Strength in Reliance Industries’ consumer verticals — digital services and retail — could cushion softness in refining and petchem business and help drive growth in consolidated revenues for the December quarter, according to analysts tracking the stock. Profitability may rise in high single digits when RIL reports its numbers on January 19.

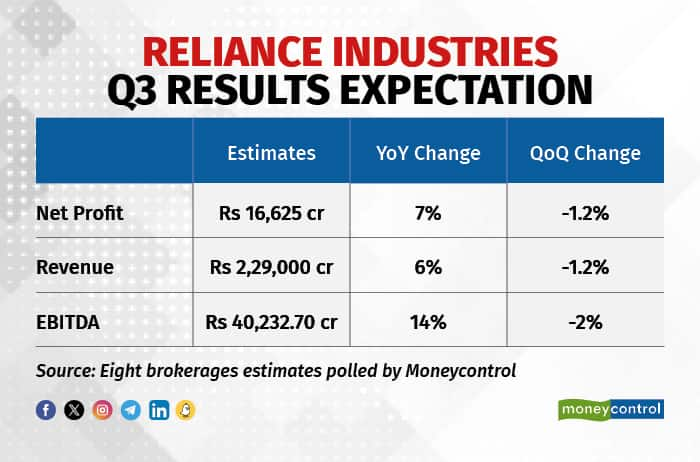

For the quarter ended December 2023, RIL is expected to post consolidated revenue of Rs 2.29 lakh crore, up 6 percent on-year. Consolidated EBITDA will be at Rs 40,232.70 crore, up 14.1 percent YoY. Consolidated net profit is likely to come in at Rs 16,625 crore, up 7 percent YoY, according to eight brokerages estimates polled by Moneycontrol.

In addition to Jio and retail, analysts expect Reliance's exploration and production (E&P) business to deliver positive performance in the third quarter. However, the oil-to-chemicals (O2C) business is expected to witness a decline on account of product cracks and lower realisations.

Also Read | Jio, Reliance Retail to steal the show in RIL’s report card for Q3?

On a quarter-on-quarter (QoQ) basis however, Reliance Industries' consolidated EBITDA is expected to decline marginally due to moderation in diesel cracks, narrowing of Russian crude discount and lower refining throughput due to maintenance shut-down and continued weakness in petchem margin.

The decline will be partly supported by robust growth in (E&P) earnings and steady growth in digital and retail business, said JM Financial Services.

O2C BusinessBased on the average estimates from seven brokerages, RIL's oil-to-chemical (O2C) EBITDA is likely to decline 12 percent QoQ to Rs 14,500 crore on due to moderation in gross refining margins (GRMs), accentuated by sustained weakness in petchem margins and reduced volumes.

Company's E&P EBITDA, however, is estimated to rise 13 percent sequentially to Rs 5,400 crore due to lower opex and a marginal increase in KG D6 gas output; partly offset by a cut in ceiling price for high-pressure, high-temperature (HPHT gas), said JM Financial.

Also Read | Reliance Industries to declare Q3FY24 financial results on January 19

TelecomThe Mukesh Ambani-led conglomerate's digital arm Reliance Jio’s EBITDA is expected to grow 4 percent QoQ to Rs 14,600 crore due to an improvement in ARPU to Rs 183 from Rs 182 in Q2 FY24, and an increase in net subscribers by around 90 lakh QoQ.

According to ICICI Securities, Reliance Jio’s Q3 FY24 revenue is estimated to rise 2.3 percent QoQ to Rs 25,300 crore, benefiting from subscriber additions. The ARPU growth was impacted in the quarter under review due to higher adoption of the 5G unlimited plan.

Reliance Jio's net profit is seen at Rs 5,200 crore, up 2.7 percent QoQ. 5G-related costs (including operating cost, depreciation and interests) are yet to be recognised in the income statement, pending the commercial launch, the brokerage said.

RIL Q3 estimatesReliance Retail

RIL Q3 estimatesReliance RetailReliance Retail’s gross revenue is anticipated to grow 23 percent on-year. Its EBITDA is also expected to grow, driven by a rising store count and an increase in footfalls. The retail arm’s EBITDA is expected to grow by 6.3 percent QoQ to Rs 6,200 crore, JM Financial analysts said.

Key monitorablesFurther clarity on Reliance Industries' Rs 75,000-crore announcements in the new energy business, growth in retail store additions, and any pricing action in telecom are the key monitorables in the Q3 earnings. Margin outlook in refinery and petchem will also be keenly eyed.

In the previous quarter, RIL reported a consolidated net profit of Rs 19,878 crore, a YoY increase of 29.7 percent, despite a dip in revenue from its O2C business. The robust performance of its retail, Jio and upstream businesses drove profit growth.

Gross revenue from operations came in at Rs 2.55 lakh crore in the quarter ended September 2023, compared to Rs 2.52 lakh crore in the year-ago period. RIL’s EBITDA increased by 30.2 percent to Rs 44,867 crore in Q2 FY24.

Also Read | Where are Reliance Industries, Jio Financial shares headed ahead of results: Check target, support

Reliance share performanceReliance Industries stock has been on a roll this year, rising over 7 percent in January so far. In comparison, benchmark Nifty 50 has risen 1.6 percent during this period. The stock hit a fresh all-time high of Rs 2,792.90 in the previous session.

Technical analysts believe that RIL stock may be headed into uncharted territory past Rs 3,000, or even Rs 3,100.

"Reliance has witnessed a multi-month breakout on the technical chart. The counter seems poised to continue its upward move with some in-between hiccups. The technical target for the counter based on chart setup is near Rs 3,000, but being an index heavyweight, we expect a gradual move over a period of time," said Osho Krishan, Sr. Analyst - Technical & Derivative Research, Angel One Ltd.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.