Closing Bell: Sensex, Nifty end marginally higher; Auto, IT drag, banks, metal, energy shine

-330

November 10, 2023· 16:00 IST

-330

November 10, 2023· 15:59 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets remained volatile for yet another session and ended marginally higher. After the initial downtick, the Nifty inched gradually higher and settled around the day’s high at 19,442.70 levels. Meanwhile, a mixed trend on the sectoral front kept the traders occupied wherein metal and energy posted decent gains while auto and IT were on the back foot. The broader indices continued their outperformance and gained over half a percent each.

We are seeing rotational buying across heavyweights, which is helping the index to hold strong amid consolidation. Markets are now awaiting fresh triggers and it could probably be from the global markets. Meanwhile, traders should stay focused on stock selection and maintain a positive bias until the Nifty breaks 19,200.

-330

November 10, 2023· 15:59 IST

Shrey Jain, Founder and CEO SAS Online

Earlier today, the Sensex and Nifty experienced a decline following Federal Reserve Chairman Jerome Powell's hawkish comments on rates. However, this negative trend, which persisted over the past three days, reversed in the Friday afternoon session, witnessing a resurgence in fresh buying.

Approaching the Diwali weekend, the domestic equities displayed a constrained range, with the Nifty 50 hovering around 19,450 and concluding at 19,425.35, up 30 points. The Sensex approached the 65,000 mark and closed at 64,904.68 , and the Nifty Bank entered positive territory at 43,820, registering a gain of 136 points.

We recommend adhering to a 'buy on dips' strategy at significant support levels. For existing long positions, it is prudent to maintain a strict stop loss at 19,300 for Nifty, while a recommended stop loss of 43,300 is suggested for Nifty Bank.

-330

November 10, 2023· 15:50 IST

Market in Samvat 2079

The broader market outperformed the benchmarks Nifty and Sensex in Samvat 2079. The Nifty Midcap 100 surged over 30 percent as against the Nifty 50's 9 percent rise in Samvat 2079. This also marks the broader market's second biggest gains in a samvat year in the past 9 years.

Majority of indices also ended the Samvat with net gains, with Realty, and PSU Banks leading at the forefront. 39 out of 50 Nifty stocks ended with net gains, with Tata Motors, L&T, ONGC and Bajaj Auto emerging as top gainers. On the other hand, Adani Enterprises, UPL and Kotak Mahindra Bank were among the few laggards.

-330

November 10, 2023· 15:44 IST

Deveya Gaglani, Research Analyst - Commodities, Axis Securities

Many festivals in India are considered auspicious to buy Gold, and Dhanteras is among the favourites. In India, people invest in Gold for long-term gains. That is why Indian households have the highest reserves of Gold, roughly 21,000 tonnes. Gold is very close to Indian's hearts and is a more sentimental investment than a speculative one. Since Dhanteras last year, Gold has given a mind-boggling return of almost 20 per cent, easily beating the returns of the Nifty 50. Gold was lingering due to the strong dollar index and the hawkish stance of the Fed at the end of September. It trapped all the bears as war broke out between Israel and Hamas. This geopolitical tension in the Middle East boosted Gold prices as it gained almost 10 per cent from the recent swing lows and made a multi-month high of 61,500 level as investors flocked towards Gold due to its safe-haven appeal. With the US election around the corner in 2024 and the geopolitical situation worldwide, the sky-high interest will not sustain for a long period. The Fed will eventually start cutting the rates, supporting Gold prices. Any dips around 57,000-58,000 can be used as a buying opportunity for investors during this Diwali season.

-330

November 10, 2023· 15:40 IST

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

In Samvat 2080, Financials are likely to do well supported by attractive valuations and impressive growth. Sustained FII selling in financials, which is impacting the sector, will be only temporary. For investors with a 2-year time horizon, the leading private banks and 3 or 4 PSU banks are good buys with good return potential.

The mid and small-cap rally is partly driven by retail exuberance and since the valuations in this broader market is high, investors have to exercise some caution

-330

November 10, 2023· 15:38 IST

Harjeet Singh Arora, Managing Director at Mastertrust

The Muhurat trading, also recognized as Auspicious trading, is a one-hour trading session held on Diwali. Over the past ten Muhurat trading sessions, seven instances concluded with positive returns, highlighting the auspicious nature of the occasion for market participants.

Meticulous planning is imperative, particularly within the short time frame of Muhurat trading. We have to clearly outline our financial goals whether we are looking for short-term gains or long-term investments. Usually, we witness volatile trading sessions hence thorough research is very important before deploying any trade. Look for companies with strong fundamentals, positive earnings reports, and growth potential. Additionally, we can also find stocks based on technical studies for short-term trading opportunities.

Risk management is a highly important part that we can’t afford to ignore. Risk appetite varies from individual to individual, for long-term investment, portfolio risk could be mitigated by proper diversification. Investors are not recommended to concentrate all investments in one stock or sector. However, given the short duration of muhurat trading, liquidity is also a big factor. Especially for intraday traders, choose stocks with sufficient liquidity to ensure smooth execution of trades.

-330

November 10, 2023· 15:34 IST

Rupee at close

Rupee ends at record low of 83.34 against the US Dollar. Rupee ends at 83.34/$ against Thursday’s close of 83.28/$.

-330

November 10, 2023· 15:32 IST

Market at close

Market recovers to close the last day of Samvat 2079 at its day's high. The Sensex settled 72.48 points or 0.11 percent higher at 64,904.68, and the Nifty was ended with gains of 30.00 points or 0.15 percent at 19,425.30.

The market breadth also favoured gainers over losers as about 1,812 shares rose, 1,747 fell, and 141 remained unchanged.

Last-hour buying in heavyweights like HDFC Bank, ITC, Axis Bank and ICICI Bank helped the benchmarks recover from losses. M&M was the worst hit among Nifty 50, down 2 percent on lower-than-expected Q2 earnings.

Within the broader market, MCX emerged as the top midcap gainer on reports of cost saving in its deal with TCS.

-330

November 10, 2023· 15:25 IST

-330

November 10, 2023· 15:21 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| Campus | 258.00 | 260.35 237.80 | 8.49% |

| Network 18 | 77.30 | 78.00 71.35 | 8.34% |

| Suven Pharma | 579.95 | 585.90 542.10 | 6.98% |

| Varroc Engineer | 471.50 | 471.95 441.15 | 6.88% |

| MCX India | 2,585.75 | 2,654.00 2,430.05 | 6.41% |

| Swan Energy | 421.90 | 446.80 397.00 | 6.27% |

| IFB Industries | 929.60 | 982.85 874.90 | 6.25% |

| Vijaya Diagnost | 629.70 | 653.90 594.00 | 6.01% |

| Engineers India | 138.25 | 141.25 130.50 | 5.94% |

| BLS Internation | 275.45 | 278.00 261.30 | 5.42% |

-330

November 10, 2023· 15:15 IST

Stock Market LIVE Updates | CLSA retains 'buy' call on Adani Ports; TP at Rs 878

Buy Call, Target Rs 878 per share

Port EBITDA Up 19% & Logistics EBITDA Rises 26% YoY

Its M&A Strategy Has Paid A Rich Dividend

Krishnapatam Port Volume Up By 27% YoY, Margin Have Gone Past ADSEZ Levels

Ports Traffic Did Well In 2Q, +13% YoY (Excl Haifa M&A) Led By Crude Imports

CEO Is Resolutely Focused On Its Next Leg Of Growth

Will Bring Down Net Debt/EBITDA To 2.5x In FY24

Net Debt/EBITDA Is Already Reaching 2.8x In 1HFY24

-330

November 10, 2023· 15:10 IST

-330

November 10, 2023· 15:04 IST

Market at 3 PM

The Sensex was up 84.21 points or 0.13 percent at 64,916.41, and the Nifty was up 27.20 points or 0.14 percent at 19,422.50. About 1,640 shares advanced, 1,516 declined, and 114 were unchanged.

-330

November 10, 2023· 15:01 IST

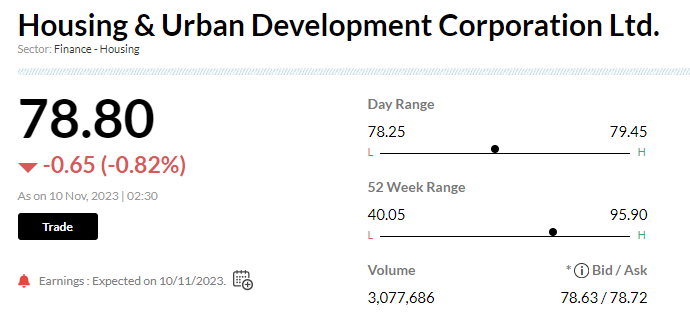

Stock Market LIVE Updates | HUDCO reports Q2 earnings

- Net profit up 13.9% at Rs451.6 cr vs Rs396.3 cr (YoY)

- Revenue up 7.3% at Rs1,864.8 cr vs Rs1,738.6 cr (YoY)

-330

November 10, 2023· 14:58 IST

-330

November 10, 2023· 14:53 IST

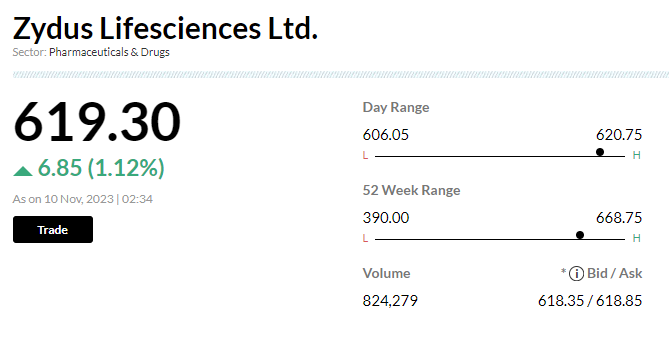

Stock Market LIVE Updates | Zydus, Torrent sign licensing pact for marketing Saroglitazar

-330

November 10, 2023· 14:49 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hero Motocorp | 3,105.15 | -2.17 | 572.22k |

| M&M | 1,527.95 | -1.55 | 4.30m |

| Titan Company | 3,241.05 | -1.3 | 1.03m |

| HCL Tech | 1,252.25 | -1.2 | 1.15m |

| Dr Reddys Labs | 5,407.25 | -0.93 | 203.30k |

| Hindalco | 480.10 | -0.9 | 2.77m |

| UPL | 545.50 | -0.89 | 1.03m |

| Wipro | 378.00 | -0.75 | 4.43m |

| Infosys | 1,365.30 | -0.69 | 2.27m |

| IndusInd Bank | 1,498.00 | -0.62 | 1.91m |

-330

November 10, 2023· 14:46 IST

Stock Market LIVE Updates | India gross direct tax collections gain 17.6% at Rs12.4 trln

India’s direct tax collections, net of refunds, stood at Rs10.6 trillion, up 21.8% from last year, the Central Board of Direct Taxes said in an emailed statement. This tax revenue was 58.2% of the total budget estimates for FY24. In terms of gross collections, corporate income tax and personal income tax grew 7.1% and 28.3% respectively. Refunds of 1.77 trillion rupees issued April 1 to Nov. 9, Bloomberg reported.

-330

November 10, 2023· 14:41 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NTPC | 241.90 | 1.66 | 7.35m |

| ONGC | 194.95 | 1.17 | 4.47m |

| UltraTechCement | 8,710.00 | 0.96 | 113.94k |

| Tech Mahindra | 1,134.00 | 0.89 | 564.20k |

| TATA Cons. Prod | 910.55 | 0.85 | 3.48m |

| HDFC Life | 626.45 | 0.82 | 2.16m |

| JSW Steel | 756.95 | 0.81 | 664.37k |

| Bajaj Finserv | 1,594.50 | 0.77 | 539.27k |

| Power Grid Corp | 211.30 | 0.71 | 8.91m |

| Bajaj Finance | 7,435.00 | 0.65 | 418.42k |

-330

November 10, 2023· 14:36 IST

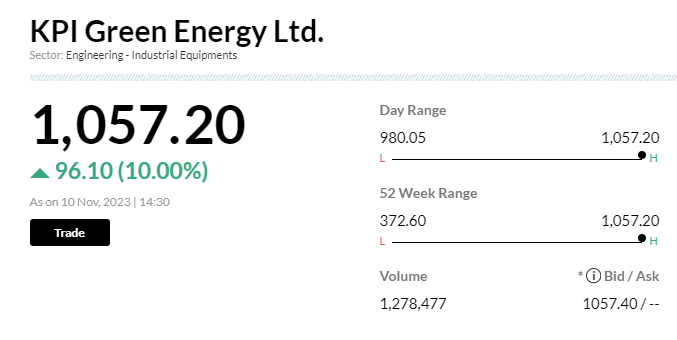

Stock Market LIVE Updates | KPI Green gets 1.6mw solar power order from Adarsh Textile

-330

November 10, 2023· 14:32 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 16242.95 -0.69 | 28.79 1.23 | 1.34 24.17 |

| NIFTY IT | 30552.70 -0.54 | 6.75 -0.74 | -6.19 7.18 |

| NIFTY PHARMA | 15493.70 0.01 | 22.99 4.11 | 2.56 19.34 |

| NIFTY FMCG | 51916.80 -0.13 | 17.53 0.03 | 0.22 16.44 |

| NIFTY PSU BANK | 5012.20 0 | 16.06 -0.85 | -2.91 32.39 |

| NIFTY METAL | 6633.60 0.51 | -1.34 2.38 | -2.20 4.98 |

| NIFTY REALTY | 659.85 -0.11 | 52.81 2.50 | 8.85 49.66 |

| NIFTY ENERGY | 27679.85 0.5 | 7.00 2.19 | 3.47 3.62 |

| NIFTY INFRA | 6293.30 0.22 | 19.82 1.91 | 1.00 20.52 |

| NIFTY MEDIA | 2218.70 -1.84 | 11.38 -2.12 | -1.80 6.22 |

-330

November 10, 2023· 14:29 IST

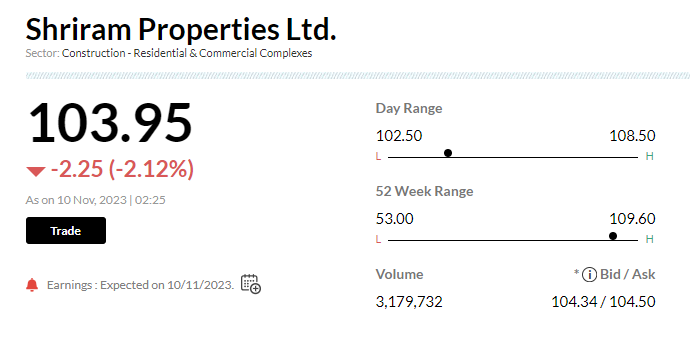

Stock Market LIVE Updates | Shriram Properties reports Q2 earnings

-Net Profit up 2% at Rs 20 Cr vs Rs 19.6 Cr (YoY)

-Revenue down 20.3% at Rs 206.1 Cr vs Rs 258.5 Cr (YoY)

-EBITDA up 17.6% at Rs40 Cr vs Rs34 Cr (YoY)

-Margin at 19.4% vs 13.1% (YoY)

-330

November 10, 2023· 14:25 IST

-330

November 10, 2023· 14:22 IST

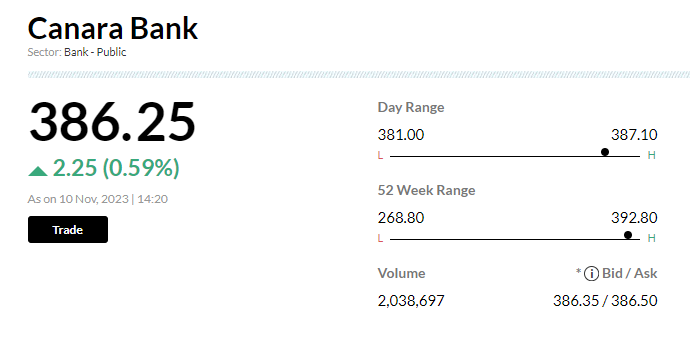

Stock Market LIVE Updates | Canara Bank is in discussion to raise $500 mln offshore loan, Bloomberg reports

-330

November 10, 2023· 14:18 IST

-330

November 10, 2023· 14:14 IST

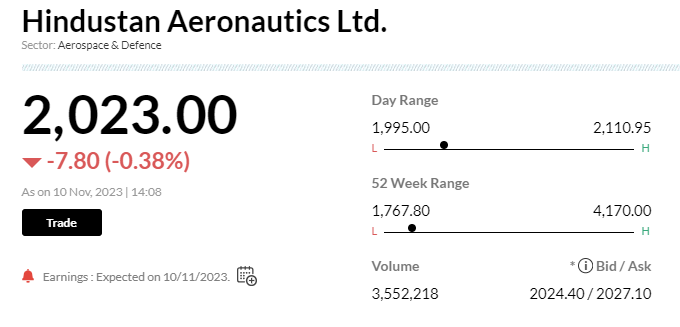

Stock Market LIVE Updates | Hindustan Aeronautics reports Q2 earnings

- Net profit up 1.3% at Rs1,236.7 cr vs Rs1,221.2 cr (YoY)

- Revenue up 9.5% at Rs5,635.7 cr vs Rs5,144.8 cr (YoY)

- EBITDA down 5.8% at Rs1,527.7 cr vs Rs1,621.7 cr (YoY)

- Margin at 27.1% vs 31.5% (YoY)

-330

November 10, 2023· 14:10 IST

-330

November 10, 2023· 14:06 IST

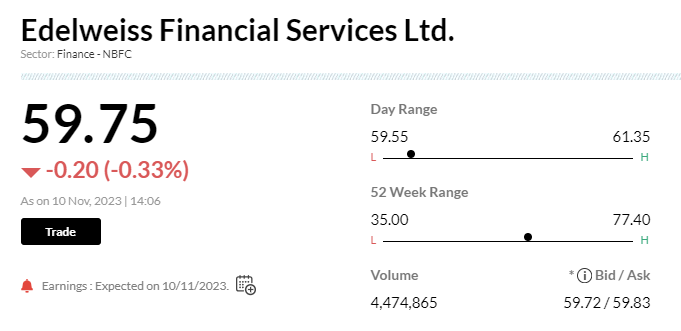

Stock Market LIVE Updates | Edelweiss Fin reports Q2 earnings

--Net income Rs75.95 crore, up 13% y/y

--Revenue Rs2160 crore, up 3.3% y/y

--Total costs Rs2060 crore, down 1.4% y/y

-330

November 10, 2023· 14:02 IST

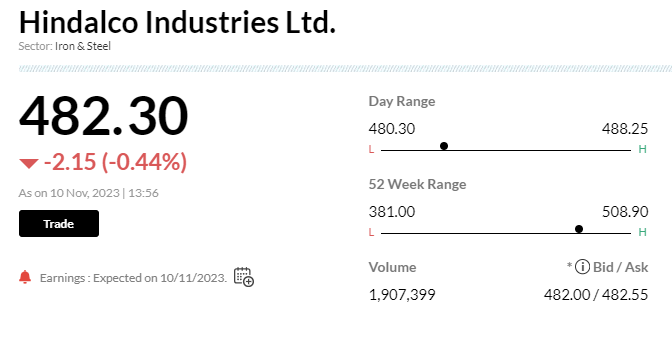

Stock Market LIVE Updates | Hindalco reports Q2 earnings

- Net profit up 54.6% at Rs847 cr vs Rs548 cr (YoY)

- Revenue up 12.5% at Rs20,676 cr vs Rs18,382 cr (YoY)

- EBITDA up 27.5% at Rs1,756 cr vs Rs1,377 cr (YoY)

- Margin at 8.5% vs 7.5% (YoY)

-330

November 10, 2023· 13:56 IST

Stock Market LIVE Updates | Panacea Bio reports Q2 earnings

- Net loss at Rs8.3 cr vs profit of Rs15.7 cr (YoY)

- Revenue up 36% at Rs143 cr vs Rs105 cr (YoY)

-330

November 10, 2023· 13:53 IST

-330

November 10, 2023· 13:50 IST

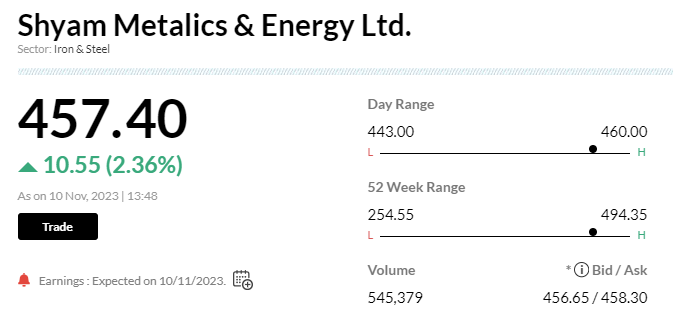

Stock Market LIVE Updates | Shyam Metalics reports Q2 earnings

- Net profit at Rs484.1 cr vs Rs114.3 cr (YoY)

- Revenue down 4.7% at Rs2,941 cr vs Rs3,085 cr (YoY)

- EBITDA up 26.4% at Rs307.4 cr vs Rs243.2 cr (YoY)

- Margin at 10.4% vs 7.8% (YoY)

-330

November 10, 2023· 13:47 IST

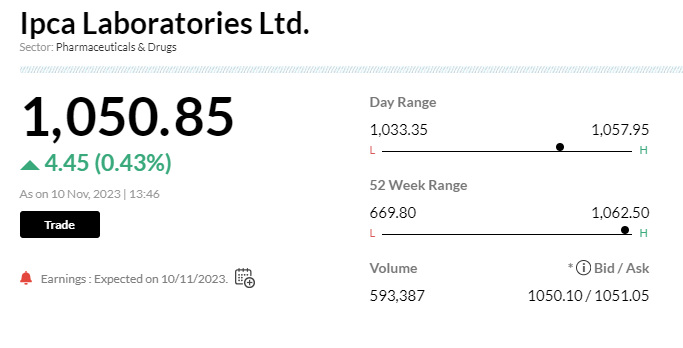

Stock Market LIVE Updates | IPCA Laboratories reports Q2 earnings

- Net profit up 0.7% at Rs145 cr vs Rs144 cr (YoY)

- Revenue up 27% at Rs2,034 cr vs Rs1,601 cr (YoY)

- EBITDA up 23.3% at Rs321.3 cr vs Rs260.6 cr (YoY)

- Margin at 15.8% vs 16.3% (YoY)

-330

November 10, 2023· 13:44 IST

-330

November 10, 2023· 13:34 IST

Stock Market LIVE Updates | Investors cheer Page Industries dividend move despite weak Q2; stock up 1.5%

Shares of Page Industries gained 2 percent to day’s high of Rs 38,327 per share on November 10 after investors were impressed with the company’s second interim dividend announcement of Rs 75 apiece for 2023-24 despite a weak second quarterly performance (Q2FY24). The S&P BSE Sensex was flat at 64,767 levels, as of 1:33pm.

So far this year, the stock of this inner-wear brand slipped 12 percent as against 6 percent surge in the benchmark Sensex. Page Industries’ consolidated net profit declined 7.3 percent on-year in Q2FY24, while total revenue fell 8.3 percent on-year.

However, earnings before interest, tax, depreciation, and amortisation (Ebitda) margin expanded to 20.8 percent in Q2FY24 versus 19 percent in Q2FY23 due to stable raw material prices.

-330

November 10, 2023· 13:27 IST

-330

November 10, 2023· 13:23 IST

USFDA issues 10 observations to Shilpa Medicare's Telangana unit

-330

November 10, 2023· 13:21 IST

Sensex Today | Sunil shah, director at Kambatta Securities

Indian equities are expected to outperform most other global markets in the face of continued geopolitical uncertainties and relatively higher domestic economic growth. The major themes will be domestic consumption and premiumisation, enabling companies to post strong earnings growth aided by margin accretion. Infra and construction plays are expected to do well as the government’s thrust on infrastructure development is seen to continue, while higher budgetary allocation in rural-focus schemes can help drive a recovery in rural consumption, especially with the upcoming budget being the last one before the general elections. In spite of rich valuations in the small- and mid-cap segments, companies with fundamentally strong businesses and good earnings growth continue to justify their valuation. If US bond yields start coming down by the second half of CY2024, FPIs will come back to the party. Upcoming state and general elections can make the market move sideways. Inflation, interest rate trajectory, and geopolitical tensions will remain the key risks.

-330

November 10, 2023· 13:11 IST

Stock Market LIVE Updates | Jefferies View On Piramal Enterprises

-Underperform call, target cut to Rs 855 per share

-Profit before tax well below our estimate

-NIM improved QoQ due to loan mix changes & stable asset quality

-Low-interest earning assets, elevated opex should cap RoA

-330

November 10, 2023· 13:08 IST

Sensex Today | BSE Metal index rose nearly 1 percent supported by NMDC, Vedanta, Jindal Steel:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NMDC | 168.05 | 3.1 | 964.34k |

| Vedanta | 241.90 | 2.87 | 342.51k |

| Jindal Steel | 635.65 | 1.74 | 183.86k |

| NALCO | 91.70 | 1.4 | 302.06k |

| SAIL | 88.07 | 1.08 | 602.46k |

| JSW Steel | 757.05 | 0.87 | 44.87k |

| APL Apollo | 1,656.85 | 0.62 | 19.54k |

| Hindalco | 486.55 | 0.44 | 52.74k |

| Tata Steel | 120.15 | 0.38 | 1.45m |

| Coal India | 324.20 | 0.22 | 313.87k |

-330

November 10, 2023· 13:05 IST

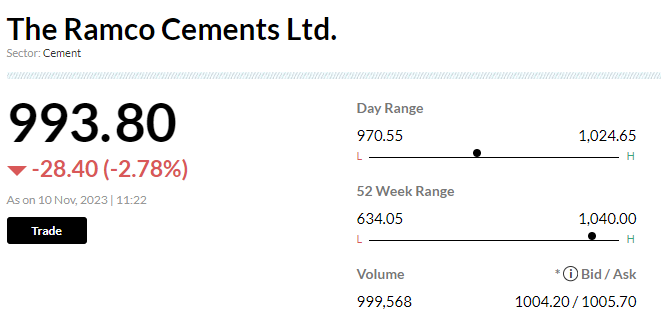

Stock Market LIVE Updates | Incred View On Ramco Cements

-Hold call, target Rs 1,060 per share

-Q2 EBITDA rises mainly due to strong volume & lower costs, outperforms peers

-Raise FY24F-25F EBITDA estimates by 4%

-Factor in a higher sales volume & profitability in 2Q

-Net debt rose QoQ driven by higher capex

-Current EV/T limits upside in stock

-330

November 10, 2023· 12:59 IST

Stock Market LIVE Udates | M&M Q2 Results:

Net profit up 66.9% YoY at Rs 3,451.8 crore and revenue up 15.7% at Rs 24,310 crore versus Rs 21,010 crore, YoY.

-330

November 10, 2023· 12:56 IST

Harjeet Singh Arora, Managing Director at Mastertrust

In light of mounting fundamental tailwinds, the market is poised to sustain its prevailing bullish momentum into Vikram Samvat 2080. Renowned global banks and financial institutions have clearly expressed optimism towards the Indian market. The stage of a bullish scenario is being set by strong corporate performance, overwhelming domestic economic numbers, and growing expectations of the return of the Modi government, known for its pro-business policies. FDI inflows in India stood at US $ 45.15 billion in 2014-2015 which has increased to the highest ever FDI at $83.6 billion in 2021-2022. The bullish sentiment is further bolstered by the speculation that the U.S. Federal Reserve has concluded its rate hike cycle, a factor contributing to the positive market outlook.

Investment in equity and gold should depend on your investment objective, time horizon, and risk profile, but proper asset allocation is require in the portfolio. Gold has been considered a safe-haven asset and used as a hedge against inflation. Gold should be viewed as a long-term investment option rather than a short-term investment. Equity markets have remained volatile both in India and globally but outperformed against other asset class. One should invest in equity from a long-term investment perspective, the equity market can deliver a phenomenal return. Ideally, you should diversify investments in sync with your risk appetite and your original investment plan that you have made for achieving your short and long-term financial goals.

-330

November 10, 2023· 12:54 IST

Stock Market LIVE Updates | Hindalco trade higher ahead of Q2 results; net profit likely to jump 21% YoY

Hindalco Industries expects double-digit YoY growth in Q2 consolidated net profit, despite weak earnings from the US unit, Novelis, which contributes two-thirds of group revenue. Indian operations anticipate strong sales and margin growth, analysts said. Results will be declared on November 10.

According to a poll of brokerages conducted by Moneycontrol.com, consolidated PAT for the quarter is expected to be around Rs 2,668.10 crore, up 21 percent year on year and 9 percent higher quarter on quarter. The consolidated revenues are likely at Rs 53,558.60 crore, down 5 percent from Rs 56,176 crore a year ago. EBITDA is likely to be at Rs 6,007.50 crore, up 12 percent YoY and 5.1 percent sequentially.

Analysts project increased domestic sales volumes for Hindalco in copper and aluminum. The accumulation of lower-cost coal inventory and captive mines may enhance margins. Additionally, higher treatment and refining charges in the copper business are expected to boost overall performance. Read More

-330

November 10, 2023· 12:46 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 64792.09 -0.06 | 6.49 0.67 | -1.95 6.89 |

| BSE 200 | 8545.95 -0.01 | 8.84 1.19 | -0.81 8.71 |

| BSE MIDCAP | 32507.40 0.15 | 28.41 2.43 | 1.44 27.84 |

| BSE SMALLCAP | 38386.30 0.4 | 32.70 2.12 | 1.88 32.87 |

| BSE BANKEX | 49470.67 0.02 | 1.15 1.04 | -0.95 3.87 |

-330

November 10, 2023· 12:44 IST

-330

November 10, 2023· 12:39 IST

Stock Market LIVE Updates | Macquarie View On Ramco Cements

-Neutral call, target Rs 1,000 per share

-Q2 volume surprise drives EBITDA beat

-Reported EBITDA at Rs 400 crore, up 1.2x YoY & 7% ahead of estimate

-EBITDA/t at Rs 879, improved QoQ & was 1% ahead of estimate

-Company's net debt increased QoQ to Rs 5,000 crore led by higher-than-expected capex towards

-Growth focus remains but balance sheet should improve

-330

November 10, 2023· 12:36 IST

-330

November 10, 2023· 12:31 IST

Stock Market LIVE Updates | Macquarie View On Page Industries

-Underperform call, target Rs 31,000 per share

-Q2 sales miss; continued caution on demand

-Volume down 8.8% as demand conditions remained weak

-Peers raised discounting levels

-This could not be offset by cost control measures, EBITDA is 9% below estimate

-Management confident of 19-21% EBITDA margin

-Focus remains on cost control while sustaining required brand investments

-330

November 10, 2023· 12:26 IST

Stock Market LIVE Updates | AstraZeneca Pharma fall 3% despite healthy Q2 net profit, revenue growth

Shares of AstraZeneca Pharma India fell over 3 percent on November 10 following reports that the parent firm's COVID-19 vaccine faces a legal challenge in the UK, overshadowing the company's robust September quarter performance.

The pharma company reported a 60.8 percent on-year growth in profit at Rs 52.4 crore, driven by exceptional gain and a higher topline. Revenue increased 31.7 percent to Rs 311 crore.

Along with Q2 earnings, the board also approved the appointment of Hooi-Bien Chuah as an Additional Director (Non-Executive) of the company with effect from November 9, 2023. She has been Asia Area Legal Director for AstraZeneca since April 2021. Read More

-330

November 10, 2023· 12:19 IST

Sensex Today | BSE Smallcap index up 0.3 percent led by Antony Waste Handling Cell, CarTrade Tech, Centrum Capital:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Antony Waste | 463.00 | 15.12 | 135.45k |

| Centrum Capital | 30.32 | 14.72 | 130.69k |

| CarTrade Tech | 831.90 | 14.15 | 145.38k |

| Sharda Motor | 1,077.00 | 10.5 | 41.24k |

| Vijaya Diagnost | 650.95 | 10.02 | 72.59k |

| IFGL Refractory | 648.90 | 9.99 | 6.80k |

| Caplin Labs | 1,204.90 | 9.64 | 30.89k |

| IFB Industries | 933.55 | 9.09 | 21.64k |

| Tracxn | 83.50 | 7.08 | 343.01k |

| NESCO | 722.70 | 6.98 | 57.16k |

-330

November 10, 2023· 12:08 IST

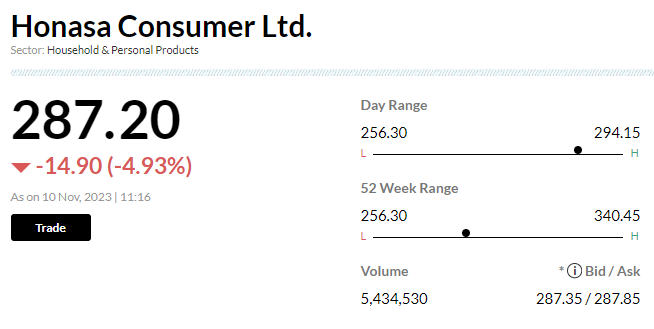

Stock Market LIVE Updates | Honasa plunges 15% further; mcap drops Rs1,300 crore since listing

Honasa Consumer Ltd, the Mamaearth parent company saw its shares decline by nearly 15 percent on November 10, reaching a new record low. The stock has now dropped by 21 percent from its initial issue price of Rs 324 per share, leading to a market capitalisation loss of over Rs 1,300 crore.

The stock has been on a continuous decline since its listing on November 7. Several analysts have advised avoiding the IPO, citing aggressive pricing. It raised around Rs 1,700 crore via IPO.

The company reported a net loss of Rs 150.9 crore during the year ended March 2023, impacted by the impairment loss on goodwill and other intangible assets, against a profit of Rs 14.4 crore in the previous year. Read More

-330

November 10, 2023· 12:05 IST

Stock Market LIVE Updates | Aditya Birla Fashion & Retail reports net loss in Q2 on sluggish demand; shares fall 3%

Aditya Birla Fashion & Retail shares slipped 3 percent in trade on November 10 as the company posted a consolidated net loss of Rs 200.3 crore for the quarter ended September FY24.

ABFRL reported a net profit of Rs 29.4 crore in the same period last fiscal year, despite a higher topline impacted by weak operating numbers.

The consolidated revenue from operations increased by 4.9 percent YoY to Rs 3,226 crore in Q2FY24, and new businesses primarily contributed to this growth. Consolidated EBITDA for the quarter stood at Rs 369 crore, down 4 percent YoY and EBITDA margin was at 11.4 percent. Read More

-330

November 10, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was down 135.70 points or 0.21 percent at 64,696.50, and the Nifty was down 21.80 points or 0.11 percent at 19,373.50. About 1630 shares advanced, 1430 shares declined, and 114 shares unchanged.

-330

November 10, 2023· 12:00 IST

-330

November 10, 2023· 11:56 IST

Sensex Today | BSE Power index up 0.7 percent led by Tata Power, ABB India, NTPC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Tata Power | 251.15 | 1.29 | 165.58k |

| ABB India | 4,363.00 | 1.24 | 9.38k |

| NTPC | 240.25 | 1.07 | 115.09k |

| Adani Energy | 754.10 | 0.58 | 6.86k |

| BHEL | 126.45 | 0.56 | 481.87k |

| Siemens | 3,410.00 | 0.48 | 3.27k |

| Adani Power | 402.95 | 0.46 | 631.89k |

| CG Power | 385.00 | 0.43 | 11.57k |

| Adani Green Ene | 940.55 | 0.31 | 10.40k |

| Power Grid Corp | 210.30 | 0.14 | 240.73k |

-330

November 10, 2023· 11:54 IST

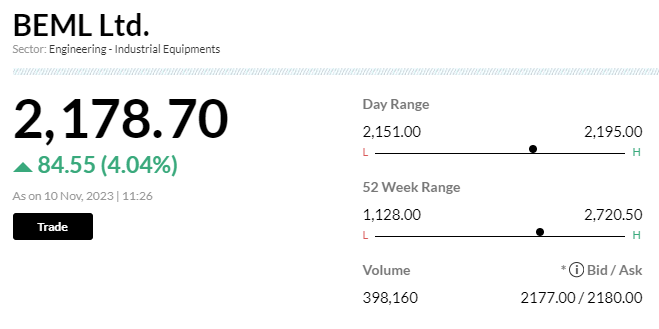

Stock Market LIVE Updates | BEML Q2 profit surges 218% YoY to Rs 51.8 crore

BEML has registered a 218.5% year-on-year jump in consolidated profit at Rs 51.8 crore for September FY24 quarter, supported by topline as well as healthy operating numbers post fall in cost of materials. Revenue from operations rose by 13.9% YoY to Rs 916.8 crore during the quarter.

-330

November 10, 2023· 11:48 IST

Stock Market LIVE Updates | NCC Q2 profit plunges 37% YoY to Rs 86.5 crore

NCC has recorded a massive 37.1% on-year fall in consolidated net profit at Rs 86.5 crore for July-September period of FY24, impacted by weak operating numbers post sharp rise in cost of materials and sub-contractor work bills. Revenue from operations increased sharply by 40% YoY to Rs 4,719.6 crore during the quarter.

-330

November 10, 2023· 11:45 IST

Stock Market LIVE Updates | Morgan Stanley View On Torrent Power

-Underweight call, target Rs 570 per share

-Revenue, EBITDA, & adjusted PAT were -4%, +8%, +12% versus estimate

-RLNG gains & profit from merchant sales at Rs 25.0 crore (Q2FY23 at Rs 170 crore)

-330

November 10, 2023· 11:42 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Majestic Auto | 256.60 18.77% | 404.36k 5,172.40 | 7,718.00 |

| Jubilant Food | 507.85 0.42% | 1.70m 27,518.40 | 6,092.00 |

| NTC Industries | 98.80 4.36% | 217.48k 7,175.40 | 2,931.00 |

| Sky Industries | 80.14 19.99% | 189.65k 6,351.00 | 2,886.00 |

| Hariyana Ship | 111.64 19.99% | 227.72k 8,593.20 | 2,550.00 |

| Campus Active | 251.25 -4.85% | 1.90m 72,236.60 | 2,525.00 |

| Sharda Motor | 1,092.60 12.1% | 39.50k 2,064.00 | 1,814.00 |

| AGS Transact | 65.85 6.73% | 455.22k 26,990.20 | 1,587.00 |

| 63 Moons Tech | 297.80 4.99% | 88.41k 6,482.20 | 1,264.00 |

| NESCO | 722.95 7.02% | 56.54k 4,450.00 | 1,171.00 |

-330

November 10, 2023· 11:35 IST

-330

November 10, 2023· 11:30 IST

Stock Market LIVE Updates | BEML shares surge 5% on robust Q2 earnings, margin expansion

Shares of BEML Ltd surged 5 percent in the early trade on November 10 as investors cheered for the company's stellar earnings in the July-September quarter.

Volumes in the counter were also strong as three lakh shares had changed hands on the exchanges, higher than the one-month daily traded average of two lakh shares.

The company's net profit multiplied manifold to Rs 51.80 crore, sharply up from Rs 16.30 crore in the same quarter of the previous fiscal. Revenue grew nearly 14 percent on year to Rs 916.80 crore.

The easing of raw material costs along with the steady rise in revenue also lifted the company's operational performance. As a result, the EBITDA margin expanded 150 basis points on year to 6.7 percent in the September quarter from 5.2 percent in the base period.

-330

November 10, 2023· 11:25 IST

Stock Market LIVE Updates | Ramco Cements stock plunges 5% as investors book profit on strong Q2 results

Investors booked profit in shares of The Ramco Cements on November 10, a day after it touched 52-week high threshold (Rs 1,040 apiece on November 9, 2023). The stock slumped 5 percent to day’s low of Rs 970 per share on November 10 after the company posted strong July-September quarter (Q2FY24) results. In the past three months, the stock of this South-based cement producer has surged 17 percent as against 1 percent decline in the benchmark Sensex.

India’s Ramco Cements second quarter profit grew nearly nine times to Rs 101 crore as strong housing sales and firm infrastructure spending outpaced higher expenses. The company’s revenue from operations, too, jumped about 31 percent on-year to Rs 2,300 crore owing to higher input prices and transportation costs.

-330

November 10, 2023· 11:20 IST

Stock Market LIVE Updates | Honasa plunges 15% further; mcap drops Rs1,300 crore since listing

Honasa Consumer Ltd, the Mamaearth parent company saw its shares decline by nearly 15 percent on November 10, reaching a new record low. The stock has now dropped by 21 percent from its initial issue price of Rs 324 per share, leading to a market capitalisation loss of over Rs 1,300 crore.

The stock hit a record low of Rs 256.10 a share and fell as much as 15 percent in intraday. At 10.30am, the stock was trading at Rs 279 on the BSE, down 7.5 percent from its previous close.

The stock has been on a continuous decline since its listing on November 7. Several analysts have advised avoiding the IPO, citing aggressive pricing. It raised around Rs 1,700 crore via IPO. Read More

-330

November 10, 2023· 11:14 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Vodafone Idea | 212630 | 14.1 | 0.3 |

| Alstone Text | 1001500 | 0.61 | 0.06 |

| Jaiprakash Pow | 302000 | 14.58 | 0.44 |

| Jaiprakash Pow | 251452 | 14.59 | 0.37 |

| RBL Bank | 51862 | 239.3 | 1.24 |

| Yes Bank | 215000 | 18.24 | 0.39 |

| Alstone Text | 300000 | 0.61 | 0.02 |

| Rattan Power | 200500 | 8.48 | 0.17 |

| Yes Bank | 289907 | 18.23 | 0.53 |

| RBL Bank | 73779 | 238.8 | 1.76 |

-330

November 10, 2023· 11:12 IST

Stock Market LIVE Updates | Morgan Stanley View On Apollo Hospitals

-Overweight call, target Rs 6,101 per share

-Hospital & pharmacy businesses delivering steady mid-teens growth

-Online platform 24x7 gaining scale

-EBITDA losses for Apollo HealthCo reduced 32% QoQ

-Apollo 24/7 GMV grew 1.5x YoY, to Rs 730 crore

-330

November 10, 2023· 11:10 IST

Stock Market LIVE Updates | Piramal Enterprises reports Q2 profit at Rs 48 crore, net interest income drops 9%

Piramal Enterprises has reported profit at Rs 48 crore for quarter ended September FY24, against loss of Rs 1,536 crore in year-ago period, as loan loss provisions & fair value loss dropped significantly to Rs 198 crore from Rs 3,257 crore during the same period. Net interest income fell 9% on-year to Rs 750 crore for the quarter.

-330

November 10, 2023· 11:08 IST

Stock Market LIVE Updates | Force Motors shares hit 5% upper circuit on robust Q2 results

Shares of Force Motors witnessed strong investor interest, reaching the 5 percent upper circuit at Rs 4,053 per share on November 10. This surge followed the company's impressive performance in the July-September quarter (Q2FY24).

The company’s revenue surged 42.5 percent on-year to Rs 1,802 crore in the September-ended quarter, while profit was up nearly five-fold to Rs 94 crore.

The auto major’s earnings before interest, tax, depreciation, and amortisation (Ebitda), too, more-than-doubled to Rs 225 crore in Q2FY24. Read More

-330

November 10, 2023· 11:02 IST

Sensex Today | Market at 11 AM

The Sensex was down 109.41 points or 0.17 percent at 64,722.79, and the Nifty was down 27.70 points or 0.14 percent at 19,367.60. About 1625 shares advanced, 1370 shares declined, and 113 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ONGC | 194.90 | 1.14 | 2.34m |

| Adani Ports | 815.35 | 1.13 | 1.36m |

| NTPC | 239.55 | 0.67 | 2.91m |

| Tech Mahindra | 1,130.65 | 0.6 | 204.10k |

| HDFC Life | 624.55 | 0.52 | 1.07m |

| Bajaj Finance | 7,422.10 | 0.48 | 192.25k |

| UltraTechCement | 8,660.00 | 0.38 | 35.75k |

| JSW Steel | 752.95 | 0.28 | 263.96k |

| Bharti Airtel | 934.85 | 0.27 | 367.28k |

| ICICI Bank | 939.50 | 0.23 | 3.30m |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| M&M | 1,517.30 | -2.24 | 870.34k |

| Hero Motocorp | 3,123.40 | -1.59 | 129.02k |

| LTIMindtree | 5,192.05 | -1.19 | 37.74k |

| Titan Company | 3,248.15 | -1.08 | 206.98k |

| Apollo Hospital | 5,254.55 | -0.81 | 372.59k |

| Asian Paints | 3,055.45 | -0.8 | 143.94k |

| Infosys | 1,364.00 | -0.79 | 678.52k |

| HCL Tech | 1,258.40 | -0.72 | 321.13k |

| Bajaj Auto | 5,380.15 | -0.72 | 49.00k |

| Dr Reddys Labs | 5,423.00 | -0.64 | 93.47k |

-330

November 10, 2023· 11:01 IST

Stock Market LIVE Updates | Torrent Power Q2 profit rises 9% YoY to Rs 526 crore

Torrent Power has recorded a 9.2% on-year increase in consolidated profit at Rs 526 crore for July-September period of FY24, partly driven by lower tax cost and higher operating margin. Revenue from operations grew by nearly 4% YoY to Rs 6,961 crore, with increase in contribution from merchant power sales in gas-based power plants; licensed distribution businesses; and renewable businesses due to capacity addition and higher wind PLF.

-330

November 10, 2023· 10:55 IST

Stock Market LIVE Updates | Lupin signs licensing & supply agreement with Amman Pharma for Ranibizumab Biosimilar

Lupin has partnered with Amman Pharmaceuticals Industries for exclusive marketing and commercialization of Ranibizumab, a biosimilar of Lucentis, in the Middle East region, including select territories of Jordan, Saudi Arabia, UAE, Iraq, Lebanon, and other GCC countries. Both Lupin and Amman Pharma are united in their mission to provide innovative, high-quality healthcare solutions to patients in the MENA region.

-330

November 10, 2023· 10:52 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 19377.20 -0.09 | 7.03 0.76 | -1.59 7.48 |

| NIFTY BANK | 43680.80 -0.01 | 1.62 0.84 | -1.53 4.99 |

| NIFTY Midcap 100 | 40517.50 -0.05 | 28.59 2.35 | 0.58 29.21 |

| NIFTY Smallcap 100 | 13316.70 0.1 | 36.84 2.71 | 4.36 37.73 |

| NIFTY NEXT 50 | 45571.70 -0.19 | 8.02 1.53 | 1.26 6.53 |

-330

November 10, 2023· 10:45 IST

Stock Market LIVE Updates | Ashok Leyland to invest Rs 1,200 crore into Switch Mobility

Ashok Leyland has received approval from the board members for investment of Rs 1,200 crore in Switch Mobility through its holding company Optare PLC UK. The funds infused will be used for capital expenditure, R&D and meeting operational requirements both in UK and India. The funds will be infused over the next few months after necessary statutory approvals in one or more tranches.

-330

November 10, 2023· 10:41 IST

| Company | Offer Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Maan Aluminium | 6529.00 | 134.90 -5 | 52653 86677.90 |

| Texmo Pipes | 98493.00 | 80.39 -5 | 2284 29629.60 |

| Sigma Solve | 1971.00 | 458.50 -4.99 | 811 7004.10 |

| Galactico Corp | 900370.00 | 3.25 -4.97 | 766879 - |

| KBC Global | 1409637.00 | 2.12 -4.93 | 4867410 3913136.80 |

| Asian Hotels | 200.00 | 202.55 -4.64 | 1250 7359.20 |

| GTL Infra | 8172537.00 | 1.07 -4.46 | 34220879 19308315.40 |

| Winsome Yarns | 110614.00 | 4.54 -1.94 | 4397 20719.05 |

-330

November 10, 2023· 10:36 IST

Stock Market LIVE Updates | Aditya Birla Fashion & Retail posts Q2 loss at Rs 200 crore despite higher topline

Aditya Birla Fashion & Retail has posted consolidated net loss at Rs 200.3 crore for quarter ended September FY24, against profit of Rs 29.4 crore in same period last fiscal despite higher topline, impacted by weak operating numbers. Consolidated revenue from operations increased by 4.9% YoY to Rs 3,226 crore in Q2FY24.

-330

November 10, 2023· 10:34 IST

Stock Market LIVE Updates | Smallcap World Fund Inc offloads half a percent stake in Aegis Logistics

Smallcap World Fund Inc has sold 18.26 lakh equity shares or half a percent stake in Aegis Logistics via open market transactions, at an average price of Rs 294 per share. Its shareholding in the company was 2.18% or 76.36 lakh shares as of September 2023.

-330

November 10, 2023· 10:31 IST

Stock Market LIVE Updates | Hindustan Aeronautics forms JV company with Safran Helicopter Engines

The company has informed that a Joint Venture Company with Safran Helicopter Engines SAS by name " SAFHAL HELICOPTER ENGINES PRIVATE LIMITED" has been incorporated, to carry out business of design, development, certification, production, sale & support of helicopter engines with one of the first opportunities identified as engine for Indian Multi Role Helicopter (IMRH) & Deck Based Multi Role Helicopter (DBMRH) projects.

-330

November 10, 2023· 10:29 IST

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

ESAF Small Finance Bank has debuted at Rs 71.90, i.e., 20% above its issue price. It has a major operation in the microloan segment, with a main focus on rural areas. The company has a strong presence in southern India. And it has a growing retail deposit portfolio. If we look at its financials, the company has reported strong growth in top- and bottom-line numbers.

The issue is coming at a P/BV of 1.5x, which seems fairly priced. Thus, considering this valuation and its better performance in terms of its CIR, NNPA, and NIM, So, allottees who applied for the public offering for listing premium are advised to maintain their stop loss at 60 and wait for further upside, whereas those who have a medium- to long-term perspective can also hold the stock.

-330

November 10, 2023· 10:26 IST

-330

November 10, 2023· 10:25 IST

Sensex Today | Mukesh kochar, National Head of Wealth at AUM Capital:

The SIP flow increased to all time high to topped 16900 crore which is great. This is structural change of savings habits through SIP and it is in good momentum. Small cap and mid cap along with thematic & multi-cap and flexi-cap funds find attraction as investors uses the correction happens in October as an opportunity to add.

Apart from this decent corporates earning also prompted investor to be positive on the market. Gilt fund along with corporate bond fund and short term fund also find interest as interest rates are picking out and these fund can deliver good return in a downward sloping interest rate environment. Arbitrage funds continue to find investors interest as spread rollover remain attractive along with tax arbitrage over other short term parking options.

-330

November 10, 2023· 10:20 IST

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| CDSL | 1,727.00 2.02 | 2.07m | 354.45 |

| Reliance | 2,302.45 -0.35 | 1.54m | 355.55 |

| Power Finance | 280.50 1.15 | 9.48m | 266.45 |

| ICICI Bank | 937.95 0.06 | 2.30m | 215.03 |

| Hindustan Aeron | 2,060.75 1.47 | 891.43k | 183.80 |

| HDFC Bank | 1,483.00 -0.18 | 1.21m | 179.27 |

| NCC | 161.20 3.93 | 11.11m | 173.57 |

| Zomato | 121.70 -0.12 | 13.90m | 169.16 |

| Muthoot Finance | 1,245.00 -5.2 | 1.31m | 161.77 |

| Apollo Hospital | 5,249.65 -0.91 | 299.82k | 158.81 |

-330

November 10, 2023· 10:17 IST

Stock Market LIVE Updates | CLSA View On Muthoot Finnance

-Underperform call, target Rs 1,350 per share

-NIMs moderate further; loan growth slows down as expected

-Yield compression on an already low base

-Expect loan growth pressure to remain for next couple of quarters

-See loan growth pressure due to largely stagnant gold prices

-See loan growth pressure due to tepid tonnage growth & a decline in LTV

-Cut PAT estimate by 6-7% due to NII cuts

-330

November 10, 2023· 10:14 IST

Stock Market LIVE Updates | RVNL down 2% on muted Q2 earnings

Shares of Rail Vikas Nigam Limited (RVNL) dropped more than 2 percent in the early trade on November 10, a day after the state-owned company posted muted numbers for the September quarter.

Rail Vikas Nigam reported a 3.5 percent rise in consolidated net profit for the September quarter. The rise in profit was despite the company's revenue remaining flat when compared to the same period last year at Rs 4,914.32 crore. A 33.4 percent on-year rise in income from other operations at Rs 296 crore also helped improve the bottom line. Read More

-330

November 10, 2023· 10:10 IST

Stock Market LIVE Updates | Genus Power Infrastructures Q2 profit spikes over 7-fold to Rs 49.2 crore

Genus Power Infrastructures has registered a robust 653.6% on-year growth in consolidated profit at Rs 49.2 crore for quarter ended September FY24, driven by strong operating numbers and higher other income. Revenue from operations increased by 18.4% YoY to Rs 259 crore in Q2FY24.

-330

November 10, 2023· 10:05 IST

Sensex Today | ESAF Small Finance Bank makes stellar debut, stock lists at 20% premium to IPO price

ESAF Small Finance Bank stock made a stellar debut, listing at 19 percent premium to the IPO price on November 10. The stock opened at Rs 71 on the NSE and Rs 71.9 on the BSE against the issue price of Rs 60.

Ahead of the listing, the shares were trading at a 26 percent premium in the grey market. The grey market is an unofficial trading platform where shares get traded well before the allotment in the IPO and until the listing day. Most investors track the grey market premium (GMP) of a stock to get an idea of the listing price. Read More

-330

November 10, 2023· 10:03 IST

Sensex Today | Market at 10 AM

The Sensex was down 225.04 points or 0.35 percent at 64,607.16, and the Nifty was down 61.30 points or 0.32 percent at 19,334. About 1454 shares advanced, 1405 shares declined, and 100 shares unchanged.

-330

November 10, 2023· 09:59 IST

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| DYNPROPP | 450.00 | 149.50 | -300.50 - |

| Spectrum Talent | 129.15 | 105.10 | -24.05 2.76k |

| National Oxygen | 45.40 | 37.40 | -8.00 - |

| Sotac Pharma | 116.40 | 97.00 | -19.40 0 |

| North Eastern | 27.65 | 23.75 | -3.90 115.66k |

| Felix Industrie | 120.00 | 108.00 | -12.00 1.22k |

| Globesecure | 65.00 | 60.15 | -4.85 4.76k |

| Universal Cable | 539.95 | 500.10 | -39.85 8.02k |

| Arrow Greentech | 437.30 | 405.55 | -31.75 8.99k |

| Quality Foils | 100.00 | 93.00 | -7.00 0 |

-330

November 10, 2023· 09:58 IST

| Company | Price at 09:00 | Price at 09:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Info Drive Soft | 0.65 | 332.80 | 332.15 - |

| Amines Plast | 2.00 | 160.00 | 158.00 - |

| Kesoram Ind PP | 5.00 | 28.40 | 23.40 - |

| RPP Infra PP | 10.00 | 36.50 | 26.50 36.32k |

| Bharat Gears RE | 103.25 | 172.05 | 68.80 - |

| D.K. Enterprise | 85.00 | 98.00 | 13.00 0 |

| Sharda Motor | 973.80 | 1,104.00 | 130.20 3.00k |

| Mahalaxmi Rub | 215.65 | 242.40 | 26.75 5.33k |

| Kothari Petro | 131.45 | 147.05 | 15.60 15.10k |

| AGS Transac | 61.50 | 68.50 | 7.00 23.97k |

-330

November 10, 2023· 09:56 IST

Stock Market LIVE Updates | GR Infraprojects share price down 2% as Q2 profit falls 35%

GR Infraprojects share price fell 2 percent in early trade on November 10 after the company posted a 35-percent fall in its September quarter net profit at Rs 217.16 crore against Rs 336.23 crore, YoY.

Its revenue from operation fell 12 percent at Rs 1,882.78 crore versus Rs 2,136.36 crore.

The company has emerged as an L‐1 bidder in a financial bid for the tender invited by RITES on behalf of Shri Mata Vaishno Devi Shrine Board, Katra (J&K), GR Infraprojects said in its statement.

The project is for the design, engineering, construction, development, finance, and operation & maintenance of passenger ropeway between Tarakote and Sanjichhat at Katra (J&K), on a BOOT basis, it added. Read More

-330

November 10, 2023· 09:52 IST

Stock Market LIVE Updates | Torrent Power gains 2% on Q2FY24 results; net profit up 9.2%

Shares of Torrent Power gained 2.28% percent at open on November 10, a day after the the power utility company company posted a nearly 9.2 percent year-on-year increase in net profit for Q2FY24. At 9:20 am, the stock was trading at Rs 777.40. The results were announced post market hours. At close on November 9, Torrent Power was trading at Rs 751.70.

For Q2FY24, Torrent Power recorded a 9.2 percent YoY increase in net profit to Rs 526 crore for Q1FY2024. The company's revenue from operations also increased 3.8 percent to Rs 6,960.9 crore for the same period. The EBITDA for Q2FY24 grew 4.9 percent to Rs 1,221.4 crore for the quarter ending September 2023, from Rs 1,164.2 crore in the year-ago fiscal. Read More

-330

November 10, 2023· 09:47 IST

Stock Market LIVE Updates | CLSA View On Adani Ports

-Buy call, target Rs 878 per share

-Port EBITDA up 19% & logistics EBITDA rises 26% YoY

-Its M&A strategy has paid a rich dividend

-Krishnapatam port volume up by 27% YoY, margin have gone past ADSEZ levels

-Ports traffic did well in 2Q, +13% YoY (Excluding Haifa M&A) led by crude imports

-CEO is resolutely focused on its next leg of growth

-Will bring down net Debt/EBITDA to 2.5x in FY24

-Net Debt/EBITDA is already reaching 2.8x in 1HFY24

-330

November 10, 2023· 09:45 IST

-330

November 10, 2023· 09:43 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Ruchinfra | 18.70 | 41.13 | 13.25 |

| INFOLLION | 259.00 | 37.15 | 188.85 |

| Norben Tea | 13.35 | 30.88 | 10.20 |

| Oil Country | 25.20 | 29.90 | 19.40 |

| Hb Stockhol | 72.50 | 29.58 | 55.95 |

| DPSC | 21.90 | 27.33 | 17.20 |

| Nitiraj Enginee | 136.40 | 19.96 | 113.70 |

| NK Industries | 85.45 | 19.76 | 71.35 |

| Homesfy Realty | 415.00 | 18.57 | 350.00 |

| Arihant Super | 217.45 | 18.18 | 184.00 |

-330

November 10, 2023· 09:41 IST

-330

November 10, 2023· 09:39 IST

Stock Market LIVE Updates | Aurobindo Pharma Q2 profit surges 85% YoY to Rs 757 crore

Aurobindo Pharma has recorded a massive 85% year-on-year growth in consolidated profit at Rs 757.2 crore for July-September period of FY24, driven by robust operating numbers, and topline. Revenue from operations grew by 25.8% YoY to Rs 7,219.4 crore with US formulations (excluding Puerto Rico) rising 35.7%, Europe formulation up 16.7%, and growth markets revenue up 24.7%.

-330

November 10, 2023· 09:37 IST

Stock Market LIVE Updates | GR Infraprojects emerges as lowest bidder for tender by RITES for passenger ropeway construction in J&K

G R Infraprojects has emerged as lowest bidder (L-1) for the tender invited by RITES on behalf of Shri Mata Vaishno Devi Shrine Board, Katra (J&K) for design, engineering, construction, development, finance, operation & maintenance of passenger ropeway between Tarakote & Sanjichhat, on BOOT basis. The project cost is Rs 200 crore.

-330

November 10, 2023· 09:33 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| IFB Industries | 960.40 12.12% | 308.04k 27,673.60 | 1,013.00 |

| Sharda Motor | 1,100.05 12.96% | 216.43k 27,676.00 | 682.00 |

| NESCO | 726.20 7.4% | 407.67k | 682.00 |

| 63 Moons Tech | 298.75 4.99% | 389.95k | 682.00 |

| Parin Furniture | 74.40 4.57% | 16.00k 3,600.00 | 344.00 |

| Subros | 413.50 4.52% | 250.20k | 344.00 |

| Campus Active | 244.85 -7.25% | 2.56m 734,378.00 | 248.00 |

| Muthoot Finance | 1,229.75 -6.36% | 693.94k | 248.00 |

| Sejal Glass | 308.35 4.99% | 9.56k | 248.00 |

| eClerx Services | 2,148.00 4.47% | 114.21k 49,643.00 | 130.00 |

-330

November 10, 2023· 09:30 IST

-330

November 10, 2023· 09:26 IST

Stock Market LIVE Updates | Muthoot Finance Q2 profit rises 14.3% YoY to Rs 991 crore

Muthoot Finance has recorded standalone profit at Rs 991 crore for July-September period of FY24, growing 14.3% over the corresponding period last fiscal. Net interest income for the quarter stood at Rs 1,858.4 crore, increasing 18.2% over a year-ago period.