LiveNow

Closing Bell: Nifty above 19,650, Sensex up 742 pts; all sectors in the green

Indian benchmark indices ended higher on November 15 with Nifty above 19,650 amid buying across the sectors. At close, the Sensex was up 742.06 points or 1.14 percent at 65,675.93, and the Nifty was up 232 points or 1.19 percent at 19,675.50.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Domestic equities surged higher fuelled by moderation in both India as well as US inflation. Nifty opened gap up and strengthen during the day to close near day’s high with gains of 232 points (+1.2%) at 19675 levels. All sectorial indices, including broader market ended in green. IT, Realty, Oil & Gas and Auto were top gainers today.

Rally was seen in global markets after weak U.S. inflation data raised hopes that interest rate-hiking cycle has reached its peak. Additionally, news of fresh stimulus in China and sharp fall in UK’s inflation boosted the sentiments. We expect market to maintain its momentum, driven by positive domestic data, cooling off US bond yields and dollar index.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened gap up and traded with a positive bias throughout the day. It closed with gains of ~232 points. On the daily charts we can observe that the narrow range of the last few trading sessions has been decisively broken on the upside. The Nifty is now stretching higher towards 19800 – 19850 where resistance in the form of the daily upper Bollinger band and the previous swing high is placed. The daily and hourly momentum indicator has a positive crossover which is a buy signal and hence intraday dips should be bought into. In terms of levels, 19580– 19550 is the crucial support zone while 19800 – 19850 is the immediate hurdle zone from short term perspective.

Bank Nifty also opened gap up and consolidated during the day. It has now reached the upper Bollinger band placed around 44400 and hence we can expect some sideways consolidation going ahead. In terms of levels, 44400 – 44500 shall act as an immediate hurdle zone while 44000 – 43900 is the crucial support zone. Unitll the support one is held we can expect the rally to continue till 44800 – 45000 from short term perspective.

Rupak De, Senior Technical analyst at LKP Securities:

Nifty has witnessed a robust upward movement, propelled by a strong global equity market sentiment, particularly following a gap-up opening. On the daily chart, the index has shown significant upward momentum after a consolidation phase, indicating an increase in optimism. The overall trend appears positive, with the index consistently maintaining levels above the critical moving average. Looking ahead, bullish sentiment is likely to persist as long as the index remains above 19,500. On the upper side, resistance is anticipated in the range of 19,700 to 19,850.

Bank Nifty exhibited a predominantly sideways movement subsequent to a gap-up commencement. Nevertheless, the index has consistently maintained its position above the crucial moving average on the daily chart, indicating a positive trend. Key support is situated at 44,000, and the sentiment is expected to stay optimistic as long as it remains above this level. On the upside, there is a potential movement towards 44,750.

Vinod Nair, Head of Research at Geojit Financial Services:

The market's strong gap-up jump in response to positive global cues on account of the softer than anticipated US and UK's inflation data, highlights the optimism for an end to the interest rate cycle, as evidenced by the ease in bond yields. This is likely to draw FII flows into emerging markets, which is good for India considering the current better earnings season and the festive demand pick-up. The drop in the CPI for India also improved the mood. The rebound was broad based with IT, realty, oil & gas, metal, and auto leading the way.

Aditya Gaggar Director of Progressive Shares:

Following strong domestic as well as global cues, Nifty50 commenced the day on a firm note and gradually compounded its gains to settle at 19,675.45, advanced by 231.90 points. All the sectors ended the day in green with Realty, IT, and Auto being the outperformers.

On a daily chart, the Index has made a long-legged DOJI candlestick pattern and not only breached its falling trendline but also gave a convincing close above its 50DMA (19,580) which shows bullishness in the markets. Now the next critical hurdle for the Index stands at 19,840 while the downside is protected at a strong support zone of 19,550-19,580.

Rupee Close:

Indian rupee ended 19 paise higher at 83.14 per dollar on Wednesday against Monday's close of 83.33.

Market Close: Indian benchmark indices ended higher on November 15 with Nifty above 19,650 amid buying across the sectors.

At close, the Sensex was up 742.06 points or 1.14 percent at 65,675.93, and the Nifty was up 232 points or 1.19 percent at 19,675.50. About 2073 shares advanced, 1223 shares declined, and 98 shares unchanged.

Eicher Motors, Tech Mahindra, Hindalco Industries, Tata Motors and Infosys were among the top gainers on the Nifty, while losers were Bajaj Finance, Power Grid Corporation, IndusInd Bank.

All the sectoral indices are trading ended in the green with capital goods, auto, metal, information technology, oil & gas and realty up 1-3 percent.

BSE Midcap and Smallcap indices up 1 percent each.

Sensex Today | Sharekhna View on Aurobindo Pharma

Aurobindo has been witnessing stronger growth in the U.S., Europe, growth markets, and APIs. The company has seen an increase in EBITDA margins over the past five quarters, which indicates likely stability in the product mix.

The launch of gRevlimid planned in Q3FY2024 and biosimilars by the end of FY2025 and Pen-G product sales coming in from Q1CY2024 will drive strong profitable growth over the short-medium term.

Injectables under Eugia are expected to grow in double digits and reach USD500 million and are expected to drive growth in the base business.

The company plans to launch 40 new products in the next 12 months. At the CMP, the stock is trading at ~15.9x/13.5x its FY2025E/FY2026E EPS, which is lesser than its historical P/E. Hence, upgrade the stock to Buy with a revised price target (PT) of Rs 1,163.

Stock Market LIVE Updates | Citi View On Aditya Birla Fashion & Retail

-Buy call, target Rs 270 per share

-Q2 near-term outlook volatile

-Demand trend expected to remain flattish to marginally positive in Q3

-Profitability will likely remain volatile due to high operating & financial leverage

-Expect profitability to improve in FY25 led by recovery in demand trend

-Trimmed EBITDA estimate by 6-7 percent for FY24-26

Sensex Today | BSE Midcap index rose 1 percent supported by Oberoi Realty, Mphasis, GlaxoSmithKline Pharmaceuticals:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Oberoi Realty | 1,303.30 | 6.05 | 43.46k |

| MphasiS | 2,268.80 | 5.52 | 11.19k |

| GlaxoSmithKline | 1,551.00 | 5.5 | 5.63k |

| Solar Ind | 6,526.35 | 5.24 | 8.06k |

| Ajanta Pharma | 1,951.55 | 4.25 | 20.43k |

| L&T Finance | 150.40 | 4.19 | 896.45k |

| ICICI Securitie | 675.30 | 3.97 | 9.88k |

| Glenmark | 751.05 | 3.66 | 120.93k |

| Shriram Finance | 2,036.30 | 3.43 | 81.23k |

| LIC Housing Fin | 466.35 | 3.42 | 139.53k |

Fedbank Financial Services, Epack Durable and Suraj Estate Developers get Sebi nod to float IPOs

Fedbank Financial Services, Epack Durable, and Suraj Estate Developers have received approvals from the capital markets regulator Sebi to launch their public issues.

Sebi issued an observation letter to Mumbai-based NBFC Fedbank Financial Services on November 2, as per the processing status of draft offer documents published by the regulator. Fedbank had filed its draft red herring prospectus with the regulator on July 28.

Uttar Pradesh-based Epack Durable, which had filed DRHP in August this year, received an observation letter from the Sebi on November 10.

The IPO by the original design manufacturer (ODM) consists of a fresh issue of Rs 400 crore worth of shares, and an OFS of 1.3 crore shares by promoters and investors.

The Sebi issued an observation letter to Suraj Estate Developers on November 8. The DRHP by the company was filed in July 2023.

The Rs 400-crore public issue by Suraj Estate Developers consists of only a fresh issue and there is no OFS component, as per the draft papers. Read More

Stock Market LIve Updates | HSBC View On Lupin

-Hold call, target raised to Rs 1,205 from Rs 1,101 per share

-Q2 beat was led by new launches in the US & operating leverage

-Execution remains key for sustainable margins pick-Up

-Ongoing spend for growth broadly masks cost savings benefits

-Consistent Pick-up in margin key for further re-rating

Sensex Today | Mohammed Imran - Research Analyst at Sharekhan by BNP Paribas:

In the short term we expect crude oil to trade range bound between $75-$81/b, as demand remains weaker from the Asian and US region while supply has been improving from OPEC and Non-OPEC region in recent month, which will keep crude oil market balance in surplus of above 1mbpd in Q4.

On macro front, the easing of US inflation to 3.2% and core to 4% has improved the risk sentiments as we believe that US rate hike has peaked, and we may see some rate cuts in 2024. The US Crude oil production remains around it all time high level of 13 mbpd. Chinese data remained mixed with improvement in consumer spending and advancement of industrial activities however the property market continued to remain a bigger dent of economic recovery.

The API forecasts another buildup of 1.3 mb of US commercial crude oil reserves last week, the larger stocks buildup will see crude oil prices plunging lower after the EIA released weekly inventory data. We advise selling crude oil for the lower target as WTI December to fall back to support of $74-$72, while resistance remains around $80.50 for the day.

Stock Market LIVE Updates | BofA Sec On Manappuram Finance:

-Buy call, target Rs 182 per share

-Earnings surprise on strong fee income, lower opex

-FY24 focus will be on profitability & portfolio diversification

-Trades at FY25E P/B of 0.94x versus 1.4x 5-year average

-Believe P/B undervalues strong non-gold business growth & improving MFI yields

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Alfa ICA | 56.68 | 52.55 | -4.13 0 |

| Salora Inter | 53.70 | 50.00 | -3.70 469 |

| Earthstahl | 55.08 | 51.60 | -3.48 0 |

| YASH INNO | 42.39 | 39.75 | -2.64 2.74k |

| Morgan Ventures | 40.31 | 38.10 | -2.21 150 |

| U. H. Zaveri | 55.60 | 52.60 | -3.00 406 |

| KSE | 1,675.00 | 1,585.20 | -89.80 880 |

| Hind Hardy | 549.90 | 521.00 | -28.90 54 |

| CCL Internation | 23.37 | 22.24 | -1.13 10 |

| Krishanveer For | 59.49 | 56.62 | -2.87 113 |

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ascensive | 40.50 | 52.00 | 11.50 0 |

| Poona Dal | 59.00 | 67.90 | 8.90 2 |

| MPIL Corp | 990.00 | 1,092.00 | 102.00 0 |

| Ras Resorts | 44.56 | 48.45 | 3.89 16 |

| Frontline Trans | 34.20 | 36.83 | 2.63 409 |

| Raghuvansh Agro | 325.00 | 350.00 | 25.00 23.50k |

| OXYGENTA PHARMA | 30.64 | 32.94 | 2.30 1 |

| Hercules Hoists | 329.95 | 350.75 | 20.80 26 |

| YOGI | 30.55 | 32.44 | 1.89 1 |

| Suditi Ind | 19.15 | 20.24 | 1.09 0 |

Stock Market LIVE Updates | Geojit View on Tube Investments of India

Tube Investments of India has a diversified revenue stream with strong growth in the core sector, and industrial segments like railways & power through inorganic form continue to support long term revenue visibility. However, delay in the EV ramp up is not supporting the current valuation. We value TII on a long term avg. basis, with a P/E of 43x FY25E EPS, and recommend sell rating with a target price of Rs 2855 at CMP.

Stock Market LIVE Updates | India's October trade deficit widens; exports, imports see significant growth

India's October Trade Deficit Surpasses Economist Estimates. Trade deficit hits $31.46 billion, exceeding expected -$20.4 billion. Exports rose by 6.2% year-on-year to $33.57 billion. Imports increased by 12.3% year-on-year to $65.03 billion. Services exports stood at $28.7 billion, while services imports totaled $14.32 billion.

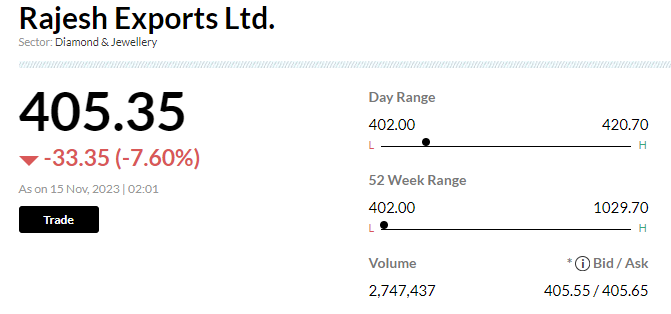

Stock Market LIVE Updates | Rajesh Exports' profits plummet, stock drops sharply

Jewellery maker Rajesh Exports's quarterly net profit plunges 88% YoY to Rs. 45.3 crore, with revenue down 53% at Rs. 38,066 crore. EBITDA also fell by 88% to Rs. 50.1 crore, with margins dropping 39 basis points to 0.13%. Rajesh Exports' stock plummeted by 17.5% on BSE, hitting Rs. 362 per share intraday. The stock was trading at Rs. 403.50 per share, an 8% drop by 2:30 pm.

Sensex Today | BSE Capital Goods index rose 1 percent led by Suzlon Energy, Sona BLW, Siemens

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Suzlon Energy | 40.40 | 4.55 | 17.21m |

| Sona BLW | 579.55 | 3.52 | 31.06k |

| Siemens | 3,487.10 | 2.02 | 33.70k |

| Carborundum | 1,087.20 | 1.99 | 1.75k |

| Bharat Forge | 1,049.00 | 1.75 | 9.77k |

| SKF India | 4,630.30 | 1.71 | 401 |

| GMR Airports | 58.17 | 1.66 | 203.57k |

| Hindustan Aeron | 2,091.85 | 1.54 | 29.95k |

| Elgi Equipments | 520.80 | 1.45 | 8.14k |

| Grindwell Norto | 2,112.20 | 0.92 | 1.20k |

Sensex Today | HSBC On CPI

-October inflation came in at 4.9 percent but may rise again in November

-Prices of some widely consumed vegetables have risen recently

-RBI will continue with a hawkish commentary

Stock Market LIVE Updates | KRChoksey View on Shree Cement

Post the Q2FY24 results, KRChoksey revise its EPS estimates, given the margin improvement through higher selling prices and a stronger product mix. The estimates factor in robust revenue growth and margin expectations from capacity expansion over the medium-term.

Broking house value Shree Cements at a premium valuation relative to peers, given its cost leadership. Despite applying a rich valuation of 18.5x EV/EBITDA multiple on its FY25E EPS, arrive at a lowered target price of Rs 28,163 on the stock. Given the limited upside of 6.8% from current levels, downgrade rating on the stock to ‘ACCUMULATE’ from BUY.

Sensex Today | Market at 2 PM

The Sensex was up 700.30 points or 1.08 percent at 65,634.17, and the Nifty was up 222.40 points or 1.14 percent at 19,665.90. About 2038 shares advanced, 1179 shares declined, and 105 shares unchanged.

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Cressanda Sol | 294918 | 23.75 | 0.7 |

| Protean eGov | 45000 | 1059.6 | 4.77 |

| M&M | 7137 | 1543.05 | 1.1 |

| Yes Bank | 300000 | 20.05 | 0.6 |

| Rajnish Wellnes | 349815 | 11.15 | 0.39 |

| Suyog Gurbaxani | 168000 | 98 | 1.65 |

| Protean eGov | 20000 | 1059.6 | 2.12 |

| Protean eGov | 10682 | 1059.6 | 1.13 |

| Vodafone Idea | 201554 | 14.02 | 0.28 |

| KCL Infra | 553921 | 2.42 | 0.13 |

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| INFOLLION | 275.00 | 263.00 | -12.00 14.73k |

| Emami Realty | 87.30 | 83.75 | -3.55 3.10k |

| Cadsys India | 232.25 | 223.00 | -9.25 7.79k |

| Quicktouch Tech | 207.50 | 200.00 | -7.50 2.96k |

| D. P. Abhushan | 616.50 | 596.50 | -20.00 298 |

| Uniinfo Telecom | 31.00 | 30.00 | -1.00 4.75k |

| Arvee Laborator | 120.25 | 116.45 | -3.80 28 |

| NRB Industrial | 30.25 | 29.30 | -0.95 4.10k |

| Golden Tobacco | 53.90 | 52.30 | -1.60 87 |

| ACE Integrated | 35.45 | 34.40 | -1.05 84 |

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Orient Abrasive | 57.50 | 60.85 | 3.35 20.43k |

| Venus Remedies | 341.05 | 357.50 | 16.45 2.03k |

| Hi-Green Carbon | 139.50 | 146.00 | 6.50 - |

| AGS Transac | 71.35 | 74.45 | 3.10 278.45k |

| Cochin Shipyard | 1,054.45 | 1,095.50 | 41.05 41.15k |

| Crown Lifters | 73.85 | 76.65 | 2.80 2.43k |

| Vinyas Innovati | 460.00 | 477.25 | 17.25 - |

| Praxis Home Ret | 29.30 | 30.30 | 1.00 2.83k |

| Poddar Housing | 143.10 | 147.95 | 4.85 128 |

| Sejal Glass | 279.00 | 288.35 | 9.35 314 |

Sensex Today | October Trade Data:

Exports up 6 percent at USD 33.57 billion versus USD 31.60 billion, Imports up 11 percent at USD 65.03 billion versus USD 57.91 billion and Trade deficit up 18 percent at USD 31.46 billion versus USD 26.3 billion, YoY.

Sensex Today | UBS View On CPI:

-Inflation to remain in 5-6 percent range in rest of FY24

-RBI likely to keep rates on hold

-Food inflation remains sticky

-Sequential increase in onion prices a key concern

-Broad-based deceleration in core inflation continues

Stock Market LIVE Updates | Goodluck India board approves fund raising up to Rs 200 crore via QIP

The meeting of the board of directors of Goodluck India has approved raising of funds through issuance of equity shares of the company by way of Qualified Institutions Placement (QIP), in one or more of the tranches for an aggregate amount up to Rs 200 crore, subject to necessary approval including the approval of the members of the company and such other permissions, sanctions and statutory approvals, as may be required.

Stock Market LIVE Updates | Cipla's arms completes 51.2% stake in Cipla Quality Chemical Industries

Cipla (EU) Limited, UK and Meditab Holdings Limited, Mauritius, wholly owned subsidiaries of the Cipla completed the sale of entire 51.18% stake held in Cipla Quality Chemical Industries Limited (CQCIL), Uganda on 14th November, 2023 for final consideration amount of USD 25 million.

Accordingly, CQCIL has now ceased to be a subsidiary of the company with effect from November 14, 2023.

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16562.60 1.21 | 31.33 2.11 | 0.72 25.90 |

| NIFTY IT | 31306.50 2.19 | 9.38 1.26 | -1.58 4.83 |

| NIFTY PHARMA | 15508.35 0.07 | 23.11 0.07 | 1.79 18.96 |

| NIFTY FMCG | 52259.00 0.45 | 18.31 -0.37 | -0.50 19.01 |

| NIFTY PSU BANK | 5218.75 0.79 | 20.84 3.92 | 3.36 39.14 |

| NIFTY METAL | 6793.95 1.19 | 1.05 2.53 | -0.39 3.10 |

| NIFTY REALTY | 679.60 2.43 | 57.39 4.15 | 10.90 50.09 |

| NIFTY ENERGY | 28349.15 1.01 | 9.58 2.63 | 4.22 5.02 |

| NIFTY INFRA | 6387.95 1 | 21.63 1.53 | 1.23 20.56 |

| NIFTY MEDIA | 2264.80 1.21 | 13.69 -0.04 | -2.37 10.49 |

Sensex Today | Praveen Singh – Associate VP, Fundamental Currencies and Commodities, Sharekhan by BNP Paribas:

US CPI coming lower than expected and prior data weighed heavily on the US Dollar Index that crashed nearly 1.50% yesterday as the ten-year US yields slumped 4% to below 4.50% mark. The US CPI MoM came in at 0% Vs the forecast of 0.10%, while YoY reading at 3.20% trailed the forecast of 3.30%.

China's industrial production and retail sales data released this morning were better than expected, though UK's inflation (October) and Japan's Q3 GDP fell short of expectations.

Markets don't see any rate hikes in December now, while even January rate hike odds have fallen to merely 7% now.

Risk-on sentiments, Goldilocks US data and soft yields are supportive for the Indian Rupee, though upside looks limited as the core US CPI YoY still stands at 4%, which is double the Fed's target.

The pair may trade between Rs 82.80 and Rs 83.30 in the near-term.

Sensex Today | Kotak Institutional Equities View On CPI:

-Inflation moderates marginally in October

-Favourable base aids moderation in October inflation

-Core inflation trajectory continues to provide respite

-Maintain our view of prolonged pause by RBI MPC

Stock Market LIVE Updates | Morgan Stanley View On Indiabulls Housing Finance

-Underweight call, target Rs 103 per share

-PPoP beat was 43 percent on higher total income (25 percent above estimate)

-Higher total income led by higher assignment income & lower ops costs

-PAT was in-line with estimate as higher PPOP was offset by higher credit costs

Stock Market LIVE Updates | PC Jeweller stock slips 2% following losses for 4th straight quarter

Shares of PC Jeweller declined 2 percent to Rs 28 per share on November 15 after the company posted net loss for the fourth straight quarter (Q2FY24) amid mounting legal battles. The S&P BSE Sensex was up 605 points or 0.9 percent to 65,549 levels, as of 10:08 am.

So far this year, the stock of this gem and jewellery company has tumbled over 64 percent as against 6 percent rise in the benchmark Sensex.

PC Jeweller reported a net loss of Rs 152 crore for Q2FY24 as against a profit of Rs 73 crore a year ago. Domestic sales, too, fell to Rs 33 crore in Q2FY24 versus Rs 836 crore in Q2FY23 as the company remains entangled in a legal battle with multiple lenders. Read More

Sensex Today | BSE Auto index rose 1 percent led by Eicher Motors, Apollo Tyres, Balkrishna Industries:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Eicher Motors | 3,817.00 | 4.72 | 42.86k |

| Apollo Tyres | 426.25 | 2.62 | 121.04k |

| Balkrishna Ind | 2,632.00 | 2.39 | 2.88k |

| Cummins | 1,818.15 | 2.2 | 24.39k |

| Bajaj Auto | 5,530.00 | 1.99 | 2.70k |

| UNO Minda | 640.55 | 1.82 | 9.61k |

| TVS Motor | 1,671.70 | 1.49 | 6.78k |

| Tata Motors | 662.70 | 1.47 | 234.31k |

| MRF | 109,162.90 | 1.41 | 289 |

| Hero Motocorp | 3,155.70 | 1.18 | 55.73k |

Sensex Today | Colin Shah, MD, Kama Jewelry:

Dhanteras this year has added more sheen to the yellow metal as the sales of gold jewellery witnessed a rise of 15–25% during the day, surpassing two-day from last year. Traditionally, gold coins and gold jewellery remained a preferred choice among buyers. However, owing to the shift in consumer mindset, diamond and platinum jewellery were majorly preferred by the young buyers, who purchased jewellery for the purpose of consumption.

It was also observed that a considerable chunk of the buyers opted to buy online. Fuelled by the strengthened purchasing power due to the rise in income levels, major volumes of low-ticket-size purchases contributed to the overall festive sales, with strong demand coming in from Tier 2 cities along with metros. Overall, this festive season has seen the strongest performance, and we foresee this trend to breach new levels in the years to come.

Sesnex Today | Market at 1 PM

The Sensex was up 615.67 points or 0.95 percent at 65,549.54, and the Nifty was up 197.80 points or 1.02 percent at 19,641.30. About 2049 shares advanced, 1157 shares declined, and 94 shares unchanged.

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| LIC Sensex ETF | 765.00 | 721.00 | -44.00 117 |

| Globesecure | 63.00 | 60.00 | -3.00 0 |

| Guj Raffia Ind | 34.50 | 33.05 | -1.45 290 |

| Prolife Industr | 263.70 | 253.00 | -10.70 250 |

| Poddar Housing | 149.00 | 143.10 | -5.90 1.06k |

| Autoline Ind | 104.05 | 101.00 | -3.05 1.89k |

| DPSC | 25.60 | 24.85 | -0.75 340.99k |

| Jay Jalaram | 382.00 | 371.30 | -10.70 0 |

| Upsurge Seeds | 400.00 | 390.00 | -10.00 0 |

| Mangalam Alloys | 56.50 | 55.10 | -1.40 0 |

| Company | Price at 12:00 | Price at 12:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Emkay Global | 107.40 | 113.85 | 6.45 31.61k |

| Sunflag Iron | 186.35 | 196.75 | 10.40 50.52k |

| Veranda Learnin | 238.00 | 250.30 | 12.30 187.15k |

| Khadim India | 342.00 | 357.60 | 15.60 1.31k |

| Uniinfo Telecom | 29.70 | 31.00 | 1.30 5.03k |

| Aries Agro | 186.25 | 194.30 | 8.05 3.89k |

| Airo Lam | 125.05 | 129.85 | 4.80 2.25k |

| Arihant Academy | 105.00 | 109.00 | 4.00 320 |

| DCX Systems | 303.30 | 314.80 | 11.50 192.00k |

| Sreeleathers | 303.50 | 314.95 | 11.45 61.60k |

Sensex Today | Warren Buffett’s Berkshire trims HP stake, exits bet on General Motors

Warren Buffett’s Berkshire Hathaway Inc. reduced the number of stocks in its portfolio in the third quarter, exiting stakes in General Motors Co. and Activision Blizzard Inc. while trimming bets on companies including HP Inc.

The conglomerate’s retreat from Activision completes Buffett’s arbitrage play amid the video-game maker’s prolonged effort to merge with Microsoft Corp., which ran into antitrust scrutiny before the deal was completed in October.

Altogether, Berkshire exited stakes in seven companies, not including the restructuring of its investment in Liberty Media Corp. and related entities. The value of its disclosed investments decreased 10% from the previous quarter to $312.8 billion.

Berkshire has been a net seller of equities throughout 2023, pocketing about $23.6 billion from stock sales after purchases in the first nine months of this year. Those equity sales have contributed to a high-class problem for the conglomerate: more money than it can easily put to work. Much of the hoard has ended up in short-dated Treasuries, helping Berkshire rack up a record $157 billion in cash. Read More

Stock Market LIVE Updates | Narayana Hrudayalaya rallies 9% to record high on robust Q2 results

Shares of Narayana Hrudayalaya zoomed 9 percent to hit an all-time high of Rs 1,182 on November 15 after the company clocked strong results for the July-September quarter. The S&P BSE Sensex was up 586 points or 0.2 percent to 65,520 as of 11:01am.

In the past three months, the stock of this healthcare company has surged 15 percent as against a flat move in the benchmark Sensex.

Narayana Hrudayalaya’s profit grew 34.3 percent on-year to Rs 226 crore in Q2FY24, while consolidated revenue surged 14.3 percent to Rs 1,305 crore, driven by higher patient volumes across units. Read More

JUST IN | UK October CPI rises 4.6% YoY

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Visagar Fin | 250000 | 0.78 | 0.02 |

| BSEL Infra | 246791 | 13.58 | 0.34 |

| Vodafone Idea | 234475 | 14.11 | 0.33 |

| Yes Bank | 566895 | 20.34 | 1.15 |

| Rajnish Wellnes | 250000 | 11.23 | 0.28 |

| Cressanda Sol | 250000 | 23.94 | 0.6 |

| Protean eGov | 25198 | 1059.6 | 2.67 |

| Yes Bank | 205250 | 20.23 | 0.42 |

| Cressanda Sol | 250000 | 24.01 | 0.6 |

| Piramal Pharma | 99850 | 119.5 | 1.19 |

Stock Market LIVE Updates | NMDC trades in red even as Q2 net profit jumps 15%; brokerages remain upbeat

Shares of National Mineral Development Corporation Ltd (NMDC) dropped 2 percent intraday on November 15 on profit-taking even as the mining giant registered a 15 percent jump in Q2 net profit. At 11:40am the stock was trading at Rs 170.24 on the NSE.

The country's largest iron ore producer reported a 15.7 percent increase in consolidated net profit for the second quarter on the back of healthy demand. NMDC's net profit climbed to Rs 1,024.86 crore in the three months ended September from Rs 885.65 crore a year earlier, the state-run company said in a statement on November 14. Its revenue from operations zoomed 20 percent to Rs 4,013.98 crore in the September quarter from Rs 3,328.5 crore last year. Read More

Stock Market LIVE Updates | Morgan Stanley View On Grasim Industries

-Overweight call, target Rs 1,985 per share

-Q2 standalone EBITDA below estimate

-EBITDA miss led by chemicals business, partially offset by viscose business

-Paints business launch timelines are on track

-B2B e-commerce business is now expanding

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Bang Overseas | 332322.00 | 56.50 19.96 | 771708 42460.60 |

| Apollo Micro Sy | 604063.00 | 133.40 9.98 | 5891386 9719320.95 |

| Shekhawati Poly | 1039950.00 | 0.70 7.69 | 93189 91341.40 |

| PTC Industries | 13842.00 | 5178.60 5 | 8246 4668.60 |

| Gayatri Highway | 220458.00 | 1.05 5 | 1873016 363484.20 |

| Shriram Pistons | 24073.00 | 1166.80 5 | 31706 66868.50 |

| Sky Gold | 18577.00 | 887.10 4.99 | 50483 233295.75 |

| Dynamic Cables | 4813.00 | 409.40 4.99 | 39673 28718.50 |

| Thomas Cook | 154114.00 | 154.85 4.98 | 997122 772793.95 |

| Deep Energy Res | 7928.00 | 146.65 4.97 | 9534 10248.35 |

Stock Market LIVE Updates | HSBC View On Interglobe Aviation:

-Buy call, target cut to Rs 3,140 from Rs 3,230 per share

-Q2 FY24 PBT better than consensus owing to positive one-offs

-Underlying LBT was slightly worse

-October yield was low YoY due to shift in festivals but should catch up

-Though high inflation may curtail bumper profitability

-Expect short-term headwinds but no erosion to long-term value

Sensex Today | BSE Smallcap index up 1 percent led by Gabriel India, Veranda Learning Solutions, Ahluwalia Contracts India

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Gabriel India | 422.35 | 15.24 | 264.79k |

| Veranda Learn | 240.95 | 11.89 | 46.78k |

| Ahluwalia | 751.40 | 11.16 | 18.79k |

| Music Broadcast | 15.80 | 10.34 | 349.14k |

| Apollo Micro Sy | 133.39 | 9.99 | 622.42k |

| DCM Shriram Ind | 135.65 | 9.97 | 62.12k |

| Den Networks | 59.04 | 9.7 | 675.75k |

| Tilaknagar Ind | 276.60 | 9.26 | 151.46k |

| Guj Themis | 201.60 | 8.83 | 375.97k |

| Hathway Cable | 20.66 | 8.28 | 2.80m |

Stock Market LIVE Updates | Axis Securities View on Coal India:

Coal India’s earnings are sensitive to coal offtake volumes. Despite the drop in e-auction premiums, the company managed to report robust EBITDA YoY, led by higher overall volume offtake and low RM costs.

FSA prices at Rs 1,542/t in Q2FY24 have also held up well so far (up 9% YoY/ flat QoQ).

Broking house revise its EBITDA upwards for FY24/25E to account for strong Q2FY24 results and revision in total coal offtake assumption upwards by 3% each at 764/795MT (CIL target is 780/850MT).

It value the stock now at 4.5x 1-year forward EV/EBITDA multiple on FY25E Adj. EBITDA (from 4.0x) on higher production and demand visibility (see Exhibit 4).

Arrive at the target price of Rs 380/share (from Rs 265/share), implying an upside of 17% from the CMP.

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Nidhi Granites | 99.20 | 90.50 | -8.70 96 |

| KJMC Fin Ser | 49.99 | 46.00 | -3.99 285 |

| Rishi Techtex | 33.98 | 31.30 | -2.68 636 |

| Southern Magnes | 205.00 | 191.45 | -13.55 1.86k |

| Infronics Syst | 38.95 | 36.71 | -2.24 1.02k |

| Osiajee | 33.83 | 32.00 | -1.83 805 |

| Maruti Interior | 103.50 | 98.00 | -5.50 6.95k |

| Comfort Comm | 21.50 | 20.40 | -1.10 1.06k |

| Maitri | 25.65 | 24.38 | -1.27 215 |

| MPIL Corp | 1,040.00 | 990.05 | -49.95 10 |

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| DRA Consultants | 24.81 | 29.70 | 4.89 2.50k |

| GG Dandekar | 87.20 | 96.50 | 9.30 3.49k |

| Gogia Capital | 94.80 | 104.65 | 9.85 130 |

| Kranti Industri | 90.52 | 99.70 | 9.18 1.39k |

| Chordia Food | 92.65 | 101.70 | 9.05 112 |

| Vantage Knowled | 95.00 | 104.00 | 9.00 191 |

| Suraj Products | 237.00 | 258.00 | 21.00 1.91k |

| Remi Edelstahl | 66.50 | 72.00 | 5.50 1.53k |

| Synthiko Foils | 92.25 | 99.47 | 7.22 962 |

| Frontline Trans | 34.25 | 36.92 | 2.67 473 |

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| SBI Life Insura | 1,350.00 | 1,350.95 1,332.05 | -0.07% |

556.35

2,327.00

3,055.00

1,592.60

3,672.10

245.95

437.50

656.55

1,750.15

Stock Market LIVE Updates | Bihar State Electronics Development Corp cancels LoI of Railtel Corp for order worth Rs 76.1 crore

Railtel Corporation of India has informed that due to some unavoidable reasons, the Bihar State Electronics Development Corporation has cancelled the Letter of Intent for the work order and released the PBG submitted for this work.

The company had received the work order from M/s. Bihar State Electronics Development Corporation Ltd. for Implementation and Management of Electronic Knowledge Network (100 Mbps Internet Connectivity, Wi-Fi system and Smart Classes) in Academic/Administrative buildings of Government Engineering Colleges and Polytechnic Institutes under Department of Science & Technology, Govt. of Bihar. The total value of the work pertaining to RailTel part was Rs 76.10 crore (inclusive of GST).

Stock Market LIVE Updates | Gland Pharma gets tentative USFDA nod for Angiotensin II injection

Gland Pharma received tentative approval from the United States Food and Drug Administration (US FDA) for Angiotensin II Injection, 2.5 mg/mL Single Dose Vial.

Gland Pharma believes that we are the only company with first to file for this product and may be eligible for 180 days of generic drug exclusivity.

Gland Pharma will launch the product with its marketing partner on receipt of final approval.

Siemens AG to buy 18% stake in Siemens India for €2.1 billion

Stock Market LIVE Updates | Metal stocks shine brighter as equities gain on easing US inflation, weak dollar

Metal stocks got an extra shine in sync with the equity market, which rallied on a decline in dollar pushed by easing retail inflation in the US.

Hindalco Industries jumped over 4 percent, NALCO 2.2 percent, Tata Steel 2 percent, JSW Steel 1.6 percent, Vedanta 1.3 percent, and Coal India 1 percent. The BSE Metal Index gained 1.6 percent, while the benchmark Sensex added 0.9 percent around 11.20am on November 15. READ MORE

Stock Market LIVE Updates | Wipro stock gains 2% on voluntary liquidation of step-down subsidiary

Stock Market LIVE Updates | Narayana Hrudayalaya hits record high on robust Q2 results

Narayana Hrudayalaya’s profit grew 34.3 percent on-year to Rs 226 crore in Q2FY24, while consolidated revenue surged 14.3 percent to Rs 1,305 crore, driven by higher patient volumes across units. READ MORE

Stock Market LIVE Updates | How to trade Bank Nifty on expiry day today

The overall trend in Bank Nifty as per analysts is likely to remain positive, contingent on its ability to sustain levels above 43750 for an upward movement towards 44250 and then 44444. On the downside, support is identified at 43500, followed by 43333 levels. READ MORE

Stock Market LIVE Updates | HSBC View On Biocon

-Hold call, target cut to Rs 245 from Rs 270 per share

-Lacklustre Q2; biosimilars sales saw muted 6.2 percent QoQ growth

-Improved channel access to raise volume for Adalimumab

-Though it remains uncertain whether Adalimumab sales will see similar step-up

-FDA clearance of pending GMP issues at malaysia plant the next catalyst

Sensex Today | Nifty Metal index up 1 percent supported by Hindalco Industries, NALCO, Jindal Steel:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hindalco | 507.45 | 4.09 | 6.83m |

| Jindal Steel | 650.80 | 2.21 | 1.31m |

| NALCO | 94.00 | 2.06 | 7.66m |

| JSW Steel | 773.25 | 1.6 | 1.15m |

| Tata Steel | 122.80 | 1.49 | 16.44m |

| Ratnamani Metal | 3,433.95 | 1.4 | 12.56k |

| Hind Zinc | 304.80 | 1.18 | 162.05k |

| Vedanta | 244.60 | 1.1 | 3.05m |

| SAIL | 88.90 | 0.79 | 9.32m |

| Coal India | 352.10 | 0.79 | 21.22m |

Sensex Today | Market at 11 AM

The Sensex was up 589.56 points or 0.91 percent at 65,523.43, and the Nifty was up 184.70 points or 0.95 percent at 19,628.20. About 2079 shares advanced, 1033 shares declined, and 110 shares unchanged.

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Vertexplus | 224.25 | 208.00 | -16.25 0 |

| Kontor Space | 85.80 | 81.00 | -4.80 - |

| Baba Food Proce | 76.00 | 72.20 | -3.80 607.47k |

| G-Tec Jainx | 103.80 | 99.80 | -4.00 469 |

| Crayons | 143.95 | 138.70 | -5.25 7.00k |

| Arvind and Comp | 58.50 | 56.45 | -2.05 9.00k |

| Praxis Home Ret | 30.00 | 28.95 | -1.05 5.60k |

| Swaraj Suiting | 103.50 | 100.00 | -3.50 1000 |

| Pulz Electronic | 84.85 | 82.00 | -2.85 6.00k |

| Cubex Tubings | 66.30 | 64.10 | -2.20 4.23k |

| Company | Price at 10:00 | Price at 10:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Bang Overseas | 48.55 | 54.60 | 6.05 1.04k |

| Parin Furniture | 80.00 | 85.60 | 5.60 4.00k |

| Shree Vasu | 157.00 | 167.00 | 10.00 30 |

| Sahana Systems | 486.65 | 517.00 | 30.35 0 |

| Sarthak Metals | 221.20 | 233.25 | 12.05 6.77k |

| Micropro Soft | 67.50 | 70.95 | 3.45 - |

| Hathway Cable | 19.35 | 20.25 | 0.90 1.20m |

| Gabriel India | 399.55 | 417.70 | 18.15 74.31k |

| Krishna Defence | 290.15 | 302.95 | 12.80 4.50k |

| MRPL | 115.65 | 120.75 | 5.10 1.03m |

Stock Market LIVE Updates | PTC Industries and Safran sign contract to provide casting parts for the LEAP engine powering single-aisle jet

PTC Industries and Safran Aircraft Engines, the French global leader in aero engine, has signed a multi-year contract to develop industrial cooperation for LEAP engines casting parts. PTC Industries will produce titanium-casting parts for Safran Aircraft Engines.

Sensex Today | Oil gains on China economic data, strong demand forecast

Oil prices rose on Wednesday as China's factory output and retail sales beat expectations, a day after the International Energy Agency (IEA) raised its oil demand growth forecast for this year.

Brent futures rose 20 cents, or 0.2%, to $82.67 a barrel by 0427 GMT, while U.S. West Texas Intermediate (WTI) crude rose 15 cents, also 0.2%, to $78.28.

China's October economic activity perked up as industrial output grew at a faster pace and retail sales growth beat expectations, an encouraging sign for the world's second-largest economy.

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Elegant Marble | 330.65 0.30 | 235.30 40.52 | 11,579 |

| Saumya Consult | 108.00 4.98 | 81.63 32.30 | 211 |

| Shri Venkatesh | 110.00 3.53 | 84.65 29.95 | 36,000 |

| Welcast Steels | 1,574.70 4.92 | 1,247.45 26.23 | 611 |

| Ravalgaon Sugar | 4,760.40 5.00 | 3,916.50 21.55 | 47 |

| Kalyani Forge | 472.50 5.00 | 388.80 21.53 | 5,485 |

| PH CAPITAL | 94.64 4.99 | 77.88 21.52 | 1,753 |

| Olatech Solutio | 217.35 5.00 | 179.00 21.42 | 18,000 |

| Purohit Constr | 12.26 4.97 | 10.10 21.39 | 327 |

| Sumeet Ind | 4.21 4.99 | 3.47 21.33 | 102,839 |

Stock Market LIVE Updates | Adani Energy Solutions plans to raise Rs 3,000 cr, arm may buy back $120-mn bonds

Shares of Adani Energy Solutions gained 1.2 percent in early trade on November 15 on the company's plans to raise around Rs 3,000 crore or $360 million from bonds to be issued on a private placement basis.

"We are looking for a private placement of $360 million of transmission assets which were commissioned in the last three to four years," said Rohit Soni, chief financial officer of Adani Energy Solutions, formerly Adani Transmission. Read More

Stock Market LIVE Updates | Asian Paints says original installed production capacity of Khandala plant increases to 4 lakh KL per annum

Asian Paints said that the original installed production capacity of the Khandala plant has been increased to 4 lakh KL per annum in order to meet the medium-term capacity requirements of the company. An amount of Rs 385 crore has been invested by the company for the increase in installed capacity and the same has been funded through internal accruals.

Stock Market LIVE Updates | Wipro's subsidiary Designit Tokyo Co voluntarily liquidated

Designit Tokyo Co Ltd, a step-down subsidiary of wipro, has been voluntarily liquidated with effect from November 13.

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| NESCO | 829.90 | 829.90 | 826.60 |

| eClerx Services | 2465.40 | 2465.40 | 2,455.20 |

| Phoenix Mills | 2366.40 | 2366.40 | 2,217.90 |

| Angel One | 2948.65 | 2948.65 | 2,945.75 |

| Suzlon Energy | 40.50 | 40.50 | 40.43 |

| Narayana Hruda | 1182.85 | 1182.85 | 1,134.10 |

| Oberoi Realty | 1293.45 | 1293.45 | 1,280.65 |

| CAMS | 2870.25 | 2870.25 | 2,799.05 |

| MCX India | 2890.00 | 2890.00 | 2,886.75 |

| Hindalco | 513.10 | 513.10 | 507.35 |

Stock Market LIVE Updates | Rail Vikas Nigam receives letter of acceptance for construction project worth Rs 311.2 crore from Central Railway

Rail Vikas Nigam has received letter of acceptance for construction work, supply of stone ballast, track linking, and side drain retaining in Dharakoh Maramjhiri section in connection with third line, from the Central Railway. The project cost is Rs 311.18 crore.

Sensex Today | Prashanth Tapse, Research Analyst-Sr VP Research at Mehta Equities:

ASK automotive listing was inline with street expectations. We believe post listing there would be decent demand for the shares as it had received overwhelming response from all kinds of investors especially from QIB’s 142 times. We also believe ASK can act as a proxy play for the growth in Indian automobile sector.

We strongly believe ASK Automotive gives allotted investors a long term opportunity to hold and raid the growth in automobile sector, hence recommending all allotted investors “HOLD FOR LONG TERM” while those who failed to get allotments can accumulate on the listing day for holding it for healthy long term returns as markets always reward a player who has high visibility and growth potential.

Sensex Today | BSE Realty index up 3 percent led by Phoenix Mills, Indiabulls Real Estate, Oberoi Realty:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 2,218.05 | 5.01 | 25.34k |

| Oberoi Realty | 1,280.00 | 4.15 | 11.15k |

| Indiabulls Real | 82.79 | 3.35 | 512.65k |

| Prestige Estate | 870.00 | 3.28 | 11.38k |

| Godrej Prop | 1,860.10 | 2.17 | 8.97k |

| Brigade Ent | 714.65 | 1.69 | 2.51k |

| Sobha | 850.90 | 1.68 | 15.23k |

| Macrotech Dev | 862.20 | 1.38 | 34.46k |

| DLF | 616.95 | 1.35 | 55.30k |

| Mahindra Life | 516.15 | 1.18 | 3.59k |

Stock Market LIVE Updates | UBS View On United Spirits

-Buy call, target raised to Rs 1,265 per share from Rs 1,200 per share

-Q2 broadly in-line with estimate

-Caution on sequential pick-up, maintains mid-term volume guidance

-Medium term tailwinds for premium segment to continue

-Company has finalised policy of distributing 50-70 percent of profits as dividend

Sensex Today | Baba Food Processing to debut on the NSE Emerge on November 15

Baba Food Processing (India) will list its equity shares on the NSE Emerge on November 15. The issue price is Rs 76 per share. Equity shares will be available for trading in trade-for-trade segment.

Sensex Today | Market at 10 AM

The Sensex was up 603.02 points or 0.93 percent at 65,536.89, and the Nifty was up 188.80 points or 0.97 percent at 19,632.30. About 2115 shares advanced, 864 shares declined, and 124 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,459.50 | 1.93 | 38.05k |

| Sun Pharma | 1,135.50 | 1.73 | 32.92k |

| TCS | 3,369.10 | 1.1 | 27.88k |

| Bharti Airtel | 923.60 | 1.09 | 25.76k |

| NTPC | 235.20 | 1.07 | 109.52k |

| Tata Motors | 633.70 | 1.01 | 176.69k |

| Infosys | 1,366.50 | 0.96 | 44.00k |

| HCL Tech | 1,271.70 | 0.96 | 20.06k |

| Reliance | 2,317.50 | 0.91 | 61.37k |

| Axis Bank | 979.90 | 0.87 | 58.00k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Power Grid Corp | 211.75 | -0.26 | 164.55k |

| Sun Pharma | 1,174.75 | -0.21 | 4.01k |

| Nestle | 24,044.10 | -0.18 | 644 |

| M&M | 1,540.00 | -0.02 | 16.38k |

Stock Market LIVE Updates | ASK Automotive stock makes decent debut, lists at 8% premium to IPO price

ASK Automotive stock made a decent debut, listing at an 8 percent premium to the IPO price on November 15. The stock opened at Rs 303.3 on NSE and Rs 304.9 on BSE against the issue price of Rs 282.

Ahead of the listing, the stock was trading at a 9 percent premium in the grey market, which is an unofficial ecosystem where shares start trading before the allotment in the IPO and until the listing day. Most investors track the grey market premium (GMP) to get an idea of the listing price.

The offer received a good response from investors with the issue getting booked 51.14 times and receiving bids for 105.85 crore shares against the issue size of 2.06 crore shares. Retail investors bid 5.7 times and non-institutional investors (NII) 35.47 times the portions set aside for them. QIBs picked 142.41 times their allotted quota. The promoters of the company are Kuldip Singh Rathee and Vijay Rathee. Read More

| Company | Price at 09:00 | Price at 09:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Info Drive Soft | 0.65 | 332.80 | 332.15 - |

| Baba Food Proce | 10.00 | 76.00 | 66.00 - |

| Kesoram Ind PP | 5.00 | 28.40 | 23.40 - |

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Bharat Gears RE | 103.25 | 172.05 | 68.80 - |

| Womancart | 108.85 | 130.60 | 21.75 - |

| Srivari Spices | 123.15 | 141.00 | 17.85 11.13k |

| Sreeleathers | 266.50 | 303.05 | 36.55 5.35k |

| Gateway Distri | 90.90 | 100.65 | 9.75 36.63k |

| Ethos | 1,927.60 | 2,112.00 | 184.40 11.20k |

Stock Market LIVE Updates | Jaiprakash Associates & Trusts holding 18.93 crore stake sign settlement agreement with ICICI Bank

With a view to reduce the debt, Jaiprakash Associates and Trusts holding 18,93,16,992 equity shares of the company have entered into a settlement agreement with lender ICICI Bank to transfer the said shares to lender.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| HDFC Bank | 1,508.00 1.29 | 5.06m | 762.99 |

| Yes Bank | 20.05 3.35 | 269.86m | 544.03 |

| Coal India | 352.90 1.02 | 12.43m | 438.21 |

| Power Finance | 307.70 0.07 | 13.62m | 419.18 |

| Infosys | 1,402.55 2.11 | 2.53m | 353.11 |

| Manappuram Fin | 151.70 8.09 | 19.37m | 294.57 |

| Reliance | 2,334.60 0.86 | 1.19m | 277.92 |

| MCX India | 2,873.05 3.54 | 972.83k | 273.04 |

| BSE Limited | 2,310.50 -0.49 | 1.20m | 278.85 |

| ICICI Bank | 941.15 0.72 | 2.90m | 272.84 |

Stock Market LIVE Updates | PVR INOX opens 6 screen multiplex Maison INOX at Jio World Centre, 4 screen multiplex in Odisha

PVR INOX has opened 6 screen multiplex Maison INOX at Jio World Centre in Mumbai and 4 screen multiplex at Utkal Kanika Galleria Mall, Bhubaneswar, Odisha. With this launch, PVR INOX now operates the largest multiplex network with 1,711 screens across 359 properties in 114 cities (India and Sri Lanka).

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Ruchinfra | 18.70 | 49.60 | 12.50 |

| Norben Tea | 13.35 | 34.17 | 9.95 |

| Windsor | 93.20 | 31.55 | 70.85 |

| Oil Country | 25.20 | 27.59 | 19.75 |

| NK Industries | 85.45 | 27.16 | 67.20 |

| Womancart | 130.60 | 23.03 | 106.15 |

| Crest Ventures | 313.05 | 20.64 | 259.50 |

| Everest Kanto | 144.70 | 19.74 | 120.85 |

| Shah Alloys | 61.25 | 18.93 | 51.50 |

| Nitiraj Enginee | 136.40 | 18.92 | 114.70 |

Stock Market LIVE Updates | Promoter Patel family to buy 1% stake in GMM Pfaudler from Pfaudler Inc

GMM Pfaudler's promoter Patel family will buy 1% stake, equivalent to 4.49 lakh equity shares, in GMM Pfaudler from Pfaudler Inc at Rs 1,700 per share. The acquisition of 1% stake is via inter-se promoter transfer.

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The October US inflation data is a game changer for the stock market. The 3.2% October inflation print is lower than expected. More importantly, the mere 0.2% MoM increase in core inflation is hugely positive. The takeaway from these numbers is that the Fed is done with rate hikes and the timeline for rate cuts in 2024 is likely to be advanced. The sharp recovery in US markets will be reflected in India, too. Short covering can add to the rally. FIIs are likely to turn buyers, lest they miss out on the rally in the best performing large economy in the world. Leading financials which were weighed down by FII selling will bounce back.

Decline in CPI inflation in India is also a favourable factor.

Across sectors, a rally is likely. Financials, automobiles, real estate, cement and platform digital companies will attract investment from DIIs, HNIs and retail investors. The tug of war between FIIs and DIIs is clearly in favour of DIIs.

Sensex Today | BSE Information Technology index up 1 percent led by Control Print, Mphasis, LTIMindtree:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Control Print | 925.15 | 6.81 | 3.17k |

| MphasiS | 2,238.50 | 4.11 | 3.94k |

| LTIMindtree | 5,426.65 | 3.2 | 2.62k |

| COFORGE LTD. | 5,220.80 | 2.68 | 753 |

| Persistent | 6,388.00 | 2.65 | 2.70k |

| Birlasoft | 598.50 | 2.65 | 15.33k |

| Tech Mahindra | 1,161.00 | 2.63 | 9.60k |

| Axiscades Tech | 583.05 | 2.54 | 16.05k |

| Intellect Desig | 685.00 | 2.36 | 8.30k |

| Quick Heal Tech | 365.00 | 2.1 | 9.82k |

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Vertexplus | 229.00 4.59% | 41.40k 1,320.00 | 3,036.00 |

| ARSS Infra | 20.90 4.76% | 51.93k 7,254.80 | 616.00 |

| Crayons | 145.00 -1.16% | 118.00k 18,000.00 | 556.00 |

| Vels Film | 96.80 -10% | 26.40k 5,280.00 | 400.00 |

| Pentagon Rubber | 126.00 5% | 19.00k 4,600.00 | 313.00 |

| Cadsys India | 232.25 5% | 71.00k 17,800.00 | 299.00 |

| Srivari Spices | 140.30 13.93% | 135.00k 34,000.00 | 297.00 |

| Rajesh Exports | 411.00 -6.31% | 1.04m 282,709.20 | 269.00 |

| Narayana Hruda | 1,133.55 4.51% | 602.19k 167,830.80 | 259.00 |

| SPML Infra | 61.40 4.96% | 59.11k 18,369.00 | 222.00 |