan Poly | 212.95 | 213.05 206.00 | -0.05% |

-330

January 19, 2024· 13:44 IST

Hindustan Zinc Q3 Results:

Net profit at Rs 2,038 crore and revenue at Rs 7,310 crore.

-330

January 19, 2024· 13:38 IST

-330

January 19, 2024· 13:34 IST

Stock Market LIVE Updates | Macquarie View On IndusInd Bank

-Outperform call, target Rs 1,900 per share

-Q3 reported PAT growth of 17 percent YoY is in-line with estimates

-Retail book (55 percent Mix) grew 24 percent YoY, which we find encouraging

-Retail book growth driven by high growth of vehicle book, up 26 percent YoY

-Retail deposit as per liquidity coverage ratio classification mix improved to 45 percent

-NIM was flat QoQ at 4.3 percent

-Believe company can deliver RoA of 1.8 percent+ over FY24-26 & exhibits room for NIM improvement

-330

January 19, 2024· 13:31 IST

Sensex Today | BSE Midcap index up 1 percent led by New India Assurance Company, Aarti Industries, Oracle Financial Services Software:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| New India Assur | 239.95 | 8.62 | 202.65k |

| Aarti Ind | 662.95 | 8.37 | 911.50k |

| Oracle Fin Serv | 7,015.00 | 7.18 | 127.25k |

| IRCTC | 979.35 | 5.63 | 420.68k |

| SJVN | 106.08 | 5.48 | 2.50m |

| Linde India | 5,711.10 | 5.38 | 9.19k |

| JSW Energy | 503.65 | 5.29 | 318.67k |

| REC | 447.15 | 5.16 | 852.52k |

| Gujarat Fluoro | 3,700.55 | 4.96 | 15.75k |

| Supreme Ind | 4,114.00 | 4.75 | 11.88k |

-330

January 19, 2024· 13:29 IST

Ananth Narayan, Whole Time Member of Sebi:

The biggest case of type 1 error in AIFs, we have seen funds being structured to circumvent existing regulations. We have seen cases of circumvention of FEMA guidelines, SARFAESI guidelines, around QIBs, investments into IPOs. We could come up with a set of regulations for each of these, but this will result in type-2 error. We propose to come up with a code of conduct for managers which will enjoin them to do due diligence to ensure that the funds are not being used to circumvent existing financial sector regulations. We intent to make it very very specific and it will be a three step process--general obligation in regulation, second what is it that we are trying to address, the specific do's and don'ts that the regulator wants done in consultation with the industry. The consultation paper should be out in a few days.

We are also proposing that old AIFs and venture capital funds to regularise and get into this dissolution process. There are 9 AIFs and 89 VCFs, they have passed the due date... rather than forcing them to close down. We are processing a one-time dissolution process for them

-330

January 19, 2024· 13:24 IST

Stock Market LIVE Updates | Atul Q3 Earnings:

Net Profit down 32.5% at Rs 70.9 crore against Rs 105 crore and revenue down 10.3% at Rs 1,137.8 crore versus Rs 1,268 crore, YoY.

-330

January 19, 2024· 13:22 IST

UltraTech Cement Q3 Results:

Net Profit rose 67% at Rs 1,775 crore against Rs 1,063 crore and revenue up 7.9% at Rs 16,740 crore versus Rs 15,521 crore, YoY.

-330

January 19, 2024· 13:21 IST

Stock Market LIVE Updates | Jefferies View On IndusInd Bank

-Buy call, target Rs 2,070 per share

-Profit met estimates but used Rs 200 crore of contingent buffers

-NII growth of 18 percent is among the best across our coverage

-NIMs sustained & saw 20 percent growth in loan

-Improving retail deposit franchise is key strength here

-Higher new NPLs were tad disappointing

-New NPLs arose in CV loans mostly due to Chennai floods & can be recouped

-See 20 percent profit CAGR in FY24-26, with RoE of 16 percent in FY25

-330

January 19, 2024· 13:18 IST

Ananth Narayan, Whole Time Member of Sebi:

We have seen the commitments in AIF industry continues to grow. Commitments now have cross Rs 9.5 trillion. The number of registrations have gone up, new funds being set up. The commitments have been growing at 35-40% CAGR.

Registrations as of Dec 2022, 71 applications were pending, 18 were more than 3 months old. Dec 23, 46 pending, nothing beyond three months, nothing beyond 2 months either. A lot of the credit has to go to merchant bankers, the improved checklists are working. Kudos the entire ecosystem to bring down the pendency. We want the bring this number down to below one month (pendency). By March, nothing should be pending beyond one month.

-330

January 19, 2024· 13:14 IST

Sensex Today | BSE Smallcap index up 1 percent supported by Rail Vikas Nigam, Ganesh Housing Corporation, HP Adhesives:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ganesh Housing | 604.45 | 17.95 | 88.78k |

| Rail Vikas | 283.30 | 16.25 | 13.30m |

| HP Adhesives | 112.60 | 15.02 | 385.79k |

| HUDCO | 154.80 | 12.46 | 7.21m |

| Orient Paper | 53.95 | 12.12 | 1.57m |

| Global Surfaces | 287.60 | 10.94 | 166.23k |

| Imagicaaworld | 73.40 | 10.71 | 791.80k |

| Nahar Spinning | 303.45 | 10.35 | 32.28k |

| Kamdhenu | 561.65 | 10 | 94.09k |

| NBCC (India) | 95.21 | 9.21 | 4.35m |

-330

January 19, 2024· 13:12 IST

Stock Market LIVE Updates | Hatsun Agro Products Q3 Earnings:

Net profit up 23.7% at Rs 57.4 crore versus Rs 46.4 crore and revenue up 11.3% at Rs 1,887.5 crore versus Rs 1,695.2 crore, YoY.

-330

January 19, 2024· 13:10 IST

Stock Market LIVE Updates | NHPC to exercise the oversubscription option, to sell additional 1% shares in the OFS

NHPC has decided to exercise the oversubscription option to the extent of up to 10,04,50,348 equity shares (representing 1% stake), in addition to 25,11,25,870 equity shares (representing 2.50% of paid up equity), the base offer size, on January 19. Accordingly, the total offer size will be 35,15,76,218 equity shares or 3.50% stake of the company. The offer-for-sale (OFS) was opened for non-retail investors on January 18 and will open for retail investors on January 19.

-330

January 19, 2024· 13:09 IST

Stock Market LIVE Updates | Supreme Industries Q3 Results

Net profit rose 22% at Rs 256.2 crore against Rs 210 crore and revenue up 6% at Rs 2,449 crore versus Rs 2,311 crore, YoY.

-330

January 19, 2024· 13:07 IST

Stock Market LIVE Updates | CLSA View On Titan Company

-Buy call, target Rs 4,494 per share

-Tanishq making charges scale with price, this is not so for competitors

-Tanishq’s focus is on design, consumer trust & customer service

-Tanishq’s focus allows brand to charge a significant premium

-The significant premium charge is reflected in higher operating margins & returns

-330

January 19, 2024· 13:03 IST

Stock Market LIVE Updates | TCS trades ex-dividend:

Tata Consultancy Services shares trading ex-date for dividend with effect from January 19. The company has announced an interim dividend of Rs 9 per share and special dividend of Rs 18 per share for the current financial year, on January 11.

-330

January 19, 2024· 13:01 IST

Sensex Today | Market at 1 PM

The Sensex was up 483.14 points or 0.68 percent at 71,670.00, and the Nifty was up 149.60 points or 0.70 percent at 21,611.90. About 2209 shares advanced, 982 shares declined, and 63 shares unchanged.

-330

January 19, 2024· 13:00 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Pramara Promoti | 144.00 | 138.70 | -5.30 - |

| Art Nirman | 73.25 | 70.60 | -2.65 550 |

| Voltamp Trans | 7,965.25 | 7,700.00 | -265.25 24.54k |

| Reliance Chemo | 280.90 | 272.50 | -8.40 375 |

| Kay Cee Energy | 246.85 | 240.00 | -6.85 46.87k |

| Prime Sec | 180.50 | 175.50 | -5.00 1.17k |

| Sagardeep Alloy | 32.50 | 31.60 | -0.90 4.28k |

| Maitreya Medica | 204.00 | 198.40 | -5.60 685 |

| Mukand | 186.35 | 181.25 | -5.10 34.50k |

| Committed Cargo | 60.50 | 58.85 | -1.65 1.20k |

-330

January 19, 2024· 12:58 IST

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Supreme Power | 173.20 | 194.40 | 21.20 195.53k |

| Albert David | 1,072.30 | 1,169.05 | 96.75 487 |

| Inspire Films | 54.60 | 59.15 | 4.55 - |

| BLB | 24.80 | 26.80 | 2.00 802.32k |

| Imagicaaworld | 68.85 | 73.60 | 4.75 349.98k |

| Cheviot Company | 1,443.00 | 1,528.40 | 85.40 137 |

| GIC Housing Fin | 247.35 | 261.20 | 13.85 55.04k |

| Sakar Healthcar | 410.75 | 433.35 | 22.60 8.37k |

| Mono Pharmacare | 46.00 | 48.50 | 2.50 - |

| Aurum Proptech | 173.20 | 181.90 | 8.70 44.48k |

-330

January 19, 2024· 12:57 IST

Stock Market LIVE Updates | CLSA View On Tata Communications

-Outperform call, target Rs 2,045 per share

-Reported data revenue up 29 percent, Kaleyra is EBITDA positive in 1st quarter

-Revenue in-line & EBITDA above estimate

-High growth in digital portfolio services

-Comfortable gearing & kaleyra business added debt

-Play on enterprise data growth

-330

January 19, 2024· 12:55 IST

Stock Market LIVE Updates | Central Bank of India Q3 Earnings:

Net profit rose 56.7% at Rs 717.9 crore versus Rs 458.2 crore and Net Interest Income (NII) down 4% at Rs3,151.8 crore versus Rs 3,284.5 crore, YoY.

-330

January 19, 2024· 12:53 IST

Stock Market LIVE Updates | Shree Digvijay Cement Q3 Results:

Net profit at Rs 31.4 crore versus Rs 10.2 crore and revenue down 7.3% at Rs 191.3 crore versus Rs 206.4 crore, YoY.

-330

January 19, 2024· 12:52 IST

Stock Market LIVE Updates | Ministry of New and Renewable Energy designates REC as overall Programme Implementation Agency for Rooftop Solar programme of the Ministry

The Ministry of New and Renewable Energy, Government of India (MNRE) has designated REC as the overall Programme Implementation Agency for rooftop solar (RTS) programme of the Ministry. The MNRE also entrusted with the responsibility for execution of the programme/scheme prepared by MNRE and for coordination with all stakeholders, across the country, with an objective to achieve the cumulative capacity of 40,000 MW from RTS by the year 2026.

-330

January 19, 2024· 12:50 IST

Stock Market LIVE Updates | Finolex Industries Q3 profit jumps 20% YoY to Rs 95.4 crore

Finolex Industries has recorded a 20% on-year increase in consolidated net profit at Rs 95.4 crore for quarter ended December FY24 despite weak topline, supported by healthy operating numbers. Revenue from operations fell 9.3% YoY to Rs 1,019.7 crore for the quarter.

-330

January 19, 2024· 12:47 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Oracle Fin Serv | 7,042.00 | 43.34 | 4,912.90 |

| PAKKA | 353.20 | 39.52 | 253.15 |

| Intrasoft Tech | 177.00 | 34.04 | 132.05 |

| Ganesh Housing | 600.90 | 33.13 | 451.35 |

| WE WIN | 92.75 | 32.31 | 70.10 |

| Indo Thai Secu | 312.25 | 28.34 | 243.30 |

| Vertoz Advertis | 796.30 | 27.02 | 626.90 |

| Rail Vikas | 283.85 | 26.97 | 223.55 |

| M K Proteins | 49.20 | 26.48 | 38.90 |

| M K Proteins | 49.20 | 26.48 | 38.90 |

-330

January 19, 2024· 12:45 IST

Sensex Today | Anand James, Chief Market Strategist, Geojit Financial Services:

Investors do well to note that Saturday’s trading dynamics will be different for a variety of reasons. For one, a shorter time frame as well the truncated nature of the session would mean that traders would not have enough time to get their eyes in. Volatility may be limited, as daily operating range would be restricted to 5% for all stocks and derivatives for the day while those already in the 2% band will continue to remain so. Also important to note that pending orders from the first session would be flushed out before the start of the second session.

-330

January 19, 2024· 12:43 IST

-330

January 19, 2024· 12:38 IST

Sensex Today | BSE Oil & Gas index up 1 percent led by Linde India, ONGC, Gail India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Linde India | 5,714.00 | 5.44 | 7.04k |

| ONGC | 238.75 | 2.27 | 476.57k |

| GAIL | 167.20 | 2.2 | 1.17m |

| IGL | 443.50 | 1.21 | 98.17k |

| Adani Total Gas | 992.55 | 0.92 | 119.14k |

| Petronet LNG | 242.05 | 0.77 | 286.43k |

| BPCL | 475.75 | 0.54 | 182.96k |

| HINDPETRO | 456.00 | 0.29 | 94.63k |

-330

January 19, 2024· 12:33 IST

SEBI Chairperson, Madhabi Puri Buch

We don't have enough data to go back to the Board with delisting and want to bring out something comprehensive on Mule account.

-330

January 19, 2024· 12:32 IST

Stock Market LIVE Updates | Shilpa Medicare receives marketing authorization from Germany for Amifampridine tablets

-330

January 19, 2024· 12:30 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Bharti Airtel | 1136.35 | 1136.35 | 1,130.50 |

| ONGC | 240.45 | 240.45 | 238.35 |

| Titan Company | 3861.50 | 3861.50 | 3,781.60 |

| Larsen | 3648.60 | 3648.60 | 3,628.00 |

| Infosys | 1665.50 | 1665.50 | 1,649.20 |

| Sun Pharma | 1344.40 | 1344.40 | 1,334.45 |

-330

January 19, 2024· 12:25 IST

Stock Market LIVE Updates | Bandhan Bank gets RBI approval for appointment of Rajinder Kumar Babbar as Whole-Time Director

The Reserve Bank of India (RBI) has granted its approval for the appointment of Rajinder Kumar Babbar as Whole-Time Director (to be designated as Executive Director) of Bandhan Bank, for three years, with effect from the date of taking charge, which should be within three months from the date of the said RBI approval.

-330

January 19, 2024· 12:22 IST

Stock Market LIVE Updates | Wipro signs definitive agreement to subscribe for 14% stake in Huoban Energy 11

Wipro has signed a definitive agreement to subscribe for 14% equity share in Huoban Energy 11, for Rs 3.17 crore. The deal will help Wipro enhance the proportion of usage of renewable energy for offices in Maharashtra. The transaction is expected to be completed before March 2024.

-330

January 19, 2024· 12:19 IST

Sensex Today | BSE Auto index up 0.7 percent led by Cummins India, Balkrishna Industries, Samvardhana Motherson International

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Cummins | 2,105.55 | 3.73 | 11.59k |

| MOTHERSON | 109.95 | 1.99 | 494.05k |

| Balkrishna Ind | 2,601.70 | 1.62 | 2.26k |

| MRF | 139,388.20 | 1.32 | 230 |

| M&M | 1,635.00 | 1.1 | 41.38k |

| Eicher Motors | 3,721.60 | 0.86 | 5.54k |

| Maruti Suzuki | 10,006.00 | 0.86 | 8.49k |

| Bajaj Auto | 7,136.10 | 0.75 | 4.21k |

| Bosch | 22,972.20 | 0.71 | 252 |

| Tata Motors | 823.00 | 0.5 | 274.14k |

-330

January 19, 2024· 12:15 IST

SEBI Chairperson, Madhabi Puri Buch on corporate governance:

We are very pleased with the three industry association -- FICCI, ASSOCHAM and CII-- in terms of the industry standards forum. The work is on how a company should implement regulations. It is just a start right now, certainly we will be going to our Board that this mechanism of industry standard forum should be formalised. That the standards that the industry sets in consultation with Sebi should have no ambiguity, uncertainty and therefore say anxiety. The whole anxiety level will come down and the compliance level will go up.

We are very hopeful that this mechanism will give good results. That is how I see that piece. On the second issue, I have a lot of empathy on how something is not working, then why have the regulation. However, there is a certain cycle of maturity and a certain leeway to independent directors. We have given some independent directors who describe (well) why they are leaving. If there are others who feel that they don't want to rock the boat, in any case the market picks up the signal.

-330

January 19, 2024· 12:07 IST

Stock Market LIVE Updates | CE Info Systems bags order worth Rs 400 crore

CE Info Systems (MapmyIndia) won new project worth Rs 400 crores (~ USD 50 Million) for Hyundai and Kia Cars OEM Business in India.

-330

January 19, 2024· 12:06 IST

Sensex Today | Cantabil Retail India to issue 20 lakh shares to Think India Opportunities Fund

The board of directors of Cantabil Retail, at its meeting held on January 18, 2024, approved the issuance of 20,00,000 equity shares of face value of Rs 2 each of the Company to Think India Opportunities Master Fund LP.

-330

January 19, 2024· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was up 392.65 points or 0.55 percent at 71,579.51, and the Nifty was up 128.70 points or 0.60 percent at 21,591. About 2232 shares advanced, 937 shares declined, and 50 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bharti Airtel | 1,133.05 | 4.23 | 6.22m |

| ONGC | 238.90 | 2.29 | 10.59m |

| Axis Bank | 1,120.45 | 2.09 | 6.57m |

| Britannia | 5,114.95 | 1.99 | 148.64k |

| ICICI Bank | 1,005.60 | 1.95 | 10.12m |

| NTPC | 305.05 | 1.92 | 8.62m |

| Tata Steel | 133.50 | 1.91 | 15.63m |

| Coal India | 382.10 | 1.72 | 9.96m |

| Tech Mahindra | 1,376.00 | 1.54 | 2.33m |

| SBI Life Insura | 1,424.45 | 1.39 | 137.86k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,565.15 | -2.96 | 5.94m |

| Divis Labs | 3,672.50 | -0.75 | 186.20k |

| Sun Pharma | 1,331.10 | -0.35 | 774.84k |

| Reliance | 2,726.40 | -0.35 | 2.31m |

| HCL Tech | 1,562.65 | -0.31 | 1.19m |

| HDFC Bank | 1,483.45 | -0.18 | 27.08m |

| Asian Paints | 3,159.90 | -0.12 | 376.75k |

| Dr Reddys Labs | 5,643.45 | -0.12 | 99.07k |

| Cipla | 1,321.45 | -0.11 | 451.13k |

| LTIMindtree | 5,597.65 | -0.1 | 547.61k |

-330

January 19, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Swaraj Suiting | 130.60 | 125.00 | -5.60 50.93k |

| Zeal Global | 197.60 | 190.00 | -7.60 1.26k |

| Udayshivakumar | 49.50 | 47.60 | -1.90 95.03k |

| Mohini Health & | 66.80 | 64.50 | -2.30 857 |

| Cellecor | 301.00 | 290.95 | -10.05 - |

| Starteck Financ | 343.00 | 331.60 | -11.40 185 |

| Golden Tobacco | 54.45 | 52.65 | -1.80 665 |

| Nidan Laborator | 39.20 | 38.00 | -1.20 30.67k |

| Fidel Softech | 127.00 | 123.15 | -3.85 3.05k |

| Almondz Global | 127.00 | 123.20 | -3.80 1.33k |

-330

January 19, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Peria Karamalai | 306.05 | 327.00 | 20.95 16 |

| Rail Vikas | 268.85 | 284.45 | 15.60 19.83m |

| Voltamp Trans | 7,546.90 | 7,973.55 | 426.65 14.70k |

| Hind Rectifiers | 564.40 | 595.00 | 30.60 2.07k |

| Ircon Internati | 215.25 | 226.55 | 11.30 9.46m |

| Orient Paper | 51.30 | 53.65 | 2.35 571.84k |

| New India Assur | 228.60 | 238.80 | 10.20 405.46k |

| RITES | 536.00 | 559.00 | 23.00 335.29k |

| Frog Cellsat | 187.50 | 195.00 | 7.50 1.95k |

| General Insuran | 317.40 | 329.20 | 11.80 396.13k |

-330

January 19, 2024· 11:59 IST

SEBI Chairperson, Madhabi Puri Buch on application of Gen AI and how Sebi officers using it:

Few days ago, we were doing a KRA review of one of the Sebi departments and one of the youngsters shared a three minute presentation. It amazed me. Going forward, those numbers, provided we get reciprocation from your side... the first real application of Gen AI. He had developed a complete mechanism using Chat GPT to basically read an annual report of a REIT and create from it a complete internal Sebi memo across 12-30 regualtions to say whether the REIT has complied with the regulations (shown in a table) and on which page of the document is the evidence of compliance. A neat summary of all compliances... he said it took 2 weeks to make it.

I immediately set up a task force, every operational department has to how to look at this and see how to see this is done... even to process IPO documents as well. Certainly in the months to come, 80 percent of the work that an officer does is done through automation, then the officer will apply mind on more substantive issues on the documents.

-330

January 19, 2024· 11:56 IST

Stock Market LIVE Updates | IndiaMart jumps 6% on strong Q3 earnings, analysts foresee business growth

Shares of IndiaMart IndiaMesh Ltd jumped over 6 percent on January 19, a day after the company reported in-line quarterly earnings. Its revenue jumped 21 percent on-year to Rs 305 crore, and operating profit came in at Rs 77 crore, led by lower employee costs during the quarter.

From a long-term perspective, IndiaMart is well-placed for encouraging growth in light of the multiple long-term contracts it has procured from the world’s leading brands, said Axis Securities.

"Richer revenue visibility also gives us further confidence in its business growth moving forward," the brokerage said as it put a 'buy' rating on the stock with a target price of Rs 3,000 per share. Read More

-330

January 19, 2024· 11:54 IST

Sensex Today | Aarti Industries rallies 8.5% to a 52-week high as brokerages hold bullish outlook

Shares of Aarti Industries Limited zoomed 8.5 percent to hit a fresh 52-week high of Rs 663 on January 19 after brokerage firms Morgan Stanley and Emkay went bullish on the counter.

Analysts at Emkay initiated coverage with a 'buy' rating on the stock and assigned a target price of Rs 750. This implies an upside potential of about 22.5 percent from the previous close of Rs 611. Read More

-330

January 19, 2024· 11:51 IST

SEBI Chairperson, Madhabi Puri Buch on IPO pricing:

My dharma is data. At the mainboard IPOs, in terms of listing date, out of the total 50 odd issues, 21-22 the ratio was 37 percent, 14 negative. 23-24, 47 positive, 6 negative. The important thing is that it is always a mixed bag and therefore the acknowledgement that IPO pricing is at best a judgemnt of various players and that it can go either way. There are odds to be played here. The price discovery mechanism of IPOs is imperfect, therefore if a retail investor (not a trader, not the flipper) then why are you taking the risk of price going up or down... wait till the price stablises, there is no hurry or impact cost for retail investor. Institutional investor will have an impact cost and they have the wherewithal to analyst the IPO. Retail investors can wait until price discovery is more stable.

-330

January 19, 2024· 11:49 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Veritas | 504.75 1.99% | 93.01k 1,609.60 | 5,678.00 |

| Classic Filamen | 37.82 5% | 376.72k 11,185.60 | 3,268.00 |

| Kunststoffe Ind | 30.00 20% | 68.84k 2,504.60 | 2,648.00 |

| Dynamic Ind | 79.90 6.62% | 38.42k 1,827.20 | 2,003.00 |

| Kaiser Corp | 15.70 19.94% | 1.07m 100,050.80 | 967.00 |

| Liberty Shoes | 367.40 10.31% | 311.43k 34,946.80 | 791.00 |

| HP Adhesives | 107.80 10.11% | 249.73k 33,288.00 | 650.00 |

| Aarti Ind | 661.05 8.06% | 706.65k 108,846.60 | 549.00 |

| DB (Int) Stock | 41.10 4% | 6.61k 1,022.20 | 546.00 |

| Apollo Pipes | 733.30 7.81% | 46.96k 7,276.60 | 545.00 |

-330

January 19, 2024· 11:46 IST

Stock Market LIVE Update | We should refrain from coming between new entrants in the market, says Sebi Chairperson

We believe in market forces, so long as there is information or level playing field, if there is risk taking in the market... we should not be coming between investors coming to the market.

-330

January 19, 2024· 11:45 IST

Stock Market LIVE Update | Unhappy about malpractices like mule accounts & inflation IPO application numbers, expresses Sebi Chairperson

What we are unhappy about is some of the malpractices that we see. For eg, mule accounts, inflating the IPO application numbers to give an impression of high amount of subscription, so either who withdraw the application... so you apply in a manner that your application gets rejected, so the whole purpose of applying is to inflate the numbers.

-330

January 19, 2024· 11:44 IST

Stock Market LIVE Update | IPO market is also a market of traders, not just investors, says SEBI Chairperson

The very fact that it is a separate board (SME) we recognise that the characteristics of the companies is different from mainboard. The value of putting on a separate board is that the investors are aware that the reporting, compliance, listing requirements are different and therefore there is a higher risk. The reality is that our retail traders... we found that the percentage of flippers within the first week in any IPO for the NII category is 68 percent, retail category is 43 percent. First we have to acknowledge that the IPO market is also a market of traders and not investors.

-330

January 19, 2024· 11:36 IST

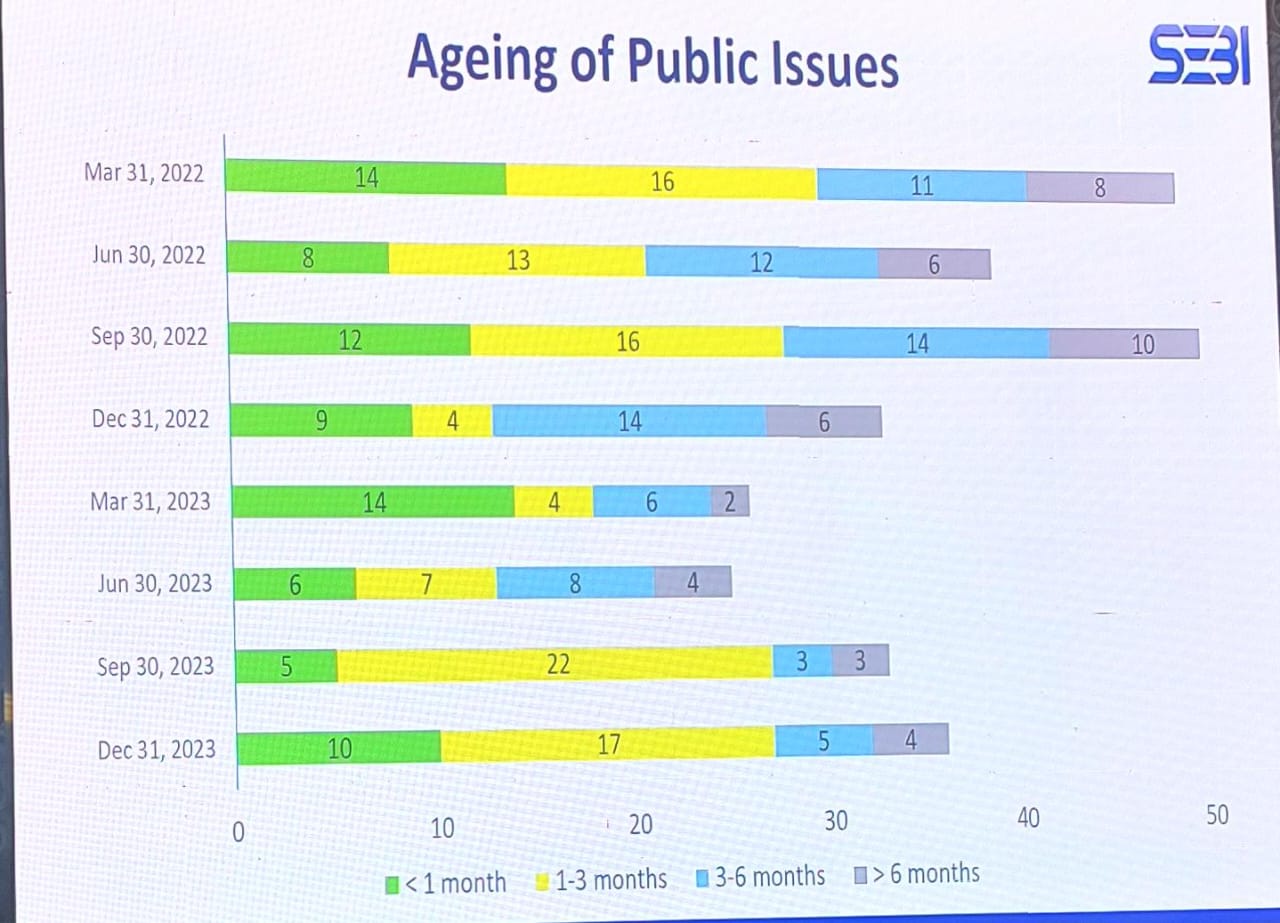

Stock Market LIVE Update | Aging of IPO applications should come down, says Madhabi Puri Buch, SEBI Chairperson

One thing we are clear about, we cannot take any credit for any of this (of IPO vibrancy). The limited role we play is only in two things, to maintain the integrity of the market (whether in terms of IT resilience, governance and disclosure, or in saying that our markets never shut)... ensuring that that trust and that faith in the market is a role we see for ourselves. The second is that Sebi recognises the time value of money, so any delay on the part of the regulator has serious consequences for issuers. So internally we have taken steps to ensure that aging of applications, especially with IPOs, the aging should come down.

-330

January 19, 2024· 11:30 IST

Stock Market LIVE Update | Tata Communications dips despite fastest quarterly growth in 9 years

-330

January 19, 2024· 11:25 IST

Stock Market LIVE Update | Aarti Industries rallies over 7% to a 52-week high as brokerages hold bullish outlook

-330

January 19, 2024· 11:17 IST

Stock Market LIVE Update | Just 6% of MF schemes exited HDFC Bank in past 6 months

Though HDFC Bank’s Q3 results were subdued, mutual funds continue to hold the stock but there are contrarians among the pack. Of the 422 actively-managed equity funds that hold the banking stock, 27 diversified funds exited the stock over the past six months. READ MORE

-330

January 19, 2024· 11:15 IST

-330

January 19, 2024· 11:12 IST

Sensex Today | Nifty PSU Bank index up 1 percent led by Punjab National Bank, Canara Bank, J&K Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| PNB | 102.00 | 3.55 | 50.55m |

| Canara Bank | 467.25 | 1.96 | 2.81m |

| JK Bank | 136.50 | 1.26 | 1.16m |

| Bank of Baroda | 230.40 | 1.19 | 3.59m |

| Central Bank | 53.25 | 0.85 | 12.62m |

| SBI | 632.75 | 0.71 | 3.15m |

| IOB | 44.50 | 0.68 | 6.76m |

| Punjab & Sind | 45.40 | 0.55 | 962.47k |

| Bank of India | 135.00 | 0.48 | 6.51m |

| UCO Bank | 41.60 | 0.48 | 6.63m |

-330

January 19, 2024· 11:09 IST

-330

January 19, 2024· 11:06 IST

Stock Market LIVE Updates | Lupin hit 52-week high on USFDA nod to generic gout drug

Lupin share price rose 0.7 percent to hit a 52-week high of Rs 1,441.75 in the early trade on January 19 after the company received the nod of the United States Food and Drug Administration (US FDA) to launch a drug for gout, the latest in a string of approvals to sell its products in the American market.

Febuxostat tablets are indicated for chronic hyperuricemia in adult patients with gout who have an inadequate response to a maximally titrated dose of allopurinol, are intolerant to allopurinol, or for whom treatment with allopurinol is not advisable, the company said. Read More

-330

January 19, 2024· 11:01 IST

Sensex Today | Market at 11 AM

The Sensex was up 520.99 points or 0.73 percent at 71,707.85, and the Nifty was up 155.60 points or 0.72 percent at 21,617.90. About 2381 shares advanced, 732 shares declined, and 60 shares unchanged.

-330

January 19, 2024· 11:00 IST

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Betex | 313.90 | 284.05 | -29.85 108 |

| SAR Auto Prod | 1,823.00 | 1,651.00 | -172.00 0 |

| Beryl Securitie | 28.47 | 25.82 | -2.65 106 |

| Lerthai Finance | 352.65 | 320.15 | -32.50 14 |

| SHRYDUS IND | 25.75 | 23.40 | -2.35 1.10k |

| Centennial Sutu | 108.70 | 99.00 | -9.70 0 |

| Rane Engine | 505.65 | 462.80 | -42.85 1.83k |

| Jai Hind Synth | 34.10 | 31.40 | -2.70 1.47k |

| Jindal Leasefin | 40.00 | 36.90 | -3.10 151 |

| Prataap Snacks | 1,363.15 | 1,260.40 | -102.75 31.34k |

-330

January 19, 2024· 10:58 IST

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Krypton | 34.51 | 38.50 | 3.99 1.15k |

| Suryavanshi Spg | 25.92 | 28.68 | 2.76 1 |

| Inani Sec | 29.45 | 32.44 | 2.99 200 |

| Vinayak Polycon | 24.02 | 26.40 | 2.38 56 |

| Nahar Spinning | 278.25 | 304.65 | 26.40 688 |

| Dhanalaxmi Cote | 68.02 | 74.35 | 6.33 0 |

| Nam Securities | 68.27 | 74.50 | 6.23 165 |

| West Leisure | 196.00 | 213.00 | 17.00 76 |

| Glance Fin | 89.00 | 96.66 | 7.66 0 |

| Sunil Agro Food | 230.00 | 249.70 | 19.70 24 |

-330

January 19, 2024· 10:58 IST

Stock Market LIVE Updates | Tata Consumer Products board approves raising up to Rs 6,500 crore

-330

January 19, 2024· 10:55 IST

Stock Market LIVE Updates | Shalby to acquire majority stake in PK Healthcare, shares trade higher

The share price of Shalby gained on January 19 as the company plans to acquire majority stake in Sanar International Hospitals, Gurugram (PK Healthcare Private Limited).

"The company has announced a strategic investment in PK Healthcare Pvt Ltd with an acquisition of 87.26 percent equity stake for a consideration of Rs 102 crore, approximately. This equity stake will be acquired within a period of one month, through primary infusion and secondary buy‐outs," company said in its exchange notice.

The hospital is located at prime location of Golf Course Road, Gurugram. With a land parcel of 1.27 acres which has been taken on a long‐term lease. The current capacity of 130 beds facility can be expanded to the level of 180 beds with additional capex, it added. Read More

-330

January 19, 2024· 10:54 IST

Stock Market LIVE Updates | Indian Bank gets RBI approval to set up a new wholly owned operations support subsidiary

Indian Bank has received approval from the Reserve Bank of India (RBI) for setting up a new wholly owned operations support subsidiary.

-330

January 19, 2024· 10:50 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| PAKKA | 358.25 | 41.52 | 253.15 |

| Oracle Fin Serv | 6,763.00 | 37.66 | 4,912.90 |

| Intrasoft Tech | 176.70 | 33.81 | 132.05 |

| WE WIN | 92.75 | 32.31 | 70.10 |

| Ganesh Housing | 596.45 | 32.15 | 451.35 |

| Indo Thai Secu | 316.10 | 29.92 | 243.30 |

| M K Proteins | 49.35 | 26.86 | 38.90 |

| M K Proteins | 49.35 | 26.86 | 38.90 |

| Vertoz Advertis | 788.45 | 25.77 | 626.90 |

| Liberty Shoes | 385.20 | 24.04 | 310.55 |

-330

January 19, 2024· 10:47 IST

Stock Market LIVE Updates | Goa Carbon temporarily shut Paradeep Unit

Goa Carbon informed that the operations at the company's Paradeep Unit located at Vili. Udayabata, Paradeepgarh, Dist. Jagatsinghpur, Odisha has been temporarily shut-down for maintenance work from yesterday, 18th January 2024.