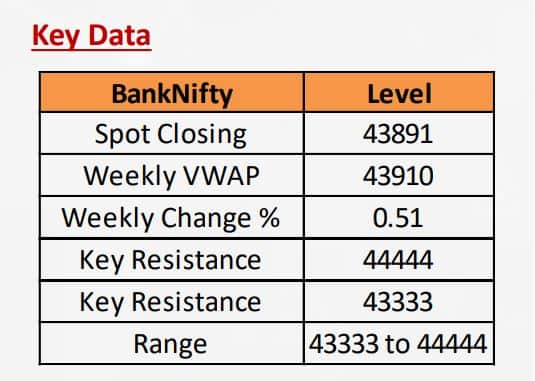

The markets seemed to be in post-festivities exuberance, with Bank Nifty opening around 500 points higher on November 15. The index has risen by 0.51 percent to 43,891 points on a weekly basis.

The Bank Nifty VWAP for the week is at 43,910, and it is currently trading near that level, suggesting a bullish stance, according to analysts.

Source: Motilal Oswal Financial Services

Source: Motilal Oswal Financial Services

Going ahead, here's what experts have to say about Bank Nifty expiry day outlook:

Expiry Day perspectives

"After such a big gap-up, Bank Nifty looks relatively weak compared to the Nifty. When the Nifty stalls after the initial jump, I expect Bank Nifty to give a small dip. Overall expecting a rangebound to negative day. Point 44,507 is the 100 DMA that can act as a big resistance," Shijumon Anthony, a derivatives trader, said.

"The sole trade I would consider for the day is a long put option if the day's low is breached and sustained," he said.

"The overall trend is likely to remain positive, contingent on its ability to sustain levels above 43,750 for an upward movement towards 44,250 and then 44,444. On the downside, support is identified at 43,500, followed by the 43,333 level," Motilal Oswal Financial Services (MOFSL) said.

MOFSL's Derivative Strategy Recommendations

Option Strategy: Option traders are advised to initiate a Bull Call Spread (Buy 44,000 CE and Sell 44,300 CE) to capitalise on the upward movement.

Option Writing: For option writers, MOFSL suggests selling Bank Nifty at 43,500 Put and selling at 44,400 Call, with a strict double-stop loss.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.