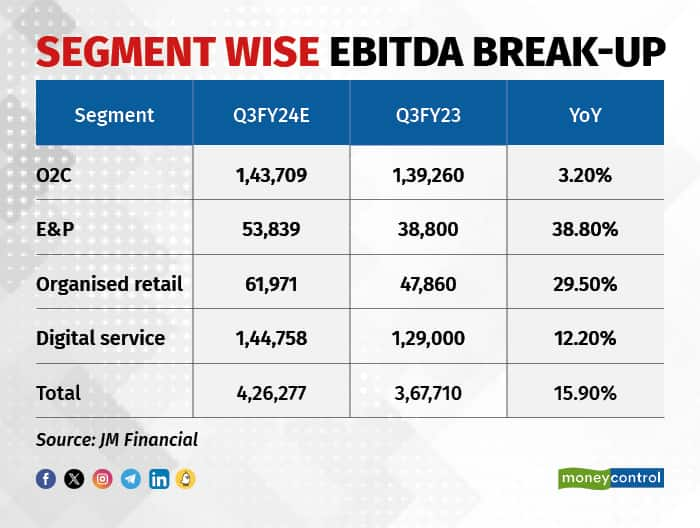

Reliance Industries’ consumer-facing segments Jio and Reliance Retail are likely to report a strong quarter, offsetting the decline in the O2C business, according to most analysts.

The delayed festive season will drive growth in Reliance Retail, while the subscriber additions during the quarter will drive Jio’s top-line growth. While the E&P segment is likely to post a high on-year surge in EBITDA, the O2C segment will see earnings soften as a result of moderation in refining margins.

Before Reliance Industries ventured into the retail and telecom space, the conglomerate’s earnings growth was led either by capex - creating new refining or chemical capacities - or margin cycles. Back then, the firm’s capex cycles impacted the stock price, noted JP Morgan.

Typically, the O2C segment’s earnings are affected by the unpredictability of crude oil prices and refining margins. A delay in refining and petrochemical projects, lasting longer than anticipated, could also have an impact on both volumes and earnings for Reliance Industries.

Also Read | Where are Reliance Industries, Jio Financial shares headed ahead of results: Check target, support

However, today, that volatility has been reduced, as Reliance Retail and Jio account for around 50 percent of RIL’s total consolidated EBITDA.

Over the past few fiscal years, the share of Reliance Retail and Reliance Jio’s contribution to the giant’s total EBITDA has risen. From FY17, the consumer-facing segments contributed around 14 percent to the consolidated EBITDA. By FY21, the contribution of the two segments surged to slightly more than half.

Over the past few fiscal years, the share of Reliance Retail and Reliance Jio’s contribution to the giant’s total EBITDA has risen. From FY17, the consumer-facing segments contributed around 14 percent to the consolidated EBITDA. By FY21, the contribution of the two segments surged to slightly more than half.

“On our estimates, [Retail and Jio] will account for 95 percent of EBITDA growth over the next three years,” added JP Morgan.

Retail to support growth

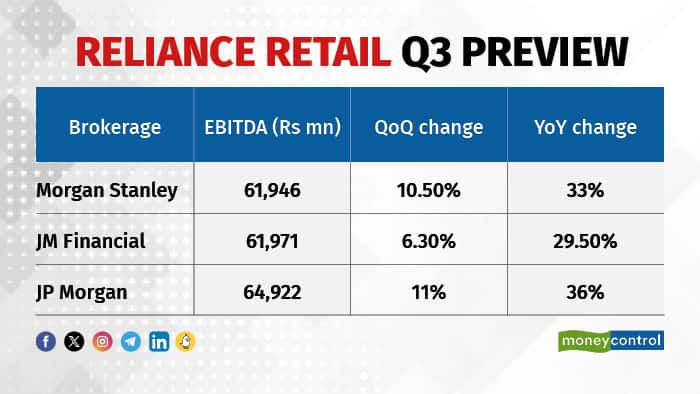

In a note, JP Morgan wrote, “As has been the case in the last couple of quarters, retail would continue to report strong growth.” The retail segment’s revenue is expected to grow 29 percent on-year, aided by festivities in the quarter and margins expansion.

According to Morgan Stanley, Reliance Retail needs a significant inflection in retail metrics, especially on margins, revenue/sq ft, and online mix of revenues. Inhouse brands, new store openings and logistics investments of around $11.7 billion over the past three years are now showing monetisation.

Also Read | RIL Q3 preview: Revenue, EBITDA to grow on robust retail, digital earnings; refinery, petrochem outlook eyed

The upcoming earnings will be closely watched, as it would showcase RIL’s ability on capturing spending trends. For the third quarter, Morgan Stanley estimated that the retail arm would see a 25 percent on-year jump in revenue and 10 percent EBITDA growth.

Reliance Retail Q3 Preview

Reliance Retail Q3 Preview

As per UBS, a key risk for the business would be the stalling of consumer migration from informal stores to modern retail and e-commerce. The speed of the digital/omnichannel ramp-up could impact sales for the retail arm.

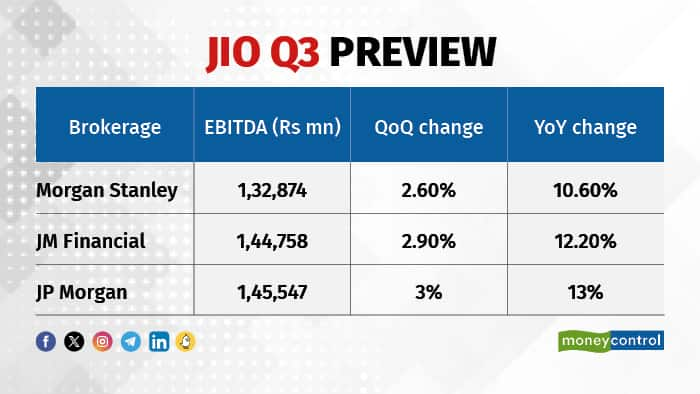

Jio adds 9 million subscribers in Q3

Reliance Jio's EBITDA is estimated to surge up to 13 percent on-year, while the ARPU growth will be muted, as a result of the higher adoption of the unlimited 5G plan. Jio also increased its overall subscribers by around nine million users over the previous quarter.

Jio Q3 Preview

Jio Q3 Preview

UBS noted that the intense pricing war and aggressive competitiveness between telecom players to maintain market share could impact ARPU. However, an upside risk for the telecom player is a 25-30 percent tariff hike across the board.

Overall outlook

Though the quarterly print is expected to come in weaker, it should not lead to significant downgrades in RIL’s EPS, according to JP Morgan. The brokerage added that Reliance has outperformed the frontline Nifty 50 index by six percent over the last three months. However, over the past year, the counter has underperformed the index by around seven percent.

Reliance Industries’ earnings in FY25 could be upgraded based on changes within the consumer-facing segments, retail and telecom, added JP Morgan. If retail growth improves, driven by capex intensity, if the telecom tariff comes through or if Jio is able to monetize its 5G investments, the brokerage could see a reason to upgrade the conglomerate’s future earnings.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.